United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

[✓] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended May 2, 2015

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to _________

Commission file number 1-14170

NATIONAL BEVERAGE CORP.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

59-2605822 |

|

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

8100 SW Tenth Street, Suite 4000, Fort Lauderdale, Florida 33324

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (954) 581-0922

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $.01 per share |

|

The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ( ) No (✓)

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ( ) No (✓)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes (✓) No ( )

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes (✓) No ( )

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (✓)

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.: Large accelerated filer ( ) Accelerated filer (✓) Non-accelerated filer ( ) Smaller reporting company ( )

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ( ) No (✓)

The aggregate market value of the common stock held by non-affiliates of Registrant computed by reference to the closing sale price of $25.12 on October 31, 2014 was approximately $288.1 million.

The number of shares of Registrant’s common stock outstanding as of July 10, 2015 was 46,398,035.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2015 Annual Meeting of Shareholders are incorporated by reference in Part III of this report.

table of contents

|

|

PAGE | |

|

PART I |

||

|

ITEM 1. |

Business | 2 |

|

ITEM 1A. |

Risk Factors | 9 |

|

ITEM 1B. |

Unresolved Staff Comments | 11 |

|

ITEM 2. |

Properties | 11 |

|

ITEM 3. |

Legal Proceedings | 11 |

|

ITEM 4. |

Mine Safety Disclosures | 11 |

|

PART II |

||

|

ITEM 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 12 |

|

ITEM 6. |

Selected Financial Data | 14 |

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

|

ITEM 7A. |

Quantitative and Qualitative Disclosure About Market Risk | 20 |

|

ITEM 8. |

Financial Statements and Supplementary Data | 21 |

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 40 |

|

ITEM 9A. |

Controls and Procedures | 40 |

|

ITEM 9B. |

Other Information | 40 |

|

PART III |

||

|

ITEM 10. |

Directors, Executive Officers and Corporate Governance | 41 |

|

ITEM 11. |

Executive Compensation | 42 |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 42 |

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence | 42 |

|

ITEM 14. |

Principal Accounting Fees and Services | 42 |

|

PART IV |

||

|

ITEM 15. |

Exhibits, Financial Statement Schedules | 42 |

|

SIGNATURES |

45 |

PART I

ITEM 1. BUSINESS

GENERAL

Currently celebrating its 30th anniversary, National Beverage Corp. is an acknowledged leader in the development, manufacturing, marketing and sale of a diverse portfolio of flavored beverage products. Our primary market focus is the United States, but our products are also distributed in Canada, Mexico, the Caribbean, Latin America, the Pacific Rim, Asia, and Europe. A holding company for various operating subsidiaries, National Beverage Corp. was incorporated in Delaware in 1985 and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

Our brands consist of (i) beverages geared toward the active and health-conscious consumer (“Power+ Brands”), including sparkling waters, energy drinks and shots, juices, and enhanced beverages, and (ii) Carbonated Soft Drinks in a variety of flavors including regular, sugar-free and reduced-calorie options. In addition, we produce soft drinks for certain retailers (“Allied Brands”) that endorse the “Strategic Alliance” concept of having our brands and Allied Brands marketed to effectuate enhanced growth of both. We employ a philosophy that emphasizes vertical integration; our manufacturing model integrates the procurement of raw materials and production of concentrates with the manufacture of finished products in our twelve manufacturing facilities. To service a diverse customer base that includes numerous national retailers as well as thousands of smaller “up-and-down-the-street” accounts, we have developed a hybrid distribution system that promotes and utilizes customer warehouse distribution facilities and our own direct-store delivery fleet plus the direct-store delivery systems of independent distributors and wholesalers.

We believe that the combination of our business strategies and philosophies is key to giving us a greater competitive advantage and differentiating us from our competitors. These points of differentiation include the following:

Lifestyle Focus – We focus on developing healthier and functional beverages in response to a global shift in consumer buying habits. As health and wellness awareness grows, consumers are turning to drinks with reduced calories, wholesome ingredients and efficacy to meet their specific lifestyle needs. We are committed to tailoring the variety and types of beverages in our portfolio to satisfy changing preferences of an increasingly diverse mix of ‘crossover consumers’ – a growing group who desire a change from Carbonated Soft Drinks and other artificially flavored, artificially sweetened beverages.

Fantasy of Flavors – Throughout our product lines, we emphasize distinctly flavored beverages. Although cola drinks account for approximately 49% of the soft drink industry’s domestic grocery channel volume, colas account for less than 20% of our total volume. In the higher margin convenience store channel, flavors represent 55% of soft drink sales and are outpacing colas. Our flavor development spans more than 125 years and originated with our flagship brands, Shasta® and Faygo®, each of which offers more than 30 flavor varieties.

Regional Share Dynamics – This is our term for the philosophy we employ for the development and support of our brands that have significant regional presence. Because we tailor our marketing and promotion programs by locale, we believe many of our brands enjoy a regional identification that fosters long-term consumer loyalty and make them less vulnerable to competitive substitution. In addition, “home-town” products often generate more aggressive retailer sponsored promotional activities and receive media exposure through community activities rather than costly national advertising.

Quality-Value Ethic – We believe that consumers demand value as the purchase default option in volatile economic times, and we are intent on producing and developing products of the highest quality that appeal to the value expectations of the family consumer. We believe we can leverage our cost-effective manufacturing and distribution systems, and our efficient regionally focused marketing programs, to profitably deliver products to the consumer at a lower price-point than our national competitors.

Creative Agility – In a beverage industry that is dominated by the “cola giants”, we pride ourselves on our ability to respond faster and more creatively to consumer trends than many of our competitors who are burdened by distribution complexity and legacy costs. We strive to build long-term brand value by developing creative marketing programs, propriety flavors and distinctive packaging. In recent years, we have introduced numerous new flavors or package sizes and have won many package design awards. We continue to develop products and package sizes designed to expand distribution. We believe that the most dynamic validation of our strategy is our competitors’ efforts to replicate our creative business model.

PRODUCTS

The National Beverage Corp. brand portfolio contains a wide variety of beverages to meet consumer needs in a multitude of market segments. National Beverage employs its flavor expertise with beverage offerings including, but not limited to, the following non-alcoholic beverage segments:

Sparkling Waters

Spring Water

Enhanced Water

Energy Drinks and Shots

Functional Beverages and Sports Drinks

Juice and Juice Drinks

Teas and Lemonades

Carbonated Soda: Sugar Free, Regular, and Reduced Calorie

Power+ Brands –

LaCroix

100% all natural LaCroix® Sparkling Water is setting the pace in the Sparkling Water category that is fast becoming the alternative to traditional carbonated soda. With zero calories, zero sweeteners and zero sodium, the innocence of LaCroix has the support of major national chains and is the top-selling domestic Sparkling Water packaged in cans.

LaCroix’s dynamic ‘theme’ LaCroix Cúrate™ (cure yourself) celebrates French sophistication with Spanish zest with three bold flavors: Piña Fraíse (pineapple strawberry), Cerise Limon (cherry lime) and Pomme Baya (apple berry) naturally refresh in tall 12 oz. consumer-favored cans. Brilliant graphics, robust aroma, naturally ‘essenced’ and premium-priced, Cúrate is a trendsetting addition to a brand that is the healthy alternative for trend-forward consumers.

NiCola™ by LaCroix, a new innovative sparkling water with the essence and flavor of cola, is ‘innocent’ of calories, sodium, sweetener or any ingredient that the health-conscious consumer avoids. Since its initial Chicago launch in October 2014, NiCola has received positive response from cola and diet cola drinkers looking to ‘crossover’ to a beverage that complements a healthier lifestyle.

