SEI Daily Income Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03451

SEI Daily Income Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

CT Corporation

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 1-800-342-5734

Date of fiscal year end: January 31, 2018

Date of reporting period: January 31, 2018

| Item 1. |

Reports to Stockholders. |

January 31, 2018

ANNUAL REPORT

SEI Daily Income Trust

> Government Fund

> Government II Fund

> Treasury Fund

> Treasury II Fund

> Ultra Short Duration Bond Fund

> Short-Duration Government

Fund

> GNMA Fund

TABLE OF CONTENTS

The Trust files its

complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The

Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the

operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Since the Funds in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they may be

required to vote proxies. Regardless, in light of the possibility of the possibility that a Fund could hold a security for which a proxy is voted, the Trust has adopted proxy voting policies. A description of the policies and procedures that the

Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period

ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the

Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

January 31, 2018

To Our Shareholders

Financial markets completed 2017 without any enduring missteps in an environment defined by strong investor appetite for higher-risk market segments. Fixed-income

performance was positive across markets but ran the gamut in terms of strength—with emerging-market debt at the top end and U.S. Treasurys at the bottom, in keeping with the risk-on sentiment.

Looking back, the projections we shared for the Funds’ most recently completed fiscal year, from the start of February 2017 through the end of January 2018, mostly

came to pass. The pace of interest-rate increases by the Federal Reserve (“Fed”) mostly followed the market’s expectations.

Strength in the euro

relative to the U.S. dollar through the year prevented a quick end to the European Central Bank’s (“ECB”) commitment to stimulus; the Japanese yen remained mostly range-bound while the Bank of Japan (“BOJ”) held monetary

policy stable through the fiscal year. China continued to guide its currency lower, hitting a low near the end of the fiscal period.

We suggested that market

sentiment would remain attuned to geopolitical developments; these accounted for the only significant exceptions to the global tranquility trend. Also, a fixation on tax reform and continued flattening of the yield curve drove market movements

throughout the latter part of the fiscal year.

The global oil supply-demand imbalance persisted throughout the first half of the period, before a strong rebound in

oil during the second half of the fiscal year, supported by rising demand, geopolitical tensions and news that Saudi Arabia and Russia would extend an agreement to curb output.

Geopolitical Events

Geopolitical threats and an assortment of other noneconomic

influences continued in various regions: civil war and domestic struggle in parts of the Middle East and Africa, the suffering of refugees and migrants in bordering countries and Europe, and acts of global terror. Severe unrest continued in some

regions of the Middle East, driven by the conflicting and overlapping regional interests of extremist groups, nationalist fighters and state actors.

The lasting

effect of the Syrian migrant crisis on the European Union (“EU”) remains unknown. Immigration served as one of the critical points of contention leading up to Great Britain’s Brexit vote to leave the European Union before the

reporting year. Prime Minister May triggered Article 50 during the fiscal period and began the formal withdrawal process.

In the U.S., President Trump’s early

actions following his inauguration just before the start of the fiscal year demonstrated a commitment to follow through on tighter U.S. immigration policy. President Trump stated that aggression from North Korea would be met with “fire and

fury” while controversy over Trump’s response to violent clashes between protesters in Charlottesville, Virginia briefly drove market sentiment after the president dissolved two advisory councils. Setbacks in the Trump

administration’s efforts to repeal and replace Obamacare initially sparked volatility, as investors assumed that tax and budget resolutions would have to wait until healthcare legislation was resolved. However, longer-term market reactions to

geopolitical events were surprisingly muted.

A raft of political surprises unfolded during the fiscal period. Centrism prevailed in elections for Europe’s

most economically significant states, although not across the continent. Brexit negotiations were less critical to investors globally than was Europe’s sustained economic expansion; while the euro’s appreciation versus sterling may offer a

clue about the market’s perception of post-divorce relative advantages, both currencies gained against the U.S. dollar. The U.K. Conservative party relinquished its parliamentary majority and was forced to seek a partner to form a minority

government. Emmanuel Macron’s early-May victory in the French presidential election amounted to a significant win for the establishment.

In the U.S., a high-profile special prosecutor was appointed to investigate the possibility of collusion between Donald Trump’s presidential campaign and Russia.

In Brazil, an ongoing top-level corruption scandal was blown wide open in mid-May as potential evidence emerged from a taped conversation featuring President Michel

Temer approving a sizeable hush-money bribe.

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

1 |

|

LETTER TO SHAREHOLDERS (Continued)

January 31, 2018

Economic Performance

U.S. economic

growth slumped early in 2017 and then rebounded solidly in the second quarter as consumer and spending boosted the economy. Fourth-quarter GDP grew at a 2.6% annual rate, following a 3.3% rise in the third quarter that was the fastest in three

years, supported by a rebound in government investment and business spending on equipment. The labor market remained historically healthy throughout the year: the unemployment rate fell, finishing the period at 4.1%, while the labor-force

participation rate ended at 62.9%, marginally down from a year ago. Average hourly earnings gained, bouncing around a mean of about 0.2% growth per month over the year; although a modest increase in price pressures weighed on real personal income

growth as the period progressed. The Fed raised its target interest rate in March 2017, and again in both June and December, with three additional rate increases projected in 2018. The Fed also began to unwind its balance sheet starting in October,

reversing some of the quantitative easing that has been so supportive of bond prices in recent years.

Market Developments

For the fiscal year ending January 31, 2018, the period started with enthusiasm for President Trump’s pro-business

policies. The “reflation trade” saw markets move in reaction to coordinated global expansion and normalizing monetary policy. However, the first few months saw setbacks for the Trump administration after Washington failed to pass a

replacement for the Affordable Care Act and controversies involving Russian election meddling plagued the new administration. There was a realization that the growth expected from promised regulatory changes would take a while to play out, and

markets began to unwind the reflation trade. Over the last four months of the year, the “reflation” trade rebounded strongly amid steady global economic growth and the prospects of U.S. tax reform.

The U.S. equity market began the fiscal year with investors focused on the newly elected Trump administration. Growth stocks in general and the technology sector, in

particular, outperformed during the full fiscal period, while high-dividend-yield segments of the market, such as utilities, lagged as they were seen as less attractive in a rising interest-rate environment. Stocks rallied toward the end of the

fiscal period amid signs of global economic synchronization, stable earnings and continued central-bank stimulus. The current bull market is now the second-longest on record.

The risk-on sentiment that pushed equities higher was also visible in fixed-income

markets, with credit outperforming government bonds. A continuing theme for U.S. fixed-income markets was the flattening yield curve. Yields for 10-year government bonds

rose and ended the period at 2.72%, while 2-year yields climbed almost 100 basis points during the year to 2.14%. The U.S. Treasury yield curve flattened to a 10-year

low, with short-term yields rising more than long-term yields. The Fed hiked rates three times in 2017 and pushed short-term yields higher. Longer-term bond yields remained flat as expectations for future inflation and economic growth remained

subdued.

Front-end Treasury yields moved higher as the Fed increased the fed funds target rate to 1.25%-1.50%, marking the fifth rate hike in this tightening cycle. The Fed’s interest-rate projections, known as the dot plot, still suggest three more rate hikes in 2018, subject to inflation moving toward the

Federal Open Market Committee’s 2% target. Jerome Powell was nominated to succeed Janet Yellen as Fed Chair, Randal Quarles was named vice chair for bank supervision and Marvin Goodfriend, former Fed economist, was nominated to fill one of

three open governor seats. President Trump signed the Tax Cuts and Jobs Act into law, introducing several new policies, including a cap on state and local tax deductions, a one-time repatriation tax on

overseas cash, a move to a territorial tax system, and a permanent drop in the corporate tax rate from 35% to 21%.

