ex99-1.htm

KINROSS GOLD CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the year ended December 31, 2014

This management's discussion and analysis ("MD&A"), prepared as of February 10, 2015, relates to the financial condition and results of operations of Kinross Gold Corporation together with its wholly owned subsidiaries, as of December 31, 2014 and for the year then ended, and is intended to supplement and complement Kinross Gold Corporation’s audited annual consolidated financial statements for the year ended December 31, 2014 and the notes thereto (the “financial statements”). Readers are cautioned that the MD&A contains forward-looking statements about expected future events and financial and operating performance of the Company, and that actual events may vary from management's expectations. Readers are encouraged to read the Cautionary Statement on Forward Looking Information included with this MD&A and to consult Kinross Gold Corporation's financial statements for 2014 and corresponding notes to the financial statements which are available on the Company's web site at www.kinross.com and on www.sedar.com. The financial statements and MD&A are presented in U.S. dollars. The financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (“IASB”). This discussion addresses matters we consider important for an understanding of our financial condition and results of operations as at and for the year ended December 31, 2014, as well as our outlook.

This section contains forward-looking statements and should be read in conjunction with the risk factors described in "Risk Analysis". In certain instances, references are made to relevant notes in the financial statements for additional information.

Where we say "we", "us", "our", the "Company" or "Kinross", we mean Kinross Gold Corporation or Kinross Gold Corporation and/or one or more or all of its subsidiaries, as it may apply. Where we refer to the "industry", we mean the gold mining industry.

1. DESCRIPTION OF THE BUSINESS

Kinross is engaged in gold mining and related activities, including exploration and acquisition of gold-bearing properties, the extraction and processing of gold-containing ore, and reclamation of gold mining properties. Kinross’ gold production and exploration activities are carried out principally in Canada, the United States, the Russian Federation, Brazil, Chile, Ghana and Mauritania. Gold is produced in the form of doré, which is shipped to refineries for final processing. Kinross also produces and sells silver.

The profitability and operating cash flow of Kinross are affected by various factors, including the amount of gold and silver produced, the market prices of gold and silver, operating costs, interest rates, regulatory and environmental compliance, the level of exploration activity and capital expenditures, general and administrative costs, and other discretionary costs and activities. Kinross is also exposed to fluctuations in currency exchange rates, political risks, and varying levels of taxation that can impact profitability and cash flow. Kinross seeks to manage the risks associated with its business operations; however, many of the factors affecting these risks are beyond the Company’s control.

Commodity prices continue to be volatile as economies around the world continue to experience economic challenges. Volatility in the price of gold and silver impacts the Company's revenue, while volatility in the price of input costs, such as oil, and foreign exchange rates, particularly the Brazilian real, Chilean peso, Russian rouble, Mauritanian ouguiya, Ghanaian cedi, and Canadian dollar, may have an impact on the Company's operating costs and capital expenditures.

Segment profile

Each of the Company's significant operating mines is considered to be a separate segment. The reportable segments are those operations whose operating results are reviewed by the Chief Executive Officer to make decisions about resources to be allocated to the segment and assess its performance.

| |

|

|

|

Ownership percentage at December 31,

|

|

|

Operating Segments

|

Operator

|

Location

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

Fort Knox

|

Kinross

|

U.S.A.

|

|

|

100 |

% |

|

|

100 |

% |

|

Round Mountain

|

Kinross

|

U.S.A.

|

|

|

50 |

% |

|

|

50 |

% |

|

Kettle River-Buckhorn

|

Kinross

|

U.S.A.

|

|

|

100 |

% |

|

|

100 |

% |

|

Kupol(a)

|

Kinross

|

Russian Federation

|

|

|

100 |

% |

|

|

100 |

% |

|

Paracatu

|

Kinross

|

Brazil

|

|

|

100 |

% |

|

|

100 |

% |

|

Maricunga

|

Kinross

|

Chile

|

|

|

100 |

% |

|

|

100 |

% |

|

Tasiast

|

Kinross

|

Mauritania

|

|

|

100 |

% |

|

|

100 |

% |

|

Chirano

|

Kinross

|

Ghana

|

|

|

90 |

% |

|

|

90 |

% |

(a) The Kupol segment includes the Kupol and Dvoinoye mines.

Consolidated Financial and Operating Highlights

| |

|

Years ended December 31,

|

|

|

2014 vs. 2013

|

|

|

2013 vs. 2012

|

|

|

(in millions, except ounces, per share amounts and

per ounce amounts)

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

|

Change

|

|

|

% Change

|

|

|

Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gold equivalent ounces (a), (e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (c)

|

|

|

2,739,044 |

|

|

|

2,658,632 |

|

|

|

2,678,131 |

|

|

|

80,412 |

|

|

|

3 |

% |

|

|

(19,499 |

) |

|

|

(1 |

%) |

|

Sold (c)

|

|

|

2,743,398 |

|

|

|

2,697,093 |

|

|

|

2,654,107 |

|

|

|

46,305 |

|

|

|

2 |

% |

|

|

42,986 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold equivalent ounces from continuing operations (a), (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (c)

|

|

|

2,739,044 |

|

|

|

2,658,632 |

|

|

|

2,647,137 |

|

|

|

80,412 |

|

|

|

3 |

% |

|

|

11,495 |

|

|

|

0 |

% |

|

Sold (c)

|

|

|

2,743,398 |

|

|

|

2,697,093 |

|

|

|

2,621,343 |

|

|

|

46,305 |

|

|

|

2 |

% |

|

|

75,750 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total attributable gold equivalent ounces (a), (e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (c)

|

|

|

2,710,390 |

|

|

|

2,631,092 |

|

|

|

2,648,807 |

|

|

|

79,298 |

|

|

|

3 |

% |

|

|

(17,715 |

) |

|

|

(1 |

%) |

|

Sold (c)

|

|

|

2,715,358 |

|

|

|

2,669,276 |

|

|

|

2,624,242 |

|

|

|

46,082 |

|

|

|

2 |

% |

|

|

45,034 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable gold equivalent ounces from continuing operations (a), (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (c)

|

|

|

2,710,390 |

|

|

|

2,631,092 |

|

|

|

2,617,813 |

|

|

|

79,298 |

|

|

|

3 |

% |

|

|

13,279 |

|

|

|

1 |

% |

|

Sold (c)

|

|

|

2,715,358 |

|

|

|

2,669,276 |

|

|

|

2,591,478 |

|

|

|

46,082 |

|

|

|

2 |

% |

|

|

77,798 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights from Continuing Operations (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metal sales

|

|

$ |

3,466.3 |

|

|

$ |

3,779.5 |

|

|

$ |

4,307.3 |

|

|

$ |

(313.2 |

) |

|

|

(8 |

%) |

|

$ |

(527.8 |

) |

|

|

(12 |

%) |

|

Production cost of sales

|

|

$ |

1,971.2 |

|

|

$ |

2,004.4 |

|

|

$ |

1,849.2 |

|

|

$ |

(33.2 |

) |

|

|

(2 |

%) |

|

$ |

155.2 |

|

|

|

8 |

% |

|

Depreciation, depletion and amortization

|

|

$ |

874.7 |

|

|

$ |

828.8 |

|

|

$ |

680.9 |

|

|

$ |

45.9 |

|

|

|

6 |

% |

|

$ |

147.9 |

|

|

|

22 |

% |

|

Impairment charges

|

|

$ |

1,251.4 |

|

|

$ |

3,169.6 |

|

|

$ |

3,527.6 |

|

|

$ |

(1,918.2 |

) |

|

|

(61 |

%) |

|

$ |

(358.0 |

) |

|

|

(10 |

%) |

|

Operating loss

|

|

$ |

(1,027.2 |

) |

|

$ |

(2,635.2 |

) |

|

$ |

(2,241.9 |

) |

|

$ |

1,608.0 |

|

|

|

61 |

% |

|

$ |

(393.3 |

) |

|

|

(18 |

%) |

|

Net loss attributable to common shareholders

|

|

$ |

(1,400.0 |

) |

|

$ |

(3,012.6 |

) |

|

$ |

(2,546.2 |

) |

|

$ |

1,612.6 |

|

|

|

54 |

% |

|

$ |

(466.4 |

) |

|

|

(18 |

%) |

|

Basic loss per share attributable to common shareholders

|

|

$ |

(1.22 |

) |

|

$ |

(2.64 |

) |

|

$ |

(2.24 |

) |

|

$ |

1.42 |

|

|

|

54 |

% |

|

$ |

(0.40 |

) |

|

|

(18 |

%) |

|

Diluted loss per share attributable to common shareholders

|

|

$ |

(1.22 |

) |

|

$ |

(2.64 |

) |

|

$ |

(2.24 |

) |

|

$ |

1.42 |

|

|

|

54 |

% |

|

$ |

(0.40 |

) |

|

|

(18 |

%) |

|

Adjusted net earnings attributable to common shareholders(b)

