UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-K

______________________________

(Mark One)

/x/ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 30, 2014

OR

/ / | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 0-12695

INTEGRATED DEVICE TECHNOLOGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE (State or Other Jurisdiction of Incorporation or Organization) | 94-2669985 (I.R.S. Employer Identification No.) |

6024 SILVER CREEK VALLEY ROAD, SAN JOSE, CALIFORNIA (Address of Principal Executive Offices) | 95138 (Zip Code) |

Registrant's Telephone Number, Including Area Code: (408) 284-8200

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common stock, $.001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

ý Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $1,059 million, computed by reference to the last sales price of $9.39 as reported by The NASDAQ Stock Market LLC, as of the last business day of the registrant’s most recently completed second fiscal quarter, September 29, 2013. Shares of common stock held by each executive officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant's Common Stock, $.001 par value, as of May 23, 2014 was approximately 149,293,619.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13, and 14 of Part III incorporate information by reference from the registrant’s Proxy Statement for the 2013 Annual Meeting of Stockholders.

INTEGRATED DEVICE TECHNOLOGY, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

PART I

Special Note Regarding Forward-Looking Statements

We have made statements in this Annual Report on Form 10-K in Part I, Item 1-“Business,” Item 1A-“Risk Factors,” Item 3-“Legal Proceedings,” Part II, Item 7-“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other sections of this Annual Report that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). These statements relate to future events and the future results of Integrated Device Technology, Inc., and are based on current expectations, estimates, forecasts and projections about our business and growth prospects, the industry in which we operate and general economic conditions and the beliefs and assumptions of our management. In addition, in this Annual Report on Form 10-K, the words “expects,” “anticipates,” ”targets,” “goals,” “projects,” “intends,” “plans, “believes,” “seeks, “estimates, “will,” “would,” “could,” “might,” and variations of such words and similar expressions, as they relate to us, our business and our management, are intended to identify such forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report under the section entitled “Risk Factors” under Part I, Item 1A and elsewhere in this Annual Report, and in other reports we file with the Securities and Exchange Commission (SEC), including our most recent quarterly reports on Form 10-Q.

Forward-looking statements speak only as of the date the statements are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

ITEM 1. BUSINESS

We develop a broad range of low-power, high-performance mixed-signal semiconductor solutions that optimize our customers’ applications in key markets. In addition to our market-leading timing products, we offer semiconductors targeting communications infrastructure - both wired and wireless - high-performance computing and power management. These products are used for next-generation development in areas such as 4G infrastructure, network communications, cloud data centers and power management for computing and mobile devices.

Our top talent and technology paired with an innovative product-development philosophy allows us to solve complex customer problems when designing communications, computing and consumer applications. Through system-level analog and digital innovation, we consistently deliver extraordinary value to our customers.

On a worldwide basis, we primarily market our products to original equipment manufacturers (OEMs) through a variety of channels, including direct sales, distributors, electronic manufacturing suppliers (EMSs) and independent sales representatives.

IDT was incorporated in California in 1980 and reincorporated in Delaware in 1987. The terms “the Company,” “IDT,” “our,” “us” and “we” refer to Integrated Device Technology, Inc. and its consolidated subsidiaries, where applicable.

Available Information

We electronically file our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC. The public may read or copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. You may obtain a free copy of our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports filed with or furnished to the SEC on our website at http://www.IDT.com, by contacting the Investor Relations Department at our corporate offices by calling (408) 284-8200 or by sending an e-mail message to ir@IDT.com. The information on our website is not part of this Annual Report on Form 10-K.

Products and Markets

We design, develop, manufacture and market a broad range of semiconductor solutions for the advanced communications, computing and consumer industries.

We measure our business based on two reportable segments: the Communications segment and the Computing and Consumer segment. In fiscal 2014, the Communications segment and the Computing and Consumer segment accounted for approximately

3

60% and 40%, respectively, of our revenues from continuing operations of $484.8 million. In fiscal 2013, the Communications segment and the Computing and Consumer segment accounted for approximately 53% and 47%, respectively, of our revenues from continuing operations of $484.5 million. In fiscal 2012, the Communications segment and the Computing and Consumer segment accounted for approximately 47% and 53%, respectively, of our revenues from continuing operations of $526.7 million. For further information, see “Note 18 - Segment Information” in Part II, Item 8 of this Form 10-K.

By leveraging our products and markets, we deliver high value to our customers’ applications through system-level analog and digital innovations.

Communications Segment

The Communications segment includes clock and timing solutions, flow-control management devices including Serial RapidIO® switching solutions, and radio frequency (RF) and MEMS oscillator products.

Communications Timing Products: We are the leading provider of silicon timing solutions, offering a complete portfolio of products for clock generation, distribution, recovery and jitter attenuation to serve performance-oriented applications. Created for networking, wireless infrastructure, wireline communications, advanced computing, and enterprise storage applications, our communications clocks include high-performance and high-reliability frequency generation and clock distribution products enabling advanced clock-tree development, clock synthesizers optimized for the latest processors and SOCs, FemtoClock® ultra-low jitter clock sources, jitter attenuation and frequency translation PLLs, RF timing products, and solutions for Synchronous Ethernet and IEEE-1588.

Serial RapidIO Solutions: Our extensive line of high-performance, low-power, low-latency RapidIO switches are ideal for peer-to-peer multiprocessor embedded systems up to 6.25 Gbaud per serial link. IDT's RapidIO switches are low power, low latency with industry-leading interoperability, configurability, and power per port. Today, IDT is shipping five generations of RapidIO switches in wireless, video, military, and industrial applications supporting both the RapidIO 1.3 and 2.1 standards. RapidIO switches are the backbone of 3G and 4G wireless base stations for chip-to-chip, board-to-board and chassis-to-chassis links including secure encryption/decryption of the S-RIO protocol for out-of-the-box cabling.

RF Products: We offer high-performance and full-featured RF signal path products to complement our clocks and timing, RapidIO, and other industry-leading devices from our rich communications portfolio. Our comprehensive portfolio of performance-leading products includes radio frequency (RF) to intermediate frequency (IF) mixers, intermediate frequency (IF) variable gain amplifiers (VGA), digital step attenuators (DSA), digital pre-distortion (DPD) demodulators, IF modulators, and RF switches.

MEMS Oscillators: MEMS oscillator technology is transforming the frequency control market. We offer an extensive portfolio of MEMS oscillators to meet the requirements of various applications. The three main product families are: standard MEMS oscillators with <1ps of phase jitter for general purpose applications, enhanced MEMS oscillators with multiple outputs and frequencies on a single chip to simplify the bill of materials, and performance MEMS oscillators with ultra-low jitter and frequency margining capability for 10GbE and other high-performance applications.

