UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSRS

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03451

SEI Daily Income Trust

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant's telephone number, including area code:

610-676-1000

Date of fiscal year end: January 31, 2024

Date of reporting period: July 31, 2023

Item

1. Reports to Stockholders.

July 31, 2023

SEMI-ANNUAL REPORT

SEI Daily Income Trust

|

❯

|

Ultra Short Duration Bond Fund

|

|

❯

|

Short-Duration Government Fund

|

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

TABLE OF CONTENTS

| Schedules of Investments |

1 |

| Statements of Assets and Liabilities |

38 |

| Statements of Operations |

40 |

| Statements of Changes in Net Assets |

42 |

| Financial Highlights |

46 |

| Notes to Financial Statements |

48 |

| Disclosure of Fund Expenses |

61 |

| Liquidity Risk Management Program |

63 |

| Board of Trustees’ Considerations in Approving the Advisory Agreement |

64 |

The Trust files

its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal

year on Form N-PORT for Ultra Short Duration Bond Fund, Short-Duration Government Fund & GNMA Fund. Additionally, for Government

Fund, Government II Fund & Treasury II Fund, the Trust files monthly its complete schedule of portfolio holdings with the Securities

and Exchange Commission on Form N-MFP. The Trust’s Forms N-PORT and N-MFP are available on the Commission’s website at https://www.sec.gov.

Since the Funds

in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they

may be required to vote proxies. Regardless, in light of the possibility that a Fund could hold a security for which a proxy is voted,

the Trust has adopted proxy voting policies. A description of the policies and procedures that the Trust uses to determine how to vote

proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities

during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii)

on the Commission’s website at https://www.sec.gov.

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

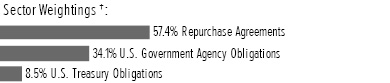

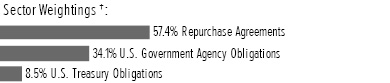

Government Fund

|

†

|

Percentages are based on total investments.

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. GOVERNMENT AGENCY OBLIGATIONS — 32.4% |