|

|

$ |

131.1 |

|

|

$ |

321.2 |

|

|

$ |

886.2 |

|

|

$ |

(190.1 |

) |

|

|

(59 |

%) |

|

$ |

(565.0 |

) |

|

|

(64 |

%) |

|

Adjusted net earnings per share (b)

|

|

$ |

0.11 |

|

|

$ |

0.28 |

|

|

$ |

0.78 |

|

|

$ |

(0.17 |

) |

|

|

(61 |

%) |

|

$ |

(0.50 |

) |

|

|

(64 |

%) |

|

Net cash flow provided from operating activities

|

|

$ |

858.1 |

|

|

$ |

796.6 |

|

|

$ |

1,317.3 |

|

|

$ |

61.5 |

|

|

|

8 |

% |

|

$ |

(520.7 |

) |

|

|

(40 |

%) |

|

Adjusted operating cash flow (b)

|

|

$ |

976.9 |

|

|

$ |

1,149.6 |

|

|

$ |

1,527.0 |

|

|

$ |

(172.7 |

) |

|

|

(15 |

%) |

|

$ |

(377.4 |

) |

|

|

(25 |

%) |

|

Capital expenditures

|

|

$ |

631.8 |

|

|

$ |

1,262.4 |

|

|

$ |

1,858.3 |

|

|

$ |

(630.6 |

) |

|

|

(50 |

%) |

|

$ |

(595.9 |

) |

|

|

(32 |

%) |

|

Average realized gold price per ounce

|

|

$ |

1,263 |

|

|

$ |

1,402 |

|

|

$ |

1,643 |

|

|

$ |

(139 |

) |

|

|

(10 |

%) |

|

$ |

(241.0 |

) |

|

|

(15 |

%) |

|

Consolidated production cost of sales per equivalent ounce(c) sold(b)

|

|

$ |

719 |

|

|

$ |

743 |

|

|

$ |

705 |

|

|

$ |

(24 |

) |

|

|

(3 |

%) |

|

$ |

38.2 |

|

|

|

5 |

% |

|

Attributable(a) production cost of sales per equivalent ounce (c) sold(b)

|

|

$ |

720 |

|

|

$ |

743 |

|

|

$ |

705 |

|

|

$ |

(23 |

) |

|

|

(3 |

%) |

|

$ |

38.0 |

|

|

|

5 |

% |

|

Attributable(a) production cost of sales per ounce sold on a by-product basis(b)

|

|

$ |

705 |

|

|

$ |

703 |

|

|

$ |

627 |

|

|

$ |

2 |

|

|

|

0 |

% |

|

$ |

76.5 |

|

|

|

12 |

% |

|

Attributable(a) all-in sustaining cost per ounce sold on a by-product basis(b)

|

|

$ |

965 |

|

|

$ |

1,063 |

|

|

$ |

1,079 |

|

|

$ |

(98 |

) |

|

|

(9 |

%) |

|

$ |

(16.1 |

) |

|

|

(1 |

%) |

|

Attributable(a) all-in sustaining cost per equivalent ounce (c) sold (b)

|

|

$ |

973 |

|

|

$ |

1,082 |

|

|

$ |

1,122 |

|

|

$ |

(109 |

) |

|

|

(10 |

%) |

|

$ |

(39.9 |

) |

|

|

(4 |

%) |

|

Attributable(a) all-in cost per ounce sold on a by-product basis(b),(f)

|

|

$ |

1,072 |

|

|

$ |

1,357 |

|

|

|

|

|

|

$ |

(285 |

) |

|

|

(21 |

%) |

|

|

|

|

|

|

|

|

|

Attributable(a) all-in cost per equivalent ounce (c) sold (b),(f)

|

|

$ |

1,077 |

|

|

$ |

1,360 |

|

|

|

|

|

|

$ |

(283 |

) |

|

|

(21 |

%) |

|

|

|

|

|

|

|

|

|

(a)

|

"Total" includes 100% of Chirano production. "Attributable" includes Kinross' share of Chirano (90%) production.

|

|

(b)

|

The definition and reconciliation of these non-GAAP financial measures is included in Section 11 of this document.

|

|

(c)

|

"Gold equivalent ounces" include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for 2014 was 66.29:1 (2013 - 59.23:1 and 2012 - 53.56:1).

|

|

(d)

|

On June 10, 2013, the Company announced its decision to cease development of Fruta del Norte ("FDN"). As a result, FDN was classified as a discontinued operation. On December 17, 2014, the Company disposed of its interest in FDN. On June 28, 2012, the Company disposed of its interest in Crixás. As a result, the comparative figures have been recast to exclude the results of FDN and Crixás.

|

|

(e)

|

The total gold equivalent ounces and total attributable gold equivalent ounces include Crixás up to June 28, 2012.

|

|

(f)

|

Amount was not computed for 2012 as this measure was adopted as of January 1, 2014.

|

Consolidated Financial Performance

2014 vs. 2013

During 2014, Kinross’ attributable production increased by 3% compared with 2013, primarily due to increases in production from the Kupol segment as a result of processing higher grade ore from Dvoinoye and at Maricunga as a result of improved heap leach performance and increased efficiency of the Adsorption, Desorption and Recovery (“ADR”) plant, partially offset by a decrease in production as a result of the suspension of mining at La Coipa in October 2013.

Metal sales decreased to $3,466.3 million in 2014 from $3,779.5 million in 2013 due to a decrease in metal prices realized, partially offset by higher gold equivalent ounces sold. The average realized gold price decreased to $1,263 per ounce in 2014 from $1,402 per ounce in 2013.

Production cost of sales decreased by 2% compared with 2013, primarily due to the impact of the suspension of mining at La Coipa and lower production costs at Chirano as a result of the transition to owner mining and reduced power costs. These decreases were partially offset by an increase in gold equivalent ounces sold from the Kupol segment as a result of Dvoinoye commencing commercial production in October 2013 and higher costs at Fort Knox as a result of mining lower grade ore.

Depreciation, depletion and amortization increased by 6% in 2014 compared with 2013, primarily due to increases in the depreciable asset base and gold equivalent ounces sold from the Kupol segment as a result of Dvoinoye commencing commercial production and an increase in the depreciable asset base and a reduction in mineral reserves at Paracatu. These increases were partially offset by the impact of the suspension of mining at La Coipa and decreases in the depreciable asset base at Tasiast and Maricunga.

As at December 31, 2014, the Company recorded an after-tax impairment charge of $932.2 million, upon completion of its annual assessment of the carrying value of its Cash Generating Units (“CGUs”). The impairment charge included goodwill impairment of $145.3 million and property plant and equipment impairment of $786.9 million. The property plant and equipment impairment included $342.5 million for Tasiast, $213.8 million for Chirano and $230.6 million for other CGUs, net of a tax recovery of $127.9 million and non-controlling interest of $23.7 million. The Company also recorded inventory impairment charges of $167.6 million in 2014 and $177.6 million in 2013. During 2013, the Company recorded after-tax impairment charges aggregating $2,834.1 million, comprised of $1,334.7 million for Tasiast, $573.6 million for Maricunga, and $925.8 million for other CGUs, net of a tax recovery of $157.9 million.

During 2014, the operating loss decreased to $1,027.2 million compared with an operating loss of $2,635.2 million in 2013. The change was primarily due to decreases in impairment charges and exploration and business development costs, partially offset by a decrease in metal sales and an increase in depreciation, depletion and amortization.

Net loss from continuing operations attributable to common shareholders in 2014 was $1,400.0 million, or $1.22 per share, compared with a net loss from continuing operations attributable to common shareholders of $3,012.6 million, or $2.64 per share, in 2013. The decrease was primarily a result of the change in operating loss as described above. In addition, at December 31, 2014, an impairment charge of $156.6 million related to the Company’s investment in Cerro Casale was recorded in other income (expense). During 2013, the Company recognized an impairment charge of $219.0 million related to its investment in Cerro Casale. These decreases were partially offset by an increase in income tax expense. The Company recorded a tax expense of $109.7 million in 2014 compared with $72.4 million in 2013. The $109.7 million tax expense in 2014 included a $137.8 million recovery due to impairment charges and $145.5 million of expense due to re-measurements of deferred tax assets and liabilities as a result of income tax reforms enacted in Chile and significant fluctuations in foreign exchange rates with respect to the Brazilian real and the Russian rouble. The $72.4 million tax expense in 2013 included a $174.6 million recovery due to a re-measurement of deferred tax liabilities in respect of impairment charges. Excluding the impact of items that are not reflective of the underlying operating performance of our business, the Company’s adjusted effective tax rate for 2014 was 48.8%, compared with an adjusted effective tax rate of 34.8 % for 2013. The increase in the Company’s adjusted effective tax rate for 2014, compared with 2013, was largely due to differences in the level of income in the Company’s operating jurisdictions from one period to the next.

