KINROSS GOLD CORPORATION

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2017

Dated March 29, 2018

TABLE OF CONTENTS

|

|

Page |

|

CAUTIONARY STATEMENT |

3 |

|

CORPORATE STRUCTURE |

5 |

|

GENERAL DEVELOPMENT OF THE BUSINESS |

9 |

|

OVERVIEW |

9 |

|

THREE YEAR HISTORY |

9 |

|

DESCRIPTION OF THE BUSINESS |

11 |

|

EMPLOYEES |

12 |

|

COMPETITIVE CONDITIONS |

12 |

|

ENVIRONMENTAL PROTECTION |

12 |

|

OPERATIONS |

14 |

|

GOLD EQUIVALENT PRODUCTION AND SALES |

15 |

|

MARKETING |

16 |

|

KINROSS MINERAL RESERVES AND MINERAL RESOURCES |

17 |

|

KINROSS MATERIAL PROPERTIES |

26 |

|

Paracatu, Brazil |

26 |

|

Kupol, Russian Federation |

36 |

|

Tasiast, Mauritania |

51 |

|

OTHER KINROSS PROPERTIES |

61 |

|

Fort Knox and Area, Alaska, United States |

61 |

|

Round Mountain, Nye County, Nevada, United States |

62 |

|

Bald Mountain, White Pine Country, Nevada, United States |

63 |

|

La Coipa, Chile |

64 |

|

Kettle River — Buckhorn, Washington State, United States |

65 |

|

Lobo-Marte, Chile |

66 |

|

Maricunga, Chile |

67 |

|

Chirano, Ghana |

68 |

|

RISK FACTORS |

70 |

|

DIVIDEND PAYMENTS AND DIVIDEND POLICY |

86 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

87 |

|

DESCRIPTION OF CAPITAL STRUCTURE |

90 |

|

MARKET PRICE FOR KINROSS SECURITIES |

91 |

|

RATINGS |

91 |

|

DIRECTORS AND OFFICERS |

93 |

|

CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS |

98 |

|

CONFLICT OF INTEREST |

98 |

|

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

99 |

|

TRANSFER AGENT AND REGISTRAR |

99 |

|

MATERIAL CONTRACTS |

99 |

|

INTERESTS OF EXPERTS |

99 |

|

AUDIT AND RISK COMMITTEE |

100 |

|

ADDITIONAL INFORMATION |

102 |

|

GLOSSARY OF TECHNICAL TERMS |

102 |

IMPORTANT NOTICE

ABOUT INFORMATION IN THIS ANNUAL INFORMATION FORM

Unless specifically stated otherwise in this Annual Information Form:

· all dollar amounts are in U.S. dollars unless expressly stated otherwise;

· information is presented as of December 31, 2017, unless expressly stated otherwise; and

· references to “Kinross”, the “Company”, “its”, “our” and “we”, or related terms, refer to Kinross Gold Corporation or Kinross Gold Corporation and/or one or more or all of its subsidiaries, as may be applicable in the context.

CAUTIONARY STATEMENT

All statements, other than statements of historical fact, contained or incorporated by reference in this Annual Information Form (“AIF”) including, but not limited to, any information as to the future financial or operating performance of Kinross, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this AIF. Forward-looking statements contained in this AIF, include, without limitation, statements with respect to our guidance for production; production costs of sales, all-in sustaining cost and capital expenditures; and continuous improvement initiatives, as well as references to other possible events, the future price of gold and silver, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations; and resolution of pending litigation. The words “aim”, “anticipate”, “assumption”, “believe”, “budget”, “consideration”, “continue”, “develop”, “enhancement”, “estimate”, “expand”, “expect”, “explore”, “extend”, “forecast”, “focus”, “future”, “guidance”, “indicate”, “intend”, “initiative”, “measures”, “opportunity”, “optimize”, “outlook”, “phased”, “plan”, “possible”, “potential”, “project”, “schedule”, “seek”, “study”, “target” or variations of or similar such words and phrases or statements that certain actions, events or results may, could, should or will be achieved, received or taken, or will occur or result and similar such expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Kinross as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates, models and assumptions of Kinross referenced, contained or incorporated by reference in this AIF, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in our Management’s Discussion and Analysis (“MD&A”) for the year ended December 31, 2017 as well as: (1) there being no significant disruptions affecting the operations of the Company whether due to extreme weather events (including, without limitation, excessive or lack of rainfall) and other or related natural disasters, labour disruptions (including but not limited to following workforce reductions), supply disruptions, power disruptions, damage to equipment or otherwise; (2) the completion of studies, including optimization studies, prefeasibility and feasibility studies, on the timelines currently expected and the results of those studies being consistent with Kinross’ current expectations; (3) permitting, development, operations and production from the Company’s operations being consistent with Kinross’ current expectations including, without limitation, the construction and operation of the tailings storage facility and semi-autogenous (“SAG”) mill at Tasiast, and work permits, necessary import authorizations for goods and equipment and exploration license conversions at Tasiast; (4) political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any escalating political tensions and uncertainty in the Russian Federation and Ukraine or any related sanctions and any other similar restrictions or penalties imposed, or actions taken, by any government, including but not limited to potential power rationing, tailings facility regulation and amendments to mining laws in Brazil, potential amendments to water laws and/or other water use restrictions and regulatory actions in Chile, potential amendments to minerals and mining laws and dam safety regulation in Ghana, potential amendments to customs and mining laws (including but not limited to amendments to the VAT) and regulations relating to work permits in Mauritania, and potential amendments to and enforcement of tax laws in Russia (including, but not limited to, the interpretation, implementation, application and enforcement of any such laws and amendments thereto), being consistent with Kinross’ current expectations; (5) the exchange rate between the Canadian dollar, Brazilian real, Chilean peso, Russian rouble, Mauritanian ouguiya, Ghanaian cedi and the U.S. dollar being approximately consistent with current

