Exhibit 99.1

Paulson Investment Company, Inc.

Statement of Financial Condition

December 31, 2013

Filed as PUBLIC information pursuant to Rule 17a-5(d) under the Securities Exchange Act of 1934.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

ANNUAL AUDITED REPORT |

SEC FILE NUMBER |

|

|

FORM X-17A-5 |

8-026807 |

|

|

PART III |

|

FACING PAGE

Information Required of Brokers and Dealers Pursuant to Section 17 of the

Securities Exchange Act of 1934 and Rule 17a-5 Thereunder

REPORT FOR THE PERIOD BEGINNING January 1, 2013 AND ENDING December 31, 2013

MM/DD/YY MM/DD/YY

A. REGISTRANT IDENTIFICATION

NAME OF BROKER-DEALER

Paulson Investment Company, Inc. OFFICIAL USE ONLY __________ ADDRESS OF PRINCIPAL PLACE OF BUSINESS: (Do not use P.O. Box No.) FIRM ID NO.

| 1331 NW Lovejoy Street, Suite 720 | ||

|

(No. and Street) |

||

|

Portland |

Oregon |

97204 |

|

(City) |

(State) |

(Zip Code) |

NAME AND TELEPHONE NUMBER OF PERSON TO CONTACT IN REGARD TO THIS REPORT

Murray G. Smith (503) 243-6005 (Area Code - Telephone No.)

B. ACCOUNTANT IDENTIFICATION

INDEPENDENT PUBLIC ACCOUNTANT whose opinion is contained in this Report*

|

PETERSON SULLIVAN LLP | |||

|

(Name - if individual, state last, first, middle name) | |||

|

601 Union Street, Suite 2300 |

Seattle |

WA |

98108 |

|

(Address) |

(City) |

(State) |

(Zip Code) |

CHECK ONE:

☒Certified Public Accountant

☐Public Accountant

☐Accountant not resident in United States or any of its possessions.

FOR OFFICIAL USE ONLY

* Claims for exemption from the requirement that the annual report be covered by the opinion of an independent public accountant must be supported by a statement of facts and circumstances relied on as the basis for the exemption. See section 240.17a-5(e)(2)

OATH OR AFFIRMATION

I, Murray Smith, swear (or affirm) that, to the best of my knowledge and belief the accompanying financial statement and supporting schedules pertaining to the firm of Paulson Investment Company, Inc. as of December 31, 2013, are true and correct. I further swear (or affirm) that neither the company nor any partner, proprietor, principal officer or director has any proprietary interest in any account classified solely as that of a customer.

|

|

|

/s/ Murray Smith |

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

State of Oregon |

|

CFO |

|

|

County of Multnomah |

|

Title |

|

|

|

|

|

|

|

Signed and sworn to before me on 27 February, 2014 by Murray Smith |

|

| |

|

|

|

|

|

|

/s/ Michele Snyder |

|

|

|

|

Notary Public |

|

|

|

This report** contains (check all applicable boxes):

|

☒ |

(a) |

Facing page. |

|

☒ |

(b) |

Statement of Financial Condition. |

|

☐ |

(c) |

Statement of Income (Loss). |

|

☐ |

(d) |

Statement of Changes in Financial Condition. (Cash Flows) |

|

☐ |

(e) |

Statement of Changes in Stockholders' Equity or Partners' or Sole Proprietor's Capital. |

|

☐ |

(f) |

Statement of Changes in Liabilities Subordinated to Claims of Creditors. (Not applicable) |

|

☐ |

(g) |

Computation of Net Capital. |

|

☐ |

(h) |

Computation for Determination of Reserve Requirements Pursuant to Rule 15c3-3. |

|

☐ |

(i) |

Information Relating to the Possession or control Requirements Under Rule 15c3-3. |

|

☐ |

(j) |

A Reconciliation, including appropriate explanation, of the Computation of Net Capital Under Rule 15c3-3 and the Computation for Determination of the Reserve Requirements Under Exhibit A of Rule 15c3-3.* |

