UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| ☒ |

Filed by the Registrant |

☐ | Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Norfolk Southern Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

On April 18, 2024, Norfolk Southern Corporation distributed the following communication to shareholders, which may be used in the future in whole or in part by the Company:

A BETTER WAY April 18, 2024

FORWARD-LOOKING STATEMENTS / NON-GAAP MEASURES This presentation and the related materials contain forward-looking statements within the meaning of the safe harbor provision of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events or future performance of Norfolk Southern Corporation (NYSE: NSC) (“Norfolk Southern,” “NS,” the “Company,” “we,” “our,” or “us”) and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or our achievements or those of our industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements may be identified by the use of words like “will,” “believe,” “expect,” “targets,” “anticipate,” “estimate,” “plan,” “consider,” “project,” “may,” “could,” would, “should,” “intend,” “predict,” “potential,” “feel,” or other similar terminology. The Company has based these forward-looking statements on management’s current expectations, assumptions, estimates, beliefs, and projections. While the Company believes these expectations, assumptions, estimates, and projections are reasonable, forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in the Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”), may cause actual results, benefits, performance, or achievements to differ materially from those expressed or implied by these forward-looking statements. Please refer to these and our subsequent SEC filings for a full discussion of those risks and uncertainties we view as most important. Forward-looking statements are not, and should not be relied upon as, a guarantee of future events or performance, nor will they necessarily prove to be accurate indications of the times at or by which any such events or performance will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. The forward-looking statements herein are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying presentation contains adjusted operating ratio figures. Adjusted operating ratio is a non-GAAP measure that should be viewed as a supplement to and not a substitute for our U.S. GAAP measures, and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. See Appendix for information regarding the definition of adjusted operating ratio. 2

NORFOLK SOUTHERN IS EXECUTING ON A BETTER STRATEGY WITH GREATER LONG TERM UPSIDE FOR SHAREHOLDERS • To grow long term freight volumes and recapture market share lost to trucking, the railroad industry must correct for the inconsistent service from barebone staffing driven by too narrow a focus on cost cutting to the detriment of safety and service • The Board appointed Alan Shaw CEO in 2022 to implement PSR in a more balanced way, delivering top-tier revenue and earnings growth with industry-competitive margins • Alan began to execute our balanced “A Better Way” strategy, focused on three pillars, with safety at its core: o Service: Reliable and resilient service through operational and economic disruptions o Productivity: Continuous productivity improvement, with a relentless pursuit of excellence through innovation o Growth: Smart and sustainable growth with consistent through-cycle service, enabling share recapture and customer retention Norfolk Southern is • The strategy was working. We delivered record 2022 revenues, closed the gap to Class I peers with an operating ratio (OR) in the low 60%’s, Emerging as a and achieved the 2nd highest 5-year TSR of our Class I peers (through 12/31/2022) Safer, • Following the East Palestine (EP) incident, we acted decisively to overhaul safety standards to protect our stakeholders and our own long-term viability More Profitable • We reduced mainline accident rate by 38% YoY to the lowest level since 1999 and among the best of the North American Class I railroads Railroad • Despite EP’s adverse impact, we continued to improve service levels – train speed by 22% and terminal dwell by 11% since Alan became CEO with Strong • We improved Intermodal on-time performance by 3,040 bps, demonstrating we have the right plan • We are applying this playbook to our Merchandise network, which represents 2/3 of train starts, already improving Merchandise velocity by 24% Execution • To accelerate execution, we made a series of organizational changes culminating in the appointment of a seasoned PSR expert, John Orr, as COO From Crisis-Tested • Since he joined us, more diligent plan adherence has already further improved both Merchandise velocity and terminal dwell by 8% each Leaders • Furthermore, as we continue to scale our operational changes throughout our network, we expect to see further sequential OR improvement (1) • We are on a clear and achievable path to close the gap with peers by achieving a <60% OR in 3-4 years • This includes a detailed, ground-up plan to capture 400 bps ($550m) of productivity savings and upcycle improvement in the next 3 years • The plan will deliver 100-150 bps of OR improvement in 2024, with line of sight to 400-450 bps improvement in 2H 2024 • Our thoughtful, achievable plan contrasts sharply with Ancora’s ungrounded and irresponsible PSR implementation strategy, which: • Requires thousands of jobs cuts, reversing service and safety progress, and impeding growth • Has already drawn increased regulatory scrutiny and extensive public concern from customers, to the detriment of shareholder value 1. The operating ratio improvements discussed and presented on this page represent adjusted operating ratio. See Appendix 3 for definition and reconciliation to GAAP operating ratio. 3

OUR FIT-FOR-PURPOSE BOARD IS ALREADY OPTIMIZED FOR THE SUCCESS OF OUR TRANSITION • The Board has been thoughtfully constructed and refreshed around diverse skills which are highly relevant to the Company’s success • Six new directors have been added in the last five years, including two in 2023, with rail transportation, operations, regulatory, safety, sustainability, cybersecurity, and other relevant skills to continue effective, independent oversight • We split the roles of Chair and CEO in 2022. Under the leadership of independent Chair Amy Miles, the Board: • Enhanced safety and operations, as well as cybersecurity and enterprise risk management Our Responsive, o Safety: Increased the cadence of Safety Committee meetings; amended the Safety Committee Charter to provide for additional solicitation of safety-related feedback from craft employees; announced a six-point plan to address NTSB findings on East Palestine; accelerated the Highly Digital Train Inspection Program; appointed a new VP of Safety and a new VP of Field Engagement; oversaw AtkinsRéalis’ independent Qualified Board is assessment of our safety culture, and added directors with significant experience specific to our industry, including safety and operations Committed to o Operations: Invested significantly in operations leadership, resources and the Company’s operating plan, culminating in the recruitment of a new COO with 40-years experience in the industry and proven scheduled railroading expertise; and further refined our strategy to Accountability outperform through market cycles to drive meaningful long-term shareholder value • Refined NEO pay practices by adding safety as a component, making operating ratio an explicit metric, and adopting a supplemental clawback policy that covers detrimental conduct, including conduct resulting in a material risk management, operational, safety, or reputational failure • We engaged with Ancora, interviewed their director nominees, and offered multiple times to add their best nominees to the Board to resolve this contest in a way that would benefit all shareholders. We have been consistently rebuffed • Ancora tasked its nominees with a single objective – wholesale leadership change – in the service of a naïve, ungrounded, and irresponsible strategy that would damage the long-term viability of our Company • Ancora is asking shareholders to replace a crisis-tested CEO, a highly-regarded COO and a majority of the fit-for-purpose Board Ancora Would • In exchange, Ancora offers only: Unnecessarily • A CEO candidate with no railroading experience who has never led a company • A COO candidate with a demonstrably poor track record on service quality, safety and overall performance, and Delay Our • Director nominees wholly bereft of the expertise NSC’s transition requires Transition and Put it o The list is astonishing: no experience running a railroad, no crisis-tested executive leadership, no cybersecurity expertise, no safety at Risk expertise, no government experience related to our industry – not even a track-record of effective corporate governance • Ancora’s tone-deaf commitment to a slash-and-burn playbook wholly unsuited to our regulatory, labor, and competitive environments – particularly after East Palestine – has already prompted public concern from regulators, customers, and other critical constituencies 4

01 NORFOLK SOUTHERN IS EMERGING AS A SAFER, MORE PROFITABLE RAILROAD WITH STRONG EXECUTION FROM CRISIS-TESTED LEADERS

RAIL SERVICE AND VOLUMES HAVE SUFFERED UNDER THE INDUSTRY’S LEGACY APPROACH TO PSR IMPLEMENTATION To grow volumes over the long-term, railroads must break the cycle of service disruptions every few years Under Industry’s Legacy PSR Implementation, … Causing Volume to Steadily Move from Rail to Rick Paterson, Loop Capital Rail Has Suffered from Inconsistent Service… Trucks in the Past Two Decades # of Rail Rail Freight Carloads and Truck Tonnage (Indexed to 100) Employees “Of the 14 Class I meltdowns (1) (000s) Class I Rail Average Weekly Speed (mph) (2)(3) vs Class I Rail Headcount since the start of 2014, a lack of resiliency—specifically around 160 170 27 crew capacity—was a contributing factor in 12 of them. In response to all the chaos the STB held its Urgent Issues in Freight Rail Service hearing in April 2022, +31% where arguably the key finding was 130 25 the lack of resiliency and key action Truck item was for the industry… to fix it. 150 NS has been the most visible in attempting to do so in the context of its public comments.” 13% worse 100 23 Jeffrey Sonnenfeld, Yale School of Management 130 “The opportunity for railroads to 70 21 recapture market share from (31%) trucks through higher-quality Rail service is massive. Amazingly, over the last decade, rail revenue growth trailed US GDP growth by nearly 50%, with rail revenues 19 40 110 stagnant or even declining while U.S. GDP growth surged.” '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '05 '07 '09 '11 '13 '15 '17 '19 '21 '23 Periodic Service Disruptions Class I Rail Aggregate Headcount Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 1. Velocity data sourced from Bloomberg – average includes Norfolk Southern, CSX, Union Pacific, BNSF, Canadian National, and Canadian Pacific. 6 2. Volume data sourced from U.S. Bureau of Transportation Statistics. 3. Employee headcount data sourced from Bloomberg and company filings – aggregate includes Norfolk Southern, CSX, Union Pacific, Canadian National, Kansas City Southern and Canadian Pacific.

