SEI Daily Income Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03451

SEI Daily Income Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

c/o CT Corporation

101 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s

telephone number, including area code: 1-800-342-5734

Date of fiscal year end: January 31, 2016

Date of reporting period: July 31, 2015

| Item 1. |

Reports to Stockholders. |

July 31, 2015

SEMI-ANNUAL REPORT

SEI Daily Income Trust

➤ Money Market Fund

➤ Government Fund

➤ Government II Fund

➤ Prime Obligation Fund

➤ Treasury Fund

➤ Treasury II Fund

➤ Ultra Short Duration

Bond Fund

➤

Short-Duration Government Fund

➤ Intermediate-Duration Government

Fund

➤ GNMA Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio

holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of

the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Since the Funds in SEI Daily Income Trust typically hold only fixed income securities, they generally are not expected to hold securities for which they may be required to vote proxies. Regardless, in light

of the possibility of the possibility that a Fund could hold a security for which a proxy is voted, the Trust has adopted proxy voting policies. A description of the policies and procedures that the Trust uses to determine how to vote proxies

relating to portfolios securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available

(i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at

http://www.sec.gov.

SCHEDULE OF INVESTMENTS (Unaudited)

Money Market Fund

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

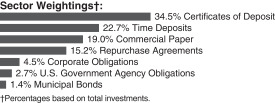

| CERTIFICATES OF DEPOSIT — 33.1% |

|

|

|

|

|

| ANZ New Zealand International |

|

|

|

|

|

|

|

|

| 0.269%, 08/05/15 (A) |

|

$ |

2,000 |

|

|

$ |

2,000 |

|

| 0.349%, 08/29/15 (A) (C) |

|

|

1,452 |

|

|

|

1,452 |

|

| Bank of Montreal |

|

|

|

|

|

|

|

|

| 0.278%, 08/04/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.210%, 09/10/15 |

|

|

2,820 |

|

|

|

2,820 |

|

| 0.190%, 09/14/15 |

|

|

1,850 |

|

|

|

1,850 |

|

| 0.190%, 09/15/15 |

|

|

2,000 |

|

|

|

2,000 |

|

| Bank of Nova Scotia |

|

|

|

|

|

|

|

|

| 0.260%, 08/01/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.250%, 08/01/15 (A) |

|

|

2,700 |

|

|

|

2,700 |

|

| 0.289%, 08/04/15 (A) |

|

|

101 |

|

|

|

101 |

|

| 0.298%, 08/09/15 (A) |

|

|

286 |

|

|

|

286 |

|

| 0.279%, 09/04/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| Bank of Tokyo-Mitsubishi UFJ NY |

|

|

|

|

|

|

|

|

| 0.327%, 08/01/15 (A) |

|

|

1,200 |

|

|

|

1,200 |

|

| 0.317%, 08/01/15 (A) |

|

|

2,300 |

|

|

|

2,300 |

|

| 0.250%, 09/08/15 |

|

|

3,000 |

|

|

|

3,000 |

|

| BMO Harris Bank |

|

|

|

|

|

|

|

|

| 0.300%, 08/03/15 |

|

|

135 |

|

|

|

135 |

|

| BNZ International Funding |

|

|

|

|

|

|

|

|

| 0.347%, 08/02/15 (A) |

|

|

1,102 |

|

|

|

1,102 |

|

| DNB Bank |

|

|

|

|

|

|

|

|

| 0.120%, 08/05/15 |

|

|

7,600 |

|

|

|

7,600 |

|

| Fairway Finance LLC |

|

|

|

|

|

|

|

|

| 0.268%, 08/20/15 (A) |

|

|

355 |

|

|

|

355 |

|

| HSBC Bank |

|

|

|

|

|

|

|

|

| 0.200%, 08/10/15 |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.230%, 09/01/15 |

|

|

1,000 |

|

|

|

1,000 |

|

| JPMorgan Securities LLC |

|

|

|

|

|

|

|

|

| 0.287%, 08/01/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.338%, 08/04/15 (A) |

|

|

1,500 |

|

|

|

1,500 |

|

| 0.308%, 08/04/15 (A) |

|

|

1,700 |

|

|

|

1,700 |

|

| 0.331%, 08/31/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| Mizuho Bank |

|

|

|

|

|

|

|

|

| 0.260%, 08/07/15 |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.270%, 08/11/15 |

|

|

1,264 |

|

|

|

1,264 |

|

| 0.260%, 09/08/15 |

|

|

3,000 |

|

|

|

3,000 |

|

| 0.270%, 09/25/15 |

|

|

1,450 |

|

|

|

1,450 |

|

| National Bank of Canada |

|

|

|

|

|

|

|

|

| 0.320%, 08/20/15 |

|

|

340 |

|

|

|

340 |

|

| Old Line Funding |

|

|

|

|

|

|

|

|

| 0.281%, 08/03/15 (A) |

|

|

830 |

|

|

|

830 |

|

| 0.370%, 08/08/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| 0.367%, 08/08/15 (A) |

|

$

|

527 |

|

|

$

|

527 |

|

| 0.277%, 08/20/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.275%, 08/20/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| State Street Bank |

|

|

|

|

|

|

|

|

| 0.347%, 08/11/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.327%, 08/15/15 (A) |

|

|

3,000 |

|

|

|

3,000 |

|

| 0.329%, 08/06/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| Sumitomo Mitsui Banking |

|

|

|

|

|

|

|

|

| 0.337%, 08/15/15 (A) |

|

|

1,082 |

|

|

|

1,082 |

|

| 0.335%, 08/23/15 (A) |

|

|

250 |

|

|

|

250 |

|

| 0.280%, 10/02/15 |

|

|

1,296 |

|

|

|

1,296 |

|

| Svenska Handelsbanken |

|

|

|

|

|

|

|

|

| 0.205%, 09/01/15 |

|

|

4,300 |

|

|

|

4,300 |

|

| 0.245%, 09/30/15 |

|

|

3,582 |

|

|

|

3,582 |

|

| 0.245%, 10/09/15 |

|

|

427 |

|

|

|

427 |

|

| Toronto-Dominion Bank |

|

|

|

|

|

|

|

|

| 0.220%, 09/17/15 |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.280%, 09/18/15 |

|

|

1,500 |

|

|

|

1,500 |

|

| Toyota Motor Credit |

|

|

|

|

|

|

|

|

| 0.267%, 08/02/15 (A) |

|

|

1,300 |

|

|

|

1,300 |

|

| 0.268%, 08/19/15 (A) |

|

|

1,055 |

|

|

|

1,055 |

|

| 0.271%, 08/27/15 (A) |

|

|

710 |

|

|

|

710 |

|

| Wells Fargo Bank |

|

|

|

|

|

|

|

|

| 0.290%, 08/01/15 (A) |

|

|

202 |

|

|

|

202 |

|

| 0.260%, 08/01/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.250%, 08/01/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| 0.250%, 08/01/15 (A) |

|

|

1,300 |

|

|

|

1,300 |

|

| 0.250%, 08/01/15 (A) |

|

|

1,300 |

|

|

|

1,300 |

|

| 0.260%, 08/03/15 |

|

|

819 |

|

|

|

819 |

|

| 0.268%, 08/07/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.268%, 08/08/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