Additional LaCroix themes are in development and feature unique packaging, ground-breaking flavor concepts, and a go-to-market strategy designed to provide additional placements within the retail environment outside the traditional grocery shelf.

Rip It

Rip It® energy fuel is the flavor innovator in the growing energy category with 14 unique flavors including six sugar free, bringing variety and value to the widening consumer base. Rip It “Tribute” themed energy is a successful military inspired addition to the lineup with the latest addition Tribute CYP-X Orange Crème. Building on the flavor tradition of original Rip It, a 2 oz. sugar free shot version with seven flavors is marketed through our distribution system in multiple displayable package configurations.

Everfresh

Everfresh® 100% juice and juice drinks are available in more than 35 flavors, from such classics as Orange, Cranberry and flavored lemonades to exotics that include Premium Papaya and Pineapple Mango. Originating in the Midwest, the Everfresh signature package is a hot-filled, 16 oz. glass bottle primarily for single-serve consumption. Additional consumer-friendly packages range from 10 oz. to 64 oz.

Everfresh Premier Varietals™, a unique theme from Everfresh, is positioned as a stand-alone brand for display in the produce section of supermarkets. Everfresh Premier Varietals is a premium line of 100% natural apple juice from a variety of apples specific to the taste of the varietal, such as Granny Smith, McIntosh, Honey Crisp, Golden Delicious, Fuji and Pink Lady. Premier Varietals are packaged in award-winning 12 oz. glass bottles with decorative tamper-evident neck seals.

Carbonated Soft Drinks –

More than 125 years old and distributed nationally, Shasta® is recognized as a bottling industry pioneer and innovator. As our largest volume brand, Shasta features multiple flavors, including products targeted to the growing Hispanic and other ethnic markets, and continues to earn consumer loyalty by delivering value, convenience and such unique tastes as California Dreamin’, Very Cherry Twist and Fiesta Punch. Honoring its origin as a sparkling water company, Shasta will soon introduce a new theme featuring Shasta’s classic flavors in an unsweetened, zero-calorie, refreshing sparkling water concept.

More than 100 years old, Faygo® products are primarily distributed east of the Mississippi River and include numerous unique flavors including RedPop®, Moon Mist®, and Rock’n’Rye®. We also produce and market Ritz® soft drinks and seltzers, primarily in the southeastern U.S., distribute Big Shot® in New Orleans and surrounding areas, and offer St. Nick’s® soft drinks during the holiday season. During recent years, we reformulated many of our brands to reduce the caloric content while still preserving their time-tested flavor profiles.

Our Brands, optically and content-wise, are always a work in process. As often as innovation develops, we endeavor to significantly improve them, striving for quality and authenticity over cost.

MANUFACTURING

Our twelve manufacturing facilities are strategically located near major metropolitan markets across the continental United States. The locations of our plants enable us to efficiently manufacture and distribute beverages to substantially all geographic markets in the United States, including all of the top 25 metropolitan statistical areas. Each manufacturing facility is generally equipped to produce both canned and bottled beverage products in a variety of package sizes. We utilize numerous package types and sizes, including cans ranging from eight to sixteen ounces and bottles ranging from ten ounces to three liters.

We believe that the innovative and controlled vertical integration of our bottling facilities provides an advantage over certain of our competitors that rely upon independent third party bottlers to manufacture and market their products. Since we control the national production, distribution and marketing of our brands, we believe we can more effectively manage product quality and customer service and respond quickly to changing market conditions.

We produce a substantial portion of the flavor concentrates used in our branded products. By controlling our own formulas throughout our bottling network, we can manufacture our products in accordance with uniform quality standards while tailoring flavors to regional taste preferences. We believe that the combination of a Company-owned bottling network, together with uniform standards for packaging, formulations and customer service, provides us with a strategic advantage in servicing national retailers and mass-merchandisers. We also maintain research and development laboratories at multiple locations. These laboratories continually test products for compliance with our strict quality control standards as well as conduct research for new products and flavors.

DISTRIBUTION

We utilize a hybrid distribution system to deliver our products through three primary distribution channels: take-home, convenience and food-service.

The take-home distribution channel consists of national and regional grocery stores, warehouse clubs, mass-merchandisers, wholesalers and dollar stores. We distribute our products to this channel through the warehouse distribution system and the direct-store delivery system. Under the warehouse distribution system, products are shipped from our manufacturing facilities to the retailer’s centralized distribution centers and then distributed by the retailer to each of its outlet locations with other goods. Products sold through the direct-store delivery system are distributed directly to the customer’s retail outlets by our direct-store delivery fleet and by independent distributors.

We distribute our products to the convenience channel through our own direct-store delivery fleet and those of independent distributors. The convenience channel consists of convenience stores, gas stations and other smaller “up-and-down-the-street” accounts. Because of the higher retail prices and margins that typically prevail, we have undertaken several measures to expand convenience channel distribution. These include development of products, packaging and graphics specifically targeted to this market.

Our food-service division distributes products to independent, specialized distributors who sell to hospitals, schools, military bases, airlines, hotels and food-service wholesalers. Also, our Company-owned direct-store delivery fleet distributes products to certain schools and other food-service customers.

Our take-home, convenience and food-service operations use vending machines and glass-door coolers as marketing and promotional tools for our brands. We provide vending machines and coolers on a placement or purchase basis to our customers. We believe vending and cooler equipment increases beverage sales, enhances brand awareness and develops brand loyalty.

SALES AND MARKETING

We sell and market our products through an internal sales force as well as specialized broker networks. Our sales force is organized to serve a specific market, focusing on one or more geographic territories, distribution channels or product lines. We believe this focus allows our sales group to provide high level, responsive service and support to our customers and markets.

The emphasis of our sales and marketing programs is to maintain and enhance consumer brand recognition and loyalty, typically through a combination of regional advertising, special event marketing, endorsements, sponsorships and social media, along with consumer coupon distribution and product sampling. We retain advertising agencies to assist with media advertising programs for our brands. Additionally, we offer numerous promotional programs to retail customers, including cooperative advertising support, in-store advertising materials and other incentives. These elements allow us to tailor our marketing and advertising programs to meet local and regional economic conditions and demographics. Additionally, we sponsor special holiday promotions which feature St. Nick’s soft drink and special holiday flavors and packaging.

Raw Materials

Our centralized procurement group maintains relationships with numerous suppliers of raw materials and packaging goods. By consolidating the purchasing function for our manufacturing facilities, we believe we are able to procure more competitive arrangements with our suppliers, thereby enhancing our ability to compete as a low-cost producer of beverages.

The products we produce and sell are made from various materials including sweeteners, juice concentrates, carbon dioxide, water, glass and plastic bottles, aluminum cans and ends, paper, cartons and closures. Most of our low-calorie soft drink products use sucralose, aspartame, stevia or acesulfame potassium. We manufacture a substantial portion of our flavor concentrates and purchase remaining raw materials from multiple suppliers.

Substantially all of the materials and ingredients we purchase are presently available from several suppliers, although strikes, weather conditions, utility shortages, governmental control or regulations, national emergencies, quality, price or supply fluctuations or other events outside our control could adversely affect the supply of specific materials. A significant portion of our raw material purchases, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, are derived from commodities. Therefore, pricing and availability tend to fluctuate based upon worldwide commodity market conditions. Our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. In certain cases, we may elect to enter into multi-year agreements for the supply of these materials with one or more suppliers, the terms of which may include variable or fixed pricing, minimum purchase quantities and/or the requirement to purchase all supplies for specified locations. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs.