|

☐ |

(k) |

A Reconciliation between the audited and unaudited Statements of Financial Condition with respect to methods of consolidation. (Not applicable) |

|

☒ |

(l) |

An Oath or Affirmation. |

|

☐ |

(m) |

A copy of the SIPC Supplemental Report. (See the separately bound report) |

|

☐ |

(n) |

A report describing any material inadequacies found to exist or found to have existed since the date of the previous audit. (Not applicable) |

|

☐ |

(o) |

Independent Auditors’ Report on Internal Control Required by SEC Rule 17a-5 for a broker-dealer claiming an exemption from SEC Rule 15c3-3. |

*Reserve Requirement is not applicable.

**For conditions of confidential treatment of certain portions of this filing, see section 240.17a-5(e)(3).

Contents

|

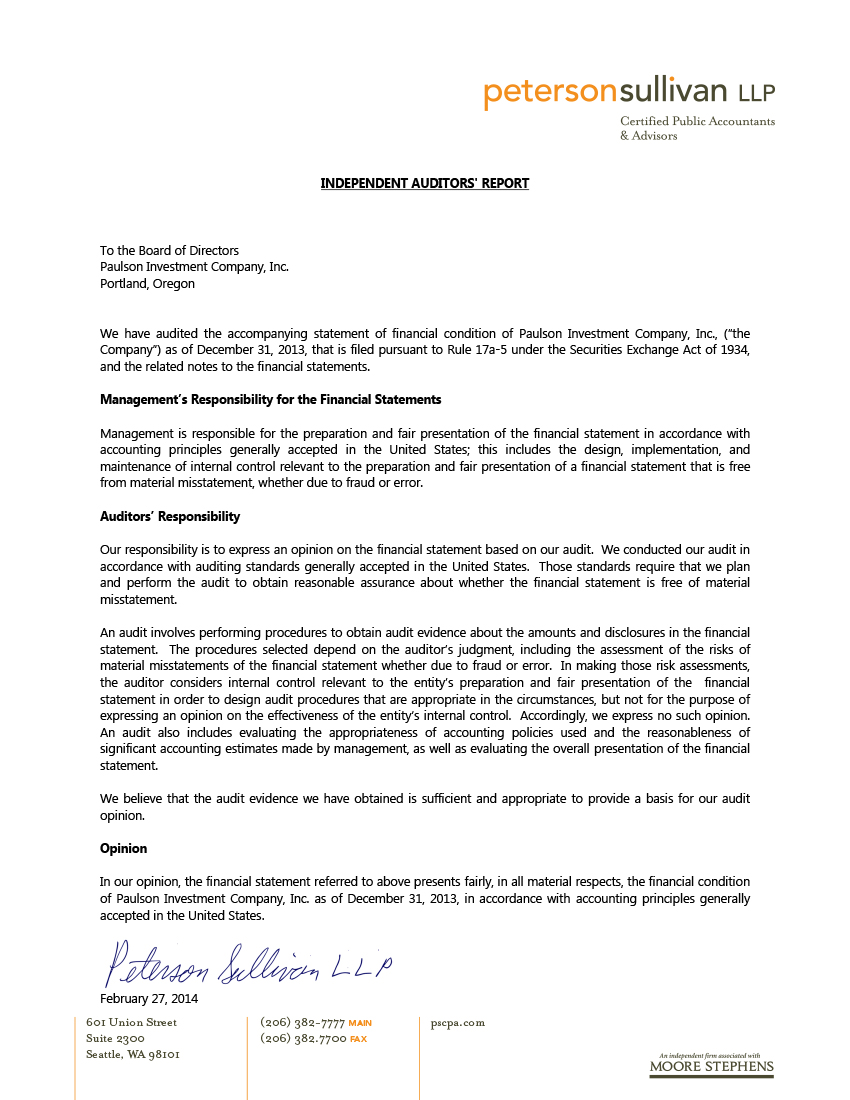

Independent Auditors’ Report |

1 |

|

|

|

|

Financial Statements |

|

|

|

|

|

Statement of financial condition |

2 |

|

|

|

|

Notes to Statement of Financial Condition |

3-11 |

Paulson Investment Company, Inc.

