SEI Daily Income Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03451

SEI Daily Income Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 1-610-676-1000

Date of fiscal year end: January 31, 2019

Date of reporting period: January 31, 2019

| Item 1. |

Reports to Stockholders. |

January 31, 2019

ANNUAL REPORT

SEI Daily Income Trust

> Government Fund

> Government II Fund

> Treasury Fund

> Treasury II Fund

> Ultra Short Duration Bond Fund

> Short-Duration Government Fund

> GNMA Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’

shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you

already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by

contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial

intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest

directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or

your financial intermediary.

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings

with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at

http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Since the Funds in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they may be

required to vote proxies. Regardless, in light of the possibility of the possibility that a Fund could hold a security for which a proxy is voted, the Trust has adopted proxy voting policies. A description of the policies and procedures that the

Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available

(i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

January 31, 2019

To Our Shareholders

After an extended period of historical calm and steady gains, volatility returned to financial markets during the fiscal year ending January 31, 2019, with a

selloff toward the end of the reporting period that sent most global indexes into or near bear market territory. Trade war fears, Italian budget negotiations, ongoing Brexit discussions, and a flattening U.S. yield curve all weighed on investor

expectations. The ongoing U.S. and China trade dispute hit a boiling point in the second half of 2018, resulting in a tit-for-tat strategy that saw various threats of tariffs from both parties.

Many of the expectations we had at the start of the Funds’ most recently completed fiscal year, from the start of January 2018 through the end of December 2018,

were actualized. The pace of interest-rate increases by the Federal Reserve (“Fed”) largely followed the market’s projections. Short-term rates rose by a greater magnitude than long-term rates after the Federal Reserve raised rates

four times during the reporting period, and the yield-curve flattened to a post-recession low.

The European Central Bank ended its bond-buying program at the end

of 2018 but made assurances that it would reinvest maturing securities for some time to help keep rates low. The Japanese yen finished the period slightly higher against the U.S. dollar as the Bank of Japan (“BOJ”) held monetary policy

stable through the fiscal year; the currency was also viewed as a safe-haven asset during equity market selloffs both early and late in the year. Driven by trade-related tensions, China’s currency slid to a 10-year low against the U.S. dollar

toward the end of the fiscal period before a slight recovery late in the year.

Oil prices rose for much of the fiscal year to a four-year high, supported by

geopolitical tensions and news that Saudi Arabia and Russia would extend an agreement to curb output. However, growing concerns over falling demand and increasing global supply, along with a broad selloff in risk assets, helped drive a correction

that sent the commodity down as much as 40% from its earlier highs during the last three months of the year.

Geopolitical Events

U.S. elections in early November 2018 produced a partial shift in power away from Republicans and toward Democrats in Congress and statehouses across the country. The

new balance of authority in Congress should substantially limit the ability of President Donald Trump and Republicans to pass meaningful legislation; it also enhances the investigatory powers available to Democrats, thereby adding to political risk

for the Trump administration.

The partial shutdown of the U.S. government lasted over a month due to an impasse between Congress and President Trump’s

administration about whether to fund a multi-billion dollar wall on the U.S.-Mexico border championed by the president. Trump ultimately relented just before the end of the fiscal period, enabling federal workers to receive pay again and setting up

a three-week negotiation window.

A meeting between Trump and North Korean Supreme Leader Kim Jong-Un garnered headlines but ended with vague commitments. President

Trump backed out of a multi-party nuclear disarmament agreement with the Iranian Republic and re-imposed sanctions on Iran despite the International Atomic Energy Agency’s assurance that Iran remained compliant with the terms of the accord; all

other original signatories to the deal remained committed.

The U.S. escalated its trade fight with China during the fiscal year, enacting tariffs of 10% on $200

billion of Chinese products and promising to increase them to 25% in the New Year. President Trump pointed to an additional prospective $267 billion in Chinese products that could also be subjected to tariffs if China were to retaliate—which it

did, although on a significantly smaller scale (applying duties of 5% to 10% on $60 billion of U.S. exports to China). China asked the World Trade Organization to impose sanctions on the U.S. during the reporting period in response to disputes

dating back several years. The situation improved after the countries’ leaders conducted a trade-focused meeting on the sidelines of the early-December G20 summit, agreeing to delay punitive actions and producing a three-month roadmap toward

more substantive progress.

NAFTA’s successor came into focus during the year—first when the U.S. and Mexico came to an agreement in August, and then when

the U.S. and Canada finally ironed out their differences in the last few hours of September. Now called the United States-Mexico-Canada Agreement, the revised deal is expected to strengthen its

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

1 |

|

LETTER TO SHAREHOLDERS (Continued)

January 31, 2019

predecessor’s provisions and improve labor standards. The U.S. is projected to offer Canada and Mexico relief from

automobile-related trade barriers as a result of the new agreement, although aluminum and steel tariffs will remain.

A raft of overseas political surprises

unfolded during the reporting period. The anti-EU implications of a new Italian government taking shape rattled financial markets in May, then again as a rejection of the coalition’s first choice for economy minister seemed to set the stage for

another round of elections and associated delays. Spain’s government also experienced turnover as center-right Prime Minister Mariano Rajoy suffered a no-confidence vote and was replaced by socialist leader Pedro Sanchez at the beginning of

June. U.K. Prime Minister Theresa May declared that Brexit negotiations had reached an impasse after EU leaders rejected her so-called Chequers plan, which had become a rallying point for cabinet officials. The U.K. Parliament also rejected

May’s deal, with the vote coming only 10 weeks before Britain was scheduled to leave the EU.

Economic Performance

U.S. economic growth slowed to 2.0% annualized at the start of the fiscal period—in line with the typically mild pace of the three-month period ending March, yet

slower than the rate of expansion recorded in the fourth quarter. Second-quarter GDP grew 4.2%, its highest annualized growth rate since 2014, primarily on strong business expenditures and a jump in exports ahead of expected retaliatory tariffs.

Consumer spending also accelerated, by 4.0%, after growing by the slowest rate in five years during the previous quarter. Third-quarter GDP was a still-solid 3.4%, pointing to a slight drop in consumer spending and a broader decline in exports.

The labor market remained robust throughout the year: the unemployment rate fell, finishing the period at 4.0%, after touching 3.7% earlier in the year, a 49-year low;

the labor-force participation rate ended at 63.2%, up slightly from a year ago. Average hourly earnings gained 3.2% over the year, although a modest increase in price pressures weighed on real personal income growth as the period progressed. The

historically strong labor market and improving wage growth helped boost the debt profile of the U.S. consumer. The Fed raised its target interest rate four times during the period and continued to unwind its balance sheet, with the pace accelerating

to $40 billion per month by the end of the year, a reversal of the quantitative easing that has been supportive of bond prices in recent years.

Market Developments

For the fiscal year ending January 31, 2019, growth stocks, in general, outperformed value stocks. The U.S. equity market experienced a significant decline

during the second half of the fiscal year as concerns about rising interest rates, trade issues, and softening global economic growth weighed on investor sentiment. The highly-cyclical materials and energy sectors experienced significant selloffs,

while the healthcare and utilities sectors, in particular, outperformed and helped mitigate some damage in the falling market. However, the fiscal year closed on a strong note, as the final month was the best January for equities in thirty years.

The final quarter of the fiscal period erased most major index gains for the year; the Russell 1000 Growth Index finished up just 0.24%, while the Russell 1000

Value Index declined 4.81% over the same period.

Large-cap stocks outperformed, with U.S. large caps (Russell 1000 Index) outpacing small caps (Russell 2000

Index), falling 2.17% and 3.52%, respectively.