THE INDUSTRY, INCLUDING NSC, FACED SIGNIFICANT SERVICE CHALLENGES WHEN EXITING THE PANDEMIC IN 2021 • Staffing constraints, a result of a singular focus on cost cutting, reduced the ability of all railroads to respond as business levels rebounded sharply following the pandemic • Norfolk Southern’s problems were exacerbated by a prior, inflexible operational approach that was at odds with the pillars of scheduled railroad operations • Certain operating principles were overemphasized at the expense of plan adherence, car handlings and balance Train Speed and Terminal Dwell are Key Indicators of the Health and Fluidity of a Rail Network (1) (2) Norfolk Southern Train Speed Norfolk Southern Terminal Dwell Measures how fast a train moves between two terminals Time either a loaded or empty rail car spends idle Alan Appointed (mph) (hours) CEO 24 28 Alan Appointed 26 CEO 22 24 20 22 20 18 18 16 16 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 1. Speed defined as the average train velocity from origination to destination. 7 2. Terminal dwell defined as the average amount of time a railcar spends in a terminal between destinations. Better Better

THE BOARD APPOINTED ALAN SHAW AS CEO BECAUSE THE DEPTH AND BREADTH OF HIS EXPERIENCE WOULD BEST POSITION US TO LEVERAGE PSR Imbalanced Strategy A Better Way 1 • NSC seeks to deliver • Inconsistent service due to • More thoughtful design and resource allocation allows for underinvestment and cyclical shareholder value through a improved service through up and down market cycles furloughs drove share loss Service balanced approach to • Consistent and strategic investment cadence results in better • Inability to quickly recover near, and long-term service product reliable service, continuous from market troughs productivity improvement, and smart growth to deliver 2 • Same underlying PSR focus on asset utilization and optimization, top-tier revenue and but with better balance of long vs. short lead-time expenses earnings growth, with • Singular focus on cost- • In downturns, lean on short lead-time costs to maintain cutting, at the expense of Productivity industry-competitive competitive margins safety, service and growth • More thoughtful with long lead-time costs to protect service and margins capacity for up-turns • Markets are shifting to 3 consumer-oriented, service- • Better and more consistent through-cycle service earns customer sensitive, truck-competitive trust • Inability to effectively serve business. NSC will need to needs of existing customers • Merchandise share that belongs on rail will have more confidence Growth or recapture market share to return deliver reliable service in • More consistent service also translates to stronger pricing growth order to grow earnings over the long-term 8

ALAN DROVE REVENUE AND OPERATIONAL IMPROVEMENTS IN 2022 Norfolk Southern was operating efficiently and driving shareholder returns prior to the East Palestine incident nd Norfolk Southern Had Substantially Closed the … And Delivered the 2 best Shareholder OR Gap by 2022… Returns 2022 Operating Ratio vs Class I Peers (%) 5 Year Total Shareholder Return as of 12/31/2022 (%) 130% Delivered record 62.3% 61.7% 60.1% 60.0% 59.5% revenue in 2022 87% 80% OR in the low ~60% 70% from 2021-2022, closing the gap to Class I peers 54% Narrowed margin gap to our regional peer, CSX, in Q4 2022 (1) Source: Public filings. 9 1. CPKC Operating Ratio reflects Adjusted OR as provided in CPKC filings.

THE IMPACT FROM THE EAST PALESTINE INCIDENT MASKS OUR OTHERWISE COMPETITIVE LONG-TERM TSR PERFORMANCE 5-year TSR Pre-East Palestine (2/2/23) 5-year TSR Pre-Ancora (1/31/24) 5-year TSR Today (4/4/24) 93% 86% 73% 59% 55% 43% Peer Median Peer Median Peer Median Peers include: CSX, CPKC, CN, Union Pacific. 10

WE TOOK DECISIVE ACTION TO OVERHAUL SAFETY STANDARDS TO PROTECT NORFOLK SOUTHERN AND OUR SHAREHOLDERS …And are now an industry-leader in safety with the second-lowest accident rate among US peers Increased Investment and Focus on … Led to Only 35 FRA Reportable Mainline Safety in 2023 Following East Palestine… Accidents in 2023, Which is Lowest Since 1999 (1) FRA Mainline Accident Rate ✓ Six-point safety and craft workforce engagement plans ✓ Consultant AtkinsRéalis retained by 0.99 Management to conduct an 0.92 independent review of safety culture, 0.85 which was overseen by the Board 38% Improvement ✓ First Class I railroad to join the Federal Railroad Administration’s (“FRA”) 0.56 Confidential Close Call Reporting System ✓ Enhanced Train Build Plan ✓ New regional safety training center in East Palestine ✓ Launched digital train inspection portal 2020 2021 2022 2023 Source: Federal Railroad Administration. 11 1. Mainline Accident Rate defined as the number of mainline accidents per million mainline train miles traveled. Better

WE RESTORED RELATIONSHIPS WITH REGULATORS, ELECTED OFFICIALS AND THE EAST PALESTINE COMMUNITY Alan’s leadership through the East Palestine incident gives us credibility with important constituents ECONOMIC RAIL SAFETY ELECTED REGULATORS REGULATORS OFFICIALS U.S. Secretary of Transportation Surface Transportation Board U.S House of Representatives East Palestine “We have been encouraged by recent data “…NS has been an industry leader in reducing “Initially, I was uncertain NS would fulfill its promise “This is a long process and it’s going to take a lot showing that Norfolk Southern has experienced a mainline rail accidents and derailments. And NS to “do the right thing” for my community. However, to get cleaned up, but after what we saw tonight, I 34 percent reduction in the rate of mainline is the only Class I railroad which has joined the once I met Alan Shaw, Norfolk Southern’s CEO, my believe this village is going to be better than it derailments in the last year. Less encouraging is Department of Transportation Confidential uncertainty vanished. As we worked through each was before the derailment... It seems like the fact that data for 2023 suggest that Norfolk Close Call Reporting System, a major advance in stage of the recovery and made actionable Norfolk Southern is trying to make it right.” Southern is alone among the Class I railroads instituting a safe culture in any workplace. Ancora requests of Norfolk Southern, I came to trust and to achieve significant reductions in the rate of has nothing to say about what it could do understand that Mr. Shaw, would listen, be mainline derailments this past year.” better.” responsive, honor his commitments, and would keep his word to both me and the broader community. He did all those things and more.” – Pete Buttigieg – Martin Oberman – Bill Johnson – Trent Conaway U.S. Secretary of Transportation STB Chairman East Palestine Mayor U.S. Representative, Ohio (R-Marietta) March 3, 2024 February 29, 2024 June 20, 2023 April 4, 2024 ENVIRONMENTAL U.S Department of Transportation COMMUNITY REGULATORS Federal Railroad Administration U.S. Environmental “I particularly commend your [NS’s] “How the shareholders want to handle this vote is East Palestine Fire Department Protection Agency commitment to investing in safety as those up to them. But I know that what’s most relevant investments are imperative for continuing the here is that Norfolk Southern, under Alan Shaw’s “[Norfolk Southern] have stepped up and done “They [Norfolk Southern] have responded to our unique progress your railroad has made; early leadership and the current board, has made a exactly what they said they were going to do, orders to date, and have have dotted every “i” data for 2023 suggest that NS was the only commitment to our community’s recovery for whether that be remediation or helping to get the and crossed every “t”. We are almost complete Class I railroad to achieve significant both the short and long term, and that both the town back to where it was. We’ve had no issues [with] clean up of the waste…” reductions in the rate of mainline derailments vision and commitment of this current leadership with them… We are holding them accountable, this past year.” team is exactly what this moment requires.” just like everybody else is and just like they should be.” – Amit Bose – Michael Regan – Bill Johnson – Keith Drabick FRA Administrator U.S. EPA Administrator U.S. Representative, Ohio (R-Marietta) East Palestine Fire Chief February 21, 2024 September 28, 2023 April 4, 2024 February 3, 2024 Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 12

ALAN TOOK DECISIVE ACTION TO ADDRESS OUR SERVICE ISSUES • Execution of our PSR operating plan under our new strategy turned around performance, including improving train speed and terminal dwell • Drove substantial operating improvements, even through the East Palestine incident, for the benefit of the franchise and shareholders • Made significant service-focused operational changes such as investing in infrastructure and technology, bolstering the Company’s workforce and training, and enhancing safety measures post-EP (1) (2) Train Speed Terminal Dwell Measures how fast a train moves between two terminals Time a loaded or empty rail car spends idle (mph) (hours) 24 34 Alan Shaw Tenure Alan Shaw Tenure Train speed Terminal dwell 32 improved ~22% improved ~11% 22 30 20.9 28 27.3 20 11% 26 better 22% better 24.2 24 18 East Palestine Derailment East Palestine Derailment 22 Train speed restricted due to Reduced capacity creates congestion and 17.1 reduced capacity in critical corridor freight backlogs that heighten dwell times 16 20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-21 Mar-22 Mar-23 Mar-24 Note: Train speed and terminal dwell through March 2024, representing the latest monthly data publicly available on our website. 1. Speed defined as the average train velocity from origination to destination. 13 2. Terminal dwell defined as the average amount of time a railcar spends in a terminal between destinations. Better Better

OUR BALANCED STRATEGY SIGNIFICANTLY IMPROVED INTERMODAL SERVICE AND IS SCALABLE ACROSS THE MERCHANDISE NETWORK Intermodal On-Time Service Performance • Improved service levels by 3,040 bps in our most service-sensitive product, 100% despite the disruption of the East Alan Shaw Tenure Palestine incident 90% • Execution in Intermodal will be similarly scaled across the Merchandise 88% East Palestine 80% network, without incremental resources Derailment ~3,040 bps • Demonstrated discipline in plan 70% better adherence 60% • On-time departures and arrivals 57% • Removed complexity to drive velocity 50% and reduce terminal dwell 40% Jan-21 Jul-21 Feb-22 Aug-22 Mar-23 Sep-23 Apr-24 Note: Charts reflect rolling 12-week average through April 2024. Latest internal data available. 14 Better