Statement of Financial Condition

|

December 31, 2013 |

||||

|

Assets |

||||

|

Cash |

$ | 6,728,680 | ||

|

Receivable from correspondent broker-dealer |

445,113 | |||

|

Notes and other receivables, net of allowances for doubtful accounts of $901,541 |

1,778,936 | |||

|

Trading and investment securities, at fair value |

4,908,753 | |||

|

Underwriter warrants, at fair value |

5,276,000 | |||

|

Furniture and equipment - net of accumulated depreciation and amortization of $66,440 |

111,180 | |||

|

Other assets |

472,016 | |||

|

Total Assets |

$ | 19,720,678 | ||

|

Liabilities and Stockholder's Equity |

||||

|

Accounts payable and accrued liabilities |

$ | 540,771 | ||

|

Compensation, employee benefits and payroll taxes |

363,665 | |||

|

Underwriter warrants payable to employees, at fair value |

3,641,035 | |||

|

Income taxes payable to parent |

192,908 | |||

|

Notes payable |

700,000 | |||

|

Advances from related parties |

1,521,781 | |||

|

Total Liabilities |

6,960,160 | |||

|

Commitments and Contingencies |

- | |||

|

Stockholder's Equity |

||||

|

Preferred stock; no par value; 500,000 shares authorized; 215,438 issued (liquidation preference $195,935) |

1,500,000 | |||

|

Common stock, no par value; 1,000,000 shares authorized; 400,100 shares issued and outstanding |

2,064,739 | |||

|

Receivable from parent |

(1,139,839 | ) | ||

|

Retained earnings |

10,335,618 | |||

|

Total Stockholder's Equity |

12,760,518 | |||

|

Total Liabilities and Stockholder's Equity |

$ | 19,720,678 | ||

See accompanying Notes to Financial Statements

Paulson Investment Company, Inc.

Notes to Statement of Financial Condition

Note 1. Nature of Business and Significant Accounting Policies

Paulson Investment Company, Inc. is a majority-owned subsidiary of Paulson Capital Corp. Paulson Investment Company, Inc., is a registered broker-dealer in securities under the Securities Exchange Act of 1934, as amended, and is a member of the Financial Industry Regulatory Authority (FINRA). We provide broker-dealer services in securities on both an agency and a principal basis to our customers who are introduced to RBC Correspondent Services, a division of RBC Capital Markets Corporation (RBC CS), our clearing organization, on a fully-disclosed basis. We also act as the managing underwriter, placement agent or participating selling group member of initial and follow-on public offerings, private investments in public equity (“PIPEs”) and private placements for smaller companies. We conduct business throughout the United States.

We operate under the provision of paragraph (k)(2)(ii) of Rule 15c3-3 of the Securities and Exchange Act of 1934 and, accordingly, are exempt from the remaining provisions of that rule. Essentially, the requirements of paragraph (k)(2)(ii) provide that we clear all transactions on behalf of our customers on a fully disclosed basis with a clearing broker-dealer and promptly transmit all customer funds and securities to the clearing broker-dealer. The clearing broker-dealer carries all of the accounts of the customers and maintains and preserves all related books and records as are customarily kept by a clearing broker-dealer.

Summary of Significant Accounting Policies:

Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our estimates regarding the fair value of underwriter warrants, not readily marketable securities and legal reserves are significant estimates and these estimates could change in the near term. Actual results could differ from those estimates.

Furniture and Equipment: Depreciation of furniture and equipment is generally computed using the straight-line method over their estimated useful lives (typically 3 or 5 years). Leasehold improvements are amortized over the lesser of their estimated useful life or the remaining lives of their related leases.

Income taxes: Our taxable income or loss is included in the consolidated federal income tax returns of Paulson Capital Corp. Paulson Capital Corp. allocates income tax expense or benefit to Paulson Investment Company, Inc. based upon its contribution to taxable income or loss as if Paulson Investment Company, Inc., were filing a separate return.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in results of operations in the period that includes the enactment date.