The risk-off sentiment that pushed global equities lower overall was also visible in fixed-income markets, with

high-yield underperforming government bonds. A continuing theme for U.S. fixed-income markets was the flattening yield curve, as short-term yields rose more than long-term yields. In early December, the spread between 2-year and 10-year Treasury

bonds compressed to 11 basis points, its narrowest point in more than 11 years. At the same time, the spread between 2-year and 5-year Treasurys inverted, as did the spread between 3-year and 5-year Treasurys. The Federal Open Market Committee

increased the federal-funds rate in mid-December—the fourth time in 2018—while softening its projections for future rate increases. The rate hike pushed short-term yields higher, while increases in longer-term bond yields were more muted

as inflation and long-term economic growth expectations remained subdued. Yields for 10-year government bonds declined and ended the period nine basis points lower at 2.63%, while 2-year yields climbed 31 basis points during the year, to 2.45%.

|

|

|

| 2 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

Front-end Treasury yields moved higher in response to the Fed increasing the fed-funds target rate to 2.25%-2.50%, marking

the fourth rate hike during the reporting period and ninth during this tightening cycle. Jerome Powell succeeded Janet Yellen as Fed Chair, and Randal Quarles was named vice chair for bank supervision. Marvin Goodfriend, a former Fed economist, was

chosen to fill one of three open governor seats just before the start of the fiscal period; however, his nomination appeared in limbo after the year ended without a Senate confirmation or re-nomination with the current Congress. President Trump

signed the Tax Cuts and Jobs Act into law just prior to the start of the reporting period, introducing several new policies, including a cap on state and local tax deductions, a one-time repatriation tax on overseas cash, a move to a territorial tax

system and a permanent drop in the corporate tax rate from 35% to 21%.

Inflation-sensitive assets, such as commodities and Treasury inflation-protected securities,

were mixed. The Bloomberg Commodity Total Return Index (which represents the broad commodity market) sunk 8.23% during the period, driven by declines in oil prices and trade concerns in the metals sector; the Bloomberg Barclays US TIPS Index (USD)

edged 0.93% higher.

Global fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, slipped 0.88% in U.S. dollar terms during the reporting

period; the high-yield market did better, with the ICE BofAML US High Yield Constrained Index up 1.57%.

U.S. investment-grade corporate debt was slightly higher,

as the Bloomberg Barclays Investment Grade US Corporate Index returned 0.75%. Despite headwinds from rising interest rates, both U.S. asset-backed securities and mortgage-backed securities also managed gains during the fiscal year.

Our View

As painful as 2018 was for risk assets, their gyrations were not outside

the norm. Instead, given our views that the global economy will continue to grow and that market participants are overreacting to the concerns of the day, we see another critical risk-on opportunity developing in equities and other risk assets. We

believe a rebalancing of assets back toward undervalued equity classes is an appropriate and timely response.

We still view the U.S. economic position as

reasonably solid. Points of strength include the improving economic status of U.S. households as labor markets tighten and real wage growth accelerates, while increased government spending has also helped. With Democrats controlling the House of

Representatives and Republicans holding power in the Senate, any fiscal-policy agreement made during a period of political gridlock will likely mean slightly more federal-government spending—not less.

The decline in energy prices is especially good news for the broader economy since it reduces concerns about inflation accelerating beyond the Fed’s comfort zone

anytime soon. It also lowers costs for consumers and businesses on a broad range of petroleum-based products.

Some Fed officials, including Chairman Powell

himself, explicitly acknowledge that the federal-funds rate now is near a level that can be considered neither stimulative nor deflationary. We are penciling in just one rate increase in 2019, and perhaps one in 2020—but these are just guesses.

The critical thing to remember is that the central bank is adopting a wait-and-see approach to monetary policy and has ended the nearly automatic quarterly rate increases of 2017 and 2018.

We think the odds favor a rebound in U.S. equity prices for the following reasons:

• The U.S. economy should continue to grow, and corporate earnings per share are expected to post a

mid-to-high single-digit gain in 2019.

• Valuations for the S&P 500 Index have declined from

almost 19 times one-year forward earnings per share to an attractive level of nearly 14 times following the decline in share prices.

• U.S. bond yields remain rather low and have moved down again in late 2018, bolstering the case for

riskier assets.

• Investor risk aversion has increased, and we think much of the bad news of recent

months is reflected in current stock prices—creating space for potential upside surprises on trade wars, the Fed’s policy path, Brexit, corporate profits and elsewhere.

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

3 |

|

LETTER TO SHAREHOLDERS (Concluded)

January 31, 2019

• Fiscal policy will not be the active catalyst for

growth in the U.S. that it was in 2018, but the impact of political gridlock should still be mildly expansionary.

As for Brexit, we believe it’s unlikely that

the U.K. will fall out of the EU without some deal in place. A no-deal divorce would deliver a mighty blow to the economy. In our view, the real choice now is between Prime Minister May’s Brexit deal or no Brexit at all. A no-Brexit-at-all

scenario could take one of two forms. The U.K. government could unilaterally revoke Article 50, basically calling off the divorce from the EU. The second alternative is to go back to voters and hold a second referendum. Although the legality would

be disputed, we think this is the far more likely scenario. The financial markets probably would respond quite positively to this decision, yet the next few months could still be volatile as the late-March Brexit date nears.

Although the European banking system is in better shape than it was in the immediate aftermath of the global financial crisis, it is still vulnerable at a time when the

ECB is in a holding pattern, policy-wise, and possesses only a few options in the event of a financial emergency. Equity-market valuations reflect a lack of enthusiasm for Europe’s economic prospects: the MSCI European Economic and Monetary

Union (“EMU”) Index price-to-earnings ratio has sunk to less than 12 times from nearly 15 times at the start of the year. Note that European equities outperformed U.S. equities in the fourth quarter of 2018.

We are leaning on the optimistic side for emerging markets in 2019. The valuation piece is already in place, in our opinion, with the price-to-forward-earnings ratio

collapsing from 13 times at the end of January to 10.5 by year-end. But what could be the catalyst for a turnaround? Significant debt expansions in China typically lead to big gains in emerging-market equities. The question is whether the Chinese

government has the will to go back to the debt well one more time.

It surely would be a big positive for the country if the threat of tariffs was negotiated away,

but we’re not holding our breath. On the contrary, the U.S.-China economic relationship will likely continue to deteriorate as the Trump administration seeks to level the playing field—even if it means a less efficient global trading

system. When push comes to shove, the Chinese government will probably get even more aggressive in easing lending constraints if the situation warrants.

Commodity

prices and the earnings of emerging-market companies are closely correlated inversely with the movements of the U.S. dollar. For most of 2018, the dollar gained against other currencies, putting downward pressure on commodity prices and the earnings

of energy and materials companies that are a large part of the MSCI Emerging Markets Index. In 2017, the opposite conditions held.

We are looking for another

change in the dollar’s trend in 2019. In our view, U.S. economic and corporate-earnings performance will move toward that of other developed countries. If there are positive developments in some of the pressure-point issues that have roiled

markets, investment capital could flow away from the U.S. and back into the world—thereby removing an important source of support for the U.S. currency and a significant headwind from the rest of the world. This potential for a reversal in

investment flows could accelerate if Fed policy becomes more dovish than currently projected by the central bank.

The awful performance of risk assets in the

fourth quarter can certainly prey on investors’ emotions. But the global economy is not exactly in dire straits. Yes, there are an unusually large number of uncertainties and concerns, some of which could have a material impact on growth if the

worst comes to pass. However, even in an extraordinarily unfavorable economic scenario in which the tariff wars with China and other countries deepen and the Fed raises interest rates too far and too fast, we doubt that the U.S. economy would

experience anything worse than a garden-variety recession by 2021. The economic and credit excesses that usually precede a deeper recession aren’t to be found.