Seasonality

The majority of our sales are seasonal with the highest volume typically realized during the summer months. We have sufficient production capacity to meet seasonal increases without maintaining significant quantities of inventory in anticipation of periods of peak demand. Additionally, our sales can be influenced by weather conditions.

Competition

The beverage industry is highly competitive and our competitive position varies in each of our market areas. Our products compete with many varieties of liquid refreshment, including soft drinks, water products, juices, fruit drinks, powdered drinks, coffees, teas, energy drinks, sports drinks, dairy-based drinks, functional beverages and various other nonalcoholic beverages. We compete with bottlers and distributors of national, regional and private label products. Several competitors, including the two that dominate the soft drink industry, PepsiCo and The Coca-Cola Company, have greater financial resources than we have and aggressive promotion of their products can adversely affect sales of our brands. Principal methods of competition in the beverage industry are price and promotional activity, advertising and marketing programs, point-of-sale merchandising, retail space management, customer service, product differentiation, packaging innovations and distribution methods. We believe our Company differentiates itself through a diversified product portfolio, strong regional brand recognition, innovative flavor variety, attractive packaging, efficient distribution methods, specialized advertising and, for some product lines, value pricing.

Trademarks

We own numerous trademarks for our brands that are significant to our business. We intend to continue to maintain all registrations of our significant trademarks and use the trademarks in the operation of our businesses.

Governmental Regulation

The production, distribution and sale of our products in the United States are subject to the Federal Food, Drug and Cosmetic Act; the Dietary Supplement Health and Education Act of 1994; the Occupational Safety and Health Act; the Lanham Act; various environmental statutes; and various other federal, state and local statutes regulating the production, transportation, sale, safety, advertising, labeling and ingredients of such products. We believe that we are in compliance, in all material respects, with such existing legislation.

Certain states and localities prohibit the sale of certain beverages unless a deposit or tax is charged for containers. These requirements vary by each jurisdiction. Similar legislation has been proposed in certain other states and localities, as well as by Congress. We are unable to predict whether such legislation will be enacted or what impact its enactment would have on our business, financial condition or results of operations.

All of our facilities in the United States are subject to federal, state and local environmental laws and regulations. Compliance with these provisions has not had any material adverse effect on our financial or competitive position. We believe that our current practices and procedures for the control and disposition of toxic or hazardous substances comply in all material respects with applicable law. Compliance with or violation of any current or future regulations and legislation could require material expenditures or have a material adverse effect on our financial results.

Employees

As of May 2, 2015, we employed approximately 1,200 people, of which approximately 300 are covered by collective bargaining agreements. We believe that relations with our employees are generally good.

AVAILABLE INFORMATION

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports are available free of charge on our website at www.nationalbeverage.com as soon as reasonably practicable after such reports are electronically filed with the Securities and Exchange Commission. In addition, our Code of Ethics is available on our website. The information on the Company’s website is not part of this Annual Report on Form 10-K or any other report that we file with, or furnish to, the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

In addition to other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating the Company’s business. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. Additional risks and uncertainties, including risks and uncertainties not presently known to the Company, or that the Company currently deems immaterial, may also impair our business and results of operations.

Changes in consumer preferences and taste. There has been an increasing focus on health and wellness by beverage consumers, which may reduce demand for caloric carbonated soft drinks and increase the consumption of products perceived to deliver health, wellness and/or functionality. If we do not adequately anticipate and react to changing demographics, consumer trends, health concerns and product preferences, our financial results could be adversely affected.

Competition. The beverage industry is extremely competitive. Our products compete with a broad range of beverage products, most of which are manufactured and distributed by companies with substantially greater financial, marketing and distribution resources. In order to generate future revenues and profits, we must continue to sell products that appeal to our customers and consumers. Discounting and other actions by our competitors may make it more difficult to sustain revenues and profits.

Customer relationships. Our retail customer base has been consolidating over the last several years resulting in fewer customers with increased purchasing power. This increased purchasing power can limit our ability to increase pricing for our products with certain of our customers. Our inability to meet the demands of our larger customers could lead to a loss of business and adversely affect our financial results.

Raw materials and energy. The production of our products is dependent on certain raw materials, including aluminum, resin, corn, linerboard, water and fruit juice. In addition, the production and distribution of our products is dependent on energy sources, including natural gas, fuel and electricity. These items are subject to price volatility caused by numerous factors. Commodity price increases ultimately result in a corresponding increase in the cost of raw materials and energy. We may be limited in our ability to pass these increases on to our customers or may incur a loss in sales volume to the extent price increases are taken. In addition, strikes, weather conditions, governmental controls, national emergencies, natural disasters, supply shortages or other events could affect our continued supply of raw materials and energy. If raw materials or energy costs increase, or the availability is limited, our financial results could be adversely affected.

Governmental regulation. Our business and properties are subject to various federal, state and local laws and regulations, including those governing the production, packaging, quality, labeling and distribution of beverage products. In addition, various governmental agencies have considered limiting the consumption of and imposing additional taxes on soft drinks and other sweetened beverages, including those sweetened with high fructose corn syrup. Changes in existing laws or regulations could negatively affect our financial results through lower sales or higher costs.

Sustained increases in the cost of employee benefits. Our profitability is affected by the cost of medical and retirement benefits provided to employees. In recent years, we have experienced significant increases in these costs as a result of certain factors beyond our control. Although we seek to limit these cost increases, continued upward pressure in these costs could reduce our profitability.

Unfavorable weather conditions. Unfavorable weather conditions could have an adverse impact on our revenue and profitability. Unusually cold or rainy weather may temporarily reduce demand for our products and contribute to lower sales, which could adversely affect our profitability for such periods. Prolonged drought conditions in the geographic regions in which we do business could lead to restrictions on the use of water, which could adversely affect our ability to manufacture and distribute products.

We are dependent on key personnel. Our performance significantly depends upon the continued contributions of our executive officers and key employees, both individually and as a group, and our ability to retain and motivate them. Our officers and key personnel have many years of experience with us and in our industry and it may be difficult to replace them. If we lose key personnel or are unable to recruit qualified personnel, our operations and ability to manage our business may be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our principal properties include twelve manufacturing facilities located in ten states, which aggregate approximately two million square feet. We own ten manufacturing facilities in the following states: California (2), Georgia, Kansas, Michigan (2), Ohio, Texas, Utah and Washington. Two manufacturing facilities, located in Maryland and Florida, are leased subject to agreements that expire through 2020. We believe our facilities are generally in good condition and sufficient to meet our present needs.

The production of beverages is capital intensive but is not characterized by rapid technological change. The technological advances that have occurred have generally been of an incremental cost-saving nature, such as the industry’s conversion to lighter weight containers or improved blending processes that enhance ingredient yields. We are not aware of any anticipated industry-wide changes in technology that would adversely impact our current physical production capacity or cost of production.