We recognize benefits for uncertain tax positions if we determine that they are “more-likely-than-not” to be sustained by the taxing authority. Interest and penalties accrued on unrecognized tax benefits are recognized as tax expense.

Subsequent events: We evaluated subsequent events through the date the financial statements were available to be issued, which is the same date as the independent auditors’ report.

Note 2. Receivable From and Payable To Correspondent Broker-Dealer

We introduce all customer transactions in securities traded on U.S. securities markets to RBC CS on a fully-disclosed basis. The agreement with our clearing broker provides that we are obligated to assume any exposure related to nonperformance by customers or counterparties. We monitor clearance and settlement of all customer transactions on a daily basis. The exposure to credit risk associated with the nonperformance of customers and counterparties in fulfilling their contractual obligations pursuant to these securities transactions can be directly impacted by volatile trading markets which may impair the customer’s or counterparty’s ability to satisfy their obligations. In the event of nonperformance, we may be required to purchase or sell financial instruments at unfavorable market prices resulting in a loss. We have not experienced credit losses in the past, and we do not anticipate experiencing credit losses in the future, due to significant nonperformance by our customers and counterparties.

At December 31, 2013, the receivable from RBC CS was comprised of $8,422 in commissions receivable and $436,691 in deposits to facilitate principal trading activity.

Note 3. Restructuring of the Company

In January 2013, the Board of Directors of Paulson Capital Corp. ("Paulson Capital"), the parent of the Company, agreed in principle to a change of ownership transaction for the Broker-Dealer license held by the Company. The purpose of the transaction is to bring in an investing partner and management team to expand on the Company’s boutique investment banking activities. Management believes that in order for the Company to be successful in the current investment environment, it must expand its investment banking capabilities to include early- and late-stage private financings, and that the management team being formed has the experience and knowledge to execute on this strategy while leveraging the existing broker-dealer platform. Under the proposed transaction, which is subject to FINRA approval, the ownership of the Company will convert to a new limited liability company ("LLC") owned by management and outside investors.

In January 2013, the Company received a $1,500,000 loan from a related party investor pursuant to a convertible promissory note bearing 5% simple interest which is due on January 13, 2016. The note is convertible, subject to FINRA approval, into preferred stock of the Company, representing approximately 35% ownership interest in the Company on a fully diluted basis. The noteholder agreed the note would stop accruing interest after April 30, 2013.

During the second quarter of fiscal 2013, the Company issued 215,438 shares of series B preferred stock for $1,500,000. The series B preferred stock is afforded no conversion or voting rights. Upon a liquidation event, the shareholder would be given a liquidation preference equal to 15.79%.

During the fourth quarter of fiscal 2013, the Company received a $700,000 loan from an outside investor pursuant to a convertible promissory note bearing 5% simple interest which is due on July 1, 2014. The note is convertible into 11.6% of the equity of PIC upon the earlier (i) all necessary FINRA and NASDAQ approvals and (ii) July 1, 2014.

The Board of Directors of Paulson Capital has also approved the formation of a trust (the "Trust") for the benefit of shareholders of Paulson Capital as of the record date of October 11, 2013. The Trust, if and when formed, will hold certain non-operating assets of the Company (the “Trust Assets”) as more fully described in Note 4. The holders of equity in the Company will have no liquidation or other rights to the Trust Assets.

The funds from these loans and the preferred stock investment have allowed the Company to expand its investment banking activities on behalf of smaller and emerging companies to include early- and late-stage private financings. During fiscal 2013, the Company added additional personnel, including institutional brokers focused on managing private financings, and two new office locations in New York City and Novato, California.