levels; (6) certain price assumptions for gold and silver; (7) prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with current levels; (8) production and cost of sales forecasts for the Company meeting expectations; (9) the accuracy of the current mineral reserve and mineral resource estimates of the Company (including but not limited to ore tonnage and ore grade estimates) and mine plans for the Company’s mining operations (including but not limited to throughput and recoveries being affected by metallurgical characteristics at Paracatu and mine life estimates at Round Mountain, Paracatu, Fort Knox and Kupol being accurate); (10) labour and materials costs increasing on a basis consistent with Kinross’ current expectations; (11) the terms and conditions of the legal and fiscal stability agreements for the Tasiast and Chirano operations being interpreted and applied in a manner consistent with their intent and Kinross’ expectations; (12) goodwill and/or asset impairment potential; (13) access to capital markets, including but not limited to maintaining debt ratings consistent with the Company’s current expectations; (13) that Kinross will complete the acquisition of the Brazilian power plants in accordance with, and on the timeline contemplated by, the terms and conditions of the relevant agreements, on a basis consistent with our current expectations; and (14) the regulatory and legislative regime regarding mining, electricity production and transmission (including rules related to power tariffs) in Brazil being consistent with Kinross’ current expectations. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: sanctions (any other similar restrictions or penalties) now or subsequently imposed, other actions taken, by, against, in respect of or otherwise impacting any jurisdiction in which the Company is domiciled or operates (including but not limited to the Russian Federation, Canada, the European Union and the United States), or any government or citizens of, persons or companies domiciled in, or the Company’s business, operations or other activities in, any such jurisdiction; fluctuations in the currency markets; fluctuations in the spot and forward price of gold or certain other commodities (such as fuel and electricity); changes in the discount rates applied to calculate the present value of net future cash flows based on country-specific real weighted average cost of capital; changes in the market valuations of peer group gold producers and the Company, and the resulting impact on market price to net asset value multiples; changes in various market variables, such as interest rates, foreign exchange rates, gold or silver prices and lease rates, or global fuel prices, that could impact the mark-to-market value of outstanding derivative instruments and ongoing payments/receipts under any financial obligations; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); changes in national and local government legislation, taxation (including but not limited to income tax, advance income tax, stamp tax, withholding tax, capital tax, tariffs, value-added or sales tax, capital outflow tax, capital gains tax, windfall or windfall profits tax, royalty, excise tax, customs/import or export taxes/duties, asset taxes, asset transfer tax, property use or other real estate tax, together with any related fine, penalty, surcharge, or interest imposed in connection with such taxes), controls, policies and regulations; the security of personnel and assets; political or economic developments in Canada, the United States, Chile, Brazil, Russia, Mauritania, Ghana, or other countries in which Kinross does business or may carry on business; business opportunities that may be presented to, or pursued by, us; our ability to successfully integrate acquisitions and complete divestitures; operating or technical difficulties in connection with mining or development activities; employee relations; litigation or other claims against, or regulatory investigations and/or any enforcement actions or sanctions in respect of the Company (and/or its directors, officers, or employees) including, but not limited to, securities class action litigation in Canada and/or the United States, or any investigations, enforcement actions and/or sanctions under any applicable anti-corruption, international sanctions and/or anti-money laundering laws and regulations in Canada, the United States or any other applicable jurisdiction; the speculative nature of gold exploration and development including, but not limited to, the risks of obtaining necessary licenses and permits; diminishing quantities or grades of reserves; adverse changes in our credit rating; and contests over title to properties, particularly title to undeveloped properties. In addition, there are risks and hazards associated with the business of gold exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, Kinross’ actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, Kinross, including but not limited to resulting in an impairment charge on goodwill and/or assets. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this AIF, including but not limited to the “Risk Factors” section hereof, are qualified by this cautionary statement and those made in our other filings with the securities regulators of Canada and the United States including, but not limited to, the cautionary statements made in the “Risk Analysis” section of our MD&A for the year ended December 31, 2017. These factors are not intended to represent a complete list of the factors that could affect Kinross. Kinross disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

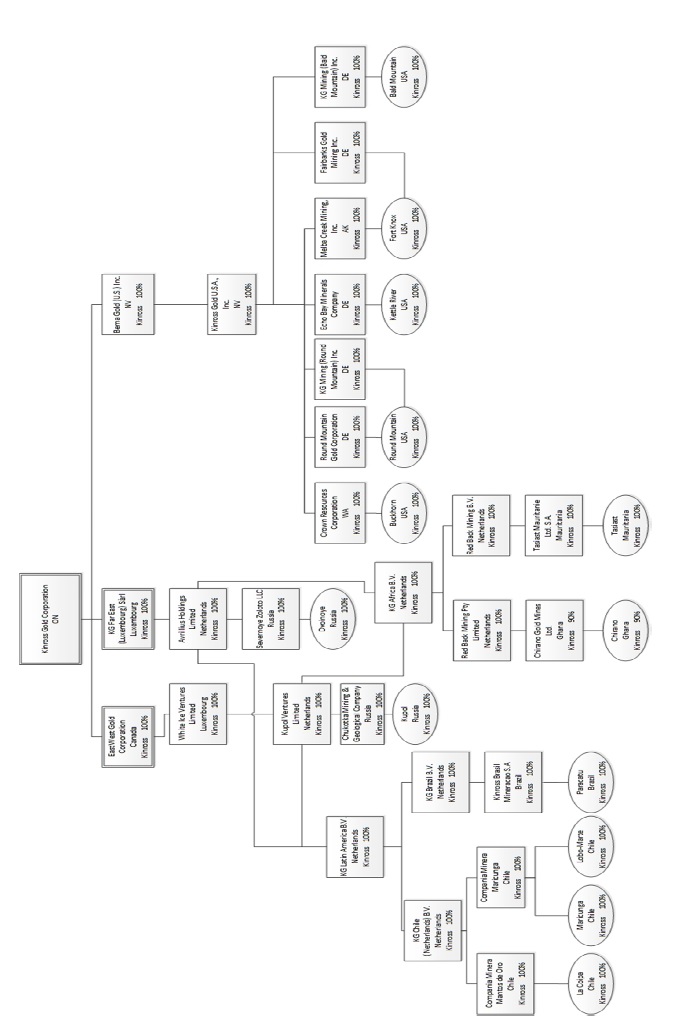

CORPORATE STRUCTURE

Kinross Gold Corporation was initially created in May 1993 by the amalgamation of CMP Resources Ltd., Plexus Resources Corporation, and 1021105 Ontario Corp. In December 2000, Kinross amalgamated with LT Acquisition Inc.; in January 2005, Kinross amalgamated with its wholly-owned subsidiary, TVX Gold Inc. (“TVX”); in January 2006, it amalgamated with its wholly-owned subsidiary, Echo Bay Mines Ltd. (“Echo Bay”); and in January 2011, it amalgamated with Underworld Resources Inc. Kinross is the continuing entity resulting from these amalgamations. Kinross is governed by the Business Corporations Act (Ontario) and its registered and principal offices are located at 25 York Street, 17th Floor, Toronto, Ontario, M5J 2V5.

Each of Kinross’ mining operations is a separate business unit. Operations outside of the United States are overseen by a Regional Vice-President employed by the applicable foreign subsidiary, who reports to the Company’s Senior Vice-President and Chief Operating Officer. Operations in the United States are overseen directly by the Company’s Senior Vice-President and Chief Operating Officer. Global exploration strategies, corporate financing, tax, additional technical support services, hedging and acquisition strategies are managed centrally. Execution of site/regional operations and exploration strategies is managed locally. Kinross’ enterprise risk management programs are subject to overview by its Audit and Risk Committee and the Board of Directors.

A significant portion of Kinross’ business is carried on through subsidiaries. A chart showing the names of the significant subsidiaries of Kinross, as of December 31, 2017, is set out below. All subsidiaries are 100% owned (directly or indirectly) unless otherwise noted.

