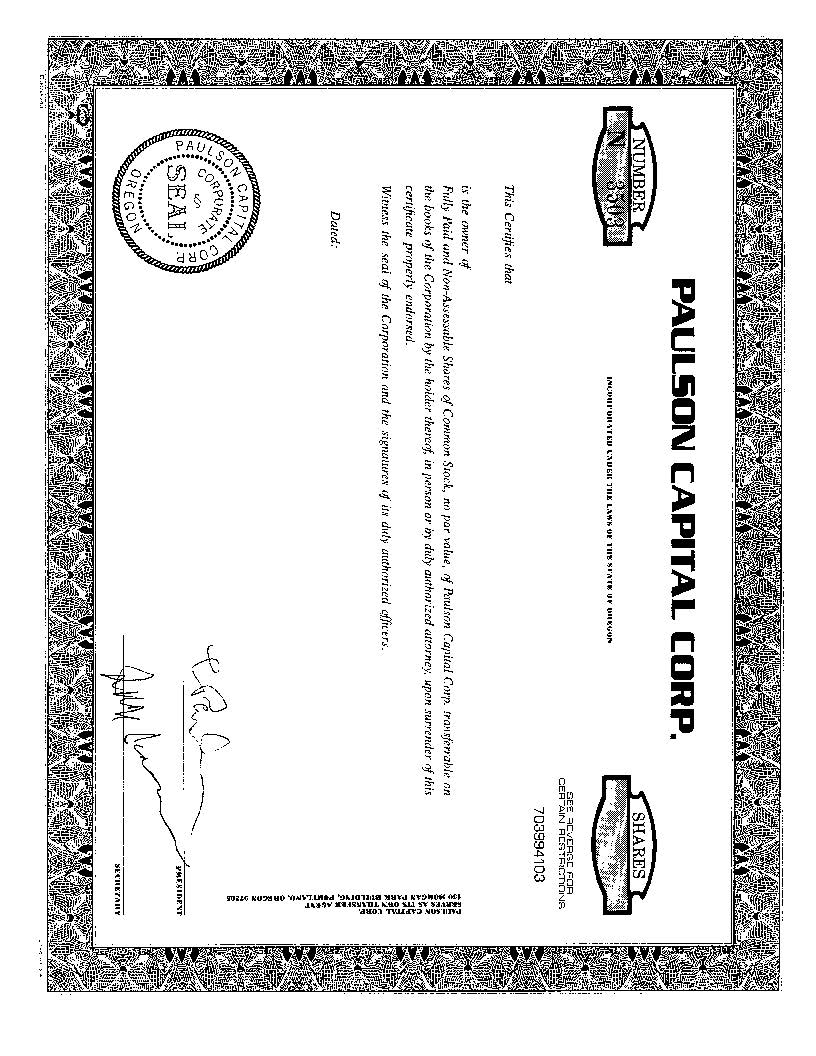

Exhibit 4.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) of the

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 20, 2014

PAULSON CAPITAL (DELAWARE) CORP.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-18188

|

Oregon |

93-0589534 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

1331 NW Lovejoy Street, Suite 720 Portland, Oregon |

97209 |

|

(Address of principal executive offices) |

(Zip Code) |

|

| |

|

Registrant’s telephone number, including area code: 503-243-6000 | |

|

PAULSON CAPITAL CORP. Former name or former address if changed since last report: | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

The information in Item 3.03 below is incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security Holders.

Effective March 20, 2014 (the “Effective Date”), the Registrant (formerly “Paulson Capital Corp.” and now “Paulson Capital (Delaware) Corp.”) changed its state of incorporation from the State of Oregon to the State of Delaware (the “Reincorporation”) pursuant to an Agreement and Plan of Merger dated March 20, 2014 by and between the Registrant’s predecessor entity, Paulson Capital Corp., an Oregon corporation (“Paulson Oregon”), and Paulson Oregon’s wholly owned subsidiary, Paulson Capital (Delaware) Corp., a Delaware corporation (“Paulson Delaware”). As a result of the Reincorporation, the Registrant is now Paulson Delaware, its name is “Paulson Capital (Delaware) Corp.” and Paulson Oregon no longer exists. The directors and officers of Paulson Oregon continue to be the directors and officers of the Registrant, and the Registrant will continue to operate the business of Paulson Oregon as it existed immediately prior to the Reincorporation. The Registrant’s shareholders approved the Reincorporation pursuant to the Agreement and Plan of Merger at the Registrant’s 2013 Annual Meeting of Shareholders held on November 8, 2013.

On the Effective Date, (i) each share of Paulson Oregon’s common stock, no par value, issued and outstanding was automatically converted into one share of Paulson Delaware’s common stock, $0.0001 par value (the “Common Stock”); (ii) each share of Paulson Oregon’s preferred stock, no par value, issued and outstanding was automatically converted into one share of Paulson Delaware’s preferred stock, $0.0001 par value (the “Preferred Stock”), and (iii) any options, warrants, or other securities of Paulson Oregon shall be enforced against Paulson Delaware to the same extent as if such options, warrants or other securities had been issued by Paulson Delaware. Paulson Oregon shareholders may, but are not required to, exchange their stock certificates as a result of the Reincorporation.

Prior to the Effective Date, the rights of Paulson Oregon’s shareholders were governed by the Oregon Business Corporation Act (the “OBCA”), Paulson Oregon’s Articles of Incorporation and its Amended and Restated Bylaws. As a result of the Reincorporation, holders of Paulson Oregon’s common stock and preferred stock are now holders of the Common Stock and the Preferred Stock, respectively, and their rights as shareholders are now governed by the Delaware General Corporation Law and the following documents: (i) Paulson Delaware’s Certificate of Incorporation (the “Certificate of Incorporation”); (ii) Paulson Delaware’s Bylaws (the “Bylaws”); (iii) and Paulson Delaware’s Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock (the “Certificate of Designation”). The Certificate of Incorporation, the Bylaws and the Certificate of Designation were each approved substantially in the form filed with the Secretary of State of Delaware by the Registrant’s shareholders at the Registrant’s 2013 Annual Meeting of Shareholders held on November 8, 2013. The Registrant will continue to use the same form of common stock certificate as it did prior to the Reincorporation. The form of common stock certificate is filed as Exhibit 4.1 hereto and is incorporated herein by reference.

The Registrant hereby incorporates by reference the description of the Reincorporation (as proposed to the Registrant’s shareholders) contained in the section entitled “PROPOSAL 7— APPROVAL OF THE CHANGE IN THE COMPANY’S STATE OF INCORPORATION TO DELAWARE FROM OREGON” in the Registrant’s Definitive Proxy Statement on Schedule 14A, as filed with the Securities and Exchange Commission on October 18, 2013 (the “Proxy Statement”), including the following captions: “Background,” “General,” “Purpose of the Reincorporation,” “Comparison of Oregon and Delaware Corporation Laws and Current Oregon Articles of Incorporation and Bylaws and Proposed Delaware Certificate of Incorporation and Bylaws,” "Filing and License Fees" and “Federal Income Tax Consequences.” The Registrant further incorporates by reference the description of the Series A Preferred Stock contained in the section entitled “PROPOSAL 6— AUTHORIZATION TO ISSUE SECURITIES IN A NON-PUBLIC OFFERING IN ACCORDANCE WITH NASDAQ LISTING RULE 5635” in the Proxy Statement, including under the following caption: “Series A Preferred Stock.”