|

|

|

|

|

|

|

|

|

| Total Certificates of Deposit

(Cost $88,635) ($ Thousands) |

|

|

|

|

|

|

88,635 |

|

|

|

|

|

|

|

|

|

|

|

|

| TIME DEPOSITS — 21.8% |

|

|

|

|

|

| Australia & New Zealand Banking Group NY |

|

|

|

|

|

|

|

|

| 0.080%, 08/03/15 |

|

|

8,000 |

|

|

|

8,000 |

|

| Bank of Montreal |

|

|

|

|

|

|

|

|

| 0.278%, 08/04/15 (A) |

|

|

1,583 |

|

|

|

1,583 |

|

| Citibank |

|

|

|

|

|

|

|

|

| 0.090%, 08/03/15 |

|

|

12,000 |

|

|

|

12,000 |

|

| Lloyds Bank PLC |

|

|

|

|

|

|

|

|

| 0.060%, 08/03/15 |

|

|

12,887 |

|

|

|

12,887 |

|

| Skandinaviska Enskilda Banken |

|

|

|

|

|

|

|

|

| 0.080%, 08/03/15 |

|

|

12,000 |

|

|

|

12,000 |

|

| Swedbank |

|

|

|

|

|

|

|

|

| 0.070%, 08/03/15 |

|

|

12,000 |

|

|

|

12,000 |

|

|

|

|

|

|

|

|

|

|

| Total Time Deposits

(Cost $58,470) ($ Thousands) |

|

|

|

|

|

|

58,470 |

|

|

|

|

|

|

|

|

|

|

|

|

| COMMERCIAL PAPER — 18.2% |

|

|

|

|

|

| Albion Capital LLC |

|

|

|

|

|

|

|

|

| 0.240%, 08/17/15 (C) (D) |

|

|

1,000 |

|

|

|

1,000 |

|

|

|

|

|

|

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

|

|

1 |

|

SCHEDULE OF INVESTMENTS (Unaudited)

Money Market Fund (Continued)

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| 0.210%, 08/26/15 (C) (D) |

|

$

|

1,000 |

|

|

$

|

1,000 |

|

| 0.230%, 09/16/15 (C) (D) |

|

|

445 |

|

|

|

445 |

|

| BNZ International Funding |

|

|

|

|

|

|

|

|

| 0.230%, 09/14/15 (C) (D) |

|

|

3,000 |

|

|

|

2,999 |

|

| Caisse Centrale Desjardins |

|

|

|

|

|

|

|

|

| 0.220%, 09/14/15 (C) (D) |

|

|

674 |

|

|

|

674 |

|

| Chariot Funding LLC |

|

|

|

|

|

|

|

|

| 0.330%, 11/30/15 (C) (D) |

|

|

2,309 |

|

|

|

2,306 |

|

| 0.401%, 12/16/15 (C) (D) |

|

|

3,000 |

|

|

|

2,995 |

|

| CRC Funding |

|

|

|

|

|

|

|

|

| 0.200%, 09/14/15 (C) (D) |

|

|

698 |

|

|

|

698 |

|

| Fairway Finance LLC |

|

|

|

|

|

|

|

|

| 0.271%, 08/29/15 (A) (C) (D) |

|

|

710 |

|

|

|

710 |

|

| 0.280%, 09/03/15 (C) (D) |

|

|

399 |

|

|

|

399 |

|

| JPMorgan Securities LLC |

|

|

|

|

|

|

|

|

| 0.300%, 08/03/15 (C) (D) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.270%, 09/08/15 (C) (D) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.310%, 10/13/15 (C) (D) |

|

|

2,500 |

|

|

|

2,498 |

|

| Jupiter Securitization |

|

|

|

|

|

|

|

|

| 0.331%, 11/30/15 to 12/01/15 (C) (D) |

|

|

2,802 |

|

|

|

2,799 |

|

| 0.371%, 12/08/15 (C) (D) |

|

|

1,000 |

|

|

|

999 |

|

| Liberty Street Funding |

|

|

|

|

|

|

|

|

| 0.300%, 10/26/15 (C) (D) |

|

|

550 |

|

|

|

549 |

|

| 0.391%, 11/30/15 (C) (D) |

|

|

719 |

|

|

|

718 |

|

| 0.381%, 12/03/15 to

12/21/15 (C) (D) |

|

|

3,438 |

|

|

|

3,432 |

|

| Manhattan Asset Funding |

|

|

|

|

|

|

|

|

| 0.250%, 08/31/15 to 09/18/15 (B) (C) (D) |

|

|

1,592 |

|

|

|

1,592 |

|

| 0.260%, 09/02/15 to

09/03/15 (C) (D) |

|

|

2,200 |

|

|

|

2,199 |

|

| 0.220%, 09/15/15 (C) (D) |

|

|

676 |

|

|

|

676 |

|

| National Bank of Canada |

|

|

|

|

|

|

|

|

| 0.300%, 09/17/15 (C) (D) |

|

|

500 |

|

|

|

500 |

|

| 0.280%, 09/17/15 (C) (D) |

|

|

3,000 |

|

|

|

2,999 |

|

| Old Line Funding |

|

|

|

|

|

|

|

|

| 0.240%, 09/04/15 to 09/10/15 (C) (D) |

|

|

1,844 |

|

|

|

1,844 |

|

| 0.230%, 09/09/15 (C) (D) |

|

|

410 |

|

|

|

410 |

|

| Svenska Handelsbanken |

|

|

|

|

|

|

|

|

| 0.210%, 09/08/15 (C) (D) |

|

|

395 |

|

|

|

395 |

|

| Thunder Bay Funding LLC |

|

|

|

|

|

|

|

|

| 0.240%, 08/31/15 (C) (D) |

|

|

568 |

|

|

|

568 |

|

| 0.230%, 09/08/15 to 09/09/15 (C) (D) |

|

|

3,260 |

|

|

|

3,259 |

|

| 0.280%, 09/21/15 (C) (D) |

|

|

753 |

|

|

|

753 |

|

| 0.401%, 12/01/15 (C) (D) |

|

|

259 |

|

|

|

258 |

|

| Toyota Motor Credit |

|

|

|

|

|

|

|

|

| 0.200%, 09/14/15 (C) (D) |

|

|

1,236 |

|

|

|

1,236 |

|

| Victory Receivables |

|

|

|

|

|

|

|

|

| 0.230%, 09/15/15 (C) (D) |

|

|

1,000 |

|

|

|

1,000 |

|

| Westpac Securities NZ |

|

|

|

|

|

|

|

|

| 0.278%, 08/10/15 (A) (C) (D) |

|

|

1,500 |

|

|

|

1,500 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| Working Capital Management |

|

|

|

|

|

|

|

|

| 0.230%, 09/02/15 (C) (D) |

|

$ |

400 |

|

|

$ |

400 |

|

| 0.210%, 09/03/15 to 09/08/15 (C) (D) |

|

|

2,347 |

|

|

|

2,347 |

|

| 0.200%, 09/09/15 (C) (D) |

|

|

690 |

|

|

|

690 |

|

|

|

|

|

|

|

|

|

|

| Total Commercial Paper

(Cost $48,847) ($ Thousands) |

|

|

|

48,847 |

|

|

|

|

|

|

|

|

|

|

|

| CORPORATE OBLIGATIONS — 4.3% |

|

| American Honda Finance MTN |

|

|

|

|

|

|

|

|

| 1.000%, 08/11/15 (B) |

|

|

245 |

|

|

|

245 |

|

| ANZ New Zealand International |

|

|

|

|

|

|

|

|

| 1.850%, 10/15/15 (B) |

|

|

375 |

|

|

|

376 |

|

| Bank of Montreal |

|

|

|

|

|

|

|

|

| 0.350%, 08/23/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| Bank of Nova Scotia |