Adjusted net earnings attributable to common shareholders was $131.1 million, or $0.11 per share, for 2014 compared with $321.2 million, or $0.28 per share, in 2013. The decrease in adjusted net earnings attributable to common shareholders was primarily due to the decrease in metal sales.

Net cash flow provided from operating activities increased by 8% compared with 2013, primarily due to more favourable working capital changes and lower exploration and business development costs, partially offset by the decrease in metal sales.

During 2014, adjusted operating cash flow decreased to $976.9 million compared with $1,149.6 million in 2013, primarily due to the decrease in margins, partially offset by lower exploration and business development costs.

Capital expenditures decreased to $631.8 million compared with $1,262.4 million in 2013, primarily due to reduced spending at Tasiast, Chirano and Fort Knox.

Attributable all-in sustaining cost and all-in cost per equivalent ounce sold and per ounce sold on a by-product basis decreased in 2014 compared with 2013, primarily due to a decrease in both sustaining and non-sustaining capital expenditures and exploration and business development costs.

2013 vs. 2012

Kinross’ attributable production from continuing operations in 2013 increased marginally compared with 2012, primarily due to increases in production at Tasiast and Fort Knox from higher mill grades and improved leach performance. In addition, production at Paracatu increased due to higher processing levels and recoveries. These increases were largely offset by decreases in production resulting from the scheduled decline in grades at Round Mountain and Chirano, a decline in both grades and heap leach performance at Maricunga, and due to the suspension of mining at La Coipa in October 2013. In addition, production decreased at the Kupol mine due to the planned decline in grades and a less favourable gold equivalent ratio, partially offset by the processing of higher grade ore from the Dvoinoye mine, which commenced commercial production in October 2013.

Metal sales from continuing operations decreased to $3,779.5 million in 2013 from $4,307.3 million in 2012, primarily due to a decrease in the metal prices realized. The average gold price realized from continuing operations decreased to $1,402 per ounce from $1,643 per ounce in 2012.

During 2013, production cost of sales from continuing operations increased to $2,004.4 million from $1,849.2 million in 2012, primarily due to increases in gold equivalent ounces sold and input costs at Fort Knox and Tasiast as well as higher input costs at Maricunga as a result of processing lower grade ore. In addition, production cost of sales at Kupol increased due to higher consumption of inputs as a result of processing ore from the Dvoinoye mine and due to inflationary pressures on certain inputs such as labour. These increases were partially offset by a decrease in production cost of sales at La Coipa, primarily due to the suspension of mining.

Depreciation, depletion and amortization from continuing operations increased by 22% in 2013 compared with 2012, primarily due to an increase in gold equivalent ounces sold at Paracatu, Fort Knox, and Tasiast and an increase in the depreciable asset base at La Coipa, Paracatu, Maricunga, and Fort Knox. These increases were partially offset by decreases in gold equivalent ounces sold at Chirano and Kettle River-Buckhorn.

As at December 31, 2013, the Company recorded an after-tax impairment charge of $544.8 million, upon completion of its annual assessment of the carrying value of its CGUs. The impairment charge included $376.0 million relating to property, plant and equipment at Maricunga, net of a tax recovery of $49.2 million, and $168.8 million relating to goodwill at Quebrada Seca, a non-operating property in Chile. The non-cash impairment charge at Maricunga was mainly a result of changes to the life of mine plan and a corresponding reduction in mineral reserves. As at June 30, 2013, the Company had identified the decline in metal prices and the deferral of potential construction at Tasiast as indicators of potential impairment, and performed an impairment assessment to determine the recoverable amount of its CGUs using updated assumptions and estimates at that time. The forecasted production output and capital expenditures included in the life of mine plans for all CGUs remained unchanged from the 2012 year-end impairment assessment with the exception of Tasiast, which was based on a 38,000 tonne per day mill, adjusted for the deferral in potential construction and production. As a result of the June 30, 2013 impairment assessment, the Company recorded after-tax non-cash impairment charges of $2,289.3 million, comprised of property, plant and equipment impairment of $1,334.7 million at Tasiast and goodwill and property, plant and equipment impairment aggregating $954.6 million at several of its other CGUs. The property, plant and equipment impairment charges were net of a tax recovery of $108.7 million. The resulting non-cash impairment charges were primarily a result of the reduction in the Company’s estimates of future metal prices. The Tasiast impairment charge was also impacted by the deferral of potential construction and production. During 2012, the Company recorded after-tax impairment charges aggregating $3,206.1 million, comprised of $3,094.8 million for Tasiast and $111.3 million for Chirano.

The operating loss from continuing operations increased to $2,635.2 million in 2013 from $2,241.9 million in 2012, primarily due to a decrease in metal sales and increases in production cost of sales and depreciation, depletion and amortization, partially offset by lower impairment charges and a decrease in exploration and business development costs.

During 2013, net loss from continuing operations attributable to common shareholders was $3,012.6 million, or $2.64 per share, compared with $2,546.2 million, or $2.24 per share, in 2012. The increase in net loss from continuing operations attributable to common shareholders was primarily a result of an increase in the operating loss as described above and an impairment charge of $219.0 million related to the Company’s investment in Cerro Casale, which was recorded in other income (expense) in 2013, partially offset by a decrease in income tax expense. For continuing operations, income tax expense for 2013 was $72.4 million compared with $259.4 million in 2012. Excluding the impact of items that are not reflective of the underlying operating performance of our business, such as impairment charges and re-measurements of the deferred tax liability due to increases in corporate income tax rates, the Company’s adjusted effective tax rate was 34.8% in 2013, compared with 31.7% in 2012. The increase in the Company’s adjusted effective tax rate was largely due to differences in the level of income in the Company’s operating jurisdictions from one year to the next.

During 2013, adjusted net earnings from continuing operations attributable to common shareholders was $321.2 million, or $0.28 per share, compared with $886.2 million, or $0.78 per share, in 2012. The decrease in adjusted net earnings from continuing operations attributable to common shareholders was mainly due to the decrease in metal sales and increases in production cost of sales and depreciation, depletion and amortization expense as described above.

Net cash flow of continuing operations provided from operating activities decreased by $520.7 million compared with 2012. The decrease in cash flows was primarily due to the decrease in metal sales and less favourable working capital movements, partially offset by a decrease in exploration and business development costs.

Adjusted operating cash flow from continuing operations decreased to $1,149.6 million from $1,527.0 million, mainly due to the decrease in metal sales, partially offset by a decrease in exploration and business development costs.

Attributable production cost of sales from continuing operations per equivalent ounce sold increased by 5% in 2013 compared with 2012 due to an increase in production cost of sales as noted above.

During 2013, attributable all-in sustaining cost from continuing operations per equivalent ounce sold and per ounce sold on a by-product basis decreased primarily due to a decrease in sustaining capital expenditures and an increase in attributable gold ounces sold, partially offset by an increase in production cost of sales.

Kinross’ total estimated proven and probable mineral reserves at year-end 2014 were approximately 34.4 million ounces of gold, a net decrease of approximately 8.4 million ounces compared with year-end 2013. The net year-over-year decrease in gold reserve estimates was mainly a result of reclassifying approximately 6.0 million estimated gold ounces at Lobo-Marte to measured and indicated mineral resources, based on a decision not to extend environmental permits for the project at this time.

The reduction was offset by slight additions at Paracatu, due to assumed higher productivity, improved recoveries, lower costs and more favourable foreign exchange rates, and at Kupol, due to extensions of the mine plan. Other changes to the mineral reserve estimates include approximate reductions of 0.51 million gold ounces at Maricunga, 0.49 million gold ounces at Chirano, 0.46 million gold ounces at Fort Knox and 0.45 million gold ounces at Tasiast mainly due to depletion.

Proven and probable silver reserves at year-end 2014 were estimated at 44.0 million ounces, a net decrease of 0.72 million ounces compared with year-end 2013, primarily due to production depletion.

Proven and probable copper reserves at year-end 2014, which are exclusively at Cerro Casale, were estimated at 1.4 billion pounds, unchanged from year-end 2013.

1 For details concerning mineral reserve and mineral resource estimates, refer to the Mineral Reserves and Mineral Resources tables and notes in the Company's press release filed with Canadian and U.S. regulators on February 10, 2015.