During periods of market volatility like the one we’ve been going through, we make sure to remind investors about the importance of sticking with a strategic and

disciplined approach to investing that is consistent with personal goals and risk tolerances. Diversification is the key to that approach, and the construction of portfolios is consistent with our long-term capital market assumptions.

Ultimately, the value of our assumptions is not in their accuracy as point estimates, but in their ability to capture relevant relationships—as well as changes in

those relationships as a function of economic and market influences.

|

|

|

| 4 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

On behalf of SEI Investments, I want to thank you for your continued confidence. We are working every day to maintain that

trust, and we look forward to serving your investment needs in the future.

Sincerely,

William Lawrence, CFA

Head and Chief Investment

Officer of Traditional Asset Management

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

5 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2019

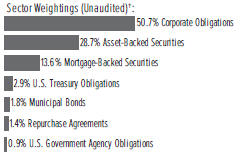

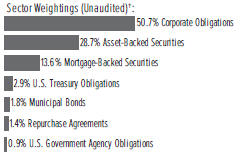

Ultra Short Duration Bond Fund

I. Objective

The Ultra Short Bond

Duration Fund (the “Fund”) seeks to provide a higher current income than typically offered by a money-market fund while maintaining a high degree of liquidity and a correspondingly higher risk of principal volatility.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number

of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). For the one-year period ending January 31, 2019,

the sub-advisors were Wellington Management Company, LLP (“Wellington”) and Logan Circle Partners, L.P. (“Logan Circle”). There were no manager changes during the period.

III. Return

For the full year ended January 31, 2019, the Ultra Short Duration

Bond Fund, Class F, returned 2.13%. The Fund’s benchmark—Bloomberg Barclays Short U.S. Treasury 9-12 Month Index—returned 2.10%.

IV. Performance

Discussion

As noted in the shareholder letter, the Federal Reserve raised rates four times during the fiscal year ending January 31, 2019; shorter-term

interest rates increased and benefited the Fund’s short duration posture. Additionally, the Fund’s barbell yield-curve position—an underweight to the one-year part of the curve and an overweight to longer-duration securities between

two and five years (which helped to hedge the Fund’s credit exposure)—was additive as rates rose and that part of the curve inverted, resulting in one-year U.S. Treasury yields higher than 5-year yields.

The Fund’s return was driven by strong performance across a number of investment-grade credit sectors—particularly financials and industrials—as well as

allocations to several asset-backed securities (“ABS”) sectors and non-agency mortgage-backed securities (“MBS”).

The Fund’s overweight to

financials, specifically banking, contributed to outperformance, as banks performed well on a relative basis due to attractive fundamentals. The Fund’s overweight to industrials also added as the spread sector outperformed the short Treasury

benchmark.

A significant allocation to specific ABS sectors contributed to outperformance. Consumer-related ABS sub-sectors, such as

auto securitizations and credit cards, performed well; the U.S. consumer remained resilient, and advancing wages supported sector fundamentals. Moreover, higher wages and low unemployment levels continued to provide support to the Fund’s

allocation to non-agency mortgage bonds; however, as mortgage rates have increased, the growth rate in house price appreciation has begun to slow and is starting to show declines on a month-to-month basis.

Both sub-advisors, Logan Circle and Wellington, contributed to Fund outperformance. Both benefited from similar exposures that contributed to outperformance, including

financials, industrials, consumer-related ABS and non-agency MBS. The Fund’s short duration positioning and yield-curve posture were also additive for both sub-advisors. An allocation to cash detracted.

The Fund used Treasury futures to efficiently manage duration and yield-curve exposures. Additionally, the Fund used to-be-announced (“TBA”) forward contracts

(TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA) to manage market exposures. None of these had a meaningful

impact on the Fund’s performance.

|

|

|

| 6 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

Ultra Short Duration Bond Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3-Year

Return |

|

|

Annualized

5-Year

Return |

|

|

Annualized

10-Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class F |

|

|

2.13% |

|

|

|

1.68% |

|

|

|

1.22% |

|

|

|

2.35% |

|

|

|

3.04% |

|

| Class Y |

|

|

2.11% |

|

|

|

1.76% |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

1.60% |

|

| Bloomberg Barclays Short U.S. Treasury 9-12 Month Index |

|

|

2.10% |

|

|

|

1.16% |

|

|

|

0.80% |

|

|

|

0.65% |

|

|

|

2.99% |

|

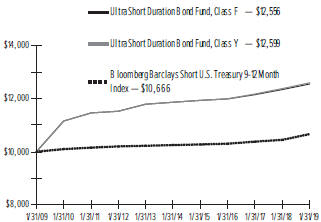

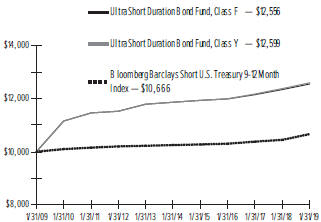

Comparison of Change in the Value of a $10,000 Investment in the Ultra Short Duration Bond Fund, Class F and Class Y, versus the

Bloomberg Barclays Short U.S. Treasury 9-12 Month Index.

| 1 |

For the periods ended January 31, 2019. Past performance is no indication of future performance. Class F Shares were

offered beginning 9/28/93. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

N/A — Not Available.

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

7 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2019

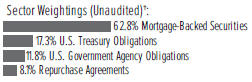

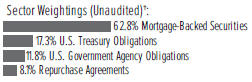

Short-Duration Government Fund

I. Objective

The Short-Duration

Government Fund (the “Fund”) seeks to preserve principal value and maintain a high degree of liquidity while providing current income.

II. Investment

Approach

The Fund uses a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation (“SIMC”). For the one-year period

ending January 31, 2019, the sub-advisor was Wellington Management Company, LLP (“Wellington”). No manager changes were made during the period.

III.

Returns

For the full year ended January 31, 2019, the Short-Duration Government Fund, Class F, returned 1.48%. The Fund’s benchmark—BofA Merrill

Lynch 1-3 Year U.S. Treasury Bond Index—returned 2.15%.

IV. Performance Discussion

As noted in the shareholder letter, the Federal Reserve raised rates four times during the fiscal year ending January 31, 2019; however, despite this overall

headwind, the Fund generated positive absolute returns over the reporting period.

The Fund’s allocation to agency mortgage-backed securities (“MBS”)

added to relative performance. MBS generated slightly negative excess returns over the period, but the Fund’s allocation to securities with positive excess returns, such as higher-coupon Government National Mortgage Association bonds and

multi-family conventional MBS with stable cash flows, contributed; this positioning offset the headwinds from the Fund’s overweight to agency MBS. The Fund’s long duration position detracted from performance in the rising-rate environment;

however, this was mitigated by a yield-curve-flattening posture. Given that short-term U.S. Treasury yields rose more than longer-term rates, an overweight to the yield curve above ten years, along with an underweight to the curve below two years,

helped. An allocation to U.S. Treasury inflation-protected securities also detracted.

The Fund used derivatives on a limited basis. U.S. Treasury futures were used

to manage yield-curve exposure and overall portfolio duration. The Fund used Treasury futures and to-be-announced (“TBA”) forward contracts to manage duration, yield-curve and market exposures (TBA contracts confer the obligation to buy or

sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—

Fannie Mae, Freddie Mac and GNMA). Treasury futures detracted from Fund performance.