PSR EXPERT JOHN ORR, OUR NEW COO, WILL ACCELERATE THE EXECUTION OF OUR BALANCED STRATEGY • Over a four-decade career, John built a reputation for applying scheduled railroading principles to drive sustainable long-term value creation “The arrival of Mr. Orr puts greater confidence in the timing of a potential operating improvement, and now allows NSC to provide investors with an acceleration of the operating margin outlook for a prior range of 100-150 basis points a year to 400 basis points in the second half of 2024 alone. This would bring NSC’s operating margins within striking • Spearheaded the turnaround of CPKC’s Mexico operations by distance of industry peers within a year.” successfully implementing a high-efficiency operating model – Jeff Kauffman Vertical Research Partners March 20, 2024 • Shaped and guided the execution of KCS’ service-focused precision scheduled railroading initiatives • Drove significant improvements in CN’s safety and operational performance • Helped deliver strong shareholder returns, reflected in CPKC’s ~13% TSR “John Orr is one of the most respected railroaders in the industry, with (1) and KCS’ ~14% TSR during his tenure decades of hands-on experience leading successful operating plans. He was instrumental in executing a scheduled railroading strategy at Kansas City • John worked under Hunter Harrison for decades at CN, is a well published Southern that significantly improved service and productivity, and led to author and thought leader on PSR, and was honored with Railway Age’s sustainable performance improvement.” – Pat Ottensmeyer 2023 Top Influencer award Former Kansas City Southern CEO March 21, 2024 • Having served as a representative for the United Transportation Union for over 15 years gives him credibility with our workforce and labor representatives Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 15 1. Calculated using FactSet and dates of April 14, 2023 to March 19, 2024 for CPKC; April 15, 2021 to December 13, 2021 for KCS.

JOHN’S TRACK RECORD OF IMPROVING OPERATIONS AT MULTIPLE CLASS I RAILROADS IS UNMATCHED (1) CPKC Highlighted Orr’s Achievements in its Q3’23 Earnings Presentation • John Orr improved network speed, average “John Orr is leading the team, leading the charge in Mexico had a lot of terminal dwell, locomotive productivity and car experience, obviously, from his previous experience as the COO of KCS and KSC de miles / car day in CPKC’s Mexico business over a Mexico. So that's working well. We're seeing progress across all the operating metrics, train speed, terminal dwell, car miles per day, locomotive productivity, 70-day period service experience for the customer.” – Keith Creel President and CEO, CPKC November 12, 2023 Slide 5 of CPKC’s Q3’23 “Former KCS EVP of Ops John Orr is leading the Mexico Task Force which has Earnings generated significant operational improvements over the last 3 months. Such Presentation improvements in fluidity and service levels have helped take GTMs on the Mexican network to all-time highs and will be critical to compete for cross-border highway conversion with a second Laredo rail bridge slated to – Brian Ossenbeck come online by the end of 2024.” J.P. Morgan October 26, 2023 “Since the appointment of a special task force led by John Orr in late July, the Mexican operations have demonstrated steady improvement. We see significant runway for additional gains as the company identifies bottlenecks/inefficiencies and continues to deploy solutions.” – Fadi Chamoun BMO November 12, 2023 Ancora wildly misrepresents the amendment NSC made to the Meridian Speedway agreement to release John from his contract with CPKC – it was not a consequential concession. • NSC maintains a competitive advantage with the fastest and highest capacity rail route for transcontinental intermodal traffic between the Southwestern U.S. and the Southeast • CPKC gains some additional flexibility to move other intermodal traffic along the Meridian Speedway corridor to and from the Dallas market Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 16 1. Per Canadian Pacific Kansas City’s Q3’2023 Earnings Review presentation, published October 25, 2023.

JOHN HAS THE SUPERIOR OPERATING TRACK RECORD COMPARED TO ANCORA’S PROPOSED CANDIDATE… • KCS train speed improved by 1% and dwell improved by 11% during Orr’s leadership • CSX train speed deteriorated by 17% and dwell worsened by 14% during Boychuk’s tenure KCS Train Speed CSX Train Speed (Indexed to 100) (Indexed to 100) 140 110 John Orr Tenure Jamie Boychuk Tenure 130 100 17% 120 worse 90 110 1% better 80 100 90 70 Mar-19 Mar-20 Mar-21 Mar-22 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 KCS Terminal Dwell CSX Terminal Dwell (Indexed to 100) (Indexed to 100) John Orr Tenure Jamie Boychuk Tenure 130 150 140 120 11% 130 better 110 120 100 110 14% 90 worse 100 80 90 Mar-19 Mar-20 Mar-21 Mar-22 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Source: Public filings. 17 Better Better Better Better

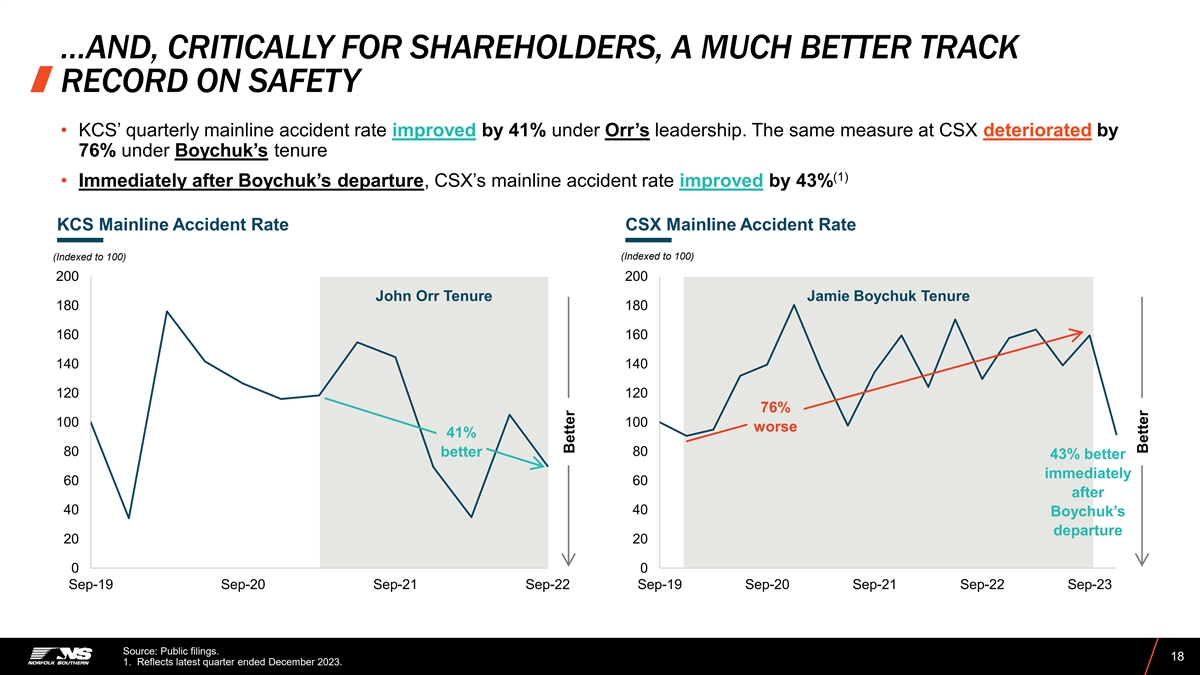

…AND, CRITICALLY FOR SHAREHOLDERS, A MUCH BETTER TRACK RECORD ON SAFETY • KCS’ quarterly mainline accident rate improved by 41% under Orr’s leadership. The same measure at CSX deteriorated by 76% under Boychuk’s tenure (1) • Immediately after Boychuk’s departure, CSX’s mainline accident rate improved by 43% KCS Mainline Accident Rate CSX Mainline Accident Rate (Indexed to 100) (Indexed to 100) 200 200 John Orr Tenure Jamie Boychuk Tenure 180 180 160 160 140 140 120 120 76% 100 100 worse 41% 80 80 better 43% better immediately 60 60 after 40 40 Boychuk’s departure 20 20 0 0 Sep-19 Sep-20 Sep-21 Sep-22 Sep-19 Sep-20 Sep-21 Sep-22 Sep-23 Source: Public filings. 18 1. Reflects latest quarter ended December 2023. Better Better

JOHN ORR IS THE EXPERT BEST EQUIPPED TO EXECUTE OUR PSR OPERATING PLAN… >400 bps of productivity improvement over the next 3 years is completely in scope The Right Man For the Job Where We Are Headed in the Next 60-90 Days ✓ A proven expert in complex situations that impair operational ➢ Reduce terminal dwell in two major yards by 30% performance ✓ Committed to a safety-first mindset and discipline, which empowers the organization to deliver industry-leading safety, ➢ Reduce overtime by 20% exceptional service, and optimized resource management ➢ Reduce recrew rate by 20% Current Network Improvement Initiatives ➢ Increase on-time connections system wide by 10% ✓ Identifying and eliminating corridor bottlenecks ✓ Targeting large-volume Merchandise terminals for ➢ Improve Merchandise on-time performance by 15% improved velocity and productivity ✓ Driving standard processes across all workstreams ➢ Increase AAR train speed by 10% ✓ Rationalizing locomotives and cars ➢ Reduce AAR terminal dwell by 15% ✓ Replicating these best practices across the network 19