Legacy Memory and Logic Products: We offer a comprehensive portfolio of memory and logic products used in a broad array of applications. Our portfolio of multi-port memory products consists of more than 150 types of asynchronous and synchronous dual-ports, tri-ports, four-ports and bank-switchable dual-ports. We produce a broad line of high-speed, industry-standard SRAMs that are used in communications and other markets, with products ranging from 16-Kbit to 18-Mbit densities in synchronous and asynchronous architectures. We provide more than 350 synchronous, asynchronous and bi-directional FIFO products that address complex issues associated with high-performance networking applications. And our digital logic products include fast CMOS TTL-compatible, low-voltage CMOS and advanced low-voltage CMOS, including a broad range of high-performance, 3.3-volt CMOS logic products.

Computing and Consumer Segment

The Computing and Consumer Segment includes clock generation and distribution products, high-performance server memory interfaces, PCI Express® switching solutions, power management solutions and signal integrity products.

Consumer and Computing Timing Products: Our timing products consist of custom and off-the-shelf solutions optimized for digital consumer and computing applications. Products include programmable timing devices that address in-system programming and test, clock redundancy and I/O translation. By directly enhancing design flexibility, portability and reliability, these products also reduce inventory and test costs. Our other consumer clocks include zero-delay buffers, clock synthesizers, voltage-controlled crystal oscillators and spread-spectrum clock generators.

4

We offer the industry’s largest portfolio of computing timing products for all generations of motherboards. Our computing timing solutions offer a unique combination of features and high performance, enabling leading-edge technologies, such as PCI Express, as well as registered and load-reduced dual in-line memory modules (LRDIMMs). In addition, we provide customized clock solutions, offering optimized feature sets to meet the needs of specific motherboards.

Memory Interface Products: The broad range of our products for DIMMs and LRDIMMs is a direct result of our significant experience in timing, high-speed serial interface and logic technologies. We offer register and PLL chipsets to meet the latest memory speed needs of server and workstation devices, including Single Data Rate (SDR), Double Data Rate (DDR), DDR2, DDR3, and DDR4 memory technology.

PCI Express Switching Solutions: Our family of PCI Express switching solutions is aimed at high-performance server, storage, embedded and communications applications. Moreover, we offer customers a complete integrated hardware/software development kit that includes evaluation boards, software drivers and a graphical user interface that enables complete system configuration and optimization. Our PCIe Gen1, Gen2 and Gen3 devices are optimized for I/O expansion system interconnects and inter-domain communications.

Power Management Solutions: Our power management portfolio includes the industry's first true single-chip Qi-certified wireless power transmitter and Qi-compliant wireless power receiver ICs, as well as a dual-mode single-chip wireless power receiver that supports both the Wireless Power Consortium (WPC) Qi and the Power Matters Alliance (PMA) standards. We offer an expanding selection of power management integrated circuits (PMICs), including a chip with a distributed power unit (DPU) and the industry's first embedded mixed-signal platform Intelligent System Power Solution.

We are a leader in wireless power transmitter and receiver solutions for battery charging applications, with proven expertise in developing solutions for both magnetic induction and magnetic resonance technologies. Addressing all major standards and technologies, our highly integrated and innovative transmitter ICs are designed for use in wireless charging stations in homes, offices, libraries, stores, public waiting areas, airports and airplane seats. Our receiver ICs are targeted for use in portable devices and accessories. We participate in all major industry associations and ecosystems, including the WPC, PMA and Alliance for Wireless Power (A4WP).

Signal Integrity Products: Computing and storage applications face increasing signal integrity challenges as data rates continuously rise. The high-speed I/O used in today’s systems make cost-effective and reliable PCB design complicated. Our signal integrity products condition signals and help alleviate constraints in computing, storage and communications applications.

Sales Channels

We sell our semiconductor products through three channels: direct sales to OEMs and EMS providers, consignment sales to OEMs and EMSs, and sales through distributors. Direct sales are managed mainly through our internal sales force and independent sales representatives. Revenue is recognized on direct sales based on the relevant shipping terms. During fiscal 2014, direct sales accounted for approximately 16% of our total worldwide revenues.

Consignment sales relate to areas where we have established hubs at or near key customers to allow them quick access to our products. We retain ownership of the product at consignment locations until the product is pulled by the customer. Consignment sales are managed by our internal sales team and accounted for approximately 20% of our total worldwide revenues in fiscal 2014.

The majority of our sales are through distributors. In general, distributors who serve our customers worldwide and distributors who serve our customers in the U.S. and Europe, have rights to price protection, ship from stock pricing credits and stock rotations. Due to the uncertainty of the amount of the credits related to these programs, revenue is not recognized until the product has been sold by the distributor to an end customer. Distributors serving only the Asia Pacific region, excluding Japan (APAC) and Japan distributors have limited stock rotation and little or no price protection rights. Revenue is recognized upon shipment to these distributors as we are able to reasonably estimate the amount of pricing adjustments and stock rotation returns. Revenue recognized on a sell through basis through distribution represented approximately 20% of our total worldwide revenues in fiscal 2014, while revenue through distribution recognized upon shipment represented 44% of our total worldwide revenues in the same period.

Sales through one distributor accounted for 10% or more of our total revenues in fiscal 2014 and sales through three distributors accounted for 10% or more of our total revenues in fiscal 2013 and 2012. Sales through a worldwide distributor, Avnet, represented approximately 12%, 10% and 11% of our total revenues in fiscal 2014, 2013 and 2012, respectively. Sales through another distributor, Maxtek and its affiliates, represented approximately 13% and 15% of our total revenues in fiscal 2013 and 2012, respectively and sales through another distributor, Uniquest, represented approximately 10%, of our total revenues in fiscal 2013 and 2012. No other distributor or single direct or consignment customer represented 10% or more of our total revenues in fiscal 2014, 2013 and 2012.

5

Customers

We market our products on a worldwide basis, primarily to OEMs who, in turn, incorporate our products into the customers’ products marketed under their brands. We work closely with our OEM customers to design and integrate current and next generation products to meet the requirements of end users. Many of our end customer OEMs have outsourced their manufacturing to a concentrated group of global EMSs and original design manufacturers (ODMs), who then buy product directly from us or through our distributors on behalf of the OEM. These EMSs and ODMs have achieved greater autonomy in design win, product qualification and product purchasing decisions, especially for commodity products. No direct OEM customer accounted for 10% or more of our total revenues in fiscal 2014, 2013 and 2012.

Manufacturing

We currently use third-party foundries that are primarily located in the APAC region to manufacture our products. In fiscal 2012, we manufactured wafers at our Oregon wafer fabrication facility which produced 200mm (8-inch) wafers ranging from 0.6-micron to 0.12-micron process technologies. In the fourth quarter of fiscal 2012, we completed the transition of wafer fabrication activities from our facility to third-party foundries. In addition, during the fourth quarter of fiscal 2012, we completed the sale of this facility to Alpha and Omega Semiconductor Limited. We assemble or package products at several different subcontractors in the APAC region. Utilizing several different subcontractors located in different countries enables us to negotiate lower prices and limits the risk associated with production concentration in one country or company. The criteria used to select assembly subcontractors include, but are not limited to, cost, quality, delivery, and subcontractor financial stability. We perform a vast majority of our test operations at our test facility located in Malaysia. A relatively small amount of test operations are also performed at third-party subcontractors in the APAC region.