Short-Duration Government Fund:

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURN1 |

|

|

| |

|

|

|

Annualized |

|

Annualized |

|

Annualized |

|

Annualized |

| |

|

One Year |

|

3-Year |

|

5-Year |

|

10-Year |

|

Inception |

| |

|

Return |

|

Return |

|

Return |

|

Return |

|

to Date |

| Class F |

|

1.48% |

|

0.71% |

|

0.71% |

|

1.44% |

|

4.27% |

| Class Y |

|

1.63% |

|

0.84% |

|

N/A |

|

N/A |

|

0.83% |

| BofA Merrill Lynch 1-3 Year U.S. Treasury Bond Index |

|

2.15% |

|

0.85% |

|

0.83% |

|

1.01% |

|

4.40% |

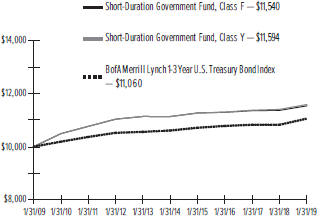

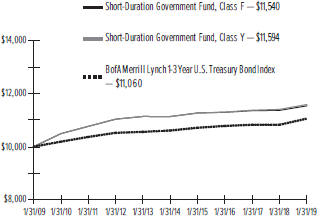

Comparison of Change in the Value of a $10,000 Investment in the Short-Duration Government Fund, Class F and Class Y, versus the BofA

Merrill Lynch 1-3 Year U.S. Treasury Bond Index.

| 1 |

For the periods ended January 31, 2019. Past performance is no indication of future performance. Class F Shares were

offered beginning 2/17/87. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

N/A — Not Available

|

|

|

| 8 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2019

GNMA Fund

I. Objective

The GNMA Fund (the

“Fund”) seeks to preserve principal value and maintain a high degree of liquidity while providing current income.

II. Investment Approach

The Fund uses a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation (“SIMC”). For the one-year period ending

January 31, 2019, the sub-advisor was Wellington Management Company, LLP (“Wellington”). No manager changes were made during the period.

III. Returns

For the full year ended January 31, 2019, the GNMA Fund, Class F, returned 2.54%. The Fund’s benchmark—Bloomberg Barclays GNMA Index—returned

2.97%.

IV. Performance Discussion

As noted in the shareholder letter, the

Federal Reserve raised rates four times during the fiscal year ending January 31, 2019; however, despite this overall headwind, the Fund generated positive absolute returns over the reporting period.

The Fund’s overweight to higher-coupon Government National Mortgage Association (“GNMA”) bonds contributed; the higher end of the coupon stack provided

more of a cushion in the rising-rate environment and generated stronger excess returns over the reporting period. An underweight to and selection within 30-year GNMA mortgage-backed securities (“MBS”) also helped drive positive Fund

performance. The Fund’s off-benchmark allocation to residential and multi-family conventional MBS securities generated positive excess returns and contributed to Fund performance.

The Fund’s modestly long duration position detracted during the fiscal year as rates generally rose.

The Fund used derivatives on a limited basis. U.S. Treasury futures were used to manage yield-curve exposure and overall portfolio duration. The Fund used Treasury

futures and to-be-announced (“TBA”) forward contracts to manage duration, yield-curve and market exposures (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that

issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA). Treasury futures detracted from the Fund’s performance. The Fund made selective use of mortgage derivatives, such as interest-only strip securities, principal-only strip securities

and

inverse floaters. The yields on these securities are sensitive to the expected or anticipated rate of principal payments

on the underlying assets, and principal payments may have a material effect on their yields. These instruments are purchased only when rigorous stress testing and analysis suggest that a higher return can be earned at similar or lower risk compared

to non-derivative securities.

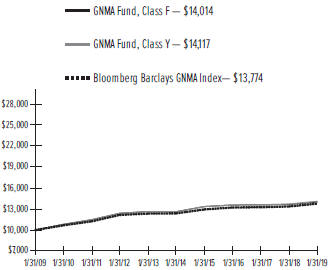

GNMA Fund:

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURN1 |

|

|

| |

|

|

|

Annualized |

|

Annualized |

|

Annualized |

|

Annualized |

| |

|

One Year |

|

3-Year |

|

5-Year |

|

10-Year |

|

Inception |

| |

|

Return |

|

Return |

|

Return |

|

Return |

|

to Date |

| Class F |

|

2.54% |

|

1.05% |

|

2.10% |

|

3.43% |

|

5.72% |

| Class Y |

|

2.88% |

|

1.31% |

|

N/A |

|

N/A |

|

1.60% |

| Bloomberg Barclays GNMA Index |

|

2.97% |

|

1.37% |

|

2.14% |

|

3.25% |

|

6.05% |

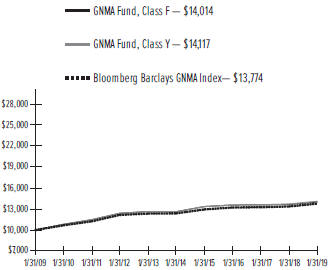

Comparison of Change in the Value of a $10,000 Investment in the GNMA Fund, Class F and Class Y, versus the Bloomberg Barclays GNMA

Index.

| 1 |

For the periods ended January 31, 2019. Past performance is no indication of future performance. Class F Shares) were

offered beginning 3/20/87. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

N/A — Not Available

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

9 |

|

Definition of Comparative Indices*

Bloomberg Barclays GNMA Index is a widely-recognized, capitalization-weighted index of 15-30 year fixed-rate securities backed by mortgage pools of GNMA.

Bloomberg Barclays Short U.S. Treasury 9-12 Month Index is a widely-recognized, market weighted index of U.S. Treasury Bonds with remaining maturities

between nine and twelve months.

BofA Merrill Lynch 1-3 Year U.S. Treasury Bond Index is a widely-recognized, unmanaged index that tracks the performance

of the direct sovereign debt of the U.S. Government having a maturity of at least one year and less than 3 years.

| |

* |

An Index measures the market price of a specific group of securities in a particular market sector. You cannot invest

directly in an index. An index does not have an investment adviser and does not pay any commissions or expenses. If an index had expenses, its performance would be lower. |

|

|

|

| 10 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

SCHEDULE OF INVESTMENTS

January 31, 2019

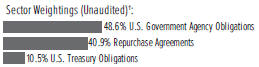

Government Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 48.1% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 2.412%, VAR ICE LIBOR USD 1 Month+-0.101%, 09/05/2019 |

