As filed with the Securities and Exchange Commission on March 7, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-3489

THE WRIGHT MANAGED EQUITY TRUST

440 Wheelers Farm Road

Milford, Connecticut 06461

Christopher A. Madden

Three Canal Plaza, Suite 600

Portland, ME 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 – December 31, 2010

ITEM 1. REPORT TO STOCKHOLDERS.

Table of Contents

|

|

|

|

|

| Investment Objectives | inside front cover | ||

| Letter to Shareholders (Unaudited) | 2 |

|

|

| Management Discussion (Unaudited) | 4 | ||

| Performance Summaries (Unaudited) | 9 | ||

| Fund Expenses (Unaudited) | 14 | ||

| Management and Organization (Unaudited) | 65 | ||

|

Board of Trustees Annual Approval of the Investment Advisory Agreement (Unaudited)

|

67 |

|

|

| Important Notices Regarding Privacy, Delivery of Shareholder Documents, Portfolio Holdings and Proxy Voting (Unaudited) | 68 | ||

FINANCIAL STATEMENTS

|

The Wright Managed Equity Trust

|

|

|

|

|

Wright Selected Blue Chip Equities Fund

|

|||

| Portfolio of Investments | 16 | ||

| Statement of Assets and Liabilities | 18 | ||

| Statement of Operations | 18 |

|

|

| Statement of Changes in Net Assets | 19 | ||

| Financial Highlights | 20 |

|

Wright Major Blue Chip Equities Fund

|

|||

| Portfolio of Investments | 21 | ||

| Statement of Assets and Liabilities | 23 | ||

| Statement of Operations | 23 |

|

|

| Statement of Changes in Net Assets | 24 | ||

| Financial Highlights | 25 |

|

Wright International Blue Chip Equities Fund

|

|||

| Portfolio of Investments | 26 | ||

| Statement of Assets and Liabilities | 28 | ||

| Statement of Operations | 28 |

|

|

| Statement of Changes in Net Assets | 29 | ||

| Financial Highlights | 30 | ||

| Notes to Financial Statements | 31 | ||

| Report of Independent Registered Public Accounting Firm | 39 | ||

| Federal Tax Information (Unaudited) | 40 |

|

The Wright Managed Income Trust

|

|

|

|

|

Wright Total Return Bond Fund

|

|||

| Portfolio of Investments | 41 | ||

| Statement of Assets and Liabilities | 46 | ||

| Statement of Operations | 46 |

|

|

| Statement of Changes in Net Assets | 47 | ||

| Financial Highlights | 48 |

|

Wright Current Income Fund

|

|||

| Portfolio of Investments | 49 | ||

| Statement of Assets and Liabilities | 53 | ||

| Statement of Operations | 54 |

|

|

| Statement of Changes in Net Assets | 55 | ||

| Financial Highlights |

| Notes to Financial Statements | 56 | ||

| Report of Independent Registered Public Accounting Firm | 63 | ||

| Federal Tax Information (Unaudited) | 64 |

1

|

Letter to Shareholders (Unaudited)

|

| January 2011 |

Dear Shareholders:

For the third year in a row, the opening day of the New Year has seen stock prices moving sharply higher, with the S&P 500 advancing 1.1% on January 3, 2011. In both 2009 and 2010, first-day market gains proved to be good omens for equity investors anxious about year-ahead prospects after the pummeling they took in 2008, when the market’s big first-day decline (-1.4%) was anything but auspicious. While Monday’s better-than-1% rise in the S&P 500 was the market’s 14th best start in eight decades, it is admittedly not much of a “forecast” to hang one’s hat on going into the New Year. Over the entire 1929-2010 period, the correlation between first-day trading and the rest of the year is slight (R2 = 5%). Also, 2010’s strong stock market opening didn’t preclude a 16% decline in the S&P 500 from April to July. Happily, global stock markets ended 2010 with a flourish, with December returns for the MSCI World ex U.S. index averaging over 7% in U.S. dollar terms, making last month the best December since 1999. For all of 2010, the S&P 500 returned a bit more than 15%, 10.8% of that coming in the fourth quarter. The U.S. bond market suffered a 1.3% loss in Q4, but returned 6.5% for the entire year, as credit spreads narrowed.

Fortunately, there is a more substantial, more fundamental basis for expecting 2011 to be a satisfying year for stock investors than its good opening day showing, namely, the quickening of economic activity that took place in the U.S. and parts of Europe as 2010 was winding down. In the U.S., the first big economic reports of the New Year, the ISM surveys of purchasing managers, showed new order rates in both manufacturing and nonmanufacturing climbing as 2010 was ending, with service industries’ orders hitting the highest level since 2005. To be sure, there remain pockets of weakness geographically and by sector, and risks of a less benign outcome are not insignificant, but chances are good in our opinion that 2011 will see a respectable increase in world GDP. The slowdown in growth engines China and India is expected to be quite limited, in our view. The food inflation that has caused the People’s Bank of China to nudge up interest rates recently is likely to be a temporary and ultimately secondary obstacle to the country’s prime objective of continuing job creation and growth. In the developed world, economic policy by and large remains pro-growth, led by the U.S. combination of $600 billion in quantitative easing and tax cutting and job programs totalling $858 billion.

If the United States economy advances by the roughly 3% that Wright Investors’ Service is forecasting for 2011, we should see another healthy increase in corporate profits, continuing what has been the most impressive aspect of the economic expansion that began 18 months ago. By the Commerce Department’s reckoning, corporate profits from current production were practically back to their all-time high in the third quarter of 2010; in Wright’s estimation, S&P 500 profits from operations will attain record heights in the year ahead, providing fundamental support for higher stock prices.

At the stock market peak in 2007, the S&P 500 was priced at 22 times trailing five-year earnings; by comparison, 2011 is starting at a more moderate 17 times trailing five-year profits. What’s more, if current projections pan out, the S&P 500 is priced at 14 times forecast 2011 profits, in line with its post-1960 average. Of course, the fact that the S&P 500 has risen 86% since its March 2009 low, the biggest 22-month advance since the 1950s, is reason enough to approach 2011 with some measure of caution. At the very least, we expect to see more evidence of a trade-up in quality by investors – favoring more seasoned and generally bigger-capitalization stocks over smaller-cap and emerging market issues. This would represent a pulling back from the so-called risk-on behavior that investors exhibited during 2009-10. Investors were somewhat more discriminating in 2010 than in the prior year, but really only during the downdrafts of the spring and summer months.

Some of the uncertainties that faced investors three months ago have begun to be clarified. As we suggested three months ago, the November elections did indeed “resolve some major uncertainties with respect to taxes and fiscal policy generally.” For example, the so-called Bush tax cuts were extended for 2011-12 and across the income spectrum, as expected. Europe’s financial crises, while still at risk of erupting from time to time and from place to place, do not appear to be as serious a threat to the survival of the euro as seemed the case this past summer. The euro was the weakest of the major currencies in 2010, the yen one of the

2

|

Letter to Shareholders (Unaudited)

|

strongest; since its June low, however, the euro has rebounded more than 10% against the U.S. dollar, an indication that market anxiety regarding the euro has receded from the panic seen last summer.

Additional quantitative easing, announced by the Federal Reserve the day after the elections but anticipated since the Fed’s Jackson Hole conclave in August, has elevated inflation expectations about 35 basis points. Somewhat perversely, anticipation of a new Treasury bond buying program from the Fed took interest rates to lows in early November, and since the actual announcement and start of QE2 long-term interest rates have risen some 75 basis points, as clear a case of “buy the rumor, sell the news” as ever there was. The renewed downtrend in home prices the past four months certainly isn’t helped by this latest escalation of mortgage rates, which along with the nation’s 9%-10% unemployment rate, are important reasons to expect accommodative policies to continue. Our call continues to be that the Federal Reserve will stay on the sidelines after QE2 ends at mid-year 2011, leaving the federal funds rate in the 0%-0.25% range throughout the year.

