| Oppenheimer Core Bond Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund seeks total return. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. You may qualify for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $50,000 in certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your financial professional and in the section “About Your Account” beginning on page 22 of the prospectus and in the appendix to the prospectus titled “Special Sales Charge Arrangements and Waivers” and in the section “How to Buy Shares” beginning on page 58 in the Fund’s Statement of Additional Information. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Any applicable fee waivers and/or expense reimbursements are reflected in the below examples for the period during which such fee waivers and/or expense reimbursements are in effect. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If shares are redeemed | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If shares are not redeemed | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 80% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal market conditions, the Fund invests at least 80% of its net assets, plus borrowings for investment purposes, in investment-grade debt securities (generally referred to as “bonds”). A debt security is a security representing money borrowed by the issuer that must be repaid. The terms of a debt security specify the amount of principal, the interest rate or discount, and the time or times at which payments are due. Debt securities can include:

The Fund can invest up to 20% of its total assets in lower-grade, high-yield debt securities that are below investment-grade (commonly referred to as “junk bonds”). “Investment-grade” debt securities are rated in one of the top four rating categories by nationally recognized statistical rating organizations such as Moody’s or Standard & Poor’s. The Fund may also invest in unrated securities, in which case the Fund’s sub-adviser, OppenheimerFunds, Inc. (the “Sub-Adviser”), may internally assign ratings to certain of those securities, after assessing their credit quality, in investment-grade or below-investment-grade categories similar to those of nationally recognized statistical rating organizations. There can be no assurance, nor is it intended, that the Sub-Adviser’s credit analysis is consistent or comparable with the credit analysis process used by a nationally recognized statistical rating organization. The Fund has no limitations on the range of maturities of the debt securities in which it can invest and may hold securities with short-, medium- or long-term maturities. The maturity of a security differs from its effective duration, which attempts to measure the expected volatility of a security’s price to interest rate changes. For example, if a bond has an effective duration of three years, a 1% increase in general interest rates would be expected to cause the bond’s value to decrease about 3%. To try to decrease volatility, the Fund seeks to maintain a weighted average effective portfolio duration of three to six years, measured on a dollar-weighted basis using the effective duration of the securities included in the portfolio and the amount invested in each of those securities. However, the duration of the portfolio might not meet that target due to market events or interest rate changes that cause debt securities to be repaid more rapidly or more slowly than expected. The Fund may invest a portion of its assets in foreign debt securities, including securities issued by foreign governments or companies in both developed and emerging markets. The Fund may not invest more than 20% of its net assets in foreign debt securities. The Fund may also use derivatives to seek increased returns or to try to manage investment risks. Futures, swaps and “structured” notes are examples of some of the types of derivatives the Fund can use. In selecting investments for the Fund, the portfolio managers analyze the overall investment opportunities and risks in different sectors of the debt securities markets by focusing on business cycle analysis and relative values between the corporate and government sectors. The Fund mainly seeks income earnings on the Fund’s investments plus capital appreciation that may arise from decreases in interest rates, from improving credit fundamentals for a particular sector or security or from other investment techniques. The Fund may sell securities that the portfolio managers believe no longer meet the above criteria. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The price of the Fund’s shares can go up and down substantially. The value of the Fund’s investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth less than what you paid for them. These risks mean that you can lose money by investing in the Fund. Risks of Investing in Debt Securities. Debt securities may be subject to interest rate risk, duration risk, credit risk, credit spread risk, extension risk, reinvestment risk, prepayment risk and event risk. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may be worth less than the amount the Fund paid for them. When interest rates change, the values of longer-term debt securities usually change more than the values of shorter-term debt securities. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Duration risk is the risk that longer-duration debt securities will be more volatile and more likely to decline in price in a rising interest rate environment than shorter-duration debt securities. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or repay principal, the Fund’s income or share value might be reduced. Adverse news about an issuer or a downgrade in an issuer’s credit rating, for any reason, can also reduce the market value of the issuer’s securities. “Credit spread” is the difference in yield between securities that is due to differences in their credit quality. There is a risk that credit spreads may increase when the market expects lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund’s lower-rated and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price. Extension risk is the risk that an increase in interest rates could cause principal payments on a debt security to be repaid at a slower rate than expected. Extension risk is particularly prevalent for a callable security where an increase in interest rates could result in the issuer of that security choosing not to redeem the security as anticipated on the security’s call date. Such a decision by the issuer could have the effect of lengthening the debt security’s expected maturity, making it more vulnerable to interest rate risk and reducing its market value. Reinvestment risk is the risk that when interest rates fall the Fund may be required to reinvest the proceeds from a security’s sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds. Prepayment risk is the risk that the issuer may redeem the security prior to the expected maturity or that borrowers may repay the loans that underlie these securities more quickly than expected, thereby causing the issuer of the security to repay the principal prior to the expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Event risk is the risk that an issuer could be subject to an event, such as a buyout or debt restructuring, that interferes with its ability to make timely interest and principal payments and cause the value of its debt securities to fall. Fixed-Income Market Risks. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity may decline unpredictably in response to overall economic conditions or credit tightening. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund’s books and could experience a loss. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds’ prices, particularly for lower-rated and unrated securities. An unexpected increase in redemptions by Fund shareholders, which may be triggered by general market turmoil or an increase in interest rates, could cause the Fund to sell its holdings at a loss or at undesirable prices. Economic and other market developments can adversely affect fixed-income securities markets in the United States, Europe and elsewhere. At times, participants in debt securities markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt securities to facilitate an orderly market. Those concerns may impact the market price or value of those debt securities and may cause increased volatility in those debt securities or debt securities markets. Under some circumstances, those concerns may cause reduced liquidity in certain debt securities markets, reducing the willingness of some lenders to extend credit, and making it more difficult for borrowers to obtain financing on attractive terms (or at all). A lack of liquidity or other adverse credit market conditions may hamper the Fund’s ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments. Risks of Below-Investment-Grade Securities. As compared to investment-grade debt securities, below-investment-grade debt securities (also referred to as “junk” bonds), whether rated or unrated, may be subject to greater price fluctuations and increased credit risk, as the issuer might not be able to pay interest and principal when due, especially during times of weakening economic conditions or rising interest rates. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. The market for below-investment-grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline. Because the Fund can invest up to 20% of its total assets in lower-grade securities, the Fund’s credit risks are greater than those funds that buy only investment grade securities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund’s Sub-Adviser has changed its assessment of the security’s credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund’s holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund’s exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. If the Fund has more than 20% of its total assets invested in below-investment-grade securities, the Sub-Adviser will not purchase additional below-investment-grade securities until the level of holdings in those securities no longer exceeds the restriction. Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund’s net assets may change on days when you will not be able to purchase or redeem the Fund’s shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight. Risks of Developing and Emerging Markets. Investments in developing and emerging markets are subject to all the risks associated with foreign investing, however, these risks may be magnified in developing and emerging markets. Developing or emerging market countries may have less well-developed securities markets and exchanges that may be substantially less liquid than those of more developed markets. Settlement procedures in developing or emerging markets may differ from those of more established securities markets, and settlement delays may result in the inability to invest assets or to dispose of portfolio securities in a timely manner. Securities prices in developing or emerging markets may be significantly more volatile than is the case in more developed nations of the world, and governments of developing or emerging market countries may also be more unstable than the governments of more developed countries. Such countries’ economies may be more dependent on relatively few industries or investors that may be highly vulnerable to local and global changes. Developing or emerging market countries also may be subject to social, political or economic instability. The value of developing or emerging market countries’ currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures, and practices such as share blocking. In addition, the ability of foreign entities to participate in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in securities of issuers in developing or emerging market countries may be considered speculative. Risks of Derivative Investments. Derivatives may involve significant risks. Derivatives may be more volatile than other types of investments, may require the payment of premiums, may increase portfolio turnover, may be illiquid, and may not perform as expected. Derivatives are subject to counterparty risk and the Fund may lose money on a derivative investment if the issuer or counterparty fails to pay the amount due. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund’s initial investment. As a result of these risks, the Fund could realize little or no income or lose money from its investment, or a hedge might be unsuccessful. In addition, under new rules enacted and currently being implemented under financial reform legislation, certain over-the-counter derivatives are (or soon will be) required to be executed on a regulated market and/or cleared through a clearinghouse. It is unclear how these regulatory changes will affect counterparty risk, and entering into a derivative transaction with a clearinghouse may entail further risks and costs. Who Is the Fund Designed For? The Fund is designed primarily for investors seeking total return from a fund that invests mainly in investment-grade debt securities but which can also hold high-yield, below investment-grade securities. Those investors should be willing to assume the credit risks of a fund that typically invests a significant amount of its assets in corporate debt securities and the changes in debt securities prices that can occur when interest rates change. The Fund is intended to be a long-term investment, not a short term trading vehicle. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

