Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

NATIONAL FUEL GAS COMPANY

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NATIONAL FUEL GAS COMPANY

Notice of Annual Meeting

and

Proxy Statement

Annual Meeting of Stockholders

to be held on

March 13, 2014

Table of Contents

| ** | To be voted on at the meeting |

| YOUR | VOTE IS IMPORTANT! |

PLEASE VOTE BY INTERNET, PHONE OR COMPLETE, SIGN, DATE AND RETURN YOUR PROXY.

i

Table of Contents

2014 Proxy Statement Overview & Summary

This overview and summary includes certain business performance information and highlights information contained elsewhere in this proxy statement. This overview and summary does not contain all of the information that you should consider, and you should read the Company’s Summary Annual Report and Form 10-K and this entire proxy statement carefully before voting.

| Annual Meeting Voting Matters |

The table below summarizes the matters that will be subject to the vote of stockholders at the 2014 Annual Meeting of Stockholders of National Fuel Gas Company:

| Proposals |

Board Vote Recommendation |

Page Number (for additional details) | ||

| 1. Election of Directors |

FOR ALL NOMINEES | Page 4 | ||

| 2. Ratification of Auditor |

FOR | Page 63 | ||

| 3. Advisory Approval of Named Executive Officer Compensation |

FOR | Page 64 | ||

| 4. Stockholder Proposal |

AGAINST | Page 71 |

| Annual Meeting of Stockholders |

| Ø Time and Date |

March 13, 2014 at 9:30 a.m. local time | |

| Ø Location |

The Ritz-Carlton Golf Resort, Naples 2600 Tiburón Drive, Naples, FL 34109 | |

| Ø Record Date |

January 13, 2014 | |

| Ø Voting Details |

Stockholders as of the record date are entitled to one vote for each share of common stock for each director nominee and each other proposal to be voted. | |

| Ø Voting Deadline |

Votes must be received by March 12, 2014. For employee benefit plans votes must be received by March 11, 2014. | |

| Ø Attending the Meeting |

National Fuel stockholders as of the record date are entitled to attend the annual meeting. In accordance with our security procedures, all persons attending the annual meeting may be asked for picture identification and proof of stock ownership. Please see “Attending the Meeting” on page 2. | |

ii

Table of Contents

| Overview of Business Performance and Long-Term Strategic Initiatives |

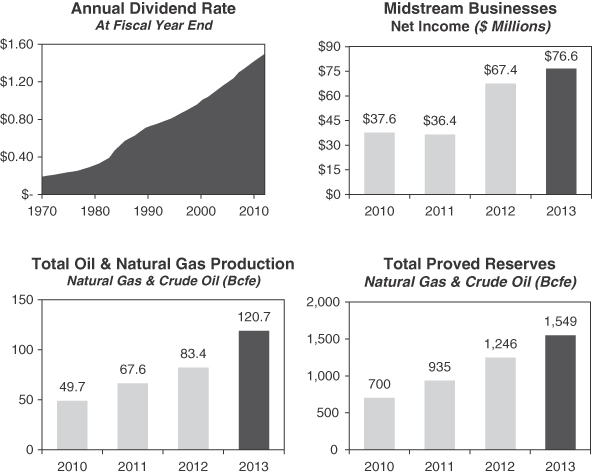

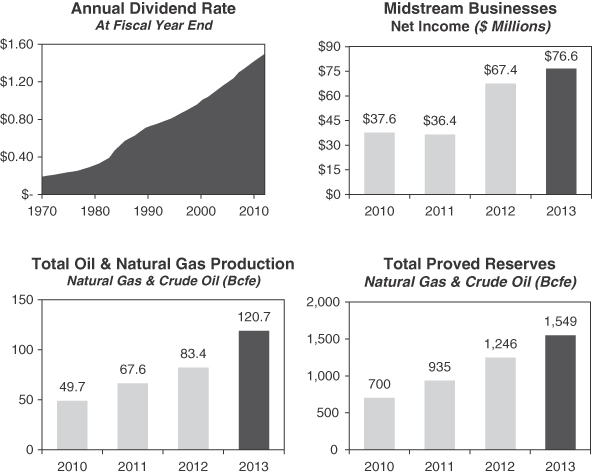

Fiscal 2013 was a remarkable year for the Company, both financially and operationally. Year over year results improved in each of the Company’s reporting segments.

The Company’s exploration & production subsidiary, Seneca Resources Corporation (“Seneca”), continued to develop its position in the Eastern Development area of its Marcellus Shale acreage. Seneca also identified a high-quality geologic trend with the potential for nearly 2,000 well locations in Elk and Cameron counties, Pennsylvania, a major breakthrough on its legacy Western Development acreage.

Additionally, the Company’s midstream businesses, consisting of the Pipeline & Storage and Gathering segments, continued to evaluate, construct and operate substantial expansions to their Appalachian pipeline infrastructure, not only for affiliated customers, but also third-party producers active in developing the Marcellus and Utica Shales. These projects can take three to five years from conception to active service and the Company continues to pursue additional expansions to alleviate the pipeline constraints facing many natural gas shippers in the Appalachian Basin.

2013 Financial and Operating Highlights:

| • | 17% Growth in Earnings per Share: The Company’s earnings per share in 2013 were $3.08, which was an increase of 17% compared to the prior year. |

| • | Strong TSR Performance: The Company’s total shareholder return (“TSR”) for the one-year, three-year and five-year periods was 30%, 43% and 87%, respectively. These results placed the Company at the 69th, 44th, and 63rd percentiles of the 2013 Hay peer group for the same respective periods. |

| • | 45% Increase in Natural Gas and Crude Oil Production: Seneca increased its total natural gas and crude oil production to 120.7 billion cubic feet equivalent (“Bcfe”), a 45% increase over the prior year. |

| • | 24% Growth in Natural Gas & Crude Oil Reserves: At the end of fiscal 2013, Seneca increased its proved reserves of natural gas and crude oil to 1.549 trillion cubic feet equivalent (“Tcfe”), an improvement of 24% from the prior year. |

| • | Midstream Businesses Achieved Growth: The Company’s midstream businesses generated combined net income of $76.6 million ($63.3 million for the Pipeline and Storage segment and $13.3 million for the Gathering segment), which was an increase of 14% over the prior year. This growth was driven by the completion of three new major pipeline projects in late fiscal 2012 and early fiscal 2013. |

| • | 43rd Year of Consecutive Dividend Increases: In June, the Company’s annual dividend rate was increased by 2.7% to $1.50 per share, marking the 43rd year of consecutive dividend increases and 111th year of uninterrupted dividend payments. |

iii

Table of Contents

2013 Long-Term Strategic Results

National Fuel’s capital intensive operations require a focus on strategic initiatives and projects that may take several years from business planning through completion. The results of this focus include:

| • | Commencing a Major New Marcellus Development Program: The Company’s Exploration & Production segment continued its multi-year delineation efforts in the Marcellus Shale. In 2013, these efforts led to a major breakthrough on Seneca’s 780,000 net acres in Pennsylvania. New wells tested during the year have significantly furthered the Company’s confidence in the long-term potential of its Marcellus Shale acreage. In particular, an additional 2,000 drilling locations, with a resource potential of more than 10 Tcfe, have been identified as economic at natural gas prices of $4 per Mcf or lower. With this new confidence, the Company moved to a full-scale development program in its Rich Valley/Clermont prospect area that will last for many years. |

| • | Ongoing Interstate Pipeline Expansion Projects: In the Pipeline & Storage segment, two major interstate pipeline expansion projects were placed in service. In the first half of fiscal 2013, the Company completed construction of National Fuel Gas Supply Corporation’s Northern Access Expansion and Line N 2012 Expansion. These projects, combined with the phase-in of previously completed projects, added more than $26 million in transportation revenue to the Pipeline & Storage segment in fiscal 2013. |

| • | Continued Build Out of Gathering Infrastructure: National Fuel Gas Midstream Corporation and its subsidiaries, within the Company’s Gathering segment, invested $48 million in 2013 for |

iv

Table of Contents

| the continued expansion of the Trout Run Gathering System in Pennsylvania. This gathering system is instrumental to the success of Seneca’s Eastern Development area, and ensuring that its natural gas production reaches a sales market promptly upon completion of wells. Additionally, initial plans were formulated for a new 1 Bcf per day gathering system to support Seneca’s development of its Rich Valley/Clermont prospect area. Net income of the Gathering segment increased 93% in 2013 to $13.3 million from $6.9 million in 2012. |

| • | Expanding Natural Gas Transportation Capabilities: The Company continues to aggressively pursue opportunities to expand its infrastructure to serve the rapid growth in volumes of natural gas produced from the Marcellus and Utica Shales in Appalachia. Capital expenditures for fiscal 2014 through fiscal 2016 are estimated to be $648.6 million in the Pipeline and Storage segment and $392.6 million in the Gathering segment, a combined addition of 84% to the $1,235.2 million of Midstream business net property plant and equipment, and 20% to the $5,151.7 million of Company net property plant and equipment, both as of the end of fiscal 2013. A component of this spending is for the Northern Access 2015 Expansion project. This is designed to provide Seneca’s production with a path to export gas to high-value Canadian markets, further enhancing the Company’s ability to export natural gas. |

| Proposal 1 — Nominees for Election as Directors |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ALL NOMINEES FOR THE BOARD OF DIRECTORS