FFCB |

|

|

|

|

|

|

|

|

5.360%, U.S. SOFR + 0.050%, 08/22/2023 (A) |

|

$ |

45,640 |

|

|

$ |

45,640 |

|

5.355%, U.S. SOFR + 0.045%, 10/16/2023 (A) |

|

|

56,020 |

|

|

|

56,020 |

|

5.370%, U.S. SOFR + 0.060%, 11/22/2023 (A) |

|

|

58,535 |

|

|

|

58,535 |

|

5.365%, U.S. SOFR + 0.055%, 01/10/2024 (A) |

|

|

9,660 |

|

|

|

9,660 |

|

5.360%, U.S. SOFR + 0.050%, 05/09/2024 (A) |

|

|

59,285 |

|

|

|

59,285 |

|

5.400%, U.S. SOFR + 0.090%, 08/26/2024 (A) |

|

|

77,740 |

|

|

|

77,740 |

|

5.450%, U.S. SOFR + 0.140%, 11/07/2024 (A) |

|

|

51,805 |

|

|

|

51,805 |

|

5.480%, U.S. SOFR + 0.170%, 01/23/2025 (A) |

|

|

16,755 |

|

|

|

16,755 |

|

FFCB DN |

|

|

|

|

|

|

|

|

5.129%, 09/11/2023 (B) |

|

|

21,965 |

|

|

|

21,840 |

|

FHLB |

|

|

|

|

|

|

|

|

5.310%, U.S. SOFR + 0.000%, 08/03/2023 (A) |

|

|

223,300 |

|

|

|

223,300 |

|

5.310%, U.S. SOFR + 0.000%, 08/08/2023 (A) |

|

|

154,600 |

|

|

|

154,600 |

|

5.320%, U.S. SOFR + 0.010%, 08/25/2023 (A) |

|

|

120,290 |

|

|

|

120,290 |

|

5.370%, U.S. SOFR + 0.060%, 09/05/2023 (A) |

|

|

130,085 |

|

|

|

130,085 |

|

5.400%, U.S. SOFR + 0.090%, 09/08/2023 (A) |

|

|

43,035 |

|

|

|

43,035 |

|

5.325%, U.S. SOFR + 0.015%, 09/08/2023 (A) |

|

|

95,200 |

|

|

|

95,200 |

|

5.330%, U.S. SOFR + 0.020%, 09/18/2023 (A) |

|

|

137,885 |

|

|

|

137,885 |

|

5.340%, U.S. SOFR + 0.030%, 09/19/2023 (A) |

|

|

148,465 |

|

|

|

148,465 |

|

5.330%, U.S. SOFR + 0.020%, 09/19/2023 (A) |

|

|

199,900 |

|

|

|

199,900 |

|

3.450%, 09/25/2023 |

|

|

52,460 |

|

|

|

52,458 |

|

5.350%, U.S. SOFR + 0.040%, 09/26/2023 (A) |

|

|

221,900 |

|

|

|

221,900 |

|

5.340%, U.S. SOFR + 0.030%, 09/26/2023 (A) |

|

|

38,800 |

|

|

|

38,800 |

|

5.405%, U.S. SOFR + 0.095%, 10/06/2023 (A) |

|

|

34,365 |

|

|

|

34,365 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

5.380%, U.S. SOFR + 0.070%, 11/30/2023 (A) |

|

$ |

40,145 |

|

|

$ |

40,145 |

|

5.390%, U.S. SOFR + 0.080%, 01/24/2024 (A) |

|

|

140,000 |

|

|

|

140,000 |

|

5.450%, 03/08/2024 |

|

|

27,135 |

|

|

|

27,125 |

|

5.470%, U.S. SOFR + 0.160%, 07/21/2025 (A) |

|

|

70,590 |

|

|

|

70,590 |

|

FHLB DN (B) |

|

|

|

|

|

|

|

|

4.925%, 08/29/2023 |

|

|

26,520 |

|

|

|

26,421 |

|

5.119%, 09/01/2023 |

|

|

111,450 |

|

|

|

110,971 |

|

5.121%, 09/15/2023 |

|

|

170,450 |

|

|

|

169,387 |

|

5.319%, 10/13/2023 |

|

|

75,000 |

|

|

|

74,202 |

|

4.910%, 02/02/2024 |

|

|

28,755 |

|

|

|

28,063 |

|

5.168%, 02/09/2024 |

|

|

120,005 |

|

|

|

116,839 |

|

| |

|

|

|

|

Total U.S. Government Agency Obligations |

|

|

|

|

(Cost $2,801,306) ($ Thousands) |

|

|

2,801,306 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

U.S. TREASURY OBLIGATIONS — 8.1% |

U.S. Treasury Bill (B) |

|

|

|

|

|

|

|

|

5.104%, 08/01/2023 |

|

|

51,870 |

|

|

|

51,870 |

|

5.136%, 08/10/2023 |

|

|

96,300 |

|

|

|

96,177 |

|

5.242%, 08/24/2023 |

|

|

74,600 |

|

|

|

74,352 |

|

5.404%, 01/04/2024 |

|

|

58,990 |

|

|

|

57,646 |

|

5.420%, 01/11/2024 |

|

|

97,455 |

|

|

|

95,127 |

|

4.733%, 04/18/2024 |

|

|

10,825 |

|

|

|

10,469 |

|

U.S. Treasury Notes |

|

|

|

|

|

|

|

|

5.491%, US Treasury 3 Month Bill Money Market Yield + 0.140%, 10/31/2024 (A) |

|

|

68,445 |

|

|

|

68,445 |

|

5.551%, US Treasury 3 Month Bill Money Market Yield + 0.200%, 01/31/2025 (A) |

|

|

90,000 |

|

|

|

90,000 |

|

5.476%, US Treasury 3 Month Bill Money Market Yield + 0.125%, 07/31/2025 (A) |

|

|

156,520 |

|

|

|

156,520 |

|

| |

|

|

|

|

|

|

|

|

Total U.S. Treasury Obligations |

|

|

|

|

(Cost $700,606) ($ Thousands) |

|

|

700,606 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

REPURCHASE AGREEMENTS(C) — 54.5% |

Barclays Bank |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $575,084,653 (collateralized by U.S. Treasury Obligations, ranging in par value $51,457,700 - $477,979,000, 0.050% - 4.000%, 04/30/2027 - 11/15/2052, with a total market value of $586,500,012) |

|

|

575,000 |

|

|

|

575,000 |

|

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

Government Fund (Concluded)

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

REPURCHASE AGREEMENTS(C) (continued) |

BNP Paribas |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $650,095,333 (collateralized by U.S. Obligations, ranging in par value $5 - $662,822,600, 0.000% - 4.000%, 07/31/2030 - 02/15/2048, with a total market value of $663,000,040) |

|

$ |

650,000 |

|

|

$ |

650,000 |

|

BOFA Securities |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $600,088,333 (collateralized by GNMA Obligations, ranging in par value $16,802,446 - $1,010,000,000, 3.000% - 6.500%, 06/20/2046 - 07/20/2053, with a total market value of $612,000,001) |

|

|

600,000 |

|

|

|

600,000 |

|

Citigroup Global Markets |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $550,080,667 (collateralized by U.S. Treasury Obligations, ranging in par value $98,816,400 - $254,100,700, 1.125% - 4.000%, 10/31/2026 - 05/31/2030, with a total market value of $561,000,009) |

|

|

550,000 |

|

|

|

550,000 |

|

Citigroup Global Markets |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $105,015,458 (collateralized by GNMA Obligations, ranging in par value $1,000 - $20,645,661, 5.500% - 6.500%, 07/20/2053, with a total market value of $107,100,278) |

|

|

105,000 |

|

|

|

105,000 |

|

Goldman Sachs |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $415,061,097 (collateralized by GNMA Obligations, ranging in par value $383,522 - $253,392,384, 3.500% - 6.000%, 04/15/2036 - 05/20/2053, with a total market value of $423,300,000) |

|

|

415,000 |

|

|

|

415,000 |

|

Goldman Sachs |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $100,014,667 (collateralized by U.S. Treasury Obligations, ranging in par value $0 - $112,765,400, 0.000% - 0.250%, 10/31/2025 - 02/15/2053, with a total market value of $102,000,000) |

|

|

100,000 |

|

|

|

100,000 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

REPURCHASE AGREEMENTS(C) (continued) |

J.P. Morgan Securities |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $114,016,720 (collateralized by U.S. Treasury Obligations, ranging in par value $300,000 - $59,303,100, 0.000% - 1.500%, 08/15/2023 - 01/31/2027, with a total market value of $116,280,030) |

|

$ |

114,000 |

|

|

$ |

114,000 |

|

Mizuho Securities |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $275,040,486 (collateralized by FNMA, ranging in par value $1,000 - $172,739,656, 1.500% - 8.000%, 05/01/2024 - 08/01/2053, with a total market value of $283,250,000) |

|

|

275,000 |

|

|

|

275,000 |

|

MUFG Securities Americas |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $200,029,333 (collateralized by U.S. Treasury Obligations, ranging in par value $24,999,300 - $152,643,100, 0.375% - 1.000%, 07/15/2025 - 07/31/2028, with a total market value of $204,000,031) |

|

|

200,000 |

|

|

|

200,000 |

|

Natixis S.A. |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $650,095,333 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $190,013,200, 0.000% - 6.625%, 10/12/2023 - 02/15/2053, with a total market value of $663,000,011) |

|

|

650,000 |

|

|

|

650,000 |

|

TD Securities |

|

|

|

|

|

|

|

|

5.300%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $25,003,681 (collateralized by U.S. Treasury Obligations, ranging in par value $2,052,100 - $10,161,600, 0.250% - 3.375%, 05/15/2024 - 05/15/2033, with a total market value of $25,500,004) |

|

|

25,000 |

|

|

|

25,000 |

|

TD Securities |

|

|

|

|

|

|

|

|

5.290%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $10,001,469 (collateralized by U.S. Treasury Obligations, ranging in par value $536,400 - $2,288,200, 0.375% - 3.875%, 04/15/2024 - 11/30/2029, with a total market value of $10,200,002) |

|

|

10,000 |

|

|

|

10,000 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

REPURCHASE AGREEMENTS(C) (continued) |

The Bank of Nova Scotia |

|

|

|

|

|

|

|

|

5.280%, dated 07/31/23, to be repurchased on 08/01/23, repurchase price $450,066,000 (collateralized by U.S. Treasury Obligations, ranging in par value $100 - $199,000,000, 0.000% - 4.250%, 09/12/2023 - 08/15/2042, with a total market value of $459,067,360) |

|

$ |

450,000 |

|

|

$ |

450,000 |

|

Total Repurchase Agreements |

|

|

|

|

|

|

|

|

(Cost $4,719,000) ($ Thousands) |

|

|

|

|

|

|

4,719,000 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total Investments — 95.0% |

|

|

|

|

|

|

|

|

(Cost $8,220,912) ($ Thousands) |

|

$ |

8,220,912 |

|

| |

|

|

|

|

|

|

|

|

|

Percentages are based on a Net Assets of $8,650,550 ($ Thousands). |

(A) |

Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are

either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

(B) |

The rate reported is the effective yield at time of purchase. |

(C) |

Tri-Party Repurchase Agreement. |

As of July 31, 2023, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

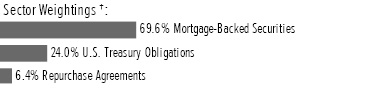

Government II Fund

|

†

|

Percentages are based on total investments.