We own and lease trucks, vans and automobiles used in the sale, delivery and distribution of our products. In addition, we lease office and warehouse space, transportation equipment, office equipment and certain manufacturing equipment.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we are a party to various litigation matters and claims arising in the ordinary course of business. We do not expect the ultimate disposition of such matters to have a material adverse effect on our consolidated financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The common stock of National Beverage Corp., par value $.01 per share, (“Common Stock”) is listed on The NASDAQ Global Select Market under the symbol “FIZZ”. The following table shows the range of high and low prices per share of the Common Stock for the fiscal quarters indicated:

|

Fiscal Year Ended |

||||||||||||||||

|

May 2, 2015 |

May 3, 2014 |

|||||||||||||||

|

High |

Low |

High |

Low |

|||||||||||||

|

First Quarter |

$ | 19.97 | $ | 15.42 | $ | 18.66 | $ | 14.48 | ||||||||

|

Second Quarter |

$ | 25.50 | $ | 17.58 | $ | 18.96 | $ | 15.63 | ||||||||

|

Third Quarter |

$ | 27.32 | $ | 21.00 | $ | 21.71 | $ | 18.06 | ||||||||

|

Fourth Quarter |

$ | 25.00 | $ | 21.00 | $ | 22.26 | $ | 18.58 | ||||||||

At July 6, 2015, there were approximately 8,000 holders of our Common Stock, the majority of which hold their shares in the names of various dealers and/or clearing agencies.

The Company paid special cash dividends on Common Stock of $118.1 million ($2.55 per share) on December 27, 2012.

In April 2012, the Board of Directors authorized an increase in the Company’s Stock Buyback Program from 800,000 to 1.6 million shares of Common Stock. As of May 2, 2015, 502,060 shares were purchased under the program and 1,097,940 shares were available for purchase. There were no shares of Common Stock purchased during the last three fiscal years.

On January 25, 2013, the Company sold 400,000 shares of Special Series D Preferred Stock, par value $1 per share (“Series D Preferred”) for an aggregate purchase price of $20 million. Series D Preferred has a liquidation preference of $50 per share and accrues dividends on this amount at an annual rate of 3% through April 30, 2014 and, thereafter, at an annual rate equal to 370 basis points above the 3-Month LIBOR. Dividends are cumulative and payable quarterly. The Series D Preferred is nonvoting and redeemable at the option of the Company since May 1, 2014 at $50 per share. Upon a change of control, as such term is defined in the Certificate of Designation of the Special Series D Preferred Stock, the holder shall have the right to convert the Series D Preferred into shares of Common Stock at a conversion price equal to the tender price per share offered to the holders of the Common Stock. The net proceeds of $19.7 million were used to repay borrowings under the Credit Facilities. The Series D Preferred was issued by the Company pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933.

On May 2, 2014, the Company redeemed 160,000 shares of Series D Preferred, representing 40% of the amount outstanding, for an aggregate price of $8 million plus accrued dividends. In conjunction with the partial redemption, the annual dividend rate on the outstanding Series D Preferred was reduced to 2.5% for the twelve-month period beginning May 1, 2014. On May 1, 2015, the Company and the holders of the Series D Preferred agreed to extend the 2.5% annual dividend rate on the outstanding Series D Preferred through April 30, 2016.

On August 1, 2014, the Company redeemed 120,000 shares of Series D Preferred, representing 50% of the amount outstanding, for an aggregate price of $6 million plus accrued dividends.

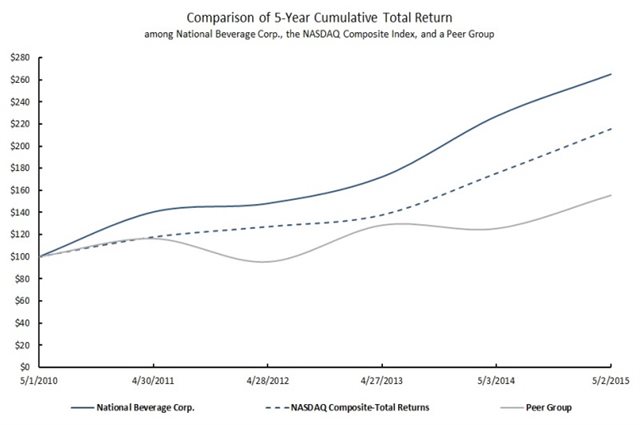

Performance Graph

The following graph shows a comparison of the five-year cumulative returns of an investment of $100 cash on May 1, 2010, assuming reinvestment of dividends, in (i) Common Stock, (ii) the NASDAQ Composite Index and (iii) a Company-constructed peer group consisting of Coca-Cola Bottling Company Consolidated and Cott Corporation. Based on the cumulative total return below, an investment in our Common Stock on May 1, 2010 provided a compounded annual return of approximately 21.5% as of May 2, 2015.

|

5/1/10 |

4/30/11 |

4/28/12 |

4/27/13 |

5/3/14 |

5/2/15 |

|||||||||||||||||||

|

National Beverage Corp. |

$ | 100.00 | $ | 140.51 | $ | 148.18 | $ | 172.25 | $ | 227.11 | $ | 265.06 | ||||||||||||

|

NASDAQ Composite |

100.00 | 117.84 | 127.17 | 137.74 | 175.48 | 215.51 | ||||||||||||||||||

|

Peer Group |

100.00 | 116.43 | 95.35 | 128.54 | 125.48 | 155.57 | ||||||||||||||||||

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and consolidated financial statements and notes thereto contained in "Item 8. Financial Statements and Supplementary Data" of this Annual Report on Form 10-K.

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

(In thousands, except per share and footnote amounts) |

|

Fiscal Year Ended |

||||||||||||||||||||

|

May 2, |

May 3, |

April 27, |

April 28, |

April 30, |

||||||||||||||||

|

2015 |

2014 (3) | 2013 | 2012 | 2011 | ||||||||||||||||

|

SUMMARY OF OPERATIONS: |

||||||||||||||||||||

|

Net sales |

$ | 645,825 | $ | 641,135 | $ | 662,007 | $ | 628,886 | $ | 600,193 | ||||||||||

|

Cost of sales |

426,685 | 423,480 | 444,757 | 415,629 | 381,539 | |||||||||||||||

|

Gross profit |

219,140 | 217,655 | 217,250 | 213,257 | 218,654 | |||||||||||||||

|

Selling, general and administrative expenses |

145,157 | 153,220 | 146,223 | 146,169 | 155,885 | |||||||||||||||

|

Interest expense |

371 | 660 | 403 | 107 | 99 | |||||||||||||||

|

Other (income) expense - net |

(1,101 | ) | 666 | 173 | 85 | 20 | ||||||||||||||

|

Income before income taxes |

74,713 | 63,109 | 70,451 | 66,896 | 62,650 | |||||||||||||||

|

Provision for income taxes |

25,402 | 19,474 | 23,531 | 22,903 | 21,896 | |||||||||||||||

|

Net income |

$ | 49,311 | $ | 43,635 | $ | 46,920 | $ | 43,993 | $ | 40,754 | ||||||||||

|

PER SHARE DATA: |

||||||||||||||||||||

|

Basic earnings per common share (1) |

$ | 1.06 | $ | .93 | $ | 1.01 | $ | .95 | $ | .88 | ||||||||||

|

Diluted earnings per common share (1) |

1.05 | .92 | 1.01 | .95 | .88 | |||||||||||||||

|

Closing stock price |

22.42 | 19.21 | 14.57 | 14.68 | 13.92 | |||||||||||||||

|

Dividends paid on common stock (2) |

- | - | 2.55 | - | 2.30 | |||||||||||||||

|

BALANCE SHEET DATA: |

||||||||||||||||||||

|

Cash and equivalents (2) |

$ | 52,456 | $ | 29,932 | $ | 18,267 | $ | 35,626 | $ | 7,372 | ||||||||||

|

Working capital (2) |

101,478 | 78,618 | 67,504 | 69,818 | 30,930 | |||||||||||||||

|

Property, plant and equipment - net |

60,182 | 59,494 | 57,307 | 56,729 | 55,337 | |||||||||||||||

|

Total assets (2) |

247,750 | 222,841 | 208,642 | 222,988 | 182,810 | |||||||||||||||

|

Long-term debt |

10,000 | 30,000 | 50,000 | - | - | |||||||||||||||

|

Deferred income tax liability |

15,245 | 13,873 | 14,327 | 14,214 | 14,548 | |||||||||||||||

|

Shareholders' equity (2) |

147,782 | 106,201 | 70,316 | 121,636 | 80,336 | |||||||||||||||

|

Dividends paid on common stock (2) |

- | - | 118,139 | - | 106,314 | |||||||||||||||

|

(1) |

Basic earnings per common share is computed by dividing earnings available to common shareholders by the weighted average number of common shares outstanding. Diluted earnings per common share includes the dilutive effect of stock options. |

|

(2) |

The Company paid special cash dividends on Common Stock of $118.1 million ($2.55 per share) on December 27, 2012 and $106.3 million ($2.30 per share) on February 14, 2011. |

|

(3) |

Fiscal 2014 consisted of 53 weeks. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

