UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03466

Fidelity Hanover Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

December 31 |

|

|

|

|

Date of reporting period: |

December 31, 2015 |

Item 1. Reports to Stockholders

Fidelity® Emerging Markets Debt

Central Fund

Annual Report

December 31, 2015

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

EMC-ANN-0216 1.926205.104

Performance: The Bottom Line

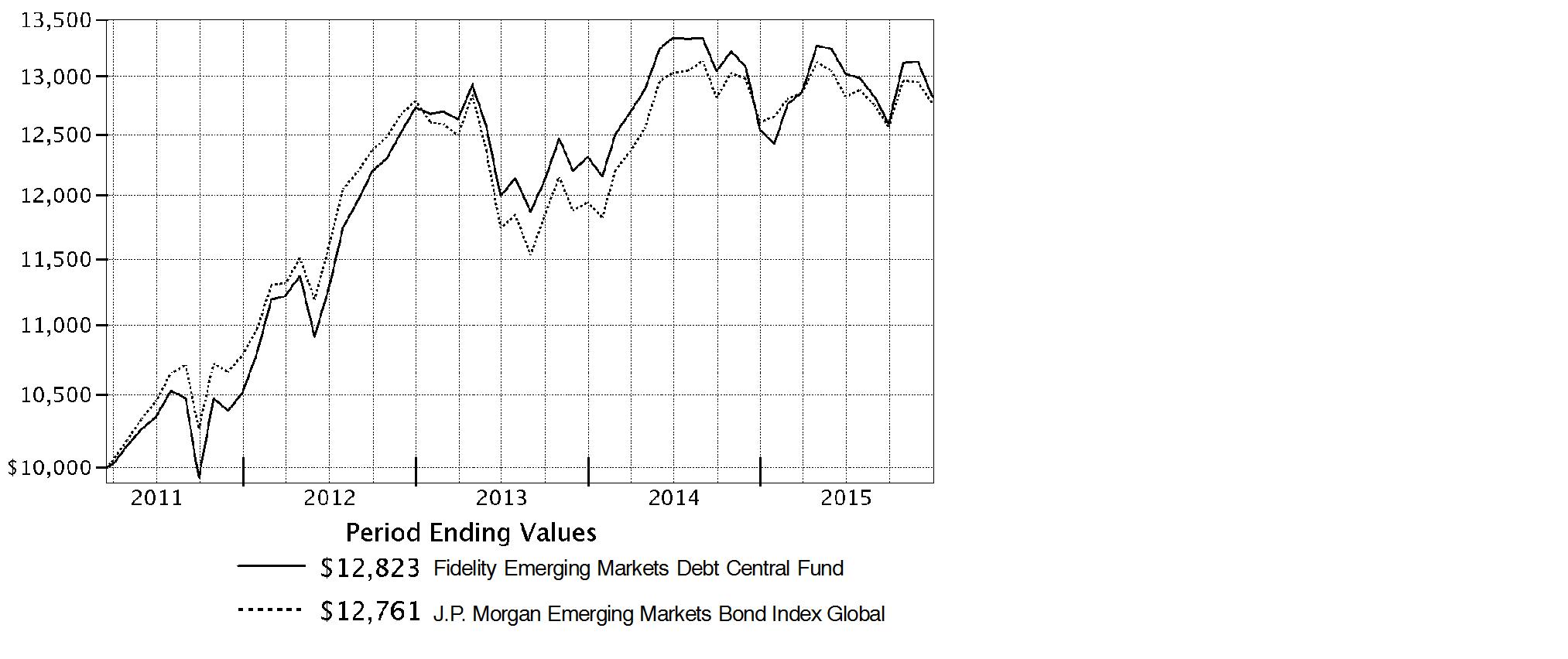

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

|

Periods ended December 31, 2015 |

Past 1 |

Life of |

|

Fidelity® Emerging Markets Debt Central Fund |

2.26% |

5.32% |

A From March 17, 2011

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Emerging Markets Debt Central Fund on March 17, 2011, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the J.P. Morgan Emerging Markets Bond Index Global performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Market Recap: Even against a number of macroeconomic challenges, the emerging-markets (EM) debt asset class, as measured by the J.P. Morgan Emerging Markets Bond Index Global, returned 1.23% for the 12 months ending December 31, 2015. Of the five regions that make up the EM-debt universe, Europe strongly outpaced the benchmark return. This was driven by strength across most Eastern European credits, such as Hungary (+6%) and Poland (+3%), which were viewed as safe havens amid volatile markets. Also driving the outperformance of this region were Russia (+21%) and Ukraine (+42%). None of the other regions outperformed the benchmark, but there were select areas of strength among individual countries. Argentina (+27%) and Venezuela (+17%) both helped to drive the outperformance of the non-investment-grade portion of the benchmark. Turning to laggards, Latin America and Africa underperformed by a wide margin. Brazil (-13%) was the main factor in the former region's underperformance, but several countries here also experienced weakness, including Colombia (-7%), Mexico (-6%) and Chile (-3%). Within Africa, most countries in the sub-Saharan region underperformed. A number of these countries are dependent on resources to fund their budgets, and experienced budget difficulties during the past year, including South Africa (-5%).

Comments from Portfolio Manager Jonathan Kelly: For the year, the fund returned 2.26%, outpacing the benchmark J.P. Morgan index. Market selection drove results versus the benchmark, especially sizable overweightings in Argentina and, to a lesser extent, Russia and Venezuela. In all three cases, weakness in commodity prices and declines in economic activity led to higher yields and spreads. In addition, the fund's focus on U.S.-dollar-denominated sovereign bonds was particularly additive. Specifically, it helped to hold shorter duration bonds and have heavier-than-benchmark exposure to both Venezuelan sovereign bonds and the country's state oil company Petroleos de Venezuela. Venezuelan bond prices fell in the latter part of 2014 at the inception of the bear market in oil, but the Venezuelan government continued to service debt throughout 2015, leading to the bonds' outperformance the past year. Conversely, performance was held back by weak security selection, especially among corporate bonds and local-currency bonds. Investments in Brazil hurt most. While the country continues to suffer from economic stagnation, a corruption scandal at state-run oil giant Petrobras had wide repercussions, leading Standard & Poor's to downgrade the country's debt to below investment grade in September. Corporate bonds here and in Colombia also detracted, hurt in part by a weaker currency.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 to December 31, 2015).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Annual Report