|

|

|

|

|

|

|

|

| 0.340%, 09/25/15 (A) |

|

|

2,000 |

|

|

|

2,000 |

|

| Caisse Centrale Desjardins |

|

|

|

|

|

|

|

|

| 2.650%, 09/16/15 (B) |

|

|

289 |

|

|

|

290 |

|

| Canadian Imperial Bank Commerce |

|

|

|

|

|

|

|

|

| 2.350%, 12/11/15 |

|

|

412 |

|

|

|

415 |

|

| National Australia Bank |

|

|

|

|

|

|

|

|

| 2.750%, 09/28/15 (B) |

|

|

145 |

|

|

|

146 |

|

| Shell International |

|

|

|

|

|

|

|

|

| 0.349%, 08/10/15 (A) |

|

|

378 |

|

|

|

378 |

|

| Toronto-Dominion Bank |

|

|

|

|

|

|

|

|

| 0.338%, 08/07/15 (A) |

|

|

2,377 |

|

|

|

2,377 |

|

| Wells Fargo Bank |

|

|

|

|

|

|

|

|

| 0.330%, 08/09/15 (A) |

|

|

3,000 |

|

|

|

3,000 |

|

| Westpac Banking |

|

|

|

|

|

|

|

|

| 3.000%, 08/04/15 |

|

|

913 |

|

|

|

913 |

|

| 1.125%, 09/25/15 |

|

|

316 |

|

|

|

316 |

|

|

|

|

|

|

|

|

|

|

| Total Corporate Obligations

(Cost $11,456) ($ Thousands) |

|

|

|

|

|

|

11,456 |

|

|

|

|

|

|

|

|

|

|

|

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 2.6% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 0.200%, 08/01/15 (A) |

|

|

760 |

|

|

|

760 |

|

| 0.207%, 08/11/15 (A) |

|

|

2,190 |

|

|

|

2,191 |

|

| 0.182%, 08/16/15 (A) |

|

|

2,700 |

|

|

|

2,700 |

|

| 0.237%, 08/24/15 (A) |

|

|

1,110 |

|

|

|

1,110 |

|

| FNMA |

|

|

|

|

|

|

|

|

| 0.207%, 08/15/15 (A) |

|

|

240 |

|

|

|

240 |

|

|

|

|

|

|

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $7,001) ($ Thousands) |

|

|

|

7,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MUNICIPAL BONDS — 1.4% |

|

|

|

|

|

|

|

|

|

|

|

| Arizona — 0.2% |

|

|

|

|

|

|

|

|

| Pima County, Industrial Development Authority, RB |

|

|

|

|

|

|

|

|

| 0.240%, 08/05/15 (A) |

|

|

600 |

|

|

|

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Iowa — 0.2% |

|

|

|

|

|

|

|

|

| Iowa State, Finance Authority, Ser C, RB |

|

|

|

|

|

|

|

|

| 0.110%, 08/06/15 (A) |

|

$ |

765 |

|

|

$ |

765 |

|

| Iowa State, Finance Authority, Ser G, RB |

|

|

|

|

|

|

|

|

| 0.110%, 08/06/15 (A) |

|

|

15 |

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Massachusetts — 0.1% |

|

|

|

|

|

|

|

|

| Simmons College, Higher Education Authority, RB |

|

|

|

|

|

|

|

|

| 0.140%, 08/06/15 (A) |

|

|

185 |

|

|

|

185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Michigan — 0.4% |

|

|

|

|

|

|

|

|

| Kent, Hospital Finance Authority, Ser C, RB |

|

|

|

|

|

|

|

|

| 0.020%, 08/05/15 (A) |

|

|

1,005 |

|

|

|

1,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Minnesota — 0.3% |

|

|

|

|

|

|

|

|

| Minnesota State, Office of Higher Education, Ser A, RB |

|

|

|

|

|

|

|

|

| 0.120%, 08/06/15 (A) |

|

|

700 |

|

|

|

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| New Hampshire — 0.1% |

|

|

|

|

|

|

|

|

| New Hampshire State, Health & Education Facilities Authority, Dartmouth College Project, Ser C, RB |

|

|

|

|

|

|

|

|

| 0.140%, 08/05/15 (A) |

|

|

190 |

|

|

|

190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| New Jersey — 0.1% |

|

|

|

|

|

|

|

|

| North Hudson Sewage Authority, RB |

|

|

|

|

|

|

|

|

| 0.120%, 08/06/15 (A) |

|

|

150 |

|

|

|

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| New York — 0.0% |

|

|

|

|

|

|

|

|

| New York State, Housing & Finance Authority, RB |

|

|

|

|

|

|

|

|

| 0.220%, 08/04/15 (A) |

|

|

105 |

|

|

|

105 |

|

|

|

|

|

|

|

|

|

|

| Total Municipal Bonds

(Cost $3,715) ($ Thousands) |

|

|

|

|

|

|

3,715 |

|

|

|

|

|

|

|

|

|

|

|

| REPURCHASE AGREEMENTS — 14.6% |

|

| Goldman Sachs

0.140%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $8,118,095 (collateralized by various FNMA

and FMAC obligations, ranging in par value $410,929 - $7,202,407, 2.351% - 3.500%, 11/01/26 - 06/01/45; with total market value $8,280,457) (E) |

|

|

8,118 |

|

|

|

8,118 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| Mistubishi

0.120%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $4,047,040 (collateralized by various FNMA

obligations, ranging in par value $492,078 - $5,869,091, 3.000% - 3.500%, 07/01/26 - 07/01/43; with total market value $4,127,982) (E) |

|

$ |

4,047 |

|

|

$ |

4,047 |

|

| RBC Capital

0.150% dated 07/30/15, to be repurchased on 08/06/15, repurchase price $1,991,058 (collateralized by various

corporate obligations*, ranging in par value $1,000 - $1,223,406, 0.436% - 6.375%, 07/15/16 - 03/15/24, with total market value of $2,090,783) (E) |

|

|

1,991 |

|

|

|

1,991 |

|

| RBC Capital

0.140%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $7,750,090 (collateralized by various FMAC,

FNMA, and GNMA obligations, ranging in par value $1,000 - $3,362,543, 1.625% - 4.500%, 05/01/26 - 07/20/45; with total market value $7,905,092) (E) |

|

|

7,750 |

|

|

|

7,750 |

|

| TD Securities

0.150% dated 07/31/15, to be repurchased on 08/03/15, repurchase price $7,750,097 (collateralized by a FMAC

obligation, par value $8,936,233, 3.500%, 11/02/42, with total market value of $7,905,099) (E) |

|

|

7,750 |

|

|

|

7,750 |

|

| Wells Fargo

0.130%, dated 07/28/15, to be repurchased on 08/04/15, repurchase price $357,009 (collateralized by a U.S. Treasury

Note, par value $357,900, 2.000%, 04/30/16, with total market value $364,219) (E) |

|

|

357 |

|

|

|

357 |

|

| Wells Fargo

0.130%, dated 07/29/15, to be repurchased on 08/05/15, repurchase price $1,413,036 (collateralized by a U.S. Treasury