Realistically, growth is the only solution to the deficit mess that the federal government and the states find themselves in. Policy makers are likely to seek some combination of faster real growth and higher inflation, preferably more of the former than the latter, with the caveat that government spending will be a target of the new Congress. If we have to characterize it, a reduced role for the government is probably the better long-term path but it comes with some short-run braking effects. In the near term, there may be other obstacles to growth that give currency to the idea of a “new normal” growth rate for the U.S. economy somewhere below the nation’s potential – for instance, the unwinding of debt by consumers and the increasing savings rate. The tectonic attitude shift reflected in the 2010 elections suggests that fiscal policy will get less accommodative as we move further away from the financial crisis that followed the Lehman bankruptcy.

Investors continue to face risks in the sphere of debt and deficits, but after two major bear markets in 10 years, the markets may have sufficiently discounted these uncertainties, so that respectable returns – in the range of the market’s long-term norms – are quite feasible looking out over the next five years. Corporate profits and conditions in the credit markets, approaching record levels in the case of profits and moving back toward normal in credit, are the focus of our scrutiny as we enter the New Year armed with caution but also with more economic optimism than has been warranted since 2006. If you have any questions or suggestions on how we can better serve your investment and wealth management needs, please let us know.

Sincerely,

Peter M. Donovan

Chairman & CEO

3

|

Management Discussion (Unaudited)

|

WRIGHT EQUITY FUNDS

The S&P 500 returned more than 15% in 2010. U.S. stocks’ strong showing in the second half of the year more than made up for ground lost in the first half. After rising without interruption for more than a year, stocks reversed course in the second quarter of 2010, giving back the first quarter’s gains on concerns about the euro region’s debt crisis and signs of a slowdown in the recovery’s momentum. But stocks turned positive in Q3 and the strength continued in the fourth quarter. Early in Q4, stocks got a boost from strong third-quarter profit reports; for all of 2010, S&P 500 operating profits probably rose more than 35%. Anticipation of the start of the second round of quantitative easing by the Fed also sent stocks higher. The rally stalled in November, with a resurgence of the debt crisis in Europe contributing to investor unease. Globally, stocks staged a bona fide year-end rally in December as conditions in Europe stabilized a bit, at least temporarily, and economic indicators pointed to better growth ahead, quite a change from earlier in the year when fears of a double dip took hold. In the U.S., economic activity quickened starting in the fall; Q4 GDP growth was probably in the 3% range after growth of 2.6% in Q3 and 1.7% in Q2. Consumer spending has picked up and manufacturing activity has firmed. So far, the recovery in jobs remains disappointing and the housing market has seen little improvement.

The S&P 500 returned 10.8% for the fourth quarter of 2010. By the end of the year, the S&P had reached its highest level in two years and was up 86% from its 2009 low – though it was still 20% shy of its all-time high reached in 2007. The Dow’s returns were a little behind the S&P 500 for the periods (8% for the quarter and 14% for the year) and Nasdaq’s were a little better (12% for the quarter and 18% for the year). For the year and the quarter, cyclical stocks generally did better than defensive in the S&P 500; high-quality stocks lagged lower quality in the first half of the year but started to make a comeback in the second half, even though in general investors seemed willing to take on more risk. This “risk-on” mood was evident in the strong showing of smaller stocks in Q4 – the S&P MidCap 400 returned 13.5% and the S&P SmallCap 600 returned more than 16%; both of these indexes returned more than 26% for the year. Investors were confident enough to push the S&P 500’s forward P/E up in the quarter and to take the VIX stock volatility index under 20, close to last April’s low. Results from international stock markets were a mixed bag in the full year and fourth quarter of 2010, as the euro region’s debt crisis put a damper on European markets. The MSCI World ex U.S. index of developed markets returned 7.2% in Q4 and 9.0% for all of 2010 in dollar terms. Developed markets in the Pacific region had a strong showing with dollar returns of 10.6% in the quarter and 15.9% for the year, with assistance from a strong yen. Not surprisingly, the returns from Europe lagged the overall index – 4.5% from Europe overall and 1.5% from the Euro countries in Q4. For the year, the Euro region lost nearly 6% in dollar terms, with the weakness of the euro detracting from dollar returns.

The fourth-quarter rally in stocks notwithstanding, WIS believes that the prospects for equities relative to bonds over the coming year look brighter than they did three months ago. Due to the quickening of economic activity in recent months, U.S. GDP will be starting 2011 at a higher level and with more momentum than appeared likely just a few months ago. In addition, the tax cut package that the Administration and Congress worked out in December will add some stimulus in 2011. Our current expectation is for 3%-3.5% GDP growth in the coming year. Corporate profits have been a bright spot of this generally tepid economic recovery almost since its beginning. S&P 500 operating profits likely rose more than 35% in 2010 and another, albeit more modest, double-digit gain is likely in 2011. Cost reduction efforts enabled companies to improve margins with only modest sales growth, and there is room for further gains in profitability should sales strengthen in 2011 as we expect they will. Even with an improving fundamental environment, there could be bouts of stock market volatility over the coming year, periods like the spring and summer of 2010 when the economic indicators were not so promising. We also believe that the ebb and flow of debt concerns both here and abroad have the potential to affect the stock market in 2011. But over the course of the year, the good news should outweigh the bad, and with the stock market’s multiple still below the average of the past 25 years, there is room for equities to respond to good news.

4

|

Management Discussion (Unaudited)

|

SELECTED BLUE CHIP FUND

The S&P MidCap 400 outperformed the S&P 500 in 2010 with a return of 26.6%. The Wright Selected Blue Chip Fund (WSBC) returned 23.9% for the year. WSBC outperformed the S&P MidCap 400 in the first and fourth quarters of 2010, but lagged in the middle six months of the year. In the fourth quarter, WSBC returned 13.7% compared to 13.5% for the mid-cap benchmark.

In 2010, stock selection was the biggest factor in WSBC’s relative performance compared to the S&P MidCap benchmark, while sector allocation played a smaller role overall. In the first and fourth quarters, when the Fund outperformed the benchmark, stocks selection was positive, while in the second and third quarters, stock selection detracted from performance. In the fourth quarter, the Fund benefitted from the relatively good performance of its holdings in financials, information technology, energy and telecom services; overall, selection was positive in six of 10 sectors. For the year, the biggest benefit came from information technology and materials, while selection in consumer discretionary stocks hurt performance. In the fourth quarter, strong positive contributions came from energy holdings Cimarex Energy and Oceaneering International, both up more than 30%, and tech stock Vishay Intertechnology, up 52%. The biggest detraction came from two health care companies, Medicis (-9.4%) and Teleflex (-10%) and retailer 99 Cents Only Store (-17%). For the year, strong relative contributions came from tech stocks F5 Networks (+146%) and Sybase (+50%) and energy company Cimarex Energy (+68%), while Manpower (-21%) and American Eagle Outfitters (-23%) lagged.

We expect that the second half of 2010’s shift toward quality stocks will continue in 2011. The WSBC Fund is positioned in the mid-cap universe to take advantage of a preference for quality. WSBC continues to be biased to the larger companies in the index and its holdings have better historic earnings growth than the index constituents. In the aggregate, WSBC companies had lower current and forward P/E multiples than those in the MidCap 400 with similar rates of expected earnings growth. WIS continues to advise diversity in investment portfolios as the best way to navigate difficult economic times.

