d485bpos.htm

As filed with the Securities and Exchange Commission April 28, 2011

File Nos. 002-78047 and 811-03489

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

Post-Effective Amendment No. 42

AND

REGISTRATION STATEMENT UNDER THE

INVESTMENT COMPANY ACT OF 1940

Amendment No. 43

_____________________________________________________________________________________________

THE WRIGHT MANAGED EQUITY TRUST

440 Wheelers Farm Road

Milford, Connecticut 06461

207-347-2000

Christopher A. Madden

Atlantic Fund Services

Three Canal Plaza, Suite 600

Portland, Maine 04101

It is proposed that this filing will become effective:

[ ] immediately upon filing pursuant to Rule 485, paragraph (b)(1)

[X] on May 1, 2011 pursuant to Rule 485, paragraph (b)(1)

[ ] 60 days after filing pursuant to Rule 485, paragraph (a)(1)

[ ] on ______ pursuant to Rule 485, paragraph (a)(1)

[ ] 75 days after filing pursuant to Rule 485, paragraph (a)(2)

[ ] on ______ pursuant to Rule 485, paragraph (a)(2)

[ ] this post-effective amendment designates a new effective date for a previously filed post-effective amendment

THE WRIGHT MANAGED BLUE CHIP INVESTMENT FUNDS

PROSPECTUS

MAY 1, 201 1

THE WRIGHT MANAGED EQUITY TRUST

|

·

|

Wright Selected Blue Chip Equities Fund (WSBEX)

|

|

·

|

Wright Major Blue Chip Equities Fund (WQCEX)

|

|

·

|

Wright International Blue Chip Equities Fund (WIBCX)

|

THE WRIGHT MANAGED INCOME TRUST

|

·

|

Wright Current Income Fund (WCIFX)

|

|

·

|

Wright Total Return Bond Fund (WTRBX)

|

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this prospectus is accurate or complete. Anyone who tells you otherwise is committing a crime.

Table of Contents

|

Summary Sections

|

|

|

Wright Selected Blue Chip Equities Fund Summary

|

2

|

|

Wright Major Blue Chip Equities Fund Summary

|

5

|

|

Wright International Blue Chip Equities Fund Summary

|

8

|

|

Wright Current Income Fund Summary

|

1 2

|

|

Wright Total Return Bond Fund Summary

|

1 6

|

| |

|

|

Additional Information Regarding Principal Investment Strategies

|

20

|

|

Wright Selected Blue Chip Equities Fund

|

20

|

|

Wright Major Blue Chip Equities Fund

|

21

|

|

Wright International Blue Chip Equities Fund

|

21

|

|

Wright Current Income Fund

|

22

|

|

Wright Total Return Bond Fund

|

23

|

| |

|

|

Additional Information Regarding Principal Risks

|

2 4

|

| |

|

|

Disclosure of Portfolio Holdings

|

2 5

|

| |

|

|

Managing the Funds

|

2 6

|

|

The Adviser

|

2 6

|

|

Investment Committee

|

2 6

|

|

Portfolio Managers

|

2 7

|

|

Administrator

|

2 7

|

| |

|

|

Information About Your Account

|

28

|

|

How the Funds Value Their Shares

|

2 8

|

|

Purchasing Shares

|

2 8

|

|

Selling Shares

|

30

|

|

Exchanging Shares

|

31

|

|

Lost Accounts

|

32

|

|

Privacy Concerns

|

3 2

|

|

Market Timing and Excessive Trading Policy

|

3 2

|

| |

|

|

Dividends and Taxes

|

|

|

Dividends and Distributions

|

3 4

|

|

Tax Consequences

|

3 4

|

| |

|

|

Financial Highlights

|

3 6

|

Wright Selected Blue Chip Equities Fund Summary

The Wright Selected Blue Chip Equities Fund (“WSBC” or “ fund ”) seeks to provide long-term total return consisting of price appreciation and current income. “Long-term” is defined as total return occurring over the course of a complete market cycle.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

|

Annual Fund Operating Expenses

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.

|

60%

|

| |

Distribution and Service (12b-1) Fees

|

0.

|

25%

|

| |

Other Expenses

|

0.

|

94%

|

|

Total Annual Fund Operating Expenses

|

1.

|

79%

|

| |

Expense Reimbursement(1)

|

(0.

|

39 %)

|

| |

Net Annual Fund Operating Expenses After Expense Reimbursement(1)

|

1.

|

40%

|

|

(1)

|

Under a written agreement in effect through April 30, 201 2 , the fund’s investment adviser, Wright Investors’ Service, Inc. (“Wright” or “Adviser”) waives a portion of its advisory fee and/or distribution fees and assumes operating expenses to the extent necessary to limit the net operating expense ratio to 1.40% (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the fund’s business) after custodian fee reductions, if any. This written agreement may be changed or eliminated only with the consent of the fund’s board of trustees (the “ Board of Trustees ” or “Trustees”) .

|

Example

This Example is intended to help you compare the cost of investing in the f und with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the f und for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the f und’s operating expenses remain the same except in year one . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$143

|

$ 525

|

$ 933

|

$ 2,073

|

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the E xample, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 60 % of the average value of its portfolio.

Principal Investment Strategies

The fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by well-established domestic companies. “Well-established companies” have an operating history of six years or longer. The portfolio investments are selected primarily from companies on the Adviser's "investment grade" list of approved companies. The fund’s portfolio is characterized as a blend of growth and value stocks. The market capitalization of the companies is typically between $1-$10 billion at the time

of the fund's investment, however the fund may hold investments in companies of any market capitalization consistent with its investment objective. The Adviser seeks to outperform the Standard & Poor's Mid-Cap 400 Index (“S&P Mid-Cap 400”) by selecting stocks using fundamental company analysis, valuation and earnings trends. The portfolio is then diversified across industries and sectors. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

In order to respond to adverse market, economic, political or other conditions, the fund may assume a temporary defensive position that is inconsistent with its principal investment strategies.

Principal Risks

|

·

|

Recent Market Events: unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on the fund.

|

|

·

|

Market Risk: when the prices of stocks fall, the value of the fund's investments may fall.

|

|

·

|

Management Risk: Wright's strategy may not produce the expected results, causing losses.

|

|

·

|

Small Capitalization and Mid-Capitalization Company Risk: securities of smaller companies may be more volatile than securities issued by companies with larger market capitalizations, and the price of smaller companies may decline more in response to selling pressure.

|

|

·

|

Value Investment Risk: the stock of value companies can continue to be undervalued for long periods of time and not realize its expected value, and the value of the fund may decrease in response to the activities and financial prospects of an individual company.

|

The fund cannot eliminate risk or assure achievement of its objective and you may lose money.