Subsidiary Governance and Internal Controls

Kinross has systems of governance, internal control over financial reporting, and disclosure controls and procedures that apply at all levels of the Company and its subsidiaries, including those that operate in emerging markets. These systems are overseen by the Company’s Board of Directors and are implemented by the Company’s senior management, and the senior management of its subsidiaries. The relevant features of these systems include:

Control over Subsidiaries. All of the Company’s subsidiaries are wholly-owned or controlled unless otherwise noted. Operations outside of the United States are overseen by a Regional Vice-President employed by the applicable foreign subsidiary, who reports to the Company’s Senior Vice-President and Chief Operating Officer. Operations in the United States are overseen directly by the Company’s Senior Vice-President and Chief Operating Officer. Kinross’ subsidiaries, including those subsidiaries in emerging markets, are located in the applicable jurisdictions. Each of the subsidiaries legally owns or controls its operating assets, and the subsidiaries’ operational decisions are localized. Kinross, as the ultimate sole shareholder, has internal policies and systems in place which provide it with visibility into the operations of its subsidiaries, including its subsidiaries operating in emerging markets, and the Company’s management team is responsible for monitoring the activities of the subsidiaries.

Further, the Board of Directors (or similar governing body) of each subsidiary is appointed by the shareholders of such subsidiary. Directors (or those holding similar positions) may be replaced at any time by a written resolution of the shareholders (or equivalent corporate action under applicable law). Through its corporate structure, Kinross has the power to directly or indirectly appoint and replace the board members of each subsidiary, including those operating in emerging markets. The boards of directors (or similar governing bodies under applicable law) of Kinross’ subsidiaries (including those operating in emerging markets) act with regard to their respective fiduciary duties and in accordance with applicable corporate procedures, and are also accountable to Kinross and its Board of Directors and senior management, as the ultimate shareholder.

With respect to the bank accounts of subsidiaries, Kinross has internal controls that require each of the Company’s subsidiaries to notify the Company’s treasury team before opening or closing any bank accounts. Kinross’ treasury team is also responsible for generally monitoring the activity within all such bank accounts on an ongoing basis via a web-based global treasury management system and/or web-based account access provided by the applicable financial institution to the extent available.

Strategic Direction. While the mining operations of each of the Company’s subsidiaries are managed locally, exploration strategies, external corporate financing, tax governance, additional technical support services, hedging and acquisition strategies are established centrally by the Company’s management, and, on consideration, implemented accordingly by senior management of applicable subsidiaries under the oversight of their respective boards of directors. Each subsidiary is responsible for the development and execution of its own risk management programs based on the enterprise risk management process established by the Company. The subsidiaries report a summary of their respective risk registers to the Company’s management on a quarterly basis which is then reported to the Audit and Risk Committee.

Financial Reporting. Kinross prepares its consolidated financial statements and Management’s Discussion & Analysis (“MD&A”) on a quarterly and annual basis using IFRS as issued by the International Accounting Standards Board, which includes financial information and disclosure from its subsidiaries. The Company has internal controls over the preparation of its financial statements and other financial disclosures to provide reasonable assurance that its financial reporting is reliable and that the quarterly and annual financial statements and MD&A are being prepared in accordance with IFRS and applicable securities laws. These internal controls include the following:

(a) As part of the quarterly results and reporting process, the Company holds quarterly business review meetings (each, a “QBR”) for each of the Company’s operating regions. The QBRs are hosted by the Chief Operating Officer, attended by senior finance and operations management of the Company and its subsidiaries and information is presented

by regional and site management of the applicable subsidiaries. The QBRs include a review of operational performance as well as key financial information pertaining to the quarter.

(b) The Company receives quarterly reporting packages from its key operating subsidiaries including financial information and disclosures required to complete the Company’s consolidated financial statements and MD&A. Those responsible for the finance function of the Company’s subsidiaries report to the Company’s management, and the Company’s management has direct access to relevant financial information and finance personnel of the subsidiaries.

(c) All public disclosure documents and financial statements relating to the Company and its subsidiaries containing material information are reviewed by senior management and approved by the Company’s disclosure committee before such material is disclosed. The disclosure committee is comprised of the Chief Financial Officer, the Chief Operating Officer and the Chief Legal Officer. With respect to quarterly reporting including consolidated financial statements and MD&A, the disclosure committee meets to review and discuss all information prior to public disclosure. A summary of such meeting is provided to the Audit and Risk Committee by the Chief Financial Officer. The disclosure committee also receives a report on quarterly and annual sub-certifications received from senior management responsible for direct oversight of the operations of each operating subsidiary.

(d) The primary responsibility of the Audit and Risk Committee is to oversee the Company’s financial reporting process on behalf of the Board of Directors of Kinross and to report the results of its activities to the Board of Directors.

(e) The Audit and Risk Committee reviews the Company’s quarterly and annual financial statements and MD&A and meets with senior management to discuss quarterly results, including accounting, disclosure and control matters. The Audit and Risk Committee recommends the quarterly and annual consolidated financial statements and MD&A to the Company’s Board of Directors for approval.

(f) The Audit and Risk Committee receives confirmation from the Chief Executive Officer and Chief Financial Officer as to the matters addressed in the quarterly and annual certifications required under National Instrument 52-109 — Certification of Disclosure in Issuer’s Annual and Interim Filings. This confirmation is obtained from the quarterly CFO report which provides a summary of management’s assessment and evaluation of internal control over financial reporting and disclosures control and procedures.

(g) The Audit and Risk Committee periodically assesses and evaluates the adequacy of the procedures in place for the review of the Company’s public disclosure of financial information extracted or derived from the Company’s financial statements, other than the annual and interim financial statements and related notes, MD&A, earnings releases and the AIF.

Pursuant to regulations adopted by the U.S. Securities and Exchange Commission, under the Sarbanes-Oxley Act of 2002 and those of the Canadian Securities Administrators, Kinross’ management evaluates the effectiveness of the design and operation of the Company’s disclosure controls and procedures and internal control over financial reporting. This evaluation is done under the supervision of, and with the participation of, the Company’s Chief Executive Officer and Chief Financial Officer.

These systems of corporate governance, internal control over financial reporting and disclosure controls and procedures are designed to enable, among other things, Kinross to have access to all material information about its subsidiaries, including those operating in emerging markets.

Fund Transfers from the Company’s Subsidiaries

Certain of the Company’s subsidiaries have a long history of operating in emerging markets and Kinross has not had any material issues with respect to transferring funds from, to or within emerging markets. Funds are transferred to, from or among Kinross’ subsidiaries pursuant to a variety of methods which include the following: chargeback of costs undertaken on behalf of the subsidiaries via intercompany invoices; advances and repayment of intercompany loans and related interest expenses; equity purchases; returns of capital and dividend declaration/payment by the subsidiaries. The method of transfer is dependent on the financing or other arrangement established amongst Kinross and/or its applicable subsidiaries. All fund transfers from Kinross’ subsidiaries are in compliance with applicable law.