…AND HE IS SPEARHEADING A RANGE OF KEY PRODUCTIVITY INITIATIVES Merchandise Intermodal Bulk Fuel Crew Planning • Pre-blocking: Pre-block from customers • Customer Release Initiative: Ongoing • Extra Board Consolidations: Combined and short line partners to reduce review taking place with the Marketing Portsmouth CO board; combining downstream handlings division on customer incentives Birmingham and Portsmouth extra boards (contractual & non-contractual) to release • Automotive Smoothing: Smooth equipment faster; review replication of outbound loadings by day of week and • Assigned Service: Implemented existing best practices train assigned service in 6 locations YTD to reduce detention time • Local Review: Identify local service day • Customer Turn Time: Data table with reductions that facilitate job reductions customer load & unload goals vs actuals, • Operations Scorecard: Targets & • Intermodal Lane Rationalizations: Two generating automated notifications on • P&L management structure in • Additional districts identified to scorecard developed for controllable rounds of intermodal lane rationalizations excessive customer dwell for proactive Transportation and Network implement, with further analysis & contributors to Fuel Efficiency handling to turn resources impacting a total of 35 intermodal lanes Operations Center (NOC): Enhanced discussions underway are in process of being completed. These • HPT full analysis with suite of budget management tools • Release to Depart: Customer to bulk lane reductions will reduce low density, recommendations completed, • Customer Pipelines: Reduced cars operations automated notification of sets low growth lanes driving greater operating • Established assigned service reviewed, & strategy finalized under customer control by 19% in the last released empty and loaded finalized, margins while reducing complexity implementation process & financial, 90 days minimizing dwell in train symbol builds • Calibrating GTMs, per planned road HP productivity scorecard through intermediate communication; IT • TOFC Lane rationalizations: Beyond the per day, of scheduled network • Precision Build Plans: Standardized development of auto-call feature lane rationalizations, we are reducing (locomotive productivity) including build plans across all terminals, which • Additional T&E Productivity: Flip trips, TOFC in lanes planned to remain to drive scheduled for 2H24 balancing Merchandise and remaining have improved execution between NOC, combined service deadheading, and further train and intermodal facility Intermodal run times Transportation, and Mechanical • Bulk Train Length: Completed review of deadhead & detention productivity • Evaluating MTO on three • Rules of Engagement: Rules of all bulk lanes to optimize productivity. districts, standardizing HPT limits closer Engagement now set to run scheduled Train length adjustments made with • High Frequency Lanes: Consolidating • System review & reduction in T&E across paperwork HPT and SHPT network to plan flex bulk multiple blocks to drive greater outlet remaining lanes now limited to customer locations frequency capacity at loading/unloading facilities. • Yard and Local Power: Concluded yard • Wabtec Pacing implementing 2H24; will and local demand by job this week after fully leverage MTO to pace trains for • Ongoing intermodal day-of-week • Road Train Miles per Day: New • T&E Manpower Availability: Review of reviewing all jobs with Divisions rolling meets to reduce stop events corporate metric in development to track adjustments taking place to calibrate elevated contributors & addressing with overall bulk set productivity train starts to volume reducing crew starts • Complete first ACS IRT locomotive collective teams and increasing overall train productivity install • Slot utilization initiative underway to • 2024 DC2AC conversion locomotive improve railcar productivity and fuel deliveries began February 2024 efficiency • GTMs IT: Accounting review continuing, expecting implementation 1Q24 • Intermodal Reservation System: Targeting MVP (Minimum Value Product) • Fuel Plan: Optimizing fuel plan to reduce by September 2024 fuel spend for March review & implementation Source: Company records. See Appendix 1 for a glossary of rail terms. 20

WE ARE ALREADY STARTING TO SEE RESULTS Merchandise Velocity Terminal Dwell (mph) (Hours) 22 28 21 26 20 8% 8% better better 24 19 18 22 17 20 16 15 18 Jan-24 Feb-24 Mar-24 Apr-24 Jan-24 Feb-24 Mar-24 Apr-24 Note: Charts reflect rolling 7-day average. 21 Source: AAR and internal data. Latest data available. Better Better

JOHN WILL FURTHER ACCELERATE MERCHANDISE VELOCITY, WHICH OFFERS A BIG PAYOFF IN PRODUCTIVITY AND PROFITABILITY Delivering on a Multi-year Plan to Improve Merchandise Velocity • Prioritize running-to-plan, even in the face of shocks and disruptions • Start with safety; confidence and empowerment at the ballast line Disciplined Plan Adherence • Data-driven performance monitoring and real-time correction to stay on schedule • Standardization of productivity expectations with targeted output for each terminal, addressing exceptions on a daily basis Enhance Productivity • Achieved through intensity and accountability at the Terminal Superintendent level, including several with prior PSR experience at CN and CSX • Optimizing yard network using density mapping software to increase throughput and capacity • Designing-out handlings through pre-blocking, working with customers and strategically increasing capacity at key locations Maximize Operating • Portfolio changes in Intermodal to reduce complexity and free-up resources Efficiency • Customer pipeline management to minimize idle cars on-line and promote better network balance; this will free-up capacity and allow us to consolidate work at the most productive yards • Targeted capital investment in strategic locations across the network to further increase yard Capital Investment efficiency 22