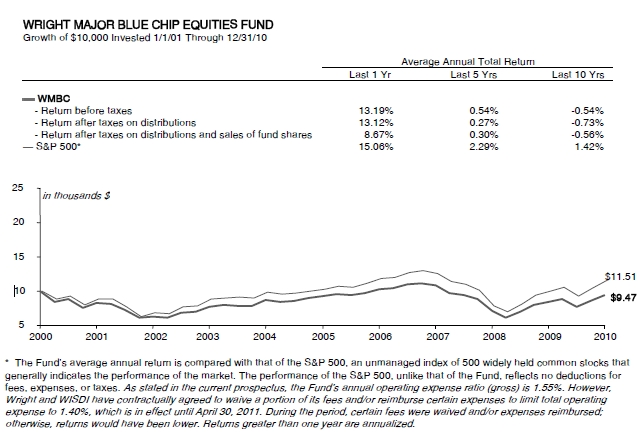

MAJOR BLUE CHIP FUND

The Wright Major Blue Chip Fund (WMBC) is managed as a blend of the large-cap growth and value stocks in the S&P 500 Composite, selected with a bias toward the higher-quality issues in the index. The WMBC Fund returned 11.2% in the fourth quarter of 2010, topping the S&P 500’s 10.8%. For the year, WMBC returned 13.2% compared to 15.1% for the S&P 500. WMBC matched its benchmark’s results in the first quarter, then lagged in Q2 and Q3 before gaining some ground in Q4.

In the first half of 2010, WMBC’s emphasis on quality worked against it as investors continued to prefer low-quality issues. In the second half of the year, investors returned to quality, but for the year as a whole its emphasis on quality hurt Fund performance. In addition, 2010 was a year when smaller stocks outperformed big stocks, so the WMBC’s larger median market cap compared to the benchmark also hurt performance for the year. As investors became more cautious in the second quarter, WMBC took a cash reserve, a plus for quarterly performance in that quarter. In the second half of the year, as stocks rallied, the cash reserve was invested in equities. In the fourth quarter, WMBC benefitted from being overweight in materials stocks, one of the strongest sectors in the S&P 500 in the quarter, and also from strong stock selection in that group. The Fund was also helped by being underweight in the defensive utility and consumer staples groups, as more cyclical groups were strong in Q4. Strong stock selection in financials was also positive in Q4. For the year, stock selection in the materials, information technology, and consumer discretionary and energy sectors was positive for the Fund, while stock selection in industrials was a drag on performance. Looking at individual issues, positive contributors to relative performance in Q4 were energy stock National Oilwell (+51%) and materials company Freeport-McMoRan (+42%). A 15% decline in retailer Best Buy, whose operating performance was disappointing, detracted from performance in Q4. For the year, National Oilwell (+54%) and Freeport-McMoRan (+53%) were among the positive contributors, along with Apple Computer (+53%), while Google (-26%), WellPoint (-18.0%) and Hewlett Packard (-18%) lagged.

5

|

Management Discussion (Unaudited)

|

Going into 2011, WIS expects that equities will continue to be supported by solid profit growth. We are expecting U.S. economic growth to pick up in 2011, and to take advantage of this, WMBC is overweight in the materials, consumer discretionary and information technology sectors, as well as financials. In addition, corporations have accumulated significant cash on their balance sheets, setting the stage for possible stock buybacks and dividend increases. WMBC is well positioned to take advantage of an environment in which stock performance is driven by fundamentals, with its bias toward the higher quality and more substantial issues in the S&P 500 and an attractive valuation. At year-end 2010, WMBC holdings in the aggregate were priced at lower current and forward P/E multiples than the S&P 500 despite better historic earnings growth and similar forecast earnings growth.

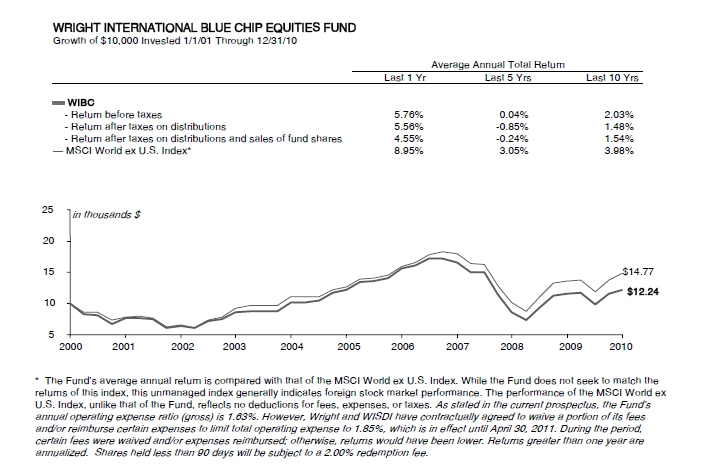

INTERNATIONAL BLUE CHIP FUND

The MSCI World ex U.S. index lagged the S&P 500 in 2010 with a 9.0% return compared to 15.1% for the S&P 500. The Wright International Blue Chip Fund (WIBC) lagged the MSCI World ex U.S. index in the first half of the year, made up some ground in Q3, but underperformed the benchmark in Q4, with a return of 6.2% compared to 7.2% for the MSCI World ex U.S. index. For all of 2010, WIBC returned 5.8% compared to the MSCI World ex U.S. benchmark’s 9.0% return.

As in the U.S., cyclical groups did better than defensive groups in international markets in 2010, and in both the full year and the fourth quarter, WIBC’s relative performance benefitted from its positioning to take advantage of this, particularly through its overweighting in the industrial and materials sectors, where it focused on companies that benefit from exports to emerging markets. Stock selection was strong in the materials sector. However, stock selection overall was negative for both periods, with the biggest drag on performance coming from the financial sector as its holdings in European banks suffered from worry about fallout from the Euro debt crisis. In line with these trends, among the positive contributors in Q4 were chemical company BASF (+27%) and miners Teck Resources (+52%) and BHP Billiton (+25%). Three banks were among the laggards: BNP Paribas (-10%), Banco Santander (-15%) and Barclays (-13%). For the year, miners Rio Tinto (+58%) and Teck Resources (+79%), industrial Itochu (+41%) and consumer discretionary company Jardine Cycle & Carriage (+53%) were leaders, while banks Banco Santander (-32%) and BNP Paribas (-18%) were again among the worst performers.

Moving into 2011, WIBC remains overweight in material, energy, industrials and consumer discretionary stocks, as we expect some pick-up in momentum in the global recovery this year. The Fund’s positioning also reflects the view that emerging markets will continue to drive global growth. WIBC is well positioned to benefit from a trend back toward quality and also offers attractive value. In the aggregate, its holdings are priced at significant discounts to the MSCI World ex U.S. index in terms of current and forward price/earnings ratios and price/cash flow ratio. Increasing dividends should also contribute to WIBC returns going forward. We continue to see the inclusion of international stocks as likely to enhance risk-adjusted returns in diversified investment portfolios.

6

|

Management Discussion (Unaudited)

|

WRIGHT FIXED INCOME FUNDS

Treasury bond yields declined over the course of 2010. For the first three quarters of the year bond yields moved lower for a number of reasons: the U.S. recovery was proceeding at a below-normal pace; inflation was low; the Fed was moving toward more quantitative easing; and concern over the euro region’s finances made the safety of Treasury bonds appealing. The yield on the 10-year Treasury moved under 2.5% early in Q4, down 130 basis points from where it started the year. Yields rose in the fourth quarter, however, as economic indicators turned more positive and indications that Europe was dealing with its crisis boosted investor confidence and drew funds out of Treasury bonds and into stocks. The 10-year Treasury yield moved up to 3.3% by year end, down about 50 bps from where it started the year. Short-term rates were much less volatile in 2010 as the likelihood that the Fed would raise rates during the year waned. The yield curve flattened in Q2 and Q3 as long yields retreated, then steepened again in Q4, with the yield spread between two-year and 10-year T-bonds closing the year just about where it began. Spreads on corporate bonds tightened for much of the year, a sign of confidence that at times was at odds with the signal being given by rising Treasury prices.