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. TREASURY OBLIGATIONS — 64.0% |

U.S. Treasury Bill (A) |

|

|

|

|

|

|

|

|

5.096%, 08/01/2023 |

|

$ |

116,350 |

|

|

$ |

116,350 |

|

5.096%, 08/03/2023 |

|

|

113,000 |

|

|

|

112,968 |

|

5.170%, 08/08/2023 |

|

|

62,000 |

|

|

|

61,938 |

|

5.153%, 08/10/2023 |

|

|

30,000 |

|

|

|

29,962 |

|

5.279%, 08/22/2023 |

|

|

102,000 |

|

|

|

101,687 |

|

5.317%, 08/24/2023 |

|

|

88,005 |

|

|

|

87,710 |

|

1.933%, 08/29/2023 |

|

|

135,000 |

|

|

|

134,450 |

|

5.272%, 08/31/2023 |

|

|

84,000 |

|

|

|

83,633 |

|

5.136%, 09/12/2023 |

|

|

95,000 |

|

|

|

94,439 |

|

5.286%, 10/05/2023 |

|

|

30,000 |

|

|

|

29,717 |

|

5.321%, 10/12/2023 |

|

|

65,000 |

|

|

|

64,317 |

|

5.239%, 10/17/2023 |

|

|

36,580 |

|

|

|

36,177 |

|

5.302%, 10/24/2023 |

|

|

45,000 |

|

|

|

44,453 |

|

5.343%, 10/26/2023 |

|

|

79,905 |

|

|

|

78,899 |

|

5.353%, 11/14/2023 |

|

|

50,000 |

|

|

|

49,233 |

|

5.404%, 01/04/2024 |

|

|

13,395 |

|

|

|

13,090 |

|

5.420%, 01/11/2024 |

|

|

22,160 |

|

|

|

21,631 |

|

5.189%, 06/13/2024 |

|

|

6,560 |

|

|

|

6,275 |

|

U.S. Treasury Notes |

|

|

|

|

|

|

|

|

5.336%, US Treasury 3 Month Bill Money Market Yield + -0.015%, 01/31/2024 (B) |

|

|

955 |

|

|

|

955 |

|

5.388%, US Treasury 3 Month Bill Money Market Yield + 0.037%, 07/31/2024 (B) |

|

|

8,000 |

|

|

|

7,996 |

|

5.491%, US Treasury 3 Month Bill Money Market Yield + 0.140%, 10/31/2024 (B) |

|

|

41,095 |

|

|

|

41,108 |

|

| |

|

|

|

|

|

|

|

|

Total U.S. Treasury Obligations |

|

|

|

|

(Cost $1,216,988) ($ Thousands) |

|

|

1,216,988 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

U.S. GOVERNMENT AGENCY OBLIGATIONS — 40.6% |

FFCB |

|

|

|

|

|

|

|

|

5.360%, U.S. SOFR + 0.050%, 08/22/2023 (B) |

|

|

16,340 |

|

|

|

16,340 |

|

5.355%, U.S. SOFR + 0.045%, 10/16/2023 (B) |

|

|

18,800 |

|

|

|

18,800 |

|

5.330%, U.S. SOFR + 0.020%, 11/15/2023 (B) |

|

|

7,790 |

|

|

|

7,789 |

|

5.370%, U.S. SOFR + 0.060%, 11/22/2023 (B) |

|

|

20,740 |

|

|

|

20,740 |

|

5.365%, U.S. SOFR + 0.055%, 01/10/2024 (B) |

|

|

3,165 |

|

|

|

3,165 |

|

5.360%, U.S. SOFR + 0.050%, 05/09/2024 (B) |

|

|

11,010 |

|

|

|

11,010 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

5.400%, U.S. SOFR + 0.090%, 08/26/2024 (B) |

|

$ |

18,510 |

|

|

$ |

18,510 |

|

5.450%, U.S. SOFR + 0.140%, 11/07/2024 (B) |

|

|

11,180 |

|

|

|

11,180 |

|

5.480%, U.S. SOFR + 0.170%, 01/23/2025 (B) |

|

|

3,245 |

|

|

|

3,245 |

|

FFCB DN (A) |

|

|

|

|

|

|

|

|

4.997%, 08/14/2023 |

|

|

21,680 |

|

|

|

21,642 |

|

5.129%, 09/11/2023 |

|

|

4,400 |

|

|

|

4,375 |

|

FHLB |

|

|

|

|

|

|

|

|

5.370%, U.S. SOFR + 0.060%, 09/05/2023 (B) |

|

|

27,075 |

|

|

|

27,075 |

|

5.400%, U.S. SOFR + 0.090%, 09/08/2023 (B) |

|

|

11,665 |

|

|

|

11,665 |

|

5.330%, U.S. SOFR + 0.020%, 09/18/2023 (B) |

|

|

29,675 |

|

|

|

29,675 |

|

3.450%, 09/25/2023 |

|

|

12,585 |

|

|

|

12,584 |

|

5.405%, U.S. SOFR + 0.095%, 10/06/2023 (B) |

|

|

6,885 |

|

|

|

6,885 |

|

5.380%, U.S. SOFR + 0.070%, 11/30/2023 (B) |

|

|

8,460 |

|

|

|

8,460 |

|

5.390%, U.S. SOFR + 0.080%, 01/24/2024 (B) |

|

|

13,450 |

|

|

|

13,450 |

|

5.470%, U.S. SOFR + 0.160%, 07/21/2025 (B) |

|

|

15,440 |

|

|

|

15,440 |

|

FHLB DN (A) |

|

|

|

|

|

|

|

|

5.201%, 08/01/2023 |

|

|

263,500 |

|

|

|

263,500 |

|

5.043%, 08/04/2023 |

|

|

4,500 |

|

|

|

4,498 |

|

4.982%, 08/18/2023 |

|

|

14,500 |

|

|

|

14,467 |

|

4.925%, 08/29/2023 |

|

|

5,370 |

|

|

|

5,350 |

|

5.117%, 09/01/2023 |

|

|

25,170 |

|

|

|

25,062 |

|

5.277%, 09/06/2023 |

|

|

21,385 |

|

|

|

21,275 |

|

5.121%, 09/15/2023 |

|

|

34,135 |

|

|

|

33,922 |

|

5.317%, 09/26/2023 |

|

|

50,000 |

|

|

|

49,590 |

|

5.319%, 10/13/2023 |

|

|

50,000 |

|

|

|

49,468 |

|

5.341%, 10/25/2023 |

|

|

12,000 |

|

|

|

11,851 |

|

4.910%, 02/02/2024 |

|

|

6,125 |

|

|

|

5,978 |

|

5.177%, 02/09/2024 |

|

|

26,340 |

|

|

|

25,643 |

|

| |

|

|

|

|

Total U.S. Government Agency Obligations |

|

|

|

|

(Cost $772,634) ($ Thousands) |

|

|

772,634 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total Investments — 104.6% |

|

|

|

|

|

|

|

|

(Cost $1,989,622) ($ Thousands) |

|

$ |

1,989,622 |

|

| |

|

|

|

|

|

|

|

|

|

Percentages are based on a Net Assets of $1,902,612 ($ Thousands). |

(A) |

The rate reported is the effective yield at time of purchase. |

(B) |

Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are

either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

As of July 31, 2023, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

Treasury II Fund

|

†

|

Percentages are based on total investments.