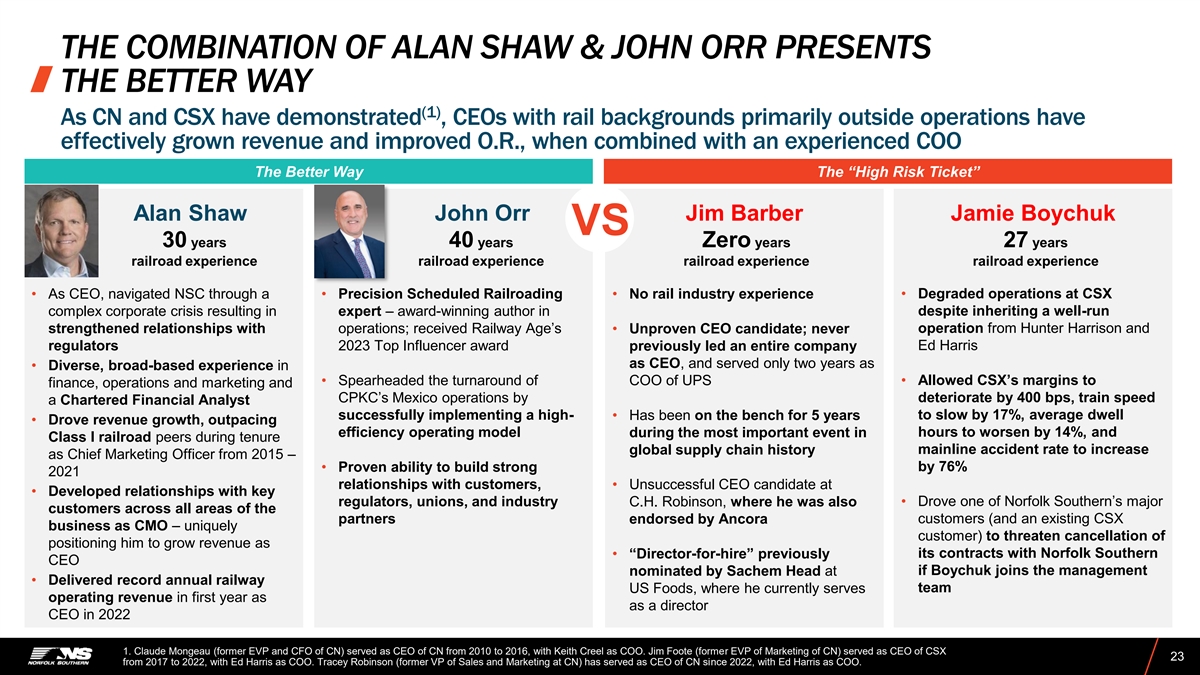

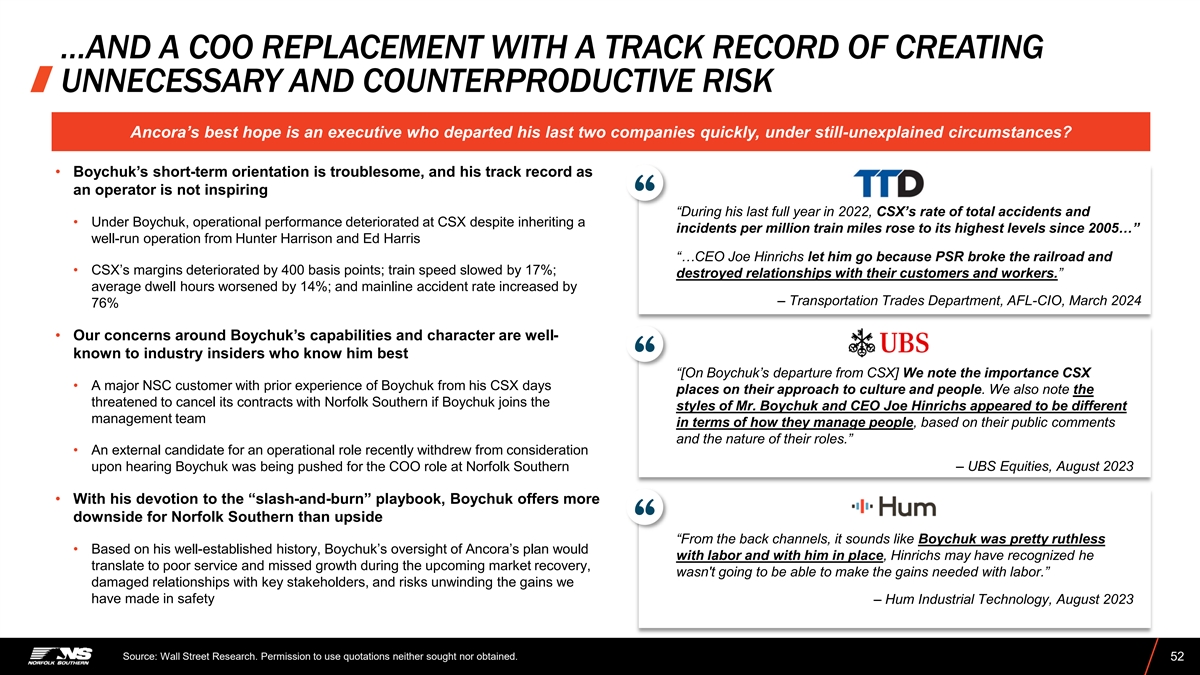

THE COMBINATION OF ALAN SHAW & JOHN ORR PRESENTS THE BETTER WAY (1) As CN and CSX have demonstrated , CEOs with rail backgrounds primarily outside operations have effectively grown revenue and improved O.R., when combined with an experienced COO The Better Way The “High Risk Ticket” Alan Shaw John Orr Jim Barber Jamie Boychuk VS 30 years 40 years Zero years 27 years railroad experience railroad experience railroad experience railroad experience • As CEO, navigated NSC through a • Precision Scheduled Railroading • No rail industry experience • Degraded operations at CSX complex corporate crisis resulting in expert – award-winning author in despite inheriting a well-run operation from Hunter Harrison and strengthened relationships with operations; received Railway Age’s • Unproven CEO candidate; never Ed Harris regulators 2023 Top Influencer award previously led an entire company as CEO, and served only two years as • Diverse, broad-based experience in • Spearheaded the turnaround of COO of UPS • Allowed CSX’s margins to finance, operations and marketing and CPKC’s Mexico operations by deteriorate by 400 bps, train speed a Chartered Financial Analyst successfully implementing a high- • Has been on the bench for 5 years to slow by 17%, average dwell • Drove revenue growth, outpacing efficiency operating model during the most important event in hours to worsen by 14%, and Class I railroad peers during tenure mainline accident rate to increase global supply chain history as Chief Marketing Officer from 2015 – by 76% • Proven ability to build strong 2021 relationships with customers, • Unsuccessful CEO candidate at • Developed relationships with key regulators, unions, and industry C.H. Robinson, where he was also • Drove one of Norfolk Southern’s major customers across all areas of the partners endorsed by Ancora customers (and an existing CSX business as CMO – uniquely customer) to threaten cancellation of positioning him to grow revenue as its contracts with Norfolk Southern • “Director-for-hire” previously CEO if Boychuk joins the management nominated by Sachem Head at • Delivered record annual railway team US Foods, where he currently serves operating revenue in first year as as a director CEO in 2022 1. Claude Mongeau (former EVP and CFO of CN) served as CEO of CN from 2010 to 2016, with Keith Creel as COO. Jim Foote (former EVP of Marketing of CN) served as CEO of CSX 23 from 2017 to 2022, with Ed Harris as COO. Tracey Robinson (former VP of Sales and Marketing at CN) has served as CEO of CN since 2022, with Ed Harris as COO.

MERCHANDISE VELOCITY ALREADY EXCEEDS 2022 LEVELS AND CONTINUES TO IMPROVE… • In Q4 2023 we achieved our best Intermodal service results in over three years by enhancing resiliency, discipline and productivity • We are now applying the principles we developed in the successful turnaround of Intermodal to our Merchandise network, where two-thirds of train starts (and associated costs) originate • While we have already significantly enhanced Merchandise velocity since 2022, we continue to improve network performance to reach our operating targets • Accelerating Merchandise will unlock significant productivity and margin improvement (1) Merchandise Velocity Impact of EP/Safety-Related Changes (mph) 22 East Palestine- • “Premier Corridor” mainline capacity cut Mid-Term Target 21 Related by over 50% for 6 months, with both Disruptions 20 Alan 24% mainline tracks out of service for a Appointed 19 better CEO period of time 18 17 • Velocity fell by 20%; when one track was out of service, the other ran at a 16 restricted speed 15 14 • $175M of lost revenue in Q2 2023 due to 13 service disruptions 12 May-22 Jul-22 Oct-22 Jan-23 Apr-23 Jul-23 Oct-23 Jan-24 Apr-24 Jul-24 Note: Charts reflect rolling 12-week average. Source: AAR and internal data. Latest data available. 24 1. Velocity defined as the average train speed from origination to destination. Better

…BOLSTERING OUR PLAN TO UNLOCK 400BPS OF MARGIN IMPROVEMENT FROM PRODUCTIVITY SAVINGS… Faster Merchandise Velocity Unlocks Productivity The Flywheel Effect From Velocity Gains Will and Cost Savings Throughout the P&L Drive Down the Cost Structure ~$550M Total Productivity Savings: >400 bps of margin Comp & Benefits ~$250M • Reduced overtime, re-crews, deadhead (1) detention , incentives, training • Reduced train and crew starts ~$150M Fuel Efficiency ~$50M Purchased Services ~$50M Equipment Rents ~$50M Materials & Other 1. “Deadhead detention” refers to crew members who earn wages without performing service while awaiting assignments or repositioning between terminals. 25

(1) …HELPING US ACHIEVE A SUB-60% OPERATING RATIO • We expect to realize an operating ratio of 60% or lower in three to four years, assuming a market recovery and associated revenue growth in line with previous freight cycles Base Line 3-Year Margin Improvement Plan Normal Economic Recovery (200+) bps 67.4% (400+) bps 160 bps (300+) bps < 60.0% 2023 Rev Growth Productivity Savings Inflation Incremental Volume + ~2026 (+3% - 3.5%) Normalized Truck Pricing ~180bps Comps & Benefits Incremental 2% revenue ~110bps Fuel Efficiency Modest volume plus growth from economic ~40bps Purchased Services Assumes 2-3% inflation pricing above inflation recovery and stronger ~40bps Equipment Rents truck rates ~40bps Materials & Other 1. The operating ratio improvements discussed and presented on this page represent adjusted operating ratio. See Appendix 3 for definition and reconciliation to GAAP operating ratio. 26

MEANINGFUL YEAR-OVER-YEAR MARGIN IMPROVEMENT WILL BE EVIDENT AS WE PROGRESS THROUGH THE YEAR • Despite revenue and cost headwinds in the first quarter of 2024, we expect to deliver ~400-500 basis points of operating ratio (1) improvement during the second half of 2024 • This is consistent with our plan to achieve ~100-150 basis points of average annual operating margin improvement (1) • Translates to a 2024 exit ratio of ~64-65% YoY ∆ 150 – 200 bps 400 – 450 bps 100 – 150 bps 68.9% 67-68% ~66% 64-65% 2H23 1H24 2H24 Full Year 1. The operating ratio improvements discussed and presented on this page represent adjusted operating ratio. See Appendix 3 for definition and reconciliation to GAAP operating ratio. 27

ANCORA’S PLAN UNNECESSARILY PUTS NORFOLK SOUTHERN AT RISK, WHILE FAILING TO DELIVER UPSIDE TO MANAGEMENT’S PLAN NSC’s Strategy and PSR Operating Plan Will Achieve <60% OR Without Execution and Timing Risks “The rapid reduction in OR championed by Ancora can only be (1) Operating Ratio (%) accomplished by new major reductions in the workforce.” “ – Marty Oberman, Surface Transportation Board Chair 67.4% Stephens Rail Shipper Survey (respondents collectively manage The only way Ancora Our thoughtful and can achieve 60% OR detailed margin estimated ~$25 billion of annual transportation spend) faster than our plan is by improvement plan will get immediately cutting Norfolk Southern to a sub- “If NSC loses the shareholder vote, 80% of [Shipper Survey] respondents said thousands of jobs, 60% OR in ~3 years, while they would shift some freight to CSX and/or Truck.” “ putting service and safety leaving us well- – Stephens at substantial risk, positioned to grow with sparking immediate our customers and backlash from regulators, “91% of respondents believe the activist's plan would result in worse deliver top-tier earnings service in the next year.” and destroying long “ and EPS growth over the – Stephens term shareholder value long-term “The vast majority of shippers participating in our survey support NSC's strategic plan with 86% choosing this approach over the activist plan.” “ – Stephens “We have seen solid improvement with NS service over the past two 60.0% <60.0% years, for both carload and intermodal. After reviewing the plan by the “ activist, I am convinced it is a short-term attempt to squeeze cash out of the NS network.” – Surveyed Shipper Current 1-2 Years ~3 Years “NS has been doing a really nice job of balancing cost and service. If the activist moves forward, it will be bad for everyone except for a few “ Ancora’s Slash and A Better Way profiteers.” – Surveyed Shipper Burn Approach Permission to use quotations neither sought nor obtained. 28 1. The operating ratio improvements discussed and presented on this page represent adjusted operating ratio. See Appendix 3 for definition and reconciliation to GAAP operating ratio.