For all of 2010, the Barclays Capital U.S. Aggregate Bond index (“Barclays Aggregate”) generated a respectable return of 6.5% despite a 1.3% loss in the fourth quarter of 2010. Treasury bonds were the worst place to be in the fourth quarter, with the sector losing 2.6%; for the year, Treasurys lagged the Aggregate with a 5.9% return. With spreads tightening, corporate bonds had a smaller loss than Treasurys, 1.6%, in Q4; they also topped Treasurys for the year with a 9.0% return. Agency securities topped Treasurys in Q4 but lagged for the year. Mortgage-backed and commercial mortgage securities both had positive returns in Q4; for all of 2010, commercial mortgages led the investment-grade sectors with a 20% return, while mortgages lagged with 5.4%. Investors’ increased appetite for risk made this a very good year for non-investment grade bonds, which returned 3% in the fourth quarter and 15% for the year.

It is unlikely that the Fed will change its near-zero interest rate policy in 2011. Although economic activity quickened late in 2010, the implementation of quantitative easing and recent comments suggest the Fed continues to be disappointed with the pace of recovery and is more worried about too little inflation rather than too much. In the year through November, the latest month available, the PCE deflator increased just 1.0% and the core PCE deflator (ex food and energy) was up less than 0.8%. We expect, however, that inflation will start to move up in 2011, though we don’t expect it to reach the 2% mark. Nevertheless, we expect that as economic growth picks up interest rates will edge higher over the course of 2011, especially in longer-dated issues. We don’t believe that the rise will be steep or continuous, especially since the potential for some soft periods in the stock market could send investors back to bonds at times. The speed and magnitude of the correction in bonds in the fourth quarter of 2010 was excessive and not a good model for what may happen in 2011, in our view. While Treasury bond prices are likely to decline in 2011, income and spread tightening on non-Treasury sectors could keep 2011’s return on the Barclays Aggregate modestly positive and just about on a pace with inflation. The always-present potential for surprises suggests that conservative long-term investors keep their portfolios diversified with a mix of asset classes.

7

|

Management Discussion (Unaudited)

|

TOTAL RETURN BOND FUND

The Wright Total Return Bond Fund (WTRB), a diversified bond fund, returned 6.2% in 2010 compared to 6.5% for the Barclays Aggregate. The Fund outperformed the index in the first and third quarters of 2010, lagged in the second quarter and in the fourth quarter of 2010 had a slight shortfall with a loss of 1.4% compared to a loss of 1.3% for the index. The WTRB had a yield of 2.6% for December 2010 calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

Sector allocation played a major role in WTRB’s performance in 2010. Throughout the year, WTRB was significantly overweight in corporate bonds (43% of assets at year end compared to 24% for the benchmark) and also overweight in commercial mortgages (7% vs 3%). With spreads on these sectors tightening in three of four quarters in 2010 (Q2 was the exception), this allocation was a plus for performance for the year. Being underweight in mortgages for the first nine months of the year, when mortgage returns lagged, also helped. Early in the fourth quarter, WTRB returned to a neutral position in mortgages, which outperformed the benchmark in the final period of the year. Throughout the year, WTRB was underweight in Treasury and Agency issues, which underperformed the Barclays Aggregate in 2010.

WTRB’s duration position was shorter than the Barclays Aggregate throughout the first nine months of 2010. This had a negative effect on the Fund’s relative performance as interest rates declined during this period. In the fourth quarter, in the belief that the impact of QE2 might increase Treasury bond volatility, the duration was moved to just about neutral with the benchmark; WTRB was also positioned relatively neutral along the yield curve. With this positioning, which was continued early in 2011, the rise in interest rates in Q4, which occurred primarily in December, had little effect on the Fund’s relative performance.

CURRENT INCOME FUND

For all of 2010, the mortgage-backed sector of the bond market returned 5.4%, lagging both Treasury bonds, which returned 5.9%, and the Barclays Aggregate, which returned 6.5%. In the fourth quarter, the MBS sector returned 0.2% compared to losses of 1.3% for the Barclays Aggregate and 2.6% for Treasuries. The Wright Current Income Fund (WCIF) is managed to be primarily invested in GNMA issues (mortgage-based securities, known as Ginnie Maes, guaranteed by the full faith and credit of the U.S. government) and other mortgage-based securities backed by government agencies. The WCIF Fund is actively managed to maximize income and minimize principal fluctuation. WCIF returned 0.1% after expenses in the fourth quarter of 2010 compared to 0.3% for the Barclays Capital GNMA Backed Bond index (“Barclays GNMA”). For all of 2010, WCIF returned 5.7% compared to 6.7% for the benchmark. The WCIF had a yield of 3.4% for December 2010 calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

In addition to its holdings in Ginnie Maes (about 60% of assets at year end), WCIF also held mortgage securities backed by Fannie Mae (FNMA) and Freddie Mac (FHLMC). These issues had returns that were slightly behind Ginnie Mae returns in each of the four quarters of 2010. During 2010, WCIFs mortgage holdings in the aggregate had a slightly shorter duration than the Barclays GNMA benchmark. This worked against the Fund when interest rates were falling in the first three quarters of 2010 but was helpful in Q4 when interest rates declined. The effect of the Fund’s duration differential compared to the benchmark was mitigated by holdings of higher-coupon, well-seasoned bonds. This contributed to the Fund having less negative convexity than the Barclays GNMA benchmark, which results in more stable performance when interest rates are volatile. In keeping with its goal of providing high income, at year end the WCIF Fund’s average coupon was 5.8% compared to 5.0% for the Barclays GNMA index.

8

|

Performance Summaries (Unaudited)

|

Important

The Total Investment Return is the percent return of an initial $10,000 investment made at the beginning of the period to the ending redeemable value assuming all dividends and distributions are reinvested. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Past performance is not predictive of future performance.

The Fund’s average annual return is compared with that of the S&P MidCap 400, an unmanaged index of stocks in a broad range of industries with market capitalizations of a few billion or less. The performance of the S&P MidCap 400, unlike that of the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.15%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.40%, which is in effect until April 30, 2011. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

* The Fund’s average annual return is compared with that of the S&P MidCap 400, an unmanaged index of stocks in a broad range of industries with market capitalizations of a few billion or less. The performance of the S&P MidCap 400, unlike that of the Fund, reflects no deductions for fees, expenses or taxes. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 2.15%. However, Wright and WISDI have contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.40%, which is in effect until April 30, 2011. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Returns greater than one year are annualized.

|

Industry Weightings

|

Ten Largest Stock Holdings

|

||||||||||||||

|

|

|

||||||||||||||

|

% of net assets @ 12/31/10

|

% of net assets @ 12/31/10

|

||||||||||||||

|

Retailing

|

11.1

|

%

|

Consumer Services

|

1.8

|

%

|

Cimarex Energy Co.

|

3.2

|

%

|

|||||||

|

Electronic Equipment & Instruments

|

8.7

|

%

|

Household & Personal Products

|

1.8

|

%

|

Fulton Financial Corp.

|

2.4

|

%

|

|||||||

|

Health Care Equipment & Services

Materials

|

8.3

7.2

|

%

%

|

Semiconductors & Semiconductor Equipment

|

1.8

|

%

|

Jones Lang LaSalle, Inc.