Ronald W. Jibson — Age 60

Principal Occupation: Chairman of the Board of Questar Corporation (“Questar”) and President and Chief Executive Officer of Questar

Expertise: Leadership, Industry

Jeffrey W. Shaw — Age 55

Principal Occupation: President and Chief Executive Officer of Southwest Gas Corporation

Expertise: Leadership, Industry

Ronald J. Tanski — Age 61

Principal Occupation: President and Chief Executive Officer of National Fuel Gas Company

Expertise: Leadership, Industry, Regional

| Proposal 2 — Ratification of Auditors |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF THIS APPOINTMENT

As a matter of good governance, it is important that stockholders vote to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for fiscal 2014.

For full details, please see page 63

| Proposal 3 — Advisory Approval of Named Executive Officer Compensation |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION.

This proposal allows stockholders to take part in a non-binding, advisory vote to approve the compensation of the Company’s named executive officers. The summary below and the discussion in the Compensation Discussion and Analysis (“CD&A”) beginning on page 21 provide information about the Company’s compensation programs.1

| 1 | Unless otherwise indicated, we intend capitalized and abbreviated terms to have the same meaning in this section as in the CD&A. |

v

Table of Contents

As described in the 2013 Financial and Operating Highlights on page 64, from both a short- and long-term perspective, fiscal 2013 was a highly successful year operationally and financially. Stockholders were rewarded with strong short-term and long-term TSR performance relative to the Company’s peers and the market. The Company’s one-year TSR of 30% was at the 69th percentile of the Company’s 2013 Hay peer group, and three- and five-year TSR of 43% and 87% were at the 44th and 63rd percentile of the same peer group, respectively. The Board of Directors (“Board”) recommends a vote FOR the advisory approval of named executive officer compensation because it believes that the Company’s compensation policies and procedures, as developed following engagement with its stockholders, encourage a culture of pay for performance and are strongly aligned with the interests of the Company’s stockholders.

For complete information on this proposal, please refer to page 64 and following.

| 2013 Advisory Vote on Executive Compensation and Stockholder Feedback |

2013 Say-on-Pay Vote and Stockholder Engagement

The 2013 Say-on-Pay advisory vote yielded a result of 84% of votes cast in support of the compensation of the Company’s named executive officers. As in 2012, in the summer of 2013 members of Company management again held meetings with some of the Company’s largest stockholders to obtain feedback on the Company’s compensation program, among other topics. This engagement, reaching holders of more than 24% of our shares outstanding as of September 30, 2013, facilitated important dialogue from which we continued to gather various viewpoints.

As a result of the stockholder feedback received in 2012, in 2013 the Compensation Committee of the Board (the “Compensation Committee”) converted a cash-based long-term incentive program to an equity-based program utilizing restricted stock units (“RSUs”). As with the cash-based program, the RSU program is subject to the same three-year total return on capital performance target relative to companies reported in the Natural Gas Distribution and Integrated Natural Gas Companies group of the Monthly Utility Reports of AUS, Inc. (“AUS peer group”). In both programs the target award will vest should the Company rank at the 60th percentile of the peer group. For the RSU program, performance at the 60th percentile will result in fifty percent of the RSUs vesting.

For fiscal 2014, the Compensation Committee adopted a new approach to long-term incentive compensation. Going forward, approximately two-thirds of a named executive officer’s long-term incentive award will be comprised of performance shares, split between two distinct performance conditions: one performance condition is tied to 3-year TSR and the other is tied to 3-year total return on capital, both relative to the performance of companies in the Hay peer group (as described below). The remaining approximately one-third of the long-term incentive award will be comprised of time-vested RSUs used as a retention tool. The Compensation Committee’s action represents an evolution from its practice prior to fiscal 2013 of utilizing a cash component for approximately one-half of long-term incentive awards.

CEO Compensation

In fiscal 2013, because of the transition to a new Chief Executive Officer (“CEO”) and away from a long-term incentive partially paid in cash, the Summary Compensation Table does not appropriately reflect the philosophy behind the Compensation Committee’s approach to CEO Compensation.

Below is a chart which compares the recommendation that Hay made to the Compensation Committee’s target for Mr. Tanski’s compensation upon his succession to the CEO position, the Compensation Committee’s targeting of Mr. Tanski’s pay for fiscal 2013 and the corresponding amounts contained in the Summary Compensation Table.

vi

Table of Contents

Fiscal 2013

CEO Compensation

| Hay Target Recommendation |

As Targeted by Compensation Committee |

As Contained in the Summary Compensation Table | ||||

| Base Salary | 750,000 | 726,148 | 726,148 | |||

| Bonus | 750,000 | 580,918 | 802,829 | |||

| Total Cash | 1,500,000 | 1,307,066 | 1,528,977 | |||

| Stock Awards (Performance-Based RSU Grant) | Not Broken Out | 1,601,750 | 3,026,063 | |||

| Equity Awards (SAR Grant) | Not Broken Out | 458,250 | 458,072 | |||

| Total Target LTI | 2,060,000 | 2,060,000 | 3,484,135 | |||

| Total Direct Compensation | 3,560,000 | 3,367,066 | 5,013,112 |

In particular, note that the amount reported in the Summary Compensation Table under Stock Awards reflects close to double the target amount. This is due to the doubling of the RSU grant to allow for performance at two times the target percentile and an estimate for Summary Compensation Table purposes close to that maximum opportunity. Should the Company achieve only target performance at the 60th percentile of the AUS peer group, 50% of the awarded RSUs will vest. Stated another way, the award amount is a maximum opportunity to be decreased should the percentile ranking be below the 100th percentile. The award will only vest following fiscal 2015, in accordance with the vesting schedule below:

| Company’s Rank as a Percentile of the AUS Peer Group |

Percentage of RSUs Vesting | |

| <45.01% |

0% | |

| 45.01% |

25.00% | |

| 60.00% |

50.00% | |

| 75.00% |

75.00% | |

|

100.00% |

100.00% |

| Compensation Summary and Overview |

Objectives of the Compensation Committee

When setting compensation for the Company’s executives, the Compensation Committee’s primary goal is to provide balanced incentives for creating value for stockholders in both the near-term and long-term. In order for this to occur, the Committee awards a combination of cash and equity components that are designed to:

| Ø |

Focus management efforts on both near-term and long-term drivers of stockholder value; | |

| Ø |

Tie a significant portion of executive compensation to long-term TSR by linking a significant portion of an executive officer’s potential compensation to the future price of the Company’s Common Stock; and | |

| Ø |

Attract, motivate, reward and retain management talent in the highly competitive energy industry in order to achieve the objectives that contribute to the overall success of the Company. | |

vii

Table of Contents

Elements of Compensation

The main elements of the 2013 executive compensation program are as follows:

| Ø |

Base Salary (Cash) — Provides a predictable base compensation for day-to-day job performance; | |

| Ø |

Short-Term Performance Incentives (Cash) — Utilizes metrics specific to each executive in order to motivate them to deliver near-term results for stockholders, generally over a period that is no longer than two years; and | |

| Ø |

Long-Term Performance Incentives (Equity) — Focuses the attention of executives on delivering long-term stockholder value and on maintaining a significant personal investment in the Company through stock ownership. | |

Recent Changes to the Compensation Program

Executive compensation for fiscal 2013 was set early in the fiscal year, prior to the voting results at the Annual Meeting of Stockholders held in March of 2013. After meeting with many of our largest stockholders during the past two fiscal years and obtaining valuable feedback, the compensation program has been amended in each of the past two years.