|

|

Annualized |

Beginning |

Ending |

Expenses Paid |

|

Actual |

.0090% |

$ 1,000.00 |

$ 984.60 |

$ .05 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,025.16 |

$ .05 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

C Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

|

Top Five Countries as of December 31, 2015 |

||

|

(excluding cash equivalents) |

% of fund's |

% of fund's net assets |

|

Argentina |

11.6 |

9.4 |

|

Mexico |

9.0 |

9.9 |

|

Venezuela |

6.5 |

7.3 |

|

Turkey |

6.3 |

6.4 |

|

Indonesia |

5.9 |

6.1 |

|

Percentages are adjusted for the effect of open futures contracts, if applicable. |

|

Top Five Holdings as of December 31, 2015 |

||

|

(by issuer, excluding cash equivalents) |

% of fund's |

% of fund's net assets |

|

Argentine Republic |

6.3 |

4.3 |

|

Turkish Republic |

5.7 |

6.0 |

|

Russian Federation |

5.0 |

5.1 |

|

Indonesian Republic |

4.4 |

4.5 |

|

U.S. Treasury Obligations |

4.4 |

3.0 |

|

|

25.8 |

|

|

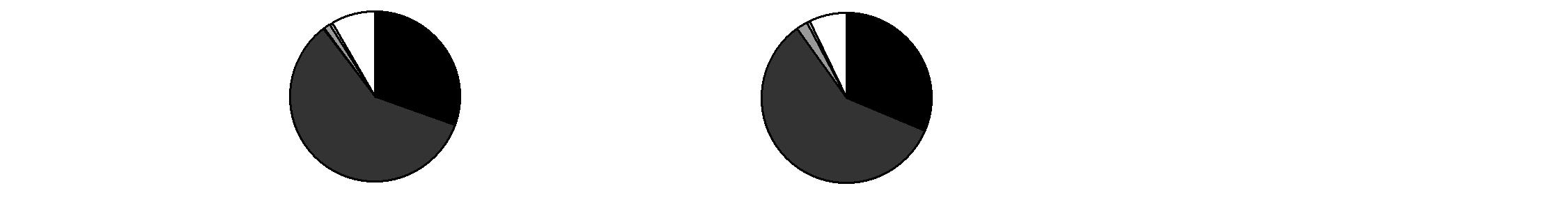

Asset Allocation (% of fund's net assets) |

|||||||

|

As of December 31, 2015 |

As of June 30, 2015 |

||||||

|

Corporate Bonds 30.5% |

|

|

Corporate Bonds 31.3% |

|

||

|

Government |

|

|

Government |

|

||

|

Supranational Obligations 0.2% |

|

|

Supranational Obligations 0.1% |

|

||

|

Preferred Securities 1.4% |

|

|

Preferred Securities 2.1% |

|

||

|

Other Investments 0.5% |

|

|

Other Investments 0.6% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

Annual Report

Investments December 31, 2015

Showing Percentage of Net Assets

|

Nonconvertible Bonds - 30.5% |

||||

|

|

Principal Amount (d) |

Value |

||

|

Argentina - 3.0% |

||||

|

Aeropuertos Argentina 2000 SA 10.75% 12/1/20 (f) |

|

$ 407,400 |

$ 428,789 |

|

|

Banco de Galicia y Buenos Aires SA 16% 1/1/19 (Reg. S) |

|

171,226 |

172,724 |

|

|

Banco Hipotecario SA 9.75% 11/30/20 (f) |

|

165,000 |

168,300 |

|

|

Inversiones y Representaciones SA 11.5% 7/20/20 (Reg. S) |

|

35,000 |

36,925 |

|

|

Pan American Energy LLC 7.875% 5/7/21 (f) |

|

155,000 |

151,513 |

|

|

Transportadora de Gas del Sur SA 9.625% 5/14/20 (f) |

|

802,841 |

820,905 |

|

|

YPF SA: |

|

|

|

|

|

8.5% 7/28/25 (f) |

|

325,000 |

309,563 |

|

|

8.75% 4/4/24 (f) |

|

770,000 |

746,900 |

|

|

8.875% 12/19/18 (f) |

|

250,000 |

252,813 |

|

|

TOTAL ARGENTINA |

3,088,432 |

|||

|

Azerbaijan - 0.3% |

||||

|

State Oil Co. of Azerbaijan Republic 4.75% 3/13/23 (Reg. S) |

|

400,000 |

337,906 |

|

|

Bailiwick of Jersey - 0.6% |

||||

|

Polyus Gold International Ltd. 5.625% 4/29/20 (f) |

|

650,000 |

622,375 |

|

|

Bangladesh - 0.4% |

||||

|

Banglalink Digital Communications Ltd. 8.625% 5/6/19 (f) |

|

400,000 |

413,000 |

|

|

Bermuda - 0.2% |

||||

|

Kosmos Energy Ltd. 7.875% 8/1/21 (f) |

|

200,000 |

161,000 |

|

|

Brazil - 0.6% |

||||

|

Banco Nacional de Desenvolvimento Economico e Social: |

|

|

|

|

|

5.5% 7/12/20 (f) |

|

370,000 |

343,175 |

|

|

5.75% 9/26/23 (f) |

|

260,000 |

224,172 |

|

|

TOTAL BRAZIL |

567,347 |

|||

|

British Virgin Islands - 0.9% |

||||

|

Arcos Dorados Holdings, Inc. 10.25% 7/13/16 (f) |

BRL |

1,905,000 |

441,791 |

|

|

Gold Fields Orogen Holding BVI Ltd. 4.875% 10/7/20 (f) |

|

600,000 |

447,000 |

|

|

TOTAL BRITISH VIRGIN ISLANDS |

888,791 |

|||

|

Canada - 0.5% |

||||

|

Evraz, Inc. NA Canada 7.5% 11/15/19 (f) |

|

265,000 |

247,775 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Canada - continued |