Note, par value $1,416,300, 2.000%, 04/30/16, with total market value $1,441,306) (E) |

|

|

1,413 |

|

|

|

1,413 |

|

|

|

|

|

|

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

|

|

3 |

|

SCHEDULE OF INVESTMENTS (Unaudited)

Money Market Fund (Concluded)

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| Wells Fargo

0.160%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $7,750,103 (collateralized by a U.S. Treasury

Note, par value $7,768,000, 2.000%, 04/30/16, with total market value $7,905,152) (E) |

|

$ |

7,750 |

|

|

$ |

7,750 |

|

|

|

|

|

|

|

|

|

|

| Total Repurchase Agreements

(Cost $39,176) ($ Thousands) |

|

|

|

|

|

|

39,176 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 96.0%

(Cost $257,300)($ Thousands) |

|

|

|

|

|

$ |

257,300 |

|

|

|

|

|

|

|

|

|

|

| * |

|

A summary of the corporate obligations used to collateralize repurchase agreements entered into by the Fund at July 31, 2015, is as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Counterparty |

|

Corporate Obligation |

|

Rate |

|

|

Maturity

Date |

|

|

Par Amount

($ Thousands) |

|

| RBC Capital |

|

AGL Capital |

|

|

6.375 |

% |

|

|

07/15/16 |

|

|

$ |

1 |

|

|

|

Amgen |

|

|

2.200 |

|

|

|

05/22/19 |

|

|

|

94 |

|

|

|

BNP Paribas |

|

|

2.450 |

|

|

|

03/17/19 |

|

|

|

529 |

|

|

|

Caterpillar Financial Services |

|

|

0.435 |

|

|

|

08/28/15 |

|

|

|

17 |

|

|

|

CDK Global |

|

|

4.500 |

|

|

|

10/15/24 |

|

|

|

1 |

|

|

|

Hospitality |

|

|

5.000 |

|

|

|

08/15/22 |

|

|

|

1,223 |

|

|

|

Hydro-Queen |

|

|

9.400 |

|

|

|

02/01/21 |

|

|

|

2 |

|

|

|

KKR Group |

|

|

6.375 |

|

|

|

09/29/20 |

|

|

|

1 |

|

|

|

McKesson |

|

|

3.796 |

|

|

|

03/15/24 |

|

|

|

10 |

|

|

|

Morgan Stanley |

|

|

2.800 |

|

|

|

06/16/20 |

|

|

|

31 |

|

|

|

Province of Ontario Canada |

|

|

2.500 |

|

|

|

09/10/21 |

|

|

|

80 |

|

|

|

Verizon Communications |

|

|

2.450 |

|

|

|

11/01/22 |

|

|

|

13 |

|

Percentages are based on Net Assets of $268,063 ($ Thousands).

| (A) |

|

Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2015. The demand and interest rate reset features give

this security a shorter effective maturity date. |

| (B) |

|

Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold

only to dealers in that program or other “accredited investors.” These securities have been determined to be liquid under guidelines established by the Board of Trustees. |

| (C) |

|

The rate reported is the effective yield at time of purchase. |

| (D) |

|

Securities are held in connection with a letter of credit issued by a major bank. |

| (E) |

|

Tri-Party Repurchase Agreement. |

FFCB

— Federal Farm Credit Bank

FMAC — Financial Management Advisory Committee

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

LLC — Limited Liability Company

MTN

— Medium Term Note

PLC — Public Limited Company

RB — Revenue Bond

As of July 31, 2015, all of the Fund’s investments were considered

Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. Generally Accepted Accounting Principles.

As of July 31, 2015, there were no transfers between Level 1 and Level 2 assets and liabilities. As of July 31, 2015, there were no Level 3 securities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 4 |

|

SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

SCHEDULE OF INVESTMENTS (Unaudited)

Government Fund

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

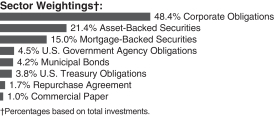

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 37.2% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 0.210%, 08/01/15 (A) |

|

$ |

1,710 |

|

|

$ |

1,710 |

|

| 0.187%, 08/01/15 (A) |

|

|

10,527 |

|

|

|

10,527 |

|

| 0.250%, 08/01/15 (A) |

|

|

310 |

|

|

|

310 |

|

| 0.187%, 08/01/15 (A) |

|

|

5,540 |

|

|

|

5,540 |

|

| 0.200%, 08/01/15 (A) |

|

|

13,480 |

|

|

|

13,480 |

|

| 0.212%, 08/02/15 (A) |

|

|

1,750 |

|

|

|

1,750 |

|

| 0.215%, 08/03/15 (A) |

|

|

1,705 |

|

|

|

1,706 |

|

| 0.165%, 08/03/15 (A) |

|

|

4,000 |

|

|

|

4,000 |

|

| 0.205%, 08/03/15 (A) |

|

|

15,738 |

|

|

|

15,741 |

|

| 0.160%, 08/03/15 (A) |

|

|

855 |

|

|

|

855 |

|

| 0.218%, 08/05/15 (A) |

|

|

3,770 |

|

|

|

3,772 |

|

| 0.198%, 08/06/15 (A) |

|

|

5,821 |

|

|

|

5,821 |

|

| 0.283%, 08/06/15 (A) |

|

|

490 |

|

|

|

491 |

|

| 0.206%, 08/08/15 (A) |

|

|

2,385 |

|

|

|

2,385 |

|

| 0.217%, 08/08/15 (A) |

|

|

3,420 |

|

|

|

3,421 |

|

| 0.187%, 08/08/15 (A) |

|

|

706 |

|

|

|

706 |

|

| 0.179%, 08/09/15 (A) |

|

|

12,335 |

|

|

|

12,335 |

|

| 0.207%, 08/11/15 (A) |

|

|

3,605 |

|

|

|

3,606 |

|

| 0.217%, 08/11/15 (A) |

|

|

4,030 |

|

|

|

4,032 |

|

| 0.212%, 08/13/15 (A) |

|

|

175 |

|

|

|

175 |

|

| 0.217%, 08/13/15 (A) |

|

|

37,345 |

|

|

|

37,375 |

|

| 0.206%, 08/14/15 (A) |

|

|

8,250 |

|

|

|

8,251 |

|

| 0.182%, 08/16/15 (A) |

|

|

8,170 |

|

|

|

8,170 |

|

| 0.196%, 08/17/15 (A) |

|

|

1,940 |

|

|

|

1,940 |

|

| 0.226%, 08/17/15 (A) |

|

|

4,525 |

|

|

|

4,525 |

|

| 0.300%, 08/17/15 |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.236%, 08/17/15 (A) |