Inflation-sensitive assets, such as commodities

and Treasury Inflation-Protected Securities, were positive. The Bloomberg Commodity Total Return Index (which represents the broad commodity market) rose 3.6% during the period, driven by the metals sector, while the Bloomberg Barclays 1-10 Year US TIPS Index (USD) edged 0.4% higher.

The price of oil ended the year up over 24%, after entering bear-market

territory in June and then rallying 35% over the last six months of the fiscal period.

Global fixed income, as measured by the Bloomberg Barclays Global Aggregate

Index, climbed 7.46% in U.S. dollar terms during the reporting period, while the high-yield market was also positive, with the ICE BofAML US High Yield Constrained Index up 6.74%.

|

|

|

| 2 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

U.S. investment-grade corporate debt was higher, as the Bloomberg Barclays Investment Grade US Corporate Index returned 5.08%. U.S. asset- and mortgage-backed

securities were both marginally positive during the fiscal year, despite headwinds from rising interest rates and expectations for further rate increases.

Our View

We can sum up the fiscal year gone by with the exclamation that, at long last, the global financial crisis appears to be in the rear-view mirror. In its place is

synchronized expansion across most developed and emerging economies. Admittedly, developed economies continued to run at a somewhat sluggish pace of 2% to 2.5% gross domestic product (GDP) growth. This is, at best, a middling sort of performance in

the context of the past five decades. Emerging-market economies, meanwhile, continued to expand at a clip well below that of the past 20 years.

Looking out

over the next year or so, we think global growth can still be vibrant enough to allow risk assets to perform well.

U.S. tax legislation is hardly perfect: we

believe it will not be as stimulative as advertised since tax cuts are skewed toward upper-income taxpayers who tend to have a higher saving rate than the median household. However, the permanent corporate tax changes, repatriation holiday, and the

full expensing of capital equipment purchases over the next five years are positive developments for economic growth and investment.

We do not anticipate a more

aggressive swing in Fed policy toward monetary tightness in the coming year. It is possible that the U.S. will see inflation pressures finally begin to build, but U.S. companies have proven able to maintain profit margins without resorting to price

increases.

In our opinion, Europe has growth potential. According to the World Economic Forum’s annual report on global competitiveness, the high-income

countries of Western Europe have made significant strides in improving labor-market efficiency over the last five years. We also would note that political concerns in the eurozone are far more muted compared with a year ago, although we have not yet

seen the end of the massive anti-establishment undercurrent.

Given our view that the region is a long way from employment levels that will stir inflation

pressures, we expect monetary policy to be supportive of growth throughout the coming year even as the ECB proceeds with its taper of quantitative easing. Since these asset purchases will continue at least until the end of September, it appears that

policy rates will stay put until 2019.

These have not been easy days for U.K. Prime Minister Theresa May. The divorce stage of Brexit talks has finally

concluded, with the U.K. mostly acceding to the EU’s demands. However, Parliament has begun to flex its muscles—and disapproval there would force the parties back to the negotiating table. Keep in mind that any changes to the withdrawal

agreement demanded by Parliament would also entail unanimous approval of the 27 EU members on the other side of the negotiating table.

The pace of U.K.

economic growth has been decelerating since 2014, although there is no indication that a recession is around the corner. The BOE’s Monetary Policy Committee forecasted only two rate increases between now and the end of 2019. While time will

tell whether the central bank’s view regarding future policy moves is accurate, policymakers in the U.K. face tremendous challenges over the next few years. We think investors should tread lightly until there are more definite signs that

inflation pressures have peaked and Brexit negotiations yield a favorable economic outcome for the country.

Japan is benefiting from the global economic

recovery. Exports to China are growing particularly quickly and are now about equal to the share going to the U.S. Exports to the U.S. and Europe also have accelerated but not to the same extent.

Although there have been rumblings that the BOJ would like to take a step away from the extraordinary monetary policies that have been in place since the financial

crisis, the central bank may find it difficult to do so. Domestic demand remains too weak, and the population has begun contracting, a trend that will likely accelerate.

Although China continued to reduce its dependence on heavy industry and increased the value added to GDP from service-producing sectors, there was some backsliding last

year. While these macro statistics need to be taken

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

3 |

|

LETTER TO SHAREHOLDERS (Concluded)

January 31, 2018

with a grain of salt, it appears that China’s growth has accelerated significantly from two years ago and advanced

at its fastest clip since the 2012 to 2013 period. If China can maintain positive momentum, commodity prices should continue to rally as well.

Many possible

events and developments could have a significant adverse impact, but we believe most have a low probability of actually happening. We will, therefore, maintain our risk-on bias until we see more evidence that

such a stance merits revision.

On behalf of SEI Investments, I want to thank you for your continued confidence. We are working every day to maintain that

trust, and we look forward to serving your investment needs in the future.

Sincerely,

William Lawrence, CFA

Head and Chief Investment

Officer of Traditional Asset Management

|

|

|

| 4 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2018

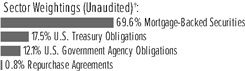

Ultra Short Duration Bond Fund

I. Objective

The Ultra Short Bond

Duration Fund (the “Fund”) seeks to provide a higher current income than typically offered by a money-market fund while maintaining a high degree of liquidity and a correspondingly higher risk of principal volatility.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number

of sub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (“SIMC”). For the one-year period ending January 31, 2018, the sub-advisors were Wellington Management Company, LLP (“Wellington”) and Logan Circle Partners, L.P. (“Logan

Circle”). There were no manager changes during the period.

III. Return

For

the full year ended January 31, 2018, the Ultra Short Duration Bond Fund, Class F, returned 1.58%. The Fund’s benchmark—Bloomberg Barclays Short U.S. Treasury 9-12 Month Index—returned

0.64%.

IV. Performance Discussion

Shorter-term interest rates increased during

the period, as noted in the shareholder letter, and benefited the Fund’s slightly short-duration posture. Additionally, the Fund’s barbell yield-curve position an overweight to longer-duration securities

(1-5 years), which tends to act as a hedge to the Fund’s credit exposure was additive as rates rose, and the curve flattened, with 2-5 year U.S. Treasury yields

rising less than the shorter end of the curve.

The Fund’s return was driven by strong performance across a number of investment-grade credit sectors

particularly financials and industrials as well as allocations to several asset-backed securities (“ABS”) sectors and non-agency mortgage-backed securities (“MBS”).

The Fund’s overweight to financials contributed to out performance as banks continued to perform well on a relative basis and spreads tightened due to attractive

fundamentals and potential tax reform benefits. The Fund’s overweight to industrials contributed to out performance as industrials are a spread sector utilized to outperform the short Treasury benchmark.

A significant allocation to specific ABS sectors contributed to out performance. Consumer-related ABS

sub-sectors, such as auto securitizations and credit cards, performed well as the U.S. consumer remained resilient and wage gains supported sector

fundamentals.

Both sub-advisors, Logan Circle and Wellington, contributed to Fund outperformance. Both benefited from

similar exposures that contributed to outperformance, including financials, industrials, consumer-related ABS and non-agency MBS. Short-duration positioning and yield-curve posture were also additive for both sub-advisors. An allocation to cash detracted from relative performance.

The Fund used Treasury futures to efficiently manage

duration and yield-curve exposures. Additionally, the Fund used to-be-announced (“TBA”) forward contracts (TBA contracts confer the obligation to buy or sell

future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA) to manage market exposures. None of these had a meaningful impact on the Fund’s performance.

