UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03466

Fidelity Hanover Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| Date of fiscal year end: | December 31 |

| | |

| Date of reporting period: | June 30, 2016 |

Item 1.

Reports to Stockholders

|

Fidelity® Emerging Markets Debt Central Fund Semi-Annual Report June 30, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Investment Summary (Unaudited)

Top Five Countries as of June 30, 2016

| (excluding cash equivalents) | % of fund's net assets | % of fund's net assets 6 months ago |

| Argentina | 13.2 | 11.6 |

| Mexico | 9.6 | 9.0 |

| Indonesia | 6.6 | 5.9 |

| Turkey | 6.2 | 6.3 |

| Brazil | 5.7 | 4.7 |

Percentages are adjusted for the effect of futures contracts, if applicable.

Top Five Holdings as of June 30, 2016

| (by issuer, excluding cash equivalents) | % of fund's net assets | % of fund's net assets 6 months ago |

| Argentine Republic | 6.6 | 6.3 |

| Turkish Republic | 5.6 | 5.7 |

| Petroleos Mexicanos | 4.9 | 4.3 |

| Indonesian Republic | 4.7 | 4.4 |

| Brazilian Federative Republic | 4.5 | 3.7 |

| 26.3 |

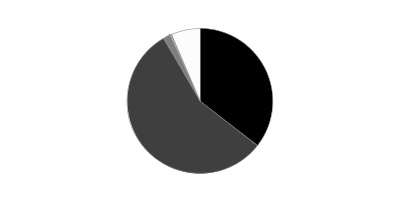

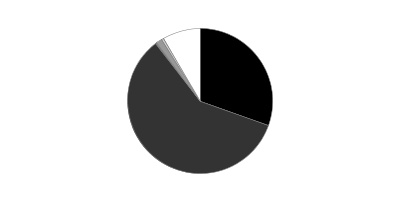

Asset Allocation (% of fund's net assets)

| As of June 30, 2016 | ||

| Corporate Bonds | 35.6% | |

| Government Obligations | 56.1% | |

| Preferred Securities | 1.5% | |

| Other Investments | 0.4% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.4% | |

| As of December 31, 2015 | ||

| Corporate Bonds | 30.5% | |

| Government Obligations | 59.1% | |

| Supranational Obligations | 0.2% | |

| Preferred Securities | 1.4% | |

| Other Investments | 0.5% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 8.3% | |

Investments June 30, 2016 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 35.6% | |||

| Principal Amount(a) | Value | ||

| Argentina - 4.1% | |||

| Aeropuertos Argentina 2000 SA 10.75% 12/1/20(b) | $366,660 | $399,659 | |

| Arcor SAIC 6% 7/6/23 (b) | 165,000 | 165,825 | |

| Banco de Galicia y Buenos Aires SA 16% 1/1/19 (Reg. S) | 175,506 | 176,823 | |

| Banco Hipotecario SA 9.75% 11/30/20 (b) | 495,000 | 536,951 | |

| Cablevision SA 6.5% 6/15/21 (b) | 150,000 | 153,000 | |

| Inversiones y Representaciones SA 11.5% 7/20/20 (Reg. S) | 35,000 | 39,025 | |

| IRSA Propiedades Comerciales SA 8.75% 3/23/23 (b) | 170,000 | 180,838 | |

| Pan American Energy LLC 7.875% 5/7/21 (b) | 600,000 | 613,500 | |

| Transportadora de Gas del Sur SA: | |||

| 7.875% 5/14/17 (Reg. S) | 21,250 | 21,409 | |

| 9.625% 5/14/20 (b) | 802,841 | 851,012 | |

| YPF SA: | |||

| 8.5% 3/23/21 (b) | 625,000 | 667,188 | |

| 8.75% 4/4/24 (b) | 835,000 | 897,625 | |

| TOTAL ARGENTINA | 4,702,855 | ||

| Azerbaijan - 0.8% | |||

| International Bank of Azerbaijan OJSC 5.625% 6/11/19 (Reg. S) | 220,000 | 215,120 | |

| Southern Gas Corridor CJSC 6.875% 3/24/26 (b) | 445,000 | 479,488 | |

| State Oil Co. of Azerbaijan Republic 4.75% 3/13/23 (Reg. S) | 200,000 | 191,311 | |

| TOTAL AZERBAIJAN | 885,919 | ||

| Bailiwick of Jersey - 0.6% | |||

| Polyus Gold International Ltd. 5.625% 4/29/20 (b) | 650,000 | 682,175 | |

| Bangladesh - 0.6% | |||

| Banglalink Digital Communications Ltd. 8.625% 5/6/19 (b) | 600,000 | 630,000 | |

| Bermuda - 0.3% | |||

| Kosmos Energy Ltd.: | |||

| 7.875% 8/1/21 (b) | 200,000 | 193,000 | |

| 7.875% 8/1/21 (b) | 200,000 | 193,000 | |

| TOTAL BERMUDA | 386,000 | ||

| Brazil - 0.8% | |||

| Banco Nacional de Desenvolvimento Economico e Social: | |||

| 5.5% 7/12/20 (b) | 170,000 | 175,100 | |

| 5.75% 9/26/23 (b) | 260,000 | 266,370 | |

| 6.369% 6/16/18 (b) | 200,000 | 208,680 | |

| Globo Comunicacao e Participacoes SA 5.307% 5/11/22 (Reg. S) (c) | 200,000 | 202,000 | |