2. IMPACT OF KEY ECONOMIC TRENDS

Source: London Bullion Marketing Association London PM Fix, Bloomberg, GFMS, Company records

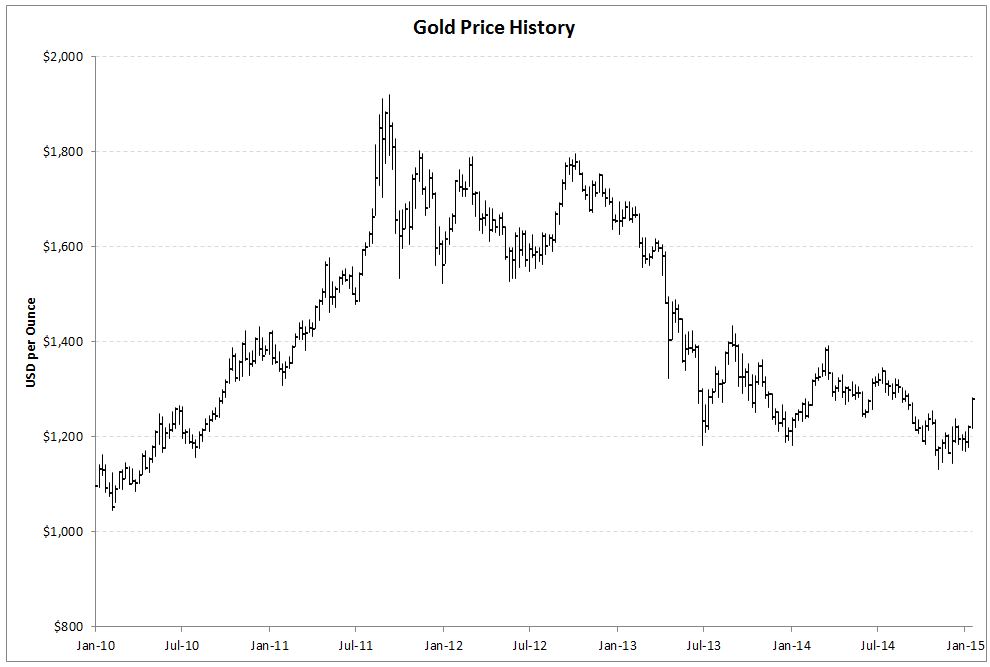

The price of gold is the largest single factor in determining profitability and cash flow from operations, therefore, the financial performance of the Company has been, and is expected to continue to be, closely linked to the price of gold. Historically, the price of gold has been subject to volatile price movements over short periods of time and is affected by numerous macroeconomic and industry factors that are beyond the Company’s control. Major influences on the gold price include currency exchange rate fluctuations and the relative strength of the U.S. dollar, the supply of and demand for gold and macroeconomic factors such as the level of interest rates and inflation expectations. During 2014, the price of gold fluctuated between a low of $1,142 per ounce in November to a high of $1,385 per ounce in March. The average price for the year based on the London Bullion Market Association PM Fix was $1,266 per ounce, a $145 decrease over the 2013 average price of $1,411 per ounce. The major influences on the gold price included strong jewelry demand, particularly in the first quarter of 2014, continued purchases by Central Banks, as well as reduced selling out of Exchange Traded Funds and speculators. These positive influences were offset by changing expectations regarding the timing of interest rate increases in the U.S. and material price declines in other commodity markets, particularly oil. Geo-political events in Ukraine, the Middle East and Russia have caused a lot of uncertainty in the financial markets, but the gold price does not seem to have been materially impacted.

Source: London Bullion Marketing Association London PM Fix, Bloomberg, GFMS, Company records

Source: London Bullion Marketing Association London PM Fix

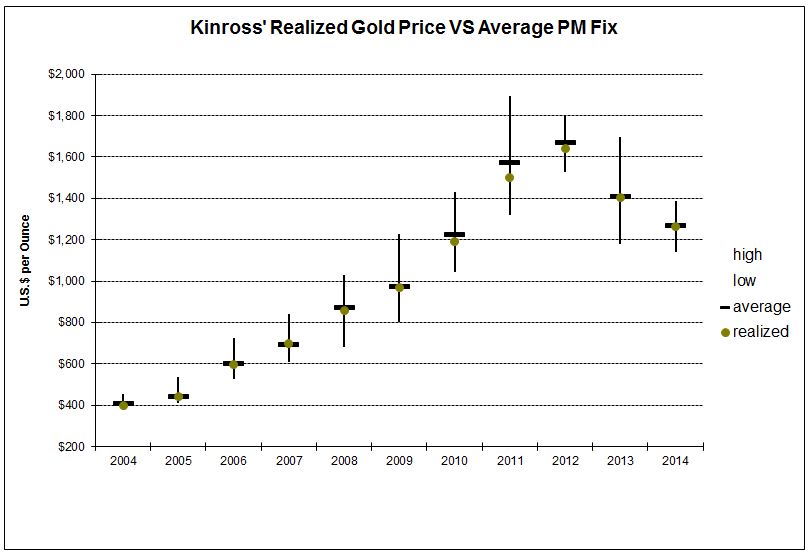

During 2014, the Company realized an average gold price of $1,263 per ounce compared to the average PM Fix of $1,266 per ounce.

Gold Supply and Demand Fundamentals

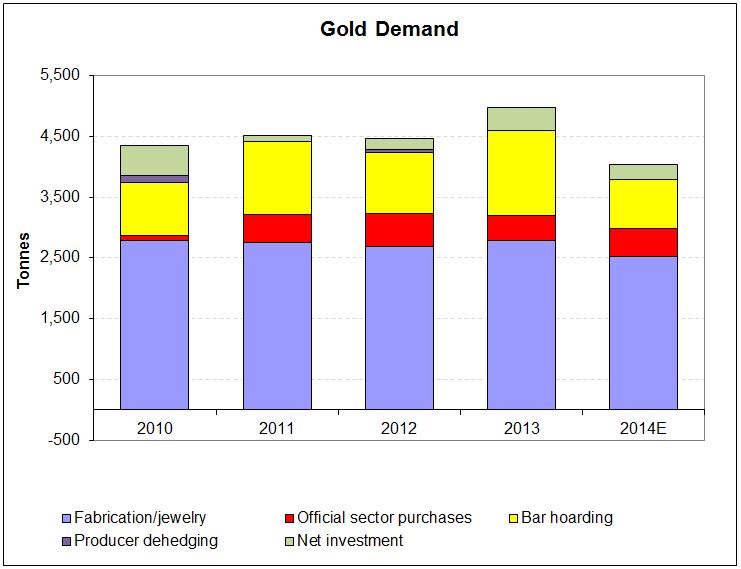

Source: GFMS Gold Survey 2014

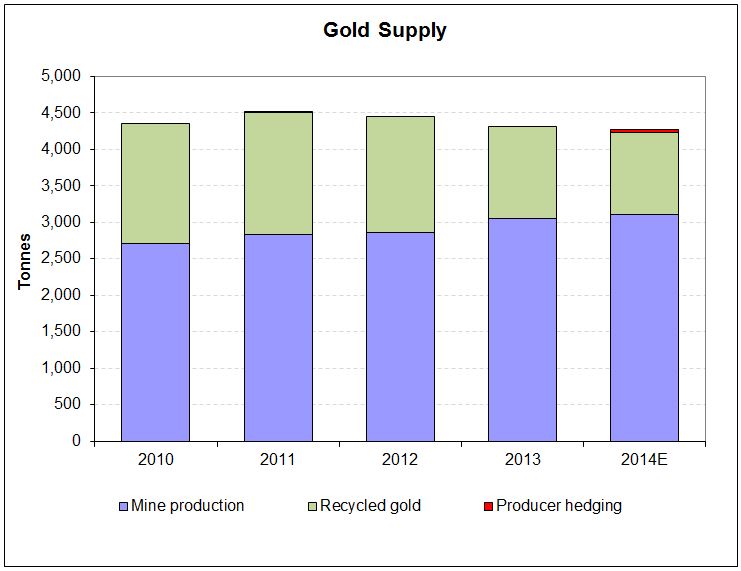

Total gold supply remained unchanged in 2014 relative to 2013, with global gold mine production increasing 2.0%, offset by a decrease of 11.1% in the supply of recycled gold. Mine production and recycled gold have been the dominant sources of gold supply, and in 2014 they represented approximately 73% and 26% of total supply, respectively.

Macroeconomic factors and geo-political events were the overwhelming drivers of gold prices in 2014, which, combined with increased mine production, contributed to lower prices during the year. Central banks have not been a source of supply to the market, but have rather been net buyers, as noted below.