The foregoing descriptions of the Agreement and Plan of Merger, the Certificate of Incorporation, the Bylaws and the Certificate of Designation do not purport to be complete and are qualified in their entirety by reference to, and should be read in conjunction with, the full text of the Agreement and Plan of Merger, the Certificate of Incorporation, the Bylaws and the Certificate of Designation, which are filed as Exhibits 2.1, 3.1, 3.2 and 3.3 hereto and incorporated herein by reference.

In accordance with Rule 12g-3 of the Securities and Exchange Act of 1934, the shares of Common Stock of Paulson Delaware were deemed to be registered under Section 12(b) of the Exchange Act as the successor to Paulson Oregon. The Common Stock continues to be listed on The NASDAQ Capital Market under the symbol “PLCC.”

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information in Item 3.03 above is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

Description |

|

2.1 |

Agreement and Plan of Merger |

|

3.1 |

Certificate of Incorporation of Paulson Capital (Delaware) Corp. |

|

3.2 |

Bylaws of Paulson Capital (Delaware) Corp. |

|

3.3 |

Certificate of Designation for Series A Preferred Stock of Paulson Capital (Delaware) Corp. |

|

4.1 |

Form of Common Stock Certificate |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PAULSON CAPITAL (DELAWARE) CORP. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

Date: March 26, 2014 |

By: |

/s/ Trent Davis |

|

|

|

|

Trent Davis |

|

|

|

|

President |

|

EXHIBIT INDEX

|

Exhibit No. |

Description |

|

2.1 |

Agreement and Plan of Merger |

|

3.1 |

Certificate of Incorporation of Paulson Capital (Delaware) Corp. |

|

3.2 |

Bylaws of Paulson Capital (Delaware) Corp. |

|

3.3 |

Certificate of Designation for Series A Preferred Stock of Paulson Capital (Delaware) Corp. |

|

4.1 |

Form of Common Stock Certificate |

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

OF

PAULSON CAPITAL CORP., AN OREGON CORPORATION

AND

PAULSON CAPITAL (DELAWARE) CORP., A DELAWARE CORPORATION

THIS AGREEMENT AND PLAN OF MERGER (the “Agreement”) dated as of March 20, 2014, made and entered into by and between Paulson Capital Corp., an Oregon corporation (“Paulson OR”), and Paulson Capital (Delaware) Corp., a Delaware corporation (“Paulson DE”), which corporations are sometimes referred to herein as the “Constituent Corporations.”

WITNESSETH:

WHEREAS, Paulson OR is a corporation organized and existing under the laws of the State of Oregon, having been incorporated on December 18, 1970, under the Oregon Business Corporation Act; and

WHEREAS, Paulson OR’s authorized capital consists of 10,500,000 shares of capital stock of which 10,000,000 shares are common stock, no par value per share (the “Oregon Common Stock”) and 500,000 shares are preferred stock, no par value per share, of which 500,000 are designated as Series A Convertible Preferred Stock, no par value per share (the “Oregon Series A Preferred Stock”); and

WHEREAS, Paulson DE is a wholly-owned subsidiary corporation of Paulson OR organized and existing under the laws of the State of Delaware, having been incorporated on March 20, 2014, under the Delaware General Corporation Law; and

WHEREAS, Paulson DE’s authorized capital consists of 120,000,000 shares of capital stock of which 90,000,000 are common stock, par value $0.0001 per share (the “Surviving Common Stock”) and 30,000,000 shares are preferred stock, $0.0001 per share (the “Surviving Preferred Stock”). Of the Surviving Preferred Stock, 500,000 shares are designated as Series A Convertible Preferred Stock, par value $0.0001 per share (the “Surviving Series A Preferred Stock”); and

WHEREAS, the respective Boards of Directors of Paulson OR and Paulson DE have determined that it is desirable to merge Paulson OR with and into Paulson DE and that Paulson DE shall be the surviving corporation (the “Merger”); and

WHEREAS, the parties intend by this Agreement to effect a reorganization under Section 368 of the Internal Revenue Code of 1986, as amended.

NOW, THEREFORE, in consideration of the mutual covenants and promises contained in this Agreement, and for other valuable consideration, the receipt and adequacy of which are hereby acknowledged, and intending to be legally bound, Paulson OR and Paulson DE hereto agree as follows:

ARTICLE I

MERGER

1.1 On the effective date of the Merger (the “Effective Date”), as provided herein, Paulson OR shall be merged with and into Paulson DE, the separate existence of Paulson OR shall cease and Paulson DE (hereinafter sometimes referred to as the “Surviving Corporation”) shall continue to exist under the name of Paulson Capital (Delaware) Corp. by virtue of, and shall be governed by, the laws of the State of Delaware. The address of the registered office of the Surviving Corporation in the State of Delaware will be 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808; and the name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service Company.

ARTICLE II

CERTIFICATE OF INCORPORATION OF SURVIVING CORPORATION

2.1 The name of the Surviving Corporation shall be “Paulson Capital (Delaware) Corp.” The Certificate of Incorporation of the Surviving Corporation, attached hereto as Exhibit A, as in effect on the date hereof, shall be the Certificate of Incorporation of Paulson DE without change, unless and until amended in accordance with this Agreement or otherwise amended in accordance with applicable law.

ARTICLE III

BYLAWS OF THE SURVIVING CORPORATION

3.1 The Bylaws of the Surviving Corporation, as in effect on the date hereof shall be the Bylaws of Paulson DE without change, unless and until amended in accordance with Article VIII of this Agreement or otherwise amended in accordance with applicable law.

ARTICLE IV

EFFECT OF MERGER ON STOCK OF CONSTITUENT CORPORATIONS

4.1 On the Effective Date, the holders of the Oregon Common Stock and the Oregon Series A Preferred Stock of Paulson OR shall receive one share of Surviving Common Stock and one share of Surviving Series A Preferred Stock, respectively, of Paulson DE as consideration and in exchange for each one share of Oregon Common Stock or one share of Oregon Series A Preferred Stock (as the case may be) of Paulson OR and shall have no further claims of any kind or nature; and all of the Surviving Common Stock of Paulson DE held by Paulson OR shall be surrendered and canceled. Each holder of record of any outstanding certificate or certificates theretofore representing Oregon Common Stock or Oregon Series A Preferred Stock of Paulson OR may surrender the same to the Surviving Corporation at its offices, and such holder shall be entitled upon such surrender to receive in exchange therefor a certificate or certificates representing the number of shares of Surviving Common Stock or Surviving Series A Preferred Stock (as the case may be) of the Surviving Corporation equal to the number of shares of Oregon Common Stock or Oregon Preferred Stock of the Corporation represented by such surrendered certificates (the “Conversion Amount”), provided however, that each certificate or certificates of the Corporation bearing a restrictive legend shall bear the same restrictive legend on the certificate or certificates of the Surviving Corporation. Until so surrendered, each outstanding certificate which prior to the effective time of the Merger represented one or more shares of stock of the Corporation shall be deemed for all corporate purposes to evidence ownership of shares of stock of the Surviving Corporation equal to the Conversion Amount.

4.2 On the Effective Date, the holders of any options, warrants, or other securities of Paulson OR shall be enforced against Paulson DE to the same extent as if such options, warrants, or other securities had been issued by Paulson DE.