|

|

2,370 |

|

|

|

2,371 |

|

| 0.198%, 08/18/15 (A) |

|

|

1,090 |

|

|

|

1,090 |

|

| 0.218%, 08/18/15 (A) |

|

|

3,000 |

|

|

|

3,000 |

|

| 0.158%, 08/19/15 (A) |

|

|

6,895 |

|

|

|

6,894 |

|

| 0.188%, 08/19/15 (A) |

|

|

4,330 |

|

|

|

4,330 |

|

| 0.278%, 08/19/15 (A) |

|

|

8,960 |

|

|

|

8,966 |

|

| 0.188%, 08/20/15 (A) |

|

|

7,000 |

|

|

|

7,000 |

|

| 0.218%, 08/20/15 (A) |

|

|

11,337 |

|

|

|

11,344 |

|

| 0.258%, 08/20/15 (A) |

|

|

5,027 |

|

|

|

5,030 |

|

| 0.214%, 08/22/15 (A) |

|

|

2,979 |

|

|

|

2,979 |

|

| 0.190%, 08/23/15 (A) |

|

|

5,900 |

|

|

|

5,899 |

|

| 0.237%, 08/24/15 (A) |

|

|

958 |

|

|

|

958 |

|

| 0.227%, 08/24/15 (A) |

|

|

1,900 |

|

|

|

1,900 |

|

| 0.232%, 08/24/15 (A) |

|

|

8,240 |

|

|

|

8,245 |

|

| 0.221%, 08/25/15 (A) |

|

|

13,989 |

|

|

|

14,001 |

|

| 0.210%, 08/26/15 (A) |

|

|

895 |

|

|

|

895 |

|

| 0.221%, 08/26/15 (A) |

|

|

175 |

|

|

|

175 |

|

| 0.209%, 08/29/15 (A) |

|

|

6,000 |

|

|

|

6,001 |

|

| 0.250%, 09/10/15 |

|

|

13,365 |

|

|

|

13,365 |

|

| 1.500%, 11/16/15 |

|

|

275 |

|

|

|

276 |

|

| 4.875%, 12/16/15 |

|

|

5,656 |

|

|

|

5,755 |

|

| 0.440%, 12/28/15 |

|

|

2,000 |

|

|

|

2,002 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| FHLB |

|

|

|

|

|

|

|

|

| 0.220%, 08/01/15 (A) |

|

$ |

4,180 |

|

|

$ |

4,180 |

|

| 0.125%, 08/04/15 |

|

|

15,295 |

|

|

|

15,295 |

|

| 1.630%, 08/20/15 |

|

|

350 |

|

|

|

350 |

|

| 0.190%, 08/21/15 |

|

|

29,240 |

|

|

|

29,242 |

|

| 0.210%, 08/26/15 |

|

|

9,660 |

|

|

|

9,661 |

|

| 1.350%, 08/28/15 |

|

|

35 |

|

|

|

35 |

|

| 0.375%, 08/28/15 |

|

|

5,935 |

|

|

|

5,936 |

|

| 1.750%, 09/11/15 |

|

|

275 |

|

|

|

276 |

|

| 2.875%, 09/11/15 |

|

|

5,195 |

|

|

|

5,211 |

|

| 0.130%, 09/11/15 |

|

|

3,465 |

|

|

|

3,465 |

|

| 4.750%, 09/11/15 |

|

|

1,740 |

|

|

|

1,749 |

|

| 0.200%, 09/15/15 |

|

|

35,165 |

|

|

|

35,169 |

|

| 0.480%, 09/18/15 |

|

|

355 |

|

|

|

355 |

|

| 0.100%, 09/23/15 |

|

|

18,755 |

|

|

|

18,754 |

|

| 0.160%, 09/25/15 |

|

|

215 |

|

|

|

215 |

|

| 0.150%, 10/02/15 |

|

|

4,460 |

|

|

|

4,460 |

|

| FHLB DN |

|

|

|

|

|

|

|

|

| 0.065%, 08/07/15 (B) |

|

|

25,000 |

|

|

|

25,000 |

|

| 0.145%, 08/09/15 (A) (B) |

|

|

7,915 |

|

|

|

7,915 |

|

| 0.090%, 09/11/15 (B) |

|

|

675 |

|

|

|

675 |

|

| 0.075%, 09/17/15 (B) |

|

|

9,955 |

|

|

|

9,954 |

|

| 0.160%, 10/07/15 (B) |

|

|

8,465 |

|

|

|

8,463 |

|

| 0.155%, 10/14/15 (B) |

|

|

3,880 |

|

|

|

3,879 |

|

| FHLMC |

|

|

|

|

|

|

|

|

| 0.192%, 08/13/15 (A) |

|

|

12,000 |

|

|

|

11,998 |

|

| 0.167%, 08/16/15 (A) |

|

|

10,125 |

|

|

|

10,125 |

|

| 0.500%, 08/28/15 |

|

|

26,549 |

|

|

|

26,556 |

|

| 0.450%, 09/04/15 |

|

|

13,975 |

|

|

|

13,980 |

|

| 1.750%, 09/10/15 |

|

|

41,427 |

|

|

|

41,499 |

|

| 0.420%, 09/18/15 |

|

|

22,894 |

|

|

|

22,902 |

|

| 4.750%, 11/17/15 |

|

|

3,769 |

|

|

|

3,819 |

|

| FHLMC DN |

|

|

|

|

|

|

|

|

| 0.160%, 09/11/15 (B) |

|

|

29,875 |

|

|

|

29,870 |

|

| 0.071%, 10/05/15 (B) |

|

|

24,000 |

|

|

|

23,997 |

|

| 0.240%, 11/04/15 (B) |

|

|

6,505 |

|

|

|

6,501 |

|

| 0.251%, 12/07/15 (B) |

|

|

5,499 |

|

|

|

5,494 |

|

| FHLMC MTN |

|

|

|

|

|

|

|

|

| 0.500%, 09/25/15 |

|

|

10,145 |

|

|

|

10,151 |

|

| FNMA |

|

|

|

|

|

|

|

|

| 0.460%, 08/01/15 (A) |

|

|

2,465 |

|

|

|

2,467 |

|

| 2.150%, 08/04/15 |

|

|

4,296 |

|

|

|

4,297 |

|

| 0.207%, 08/15/15 (A) |

|

|

8,442 |

|

|

|

8,444 |

|

| 0.207%, 08/16/15 (A) |

|

|

7,695 |

|

|

|

7,696 |

|

| 2.000%, 08/18/15 |

|

|

2,499 |

|

|

|

2,501 |

|

| 0.200%, 08/25/15 (A) |

|

|

3,360 |

|

|

|

3,360 |

|

| 0.210%, 08/26/15 (A) |

|

|

565 |

|

|

|

565 |

|

| 0.670%, 08/26/15 |

|

|

510 |

|

|

|

510 |

|

| 0.205%, 08/26/15 (A) |

|

|

4,000 |

|

|

|

3,999 |

|

| 0.350%, 08/28/15 |

|

|

4,980 |

|

|

|

4,981 |

|

| 1.875%, 09/09/15 |

|

|

2,165 |

|

|

|

2,170 |

|

| 2.200%, 09/16/15 |

|

|

2,565 |

|

|

|

2,572 |

|

| 0.500%, 09/28/15 |

|

|

48,890 |

|

|

|

48,919 |

|

| 4.375%, 10/15/15 |

|

|

4,089 |

|

|

|

4,124 |

|

|

|

|

|

|

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

|

|

5 |

|

SCHEDULE OF INVESTMENTS (Unaudited)

Government Fund (Concluded)

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| 1.625%, 10/26/15 |

|

$ |

1,590 |

|

|

$ |

1,595 |

|

| 0.375%, 12/21/15 |

|

|

6,557 |

|

|

|

6,561 |

|

| FNMA DN |

|

|

|

|

|

|

|

|

| 0.150%, 09/23/15 (B) |

|

|

535 |

|

|

|

535 |

|

|

|

|

|

|

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $768,527) ($ Thousands) |

|

|

|

|

|

|

768,527 |

|

|

|

|

|

|

|

|

|

|

|

| REPURCHASE AGREEMENTS — 56.5% |

|

| Bank of Nova Scotia

0.160%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $50,000,667 (collateralized by

various FMAC, FHLB, and GNMA obligations, ranging in par value $10,000 - $35,233,107, 1.050% - 4.805%, 09/10/15 - 07/20/62; with total market value $51,004,642) (C) |

|

|

50,000 |

|

|

|

50,000 |

|

| Goldman Sachs

0.120%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $460,004,600 (collateralized by various