Records Management of the Company’s Subsidiaries

As required by applicable law, original copies of all corporate records are required to be maintained in the language of, and stored at the offices of, each subsidiary in the jurisdiction of incorporation. However, where practical, a duplicate set of corporate records for certain subsidiaries is maintained at Kinross’ head office in Toronto. Kinross also maintains a web-based global entity management system for recording such corporate information and documents which is regularly monitored and updated by Kinross’ corporate secretarial team and/or the regional legal teams.

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

Kinross is principally engaged in the mining and processing of gold and, as a by-product, silver ore and the exploration for, and the acquisition of, gold bearing properties in the Americas, the Russian Federation, West Africa and worldwide. The principal products of Kinross are gold and silver produced in the form of doré that is shipped to refineries for final processing.

Kinross’ strategy is to increase shareholder value through increases in precious metal reserves, net asset value, production, long-term cash flow and earnings per share. Kinross’ strategy also consists of optimizing the performance, and therefore, the value, of existing operations, investing in quality exploration and development projects and acquiring new potentially accretive properties and projects.

Kinross’ operations and mineral reserves are impacted by, among other things, changes in metal prices. The average gold price during 2017 was approximately $ 1,257 ($ 1,251 during 2016). Kinross used a gold price of $1,200 per ounce at the end of 2017 to estimate mineral reserves.

Kinross’ attributable estimated proven and probable mineral reserves as at December 31, 2017, was 25.9 million ounces of gold and 52.6 million ounces of silver.1

Three-Year History

On November 12, 2015, Kinross announced that it had entered into a definitive asset purchase agreement to acquire 100% of the Bald Mountain (“Bald Mountain”) gold mine, which includes a large associated land package, and the remaining 50% of the Round Mountain gold mine in Nevada from Barrick Gold Corporation (“Barrick”) for $610 million in cash, subject to a working capital adjustment, which reduced the purchase price to $588 million. In addition, Barrick received a contingent 2% net smelter return

1 The Company no longer has any proven and probable copper reserves, which were exclusively at Cerro Casale. Cerro Casale was sold by the Company on June 9, 2017.

royalty on future gold production from Kinross’ 100%-owned Bald Mountain lands that will come into effect following the post-closing production of 10 million ounces from such lands. Barrick also retained a 50% interest in an exploration joint venture partnership with Kinross over 40% of the land package outside the current core mining area. The transaction was completed on January 11, 2016.

On February 24, 2016, Kinross announced a bought deal public equity offering of 83,400,000 common shares at a price of $3.00 per common share for gross proceeds of approximately $250 million. Kinross sold the common shares to a syndicate of underwriters led by TD Securities Inc. and Scotiabank pursuant to an underwriting agreement dated February 24, 2016. Kinross used $175 million of the net proceeds to repay the credit facilities that were utilized to purchase assets from Barrick, with the balance being used to repay debt maturing in 2016 and for general corporate purposes. The offering was completed on March4, 2016. On March 18, 2016, Kinross completed the offering of an additional 12,510,000 common shares at a price of $3.00 per common share for an additional gross proceeds of $37,530,000 pursuant to the exercise of the over-allotment option by the syndicate of underwriters.

On March 28, 2017, Kinross announced the sale of its 25% interest in the Cerro Casale project in Chile, and its 100% interest in the Quebrada Seca exploration project located adjacent to Cerro Casale, to Goldcorp Inc. (“Goldcorp”) for: (i) $260 million in cash paid at closing (which includes $20 million for Quebrada Seca); (ii) $40 million in cash, payable following a positive construction decision by the Cerro Casale joint venture; (iii) the assumption by Goldcorp of a $20 million contingent payment obligation due to Barrick under the existing Cerro Casale shareholders agreement, which is payable when commercial production at Cerro Casale commences; and (iv) a 1.25% royalty from Goldcorp based on 25% of gross revenues from all metals sold at Cerro Casale and Quebrada Seca, with Kinross foregoing the first $10 million in royalty payments. The transaction was completed on June 9, 2017. Additionally, on closing Kinross entered into a water supply agreement with the Cerro Casale joint venture. After certain conditions are met, the agreement provides Kinross with certain rights to access, up to a fixed amount, water not required by the Cerro Casale joint venture. Kinross expects to use this water for its Chilean assets and would be responsible for the incremental capital costs to accommodate the supply of water to the Company along with its pro rata share of operating and maintenance costs.

On March 30, 2016, the Company filed an updated NI 43-101 Technical Report in respect of its Tasiast project and announced that it would proceed with a phase one expansion of its Tasiast mine as outlined in the Technical Report. The Company proposed a two-phased expansion of the Tasiast project that leverages the existing mill infrastructure. Phase One of the expansion is expected to increase the mill throughput from the current 8,000 tonnes per day to 12,000 tonnes per day (“t/d”).

On May 18, 2017, Kinross announced that it had entered into an agreement to sell its 100% interest in the White Gold exploration project in the Yukon Territory to White Gold Corp. (“White Gold”). On June 14, 2017, the Company completed the sale for gross cash proceeds of $7.6 million, 17.5 million common shares of White Gold representing 19.9% of the issued and outstanding shares of White Gold, and deferred payments of $11.4 million payable in three equal payments of $3.8 million upon completion of specific milestones.

On June 28, 2017, Kinross announced an offering of $500 million principal amount of its 4.50% Senior Notes due 2027. The notes are unsecured, senior obligations of Kinross and are wholly and unconditionally guaranteed by certain of Kinross’ wholly-owned subsidiaries that are also guarantors under Kinross’ senior unsecured credit agreement. The offering was completed on July 6, 2017. Kinross used the net proceeds, along with available cash on hand, to repay its term loan, which was due August 2020.

On July 28, 2017, Kinross extended the maturity date of its $1.5 billion revolving credit facility by one year to 2022.

On September 18, 2017, Kinross announced that it was proceeding with the Phase Two expansion of its Tasiast mine. Phase Two is expected to increase mill capacity to 30,000 t/d.

On September 18, 2017, Kinross also announced its intent to proceed with the Round Mountain Phase W project in Nevada.

On September 19, 2017, Kinross agreed to sell 100% of the DeLamar project to Integra Resources Corp. (“Integra”) for cash and a non-interest bearing promissory note, payable 18 months after closing, totaling C$7.2 million and the issuance of Integra shares equal to 9.9% of all of the issued and outstanding Integra shares upon closing of the transaction. The DeLamar project is subject to a 2.5% retained variable net smelter return (“NSR”) royalty payable to Kinross that will be reduced to 1% when royalty payments have accumulated to C$10.0 million. The transaction was completed on November 3, 2017.

On December 12, 2017, Kinross announced that it had gained mineral rights to a 287-hectare (709-acre) parcel of land known as Gilmore located immediately west of its Fort Knox mine in Alaska.