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. TREASURY OBLIGATIONS — 105.0% |

U.S. Treasury Bill (A) |

|

|

|

|

|

|

|

|

5.105%, 08/01/2023 |

|

$ |

24,000 |

|

|

$ |

24,000 |

|

5.174%, 08/03/2023 |

|

|

4,000 |

|

|

|

3,999 |

|

5.176%, 08/08/2023 |

|

|

42,415 |

|

|

|

42,372 |

|

5.152%, 08/10/2023 |

|

|

7,000 |

|

|

|

6,991 |

|

5.154%, 08/17/2023 |

|

|

59,585 |

|

|

|

59,450 |

|

5.216%, 08/22/2023 |

|

|

58,000 |

|

|

|

57,825 |

|

5.321%, 08/24/2023 |

|

|

18,000 |

|

|

|

17,939 |

|

2.300%, 08/29/2023 |

|

|

45,400 |

|

|

|

45,215 |

|

5.272%, 08/31/2023 |

|

|

15,000 |

|

|

|

14,934 |

|

5.149%, 09/12/2023 |

|

|

35,000 |

|

|

|

34,793 |

|

5.286%, 10/05/2023 |

|

|

15,000 |

|

|

|

14,859 |

|

5.321%, 10/12/2023 |

|

|

10,000 |

|

|

|

9,895 |

|

5.239%, 10/17/2023 |

|

|

8,535 |

|

|

|

8,441 |

|

5.308%, 10/24/2023 |

|

|

23,195 |

|

|

|

22,913 |

|

5.343%, 10/26/2023 |

|

|

20,095 |

|

|

|

19,842 |

|

5.353%, 11/14/2023 |

|

|

12,000 |

|

|

|

11,816 |

|

5.404%, 01/04/2024 |

|

|

3,165 |

|

|

|

3,093 |

|

5.420%, 01/11/2024 |

|

|

5,385 |

|

|

|

5,256 |

|

4.734%, 04/18/2024 |

|

|

555 |

|

|

|

537 |

|

5.189%, 06/13/2024 |

|

|

1,550 |

|

|

|

1,483 |

|

U.S. Treasury Bill - When Issued |

|

|

|

|

|

|

|

|

5.116%, 09/05/2023 |

|

|

55,000 |

|

|

|

54,730 |

|

U.S. Treasury Notes |

|

|

|

|

|

|

|

|

5.336%, US Treasury 3 Month Bill Money Market Yield + -0.015%, 01/31/2024 (B) |

|

|

5,000 |

|

|

|

5,000 |

|

5.276%, US Treasury 3 Month Bill Money Market Yield + -0.075%, 04/30/2024 (B) |

|

|

5,890 |

|

|

|

5,887 |

|

5.388%, US Treasury 3 Month Bill Money Market Yield + 0.037%, 07/31/2024 (B) |

|

|

3,000 |

|

|

|

2,999 |

|

5.491%, US Treasury 3 Month Bill Money Market Yield + 0.140%, 10/31/2024 (B) |

|

|

21,780 |

|

|

|

21,773 |

|

5.551%, US Treasury 3 Month Bill Money Market Yield + 0.200%, 01/31/2025 (B) |

|

|

14,375 |

|

|

|

14,379 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

U.S. TREASURY OBLIGATIONS (continued) |

5.520%, US Treasury 3 Month Bill Money Market Yield + 0.169%, 04/30/2025 (B) |

|

$ |

7,000 |

|

|

$ |

7,000 |

|

| |

|

|

|

|

|

|

|

|

Total U.S. Treasury Obligations |

|

|

|

|

(Cost $517,421) ($ Thousands) |

|

|

517,421 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Total Investments — 105.0% |

|

|

|

|

|

|

|

|

(Cost $517,421) ($ Thousands) |

|

$ |

517,421 |

|

| |

|

|

|

|

|

|

|

|

|

Percentages are based on a Net Assets of $492,911 ($ Thousands). |

(A) |

The rate reported is the effective yield at time of purchase. |

(B) |

Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are

either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

As of July 31, 2023, all of the Fund's investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP. |

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

Ultra Short Duration Bond Fund

|

†

|

Percentages are based on total investments. Total investments exclude options, futures contracts, forward contracts, and swap contracts, if applicable.