Note 4. Trust Assets

As a component of the restructuring the Company as described in Note 3, the Board of Directors of Paulson Capital approved the creation of an irrevocable liquidating trust (the “Trust”) for the benefit of Paulson Capital shareholders (the "Legacy Shareholders") as of the record date of October 11, 2013 (the "Record Date"). As of December 31, 2013, the Trust had not yet been formed. Upon its formation, the Trust will hold certain non-operating assets of the Company consisting primarily of underwriter warrants, trading and investment securities, an insurance policy on the life of the Founder of Paulson Capital (or the proceeds from its sale), and cash and accounts receivable (the "Trust Assets"). Once the Trust Assets are transferred to the Trust, the Company and Paulson Capital will have no access or rights to the Trust Assets, but the Trust Assets may be subject to the claims of Paulson Capital’s general creditors.

Upon formation of the Trust, the Legacy Shareholders will receive non-transferable beneficial interests in the Trust in proportion to their pro rata ownership interest in the Common Stock of Paulson Capital as of the Record Date. It is expected that the Trust Assets will be liquidated and distributed to the Legacy Shareholders over time.

Note 5. Notes and Other Receivables

Notes and other receivables generally are stated at their outstanding unpaid principal balance. Interest income on receivables is recognized on an accrual basis.

Notes and other receivables consisted of the following:

|

December 31, 2013 |

||||

|

Employees |

$ | 1,958,014 | ||

|

Corporate Finance |

65,853 | |||

|

Other |

656,610 | |||

| 2,680,477 | ||||

|

Allowance for doubtful accounts |

(901,541 | ) | ||

|

Total |

$ | 1,778,936 | ||

Employee receivables include several promissory notes issued to new employees totaling approximately $1.2 million that are payable in three years and bear 1% interest. These notes will be forgiven if the employees meet certain performance milestones and are still employed by the Company at the end of the three-year term. Other employee receivables relate to advances and expenses in excess of commission earnings and investment losses charged to our current and former employees and registered representatives. Corporate Finance receivables are unsecured and principally relate to bridge loans and other short-term advances to corporate finance clients. Other receivables primarily consists of the final installment due from the sale of one private investment.

Receivables are reviewed on a regular and continual basis by our management and, if events or changes in circumstances cause us to doubt the collectability of the contractual payments, a receivable will be assessed for impairment. The Company considers a receivable to be impaired when, based on upon current information and events, it believes it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the receivable agreement. When we determine collection to be doubtful, an allowance for amounts receivable is recorded and the receivable is placed on a non-performing (non-accrual) status. Payments received on non-accrual receivables are applied first to reduce the outstanding interest, and are then applied to the receivable unless we determine impairment is likely in which case payments are applied to the outstanding receivable balance (cost recovery method).

Note 5. Notes and Other Receivables (Continued)

Interest received on impaired receivables is recorded using the cash receipts method unless management determines further impairment is probable. No impairment loss is recorded if the carrying amount of the receivable (principal and accrued interest) is expected to be fully recovered through borrower payments and enforcement of action against the borrower's collateral, if any.

Impaired Receivables

The following is a summary of the Company's impaired receivables as of December 31, 2013:

|

Recorded Receivable |

Unpaid Balance |

Related Allowance |

# of Receivables |

Average Recorded Receivable |

Interest Income Recognized |

|||||||||||||||||||

|

Employees |

$ | 601,541 | $ | 601,541 | $ | 601,541 | 6 | $ | 100,257 | $ | - | |||||||||||||

|

Other |

643,176 | 643,176 | 300,000 | 1 | 643,176 | - | ||||||||||||||||||

|

Total |

$ | 1,244,717 | $ | 1,244,717 | $ | 901,541 | 7 | $ | 177,817 | $ | - | |||||||||||||

Allowance for Doubtful Accounts

The conclusion that a receivable may become uncollectible, in whole or in part, is a matter of judgment. We do not have a formal risk rating system. Receivables and the related accrued interest are analyzed on an individual and continuous basis for recoverability.

Delinquencies are determined based upon contractual terms. A provision is made for doubtful accounts to adjust the allowance for doubtful accounts to an amount considered to be adequate, with due consideration to workout agreements, to provide for unrecoverable receivables and receivables, including impaired receivables, other receivables, and accrued interest. Uncollectible receivables and related interest receivable are posted directly to the allowance account once it is determined that the full amount is not collectible.