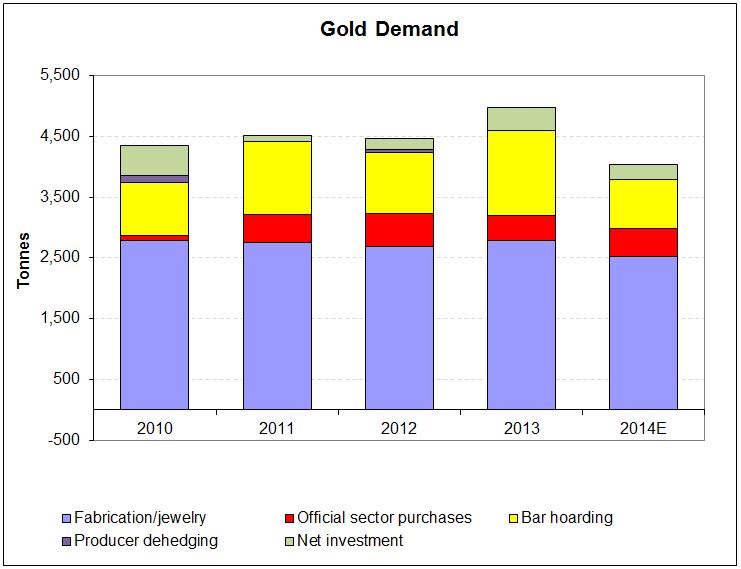

Source: GFMS 2014 Gold Survey

Overall demand decreased by 18.7% in 2014 relative to 2013. Fabrication demand is estimated to have decreased by 9.7% in 2014 relative to 2013 despite lower gold prices, mainly due to restrained demand in China. This was partially offset by an increase in demand in India, the United States and some European countries. Bar hoarding decreased by approximately 40.1% in 2014, as speculative interest from key Asian markets was largely absent during the year. Central banks continued to be buyers in 2014, increasing net purchases by 12.7% during the year.

Inflationary Cost Pressures

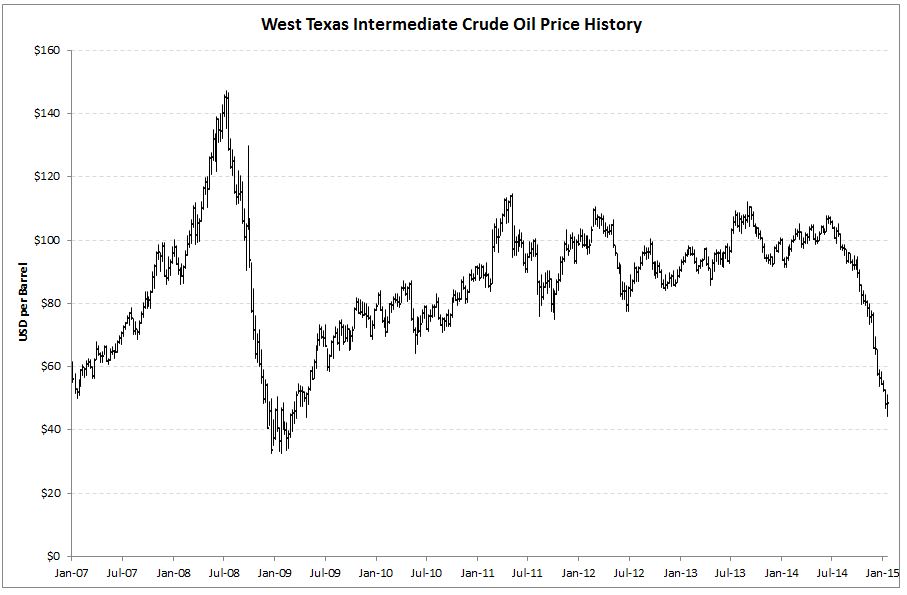

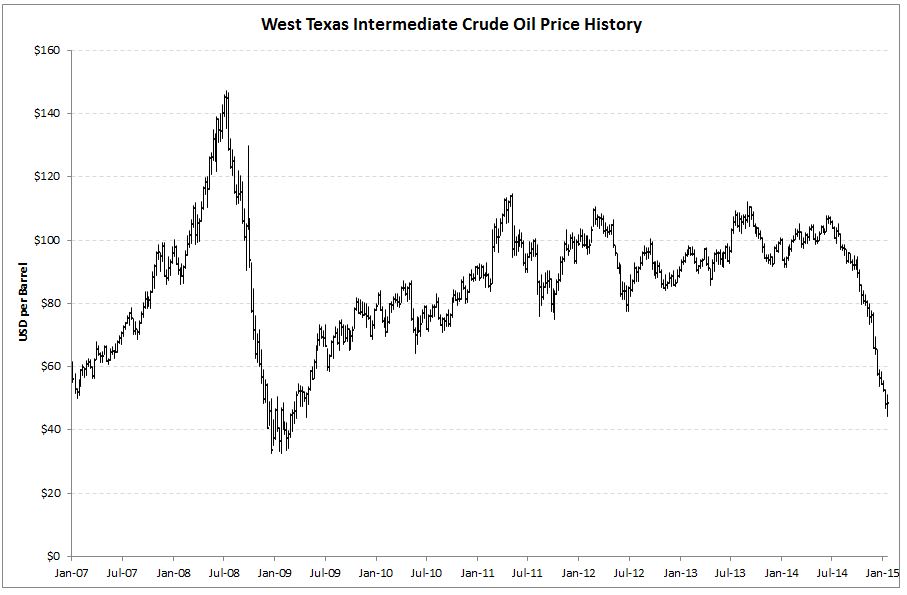

The Company’s profitability is subject to industry wide cost pressures on development and operating costs with respect to labour, energy, capital expenditures and consumables in general. Since mining is generally an energy intensive activity, especially in open pit mining, energy prices can have a significant impact on operations. The cost of fuel as a percentage of operating costs varies amongst the Company’s mines, and overall, operations have experienced modest decreases in fuel costs in 2014, reflecting global oil and fuel price decreases that occurred during the second half of 2014. Kinross manages its exposure to energy costs by entering, from time to time, into various hedge positions – refer to Section 6 Liquidity and Capital Resources for details.

Source: Bloomberg

In order to mitigate the impact of higher consumable prices, the Company continues to focus on continuous improvement, both by promoting more efficient use of materials and supplies, and by pursuing more advantageous pricing, whilst increasing performance and without compromising operational integrity.

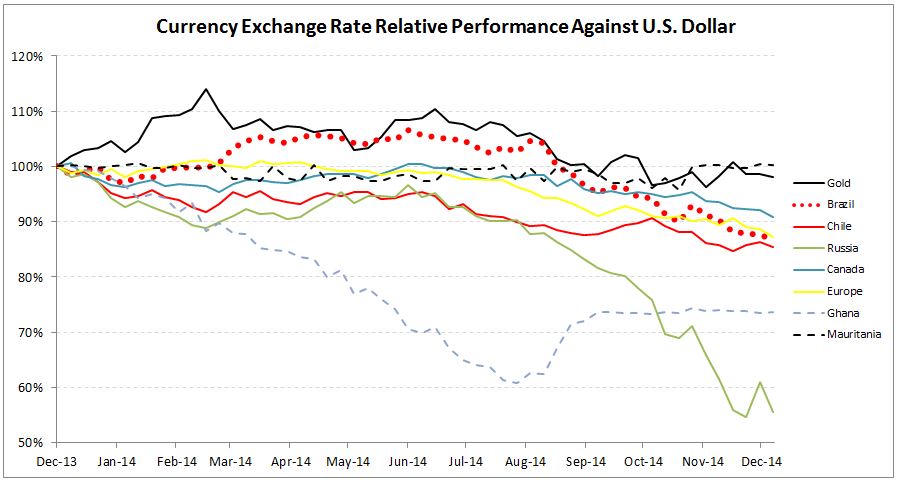

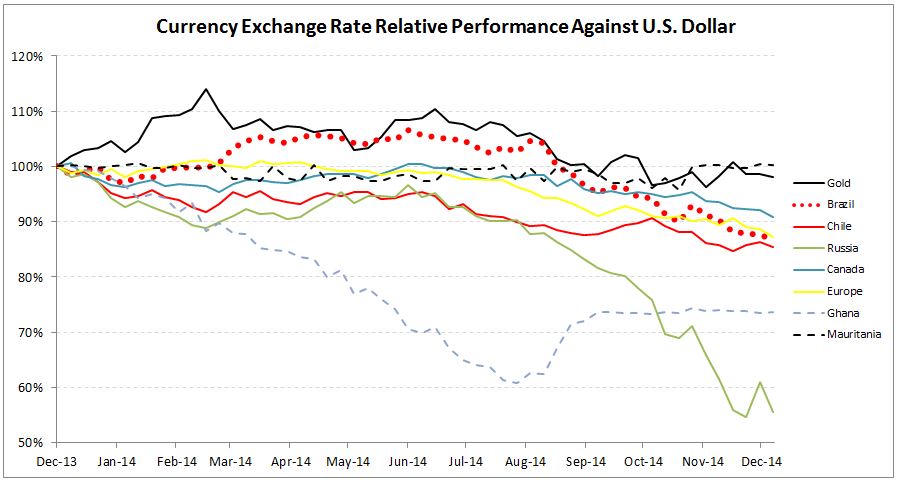

Currency Fluctuations

At the Company’s non-U.S. mining operations and exploration activities, which are primarily located in Brazil, Chile, Ghana, Mauritania, the Russian Federation, and Canada, a portion of operating costs and capital expenditures are denominated in their respective local currencies. Generally, as the U.S. dollar strengthens, these currencies weaken, and as the U.S. dollar weakens, these foreign currencies strengthen. These currencies were subject to high market volatility over the course of the year. Approximately 75% of the Company’s expected attributable production in 2015 is forecast to come from operations outside the U.S. and costs will continue to be exposed to foreign exchange rate movements. In order to manage this risk, the Company uses currency hedges for certain foreign currency exposures – refer to Section 6 Liquidity and Capital Resources for details.