These recent changes to the executive compensation program are as follows:

| Ø |

Shifting Long-Term Performance Incentive to Equity — Prior to 2013, the Company granted a combination of equity-based awards (restricted stock and stock appreciation rights (“SARs”)) and performance-based cash target awards tied to total return on capital goals. In 2013, as an interim step prior to an in-depth review of its long term incentive (“LTI”) approach, the Compensation Committee replaced the cash portion of the program with performance-based RSUs, utilizing the same relative total return on capital metric. For 2014, the Company further revised the mix of awards to be approximately two-thirds performance shares (split between two distinct performance metrics measured over three years against a peer group) and one-third time-vested RSUs (vesting ratably over a 3-year period). | |

| Ø |

Adoption of Relative Performance Conditions for Fiscal 2014 — As noted above, for fiscal 2014, the Compensation Committee devoted two-thirds of the LTI award to performance shares. The Committee established two distinct performance metrics: 3-year TSR relative to the Hay peer group and 3-year total return on capital relative to the Hay peer group. | |

| Ø |

CEO Compensation — To increase the CEO compensation tied to equity and moderate cash compensation, upon his appointment as CEO, Mr. Tanski’s salary was set at approximately the 25th percentile of the Hay Energy Industry data and an additional performance-based equity award was made so that total direct compensation is targeted at the 50th percentile. | |

| Ø |

Ownership Requirements were Increased for the CEO to Six Times Base Salary. Our CEO’s stock ownership is 22 times his base salary as of November 29, 2013. | |

Other Key Compensation Features

| Ø |

The Company does not provide tax “gross-ups”; | |

| Ø |

Executive officers and other officers are required to meet stock ownership guidelines that range from one to six times base salary; | |

| Ø |

Equity incentive plans prohibit the repricing or exchange of equity awards without stockholder approval; | |

| Ø |

The Committee has engaged two independent compensation consultants to assist in setting compensation; and | |

| Ø |

All change-in-control agreements are double triggered. | |

viii

Table of Contents

“Reported” Pay Does Not Adequately Reflect The Changing Compensation Approach

Given changes by the Compensation Committee (following stockholder outreach) to the LTI program as discussed above, we have provided an additional, supplemental compensation table below in order to distinguish the annual short-term cash incentive from the 3-year long-term cash incentive, to remove the impact of the 2013 move from a cash-based LTI award to an RSU-based LTI award, and to remove the volatile, significant effects of changes in actuarial assumptions on the value of the named executive officers’ pension benefits disclosed in the 2013 Summary Compensation Table. This table, however, is not a substitute for the Summary Compensation Table, which can be found at page 41 in this proxy statement.

| Name and Principal Position |

Year | Salary ($) |

Short-Term Cash Incentive ($) |

Long-Term Cash Incentive (1)($) |

Stock Awards (2)($) |

Option Awards ($) |

All

Other Compensation ($) |

Total ($) |

||||||||||||||||||||||||

| David F. Smith |

2013 | 776,600 | 1,378,894 | 1,439,730 | N/A | 909,650 | 168,863 | 4,673,737 | ||||||||||||||||||||||||

| Chairman and Chief |

2012 | 880,000 | 1,073,160 | 1,317,400 | 550,900 | 448,008 | 151,211 | 4,420,679 | ||||||||||||||||||||||||

| Executive Officer of the Company until 3/7/13, when named |

2011 | 835,000 | 1,457,075 | 1,091,232 | 598,734 | 574,838 | 171,440 | 4,728,319 | ||||||||||||||||||||||||

| Executive Chairman |

||||||||||||||||||||||||||||||||

| Ronald J. Tanski |

2013 | 726,148 | 802,829 | 809,260 | N/A | 458,072 | 107,613 | 2,903,922 | ||||||||||||||||||||||||

| President and Chief |

2012 | 681,000 | 640,140 | 752,800 | 344,313 | 280,005 | 96,124 | 2,794,382 | ||||||||||||||||||||||||

| Executive Officer of the Company since 3/7/13 |

2011 | 652,500 | 810,144 | 631,500 | 399,156 | 383,225 | 104,539 | 2,981,064 | ||||||||||||||||||||||||

| David P. Bauer |

2013 | 318,000 | 233,000 | 225,840 | N/A | 113,353 | 26,042 | 916,235 | ||||||||||||||||||||||||

| Treasurer and Principal |

2012 | 293,750 | 215,000 | 75,280 | 68,863 | 56,001 | 23,728 | 732,622 | ||||||||||||||||||||||||

| Financial Officer of the |

2011 | 268,750 | 200,000 | 50,520 | 79,831 | 76,645 | 20,039 | 695,785 | ||||||||||||||||||||||||

| Company |

||||||||||||||||||||||||||||||||

| Matthew D. Cabell |

2013 | 591,250 | 774,981 | 564,600 | N/A | 356,866 | 80,721 | 2,368,418 | ||||||||||||||||||||||||

| President of Seneca |

2012 | 573,750 | 445,402 | 564,600 | 309,881 | 252,005 | 58,412 | 2,204,050 | ||||||||||||||||||||||||

| Resources Corporation |

2011 | 547,789 | 676,060 | 404,160 | 359,241 | 344,903 | 55,962 | 2,388,115 | ||||||||||||||||||||||||

| Anna Marie Cellino |

2013 | 497,000 | 543,942 | 432,860 | N/A | 249,901 | 78,171 | 1,801,874 | ||||||||||||||||||||||||

| President of National Fuel |

2012 | 482,250 | 585,861 | 423,450 | 206,588 | 168,003 | 79,695 | 1,945,847 | ||||||||||||||||||||||||

| Gas Distribution Corporation |

2011 | 458,750 | 551,853 | 336,800 | 239,494 | 229,935 | 76,204 | 1,893,036 | ||||||||||||||||||||||||

| John R. Pustulka |

2013 | 462,750 | 415,272 | 432,860 | N/A | 235,909 | 70,306 | 1,617,097 | ||||||||||||||||||||||||

| President of National Fuel |

2012 | 425,000 | 443,573 | 225,840 | 206,588 | 168,003 | 69,617 | 1,538,621 | ||||||||||||||||||||||||

| Gas Supply Corporation |

2011 | 383,750 | 448,201 | 176,820 | 239,494 | 229,935 | 67,309 | 1,545,509 | ||||||||||||||||||||||||

| (1) | For fiscal 2013, Long-Term Cash Incentive represents an estimated payment for the three-year performance period ended September 30, 2013. See footnote 3 to the Summary Compensation Table for more information. |

| (2) | This column as shown includes the full grant date fair value of Restricted Stock awards for fiscal 2012 and 2011 and excludes any value for performance-based RSU awards for fiscal 2013. |

CEO Compensation in Alignment with Peers

The Compensation Committee understands the importance of using benchmark data that reflects information from companies with comparable business segments over similar time periods. Reflected in the chart below is The Hay Group’s comparison of fiscal 2012 total direct compensation for the Company’s then CEO (Mr. Smith) against that of CEOs in our Hay peer group. The Company’s CEO total direct compensation, shown in the table below, is in line with that of our peers.