Lincare Holdings, Inc.

|

2.4

2.3

|

%

%

|

|||||||

|

Insurance

|

6.9

|

%

|

Capital Goods

|

1.5

|

%

|

F5 Networks, Inc.

|

2.2

|

%

|

|||||||

|

Software & Services

|

6.8

|

%

|

Oil & Gas

|

1.2

|

%

|

Lubrizol Corp.

|

2.1

|

%

|

|||||||

|

Energy

|

6.5

|

%

|

Telecommunication Services

|

1.1

|

%

|

Ross Stores, Inc.

|

2.0

|

%

|

|||||||

|

Industrial

|

5.7

|

%

|

Commercial Services & Supplies

|

0.9

|

%

|

Avnet, Inc.

|

1.7

|

%

|

|||||||

|

Real Estate

|

5.5

|

%

|

Machinery

|

0.9

|

%

|

Endo Pharmaceuticals Holdings, Inc.

|

1.7

|

%

|

|||||||

|

Banks

|

4.9

|

%

|

Aerospace & Defense

|

0.8

|

%

|

HCC Insurance Holdings, Inc.

|

1.7

|

%

|

|||||||

|

Utilities

|

4.7

|

%

|

Food, Beverage & Tobacco

|

0.8

|

%

|

||||||||||

|

Pharmaceuticals & Biotechnology

|

3.2

|

%

|

Consumer Products

|

0.7

|

%

|

||||||||||

|

Diversified Financials

|

2.0

|

%

|

Communications Equipment

|

0.5

|

%

|

||||||||||

|

Automobiles & Components

|

1.9

|

%

|

Media

|

0.4

|

%

|

||||||||||

|

Chemicals

|

1.8

|

%

|

Education

|

0.3

|

%

|

||||||||||

9

|

Performance Summaries (Unaudited)

|

|

Industry Weightings

|

Ten Largest Stock Holdings

|

||||||||||||||

|

|

|

||||||||||||||

|

% of net assets @ 12/31/10

|

% of net assets @ 12/31/10

|

||||||||||||||

|

Computers & Peripherals

|

12.4

|

%

|

Telecommunication Services

|

2.9

|

%

|

Apple, Inc.

|

5.0

|

%

|

|||||||

|

Energy

|

11.0

|

%

|

Food & Staples Retailing

|

2.7

|

%

|

International Business Machines Corp.

|

4.1

|

%

|

|||||||

|

Diversified Financials

|

9.1

|

%

|

Household Durables

|

2.0

|

%

|

Oracle Corp.

|

3.4

|

%

|

|||||||

|

Software & Services

|

8.0

|

%

|

Utilities

|

1.6

|

%

|

JPMorgan Chase & Co.

|

3.1

|

%

|

|||||||

|

Pharmaceuticals & Biotechnology

|

7.1

|

%

|

Food, Beverage & Tobacco

|

1.5

|

%

|

Chevron Corp.

|

3.0

|

%

|

|||||||

|

Media

|

5.1

|

%

|

Consumer Durables & Apparel

|

1.3

|

%

|

Freeport-McMoRan Copper & Gold, Inc.

|

2.9

|

%

|

|||||||

|

Insurance

|

4.9

|

%

|

Industrial

|

1.0

|

%

|

Hewlett-Packard Co.

|

2.7

|

%

|

|||||||

|

Health Care Equipment & Services

|

4.7

|

%

|

Communications Equipment

|

0.8

|

%

|

Wells Fargo & Co.

|

2.4

|

%

|

|||||||

|

Materials

|

4.7

|

%

|

Technology Hardware & Equipment

|

0.8

|

%

|

Microsoft Corp.

|

2.4

|

%

|

|||||||

|

Retailing

|

4.5

|

%

|

Transportation

|

0.7

|

%

|

National Oilwell Varco, Inc.

|

2.3

|

%

|

|||||||

|

Banks

|

4.3

|

%

|

Automobiles & Components

|

0.6

|

%

|

||||||||||

|

Capital Goods

|

3.4

|

%

|

Hotels, Restaurants & Leisure

|

0.5

|

%

|

||||||||||

|

Aerospace

|

3.3

|

%

|

Semiconductors & Semiconductor Equipment

|

0.5

|

%

|

||||||||||

10

|

Performance Summaries (Unaudited)

|

|

Country Weightings

|

Ten Largest Stock Holdings

|

||||||||||||

|

|

|

||||||||||||

|

% of net assets @ 12/31/10

|

% of net assets @ 12/31/10

|

||||||||||||

|

United Kingdom

|

18.6

|

%

|

Hong Kong

|

2.6

|

%

|

BP PLC

|

3.6

|

%

|

|||||

|

Japan

|

16.4

|

%

|

Israel

|

2.3

|

%

|

BASF SE

|

2.3

|

%

|

|||||

|

France

|

8.7

|

%

|

Netherlands

|

2.1

|

%

|

Nestle SA

|

2.2

|

%

|

|||||

|

Canada

|

8.5

|

%

|

Sweden

|

1.6

|

%

|

ITOCHU Corp.

|

2.0

|

%

|

|||||

|

Switzerland

|

6.7

|

%

|

Denmark

|

1.4

|

%

|

Rio Tinto, Ltd.

|

2.0

|

%

|

|||||

|

Germany

|

6.6

|

%

|

Belgium

|

1.1

|

%

|

Toronto-Dominion Bank

|

2.0

|

%

|

|||||

|

Australia

|

6.2

|

%

|

Norway

|

0.9

|

%

|

AstraZeneca PLC

|

1.8

|

%

|

|||||

|

Spain

|

4.2

|

%

|

South Africa

|

0.6

|

%

|

Mitsubishi Corp.

|

1.8

|

%

|

|||||

|

China

|

4.0

|

%

|

Finland

|

0.6

|

%

|

Mitsui & Co., Ltd.

|

1.7

|

%

|

|||||

|

Italy

|

2.8

|

%

|

South Korea

|

0.5

|

%

|

Swatch Group AG

|

1.7

|

%

|

|||||

|

Singapore

|

2.7

|

%

|

|||||||||||

11

|

Performance Summaries (Unaudited)

|

|

WRIGHT TOTAL RETURN BOND FUND

|

|

|

Growth of $10,000 Invested 1/1/01 Through 12/31/10

|

|

Holdings by Sector

|

Five Largest Bond Holdings

|

||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

|

% of net assets @ 12/31/10

|

% of net assets @ 12/31/10

|

||||||||||||||||||||||||||

|

Asset-Backed Securities

|

2.8

|

%

|

U.S. Treasury Note

|

4.00%

|

08/15/18

|

5.9

|

%

|

||||||||||||||||||||

|

Convertible Bonds

|

0.8

|

%

|

GNMA, Series 2010-44 NK

|

4.00%

|

10/20/37

|

3.3

|

%

|

||||||||||||||||||||

|

Corporate Bonds

|

42.8

|

%

|

FNMA Pool #888366

|

7.00%

|

04/01/37

|

2.9

|

%

|

||||||||||||||||||||

|

Mortgage-Backed Securities

|

37.0

|

%

|

U.S. Treasury Note

|

3.25%

|

06/30/16

|

2.7

|

%

|

||||||||||||||||||||

|

U.S. Treasuries

|

15.8

|

%

|

FHLMC Series 2627, Class MW

|

5.00%

|

06/15/23

|

1.8

|

%

|

||||||||||||||||||||

|

Holdings by Credit Quality

|

Weighted Average Maturity

|

6.1 years

|

|||||||||||||||||||||||||

|

% of portfolio @ 12/31/10

|

@12/31/10

|

||||||||||||||||||||||||||

|

A

|

20

|

%

|

|||||||||||||||||||||||||

|

Aa

|

4

|

%

|

|||||||||||||||||||||||||

|

Aaa

|

12

|

%

|

|||||||||||||||||||||||||

|

Baa

|

17

|

%

|

|||||||||||||||||||||||||

|

<Baa

|

2

|

%

|

|||||||||||||||||||||||||

|

Agency-Backed Securities

|

29

|

%

|

|||||||||||||||||||||||||

|

U.S. Treasuries

|

16

|

%

|

|||||||||||||||||||||||||

12

|

Performance Summaries (Unaudited)