ARTICLE V

CORPORATE EXISTENCE, POWERS AND LIABILITIES OF THE SURVIVING

CORPORATION

5.1 On the Effective Date, the separate existence of Paulson OR shall cease. Paulson OR shall be merged with and into Paulson DE, the Surviving Corporation, in accordance with the provisions of this Agreement. Thereafter, Paulson DE shall possess all the rights, privileges, powers and franchises of a public as well as of a private nature, and shall be subject to all the restrictions, disabilities and duties of each of the parties to this Agreement; all singular rights, privileges, powers and franchises of Paulson OR and Paulson DE, and all property, real, personal and mixed and all debts due to each of them on whatever account, shall be vested in Paulson DE, and all contractual rights and obligations shall be transferred and/or assigned to Paulson DE; and all property, rights, privileges, powers and franchises, and all and every other interest shall be thereafter the property of Paulson DE, the Surviving Corporation, as they were of the respective constituent entities, and the title to any real estate, whether by deed or otherwise, vested in Paulson OR and Paulson DE, or either of them, shall not revert or be in any way impaired by reason of the Merger, but all rights of creditors and all liens upon the property of the parties hereto, shall be preserved unimpaired, and all debts, liabilities and duties of Paulson OR shall thenceforth attach to Paulson DE, and may be enforced against it to the same extent as if said debts, liabilities and duties had been incurred or contracted by it.

5.2 Paulson OR agrees that it will execute and deliver, or cause to be executed and delivered, all such deeds and other instruments and will take or cause to be taken such further or other action as the Surviving Corporation may deem necessary in order to vest in and confirm to the Surviving Corporation title to and possession of all the property, rights, privileges, immunities, powers, purposes and franchises, and all and every other interest of Paulson OR and otherwise to carry out the intent and purposes of this Agreement.

ARTICLE VI

OFFICERS AND DIRECTORS OF SURVIVING CORPORATION

6.1 Upon the Effective Date, the officers and directors of Paulson DE shall be the officers and directors of the Surviving Corporation.

6.2 If upon the Effective Date, a vacancy shall exist in the Board of Directors of the Surviving Corporation, such vacancy shall be filled in the manner provided by the Paulson DE Bylaws.

ARTICLE VII

APPROVAL BY SHAREHOLDERS, EFFECTIVE DATE, CONDUCT OF BUSINESS

PRIOR TO EFFECTIVE DATE

7.1 Promptly after the approval of this Agreement by the requisite number of shareholders of Paulson OR and Paulson DE, the respective Boards of Directors of Paulson OR and Paulson DE will cause their duly authorized officers to make and execute a Certificate of Merger or other applicable certificates or documentation effecting this Agreement and shall cause the same to be filed with the Secretary of State of the State of Oregon and the Secretary of the State of Delaware, respectively, in accordance with the Oregon Business Corporation Act and the Delaware General Corporation Law. The Effective Date shall be the date on which the Certificate of Merger is filed with the Secretaries of the State of Oregon and the State of Delaware.

7.2 The Boards of Directors of Paulson OR and Paulson DE may amend this Agreement and the Paulson DE Certificate of Incorporation or Paulson DE Bylaws at any time prior to the Effective Date, provided that an amendment made subsequent to the approval of the Merger by the shareholders of Paulson OR may not (i) change the amount or kind of shares to be received in exchange for the Paulson OR common stock or preferred stock, as the case may be; or (ii) alter or change any of the terms and conditions of this Agreement or the Paulson DE Certificate of Incorporation or Paulson DE Bylaws if such change would adversely affect the holders of the Surviving Common Stock or the Surviving Preferred Stock.

ARTICLE VIII

TERMINATION OF MERGER

8.1 This Agreement may be terminated and the Merger abandoned at any time prior to the Effective Date, whether before or after shareholder approval of this Agreement, by the consent of the Board of Directors of Paulson OR and Paulson DE.

ARTICLE IX

MISCELLANEOUS

9.1 GOVERNING LAW. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without reference to its principles of conflicts of law.

9.2 EXPENSES. If the Merger becomes effective, the Surviving Corporation shall assume and pay all expenses in connection therewith not theretofore paid by the respective parties. If for any reason the Merger shall not become effective, Paulson OR shall pay all expenses incurred in connection with all the proceedings taken in respect of this Merger Agreement or relating thereto.

9.3 AGREEMENT. An executed copy of this Agreement will be on file at the principal place of business of the Surviving Corporation at 1331 NW Lovejoy Street, Suite 720, Portland, OR 97209, and, upon request and without cost, a copy thereof will be furnished to any shareholder.

9.4 COUNTERPARTS. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the day and year first above written.

PAULSON CAPITAL (DELAWARE) CORP.

A Delaware corporation

By: /s/ Trent D. Davis

Trent D. Davis, President

PAULSON CAPITAL CORP.

An Oregon corporation

By: /s/ Trent D. Davis

Trent D. Davis, President

Exhibit A

(Certificate of Incorporation)

Exhibit 3.1

CERTIFICATE OF INCORPORATION

OF

PAULSON CAPITAL (DELAWARE) CORP.

First: The name of this Corporation is Paulson Capital (Delaware) Corp.

Second: The address, including street, number, city and county, of the registered office of the Corporation in the State of Delaware is 2711 Centerville Road, Suite 400, Wilmington 19808, County of New Castle; and the name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service Company.

Third: The nature of the business and of the purposes to be conducted and promoted by the Corporation is to conduct any lawful business, to promote any lawful purpose, and to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware.

FOURTH:

A. Number of Directors. The number of directors of the Corporation shall be fixed by the bylaws of the Corporation.

B. Classified Board. The Board of Directors of the Corporation shall be classified into three classes, as nearly equal in number as possible, with staggered terms as provided under section 141(d) of the General Corporation Law of the State of Delaware, with one class being elected each year to serve a staggered three-year term. Directors in each class shall be elected at the annual meeting of shareholders of the Corporation. The directors initially elected in Class I will serve until the 2014 annual meeting of shareholders and the election and qualification of their successors. The directors initially elected in Class II will serve until the 2015 annual meeting of shareholders and the election and qualification of their successors. The directors initially elected in Class III will serve until the 2016 annual meeting of shareholders and the election and qualification of his or her successors. Beginning with the election of directors to be held at the 2014 annual meeting of shareholders, and going forward, the class of directors to be elected in such year shall be elected for a three-year term, and at each successive annual meeting of shareholders, the class of directors to be elected in such year would be elected for a three-year term, so that the term of office of one class of directors shall expire in each year. Any director appointed by the Board of Directors of the Corporation to fill a vacancy of a director that resigns, retires, is removed, or otherwise ceases to serve prior to the end of such director’s term in office, shall hold office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and qualified or until his or her earlier resignation, removal or death.

FIFTH:

A. Classes and Number of Shares. The total number of shares of stock that the Corporation shall have authority to issue is One Hundred and Twenty Million (120,000,000). The classes and aggregate number of shares of each class which the Corporation shall have authority to issue are as follows:

1. Ninety Million (90,000,000) shares of common stock, par value $0.0001 per share (the “Common Stock”); and

2. Thirty Million (30,000,000) shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”).

C. Blank Check Powers. The Corporation may issue any class of the Preferred Stock in any series. The Board of Directors shall have authority to establish and designate series, and to fix the number of shares included in each such series and the variations in the relative rights, preferences and limitations as between series, provided that, if the stated dividends and amounts payable on liquidation are not paid in full, the shares of all series of the same class shall share ratably in the payment of dividends including accumulations, if any, in accordance with the sums which would be payable on such shares if all dividends were declared and paid in full, and in any distribution of assets other than by way of dividends in accordance with the sums which would be payable on such distribution if all sums payable were discharged in full. Shares of each such series when issued shall be designated to distinguish the shares of each series from shares of all other series. To the maximum extent permitted by the Delaware General Corporation Law, any series or class of Preferred Stock may by vote of the holders of such series of class of Preferred Stock if set forth in the Certificate of Designation of Limitations, Rights and Preferences therefore, amend such series of class of Preferred Stock with or without the vote of any other series or class of stock of the Corporation (including Common Stock).