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS — 38.1% |

Communication Services — 1.4% |

|

|

|

|

AT&T |

|

|

|

|

|

|

|

|

5.539%, 02/20/2026 |

|

$ |

300 |

|

|

$ |

299 |

|

Take-Two Interactive Software |

|

|

|

|

|

|

|

|

3.300%, 03/28/2024 |

|

|

21 |

|

|

|

21 |

|

Verizon Communications |

|

|

|

|

|

|

|

|

6.023%, SOFRINDX + 0.790%, 03/20/2026 (A) |

|

|

500 |

|

|

|

505 |

|

5.742%, SOFRINDX + 0.500%, 03/22/2024 (A) |

|

|

500 |

|

|

|

500 |

|

3.500%, 11/01/2024 |

|

|

1,680 |

|

|

|

1,640 |

|

Warnermedia Holdings |

|

|

|

|

|

|

|

|

3.428%, 03/15/2024 |

|

|

750 |

|

|

|

738 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

3,703 |

|

| |

|

|

|

|

|

|

|

|

Consumer Discretionary — 2.3% |

|

|

|

|

AutoZone |

|

|

|

|

|

|

|

|

5.050%, 07/15/2026 |

|

|

450 |

|

|

|

449 |

|

Daimler Truck Finance North America LLC |

|

|

|

|

|

|

|

|

6.274%, U.S. SOFR + 1.000%, 04/05/2024 (A)(B) |

|

|

450 |

|

|

|

451 |

|

5.972%, U.S. SOFR + 0.750%, 12/13/2024 (A)(B) |

|

|

600 |

|

|

|

599 |

|

General Motors Financial |

|

|

|

|

|

|

|

|

5.962%, U.S. SOFR + 0.760%, 03/08/2024 (A) |

|

|

500 |

|

|

|

500 |

|

5.925%, U.S. SOFR + 0.620%, 10/15/2024 (A) |

|

|

2,895 |

|

|

|

2,879 |

|

Howard University |

|

|

|

|

|

|

|

|

2.801%, 10/01/2023 |

|

|

380 |

|

|

|

378 |

|

Hyatt Hotels |

|

|

|

|

|

|

|

|

1.300%, 10/01/2023 |

|

|

175 |

|

|

|

173 |

|

Nordstrom |

|

|

|

|

|

|

|

|

2.300%, 04/08/2024 |

|

|

210 |

|

|

|

203 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

Starbucks |

|

|

|

|

|

|

|

|

5.547%, SOFRINDX + 0.420%, 02/14/2024 (A) |

|

$ |

345 |

|

|

$ |

345 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

5,977 |

|

| |

|

|

|

|

|

|

|

|

Consumer Staples — 2.2% |

|

|

|

|

BAT Capital |

|

|

|

|

|

|

|

|

3.222%, 08/15/2024 |

|

|

2,080 |

|

|

|

2,024 |

|

Conagra Brands |

|

|

|

|

|

|

|

|

0.500%, 08/11/2023 |

|

|

325 |

|

|

|

325 |

|

General Mills |

|

|

|

|

|

|

|

|

5.241%, 11/18/2025 |

|

|

320 |

|

|

|

319 |

|

JDE Peet's |

|

|

|

|

|

|

|

|

0.800%, 09/24/2024 (B) |

|

|

500 |

|

|

|

469 |

|

Kenvue |

|

|

|

|

|

|

|

|

5.500%, 03/22/2025 (B) |

|

|

275 |

|

|

|

276 |

|

Keurig Dr Pepper |

|

|

|

|

|

|

|

|

0.750%, 03/15/2024 |

|

|

2,010 |

|

|

|

1,949 |

|

Mondelez International |

|

|

|

|

|

|

|

|

2.125%, 03/17/2024 |

|

|

290 |

|

|

|

283 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

5,645 |

|

| |

|

|

|

|

|

|

|

|

Energy — 3.3% |

|

|

|

|

Enbridge |

|

|

|

|

|

|

|

|

5.768%, SOFRINDX + 0.630%, 02/16/2024 (A) |

|

|

775 |

|

|

|

775 |

|

Energy Transfer |

|

|

|

|

|

|

|

|

5.875%, 01/15/2024 |

|

|

1,370 |

|

|

|

1,369 |

|

Gray Oak Pipeline LLC |

|

|

|

|

|

|

|

|

2.000%, 09/15/2023 (B) |

|

|

212 |

|

|

|

211 |

|

Kinder Morgan Energy Partners |

|

|

|

|

|

|

|

|

4.300%, 05/01/2024 |

|

|

1,350 |

|

|

|

1,334 |

|

Occidental Petroleum |

|

|

|

|

|

|

|

|

5.875%, 09/01/2025 |

|

|

375 |

|

|

|

376 |

|

Ovintiv |

|

|

|

|

|

|

|

|

5.650%, 05/15/2025 |

|

|

400 |

|

|

|

399 |

|

Saudi Arabian Oil |

|

|

|

|

|

|

|

|

1.250%, 11/24/2023 (B) |

|

|

200 |

|

|

|

197 |

|

Saudi Arabian Oil MTN |

|

|

|

|

|

|

|

|

2.875%, 04/16/2024 (B) |

|

|

1,230 |

|

|

|

1,202 |

|

Southern Union |

|

|

|

|

|

|

|

|

7.600%, 02/01/2024 |

|

|

700 |

|

|

|

701 |

|

Western Midstream Operating |

|

|

|

|

|

|

|

|

3.100%, 02/01/2025 |

|

|

400 |

|

|

|

382 |

|

Williams |

|

|

|

|

|

|

|

|

5.400%, 03/02/2026 |

|

|

110 |

|

|

|

110 |

|

4.300%, 03/04/2024 |

|

|

1,365 |

|

|

|

1,352 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

8,408 |

|

| |

|

|

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

Ultra Short Duration Bond Fund (Continued)