|

|

Holdings by Sector

|

Five Largest Bond Holdings

|

||||||||||||||

|

|

|||||||||||||||

|

% of net assets @ 12/31/10

|

% of net assets @ 12/31/10

|

||||||||||||||

|

GNMA II Pool #004838

|

6.50%

|

10/20/40

|

3.9

|

%

|

|||||||||||

|

Mortgage-Backed Securities

|

96.9

|

%

|

GNMA, Series 2010-23 DP

|

4.50%

|

10/20/37

|

3.8

|

%

|

||||||||

|

GNMA II Pool #719213

|

6.50%

|

02/20/33

|

3.3

|

%

|

|||||||||||

|

FNMA Pool #851655

|

6.00%

|

12/01/35

|

2.8

|

%

|

|||||||||||

|

FHLMC Series 3413, Class B

|

5.50%

|

04/15/37

|

2.5

|

%

|

|||||||||||

|

Weighted Average Maturity

|

|||||||||||||||

|

@ 12/31/10

|

4.3

|

Years

|

|||||||||||||

13

|

Fund Expenses (Unaudited)

|

Example:

As a shareholder of a fund, you incur two types of costs: (1) transaction costs, including redemption fees (if applicable); and (2) ongoing costs including management fees; distribution or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2010 – December 31, 2010).

Actual Expenses:

The first line of the tables shown on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes:

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees (if payable). Therefore, the second line of the tables is useful in comparing ongoing costs only, and will help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

14

|

Fund Expenses (Unaudited)

|

EQUITY FUNDS

Wright Selected Blue Chip Equities Fund

|

Beginning Account Value (7/1/10)

|

Ending

Account Value (12/31/10)

|

Expenses Paid

During Period*

(7/1/10-12/31/10)

|

|

|

|

|

|

|

|

Actual Fund Shares

|

$1,000.00

|

$1,260.64

|

$7.98

|

|

|

|

|

|

|

Hypothetical (5% return per year before expenses)

|

|||

|

Fund Shares

|

$1,000.00

|

$1,018.15

|

$7.12

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2010.

Wright Major Blue Chip Equities Fund

|

Beginning Account Value (7/1/10)

|

Ending

Account Value (12/31/10)

|

Expenses Paid

During Period*

(7/1/10-12/31/10)

|

|

|

|

|

|

|

|

Actual Fund Shares

|

$1,000.00

|

$1,229.04

|

$7.98

|

|

|

|

|

|

|

Hypothetical (5% return per year before expenses)

|

|||

|

Fund Shares

|

$1,000.00

|

$1,018.05

|

$7.22

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.42% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2010.

Wright International Blue Chip Equities Fund

|

Beginning Account Value (7/1/10)

|

Ending

Account Value (12/31/10)

|

Expenses Paid

During Period*

(7/1/10-12/31/10)

|

|

|

|

|

|

|

|

Actual Fund Shares

|

$1,000.00

|

$1,251.57

|

$10.56

|

|

|

|

|

|

|

Hypothetical (5% return per year before expenses)

|

|||

|

Fund Shares

|

$1,000.00

|

$1,015.83

|

$9.45

|

*Expenses are equal to the Fund’s annualized expense ratio of 1.86% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2010.

FIXED INCOME FUNDS

Wright Total Return Bond Fund

|

Beginning Account Value (7/1/10)

|

Ending

Account Value (12/31/10)

|

Expenses Paid

During Period*

(7/1/10-12/31/10)

|

|

|

|

|

|

|

|

Actual Fund Shares

|

$1,000.00

|

$1,012.82

|

$4.72

|

|

|

|

|

|

|

Hypothetical (5% return per year before expenses)

|

|||

|

Fund Shares

|

$1,000.00

|

$1,020.52

|

$4.74

|

*Expenses are equal to the Fund’s annualized expense ratio of 0.93% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2010.

Wright Current Income Fund

|

Beginning Account Value (7/1/10)

|

Ending

Account Value (12/31/10)

|

Expenses Paid

During Period*

(7/1/10-12/31/10)

|

|

|

|

|

|

|

|

Actual Fund Shares

|

$1,000.00

|

$1,010.40

|

$4.56

|

|

|

|

|

|

|

Hypothetical (5% return per year before expenses)

|

|||

|

Fund Shares

|

$1,000.00

|

$1,020.67

|

$4.58

|

*Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2010.

15

| Wright Selected Blue Chip Equities Fund (WSBC) |

|

Portfolio of Investments - As of December 31, 2010

|

|

Shares

|

Value

|

||||

|

|

|

|

|

|

|

EQUITY INTERESTS - 99.7%

|

|

AEROSPACE & DEFENSE - 0.8%

|

|||||

|

BE Aerospace, Inc.*

|

6,395

|

$

|

236,807

|

||

|

|

|

||||

|

AUTOMOBILES & COMPONENTS - 1.9%

|

|||||

|

Advance Auto Parts, Inc.

|

5,935

|

$

|

392,600

|

||

|

Oshkosh Corp.*

|

4,495

|

158,404

|

|||

|

$

|

551,004

|

||||

|

|

|

||||

|

BANKS - 4.9%

|

|||||

|

Commerce Bancshares, Inc.

|

6,749

|

$

|

268,138

|

||

|

Fulton Financial Corp.

|

65,710

|

679,441

|

|||

|

SVB Financial Group*

|

8,220

|

436,071

|

|||

|

$

|

1,383,650

|

||||

|

|

|

||||

|

CAPITAL GOODS - 1.5%

|

|||||

|

SPX Corp.

|

5,860

|

$

|

418,931

|

||

|

|

|

||||

|

CHEMICALS - 1.8%

|

|||||

|

Albemarle Corp.

|

2,360

|

$

|

131,641

|

||

|

Ashland, Inc.

|

4,200

|

213,612

|

|||

|

Cytec Industries, Inc.

|

2,965

|

157,323

|

|||

|

$

|

502,576

|

||||

|

|

|

||||

|

COMMERCIAL SERVICES & SUPPLIES - 0.9%

|

|||||

|

Global Payments, Inc.

|

5,780

|

$

|

267,094

|

||

|

|

|

||||

|

COMMUNICATIONS EQUIPMENT - 0.5%

|

|||||

|

RF Micro Devices, Inc.*

|

19,955

|

$

|

146,669

|

||

|

|

|

||||

|

CONSUMER PRODUCTS - 0.7%

|

|||||

|

Mohawk Industries, Inc.*

|

3,655

|

$

|

207,458

|

||

|

|

|

||||

|

CONSUMER SERVICES - 1.8%

|

|||||

|

Panera Bread Co. - Class A*

|

2,370

|

$

|

239,868

|

||

|

WMS Industries, Inc.*

|

5,860

|

265,106

|

|||

|

$

|

504,974

|

||||

|

|

|

||||

|

DIVERSIFIED FINANCIALS - 2.0%

|

|||||

|

Affiliated Managers Group, Inc.*

|

3,370

|

$

|

334,372

|

||

|

Raymond James Financial, Inc.

|

5,402

|

176,645

|

|||

|

SEI Investments Co.

|

2,660

|

63,281

|

|||

|

$

|

574,298

|

||||

|

|

|

||||

|

EDUCATION - 0.3%

|

|||||

|

ITT Educational Services, Inc.*

|

1,150

|

$

|

73,243

|

||

|

|

|

||||

|

ELECTRONIC EQUIPMENT & INSTRUMENTS - 8.7%

|

|||||

|

Arrow Electronics, Inc.*

|

13,080

|

$

|

447,990

|

||

|

Avnet, Inc.*

|

14,995

|

495,285

|

|||

|

Hubbell, Inc. - Class B

|

5,935

|

356,871

|

|||

|

Pentair, Inc.