| TOTAL BRAZIL | 852,150 | ||

| British Virgin Islands - 0.7% | |||

| Gold Fields Orogen Holding BVI Ltd. 4.875% 10/7/20 (b) | 800,000 | 788,000 | |

| Canada - 1.0% | |||

| Evraz, Inc. NA Canada 7.5% 11/15/19 (b) | 745,000 | 726,375 | |

| Pacific Exploration and Production Corp. 12% 12/22/17 | 220,000 | 193,600 | |

| Pacific Rubiales Energy Corp.: | |||

| 7.25% 12/12/21 (b)(d) | 1,245,000 | 230,325 | |

| 7.25% 12/12/21 (Reg. S) | 100,000 | 18,500 | |

| Sino-Forest Corp. 6.25% 10/21/17 (b)(d) | 420,000 | 0 | |

| TOTAL CANADA | 1,168,800 | ||

| Cayman Islands - 0.5% | |||

| Vale Overseas Ltd.: | |||

| 4.375% 1/11/22 | 260,000 | 243,672 | |

| 4.625% 9/15/20 | 165,000 | 160,256 | |

| 5.875% 6/10/21 | 165,000 | 165,206 | |

| TOTAL CAYMAN ISLANDS | 569,134 | ||

| Cyprus - 0.2% | |||

| Global Ports Finance PLC 6.872% 1/25/22 (b) | 200,000 | 206,500 | |

| Dominican Republic - 0.2% | |||

| Banco de Reservas de La Republica Dominicana 7% 2/1/23 (b) | 200,000 | 198,000 | |

| Georgia - 0.6% | |||

| Georgia Bank Joint Stock Co.: | |||

| 7.75% 7/5/17 (b) | 200,000 | 207,700 | |

| 7.75% 7/5/17 (Reg. S) | 200,000 | 207,700 | |

| Georgian Oil & Gas Corp. 6.75% 4/26/21 (b) | 200,000 | 206,540 | |

| TOTAL GEORGIA | 621,940 | ||

| Indonesia - 1.7% | |||

| PT Pertamina Persero: | |||

| 4.3% 5/20/23 (b) | 200,000 | 203,325 | |

| 4.875% 5/3/22 (b) | 200,000 | 210,402 | |

| 5.25% 5/23/21 (b) | 235,000 | 251,625 | |

| 5.625% 5/20/43 (b) | 200,000 | 193,739 | |

| 5.625% 5/20/43 (Reg. S) | 400,000 | 387,478 | |

| 6% 5/3/42 (b) | 200,000 | 202,198 | |

| 6.5% 5/27/41 (b) | 400,000 | 424,040 | |

| TOTAL INDONESIA | 1,872,807 | ||

| Ireland - 1.4% | |||

| EDC Finance Ltd. 4.875% 4/17/20 (b) | 400,000 | 403,000 | |

| Metalloinvest Finance Ltd. 5.625% 4/17/20 (b) | 400,000 | 416,488 | |

| MTS International Funding Ltd. 8.625% 6/22/20 (b) | 150,000 | 175,877 | |

| Vimpel Communications OJSC 7.748% 2/2/21 (Issued by VIP Finance Ireland Ltd. for Vimpel Communications) (b) | 520,000 | 574,934 | |