02 OUR RESPONSIVE, HIGHLY QUALIFIED BOARD IS COMMITTED TO ACCOUNTABILITY

WE ENHANCED OUR BOARD TO DRIVE ENHANCEMENTS IN SAFETY AND OPERATIONAL PERFORMANCE… Board and Governance Changes January 2022 May 2023 July and August 2023 February 2024 th • Nominated Richard Anderson and Heidi Heitkamp to Announced separation of • Appointed Admiral Philip Davidson, former 25 the Board the roles of CEO and Commander of the United States Indo-Pacific Board oversaw independent Board Chair; appointed Command, and Francesca DeBiase to the Board – • Mr. Anderson’s extensive career in rail / culture assessments by Amy Miles as independent both are senior executives who have led large- transportation spans 3 decades AtkinsRéalis, a renowned Chair of the Board, scale organizations and have significant advisor with Nuclear Navy • Ms. Heitkamp brings government and policy effective May 2022 operational experience (vessels powered by nuclear experience stemming from her work championing reactors) experience • Announced future rotation of Board Committee rail safety in the U.S. Senate leadership including Safety and Governance and • Amended the Safety Committee Charter to receive Nominating Committees comprehensive feedback on NSC’s safety program, • Increased cadence of Safety Committee meetings practices, and performance, including from craft employees 2022 2023 2024 Operational and Safety Changes December 2021 June 2022 March 2023 March 2024 Appointed John Orr • Announced six-point safety plan to address NTSB findings on East Palestine Announced Appointed Alan Shaw EVP and COO TOP|SPG • Appointed John Fleps as VP of Safety and Floyd Hudson as VP of Field Engagement as President, effective Strategy immediately, and as • Accelerated the Digital Train Inspection program CEO, effective • Launched a leadership development program for front-line field supervisors May 2022 Source: 2024 Definitive Proxy Statement. 30

…BUILDING A STRONG FOUNDATION TO DELIVER SUSTAINABLE SHAREHOLDER VALUE… Thoughtful and Creating a Safer, More Reliable Transformed Strategy Comprehensive Refreshment Railroad ✓Implemented balanced strategy to safely ✓Achieved industry-leading safety results, deliver reliable and resilient service, drive notably a 38% reduction in mainline continuous productivity improvement and accident rate in 2023 and the fewest propel smart and sustainable growth mainline accidents since 1999 ✓Strategy designed to outperform through ✓Improved Intermodal service performance market cycles and drive meaningful long- by 3,040 bps, from 57% to 88%, since term shareholder value Alan Shaw appointed CEO ✓Made significant investments in operations ✓Improved terminal dwell time by 11%, leadership, resources and the Company’s Merchandise velocity by 24% and operating plan manifest train speed by 22% since Alan Shaw appointed CEO ✓Increased focus and investment in safety including joining FRA’s Confidential Close ✓Targeting 100-150 bps of annual Call Reporting System and overseeing productivity-driven operating ratio (1) AtkinsRéalis’ independent review and improvement in 2024 recommendations on our safety culture ✓Targeting $550m (~400 bps of margin ✓Identified opportunities to further simplify improvement) of savings over next 3 years and accelerate the network through full by increasing Merchandise velocity Appointed within last 5 years portfolio review of intermodal franchise New director nominee in 2024 Source: 2024 Definitive Proxy Statement. 31 1. The operating ratio improvements discussed and presented on this page represent adjusted operating ratio. See Appendix 3 for definition and reconciliation to GAAP operating ratio.

…WE ALSO ENHANCED SAFETY, CYBERSECURITY AND ENTERPRISE RISK MANAGEMENT PRACTICES… Safety Enterprise Risk Management Cybersecurity • Increased Safety Committee meeting • Amended Finance and Risk Management cadence to provide regular reporting on the Committee charter to enhance reporting status of the six-point safety plan and the related to the resiliency of the Company’s IT implementation of AtkinsRéalis-and FRA- infrastructure and the quality, adequacy, and approved responsive activities effectiveness of security controls, policies, and procedures • Recalibrated the Company's event management process to prioritize root cause • Supplemented existing Enterprise Risk • Streamlined procedures to ensure timely analysis and corrective actions Council with cross-functional working reporting of material cybersecurity incidents • Rotated the Safety Committee Chair and groups providing periodic reports to the Finance to the Finance and Risk Management th added Admiral Philip Davidson, former 25 and Risk Management Committee Committee and to the full Board Commander of United States Indo-Pacific • Aligned reporting of quarterly and monthly Command, who led comprehensive reviews of • Enhanced reporting to Board of IT resiliency risk metrics with reporting of other operational the U.S. Navy’s safety protocols and cybersecurity assessments and performance metrics • Amended the Safety Committee Charter to • Tracked key risk indicators with respect to our receive comprehensive feedback on NSC’s • Developed a crisis management playbook primary information technology, cybersecurity, safety program, practices, and performance, and conducted periodic tabletop exercises and privacy risks including from craft employees • Enhanced third-party risk management • Added Safety metrics to our executive programs compensation plan Source: 2024 Definitive Proxy Statement. 32

…AND REFINED PAY PRACTICES TO ENHANCE ALIGNMENT WITH VALUE CREATION AND DELIVER ON OUR COMMITMENTS… In 2023, our engagement team (which includes directors in certain instances) held 55 engagement meetings with 40 shareholders representing 49% of our outstanding shares In response, we: Our plan aligns executive and shareholder outcomes… Made Operating Ratio an explicit performance metric in 2024: CEO Pay 92% At-Risk Average NEO Pay 81% At-Risk • The 2024 operating ratio targets align with the improvements needed to achieve the Company’s long-term objectives of achieving a sub-60% 64% 65% Performance (1) 79% 80% Performance operating ratio in three to four years and closing the gap with peers Long-Term -Based Long-Term -Based 16% 12% 19% 8% Added new safety component in 2023: 13% • Incorporated two publicly reported safety measures in our 2023 plan and ▪ Base committed to maintain safety performance metrics in our 2024 plan 20% 16% ▪ Annual Incentive 17% ▪ PSUs Applied negative discretion to 2023 compensation: ▪ Stock Options • Reduced the 2023 annual incentive plan payout to zero for all NEOs to reflect ▪ RSUs 47% 32% impact of EP on shareholders Implemented a Supplemental Clawback Policy in 2023: • Expanded clawback policy which exceeds the NYSE requirements and covers …as 2023 realizable pay demonstrated (as of December 31, 2023) detrimental conduct, including conduct resulting in a material risk, operational, safety, or reputational failure CEO Average Other NEO’s $12.8M Updated 2024 Performance Metrics: (33%) $8.6M 70% Financial 20% Service 10% Safety $3.4M (32%) $2.3M 30% Operating Ratio 10% Merchandise 5% FRA Injury Rate On-Time Delivery 25% Operating Income Target Realizable Target Realizable Compensation Compensation Compensation Compensation 10% Intermodal 5% FRA Reportable 15% Annual Revenue Composite Accident Rate Source: 2024 Definitive Proxy Statement. Note: Target Compensation includes: 2023 base salary earned, 2023 target annual incentive compensation, and 2023 target value of the annual equity awards. Realizable Compensation Value reflects: 2023 base salary earned, no 2023 annual incentive earned, and the end-of-year value of performance share units (“PSUs”), restricted stock units (“RSUs”), and Stock Options issued in 2023, in each case valued based on a stock price of $236.38 at December 29, 2023, with PSUs valued at target and stock options valued based on an exercise price of $241.18. 33 1. The operating ratio improvements discussed and presented on this page represents adjusted operating ratio. See Appendix 3 for definition and reconciliation of non-GAAP operating ratio.

…ALL UNDER THE LEADERSHIP OF A NEW, EXPERIENCED INDEPENDENT CHAIR In January 2022, we announced the separation of the CEO and Chair roles and elected Amy Miles as independent Chair, effective May 2022 Brings Extensive Experience to the Role Delivers for Shareholders Extensive Governance Experience Holds Management Accountable • Previously Chair at another large public company, Regal • Stays fully engaged on key strategic, operational, and emerging Entertainment Group, and currently a director at Amgen and Gap matters through regular onsite meetings with executive team, and addresses ongoing matters in greater detail through regular Leadership Track Record at Public Companies meetings with C-Suite • Successful track record as a corporate executive and director of 27% Leads Engagement with Shareholders multiple large public companies, including as CEO of Regal (1) Total Shareholder Return Entertainment Group • Engages with key shareholders, providing the Board with their insight and feedback on governance, safety, and compensation • Valuable experience driving operational efficiencies, investing in matters before the Board customer experience-related infrastructure, marketing, and Drives Board Agenda and Oversees Board Fitness expanding organizational capabilities 435% • Ensures entire Board is focused on key topics, and balances • Financial and accounting expert as a former CFO (1) Total Shareholder Return near-term and long-term priorities Deeply Familiar with Norfolk Southern’s Business • Involves herself in emerging issues, including by participating in • Over a decade of experience on Norfolk Southern’s Board, which committee meetings as necessary provides a unique perspective on the evolution of our Company • Leads Board’s annual self-evaluation process, including strategy, operating model, financial performance and safety conducting one-on-one interviews with each Board member 230% initiatives since her appointment in 2014 (1) Total Shareholder Return • Led the Board refreshment and governance enhancements • Fully engaged in guiding Norfolk Southern through the challenges following the East Palestine incident relating to East Palestine and others since, including legal and regulatory scrutiny, leadership change, investor engagement and operational refocus Source: 2024 Definitive Proxy Statement. 34 1. Calculated using FactSet and date ranges July 23, 2020 and April 1, 2024 for Amgen; April 1, 2020 to April 1, 2024 for Gap; June 30, 2009 to February 28, 2018 for Regal Entertainment.