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

5 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2018

Ultra Short Duration Bond Fund (Concluded)

Ultra Short Duration Bond Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

One Year

Return |

|

|

Annualized

3-Year

Return |

|

|

Annualized

5-Year

Return |

|

|

Annualized

10-Year

Return |

|

|

Annualized

Inception

to Date |

|

| Class F† |

|

|

1.58% |

|

|

|

1.12% |

|

|

|

0.92% |

|

|

|

1.17% |

|

|

|

3.07% |

|

| Class Y† |

|

|

1.67% |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

1.40%* |

|

| Bloomberg Barclays Short U.S. Treasury 9-12 Month Index |

|

|

0.64% |

|

|

|

0.56% |

|

|

|

0.43% |

|

|

|

0.77% |

|

|

|

3.03% |

|

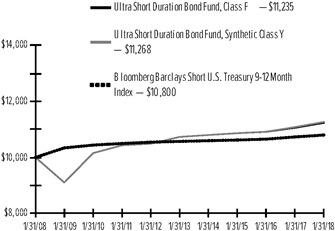

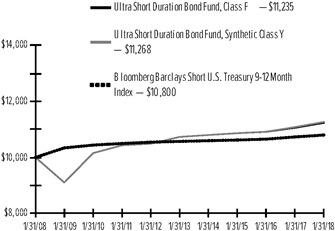

Comparison of Change in the Value of a $10,000 Investment in the Ultra Short Duration Bond Fund, Class F and Class Y, versus

the Bloomberg Barclays Short U.S. Treasury 9-12 Month Index.

| 1 |

For the periods ended January 31, 2018. Past performance is no indication of future performance. Class F Shares (formerly Class A Shares) were offered beginning 9/28/93. Returns shown do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| † |

The graph is based on only Class F Shares (formerly Class A Shares); performance for Class Y Shares would be different due to differences in fee structures. |

| * |

Cumulative inception to date as of August 31, 2015. |

N/A — Not Available.

|

|

|

| 6 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2018

Short-Duration Government Fund

I. Objective

The Short-Duration Government Fund (the “Fund”) seeks to preserve principal value and maintain a high degree of

liquidity while providing current income.

II. Investment Approach

The Fund uses

a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation (“SIMC”). For the one-year period ending January 31,

2018, the sub-advisor was Wellington Management Company, LLP (“Wellington”). No manager changes were made during the period.

III. Returns

For the full year ended January 31, 2018, the Short-Duration

Government Fund, Class F, returned 0.13%. The Fund’s benchmark—ICE BofAML 1-3 Year U.S. Treasury Index—returned 0.01%.

IV. Performance Discussion

Despite the

low-interest-rate environment, the Fund was able to generate positive absolute returns due to its allocation to mortgage-backed securities (“MBS”) versus the Fund’s all-Treasury benchmark.

The Fund’s allocation to MBS added to relative performance. MBS generated strong excess returns and

outperformed Treasurys over the fiscal year. The Fund’s yield-curve-flattening posture, via an overweight to the 7-10 year part of the curve and underweight to the

1-3 year part of the curve, was also additive given that short-term U.S. Treasury yields rose more than longer-term rates as the shareholder letter addressed.

Derivatives were used by the Fund on a limited basis. U.S. Treasury futures were used to manage yield-curve exposure and overall portfolio duration. The Fund used

Treasury futures and to-be-announced (“TBA”) forward contracts to manage duration, yield-curve and market exposures (TBA contracts confer the obligation to buy

or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA). Treasury futures detracted from the Fund’s performance.

Short-Duration Government Fund:

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURN1 |

|

|

| |

|

|

|

Annualized |

|

Annualized |

|

Annualized |

|

Annualized |

| |

|

One Year |

|

3-Year |

|

5-Year |

|

10-Year |

|

Inception |

| |

|

Return |

|

Return |

|

Return |

|

Return |

|

to Date |

| Class F† |

|

0.13% |

|

0.30% |

|

0.41% |

|

1.70% |

|

4.36% |

| Class Y† |

|

0.27% |

|

0.41% |

|

N/A |

|

N/A |

|

0.57% |

| ICE BofA Merrill Lynch 1-3 Year U.S. Treasury Bond Index |

|

0.01% |

|

0.35% |

|

0.50% |

|

1.24% |

|

4.47% |

Comparison of Change in the Value of a $10,000 Investment in the Short-Duration Government Fund, Class F and Class Y, versus

the ICE BofA Merrill Lynch 1-3 Year U.S. Treasury Bond Index.

| 1 |

For the periods ended January 31, 2018. Past performance is no indication of future performance. Class F Shares (formerly Class A Shares) were offered beginning 2/17/87. Returns shown do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| † |

The graph is based on only Class F Shares (formerly Class A Shares); performance for Class Y Shares would be different due to differences in fee structures. |

N/A — Not Available

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

7 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

January 31, 2018

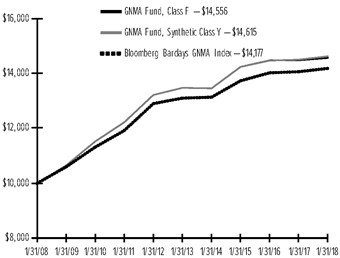

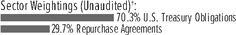

GNMA Fund

I. Objective

The GNMA Fund (the

“Fund”) seeks to preserve principal value and maintain a high degree of liquidity while providing current income.

II. Investment Approach

The Fund uses a sub-advisor to manage the Fund under the supervision of SEI Investments Management Corporation

(“SIMC”). For the one-year period ending January 31, 2018, the sub-advisor was Wellington Management Company, LLP (“Wellington”). No manager

changes were made during the period.

III. Returns

For the full year ended

January 31, 2018, the GNMA Fund, Class F, returned 0.58%. The Fund’s benchmark—Bloomberg Barclays GNMA Index—returned 0.86%.

IV.

Performance Discussion

Despite the low interest-rate environment over the period and the beginning of the Fed’s tightening cycle, the Fund was able to generate

positive absolute returns.

The Fund’s overweight to higher coupons and underweight to 30-year mortgage-backed

securities (“MBS”) detracted from relative performance. Higher-coupon MBS underperformed those with lower coupons, as the Fed’s unwinding of rates kept prepayment speeds lower on lower-coupon mortgages and made higher-coupon

securities more subject to prepayment risk.

An underweight to GNMA securities, in favor of residential and multi-family conventional MBS, contributed to relative

performance, as GNMA securities underperformed those sectors. GNMA underperformed conventionals due to unwinding in GNMA valuations after significant spread tightening in 2016.

The Fund’s long-duration posture, detracted as all rates except 30-year Treasurys rose across the curve in conjunction with

the Federal Reserve’s rate hikes over the fiscal year, as noted in the shareholder letter.

The Fund used derivatives on a limited basis. U.S. Treasury futures

were used to manage yield-curve exposure and overall portfolio duration. The Fund used Treasury futures and to-be-announced (“TBA”) forward contracts to manage

duration, yield-curve and market exposures (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and GNMA). Treasury

futures detracted from the Fund’s performance. The Fund made

selective use of mortgage derivatives, such as interest-only strip securities, principal-only strip securities and inverse floaters. The yields on these securities are sensitive to the expected

or anticipated rate of principal payments on the underlying assets, and principal payments may have a material effect on their yields. These instruments are purchased only when rigorous stress testing and analysis suggest that a higher return can be

earned at similar or lower risk compared to non-derivative securities.