SIXTH: Whenever a compromise or arrangement is proposed between this Corporation and its creditors or any class of them and/or between this Corporation and its stockholders or any class of them, any court of equitable jurisdiction within the State of Delaware may, on the application in a summary way of this Corporation or any creditor or stockholder thereof or on the application of any receiver or receivers appointed for this Corporation under the provisions of Section 291 of Title 8 of the Delaware Code or on the application of trustees in dissolution or of any receiver or receivers appointed for this Corporation under the provisions of Section 279 of Title 8 of the Delaware Code order a meeting of the creditors or class of creditors, and/or of the stockholders or class of stockholders, of this Corporation, as the case may be, to be summoned in such manner as the said court directs. If a majority in number representing three-fourths in value of the creditors or class of creditors, and/or of the stockholders or class of stockholders, of this Corporation, as the case may be, agree to any compromise or arrangement and to any reorganization of this Corporation as a consequence of such compromise or arrangement, the said compromise or arrangement and the said reorganization shall, if sanctioned by the court to which the said application has been made, be binding on all the creditors or class of creditors, and/or on all the stockholders or class of stockholders, of this Corporation, as the case may be, and also on this Corporation.

SEVENTH: The original Bylaws of the Corporation shall be adopted by the incorporator. Thereafter, the power to make, alter, or repeal the Bylaws, and to adopt any new Bylaw, shall be vested in the Board of Directors.

EIGHTH: To the fullest extent that the General Corporation Law of the State of Delaware, as it exists on the date hereof or as it may hereafter be amended, permits the limitation or elimination of the liability of directors, no director of this Corporation shall be personally liable to this Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. Notwithstanding the foregoing, a director shall be liable to the extent provided by applicable law: (1) for any breach of the directors’ duty of loyalty to the Corporation or its stockholders; (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (3) under Section 174 of the General Corporation Law of the State of Delaware; or (4) for any transaction from which the director derived any improper personal benefit. Neither the amendment nor repeal of this Article, nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article, shall adversely affect any right or protection of a director of the Corporation existing at the time of such amendment or repeal.

NINTH: The Corporation shall, to the fullest extent permitted by Section 145 of the General Corporation Law of the State of Delaware, as the same may be amended and supplemented, indemnify any and all persons whom it shall have power to indemnify under said section from and against any and all of the expenses, liabilities or other matters referred to in or covered by said section. The Corporation shall advance expenses to the fullest extent permitted by said section. Such right to indemnification and advancement of expenses shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person. The indemnification and advancement of expenses provided for herein shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any Bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

TENTH: The name and mailing address of the incorporator is:

Trent D. Davis

c/o Paulson Capital (Delaware) Corp.

1331 NW Lovejoy Street

Suite 720

Portland, Oregon 97209

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Incorporation to be executed on this 20th day of March, 2014.

|

|

/s/ Trent D. Davis |

|

|

|

Trent D. Davis, Incorporator |

|

Exhibit 3.2

BYLAWS

OF

PAULSON CAPITAL (DELAWARE) Corp.

(A Delaware corporation)

_________________________________________________________

ARTICLE I

STOCKHOLDERS

1.1 CERTIFICATES REPRESENTING STOCK.

(a) Execution of Certificate. Every holder of stock in the corporation shall be entitled to have a certificate signed by, or in the name of, the corporation by the Chairman or Vice-Chairman of the Board of Directors, if any, or by the President or a Vice-President and by the Treasurer or an Assistant Treasurer or the Secretary or an Assistant Secretary of the corporation representing the number of shares owned by him in the corporation. If such certificate is countersigned by a transfer agent other than the corporation or its employee or by a registrar other than the corporation or its employee, any other signature on the certificate may be a facsimile. In case any officer, transfer agent, or registrar who has signed or whose facsimile signature has been placed upon a certificate shall have ceased to be such officer, transfer agent, or registrar before such certificate is issued, it may be issued by the corporation with the same effect as if he were such officer, transfer agent, or registrar at the date of issue.

(b) Legends. Whenever the corporation shall be authorized to issue more than one class of stock or more than one series of any class of stock, and whenever the corporation shall issue any shares of its stock as partly paid stock, the certificates representing shares of any such class or series or of any such partly paid stock shall set forth thereon the statements prescribed by the Delaware General Corporation Law, 8 Del. C. § 101 et seq. (the “General Corporation Law”). Any restrictions on the transfer or registration of transfer of any shares of stock of any class or series shall be noted conspicuously on the certificate representing such shares.

(c) Lost, Stolen or Destroyed Certificates. The corporation may issue a new certificate of stock in place of any certificate theretofore issued by it, alleged to have been lost, stolen, or destroyed, and the Board of Directors may require the owner of any lost, stolen, or destroyed certificate, or his legal representative, to give the corporation a bond sufficient to indemnify the corporation against any claim that may be made against it on account of the alleged loss, theft, or destruction of any such certificate or the issuance of any such new certificate.

(d) Book Entry Form. Notwithstanding anything herein contained to the contrary, the corporation may issue shares of its stock in uncertificated or book-entry form. In such event, the corporation’s transfer agent and registrar shall keep appropriate records indicating (a) the person to whom such uncertificated shares of stock were issued, (b) the number, class and designation of series, if any, of shares of stock held by such person and (c) other information deemed relevant to the corporation.

1.2 FRACTIONAL SHARE INTERESTS.

The corporation may, but shall not be required to, issue fractions of a share.

1.3 STOCK TRANSFERS.

Upon compliance with provisions restricting the transfer or registration of transfer of shares of stock, if any, transfers or registration of transfer of shares of stock of the corporation shall be made only on the stock ledger of the corporation by the registered holder thereof, or by his attorney thereunto authorized by power of attorney duly executed and filed with the Secretary of the corporation or with a transfer agent or a registrar, if any, and on surrender of the certificate or certificates for such shares of stock properly endorsed and the payment of all taxes due thereon.

1.4 RECORD DATE FOR STOCKHOLDERS.

(a) Voting; Meeting Notice. In order that the corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which record date shall not be more than sixty (60) nor less than ten (10) days before the date of such meeting. If no record date has been fixed by the board of directors, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the board of directors may fix a new record date for the adjourned meeting.

(b) Dividend or other Rights Regarding Shares. In order that the corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment of any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than sixty (60) days prior to such action. If no record date has been fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the board of directors adopts the resolution relating thereto.

1.5. MEANING OF CERTAIN TERMS.

As used herein in respect of the right to notice of a meeting of stockholders or a waiver thereof or to participate or vote thereat or to consent or dissent in writing in lieu of a meeting, as the case may be, the term “share” or “shares” or “share of stock” or “shares of stock” or “stockholder” or “stockholders” refers to an outstanding share or shares of stock and to a holder or holders of record of outstanding shares of stock when the corporation is authorized to issue only one class of shares of stock, and said reference is also intended to include any outstanding share or shares of stock and any holder or holders of record of outstanding shares of stock of any class upon which or upon whom the certificate of incorporation confers such rights where there are two or more classes or series of shares of stock or upon which or upon whom the General Corporation Law confers such rights notwithstanding that the certificate of incorporation may provide for more than one class or series of shares of stock, one or more of which are limited or denied such rights thereunder; provided, however, that no such right shall vest in the event of an increase or a decrease in the authorized number of shares of stock of any class or series which is otherwise denied voting rights under the provisions of the certificate of incorporation, including any preferred stock which is denied voting rights under the provisions of the resolution or resolutions adopted by the Board of Directors with respect to the issuance thereof.