| TOTAL IRELAND | 1,570,299 | ||

| Kazakhstan - 0.8% | |||

| KazMunaiGaz Finance Sub BV 9.125% 7/2/18 (b) | 100,000 | 111,020 | |

| Zhaikmunai International BV 7.125% 11/13/19 (b) | 930,000 | 816,261 | |

| TOTAL KAZAKHSTAN | 927,281 | ||

| Luxembourg - 3.3% | |||

| EVRAZ Group SA: | |||

| 6.5% 4/22/20 (b) | 200,000 | 204,250 | |

| 8.25% 1/28/21 (Reg. S) | 200,000 | 216,500 | |

| 9.5% 4/24/18 (Reg. S) | 450,000 | 488,700 | |

| MHP SA 8.25% 4/2/20 (b) | 200,000 | 189,000 | |

| Millicom International Cellular SA 6.625% 10/15/21 (b) | 400,000 | 410,680 | |

| Petrobras International Finance Co. Ltd.: | |||

| 5.75% 1/20/20 | 1,020,000 | 985,422 | |

| 5.875% 3/1/18 | 345,000 | 351,900 | |

| 6.875% 1/20/40 | 580,000 | 471,018 | |

| SB Capital SA 5.5% 2/26/24 (b)(e) | 250,000 | 246,625 | |

| TMK Capital SA 6.75% 4/3/20 (Reg. S) | 200,000 | 203,852 | |

| TOTAL LUXEMBOURG | 3,767,947 | ||

| Mexico - 7.2% | |||

| America Movil S.A.B. de CV 6.45% 12/5/22 | MXN | 6,500,000 | 340,598 |

| Credito Real S.A.B. de CV 7.5% 3/13/19 (b) | 200,000 | 206,000 | |

| Nacional Financiera SNC 3.375% 11/5/20 (b) | 245,000 | 249,655 | |

| Pemex Project Funding Master Trust: | |||

| 6.625% 6/15/35 | 1,350,000 | 1,391,850 | |

| 6.625% 6/15/38 | 25,000 | 25,378 | |

| Petroleos Mexicanos: | |||

| 3.5% 1/30/23 | 310,000 | 291,896 | |

| 4.875% 1/18/24 | 290,000 | 294,002 | |

| 5.5% 2/4/19 (b) | 350,000 | 367,850 | |

| 5.5% 1/21/21 | 255,000 | 270,020 | |

| 5.5% 6/27/44 | 750,000 | 677,663 | |

| 6.375% 2/4/21 (b) | 170,000 | 184,841 | |

| 6.375% 1/23/45 | 780,000 | 783,900 | |

| 6.5% 6/2/41 | 1,400,000 | 1,417,500 | |

| 6.625% (b)(f) | 1,295,000 | 1,278,813 | |

| TV Azteca SA de CV 7.5% 5/25/18 (Reg. S) | 600,000 | 400,500 | |

| TOTAL MEXICO | 8,180,466 | ||

| Netherlands - 4.3% | |||

| GTB Finance BV 6% 11/8/18 (b) | 800,000 | 784,080 | |

| GTH Finance BV: | |||

| 6.25% 4/26/20 (b) | 400,000 | 414,512 | |

| 7.25% 4/26/23 (b) | 400,000 | 416,000 | |

| HSBK BV: | |||

| 7.25% 5/3/17 (b) | 400,000 | 412,000 | |

| 7.25% 5/3/17 (Reg. S) | 100,000 | 103,000 | |

| Metinvest BV: | |||

| 10.5% 11/28/17 (b) | 874,416 | 559,801 | |

| 10.5% 11/28/17 (Reg. S) | 248,944 | 159,374 | |

| Nord Gold NV 6.375% 5/7/18 (b) | 200,000 | 209,120 | |

| Nostrum Oil & Gas Finance BV 6.375% 2/14/19 (b) | 430,000 | 376,861 | |

| Petrobras Global Finance BV: | |||

| 2.7684% 1/15/19 (e) | 320,000 | 289,120 | |

| 3% 1/15/19 | 655,000 | 606,858 | |

| 8.375% 5/23/21 | 505,000 | 521,160 | |

| TOTAL NETHERLANDS | 4,851,886 | ||

| Nigeria - 0.7% | |||

| Zenith Bank PLC 6.25% 4/22/19 (b) | 900,000 | 848,430 | |

| Tunisia - 0.2% | |||

| Banque Centrale de Tunisie 5.75% 1/30/25 (b) | 270,000 | 243,675 | |

| Turkey - 0.6% | |||

| Export Credit Bank of Turkey 5.875% 4/24/19 (b) | 400,000 | 424,021 | |

| Turkiye Vakiflar Bankasi TAO 6.875% 2/3/25 (Reg. S) (e) | 200,000 | 202,650 | |

| TOTAL TURKEY | 626,671 | ||

| United Kingdom - 0.8% | |||

| Afren PLC: | |||

| 6.625% 12/9/20 (b)(d) | 195,167 | 195 | |

| 10.25% 4/8/19 (Reg. S) (d) | 585,502 | 586 | |

| Biz Finance PLC 9.625% 4/27/22 (Reg. S) | 300,000 | 291,600 | |

| Ferrexpo Finance PLC: | |||

| 10.375% 4/7/19 (b) | 450,000 | 371,250 | |

| 10.375% 4/7/19 (b) | 150,000 | 123,750 | |

| Vedanta Resources PLC 6% 1/31/19 (b) | 200,000 | 170,750 | |

| TOTAL UNITED KINGDOM | 958,131 | ||

| United States of America - 0.4% | |||

| CEMEX Finance LLC 9.375% 10/12/22 (b) | 200,000 | 220,000 | |

| Southern Copper Corp. 7.5% 7/27/35 | 250,000 | 276,150 | |

| TOTAL UNITED STATES OF AMERICA | 496,150 | ||

| Venezuela - 3.8% | |||

| Petroleos de Venezuela SA: | |||

| 5.375% 4/12/27 | 475,000 | 165,633 | |

| 5.5% 4/12/37 | 165,000 | 56,513 | |

| 6% 5/16/24 (b) | 820,000 | 283,925 | |

| 6% 11/15/26 (b) | 775,000 | 270,243 | |

| 8.5% 11/2/17 (b) | 4,036,667 | 2,823,757 | |

| 8.5% 11/2/17 (Reg. S) | 160,000 | 111,924 | |

| 9.75% 5/17/35 (b) | 910,000 | 363,955 | |

| 12.75% 2/17/22 (b) | 575,000 | 291,525 | |

| TOTAL VENEZUELA | 4,367,475 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $41,907,041) | 40,402,691 | ||