Backlog

We offer custom designed products, as well as industry-standard products and ASSPs. Sales are made primarily pursuant to standard purchase orders, which are frequently revised by customers as their requirements change. We have also entered into master purchase agreements, which do not require minimum purchase quantities, with many of our OEM and EMS customers. We schedule product deliveries upon receipt of purchase orders under the related customer agreements. Generally, these purchase orders and customer agreements, especially those for standard products, also allow customers to change the quantities, reschedule delivery dates and cancel purchase orders without significant penalties. In general, orders, especially for industry standard products, are often made with very short lead times and may be canceled, rescheduled, re-priced or otherwise revised prior to shipment. In addition, certain distributor orders are subject to price adjustments both before and after shipment. For all these reasons, we do not believe that our order backlog is a reliable indicator of future revenues.

Seasonal Trends

Certain of our products are sold in the computing and consumer end markets which generally have followed annual seasonal trends. Historically, sales of products for these end markets have been higher in the second and third quarters of the fiscal year as consumer purchases of PCs and gaming systems increase significantly in the second half of the calendar year due to back-to-school and holiday demand.

Research and Development

Our research and development efforts emphasize the development and design of proprietary, differentiated, high-performance, low-power analog and mixed-signal semiconductor products. We believe that a sustained level of investment in research and development is necessary to maintain our competitive position. We operate research and development centers in Irvine and San Jose, California; Tempe, Arizona; Fort Meyers, Florida; Duluth, Georgia; Westford, Massachusetts; Cary, North Carolina; Smithfield, Rhode Island; Ottawa, Canada and Shanghai, China. Research and development expenses, as a percentage of revenues, were approximately 29%, 33% and 30% in fiscal 2014, 2013 and 2012, respectively.

Our product development activities are focused on the design of integrated circuits that provide differentiated features and enhanced performance primarily for communications, computing and consumer applications.

Competition

The semiconductor industry is characterized by rapid technological advances, cyclical market patterns, erosion of product sale prices and evolving industry standards. Many of our competitors have substantially greater technical, marketing, manufacturing or financial resources than we do. In addition, several foreign competitors receive financial assistance from their governments, which could give them a competitive advantage. We compete in different product areas to varying degrees on the basis of technical innovation and product performance, as well as product quality, availability and price.

6

Our competitive strategy is to use our applications expertise to develop a deep understanding of customers’ systems and to use our unique combination of analog and digital technologies to develop complete product portfolios that solve our customers’ whole problem. We differentiate our products through innovative configurations, proprietary features, high performance, and breadth of offerings. Our ability to compete successfully and to expand our business will depend on a number of factors, including but not limited to:

▪ | Performance, feature, quality and price of our products; |

▪ | Timing and success of new product introductions by us, our customers and our competitors; |

▪ | Quality of technical service and support and brand awareness; |

▪ | Cost effectiveness of our design, development, manufacturing and marketing efforts; and |

▪ | Global economic conditions. |

We compete with product offerings from numerous companies, including Analog Devices, Inc.; Cypress Semiconductor Corporation; Inphi Corporation; Linear Technology Corporation; Maxim Integrated Products, Inc.; Micrel Incorporated; Montage Technology; On Semiconductor Corporation; Pericom Semiconductor Corporation; PLX Technology Inc.; Realtek Semiconductor Corporation; Silicon Laboratories Inc.; SiTime Corporation; Skyworks Solutions Inc.; and Texas Instruments Inc.

Intellectual Property and Licensing

We rely primarily on our patents, trade secrets, contractual provisions, licenses, copyrights, trademarks, and other proprietary rights mechanisms to protect our intellectual property. We believe that our intellectual property is a key corporate asset, and we continue to invest in intellectual property protection. We also intend to increase the breadth of our patent portfolio. There can be no assurance that any patents issued to us will not be challenged, invalidated or circumvented, that the rights granted thereunder will provide competitive advantages to us or that our efforts to protect our intellectual property rights will be successful.

In recent years, there has been a growing trend of companies resorting to litigation to protect their semiconductor technology from unauthorized use by others. We have been involved in patent litigation, which has adversely affected our operating results. Although we have obtained patent licenses from certain semiconductor manufacturers, we do not have licenses from a number of semiconductor manufacturers with broad patent portfolios. While we are not knowingly infringing on any of their patents, these semiconductor manufacturers may resort to litigation or other means in an effort to allege infringement and force us to obtain licenses to their patents. Our success will depend in part on our ability to obtain necessary intellectual property rights and protect our intellectual property rights. While we have filed patent applications, we cannot be certain that these applications will issue into patents or that we will be able to obtain the patent coverage and other intellectual property rights necessary to protect our technology. Further, we cannot be certain that once granted, the intellectual property rights covered by such patents will not be challenged by other parties.

Environmental Regulation

We are committed to protecting the environment and the health and safety of our employees, customers and the public. We endeavor to adhere to the most stringent standards across all of our facilities, to encourage pollution prevention and to strive towards continual improvement. As an integral part of our total quality management system, we strive to exceed compliance with regulatory standards in order to achieve a standard of excellence in environmental, health and safety management practices.

Our manufacturing facilities are subject to numerous environmental laws and regulations, particularly with respect to the storage, handling, use, discharge and disposal of certain chemicals, gases and other substances used or produced in the semiconductor manufacturing process. Compliance with these laws and regulations has not had a material impact on our capital expenditures, earnings, financial condition or competitive position. Although we believe that we are fully compliant with all applicable environmental laws and regulations there can be no assurance that current or future environmental laws and regulations will not impose costly requirements upon us. Any failure by us to comply with applicable environmental laws and regulations could result in fines, suspension of production and legal liability.

Employees

As of March 30, 2014, we had approximately 1,484 employees worldwide, with approximately 579 employees located in the United States. Our future success depends in part on our ability to attract and retain qualified personnel, particularly engineers, who are often in great demand. We have implemented policies enabling our employees to share in our success, including stock option, restricted stock unit, stock purchase and incentive bonus plans. We have never had a work stoppage related to labor issues. With the exception of 53 employees in France, none of our employees are currently represented by a collective bargaining agreement.

7

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all information contained in this report before you decide to purchase our common stock. If any of the possible adverse events described below actually occurs, we may be unable to conduct our business as currently planned and our financial condition and operating results could be harmed. In addition, the trading price of our common stock could decline due to the occurrence of any of these risks, and you may lose all or part of your investment. The risks described below are not the only risks facing us. Additional risks not currently known to us or that we currently believe are immaterial may also impair our business, results of operations, and financial condition.