Performance

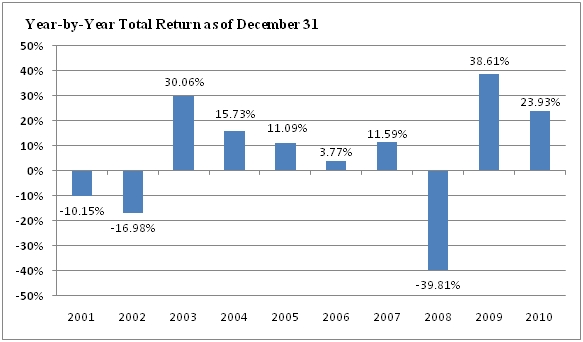

The information on the following bar chart shows the performance of the fund for the ten-year period through December 31, 20 1 0. As with all mutual funds, past performance (before and after taxes) does not guarantee future results.

The following bar chart illustrates the risk of investing in the fund by showing the variability of the fund's performance for each calendar year for the past ten years.

During the period shown, the highest return for a quarter was 21.41% (3rd quarter 2009) and the lowest return was -24.81% (4th quarter 2008).

The fund's annual return shown on the bar chart does not reflect the impact of taxes. The table below shows before and after-tax performance. The fund's average annual return is compared with that of the S&P Mid-Cap 400. After-tax returns are calculated using the highest individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Returns as of December 31, 20 1 0

|

| |

1 Year

|

5 Years

|

10 Years

|

|

WSBC

|

|

|

|

|

- Return before taxes

|

23.93%

|

3.67%

|

4.09%

|

|

- Return after taxes on distributions

|

23.91%

|

2.45%

|

2.97%

|

|

- Return after taxes on distributions and sales of fund shares

|

15.57%

|

3.04%

|

3.29%

|

|

S&P Mid-Cap 400 (reflects no deductions for fees, expenses or taxes)

|

26.64%

|

5.73%

|

7.16%

|

Management

Investment Adviser. Wright Investors' Service, Inc. is the investment adviser for the Wright Selected Blue Chip Equities Fund.

Portfolio Manager. As p ortfolio m anager, Amit S. Khandwala is primarily responsible for the day-to-day management of the Wright Selected Blue Chip Equities Fund. Mr. Khandwala has been portfolio manager since August 2008.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through your financial intermediary or by mail (Wright Managed Investment Funds, Atlantic Fund Services, Wright Selected Blue Chip Equities Fund, P.O. Box 588, Portland, ME 04112). Shares also may be purchased by wire (please contact the transfer agent at 1-800-555-0644 for wire instructions) or through an automatic investment program. Shares may also be redeemed by telephone (1-800-555-0644). The minimum initial investment in the fund is $1,000. There are no minimums for subsequent investments. The minimums may be waived for investments by bank trust departments, 401(k) tax-sheltered retirement plans and automatic investment programs.

Tax Information

You may receive distributions from the fund of dividends and capital gains, which may be taxed as ordinary income or capital gains.

Payments to Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Wright Major Blue Chip Equities Fund Summary

The Wright Major Blue Chip Equities Fund (“WMBC” or “ fund ”) seeks total return, consisting of price appreciation plus income.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

|

Annual Fund Operating Expenses

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.

|

60%

|

| |

Distribution and Service (12b-1) Fees

|

0.

|

25%

|

| |

Other Expenses

|

0.

|

82 %

|

| |

Interest Expense

|

0.

|

01%

|

|

Total Annual Fund Operating Expenses

|

1.

|

68 %

|

| |

Expense Reimbursement(1)

|

(0.

|

27 %)

|

| |

Net Annual Fund Operating Expenses After Expense Reimbursement(1)

|

1.

|

4 1 %

|

|

(1)

|

Under a written agreement in effect through April 30, 201 2 , the fund’s investment adviser, Wright Investors’ Service, Inc. (“Wright” or “Adviser”) waives a portion of its advisory fee and/or distribution fees and assumes operating expenses to the extent necessary to limit the net operating expense ratio to 1.40% (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the fund’s business) after custodian fee reductions, if any. This written agreement may be changed or eliminated only with the consent of the fund’s board of trustees (the “ Board of Trustees ” or “Trustees”) .

|

Example

This Example is intended to help you compare the cost of investing in the f und with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the f und for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the f und’s operating expenses remain the same except in year one . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$14 4

|

$ 503

|

$ 887

|

$ 1,964

|

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the E xample, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 68 % of the average value of its portfolio.

Principal Investment Strategies

The fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by “major” companies, which the Adviser defines as well-established companies with market values of $5-$10 billion or more at the time of the fund's investment. “Well-established companies” have an operating history of six years or longer. The fund may also hold investments in companies of

any market capitalization consistent with its investment objective. The portfolio investments are chosen primarily from companies on the Adviser's "investment grade" list of approved companies. The Adviser seeks to outperform the Standard & Poor's 500 Index (“S&P 500”) by selecting stocks using fundamental company analysis, valuation and earnings trends. The portfolio is then diversified across industries and sectors. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

In order to respond to adverse market, economic, political or other conditions, the fund may assume a temporary defensive position that is inconsistent with its principal investment strategies.

Principal Risks

|

·

|

Recent Market Events: unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on the fund.

|

|

·

|

Market Risk: when the prices of stocks fall, the value of the fund's investments may fall.

|

|

·

|

Management Risk: Wright's strategy may not produce the expected results, causing losses.

|

|

·

|

Large Capitalization Company Risk: companies with large market capitalizations go in and out of favor based on market and economic conditions and may underperform other market segments.

|

|

·

|

Value Investment Risk: the stock of value companies can continue to be undervalued for long periods of time and not realize its expected value, and the value of the fund may decrease in response to the activities and financial prospects of an individual company.

|

The fund cannot eliminate risk or assure achievement of its objective and you may lose money.

Performance

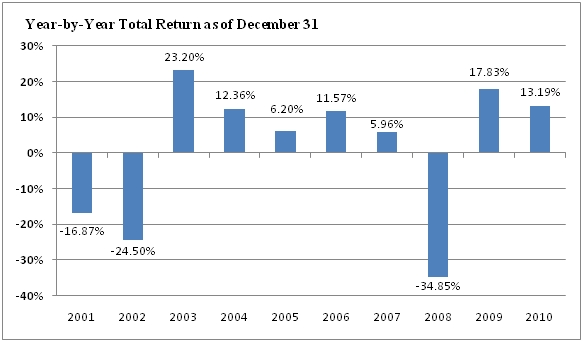

The information on the following bar chart shows the performance of the fund for the ten-year period through December 31, 20 1 0. As with all mutual funds, past performance (before and after taxes) does not guarantee future results.

The following bar chart illustrates the risk of investing in the fund by showing the variability of the fund's performance for each calendar year for the past ten years.