|

$ |

16,760 |

|

|

$ |

16,760 |

|

| 2.463%, VAR ICE LIBOR USD 1 Month+-0.050%, 02/07/2020 |

|

|

79,365 |

|

|

|

79,364 |

|

| 2.458%, VAR ICE LIBOR USD 1 Month+-0.050%, 08/17/2020 |

|

|

25,255 |

|

|

|

25,255 |

|

| 2.479%, VAR ICE LIBOR USD 1 Month+-0.040%, 09/11/2020 |

|

|

33,895 |

|

|

|

33,894 |

|

| 2.539%, VAR ICE LIBOR USD 1 Month+0.025%, 12/14/2020 |

|

|

37,000 |

|

|

|

36,997 |

|

| FFCB DN |

|

|

|

|

|

|

|

|

| 2.555%, 07/23/2019 (A) |

|

|

23,485 |

|

|

|

23,204 |

|

| FHLB |

|

|

|

|

|

|

|

|

| 2.390%, VAR ICE LIBOR USD 1 Month+-0.130%, 02/01/2019 |

|

|

49,095 |

|

|

|

49,095 |

|

| 2.427%, VAR ICE LIBOR USD 1 Month+-0.080%, 02/04/2019 |

|

|

135,000 |

|

|

|

135,000 |

|

| 2.393%, VAR ICE LIBOR USD 1 Month+-0.110%, 02/22/2019 |

|

|

71,405 |

|

|

|

71,403 |

|

| 2.395%, VAR ICE LIBOR USD 1 Month+-0.115%, 02/25/2019 |

|

|

42,730 |

|

|

|

42,730 |

|

| 2.380%, VAR ICE LIBOR USD 1 Month+-0.130%, 02/25/2019 |

|

|

10,000 |

|

|

|

10,000 |

|

| 2.421%, VAR ICE LIBOR USD 1 Month+-0.100%, 03/08/2019 |

|

|

100,000 |

|

|

|

100,000 |

|

| 2.390%, VAR ICE LIBOR USD 1 Month+-0.120%, 03/25/2019 |

|

|

87,345 |

|

|

|

87,345 |

|

| 2.502%, VAR ICE LIBOR USD 3 Month+-0.320%, 03/27/2019 |

|

|

59,970 |

|

|

|

59,970 |

|

| 2.477%, VAR ICE LIBOR USD 3 Month+-0.320%, 04/09/2019 |

|

|

36,140 |

|

|

|

36,129 |

|

| 2.450%, 05/23/2019 |

|

|

49,870 |

|

|

|

49,870 |

|

| 2.392%, VAR ICE LIBOR USD 1 Month+-0.115%, 06/04/2019 |

|

|

58,135 |

|

|

|

58,135 |

|

| 2.616%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/12/2019 |

|

|

23,955 |

|

|

|

23,953 |

|

| 2.424%, VAR ICE LIBOR USD 1 Month+-0.090%, 06/14/2019 |

|

|

108,320 |

|

|

|

108,320 |

|

| 2.632%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/20/2019 |

|

|

55,365 |

|

|

|

55,365 |

|

| 2.458%, VAR ICE LIBOR USD 1 Month+-0.045%, 06/20/2019 |

|

|

10,430 |

|

|

|

10,430 |

|

| 2.430%, VAR United States Secured Overnight Financing Rate+0.040%, 06/21/2019 |

|

|

12,920 |

|

|

|

12,920 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 2.474%, VAR ICE LIBOR USD 1 Month+-0.045%, 06/24/2019 |

|

$ |

62,575 |

|

|

$ |

62,575 |

|

| 2.457%, VAR ICE LIBOR USD 1 Month+-0.045%, 06/28/2019 |

|

|

10,430 |

|

|

|

10,430 |

|

| 2.433%, VAR ICE LIBOR USD 1 Month+-0.080%, 07/05/2019 |

|

|

75,000 |

|

|

|

75,000 |

|

| 2.439%, VAR ICE LIBOR USD 1 Month+-0.080%, 07/11/2019 |

|

|

93,315 |

|

|

|

93,315 |

|

| 2.410%, VAR United States Secured Overnight Financing Rate+0.020%, 07/17/2019 |

|

|

14,840 |

|

|

|

14,840 |

|

| 2.398%, VAR ICE LIBOR USD 1 Month+-0.105%, 07/19/2019 |

|

|

118,295 |

|

|

|

118,295 |

|

| 2.422%, VAR ICE LIBOR USD 1 Month+-0.080%, 08/27/2019 |

|

|

51,990 |

|

|

|

51,990 |

|

| 2.426%, VAR ICE LIBOR USD 1 Month+-0.085%, 09/09/2019 |

|

|

92,435 |

|

|

|

92,435 |

|

| 2.444%, VAR ICE LIBOR USD 1 Month+-0.065%, 09/17/2019 |

|

|

35,665 |

|

|

|

35,665 |

|

| 2.592%, VAR ICE LIBOR USD 3 Month+-0.160%, 10/29/2019 |

|

|

25,000 |

|

|

|

25,000 |

|

| 2.664%, VAR ICE LIBOR USD 3 Month+-0.140%, 12/19/2019 |

|

|

29,005 |

|

|

|

29,005 |

|

| 2.479%, VAR ICE LIBOR USD 1 Month+-0.035%, 01/14/2020 |

|

|

26,280 |

|

|

|

26,280 |

|

| 2.440%, VAR United States Secured Overnight Financing Rate+0.050%, 01/17/2020 |

|

|

4,945 |

|

|

|

4,945 |

|

| 2.459%, VAR ICE LIBOR USD 1 Month+-0.060%, 02/24/2020 |

|

|

62,770 |

|

|

|

62,770 |

|

| 2.468%, VAR ICE LIBOR USD 1 Month+-0.040%, 04/17/2020 |

|

|

41,910 |

|

|

|

41,910 |

|

| 2.636%, VAR ICE LIBOR USD 3 Month+-0.140%, 04/20/2020 |

|

|

46,785 |

|

|

|

46,785 |

|

| 2.465%, VAR United States Secured Overnight Financing Rate+0.075%, 07/24/2020 |

|

|

13,635 |

|

|

|

13,635 |

|

| 2.484%, VAR ICE LIBOR USD 1 Month+-0.030%, 08/04/2020 |

|

|

28,850 |

|

|

|

28,850 |

|

| 2.665%, VAR ICE LIBOR USD 3 Month+-0.125%, 12/21/2020 |

|

|

51,040 |

|

|

|

51,040 |

|

| FHLB DN (A) |

|

|

|

|

|

|

|

|

| 2.372%, 02/04/2019 |

|

|

200,000 |

|

|

|

199,961 |

|

| 2.358%, 02/05/2019 |

|

|

24,490 |

|

|

|

24,484 |

|

| 2.377%, 02/06/2019 |

|

|

230,235 |

|

|

|

230,159 |

|

| 2.376%, 02/08/2019 |

|

|

120,003 |

|

|

|

119,948 |

|

| 2.316%, 02/11/2019 |

|

|

174,320 |

|

|

|

174,209 |

|

| 2.400%, 02/12/2019 |

|

|

17,700 |

|

|

|

17,687 |

|

| 2.393%, 02/13/2019 |

|

|

320,525 |

|

|

|

320,270 |

|

| 2.320%, 02/14/2019 |

|

|

73,055 |

|

|

|

72,994 |

|

| 2.391%, 02/15/2019 |

|

|

68,100 |

|

|

|

68,037 |

|

| 2.390%, 02/20/2019 |

|

|

20,615 |

|

|

|

20,589 |

|

| 2.404%, 03/04/2019 |

|

|

45,080 |

|

|

|

44,987 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

11 |

|

SCHEDULE OF INVESTMENTS

January 31, 2019

Government Fund (Continued)

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 2.274%, 03/06/2019 |

|

$ |

10,190 |

|

|

$ |

10,169 |

|

| 2.404%, 03/13/2019 |

|

|

85,705 |

|

|

|

85,477 |

|

| 2.352%, 03/20/2019 |

|

|

55,580 |

|

|

|

55,411 |

|

| 2.353%, 03/22/2019 |

|

|

35,985 |

|

|

|

35,871 |

|

| 2.454%, 04/01/2019 |

|

|

9,310 |

|

|

|

9,273 |

|

| 2.456%, 04/09/2019 |

|

|

90,110 |

|

|

|

89,701 |

|

| 2.437%, 04/10/2019 |

|

|

35,830 |

|

|

|

35,666 |

|

| 2.462%, 04/15/2019 |

|

|

16,785 |

|

|

|

16,702 |

|

| 2.419%, 04/24/2019 |

|

|

131,195 |

|

|

|

130,477 |

|

| 2.421%, 04/26/2019 |

|

|

59,870 |

|

|

|

59,534 |

|

| 2.477%, 04/29/2019 |

|

|

150,000 |

|

|

|

149,110 |

|

| 2.445%, 05/01/2019 |

|

|

104,705 |

|

|

|

104,078 |

|

| 2.481%, 05/03/2019 |

|

|

46,800 |

|

|

|

46,510 |

|

| 2.427%, 05/08/2019 |

|

|

135,195 |

|

|

|

134,326 |

|

| 0.967%, 05/13/2019 |

|

|

48,075 |

|

|

|

47,751 |

|

| 2.498%, 05/14/2019 |

|

|

110,825 |

|

|

|

110,048 |

|

| 2.417%, 05/15/2019 |

|

|

19,230 |

|

|

|

19,098 |

|

| 2.522%, 05/22/2019 |

|

|

35,845 |

|

|

|

35,572 |

|

| 2.527%, 05/24/2019 |

|

|

80,040 |

|

|

|

79,419 |

|

| 2.527%, 05/31/2019 |

|

|

91,560 |

|

|

|

90,805 |

|

| 2.542%, 06/05/2019 |

|

|

40,000 |

|

|

|

39,654 |

|

| 2.524%, 06/21/2019 |

|

|

86,835 |

|

|

|

85,993 |

|

| 2.509%, 07/10/2019 |

|

|

9,275 |

|

|

|

9,173 |

|

| FHLMC MTN |

|

|

|

|

|

|

|

|

| 2.380%, VAR United States Secured Overnight Financing Rate+-0.010%, 04/17/2019 |