WE OFFERED TO ADD THE BEST OF ANCORA’S NOMINEES. WE WERE CONSISTENTLY REBUFFED Our best efforts to find the right answer for all shareholders were derailed by Ancora’s zero-sum mentality February 4-9, 2024 Each Ancora nominee is interviewed by our independent November 2023 Chair and the outgoing and incoming Gov/Nom Chairs Ancora first contacts February 21, 2024 After identifying the strongest nominees, our independent NSC requesting the Chair proposes to Ancora that adding those nominees Ancora announces on CNBC it is questionnaire seeking to take control of the Board, might be a resolution in the best interests of all required under our replace the CEO, and install Ancora’s shareholders bylaws to nominate preferred candidate for COO Ancora instead insists it must obtain five seats and replace director candidates the CEO March 19, 2024 February 13-14, 2024 January 2024 Our independent Chair In an effort to identify The Board reiterates its interest in finding a peaceful resolution proposed a settlement common ground and which serves all shareholders by adding Ancora’s best nominees to framework including work out a resolution, the Board Board seats to help reach NSC management meets Ancora insists on CEO change a resolution with Ancora and certain of After more engagement, during which the Board reiterates its commitment Ancora cut off discussions, its director nominees to to a settlement which would add Ancora’s best nominees, Ancora insisting that any discuss the business, remained insistent that CEO change was required to reach a settlement must include a strategy, and operations resolution CEO change Source: 2024 Definitive Proxy Statement. 35

ANCORA’S PROPOSALS WOULD ELIMINATE RAILROAD EXPERTISE HIGHLY RELEVANT TO NORFOLK SOUTHERN’S OPERATIONS… Richard Anderson Claude Mongeau Alan Shaw Nominee for Independent Director Independent Director President & CEO • Mr. Shaw’s 30 years of • Mr. Anderson was appointed • Mr. Mongeau is one of the most experience at Norfolk Southern CEO of Amtrak after a respected leaders in the rail are second to none; his successful career navigating industry with more than 25 years engineering background, strong Delta Air Lines through of experience overseeing all leadership and clear strategic transformative and key strategic facets of railroad management direction have driven substantial changes, including formative with a deep understanding of operating improvements for the M&A, post bankruptcy recovery, PSR operations franchise and shareholders and a major recession Track Record • Took decisive action to change leadership and • Under Anderson, Amtrak set ridership records • Partnered with Hunter Harrison for nearly a implement a new strategy, which: with over 32.5M trips in 2019 and achieved the decade, successfully implementing CN's bold best operating results in its history, including business transformation during tenure as CFO • Achieved a 38% reduction in mainline (1) $3.3B in operating revenue • Key architect of CN's customer-centric pivot accident rate in 2023, and the fewest • Anderson is also credited with executing on leading to superior growth and a record 55.9% mainline accidents since 1999 (3) several safety initiatives at Amtrak including operating ratio during tenure as CEO • Improved Intermodal service (2) $713M in infrastructure improvements • Oversaw and developed several veteran PSR performance by 3,040 bps • Transformed Delta into a global leader by leaders, including Keith Creel, Jim Vena, Mike • Improved terminal dwell time by 11% overseeing the Northwest Airlines merger, de- Cory and John Orr and manifest train speed by 22% risking the balance sheet and leading peers on • Extensive governance experience as director operational metrics like on-time performance of several large North American public • Revenue growth outpaced Class I railroad • Increased Delta’s market capitalization by companies in engineering, telecommunications, peers during tenure as Chief Marketing Officer (2) ~8x during tenure as CEO banking, oil & gas and rail sectors from 2015 – 2021 Source: 2024 Definitive Proxy Statement. 1. Per WSJ’s “Amtrak, Seeking to Break Even, Sees Some Light at the End of the Tunnel”, published November 8, 2019 36 2. Calculated using FactSet and date range of September 1, 2007 to May 2, 2016. 3. Per 2016 Canadian National Annual Report filed February 1, 2017.

…AND REPLACE IT WITH LESS RELEVANT NOMINEES WITH NO OPERATING EXPERIENCE IN A POST-COVID ENVIRONMENT Jim Barber Sameh Fahmy Gilbert Lamphere Ancora’s CEO Nominee Ancora Nominee Ancora Nominee • Mr. Barber also has no experience in the • Mr. Fahmy has limited leadership or • Mr. Lamphere, a career private equity investor, railroad industry, is foreign to rail operations and governance credentials and is unfit to execute has no operating experience in the rail industry has no credibility with rail regulators in a highly the duties required for effective Board oversight • Underwhelming operational performance while regulated industry, at a company undergoing of a large North American infrastructure on Board of CSX – required new management regulatory scrutiny company and Board to improve operations No CEO or rail experience Less relevant than targeted Directors • Mr. Barber hasn’t worked a full-time job • Retired from CN more than a decade ago as • Tenure on CSX Board notable for industry- SVP of Engineering, Mechanical and Supply lagging operational performance with since the onset of the pandemic; instead, he has become a director-for-hire by activist Management under Claude Mongeau's operating ratios consistently more than 70% leadership investors • Lacks knowledge of current industry trends – • As KCS’ EVP of Precision Railroading from tenure on CSX’s Board was almost a decade • Mr. Barber was not selected as Chief 2019-2021, he returned to active ago in a markedly different industry Executive Officer of UPS despite a 35-year management role with mixed safety and environment career at the company operational results • Mr. Lamphere is another “director for hire” • Very limited C-suite experience; all whose allegiance will be to Ancora and their “Barber's involvement at CHRW has so far not solved that operations-focused roles reckless strategy company's ills. Nor has a CEO change made a difference… And if Ancora is bothered by NSC's industry lagging margins, then • No U.S. public company governance • Experience is already well covered by Claude it surely can't like what it is seeing from CHRW right now.” experience; ill-prepared to act in an Mongeau, Richard Anderson and other – Gordon Haskett, March 2024 oversight role as director operationally focused directors Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 37

ANCORA WOULD REMOVE CRITICAL EXECUTIVE LEADERSHIP Alan Shaw Jim Barber Norfolk Southern CEO Ancora’s CEO Nominee • Appointed as CEO because the depth and breadth of • Mr. Barber is an unproven CEO candidate, he has never been his experience best positions us to leverage PSR selected for the role despite being “next in line” twice before, including • Alan has the skills to execute on our strategy and at UPS deliver top-tier revenue and earnings growth, with • Mr. Barber also has no experience in the railroad industry or with rail industry-competitive margins operations and is not qualified to be Norfolk Southern’s chief executive • Diverse, broad-based experience in finance, operations and marketing and a Chartered Financial Analyst Highly-relevant experience Less relevant than targeted Director VS • Delivered record annual railway operating revenue in first year as • The full extent of his executive leadership experience is less CEO in 2022 than two years. Mr. Barber’s tenure as COO of UPS was short lived – he was appointed in March 2018 and resigned in January 2020 • Alan led the Company through an extremely challenging corporate crisis, restored relationships and built trust with elected officials, • Mr. Barber was no longer serving as UPS’ COO during the most regulators, labor unions and the communities in which we operate – disruptive and impactful period ever for the global supply chain while maintaining and strengthening partnerships with customers – all • This isn’t the first time Ancora has tried to install Mr. Barber as critical constituencies CEO; they failed to do so at C.H. Robinson in 2022. Barber was instead appointed to the Board; since that time, the company’s stock “The unions said that Shaw is doing the right thing and that he has fallen to a 52-week low should be given more time to reshape the railroad. They feel that if Ancora gets its way and replaces Shaw with another person, and • Mr. Barber has not worked a full-time job since the onset of the bringing the cost-cutting measures that they so feared, it would erase pandemic, turning his energies instead to running as an activist all the gains that they had seen under Shaw's leadership.” – Esther Fung, Wall Street Journal, March 2024 candidate for Boards Source: 2024 Definitive Proxy Statement and Wall Street Research. Permission to use quotations neither sought nor obtained. 38

ANCORA WOULD REMOVE CRITICAL SAFETY EXPERTISE Allison Landry Jennifer Scanlon Independent Director Ancora Nominee • Ms. Scanlon has significant executive and Board • Ms. Landry’s background as an equity research analyst writing about experience in the product safety testing and public companies has not prepared her to act in an oversight role as a manufacturing industries; as the CEO of a safety director of a large public infrastructure company focused company, she brings important expertise with • In her only public Board role as XPO’s Vice Chair and member of the respect to safety and governance matters compensation committee, she oversaw poor pay practices that were rejected by a majority of shareholders at the 2023 Say-on-Pay vote • She has 16+ years of executive experience as a • No experience championing safety initiatives former Norfolk Southern customer • No public or private company executive experience or operational know-how specific to rail or otherwise Highly-relevant experience Less relevant than targeted Director VS 2016 winner of the National Safety Council’s Robert W. Campbell award, a top honor recognizing companies that have attained business excellence through the integration of environment, health and (1) Senior Transportation Financial Analyst and safety management as a key business function Research Analyst Senior Accountant 2023 ChicagoCIO ORBIE Leadership Award Recipient, honoring CIOs and CISOs who have demonstrated excellence in technology leadership None of these positions provide her with relevant skills to inform the company’s operational or safety initiatives. Ms. Landry’s “skills” are redundant to our current Board One of Crain Chicago’s Most Powerful Women and to Ancora’s own slate of candidates in Chicago Business in 2018 Source: 2024 Definitive Proxy Statement. 39 1. 2016 USG Corporate Sustainability Report.

ANCORA WOULD REMOVE CRITICAL GOVERNMENT RELATIONS EXPERTISE Heidi Heitkamp John Kasich Nominee for Independent Director Ancora Nominee • Mr. Kasich's Washington experience is nearly a quarter century out • Ms. Heitkamp's significant public service experience of date as a United States Senator, state Attorney General, and rail safety advocate provides the Board with • No industry experience as an executive or a director strong relationships across the safety, rail, and • Involvement in this campaign appears entirely mercenary: agriculture industries, including key Norfolk Southern demanded (and won) a higher fee than any other Ancora nominee and customers insisted on payment up-front Highly-relevant experience Less relevant than targeted Director VS • Ms. Heitkamp brings a wealth of government and policy expertise, • Mr. Kasich has no relevant credentials in the transportation with a proven bipartisan track record and a deep understanding of industry, even on a regulatory level: he lacks any clear rail transportation safety matters connection, expertise or interest in railroading • Relevant Washington credentials pale beside those of the director he • Widely recognized as a strong advocate for rail safety seeks to replace, Heidi Heitkamp • Track record of opposing infrastructure investment and collective Heitkamp was instrumental in the Railroad Emergency Services bargaining rights while Governor of Ohio is radically out of touch with Preparedness, Operational Needs, and NSC’s interests and operating realities Safety Evaluation (RESPONSE) Act • Tried to cut collective bargaining rights for hundreds of that ensures first responders have the thousands of government workers, a move eventually proper training and resources to overturned by voters themselves handle train derailments involving hazardous materials (1) (1) TSR Declined by TSR Declined by During his tenure on During his tenure on the Instinet Board… 60.0% the Invacare Board… 23.5% Source: 2024 Definitive Proxy Statement. 40 1. Calculated using FactSet and date ranges May 18, 2001 and December 8, 2005 for Instinet; March 1, 2001 and November 3, 2010 for Invacare.