||||

|

Pacific Rubiales Energy Corp. 7.25% 12/12/21 (f) |

|

$ 1,145,000 |

$ 229,000 |

|

|

Sino-Forest Corp. 6.25% 10/21/17 (c)(f) |

|

420,000 |

0 |

|

|

TOTAL CANADA |

476,775 |

|||

|

Cayman Islands - 1.5% |

||||

|

Petrobras International Finance Co. Ltd.: |

|

|

|

|

|

5.75% 1/20/20 |

|

470,000 |

368,950 |

|

|

5.875% 3/1/18 |

|

670,000 |

596,300 |

|

|

6.875% 1/20/40 |

|

925,000 |

601,250 |

|

|

TOTAL CAYMAN ISLANDS |

1,566,500 |

|||

|

Chile - 0.1% |

||||

|

Empresa Nacional de Petroleo 4.75% 12/6/21 (f) |

|

100,000 |

100,996 |

|

|

Georgia - 0.8% |

||||

|

Georgia Bank Joint Stock Co.: |

|

|

|

|

|

7.75% 7/5/17 (f) |

|

400,000 |

412,812 |

|

|

7.75% 7/5/17 (Reg. S) |

|

200,000 |

206,406 |

|

|

Georgian Oil & Gas Corp. 6.875% 5/16/17 (f) |

|

200,000 |

201,480 |

|

|

TOTAL GEORGIA |

820,698 |

|||

|

Indonesia - 1.5% |

||||

|

PT Pertamina Persero: |

|

|

|

|

|

4.3% 5/20/23 (f) |

|

200,000 |

181,806 |

|

|

4.875% 5/3/22 (f) |

|

200,000 |

191,765 |

|

|

5.25% 5/23/21 (f) |

|

235,000 |

234,522 |

|

|

5.625% 5/20/43 (f) |

|

200,000 |

156,529 |

|

|

5.625% 5/20/43 (Reg. S) |

|

400,000 |

313,057 |

|

|

6% 5/3/42 (f) |

|

200,000 |

163,759 |

|

|

6.5% 5/27/41 (f) |

|

400,000 |

349,529 |

|

|

TOTAL INDONESIA |

1,590,967 |

|||

|

Ireland - 2.5% |

||||

|

EDC Finance Ltd. 4.875% 4/17/20 (f) |

|

600,000 |

525,838 |

|

|

Metalloinvest Finance Ltd. 5.625% 4/17/20 (f) |

|

400,000 |

384,488 |

|

|

MTS International Funding Ltd. 8.625% 6/22/20 (f) |

|

650,000 |

716,300 |

|

|

Vimpel Communications OJSC 7.748% 2/2/21 (Issued by VIP Finance Ireland Ltd. for Vimpel Communications) (f) |

|

920,000 |

940,498 |

|

|

TOTAL IRELAND |

2,567,124 |

|||

|

Kazakhstan - 0.4% |

||||

|

Zhaikmunai International BV 7.125% 11/13/19 (f) |

|

530,000 |

412,075 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Korea (South) - 0.1% |

||||

|

Export-Import Bank of Korea 6% 6/4/16 (Reg. S) |

INR |

7,100,000 |

$ 106,661 |

|

|

Luxembourg - 2.0% |

||||

|

EVRAZ Group SA: |

|

|

|

|

|

6.5% 4/22/20 (f) |

|

$ 400,000 |

374,800 |

|

|

9.5% 4/24/18 (Reg. S) |

|

650,000 |

681,200 |

|

|

Millicom International Cellular SA 6.625% 10/15/21 (f) |

|

200,000 |

184,750 |

|

|

OJSC Russian Agricultural Bank 7.75% 5/29/18 (Issued by RSHB Capital SA for OJSC Russian Agricultural Bank) (f) |

|

240,000 |

251,710 |

|

|

SB Capital SA 5.5% 2/26/24 (f)(h) |

|

450,000 |

395,213 |

|

|

TMK Capital SA 6.75% 4/3/20 (Reg. S) |

|

200,000 |

188,250 |

|

|

TOTAL LUXEMBOURG |

2,075,923 |

|||

|

Mexico - 6.5% |

||||

|

America Movil S.A.B. de CV 6.45% 12/5/22 |

MXN |

6,500,000 |

357,539 |

|

|

Credito Real S.A.B. de CV 7.5% 3/13/19 (f) |

|

200,000 |

198,000 |

|

|

Nacional Financiera SNC 3.375% 11/5/20 (f) |

|

245,000 |

242,642 |

|

|

Pemex Project Funding Master Trust: |

|

|

|

|

|

6.625% 6/15/35 |

|

1,220,000 |

1,090,375 |

|

|

6.625% 6/15/38 |

|

25,000 |

22,000 |

|

|

Petroleos Mexicanos: |

|

|

|

|

|

3.5% 1/30/23 |

|

310,000 |

270,475 |

|

|

4.875% 1/18/24 |

|

290,000 |

270,425 |

|

|

5.5% 1/21/21 |

|

255,000 |

257,219 |

|

|

5.5% 6/27/44 (f) |

|

210,000 |

157,991 |

|

|

5.5% 6/27/44 |

|

540,000 |

406,264 |

|

|

6.375% 1/23/45 |

|

830,000 |

702,496 |

|

|

6.5% 6/2/41 |

|

1,245,000 |

1,076,303 |

|

|

6.625% (f)(g) |

|

1,380,000 |

1,276,500 |

|

|

TV Azteca SA de CV 7.5% 5/25/18 (Reg. S) |

|

600,000 |

408,000 |

|

|

TOTAL MEXICO |

6,736,229 |

|||

|

Netherlands - 2.9% |

||||

|

GTB Finance BV 6% 11/8/18 (f) |

|

800,000 |

733,928 |

|

|

HSBK BV: |

|

|

|

|

|

7.25% 5/3/17 (f) |

|

400,000 |

411,278 |

|

|

7.25% 5/3/17 (Reg. S) |

|

100,000 |

102,820 |

|

|

Intergas Finance BV 6.375% 5/14/17 (Reg. S) |

|

150,000 |

152,766 |

|

|

Metinvest BV 10.5% 11/28/17 (f) |

|

993,000 |

441,885 |

|

|

Nord Gold NV 6.375% 5/7/18 (f) |

|

200,000 |

201,118 |

|

|

Nostrum Oil & Gas Finance BV 6.375% 2/14/19 (f) |

|

430,000 |

334,863 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Netherlands - continued |