Fiscal 2012 is the most recent complete fiscal year for which proxy statement data is available. 2013 compensation may not yet be accurately compared to peers because 2013 compensation data for those peers is not yet available.

ix

Table of Contents

| ||||

| Chairman and CEO |

||||

| Compared to CEO proxy data for fiscal year 2012 |

||||

| Total

Direct Compensation | ||||||||

| Company | Title | Sales ($M) |

Actual |

Target | ||||

| AGL Resources, Inc. |

Chairman, President & CEO | $3,922 | $4,411,529 | $5,422,429 | ||||

| Atmos Energy Corp. |

President & CEO | $3,438 | $3,716,482 | $3,510,867 | ||||

| Cabot Oil & Gas Corp. |

Chairman, President & CEO | $1,205 | $7,625,350 | $6,553,555 | ||||

| Energen Corp. |

Chairman & CEO | $1,617 | $3,737,734 | $3,973,008 | ||||

| EQT Corp. |

Chairman, President & CEO | $1,642 | $7,886,279 | $6,717,202 | ||||

| MDU Resources Group Inc |

President & CEO | $4,075 | $2,165,527 | $2,397,277 | ||||

| New Jersey Resources Corp. |

Chairman, President & CEO | $2,249 | $2,445,243 | $2,445,243 | ||||

| Northwest Natural Gas Co. |

President & CEO | $731 | $1,735,204 | $1,854,929 | ||||

| Questar Corp. |

Chairman, President & CEO | $1,099 | $3,522,862 | $3,315,507 | ||||

| Quicksilver Resources Inc |

President & CEO | $709 | $4,009,998 | $4,692,498 | ||||

| Range Resources Corp. |

President & CEO | $1,408 | $7,443,134 | $7,188,230 | ||||

| SM Energy Co. |

CEO | $1,532 | $4,691,137 | $4,762,291 | ||||

| Southwest Gas Corp. |

President & CEO | $1,928 | $2,257,698 | $2,180,418 | ||||

| UGI Corp. |

Chairman & CEO | $6,519 | $5,108,935 | $5,582,345 | ||||

| Ultra Petroleum Corp. |

Chairman, President & CEO | $1,114 | $5,800,000 | $5,400,000 | ||||

| Whiting Petroleum Corp. |

Chairman & CEO | $2,170 | $7,969,957 | $6,305,539 | ||||

|

Summary Statistics |

||||||||

| 75th Percentile |

$2,546 | $6,210,784 | $5,763,144 | |||||

| Average |

$2,210 | $4,657,942 | $4,518,834 | |||||

| Median |

$1,629 | $4,210,764 | $4,727,395 | |||||

| 25th Percentile |

$1,182 | $3,253,457 | $3,097,941 | |||||

| National Fuel Gas Company |

Chairman & CEO | $1,830 | $3,752,068 | $3,558,908 | ||||

|

Percentile Rank |

58% | 40% | 34% | |||||

Total Direct Compensation = base salary + bonus + long-term incentives (target value for cash and grant date value for equity).

© 2013 Hay Group. All rights reserved

x

Table of Contents

NATIONAL FUEL GAS COMPANY

6363 MAIN STREET

WILLIAMSVILLE, NEW YORK 14221

January 24, 2014

Dear Stockholders of National Fuel Gas Company:

We are pleased to invite you to join us at the Annual Meeting of Stockholders of National Fuel Gas Company. The meeting will be held at 9:30 a.m. local time on March 13, 2014, at The Ritz-Carlton Golf Resort, Naples, 2600 Tiburón Drive, Naples, Florida, 34109. The matters on the agenda for the meeting are outlined in the enclosed Notice of Annual Meeting and Proxy Statement.

So that you may elect Company directors and secure the representation of your interests at the Annual Meeting, we urge you to vote your shares. The preferred methods of voting are either by telephone or by Internet as described on the proxy card. These methods are both convenient for you and reduce the expense of soliciting proxies for the Company. If you prefer not to vote by telephone or the Internet, please complete, sign and date your proxy card and mail it in the envelope provided. The Proxies are committed by law to vote your shares as you instruct on the proxy card, by telephone or by Internet.

A company’s annual proxy statement contains important stockholder and/or company proposals for which votes are needed in order to be passed — and your vote is always important. Stockholder voting is the primary means by which stockholders can influence a company’s operations and its corporate governance. In fact, stockholders who do vote can influence the outcome of the election in greater proportion than their percentage share ownership.

Your vote is important. Please make your voice heard by voting your shares on these important matters.

If you plan to be present at the Annual Meeting, you may so indicate when you vote by telephone or the Internet, or you can check the “WILL ATTEND MEETING” box on the proxy card. Even if you plan to be present, we encourage you to promptly vote your shares either by telephone or the Internet, or to complete, sign, date and return your proxy card in advance of the meeting. If you later wish to vote in person at the Annual Meeting, you can revoke your proxy by giving written notice to the Secretary of the Annual Meeting and/or the Trustee (as described on the first page of this proxy statement), and/or by casting your ballot at the Annual Meeting.

Coffee will be served at 9:00 a.m. and I look forward to meeting with you at that time.

Please review the proxy statement and take advantage of your right to vote.

Sincerely yours,

David F. Smith

Executive Chairman of the Board of Directors

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on March 13, 2014

To the Stockholders of National Fuel Gas Company:

Notice is hereby given that the Annual Meeting of Stockholders of National Fuel Gas Company (the “Company”) will be held at 9:30 a.m. local time on March 13, 2014 at The Ritz-Carlton Golf Resort, Naples, 2600 Tiburón Drive, Naples, Florida, 34109. The doors to the meeting will open at 9:00 a.m. local time. At the meeting, action will be taken with respect to:

| (1) | the election of three directors to hold office for three-year terms as provided in the attached proxy statement and until their respective successors have been elected and qualified; |

| (2) | ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2014; |

| (3) | advisory approval of named executive officer compensation; and |

| (4) | a Stockholder Proposal |

and such other business as may properly come before the meeting or any adjournment or postponement thereof.

Stockholders of record at the close of business on January 13, 2014, will be entitled to vote at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

PAULA M. CIPRICH

General Counsel and Secretary

January 24, 2014

Important Notice Regarding The Availability Of Proxy Materials For The Stockholder

Meeting To Be Held On March 13, 2014

The proxy statement and summary annual report to security holders and financial statements are available at

proxy.nationalfuelgas.com

| YOUR VOTE IS IMPORTANT Please vote by telephone or Internet.

Whether or not you plan to attend the meeting, and whatever the number of shares you own, please vote your shares either by telephone or the Internet as described in the proxy/voting instruction card and reduce National Fuel Gas Company’s expense in soliciting proxies. Alternatively, you may complete, sign, date and promptly return the enclosed proxy/voting instruction card in the accompanying envelope, which requires no postage if mailed in the United States. |

||||||

Table of Contents

6363 MAIN STREET

WILLIAMSVILLE, NEW YORK 14221

PROXY STATEMENT

GENERAL INFORMATION

Introduction

This proxy statement is furnished to the holders of National Fuel Gas Company (the “Company”) common stock (the “Common Stock”) in connection with the solicitation of proxies on behalf of the Board of Directors of the Company (the “Board of Directors” or the “Board”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on March 13, 2014, or any adjournment or postponement thereof. This proxy statement and the accompanying proxy/voting instruction card are first being mailed to stockholders on or about January 24, 2014.

Solicitation of Proxies

All costs of soliciting proxies will be borne by the Company. MacKenzie Partners, Inc., 105 Madison Avenue, New York, NY 10016, has been retained to assist in the solicitation of proxies by mail, telephone, and electronic communication and will be compensated in the estimated amount of $12,500 plus reasonable out-of-pocket expenses.

Record Date, Outstanding Voting Securities and Voting Rights

Only stockholders of record at the close of business on January 13, 2014, will be eligible to vote at the Annual Meeting or any adjournment or postponement thereof. As of that date, 83,745,862 shares of Common Stock were issued and outstanding. The holders of 41,872,932 shares will constitute a quorum at the meeting.

Each share of Common Stock entitles the holder thereof to one vote with respect to each matter that is subject to a vote at the Annual Meeting. Shares may not be voted unless the owner is present or represented by proxy. To be represented by proxy, a stockholder can return a signed proxy card or use the telephone or Internet voting procedures. All shares that are represented by effective proxies received by the Company in time to be voted shall be voted by the authorized Proxy at the Annual Meeting or any adjournment or postponement thereof.

If you hold your shares through a broker, bank or other nominee (in “street name”), you will receive instructions from them on how to vote your shares. If you do not give the broker specific instructions on how you would like your shares to be voted, your broker may nonetheless vote your shares on “routine” matters such as Proposal 2 — Ratification of Independent Auditor. However, your broker is prohibited from voting uninstructed shares on “non-routine” matters such as Proposal 1 — Election of Directors. Proposal 3 — Advisory Approval of Named Executive Officer Compensation and Proposal 4 — Stockholder Proposal. The absence of voting instruction results in what is called a “broker non-vote” on those proposals and will not be counted. Your vote is important. Please make your voice heard by voting your shares on these important matters.