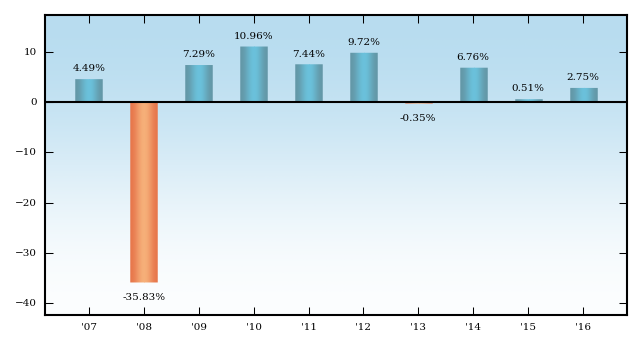

| The Fund’s Past Performance. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance (for Class A Shares) from calendar year to calendar year and by showing how the Fund’s average annual returns for the periods of time shown in the table compare with those of a broad measure of market performance. The Fund’s past investment performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Sales charges are not reflected in the bar chart and if those charges were included, returns would be less than those shown. More recent performance information is available by calling the toll-free number on the back of this prospectus and on the Fund’s website: https://www.oppenheimerfunds.com/fund/CoreBondFund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest return for a calendar quarter was 8.88% (3rd Qtr 09) and the lowest return for a calendar quarter was -26.30% (4th Qtr 08). For the period from January 1, 2016 to December 31, 2016 the return before sales charges and taxes was 2.75%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table shows the average annual total returns for each class of the Fund’s shares. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns for the periods ended December 31, 2016 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||