Our operating results can fluctuate dramatically. Our operating results have fluctuated in the past and are likely to vary in the future. Fluctuations in operating results can result from a wide variety of factors, including:

• | global economic conditions, including those related to the credit markets; |

• | the cyclicality of the semiconductor industry; |

• | changes in the demand for and mix of products sold and in the markets we and our customers serve; |

• | the availability of industry-wide wafer processing capacity; |

• | the availability of industry-wide and package specific assembly subcontract capacity and related raw materials; |

• | competitive pricing pressures; |

• | the success and timing of new product and process technology announcements and introductions from us or our competitors; |

• | potential loss of market share among a concentrated group of customers; |

• | difficulty in attracting and retaining key personnel; |

• | difficulty in predicting customer product requirements; |

• | production difficulties and interruptions caused by our complex manufacturing and logistics operations; |

• | reduced control over our manufacturing and product delivery as a result of our increasing reliance on subcontractors, foundry and other manufacturing services; |

• | unrealized potential of acquired businesses and resulting assets impairment; |

• | availability and costs of raw materials from a limited number of suppliers; |

• | political and economic conditions in various geographic areas; |

• | timing and execution of plans and programs subject to foreign labor law requirements, including consultation with work councils; |

• | reduced customer demand as a result of the impact from natural and/or man-made disasters which may adversely impact our customer's manufacturing capability or reduce our customer's ability to acquire critical materials or components to manufacture their end products; |

• | costs associated with other events, such as intellectual property disputes or other litigation; and |

• | legislative, tax, accounting, or regulatory changes or changes in their interpretation. |

Global economic conditions may adversely affect our business and results of operations.

Adverse changes in global economic business conditions may negatively affect customer demand for our products. Continuing concerns about the impact of geopolitical issues, the availability and cost of credit, the debt crises in Europe, low business and consumer confidence, high unemployment and high energy costs, have contributed to substantial volatility in global capital markets and uncertain demand for the semiconductor industry and our products. If economic conditions are not sustained or begin to deteriorate, or if we are unable to timely adapt to changes in macroeconomic conditions, our business, financial condition and results of operations may be adversely affected.

The cyclicality of the semiconductor industry exacerbates the volatility of our operating results.

The semiconductor industry is highly cyclical and has experienced significant downturns, often in connection with product cycles of both semiconductor companies and their customers, but also related to declines in general economic conditions. These downturns have been characterized by volatile customer demand, high inventory levels and accelerated erosion of average selling prices. Any future economic downturns could materially and adversely affect our business from one period to the next relative to demand and product pricing. In addition, the semiconductor industry may experience periods of increased demand, during which we may experience internal and external manufacturing constraints. We may also experience substantial changes in future operating results due to the cyclical nature of the semiconductor industry.

Demand for our products depends primarily on demand in the communications, enterprise computing, personal computer (PC), and consumer markets which can be significantly affected by concerns over macroeconomic issues.

Our product portfolio consists predominantly of semiconductor solutions for the communications, computing, and consumer markets. Our strategy and resources are directed at the development, production and marketing of products for these markets. The markets for our products will depend on continued and growing demand for communications equipment, servers, PCs and

8

consumer electronics. These end-user markets may experience changes in demand that could adversely affect our business and could be greater in periods of economic uncertainty and contraction. To the extent demand or markets for our products do not grow, our business could be adversely affected.

We are reliant upon subcontractors and third-party foundries.

We are dependent on third-party subcontractors for all of our assembly operations. We are also dependent on third-party outside foundries for the manufacture of our silicon wafers. Our increased reliance on subcontractors and third-party foundries for our current products increases certain risks because we will have less control over manufacturing quality and delivery schedules, maintenance of sufficient capacity to meet our orders and maintaining the manufacturing processes we require. During the fourth quarter of fiscal 2012, we completed the transfer of our internal wafer fabrication production to outside foundries. Due to production lead times and potential capacity constraints, any failure on our part to adequately forecast the mix of product demand and resulting foundry and subcontractor requirements could adversely affect our operating results. In addition, we cannot be certain that these foundries and subcontractors will continue to manufacture, assemble, package and test products for us on acceptable economic and quality terms, or at all, and it may be difficult for us to find alternatives in a timely and cost-effective manner if they do not do so.

We build most of our products based on estimated demand forecasts.

Demand for our products can change rapidly and without advance notice. Demand can also be affected by changes in our customers' levels of inventory and differences in the timing and pattern of orders from their end customers. A large percentage of our revenue in the APAC region is recognized upon shipment to our distributors. Consequently, we have less visibility over both inventory levels at our distributors and end customer demand for our products. Further, the distributors have assumed more risk associated with changes in end demand for our products. Accordingly, significant changes in end demand in the semiconductor business in general, or for our products in particular, may be difficult for us to detect or otherwise measure, which could cause us to incorrectly forecast end-market demand for our products. If we are not able to accurately forecast end demand for our products, we may be left with large amounts of unsold products, may not be able to fill all actual orders, and may not be able to efficiently utilize our existing manufacturing capacity or make optimal investment and other business decisions. As a result, we may end up with excess and obsolete inventory or we may be unable to meet customer short-term demands, either of which could have an adverse impact on our operating results.

If we are unable to execute our business strategy successfully, our revenues and profitability may be adversely affected.

Our future financial performance and success are largely dependent on our ability to execute our business strategy successfully. Our present business strategy to be a leading provider of essential mixed signal semiconductor solutions will be affected, without limitation, by: (1) our ability to continue to aggressively manage, maintain and refine our product portfolio including focus on the development and growth of new applications; (2) our ability to continue to maintain existing customers, aggressively pursue and win new customers; (3) our ability to successfully develop, manufacture and market new products in a timely manner; (4) our ability to develop new products in a more efficient manner; (5) our ability to sufficiently differentiate and enhance our products; (6) our ability to successfully deploy research and development (R&D) investment in the areas of displays, silicon timing, power management, signal integrity and radio frequency, and (7) our ability to improve our results of operations.

We cannot assure you that we will successfully implement our business strategy or that implementing our strategy will sustain or improve our results of operations. In particular, we cannot assure you that we will be able to build our position in markets with high growth potential, increase our volume or revenue, rationalize our manufacturing operations or reduce our costs and expenses.

Our business strategy is based on our assumptions about the future demand for our current products and the new products and applications that we are developing and on our ability to produce our products profitably. Each of these factors is subject to one or more of the risk factors set forth in this report. Several risks that could affect our ability to implement our business strategy are beyond our control. In addition, circumstances beyond our control and changes in our business or industry may require us to change our business strategy.

Our results are dependent on the success of new products.