During the period shown, the highest return for a quarter was 13.83% (2nd quarter 2009) and the lowest return was -19.46% (4th quarter 2008).

The fund's annual return shown on the bar chart does not reflect the impact of taxes. The table below shows before and after-tax performance. The fund's average annual return is compared with that of the S&P 500. After-tax returns are calculated using the highest individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Returns as of December 31, 20 1 0

|

| |

1 Year

|

5 Years

|

10 Years

|

|

WMBC

|

|

|

|

|

- Return before taxes

|

13.19 %

|

0.54 %

|

( 0.54 %)

|

|

- Return after taxes on distributions

|

13.12 %

|

0.27 %

|

( 0.73 %)

|

|

- Return after taxes on distributions and sales of fund shares

|

8.67 %

|

0.30 %

|

( 0.56 %)

|

|

S&P 500 (reflects no deductions for fees, expenses or taxes)

|

15.06 %

|

2.29 %

|

1.42 %

|

Management

Investment Adviser. Wright Investors' Service, Inc. is the investment adviser for the Wright Major Blue Chip Equities Fund.

Portfolio Manager. As p ortfolio m anager, Amit S. Khandwala is primarily responsible for the day-to-day management of the Wright Major Blue Chip Equities Fund. Mr. Khandwala has been manager of the fund's portfolio since June 8, 2009.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through your financial intermediary or by mail (Wright Managed Investment Funds, Atlantic Fund Services, Wright Major Blue Chip Equities Fund, P.O. Box 588, Portland, ME 04112). Shares may also be purchased by wire (please contact the transfer agent at 1-800-555-0644 for wire instructions) or through an automatic investment program. Shares may also be redeemed by telephone (1-800-555-0644). The minimum initial investment in the fund is $1,000. There are no minimums for subsequent investments. The minimums may be waived for investments by bank trust departments, 401(k) tax-sheltered retirement plans and automatic investment programs.

Tax Information

You may receive distributions from the fund of dividends and capital gains, which may be taxed as ordinary income or capital gains.

Payments to Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Wright International Blue Chip Equities Fund Summary

The Wright International Blue Chip Equities Fund (“WIBC” or “ fund ”) seeks total return consisting of price appreciation plus income.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

|

Shareholder Fees*

|

|

(fees paid directly from your investment)

|

|

Redemption Fee

|

2.

|

00%

|

| |

|

|

(as a percentage of the amount redeemed, if applicable)

|

|

|

* A redemption fee applies if you redeem your shares within three months of purchase .

|

|

| |

|

|

| |

|

|

|

Annual Fund Operating Expenses

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.

|

80%

|

| |

|

Distribution and Service (12b-1) Fees

|

0.

|

25%

|

| |

|

Other Expenses

|

0.

|

70 %

|

| |

|

Interest Expense

|

0.

|

01%

|

| |

|

Acquired Fund Fees & Expenses (1)

|

0.

|

01%

|

| |

Total Annual Fund Operating Expenses( 2 )

|

1.

|

77 %

|

|

(1)

|

The Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets given in the Fund’s most recent annual report which does not include the Acquired Fund Fees and Expenses.

|

|

(2)

|

Under a written agreement in effect through April 30, 201 2 , the fund’s investment adviser, Wright Investors’ Service, Inc. (“Wright” or “Adviser”) waives a portion of its advisory fee and/or distribution fees and assumes operating expenses to the extent necessary to limit the net operating expense ratio to 1.85% (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the fund’s business) after custodian fee reductions, if any. This written agreement may be changed or eliminated only with the consent of the fund’s board of trustees (the “ Board of Trustees ” or “Trustees”) .

|

Example

This Example is intended to help you compare the cost of investing in the f und with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the f und for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the f und’s operating expenses remain the same except in year one . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$ 180

|

$ 557

|

$ 959

|

$ 2,084

|

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the E xample, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 92 % of the average value of its portfolio.

Principal Investment Strategies

The fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by well-established non-U.S. companies of any size located worldwide. “Well-established companies” have an operating history of six years or longer. The portfolio investments are chosen primarily from companies on the Adviser's "investment grade" list of approved companies. Securities of these companies may be traded on the securities market of their own country, on other foreign exchanges or in the U.S. through American Depository Receipts (ADRs). ADRs represent interest in the underlying security. ADRs purchased by the fund are typically sponsored by the issuer of the underlying security, however the fund may invest in unsponsored ADRs consistent with its investment objective. The Adviser seeks to outperform the MSCI World ex U.S. Index by selecting stocks using fundamental company analysis, valuation and earnings trends. The portfolio is then diversified across industries and sectors. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

In order to respond to adverse market, economic, political or other conditions, the fund may assume a temporary defensive position that is inconsistent with its principal investment strategies.

Principal Risks

|

·

|

Recent Market Events: unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on the fund.

|

|

·

|

Market Risk: when the prices of stocks fall, the value of the fund's investments may fall.

|

|

·

|

Management Risk: Wright's strategy may not produce the expected results, causing losses.

|

|

·

|

Foreign Securities Risk: foreign securities are subject to additional risks including currency risk (changes in foreign currency rates reducing the value of the fund's assets), seizure, expropriation or nationalization of a company's assets, less publicly available information, and the impact of political, social or diplomatic events.

|

|

·

|

Large Capitalization Company Risk: companies with large market capitalizations go in and out of favor based on market and economic conditions and may underperform other market segments.

|

|

·

|

Small Capitalization and Mid-Capitalization Company Risk: securities of smaller companies may be more volatile than securities issued by companies with larger market capitalizations, and the price of smaller companies may decline more in response to selling pressure.

|

|

·

|

Value Investment Risk: the stock of value companies can continue to be undervalued for long periods of time and not realize its expected value, and the value of the fund may decrease in response to the activities and financial prospects of an individual company.

|

The fund cannot eliminate risk or assure achievement of its objective and you may lose money.

Performance

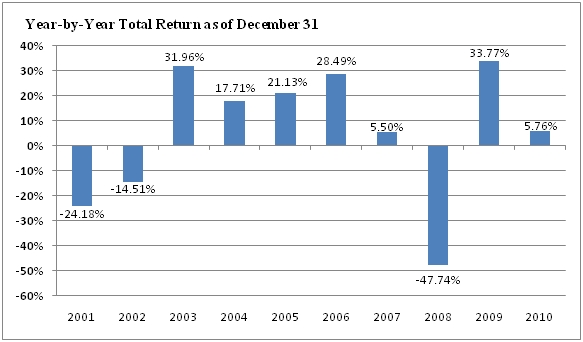

The information on the following bar chart shows the performance of the fund for the periods indicated through December 31, 20 1 0. As with all mutual funds, past performance (before and after taxes) does not guarantee future results.