| Government Obligations - 56.1% | |||

| Argentina - 9.1% | |||

| Argentine Republic: | |||

| 6.25% 4/22/19 (b) | 1,445,000 | 1,506,413 | |

| 6.875% 4/22/21 (b) | 1,490,000 | 1,589,085 | |

| 7% 4/17/17 | 3,145,000 | 3,226,158 | |

| 7.5% 4/22/26 (b) | 945,000 | 1,021,545 | |

| 8.75% 5/7/24 | 170,000 | 194,801 | |

| Buenos Aires Province: | |||

| 5.75% 6/15/19 (b) | 165,000 | 167,063 | |

| 9.375% 9/14/18 (b) | 125,000 | 135,000 | |

| 10.875% 1/26/21 (Reg. S) | 1,200,000 | 1,353,000 | |

| City of Buenos Aires 8.95% 2/19/21 (b) | 275,000 | 306,625 | |

| Provincia de Cordoba: | |||

| 7.125% 6/10/21 (b) | 550,000 | 551,375 | |

| 12.375% 8/17/17 (b) | 277,000 | 298,468 | |

| TOTAL ARGENTINA | 10,349,533 | ||

| Armenia - 0.7% | |||

| Republic of Armenia: | |||

| 6% 9/30/20 (b) | 600,000 | 603,732 | |

| 7.15% 3/26/25 (b) | 200,000 | 203,000 | |

| TOTAL ARMENIA | 806,732 | ||

| Belarus - 0.9% | |||

| Belarus Republic 8.95% 1/26/18 | 1,010,000 | 1,047,370 | |

| Brazil - 4.5% | |||

| Brazilian Federative Republic: | |||

| 4.25% 1/7/25 | 800,000 | 786,000 | |

| 5.625% 1/7/41 | 1,040,000 | 1,008,800 | |

| 6% 4/7/26 | 330,000 | 358,050 | |

| 7.125% 1/20/37 | 1,100,000 | 1,237,500 | |

| 8.25% 1/20/34 | 1,415,000 | 1,719,225 | |

| TOTAL BRAZIL | 5,109,575 | ||

| Colombia - 2.0% | |||

| Colombian Republic: | |||

| 4.375% 3/21/23 | COP | 1,875,000,000 | 547,490 |

| 5% 6/15/45 | 200,000 | 207,500 | |

| 5.625% 2/26/44 | 200,000 | 221,500 | |

| 6.125% 1/18/41 | 115,000 | 132,825 | |

| 7.375% 9/18/37 | 275,000 | 357,156 | |

| 10.375% 1/28/33 | 525,000 | 787,500 | |

| TOTAL COLOMBIA | 2,253,971 | ||

| Congo - 0.6% | |||

| Congo Republic 4% 6/30/29 (c) | 927,960 | 668,317 | |

| Costa Rica - 0.5% | |||

| Costa Rican Republic: | |||

| 7% 4/4/44 (b) | 400,000 | 398,000 | |

| 7.158% 3/12/45 (b) | 200,000 | 199,500 | |

| TOTAL COSTA RICA | 597,500 | ||

| Croatia - 1.4% | |||

| Croatia Republic: | |||

| 5.5% 4/4/23 (b) | 200,000 | 211,920 | |

| 6% 1/26/24 (b) | 400,000 | 436,120 | |

| 6.375% 3/24/21 (b) | 450,000 | 490,928 | |

| 6.625% 7/14/20 (b) | 175,000 | 190,925 | |

| 6.75% 11/5/19 (b) | 200,000 | 217,750 | |

| TOTAL CROATIA | 1,547,643 | ||

| Dominican Republic - 2.5% | |||

| Dominican Republic: | |||

| 1.5% 8/30/24 (e) | 1,000,000 | 975,000 | |

| 5.5% 1/27/25 (b) | 180,000 | 183,150 | |

| 6.85% 1/27/45 (b) | 355,000 | 367,425 | |

| 6.875% 1/29/26 (b) | 365,000 | 402,778 | |

| 7.45% 4/30/44 (b) | 455,000 | 500,500 | |

| 7.5% 5/6/21 (b) | 325,000 | 361,075 | |

| TOTAL DOMINICAN REPUBLIC | 2,789,928 | ||

| El Salvador - 0.2% | |||

| El Salvador Republic 7.65% 6/15/35 (Reg. S) | 215,000 | 191,350 | |

| Georgia - 0.2% | |||

| Georgia Republic 6.875% 4/12/21 (b) | 200,000 | 220,024 | |

| Guatemala - 0.2% | |||

| Guatemalan Republic 4.5% 5/3/26 (b) | 200,000 | 203,500 | |

| Hungary - 0.7% | |||

| Hungarian Republic: | |||

| 5.375% 3/25/24 | 116,000 | 129,572 | |

| 5.75% 11/22/23 | 231,000 | 262,970 | |

| 7.625% 3/29/41 | 316,000 | 458,200 | |

| TOTAL HUNGARY | 850,742 | ||

| Indonesia - 4.5% | |||

| Indonesian Republic: | |||

| 3.375% 4/15/23 (b) | 200,000 | 201,086 | |

| 4.75% 1/8/26 (b) | 200,000 | 217,774 | |

| 4.875% 5/5/21 (b) | 300,000 | 325,721 | |

| 5.25% 1/17/42 (b) | 200,000 | 212,128 | |

| 5.375% 10/17/23 | 200,000 | 225,061 | |

| 5.95% 1/8/46 (b) | 200,000 | 235,666 | |

| 6.625% 2/17/37 (b) | 375,000 | 462,048 | |

| 6.75% 1/15/44 (b) | 400,000 | 508,299 | |

| 7.75% 1/17/38 (b) | 855,000 | 1,160,249 | |

| 8.375% 3/15/24 | IDR | 3,437,000,000 | 274,310 |

| 8.5% 10/12/35 (Reg. S) | 775,000 | 1,105,927 | |

| Perusahaan Penerbit SBSN 4.55% 3/29/26 (b) | 200,000 | 209,000 | |

| TOTAL INDONESIA | 5,137,269 | ||

| Iraq - 0.7% | |||

| Republic of Iraq 5.8% 1/15/28 (Reg. S) | 1,050,000 | 799,365 | |

| Ivory Coast - 0.8% | |||

| Ivory Coast 5.75% 12/31/32 | 1,025,000 | 954,439 | |

| Kazakhstan - 0.4% | |||

| Kazakhstan Republic: | |||

| 5.125% 7/21/25 (b) | 230,000 | 251,878 | |

| 6.5% 7/21/45 (b) | 200,000 | 232,428 | |

| TOTAL KAZAKHSTAN | 484,306 | ||

| Lebanon - 0.9% | |||

| Lebanese Republic: | |||

| 4% 12/31/17 | 237,000 | 233,753 | |

| 5.15% 11/12/18 | 250,000 | 249,465 | |

| 5.45% 11/28/19 | 330,000 | 324,951 | |

| 6.375% 3/9/20 | 230,000 | 233,105 | |

| TOTAL LEBANON | 1,041,274 | ||

| Mexico - 2.4% | |||

| United Mexican States: | |||

| 4% 10/2/23 | 262,000 | 282,056 | |

| 4.6% 1/23/46 | 200,000 | 211,000 | |

| 4.75% 3/8/44 | 569,000 | 613,098 | |

| 5.55% 1/21/45 | 150,000 | 179,625 | |

| 6.05% 1/11/40 | 654,000 | 822,405 | |

| 6.5% 6/10/21 | MXN | 4,885,000 | 279,224 |

| 6.75% 9/27/34 | 250,000 | 338,125 | |

| TOTAL MEXICO | 2,725,533 | ||

| Netherlands - 0.4% | |||

| Republic of Angola 7% 8/16/19 (Issued by Northern Lights III BV for Republic of Angola) (Reg. S) | 414,375 | 417,483 | |