GNMA Fund:

AVERAGE ANNUAL TOTAL RETURN1

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Annualized |

|

Annualized |

|

Annualized |

|

Annualized |

| |

|

One Year |

|

3-Year |

|

5-Year |

|

10-Year |

|

Inception |

| |

|

Return |

|

Return |

|

Return |

|

Return |

|

to Date |

| Class F† |

|

0.58% |

|

0.75% |

|

1.56% |

|

3.83% |

|

5.83% |

| Class Y† |

|

0.82% |

|

N/A |

|

N/A |

|

N/A |

|

1.04%* |

| Bloomberg Barclays GNMA Index |

|

0.86% |

|

1.08% |

|

1.60% |

|

3.55% |

|

6.15% |

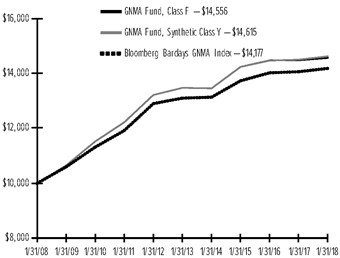

Comparison of Change in the Value of a $10,000 Investment in the GNMA Fund, Class F and Class Y, versus the Bloomberg Barclays

GNMA Index.

| 1 |

For the periods ended January 31, 2018. Past performance is no indication of future performance. Class F Shares (formerly Class A Shares) were offered beginning 3/20/87. Returns shown do not reflect the

deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| † |

The graph is based on only Class F Shares (formerly Class A Shares); performance for Class Y Shares would be different due to differences in fee structures. |

| * |

Cumulative inception to date as of October 30, 2015. |

N/A — Not Available

|

|

|

| 8 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

Definition of Comparative Indices*

Bloomberg Barclays GNMA Index is a widely-recognized, capitalization-weighted index of 15-30 year fixed-rate securities backed by mortgage pools of GNMA.

Bloomberg Barclays Short U.S. Treasury

9-12 Month Index is a widely-recognized, market weighted index of U.S. Treasury Bonds with remaining maturities between nine and twelve months.

ICE BofA Merrill Lynch 1-3 Year U.S. Treasury Bond Index is a widely-recognized, unmanaged index that tracks the

performance of the direct sovereign debt of the U.S. Government having a maturity of at least one year and less than 3 years.

| |

* |

An Index measures the market price of a specific group of securities in a particular market sector. You cannot invest directly in an index. An index does not have an investment adviser and does not pay any commissions

or expenses. If an index had expenses, its performance would be lower. |

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

9 |

|

SCHEDULE OF INVESTMENTS

January 31, 2018

Government Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS – 45.7% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 1.530%, VAR ICE LIBOR USD 1 Month+-0.030%, 08/13/2018 |

|

$ |

40,075 |

|

|

$ |

40,075 |

|

| 1.660%, VAR ICE LIBOR USD 1 Month+0.105%, 09/06/2018 |

|

|

69,315 |

|

|

|

69,314 |

|

| FFCB DN |

|

|

|

|

|

|

|

|

| 1.060%, 02/15/2018 (A) |

|

|

39,608 |

|

|

|

39,592 |

|

| FHLB |

|

|

|

|

|

|

|

|

| 1.281%, VAR ICE LIBOR USD 3 Month+-0.110%, 02/05/2018 |

|

|

47,500 |

|

|

|

47,500 |

|

| 1.287%, VAR ICE LIBOR USD 3 Month+-0.200%, 03/02/2018 |

|

|

20,000 |

|

|

|

20,000 |

|

| 0.875%, 03/19/2018 |

|

|

39,035 |

|

|

|

39,019 |

|

| 1.419%, VAR ICE LIBOR USD 1 Month+-0.140%, 04/13/2018 |

|

|

200,130 |

|

|

|

200,130 |

|

| 1.419%, VAR ICE LIBOR USD 1 Month+-0.140%, 04/17/2018 |

|

|

40,220 |

|

|

|

40,220 |

|

| 1.414%, VAR ICE LIBOR USD 1 Month+-0.145%, 04/17/2018 |

|

|

69,130 |

|

|

|

69,130 |

|

| 1.416%, VAR ICE LIBOR USD 1 Month+-0.140%, 05/18/2018 |

|

|

56,905 |

|

|

|

56,905 |

|

| 1.321%, VAR ICE LIBOR USD 3 Month+-0.160%, 05/30/2018 |

|

|

62,670 |

|

|

|

62,670 |

|

| 1.422%, VAR ICE LIBOR USD 1 Month+-0.135%, 06/05/2018 |

|

|

47,000 |

|

|

|

47,000 |

|

| 1.417%, VAR ICE LIBOR USD 1 Month+-0.140%, 07/05/2018 |

|

|

74,525 |

|

|

|

74,525 |

|

| 1.513%, VAR ICE LIBOR USD 1 Month+-0.040%, 07/09/2018 |

|

|

78,000 |

|

|

|

78,000 |

|

| 1.414%, VAR ICE LIBOR USD 1 Month+-0.145%, 08/15/2018 |

|

|

28,960 |

|

|

|

28,960 |

|

| 1.416%, VAR ICE LIBOR USD 1 Month+-0.145%, 08/22/2018 |

|

|

57,925 |

|

|

|

57,925 |

|

| 1.449%, VAR ICE LIBOR USD 1 Month+-0.115%, 10/03/2018 |

|

|

57,000 |

|

|

|

57,000 |

|

| 1.475%, VAR ICE LIBOR USD 1 Month+-0.100%, 11/01/2018 |

|

|

110,000 |

|

|

|

110,000 |

|

| 1.468%, VAR ICE LIBOR USD 1 Month+-0.100%, 11/02/2018 |

|

|

19,500 |

|

|

|

19,500 |

|

| 1.465%, VAR ICE LIBOR USD 1 Month+-0.090%, 11/08/2018 |

|

|

120,000 |

|

|

|

120,000 |

|

| 1.429%, VAR ICE LIBOR USD 1 Month+-0.130%, 11/15/2018 |

|

|

75,000 |

|

|

|

75,000 |

|

| 1.471%, VAR ICE LIBOR USD 1 Month+-0.090%, 01/25/2019 |

|

|

65,345 |

|

|

|

65,345 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 1.482%, VAR ICE LIBOR USD 1 Month+-0.080%, 02/04/2019 |