FMAC, FNMA, FCSB, FHLB and FICO obligations, ranging in par value $1,000 - $89,465,000, 0.000% - 9.650%, 09/08/15 - 08/27/32; with total market value $469,205,335) (C) |

|

|

460,000 |

|

|

|

460,000 |

|

| Mitsubishi

0.110%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $450,004,125 (collateralized by FMAC, FNMA,

FHLB, FCSB, GNMA and U.S. Treasury Notes, ranging in par value $100 - $349,373,730, 0.000% - 8.875%, 08/05/15 - 02/15/45, with total market value $459,004,271) (C) |

|

|

450,000 |

|

|

|

450,000 |

|

| TD Securities

0.130% dated 07/31/15, to be repurchased on 08/03/15, repurchase price $100,001,083 (collateralized by U.S.

Treasury Notes, ranging in par value $400 - $99,687,900, 1.250% - 3.000%, 10/31/15 - 05/15/45, with total market value of $102,001,165) (C) |

|

|

100,000 |

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| TD Securities

0.120%, dated 07/31/15, to be repurchased on 08/03/15, repurchase price $110,001,100 (collateralized by a U.S.

Treasury Notes, par value $113,752,800, 2.000%, 02/15/25, with total market value $112,201,129) (C) |

|

$ |

110,000 |

|

|

$ |

110,000 |

|

|

|

|

|

|

|

|

|

|

| Total Repurchase Agreements

(Cost $1,170,000) ($ Thousands) |

|

|

|

|

|

|

1,170,000 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 93.7%

(Cost $1,938,527)($ Thousands) |

|

|

|

|

|

$ |

1,938,527 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $2,069,769 ($ Thousands).

| (A) |

|

Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2015. The demand and interest rate reset features give

this security a shorter effective maturity date. |

| (B) |

|

The rate reported is the effective yield at time of purchase. |

| (C) |

|

Tri-Party Repurchase Agreement. |

DN — Discount

Note

FCSB — Federal Farm Credit Banks Consolidated Systemwide Bonds

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FICO — Fair Isaac Credit Organization

FMAC

— Financial Management Advisory Committee

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

MTN — Medium Term Note

As of July 31, 2015,

all of the Fund’s investments were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. Generally Accepted Accounting Principles.

As of July 31, 2015, there were no transfers between Level 1 and Level 2 assets and liabilities. As of July 31, 2015, there were no Level 3

securities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

|

|

|

| 6 |

|

SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

SCHEDULE OF INVESTMENTS (Unaudited)

Government II Fund

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

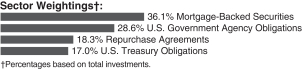

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 84.1% |

|

| FFCB |

|

|

|

|

|

|

|

|

| 0.340%, 08/01/15 (A) |

|

$ |

595 |

|

|

$ |

595 |

|

| 0.250%, 08/01/15 (A) |

|

|

190 |

|

|

|

190 |

|

| 0.200%, 08/01/15 (A) |

|

|

13,785 |

|

|

|

13,785 |

|

| 0.187%, 08/01/15 (A) |

|

|

5,855 |

|

|

|

5,855 |

|

| 0.187%, 08/01/15 (A) |

|

|

3,845 |

|

|

|

3,845 |

|

| 0.210%, 08/01/15 (A) |

|

|

1,580 |

|

|

|

1,580 |

|

| 0.172%, 08/01/15 (A) |

|

|

7,210 |

|

|

|

7,210 |

|

| 0.212%, 08/02/15 (A) |

|

|

1,250 |

|

|

|

1,250 |

|

| 0.217%, 08/02/15 (A) |

|

|

1,970 |

|

|

|

1,971 |

|

| 0.185%, 08/03/15 (A) |

|

|

800 |

|

|

|

800 |

|

| 0.205%, 08/03/15 (A) |

|

|

9,317 |

|

|

|

9,319 |

|

| 0.165%, 08/03/15 (A) |

|

|

5,000 |

|

|

|

5,000 |

|

| 0.160%, 08/03/15 (A) |

|

|

570 |

|

|

|

570 |

|

| 0.215%, 08/03/15 (A) |

|

|

5,280 |

|

|

|

5,281 |

|

| 0.218%, 08/05/15 (A) |

|

|

2,330 |

|

|

|

2,331 |

|

| 0.283%, 08/06/15 (A) |

|

|

285 |

|

|

|

285 |

|

| 0.198%, 08/06/15 (A) |

|

|

3,904 |

|

|

|

3,904 |

|

| 0.217%, 08/08/15 (A) |

|

|

2,080 |

|

|

|

2,081 |

|

| 0.187%, 08/08/15 (A) |

|

|

523 |

|

|

|

523 |

|

| 0.206%, 08/08/15 (A) |

|

|

1,615 |

|

|

|

1,615 |

|

| 0.179%, 08/09/15 (A) |

|

|

7,665 |

|

|

|

7,665 |

|

| 0.188%, 08/10/15 (A) |

|

|

1,063 |

|

|

|

1,063 |

|

| 0.217%, 08/11/15 (A) |

|

|

2,020 |

|

|

|

2,021 |

|

| 0.207%, 08/11/15 (A) |

|

|

2,295 |

|

|

|

2,295 |

|

| 0.217%, 08/13/15 (A) |

|

|

22,655 |

|

|

|

22,673 |

|

| 0.206%, 08/14/15 (A) |

|

|

5,250 |

|

|

|

5,251 |

|

| 0.186%, 08/14/15 (A) |

|

|

1,557 |

|

|

|

1,557 |

|

| 0.182%, 08/16/15 (A) |

|

|

5,830 |

|

|

|

5,830 |

|

| 0.196%, 08/17/15 (A) |

|

|

1,360 |

|

|

|

1,360 |

|

| 0.226%, 08/17/15 (A) |

|

|

3,658 |

|

|

|

3,658 |

|

| 0.236%, 08/17/15 (A) |

|

|

360 |

|

|

|

360 |

|

| 0.236%, 08/17/15 (A) |

|

|

1,000 |

|

|

|

1,000 |

|

| 0.550%, 08/17/15 |

|

|

305 |

|

|

|

305 |

|

| 0.218%, 08/18/15 (A) |

|

|

6,500 |

|

|

|

6,501 |

|

| 0.198%, 08/18/15 (A) |

|

|

810 |

|

|

|

810 |

|

| 0.188%, 08/19/15 (A) |

|

|

7,500 |

|

|

|

7,500 |

|

| 0.158%, 08/19/15 (A) |

|

|

4,360 |

|

|

|

4,360 |

|

| 0.278%, 08/19/15 (A) |

|

|

6,840 |

|

|

|

6,845 |

|

| 0.258%, 08/20/15 (A) |

|

|

3,101 |

|

|

|

3,103 |

|

| 0.218%, 08/20/15 (A) |

|

|

6,968 |

|

|

|

6,972 |

|

| 0.214%, 08/22/15 (A) |

|

|

2,189 |

|

|

|

2,189 |

|

| 0.190%, 08/23/15 (A) |

|

|

4,100 |

|

|

|

4,099 |

|

| 0.232%, 08/24/15 (A) |

|

|

5,055 |

|

|

|

5,058 |

|

| 0.237%, 08/24/15 (A) |

|

|

625 |

|

|

|

625 |

|

| 0.221%, 08/25/15 (A) |

|

|

9,946 |

|

|

|

9,954 |

|

| 0.241%, 08/26/15 (A) |

|

|

1,460 |

|

|

|

1,460 |

|

| 0.210%, 08/26/15 (A) |

|

|

605 |

|

|

|

605 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| 0.221%, 08/26/15 (A) |