||||

|

Petrobras Global Finance BV: |

|

|

|

|

|

2.4605% 1/15/19 (h) |

|

$ 70,000 |

$ 53,200 |

|

|

3% 1/15/19 |

|

490,000 |

372,400 |

|

|

VimpelCom Holdings BV: |

|

|

|

|

|

9% 2/13/18 (f) |

RUB |

5,000,000 |

64,846 |

|

|

9% 2/13/18 (Reg S.) |

RUB |

12,000,000 |

155,630 |

|

|

TOTAL NETHERLANDS |

3,024,734 |

|||

|

Nigeria - 0.6% |

||||

|

Zenith Bank PLC 6.25% 4/22/19 (f) |

|

700,000 |

629,650 |

|

|

Paraguay - 0.4% |

||||

|

BBVA Paraguay SA 9.75% 2/11/16 (f) |

|

375,000 |

376,137 |

|

|

Tunisia - 0.2% |

||||

|

Banque Centrale de Tunisie 5.75% 1/30/25 (f) |

|

270,000 |

233,677 |

|

|

Turkey - 0.6% |

||||

|

Export Credit Bank of Turkey 5.875% 4/24/19 (f) |

|

400,000 |

413,095 |

|

|

Finansbank A/S 5.5% 5/11/16 (Reg. S) |

|

200,000 |

202,016 |

|

|

TOTAL TURKEY |

615,111 |

|||

|

United Kingdom - 0.5% |

||||

|

Afren PLC: |

|

|

|

|

|

6.625% 12/9/20 (c)(f) |

|

195,167 |

1,991 |

|

|

10.25% 4/8/19 (Reg. S) (c) |

|

585,502 |

5,972 |

|

|

Biz Finance PLC 9.625% 4/27/22 (Reg. S) |

|

150,000 |

134,100 |

|

|

Ferrexpo Finance PLC: |

|

|

|

|

|

10.375% 4/7/19 (f) |

|

600,000 |

327,000 |

|

|

10.375% 4/7/19 (f) |

|

150,000 |

81,750 |

|

|

TOTAL UNITED KINGDOM |

550,813 |

|||

|

United States of America - 0.2% |

||||

|

Southern Copper Corp. 7.5% 7/27/35 |

|

250,000 |

233,698 |

|

|

Venezuela - 3.2% |

||||

|

Petroleos de Venezuela SA: |

|

|

|

|

|

5.375% 4/12/27 |

|

475,000 |

172,188 |

|

|

5.5% 4/12/37 |

|

165,000 |

59,813 |

|

|

6% 5/16/24 (f) |

|

415,000 |

153,550 |

|

|

6% 11/15/26 (f) |

|

540,000 |

198,450 |

|

|

8.5% 11/2/17 (f) |

|

3,270,000 |

1,741,275 |

|

|

8.5% 11/2/17 (Reg. S) |

|

160,000 |

85,200 |

|

|

9% 11/17/21 (Reg. S) |

|

240,000 |

96,120 |

|

|

Nonconvertible Bonds - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Venezuela - continued |