The following bar chart illustrates the risk of investing in the fund by showing the variability of the fund's performance for each calendar year for the past ten years.

During the period shown, the highest return for a quarter was 28.54% (2nd quarter 2009) and the lowest return was -24.32% (4th quarter 2008).

The fund's annual return shown above does not reflect the impact of taxes. The table below shows before and after-tax performance. The fund's average annual return is compared with that of the MSCI World ex U.S. Index. After-tax returns are calculated using the highest individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Returns as of December 31, 20 1 0

|

| |

1 Year

|

5 Years

|

10 Years

|

|

WIBC

|

|

|

|

|

- Return before taxes

|

5.76 %

|

0.04 %

|

2.03 %

|

|

- Return after taxes on distributions

|

5.56 %

|

(0.85 % )

|

1.48 %

|

|

- Return after taxes on distributions and sales of fund shares

|

4.55 %

|

(0.24 % )

|

1.54 %

|

|

MSCI World ex U.S. Index (reflects no deductions for fees, expenses or taxes)

|

8.95 %

|

3.05 %

|

3.98 %

|

Investment Adviser. Wright Investors' Service, Inc. is the investment adviser for the Wright International Blue Chip Equities Fund.

Portfolio Manager. As p ortfolio m anager, Amit S. Khandwala is primarily responsible for the day-to-day management of the Wright International Blue Chip Equities Fund. Mr. Khandwala has been p ortfolio m anager for the Wright International Blue Chip Equities Fund since December 1996.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through your financial intermediary or by mail (Wright Managed Investment Funds, Atlantic Fund Services, Wright International Blue Chip Equities Fund, P.O. Box 588, Portland, ME 04112). Shares also may be purchased by wire (please contact the transfer agent at 1-800-555-0644 for wire instructions) or through an automatic investment program. Shares may also be redeemed by telephone (1-800-555-0644). The minimum initial investment in the fund is $1,000. There are no minimums for subsequent investments. The minimums may be waived for investments by bank trust departments, 401(k) tax-sheltered retirement plans and automatic investment programs. If you redeem shares of Wright International Blue Chip Equities Fund within three months after purchase, you will pay a redemption fee of 2.00%.

These redemption fees may be waived on shares purchased for Wright's investment advisory clients and 401(k) or similar plans. All redemptions are taxable for shareholders that are subject to tax.

Tax Information

You may receive distributions from the fund of dividends and capital gains, which may be taxed as ordinary income or capital gains.

Payments to Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Wright Current Income Fund Summary

The Wright Current Income Fund (“WCIF” or the “ fund ”) seeks a high level of current income consistent with moderate fluctuations of principal. “High level” is measured relative to other fixed income instruments that may seek relative stability of principal.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

|

Annual Fund Operating Expenses

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.

|

45%

|

| |

Distribution and Service (12b-1) Fees

|

0.

|

25%

|

|

|

Other Expenses

|

0.

|

63 %

|

|

Total Annual Fund Operating Expenses

|

1.

|

33 %

|

| |

Expense Reimbursement(1)

|

(0.

|

33 %)

|

| |

Net Annual Fund Operating Expenses After Expense Reimbursement(1)

|

1.

|

00%

|

|

(1)

|

Under a written agreement in effect through April 30, 201 2 , the fund’s investment adviser, Wright Investors’ Service, Inc. (“Wright” or “Adviser”) waives a portion of its advisory fee and/or distribution fees and assumes operating expenses to the extent necessary to limit the net operating expense ratio to 1.00% (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the fund’s business) after custodian fee reductions, if any. This written agreement may be changed or eliminated only with the consent of the fund’s board of trustees (the “ Board of Trustees ” or “Trustees”) .

|

Example

This Example is intended to help you compare the cost of investing in the f und with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the f und for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the f und’s operating expenses remain the same except in year one . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$102

|

$ 389

|

$ 697

|

$ 1,573

|

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the E xample, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 54 % of the average value of its portfolio.

Principal Investment Strategies

The fund invests at least 80% of its total assets in debt obligations issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, mortgage-related securities of governmental or corporate issuers and corporate debt securities. The U.S. Government securities in which the fund may invest are bills, notes, and bonds issued by the U.S. Treasury which are direct obligations of the U.S. Government; securities of the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) or the Export-Import Bank of the United

States (“Ex-Im Bank”), which are obligations of U.S. Government agencies and instrumentalities secured by the full faith and credit of the U.S. Treasury; obligations secured by the right to borrow from the U.S. Treasury; and securities of the Federal Home Loan Bank (“FHLB”), the Federal National Mortgage Association (“FNMA” or “Fannie Mae”), and the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”) which are obligations backed only by the credit of the government agency itself.

The fund may invest in commercial paper, certificates of deposit, bankers acceptances rated A-1 by Standard & Poor's Ratings Group (“S&P”) or P-1 by Moody's Investors Service, Inc. (“Moody’s”). The fund may also invest in corporate obligations with maturities longer than one year rated BBB- by S&P or Baa3 by Moody’s and comparable unrated securities. The fund reinvests all principal payments. There are no limits on the minimum or maximum weighted average maturity of the fund's portfolio or an individual security. As of December 31, 20 1 0, the fund's average maturity was 4.3 years and its duration was 3.1 years. Duration measures how quickly the principal and interest of a bond is expected to be paid. It is also used to predict how much a bond's value will rise and fall in response to small changes in interest rates. Generally, the shorter a fund's duration is, the less its securities will decline in value when there is an increase in interest rates. The fund seeks to outperform the Barclays Capital GNMA Backed Bond Index. Securities held in the fund may have variable rates or may have fixed rates for a specified period before becoming variable at a predetermined positive or negative increment versus a widely available index or benchmark such as the 3-month London Interbank Offer Rate (“LIBOR”) or 3-month U.S. Treasury Bills.

In order to respond to adverse market, economic, political or other conditions, the fund may assume a temporary defensive position that is inconsistent with its principal investment strategies.

Principal Risks

|

·

|

Recent Market Events: unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on the fund.

|

|

·

|

Management Risk: Wright's strategy may not produce the expected results, causing losses.

|

|

·

|

Interest Rate Risk: Bond prices fall when interest rates rise and vice versa. The longer the duration of a bond, the greater the potential change in price.

|

|

·

|

Credit or Default Risk: An issuer's credit rating may be downgraded or the issuer may be unable to pay principal and interest obligations.

|

|

·

|

Prepayment Risk: When interest rates decline, the issuer of a security may exercise an option to prepay the principal. This forces the fund to reinvest in lower yielding securities.

|

|

·

|

Extension Risk: When interest rates rise, the life of a mortgage-related security is extended beyond the expected prepayment time, reducing the value of the security.

|

The fund cannot eliminate risk or assure achievement of its objective and you may lose money.