|

$ |

135,000 |

|

|

$ |

135,000 |

|

| 1.389%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/12/2019 |

|

|

23,955 |

|

|

|

23,947 |

|

| 1.465%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/20/2019 |

|

|

55,365 |

|

|

|

55,365 |

|

| 1.473%, VAR ICE LIBOR USD 3 Month+-0.140%, 12/19/2019 |

|

|

29,005 |

|

|

|

29,005 |

|

| FHLB DN (A) |

|

|

|

|

|

|

|

|

| 1.189%, 02/02/2018 |

|

|

111,000 |

|

|

|

110,996 |

|

| 1.219%, 02/07/2018 |

|

|

63,500 |

|

|

|

63,487 |

|

| 1.179%, 02/14/2018 |

|

|

172,555 |

|

|

|

172,482 |

|

| 1.322%, 02/21/2018 |

|

|

68,030 |

|

|

|

67,980 |

|

| 1.128%, 02/23/2018 |

|

|

85,100 |

|

|

|

85,042 |

|

| 1.126%, 02/28/2018 |

|

|

137,600 |

|

|

|

137,484 |

|

| 1.131%, 03/02/2018 |

|

|

67,520 |

|

|

|

67,459 |

|

| 1.308%, 03/07/2018 |

|

|

68,870 |

|

|

|

68,785 |

|

| 1.332%, 03/09/2018 |

|

|

123,935 |

|

|

|

123,770 |

|

| 1.343%, 03/13/2018 |

|

|

81,140 |

|

|

|

81,019 |

|

| 1.182%, 03/21/2018 |

|

|

67,325 |

|

|

|

67,219 |

|

| 1.253%, 03/23/2018 |

|

|

125,220 |

|

|

|

125,003 |

|

| 1.343%, 03/27/2018 |

|

|

59,485 |

|

|

|

59,366 |

|

| 1.182%, 03/28/2018 |

|

|

26,395 |

|

|

|

26,348 |

|

| 1.363%, 04/03/2018 |

|

|

90,325 |

|

|

|

90,117 |

|

| 1.415%, 04/06/2018 |

|

|

50,755 |

|

|

|

50,628 |

|

| 1.500%, 04/11/2018 |

|

|

17,380 |

|

|

|

17,332 |

|

| 1.466%, 05/01/2018 |

|

|

59,315 |

|

|

|

59,101 |

|

| 1.644%, 08/01/2018 |

|

|

46,515 |

|

|

|

46,134 |

|

| FHLB DN DN, Ser 2005- |

|

|

|

|

|

|

|

|

| 1.303%, 02/15/2018 (A) |

|

|

57,495 |

|

|

|

57,466 |

|

| FHLMC |

|

|

|

|

|

|

|

|

| 0.875%, 03/07/2018 |

|

|

34,000 |

|

|

|

33,993 |

|

| FHLMC DN |

|

|

|

|

|

|

|

|

| 1.096%, 02/16/2018 (A) |

|

|

17,245 |

|

|

|

17,237 |

|

| FNMA |

|

|

|

|

|

|

|

|

| 0.875%, 05/21/2018 |

|

|

46,870 |

|

|

|

46,820 |

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $3,336,395) ($ Thousands) |

|

|

|

|

|

|

3,336,395 |

|

|

| U.S. TREASURY OBLIGATIONS – 23.5% |

|

| U.S. Treasury Bills (A) |

|

|

|

|

|

|

|

|

| 1.294%, 03/08/2018 |

|

|

125,000 |

|

|

|

124,843 |

|

| 1.187%, 03/22/2018 |

|

|

58,685 |

|

|

|

58,591 |

|

| 1.177%, 03/29/2018 |

|

|

328,290 |

|

|

|

327,692 |

|

| 1.197%, 04/05/2018 |

|

|

75,000 |

|

|

|

74,844 |

|

| 1.271%, 05/03/2018 |

|

|

57,130 |

|

|

|

56,948 |

|

| 1.446%, 05/31/2018 |

|

|

34,100 |

|

|

|

33,938 |

|

| 1.461%, 06/07/2018 |

|

|

114,320 |

|

|

|

113,740 |

|

| 1.461%, 06/14/2018 |

|

|

16,360 |

|

|

|

16,272 |

|

| 1.496%, 06/21/2018 |

|

|

5,340 |

|

|

|

5,309 |

|

| 1.542%, 06/28/2018 |

|

|

300,000 |

|

|

|

298,126 |

|

|

|

|

| 10 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($Thousands) |

|

|

| U.S. TREASURY OBLIGATIONS (continued) |

|

| 1.588%, 07/12/2018 |

|

$ |

150,000 |

|

|

$ |

148,943 |

|

| 1.611%, 07/19/2018 |

|

|

223,175 |

|

|

|

221,511 |

|

| 1.638%, 08/02/2018 |

|

|

150,000 |

|

|

|

148,768 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 0.750%, 02/28/2018 |

|

|

33,930 |

|

|

|

33,921 |

|

| 1.375%, 07/31/2018 |

|

|

33,750 |

|

|

|

33,740 |

|

| 0.875%, 10/15/2018 |

|

|

12,615 |

|

|

|

12,543 |

|

| 1.375%, 11/30/2018 |

|

|

10,285 |

|

|

|

10,254 |

|

| Total U.S. Treasury Obligations

(Cost $1,719,983) ($ Thousands) |

|

|

|

1,719,983 |

|

|

| REPURCHASE AGREEMENTS(B) – 32.4% |

|

| BNP Paribas |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/18, to be repurchased on 02/01/18, repurchase price $189,006,980 (collateralized by various U.S. Treasury

obligations, ranging in par value $.01 - $79,146,100, 0.000% - 3.750%, 02/15/18 - 02/15/46; with total market value $192,780,000) |

|

|

189,000 |

|

|

|

189,000 |

|

| Citigroup Global |

|

|

|

|

|

|

|

|

| 1.350%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $9,000,338 (collateralized by various FHLMC, FNMA, GNMA

and U.S. Treasury obligations, ranging in par value$ 5,000 - $4,282,518, 0.000% - 5.000%, 08/15/24- 01/20/48; with total market value $9,221,374) |

|

|

9,000 |

|

|

|

9,000 |

|

| Citigroup Global |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $41,001,515 (collateralized by U.S. Treasury

obligations, par value $41,467,100 2.500%, 08/15/23; with total market value $41,820,026) |

|

|

41,000 |

|

|

|

41,000 |

|

| Goldman Sachs |

|

|

|

|

|

|

|

|

| 1.250%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $74,002,569 (collateralized by various U.S. Treasury

obligations, ranging in par value $9,200 -$76,440,000, 0.000% - 0.5000%, 02/01/18- 01/15/28; with total market value $75,480,006) |

|

|

74,000 |

|

|

|

74,000 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($Thousands) |

|

|

| REPURCHASE AGREEMENTS(B) (continued) |

|

| Goldman Sachs |

|

|

|

|

|

|

|

|

| 1.310%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $325,011,826 (collateralized by FFCB, FNMA and U.S.

Treasury obligation, ranging in par value $910,000 -$327,844,100, 2.000% - 7.125%, 08/31/21- 11/16/37; with total market value $331,500,031) |

|

$ |

325,000 |

|

|

$ |

325,000 |

|

| J P Morgan |

|

|

|

|

|

|

|

|

| 1.370%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $375,014,271 (collateralized by various U.S. Treasury

obligations, ranging in par value $3,745,000 - $391,090,200, 1.435% - 2.125%, 01/31/20 - 05/16/25; with total market value $382,503,855) |

|

|

375,000 |

|

|

|

375,000 |

|

| Merrill Lynch |

|

|

|

|

|

|

|

|

| 1.360%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $150,005,667 (collateralized by various U.S. Government

Agency obligations, ranging in par value $13,095,266 - $146,277,996, 3.000% - 4.000%, 01/01/42- 01/01/48; with total market value $154,500,089) |

|

|

150,000 |

|

|

|

150,000 |

|

| Mitsubishi UFJ |

|

|

|

|

|

|

|

|

| 1.310%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $280,010,189 (collateralized by various U.S. Treasury

obligations, ranging in par value $200 - $139,790,800, 0.000% - 5.375%, 09/30/18 - 05/15/46; with total market value $285,600,010) |

|

|

280,000 |

|

|

|

280,000 |

|

| Mizuho Securities |

|

|

|

|

|

|

|

|

| 1.370%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $150,005,708 (collateralized by FHLMC and GNMA

obligations, ranging in par value $185,980 - $74,577,864, 4.500% - 5.000%, 01/20/47- 01/20/48; with total market value $153,322,978) |

|

|

150,000 |

|

|

|

150,000 |

|

| Natixis S.A. |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $65,002,401 (collateralized by various U.S. Government

Agency and U.S. Treasury obligations, ranging in par value $100 - 31,253,364, 0.000% - 6.625%, 06/21/18 - 10/01/47; with total market value $66,659,232) |

|

|

65,000 |

|

|

|

65,000 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

11 |

|

SCHEDULE OF INVESTMENTS

January 31, 2018

Government Fund (Concluded)