The markets we serve are characterized by competition, rapid technological change, evolving standards, short product life cycles and continuous erosion of average selling prices. Consequently, our future success will be highly dependent upon our ability to continually develop new products using the latest and most cost-effective technologies, introduce our products in commercial quantities to the marketplace ahead of the competition and have our products selected for inclusion in leading system manufacturers' products. In addition, the development of new products will continue to require significant R&D expenditures. If we are unable to successfully develop, produce and market new products in a timely manner, have our products available in commercial quantities ahead of competitive products or have our products selected for inclusion in products of systems manufacturers and sell them at gross margins comparable to or better than our current products, our future results of operations could be adversely affected. In addition, our future revenue growth is also partially dependent on our ability to penetrate new markets in which we have limited experience and where competitors are already entrenched. Future success for certain new products will also depend on the

9

development of product solutions for new emerging markets and new applications for existing markets. The success of such products is dependent on the ability of our customers and their customers to successfully develop new markets and gain market acceptance for new product solutions in those markets. Even if we are able to develop, produce and successfully market new products in a timely manner, such new products may not achieve market acceptance. The above described events could have a variety of negative effects on our competitive position and our financial results, such as reducing our revenue, increasing our costs, lowering our gross margin percentage, and ultimately leading to impairment of assets.

The loss of the services of any key personnel may adversely affect our business and growth prospects.

Our performance is substantially dependent on the performance of our executive officers and key employees. The loss of the services of any of our executive officers, technical personnel or other key employees could adversely affect our business. In addition, our future success depends on our ability to successfully compete with other technology firms in attracting and retaining specialized technical and management personnel. If we are unable to identify, hire, and retain highly qualified technical and managerial personnel, our business and growth prospects could be adversely affected.

We have made and may continue to make acquisitions and divestitures which could divert management's attention, cause ownership dilution to our stockholders, be difficult to integrate, and/or adversely affect our financial results.

Acquisitions and divestitures are commonplace in the semiconductor industry and we have acquired and divested, and may continue to acquire or divest, businesses and technologies. Integrating newly acquired businesses or technologies could put a strain on our resources, could be costly and time consuming, and might not be successful. Acquisitions or divestitures could divert our management's attention and other resources from other business concerns. In addition, we might lose key employees while integrating new organizations. Acquisitions and divestitures could also result in customer dissatisfaction, performance problems with an acquired company or technology, dilutive or potentially dilutive issuances of equity securities, the incurrence of debt, the assumption or incurrence of contingent liabilities, or other unanticipated events or circumstances, any of which could harm our business. Consequently, we might not be successful in acquiring or integrating any new businesses, products, or technologies, and might not achieve anticipated revenues and cost benefits. In addition, we might be unsuccessful in finding or completing acquisition or divestiture opportunities on acceptable terms in a timely manner.

We are dependent on a concentrated group of customers for a significant part of our revenues.

A large portion of our revenues depends on sales to a limited number of customers. If these relationships were to diminish, or if these customers were to develop their own solutions or adopt a competitor's solution instead of buying our products, our results could be adversely affected.

Many of our end-customer OEMs have outsourced their manufacturing to a concentrated group of global EMSs and original design manufacturers (ODMs) who then buy products directly from us or from our distributors on behalf of the OEM. These EMSs and ODMs have achieved greater autonomy in the design win, product qualification and product purchasing decisions, especially for commodity products. Competition for the business from EMSs and ODMs is intense and there is no assurance we can remain competitive and retain our existing market share with these customers. If these companies were to allocate a higher share of commodity or second-source business to our competitors instead of buying our products, our results would be adversely affected. Furthermore, as EMSs and ODMs have represented a growing percentage of our overall business, our concentration of credit and other business risks with these customers has increased. Competition among global EMSs and ODMs is intense as they operate on very low margins. If any one or more of our global EMSs or ODMs customers were to file for bankruptcy or otherwise experience significantly adverse financial conditions, our business would be adversely affected as well.

In addition, we utilize a relatively small number of global and regional distributors around the world, who buy product directly from us on behalf of their customers. If our business relationships with any of these distributors were to diminish or any of these distributors were to file for bankruptcy or otherwise experience significantly adverse financial conditions, our business could be adversely affected. Because we continue to be dependent on product demand from a small group of OEM end customers and global and regional distributors, any material delay, cancellation or reduction of orders from or loss of these or other major customers could cause our revenue to decline significantly.

We are dependent on a limited number of suppliers.

Our manufacturing operations depend upon obtaining adequate raw materials on a timely basis. The number of suppliers of certain raw materials, such as silicon wafers, ultra-pure metals and certain chemicals and gases needed for our products, is very limited. In addition, certain packages for our products require long lead times and are available from only a few suppliers. From time to time, suppliers have extended lead times or limited supply to us due to capacity constraints. Our results of operations would be materially and adversely affected if we were unable to obtain adequate supplies of raw materials in a timely manner or if there were significant increases in the costs of raw materials, or if foundry or assembly subcontractor capacity were not available, or if capacity were only available at unfavorable prices.

10

Our operations and business could be significantly harmed by natural disasters or acts of terrorism.

A majority of the third-party foundries and subcontractors we currently use are located in Malaysia, South Korea, the Philippines, Singapore, Taiwan, Thailand, and China. In addition, we own a test facility in Malaysia. The risk of an earthquake or tsunami in these Pacific Rim locations is significant. The occurrence of an earthquake, drought, flood, fire, or other natural disaster near any of these locations could cause a significant reduction of end-customer demand and/or availability of materials, a disruption of the global supply chain, an increase in the cost of products that we purchase, and otherwise interfere with our ability to conduct business. In addition, public health issues, acts of terrorism or other catastrophic events could significantly delay the production or shipment of our products. Although we maintain insurance for some of the damage that may be caused by natural disasters, our insurance coverage may not be sufficient to cover all of our potential losses and would not cover us for lost business. As a result, a natural disaster in one or more of these regions could have a material adverse effect on our financial condition and results of operations.

Costs related to product defects and errata may harm our results of operations and business.

Costs associated with unexpected product defects and errata, or deviations from published specifications, due to, for example, unanticipated problems in our design and manufacturing processes, could include:

• | writing off the value of inventory of such products; |

• | disposing of products that cannot be fixed; |

• | recalling such products that have been shipped to customers; |

• | providing product replacements for, or modifications to, such products; and |

• | defending against litigation related to such products. |

These costs could be substantial and may therefore increase our expenses and lower our gross margin. In addition, our reputation with our customers or users of our products could be damaged as a result of such product defects and errata, and the demand for our products could be reduced. The announcement of product defects and/or errata could cause customers to purchase products from our competitors as a result of anticipated shortages of our components or for other reasons. These factors could harm our financial results and the prospects for our business.

Intellectual property claims against and/or on behalf of the Company could adversely affect our business and operations.

The semiconductor industry is characterized by vigorous protection and pursuit of intellectual property rights, which has resulted in significant and often protracted and expensive litigation. We have been involved with patent litigation and asserted intellectual property claims in the past, both as a plaintiff and a defendant, some of which have adversely affected our operating results. Although we have obtained patent licenses from certain semiconductor manufacturers, we do not have licenses from a number of semiconductor manufacturers that have broad patent portfolios. Claims alleging infringement of intellectual property rights have been asserted against us in the past and could be asserted against us in the future.