National Beverage Corp. is an acknowledged leader in the development, manufacturing, marketing and sale of a diverse portfolio of flavored beverage products. Our primary market focus is the United States, but our products are also distributed in Canada, Mexico, the Caribbean, Latin America, the Pacific Rim, Asia and Europe. A holding company for various operating subsidiaries, National Beverage Corp. was incorporated in Delaware in 1985 and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

Our brands consist of (i) beverages geared toward the active and health-conscious consumer (“Power+ Brands”), including sparkling waters, energy drinks and shots, juices, and enhanced beverages, and (ii) Carbonated Soft Drinks in a variety of flavors including regular, sugar-free and reduced-calorie options. In addition, we produce soft drinks for certain retailers (“Allied Brands”) that endorse the “Strategic Alliance” concept of having our brands and Allied Brands marketed to effectuate enhanced growth of both. We employ a philosophy that emphasizes vertical integration; our manufacturing model integrates the procurement of raw materials and production of concentrates with the manufacture of finished products in our twelve manufacturing facilities. To service a diverse customer base that includes numerous national retailers as well as thousands of smaller “up-and-down-the-street” accounts, we have developed a hybrid distribution system that promotes and utilizes customer warehouse distribution facilities and our own direct-store delivery fleet plus the direct-store delivery systems of independent distributors and wholesalers.

We consider ourselves to be a leader in the development and sale of flavored beverage products. The National Beverage Corp. brand portfolio contains a wide variety of beverages to meet consumer needs in a multitude of market segments. Our portfolio of Power+ Brands is targeted to consumers seeking healthier and functional alternatives to complement their active lifestyles, and includes LaCroix®, LaCroix Cúrate™ and LaCroix NiCola™ sparkling water products; Rip It® energy drinks and shots; and Everfresh® and Everfresh Premier Varietals™, 100% juice and juice-based products. Our carbonated soft drink flavor development spans more than 125 years originating with our flagship brands, Shasta® and Faygo®.

Our strategy emphasizes the growth of our products by (i) expanding our focus on healthier and functional beverages tailored toward healthy, active lifestyles, (ii) offering a beverage portfolio of proprietary flavors with distinctive packaging and broad demographic appeal, (iii) supporting the franchise value of regional brands, (iv) appealing to the “quality-value” expectations of the family consumer, and (v) responding to demographic trends by developing innovative products designed to expand distribution.

The majority of our sales are seasonal with the highest volume typically realized during the summer months. As a result, our operating results from one fiscal quarter to the next may not be comparable. Additionally, our operating results are affected by numerous factors, including fluctuations in the costs of raw materials, changes in consumer preference for beverage products, competitive pricing in the marketplace and weather conditions.

RESULTS OF OPERATIONS

Net Sales

Net sales for the fiscal year ended May 2, 2015 (“Fiscal 2015”) increased .7% to $645.8 million as compared to $641.1 million for the fiscal year ended May 3, 2014 (“Fiscal 2014”). The higher sales resulted from a 1.1% increase in case volume partially offset by a .4% decline in average selling price per unit. The increase in case volume reflects a 2.9% increase in branded volume, including a 15.3% case volume growth for our Power+ Brands, partially offset by a decline in Allied Brands. The decline in selling price per unit is related to changes in product mix.

Net sales for the fiscal year ended May 3, 2014 decreased 3.2% to $641.1 million as compared to $662.0 million for the fiscal year ended April 27, 2013 (“Fiscal 2013”). The lower sales resulted from a 7.5% volume decline in Carbonated Soft Drinks, principally due to extended periods of unfavorable weather conditions and industry-wide consumption decline. This volume decline was partially offset by case volume growth of 8.2% for our Power+ Brands. Average net selling price per case was approximately the same for both years.

Gross Profit

Gross profit approximated 33.9% of net sales for Fiscal 2015 and Fiscal 2014. Cost of sales per unit declined .3% primarily due to product mix changes.

Gross profit was 33.9% of net sales for Fiscal 2014, which represents a 1.1% margin improvement compared to Fiscal 2013. The gross margin improvement is primarily due to favorable product mix changes and lower raw material costs. Cost of sales decreased 1.7% on a per case basis.

Shipping and handling costs are included in selling, general and administrative expenses, the classification of which is consistent with many beverage companies. However, our gross margin may not be comparable to companies that include shipping and handling costs in cost of sales. See Note 1 of Notes to Consolidated Financial Statements.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $145.2 million or 22.5% of net sales for Fiscal 2015 compared to $153.2 million or 23.9% of net sales for Fiscal 2014. Fiscal 2015 expenses reflect lower selling and marketing costs.

Selling, general and administrative expenses were $153.2 million or 23.9% of net sales for Fiscal 2014 compared to $146.2 million or 22.1% of net sales for Fiscal 2013. Fiscal 2014 expenses reflect higher selling and marketing costs, primarily due to increased advertising expenses.

Interest Expense and Other (Income) Expense - Net

Interest expense is comprised of interest on borrowings and fees related to maintaining lines of credit. The Company paid a special cash dividend of $118.1 million ($2.55 per common share) on December 27, 2012 from available cash and borrowings under our credit facilities. Due to repayments on borrowings, interest expense decreased to $371,000 in Fiscal 2015 from $660,000 in Fiscal 2014 and $403,000 in Fiscal 2013. Other expense is net of interest income of $30,000 for Fiscal 2015, $15,000 for Fiscal 2014 and $37,000 for Fiscal 2013. The change in interest income for Fiscal 2015, Fiscal 2014 and Fiscal 2013 is due to changes in average invested balances. Other income for Fiscal 2015 includes a $1.3 million gain on sale of property.

Income Taxes

Our effective tax rate was approximately 34% for Fiscal 2015, 30.9% for Fiscal 2014 and 33.4% for Fiscal 2013. The difference between the effective rate and the federal statutory rate of 35% was primarily due to the effects of state income taxes, the manufacturing deduction and, for Fiscal 2014, adjustment of unrecognized tax benefits related to the resolution of certain open tax years. See Note 7 of Notes to Consolidated Financial Statements.

LIQUIDITY AND FINANCIAL CONDITION

Liquidity and Capital Resources

Our principal source of funds is cash generated from operations and borrowings available under our credit facilities. At May 2, 2015, we maintained $100 million unsecured revolving credit facilities, of which $10 million of borrowings were outstanding and $2.2 million were reserved for standby letters of credit. We believe that existing capital resources will be sufficient to meet our liquidity and capital requirements for the next twelve months. See Note 4 of Notes to Consolidated Financial Statements.