Where stockholders direct how their votes shall be cast, shares will be voted in accordance with such directions. Proxies submitted with abstentions and broker non-votes will be included in determining whether or not a quorum is present. Abstentions and broker non-votes will not be counted in tabulating the number of votes cast on proposals submitted to stockholders and therefore will have no effect on the outcome of the votes.

The proxy also confers discretionary authority to vote on all matters that may properly come before the Annual Meeting, or any adjournment or postponement thereof, respecting (i) matters of which the Company did not have timely notice but that may be presented at the meeting; (ii) approval of the minutes

1

Table of Contents

of the prior meeting; (iii) the election of any person as a director if a nominee is unable to serve or for good cause will not serve; (iv) any stockholder proposal omitted from this proxy statement pursuant to Rule 14a-8 or 14a-9 of the Securities and Exchange Commission’s (the “SEC”) proxy rules; and (v) all matters incident to the conduct of the meeting.

Attending the Meeting

You are entitled to attend the Annual Meeting if you are a stockholder as of the close of business on January 13, 2014, the record date. In order to be admitted to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as driver’s license or passport, and proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Revoking a Proxy

Any stockholder giving a proxy may revoke it at any time prior to the voting thereof by mailing a revocation or a subsequent proxy to Paula M. Ciprich, General Counsel and Secretary of the Company, at the National Fuel Gas Company address noted below, by voting a subsequent proxy by Internet or phone, or by filing written revocation at the meeting with Ms. Ciprich, Secretary of the meeting, or by casting a ballot at the meeting. If you are an employee stockholder or retired employee stockholder, you may revoke voting instructions given to the Trustee by following the instructions under “Employee and Retiree Stockholders” in this proxy statement.

Employee and Retiree Stockholders

If you are a participant in the Company’s Employee Stock Ownership Plan or any of the Company’s Tax-Deferred Savings Plans (the “Plans”), the proxy card will also serve as a voting instruction form to instruct Vanguard Fiduciary Trust Company (the “Trustee” for the Plans), as to how to vote your shares. All shares of Common Stock for which the Trustee has not received timely directions shall be voted by the Trustee in the same proportion as the shares of Common Stock for which the Trustee received timely directions, except in the case where to do so would be inconsistent with the provisions of Title I of the Employee Retirement Income Security Act (“ERISA”). If the voting instruction form is returned signed but without directions marked for one or more items, regarding the unmarked items you are instructing the Trustee and the Proxies to vote FOR Proposals 1, 2 and 3 and AGAINST Proposal 4. Participants in the Plan(s) may also provide those voting instructions by telephone or the Internet. Those instructions may be revoked by re-voting or by written notice to the Trustee on or before March 11, 2014 in care of the following address:

To: Vanguard Fiduciary Trust Co.

c/o National Fuel Gas Company

Attn: Legal Department

6363 Main Street

Williamsville, NY 14221

Multiple Copies of Proxy Statement

The Company has adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name may receive only one copy of the proxy statement and the Company’s annual report. However, if any stockholder wishes to revoke consent for householding and receive a separate summary annual report, financial statements or proxy statement for the upcoming Annual Meeting or in the future, he or she may telephone, toll-free, 1-800-542-1061. The stockholder will need their 12-digit Investor ID number and should simply follow the prompts. Stockholders may also write Broadridge Householding Department, 51 Mercedes Way,

2

Table of Contents

Edgewood, NY 11717. Stockholders sharing an address who wish to receive a single set of reports may do so by contacting their banks or brokers if they are the beneficial holders, or by contacting Broadridge at the address provided above if they are the record holders. This procedure will reduce our printing costs and postage fees, and reduce the quantity of paper arriving at your address.

Stockholders who participate in householding will continue to receive separate proxy cards. Householding will not affect your dividend check mailings.

For additional information on householding, please see “IMPORTANT NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS” in this proxy statement.

Other Matters

The Board of Directors does not know of any other matter that will be presented for consideration at the Annual Meeting. If any other matter does properly come before the Annual Meeting, the Proxies will vote in their discretion on such matter.

Annual Report

Mailed herewith is a copy of the Company’s Summary Annual Report for the fiscal year ended September 30, 2013 (“fiscal 2013”). Also enclosed are the financial statements for fiscal 2013. The Company will furnish any exhibit to the Form 10-K upon request to the Secretary at the Company’s principal office, and upon payment of $5 per exhibit.

3

Table of Contents

PROPOSAL 1. ELECTION OF DIRECTORS

Three directors are to be elected at the Annual Meeting. The nominees for the three directorships are: Ronald W. Jibson, Jeffrey W. Shaw, and Ronald J. Tanski. The nomination process is discussed under “Nominating/Corporate Governance” on page 11 of this proxy statement.

The services of Mr. Robert T. Brady and Mr. Rolland E. Kidder conclude at the 2014 Annual Meeting, in accordance with the provisions of the Company’s Corporate Governance Guidelines on Director Age. Mr. Brady has been a director since 1995 and has served as the Company’s Lead Director since 2003. In addition, Mr. Kidder has been a director since 2002. The Board is deeply appreciative of their strong leadership and valuable contributions.

The Company’s Restated Certificate of Incorporation provides that the Board of Directors shall be divided into three classes, and that these three classes shall be as nearly equal in number as possible. (A class of directors is the group of directors whose terms expire at the same annual meeting of stockholders.) As well, the Company’s Restated Certificate of Incorporation provides that any elected director shall hold office until their successors are elected and qualify, subject to prior death, resignation, retirement, disqualification or removal from office. Accordingly, Messrs. Jibson, Shaw and Tanski have been nominated for terms of three years and until their respective successors shall be elected and shall qualify.

It is intended that the Proxies will vote for the election of Messrs. Jibson, Shaw and Tanski as directors, unless they are otherwise directed by the stockholders. Although the Board of Directors has no reason to believe that any of the nominees will be unavailable for election or service, stockholders’ proxies confer discretionary authority upon the Proxies to vote for the election of another nominee for director in the event any nominee is unable to serve, or for good cause will not serve. Messrs. Jibson, Shaw and Tanski have consented to being named in this proxy statement and to serve if elected.

The affirmative vote of a plurality of the votes cast by the holders of shares of Common Stock entitled to vote is required to elect each of the nominees for director.

Refer to the following pages for information concerning the three nominees for director, as well as concerning the six incumbent directors of the Company whose current terms will continue after the Annual Meeting, including information with respect to their principal occupations and certain other positions held by them.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR

THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW.

Nominees for Election as Directors for Three-Year Terms to Expire in 2017

Ronald W. Jibson has been Chairman of the Board of Questar Corporation (“Questar”), since July 2012 and President and Chief Executive Officer since June 2010. He is also President and CEO of both Questar Gas Company (a natural gas utility) and Wexpro Company (an exploration and production subsidiary), and he is Chairman of Questar Pipeline Company. Mr. Jibson has been a director of Questar since 2010. Mr. Jibson has held various positions at Questar and its subsidiaries over his 33-year career, including Senior Vice President, Executive Vice President, General Manager of Operations and Director of Engineering. Mr. Jibson has served on the Board of IDACORP, Inc. since September of 2013. Mr. Jibson has additional significant industry board experience as Chairman of the Board of Directors of the American Gas Association (“AGA”) and as past Chairman of the Western Energy Institute. He also serves on the Board of Gas Technology Institute. He serves as Chairman of Utah State University’s Board of Trustees and the Chair of the Salt Lake Chamber Board of Directors, as well as past Chair of the Economic Development Corporation of Utah. Mr. Jibson, 60, is a licensed engineer in the state of Utah and received his B.S. in engineering from Utah State University and MBA from Westminster College. (1)

| (1) | All ages are as of the Annual Meeting date. |

4

Table of Contents

Mr. Jibson brings to the National Fuel Board his substantial industry experience at Questar, across three major business segments (utility, pipeline and exploration and production) in which the Company also participates. Mr. Jibson will provide insight with respect to strategic business planning, operations, performance, and regulatory issues. In addition, his participation in industry organizations will provide the Board with knowledge and perspectives on current natural gas industry trends and developments.