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

Financials — 18.6% |

|

|

|

|

American Express |

|

|

|

|

|

|

|

|

4.990%, U.S. SOFR + 0.999%, 05/01/2026 (A) |

|

$ |

275 |

|

|

$ |

272 |

|

3.950%, 08/01/2025 |

|

|

325 |

|

|

|

316 |

|

3.375%, 05/03/2024 |

|

|

350 |

|

|

|

344 |

|

Athene Global Funding |

|

|

|

|

|

|

|

|

5.862%, SOFRINDX + 0.700%, 05/24/2024 (A)(B) |

|

|

825 |

|

|

|

817 |

|

Banco Santander |

|

|

|

|

|

|

|

|

3.892%, 05/24/2024 |

|

|

400 |

|

|

|

393 |

|

Bank of America |

|

|

|

|

|

|

|

|

6.026%, U.S. SOFR + 0.690%, 04/22/2025 (A) |

|

|

650 |

|

|

|

649 |

|

5.080%, U.S. SOFR + 1.290%, 01/20/2027 (A) |

|

|

275 |

|

|

|

272 |

|

Bank of America MTN |

|

|

|

|

|

|

|

|

6.006%, U.S. SOFR + 0.660%, 02/04/2025 (A) |

|

|

510 |

|

|

|

509 |

|

1.843%, U.S. SOFR + 0.670%, 02/04/2025 (A) |

|

|

1,830 |

|

|

|

1,793 |

|

Bank of Montreal |

|

|

|

|

|

|

|

|

5.552%, SOFRINDX + 0.350%, 12/08/2023 (A) |

|

|

600 |

|

|

|

600 |

|

Bank of Montreal MTN |

|

|

|

|

|

|

|

|

5.842%, SOFRINDX + 0.620%, 09/15/2026 (A) |

|

|

675 |

|

|

|

666 |

|

5.605%, SOFRINDX + 0.320%, 07/09/2024 (A) |

|

|

325 |

|

|

|

324 |

|

Bank of New York Mellon MTN |

|

|

|

|

|

|

|

|

5.148%, U.S. SOFR + 1.067%, 05/22/2026 (A) |

|

|

250 |

|

|

|

249 |

|

Bank of Nova Scotia |

|

|

|

|

|

|

|

|

5.725%, U.S. SOFR + 0.380%, 07/31/2024 (A) |

|

|

650 |

|

|

|

648 |

|

Banque Federative du Credit Mutuel |

|

|

|

|

|

|

|

|

4.935%, 01/26/2026 (B) |

|

|

350 |

|

|

|

343 |

|

4.524%, 07/13/2025 (B) |

|

|

250 |

|

|

|

244 |

|

Barclays PLC |

|

|

|

|

|

|

|

|

2.852%, U.S. SOFR + 2.714%, 05/07/2026 (A) |

|

|

235 |

|

|

|

222 |

|

BPCE |

|

|

|

|

|

|

|

|

5.029%, 01/15/2025 (B) |

|

|

345 |

|

|

|

340 |

|

Brighthouse Financial Global Funding MTN |

|

|

|

|

|

|

|

|

6.057%, U.S. SOFR + 0.760%, 04/12/2024 (A)(B) |

|

|

445 |

|

|

|

442 |

|

Canadian Imperial Bank of Commerce |

|

|

|

|

|

|

|

|

5.620%, SOFRINDX + 0.400%, 12/14/2023 (A) |

|

|

575 |

|

|

|

575 |

|

Capital One Financial |

|

|

|

|

|

|

|

|

5.892%, U.S. SOFR + 0.690%, 12/06/2024 (A) |

|

|

425 |

|

|

|

419 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

4.985%, U.S. SOFR + 2.160%, 07/24/2026 (A) |

|

$ |

250 |

|

|

$ |

245 |

|

Citigroup |

|

|

|

|

|

|

|

|

6.023%, U.S. SOFR + 0.694%, 01/25/2026 (A) |

|

|

350 |

|

|

|

349 |

|

6.014%, U.S. SOFR + 0.669%, 05/01/2025 (A) |

|

|

250 |

|

|

|

250 |

|

3.352%, TSFR3M + 1.158%, 04/24/2025 (A) |

|

|

1,695 |

|

|

|

1,661 |

|

Citizens Bank |

|

|

|

|

|

|

|

|

5.284%, U.S. SOFR + 1.020%, 01/26/2026 (A) |

|

|

250 |

|

|

|

238 |

|

4.119%, U.S. SOFR + 1.395%, 05/23/2025 (A) |

|

|

250 |

|

|

|

241 |

|

CNA Financial |

|

|

|

|

|

|

|

|

7.250%, 11/15/2023 |

|

|

200 |

|

|

|

201 |

|

Commonwealth Bank of Australia |

|

|

|

|

|

|

|

|

5.742%, U.S. SOFR + 0.520%, 06/15/2026 (A)(B) |

|

|

425 |

|

|

|

422 |

|

Cooperatieve Rabobank UA |

|

|

|

|

|

|

|

|

5.500%, 07/18/2025 |

|

|

250 |

|

|

|

250 |

|

Corebridge Financial |

|

|

|

|

|

|

|

|

3.500%, 04/04/2025 |

|

|

230 |

|

|

|

221 |

|

Corebridge Global Funding |

|

|

|

|

|

|

|

|

5.750%, 07/02/2026 (B) |

|

|

180 |

|

|

|

180 |

|

Credit Agricole |

|

|

|

|

|

|

|

|

5.589%, 07/05/2026 (B) |

|

|

420 |

|

|

|

420 |

|

Credit Suisse NY |

|

|

|

|

|

|

|

|

5.735%, SOFRINDX + 0.390%, 02/02/2024 (A) |

|

|

2,280 |

|

|

|

2,272 |

|

4.750%, 08/09/2024 |

|

|

250 |

|

|

|

246 |

|

0.520%, 08/09/2023 |

|

|

650 |

|

|

|

649 |

|

Danske Bank |

|

|

|

|

|

|

|

|

6.466%, H15T1Y + 2.100%, 01/09/2026 (A)(B) |

|

|

350 |

|

|

|

351 |

|

Deutsche Bank NY |

|

|

|

|

|

|

|

|

6.357%, U.S. SOFR + 1.219%, 11/16/2027 (A) |

|

|

550 |

|

|

|

507 |

|

5.611%, U.S. SOFR + 0.500%, 11/08/2023 (A) |

|

|

600 |

|

|

|

599 |

|

DNB Bank |

|

|

|

|

|

|

|

|

2.968%, SOFRINDX + 0.810%, 03/28/2025 (A)(B) |

|

|

275 |

|

|

|

269 |

|

Equitable Financial Life Global Funding |

|

|

|

|

|

|

|

|

5.500%, 12/02/2025 (B) |

|

|

300 |

|

|

|

297 |

|

Fifth Third Bank |

|

|

|

|

|

|

|

|

5.852%, SOFRINDX + 1.230%, 10/27/2025 (A) |

|

|

470 |

|

|

|

463 |

|

GA Global Funding Trust |

|

|

|

|

|

|

|

|

5.715%, U.S. SOFR + 0.500%, 09/13/2024 (A)(B) |

|

|

1,745 |

|

|

|

1,713 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

Goldman Sachs Group |

|

|