1.6. STOCKHOLDER MEETINGS.

(a) Time. The annual meeting shall be held each year on the date and at the time fixed, from time to time, by the Board of Directors which shall be not more than thirteen (13) months following the prior annual meeting. Special meetings shall be held on the date and at the time fixed by the directors.

(b) Place. Annual meetings and special meetings shall be held at such place, within or without the State of Delaware, as the Board of Directors may, from time to time, fix. Whenever the Board of Directors shall fail to fix such place, the meeting shall be held at the registered office of the corporation in the State of Delaware.

(c) Call. Annual meetings and special meetings may be called by the Board of Directors or by any officer instructed by the Board of Directors to call the meeting or by stockholders owning not less than 75% of the voting stock of the corporation.

(d) Notice. Written notice of all meetings shall be given, stating the place, date, and hour of the meeting. The notice of an annual meeting shall state that the meeting is called for the election of directors and for the transaction of other business which may properly come before the meeting, and shall (if any other action which could be taken at a special meeting is to be taken at such annual meeting), state such other action or actions as are known at the time of such notice. The notice of a special meeting shall in all instances state the purpose or purposes for which the meeting is called. If any action is proposed to be taken which would, if taken, entitle stockholders to receive payment for their shares of stock, the notice shall include a statement of that purpose and to that effect. Except as otherwise provided by the General Corporation Law, a copy of the notice of any meeting shall be given, personally or by mail, not less than ten days nor more than sixty (60) days before the date of the meeting, unless the lapse of the prescribed period of time shall have been waived, and directed to each stockholder at his address as it appears on the records of the corporation. Notice by mail shall be deemed to be given when deposited, with postage thereon prepaid, in the United States mail. Electronic notice shall be effective as written notice and shall be deemed to be given when sent to each stockholder consenting to notices by electronic mail.

(e) Notice to Stockholders Sharing an Address. Without limiting the manner by which notice may be effectively given to stockholders, to the extent permitted by Section 233 of the General Corporation Law, a notice to stockholders shall be effective if given by single written notice to stockholders sharing an address if consented to by such stockholders at that address to whom notice is given and if such consent has not been revoked as provided by law. Any stockholder who fails to object in writing to the corporation within sixty (60) days of having been given written notice by the corporation of its intent to send a single notice to multiple stockholders sharing an address with that stockholder shall be deemed to have consented to receiving such single written notice.

(f) Notice of Adjourned Meeting. If a meeting is adjourned to another time, not more than thirty (30) days hence, and/or to another place, and if an announcement of the adjourned time and place is made at the meeting, it shall not be necessary to give notice of the adjourned meeting unless the directors, after adjournment, fix a new record date for the adjourned meeting.

(g) Waiver of Notice. Notice need not be given to any stockholder who submits a written waiver of notice by him before or after the time stated therein. Attendance of a person at a meeting of stockholders shall constitute a waiver of notice of such meeting, except when the stockholder attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special meeting of the stockholders need be specified in any written waiver of notice.

(h) Stockholder List. There shall be prepared and made, at least ten days before every meeting of stockholders, a complete list of the stockholders, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Nothing in these Bylaws shall require the corporation to provide electronic mail addresses or other electronic mail information as a part of such list. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten days prior to the meeting either (i) on a reasonably accessible electronic network available only to stockholders, provided that information required to gain access to such list is provided with the notice of the meeting, or (ii) during ordinary business hours, at the principal place of business of the corporation. . If the meeting is to be held at a physical location, the list shall also be produced and kept at the time and place of the meeting during the whole time thereof, and may be inspected by any stockholder who is present. If the list is maintained on a reasonably accessible electronic network in accordance with (i) above, it shall be open to the examination of any stockholder during the duration of the meeting, and the information required to access such list shall be provided with the notice of the meeting. The stock ledger shall be the only evidence as to who are the stockholders entitled to examine the stock ledger, the list required by this section or the books of the corporation, or to vote at any meeting of stockholders.

(i) Conduct Of Meeting. Meetings of the stockholders shall be presided over by one of the following officers in the order of seniority and if present and acting: the Chairman of the Board, if any, the Vice-Chairman of the Board, if any, the President, a Vice President, a chairman for the meeting chosen by the Board of Directors, or, if none of the foregoing is in office and present and acting, by a chairman to be chosen by the stockholders. The Secretary of the corporation, or, in his absence, an Assistant Secretary, shall act as secretary of every meeting, but if neither the Secretary nor an Assistant Secretary is present the Chairman for the meeting shall appoint a secretary of the meeting.

(j) Proxy Representation. Every stockholder may authorize another person or persons to act for him by proxy in all matters in which a stockholder is entitled to participate, including, without limitation, by waiving notice of any meeting, voting or participating at a meeting, or expressing consent or dissent without a meeting. Every proxy must be signed by the stockholder or by his attorney-in-fact. No proxy shall be voted or acted upon after three years from its date unless such proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and, if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may be made irrevocable regardless of whether the interest with which it is coupled is an interest in the stock itself or an interest in the corporation generally.

(k) Inspectors And Judges. The directors, in advance of any meeting, may, but need not, appoint one or more inspectors of election or judges of the vote, as the case may be, to act at the meeting or any adjournment thereof. If an inspector or inspectors or judge or judges are not appointed in advance, the person presiding at the meeting may, but need not, appoint one or more inspectors or judges. In case any person who may be appointed as an inspector or judge fails to appear or act, the vacancy may be filled by appointment made by the person presiding thereat. Each inspector or judge, if any, before entering upon the discharge of his duties, shall take and sign an oath faithfully to execute the duties of inspector or judge at such meeting with strict impartiality and according to the best of his ability. The inspectors or judges, if any, shall determine the number of shares of stock outstanding and the voting power of each, the shares of stock represented at the meeting, the existence of a quorum, the validity and effect of proxies, and shall receive votes, ballots or consents, hear and determine all challenges and questions arising in connection with the right to vote, count and tabulate all votes, ballots or consents, determine the result, and do such acts as are proper to conduct the election or vote with fairness to all stockholders. On request of the person presiding at the meeting, the inspector or inspectors or judge or judges, if any, shall make a report in writing of any challenge, question or matter determined by him or them and execute a certificate of any fact found by him or them.

(l) Quorum. Except as the General Corporation Law or these Bylaws may otherwise provide, the holders of a majority of the outstanding shares of stock entitled to vote shall constitute a quorum at a meeting of stockholders for the transaction of any business. The stockholders present may adjourn the meeting despite the absence of a quorum. When a quorum is once present to organize a meeting, it is not broken by the subsequent withdrawal of any stockholders.

(m) Voting. Each stockholder entitled to vote in accordance with the terms of the certificate of incorporation and of these Bylaws, or, with respect to the issuance of Preferred Stock, in accordance with the terms of a resolution or resolutions of the Board of Directors, shall be entitled to one vote, in person or by proxy, for each share of stock entitled to vote held by such stockholder. In the election of directors, a plurality of the votes present at the meeting shall elect. Any other action shall be authorized by a majority of the votes cast except where the certificate of incorporation or the General Corporation Law prescribes a different percentage of votes and/or a different exercise of voting power. Voting by ballot shall not be required for corporate action except as otherwise provided by the General Corporation Law or these Bylaws.