On February 2, 2018, Compania Minera Mantos de Oro (“MDO”), a subsidiary of the Company, Minera La Coipa (“MLC”) and Salmones de Chile Alimentos S.A. (“SDCA”) agreed, among other things, to spin out the Phase 7 concessions surrounding Kinross’ La Coipa mine into a new company and MDO agreed to purchase SDCA’s 50% interest in such company in exchange for payments to SDCA totaling $65 million. Prior to completion of the transaction, MDO held a 50% ownership interest in the Phase 7 deposit through its 50% ownership of MLC, with the remaining 50% held by Salmones de Chile Alimentos S.A. (“SDCA”). Following completion of the transaction on March 19 2018, MDO now holds a 100% ownership interest in the Phase 7 deposit.

On February 14, 2018, Kinross announced that its wholly-owned subsidiary, Kinross Brasil Mineraçao, had agreed to acquire two hydroelectric power plants in Brazil from a subsidiary of Gerdau SA for $257 million2. The acquisition is expected to close within approximately three to six months after announcement, subject to regulatory approvals and the satisfaction of other conditions precedent.

DESCRIPTION OF THE BUSINESS

Kinross is principally engaged in the mining and processing of gold and, as a by-product, silver ore and the exploration for, and the acquisition of, gold bearing properties in the Americas, the Russian Federation, West Africa and worldwide. The material properties of Kinross as of December 31, 2017 were as follows:

|

Property |

|

Location |

|

Property |

|

|

Paracatu |

|

Brazil |

|

100 |

% |

|

Kupol-Dvoinoye |

|

Russian Federation |

|

100 |

% |

|

Tasiast |

|

Mauritania |

|

100 |

% |

(1) The Paracatu and Tasiast properties are subject to various royalties (see “Kinross Material Properties” —“Paracatu, Brazil” and “Tasiast, Mauritania”).

In addition, as of December 31, 2017, Kinross held a 100% interest in the Fort Knox property in Alaska, United States, a 100% interest in the Kettle River-Buckhorn properties in Washington, United States, which includes the Kettle River mill and the Buckhorn mine, a 100% interest in the Round Mountain mine in Nevada, United States, a 100% interest in the Bald Mountain mine in Nevada, United States, a 100% interest in the La Coipa mine in Chile, a 90% interest in the Chirano mine in Ghana, a 100% interest in the Lobo-Marte property in Chile, a 100% interest in the Maricunga mine in Chile and other mining properties in

2 This amount assumes a foreign exchange rate of 3.25 Brazilian reais to the U.S. dollar.

various stages of exploration, development, reclamation, and closure. The Company’s principal product is gold and it also produces silver as a by-product.

Employees

At December 31, 2017, Kinross and its subsidiaries employed approximately 8,850 employees. In Brazil, a new collective agreement for Paracatu was signed on February 1, 2017. In Chile two new collective agreements for Maricunga were signed in February 2017. In West Africa, employees at the Chirano and Tasiast mines are also represented by unions. In Mauritania a new collective agreement was signed in October 2016 and is valid until November 2019. In Ghana, new collective agreements for junior staff and senior staff at Chirano were signed in January 2017. In Russia, a union was registered at Kupol in February 2012, but there are currently no union members. At Dvoinoye, a union was registered in 2015, which currently has two members. Collective bargaining is not required until a majority of Dvoinoye employees have joined the union. All of Kinross’ employees in the United States and Canada are non-unionized.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. Kinross competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of Kinross to replace or increase its mineral reserves and mineral resources in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Environmental Protection

Kinross’ exploration activities and mining and processing operations are subject to the federal, state, provincial, regional and local environmental laws and regulations of the jurisdictions in which Kinross’ activities and facilities are located. For example, in the United States, Kinross is subject to a number of such laws and regulations including, without limitation: the Clean Air Act; the Clean Water Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right to Know Act; the Endangered Species Act; the Federal Land Policy and Management Act; the National Environmental Policy Act; the Resource Conservation and Recovery Act; and related state laws.

Kinross is subject to similar laws in other jurisdictions in which it operates. In all jurisdictions in which Kinross operates, environmental licences, permits and other regulatory approvals are required in order to engage in exploration, mining and processing, and mine closure activities. Regulatory approval of a detailed plan of operations and a comprehensive environmental impact assessment is required prior to initiating mining or processing activities or for any substantive change to previously approved plans. In all jurisdictions in which Kinross operates, specific statutory and regulatory requirements and standards must be met throughout the life of the mining or processing operations in regard to air quality, water quality, fisheries, wildlife and biodiversity protection, archaeological and cultural resources, solid and hazardous waste management and disposal, the management and transportation of hazardous chemicals, toxic substances, noise, community right-to-know, land use, and reclamation. Except as may be otherwise disclosed herein, Kinross is currently in compliance, in all material respects, with all material applicable environmental laws and regulations. Details and quantification of the Company’s reclamation and remediation obligations are set out in Note 13 to the audited consolidated financial statements of the Company for the year ended December 31, 2017.

As part of Kinross’ Corporate Responsibility Management System, Kinross has implemented corporate environmental governance programs including:

POLICY - The Corporate Environmental Policy sets the overall expectations for maintaining environmental compliance, managing our environmental footprint, and systematic monitoring of our

environmental performance. The policy assigns accountabilities to implement those expectations, which apply to all stages of exploration, development, operation and closure.

STANDARDS — Corporate environmental management standards provide a clear bottom line for all Kinross activities in all jurisdictions in which we carry on business. Where legal requirements are unclear, Kinross’ environmental management standards provide clear direction regarding performance expectations and minimum design and operating requirements.

An example of this is Kinross’ adoption of the standards outlined in the International Cyanide Management Code for the Manufacture, Transport and Use of Cyanide in the Production of Gold (the “Cyanide Code”). Kinross is a signatory to the Cyanide Code, which is administered by the International Cyanide Management Institute (the “ICMI”). The ICMI is an independent body that was established by a multi-stakeholder group under the guidance of the United Nations Environmental Program. The ICMI established operating standards for cyanide manufacturers, transporters and mines and provides for third party certification of facilities’ compliance with the Cyanide Code. All Kinross operations have either already been certified as compliant with the Cyanide Code or are in the process of being certified.

AUDITS - Comprehensive environmental compliance audits are conducted at all operations and at selected residual properties on a triennial basis. The audit program assesses compliance with applicable legal requirements, measures effectiveness of management systems, and includes procedures to ensure timely follow-up on audit findings. Audit topics for detailed review are based on site-specific risks.

METRICS - Kinross has identified operational parameters that are key indicators of environmental performance, and measures these indicators on a regular basis. The Company tracks an index of these key performance indicators and sets performance targets to encourage continuous environmental improvement.