|

$ |

325 |

|

|

$ |

325 |

|

| 0.245%, 08/27/15 (A) |

|

|

3,030 |

|

|

|

3,032 |

|

| 0.250%, 09/10/15 |

|

|

9,415 |

|

|

|

9,415 |

|

| 0.420%, 10/15/15 |

|

|

300 |

|

|

|

300 |

|

| 0.430%, 11/16/15 |

|

|

90 |

|

|

|

90 |

|

| 1.500%, 11/16/15 |

|

|

5,245 |

|

|

|

5,264 |

|

| FFCB DN |

|

|

|

|

|

|

|

|

| 0.050%, 08/24/15 (B) |

|

|

1,455 |

|

|

|

1,455 |

|

| FHLB |

|

|

|

|

|

|

|

|

| 0.220%, 08/01/15 (A) |

|

|

2,355 |

|

|

|

2,355 |

|

| 0.120%, 08/03/15 |

|

|

13,525 |

|

|

|

13,525 |

|

| 0.125%, 08/04/15 |

|

|

25,715 |

|

|

|

25,715 |

|

| 0.200%, 08/12/15 |

|

|

34,445 |

|

|

|

34,448 |

|

| 0.196%, 08/14/15 (A) |

|

|

2,132 |

|

|

|

2,132 |

|

| 1.630%, 08/20/15 |

|

|

1,705 |

|

|

|

1,706 |

|

| 0.190%, 08/21/15 |

|

|

35,315 |

|

|

|

35,317 |

|

| 0.210%, 08/21/15 |

|

|

9,025 |

|

|

|

9,025 |

|

| 0.650%, 08/24/15 |

|

|

995 |

|

|

|

995 |

|

| 1.350%, 08/28/15 |

|

|

20 |

|

|

|

20 |

|

| 0.440%, 08/28/15 |

|

|

145 |

|

|

|

145 |

|

| 0.230%, 08/28/15 |

|

|

3,520 |

|

|

|

3,521 |

|

| 0.375%, 08/28/15 |

|

|

22,885 |

|

|

|

22,889 |

|

| 4.750%, 09/11/15 |

|

|

1,040 |

|

|

|

1,045 |

|

| 0.130%, 09/11/15 |

|

|

2,150 |

|

|

|

2,150 |

|

| 2.875%, 09/11/15 |

|

|

2,565 |

|

|

|

2,573 |

|

| 1.750%, 09/11/15 |

|

|

785 |

|

|

|

786 |

|

| 0.480%, 09/18/15 |

|

|

215 |

|

|

|

215 |

|

| 0.450%, 09/21/15 |

|

|

885 |

|

|

|

886 |

|

| 0.100%, 09/23/15 |

|

|

23,295 |

|

|

|

23,294 |

|

| 0.160%, 09/25/15 |

|

|

255 |

|

|

|

255 |

|

| 0.170%, 09/25/15 |

|

|

645 |

|

|

|

645 |

|

| 0.150%, 10/02/15 |

|

|

3,070 |

|

|

|

3,070 |

|

| 0.250%, 10/15/15 |

|

|

885 |

|

|

|

885 |

|

| 0.180%, 10/27/15 |

|

|

1,020 |

|

|

|

1,020 |

|

| 0.500%, 11/20/15 |

|

|

2,160 |

|

|

|

2,162 |

|

| 0.220%, 11/23/15 |

|

|

400 |

|

|

|

400 |

|

| 1.400%, 11/27/15 |

|

|

915 |

|

|

|

918 |

|

| 1.875%, 12/11/15 |

|

|

180 |

|

|

|

181 |

|

| 0.270%, 12/15/15 |

|

|

3,725 |

|

|

|

3,725 |

|

| 5.000%, 12/21/15 |

|

|

2,170 |

|

|

|

2,210 |

|

| FHLB DN |

|

|

|

|

|

|

|

|

| 0.050%, 08/03/15 (B) |

|

|

33,260 |

|

|

|

33,260 |

|

| 0.063%, 08/05/15 (B) |

|

|

10,153 |

|

|

|

10,153 |

|

| 0.060%, 08/07/15 (B) |

|

|

58,384 |

|

|

|

58,382 |

|

| 0.145%, 08/09/15 (A) (B) |

|

|

5,140 |

|

|

|

5,140 |

|

| 0.075%, 08/12/15 (B) |

|

|

48,753 |

|

|

|

48,752 |

|

| 0.061%, 08/14/15 (B) |

|

|

18,298 |

|

|

|

18,298 |

|

| 0.045%, 08/17/15 (B) |

|

|

22,606 |

|

|

|

22,606 |

|

| 0.066%, 08/19/15 (B) |

|

|

5,292 |

|

|

|

5,292 |

|

| 0.072%, 08/21/15 (B) |

|

|

61,900 |

|

|

|

61,898 |

|

| 0.076%, 08/26/15 (B) |

|

|

89,705 |

|

|

|

89,697 |

|

| 0.065%, 09/02/15 (B) |

|

|

31,020 |

|

|

|

31,018 |

|

| 0.059%, 09/04/15 (B) |

|

|

24,320 |

|

|

|

24,319 |

|

| 0.070%, 09/15/15 (B) |

|

|

11,309 |

|

|

|

11,308 |

|

|

|

|

|

|

| SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

|

|

7 |

|

SCHEDULE OF INVESTMENTS (Unaudited)

Government II Fund (Concluded)