| Nigeria - 0.4% | |||

| Central Bank of Nigeria warrants 11/15/20 (g) | 250 | 19,219 | |

| Republic of Nigeria 5.125% 7/12/18 (b) | 400,000 | 400,352 | |

| TOTAL NIGERIA | 419,571 | ||

| Pakistan - 0.8% | |||

| Islamic Republic of Pakistan: | |||

| 7.25% 4/15/19 (b) | 640,000 | 672,150 | |

| 8.25% 4/15/24 (b) | 200,000 | 210,347 | |

| TOTAL PAKISTAN | 882,497 | ||

| Panama - 0.4% | |||

| Panamanian Republic: | |||

| 6.7% 1/26/36 | 120,000 | 159,300 | |

| 8.875% 9/30/27 | 75,000 | 110,250 | |

| 9.375% 4/1/29 | 120,000 | 183,000 | |

| TOTAL PANAMA | 452,550 | ||

| Peru - 0.6% | |||

| Peruvian Republic: | |||

| 4% 3/7/27 (c) | 380,000 | 380,000 | |

| 8.75% 11/21/33 | 180,000 | 282,375 | |

| TOTAL PERU | 662,375 | ||

| Philippines - 0.7% | |||

| Philippine Republic: | |||

| 7.75% 1/14/31 | 270,000 | 419,046 | |

| 9.5% 2/2/30 | 255,000 | 436,188 | |

| TOTAL PHILIPPINES | 855,234 | ||

| Romania - 0.3% | |||

| Romanian Republic: | |||

| 4.375% 8/22/23 (b) | 158,000 | 169,060 | |

| 6.125% 1/22/44 (b) | 160,000 | 199,552 | |

| TOTAL ROMANIA | 368,612 | ||

| Russia - 4.3% | |||

| Russian Federation: | |||

| 4.5% 4/4/22 (b) | 200,000 | 213,730 | |

| 4.875% 9/16/23 (b) | 600,000 | 654,444 | |

| 5% 4/29/20 (b) | 300,000 | 323,676 | |

| 5.875% 9/16/43 (b) | 1,000,000 | 1,168,400 | |

| 12.75% 6/24/28 (Reg. S) | 1,450,000 | 2,538,532 | |

| TOTAL RUSSIA | 4,898,782 | ||

| Serbia - 0.9% | |||

| Republic of Serbia: | |||

| 4.875% 2/25/20 (b) | 200,000 | 206,232 | |

| 5.875% 12/3/18 (b) | 200,000 | 212,000 | |

| 6.75% 11/1/24 (b) | 269,914 | 277,337 | |

| 6.75% 11/1/24 (Reg. S) | 72,950 | 74,956 | |

| 7.25% 9/28/21 (b) | 200,000 | 228,946 | |

| TOTAL SERBIA | 999,471 | ||

| South Africa - 0.1% | |||

| South African Republic 5.875% 5/30/22 | 100,000 | 111,300 | |

| Sri Lanka - 0.6% | |||

| Democratic Socialist Republic of Sri Lanka: | |||

| 5.125% 4/11/19 (b) | 200,000 | 200,293 | |

| 6.25% 10/4/20 (b) | 275,000 | 280,535 | |

| 6.25% 7/27/21 (b) | 250,000 | 251,444 | |

| TOTAL SRI LANKA | 732,272 | ||

| Turkey - 5.6% | |||

| Turkish Republic: | |||

| 3.25% 3/23/23 | 200,000 | 193,750 | |

| 5.125% 3/25/22 | 220,000 | 235,232 | |

| 5.625% 3/30/21 | 310,000 | 337,900 | |

| 6.25% 9/26/22 | 405,000 | 457,978 | |

| 6.75% 5/30/40 | 400,000 | 487,638 | |

| 6.875% 3/17/36 | 795,000 | 969,169 | |

| 7% 3/11/19 | 100,000 | 110,658 | |

| 7% 6/5/20 | 230,000 | 260,859 | |

| 7.25% 3/5/38 | 545,000 | 695,529 | |

| 7.375% 2/5/25 | 760,000 | 937,741 | |

| 7.5% 11/7/19 | 425,000 | 485,388 | |

| 8% 2/14/34 | 250,000 | 336,585 | |

| 9.4% 7/8/20 | TRY | 805,000 | 285,311 |

| 11.875% 1/15/30 | 315,000 | 549,675 | |

| TOTAL TURKEY | 6,343,413 | ||

| Ukraine - 1.4% | |||

| Ukraine Government: | |||

| 0% 5/31/40(b)(e) | 353,000 | 114,354 | |