1.7. Stockholder Action Without Meetings.

Any action required to be taken, or any action which may be taken, at any annual or special meeting of stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written consent shall be given to those stockholders who have not consented in writing and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date therefor had been the date consents signed by a sufficient number of holders to take the action were delivered to the corporation as required by statute and these Bylaws, and shall be delivered to the corporation by delivery to its registered office in Delaware, its principal place of business, or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to a corporation's registered office shall be by hand or by certified or registered mail, return receipt requested.

1.8. Notice Of Stockholder Business.

(a) Generally. At any annual or special meeting of the stockholders or upon written consent of the stockholders without a meeting, only such business shall be conducted as shall have been brought before the meeting (A) pursuant to the corporation’s notice of meeting, (B) by or at the direction of the Board of Directors or (C) by any stockholder of the corporation who is a stockholder of record at the time of giving of the notice provided for in this Bylaw, who shall be entitled to vote at such meeting and who complies with the notice procedures set forth in these Bylaws. To the extent that a special meeting is called by stockholders having the ownership threshold set forth in these Bylaws, only the stockholders requesting such meeting and the corporation may propose business to be conducted at such special meeting.

Notwithstanding anything in these Bylaws to the contrary, no business shall be conducted at an annual meeting except in accordance with the procedures set forth in this Bylaw. The Chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that business was not properly brought before the meeting and in accordance with the procedures prescribed by these Bylaws, and if he should so determine, he shall so declare to the meeting and any such business not properly brought before the meeting shall not be transacted.

(b) Stockholder Proposals Relating to Nominations for and Election of Directors.

Nominations by a stockholder of candidates for election to the Board of Directors by stockholders at a meeting of stockholders or upon written consent without a meeting may be made only if the stockholder complies with the procedures set forth in this Bylaw, and any candidate proposed by a stockholder not nominated in accordance with such provisions shall not be considered or acted upon for execution at such meeting of stockholders.

(i) Eligibility. A proposal by a stockholder for the nomination of a candidate for election by stockholders as a director at any meeting of stockholders at which directors are to be elected or upon written consent without a meeting may be made only by a stockholder who (A) was a stockholder of record at the time of giving of notice provided for in this Bylaw, (B) is entitled to vote at the meeting, (C) complies with the notice procedures set forth in this Bylaw, and (D) holds not less than 5% of the shares of stock entitled to vote at the meeting, and who gives notice in writing, delivered in person or by first class United States mail postage prepaid or by reputable overnight delivery service, to the Board of Directors of the corporation to the attention of the Secretary of the corporation at the principal office of the corporation, within the time limits specified herein.

(ii) Timing. In the case of an annual meeting of stockholders, any such written proposal of nomination must be received by the Board of Directors not less than ninety (90) days nor more than one hundred twenty (120) days before the first anniversary of the date on which the corporation held its annual meeting in the immediately preceding year; provided, however, that in the case of an annual meeting of stockholders (A) that is called for a date that is not within thirty (30) days before or after the first anniversary date of the annual meeting of stockholders in the immediately preceding year, or (B) in the event that the corporation did not have an annual meeting of stockholders in the prior year any such written proposal of nomination must be received by the Board of Directors not less than ten days after the earlier of the date the corporation shall have (w) mailed notice to its stockholders that an annual meeting of stockholders will be held or (x) issued a press release, or (y) filed a periodic report with the Securities and Exchange Commission (the “SEC”) or (z) otherwise publicly disseminated notice that an annual meeting of stockholders will be held.

In the case of a special meeting of stockholders, any such written proposal of nomination must be received by the Board of Directors not less than ten days after the earlier of the date that the corporation shall have mailed notice to its stockholders that a special meeting of stockholders will be held or shall have issued a press release, filed a periodic report with the SEC or otherwise publicly disseminated notice that a special meeting of stockholders will be held.

In the case of stockholder action by written consent with respect to the election by stockholders of a candidate as director, the stockholder seeking to have the stockholders elect such candidate by written consent shall submit a written proposal of nomination to the Board of Directors not less than forty-five (45) days nor more than ninety (90) days prior to the record date for such election.

(iii) Content of Notice. The written proposal of nomination required by this Bylaw shall set forth: (A) the name and address of the stockholder who intends to make the nomination, and the name and address of the beneficial owner, if any, on whose behalf the proposal is made, (B) the name, age, business address and, if known, residence address of each person so proposed, (C) the principal occupation or employment of each person so proposed for the past five (5) years, (D) the number of shares of capital stock of the corporation beneficially owned within the meaning of SEC Rule 13d-1 by each person so proposed and the earliest date of acquisition of any such capital stock and the class and number of shares of the corporation which are beneficially held by such stockholder, any voting rights with respect to shares not beneficially owned and other ownership or voting interest in shares of the corporation, whether economic or otherwise, including derivatives and hedges, (E) a description of any arrangement or understanding between each person so proposed and the stockholder(s) making such nomination with respect to such person's proposal for nomination and election as a director and actions to be proposed or taken by such person if elected a director, (F) the written consent of each person so proposed to serve as a director if nominated and elected as a director and (G) such other information regarding each such person as would be required under the proxy solicitation rules of the SEC if proxies were to be solicited for the election as a director of each person so proposed.

If a written proposal of nomination timely submitted to the Board of Directors fails, in the reasonable judgment of the Board of Directors or a nominating committee established by it, to contain the information specified in the preceding paragraph of this Bylaw or is otherwise deficient (except as to timeliness), the Board of Directors shall, as promptly as is practicable under the circumstances, provide written notice to the stockholder(s) making such nomination of such failure or deficiency in the written proposal of nomination and such nominating stockholder shall have five (5) days from receipt of such notice to submit a revised written proposal of nomination that corrects such failure or deficiency in all material respects.

(c) Stockholder Proposals Relating to Matters Other Than Nominations for and Elections of Directors.

(i) Eligibility. A stockholder who (A) holds not less than 5% of the shares of stock entitled to vote, (B) was a stockholder of record at the time of giving of notice provided for in this Bylaw, (C) is entitled to vote at the meeting and (D) complies with the notice procedures set forth in this Bylaw, may bring a matter (other than a nomination of a candidate for election as a director) before a meeting of stockholders or for action by written consent without a meeting only (x) if such stockholder matter is a proper matter for stockholder action and (y) such stockholder shall have provided notice in writing, delivered in person or by first class United States mail postage prepaid or by reputable overnight delivery service, to the Board of Directors of the corporation to the attention of the Secretary of the corporation at the principal office of the corporation, within the time limits specified in this Bylaw; provided, however, that a proposal submitted by such a stockholder for inclusion in the corporation's proxy statement for an annual meeting that is appropriate for inclusion therein and otherwise complies (including as to timeliness) with the provisions of Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) shall be deemed to have also been submitted on a timely basis pursuant to this Bylaw.

(ii) In the case of an annual meeting of stockholders, any such written notice of a proposal of a stockholder matter must be received by the Board of Directors not less than ninety (90) days nor more than one hundred twenty (120) days before the first anniversary of the date on which the corporation held its annual meeting of stockholders in the immediately preceding year; provided, however, that (A) in the case of an annual meeting of stockholders that is called for a date which is not within thirty (30) days before or after the first anniversary date of the annual meeting of stockholders in the immediately preceding year, or (B) in the event that the corporation did not have an annual meeting of stockholders in the prior year, any such written notice of a proposal of a stockholder matter must be received by the Board of Directors not less than ten (10) days after the date the corporation shall have (w) mailed notice to its stockholders that an annual meeting of stockholders will be held or (x) issued a press release, or (y) filed a periodic report with the SEC or (z) otherwise publicly disseminated notice that an annual meeting of stockholders will be held.