Allowance for receivables from employees principally consists of uncollectible unsecured forgivable promissory notes to registered representatives that are forgiven over a specific period, typically 5 years, if the borrower remains an employee of the Company. Any amounts remaining under the note become due immediately when the individual either leaves the Company voluntarily or is terminated. Amounts from corporate finance clients principally consist of bridge loans and other advances to underwriting clients.

The following is a summary of the Company's allowance for doubtful accounts for the year ended December 31, 2013:

|

Allowance for doubtful accounts as of December 31, 2012 |

$ | 847,796 | ||

|

Bad debt expense in fiscal 2013 |

359,058 | |||

|

Direct write-off against allowance in fiscal 2013 |

(305,313 | ) | ||

|

Recoveries of assets previously written-off |

- | |||

|

Allowance for doubtful accounts as of December 31, 2013 |

$ | 901,541 |

Note 6. Fair Value Measurements

Various inputs are used in determining the fair value of our financial assets and liabilities and are summarized into three broad categories:

|

● |

Level 1 – unadjusted quoted prices in active markets for identical securities; |

|

● |

Level 2 – other significant observable inputs, including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.; and |

|

● |

Level 3 – significant unobservable inputs, including our own assumptions in determining fair value. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

|

December 31, 2013 | |||||

|

Fair Value |

Input Level | ||||

|

Trading and investment securities owned: |

|||||

|

Corporate equities, marketable |

$ | 3,719,922 |

Level 1 | ||

|

Corporate equities, not readily marketable |

1,122,000 |

Level 3 | |||

|

Corporate options/warrants, marketable |

66,831 |

Level 1 | |||

|

Trading securities sold, not yet purchased: |

|||||

|

Corporate equities |

- |

Level 1 | |||

|

Underwriter warrants |

5,276,000 |

Level 3 | |||

|

Underwriter warrants payable to employees |

(3,641,035 | ) |

Level 3 | ||

Following is a summary of activity related to our Level 3 financial assets and liabilities:

|

Underwriter Warrants |

Underwriter Warrants Payable to Employees |

Not Readily Marketable Investment Securities |

||||||||||

|

Balance, December 31, 2012 |

$ | 1,548,000 | $ | - | $ | 4,877,715 | ||||||

|

Fair value of securities received included as a component of corporate finance income |

6,523,000 | - | - | |||||||||

|

Fair value of securities received included as a component of compensation expense |

- | (3,641,035 | ) | - | ||||||||

|

Investment in privately held company |

- | - | 200,000 | |||||||||

|

Sale of investment in privately held company |

- | - | (5,628,548 | ) | ||||||||

|

Net unrealized gain / (loss), included as a component of investment loss related to securities held at December 31, 2013 |

(2,746,000 | ) | - | 1,672,833 | ||||||||

|

Underwriter warrants exercised or expired included as a component of investment income |

(49,000 | ) | - | - | ||||||||

|

Balance, December 31, 2013 |

$ | 5,276,000 | $ | (3,641,035 | ) | $ | 1,122,000 | |||||

Valuation of Marketable Trading and Investment Securities Owned

The fair value of our marketable trading and investment securities owned is determined based on quoted market prices. Securities traded on a national exchange are stated at the last reported sales price on the day of valuation; other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are stated at the last quoted bid price.

Note 6. Fair Value Measurements (Continued)

Valuation of Not Readily Marketable Investment Securities Owned

Securities not readily marketable include investment securities (a) for which there is no market on a securities exchange or no independent publicly quoted market, (b) that cannot be publicly offered or sold unless registration has been effected under the Securities Act of 1933, or (c) that cannot be offered or sold because of other arrangements, restrictions or conditions applicable to the securities or to us. The fair value of not readily marketable securities is estimated by management using available information including the following: quoted market prices of similar securities (i.e., unrestricted shares of the same company); price of recent known trades of the same or similar securities; the cost of the security, if recently purchased, adjusted for changes in the financial condition of the issuer; all other information available from review of available documents related to the issuer or discussions with management of the issuer. Significant unobservable inputs include the discount rate for lack of liquidity, and the volatility index of comparable companies. Changes to these unobservable inputs would cause the fair value to fluctuate substantially.