ENGINEERING - To effectively manage environmental risk, programs are in place to assess the management and stability of tailings and other engineered facilities. They include detailed water balance accounting, to assure sufficient storage capacity, and effective operational procedures. Every Kinross operation has a tailings or heap management plan in place, and tailings facilities are the subject of periodic review by independent experts. In addition, Kinross performs periodic assessments of engineered systems to assure adequate systems are in place to minimize or eliminate environmental risks.

RECLAMATION - Kinross recognizes its responsibility to manage the environmental change associated with its operations, and requires all sites to develop and maintain reclamation and closure plans to address the Company’s reclamation and closure obligations in accordance with applicable local regulations and Kinross’ corporate environmental management standards.

The results of these programs have been recognized by others within and outside the mining industry. Examples of significant recognition of Kinross’ efforts are listed on Kinross’ website at www.kinross.com.

Operations

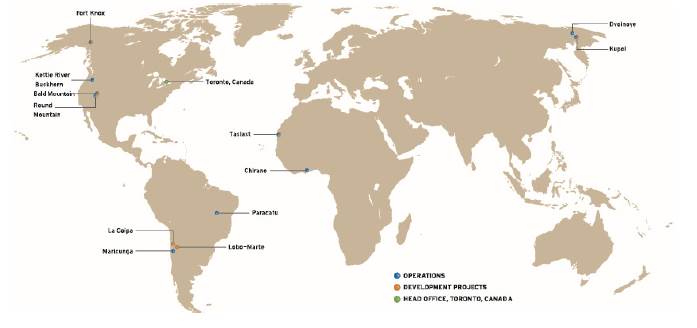

Kinross’ total attributable production in 2017 was derived from the mines in the Americas (61%), West Africa (17%) and the Russian Federation (22%). The following shows the location of Kinross’ properties as of the date hereof.

Gold Equivalent Production and Sales

The following table summarizes total attributable production and sales from continuing operations by Kinross in the last three years:

|

|

|

Years ended December 31, |

| ||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

Gold equivalent production — ounces |

|

2,673,533 |

|

2,789,150 |

|

2,594,652 |

|

|

|

|

|

|

|

|

|

|

|

Gold equivalent sales — ounces |

|

2,596,754 |

|

2,758,306 |

|

2,608,870 |

|

Included in gold equivalent production and sales is silver production and sales, as applicable, converted into gold production using a ratio of the average spot market prices of gold and silver for each of the three comparative years. The ratios were 73.72:1 in 2017, 72.95:1 in 2016 and 73.92:1 in 2015.

The following table sets forth the total attributable gold equivalent production (in ounces) reflective of Kinross’ interest in each of its operating assets during the last three years:

|

|

|

2017 |

|

2016 |

|

2015 |

|

|

Americas: |

|

|

|

|

|

|

|

|

Fort Knox |

|

381,115 |

|

409,844 |

|

401,553 |

|

|

Round Mountain(1) |

|

436,932 |

|

378,264 |

|

197,818 |

|

|

Bald Mountain(2) |

|

282,715 |

|

130,144 |

|

n/a |

|

|

Kettle River-Buckhorn |

|

76,570 |

|

112,274 |

|

97,368 |

|

|

Paracatu |

|

359,959 |

|

483,014 |

|

477,662 |

|

|

Maricunga |

|

91,127 |

|

175,532 |

|

212,155 |

|

|

Total |

|

1,628,418 |

|

1,689,072 |

|

1,386,556 |

|

|

|

|

|

|

|

|

|

|

|

West Africa: |

|

|

|

|

|

|

|

|

Tasiast |

|

243,240 |

|

175,176 |

|

219,045 |

|

|

Chirano(3) |

|

221,424 |

|

190,759 |

|

230,488 |

|

|

Total |

|

464,664 |

|

365,935 |

|

449,533 |

|

|

|

|

|

|

|

|

|

|

|

Russian Federation: |

|

|

|

|

|

|

|

|

Kupol-Dvoinoye |

|

580,451 |

|

734,143 |

|

758,563 |

|

(1) Represents Kinross’ 50% ownership interest up to January 11, 2016. On January 11, 2016, Kinross acquired the remaining 50% interest.

(2) Represents partial year only. Kinross acquired Bald Mountain on January 11, 2016.

(3) Represents Kinross’ 90% ownership interest.

Marketing

Gold is a metal that is traded on world markets, with benchmark prices generally based on the London market. Gold has two principal uses: product fabrication and bullion investment. Fabricated gold has a wide variety of end uses, including jewelry manufacture (the largest fabrication component), electronics, dentistry, industrial and decorative uses, medals, medallions, and official coins. Gold bullion is held primarily as a store of value and a safeguard against devaluation of paper assets denominated in fiat currencies. Kinross sells all of its refined gold to banks, bullion dealers, and refiners. In 2017, sales from operations to its top three customers totaled $694.5 million, $531.5 million, and $342.1 million respectively, for an aggregate of $1,568.1 million. In 2016, sales from operations to its top three customers totaled $611.4 million, $473.5 million, and $405.5 million respectively, for an aggregate of $1,490.4 million. Due to the size of the bullion market and the above ground inventory of bullion, activities by Kinross will generally not influence gold prices. Kinross believes that the loss of any of these customers would have no material adverse impact on Kinross because of the active worldwide market for gold.

The following table sets forth for the years indicated the high and low London Bullion Market afternoon fix prices for gold:

|

Year |

|

High |

|

Low |

|

Average |

| |||

|

2007 |

|

$ |

841.10 |

|

$ |

608.40 |

|

$ |

695.39 |

|

|

2008 |

|

$ |

1,011.25 |

|

$ |

712.50 |

|

$ |

871.96 |

|

|

2009 |

|

$ |

1,212.50 |

|

$ |

810.00 |

|

$ |

972.35 |

|

|

2010 |

|

$ |

1,421.00 |

|

$ |

1,058.00 |

|

$ |

1,224.52 |

|

|

2011 |

|

$ |

1,895.00 |

|

$ |

1,319.00 |

|

$ |

1,570.25 |

|

|

2012 |

|

$ |

1,791.75 |

|

$ |

1,540.00 |

|

$ |

1,668.98 |

|

|

2013 |

|

$ |

1,693.75 |

|

$ |

1,192.00 |

|

$ |

1,411.23 |

|

|

2014 |

|

$ |

1,385.00 |

|

$ |

1,142.00 |

|

$ |

1,266.40 |

|

|

2015 |

|

$ |

1,295.75 |

|

$ |

1,049.40 |

|

$ |

1,160.06 |

|

|

2016 |

|

$ |

1,366.25 |

|

$ |

1,077.00 |

|

$ |

1,250.80 |

|

|

2017 |

|

$ |

1,346.25 |

|

$ |

1,151.00 |

|

$ |

1,257.15 |

|

Kinross Mineral Reserves and Mineral Resources

Definitions

The estimated mineral reserves and mineral resources for Kinross’ properties have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definitions Adopted by CIM Council on May 10, 2014 (the “CIM Standards”) which are incorporated in the Canadian Securities Administrators’ National Instrument 43-101 Standards of Disclosure for Mineral Projects. The following definitions are reproduced from the CIM Standards:

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A Mineral Reserve is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study.