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| REPURCHASE AGREEMENTS(B) (continued) |

|

| Natixis S.A. |

|

|

|

|

|

|

|

|

| 1.320%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $25,000,917 (collateralized by various U.S. Treasury

obligations, ranging in par value $100 -$19,393,600, 0.000% - 2.500%, 04/15/18- 02/15/45; with total market value $25,500,080) |

|

$ |

25,000 |

|

|

$ |

25,000 |

|

| TD Securities |

|

|

|

|

|

|

|

|

| 1.350%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $250,009,375 (collateralized by FNMA and GNMA

obligations, ranging in par value $50,147,533 -$183,686,399, 3.500% - 4.000%, 02/20/42- 08/01/46; with total market value $257,040,873) |

|

|

250,000 |

|

|

|

250,000 |

|

| TD Securities |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $250,009,236 (collateralized by various U.S. Treasury

obligations, ranging in par value $79,738,400 -$156,095,900, 2.500% - 4.375%, 05/15/24- 05/15/40; with total market value $255,000,025) |

|

|

250,000 |

|

|

|

250,000 |

|

| Bank of Nova Scotia |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $13,000,480 (collateralized by various U.S. Treasury

obligations, ranging in par value $35,000 - $6,517,600, 1.250% - 3.875%, 01/31/20 - 04/15/29; with total market value $13,260,501) |

|

|

13,000 |

|

|

|

13,000 |

|

| Wells Fargo |

|

|

|

|

|

|

|

|

| 1.350%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $175,006,563 (collateralized by U.S. Treasury

obligation, par value $181,013,400, 2.875%, 11/15/46; with total market value $178,500,089) |

|

|

175,000 |

|

|

|

175,000 |

|

|

|

|

| Total Repurchase Agreements

(Cost $2,371,000) ($ Thousands) |

|

|

|

|

|

|

2,371,000 |

|

|

|

|

| Total Investments — 101.6%

(Cost $7,427,378) ($ Thousands) |

|

|

|

|

|

$ |

7,427,378 |

|

|

|

|

|

|

|

|

|

|

| |

Percentages are based on Net Assets of $7,309,291 ($ Thousands). |

| (A) |

Zero coupon security. The rate shown on the Schedule of Investments is the effective yield at the time of purchase. |

| (B) |

Tri-Party Repurchase Agreement.

|

DN — Discount Note

FFCB

— Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC

— Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

Ser — Series

As of January 31, 2018, all of the Fund’s investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and

disclosure under U.S. GAAP.

For the year ended January 31, 2018, there were no transfers between Level 1, Level 2 and/or Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 12 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

SCHEDULE OF INVESTMENTS

January

31, 2018

Government II Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 52.0% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 1.470%, VAR ICE LIBOR USD 1 Month+-0.085%, 05/07/2019 |

|

$ |

29,000 |

|

|

$ |

28,998 |

|

| 1.400%, VAR ICE LIBOR USD 1 Month+0.160%, 03/26/2018 |

|

|

6,740 |

|

|

|

6,742 |

|

| 1.598%, VAR ICE LIBOR USD 1 Month+0.045%, 04/09/2018 |

|

|

20,185 |

|

|

|

20,187 |

|

| 1.257%, VAR ICE LIBOR USD 1 Month+0.020%, 05/17/2018 |

|

|

5,260 |

|

|

|

5,261 |

|

| 1.529%, VAR ICE LIBOR USD 1 Month+-0.030%, 08/13/2018 |

|

|

9,925 |

|

|

|

9,925 |

|

| FFCB DN DN |

|

|

|

|

|

|

|

|

| 1.294%, 07/13/2018 (A) |

|

|

12,375 |

|

|

|

12,304 |

|

| 1.261%, 06/06/2018 (A) |

|

|

4,865 |

|

|

|

4,844 |

|

| 1.250%, 05/25/2018 (A) |

|

|

19,070 |

|

|

|

18,996 |

|

| 1.167%, 03/23/2018 (A) |

|

|

7,630 |

|

|

|

7,617 |

|

| FHLB |

|

|

|

|

|

|

|

|

| 1.482%, VAR ICE LIBOR USD 1 Month+-0.080%, 02/04/2019 |

|

|

15,000 |

|

|

|

15,000 |

|

| 1.473%, VAR ICE LIBOR USD 3 Month+-0.140%, 12/19/2019 |

|

|

8,040 |

|

|

|

8,040 |

|

| 1.471%, VAR ICE LIBOR USD 1 Month+-0.090%, 01/25/2019 |

|

|

15,470 |

|

|

|

15,470 |

|

| 1.466%, VAR ICE LIBOR USD 1 Month+-0.095%, 12/21/2018 |

|

|

17,000 |

|

|

|

17,000 |

|

| 1.465%, VAR ICE LIBOR USD 1 Month+-0.090%, 11/08/2018 to 06/20/2019 |

|

|

43,675 |

|

|

|

43,675 |

|

| 1.449%, VAR ICE LIBOR USD 1 Month+-0.115%, 10/03/2018 |

|

|

15,500 |

|

|

|

15,500 |

|

| 1.431%, VAR ICE LIBOR USD 1 Month+-0.130%, 01/28/2019 |

|

|

10,580 |

|

|

|

10,580 |

|

| 1.429%, VAR ICE LIBOR USD 1 Month+-0.130%, 11/15/2018 |

|

|

15,000 |

|

|

|

15,000 |

|

| 1.422%, VAR ICE LIBOR USD 1 Month+-0.135%, 06/05/2018 |

|

|

13,000 |

|

|

|

13,000 |

|

| 1.419%, VAR ICE LIBOR USD 1 Month+-0.140%, 04/17/2018 |

|

|

30,280 |

|

|

|

30,280 |

|

| 1.416%, VAR ICE LIBOR USD 1 Month+-0.140%, 05/18/2018 to 08/22/2018 |

|

|

44,445 |

|

|

|

44,445 |

|

| 1.414%, VAR ICE LIBOR USD 1 Month+-0.145%, 04/17/2018 to 08/15/2018 |

|

|

35,670 |

|

|

|

35,670 |

|

| 1.411%, VAR ICE LIBOR USD 1 Month+-0.150%, 07/27/2018 |

|

|

15,445 |

|

|

|

15,445 |

|

| 1.408%, VAR ICE LIBOR USD 1 Month+-0.160%, 07/27/2018 |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