Valuation of Underwriter Warrants and Underwriter Warrants Payable to Employees

We estimate the fair value of underwriter warrants using the Black-Scholes Option Pricing Model. The warrants generally have a five-year expiration date and vest immediately. The warrants are generally subject to a restriction period of six months to one-year in which the warrants cannot be exercised. The Black-Scholes model requires us to use five inputs including: stock price, risk free rate, exercise price, time remaining on the warrant and price volatility. After stock price, the most influential factor in this model is price volatility, which we calculate for each company’s warrants based on each company’s own historical closing stock prices as well as an index of historical prices for comparable companies. When we initially receive a new underwriter warrant from an initial public offering, its calculated volatility factor is entirely based on the volatility of an index of comparable companies, since there is no price history for a new publicly traded company. For publicly traded companies, as each underwriter warrant approaches its expiration date, its volatility factor is derived primarily from the historical prices of its underlying common stock. Private company underwriter warrant valuations use the volatility index of comparable companies. There is no assurance that we will ultimately be able to exercise any of our warrants in a way that will realize the fair value that has been recorded in the financial statements based on this model. Underwriter warrants payable to employees represent warrants that are held by the Company, but are distributable to employees as compensation at December 31, 2013.

|

Quantitative Information about Level 3 Fair Value Measurements |

||||||||||||||||||

|

Fair Value at December 31, 2013 |

Valuation Technique |

Unobservable Input |

Range |

Weighted Average |

||||||||||||||

|

(in thousands) |

Minimum |

Maximum |

||||||||||||||||

|

Investments in privately-held companies |

$ | 1,122 |

Market approach; Asset approach |

Discount rate for lack of liquidity |

13.0 | % | 20.0 | % | 15.3 | % | ||||||||

|

Underwriter warrants |

5,276 |

Black-Scholes Option Pricing Model |

Volatility index of comparable companies |

66.7 | % | 99.5 | % | 76.5 | % | |||||||||

| Underwriter warrants payable to employees | (3,641 | ) | ||||||||||||||||

| $ | 2,757 | |||||||||||||||||

Note 7. Income Taxes

The deferred income tax asset (liability) consisted of the following:

|

December 31, 2013 |

||||

|

Deferred revenue |

$ | - | ||

|

Furniture and equipment |

23,363 | |||

|

Allowance for doubtful accounts |

353,192 | |||

|

Federal net operating loss carryforward |

1,890,448 | |||

|

State net operating loss carryforwards and credits |

754,995 | |||

|

State net capital loss carryforwards |

170,904 | |||

|

Compensation and benefits |

51,813 | |||

|

Unrealized loss on securities |

158,249 | |||

|

Straight line deferred rent |

26,818 | |||

|

Charitable contribution carryforwards and other |

- | |||

| 3,429,782 | ||||

|

Valuation allowance |

(3,377,431 | ) | ||

| 52,351 | ||||

|

Prepaid expense |

(41,964 | ) | ||

|

Basis difference in non-consolidating entity |

(10,387 | ) | ||

| $ | - | |||

Federal net operating loss carryforwards of approximately $5.5 million at December 31, 2013 fully expire by 2033. State net operating loss carryforwards of approximately $15.9 million at December 31, 2013 expire from 2014 through 2033. State net capital losses of approximately $4.1 million at December 31, 2013 expire from 2014 to 2017.

The future utilization of net operating loss carryforwards may be subject to annual limitations if there is a change in control as defined under Internal Revenue Code Section 382.

As of December 31, 2013, we have no uncertain tax positions and as such, do not have any reserves for uncertain tax positions.