|

|

|

|

|

|

6.025%, U.S. SOFR + 0.700%, 01/24/2025 (A) |

|

$ |

425 |

|

|

$ |

424 |

|

5.706%, U.S. SOFR + 0.500%, 09/10/2024 (A) |

|

|

250 |

|

|

|

249 |

|

1.757%, U.S. SOFR + 0.730%, 01/24/2025 (A) |

|

|

2,200 |

|

|

|

2,151 |

|

HSBC Holdings PLC |

|

|

|

|

|

|

|

|

7.336%, U.S. SOFR + 3.030%, 11/03/2026 (A) |

|

|

300 |

|

|

|

310 |

|

5.727%, U.S. SOFR + 0.580%, 11/22/2024 (A) |

|

|

425 |

|

|

|

424 |

|

Huntington National Bank |

|

|

|

|

|

|

|

|

4.008%, U.S. SOFR + 1.205%, 05/16/2025 (A) |

|

|

250 |

|

|

|

243 |

|

Jackson Financial |

|

|

|

|

|

|

|

|

1.125%, 11/22/2023 |

|

|

425 |

|

|

|

419 |

|

JPMorgan Chase |

|

|

|

|

|

|

|

|

5.825%, U.S. SOFR + 0.580%, 06/23/2025 (A) |

|

|

325 |

|

|

|

324 |

|

5.719%, U.S. SOFR + 0.535%, 06/01/2025 (A) |

|

|

400 |

|

|

|

398 |

|

3.845%, U.S. SOFR + 0.980%, 06/14/2025 (A) |

|

|

2,090 |

|

|

|

2,051 |

|

KeyBank |

|

|

|

|

|

|

|

|

5.608%, SOFRINDX + 0.340%, 01/03/2024 (A) |

|

|

575 |

|

|

|

574 |

|

5.540%, SOFRINDX + 0.320%, 06/14/2024 (A) |

|

|

400 |

|

|

|

391 |

|

Macquarie Group MTN |

|

|

|

|

|

|

|

|

6.013%, U.S. SOFR + 0.710%, 10/14/2025 (A)(B) |

|

|

425 |

|

|

|

422 |

|

Manufacturers & Traders Trust |

|

|

|

|

|

|

|

|

5.400%, 11/21/2025 |

|

|

300 |

|

|

|

294 |

|

4.650%, 01/27/2026 |

|

|

460 |

|

|

|

443 |

|

MassMutual Global Funding II |

|

|

|

|

|

|

|

|

5.657%, U.S. SOFR + 0.360%, 04/12/2024 (A)(B) |

|

|

400 |

|

|

|

400 |

|

2.750%, 06/22/2024 (B) |

|

|

705 |

|

|

|

687 |

|

Mitsubishi UFJ Financial Group |

|

|

|

|

|

|

|

|

4.788%, H15T1Y + 1.700%, 07/18/2025 (A) |

|

|

325 |

|

|

|

321 |

|

Morgan Stanley |

|

|

|

|

|

|

|

|

5.050%, U.S. SOFR + 1.295%, 01/28/2027 (A) |

|

|

275 |

|

|

|

272 |

|

3.620%, U.S. SOFR + 1.160%, 04/17/2025 (A) |

|

|

2,130 |

|

|

|

2,095 |

|

Morgan Stanley Bank |

|

|

|

|

|

|

|

|

5.479%, 07/16/2025 |

|

|

375 |

|

|

|

376 |

|

4.754%, 04/21/2026 |

|

|

250 |

|

|

|

247 |

|

National Bank of Canada |

|

|

|

|

|

|

|

|

0.750%, 08/06/2024 |

|

|

325 |

|

|

|

309 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

National Securities Clearing |

|

|

|

|

|

|

|

|

5.150%, 05/30/2025 (B) |

|

$ |

250 |

|

|

$ |

250 |

|

Nationwide Building Society |

|

|

|

|

|

|

|

|

0.550%, 01/22/2024 (B) |

|

|

400 |

|

|

|

390 |

|

NatWest Markets PLC |

|

|

|

|

|

|

|

|

5.657%, U.S. SOFR + 0.530%, 08/12/2024 (A)(B) |

|

|

490 |

|

|

|

488 |

|

Pacific Life Global Funding II |

|

|

|

|

|

|

|

|

0.500%, 09/23/2023 (B) |

|

|

400 |

|

|

|

397 |

|

PNC Financial Services Group |

|

|

|

|

|

|

|

|

5.812%, U.S. SOFR + 1.322%, 06/12/2026 (A) |

|

|

200 |

|

|

|

200 |

|

5.671%, SOFRINDX + 1.090%, 10/28/2025 (A) |

|

|

425 |

|

|

|

423 |

|

Principal Life Global Funding II |

|

|

|

|

|

|

|

|

5.747%, U.S. SOFR + 0.450%, 04/12/2024 (A)(B) |

|

|

170 |

|

|

|

170 |

|

5.538%, U.S. SOFR + 0.380%, 08/23/2024 (A)(B) |

|

|

665 |

|

|

|

664 |

|

Royal Bank of Canada MTN |

|

|

|

|

|

|

|

|

5.787%, SOFRINDX + 0.450%, 10/26/2023 (A) |

|

|

400 |

|

|

|

400 |

|

5.200%, 07/20/2026 |

|

|

250 |

|

|

|

250 |

|

Societe Generale |

|

|

|

|

|

|

|

|

6.373%, U.S. SOFR + 1.050%, 01/21/2026 (A)(B) |

|

|

425 |

|

|

|

424 |

|

4.351%, 06/13/2025 (B) |

|

|

500 |

|

|

|

486 |

|

Standard Chartered PLC |

|

|

|

|

|

|

|

|

7.776%, H15T1Y + 3.100%, 11/16/2025 (A)(B) |

|

|

300 |

|

|

|

307 |

|

6.170%, H15T1Y + 2.050%, 01/09/2027 (A)(B) |

|

|

350 |

|

|

|

353 |

|

Sumitomo Mitsui Trust Bank MTN |

|

|

|

|

|

|

|

|

5.660%, U.S. SOFR + 0.440%, 09/16/2024 (A)(B) |

|

|

500 |

|

|

|

499 |

|

Toronto-Dominion Bank MTN |

|

|

|

|

|

|

|

|

5.796%, U.S. SOFR + 0.590%, 09/10/2026 (A) |

|

|

425 |

|

|

|

420 |

|

5.556%, U.S. SOFR + 0.350%, 09/10/2024 (A) |

|

|

500 |

|

|

|

498 |

|

5.542%, U.S. SOFR + 0.355%, 03/04/2024 (A) |

|

|

575 |

|

|

|

574 |

|

Truist Financial MTN |

|

|

|

|

|

|

|

|

5.605%, U.S. SOFR + 0.400%, 06/09/2025 (A) |

|

|

400 |

|

|

|

391 |

|

UBS |

|

|

|

|

|

|

|

|

0.700%, 08/09/2024 (B) |

|

|

400 |

|

|

|

380 |

|

UBS MTN |

|

|

|

|

|

|

|

|

5.479%, U.S. SOFR + 0.360%, 02/09/2024 (A)(B) |

|

|

400 |

|

|

|

399 |

|

US Bank |

|

|

|

|

|

|

|

|

2.050%, 01/21/2025 |

|

|

1,495 |

|

|

|

1,418 |

|

SCHEDULE OF INVESTMENTS

July 31, 2023 (Unaudited)

Ultra Short Duration Bond Fund (Continued)