As a result of these claims, we may have to discontinue the use of certain processes, license certain technologies, cease the manufacture, use, and sale of infringing products, incur significant litigation costs and damages and develop non-infringing technology. We might not be able to obtain such licenses on acceptable terms or develop non-infringing technology. Further, the failure to renew or renegotiate existing licenses on favorable terms, or the inability to obtain a key license, could materially and adversely affect our business. Future litigation, either as a plaintiff or a defendant, could adversely affect our operating results, as a result of increased expenses, the cost of settled claims, and/or payment of damages.

Our product manufacturing operations are complex and subject to interruption.

From time to time, we have experienced production difficulties, including lower manufacturing yields or products that do not meet our or our customers' specifications, which has resulted in delivery delays, quality problems and lost revenue opportunities. While delivery delays have been infrequent and generally short in duration, we could experience manufacturing problems, capacity constraints and/or product delivery delays in the future as a result of, among other things, the complexity of our manufacturing processes, changes to our process technologies (including transfers to other facilities and die size reduction efforts), and difficulties in ramping production. In addition, any significant quality problems could damage our reputation with our customers and could take focus away from the development of new and enhanced products. These could have a significant negative impact on our financial results.

We are dependent upon electric power and water provided by public utilities where we operate our manufacturing facility. We maintain limited backup generating capability, but the amount of electric power that we can generate on our own is insufficient to fully operate this facility, and prolonged power interruptions and restrictions on our access to water could have a significant adverse impact on our business.

11

Tax benefits we receive may be terminated or reduced in the future, which would increase our costs.

As a result of our international manufacturing operations, a significant portion of our worldwide profits are in jurisdictions outside the United States, primarily Malaysia, which has granted the Company significant reductions in tax rates. These lower tax rates allow us to record a relatively low tax expense on a worldwide basis. Under current Malaysia law, we are not subject to tax on our operational and investment income. If U.S. corporate income tax laws were to change regarding deferral of U.S. income tax on foreign earnings or other matters impacting our operating structure, this would have a significant impact to our financial results.

In addition, we were granted a tax holiday in Malaysia during fiscal 2009. The tax holiday was contingent upon us continuing to meet specified investment criteria in fixed assets, and to operate as an APAC regional headquarters center. In the first quarter of fiscal 2012, we entered into an agreement with the Malaysia Industrial Development Board (MIDA) who agreed to cancel the previously granted tax holiday and entered into a new tax holiday which is a full tax exemption on statutory income for a period of 10 years commencing April 4, 2011. We are required to meet several requirements as to financial targets, investment, headcount and activities in Malaysia to retain this status. Our inability to renew this tax holiday when it expires or meet certain conditions of the agreement with MIDA may adversely impact our effective tax rate.

Our financial results may be adversely affected by higher than expected tax rates or exposure to additional tax liabilities. Tax audits may have a material adverse effect on our profitability.

As a global company, our effective tax rate is highly dependent upon the geographic composition of worldwide earnings and tax regulations governing each region in which we operate. We are subject to income taxes in the United States and various foreign jurisdictions, and significant judgment is required to determine worldwide tax liabilities. Our effective tax rate could be adversely affected by changes in the mix of earnings between countries with differing statutory tax rates, in the valuation of deferred tax assets, in tax laws or by material audit assessments, which could affect our profitability. In particular, the carrying value of deferred tax assets, which are predominantly in the United States, is dependent upon our ability to generate future taxable income in the United States. In addition, the amount of income taxes we pay is subject to ongoing audits in various jurisdictions, and a material assessment by a governing tax authority such as the Internal Revenue Service in the United States could have a material effect on our profitability.

The costs associated with legal proceedings can be substantial, specific costs are unpredictable and not completely within our control, and unexpected increases in litigation costs could adversely affect our operating results.

We have been involved in various legal proceedings, such as those described below in Part I, Item 3 "Legal Proceedings." The costs associated with legal proceedings are typically high, relatively unpredictable, and are not completely within our control. The costs may be materially more than expected, which could adversely affect our operating results. Moreover, we may become involved in unexpected litigation with additional litigants at any time, which would increase our aggregate litigation costs, and could adversely affect our operating results. We are not able to predict the outcome of any legal action, and an adverse decision in any legal action could significantly harm our business and financial performance.

If the credit market conditions deteriorate, it could have a material adverse impact on our investment portfolio.

Although we manage our investment portfolio by purchasing only highly-rated securities and diversifying our investments across various sectors, investment types, and underlying issuers, recent volatility in the short-term financial markets has been high. We have no securities in asset-backed commercial paper and hold no auction rated or mortgage-backed securities. However, it is uncertain as to the full extent of the current credit and liquidity crisis and with possible further deterioration, particularly within one or several of the large financial institutions, the value of our investments could be negatively impacted.

Our results of operations could vary as a result of the methods, estimates, and judgments we use in applying our accounting policies.

The methods, estimates, and judgments we use in applying our accounting policies have a significant impact on our results of operations. Such methods, estimates, and judgments are, by their nature, subject to substantial risks, uncertainties and assumptions, and factors may arise over time that lead us to change our methods, estimates, and judgments. Changes in those methods, estimates, and judgments could significantly affect our results of operations. In particular, the calculation of stock-based compensation expense under the authoritative guidance requires us to use valuation methodologies that were not developed for use in valuing employee stock options and make a number of assumptions, estimates, and conclusions regarding matters such as expected forfeitures, expected volatility of our share price and the exercise behavior of our employees. Changes in these variables could affect our stock-based compensation expense and have a significant and potentially adverse effect on our gross margins, research and development expense and selling, general and administrative expense.

12

International operations add increased volatility to our operating results.

A substantial percentage of our total revenues are derived from international sales, as summarized below:

(percentage of total revenues) | Fiscal 2014 | Fiscal 2013 | Fiscal 2012 | |||||

APAC | 64 | % | 64 | % | 66 | % | ||

Americas | 15 | % | 16 | % | 15 | % | ||

Japan | 8 | % | 8 | % | 8 | % | ||

Europe | 13 | % | 12 | % | 11 | % | ||

Total | 100 | % | 100 | % | 100 | % | ||

In addition, our test facility in Malaysia, our design centers in Canada and China, and our foreign sales offices incur payroll, facility, and other expenses in local currencies. Accordingly, movements in foreign currency exchange rates can impact our revenues and costs of goods sold, as well as both pricing and demand for our products.