A Probable Mineral Reserve is the economically mineable part of an Indicated Mineral Reserve, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. The qualified person(s) may elect, to convert Measured Mineral Resources to Probable Mineral Reserves if the confidence in the Modifying Factors is lower than that applied to a Proven Mineral Reserve. Probable Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a Pre-Feasibility Study.

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. Application of the Proven Mineral Reserve category implies that the qualified person has the highest degree of confidence in

the estimate with the consequent expectation in the minds of the readers of the report. The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect the potential economic viability of the deposit. Proven Mineral Reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a Pre-Feasibility Study. Within the CIM Standards, the term Proved Mineral Reserve is an equivalent term to a Proven Mineral Reserve.

Modifying Factors are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

Mineral Reserve and Mineral Resource Estimates

The following tables set forth the estimated mineral reserves and mineral resources attributable to interests held by Kinross for each of its properties:

|

MINERAL RESERVE AND MINERAL RESOURCE STATEMENT |

GOLD |

|

PROVEN AND PROBABLE MINERAL RESERVES (1,3,4,5,6,8) | |

|

Kinross Gold Corporation’s Share at December 31, 2017 | |

|

|

|

|

|

Kinross |

|

Proven |

|

Probable |

|

Proven and Probable |

| ||||||||||||

|

|

|

|

|

Interest |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

|

Property |

|

Location |

|

(%) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

|

NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bald Mountain |

|

USA |

|

100.0 |

% |

6,490 |

|

0.7 |

|

143 |

|

88,726 |

|

0.5 |

|

1,555 |

|

95,216 |

|

0.6 |

|

1,698 |

|

|

Fort Knox Area |

|

USA |

|

100.0 |

% |

23,671 |

|

0.5 |

|

357 |

|

65,187 |

|

0.4 |

|

888 |

|

88,858 |

|

0.4 |

|

1,245 |

|

|

Round Mountain Area |

|

USA |

|

100.0 |

% |

49,266 |

|

0.5 |

|

853 |

|

75,116 |

|

0.8 |

|

2,031 |

|

124,382 |

|

0.7 |

|

2,884 |

|

|

SUBTOTAL |

|

|

|

|

|

79,427 |

|

0.5 |

|

1,353 |

|

229,029 |

|

0.6 |

|

4,474 |

|

308,456 |

|

0.6 |

|

5,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOUTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Coipa 8 |

|

Chile |

|

100.0 |

% |

59 |

|

1.6 |

|

3 |

|

15,603 |

|

1.7 |

|

841 |

|

15,662 |

|

1.7 |

|

844 |

|

|

Paracatu |

|

Brazil |

|

100.0 |

% |

511,127 |

|

0.4 |

|

6,805 |

|

131,194 |

|

0.5 |

|

2,019 |

|

642,321 |

|

0.4 |

|

8,824 |

|

|

SUBTOTAL |

|

|

|

|

|

511,186 |

|

0.4 |

|

6,808 |

|

146,797 |

|

0.6 |

|

2,860 |

|

657,983 |

|

0.5 |

|

9,668 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFRICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chirano |

|

Ghana |

|

90.0 |

% |

3,639 |

|

1.0 |

|

122 |

|

4,662 |

|

3.0 |

|

445 |

|

8,301 |

|

2.1 |

|

567 |

|

|

Tasiast |

|

Mauritania |

|

100.0 |

% |

30,535 |

|

1.2 |

|

1,191 |

|

94,254 |

|

2.2 |

|

6,670 |

|

124,789 |

|

2.0 |

|

7,861 |

|

|

SUBTOTAL |

|

|

|

|

|

34,174 |

|

1.2 |

|

1,313 |

|

98,916 |

|

2.2 |

|

7,115 |

|

133,090 |

|

2.0 |

|

8,428 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RUSSIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dvoinoye |

|

Russia |

|

100.0 |

% |

1,287 |

|

5.2 |

|

216 |

|

1,296 |

|

8.6 |

|

360 |

|

2,583 |

|

6.9 |

|

576 |

|

|

Kupol |

|

Russia |

|

100.0 |

% |

770 |

|

6.2 |

|

155 |

|

4,808 |

|

8.3 |

|

1,280 |

|

5,578 |

|

8.0 |

|

1,435 |

|

|

SUBTOTAL |

|

|

|

|

|

2,057 |

|

5.6 |

|

371 |

|

6,104 |

|

8.4 |

|

1,640 |

|

8,161 |

|

7.7 |

|

2,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GOLD |

|

|

|

|

|

626,844 |

|

0.5 |

|

9,845 |

|

480,846 |

|

1.0 |

|

16,089 |

|

1,107,690 |

|

0.7 |

|

25,934 |

|

|

MINERAL RESERVE AND MINERAL RESOURCE STATEMENT |

SILVER |

|

PROVEN AND PROBABLE MINERAL RESERVES (1,3,4,5,6,8) | |

|

Kinross Gold Corporation’s Share at December 31, 2017 | |

|

|

|

|

|

Kinross |

|

Proven |

|

Probable |

|

Proven and Probable |

| ||||||||||||

|

|

|

|

|

Interest |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

|

Property |

|

Location |

|

(%) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

|

NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round Mountain Area |

|

USA |

|

100.0 |

% |

3,652 |

|

6.1 |

|

713 |

|

3,641 |

|

5.6 |

|

658 |

|

7,293 |

|

5.8 |

|

1,371 |

|

|

SUBTOTAL |

|

|

|

|

|

3,652 |

|

6.1 |

|

713 |

|

3,641 |

|

5.6 |

|

658 |

|

7,293 |

|

5.8 |

|

1,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOUTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Coipa 8 |

|

Chile |

|

100.0 |

% |

59 |

|

152.9 |

|

291 |

|

15,603 |

|

67.6 |

|

33,897 |

|

15,662 |

|

67.9 |

|

34,188 |

|

|

SUBTOTAL |

|

|

|

|

|

59 |

|

152.9 |

|

291 |

|

15,603 |

|

67.6 |

|

33,897 |

|

15,662 |

|

67.9 |

|

34,188 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RUSSIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dvoinoye |

|

Russia |

|

100.0 |

% |

1,287 |

|

9.7 |

|

402 |

|

1,296 |

|

13.1 |

|

544 |

|

2,583 |

|

11.4 |

|

946 |

|

|

Kupol |

|

Russia |

|

100.0 |

% |

770 |

|

81.8 |

|

2,025 |

|

4,808 |

|

91.1 |

|

14,086 |

|

5,578 |

|

89.8 |

|

16,111 |

|

|

SUBTOTAL |

|

|

|

|

|

2,057 |

|

36.7 |

|

2,427 |

|

6,104 |

|

74.6 |

|

14,630 |

|

8,161 |

|

65.0 |

|

17,057 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SILVER |

|

|

|

|

|

5,768 |

|

18.5 |

|

3,431 |

|

25,348 |

|

60.4 |

|

49,185 |

|

31,116 |

|

52.6 |

|

52,616 |

|

Measured and Indicated Mineral Resources

Cautionary Note to United States Investors Concerning Estimates of Measured and Indicated Mineral Resources