3. OUTLOOK

The forward-looking information contained in this section is subject to the risk factors and assumptions contained in the Cautionary Statement on Forward-Looking Information included with this MD&A and the risk factors set out in Section 10 – Risk Analysis.

Unless otherwise stated "attributable" production includes only Kinross' share of Chirano production (90%). Production cost of sales per attributable gold equivalent ounce is defined as production cost of sales as per the financial statements divided by the number of gold equivalent ounces sold, reduced for Chirano (10%) sales attributable to third parties.

Approximately 60%-70% of the Company’s costs are denominated in U.S. dollars.

A 10% change in foreign exchange could result in an approximate $14 impact on production cost of sales per ounce2.

Specific to the Russian rouble, a 10% change in the exchange rate would be expected to result in an approximate $11 impact on Russian production cost of sales per ounce.

A $10 per barrel change in the price of oil could result in an approximate $1 impact on production cost of sales per ounce.

The impact on royalties of a $100 change in the gold price could result in an approximate $3 impact on production cost of sales per ounce.

Operational Outlook

In 2015, Kinross expects to produce approximately 2.4 to 2.6 million gold equivalent ounces from its current operations, lower than the 2014 production of 2.71 million gold equivalent ounces.

Production cost of sales per gold equivalent ounce is expected to be in the range of $720 to $780 for 2015.

The Company has forecast an all-in sustaining cost for 2015 of $1,000 to $1,100 per gold equivalent ounce sold and per ounce sold on a by-product basis.

Material assumptions used to forecast 2015 production costs are: a gold price of $1,200 per ounce, a silver price of $18 per ounce, an oil price of $90 per barrel, and foreign exchange rates of 2.5 Brazilian reais to the U.S. dollar, 1.10 Canadian dollar to the U.S. dollar, 40 Russian roubles to the U.S. dollar, 575 Chilean pesos to the U.S. dollar, 2.75 Ghanaian cedi to the U.S. dollar, 290 Mauritanian ouguiya to the U.S. dollar, and 1.30 U.S. dollars to the Euro. Taking into account existing currency and oil hedges, a 10% change in foreign currency exchange rates would be expected to result in an approximate $14 impact on our production cost of sales per ounce and specific to the Russian rouble, a 10% change in the exchange rate would be expected to result in an approximate $11 impact on Russian production cost of sales per ounce. A $10 per barrel change in the price of oil would be expected to result in an approximate $1 impact on our production cost of sales per ounce, and a $100 change in the price of gold would be expected to result in an approximate $3 impact on our production cost of sales per ounce as a result of a change in royalties.

Total capital expenditures for 2015 are forecast to be approximately $725 million (including estimated capitalized interest of approximately $40 million). Of this amount, sustaining capital expenditures are expected to be approximately $505 million.

Exploration expenditures are forecast to be approximately $95 million, none of which is expected to be capitalized. 2015 overhead (general and administrative expenses and business development) is expected to be approximately $205 million.

Other operating costs are forecast to be approximately $50 million, including $11 million for care and maintenance costs at La Coipa. The above forecast expenses include approximately $30 million related to expected equity-based compensation.

Income tax expenses are expected to be $55 million based on our assumed gold price plus approximately 24% of any profit resulting from higher gold prices. Depreciation, depletion and amortization is forecast to be approximately $330 per gold equivalent ounce.

2 Refers to all of the currencies in the countries where the Company has mining operations, fluctuating simultaneously by 10% in the same direction, either appreciating or depreciating, taking into consideration the impact of hedging and the weighting of each currency within our consolidated cost structure.

4. PROJECT UPDATES AND NEW DEVELOPMENTS

Tasiast mill expansion update

Following a comprehensive review, the Company has decided not to proceed with the 38,000 tonne per day mill expansion at the present time. The current gold price environment does not provide the Company with sufficient confidence that it will be able to maintain balance sheet strength while financing the expansion during the three-year construction period.

In addition to a supportive gold price environment, the Company previously identified project financing, de-risking of the execution plan and conducive investment conditions in Mauritania as critical to a positive construction decision. Progress has been made towards securing project financing and de-risking execution. All necessary project permits have been secured from the Government of Mauritania, as well as approval for continuing to utilize 12-hour shifts. However, more work needs to be done to secure effective implementation of recent legislation granting the mining industry a VAT exemption. In addition, the Company has thus far been unable to reach a satisfactory agreement with the Government of Mauritania on payment of certain VAT refunds owed to the Company.

Kinross continues to believe a Tasiast mill expansion has the potential to create significant value over the long term. The Company will continue to assess market conditions with a view to possibly expanding Tasiast, should circumstances change. In addition, Kinross will continue to focus on reducing operating costs at Tasiast, consistent with the Company’s standards of operational excellence and drive for continuous improvement.

La Coipa Phase 7 update

A pre-feasibility study (“PFS”), begun in the second quarter of 2014, to explore potential re-start options at La Coipa, is on track to be completed during the third quarter of 2015. Kinross is also conducting a scoping study that focuses on processing options for known near-surface sulfide mineralization in the district. Exploration continues at La Coipa, with the assessment of some attractive opportunities to extend the mine life beyond what the PFS will contemplate.

Metallurgical test work continues to be a major component of the study. Results to date confirm the complexity of the ore types, with more test work to follow.

Recent transactions

Completion of $500.0 million unsecured debt offering

On March 6, 2014, Kinross completed a $500.0 million offering of debt securities consisting of 5.950% senior notes due 2024. The notes are senior unsecured obligations of the Company. Kinross received net proceeds of $492.9 million from the offering, after discount, payment of the commissions to the initial purchasers and expenses of the offering.

On March 10, 2014, the Company used the net proceeds raised from the above mentioned debt offering to repay $500.0 million of the term loan.

Amendment of Letter of Credit guarantee facility

On July 17, 2014, the Company entered into an amendment to increase the amount of its Letter of Credit guarantee facility with Export Development Canada (“EDC”) from $200.0 million to $250.0 million.

Amendment of revolving credit and term loan facilities

On July 28, 2014, the Company amended its $500.0 million term loan and $1,500.0 million revolving credit facility to extend the respective maturity dates by one year to August 10, 2018 and August 10, 2019, respectively. As part of this amendment, the interest charge on the term loan is now LIBOR plus 1.65%, based on the Company’s current credit rating, and consequently, the fixed rate on the hedged portion of the term loan is now 2.14%.

Sale of Fruta del Norte (“FDN”) project in Ecuador

On October 21, 2014, Kinross announced that it entered into an agreement with Fortress Minerals Corp. (“Fortress”, subsequently renamed Lundin Gold Inc. (“Lundin Gold”)), a member of the Lundin Group of Companies, to sell all of its interest in Aurelian Resources Inc. (“Aurelian”) and the FDN project in Ecuador for $240.0 million in cash and shares.

On December 17, 2014, the Company completed the sale for gross cash proceeds of $150.0 million and $90.0 million of Lundin Gold common shares, resulting in an after-tax recovery of $238.0 million.

Other developments

Board of Directors update

Mr. John Macken resigned from the Kinross Board of Directors, effective July 30, 2014.

Mr. Kenneth Irving is resigning from the Kinross Board of Directors, effective February 10, 2015.

Temporary suspension of mill at Round Mountain mine

Mill operations at Round Mountain have been temporarily suspended as of October 1, 2014, following a fire in the mill building. Mill repairs have commenced and the mill is expected to be re-commissioned in March 2015 with costs expected to be almost entirely covered by insurance. Production continues uninterrupted from the mine's heap leach facilities, which account for approximately 75% of production. There was no material impact on the region’s 2014 production guidance from the temporary suspension of mill operations.