ANCORA WOULD REMOVE CRITICAL CYBER RISK MANAGEMENT EXPERTISE John Huffard, Jr. Betsy Atkins Independent Director Ancora Nominee • Mr. Huffard is a cybersecurity innovator credited with • Ms. Atkins has not worked in an operating role in over two decades pioneering vulnerability management software at • Her claimed “technology expertise” falls miles short of Mr. Huffard’s Tenable, a leading global cybersecurity software firm undisputed reputation as a technology leader and innovator he co-founded and managed for nearly two decades • Having refocused her career around being a “director-for-hire” at as President and COO more than 40 public and private companies – and, as a current • Currently also serves as chairman of two high-growth director on 5 public company Boards, is already considered private technology companies overboarded under many institutional investor voting guidelines Highly-relevant experience Less relevant than targeted Director VS In 2020, Mr. Huffard was appointed by the White House as a Atkins uses Board membership as member of the National Security Telecommunications publicity for her own brand, featuring (1) Advisory Committee her Board memberships on her (4) personal website Creating value for shareholders is not her top priority (2) Inducted into the Cyber Security Hall of Fame in 2023 Median TSR across her Goldman Sachs recognized Mr. Huffard as one of the 100 Most nearly 20 public Board (14)% (2) Intriguing Entrepreneurs of 2016 and 2017 ; he is currently a (5) directorships since 2010 member of the Goldman Sachs Value Accelerator as a tech sector expert where he mentors portfolio company executives Ms. Atkins has a history of poor governance practices, including as Chair of the Compensation Committee at Wynn, where Say-on-Pay failed to gain TSR during his tenure as a director majority support in 2022 under her oversight; (3) 59% of Tenable ISS has recommended against her election at SolarEdge and Enovix for poor corporate governance practices Source: 2024 Definitive Proxy Statement. 4. Betsy Atkins Website. 1. Workstorm Website: About Jack Huffard. 5. Calculated using FactSet; median total shareholder return inclusive of current public boards and past 41 2. Tenable Press Releases. public boards with tenures ending on or after January 1, 2010, through April 2, 2024 where applicable. 3. Calculated using FactSet and date ranges of July 26, 2018 and April 2, 2024.

ANCORA WOULD REMOVE CRITICAL CORPORATE GOVERNANCE EXPERTISE Amy Miles John Thompson William Clyburn Independent Chair Independent Director Ancora Nominee • Ms. Miles has a successful • Mr. Thompson has extensive • Mr. Clyburn is a career bureaucrat with no experience as a director and track record as a corporate public company management or Board executive and director, having senior executive at customer- experience previously served in the role of facing publicly traded • Rail experience is limited to long out-of-date companies, and brings highly CEO and Chair at a large public regulatory experience and zero operational company relevant governance experience; does not add any new skills to the expertise to our Board Board Highly-relevant experience No relevant governance experience VS • Ms. Miles has overseen the evolution of • Mr. Thompson has over a decade of public • The rail industry has undergone large-scale transformation since Mr. Clyburn served as a Norfolk Southern’s strategy, operating model, company Board experience at Belk and Commissioner of the STB between 1998 and financial performance and safety profile Wendy’s International, where he served on several Board-level committees overseeing 2001 • Ms. Miles brings proven governance audit, compensation and governance matters • The industry has encountered supply chain expertise to the Board having previously shocks, including the effects of the pandemic served as CEO and Chair at Regal Retail Systems Alert Career Entertainment Group, and director of Achievement Award • Mr. Clyburn has been away from the industry “Turning a challenge into an opportunity seems to be a Amgen and Gap for over two decades and has instead focused mantra for John R. Thompson. Regardless of the position his attention on his political lobbying business he holds, he approaches all business challenges the same way: as a chance to serve the customer better, • Amy Miles and John Thompson are seasoned (2) while improving the performance of the enterprise” (1) public company directors with a wealth of Successfully oversaw the $5.9bn TEV merger of experience that Clyburn does not possess Regal Entertainment and Cineworld Group in 2017 During his tenure as a 341% (3) director of Belk Source: 2024 Definitive Proxy Statement. Permission to use quotations neither sought nor obtained. 1. Total Enterprise Value. 42 2. The best man for the job: John R. Thompson's robust career has earned him the Retail Systems Alert Career Achievement Award” by Deena M. Amato-McCoy published July 2006. 3. Calculated using FactSet and date ranges May 25, 2006 and December 9, 2015 for Belk.

03 ANCORA WOULD UNNECESSARILY DELAY OUR TRANSITION AND PUT IT AT RISK

OUR BALANCED STRATEGY CREATES LONG-TERM VALUE BY FOCUSING ON RELIABLE, RESILIENT SERVICE Our competitors and analysts agree: there is “A Better Way” “Here's why Ancora may want to rethink its [pejorative] use of the term [“resiliency railroading”]: Lack of resiliency has been the industry's Achilles Heel over the last decade. It was a lack of resiliency that contributed to Union Objective is a Pacific, BNSF, and CSX's meltdowns in 2014 and 2022, Norfolk Southern's meltdowns in 2014, 2018, more resilient and 2021, Kansas City Southern's meltdowns in 2014 and 2021, and Canadian National's meltdown railroad with a in 2017.” “If you concentrate on O.R. as the [Improvements at end of 2023] “is all compelling service Loop Capital driving force of what you do and the about asset turn, speed and velocity… April 1, 2024 decision making, then you’re making with a little bit of strategic investment, product that a mistake, O.R. … is a result of what much like in the playbook of PSR in you do. It’s a result of having service, the past, this isn't about cutting outperforms and having operational excellence, costs. It's about strategically and “If there is an activist looking at NSC, we still safety. But it’s also a result of making surgically investing money, the career throughout market believe the prior PSR playbook won’t apply and sure that you grow your business capacity and resiliency to eliminate that the railroad model in general is more cyclical cycles and drives because there’s nothing better than bottlenecks, turn assets more. It's about growing the business.” than before with a broader pivot to growth…Our locomotive productivity.” thesis remains centered on NS improving service to meaningful long- handle an eventual volume inflection while also Jim Vena at Morgan Keith Creel in Q4 2023 term shareholder realizing company-specific productivity initiatives.” Stanley Laguna Conference Earnings Call (September 12, 2023) (January 30, 2024) value J.P. Morgan Research Report (January 26, 2024) Permission to use quotations neither sought nor obtained. 44

ANCORA’S MYOPIC “STRATEGIES,” BY CONTRAST, HAVE ONLY CREATED DEEP AND UNDERSTANDABLE CONCERN AMONG KEY CONSTITUENTS REGULATORS CUSTOMERS LABOR Brotherhood of Locomotive U.S Department of Transportation Engineers and Trainmen Federal Railroad Administration Private Railcar Food and Beverage Assn. “Any backsliding, as a result of a change in leadership or Freight Rail Customer Alliance otherwise, on the safety-oriented path you have laid out and National Industrial Transportation League communicated to us will likely attract renewed oversight “Ancora would be bad for investors. It’s easy to imagine a train attention from my office as we pursue our safety mission.” wreck under their proposed plans, both literally and “…this proposed new leadership slate seems to be an excessive figuratively speaking.” – Amit Bose reaction to what may be a brief rise in NS’ operating ratio where FRA Administrator – Dewayne Dehart they are only interested in short-term gain rather than what is February 21, 2024 BLET General Chairman needed in the long run for NS to better serve its customers and February 29, 2024 its investors.” Surface Transportation Board – Ann Warner Spokeswoman for the FRCA, NITL, and PRFBA “The problem with activist investors bowing down to the cult February 29, 2024 of the OR is that they are impatient and want immediate returns.” Transportation Trades Dept., “Clearly, their plan is to install a CEO ordered to reverse Norfolk Survey of Rail Shippers AFL-CIO Southern’s recently instituted corporate strategy...” “I do not expect the STB will sit by and watch and wait while “If NSC loses the shareholder vote, 80% of respondents said “In our opinion, Ancora’s proposed strategy for Norfolk another service crisis unfolds as we confronted in 2022.” they would shift some freight to CSX and/or truck” Southern is ‘not fit for purpose’ and the election of Ancora’s – Martin J. Oberman proposed directors will derail the safety and service “The vast majority of [respondents] support NSC's strategic plan STB Chairman; SEARS Conference improvements that are currently underway at Norfolk Southern. with 86% choosing this approach over the activist plan” February 29, 2024 We believe that if Ancora wins this proxy contest, Norfolk “91% of respondents believe the activist's plan would result in Southern’s workers, communities, customers, and long-term A letter from STB Chairman Martin J. Oberman to worse service in the next year” shareholders will be left to pick up the tab.” Ancora indicated they declined a meeting “NS has been doing a really nice job of balancing cost and service. “Ancora’s proposed strategy to achieve additional reductions in If the activist moves forward, it will be bad for everyone “In response to your offer [to meet], my office contacted you the Norfolk Southern’s operating ratio without significantly reducing except for a few profiteers.” next day to arrange a meeting. You responded by indicating headcount is, in our view, not based in reality.” that Ancora was not prepared to meet at that time, despite – AFL-CIO your offer. I am disappointed that you have not yet scheduled – Stephens Rail Shipper Survey Letter to Norfolk Southern Shareholders a meeting.” – March 8, 2024 April 4, 2024 April 16, 2024 Source: Wall Street Research. Permission to use quotations neither sought nor obtained. 45