| 7.75% 9/1/19 (b) | 100,000 | 98,520 | |

| 7.75% 9/1/20 (b) | 543,000 | 530,891 | |

| 7.75% 9/1/21 (b) | 231,000 | 224,694 | |

| 7.75% 9/1/22 (b) | 231,000 | 223,319 | |

| 7.75% 9/1/23 (b) | 231,000 | 222,384 | |

| 7.75% 9/1/24 (b) | 113,000 | 108,169 | |

| 7.75% 9/1/27 (b) | 100,000 | 94,520 | |

| TOTAL UKRAINE | 1,616,851 | ||

| United States of America - 3.5% | |||

| U.S. Treasury Notes 1.375% 4/30/20 | 3,884,000 | 3,957,877 | |

| Uruguay - 0.4% | |||

| Uruguay Republic 7.875% 1/15/33 pay-in-kind | 365,000 | 496,856 | |

| Venezuela - 1.1% | |||

| Venezuelan Republic: | |||

| oil recovery rights 4/15/20 (g) | 5,800 | 5,800 | |

| 9.25% 9/15/27 | 1,295,000 | 624,838 | |

| 11.95% 8/5/31 (Reg. S) | 720,000 | 338,400 | |

| 12.75% 8/23/22 | 495,000 | 249,975 | |

| 13.625% 8/15/18 | 95,000 | 59,660 | |

| TOTAL VENEZUELA | 1,278,673 | ||

| Vietnam - 1.4% | |||

| Vietnamese Socialist Republic: | |||

| 1.75% 3/13/28 (e) | 45,000 | 39,038 | |

| 4% 3/12/28 (c) | 1,077,667 | 1,060,155 | |

| 6.75% 1/29/20 (b) | 405,000 | 448,905 | |

| TOTAL VIETNAM | 1,548,098 | ||

| TOTAL GOVERNMENT OBLIGATIONS | |||

| (Cost $60,947,331) | 63,820,286 | ||

| Shares | Value | ||

| Common Stocks - 0.0% | |||

| Canada - 0.0% | |||

| Pacific Exploration and Production Corp. warrants (h) | |||

| (Cost $17,600) | 5,500 | 17,600 | |

| Principal Amount(a) | Value | ||

| Sovereign Loan Participations - 0.4% | |||

| Indonesia - 0.4% | |||

| Indonesian Republic loan participation: | |||

| Goldman Sachs 1.6875% 12/14/19 (e) | 388,889 | 381,111 | |

| Mizuho 1.6875% 12/14/19 (e) | 108,621 | 106,448 | |

| TOTAL INDONESIA | |||

| (Cost 484,772) | 487,559 | ||

| Preferred Securities - 1.5% | |||

| Brazil - 0.4% | |||

| Cosan Overseas Ltd. 8.25% (f) | 460,000 | 440,578 | |

| British Virgin Islands - 0.2% | |||

| Magnesita Finance Ltd. 8.625% (b)(f) | 200,000 | 154,623 | |

| Cayman Islands - 0.9% | |||

| Banco Do Brasil SA 9% (b)(e)(f) | 200,000 | 155,639 | |

| CSN Islands XII Corp. 7% (Reg. S) (f) | 450,000 | 180,685 | |

| Odebrecht Finance Ltd. 7.5% (b)(f) | 1,450,000 | 708,274 | |

| TOTAL CAYMAN ISLANDS | 1,044,598 | ||

| TOTAL PREFERRED SECURITIES | |||

| (Cost $2,466,207) | 1,639,799 | ||

| Shares | Value | ||

| Money Market Funds - 5.1% | |||

| Fidelity Cash Central Fund, 0.43% (i) | |||

| (Cost $5,804,710) | 5,804,710 | 5,804,710 | |

| TOTAL INVESTMENT PORTFOLIO - 98.7% | |||

| (Cost $111,627,661) | 112,172,645 | ||

| NET OTHER ASSETS (LIABILITIES) - 1.3% | 1,531,050 | ||

| NET ASSETS - 100% | $113,703,695 |

Currency Abbreviations

COP – Colombian peso

IDR – Indonesian rupiah

MXN – Mexican peso

TRY – Turkish Lira

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Amount is stated in United States dollars unless otherwise noted.

