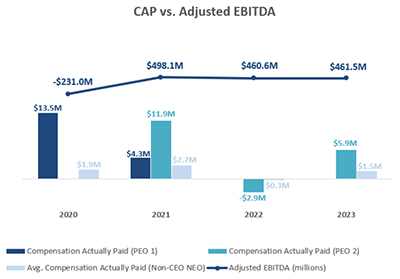

Accordingly, PSU awards were granted to Mr. Bassoul in November 2021, and to Mr. Mick and Ms. Williams-Ramey in 2022, with performance to be determined over a three-year period. The performance goals are based on (i) Adjusted EBITDA for the 2022, 2023 and 2024 calendar years ranging from $560,000,000 to $710,000,000, (ii) employee and guest satisfaction, and (iii) ESG achievement metrics. The target payout opportunity for the Adjusted EBITDA performance component requires achievement of Adjusted EBITDA that the Company has never achieved (see below graphic). To achieve the target payout by 2024, the Company must increase Adjusted EBITDA by 12% from the level achieved in 2021, compared to the 4% increase achieved in the three-year period ending in 2019. The maximum payout opportunity requires an aspirational level of Adjusted EBITDA representing a 43% increase from the level achieved in 2021. Additionally, to incentivize sustainable long-term growth, the PSU award provides for payout of additional shares upon achievement of three ESG goals: Guest Satisfaction, Employee Satisfaction and ESG relative performance.

The ESG relative performance payout opportunity will be based on the Company’s ESG risk ratings compared to its peer group. The ESG risk ratings measures a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks. The Company is assigned an ESG Risk Rating in eight separate categories based on its ESG risk exposure compared to its ESG risk management.

In light of the significant opportunity of Mr. Bassoul’s 2021 PSU award and the awards granted to other NEOs in 2022, the Compensation Committee does not intend to make any additional equity grants to Mr. Bassoul or any additional PSU grants to other NEOs until the earlier of (x) 2025 and (y) when the Company achieves $710,000,000 in Adjusted EBITDA. The Compensation Committee expects to provide annual RSU grants for other NEOs (excluding the CEO) on an annual basis for retention purposes. The Compensation Committee maintains flexibility to make additional equity grants to the CEO in the event that the Company achieves $710,000,000 in Adjusted EBITDA prior to the end of Mr. Bassoul’s tenure.

RSUs were awarded to Mr. Mick and Ms. Williams-Ramey on March 8, 2023 that were scheduled to vest on each of the first three anniversaries of the grant date. Effective December 20, 2023, all but 5,854 of Mr. Mick’s RSUs were converted into Converted Restricted Stock as described above in Merger Agreement and 280G Mitigation Actions.

Actions Taken in Connection with the Merger

As described above in Merger Agreement and 280G Mitigation Actions, Messrs. Bassoul and Mick received Converted Restricted Stock in respect of certain RSUs and PSUs. The Converted Restricted Stock will vest on the Closing Effective Time, subject to continued service through such date; provided, that, if the Closing Effective Time does not occur, the Converted Restricted Stock will be subject to the terms previously applicable to the RSUs and PSUs.

Following the 280G Mitigation Actions, Mr. Bassoul’s PSUs and Mr. Mick’s PSUs and RSUs that remained outstanding following the 280G Mitigation Actions remained subject to, and eligible to vest in accordance with, the original award agreement terms. For a description of the effect of certain terminations on the Converted Restricted Stock and continuing PSUs and RSUs, see Potential Payments upon Termination below.

Minimal Perquisites

The Company provides a limited number of perquisites and other personal benefits to the NEOs, which the Company believes are reasonable and consistent with market practices. The “All Other Compensation” column of the 2023 Summary Compensation Table sets forth these perquisites in accordance with the requirements of the SEC.

Retirement and Other Benefits

The Company believes retirement plans serve to attract and retain talented personnel generally, but they should not be a significant part of the overall compensation program. The Company has a contributory 401(k) Plan available to employees of the Company who meet the age and service requirements. The Company makes matching contributions in the amount of 100% of the first 3% of salary contributions and 50% of the next 2% of salary contributions made by employees (subject to tax law limits).

16