In the case of a special meeting of stockholders, any such written notice of a proposal of a stockholder matter must be received by the Board of Directors not less than ten (10) days after the earlier of the date the corporation shall have mailed notice to its stockholders that a special meeting of stockholders will be held, issued a press release, filed a periodic report with the SEC or otherwise publicly disseminated notice that a special meeting of stockholders will be held.

In the case of stockholder action by written consent (other than the nomination of a candidate for election as a director), the stockholder seeking to have the stockholders authorize or take corporate action by written consent shall, by written notice to the Board of Directors, set forth the written proposal not less than forty-five (45) days nor more than ninety (90) days prior to the record date for the vote to be taken regarding such proposal.

(iii) Content of Notice. Such written notice of a proposal of a stockholder matter shall set forth information regarding such stockholder matter equivalent to the information regarding such stockholder matter that would be required under the proxy solicitation rules of the SEC if proxies were solicited for stockholder consideration of such stockholder matter at a meeting of stockholders. In addition, such notice shall include (A) the name and address of the stockholder making the proposal, and the name and address of the beneficial owner, if any, on whose behalf the proposal is made, (B) the name, age, business address and, if known, residence address of each person so proposed, (C) the number of shares of capital stock of the corporation beneficially owned within the meaning of SEC Rule 13d-1 by each person so proposed and the earliest date of acquisition of any such capital stock and the class and number of shares of the corporation which are beneficially held by such stockholder, any voting rights with respect to shares not beneficially owned and other ownership or voting interest in shares of the corporation, whether economic or otherwise, including derivatives and hedges.

If a written notice of a proposal of a stockholder matter timely submitted to the Board of Directors fails, in the reasonable judgment of the Board of Directors, to contain the information specified in this Bylaw or is otherwise deficient (except as to timeliness), the Board of Directors shall, as promptly as is practicable under the circumstances, provide written notice to the stockholder who submitted the written notice of presentation of a stockholder matter of such failure or deficiency in the written notice of presentation of a stockholder matter and such stockholder shall have five days from receipt of such notice to submit a revised written notice of presentation of a matter that corrects such failure or deficiency in all material respects.

ARTICLE II

DIRECTORS

2.1 Functions And Definition.

The business and affairs of the corporation shall be managed by or under the direction of the Board of Directors of the corporation. The use of the phrase “whole board” herein refers to the total number of directors which the corporation would have if there were no vacancies.

2.2. Qualifications And Number.

A director need not be a stockholder, a citizen of the United States, or a resident of the State of Delaware. The number of directors constituting the entire Board of Directors shall be the number, not less than one nor more than fifteen (15), fixed from time to time by a majority of the total number of directors which the corporation would have, prior to any increase or decrease, if there were no vacancies, provided, however, that no decrease shall shorten the term of an incumbent director. The number of directors may be increased or decreased by the vote of stockholders holding not less than a majority of the voting stock of the corporation then outstanding or by majority vote of the directors then in office.

2.3 Election And Term.

(a) Election. The Board of Directors of the corporation shall be classified into three classes, as nearly equal in number as possible, with staggered terms as provided under DGCL Section 141(d), with one class being elected each year to serve a staggered three-year term.

Directors in each class shall be elected at the annual meeting of stockholders of the corporation. The directors initially elected in Class I will serve until the 2014 annual meeting of stockholders and the election and qualification of their successors. The directors initially elected in Class II will serve until the 2015 annual meeting of stockholders and the election and qualification of their successors. The directors initially elected in Class III will serve until the 2016 annual meeting of stockholders and the election and qualification of his or her successor.

Beginning with the election of directors to be held at the 2014 annual meeting of stockholders, and going forward, the class of directors to be elected in such year (Class I) shall be elected for a three-year term, and at each successive annual meeting of stockholders, the class of directors to be elected in such year would be elected for a three-year term, so that the term of office of one class of directors shall expire in each year.

Any director appointed by the Board of Directors of the corporation to fill a vacancy of a director that resigns, retires, is removed, or otherwise ceases to serve prior to the end of such director’s term in office, shall hold office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and qualified or until his or her earlier resignation, removal or death.”

(b) Resignations. Any director of the corporation may resign at any time by giving written notice to the Board or to the Secretary of the corporation. Any such resignation shall take effect at the time specified therein, or, if the time be not specified, it shall take effect immediately upon its receipt; and unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective.

(c) Removal. Subject to the rights of any class or series of stock having a preference over the common stock as to dividends or upon liquidation to elect directors under specified circumstances, any director may be removed from office at any time, but only:

(i) for cause, which may include any adjudication in any civil suit, or written acknowledgment by the director in any agreement or stipulation of the Securities Exchange Commission of any theft, embezzlement or fraud and only by the affirmative vote of the holders of at least a majority of the combined voting power of the then outstanding shares of stock entitled to vote generally in the election of directors, voting together as a single class; or

(ii) by a vote of a majority of the other members of the Board in the case of a conviction of or plea of guilty or nolo contendere by such director to either (A) a felony, or (B) any crime involving fraud or embezzlement, or (C) any adjudication in any civil suit, or written acknowledgment by the director in any agreement or stipulation of the Securities Exchange Commission of any theft, embezzlement or fraud.

2.4. Meetings.

(a) Time. Meetings of the Board of Directors shall be held at such time as the Board shall fix.

(b) First Meeting. The first meeting of each newly elected Board may be held immediately after each annual meeting of the stockholders at the same place at which the meeting is held, and no notice of such meeting shall be necessary to call the meeting, provided a quorum shall be present. In the event such first meeting is not so held immediately after the annual meeting of the stockholders, it may be held at such time and place as shall be specified in the notice given as hereinafter provided for special meetings of the Board of Directors, or at such time and place as shall be fixed by the consent in writing of all of the directors.

(c) Place. Meetings, both regular and special, shall be held at such place within or without the State of Delaware as shall be fixed by the Board. Directors may participate in any regular or special meeting of the Board (or any committee of the Board) by means of conference telephone or similar communications equipment pursuant to which all persons participating in the meeting of the Board can hear each other, and such participation shall constitute presence in person at such meeting.

(d) Call. No call or notice of meeting shall be required for regular meetings for which the time and place have been fixed. Special meetings may be called by or at the direction of the Chairman of the Board, if any, the Vice-Chairman of the Board, if any, or the President, or of a majority of the directors in office.

(e) Notice Or Actual Or Constructive Waiver. No notice shall be required for regular meetings for which the time and place have been fixed. Written, oral, or any other mode of notice of the time and place shall be given for special meetings at least twenty-four hours prior to the meeting. The notice of any meeting need not specify the purpose of the meeting. Any requirement of furnishing a notice shall be waived by any director who signs a written waiver of such notice before or after the time stated therein.

Attendance of a director at a meeting of the Board shall constitute a waiver of notice of such meeting, except when the director attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened.

(f) Quorum And Action. A majority of the Board then in office shall constitute a quorum, except when a vacancy or vacancies prevents such majority, whereupon a majority of the directors in office shall constitute a quorum, provided that such majority shall constitute at least one-third (1/3) of the whole Board. Any director may participate in a meeting of the Board by means of a conference telephone or similar communications equipment by means of which all directors participating in the meeting can hear each other, and such participation in a meeting of the Board shall constitute presence in person at such meeting. A majority of the directors present, whether or not a quorum is present, may adjourn a meeting to another time and place. Except as herein otherwise provided, and except as otherwise provided by the General Corporation Law, the act of the Board shall be the act by vote of a majority of the directors present at a meeting, a quorum being present. The quorum and voting provisions herein stated shall not be construed as conflicting with any provisions of the General Corporation Law and these Bylaws which govern a meeting of directors held to fill vacancies and newly created directorships in the Board.