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

Wells Fargo MTN |

|

|

|

|

|

|

|

|

2.406%, TSFR3M + 1.087%, 10/30/2025 (A) |

|

$ |

2,085 |

|

|

$ |

1,995 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

48,081 |

|

| |

|

|

|

|

|

|

|

|

Health Care — 3.7% |

|

|

|

|

AbbVie |

|

|

|

|

|

|

|

|

2.600%, 11/21/2024 |

|

|

1,735 |

|

|

|

1,670 |

|

Amgen |

|

|

|

|

|

|

|

|

5.250%, 03/02/2025 |

|

|

275 |

|

|

|

274 |

|

Baxter International |

|

|

|

|

|

|

|

|

5.610%, SOFRINDX + 0.440%, 11/29/2024 (A) |

|

|

425 |

|

|

|

422 |

|

Bristol-Myers Squibb |

|

|

|

|

|

|

|

|

0.537%, 11/13/2023 |

|

|

425 |

|

|

|

419 |

|

Cigna Group |

|

|

|

|

|

|

|

|

0.613%, 03/15/2024 |

|

|

190 |

|

|

|

184 |

|

CVS Health |

|

|

|

|

|

|

|

|

5.000%, 02/20/2026 |

|

|

275 |

|

|

|

274 |

|

GE HealthCare Technologies |

|

|

|

|

|

|

|

|

5.550%, 11/15/2024 |

|

|

375 |

|

|

|

375 |

|

Haleon US Capital LLC |

|

|

|

|

|

|

|

|

3.024%, 03/24/2024 |

|

|

420 |

|

|

|

413 |

|

Humana |

|

|

|

|

|

|

|

|

5.700%, 03/13/2026 |

|

|

275 |

|

|

|

275 |

|

0.650%, 08/03/2023 |

|

|

430 |

|

|

|

430 |

|

Illumina |

|

|

|

|

|

|

|

|

5.800%, 12/12/2025 |

|

|

300 |

|

|

|

301 |

|

Pfizer Investment Enterprises Pte |

|

|

|

|

|

|

|

|

4.650%, 05/19/2025 |

|

|

1,730 |

|

|

|

1,715 |

|

Revvity |

|

|

|

|

|

|

|

|

0.550%, 09/15/2023 |

|

|

600 |

|

|

|

596 |

|

Royalty Pharma PLC |

|

|

|

|

|

|

|

|

0.750%, 09/02/2023 |

|

|

700 |

|

|

|

697 |

|

Stryker |

|

|

|

|

|

|

|

|

0.600%, 12/01/2023 |

|

|

230 |

|

|

|

226 |

|

Thermo Fisher Scientific |

|

|

|

|

|

|

|

|

5.840%, SOFRINDX + 0.530%, 10/18/2024 (A) |

|

|

1,335 |

|

|

|

1,335 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

9,606 |

|

| |

|

|

|

|

|

|

|

|

Industrials — 0.8% |

|

|

|

|

AerCap Ireland Capital DAC |

|

|

|

|

|

|

|

|

5.942%, U.S. SOFR + 0.680%, 09/29/2023 (A) |

|

|

700 |

|

|

|

699 |

|

Boeing |

|

|

|

|

|

|

|

|

1.950%, 02/01/2024 |

|

|

425 |

|

|

|

417 |

|

Carlisle |

|

|

|

|

|

|

|

|

0.550%, 09/01/2023 |

|

|

175 |

|

|

|

174 |

|

DAE Funding LLC MTN |

|

|

|

|

|

|

|

|

1.550%, 08/01/2024 (B) |

|

|

450 |

|

|

|

429 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

Penske Truck Leasing Lp |

|

|

|

|

|

|

|

|

5.750%, 05/24/2026 (B) |

|

$ |

250 |

|

|

$ |

249 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

1,968 |

|

| |

|

|

|

|

|

|

|

|

Information Technology — 2.2% |

|

|

|

|

Hewlett Packard Enterprise |

|

|

|

|

|

|

|

|

5.900%, 10/01/2024 |

|

|

1,500 |

|

|

|

1,501 |

|

4.450%, 10/02/2023 |

|

|

250 |

|

|

|

250 |

|

Microchip Technology |

|

|

|

|

|

|

|

|

0.972%, 02/15/2024 |

|

|

375 |

|

|

|

365 |

|

Sprint LLC |

|

|

|

|

|

|

|

|

7.125%, 06/15/2024 |

|

|

1,675 |

|

|

|

1,691 |

|

TD SYNNEX |

|

|

|

|

|

|

|

|

1.250%, 08/09/2024 |

|

|

650 |

|

|

|

618 |

|

VMware |

|

|

|

|

|

|

|

|

1.000%, 08/15/2024 |

|

|

1,445 |

|

|

|

1,374 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

5,799 |

|

| |

|

|

|

|

|

|

|

|

Materials — 0.4% |

|

|

|

|

Celanese US Holdings LLC |

|

|

|

|

|

|

|

|

5.900%, 07/05/2024 |

|

|

325 |

|

|

|

325 |

|

Nutrien |

|

|

|

|

|

|

|

|

5.900%, 11/07/2024 |

|

|

175 |

|

|

|

175 |

|

Sherwin-Williams |

|

|

|

|

|

|

|

|

4.050%, 08/08/2024 |

|

|

250 |

|

|

|

246 |

|

Vulcan Materials |

|

|

|

|

|

|

|

|

5.800%, 03/01/2026 |

|

|

275 |

|

|

|

275 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

1,021 |

|

| |

|

|

|

|

|

|

|

|

Utilities — 3.2% |

|

|

|

|

American Electric Power |

|

|

|

|

|

|

|

|

6.114%, ICE LIBOR USD 3 Month + 0.480%, 11/01/2023 (A) |

|

|

1,060 |

|

|

|

1,060 |

|

5.699%, 08/15/2025 |

|

|

350 |

|

|

|

350 |

|

CenterPoint Energy |

|

|

|

|

|

|

|

|

5.777%, SOFRINDX + 0.650%, 05/13/2024 (A) |

|

|

325 |

|

|

|

325 |

|

Dominion Energy |

|

|

|

|

|

|

|

|

6.082%, ICE LIBOR USD 3 Month + 0.530%, 09/15/2023 (A) |

|

|

475 |

|

|

|

475 |

|

Edison International |

|

|

|

|

|

|

|

|

3.550%, 11/15/2024 |

|

|

275 |

|

|

|

266 |

|

Mississippi Power |

|

|

|

|

|

|

|

|

5.560%, U.S. SOFR + 0.300%, 06/28/2024 (A) |

|

|

350 |

|

|

|

348 |

|

NextEra Energy Capital Holdings |

|

|

|

|

|

|

|

|

6.051%, 03/01/2025 |

|

|

200 |

|

|

|

201 |

|

2.940%, 03/21/2024 |

|

|

450 |

|

|

|

442 |

|

Oncor Electric Delivery LLC |

|

|

|

|

|

|

|

|

2.750%, 06/01/2024 |

|

|

1,340 |

|

|

|

1,307 |

|

Pacific Gas and Electric |

|

|

|

|

|

|

|

|

3.250%, 02/16/2024 |

|

|

350 |

|

|

|

344 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

CORPORATE OBLIGATIONS (continued) |

1.700%, 11/15/2023 |

|

$ |

275 |

|

|

$ |

272 |

|

Public Service Enterprise Group |

|

|

|

|

|

|

|

|

0.841%, 11/08/2023 |

|

|

1,170 |

|

|

|

1,154 |

|

Sempra |

|

|

|

|

|

|

|

|

5.400%, 08/01/2026 |

|

|

370 |

|

|

|

370 |

|

Southern California Edison |

|

|

|

|

|

|

|

|

6.098%, SOFRINDX + 0.830%, 04/01/2024 (A) |

|

|

960 |

|

|

|

960 |

|

Tampa Electric |

|

|

|

|

|

|

|

|

3.875%, 07/12/2024 |

|

|

325 |

|

|

|

320 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

8,194 |

|

| |

|

|

|

|

|

|

|

|

Total Corporate Obligations |

|

|

|

|

|

|

|

|

(Cost $99,200) ($ Thousands) |

|

|

|

|

|

|

98,402 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

ASSET-BACKED SECURITIES — 29.1% |

Automotive — 15.9% |

|

|

|

|

| |

|

|

|

|

Ally Auto Receivables Trust, Ser 2023-1, Cl A2 |

|

|

|

|

|

|

|

|

5.760%, 11/15/2026 |

|

|

585 |

|

|

|

586 |

|

American Credit Acceptance Receivables Trust, Ser 2022-2, Cl A |

|

|

|

|

|

|

|

|

2.660%, 02/13/2026 (B) |

|

|

5 |

|

|

|

5 |

|

American Credit Acceptance Receivables Trust, Ser 2023-1, Cl A |

|

|

|

|

|

|

|

|

5.450%, 09/14/2026 (B) |

|

|

282 |

|

|

|

281 |

|

American Credit Acceptance Receivables Trust, Ser 2023-2, Cl A |

|

|

|

|

|

|

|

|

5.890%, 10/13/2026 (B) |

|

|

159 |

|

|

|

159 |

|

AmeriCredit Automobile Receivables Trust, Ser 2019-3, Cl C |

|

|

|

|

|

|

|

|

2.320%, 07/18/2025 |

|

|

193 |

|

|

|

191 |

|

AmeriCredit Automobile Receivables Trust, Ser 2020-2, Cl C |

|

|

|

|

|

|

|

|

1.480%, 02/18/2026 |

|

|

675 |

|

|

|

653 |

|

Americredit Automobile Receivables Trust, Ser 2023-1, Cl A2A |

|

|

|

|

|

|

|

|

5.840%, 10/19/2026 |

|

|

465 |

|

|

|

465 |

|

ARI Fleet Lease Trust, Ser 2021-A, Cl A2 |

|

|

|

|

|

|

|

|

0.370%, 03/15/2030 (B) |

|

|

31 |

|

|

|

31 |

|

Bank of America Auto Trust, Ser 2023-1A, Cl A2 |

|

|

|

|

|

|

|

|

5.830%, 05/15/2026 (B) |

|

|

295 |

|

|

|

295 |

|

BMW Vehicle Owner Trust, Ser 2023-A, Cl A2A |

|

|

|

|

|

|

|

|

5.720%, 04/27/2026 |

|

|

115 |

|

|

|

115 |

|

Capital One Prime Auto Receivables Trust, Ser 2022-2, Cl A2A |

|

|

|

|

|

|

|

|

3.740%, 09/15/2025 |

|

|

363 |

|

|

|

360 |

|

| |

|

|

|

|

|

|

Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

ASSET-BACKED SECURITIES (continued) |

Capital One Prime Auto Receivables Trust, Ser 2023-1, Cl A2 |

|

|

|

|

|

|

|

|

5.200%, 05/15/2026 |

|

$ |

300 |

|

|

$ |

299 |

|

Carmax Auto Owner Trust, Ser 2019-3, Cl C |

|

|

|

|

|

|

|

|

2.600%, 06/16/2025 |

|

|

375 |

|

|

|

374 |

|

Carmax Auto Owner Trust, Ser 2021-1, Cl A3 |

|

|

|

|

|

|

|

|

0.340%, 12/15/2025 |

|

|

408 |

|

|

|

397 |

|

Carmax Auto Owner Trust, Ser 2021-2, Cl A3 |

|

|

|

|

|

|

|

|

0.520%, 02/17/2026 |

|

|

384 |

|

|

|

372 |

|

CarMax Auto Owner Trust, Ser 2022-1, Cl A3 |

|

|

|

|

|

|

|

|

1.470%, 12/15/2026 |

|

|

1,700 |

|

|

|

1,633 |

|

CarMax Auto Owner Trust, Ser 2023-1, Cl A2A |

|

|

|

|

|

|

|

|

5.230%, 01/15/2026 |

|

|

555 |

|

|

|

553 |

|

Carmax Auto Owner Trust, Ser 2023-2, Cl A2A |

|

|

|

|

|

|

|

|

5.500%, 06/15/2026 |

|

|

920 |

|

|

|

917 |

|

Carmax Auto Owner Trust, Ser 2023-3, Cl A2A |

|