We continually evaluate capital projects to expand our production capacity, enhance packaging capabilities or improve efficiencies at our manufacturing facilities. Expenditures for property, plant and equipment amounted to $11.6 million for Fiscal 2015. There were no material capital expenditure commitments at May 2, 2015.

On January 25, 2013, the Company sold 400,000 shares of Special Series D Preferred Stock (“Series D Preferred”), par value $1 per share for an aggregate purchase price of $20 million. On May 2, 2014, the Company redeemed 160,000 shares of Series D Preferred, representing 40% of the amount outstanding, for an aggregate price of $8 million. On August 1, 2014, The Company redeemed 120,000 shares of Series D Preferred, representing 50% of the amount outstanding, for an aggregate price of $6 million. See Note 5 of Notes to Consolidated Financial Statements.

The Company paid special cash dividends on common stock of $118.1 million ($2.55 per share) on December 27, 2012.

Pursuant to a management agreement, we incurred a fee to Corporate Management Advisors, Inc. (“CMA”) of $6.5 million for Fiscal 2015, $6.4 million for Fiscal 2014 and $6.6 million for Fiscal 2013. At May 2, 2015, management fees payable to CMA were $1.6 million. See Note 5 of Notes to Consolidated Financial Statements.

Cash Flows

During Fiscal 2015, $58.0 million was provided by operating activities, $9.7 million was used in investing activities and $25.8 million was used in financing activities. Cash provided by operating activities increased $5.6 million primarily due to increased earnings. Cash used in investing activities decreased $2.3 million reflecting lower capital expenditures and proceeds of $1.9 from the sale of property. Cash used in financing activities was $25.8 million which included a $6 million redemption of preferred stock and $20 million in principal repayments under credit facilities.

During Fiscal 2014, $52.4 million was provided by operating activities, $12.1 million was used in investing activities and $28.7 million was used in financing activities. Cash provided by operating activities increased $12.1 million primarily due to changes in working capital. Cash used in investing activities increased $2.4 million reflecting higher capital expenditures in Fiscal 2014. Cash used in financing activities was $28.7 million reflecting an $8 million redemption of preferred stock and $20 million in principal repayments under credit facilities.

Financial Position

During Fiscal 2015, our working capital increased $22.9 million to $101.5 million primarily due to cash generated from operating activities. Trade receivables increased $1.7 million due to higher sales activity and days sales outstanding improved from 34.7 days to 33.1 days. Inventories decreased $1.0 million and annual inventory turns improved from 9.4 to 10.2 times. At May 2, 2015, the current ratio was 2.5 to 1 as compared to 2.2 to 1 at May 3, 2014.

During Fiscal 2014, our working capital increased $11.1 million to $78.6 million primarily due to cash generated from operating activities. Trade receivables decreased $5.9 million due to lower sales activity and days sales outstanding remain unchanged at 34.7 days. Inventories increased $4.7 million primarily due to higher quantities related to new products and to support more frequent customer promotions. At May 3, 2014, the current ratio was 2.2 to 1 as compared to 2.1 to 1 at April 27, 2013.

CONTRACTUAL OBLIGATIONS

Contractual obligations at May 2, 2015 are payable as follows:

|

(In thousands) |

||||||||||||||||||||

|

Total |

Less Than 1 Year |

1 to 3 Years |

3 to 5 Years |

More Than 5 Years |

||||||||||||||||

|

Long-term debt |

$ | 10,000 | $ | - | $ | 10,000 | $ | - | $ | - | ||||||||||

|

Operating leases |

22,194 | 5,399 | 8,409 | 5,980 | 2,406 | |||||||||||||||

|

Purchase commitments |

53,990 | 53,990 | - | - | - | |||||||||||||||

|

Total |

$ | 86,184 | $ | 59,389 | $ | 18,409 | $ | 5,980 | $ | 2,406 | ||||||||||

As of May 2, 2015, we guaranteed the residual value of certain leased equipment in the amount of $4.9 million. If the proceeds from the sale of such equipment are less than the balance required by the lease when the lease terminates on August 1, 2017, the Company shall be required to pay the difference up to such guaranteed amount. The Company expects to have no loss on such guarantee.

We contribute to certain pension plans under collective bargaining agreements and to a discretionary profit sharing plan. Total contributions were $2.7 million for Fiscal 2015, $2.7 million for Fiscal 2014 and $2.6 million for Fiscal 2013. See Note 9 of Notes to Consolidated Financial Statements.

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Other long-term liabilities include known claims and estimated incurred but not reported claims not otherwise covered by insurance, based on actuarial assumptions and historical claims experience. Since the timing and amount of claim payments vary significantly, we are not able to reasonably estimate future payments for specific periods and therefore have not been included in the table above. Standby letters of credit aggregating $2.2 million have been issued in connection with our self-insurance programs. These standby letters of credit expire through March 2016 and are expected to be renewed.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our financial condition.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on management’s knowledge of current events and actions it may undertake in the future, they may ultimately differ from actual results. We believe that the critical accounting policies described in the following paragraphs comprise the most significant estimates and assumptions used in the preparation of our consolidated financial statements. For these policies, we caution that future events rarely develop exactly as estimated and the best estimates routinely require adjustment.

Credit Risk

We sell products to a variety of customers and extend credit based on an evaluation of each customer’s financial condition, generally without requiring collateral. Exposure to credit losses varies by customer principally due to the financial condition of each customer. We monitor our exposure to credit losses and maintain allowances for anticipated losses based on specific customer circumstances, credit conditions and historical write-offs.

Impairment of Long-Lived Assets

All long-lived assets, excluding goodwill and intangible assets not subject to amortization, are evaluated for impairment on the basis of undiscounted cash flows whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An impaired asset is written down to its estimated fair market value based on the best information available. Estimated fair market value is generally measured by discounting future cash flows. Goodwill and intangible assets not subject to amortization are evaluated for impairment annually or sooner if we believe such assets may be impaired. An impairment loss is recognized if the carrying amount or, for goodwill, the carrying amount of its reporting unit, is greater than its fair value.

Income Taxes

Our effective income tax rate is based on estimates of taxes which will ultimately be payable. Deferred taxes are recorded to give recognition to temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Valuation allowances are established to reduce the carrying amounts of deferred tax assets when it is deemed, more likely than not, that the benefit of deferred tax assets will not be realized.

Insurance Programs

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Accordingly, we accrue for known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience.

Sales Incentives

We offer various sales incentive arrangements to our customers that require customer performance or achievement of certain sales volume targets. When the incentive is paid in advance, we amortize the amount paid over the period of benefit or contractual sales volume; otherwise, we accrue the expected amount to be paid over the period of benefit or expected sales volume. The recognition of these incentives involves the use of judgment related to performance and sales volume estimates that are made based on historical experience and other factors. Sales incentives are accounted for as a reduction of sales and actual amounts ultimately realized may vary from accrued amounts.