Performance

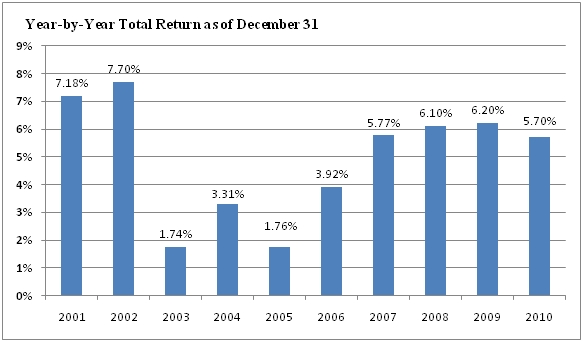

The information on the following bar chart shows the fund's performance for the ten-year period through December 31, 20 1 0. As with all mutual funds, past performance (before and after taxes) does not guarantee future results.

The following bar chart illustrates the risk of investing in the fund by showing the variability of the fund's performance for each calendar year for the past ten years.

During the period shown, the highest return for a quarter was 3.80% (3rd quarter 2001) and the lowest return was -0.79% (2nd quarter 2004).

The fund's annual return shown above does not reflect the impact of taxes. The table below shows before and after-tax performance. The fund's average annual return is compared with that of the Barclays Capital GNMA Backed Bond Index. After-tax returns are calculated using the highest individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Returns as of December 31, 20 1 0

|

| |

1 Year

|

5 Years

|

10 Years

|

|

WCIF

|

|

|

|

|

- Return before taxes

|

5.70 %

|

5.53 %

|

4.92 %

|

|

- Return after taxes on distributions

|

3.96 %

|

3.80 %

|

3.04 %

|

|

- Return after taxes on distributions and sales of fund shares

|

3.68 %

|

3.71 %

|

3.10 %

|

|

Barclays Capital GNMA Backed Bond Index (reflects no deductions for fees, expenses or taxes)

|

6.71 %

|

6.30 %

|

5.87 %

|

Management

Investment Adviser. Wright Investors' Service, Inc. is the investment adviser for the Wright Current Income Fund.

Portfolio Manager. As p ortfolio m anager, M. Anthony E. van Daalen, CFA, is primarily responsible for the day-to-day management of the Wright Current Income Fund. Mr. van Daalen has been p ortfolio m anager for the Wright Current Income Fund since June 8, 2009.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through your financial intermediary or by mail (Wright Managed Investment Funds, Atlantic Fund Services, Wright Current Income Fund, P.O. Box 588, Portland, ME 04112). Shares also may be purchased by wire (please contact the transfer agent at 1-800-555-0644 for wire instructions) or through an automatic investment program. Shares may also be redeemed by telephone (1-800-555-0644). The minimum initial investment in the fund is $1,000. There are no minimums for subsequent investments. The minimums may be waived for investments by bank trust departments, 401(k) tax-sheltered retirement plans and automatic investment programs.

Tax Information

You may receive distributions from the fund of dividends and capital gains, which may be taxed as ordinary income or capital gains.

Payments to Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Wright Total Return Bond Fund Summary

The Wright Total Return Bond Fund (“WTRB” or “ fund ”) seeks a superior rate of total return, consisting of a high level of income plus price appreciation. “Superior rate” is measured relative to other bond investments that may seek a high level of income. “High level” is measured relative to other bond investments that may seek total return.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

|

Annual Fund Operating Expenses

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.

|

45%

|

| |

Distribution and Service (12b-1) Fees

|

0.

|

25%

|

| |

Other Expenses

|

0.

|

73 %

|

|

Total Annual Fund Operating Expenses

|

1.

|

43 %

|

| |

Expense Reimbursement(1)

|

(0.

|

48 %)

|

| |

Net Annual Fund Operating Expenses After Expense Reimbursement(1)

|

0.

|

95%

|

|

(1)

|

Under a written agreement in effect through April 30, 201 2 , the fund’s investment adviser, Wright Investors Service, Inc. (“Wright” or “Adviser”) waives a portion of its advisory fee and/or distribution fees and assumes operating expenses to the extent necessary to limit the net operating expense ratio to 0.95% (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the fund’s business) after custodian fee reductions, if any. This written agreement may be changed or eliminated only with the consent of the fund’s board of trustees (the “ Board of Trustees ” or “Trustees”) .

|

Example

This Example is intended to help you compare the cost of investing in the f und with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the f und for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the f und’s operating expenses remain the same except in year one . Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$97

|

$ 405

|

$ 736

|

$ 1,672

|

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the E xample, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 119 % of the average value of its portfolio.

Principal Investment Strategies

The fund invests at least 80% of its total assets in U.S. Government and investment grade (rated BBB- by S&P or Baa3 by Moody's, or higher or of comparable quality if unrated) corporate debt securities. Government securities in which the fund may invest are bills, notes, and bonds issued by the U.S. Treasury which are direct obligations of the U.S. Government; securities of the Government National Mortgage Association (“GNMA” or “Ginnie Mae”)

or the Export-Import Bank of the United States (“Ex-Im Bank”), which are obligations of U.S. Government agencies and instrumentalities secured by the full faith and credit of the U.S. Treasury; obligations secured by the right to borrow from the U.S. Treasury; and securities of the Federal Home Loan Bank (“FHLB”), the Federal National Mortgage Association (“FNMA” or “Fannie Mae”), and the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”) which are obligations backed only by the credit of the government agency itself. These securities meet the Wright Quality Rating s s tandards (“Wright Quality Ratings”), which reflect fundamental criteria for investment acceptance, financial strength, profitability & stability and growth . The fund may invest in commercial paper, certificates of deposit, bankers acceptances rated A-1 by S&P or P-1 by Moody's. Investment selections differ depending on the trend in interest rates. The fund looks for securities that in Wright's judgment will produce the best total return.

Wright allocates assets among different market sectors (U.S. Treasury securities, U.S. Government agency securities and corporate bonds) with different maturities based on its view of the relative value of each sector or maturity. There are no limits on the minimum or maximum weighted average maturity of the fund's portfolio or an individual security. As of December 31, 20 1 0, the fund's average maturity was 6.1 years and its duration was 4.7 years. Duration measures how quickly the principal and interest of a bond is expected to be paid. It is also used to predict how much a bond's value will rise and fall in response to small changes in interest rates. Generally, the shorter a fund's duration is, the less its securities will decline in value when there is an increase in interest rates. The fund seeks to outperform the Barclays Capital U.S. Aggregate Bond Index.

In order to respond to adverse market, economic, political or other conditions, the fund may assume a temporary defensive position that is inconsistent with its principal investment strategies.