Our non-U.S. offshore sites, manufacturing subcontractors and export sales are also subject to risks associated with foreign operations, including:

• | political instability and acts of war or terrorism, which could disrupt our manufacturing and logistical activities; |

• | regulations regarding use of local employees and suppliers; |

• | exposure to foreign employment practices and labor laws; |

• | currency controls and fluctuations, devaluation of foreign currencies, hard currency shortages and exchange rate fluctuations; |

• | changes in local economic conditions; |

• | governmental regulation of taxation of our earnings and those of our personnel; and |

• | changes in tax laws, import and export controls, tariffs and freight rates. |

Our international locations are subject to local labor laws, which are often significantly different from U.S. labor laws and which may under certain conditions result in large separation costs upon termination.

Contract pricing for raw materials and equipment used in the fabrication and assembly processes, as well as for foundry and subcontract assembly services, may also be affected by currency controls, exchange rate fluctuations and currency devaluations. We sometimes hedge currency risk for currencies that are highly liquid and freely quoted, but may not enter into hedge contracts for currencies with limited trading volume. In addition, as much of our revenues are generated outside the United States, a significant portion of our cash and investment portfolio accumulates in the foreign countries in which we operate. On March 30, 2014, we had cash, cash equivalents and investments of approximately $318.0 million invested overseas in accounts belonging to our foreign subsidiaries. While these amounts are primarily invested in U.S. dollars, a portion is held in foreign currencies, and all offshore balances are exposed to local political, banking, currency control and other risks. In addition, these amounts may be subject to tax and other transfer restrictions.

We rely upon certain critical information systems for the operation of our business.

We maintain and rely upon certain critical information systems for the effective operation of our business. These information systems include telecommunications, the Internet, our corporate intranet, various computer hardware and software applications, network communications, and e-mail. These information systems are subject to attacks, failures, and access denials from a number of potential sources including viruses, destructive or inadequate code, power failures, and physical damage to computers, communication lines and networking equipment. To the extent that these information systems are under our control, we have implemented security procedures, such as virus protection software and emergency recovery processes, to address the outlined risks. While we believe that our information systems are appropriately controlled and that we have processes in place to adequately manage these risks, security procedures for information systems cannot be guaranteed to be failsafe and our inability to use or access these information systems at critical points in time could unfavorably impact the timely and efficient operation of our business.

We are exposed to potential impairment charges on certain assets.

Over the past several years, we have made several acquisitions. As a result of these acquisitions, we had $135.6 million of goodwill and $18.7 million of intangible assets on our balance sheet as of March 30, 2014. In determining fair value, we consider various factors, including our market capitalization, forecasted revenue and costs, risk-adjusted discount rates, future economic and market conditions, determination of appropriate market comparables and expected periods over which our assets will be utilized and other variables. If our assumptions regarding forecasted cash flow, revenue and margin growth rates of certain long-lived asset groups and reporting units are not achieved, an impairment review may be triggered for the remaining balance of goodwill and long-lived

13

assets prior to the next annual review in the fourth quarter of fiscal 2015, which could result in material charges that could impact our operating results and financial position.

Our reported financial results may be adversely affected by new accounting pronouncements or changes in existing accounting standards and practices.

We prepare our financial statements in conformity with accounting principles generally accepted in the United States. These accounting principles are subject to interpretation by the Financial Accounting Standards Board (FASB), SEC and various organizations formed to interpret and create appropriate accounting standards and practices. New accounting pronouncements and varying interpretations of accounting standards and practices have occurred and may occur in the future. New accounting pronouncements or a change in the interpretation of existing accounting standards or practices may have a significant effect on our reported financial results and may even affect our reporting of transactions completed before the change is announced or effective.

Our common stock may experience substantial price volatility.

Our stock price has experienced volatility in the past, and volatility in the price of our common stock may occur in the future, particularly as a result of fluctuations in global economic conditions and quarter-to-quarter variations in our actual or anticipated financial results, or the financial results of other semiconductor companies or our customers. Stock price volatility may also result from product announcements by us or our competitors, or from changes in perceptions about the various types of products we manufacture and sell. In addition, our stock price may fluctuate due to price and volume fluctuations in the stock market, especially in the technology sector, and as a result of other considerations or events described in this section.

We depend on the ability of our personnel, raw materials, equipment and products to move reasonably unimpeded around the world.

Any political, military, world health or other issue which hinders the worldwide movement of our personnel, raw materials, equipment or products or restricts the import or export of materials could lead to significant business disruptions. Furthermore, any strike, economic failure, or other material disruption on the part of major airlines or other transportation companies could also adversely affect our ability to conduct business. If such disruptions result in cancellations of customer orders or contribute to a general decrease in economic activity or corporate spending on information technology, or directly affect our marketing, manufacturing, financial and logistics functions, our results of operations and financial condition could be materially and adversely affected.

We invest in companies for strategic reasons and may not realize a return on our investments.

We make investments in companies around the world to further our strategic objectives and support our key business initiatives. Such investments include equity instruments of private companies, and many of these instruments are non-marketable at the time of our initial investment. These companies range from early-stage companies that are often still defining their strategic direction to more mature companies with established revenue streams and business models. The success of these companies is dependent on product development, market acceptance, operational efficiency, and other key business factors as well as their ability to secure additional funding, obtain favorable investment terms for future financings, or participate in liquidity events such as public offerings, mergers, and private sales. If any of these private companies fail, we could lose all or part of our investment in that company. If we determine that other-than-temporary decline in the fair value exists for an equity investment in a private company in which we have invested, we write down the investment to its fair value and recognize the related write-down as an investment loss.

When the strategic objectives of an investment have been achieved, or if the investment or business diverges from our strategic objectives, we may decide to dispose of the investment. We may incur losses on the disposal of our non-marketable investments. Additionally, for cases in which we are required under equity method accounting to recognize a proportionate share of another company's income or loss, such income or loss may impact our earnings. Gains or losses from equity securities could vary from expectations depending on gains or losses realized on the sale or exchange of securities, gains or losses from equity method investments, and impairment charges for equity and other investments.

We are subject to a variety of environmental and other regulations related to hazardous materials used in our manufacturing processes.

The manufacturing and testing of our products require the use of hazardous materials that are subject to a broad array of environmental, health and safety laws and regulations. Any failure by us to adequately control the use or discharge of hazardous materials under present or future regulations could subject us to substantial costs or liabilities or cause our manufacturing operations to be suspended.

Existing and future environmental, health and safety laws and regulations could also require us to acquire pollution abatement or remediation equipment, modify our product designs, or incur other expenses associated with such laws and regulations. Many new materials that we are evaluating for use in our operations may be subject to regulation under existing or future environmental laws and regulations that may restrict our use of one or more of such materials in our manufacturing, and test processes, or products.

14

Any of these restrictions could harm our business and results of operations by increasing our expenses or requiring us to alter our manufacturing and test processes.

New regulations related to “conflict minerals” may force us to incur additional expenses, may make our supply chain more complex and may result in damage to our reputation with customers.