|

4,640

|

169,406

|

|||

|

Rovi Corp.*

|

1,825

|

113,168

|

|||

|

Synopsys, Inc.*

|

2,715

|

73,061

|

|||

|

Tech Data Corp.*

|

3,195

|

140,644

|

|||

|

Vishay Intertechnology, Inc.*

|

26,230

|

385,056

|

|||

|

Woodward Governor Co.

|

7,385

|

277,381

|

|||

|

|

|

||||

|

$

|

2,458,862

|

||||

|

|

|

||||

|

Shares

|

Value

|

||||

|

|

|

|

|

|

|

|

ENERGY - 6.5%

|

|||||

|

Cimarex Energy Co.

|

10,410

|

$

|

921,597

|

||

|

Energen Corp.

|

9,135

|

440,855

|

|||

|

Oceaneering International, Inc.*

|

6,545

|

481,909

|

|||

|

$

|

1,844,361

|

||||

|

|

|

||||

|

FOOD, BEVERAGE & TOBACCO - 0.8%

|

|||||

|

Ralcorp Holdings, Inc.*

|

3,580

|

$

|

232,736

|

||

|

|

|

||||

|

HEALTH CARE EQUIPMENT & SERVICES - 8.3%

|

|||||

|

Community Health Systems, Inc.*

|

3,730

|

$

|

139,390

|

||

|

Health Management Associates, Inc. - Class A*

|

22,740

|

216,940

|

|||

|

Henry Schein, Inc.*

|

1,595

|

97,917

|

|||

|

Kinetic Concepts, Inc.*

|

6,240

|

261,331

|

|||

|

LifePoint Hospitals, Inc.*

|

8,145

|

299,329

|

|||

|

Lincare Holdings, Inc.

|

23,905

|

641,371

|

|||

|

Mednax, Inc.*

|

2,285

|

153,758

|

|||

|

Owens & Minor, Inc.

|

4,750

|

139,793

|

|||

|

Service Corp. International

|

14,985

|

123,626

|

|||

|

STERIS Corp.

|

3,655

|

133,261

|

|||

|

Universal Health Services, Inc. - Class B

|

3,270

|

141,983

|

|||

|

$

|

2,348,699

|

||||

|

|

|

||||

|

HOUSEHOLD & PERSONAL PRODUCTS - 1.8%

|

|||||

|

Church & Dwight Co., Inc.

|

3,425

|

$

|

236,394

|

||

|

Tupperware Brands Corp.

|

5,935

|

282,921

|

|||

|

$

|

519,315

|

||||

|

|

|

||||

|

INDUSTRIAL - 5.7%

|

|||||

|

Carlisle Cos., Inc.

|

11,165

|

$

|

443,697

|

||

|

Energizer Holdings, Inc.*

|

2,490

|

181,521

|

|||

|

Joy Global, Inc.

|

5,410

|

469,318

|

|||

|

Kansas City Southern*

|

6,670

|

319,226

|

|||

|

Timken Co.

|

4,000

|

190,920

|

|||

|

$

|

1,604,682

|

||||

|

|

|

||||

|

INSURANCE - 6.9%

|

|||||

|

American Financial Group, Inc.

|

6,800

|

$

|

219,572

|

||

|

Everest Re Group, Ltd.

|

1,385

|

117,476

|

|||

|

HCC Insurance Holdings, Inc.

|

16,670

|

482,430

|

|||

|

Protective Life Corp.

|

5,860

|

156,110

|

|||

|

Reinsurance Group of America, Inc.

|

3,430

|

184,225

|

|||

|

StanCorp Financial Group, Inc.

|

8,450

|

381,433

|

|||

|

WR Berkley Corp.

|

15,067

|

412,535

|

|||

|

$

|

1,953,781

|

||||

|

|

|

||||

|

MACHINERY - 0.9%

|

|||||

|

Regal-Beloit Corp.

|

3,805

|

$

|

254,022

|

||

|

|

|

||||

|

MATERIALS - 7.2%

|

|||||

|

Crane Co.

|

3,955

|

$

|

162,432

|

||

|

Lubrizol Corp.

|

5,515

|

589,443

|

|||

|

Packaging Corp. of America

|

3,270

|

84,497

|

|||

|

Reliance Steel & Aluminum Co.

|

3,655

|

186,771

|

|||

|

Steel Dynamics, Inc.

|

7,615

|

139,355

|

|||

|

Temple-Inland, Inc.

|

8,535

|

181,283

|

|||

|

Thomas & Betts Corp.*

|

9,585

|

462,955

|

|||

|

Valspar Corp.

|

6,715

|

231,533

|

|||

|

|

|

|

|||

|

$

|

2,038,269

|

||||

|

|

|

|

|||

See notes to financial statements 16

| Wright Selected Blue Chip Equities Fund (WSBC) |

|

Portfolio of Investments - As of December 31, 2010

|

|

Shares

|

Value

|

||||

|

|

|

|

|

|

|

|

MEDIA - 0.4%

|

|||||

|

Harte-Hanks, Inc.

|

7,675

|

$

|

98,010

|

||

|

|

|

||||

|

OIL & GAS - 1.2%

|

|||||

|

Newfield Exploration Co.*

|

3,095

|

$

|

223,180

|

||

|

Southern Union Co.

|

4,640

|

111,685

|

|||

|

$

|

334,865

|

||||

|

|

|

||||

|

PHARMACEUTICALS & BIOTECHNOLOGY - 3.2%

|

|||||

|

Endo Pharmaceuticals Holdings, Inc.*

|

13,625

|

$

|

486,549

|

||

|

Medicis Pharmaceutical Corp. - Class A

|

7,155

|

191,682

|

|||

|

Perrigo Co.

|

3,770

|

238,754

|

|||

|

$

|

916,985

|

||||

|

|

|

||||

|

REAL ESTATE - 5.5%

|

|||||

|

Hospitality Properties Trust (REIT)

|

15,000

|

$

|

345,600

|

||

|

Jones Lang LaSalle, Inc.

|

8,090

|

678,913

|

|||

|

Rayonier, Inc. (REIT)

|

5,860

|

307,767

|

|||

|

UDR, Inc. (REIT)

|

9,106

|

214,173

|

|||

|

$

|

1,546,453

|

||||

|

|

|

||||

|

RETAILING - 11.1%

|

|||||

|

Aeropostale, Inc.*

|

13,675

|

$

|

336,952

|

||

|

American Eagle Outfitters, Inc.

|

14,000

|

204,820

|

|||

|

Chico's FAS, Inc.

|

6,670

|

80,240

|

|||

|

Dick's Sporting Goods, Inc.*

|

6,845

|

256,688

|

|||

|

Dollar Tree, Inc.*

|

5,182

|

290,607

|

|||

|

Dress Barn, Inc. (The)*

|

3,300

|

87,186

|

|||

|

Foot Locker, Inc.

|

9,895

|

194,140

|

|||

|

Guess?, Inc.

|

4,035

|

190,936

|

|||

|

PetSmart, Inc.

|

3,270

|

130,211

|

|||

|

Phillips-Van Heusen Corp.

|

4,335

|

273,148

|

|||

|

Rent-A-Center, Inc.

|

7,695

|

248,395

|

|||

|

Ross Stores, Inc.

|

8,810

|

557,232

|

|||

|

Williams-Sonoma, Inc.