Principal Risks

|

·

|

Recent Market Events: unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on the fund.

|

|

·

|

Management Risk: Wright's strategy may not produce the expected results, causing losses.

|

|

·

|

Interest Rate Risk: Bond prices fall when interest rates rise and vice versa. The longer the duration of a bond, the greater the potential change in price.

|

|

·

|

Credit or Default Risk: An issuer's credit rating may be downgraded or the issuer may be unable to pay principal and interest obligations.

|

|

·

|

Prepayment Risk: When interest rates decline, the issuer of a security may exercise an option to prepay the principal. This forces the fund to reinvest in lower yielding securities. Corporate bonds may have a "call" feature which gives the issuer the right to redeem outstanding bonds before their scheduled maturity.

|

|

·

|

Extension Risk: When interest rates rise, the life of a mortgage-related security is extended beyond the expected prepayment time, reducing the value of the security.

|

Also, the fund's yield may decline during times of falling interest rates. The fund cannot eliminate risk or assure achievement of its objective and you may lose money.

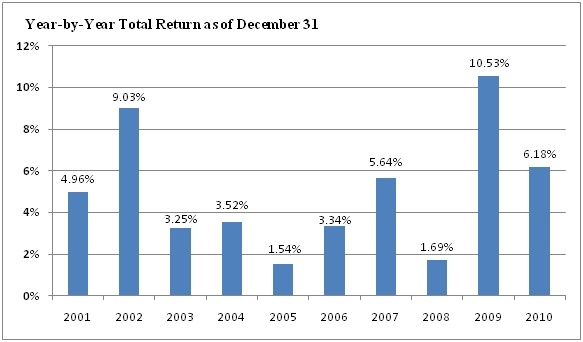

Performance

The information on the following bar chart shows the fund's performance for the ten-year period through December 31, 20 1 0. As with all mutual funds, past performance (before and after taxes) does not guarantee future results.

The following bar chart illustrates the risk of investing in the fund by showing the variability of the fund's performance for each calendar year for the past ten years.

During the period shown, the highest return for a quarter was 4.94% (3rd quarter 2002) and the lowest return was -2.48% (2nd quarter 2004).

The fund's annual return shown above does not reflect the impact of taxes. The table below shows before and after-tax performance. The fund's average annual return is compared with that of the Barclays Capital U.S. Aggregate Bond Index. After-tax returns are calculated using the highest individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

Average Annual Returns as of December 31, 20 1 0

|

| |

1 Year

|

5 Years

|

10 Years

|

|

WTRB

|

|

|

|

|

- Return before taxes

|

6.18 %

|

5.43 %

|

4.93 %

|

|

- Return after taxes on distributions

|

4.75 %

|

3.77 %

|

3.21 %

|

|

- Return after taxes on distributions and sales of fund shares

|

4.00 %

|

3.65 %

|

3.18 %

|

|

Barclays Capital U.S. Aggregate Bond Index (reflects no deductions for fees, expenses or taxes)

|

6.54 %

|

5.80 %

|

5.84 %

|

Management

Investment Adviser. Wright Investors' Service, Inc. is the investment adviser for the Wright Total Return Bond Fund.

Portfolio Manager. As p ortfolio m anager, M. Anthony E. van Daalen, CFA is primarily responsible for the day-to-day management of the Wright Total Return Bond Fund. Mr. van Daalen has been p ortfolio m anager for the Wright Total Return Bond Fund since October of 2002.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the fund on any business day through your financial intermediary or by mail (Wright Managed Investment Funds, Atlantic Fund Services, Wright Total Return Bond Fund, P.O. Box 588, Portland, ME 04112). Shares also may be purchased by wire (please contact the transfer agent at 1-800-555-0644 for wire instructions) or through an automatic investment program. Shares may also be redeemed by telephone (1-800-555-0644). The minimum initial investment in the fund is $1,000. There are no minimums for subsequent investments. The minimums may be waived for investments by bank trust departments, 401(k) tax-sheltered retirement plans and automatic investment programs.

Tax Information

You may receive distributions from the fund of dividends and capital gains, which may be taxed as ordinary income or capital gains.

Payments to Financial Intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Additional Information Regarding Principal Investment Strategies

This prospectus offers a variety of equity and fixed-income mutual funds designed to meet various individual investment objectives. You can use them singularly or in any combination to meet your objectives.

The investment process at Wright is directed and controlled by an investment committee of experienced analysts each with areas of expertise (the “Investment Committee”), described in greater detail on page 26 .

Securities selected for investment in these funds are chosen mainly from a list of "investment grade" companies maintained by Wright.

More than 3 1 ,000 global companies (covering 63 countries) in Wright's database are screened as new data becomes available to determine any eligible additions or deletions to the list.

The qualifications for inclusion as "investment grade" are companies that meet the Wright Quality Rating criteria. This rating reflects fundamental criteria for investment acceptance, financial strength, profitability & stability and growth.

In addition, securities, which are not included in Wright's "investment grade" list, may also be selected from companies in a fund's specific benchmark (up to 20% of the market value of the portfolio) in order to achieve broad diversification.

Different quality criteria may apply for the different funds. For example, the companies in the Wright Major Blue Chip Equities Fund would require a higher rating in terms of i nvestment a cceptance ( i.e. , the acceptability of a security by and its marketability among investors, and the adequacy of the floating supply of its common shares for the investment of substantial funds) than the companies in the Wright Selected Blue Chip Equities Fund.

An experienced portfolio manager responsible for the investments in each fund works with the investment analysts to consider the suitability of each selection in consideration of sector and industry weightings, the portfolios objective and the benchmark.

The portfolio is then analyzed using third party software to determine the risk and deviation from the specific benchmark.

The goal is to construct portfolios that have risk characteristics similar to their benchmarks but include companies with better overall earnings growth, financial strength and profitability.

Wright Selected Blue Chip Equities Fund

Investment Objective. The Wright Selected Blue Chip Equities Fund seeks to provide long-term total return consisting of price appreciation and current income. “Long-term” is defined as total return occurring over the course of a complete market cycle. The fund's objective may be changed by the T rustees upon notice without shareholder approval.