||||

|

Petroleos de Venezuela SA: - continued |

|

|

|

|

|

9.75% 5/17/35 (f) |

|

$ 1,170,000 |

$ 485,550 |

|

|

12.75% 2/17/22 (f) |

|

645,000 |

290,250 |

|

|

TOTAL VENEZUELA |

3,282,396 |

|||

|

TOTAL NONCONVERTIBLE BONDS (Cost $38,008,083) |

|

|||

|

Government Obligations - 59.1% |

||||

|

|

||||

|

Argentina - 8.6% |

||||

|

Argentine Republic: |

|

|

|

|

|

7% 4/17/17 |

|

4,670,000 |

4,724,217 |

|

|

8.28% 12/31/33 (c) |

|

848,233 |

975,468 |

|

|

8.75% 6/2/17 (c) |

|

665,000 |

759,763 |

|

|

Buenos Aires Province: |

|

|

|

|

|

9.375% 9/14/18 (f) |

|

325,000 |

331,500 |

|

|

9.95% 6/9/21 |

|

240,000 |

245,100 |

|

|

10.875% 1/26/21 (Reg. S) |

|

950,000 |

1,002,250 |

|

|

City of Buenos Aires 8.95% 2/19/21 (f) |

|

205,000 |

216,275 |

|

|

Provincia de Cordoba 12.375% 8/17/17 (f) |

|

550,000 |

569,250 |

|

|

TOTAL ARGENTINA |

8,823,823 |

|||

|

Armenia - 0.7% |

||||

|

Republic of Armenia: |

|

|

|

|

|

6% 9/30/20 (f) |

|

600,000 |

581,778 |

|

|

7.15% 3/26/25 (f) |

|

200,000 |

193,222 |

|

|

TOTAL ARMENIA |

775,000 |

|||

|

Belarus - 1.0% |

||||

|

Belarus Republic 8.95% 1/26/18 |

|

1,010,000 |

1,032,503 |

|

|

Brazil - 3.7% |

||||

|

Brazilian Federative Republic: |

|

|

|

|

|

4.25% 1/7/25 |

|

800,000 |

644,000 |

|

|

5.625% 1/7/41 |

|

1,240,000 |

899,000 |

|

|

7.125% 1/20/37 |

|

1,100,000 |

948,750 |

|

|

8.25% 1/20/34 |

|

1,415,000 |

1,361,938 |

|

|

TOTAL BRAZIL |

3,853,688 |

|||

|

Government Obligations - continued |

||||

|

|

Principal |

Value |

||

|

Colombia - 1.9% |

||||

|

Colombian Republic: |

|

|

|

|

|

4.375% 3/21/23 |

COP |

1,836,000,000 |

$ 482,351 |

|

|

5% 6/15/45 |

|

$ 200,000 |

167,000 |

|

|

5.625% 2/26/44 |

|

200,000 |

182,500 |

|

|

6.125% 1/18/41 |

|

115,000 |

110,975 |

|

|

7.375% 9/18/37 |

|

275,000 |

303,188 |

|

|

10.375% 1/28/33 |

|

525,000 |

740,250 |

|

|

TOTAL COLOMBIA |

1,986,264 |

|||

|

Congo - 0.8% |

||||

|

Congo Republic 4% 6/30/29 (e) |

|

1,098,675 |

862,460 |

|

|

Costa Rica - 0.7% |

||||

|

Costa Rican Republic: |

|

|

|

|

|

4.25% 1/26/23 (f) |

|

200,000 |

175,000 |

|

|

7% 4/4/44 (f) |

|

400,000 |

333,500 |

|

|

7.158% 3/12/45 (f) |

|

200,000 |

167,500 |

|

|

TOTAL COSTA RICA |

676,000 |

|||

|

Croatia - 1.2% |

||||

|

Croatia Republic: |

|

|

|

|

|

5.5% 4/4/23 (f) |

|

200,000 |

203,040 |

|

|

6% 1/26/24 (f) |

|

400,000 |

416,692 |

|

|

6.375% 3/24/21 (f) |

|

250,000 |

265,500 |

|

|

6.625% 7/14/20 (f) |

|

175,000 |

187,521 |

|

|

6.75% 11/5/19 (f) |

|

200,000 |

214,250 |

|

|

TOTAL CROATIA |

1,287,003 |

|||

|

Dominican Republic - 2.0% |

||||

|

Dominican Republic: |

|

|

|

|

|

1.4674% 8/30/24 (h) |

|

750,000 |

734,063 |

|

|

5.5% 1/27/25 (f) |

|

180,000 |

173,250 |

|

|

6.85% 1/27/45 (f) |

|

355,000 |

334,588 |

|

|

7.45% 4/30/44 (f) |

|

455,000 |

458,413 |

|

|

7.5% 5/6/21 (f) |

|

325,000 |

348,563 |

|

|

TOTAL DOMINICAN REPUBLIC |

2,048,877 |

|||

|

El Salvador - 0.1% |

||||

|

El Salvador Republic 7.65% 6/15/35 (Reg. S) |

|

115,000 |

98,038 |

|

|

Georgia - 0.2% |

||||

|

Georgia Republic 6.875% 4/12/21 (f) |

|

200,000 |

206,720 |

|

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Hungary - 0.9% |

||||

|

Hungarian Republic: |

|

|

|

|

|

5.375% 3/25/24 |

|

$ 116,000 |

$ 127,020 |

|

|

5.75% 11/22/23 |

|

231,000 |

258,466 |

|

|

7.625% 3/29/41 |

|

376,000 |

508,773 |

|

|

TOTAL HUNGARY |

894,259 |

|||

|

Indonesia - 3.9% |

||||

|

Indonesian Republic: |

|

|

|

|

|

3.375% 4/15/23 (f) |

|

200,000 |

185,848 |

|

|

4.75% 1/8/26 (f) |

|

200,000 |

197,532 |

|

|

4.875% 5/5/21 (f) |

|

300,000 |

310,745 |

|

|

5.25% 1/17/42 (f) |

|

200,000 |

180,601 |

|

|

5.375% 10/17/23 |

|

200,000 |

207,938 |

|

|

5.95% 1/8/46 (f) |

|

200,000 |

196,915 |

|

|

6.625% 2/17/37 (f) |

|

375,000 |

392,920 |

|

|

6.75% 1/15/44 (f) |

|

400,000 |

428,722 |

|

|

7.75% 1/17/38 (f) |

|

855,000 |

1,000,211 |

|

|

8.5% 10/12/35 (Reg. S) |

|

775,000 |

963,903 |

|

|

TOTAL INDONESIA |

4,065,335 |

|||

|

Iraq - 0.7% |

||||

|

Republic of Iraq 5.8% 1/15/28 (Reg. S) |

|

1,050,000 |

706,692 |

|

|

Ivory Coast - 0.9% |

||||

|

Ivory Coast 5.75% 12/31/32 |

|

1,025,000 |

911,164 |

|

|

Kazakhstan - 0.4% |

||||

|

Kazakhstan Republic: |

|

|

|

|

|

5.125% 7/21/25 (f) |

|

230,000 |

226,670 |

|

|

6.5% 7/21/45 (f) |

|

200,000 |

196,608 |

|

|

TOTAL KAZAKHSTAN |

423,278 |

|||

|

Lebanon - 1.1% |

||||

|

Lebanese Republic: |

|

|

|

|

|

4% 12/31/17 |

|

316,000 |

311,734 |

|

|

5.15% 11/12/18 |

|

250,000 |

247,960 |

|

|

5.45% 11/28/19 |

|

330,000 |

324,086 |

|

|

6.375% 3/9/20 |

|

230,000 |

231,700 |

|

|

TOTAL LEBANON |

1,115,480 |

|||

|

Mexico - 2.5% |

||||

|

United Mexican States: |

|

|

|

|

|

4% 10/2/23 |

|

312,000 |

316,056 |

|

|

4.6% 1/23/46 |

|

200,000 |

177,000 |

|

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Mexico - continued |

||||

|

United Mexican States: - continued |

|

|

|

|

|

4.75% 3/8/44 |

|

$ 569,000 |

$ 518,359 |

|

|

5.55% 1/21/45 |

|

150,000 |

153,750 |

|

|

6.05% 1/11/40 |

|

694,000 |

759,930 |

|

|

6.5% 6/10/21 |

MXN |

4,610,000 |

276,721 |

|

|

6.75% 9/27/34 |

|

350,000 |

420,000 |

|

|

TOTAL MEXICO |

2,621,816 |

|||

|

Netherlands - 0.2% |

||||

|

Republic of Angola 7% 8/16/19 (Issued by Northern Lights III BV for Republic of Angola) (Reg. S) |