|

8,450

|

301,581

|

|||

|

$

|

3,152,136

|

||||

|

|

|

||||

|

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 1.8%

|

|||||

|

Fairchild Semiconductor International, Inc.*

|

9,260

|

$

|

144,548

|

||

|

Lam Research Corp.*

|

7,115

|

368,415

|

|||

|

$

|

512,963

|

||||

|

|

|

||||

|

Shares

|

Value

|

||||

|

|

|

|

|

|

|

SOFTWARE & SERVICES - 6.8%

|

|||||

|

Acxiom Corp.*

|

16,675

|

$

|

285,976

|

||

|

F5 Networks, Inc.*

|

4,745

|

617,609

|

|||

|

Factset Research Systems, Inc.

|

1,000

|

93,760

|

|||

|

Ingram Micro, Inc.* - Class A

|

12,405

|

236,812

|

|||

|

Parametric Technology Corp.*

|

15,150

|

341,330

|

|||

|

ValueClick, Inc.*

|

22,145

|

354,984

|

|||

|

$

|

1,930,471

|

||||

|

|

|

||||

|

TELECOMMUNICATION SERVICES - 1.1%

|

|||||

|

Syniverse Holdings, Inc.*

|

10,350

|

$

|

319,297

|

||

|

|

|

||||

|

UTILITIES - 4.7%

|

|||||

|

DPL, Inc.

|

17,735

|

$

|

455,967

|

||

|

MDU Resources Group, Inc.

|

11,208

|

227,186

|

|||

|

Oneok, Inc.

|

7,110

|

394,392

|

|||

|

UGI Corp.

|

8,395

|

265,114

|

|||

|

$

|

1,342,659

|

||||

|

|

|

||||

|

TOTAL EQUITY INTERESTS - 99.7%

(identified cost, $23,233,088)

|

$

|

28,275,270

|

||

|

|

|

|

SHORT-TERM INVESTMENTS - 22.0%

|

|||||

|

Fidelity Government Money Market Fund, 0.01% (1)

|

6,257,103

|

$

|

6,257,103

|

||

|

|

|

||||

|

TOTAL SHORT-TERM INVESTMENTS - 22.0%

(identified cost, $6,257,103)

|

$

|

6,257,103

|

||

|

|

|

|

TOTAL INVESTMENTS — 121.7%

(identified cost, $29,490,191)

|

$

|

34,532,373

|

|

LIABILITIES, IN EXCESS OF OTHER

ASSETS — (21.7)%

|

(6,161,918

|

)

|

||

|

|

|

|

NET ASSETS — 100.0%

|

$

|

28,370,455

|

||

|

|

|

REIT — Real Estate Investment Trust

|

*

|

Non-income producing security.

|

|

(1)

|

Variable rate security. Rate presented is as of December 31, 2010.

|

See notes to financial statements 17

| Wright Selected Blue Chip Equities Fund (WSBC) |

|

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

||||||

|

As of December 31, 2010

|

||||||

|

ASSETS:

|

||||||

|

Investments, at value

|

||||||

|

(identified cost $29,490,191) (Note 1A)

|

$

|

34,532,373

|

||||

|

Receivable for fund shares sold

|

645,386

|

|||||

|

Dividends receivable

|

15,877

|

|||||

|

Prepaid expenses and other assets

|

14,190

|

|||||

|

Total assets

|

$

|

35,207,826

|

||||

|

|

|

|

||||

|

LIABILITIES:

|

||||||

|

Payable for fund shares reacquired

|

$

|

1,360

|

||||

|

Investment securities purchased

|

6,820,252

|

|||||

|

Accrued expenses and other liabilities

|

15,759

|

|||||

|

Total liabilities

|

$

|

6,837,371

|

||||

|

|

|

|

||||

|

NET ASSETS

|

$

|

28,370,455

|

||||

|

|

|

|

||||

|

NET ASSETS CONSIST OF:

|

||||||

|

Paid-in capital

|

$

|

24,323,381

|

||||

|

Accumulated net realized loss on investments

|

(995,108

|

)

|

||||

|

Unrealized appreciation on investments

|

5,042,182

|

|||||

|

Net assets applicable to outstanding shares

|

$

|

28,370,455

|

||||

|

|

|

|

||||

|

SHARES OF BENEFICIAL INTEREST OUTSTANDING AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

2,727,894

|

|||||

|

|

|

|

||||

|

NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST

|

$

|

10.40

|

||||

|

|

|

|

||||

|

STATEMENT OF OPERATIONS

|

||||||

|

For the Year Ended December 31, 2010

|

||||||

|

INVESTMENT INCOME (Note 1C)

|

||||||

|

Dividend income

|

$

|

218,271

|

||||

|

Total investment income

|

$

|

218,271

|

||||

|

|

|

|

||||

|

Expenses –

|

||||||

|

Investment adviser fee (Note 3)

|

$

|

112,869

|

||||

|

Administrator fee (Note 3)

|

22,574

|

|||||

|

Trustee expense (Note 3)

|

15,450

|

|||||

|

Custodian fee

|

1,888

|

|||||

|

Accountant fees

|

37,515

|

|||||

|

Distribution expenses (Note 4)

|

47,029

|

|||||

|

Transfer agent fees

|

37,679

|

|||||

|

Printing

|

114

|

|||||

|

Shareholder communications

|

4,896

|

|||||

|

Audit services

|

33,159

|

|||||

|

Legal services

|

8,945

|

|||||

|

Registration costs

|

9,521

|

|||||

|

Interest expense (Note 8)

|

54

|

|||||

|

Miscellaneous

|

5,066

|

|||||

|

Total expenses

|

$

|

336,759

|

||||

|

|

|

|

||||

|

Deduct –

|

||||||

|

Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 4)

|

$

|

(73,344

|

)

|

|||

|

|

|

|

||||

|

Net expenses

|

$

|

263,415

|

||||

|

|

|

|

||||

|

Net investment loss

|

$

|

(45,144

|

)

|

|||

|

|

|

|

||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS:

|

||||||

|

Net realized gain on investment transactions

|

$

|

1,233,621

|

||||

|

Net change in unrealized appreciation on investments

|

2,909,492

|

|||||

|

Net realized and unrealized gain on investments

|

$

|

4,143,113

|

||||

|

|

|

|

||||

|

Net increase in net assets from operations

|

$

|

4,097,969

|

||||

|

|

|

|

||||

See notes to financial statements 18

| Wright Selected Blue Chip Equities Fund (WSBC) |

|

Year Ended

|

||||||||||

|

|

||||||||||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

December 31, 2010

|

December 31, 2009

|

||||||||

|

|

|

|

|

|

||||||

|

INCREASE (DECREASE) IN NET ASSETS:

|

||||||||||

|

From operations –

|

||||||||||

|

Net investment income (loss)

|

$

|

(45,144

|

)

|

$

|

21,795

|

|||||

|

Net realized gain (loss) on investment transactions

|

1,233,621

|

(818,298

|

)

|

|||||||

|

Net change in unrealized appreciation on investments

|

2,909,492

|

5,533,574

|

||||||||

|

Net increase in net assets from operations

|

$

|

4,097,969

|

$

|

4,737,071

|

||||||

|

|

|

|

|

|

|

|||||

|

Distributions to shareholders (Note 2)

|

||||||||||

|

From net investment income

|

$

|

(17,380

|

)

|

$

|

-

|

|||||

|

Total distributions

|

$

|

(17,380

|

)

|

$

|

-

|

|||||

|

|

|

|

|

|

|

|||||

|

Net increase (decrease) in net assets resulting from fund share transactions (Note 6)

|

$

|

7,526,879

|

$

|

(1,337,892

|

)

|

|||||

|

|

|

|

|

|

|

|||||

|

Net increase in net assets

|

$

|

11,607,468

|

$

|

3,399,179

|

||||||

|

|

||||||||||

|

NET ASSETS:

|

||||||||||

|

At begining of year

|

16,762,987

|

13,363,808

|