(g) Chairman Of The Meeting. The Chairman of the Board, if any and if present and acting, shall preside at all meetings. Otherwise, the Vice-Chairman of the Board, if any and if present and acting, or the President, if present and acting, or any other director chosen by the Board, shall preside.

(h) The Chairman Of The Board Of Directors. The Chairman of the Board of Directors, and any Vice-Chairman of the Board, may be elected by a majority vote of the Board of Directors and shall serve until the meeting of the Board of Directors next following the Annual Meeting of the Stockholders at which a Chairman, and any Vice-Chairman, shall be newly elected or re-elected from amongst the Directors then in office.

2.5. Removal Of Directors.

Except to the extent otherwise provided in the corporation’s Certificate of Incorporation or any preferred stock designation (as the same may be amended from time to time), any or all of the directors may be removed for cause or without cause by the stockholders by the vote required to elect such directors.

2.6 Committees.

The Board of Directors may, by resolution passed by a majority of the whole Board, designate one or more committees, each committee to consist of one or more of the directors of the corporation. The Board may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. Any such committee, to the extent provided in the resolution of the Board, shall have and may exercise the powers of the Board of Directors in the management of the business and affairs of the corporation, and may authorize the seal of the corporation to be affixed to all papers which may require it; provided, however, that no committee shall have power or authority in reference to the following matters: (i) approving, adopting or recommending to the stockholders any action or matter (other than the election or removal of directors) expressly required by statute to be submitted to stockholders for approval, or (ii) adopting, amending or repealing any portion of these Bylaws. In the absence or disqualification of any member of any such committee or committees, the member or members thereof present at any meeting and not disqualified from voting, whether or not he or they constitute a quorum, may unanimously appoint another member of the Board of Directors to act at the meeting in the place of any such absent or disqualified member.

2.7 Action In Writing.

Unless otherwise restricted by the certificate of incorporation or these Bylaws, any action required or permitted to be taken at any meeting of the Board of Directors or any committee thereof may be taken without a meeting if all members of the Board or committee, as the case may be, consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the Board or committee; provided that such filing may be maintained in electronic form if the records of all meeting minutes are so maintained.

2.8. Vacancies.

Between annual meetings of stockholders or special meetings of stockholders called for the election of directors and/or for the removal of one or more directors and for the filling of any vacancies in the Board of Directors, including vacancies resulting from any increase in the number of directors serving on the Board of Directors or the removal of directors for cause or without cause, any vacancy in the Board of Directors may be filled by the vote of a majority of the remaining directors then in office, although less than a quorum, or by the sole remaining director, per DGCL Section 223(a)(1).

2.9. Compensation.

The directors shall receive only such compensation for their services as directors as may be allowed by resolution of the Board. The Board may also provide that the corporation shall reimburse each such director for any expense incurred by him on account of his attendance at any meetings of the Board or Committees of the Board. Neither the payment of such compensation nor the reimbursement of such expenses shall be construed to preclude any director from serving the corporation or its subsidiaries in any other capacity and receiving compensation therefor.

ARTICLE III

OFFICERS

3.1. Executive Officers.

The directors may elect or appoint a Chairman of the Board of Directors, a Chief Executive Officer, a President, one or more Vice Presidents (one or more of whom may be denominated “Executive Vice President”), a Secretary, one or more Assistant Secretaries, a Treasurer, one or more Assistant Treasurers, and such other officers as they may determine. If the Corporation has a General Counsel or Chief Legal Officer then, whether or not official action of the Board or the Corporation is taken to appoint such person a Vice President, such person shall be deemed to be a Vice President of the Corporation. Any number of offices may be held by the same person. The Board of Directors may appoint such other officers and agents as it shall deem necessary who shall hold their offices for such terms and shall exercise such powers and perform such duties as shall be determined from time to time by the Board.

3.2. Term Of Office: Removal.

Unless otherwise provided in the resolution of election or appointment, each officer shall hold office until the meeting of the Board of Directors following the next annual meeting of stockholders and until his successor has been elected and qualified or until his earlier resignation or removal. The Board of Directors may remove any officer for cause or without cause.

3.3. Authority And Duties.

All officers, as between themselves and the corporation, shall have such authority and perform such duties in the management of the corporation as may be provided in these Bylaws, or, to the extent not so provided, by the Board of Directors.

3.4. Chief Executive Officer.

The Chief Executive Officer shall, subject to the discretion of the Board of Directors, have general supervision and control of the corporation’s business and such duties as may from time to time be prescribed by the Board of Directors.

3.5. President.

The President shall preside at all meetings of the stockholders and in the absence of the Chairman of the Board of Directors, at the meeting of the Board of Directors, shall, subject to the discretion of the Board of Directors, have general supervision and control of the corporation’s business and shall see that all orders and resolutions of the Board of Directors are carried into effect. In the absence of a separately designated Chief Executive Officer, the President shall be the Chief Executive Officer and, in the case where there is a separately designated Chief Executive Officer, shall be the Chief Operating Officer of the corporation. In addition to those powers delegated to the President by the Board of Directors, the President shall have the power to execute bonds, mortgages and other contracts requiring a seal, under the seal of the corporation, except where required or permitted by law to be otherwise signed and executed and except where the signing and execution thereof shall be expressly delegated by the board of directors to some other officer or agent of the corporation.

3.6. Vice Presidents.

Any Vice President that may have been appointed, in the absence or disability of the President, shall perform the duties and exercise the powers of the President, in the order of their seniority, and shall perform such other duties, and have such other powers, as the Board of Directors shall prescribe.

3.7. Secretary.

The Secretary shall keep in safe custody the seal of the corporation and affix it to any instrument when authorized by the Board of Directors, and shall perform such other duties as may be prescribed by the Board of Directors. The Secretary (or in his absence, an Assistant Secretary, but if neither is present another person selected by the Chairman for the meeting) shall have the duty to record the proceedings of the meetings of the stockholders and directors in a book to be kept for that purpose.

3.8. Chief Financial Officer And Treasurer.

The Chief Financial Officer shall be the Treasurer, unless the Board of Directors shall elect another officer to be the Treasurer. If the Chief Financial Officer is not the Treasurer, the Chief Financial Officer nevertheless shall be the principal financial and accounting officer of the corporation to whom the Treasurer shall report The Treasurer shall have the care and custody of the corporate funds, and other valuable effects, including securities, and shall keep full and accurate accounts of receipts and disbursements in books belonging to the corporation and shall deposit all moneys and other valuable effects in the name and to the credit of the corporation in such depositories as may be designated by the Board of Directors. The Treasurer shall disburse the funds of the corporation as may be ordered by the Board, taking proper vouchers for such disbursements, and shall render to the President and directors, at the regular meetings of the Board, or whenever they may require it, an account of all his transactions as Treasurer and of the financial condition of the corporation. If required by the Board of Directors, the Treasurer shall give the corporation a bond for such term, in such sum and with such surety or sureties as shall be satisfactory to the Board for the faithful performance of the duties of his office and for the restoration to the corporation, in case of his death, resignation, retirement or removal from office, of all books, papers, vouchers, money and other property of whatever kind in his possession or under his control belonging to the corporation.