|

243,750 |

234,658 |

|

|

Nigeria - 0.4% |

||||

|

Central Bank of Nigeria warrants 11/15/20 (a)(i) |

|

250 |

12,067 |

|

|

Republic of Nigeria 5.125% 7/12/18 (f) |

|

400,000 |

381,000 |

|

|

TOTAL NIGERIA |

393,067 |

|||

|

Pakistan - 1.6% |

||||

|

Islamic Republic of Pakistan: |

|

|

|

|

|

7.125% 3/31/16 (f) |

|

575,000 |

575,754 |

|

|

7.25% 4/15/19 (f) |

|

640,000 |

651,831 |

|

|

8.25% 4/15/24 (f) |

|

200,000 |

205,080 |

|

|

8.25% 9/30/25 (f) |

|

200,000 |

203,232 |

|

|

TOTAL PAKISTAN |

1,635,897 |

|||

|

Panama - 0.4% |

||||

|

Panamanian Republic: |

|

|

|

|

|

6.7% 1/26/36 |

|

120,000 |

142,500 |

|

|

8.875% 9/30/27 |

|

75,000 |

103,688 |

|

|

9.375% 4/1/29 |

|

120,000 |

172,800 |

|

|

TOTAL PANAMA |

418,988 |

|||

|

Peru - 0.6% |

||||

|

Peruvian Republic: |

|

|

|

|

|

4% 3/7/27 (e) |

|

380,000 |

380,000 |

|

|

8.75% 11/21/33 |

|

180,000 |

253,800 |

|

|

TOTAL PERU |

633,800 |

|||

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Philippines - 0.8% |

||||

|

Philippine Republic: |

|

|

|

|

|

7.75% 1/14/31 |

|

$ 270,000 |

$ 379,342 |

|

|

9.5% 2/2/30 |

|

255,000 |

401,614 |

|

|

TOTAL PHILIPPINES |

780,956 |

|||

|

Romania - 0.5% |

||||

|

Romanian Republic: |

|

|

|

|

|

4.375% 8/22/23 (f) |

|

258,000 |

268,565 |

|

|

6.125% 1/22/44 (f) |

|

178,000 |

208,260 |

|

|

TOTAL ROMANIA |

476,825 |

|||

|

Russia - 5.0% |

||||

|

Russian Federation: |

|

|

|

|

|

4.875% 9/16/23 (f) |

|

600,000 |

609,600 |

|

|

5% 4/29/20 (f) |

|

300,000 |

309,600 |

|

|

5.875% 9/16/43 (f) |

|

1,000,000 |

972,700 |

|

|

7.5% 3/31/30 (Reg. S) |

|

647,434 |

755,633 |

|

|

12.75% 6/24/28 (Reg. S) |

|

1,565,000 |

2,473,733 |

|

|

TOTAL RUSSIA |

5,121,266 |

|||

|

Serbia - 0.8% |

||||

|

Republic of Serbia: |

|

|

|

|

|

5.875% 12/3/18 (f) |

|

200,000 |

210,400 |

|

|

6.75% 11/1/24 (f) |

|

285,792 |

290,793 |

|

|

6.75% 11/1/24 (Reg. S) |

|

77,241 |

78,593 |

|

|

7.25% 9/28/21 (f) |

|

200,000 |

226,090 |

|

|

TOTAL SERBIA |

805,876 |

|||

|

Sri Lanka - 0.7% |

||||

|

Democratic Socialist Republic of Sri Lanka: |

|

|

|

|

|

5.125% 4/11/19 (f) |

|

200,000 |

189,940 |

|

|

6.25% 10/4/20 (f) |

|

275,000 |

265,099 |

|

|

6.25% 7/27/21 (f) |

|

250,000 |

237,688 |

|

|

TOTAL SRI LANKA |

692,727 |

|||

|

Turkey - 5.7% |

||||

|

Turkish Republic: |

|

|

|

|

|

3.25% 3/23/23 |

|

200,000 |

183,211 |

|

|

4.875% 4/16/43 |

|

200,000 |

176,000 |

|

|

5.125% 3/25/22 |

|

220,000 |

225,775 |

|

|

5.625% 3/30/21 |

|

425,000 |

449,397 |

|

|

6.25% 9/26/22 |

|

405,000 |

439,668 |

|

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Turkey - continued |

||||

|

Turkish Republic: - continued |

|

|

|

|

|

6.75% 5/30/40 |

|

$ 400,000 |

$ 444,590 |

|

|

6.875% 3/17/36 |

|

795,000 |

890,305 |

|

|

7% 3/11/19 |

|

100,000 |

109,376 |

|

|

7.25% 3/5/38 |

|

545,000 |

638,428 |

|

|

7.375% 2/5/25 |

|

760,000 |

887,376 |

|

|

7.5% 11/7/19 |

|

530,000 |

594,273 |

|

|

8% 2/14/34 |

|

250,000 |

312,475 |

|

|

11.875% 1/15/30 |

|

315,000 |

516,216 |

|

|

TOTAL TURKEY |

5,867,090 |

|||

|

Ukraine - 1.5% |

||||

|

Ukraine Financing of Infrastructure Projects State Enterprise 8.375% 11/3/17 (f) |

|

80,000 |

63,739 |

|

|

Ukraine Government: |

|

|

|

|

|

0% 5/31/40 (f) |

|

353,000 |

139,435 |

|

|

7.75% 9/1/20 (f) |

|

543,000 |

499,560 |

|

|

7.75% 9/1/21 (f) |

|

231,000 |

209,877 |

|

|

7.75% 9/1/22 (f) |

|

231,000 |

209,235 |

|

|

7.75% 9/1/23 (f) |

|

231,000 |

205,636 |

|

|

7.75% 9/1/24 (f) |

|

113,000 |

99,995 |

|

|

7.75% 9/1/27 (f) |

|

100,000 |

87,000 |

|

|

TOTAL UKRAINE |

1,514,477 |

|||

|

United States of America - 4.4% |

||||

|

U.S. Treasury Bonds 2.5% 2/15/45 |

|

1,222,000 |

1,094,171 |

|

|

U.S. Treasury Notes 1.375% 4/30/20 |

|

3,491,000 |

3,446,570 |

|

|

TOTAL UNITED STATES OF AMERICA |

4,540,741 |

|||

|

Uruguay - 0.4% |

||||

|

Uruguay Republic 7.875% 1/15/33 pay-in-kind |

|

365,000 |

454,424 |

|

|

Venezuela - 3.3% |

||||

|

Venezuelan Republic: |

|

|

|

|

|

oil recovery rights 4/15/20 (i) |

|

5,800 |

37,700 |

|

|

5.75% 2/26/16 (Reg S.) |

|

1,900,000 |

1,705,250 |

|

|

9% 5/7/23 (Reg. S) |

|

400,000 |

159,000 |

|

|

9.25% 9/15/27 |

|

310,000 |

127,100 |

|

|

9.25% 5/7/28 (Reg. S) |

|

350,000 |

136,500 |

|

|

11.75% 10/21/26 (Reg. S) |

|

460,000 |

204,700 |

|

|

11.95% 8/5/31 (Reg. S) |

|

1,520,000 |

672,600 |

|

|

Government Obligations - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Venezuela - continued |