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $50,320,292 or 44.3% of net assets.

(c) Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end.

(d) Non-income producing - Security is in default.

(e) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(f) Security is perpetual in nature with no stated maturity date.

(g) Quantity represents share amount.

(h) Non-income producing

(i) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $12,270 |

| Total | $12,270 |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2016, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Energy | $17,600 | $-- | $-- | $17,600 |

| Corporate Bonds | 40,402,691 | -- | 40,208,896 | 193,795 |

| Government Obligations | 63,820,286 | -- | 63,434,486 | 385,800 |

| Sovereign Loan Participations | 487,559 | -- | -- | 487,559 |

| Preferred Securities | 1,639,799 | -- | 1,639,799 | -- |

| Money Market Funds | 5,804,710 | 5,804,710 | -- | -- |

| Total Investments in Securities: | $112,172,645 | $5,804,710 | $105,283,181 | $1,084,754 |

Other Information

The composition of credit quality ratings as a percentage of Total Net Assets is as follows (Unaudited):

| U.S. Government and U.S. Government Agency Obligations | 3.5% |

| AAA,AA,A | 3.5% |

| BBB | 22.8% |

| BB | 21.1% |

| B | 26.5% |

| CCC,CC,C | 8.3% |

| D | 0.2% |

| Not Rated | 7.7% |

| Equities | 0.0% |

| Short-Term Investments and Net Other Assets | 6.4% |

| 100% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| June 30, 2016 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $105,822,951) | $106,367,935 | |

| Fidelity Central Funds (cost $5,804,710) | 5,804,710 | |

| Total Investments (cost $111,627,661) | $112,172,645 | |

| Cash | 220,039 | |

| Receivable for investments sold | 186,950 | |

| Receivable for fund shares sold | 25,638 | |

| Interest receivable | 1,806,696 | |

| Distributions receivable from Fidelity Central Funds | 1,709 | |

| Total assets | 114,413,677 | |

| Liabilities | ||

| Payable for investments purchased | $628,228 | |

| Payable for fund shares redeemed | 79,400 | |

| Other payables and accrued expenses | 2,354 | |

| Total liabilities | 709,982 | |

| Net Assets | $113,703,695 | |

| Net Assets consist of: | ||

| Paid in capital | $114,632,065 | |

| Undistributed net investment income | 2,085,275 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (3,559,052) | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 545,407 | |

| Net Assets, for 11,506,123 shares outstanding | $113,703,695 | |

| Net Asset Value, offering price and redemption price per share ($113,703,695 ÷ 11,506,123 shares) | $9.88 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended June 30, 2016 (Unaudited) | ||

| Investment Income | ||

| Dividends | $112,589 | |

| Interest | 3,990,491 | |

| Income from Fidelity Central Funds | 12,270 | |

| Total income | 4,115,350 | |

| Expenses | ||

| Custodian fees and expenses | $5,285 | |

| Independent trustees' fees and expenses | 232 | |

| Total expenses before reductions | 5,517 | |

| Expense reductions | (639) | 4,878 |

| Net investment income (loss) | 4,110,472 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (1,795,179) | |

| Foreign currency transactions | (9,321) | |

| Total net realized gain (loss) | (1,804,500) | |

| Change in net unrealized appreciation (depreciation) on: Investment securities | 10,808,263 | |

| Assets and liabilities in foreign currencies | 4,176 | |

| Total change in net unrealized appreciation (depreciation) | 10,812,439 | |

| Net gain (loss) | 9,007,939 | |

| Net increase (decrease) in net assets resulting from operations | $13,118,411 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended June 30, 2016 (Unaudited) | Year ended December 31, 2015 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $4,110,472 | $8,365,554 |

| Net realized gain (loss) | (1,804,500) | (1,851,146) |

| Change in net unrealized appreciation (depreciation) | 10,812,439 | (4,135,327) |

| Net increase (decrease) in net assets resulting from operations | 13,118,411 | 2,379,081 |

| Distributions to shareholders from net investment income | (3,455,427) | (7,294,287) |

| Share transactions | ||

| Proceeds from sales of shares | 1,261,683 | 4,439,681 |

| Reinvestment of distributions | 3,455,427 | 7,294,279 |

| Cost of shares redeemed | (3,756,368) | (7,863,469) |

| Net increase (decrease) in net assets resulting from share transactions | 960,742 | 3,870,491 |

| Total increase (decrease) in net assets | 10,623,726 | (1,044,715) |

| Net Assets | ||

| Beginning of period | 103,079,969 | 104,124,684 |

| End of period | $113,703,695 | $103,079,969 |

| Other Information | ||

| Undistributed net investment income end of period | $2,085,275 | $1,430,230 |

| Shares | ||

| Sold | 135,355 | 471,526 |

| Issued in reinvestment of distributions | 368,299 | 776,584 |

| Redeemed | (405,481) | (841,013) |

| Net increase (decrease) | 98,173 | 407,097 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Emerging Markets Debt Central Fund

| Six months ended (Unaudited) June 30, | Years ended December 31, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | 2011 A | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.04 | $9.47 | $9.94 | $11.21 | $9.98 | $10.00 |