We are no longer subject to U.S. federal income tax examinations by tax authorities for years prior to the tax year ended December 2009. Depending on the jurisdiction, we are no longer subject to state examinations by tax authorities for years prior to the December 2009 tax years. The tax years which remain open to examination in the U.S., our only major taxing jurisdiction, are 2009 through 2013.

Note 8. Related Party Transactions

We advance funds to Paulson Capital Corp. in the normal course of business to pay for the operations of Paulson Capital Corp. The receivable from parent on the balance sheet is the accumulation of these transactions. The amount is not considered collectible and is included as a reduction of Stockholder’s Equity.

Note 9. Commitments, Contingencies and Guarantees

Leases

We lease office space under the terms of various non-cancellable operating leases. The Company signed an eighteen month sublease for office space in Portland, Oregon commencing in April 2013; a five-year lease for New York City office space commencing in June 2013; and a two-year lease for office space in Novato, California commencing in October 2013.

Note 9. Commitments, Contingencies and Guarantees (Continued)

The future minimum payments for each of the next five years and thereafter required for leases were as follows:

|

As of December 31, 2013 |

|||||

|

Years ended December 31, |

|||||

|

2014 |

$ | 342,728 | |||

|

2015 |

272,863 | ||||

|

2016 |

212,124 | ||||

|

2017 |

219,346 | ||||

|

2018 |

92,517 | ||||

|

Total |

$ | 1,139,578 | |||

Legal

We have been named by individuals in certain legal actions, some of which claim state and federal securities law violations and claim principal and punitive damages. Included in the financial statements is an accrual of $52,500 for pending settlements near and subsequent to our year-end. As preliminary hearings and discovery in the remaining cases is not complete, it is not possible to assess the degree of liability, the probability of an unfavorable outcome or the impact on our financial statements, if any. Our management denies the charges in the remaining legal actions and is vigorously defending against them. No provision for any liability that may result from the remaining contingencies has been made in the financial statements.

Guarantees

There are no guarantees made by the Company that may result in a loss or future obligations as of December 31, 2013.

Note 10. Net Capital Requirement

We are subject to the Securities and Exchange Commission Uniform Net Capital Rule (Rule 15c3-1), which requires the maintenance of minimum net capital (as defined) of 6 2/3% of total aggregate indebtedness or $100,000, whichever is greater. At December 31, 2013, the required minimum net capital was $464,011. At December 31, 2013, we had net capital of $6,584,250, which was $6,120,239 in excess of our required net capital of $464,011. In addition, we are not allowed to have a ratio of aggregate indebtedness to net capital in excess of 15 to 1. The Rule also provides that equity capital may not be withdrawn or cash dividends paid if the resulting net capital ratio would exceed 10 to 1. Our net capital ratio was 1.06 to 1 at December 31, 2013.

Note 11. Concentrations of Risk

Trading and investment securities owned include investments in the common stock and warrants of the following companies, which represent more than 10% of trading and investment securities owned at December 31, 2013:

|

December 31, 2013 |

||||||||

|

Investment at Fair Value |

Percentage of Total |

|||||||

|

Charles & Colvard, Ltd. |

$ | 3,606,710 | 73.4 | % | ||||

|

Yamhill Valley Vineyards |

525,000 | 10.6 | % | |||||

| $ | 4,131,710 | 84.0 | % | |||||

Warrants from one company represented 87.1% of the total underwriting warrants owned as of December 31, 2013.

Note 11. Concentrations of Risk (Continued)

We are also exposed to concentrations of credit risk related to our cash deposits. We maintain cash at a financial institution where the total cash balance is insured by the Federal Deposit Insurance Corporation (“FDIC”) up to its limit. At any given time, our cash balance may exceed the balance insured by the FDIC. We monitor such credit risk at the financial institution and have not experienced any losses related to such risks to date.

In addition, we are engaged in trading and brokerage activities with RBC CS. In the event RBC CS does not fulfill its obligations, we may be exposed to risk. The risk of default depends on the creditworthiness of RBC CS. It is our policy to review, as necessary, the credit standing of RBC CS.

11