||||

|

Venezuelan Republic: - continued |

|

|

|

|

|

12.75% 8/23/22 |

|

$ 665,000 |

$ 297,588 |

|

|

13.625% 8/15/18 |

|

95,000 |

57,048 |

|

|

TOTAL VENEZUELA |

3,397,486 |

|||

|

Vietnam - 1.5% |

||||

|

Vietnamese Socialist Republic: |

|

|

|

|

|

1.3725% 3/12/16 (h) |

|

36,956 |

36,541 |

|

|

4% 3/12/28 (e) |

|

1,098,000 |

1,070,550 |

|

|

6.75% 1/29/20 (f) |

|

405,000 |

443,856 |

|

|

TOTAL VIETNAM |

1,550,947 |

|||

|

TOTAL GOVERNMENT OBLIGATIONS (Cost $63,645,851) |

|

|||

|

Supranational Obligations - 0.2% |

||||

|

|

||||

|

European Bank for Reconstruction & Development 6% 3/3/16 |

INR |

10,500,000 |

|

|

|

Sovereign Loan Participations - 0.5% |

||||

|

|

||||

|

Indonesia - 0.5% |

||||

|

Indonesian Republic loan participation: |

|

|

|

|

|

Goldman Sachs 1.4375% 12/14/19 (h) |

|

444,444 |

435,556 |

|

|

Mizuho 1.4375% 12/14/19 (h) |

|

124,138 |

121,655 |

|

|

TOTAL SOVEREIGN LOAN PARTICIPATIONS (Cost $552,026) |

|

|||

|

Preferred Securities - 1.4% |

||||

|

|

||||

|

Brazil - 0.4% |

||||

|

Cosan Overseas Ltd. 8.25% (g) |

|

460,000 |

372,738 |

|

|

British Virgin Islands - 0.1% |

||||

|

Magnesita Finance Ltd. 8.625% (f)(g) |

|

200,000 |

112,125 |

|

|

Cayman Islands - 0.9% |

||||

|

Banco Do Brasil SA 9% (f)(g)(h) |

|

200,000 |

131,689 |

|

|

Preferred Securities - continued |

||||

|

|

Principal Amount (d) |

Value |

||

|

Cayman Islands - continued |

||||

|

CSN Islands XII Corp. 7% (Reg. S) (g) |

|

$ 550,000 |

$ 187,952 |

|

|

Odebrecht Finance Ltd. 7.5% (f)(g) |

|

1,250,000 |

668,698 |

|

|

TOTAL CAYMAN ISLANDS |

988,339 |

|||

|

TOTAL PREFERRED SECURITIES (Cost $2,468,922) |

|

|||

|

Money Market Funds - 7.4% |

|||

|

Shares |

|

||

|

Fidelity Cash Central Fund, 0.33% (b) |

7,580,914 |

|

|

|

TOTAL INVESTMENT PORTFOLIO - 99.1% (Cost $112,419,730) |

102,156,451 |

||

|

NET OTHER ASSETS (LIABILITIES) - 0.9% |

923,518 |

||

|

NET ASSETS - 100% |

$ 103,079,969 |

||

|

Currency Abbreviations |

||

|

BRL |

- |

Brazilian real |

|

COP |

- |

Colombian peso |

|

INR |

- |

Indian rupee |

|

MXN |

- |

Mexican peso |

|

RUB |

- |

Russian ruble |

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

|

(c) Non-income producing - Security is in default. |

|

(d) Amount is stated in United States dollars unless otherwise noted. |

|

(e) Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

|

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $38,552,178 or 37.4% of net assets. |

|

(g) Security is perpetual in nature with no stated maturity date. |

|

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

|

(i) Quantity represents share amount. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 10,182 |

|

Other Information |

|

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

|

The following is a summary of the inputs used, as of December 31, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

|

Valuation Inputs at Reporting Date: |

||||

|

Description |

Total |

Level 1 |

Level 2 |

Level 3 |

|

Investments in Securities: |

||||

|

Corporate Bonds |

$ 31,479,015 |

$ - |

$ 31,479,015 |

$ - |

|

Government Obligations |

60,907,625 |

- |

60,426,186 |

481,439 |

|

Supranational Obligations |

158,484 |

- |

158,484 |

- |

|

Sovereign Loan Participations |

557,211 |

- |

- |

557,211 |

|

Preferred Securities |

1,473,202 |

- |

1,473,202 |

- |

|

Money Market Funds |

7,580,914 |

7,580,914 |

- |

- |

|

Total Investments in Securities: |

$ 102,156,451 |

$ 7,580,914 |

$ 93,536,887 |

$ 1,038,650 |

|

Valuation Inputs at Reporting Date: |

|

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

|

Investments in Securities: |

|

|

Government Obligations |

|

|

Beginning Balance |

$ 1,816,121 |

|

Net Realized Gain (Loss) on Investment Securities |

(7,261) |

|

Net Unrealized Gain (Loss) on Investment Securities |

49,278 |

|

Cost of Purchases |

- |

|

Proceeds of Sales |

(392,079) |

|

Amortization/Accretion |

5,309 |

|

Transfers into Level 3 |

120,000 |

|

Transfers out of Level 3 |

(1,109,929) |

|

Ending Balance |

$ 481,439 |

|

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at December 31, 2015 |

$ 44,448 |

|

Other Investments in Securities |

|

|

Beginning Balance |

$ 755,534 |

|

Net Realized Gain (Loss) on Investment Securities |

2,973 |

|

Net Unrealized Gain (Loss) on Investment Securities |

2,771 |

|

Cost of Purchases |

- |

|

Proceeds of Sales |

(97,725) |

|

Amortization/Accretion |

4,540 |

|

Transfers into Level 3 |

- |

|

Transfers out of Level 3 |

(110,882) |

|

Ending Balance |

$ 557,211 |

|

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at December 31, 2015 |

$ 2,771 |

|

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliations are included in Net Gain (Loss) on the Fund's Statement of Operations. |

|

Other Information |

|

The composition of credit quality ratings as a percentage of net assets is as follows (Unaudited): |

|

U.S. Government and U.S. Government Agency Obligations |

4.4% |

|

AAA,AA,A |

3.9% |

|

BBB |

26.6% |

|

BB |

21.3% |

|

B |

10.2% |

|

CCC,CC,C |

14.5% |

|

D |

0.0% |

|

Not Rated |

10.8% |

|

Equities |

0.0% |

|

Short-Term Investments and Net Other Assets |

8.3% |

|

|

100.0% |

|

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

|

|

|

December 31, 2015 |

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $104,838,816) |

$ 94,575,537 |

|

|

Fidelity Central Funds (cost $7,580,914) |

7,580,914 |

|

|

Total Investments (cost $112,419,730) |

|

$ 102,156,451 |

|

Cash |

|

101,016 |

|

Receivable for investments sold |

|

75,738 |

|

Receivable for fund shares sold |

|

105,370 |

|

Interest receivable |

|

1,820,035 |

|

Distributions receivable from Fidelity Central Funds |

|

1,629 |

|

Total assets |

|

104,260,239 |

|

|

|

|

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 101,016 |

|

|

Payable for fund shares redeemed |

1,077,577 |

|

|

Other payables and accrued expenses |

1,677 |

|

|

Total liabilities |

|

1,180,270 |

|

|

|

|

|

Net Assets |

|

$ 103,079,969 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 113,671,323 |

|

Undistributed net investment income |

|

1,430,230 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(1,754,552) |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

(10,267,032) |

|

Net Assets, for 11,407,950 shares outstanding |

|

$ 103,079,969 |

|

Net Asset Value, offering price and redemption price per share ($103,079,969 divided by 11,407,950 shares) |

|

$ 9.04 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

|

Year ended December 31, 2015 |

||

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 232,698 |

|

Interest |

|

8,133,556 |

|

Income from Fidelity Central Funds |

|

10,182 |

|

Income before foreign taxes withheld |

|

8,376,436 |

|

Less foreign taxes withheld |

|

(2,545) |

|

Total income |

|

8,373,891 |

|

|

|

|

|

Expenses |

|

|

|

Custodian fees and expenses |

$ 8,665 |

|

|

Independent trustees' compensation |

453 |

|

|

Total expenses before reductions |

9,118 |

|

|

Expense reductions |

(781) |

8,337 |

|

Net investment income (loss) |

|

8,365,554 |

|

Realized and Unrealized Gain (Loss) |

|

|

|

Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

(1,834,934) |

|

|

Foreign currency transactions |

(16,212) |

|

|

Total net realized gain (loss) |

|

(1,851,146) |

|

Change in net unrealized appreciation (depreciation) on: Investment securities |

(4,140,289) |

|

|

Assets and liabilities in foreign currencies |

4,962 |

|

|

Total change in net unrealized appreciation (depreciation) |

|

(4,135,327) |

|

Net gain (loss) |

|

(5,986,473) |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 2,379,081 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ 8,365,554 |