FORWARD-LOOKING STATEMENTS

National Beverage and its representatives may make written or oral statements relating to future events or results relative to our financial, operational and business performance, achievements, objectives and strategies. These statements are "forward-looking" within the meaning of the Private Securities Litigation Reform Act of 1995 and include statements contained in this report and other filings with the Securities and Exchange Commission and in reports to our stockholders. Certain statements including, without limitation, statements containing the words "believes," "anticipates," "intends," "plans," "expects," and "estimates" constitute "forward-looking statements" and involve known and unknown risk, uncertainties and other factors that may cause the actual results, performance or achievements of our Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the following: general economic and business conditions, pricing of competitive products, success in acquiring other beverage businesses, success of new product and flavor introductions, fluctuations in the costs of raw materials and packaging supplies, ability to pass along cost increases to our customers, labor strikes or work stoppages or other interruptions in the employment of labor, continued retailer support for our products, changes in consumer preferences and our success in creating products geared toward consumers’ tastes, success in implementing business strategies, changes in business strategy or development plans, government regulations, taxes or fees imposed on the sale of our products, unseasonably cold ,wet weather conditions or droughts and other factors referenced in this report, filings with the Securities and Exchange Commission and other reports to our stockholders. We disclaim an obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein to reflect future events or developments.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Commodities

We purchase various raw materials, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, the prices of which fluctuate based on commodity market conditions. Our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. At times, we manage our exposure to this risk through the use of supplier pricing agreements that enable us to establish the purchase prices for certain commodities. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs.

Interest Rates

At May 2, 2015, the Company had $10 million in borrowings outstanding under its credit facilities with a weighted average interest rate of 1.0%. Interest rate hedging products are not currently used to mitigate risk from interest fluctuations. If the interest rate on our debt changed by 100 basis points (1%), our interest expense for Fiscal 2015 would have changed by approximately $200,000.

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except share data) |

|

May 2, |

May 3, |

|||||||

|

2015 |

2014 |

|||||||

| Assets | ||||||||

| Current assets: | ||||||||

|

Cash and equivalents |

$ | 52,456 | $ | 29,932 | ||||

|

Trade receivables - net |

59,951 | 58,205 | ||||||

|

Inventories |

42,924 | 43,914 | ||||||

|

Deferred income taxes - net |

4,348 | 2,685 | ||||||

|

Prepaid and other assets |

8,050 | 8,405 | ||||||

|

Total current assets |

167,729 | 143,141 | ||||||

| Property, plant and equipment - net | 60,182 | 59,494 | ||||||

| Goodwill | 13,145 | 13,145 | ||||||

| Intangible assets | 1,615 | 1,615 | ||||||

| Other assets | 5,079 | 5,446 | ||||||

| Total assets | $ | 247,750 | $ | 222,841 | ||||

| Liabilities and Shareholders' Equity | ||||||||

| Current liabilities: | ||||||||

|

Accounts payable |

$ | 44,896 | $ | 45,606 | ||||

|

Accrued liabilities |

21,257 | 18,873 | ||||||

|

Income taxes payable |

98 | 44 | ||||||

|

Total current liabilities |

66,251 | 64,523 | ||||||

| Long-term debt | 10,000 | 30,000 | ||||||

| Deferred income taxes - net | 15,245 | 13,873 | ||||||

| Other liabilities | 8,472 | 8,244 | ||||||

| Shareholders' equity: | ||||||||

| Preferred stock, $1 par value - 1,000,000 shares authorized | ||||||||

|

Series C - 150,000 shares issued |

150 | 150 | ||||||

|

Series D - 120,000 shares (2015) and 240,000 shares (2014) issued, aggregate liquidation preference of $6,000 (2015) and $12,000 (2014) |

120 | 240 | ||||||

|

Common stock, $.01 par value - 75,000,000 shares authorized; 50,418,019 shares (2015) and 50,367,799 shares (2014) issued |

504 | 504 | ||||||

| Additional paid-in capital | 37,759 | 42,775 | ||||||

| Retained earnings | 129,773 | 80,737 | ||||||

| Accumulated other comprehensive loss | (2,524 | ) | (205 | ) | ||||

| Treasury stock - at cost: | ||||||||

|

Series C preferred stock - 150,000 shares |

(5,100 | ) | (5,100 | ) | ||||

|

Common stock - 4,032,784 shares |

(12,900 | ) | (12,900 | ) | ||||

| Total shareholders' equity | 147,782 | 106,201 | ||||||

| Total liabilities and shareholders' equity | $ | 247,750 | $ | 222,841 | ||||

|

See accompanying Notes to Consolidated Financial Statements. |

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

(In thousands, except per share amounts) |

|

Fiscal Year Ended |

||||||||||||

|

May 2, |

May 3, |

April 27, |

||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Net sales |

$ | 645,825 | $ | 641,135 | $ | 662,007 | ||||||

|

Cost of sales |

426,685 | 423,480 | 444,757 | |||||||||

|

Gross profit |

219,140 | 217,655 | 217,250 | |||||||||

|

Selling, general and administrative expenses |

145,157 | 153,220 | 146,223 | |||||||||

|

Interest expense |

371 | 660 | 403 | |||||||||

|

Other (income) expense - net |

(1,101 | ) | 666 | 173 | ||||||||

|

Income before income taxes |

74,713 | 63,109 | 70,451 | |||||||||

|

Provision for income taxes |

25,402 | 19,474 | 23,531 | |||||||||

|

Net income |

49,311 | 43,635 | 46,920 | |||||||||

|

Less preferred dividends and accretion |

(275 | ) | (726 | ) | (153 | ) | ||||||

|

Earnings available to common shareholders |

$ | 49,036 | $ | 42,909 | $ | 46,767 | ||||||

|

Earnings per common share: |

||||||||||||

|

Basic |

$ | 1.06 | $ | .93 | $ | 1.01 | ||||||

|

Diluted |

$ | 1.05 | $ | .92 | $ | 1.01 | ||||||

|

Weighted average common shares outstanding: |

||||||||||||

|

Basic |

46,353 | 46,331 | 46,310 | |||||||||

|

Diluted |

46,559 | 46,519 | 46,482 | |||||||||

|

See accompanying Notes to Consolidated Financial Statements. |

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

(In thousands) |

|

Fiscal Year Ended |

||||||||||||

|

May 2, |

May 3, |

April 27, |

||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Net income |

$ | 49,311 | $ | 43,635 | $ | 46,920 | ||||||

|

Other comprehensive income (loss), net of tax: |

||||||||||||

| Cash flow hedges | (2,350 | ) | 610 | (295 | ) | |||||||

| Other | 31 | 149 | (27 | ) | ||||||||

| Total | (2,319 | ) | 759 | (322 | ) | |||||||

|

Comprehensive income |

$ | 46,992 | $ | 44,394 | $ | 46,598 | ||||||

|

See accompanying Notes to Consolidated Financial Statements. |

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY |

|

(In thousands) |

| Fiscal Year Ended | ||||||||||||||||||||||||

| May 2, 2015 | May 3, 2014 | April 27, 2013 | ||||||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