|

|

22,490 |

|

|

|

22,490 |

|

| FNMA |

|

|

|

|

|

|

|

|

| 0.875%, 08/02/2019 |

|

|

52,188 |

|

|

|

51,737 |

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $4,858,274) ($ Thousands) |

|

|

|

|

|

|

4,858,274 |

|

|

| U.S. TREASURY OBLIGATIONS — 10.4% |

|

| U.S. Treasury Bills (A) |

|

|

|

|

|

|

|

|

| 2.303%, 02/07/2019 |

|

|

58,500 |

|

|

|

58,479 |

|

| 2.209%, 02/21/2019 |

|

|

60,000 |

|

|

|

59,927 |

|

| 2.380%, 03/05/2019 |

|

|

200,000 |

|

|

|

199,578 |

|

| 2.455%, 05/02/2019 |

|

|

210,975 |

|

|

|

209,693 |

|

| 2.509%, 05/30/2019 |

|

|

23,625 |

|

|

|

23,433 |

|

| 2.473%, 07/25/2019 |

|

|

78,060 |

|

|

|

77,139 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 1.500%, 03/31/2019 |

|

|

65,000 |

|

|

|

64,920 |

|

| 3.125%, 05/15/2019 |

|

|

8,565 |

|

|

|

8,581 |

|

| 0.875%, 05/15/2019 |

|

|

4,410 |

|

|

|

4,390 |

|

| 2.434%, VAR US Treasury 3 Month Bill Money Market Yield+0.045%, 10/31/2020 |

|

|

240,000 |

|

|

|

239,563 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| U.S. TREASURY OBLIGATIONS (continued) |

|

| 2.504%, VAR US Treasury 3 Month Bill Money Market Yield+0.115%, 01/31/2021

|

|

$ |

100,000 |

|

|

$ |

100,000 |

|

|

|

|

| Total U.S. Treasury Obligations

(Cost $1,045,703) ($ Thousands) |

|

|

|

|

|

|

1,045,703 |

|

|

| REPURCHASE AGREEMENTS(B) — 40.5% |

|

| Barclays Bank

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $350,024,792

(collateralized by U.S. Treasury obligation, par value $356,839,800, 2.500%, 01/31/2021; with total market value $357,000,021) |

|

|

350,000 |

|

|

|

350,000 |

|

| BNP Paribas

2.580%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $250,017,917

(collateralized by various U.S. Treasury obligations, ranging in par value $9 - $58,605,200, 0.000% - 3.875%, 05/15/2019 - 11/15/2048; with total market value $255,000,000) |

|

|

250,000 |

|

|

|

250,000 |

|

| Citigroup Global

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $220,015,583

(collateralized by various U.S. Treasury obligations, ranging in par value $100 - $220,088,000, 1.625% - 6.375%, 01/31/2021 - 02/15/2037; with total market value $224,400,006) |

|

|

220,000 |

|

|

|

220,000 |

|

| Citigroup Global

2.570%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $9,000,643

(collateralized by FNMA, FHLB, FHLMC, GNMA, ranging in par value $1,000 - $12,476,189, 0.000% - 6.000%, 10/26/2020 - 01/01/2049; with total market value $9,180,815) |

|

|

9,000 |

|

|

|

9,000 |

|

| Credit Agricole

2.560%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $394,028,018

(collateralized by U.S. Treasury obligation, par value $401,949,900, 0.125%, 07/15/2026; with total market value $401,880,029) |

|

|

394,000 |

|

|

|

394,000 |

|

|

|

|

| 12 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| REPURCHASE AGREEMENTS(B) (continued) |

|

| Goldman Sachs

2.530%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $6,00,422

(collateralized by U.S. Treasury obligation, par value $9,956,238, 0.000%, 08/15/2035; with total market value $6,120,000) |

|

$ |

6,000 |

|

|

$ |

6,000 |

|

| Goldman Sachs

2.540%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $350,024,694

(collateralized by FNMA, FFCB, FHLB, FHLMC, various U.S. Treasury obligations, ranging in par value $20,000 - $100,000,000, 0.000% - 6.250%, 02/07/2019 - 08/15/2045; with total market value $357,000,000) |

|

|

350,000 |

|

|

|

350,000 |

|

| J.P. Morgan

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $531,037,613

(collateralized by various U.S. Treasury obligations, ranging in par value $19,260,518 - $371,647,200, 0.000% - 3.625%, 10/31/2020 - 02/15/2042; with total market value $541,620,012) |

|

|

531,000 |

|

|

|

531,000 |

|

| Merrill Lynch

2.570%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $347,024,772

(collateralized by FNMA, FHLMC, GNMA, ranging in par value $4,757,083 - $44,533,829, 2.500% - 4.500%, 10/15/2029 - 01/20/2049; with total market value $364,350,001) |

|

|

347,000 |

|

|

|

347,000 |

|

| Mizuho Securities

2.570%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $135,009,638

(collateralized by various U.S. Treasury obligations, ranging in par value $10,737,900 - $90,130,800, 2.125% - 2.625%, 08/15/2020 - 07/31/2024; with total market value $137,700,001) |

|

|

135,000 |

|

|

|

135,000 |

|

| MUFG Securities

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $280,019,833

(collateralized by various U.S. Treasury obligations, ranging in par value $1,261,600 - $97,736,600, 0.625% - 3.375%, 04/30/2021 - 05/15/2044; with total market value $285,600,069) |

|

|

280,000 |

|

|

|

280,000 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| REPURCHASE AGREEMENTS(B) (continued) |

|

| Natixis

2.570%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $65,004,640

(collateralized by FNMA, FFCB, FHLB, FHLMC, various U.S. Treasury obligations, ranging in par value $100 - $44,413,600 0.000% - 7.625%, 06/30/2020 - 06/01/2048; with total market value $66,339,077) |

|

$ |

65,000 |

|

|

$ |

65,000 |

|

| Natixis

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $23,001,629

(collateralized by various U.S. Treasury obligation, ranging in par value $100 - $17,977,100, 1.375% - 2.500%, 6/30/2020 - 11/30/2024; with total market value $23,460,055) |

|

|

23,000 |

|

|

|

23,000 |

|

| TD Securities

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $250,017,708

(collateralized by various U.S. Treasury obligations, ranging in par value $622,400 - $92,843,000, 0.000% - 4.250%, 07/11/2019 - 02/15/2045; with total market value $255,000,060) |

|

|

250,000 |

|

|

|

250,000 |

|

| TD Securities

2.570%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $250,017,847

(collateralized by GNMA, FNMA, ranging in par value $16,795,239 - $300,000,000, 3.500% - 4.500%, 12/20/2040 - 11/01/2048; with total market value $256,199,621) |

|

|

250,000 |

|

|

|

250,000 |

|

| The Bank of Nova Scotia

2.550%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price

$127,008,996 (collateralized by various U.S. Treasury obligations, ranging in par value $650,400 - $53,057,800, 1.500% - 3.750%, 08/31/2021 - 08/15/2041; with total market value $129,549,194) |

|

|

127,000 |

|

|

|

127,000 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

13 |

|

SCHEDULE OF INVESTMENTS

January 31, 2019

Government Fund (Concluded)