Jeffrey W. Shaw has been President and Chief Executive Officer of Southwest Gas Corporation (“Southwest”) since July 2012. He was named Chief Executive Officer and a director of Southwest in 2004. Previously Mr. Shaw, a CPA, held various positions at Southwest, including Director of Internal Audit, Controller and Chief Accounting Officer, Vice President/Controller and Chief Accounting Officer, Vice President and Treasurer, Senior Vice President/Finance and Treasurer, Senior Vice President/Gas Resources and Pricing, and President. He worked for Arthur Anderson & Co. in its Dallas and Las Vegas offices in the audit division prior to joining Southwest in May of 1988. He is a member of the American Institute of Certified Public Accountants, the Nevada Society of CPAs and the Leadership Las Vegas Alumni Association. Mr. Shaw serves on the boards of the AGA and the UNLV Foundation, and is past President of the Western Energy Institute and past President of the Las Vegas Area Council of the Boy Scouts of America. Mr. Shaw, 55, received a B.S. in accounting from the University of Utah.

Mr. Shaw’s extensive executive management experience at an energy company with regulated businesses similar to those of the Company provides the Board with an additional and valuable perspective on the Company’s operations. In addition, Mr. Shaw’s accounting and finance background, and the significant roles he has held in this area over his career qualify him as an audit committee financial expert and position him to assist the Board in its audit oversight function.

Ronald J. Tanski has been President and Chief Executive Officer of the Company since March 2013. Prior to that Mr. Tanski served as President and Chief Operating Officer of the Company from July 2010 and as Treasurer and Principal Financial Officer from April 2004. Mr. Tanski was President of National Fuel Gas Supply Corporation (2) from July 2008 to July 2010 and President of National Fuel Gas Distribution Corporation (2) from February 2006 to July 2008. He was previously Treasurer of Distribution, Supply, Empire Pipeline, Inc. and National Fuel Resources, Inc. (2), as well as Senior Vice President of Distribution. Mr. Tanski also served in management roles at Seneca Resources Corporation (2), and other Company subsidiaries, including Empire Exploration, Inc. (merged into Seneca), and Horizon Energy Development, Inc. (sold in 2010). He is a Board Member of the Interstate Natural Gas Association of America (INGAA). Mr. Tanski, 61, holds a B.A. in biology and an MBA from the State University of New York at Buffalo, as well as a J.D. from the State University of New York at Buffalo School of Law.

Mr. Tanski has been employed by the Company since 1979, and during his career, as noted above, has served in numerous positions in both the regulated and non-regulated businesses. Mr. Tanski’s substantial management experience with the varied subsidiaries, and in particular, his financial background with the Company will assist the Board with in-depth review of the Company’s operations. Mr. Tanski also has deep ties to Western New York, the location of the Company’s corporate headquarters and a number of its significant business units.

Directors Whose Terms Expire in 2015

Philip C. Ackerman was Chief Executive Officer of the Company from October 2001 to February 2008, Chairman of the Board of the Company from January 2002 to March 2010, President of the Company from July 1999 to February 2006, Senior Vice President of the Company from June 1989 to July 1999 and Vice President of the Company from 1980 to June 1989. He was also President of National Fuel Gas Distribution Corporation (2) from October 1995 to July 1999 and Executive Vice President from June 1989 to October 1995, Executive Vice President of National Fuel Gas Supply Corporation (2) from

| (2) | Wholly-owned subsidiary of the Company |

5

Table of Contents

October 1994 to March 2002, President of Seneca Resources Corporation (2) from June 1989 to October 1996, President of Horizon Energy Development, Inc. (2) from September 1995 to March 2008 and President of certain other non-regulated subsidiaries of the Company from prior to 1992 to March 2008. Mr. Ackerman is also currently a Director of Associated Electric and Gas Insurance Services Limited. Mr. Ackerman holds a B.S. in accounting from the State University of New York at Buffalo and a J.D. from Harvard University. Mr. Ackerman, 70, has been a Company director since 1994.

Mr. Ackerman’s more than 40 years’ involvement with the Company, including his experience as President of all of the Company’s major subsidiaries, enables him to provide the Board with an in-depth perspective on the Company. During his tenure with the Company, National Fuel grew from a regional utility company with $300 million in assets to a fully integrated energy company with over $5.1 billion in assets. Also, Mr. Ackerman has deep ties to Western New York, the location of the Company’s corporate headquarters and a number of its significant business operations.

R. Don Cash has been Chairman Emeritus since May 2003, and a Board Director since May 1978, of Questar Corporation, an integrated natural gas company headquartered in Salt Lake City, Utah. He was Chairman of Questar from May 1985 to May 2003, Chief Executive Officer of Questar from May 1984 to May 2002 and President of Questar from May 1984 to February 1, 2001. Mr. Cash has been a director of Zions Bancorporation since 1982, a director of Associated Electric and Gas Insurance Services Limited since 1993 and is a director of the Ranching Heritage Association. He was a director of TODCO (The Offshore Drilling Company) from May 2004 to July 2007 and a former Trustee, until September 2002, of the Salt Lake Organizing Committee for the Olympic Winter Games of 2002. Mr. Cash holds a B.S. in engineering from Texas Tech University. Mr. Cash, 71, has been a Company director since 2003.

Because of his nearly 18 years of experience at the helm of Questar Corporation and over 30 years of directorship experience on multiple oil and gas industry-related boards, Mr. Cash provides a broad perspective on the issues facing the Company. In particular, Mr. Cash’s depth of experience with Questar (a company which at the time had utility, pipeline and storage and exploration and production businesses) uniquely positions him to provide valuable insights and to inform Board discussions.

Stephen E. Ewing was Vice Chairman of DTE Energy (“DTE”), a Detroit-based diversified energy company involved in the development and management of energy-related businesses and services nationwide, from November 2005 to December 2006. Two of DTE’s subsidiaries are Detroit Edison, the nation’s 7th largest electric utility, and Michigan Consolidated Gas Co. (“MichCon”), the nation’s 10th largest natural gas local distribution company. Mr. Ewing also had responsibility for DTE’s exploration and production subsidiary (DTE Gas Resources) with operations in the Antrim and Barnett Shales. He was also at various times Group President, Gas Division, DTE, President and Chief Operating Officer of MCN Energy Group, Inc. (the then parent of MichCon and a company which had utility, pipeline and storage and exploration and production businesses) and President and Chief Executive Officer of MichCon, until it was acquired by DTE. Mr. Ewing has been a Director of CMS Energy since July 2009. He was also Chairman of the Board of Directors of the AGA for 2006, a member of the National Petroleum Council, and Chairman of the Midwest Gas Association and the Natural Gas Vehicle Coalition. He is currently a Trustee and past Chairman of the Board of The Skillman Foundation, a not-for-profit foundation focused on providing education for low-income children, Chairman of the Auto Club of Michigan and Chairman of the Board of the Auto Club Group (AAA). Mr. Ewing holds a B.A. from DePauw University and an MBA from Michigan State University, and completed the Harvard Advanced Management Program. Mr. Ewing, 69, has been a Company director since 2007.

Mr. Ewing’s extensive executive management experience at energy companies with regulated businesses similar to those of the Company provides the Board with a valuable perspective on the Company’s regulated operations. Also, his responsibility for DTE’s exploration and production subsidiary, with operations in the Antrim and Barnett Shales, enables Mr. Ewing to provide knowledgeable insights with regard to the Company’s exploration and production business.

| (2) | Wholly-owned subsidiary of the Company |

6

Table of Contents

Directors Whose Terms Expire in 2016

David C. Carroll has been President and CEO of Gas Technology Institute (“GTI”) since 2006. He joined GTI in 2001 as Vice President of Business Development. From 1996 to 2001, he worked for Praxair, Inc., serving as Director of Business Development from 1999 to 2001. Prior to that, Mr. Carroll held positions of increasing responsibility with Liquid Carbonic Industries, a subsidiary of Chicago Bridge & Iron, from 1994 to 1996, and Air Products and Chemicals, Inc. from 1980 to 1994. All of these companies are industrial gas producers and manufacturers. He is a member of the Society of Gas Lighting. Mr. Carroll served on the board of Versa Power Systems, Inc. from 2006 through 2012. He was also Chairman of the steering committee for the 17th International Conference and Exhibition on Liquified Natural Gas in Houston (2013). In June 2015, Mr. Carroll will become President of the International Gas Union as the United States prepares to host the 2018 World Gas Conference in Washington, D.C. Mr. Carroll earned a B.S. in chemical engineering from the University of Pittsburgh, an MBA from Lehigh University, and has completed the Stanford Executive Program at Stanford University’s Graduate School of Business. Mr. Carroll, 57, has been a Company director since June 2012.