On August 22, 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the SEC adopted new requirements for companies that use certain minerals and metals, known as conflict minerals, in their products, whether or not these products are manufactured by third parties. These requirements will require companies to disclose and report whether or not such minerals originate from the Democratic Republic of Congo and adjoining countries. The implementation of these new requirements could adversely affect the sourcing, availability and pricing of such minerals if they are found to be used in the manufacture of our products. In addition, we will incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. Since our supply chain is complex, we may not be able to sufficiently verify the origins for these minerals and metals used in our products through the due diligence procedures that we implement, and may face difficulties in satisfying customers who require that all of the components of our products are certified as free of any conflict minerals. The first report is due on June 2, 2014 for the 2013 calendar year.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We own and operate a test facility in Malaysia (approximately 145,000 square feet). Our Malaysia facility is subject to ground leases. We owned and operated a wafer fabrication facility in Hillsboro, Oregon (approximately 245,000 square feet) until January 2012. In January 2012, we completed the sale of this facility.

Our corporate headquarters and various administrative, engineering and support functions are located in San Jose, California. We own and occupy approximately 263,000 square feet of space at our San Jose headquarters. We also lease various facilities throughout the world for sales and marketing functions and research and development, including design centers in the United States, Canada, Europe and Asia.

We believe that the facilities that we currently own or lease are suitable and adequate for our needs for the immediate future.

ITEM 3. LEGAL PROCEEDINGS

For a discussion of legal proceedings, please see “Note 15 – Commitments and Contingencies – Litigation” in Part II, Item 8 of this Annual Report on Form 10-K.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

15

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock

Our Common Stock is traded on the NASDAQ Global Select Market under the symbol IDTI. The following table shows the high and low sales prices for our Common Stock as reported by the NASDAQ Global Select Market for the fiscal periods indicated:

High | Low | ||||||

Fiscal 2014 | |||||||

First Quarter | $ | 8.78 | $ | 6.48 | |||

Second Quarter | 9.66 | 7.92 | |||||

Third Quarter | 11.60 | 9.15 | |||||

Fourth Quarter | 13.29 | 9.18 | |||||

Fiscal 2013 | |||||||

First Quarter | $ | 7.47 | $ | 5.06 | |||

Second Quarter | 6.45 | 4.60 | |||||

Third Quarter | 7.33 | 5.30 | |||||

Fourth Quarter | 7.85 | 6.49 | |||||

Stockholders

As of May 23, 2014 there were approximately 666 record holders of our Common Stock. A substantial majority of our shares are held by brokers and other institutions on behalf of individual stockholders.

Dividends

We have never paid cash dividends on our Common Stock. We currently plan to retain any future earnings for use in our business and do not currently anticipate paying cash dividends in the foreseeable future.

Equity Incentive Programs

We primarily issue awards under our equity-based plans in order to provide additional incentive and retention to directors and employees who are considered to be essential to the long-rang success of the Company. Please see “Note 8 – Stock-Based Employee Compensation” in Part II, Item 8 of this Annual Report on Form 10-K.

Other equity plan information required by this Item is incorporated by reference to the information in Part III, Item 12 of this Annual Report on Form 10-K.

Issuer Purchases of Equity Securities

The following table sets forth information with respect to repurchases of our common stock during the fourth quarter of fiscal 2014:

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||||

December 30, 2013 - January 26, 2014 | 491,600 | $ | 10.18 | 491,600 | $ | 124,619,907 | |||||||

January 27, 2014 - February 23, 2014 | 607,600 | $ | 10.43 | 607,600 | $ | 118,282,639 | |||||||

February 24, 2014 - March 30, 2014 | 990,300 | $ | 12.41 | 990,300 | $ | 105,993,016 | |||||||

Total | 2,089,500 | $ | 11.31 | 2,089,500 | |||||||||

16

On July 21, 2010, our Board of Directors approved a share repurchase plan to repurchase up to $225 million of our common stock. In fiscal 2012, we repurchased approximately 10.4 million shares of our common stock at an average price of $6.49 per share for a total purchase price of $67.5 million under this program. In fiscal 2013, we made no repurchases under the program. On October 22, 2013, our Board approved a new share repurchase authorization for $150 million. In fiscal 2014, we repurchased 4.1 million shares of our common stock for $44.0 million.

As of March 30, 2014, approximately $106.0 million was available for future purchase under this new share repurchase program. Share repurchases were recorded as treasury stock and resulted in a reduction of stockholders’ equity. The program is intended to reduce the number of outstanding shares of our common stock to offset dilution from employee equity grants and increase stockholder value.

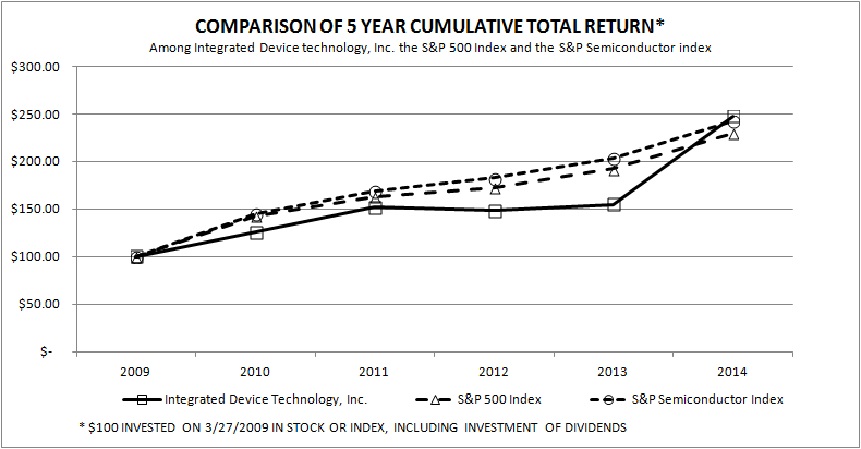

Stock Performance Graph

Set forth below is a line graph comparing the percentage change in the cumulative total stockholder return on our common stock against the cumulative total return of the S&P 500 Index and the S&P Electronics (Semiconductors) Index for a period of five fiscal years. Our fiscal year ends on a different day each year because our year ends at midnight on the Sunday nearest to March 31 of each calendar year. However, for convenience, the amounts shown below are based on a March 31 fiscal year end. “Total return,” for the purpose of this graph, assumes reinvestment of all dividends.

The performance of our stock price shown in the following graph is not necessarily indicative of future stock price performance.

Cumulative Total Return | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||||

Integrated Device Technology, Inc. | $ | 100.00 | $ | 125.93 | $ | 152.28 | $ | 148.34 | $ | 154.98 | $ | 247.72 | |||||||||||

S&P Semiconductor Index | $ | 100.00 | $ | 145.12 | $ | 169.03 | $ | 182.51 | $ | 203.07 | $ | 242.40 | |||||||||||

S&P 500 Index | $ | 100.00 | $ | 142.97 | $ | 163.30 | $ | 172.62 | $ | 192.32 | $ | 229.47 | |||||||||||

17

ITEM 6. SELECTED FINANCIAL DATA