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| REPURCHASE AGREEMENTS(B) (continued) |

|

| Wells Fargo

2.580%, dated 01/31/19, to be repurchased on 02/01/19, repurchase price $500,035,833

(collateralized by various U.S. Treasury obligations, ranging in par value $6,000 - $286,163,200, 0.000% - 2.875%, 05/31/2019 - 05/15/2043; with total market value $510,000,047) |

|

$ |

500,000 |

|

|

$ |

500,000 |

|

|

|

|

| Total Repurchase Agreements

(Cost $4,087,000) ($ Thousands) |

|

|

|

|

|

|

4,087,000 |

|

|

|

|

| Total Investments — 99.0%

(Cost $9,990,977) ($ Thousands) |

|

|

|

|

|

$ |

9,990,977 |

|

|

|

|

|

|

|

|

|

|

| |

Percentages are based on Net Assets of $10,090,351 ($ Thousands). |

| (A) |

Zero coupon security. The rate shown on the Schedule of Investments is the security’s effective yield at the time of

purchase. |

| (B) |

Tri-Party Repurchase Agreement. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National

Mortgage Association

ICE — Intercontinental Exchange

LIBOR — London

Interbank Offered Rate

MTN — Medium Term Note

USD — U.S. Dollar

VAR – Variable Rate

As of January 31, 2019, all of the Fund’s

investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended

January 31, 2019, there were no transfers between Level 1, Level 2 and/or Level 3 assets and liabilities.

For more information on valuation inputs, see Note

2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 14 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

SCHEDULE OF INVESTMENTS

January 31, 2019

Government II Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Market Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 73.5% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 2.407%, VAR ICE LIBOR USD 1 Month+-0.100%, 04/04/2019 |

|

$ |

6,840 |

|

|

$ |

6,840 |

|

| 2.428%, VAR ICE LIBOR USD 1 Month+-0.085%, 05/07/2019 |

|

|

29,000 |

|

|

|

29,000 |

|

| 2.463%, VAR ICE LIBOR USD 1 Month+-0.050%, 02/07/2020 |

|

|

20,870 |

|

|

|

20,870 |

|

| 2.503%, VAR ICE LIBOR USD 1 Month+0.000%, 06/19/2020 |

|

|

16,500 |

|

|

|

16,511 |

|

| 2.458%, VAR ICE LIBOR USD 1 Month+-0.050%, 08/17/2020 |

|

|

6,265 |

|

|

|

6,265 |

|

| 2.479%, VAR ICE LIBOR USD 1 Month+-0.040%, 09/11/2020 |

|

|

8,630 |

|

|

|

8,629 |

|

| 2.539%, VAR ICE LIBOR USD 1 Month+0.025%, 12/14/2020 |

|

|

7,925 |

|

|

|

7,924 |

|

| FFCB DN(A) |

|

|

|

|

|

|

|

|

| 2.446%, 06/17/2019 |

|

|

10,885 |

|

|

|

10,786 |

|

| 2.458%, 06/28/2019 |

|

|

7,535 |

|

|

|

7,461 |

|

| 2.574%, 07/22/2019 |

|

|

9,845 |

|

|

|

9,727 |

|

| 2.555%, 07/23/2019 |

|

|

6,080 |

|

|

|

6,007 |

|

| 2.458%, 08/15/2019 |

|

|

10,695 |

|

|

|

10,556 |

|

| FHLB |

|

|

|

|

|

|

|

|

| 2.427%, VAR ICE LIBOR USD 1 Month+-0.080%, 02/04/2019 |

|

|

15,000 |

|

|

|

15,000 |

|

| 2.395%, VAR ICE LIBOR USD 1 Month+-0.115%, 02/25/2019 |

|

|

11,135 |

|

|

|

11,135 |

|

| 2.390%, VAR ICE LIBOR USD 1 Month+-0.120%, 03/25/2019 |

|

|

17,000 |

|

|

|

17,000 |

|

| 2.502%, VAR ICE LIBOR USD 3 Month+-0.320%, 03/27/2019 |

|

|

14,910 |

|

|

|

14,910 |

|

| 2.477%, VAR ICE LIBOR USD 3 Month+-0.320%, 04/09/2019 |

|

|

7,135 |

|

|

|

7,133 |

|

| 2.450%, 05/23/2019 |

|

|

9,485 |

|

|

|

9,485 |

|

| 2.616%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/12/2019 |

|

|

6,510 |

|

|

|

6,509 |

|

| 2.424%, VAR ICE LIBOR USD 1 Month+-0.090%, 06/14/2019 |

|

|

23,120 |

|

|

|

23,120 |

|

| 2.632%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/20/2019 to 06/20/2019 |

|

|

16,565 |

|

|

|

16,565 |

|

| 2.430%, VAR United States Secured Overnight Financing Rate+0.040%, 06/21/2019 |

|

|

2,930 |

|

|

|

2,930 |

|

| 2.474%, VAR ICE LIBOR USD 1 Month+-0.045%, 06/24/2019 to 06/24/2019 |

|

|

11,715 |

|

|

|

11,715 |

|

| 2.457%, VAR ICE LIBOR USD 1 Month+-0.045%, 06/28/2019 |

|

|

1,950 |

|

|

|

1,950 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Market Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 2.433%, VAR ICE LIBOR USD 1 Month+-0.080%, 07/05/2019 |

|

$ |

17,000 |

|

|

$ |

17,000 |

|

| 2.410%, VAR United States Secured Overnight Financing Rate+0.020%, 07/17/2019 |

|

|

2,740 |

|

|

|

2,740 |

|

| 2.398%, VAR ICE LIBOR USD 1 Month+-0.105%, 07/19/2019 |

|

|

30,645 |

|

|

|

30,645 |

|

| 2.423%, VAR ICE LIBOR USD 1 Month+-0.080%, 08/22/2019 |

|

|

8,130 |

|

|

|

8,130 |

|

| 2.422%, VAR ICE LIBOR USD 1 Month+-0.080%, 08/27/2019 |

|

|

14,270 |

|

|

|

14,270 |

|

| 2.426%, VAR ICE LIBOR USD 1 Month+-0.085%, 09/09/2019 |

|

|

23,785 |

|

|

|

23,785 |

|

| 2.664%, VAR ICE LIBOR USD 3 Month+-0.140%, 12/19/2019 |

|

|

8,040 |

|

|

|

8,040 |

|

| 2.479%, VAR ICE LIBOR USD 1 Month+-0.035%, 01/14/2020 |

|

|

4,970 |

|

|

|

4,970 |

|

| 2.440%, VAR United States Secured Overnight Financing Rate+0.050%, 01/17/2020 |

|

|

915 |

|

|

|

915 |

|

| 2.468%, VAR ICE LIBOR USD 1 Month+-0.040%, 04/17/2020 |

|

|

10,850 |

|

|

|

10,850 |

|

| 2.465%, VAR United States Secured Overnight Financing Rate+0.075%, 07/24/2020 |