| Income from Investment Operations | ||||||

| Net investment income (loss)B | .360 | .744 | .702 | .711 | .743 | .526 |

| Net realized and unrealized gain (loss) | .783 | (.526) | (.501) | (1.070) | 1.287 | (.017) |

| Total from investment operations | 1.143 | .218 | .201 | (.359) | 2.030 | .509 |

| Distributions from net investment income | (.303) | (.648) | (.627) | (.650) | (.680) | (.489) |

| Distributions from net realized gain | – | – | (.044) | (.261) | (.120) | (.040) |

| Total distributions | (.303) | (.648) | (.671) | (.911) | (.800) | (.529) |

| Net asset value, end of period | $9.88 | $9.04 | $9.47 | $9.94 | $11.21 | $9.98 |

| Total ReturnC,D | 12.87% | 2.26% | 1.81% | (3.22)% | 20.99% | 5.18% |

| Ratios to Average Net AssetsE,F | ||||||

| Expenses before reductions | .01%G | .01% | .01% | .02% | .01% | .02%G |

| Expenses net of fee waivers, if any | .01%G | .01% | .01% | .01% | .01% | .02%G |

| Expenses net of all reductions | .01%G | .01% | .01% | .01% | .01% | .02%G |

| Net investment income (loss) | 7.78%G | 7.89% | 6.96% | 6.69% | 6.99% | 6.61%G |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $113,704 | $103,080 | $104,125 | $76,240 | $114,200 | $111,537 |

| Portfolio turnover rateH | 42%G | 39% | 42% | 35% | 49% | 55%G |

A For the period March 17, 2011 (commencement of operations) to December 31, 2011.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2016

1. Organization.

Fidelity Emerging Markets Debt Central Fund (the Fund) is a non-diversified fund of Fidelity Hanover Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Shares of the Fund are only offered to other investment companies and accounts managed by Fidelity Management & Research Company (FMR), or its affiliates (the Investing Funds). The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the FMR Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, foreign government and government agency obligations, preferred securities, U.S. government and government agency obligations and sovereign loan participations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. For foreign debt securities, when significant market or security specific events arise, valuations may be determined in good faith in accordance with procedures adopted by the Board. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2016 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, defaulted bonds, market discount, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $6,988,718 |

| Gross unrealized depreciation | (5,084,391) |

| Net unrealized appreciation (depreciation) on securities | $1,904,327 |

| Tax cost | $110,268,318 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

| No expiration | |

| Short-term | $(990,516) |

| Long-term | (649,467) |

| Total capital loss carryforward | $(1,639,983) |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Loans and Other Direct Debt Instruments. The Fund invests in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. These instruments may be in the form of loans, trade claims or other receivables and may include standby financing commitments such as revolving credit facilities that obligate the Fund to supply additional cash to the borrower on demand. Loans may be acquired through assignment or participation. The Fund did not have any unfunded loan commitments, which are contractual obligations for future funding, at period end.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $22,455,959 and $18,835,067, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. FMR Co., Inc. (the investment adviser), an affiliate of FMR, provides the Fund with investment management services. The Fund does not pay any fees for these services. Pursuant to the Fund's management contract with the investment adviser, FMR pays the investment adviser a portion of the management fees it receives from the Investing Funds. In addition, under an expense contract, FMR also pays all other expenses of the Fund, excluding custody fees, the compensation of the independent Trustees, and certain exceptions such as interest expense.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Expense Reductions.

FMR has voluntarily agreed to reimburse a portion of the Fund's operating expenses. For the period, the reimbursement reduced the expenses by $232.

In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $407.

7. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, mutual funds managed by the investment adviser or its affiliates were the owners of record of all of the outstanding shares of the Fund.

8. Credit Risk.

The Fund's relatively large investment in countries with limited or developing capital markets may involve greater risks than investments in more developed markets and the prices of such investments may be volatile. The yields of emerging market debt obligations reflect, among other things, perceived credit risk. The consequences of political, social or economic changes in these markets may have disruptive effects on the market prices of the Fund's investments and the income they generate, as well as the Fund's ability to repatriate such amounts.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2016 to June 30, 2016).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized Expense Ratio-A | Beginning Account Value January 1, 2016 | Ending Account Value June 30, 2016 | Expenses Paid During Period-B January 1, 2016 to June 30, 2016 |

|

| Actual | .0100% | $1,000.00 | $1,128.70 | $.05 |

| Hypothetical-C | $1,000.00 | $1,024.81 | $.05 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

C 5% return per year before expenses

Corporate Headquarters

245 Summer St.

Boston, MA 02210

www.fidelity.com

EMC-SANN-0816

1.926208.105

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Hanover Street Trust’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Hanover Street Trust’s (the “Trust”) disclosure controls and procedures (as

defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Exhibits

| (a) | (1) | Not applicable. |

| (a) | (2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. |

| (a) | (3) | Not applicable. |

| (b) | | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Hanover Street Trust

| By: | /s/Stacie M. Smith |

| | Stacie M. Smith President and Treasurer |

| |

|

| | |

| Date: | August 25, 2016 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/Stacie M. Smith |

| | Stacie M. Smith |

| |

|

| | |

| Date: | August 25, 2016 |

| By: | /s/Howard J. Galligan III |

| | Howard J. Galligan III |

| |

|

| | |

| Date: | August 25, 2016 |