|

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS (continued) |

|

| 1.403%, VAR ICE LIBOR USD 1 Month+-0.155%, 05/25/2018 |

|

$ |

15,000 |

|

|

$ |

15,000 |

|

| 1.389%, VAR ICE LIBOR USD 3 Month+-0.160%, 06/12/2019 |

|

|

6,510 |

|

|

|

6,507 |

|

| 1.202%, VAR ICE LIBOR USD 3 Month+-0.110%, 02/05/2018 |

|

|

5,000 |

|

|

|

5,000 |

|

| 1.513%, VAR ICE LIBOR USD 1 Month+-0.040%, 07/09/2018 |

|

|

19,000 |

|

|

|

19,000 |

|

| 1.321%, VAR ICE LIBOR USD 3 Month+-0.160%, 05/30/2018 |

|

|

14,080 |

|

|

|

14,080 |

|

| 1.118%, VAR ICE LIBOR USD 3 Month+-0.200%, 03/02/2018 |

|

|

4,000 |

|

|

|

4,000 |

|

| FHLB DN |

|

|

|

|

|

|

|

|

| 1.466%, 05/01/2018 (A) |

|

|

17,635 |

|

|

|

17,571 |

|

| 1.363%, 04/03/2018 (A) |

|

|

26,185 |

|

|

|

26,125 |

|

| 1.343%, 03/13/2018 to 03/27/2018 (A) |

|

|

43,185 |

|

|

|

43,112 |

|

| 1.332%, 03/09/2018 (A) |

|

|

37,805 |

|

|

|

37,755 |

|

| 1.322%, 02/21/2018 (A) |

|

|

19,520 |

|

|

|

19,506 |

|

| 1.308%, 03/07/2018 (A) |

|

|

18,185 |

|

|

|

18,163 |

|

| 1.253%, 03/23/2018 (A) |

|

|

16,535 |

|

|

|

16,504 |

|

| 1.219%, 02/07/2018 (A) |

|

|

15,500 |

|

|

|

15,497 |

|

| 1.182%, 03/21/2018 (A) |

|

|

25,000 |

|

|

|

24,961 |

|

| 1.179%, 02/14/2018 (A) |

|

|

44,570 |

|

|

|

44,551 |

|

| 1.131%, 03/02/2018 (A) |

|

|

17,035 |

|

|

|

17,019 |

|

| 1.128%, 02/23/2018 (A) |

|

|

123,620 |

|

|

|

123,523 |

|

| 1.126%, 02/28/2018 (A) |

|

|

96,245 |

|

|

|

96,153 |

|

| 1.430%, 04/11/2018 (A) |

|

|

5,165 |

|

|

|

5,151 |

|

| 1.265%, 02/02/2018 (A) |

|

|

95,500 |

|

|

|

95,497 |

|

| 0.060%, 08/01/2018 (A) |

|

|

38,200 |

|

|

|

37,887 |

|

| FHLB DN DN, Ser 2005- |

|

|

|

|

|

|

|

|

| 1.303%, 02/15/2018 (A) |

|

|

15,935 |

|

|

|

15,927 |

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $1,132,468) ($ Thousands) |

|

|

|

|

|

|

1,132,468 |

|

|

| U.S. TREASURY OBLIGATIONS — 50.1% |

|

| U.S. Treasury Bills |

|

|

|

|

|

|

|

|

| 1.252%, 02/01/2018 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 1.271%, 02/08/2018 (A) |

|

|

184,000 |

|

|

|

183,955 |

|

| 1.266%, 02/15/2018 (A) |

|

|

415,000 |

|

|

|

414,796 |

|

| 1.294%, 03/08/2018 (A) |

|

|

75,000 |

|

|

|

74,906 |

|

| 1.177%, 03/29/2018 (A) |

|

|

62,775 |

|

|

|

62,660 |

|

| 1.197%, 04/05/2018 (A) |

|

|

24,000 |

|

|

|

23,950 |

|

| 1.270%, 05/03/2018 (A) |

|

|

13,330 |

|

|

|

13,287 |

|

| 1.446%, 05/31/2018 (A) |

|

|

13,595 |

|

|

|

13,531 |

|

| 1.461%, 06/07/2018 (A) |

|

|

32,860 |

|

|

|

32,693 |

|

| 1.496%, 06/21/2018 (A) |

|

|

1,460 |

|

|

|

1,452 |

|

| 1.542%, 06/28/2018 (A) |

|

|

111,810 |

|

|

|

111,112 |

|

| 1.588%, 07/12/2018 (A) |

|

|

45,000 |

|

|

|

44,683 |

|

| 1.611%, 07/19/2018 (A) |

|

|

67,800 |

|

|

|

67,294 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

13 |

|

SCHEDULE OF INVESTMENTS

January 31, 2018

Government II Fund (Concluded)

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Market Value

($ Thousands) |

| U.S. TREASURY OBLIGATIONS

(continued) |

| 1.638%, 08/02/2018 (A) |

|

$ |

45,000 |

|

|

$ 44,630 |

|

|

|

| Total U.S. Treasury Obligations

(Cost $1,089,949) ($ Thousands) |

|

|

|

|

|

1,089,949 |

|

|

|

| Total Investments in Securities— 102.1%

(Cost $2,222,417) ($ Thousands) |

|

|

|

|

|

$ 2,222,417 |

|

|

|

|

|

|

|

| |

Percentages are based on Net Assets of $2,177,761 ($ Thousands). |

| (A) |

Zero Coupon Rate — The rate reported on the Schedule of Investments is the effective yield at the time of purchase. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

Ser — Series

As of January 31, 2018, all of the Fund’s investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and

disclosure under U.S. GAAP.

For the year ended January 31, 2018, there were no transfers between Level 1, Level 2 and/or Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2—Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 14 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

SCHEDULE OF INVESTMENTS

January 31, 2018

Treasury Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| U.S. TREASURY OBLIGATIONS – 68.4% |

|

| U.S. Treasury Bills (A) |

|

|

|

|

|

|

|

|

| 1.252%, 02/01/2018 |

|

$ |

10,000 |

|

|

$ |

10,000 |

|

| 1.294%, 03/08/2018 |

|

|

1,000 |

|

|

|

999 |

|

| 1.182%, 03/22/2018 |

|

|

4,945 |

|

|

|

4,937 |

|

| 1.249%, 03/29/2018 |

|

|

14,800 |

|

|

|

14,771 |

|

| 1.197%, 04/05/2018 |

|

|

2,000 |

|

|

|

1,996 |

|

| 1.227%, 04/12/2018 |

|

|

2,000 |

|

|

|

1,995 |

|

| 1.436%, 04/26/2018 |

|

|

1,000 |

|

|

|

997 |

|

| 1.270%, 05/03/2018 |

|

|

620 |

|

|

|

618 |

|

| 1.311%, 05/10/2018 |

|

|

2,195 |

|

|

|

2,187 |

|

| 1.359%, 05/17/2018 |

|

|

115 |

|

|

|

115 |

|

| 1.446%, 05/31/2018 |

|

|

1,180 |

|

|

|

1,174 |

|

| 1.461%, 06/07/2018 |

|

|

1,750 |

|

|

|

1,741 |

|

| 1.542%, 06/28/2018 |

|

|

2,635 |

|

|

|

2,618 |

|

| 1.588%, 07/12/2018 |

|

|

3,000 |

|

|

|

2,979 |

|

| 1.222%, 07/19/2018 |

|

|

6,760 |

|

|

|

6,715 |

|

| 1.639%, 08/02/2018 |

|

|

3,000 |

|

|

|

2,975 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 3.500%, 02/15/2018 |

|

|

750 |

|

|

|

751 |

|

| 1.000%, 02/15/2018 |

|

|

705 |

|

|

|

705 |

|

| 0.750%, 02/28/2018 |

|

|

470 |

|

|

|

470 |

|

| 2.875%, 03/31/2018 |

|

|

1,500 |

|

|

|

1,504 |

|

| 1.625%, VAR US Treasury 3 Month Bill Money Market Yield+0.190%, 04/30/2018 |

|

|

8,500 |

|

|

|

8,500 |

|

| 1.375%, 07/31/2018 |

|

|

465 |

|

|

|

465 |

|

| 0.875%, 10/15/2018 |

|

|

160 |

|

|

|

159 |

|

| 1.605%, VAR US Treasury 3 Month Bill Money Market Yield+0.170%, 10/31/2018 |

|

|

2,830 |

|

|

|

2,830 |

|

| 1.375%, 11/30/2018 |

|

|

120 |

|

|

|

120 |

|

| 1.505%, VAR US Treasury 3 Month Bill Money Market Yield+0.070%, 04/30/2019 |

|

|

1,735 |

|

|

|

1,735 |

|

| 1.483%, VAR US Treasury 3 Month Bill Money Market Yield+0.048%, 10/31/2019 |

|

|

2,000 |

|

|

|

2,000 |

|

| 1.435%, VAR US Treasury 3 Month Bill Money Market Yield+0.000%, 01/31/2020 |

|

|

2,000 |

|

|

|

2,000 |

|

| Total U.S. Treasury Obligations (Cost $78,056) ($ Thousands) |

|

|

|

|

|

|

78,056 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| REPURCHASE AGREEMENTS(B) – 28.9% |