|

|

2,595 |

|

|

|

2,595 |

|

| 2.665%, VAR ICE LIBOR USD 3 Month+-0.125%, 12/21/2020 |

|

|

11,445 |

|

|

|

11,445 |

|

| FHLB DN(A) |

|

|

|

|

|

|

|

|

| 2.260%, 02/01/2019 |

|

|

87,895 |

|

|

|

87,895 |

|

| 2.377%, 02/06/2019 |

|

|

55,665 |

|

|

|

55,647 |

|

| 2.376%, 02/08/2019 |

|

|

76,220 |

|

|

|

76,185 |

|

| 2.316%, 02/11/2019 |

|

|

30,560 |

|

|

|

30,541 |

|

| 2.393%, 02/13/2019 |

|

|

23,940 |

|

|

|

23,921 |

|

| 2.320%, 02/14/2019 |

|

|

17,200 |

|

|

|

17,186 |

|

| 2.391%, 02/15/2019 |

|

|

13,175 |

|

|

|

13,163 |

|

| 2.390%, 02/20/2019 |

|

|

120,180 |

|

|

|

120,030 |

|

| 2.374%, 02/22/2019 |

|

|

38,675 |

|

|

|

38,621 |

|

| 2.366%, 02/27/2019 |

|

|

40,000 |

|

|

|

39,932 |

|

| 2.404%, 03/04/2019 |

|

|

9,650 |

|

|

|

9,630 |

|

| 2.404%, 03/13/2019 |

|

|

15,820 |

|

|

|

15,778 |

|

| 2.395%, 03/15/2019 |

|

|

10,000 |

|

|

|

9,972 |

|

| 2.352%, 03/20/2019 |

|

|

13,370 |

|

|

|

13,329 |

|

| 2.387%, 03/21/2019 |

|

|

3,970 |

|

|

|

3,957 |

|

| 2.353%, 03/22/2019 |

|

|

29,015 |

|

|

|

28,922 |

|

| 2.450%, 04/05/2019 |

|

|

49,150 |

|

|

|

48,941 |

|

| 2.437%, 04/10/2019 |

|

|

43,300 |

|

|

|

43,102 |

|

| 2.462%, 04/15/2019 |

|

|

3,215 |

|

|

|

3,199 |

|

| 2.423%, 04/22/2019 |

|

|

36,565 |

|

|

|

36,369 |

|

| 2.419%, 04/24/2019 |

|

|

24,625 |

|

|

|

24,490 |

|

| 2.421%, 04/26/2019 |

|

|

11,000 |

|

|

|

10,938 |

|

| 2.445%, 05/01/2019 |

|

|

19,570 |

|

|

|

19,453 |

|

| 2.481%, 05/03/2019 |

|

|

9,640 |

|

|

|

9,580 |

|

| 2.454%, 05/07/2019 |

|

|

8,935 |

|

|

|

8,878 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2019 |

|

|

15 |

|

SCHEDULE OF INVESTMENTS

January 31, 2019

Government II Fund (Concluded)

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Market Value

($ Thousands) |

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 2.522%, 05/22/2019 |

|

$ |

7,205 |

|

|

$ |

7,150 |

|

| 2.527%, 05/24/2019 |

|

|

18,190 |

|

|

|

18,049 |

|

| 2.472%, 05/29/2019 |

|

|

25,280 |

|

|

|

25,079 |

|

| 2.527%, 05/31/2019 |

|

|

19,435 |

|

|

|

19,275 |

|

| 2.542%, 06/05/2019 |

|

|

10,000 |

|

|

|

9,913 |

|

| 2.524%, 06/21/2019 |

|

|

15,875 |

|

|

|

15,721 |

|

| 2.509%, 07/10/2019 |

|

|

31,070 |

|

|

|

30,730 |

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $1,328,989) ($ Thousands) |

|

|

|

|

|

|

1,328,989 |

|

|

|

|

| U.S. TREASURY OBLIGATIONS — 35.1% |

|

|

|

|

|

|

|

|

| U.S. Treasury Bills (A) |

|

|

|

|

|

|

|

|

| 2.301%, 02/05/2019 |

|

|

119,975 |

|

|

|

119,943 |

|

| 2.303%, 02/07/2019 |

|

|

14,405 |

|

|

|

14,400 |

|

| 2.382%, 02/12/2019 |

|

|

7,000 |

|

|

|

6,995 |

|

| 2.354%, 02/14/2019 |

|

|

50,000 |

|

|

|

49,958 |

|

| 2.209%, 02/21/2019 |

|

|

14,535 |

|

|

|

14,517 |

|

| 2.396%, 03/05/2019 |

|

|

216,385 |

|

|

|

215,968 |

|

| 2.374%, 03/19/2019 |

|

|

95,000 |

|

|

|

94,713 |

|

| 2.378%, 03/26/2019 |

|

|

61,525 |

|

|

|

61,313 |

|

| 2.473%, 07/25/2019 |

|

|

14,475 |

|

|

|

14,304 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 0.875%, 05/15/2019 |

|

|

810 |

|

|

|

806 |

|

| 3.125%, 05/15/2019 |

|

|

1,570 |

|

|

|

1,573 |

|

| 2.434%, VAR US Treasury 3 Month Bill Money Market Yield+0.045%, 10/31/2020 |

|

|

30,000 |

|

|

|

29,946 |

|

| 2.504%, VAR US Treasury 3 Month Bill Money Market Yield+0.115%, 01/31/2021 |

|

|

11,750 |

|

|

|

11,750 |

|

|

|

|

| Total U.S. Treasury Obligations

(Cost $636,186) ($ Thousands) |

|

|

|

|

|

|

636,186 |

|

|

|

|

| Total Investments in Securities — 108.6%

(Cost $1,965,175) ($ Thousands) |

|

|

|

|

|

$ |

1,965,175 |

|

|

|

|

|

|

|

|

|

|

| |

Percentages are based on Net Assets of $1,808,839 ($ Thousands). |

| (A) |

Zero coupon security. The rate shown on the Schedule of Investments is the security’s effective yield at the time of

purchase. |

DN — Discount Note

FFCB — Federal Farm

Credit Bank

FHLB — Federal Home Loan Bank

ICE — Intercontinental

Exchange

LIBOR — London Interbank Offered Rate

USD — U.S. Dollar

VAR — Variable Rate

As of January 31, 2019, all of the Fund’s investments were considered Level 2, in accordance with the

authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended January 31, 2019, there were no transfers between Level 1,

Level 2 and/or Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial

Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 16 |

|

SEI Daily Income Trust / Annual Report / January 31, 2019 |

SCHEDULE OF INVESTMENTS

January 31, 2019

Treasury Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

Value

($ Thousands) |

|

| U.S. TREASURY OBLIGATIONS — 60.8% |

|

| U.S. Treasury Bills (A)

2.303%, 02/07/2019 |

|

$ |

1,795 |

|

|

$ |

1,794 |

|

| 2.382%, 02/12/2019 |

|

|

450 |

|

|

|

449 |

|

| 2.384%, 02/19/2019 |

|

|

5,000 |

|

|

|

4,994 |

|

| 2.396%, 03/05/2019 |

|

|

7,690 |

|

|

|

7,676 |

|

| 2.335%, 03/21/2019 |

|

|

4,000 |

|

|

|

3,987 |

|

| 2.378%, 03/26/2019 |

|

|

7,000 |

|

|

|

6,976 |

|

| 2.455%, 05/02/2019 |

|

|

3,000 |

|

|

|

2,982 |

|

| 2.479%, 05/09/2019 |

|

|

2,000 |

|

|

|

1,987 |

|

| 2.473%, 07/25/2019 |

|

|

4,170 |

|

|

|

4,121 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 2.750%, 02/15/2019 |

|

|

3,000 |

|

|

|

3,001 |

|

| 1.125%, 02/28/2019 |

|

|

280 |

|

|

|

280 |

|