Principal Investment Strategies. The Wright Selected Blue Chip Equities Fund is characterized as a blend of growth and value. The Adviser seeks to outperform the S&P Mid-Cap 400 by selecting stocks using fundamental company analysis, valuation and earnings trends. Under normal market conditions, the fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by well-established companies. This is a fundamental policy that can only be changed with shareholder approval. “Well-established companies” have a history of six years or longer. The market capitalization of the companies is typically between $1-$10 billion at the time of the fund's investment, however the fund may hold investments in companies of any market capitalization consistent with its investment objective. The fund invests only in those companies whose current operations reflect defined, quantified characteristics which have been identified by Wright as being likely to provide comparatively superior total investment return. The process selects companies from the list of investment-grade companies or the benchmark on the basis of Wright's evaluation of their recent valuation and price/earnings momentum. These selections are further reviewed to determine those that have the best value in terms of current price and current, as well as forecasted, earnings. The portfolio is then

diversified across industries and sectors. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

Temporary Defensive Position. In order to respond to periods of unusual market conditions, when Wright believes that investing for temporary defensive purposes is appropriate, all or a portion of the fund's assets may be held in cash or invested in short-term obligations. A defensive position, taken at the wrong time, may have an adverse impact on the fund’s performance. Although the fund would do this to reduce losses, the fund may be unable to achieve its investment objective during the employment of a temporary defensive measure.

Who May Want to Invest. You may be interested in the fund if you are seeking an investment in common stock, preferred stock and securities convertible into stock for total investment return and intend to make a long-term investment commitment.

Wright Major Blue Chip Equities Fund

Investment Objective. The Wright Major Blue Chip Equities Fund seeks total return, consisting of price appreciation plus income. The fund's objective may be changed by the T rustees upon notice without shareholder approval.

Principal Investment Strategies. The Wright Major Blue Chip Equities Fund seeks to enhance total investment return (consisting of price appreciation plus income) by providing management of a broadly diversified portfolio of equity securities of larger well-established companies. The Adviser defines “major” companies as well-established companies with market values of $5-$10 billion or more at the time of the fund's investment. The fund may also hold investments in companies of any market capitalization consistent with its investment objective. “Well-established companies” have a history of six years or longer. The Adviser seeks to outperform the S&P 500 by selecting stocks using fundamental company analysis, valuation and earnings trends. Under normal market conditions, the fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by well-established large capitalization companies. This is a fundamental policy that can only be changed with shareholder approval. Investment will be made mainly in larger companies on the investment-grade list. In selecting companies for this portfolio, the Investment Committee of Wright selects, based on quantitative formulae, those companies which are expected to do better over the intermediate term. The quantitative formulae take into consideration over/under valuation and compatibility with current market trends. The portfolio is then diversified across industries and sectors. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

Temporary Defensive Position. In order to respond to periods of unusual market conditions, when Wright believes that investing for temporary defensive purposes is appropriate, all or a portion of the fund's assets may be held in cash or invested in short-term obligations. A defensive position, taken at the wrong time, may have an adverse impact on the fund’s performance. Although the fund would do this to reduce losses, the fund may be unable to achieve its investment objective during the employment of a temporary defensive measure.

Who May Want to Invest. This fund may be suitable for investors seeking an investment in common stock, preferred stock and securities convertible into stock for total investment return or a core equity portfolio for those investing in several asset classes.

Wright International Blue Chip Equities Fund

Investment Objective. The Wright International Blue Chip Equities Fund seeks total return consisting of price appreciation plus income. The fund's objective may be changed by the T rustees upon notice without shareholder approval.

Principal Investment Strategies. The Wright International Blue Chip Equities Fund seeks to enhance total investment return (consisting of price appreciation plus income) by investing in a diversified portfolio of equity securities of high-quality, well-established and profitable non-U.S. companies having their principal business activities in at least three different countries outside the United States. “Well-established companies” have a history of six years or longer. The Adviser seeks to outperform the MSCI World ex U.S. Index by selecting stocks using fundamental company analysis, valuation and earnings trends. The portfolio is then diversified across

industries and sectors. The portfolio investments are chosen primarily from companies on the Adviser's "investment grade" list of approved companies. Under normal market conditions, the fund invests at least 80% of its total assets in a diversified portfolio of common stock, preferred stock and securities convertible into stock issued by well-established non-U.S. companies. This is a fundamental policy that can only be changed with shareholder approval. The fund may purchase equity securities traded on a securities market of the country in which the company is located or other foreign securities exchanges, or it may purchase ADR traded in the United States. ADRs represent an interest in the underlying security. ADRs purchased by the fund are typically sponsored by the issuer of the underlying security, however the fund may invest in unsponsored ADRs consistent with its investment objective. The Adviser believes that the resulting diversified portfolio has better overall fundamental characteristics than the benchmark, i.e. earnings growth, financial strength and profitability.

Temporary Defensive Position. In order to respond to periods of unusual market conditions, when Wright believes that investing for temporary defensive purposes is appropriate, all or a portion of the fund's assets may be held in cash or invested in short-term obligations. A defensive position, taken at the wrong time, may have an adverse impact on the fund’s performance. Although the fund would do this to reduce losses, the fund may be unable to achieve its investment objective during the employment of a temporary defensive measure.

Who May Want to Invest. The fund may be suitable for investors seeking a diversified portfolio of quality non-U.S. common stock, preferred stock and securities convertible into stock offering ownership in companies throughout the world and who are not adverse to the risks associated with international investing. Also, because foreign stock prices may not move in concert with U.S. market prices, the fund may be a useful way for an investor to diversify equity investments.

Wright Current Income Fund

Investment Objective. The Wright Current Income Fund seeks a high level of current income consistent with moderate fluctuations of principal. “High level” is measured relative to other fixed income instruments that may seek relative stability of principal. The fund's objective may be changed by the T rustees upon notice without shareholder approval.

Principal Investment Strategies. The Wright Current Income Fund seeks a high level of current income through investments in debt obligations. The Adviser seeks to outperform the Barclays GNMA Backed Bond Index by analyzing securities' structural features, current prices compared with estimated long-term prices, and the credit quality of issuers. Under normal market conditions, the fund invests at least 80% of its total assets primarily in debt obligations issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, mortgage-related securities of governmental or corporate issuers and corporate debt securities. This is a fundamental policy that can only be changed with shareholder approval. The Adviser may allocate assets among different market sectors (agency securities, U.S. Government and Treasury securities, and corporate debt securities) with different maturities based on its view of the relative value of each sector or maturity. The U.S. Government securities in which the fund may invest are bills, notes, and bonds issued by the U.S. Treasury which are direct obligations of the U.S. Government; securities of the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) or the Export-Import Bank of the United States (“Ex-Im Bank”) which are obligations of U.S. Government agencies and instrumentalities secured by the full faith and credit of the U.S. Treasury; obligations secured by the right to borrow from the U.S. Treasury; and securities of the Federal Home Loan Bank (“FHLB”), the Federal National Mortgage Association (“FNMA” or “Fannie Mae”), and the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”) which are obligations backed only by the credit of the government agency itself. The fund may invest in commercial paper, certificates of deposit, bankers acceptances rated A-1 by S&P or P-1 by Moody's. The fund may also invest in corporate obligations with maturities longer than one year rated BBB- by S&P or Baa3 by Moody’s or, if not rated by such rating organizations, of comparable quality as determined by Wright pursuant to guidelines established by the Trustees. The fund reinvests all principal payments. There are no limits on the minimum or maximum weighted average maturity of the fund's portfolio or an individual security. As of December 31, 20 1 0, the fund's average maturity was 4.3 years and its duration was 3.1 years. Duration measures how quickly the principal and interest of a bond is expected to be paid. It is also used to predict how much a bond's value will rise and fall in response to small changes in interest rates. Generally, the shorter a fund's duration is, the less its securities will decline in value when there is an increase in interest rates. Securities held in the fund may have variable rates or may have fixed rates for a specified period before becoming variable at a predetermined positive or negative increment versus a widely available index or benchmark such as the 3-month London Interbank Offer Rate (“LIBOR”) or 3-month U.S. Treasury Bills.