This section uses the terms “Measured” and “Indicated” mineral resources. United States investors are advised that while those terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. United States investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable mineral reserves or recovered.

|

MINERAL RESERVE AND MINERAL RESOURCE STATEMENT |

GOLD |

|

MEASURED AND INDICATED MINERAL RESOURCES (EXCLUDES PROVEN AND PROBABLE MINERAL RESERVES) (2,3,4,5,6,7,8) |

|

|

Kinross Gold Corporation’s Share at December 31, 2017 |

|

|

|

|

|

|

Kinross |

|

Measured |

|

Indicated |

|

Measured and Indicated |

| ||||||||||||

|

|

|

|

|

Interest |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

|

Property |

|

Location |

|

(%) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

|

NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bald Mountain |

|

USA |

|

100.0 |

% |

21,853 |

|

0.7 |

|

465 |

|

158,485 |

|

0.6 |

|

2,884 |

|

180,338 |

|

0.6 |

|

3,349 |

|

|

Fort Knox Area |

|

USA |

|

100.0 |

% |

24,606 |

|

0.4 |

|

320 |

|

213,425 |

|

0.4 |

|

2,909 |

|

238,031 |

|

0.4 |

|

3,229 |

|

|

Round Mountain Area |

|

USA |

|

100.0 |

% |

2,378 |

|

0.4 |

|

30 |

|

102,683 |

|

0.7 |

|

2,363 |

|

105,061 |

|

0.7 |

|

2,393 |

|

|

SUBTOTAL |

|

|

|

|

|

48,837 |

|

0.5 |

|

815 |

|

474,593 |

|

0.5 |

|

8,156 |

|

523,430 |

|

0.5 |

|

8,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOUTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Coipa 8 |

|

Chile |

|

100.0 |

% |

5,305 |

|

1.8 |

|

304 |

|

9,849 |

|

1.9 |

|

599 |

|

15,154 |

|

1.9 |

|

903 |

|

|

Lobo Marte |

|

Chile |

|

100.0 |

% |

96,646 |

|

1.1 |

|

3,525 |

|

88,720 |

|

1.2 |

|

3,489 |

|

185,366 |

|

1.2 |

|

7,014 |

|

|

Maricunga |

|

Chile |

|

100.0 |

% |

35,908 |

|

0.8 |

|

937 |

|

209,097 |

|

0.7 |

|

4,492 |

|

245,005 |

|

0.7 |

|

5,429 |

|

|

Paracatu |

|

Brazil |

|

100.0 |

% |

164,286 |

|

0.3 |

|

1,530 |

|

158,541 |

|

0.3 |

|

1,719 |

|

322,827 |

|

0.3 |

|

3,249 |

|

|

SUBTOTAL |

|

|

|

|

|

302,145 |

|

0.6 |

|

6,296 |

|

466,207 |

|

0.7 |

|

10,299 |

|

768,352 |

|

0.7 |

|

16,595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFRICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chirano |

|

Ghana |

|

90.0 |

% |

3,075 |

|

1.7 |

|

166 |

|

7,900 |

|

2.3 |

|

580 |

|

10,975 |

|

2.1 |

|

746 |

|

|

Tasiast |

|

Mauritania |

|

100.0 |

% |

4,936 |

|

0.7 |

|

113 |

|

69,655 |

|

1.3 |

|

2,846 |

|

74,591 |

|

1.2 |

|

2,959 |

|

|

SUBTOTAL |

|

|

|

|

|

8,011 |

|

1.1 |

|

279 |

|

77,555 |

|

1.4 |

|

3,426 |

|

85,566 |

|

1.3 |

|

3,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RUSSIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dvoinoye |

|

Russia |

|

100.0 |

% |

— |

|

— |

|

— |

|

28 |

|

6.2 |

|

6 |

|

28 |

|

6.2 |

|

6 |

|

|

Kupol |

|

Russia |

|

100.0 |

% |

75 |

|

8.9 |

|

21 |

|

826 |

|

11.2 |

|

296 |

|

901 |

|

11.0 |

|

317 |

|

|

SUBTOTAL |

|

|

|

|

|

75 |

|

8.9 |

|

21 |

|

854 |

|

11.0 |

|

302 |

|

929 |

|

10.8 |

|

323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GOLD |

|

|

|

|

|

359,068 |

|

0.6 |

|

7,411 |

|

1,019,209 |

|

0.7 |

|

22,183 |

|

1,378,277 |

|

0.7 |

|

29,594 |

|

|

MINERAL RESERVE AND MINERAL RESOURCE STATEMENT |

SILVER |

|

MEASURED AND INDICATED MINERAL RESOURCES (EXCLUDES PROVEN AND PROBABLE MINERAL RESERVES) (2,3,4,5,6,7,8) |

|

|

Kinross Gold Corporation’s Share at December 31, 2017 |

|

|

|

|

|

|

Kinross |

|

Measured |

|

Indicated |

|

Measured and Indicated |

| ||||||||||||

|

|

|

|

|

Interest |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

Tonnes |

|

Grade |

|

Ounces |

|

|

Property |

|

Location |

|

(%) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

(kt) |

|

(g/t) |

|

(koz) |

|

|

NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round Mountain Area |

|

USA |

|

100.0 |

% |

2,378 |

|

8.7 |

|

667 |

|

5,309 |

|

6.8 |

|

1,160 |

|

7,687 |

|

7.4 |

|

1,827 |

|

|

SUBTOTAL |

|

|

|

|

|

2,378 |

|

8.7 |

|

667 |

|

5,309 |

|

6.8 |

|

1,160 |

|

7,687 |

|

7.4 |

|

1,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOUTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Coipa 8 |

|

Chile |

|

100.0 |

% |

5,305 |

|

37.1 |

|

6,330 |

|

9,849 |

|

74.0 |

|

23,445 |

|

15,154 |

|

61.1 |

|

29,775 |

|

|

SUBTOTAL |

|

|

|

|

|

5,305 |

|

37.1 |

|

6,330 |

|

9,849 |

|

74.0 |

|

23,445 |

|

15,154 |

|

61.1 |

|

29,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RUSSIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dvoinoye |

|

Russia |

|

100.0 |

% |

— |

|

— |

|

— |

|

28 |

|

6.0 |

|

5 |

|

28 |

|

6.0 |

|

5 |

|

|

Kupol |

|

Russia |

|

100.0 |

% |

75 |

|

126.4 |

|

303 |

|

826 |

|

135.5 |