5. CONSOLIDATED RESULTS OF OPERATIONS

|

(in millions, except ounces and per ounce amounts)

|

|

Years ended December 31, |

|

|

|

2013 vs. 2012

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

|

Change

|

|

|

% Change

|

|

|

Operating Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gold equivalent ounces (a), (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (b)

|

|

|

2,739,044 |

|

|

|

2,658,632 |

|

|

|

2,678,131 |

|

|

|

80,412 |

|

|

|

3 |

% |

|

|

(19,499 |

) |

|

|

(1 |

%) |

|

Sold (b)

|

|

|

2,743,398 |

|

|

|

2,697,093 |

|

|

|

2,654,107 |

|

|

|

46,305 |

|

|

|

2 |

% |

|

|

42,986 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold equivalent ounces from continuing operations (a), (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (b)

|

|

|

2,739,044 |

|

|

|

2,658,632 |

|

|

|

2,647,137 |

|

|

|

80,412 |

|

|

|

3 |

% |

|

|

11,495 |

|

|

|

0 |

% |

|

Sold (b)

|

|

|

2,743,398 |

|

|

|

2,697,093 |

|

|

|

2,621,343 |

|

|

|

46,305 |

|

|

|

2 |

% |

|

|

75,750 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable gold equivalent ounces (a), (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced (b)

|

|

|

2,710,390 |

|

|

|

2,631,092 |

|

|

|

2,648,807 |

|

|

|

79,298 |

|

|

|

3 |

% |

|

|

(17,715 |

) |

|

|

(1 |

%) |

|

Sold (b)

|

|

|

2,715,358 |

|

|

|

2,669,276 |

|

|

|

2,624,242 |

|

|

|

46,082 |

|

|

|

2 |

% |

|

|

45,034 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable gold equivalent ounces from continuing operations (a), (c)

|

|

|

Produced (b)

|

|

|

2,710,390 |

|

|

|

2,631,092 |

|

|

|

2,617,813 |

|

|

|

79,298 |

|

|

|

3 |

% |

|

|

13,279 |

|

|

|

1 |

% |

|

Sold (b)

|

|

|

2,715,358 |

|

|

|

2,669,276 |

|

|

|

2,591,478 |

|

|

|

46,082 |

|

|

|

2 |

% |

|

|

77,798 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold ounces - sold from continuing operations(c)

|

|

|

2,669,278 |

|

|

|

2,545,736 |

|

|

|

2,421,447 |

|

|

|

123,542 |

|

|

|

5 |

% |

|

|

124,289 |

|

|

|

5 |

% |

|

Silver ounces - sold from continuing operations (000's)(c)

|

|

|

4,923 |

|

|

|

9,021 |

|

|

|

10,717 |

|

|

|

(4,098 |

) |

|

|

(45 |

%) |

|

|

(1,696 |

) |

|

|

(16 |

%) |

|

Average realized gold price per ounce

|

|

$ |

1,263 |

|

|

$ |

1,402 |

|

|

$ |

1,643 |

|

|

$ |

(139 |

) |

|

|

(10 |

%) |

|

$ |

(241 |

) |

|

|

(15 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Data from Continuing Operations (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metal sales

|

|

$ |

3,466.3 |

|

|

$ |

3,779.5 |

|

|

$ |

4,307.3 |

|

|

$ |

(313.2 |

) |

|

|

(8 |

%) |

|

$ |

(527.8 |

) |

|

|

(12 |

%) |

|

Production cost of sales

|

|

$ |

1,971.2 |

|

|

$ |

2,004.4 |

|

|

$ |

1,849.2 |

|

|

$ |

(33.2 |

) |

|

|

(2 |

%) |

|

$ |

155.2 |

|

|

|

8 |

% |

|

Depreciation, depletion and amortization

|

|

$ |

874.7 |

|

|

$ |

828.8 |

|

|

$ |

680.9 |

|

|

$ |

45.9 |

|

|

|

6 |

% |

|

$ |

147.9 |

|

|

|

22 |

% |

|

Impairment charges

|

|

$ |

1,251.4 |

|

|

$ |

3,169.6 |

|

|

$ |

3,527.6 |

|

|

$ |

(1,918.2 |

) |

|

|

(61 |

%) |

|

$ |

(358.0 |

) |

|

|

(10 |

%) |

|

Operating loss

|

|

$ |

(1,027.2 |

) |

|

$ |

(2,635.2 |

) |

|

$ |

(2,241.9 |

) |

|

$ |

1,608.0 |

|

|

|

61 |

% |

|

$ |

(393.3 |

) |

|

|

(18 |

%) |

|

Net loss attributable to common shareholders

|

|

$ |

(1,400.0 |

) |

|

$ |

(3,012.6 |

) |

|

$ |

(2,546.2 |

) |

|

$ |

1,612.6 |

|

|

|

54 |

% |

|

$ |

(466.4 |

) |

|

|

(18 |

%) |

|

(a)

|

|

"Total" includes 100% of Chirano production. "Attributable" includes Kinross' share of Chirano (90%) production.

|

|

(b)

|

|

"Gold equivalent ounces" include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for 2014 was 66.29:1 (2013 - 59.23:1 and 2012 - 53.56:1).

|

|

(c)

|

|

On June 10, 2013, the Company announced its decision to cease development of Fruta del Norte ("FDN"). As a result, FDN was classified as a discontinued operation. On December 17, 2014, the Company disposed of its interest in FDN. On June 28, 2012, the Company disposed of its interest in Crixás. As a result, the comparative figures have been recast to exclude the results of FDN and Crixás.

|

|

(d)

|

|

The total gold equivalent ounces and total attributable gold equivalent ounces include Crixás up to June 28, 2012.

|

Operating Earnings (Loss) by Segment

| |

|

Years ended December 31, |

|

|

|

|

2013 vs. 2012

|

|

|

(in millions)

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Change

|

|

|

% Change

|

|

|

Change

|

|

|

% Change(d)

|

|

|

Operating segments (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fort Knox

|

|

$ |

99.9 |

|

|

$ |

251.0 |

|

|

$ |

260.9 |

|

|

$ |

(151.1 |

) |

|

|

(60 |

%) |

|

$ |

(9.9 |

) |

|

|

(4 |

%) |

|

Round Mountain

|

|

|

44.0 |

|

|

|

(106.7 |

) |

|

|

151.2 |

|

|

|

150.7 |

|

|

|

141 |

% |

|

|

(257.9 |

) |

|

|

(171 |

%) |

|

Kettle River-Buckhorn

|

|

|

(45.6 |

) |

|

|

53.6 |

|

|

|

90.2 |

|

|

|

(99.2 |

) |

|

|

(185 |

%) |

|

|

(36.6 |

) |

|

|

(41 |

%) |

|

Paracatu

|

|

|

69.3 |

|

|

|

106.6 |

|

|

|

284.2 |

|

|

|

(37.3 |

) |

|

|

(35 |

%) |

|

|

(177.6 |

) |

|

|

(62 |

%) |

|

Maricunga

|

|

|

36.3 |

|

|

|

(711.6 |

) |

|

|

178.9 |

|

|

|

747.9 |

|

|

|

105 |

% |

|

|

(890.5 |

) |

|

nm

|

|

|

Kupol (b)

|

|

|

282.8 |

|

|

|

316.0 |

|

|

|

495.5 |

|

|

|

(33.2 |

) |

|

|

(11 |

%) |

|

|

(179.5 |

) |

|

|

(36 |

%) |

|

Tasiast

|

|

|

(571.4 |

) |

|

|

(1,575.4 |

) |

|

|

(3,466.8 |

) |

|

|

1,004.0 |

|

|

|

64 |

% |

|

|

1,891.4 |

|

|

|

55 |

% |

|

Chirano

|

|

|

(365.4 |

) |

|

|

(344.4 |

) |

|

|

(8.3 |

) |

|

|

(21.0 |

) |

|

|

(6 |

%) |

|

|

(336.1 |

) |

|

nm

|

|

|

Non-operating segments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other (c)

|

|

|

(577.1 |

) |

|

|

(624.3 |

) |

|

|

(227.7 |

) |

|

|

47.2 |

|

|

|

8 |

% |

|

|

(396.6 |

) |

|

|

(174 |

%) |

|

Total

|

|

$ |

(1,027.2 |

) |

|

$ |

(2,635.2 |

) |

|

$ |

(2,241.9 |

) |

|

$ |

1,608.0 |

|

|

|

61 |

% |

|

$ |

(393.3 |

) |

|

|

(18 |

%) |

|

Discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crixás

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

16.6 |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

(16.6 |

) |

|

|

(100 |

%) |

|

Fruta del Norte

|

|

$ |

(5.2 |

) |

|

$ |

(735.9 |

) |

|

$ |

(6.9 |

) |

|

$ |

730.7 |

|

|

|

99 |

% |

|

$ |

(729.0 |

) |

|

nm

|

|

|

(a)

|

On June 10, 2013, the Company announced its decision to cease development of Fruta del Norte ("FDN"). As a result, FDN was classified as a discontinued operation. On December 17, 2014, the Company disposed of its interest in FDN. On June 28, 2012, the Company disposed of its interest in Crixás. As a result, the comparative figures have been recast to exclude the results of FDN and Crixás.

|

|

(b)

|

The Kupol segment includes the Kupol and Dvoinoye mines.