As a highly respected, nationally recognized leader with a multi-faceted knowledge of the natural gas industry, Mr. Carroll brings both industry and leadership experience to the Board. His technical expertise on unconventional gas production, transmission and distribution pipeline integrity, and end-use technologies is directly relevant to the Company’s business operations. In addition, Mr. Carroll’s involvement in both the domestic and international natural gas communities provides the Board with a broad perspective on emerging issues.

Craig G. Matthews was President, Chief Executive Officer and Director of NUI Corporation, a diversified energy company acquired by AGL Resources Inc. on November 30, 2004, from February 2004 to December 2004. In addition, he was Vice Chairman, Chief Operating Officer and Director of KeySpan Corporation (“KeySpan”, previously Brooklyn Union Gas Co.), a natural gas utility company, from March 2001 to March 2002, and held various positions over a 36-year career at KeySpan, including Executive Vice President, and Chief Financial Officer. He was also a Director of KeySpan as well as its exploration and production subsidiary Houston Natural Gas Co. He was a Director of Hess Corporation (formerly Amerada Hess Corporation) from 2002 until 2013, and has been a Board member of Republic Financial Corporation since May 2007. Mr. Matthews is a Member and Former Chairman of the Board of Trustees, Polytechnic Institute of New York University, and is a member of the National Advisory Board for the Salvation Army as well as the founding Chairman of the New Jersey Salvation Army Board. He received his B.S. in civil engineering from Rutgers in 1965, and completed his M.S. in industrial management at Brooklyn Polytechnic University. He also holds a Doctor of Engineering (Honorary) from NYU/POLY received in 2009. Mr. Matthews, 71, has been a Company director since 2005.

Mr. Matthews’ substantial background in the energy industry, including executive, managerial and financial experience with KeySpan and NUI Corporation over 37 years, and particularly his experience in applying accounting principles and developing financial strategy at energy companies, makes him highly qualified for his service as Chairman of the Company’s Audit Committee. As more fully described in the Audit Committee discussion on page 16, Mr. Matthews qualifies as an “audit committee financial expert” under the Securities and Exchange Commission Rules. During his career, Mr. Matthews has had responsibilities in the areas of marketing, information systems, engineering, finance, and strategic planning.

David F. Smith became Executive Chairman of the Board of the Company on March 7, 2013. Prior to that he served as Chairman of the Board from March 11, 2010 and Chief Executive Officer of the Company from February 2008. Mr. Smith was Chairman of National Fuel Gas Distribution Corporation (2), and National Fuel Gas Supply Corporation (2) and Chairman of Empire Pipeline, Inc. (2) and Seneca Resources Corporation (2) from April of 2008 until March of 2013. He was previously President of the Company from February 2006 to June 2010 and Vice President from April 2005 to February 2006, President from April 2005 to July 2008 and Senior Vice President from June 2000 to April

| (2) | Wholly-owned subsidiary of the Company |

7

Table of Contents

2005 of National Fuel Gas Supply Corporation (2), and President from July 1999 to April 2005 and Senior Vice President from January 1993 to July 1999 of National Fuel Gas Distribution Corporation (2). Mr. Smith was also President of Empire State Pipeline (2) from April 2005 through July 2008, and President or Chairman of various non-regulated subsidiaries of the Company. He is a Board member of the AGA (Executive Committee and Policy Committee), American Gas Foundation, Gas Technology Institute (Executive Committee and Audit Committee), the Business Council of New York State (Chairman and member of the Executive Committee), the Buffalo Niagara Enterprise (immediate past Chairman and member of the Executive Committee), the State University of New York at Buffalo Law School Dean’s Advisory Council and The Buffalo Sabres Foundation. Mr. Smith holds a B.A. in political science from the State University of New York at Fredonia, as well as a J.D. from the State University of New York at Buffalo School of Law. Mr. Smith, 60, has been a Company director since 2007.

Mr. Smith has been employed by the Company since 1978, and during his tenure has served as President of the Company’s pipeline and storage, and utility subsidiaries, and Chairman of Seneca Resources Corporation. He has a long and active participation in industry groups that tackle important issues facing our industry. Also, Mr. Smith has deep ties to Western New York, the location of the Company’s corporate headquarters and a number of its significant business units.

Annual Meeting Attendance

Last year all directors attended the 2013 Annual Meeting, and they are expected to do so this year. A meeting of the Board of Directors will take place on the same day and at the same place as the Annual Meeting (and probably future years), and directors are expected to attend all meetings. If a director is unable to attend a Board meeting in person, participation by telephone is permitted and in that event the director may not be physically present at the Annual Meeting of Stockholders.

Director Independence

The Board of Directors has determined that directors Ackerman, Brady, Carroll, Cash, Ewing, Kidder and Matthews are independent, and that Mr. Smith, Executive Chairman of the Board, is not independent due to his employment relationship with the Company. Mr. Reiten and Mr. Salerno, whose Board service ended in fiscal 2013, had been determined by the Board to be independent. The Board has determined that Messrs. Jibson and Shaw are independent and that Mr. Tanski is not independent due to his employment with the Company. The Board’s determinations of director independence were made in accordance with the listing standards of the New York Stock Exchange (the “NYSE”) and SEC regulations. In making its independence determinations, the Board considered that Mr. Brady is Executive Chairman of Moog, which maintains its headquarters in the Company’s utility service territory, and that payments made by Moog to Company affiliates for natural gas service in each of Moog’s last three fiscal years were less than (i) $1,000,000 or (ii) 2% of Moog’s consolidated gross revenues for the applicable fiscal year. Similarly, the Board considered that Mr. Carroll is President and Chief Executive Officer of GTI, an organization that receives payments from the Company for dues and fees to support research and development, and that such payments in each of GTI’s last three fiscal years were less than (i) $1,000,000 or (ii) 2% of GTI’s consolidated gross revenues for the applicable fiscal year. The Board also considered that a son of Mr. Kidder is employed by an affiliate of the Company (since before Mr. Kidder became a Company director) in a non-executive supervisory position, at a rate of total compensation that does not implicate the SEC’s regulations regarding related person transactions.

Board Leadership Structure

The Board of Directors has decided that the appropriate leadership structure at the present time is to separate the CEO and Chairman positions. The Board believes that Mr. Smith’s role as Chairman and Mr. Tanski’s position as Chief Executive Officer, since March of 2013, is an effective leadership model given Mr. Smith’s experience in the role of CEO in the past and his experience as Chairman of the Board and Mr. Tanski taking on the role of CEO. The Board believes this is the optimal

| (2) | Wholly-owned subsidiary of the Company |

8

Table of Contents

leadership at this time. As in the past, it is the Board’s opinion that the stockholders’ interests are best served by allowing the Board to retain flexibility to determine the optimal organizational structure for the Company at a given time, including whether the Chairman role should be filled by the CEO who serves on the Board. At times in the past the roles have been separate and have been combined. The members of the Board possess considerable experience and unique knowledge of the challenges and opportunities the Company faces, have significant industry experience and are in the best position to evaluate its needs and how best to organize the capabilities of the directors and management to meet those needs.

The independent directors met three times during fiscal 2013, consistent with the requirements of the NYSE rules. In addition, non-management directors meet at regularly scheduled executive sessions without management. The sessions have been chaired by the Lead Independent Director, Robert T. Brady. The Board of Directors provides a process for stockholders and other interested parties to send communications to the Board or to certain directors. Communications to the Lead Director, to the non-management directors as a group, or to the entire Board should be addressed as follows: Lead Independent Director, c/o 6363 Main Street, Williamsville, NY 14221. For the present, all stockholder and interested parties’ communications addressed in such manner will go directly to the indicated directors. If the volume of communication becomes such that the Board determines to adopt a process for determining which communications will be relayed to Board members, that process will appear on the Company’s website at www.nationalfuelgas.com.

Diversity

Under the Company’s Corporate Governance Guidelines, the Board of Directors is required, when selecting candidates for re-election and candidates for Board membership, to consider factors that include a diversity of experience related to the business segments in which the Company operates, as well as a diversity of perspectives to be brought to the Board by the individual members.