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| 0.069%, 09/16/15 (B) |

|

$ |

33,516 |

|

|

$ |

33,513 |

|

| 0.081%, 09/17/15 (B) |

|

|

13,883 |

|

|

|

13,882 |

|

| 0.090%, 10/02/15 (B) |

|

|

1,103 |

|

|

|

1,103 |

|

| 0.149%, 10/07/15 (B) |

|

|

6,933 |

|

|

|

6,931 |

|

| 0.099%, 10/09/15 (B) |

|

|

2,380 |

|

|

|

2,380 |

|

| 0.136%, 10/14/15 (B) |

|

|

6,015 |

|

|

|

6,013 |

|

| 0.100%, 10/20/15 (B) |

|

|

19,685 |

|

|

|

19,681 |

|

| 0.095%, 10/21/15 (B) |

|

|

6,313 |

|

|

|

6,312 |

|

| 0.112%, 10/28/15 (B) |

|

|

13,017 |

|

|

|

13,013 |

|

| 0.230%, 11/02/15 (B) |

|

|

2,965 |

|

|

|

2,963 |

|

| 0.240%, 11/06/15 (B) |

|

|

1,080 |

|

|

|

1,079 |

|

| 0.225%, 12/01/15 (B) |

|

|

4,304 |

|

|

|

4,301 |

|

| 0.271%, 12/08/15 (B) |

|

|

180 |

|

|

|

180 |

|

| FHLMC DN |

|

|

|

|

|

|

|

|

| 0.053%, 10/05/15 (B) |

|

|

18,817 |

|

|

|

18,815 |

|

| Tennessee Valley Authority DN |

|

|

|

|

|

|

|

|

| 0.051%, 08/04/15 (B) |

|

|

67,850 |

|

|

|

67,850 |

|

| 0.060%, 08/25/15 (B) |

|

|

3,780 |

|

|

|

3,780 |

|

|

|

|

|

|

|

|

|

|

| Total U.S. Government Agency Obligations

(Cost $1,023,122) ($ Thousands) |

|

|

|

|

|

|

1,023,122 |

|

|

|

|

|

|

|

|

|

|

|

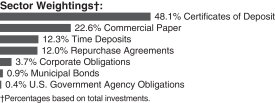

| U.S. TREASURY OBLIGATIONS — 16.1% |

|

| U.S. Treasury Bills |

|

|

|

|

|

|

|

|

| 0.030%, 08/20/15 |

|

|

18,125 |

|

|

|

18,125 |

|

| 0.050%, 08/27/15 |

|

|

15,150 |

|

|

|

15,149 |

|

| U.S. Treasury Notes |

|

|

|

|

|

|

|

|

| 4.250%, 08/15/15 |

|

|

18,860 |

|

|

|

18,891 |

|

| 0.250%, 08/15/15 |

|

|

80,213 |

|

|

|

80,220 |

|

| 1.250%, 08/31/15 |

|

|

6,297 |

|

|

|

6,303 |

|

| 0.375%, 08/31/15 |

|

|

56,567 |

|

|

|

56,582 |

|

|

|

|

|

|

|

|

|

|

| Total U.S. Treasury Obligations

(Cost $195,270) ($ Thousands) |

|

|

|

|

|

|

195,270 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.2%

(Cost $1,218,392) ($ Thousands) |

|

|

|

|

|

$ |

1,218,392 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $1,215,969 ($ Thousands).

| (A) |

|

Floating Rate Instrument. The rate reflected on the Schedule of Investments is the rate in effect on July 31, 2015. The demand and interest rate reset features give

this security a shorter effective maturity date. |

| (B) |

|

The rate reported is the effective yield at time of purchase. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC —

Federal Home Loan Mortgage Corporation

As of July 31, 2015, all of the Fund’s investments were considered Level 2, in accordance with

the authoritative guidance on fair value measurements and disclosure under U.S. Generally Accepted Accounting Principles.

As of July 31,

2015, there were no transfers between Level 1 and Level 2 assets and liabilities. As of July 31, 2015, there were no Level 3 securities.

For

more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes

are an integral part of the financial statements.

|

|

|

| 8 |

|

SEI Daily Income Trust / Semi-Annual Report / July 31, 2015 |

SCHEDULE OF INVESTMENTS (Unaudited)

Prime Obligation Fund

July 31, 2015

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

| CERTIFICATES OF DEPOSIT — 46.0% |

|

| ANZ New Zealand International |

|

|

|

|

|

|

|

|

| 0.269%, 08/05/15 (A) |

|

$ |

57,519 |

|

|

$ |

57,519 |

|

| 0.349%, 08/29/15 (A) |

|

|

30,078 |

|

|

|

30,078 |

|

| Bank of Montreal |

|

|

|

|

|

|

|

|

| 0.278%, 08/04/15 (A) |

|

|

42,000 |

|

|

|

42,000 |

|

| 0.210%, 09/10/15 |

|

|

54,180 |

|

|

|

54,182 |

|

| 0.190%, 09/14/15 |

|

|

53,000 |

|

|

|

53,000 |

|

| 0.190%, 09/15/15 |

|

|

26,000 |

|

|

|

26,000 |

|

| 0.250%, 09/16/15 |

|

|

34,000 |

|

|

|

34,000 |

|

| Bank of Nova Scotia |

|

|

|

|

|

|

|

|

| 0.260%, 08/01/15 (A) |

|

|

60,000 |

|

|

|

60,000 |

|

| 0.250%, 08/01/15 (A) |

|

|

26,000 |

|

|

|

26,000 |

|

| 0.279%, 09/04/15 (A) |

|

|

40,000 |

|

|

|

40,000 |

|

| Bank of Tokyo-Mitsubishi UFJ NY |

|

|

|

|

|

|

|

|

| 0.327%, 08/01/15 (A) |

|

|

26,800 |

|

|

|

26,800 |

|

| 0.317%, 08/01/15 (A) |

|

|

36,000 |

|

|

|

36,000 |

|

| 0.464%, 09/04/15 (A) |

|

|

1,612 |

|

|

|

1,612 |

|

| 0.250%, 09/08/15 |

|

|

22,000 |

|

|

|

22,000 |

|

| BMO Harris Bank |

|

|

|

|

|

|

|

|

| 0.300%, 08/03/15 |

|

|

2,547 |

|

|

|

2,547 |

|

| BNZ International Funding |

|

|

|

|

|

|

|

|

| 0.347%, 08/02/15 (A) |

|

|

22,552 |

|

|

|

22,552 |

|

| DNB Bank |

|

|

|

|

|

|

|

|

| 0.120%, 08/05/15 |

|

|

136,700 |

|

|

|

136,700 |

|

| Fairway Finance LLC |

|

|

|

|

|

|

|

|

| 0.268%, 08/20/15 (A) |

|

|

7,750 |

|

|

|

7,750 |

|

| 0.258%, 08/24/15 (A) |

|

|

29,000 |

|

|

|

29,000 |

|

| HSBC Bank |

|

|

|

|

|

|

|

|

| 0.200%, 08/10/15 |

|

|

44,000 |

|

|

|

44,000 |

|

| 0.230%, 09/01/15 |

|

|

80,500 |

|

|

|

80,500 |

|

| JPMorgan Securities LLC |

|

|

|

|

|

|

|

|

| 0.287%, 08/01/15 (A) |

|

|

40,000 |

|

|

|

40,000 |

|

| 0.308%, 08/04/15 (A) |

|

|

57,300 |

|

|

|

57,300 |

|

| 0.349%, 08/13/15 (A) |

|

|

6,425 |

|

|

|

6,426 |

|

| 0.331%, 08/31/15 (A) |

|

|

10,000 |

|

|

|

10,000 |

|

| Mizuho Bank |

|

|

|

|

|

|

|

|

| 0.260%, 08/07/15 |

|

|

45,000 |

|

|

|

45,000 |

|

| 0.270%, 08/11/15 |

|

|

26,362 |

|

|

|

26,362 |

|

| 0.270%, 09/10/15 |

|

|

9,166 |

|

|

|

9,166 |

|

| 0.270%, 09/25/15 |

|

|

37,950 |

|

|

|

37,951 |

|

| 0.280%, 10/01/15 |

|

|

4,000 |

|

|

|

4,000 |

|

| 0.270%, 10/07/15 |

|

|

34,000 |

|

|

|

34,001 |

|

| National Bank of Canada |

|

|

|

|

|

|

|

|

| 0.416%, 09/11/15 (A) |

|

|

2,324 |

|

|

|

2,324 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Face Amount

($ Thousands) |

|

|

Value

($ Thousands) |

|

|

|

|

|

|

|

|

|

|

| Nordea Bank |

|

|