|

|

|

|

|

|

(c)

|

"Corporate and Other" includes operating costs which are not directly related to individual mining properties such as overhead expenses, gains and losses on disposal of assets and investments, and other costs relating to non-operating assets (including La Coipa (as of January 1, 2014), Lobo-Marte and White Gold). The comparative figures have been reclassified to conform to the 2014 segment presentation.

|

|

(d)

|

"nm" means not meaningful.

|

|

|

|

|

|

|

|

Mining operations

Fort Knox (100% ownership and operator) – USA

| |

|

Years ended December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

Change

|

|

|

% Change

|

|

|

Operating Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tonnes ore mined (000's)

|

|

|

14,886 |

|

|

|

21,634 |

|

|

|

(6,748 |

) |

|

|

(31 |

%) |

|

Tonnes processed (000's) (a)

|

|

|

39,386 |

|

|

|

42,419 |

|

|

|

(3,033 |

) |

|

|

(7 |

%) |

|

Grade (grams/tonne)(b)

|

|

|

0.66 |

|

|

|

0.82 |

|

|

|

(0.16 |

) |

|

|

(20 |

%) |

|

Recovery(b)

|

|

|

84.4 |

% |

|

|

83.7 |

% |

|

|

0.7 |

% |

|

|

1 |

% |

|

Gold equivalent ounces:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced

|

|

|

379,453 |

|

|

|

421,641 |

|

|

|

(42,188 |

) |

|

|

(10 |

%) |

|

Sold

|

|

|

408,472 |

|

|

|

416,103 |

|

|

|

(7,631 |

) |

|

|

(2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Data (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metal sales

|

|

$ |

515.7 |

|

|

$ |

596.5 |

|

|

$ |

(80.8 |

) |

|

|

(14 |

%) |

|

Production cost of sales

|

|

|

291.0 |

|

|

|

236.6 |

|

|

|

54.4 |

|

|

|

23 |

% |

|

Depreciation, depletion and amortization

|

|

|

118.0 |

|

|

|

103.7 |

|

|

|

14.3 |

|

|

|

14 |

% |

| |

|

|

106.7 |

|

|

|

256.2 |

|

|

|

(149.5 |

) |

|

|

(58 |

%) |

|

Exploration and business development

|

|

|

6.8 |

|

|

|

5.2 |

|

|

|

1.6 |

|

|

|

31 |

% |

|

Segment operating earnings

|

|

$ |

99.9 |

|

|

$ |

251.0 |

|

|

$ |

(151.1 |

) |

|

|

(60 |

%) |

|

(a)

|

Includes 25,848,000 tonnes placed on the heap leach pads during 2014 (2013 - 29,751,000 tonnes).

|

|

(b)

|

Amount represents mill grade and recovery only. Ore placed on the heap leach pads had an average grade of 0.29 grams per tonne during 2014 (2013 - 0.29 grams per tonne). Due to the nature of heap leach operations, point-in-time recovery rates are not meaningful.

|

The Company has been operating the Fort Knox mine, located near Fairbanks, Alaska, since it was acquired in 1998.

2014 vs. 2013

Tonnes of ore mined decreased by 31% compared with 2013 due to planned mine sequencing, which involved mining activities focused on Phase 7 South. During 2014, tonnes of ore processed were 7% lower compared with 2013, primarily due to a decrease in tonnage placed on the heap leach pads as a result of mine sequencing, which involved longer heap leach haulage cycles, partially offset by higher mill throughput due to increased availability of the mill crusher. Mill grades decreased by 20% compared with 2013 as a result of lower grade stockpile ore being processed through the mill rather than higher grade pit ore. Gold equivalent ounces produced decreased by 10% compared with 2013, primarily due to lower mill grades. During 2014, gold equivalent ounces sold exceeded production as ounces produced at the end of 2013 were sold in 2014.

Metal sales were 14% lower compared with 2013 due to decreases in metal prices realized and gold equivalent ounces sold. Production cost of sales increased by 23% in 2014 compared with 2013, primarily due to higher costs associated with mining lower grade ore, higher labour costs, increased consumption of reagents for heap leach operations, and a decrease in tonnes placed on the heap leach pads. This increase was partially offset by lower gold equivalent ounces sold. Depreciation, depletion and amortization increased by 14% compared with 2013, primarily due to an increase in the depreciable asset base and a decrease in mineral reserves at December 31, 2013, partially offset by a decrease in gold equivalent ounces sold.

Round Mountain (50% ownership and operator; Barrick 50% ownership) – USA

| |

|

Years ended December 31, |

|

| |

|

2014

|

|

|

2013

|

|

|

Change

|

|

|

% Change

|

|

|

Operating Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tonnes ore mined (000's)(a)

|

|

|

26,356 |

|

|

|

19,648 |

|

|

|

6,708 |

|

|

|

34 |

% |

|

Tonnes processed (000's)(a)

|

|

|

26,026 |

|

|

|

21,595 |

|

|

|

4,431 |

|

|

|

21 |

% |

|

Grade (grams/tonne)(b)

|

|

|

0.94 |

|

|

|

0.69 |

|

|

|

0.25 |

|

|

|

36 |

% |

|

Recovery(b)

|

|

|

68.6 |

% |

|

|

65.7 |

% |

|

|

2.9 |

% |

|

|

4 |

% |

|

Gold equivalent ounces:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Produced

|

|

|

169,839 |

|

|

|

162,826 |

|

|

|

7,013 |

|

|

|

4 |

% |

|

Sold

|

|

|

166,441 |

|

|

|

161,836 |

|

|

|

4,605 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Data (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metal sales

|

|

$ |

211.7 |

|

|

$ |

228.7 |

|

|

$ |

(17.0 |

) |

|

|

(7 |

%) |

|

Production cost of sales

|

|

|

142.3 |

|

|

|

135.3 |

|

|

|

7.0 |

|

|

|

5 |

% |

|

Depreciation, depletion and amortization

|

|

|

25.2 |

|

|

|

22.4 |

|

|

|

2.8 |

|

|

|

13 |

% |

|

Impairment charges

|

|

|

- |

|

|

|

177.4 |

|

|

|

(177.4 |

) |

|

|

(100 |

%) |

| |

|

|

44.2 |

|

|

|

(106.4 |

) |

|

|

150.6 |

|

|

|

142 |

% |

|

Exploration and business development

|

|

|

0.2 |

|

|

|

0.3 |

|

|

|

(0.1 |

) |

|

|

(33 |

%) |

|

Segment operating earnings (loss)

|

|

$ |

44.0 |

|

|

$ |

(106.7 |

) |

|

$ |

150.7 |

|

|

|

141 |

% |

|

(a)

|

Tonnes of ore mined/processed represent 100% of operations. Includes 23,098,000 tonnes placed on the heap leach pads during 2014 (2013 - 17,784,000 tonnes).

|

|

(b)

|

Amount represents mill grade and recovery only. Ore placed on the heap leach pads had an average grade of 0.36 grams per tonne during 2014 (2013 - 0.36 grams per tonne). Due to the nature of heap leach operations, point-in-time recovery rates are not meaningful.

|

The Company acquired its ownership interest in the Round Mountain open pit mine, located in Nye County, Nevada, with the acquisition of Echo Bay Mines Ltd. ("Echo Bay") on January 31, 2003.

2014 vs. 2013

Tonnes of ore mined and mill grades increased by 34% and 36%, respectively, compared with 2013, primarily due to planned mine sequencing. Tonnes of ore processed were 21% higher in 2014 compared with 2013, primarily due to an increase in tonnage placed on the leach pads. Gold equivalent ounces produced increased by 4% compared with 2013, largely due to higher mill grades and recoveries, partially offset by a decrease in ounces recovered from the heap leach pads.

Metal sales were 7% lower in 2014 compared with 2013 due to a decrease in metal prices realized, partially offset by an increase in gold equivalent ounces sold. Production cost of sales increased by 5% compared with 2013, primarily due to an increase in gold equivalent ounces sold and higher tire costs, partially offset by lower royalty and cyanide costs. Depreciation, depletion and amortization increased by 13% in 2014 compared with 2013, primarily due to an increase in gold equivalent ounces sold and a decrease in mineral reserves at December 31, 2013, partially offset by a decrease in the depreciable asset base resulting from the impairment charges recognized at June 30, 2013. During 2013, the Company recorded impairment charges of $177.4 million, comprised of $58.7 million related to goodwill and $118.7 million related to property, plant and equipment, primarily due to the reduction in the Company’s estimates of future metal prices. No new impairment charges were recognized in 2014.

Kettle River–Buckhorn (100% ownership and operator) – USA

| |

|

Years ended December 31, |

|

| |

|

2014

|

|

|

2013

|

|

|

Change

|

|

|

% Change

|

|

|

Operating Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|