Meetings of the Board of Directors and Standing Committees

In fiscal 2013, there were four meetings of the Board of Directors. In addition, directors attended meetings of standing or pro tempore committees. The Audit Committee held nine meetings, the Compensation Committee held seven meetings, the Executive Committee did not meet, and the Nominating/Corporate Governance Committee held three meetings. During fiscal 2013, all directors attended at least 75% of the aggregate of meetings of the Board and of the committees of the Board on which they served.

The table below shows the number of meetings conducted in fiscal 2013 and the directors who serve or did serve during fiscal 2013 on these committees. As previously announced, Mr. Reiten retired from the Board on March 7, 2013, and Mr. Salerno stepped down on June 12, 2013. As noted above, Messrs. Brady and Kidder will conclude their tenure as Directors at the 2014 Annual Meeting.

| BOARD COMMITTEES | ||||||||

| DIRECTOR |

Audit | Compensation | Executive | Nominating/ Corporate Governance | ||||

| Philip C. Ackerman |

X | |||||||

| Robert T. Brady |

X | X | X (Chair) | |||||

| David C. Carroll |

X | |||||||

| R. Don Cash |

X | X(Chair) | X | |||||

| Stephen E. Ewing |

X | X | ||||||

| Rolland E. Kidder |

X | X | ||||||

| Craig G. Matthews |

X (Chair) | X | ||||||

| Richard G. Reiten |

X | X | ||||||

| Frederic V. Salerno |

X | X | ||||||

| David F. Smith |

X (Chair) | |||||||

| Number of Meetings in Fiscal 2013 |

9 | 7 | 0 | 3 | ||||

9

Table of Contents

Audit

The Audit Committee is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held nine meetings during fiscal 2013 in order to review the scope and results of the annual audit, to receive reports of the Company’s independent registered public accounting firm and chief internal auditor, to monitor compliance with the Company’s Reporting Procedures for Accounting and Auditing Matters (included in this proxy statement as Appendix A) and to prepare a report of the committee’s findings and recommendations to the Board of Directors. The members of the committee are independent as independence for audit committee members is defined in NYSE listing standards, and in SEC regulations. No Audit Committee member simultaneously serves on the audit committees of more than three public companies. The Board limits the number of audit committees on which an Audit Committee member can serve to three, unless the Board has determined that such simultaneous service would not impair the ability of such members to serve effectively. The Company’s Board of Directors has determined that the Company has one audit committee financial expert (as defined by SEC regulations) serving on its Audit Committee, namely Mr. Matthews who is an independent director.

In connection with its review of the Company’s internal audit function, the Audit Committee in 2011 had a Quality Assessment performed by Ernst & Young that concluded that the Company’s Audit Services Department conducts its audits in accordance with the Institute of Internal Auditors International Standards for the Professional Practice of Internal Auditing (the “Standards”). The Standards state that an external Quality Assessment should be conducted at least once every five years.

Further information relating to the Audit Committee appears in this proxy statement under the headings “Audit Fees” and “Audit Committee Report.” A current copy of the Audit Committee charter is available to security holders on the Company’s website at www.nationalfuelgas.com.

Compensation

As described in the Compensation Discussion and Analysis in this proxy statement, the Compensation Committee held seven meetings during fiscal 2013, in order to review and determine the compensation of Company executive officers and to review reports and/or grant awards under the Company’s 2010 Equity Compensation Plan, the National Fuel Gas Company Performance Incentive Program, the National Fuel Gas Company 2012 Performance Incentive Program (both referred to herein as the “Performance Incentive Program” and separately referred to by name), the Annual At Risk Compensation Incentive Program (“AARCIP” or the “At Risk Plan”), and the Executive Annual Cash Incentive Program (“EACIP”). The members of the committee are independent as independence is defined in NYSE listing standards. The members of the committee are also “non-employee directors” as defined in SEC regulations and “outside directors” as defined in Federal tax regulations. A current copy of the charter of the Compensation Committee is available to security holders on the Company’s website at www.nationalfuelgas.com.

The Compensation Committee is responsible for various aspects of executive compensation, including approval of the base salaries and incentive compensation of the Company’s executive officers. The committee is authorized to evaluate director compensation and make recommendations to the full Board regarding director compensation. The committee may form subcommittees and delegate to those subcommittees such authority as the committee deems appropriate, other than authority required to be exercised by the committee as a whole. The committee also administers the Company’s 2010 Equity Compensation Plan, the 1997 Award and Option Plan, the At Risk Plan, and the National Fuel Gas Company Performance Incentive Program, and approves performance conditions and target incentives of executive officers under the EACIP. As described more fully in the Compensation Discussion and Analysis, the Company retained The Hay Group, and Meridian Compensation Partners, LLC, both independent compensation consulting firms, to assist in determining executive compensation. In addition, as set forth in the Compensation Committee’s charter, the Chief Executive Officer may and does make,

10

Table of Contents

and the committee may and does consider, recommendations regarding the Company’s compensation and employee benefit plans and practices. The committee then approves executive compensation as it deems appropriate.

Executive

The Executive Committee did not meet during fiscal 2013. The committee has, and may exercise, the authority of the full Board, except as may be prohibited by New Jersey corporate law (N.J.S.A.§ 14A:6-9).

Nominating/Corporate Governance

All the members of the Nominating/Corporate Governance Committee are independent, as independence is defined in NYSE listing standards. The committee makes recommendations to the full Board on nominees for the position of director. The committee also has duties regarding corporate governance matters as required by law, regulation or NYSE rules. The committee held three meetings during fiscal 2013. Stockholders may recommend individuals to the committee to consider as potential nominees. Procedures by which stockholders may make such recommendations are set forth in Exhibit B to the Company’s Corporate Governance Guidelines, described in the following paragraph.

In general, the committee’s charter provides for the committee to develop and recommend to the Board criteria for selecting new director nominees and evaluating unsolicited nominations, which criteria are included in this proxy statement as part of the Company’s Corporate Governance Guidelines. A current copy of the charter of the committee is available to stockholders on the Company’s website at www.nationalfuelgas.com and in print to stockholders who request a copy from the Company’s Secretary at its principal office. A current copy of the Corporate Governance Guidelines is included in this proxy statement as Appendix B, and is available to stockholders on the Company’s website at www.nationalfuelgas.com. Appendix B also addresses the qualifications and skills the committee believes are necessary in a director, and the committee’s consideration of stockholder recommendations for director. Stockholder recommendations identifying a proposed nominee and setting out his or her qualifications should be delivered to the Company’s Secretary at its principal office no later than September 26, 2014 in order to be eligible for consideration at the 2015 Annual Meeting of Stockholders.

Under the process for selecting new Board candidates, the Chairman and the Chief Executive Officer and the committee discuss the need to add a new Board member or to fill a vacancy on the Board. The committee will initiate a search, working with staff support and seeking input from Board members and senior management, hiring a search firm if necessary, and considering candidates recommended by stockholders in accordance with Exhibit B to the Corporate Governance Guidelines. In 2013, the Committee retained a search firm to assist in identifying qualified candidates. As part of that process, Messrs. Smith and Tanski reviewed the search firm’s list of potential candidates and identified a number of other possible candidates including Mr. Shaw. Candidates were then approached by the search firm as to their interest in serving on the Board. The firm was specifically directed to pursue diversity in candidates. Of the candidates approached, three were women, and each declined consideration. Mr. Jibson was separately identified by Messrs. Smith and Tanski for Committee consideration. The Committee interviewed Mr. Shaw and Mr. Jibson and subsequently recommended their nomination to the Board.

Charitable Contributions by Company

Within the preceding three years, the Company did not make any charitable contributions to any charitable organization in which a director served as an executive officer which exceeded the greater of $1 million or 2% of the charitable organization’s consolidated gross revenues in a single fiscal year.

Compensation Committee Interlocks and Insider Participation

There are no “Compensation Committee interlocks” or “insider participation” which SEC regulations or NYSE listing standards require to be disclosed in this proxy statement.

11

Table of Contents

The Company has an enterprise risk management program developed by senior management and the Board and overseen by the CEO. Under this program, major enterprise-wide risks have been identified, along with the mitigative measures to address and manage such risk. At each quarterly meeting of the Audit Committee, to which all Directors are invited and typically attend, the major risks and associated mitigative measures are reviewed. At each Board meeting, a specific presentation is made regarding one or two specific areas of risk. Additional review or reporting on enterprise risks is conducted as needed or as requested by the Board.