|

| BNP Paribas |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $5,000,185 (collateralized by various U.S. Treasury

obligations, ranging in par value $200 - $3,043,000, 0.000% - 1.575%, 02/01/18- 01/31/19; with total market value $5,100,059) |

|

$ |

5,000 |

|

|

$ |

5,000 |

|

| Citigroup Global |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $5,000,185 (collateralized by U.S. Treasury obligation,

par value $5,157,800, 1.250%, 10/31/19; with total market value $5,100,042) |

|

|

5,000 |

|

|

|

5,000 |

|

| Goldman Sachs |

|

|

|

|

|

|

|

|

| 1.250%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $1,000,035 (collateralized by U.S. Treasury obligation,

par value $1,397,700, 0.000%, 08/15/29; with total market value $1,020,041) |

|

|

1,000 |

|

|

|

1,000 |

|

| Mitsubishi UFJ |

|

|

|

|

|

|

|

|

| 1.310%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $4,000,146 (collateralized by various U.S. Treasury

obligations, ranging in par value $800 - $6,188,000, 0.000% - 2.500%, 01/31/21 -10/15/44; with total market value$4,080,050) |

|

|

4,000 |

|

|

|

4,000 |

|

| Natixis S.A. |

|

|

|

|

|

|

|

|

| 1.320%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $3,000,110 (collateralized by various U.S. Treasury

obligations, ranging in par value $100 - $3,063,000, 0.000% - 2.500%, 03/22/18 - 05/15/24; with total market value $3,060,063) |

|

|

3,000 |

|

|

|

3,000 |

|

| TD Securities |

|

|

|

|

|

|

|

|

| 1.330%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $4,000,148 (collateralized by U.S. Treasury obligation,

par value $4,105,700, 2.375%, 01/31/23; with total market value $4,080,039) |

|

|

4,000 |

|

|

|

4,000 |

|

| Bank of Nova Scotia |

|

|

|

|

|

|

|

|

| 1.320%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $2,000,073 (collateralized by various U.S. Treasury

obligations, ranging in par value $200 - $2,055,200, 1.250% - 2.125%, 08/31/19- 07/31/24; with total market value $2,040,089) |

|

|

2,000 |

|

|

|

2,000 |

|

|

|

|

|

|

| SEI Daily Income Trust / Annual Report / January 31, 2018 |

|

|

15 |

|

SCHEDULE OF INVESTMENTS

January 31, 2018

Treasury Fund (Concluded)

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

| REPURCHASE AGREEMENTS(B)

(continued) |

| Wells Fargo |

|

|

|

|

|

|

| 1.350%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $4,000,150 (collateralized by various U.S. Treasury

obligations, ranging in par value $295,400 - $3,264,000, 1.000% - 2.875%, 09/30/19 - 11/15/46; with total market value $4,080,077) |

|

$ |

4,000 |

|

|

$ 4,000 |

| Merrill Lynch |

|

|

|

|

|

|

| 1.350%, dated 01/31/2018, to be repurchased on 02/01/18, repurchase price $5,000,188 (collateralized by U.S. Treasury obligation,

par value $5,150,800, 2.500%, 01/31/25; with total market value $5,100,097) |

|

|

5,000 |

|

|

5,000 |

|

|

|

| Total Repurchase Agreements

(Cost $33,000) ($ Thousands) |

|

|

|

|

|

33,000 |

|

|

|

| Total Investments – 97.3%

(Cost $111,056) ($ Thousands) |

|

|

|

|

|

$ 111,056 |

|

|

|

|

|

|

|

| |

Percentages are based on Net Assets of $114,120 ($ Thousands). |

| (A) |

Zero coupon security. The rate shown on the Schedule of Investments is the effective yield at the time of purchase. |

| (B) |

Tri-Party Repurchase Agreement. |

As of January 31, 2018, all of the Fund’s investments were considered Level 2,

in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended January 31, 2018, there were no

transfers between Level 1, Level 2 and/or Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2–Significant Accounting Policies

in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 16 |

|

SEI Daily Income Trust / Annual Report / January 31, 2018 |

SCHEDULE OF INVESTMENTS

January 31, 2018

Treasury II Fund

†Percentages are based

on total investments.

|

|

|

|

|

|

|

|

|

| |

|

|

| Description |

|

Face Amount

(Thousands) |

|

|

Value

($ Thousands) |

|

|

| U.S. TREASURY OBLIGATIONS – 102.0% |

|

| U.S. Treasury Bills (A) |

|

|

|

|

|

|

|

|

| 1.252%, 02/01/2018 |

|

$ |

13,000 |

|

|

$ |

13,000 |

|

| 1.271%, 02/08/2018 |

|

|

50,000 |

|

|

|

49,988 |

|

| 1.121%, 02/15/2018 |

|

|

157,000 |

|

|

|

156,922 |

|

| 1.240%, 02/22/2018 |

|

|

10,000 |

|

|

|

9,993 |

|

| 1.294%, 03/08/2018 |

|

|

20,000 |

|

|

|

19,975 |

|

| 1.147%, 03/15/2018 |

|

|

10,000 |

|

|

|

9,987 |

|

| 1.182%, 03/22/2018 |

|

|

18,845 |

|

|

|

18,812 |

|

| 1.177%, 03/29/2018 |

|

|

58,125 |

|

|

|

58,013 |

|

| 1.196%, 04/05/2018 |

|

|

11,000 |

|

|

|

10,977 |

|

| 1.227%, 04/12/2018 |

|

|

10,000 |

|

|

|

9,976 |

|

| 1.436%, 04/26/2018 |

|

|

7,000 |

|

|

|

6,977 |

|

| 1.266%, 05/03/2018 |

|

|

10,920 |

|

|

|

10,885 |

|

| 1.311%, 05/10/2018 |

|

|

11,180 |

|

|

|

11,140 |

|

| 1.359%, 05/17/2018 |

|

|

695 |

|

|

|

692 |

|

| 1.446%, 05/31/2018 |

|

|

2,770 |

|

|

|

2,757 |

|

| 1.461%, 06/07/2018 |

|

|

6,250 |

|

|

|

6,218 |

|

| 1.461%, 06/14/2018 |

|

|

4,360 |

|

|

|

4,337 |

|

| 1.496%, 06/21/2018 |

|

|

430 |

|

|

|

428 |

|

| 1.542%, 06/28/2018 |

|

|

30,835 |

|

|

|

30,642 |

|

| 1.588%, 07/12/2018 |

|

|

15,000 |

|

|

|

14,894 |

|

| 1.205%, 07/19/2018 |

|

|

20,820 |

|

|

|

20,669 |

|

| 1.638%, 08/02/2018 |

|

|

12,000 |

|

|

|

11,901 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 1.000%, 02/15/2018 |

|

|

3,325 |

|

|

|

3,325 |

|

| 0.750%, 02/28/2018 |

|

|

2,320 |

|

|

|

2,319 |

|

| 2.875%, 03/31/2018 |

|

|

4,000 |

|

|

|

4,011 |

|

| 1.298%, VAR US Treasury 3 Month Bill Money Market Yield+0.190%, 04/30/2018 |

|

|

30,000 |

|

|

|

30,000 |

|

| 1.375%, 07/31/2018 |

|

|

5,280 |

|

|

|

5,279 |

|

| 0.875%, 10/15/2018 |

|

|

990 |

|

|

|

984 |

|

| 1.605%, VAR US Treasury 3 Month Bill Money Market Yield+0.170%, 10/31/2018 |

|

|

11,940 |

|

|

|

11,940 |

|

| 1.375%, 11/30/2018 |

|

|

820 |

|

|