$ 7,452,357 |

|

Net realized gain (loss) |

(1,851,146) |

(505,863) |

|

Change in net unrealized appreciation (depreciation) |

(4,135,327) |

(6,174,115) |

|

Net increase (decrease) in net assets resulting from operations |

2,379,081 |

772,379 |

|

Distributions to shareholders from net investment income |

(7,294,287) |

(6,622,037) |

|

Distributions to shareholders from net realized gain |

- |

(496,491) |

|

Total distributions |

(7,294,287) |

(7,118,528) |

|

Share transactions |

|

|

|

Proceeds from sales of shares |

4,439,681 |

49,666,316 |

|

Reinvestment of distributions |

7,294,279 |

7,082,301 |

|

Cost of shares redeemed |

(7,863,469) |

(22,517,501) |

|

Net increase (decrease) in net assets resulting from share transactions |

3,870,491 |

34,231,116 |

|

Total increase (decrease) in net assets |

(1,044,715) |

27,884,967 |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

104,124,684 |

76,239,717 |

|

End of period (including undistributed net investment income of $1,430,230 and undistributed net investment income of $1,006,881, respectively) |

$ 103,079,969 |

$ 104,124,684 |

|

Other Information |

|

|

|

Shares |

|

|

|

Sold |

471,526 |

4,887,263 |

|

Issued in reinvestment of distributions |

776,584 |

702,089 |

|

Redeemed |

(841,013) |

(2,256,244) |

|

Net increase (decrease) |

407,097 |

3,333,108 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Emerging Markets Debt Central Fund

|

Years ended December 31, |

2015 |

2014 |

2013 |

2012 |

2011 G |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 9.47 |

$ 9.94 |

$ 11.21 |

$ 9.98 |

$ 10.00 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) D |

.744 |

.702 |

.711 |

.743 |

.526 |

|

Net realized and unrealized gain (loss) |

(.526) |

(.501) |

(1.070) |

1.287 |

(.017) |

|

Total from investment operations |

.218 |

.201 |

(.359) |

2.030 |

.509 |

|

Distributions from net investment income |

(.648) |

(.627) |

(.650) |

(.680) |

(.489) |

|

Distributions from net realized gain |

- |

(.044) |

(.261) |

(.120) |

(.040) |

|

Total distributions |

(.648) |

(.671) |

(.911) |

(.800) |

(.529) |

|

Net asset value, end of period |

$ 9.04 |

$ 9.47 |

$ 9.94 |

$ 11.21 |

$ 9.98 |

|

Total ReturnB, C |

2.26% |

1.81% |

(3.22)% |

20.99% |

5.18% |

|

Ratios to Average Net AssetsE, H |

|

|

|

|

|

|

Expenses before reductions |

.01% |

.01% |

.02% |

.01% |

.02%A |

|

Expenses net of fee waivers, if any |

.01% |

.01% |

.01% |

.01% |

.02%A |

|

Expenses net of all reductions |

.01% |

.01% |

.01% |

.01% |

.02%A |

|

Net investment income (loss) |

7.89% |

6.96% |

6.69% |

6.99% |

6.61%A |

|

Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 103,080 |

$ 104,125 |

$ 76,240 |

$ 114,200 |

$ 111,537 |

|

Portfolio turnover rateF |

39% |

42% |

35% |

49% |

55%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period March 17, 2011 (commencement of operations) to December 31, 2011.

H Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended December 31, 2015

1. Organization.

Fidelity Emerging Markets Debt Central Fund (the Fund) is a non-diversified fund of Fidelity Hanover Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund are only offered to other investment companies and accounts managed by Fidelity Management & Research Company (FMR), or its affiliates (the Investing Funds).

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the FMR Fair Value

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Valuation - continued

Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, foreign government and government agency obligations, preferred securities, supranational obligations, U.S. government and government agency obligations and sovereign loan participations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2015, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Transactions and Income - continued

taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2015, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Book-tax differences are primarily due to foreign currency transactions, defaulted bonds, market discount, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

|

Gross unrealized appreciation |

$ 2,469,211 |

|

Gross unrealized depreciation |

(11,575,451) |

|

Net unrealized appreciation (depreciation) on securities |

$ (9,106,240) |

|

Tax Cost |

$ 111,262,691 |

The tax-based components of distributable earnings as of period end were as follows:

|

Undistributed ordinary income |

$ 158,623 |

|

Capital loss carryforward |

$ (1,639,983) |

|

Net unrealized appreciation (depreciation) on securities and other investments |

$ (9,109,993) |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

|

No expiration |

|

|

Short-term |

$ (990,516) |

|

Long-term |

(649,467) |

|

Total capital loss carryforward |

$ (1,639,983) |

The tax character of distributions paid was as follows:

|

|

December 31, 2015 |

December 31, 2014 |

|

Ordinary Income |

$ 7,294,287 |

$ 7,118,528 |

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Loans and Other Direct Debt Instruments. The Fund invests in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. These instruments may be in the form of loans, trade claims or other receivables and may include standby financing commitments such as revolving credit facilities that obligate the Fund to supply additional cash to the borrower on demand. Loans may be acquired through assignment or participation. The Fund did not have any unfunded loan commitments, which are contractual obligations for future funding, at period end.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $35,340,894 and $35,889,004, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. FMR Co., Inc. (the investment adviser), an affiliate of FMR, provides the Fund with investment management services. The Fund does not pay any fees for these services. Pursuant to the Fund's management contract with the investment adviser, FMR pays the investment adviser a portion of the management fees it receives from the Investing Funds. In addition, under an expense contract, FMR also pays all other expenses of the Fund, excluding custody fees, the compensation of the independent Trustees, and certain exceptions such as interest expense.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Annual Report

6. Expense Reductions.

FMR has voluntarily agreed to reimburse a portion of the Fund's operating expenses. For the period, the reimbursement reduced the expenses by $453.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $328.

7. Other.