Temporary Defensive Position. In order to respond to periods of unusual market conditions, when Wright believes that investing for temporary defensive purposes is appropriate, all or a portion of the fund's assets may be held in cash or invested in short-term obligations. A defensive position, taken at the wrong time, may have an adverse impact on the fund’s performance. Although the fund would do this to reduce losses, the fund may be unable to achieve its investment objective during the employment of a temporary defensive measure.

Who May Want to Invest. You may want to invest in the fund if you are seeking income over a long period of time. The fund is designed for investors who want to receive the kind of income that mortgage-related securities provide, but do not want to bother with the receipt or reinvestment of principal payments.

Wright Total Return Bond Fund

Investment Objective. The Wright Total Return Bond Fund seeks a superior rate of total return, consisting of a high level of income plus price appreciation. “Superior rate” is measured relative to other bond investments that may seek a high level of income. “High level” is measured relative to bond investments that may seek total return. The fund's objective may be changed by the T rustees upon notice without shareholder approval.

Principal Investment Strategies. The Wright Total Return Bond Fund seeks to invest in bonds and debt securities that will produce the best total return. The Adviser seeks to outperform the Barclays U.S. Aggregate Bond Index through maintaining a portfolio with a weighted average maturity that produces the highest total of ordinary income plus capital appreciation. Assets may be allocated among different market sectors (U.S. Treasury securities, U.S. Government agency securities and corporate bonds) with different maturities based on the Adviser’s view of the relative value of each sector or maturity. Under normal market conditions, the fund may invest at least 80% in U.S. Government and agency obligations, asset-backed and mortgage-backed securities of government or corporate issuers, certificates of deposit of federally insured banks and corporate obligations rated at the date of investment BBB- or better (investment grade) by S&P or Baa3 or better by Moody's or, if not rated by such rating organizations, of comparable quality as determined by Wright pursuant to guidelines established by the T rustees. This is a fundamental policy that can only be changed with shareholder approval. Government securities in which the fund may invest are bills, notes, and bonds issued by the U.S. Treasury which are direct obligations of the U.S. Government; securities of the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) or the Export-Import Bank of the United States (“Ex-Im Bank”), which are obligations of U.S. Government agencies and instrumentalities secured by the full faith and credit of the U.S. Treasury; obligations secured by the right to borrow from the U.S. Treasury; and securities of the Federal Home Loan Bank (“FHLB”), the Federal National Mortgage Association (“FNMA” or “Fannie Mae”), and the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”) which are obligations backed only by the credit of the government agency itself. The fund may invest in commercial paper, certificates of deposit, bankers acceptances rated A-1 by S&P or P-1 by Moody's. There are no limits on the minimum or maximum weighted average maturity of the fund's portfolio or on the maturity of any individual security. Accordingly, investment selections may differ depending on the particular phase of the interest rate cycle. These securities meet the Wright Quality Rating Standards. Investment selections differ depending on the trend in interest rates. The fund looks for securities that in Wright's judgment will produce the best total return. Wright allocates assets among different market sectors (U.S. Treasury securities, U.S. Government agency securities and corporate bonds) with different maturities based on its view of the relative value of each sector or maturity. There are no limits on the minimum or maximum weighted average maturity of the fund's portfolio or an individual security. As of December 31, 20 1 0, the fund's average maturity was 6.1 years and its duration was 4.7 years. Duration measures how quickly the principal and interest of a bond is expected to be paid. It is also used to predict how much a bond's value will rise and fall in response to small changes in interest rates. Generally, the shorter a fund's duration is, the less its securities will decline in value when there is an increase in interest rates.

Temporary Defensive Position. In order to respond to periods of unusual market conditions, when Wright believes that investing for temporary defensive purposes is appropriate, all or a portion of the fund's assets may be held in cash or invested in short-term obligations. A defensive position, taken at the wrong time, may have an adverse impact on the fund’s performance. Although the fund would do this to reduce losses, the fund may be unable to achieve its investment objective during the employment of a temporary defensive measure.

Who May Want to Invest. You may be interested in the fund if you seek a level of income consistent with total return by investing in intermediate and longer term debt and can accept price fluctuations.

Additional Information Regarding Principal Risks

It is important that you closely review and understand the risks of investing in each fund.

Principal risks for Wright Selected Blue Chip Equities Fund, Wright Major Blue Chip Equities Fund, and Wright International Blue Chip Equities Fund include:

Recent Market Events Risk. Unprecedented recent turbulence in the financial markets and reduced liquidity in equity, credit and fixed income markets may negatively affect issuers worldwide, which could have an adverse effect on a fund.

Market Risk: An investment in a fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. In general, stock values are affected by activities specific to a company, as well as general market, economic and political conditions. A fund’s net asset value (“NAV”) and investment return will fluctuate based on changes in value of its portfolio securities. The market value of a fund’s securities is based upon the market’s perception of value and is not necessarily an objective measure of the securities’ value. A fund is not by itself a complete investment program, and there is no assurance that a fund will achieve its investment objective. You could lose money on your investment in a fund, and a fund could underperform other investments. The principal risks of an investment in a fund include:

|

·

|

The market may experience declines in general, or a decline in investor demand for the stocks held by the fund may adversely affect the value of the securities held;

|

|

·

|

The earnings of the companies in which a fund invests may not continue to grow at expected rates, thus causing the price of the underlying stocks to decline; and

|

|

·

|

The Adviser’s strategy may fail to produce the intended results.

|

Management Risk. A fund is actively managed and its performance, therefore, will reflect the Adviser’s ability to make investment decisions which are suited to achieving a fund’s investment objective. Due to its active management, a fund could underperform other mutual funds with similar investment objectives.

Large Capitalization Company Risk (except for Wright Selected Blue Chip Equities Fund). Large capitalization company stocks may underperform other segments of the equity market or the equity market as a whole. Larger, more established companies may be slow to respond to challenges and may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.