Shares |

Amount |

|||||||||||||||||||

|

Series C Preferred Stock |

||||||||||||||||||||||||

|

Beginning and end of year |

150 | $ | 150 | 150 | $ | 150 | 150 | $ | 150 | |||||||||||||||

|

Series D Preferred Stock |

||||||||||||||||||||||||

|

Beginning of year |

240 | 240 | 400 | 400 | - | - | ||||||||||||||||||

|

Series D preferred (redeemed) issued |

(120 | ) | (120 | ) | (160 | ) | (160 | ) | 400 | 400 | ||||||||||||||

|

End of year |

120 | 120 | 240 | 240 | 400 | 400 | ||||||||||||||||||

|

Common Stock |

||||||||||||||||||||||||

|

Beginning of year |

50,368 | 504 | 50,362 | 504 | 50,322 | 503 | ||||||||||||||||||

|

Stock options exercised |

50 | - | 6 | - | 40 | 1 | ||||||||||||||||||

|

End of year |

50,418 | 504 | 50,368 | 504 | 50,362 | 504 | ||||||||||||||||||

|

Additional Paid-In Capital |

||||||||||||||||||||||||

|

Beginning of year |

42,775 | 50,398 | 30,425 | |||||||||||||||||||||

|

Series D preferred (redeemed) issued |

(5,791 | ) | (7,722 | ) | 19,304 | |||||||||||||||||||

|

Stock options exercised |

228 | 47 | 238 | |||||||||||||||||||||

|

Stock-based compensation |

307 | 95 | 230 | |||||||||||||||||||||

|

Other |

240 | (43 | ) | 201 | ||||||||||||||||||||

|

End of year |

37,759 | 42,775 | 50,398 | |||||||||||||||||||||

|

Retained Earnings |

||||||||||||||||||||||||

|

Beginning of year |

80,737 | 37,828 | 109,200 | |||||||||||||||||||||

|

Net income |

49,311 | 43,635 | 46,920 | |||||||||||||||||||||

|

Common stock dividends |

- | - | (118,139 | ) | ||||||||||||||||||||

|

Preferred stock dividends & accretion |

(275 | ) | (726 | ) | (153 | ) | ||||||||||||||||||

|

End of year |

129,773 | 80,737 | 37,828 | |||||||||||||||||||||

|

Accumulated Other Comprehensive Loss |

||||||||||||||||||||||||

|

Beginning of year |

(205 | ) | (964 | ) | (642 | ) | ||||||||||||||||||

|

Cash flow hedges |

(2,350 | ) | 610 | (295 | ) | |||||||||||||||||||

|

Other |

31 | 149 | (27 | ) | ||||||||||||||||||||

|

End of year |

(2,524 | ) | (205 | ) | (964 | ) | ||||||||||||||||||

|

Treasury Stock - Series C Preferred |

||||||||||||||||||||||||

|

Beginning and end of year |

150 | (5,100 | ) | 150 | (5,100 | ) | 150 | (5,100 | ) | |||||||||||||||

|

Treasury Stock - Common |

||||||||||||||||||||||||

|

Beginning and end of year |

4,033 | (12,900 | ) | 4,033 | (12,900 | ) | 4,033 | (12,900 | ) | |||||||||||||||

|

Total Shareholders' Equity |

$ | 147,782 | $ | 106,201 | $ | 70,316 | ||||||||||||||||||

|

See accompanying Notes to Consolidated Financial Statements. |

|

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(In thousands) |

|

Fiscal Year Ended |

||||||||||||

|

May 2, |

May 3, |

April 27, |

||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Operating Activities: |

||||||||||||

|

Net income |

$ | 49,311 | $ | 43,635 | $ | 46,920 | ||||||

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

||||||||||||

| Depreciation and amortization | 11,580 | 11,708 | 11,002 | |||||||||

| Deferred income tax provision | 1,076 | 79 | 172 | |||||||||

| (Gain) loss on disposal of property, net | (1,188 | ) | 51 | 63 | ||||||||

| Stock-based compensation | 307 | 95 | 230 | |||||||||

| Changes in assets and liabilities: | ||||||||||||

| Trade receivables | (1,746 | ) | 5,864 | (2,478 | ) | |||||||

| Inventories | 990 | (4,680 | ) | 1,628 | ||||||||

| Prepaid and other assets | (605 | ) | (2,548 | ) | (2,466 | ) | ||||||

| Accounts payable | (710 | ) | 1,345 | (10,614 | ) | |||||||

| Accrued and other liabilities | (995 | ) | (3,167 | ) | (4,193 | ) | ||||||

|

Net cash provided by operating activities |

58,020 | 52,382 | 40,264 | |||||||||

|

Investing Activities: |

||||||||||||

|

Additions to property, plant and equipment |

(11,630 | ) | (12,124 | ) | (9,693 | ) | ||||||

|

Proceeds from sale of property, plant and equipment |

1,905 | 62 | 77 | |||||||||

|

Net cash used in investing activities |

(9,725 | ) | (12,062 | ) | (9,616 | ) | ||||||

|

Financing Activities: |

||||||||||||

|

Dividends paid on common stock |

- | - | (118,139 | ) | ||||||||

|

Dividends paid on preferred stock |

(239 | ) | (659 | ) | (12 | ) | ||||||

|

(Repayments) borrowings under credit facilities, net |

(20,000 | ) | (20,000 | ) | 50,000 | |||||||

|

(Redemption) issuance of preferred stock |

(6,000 | ) | (8,000 | ) | 19,704 | |||||||

|

Proceeds from stock options exercised |

228 | 47 | 239 | |||||||||

|

Other |

240 | (43 | ) | 201 | ||||||||

|

Net cash used in financing activities |

(25,771 | ) | (28,655 | ) | (48,007 | ) | ||||||

|

Net Increase (Decrease) in Cash and Equivalents |

22,524 | 11,665 | (17,359 | ) | ||||||||

|

Cash and Equivalents - Beginning of Year |

29,932 | 18,267 | 35,626 | |||||||||

|

Cash and Equivalents - End of Year |

$ | 52,456 | $ | 29,932 | $ | 18,267 | ||||||

|

Other Cash Flow Information: |

||||||||||||

|

Interest paid |

$ | 380 | $ | 723 | $ | 341 | ||||||

|

Income taxes paid |

$ | 24,745 | $ | 23,079 | $ | 24,327 | ||||||

|

See accompanying Notes to Consolidated Financial Statements. |

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

National Beverage Corp. develops, manufactures, markets and sells a diverse portfolio of flavored beverage products primarily in North America. Incorporated in Delaware in 1985, National Beverage Corp. is a holding company for various operating subsidiaries. When used in this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries.

|

|

|

1. |

significant accounting policies |

Basis of Presentation

The consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“GAAP”) and rules and regulations of the Securities and Exchange Commission. The consolidated financial statements include the accounts of National Beverage Corp. and all subsidiaries. All significant intercompany transactions and accounts have been eliminated. Our fiscal year ends the Saturday closest to April 30 and, as a result, an additional week is added every five or six years. Fiscal 2015 and Fiscal 2013 consisted of 52 weeks while Fiscal 2014 consisted of 53 weeks.

Cash and Equivalents

Cash and equivalents are comprised of cash and highly liquid securities (consisting primarily of short-term money-market investments) with an original maturity of three months or less.

Derivative Financial Instruments

We use derivative financial instruments to partially mitigate our exposure to changes in raw material costs. All derivative financial instruments are recorded at fair value in our Consolidated Balance Sheets. We do not use derivative financial instruments for trading or speculative purposes. Credit risk related to derivative financial instruments is managed by requiring high credit standards for counterparties and frequent cash settlements. See Note 6.

Earnings Per Common Share

Basic earnings per common share is computed by dividing earnings available to common shareholders by the weighted average number of common shares outstanding during the period. Diluted earnings per common share is calculated in a similar manner, but includes the dilutive effect of stock options amounting to 206,000 shares in Fiscal 2015, 188,000 shares in Fiscal 2014 and 172,000 shares in Fiscal 2013.

Fair Value

The fair value of long-term debt approximates its carrying value due to its variable interest rate and lack of prepayment penalty. The estimated fair values of derivative financial instruments are calculated based on market rates to settle the instruments. These values represent the estimated amounts we would receive upon sale, taking into consideration current market prices and credit worthiness. See Note 6.

Impairment of Long-Lived Assets

All long-lived assets, excluding goodwill and intangible assets not subject to amortization, are evaluated for impairment on the basis of undiscounted cash flows whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An impaired asset is written down to its estimated fair value based on the best information available. Estimated fair value is generally measured by discounting future cash flows. Goodwill and intangible assets not subject to amortization are evaluated for impairment annually or sooner if we believe such assets may be impaired. An impairment loss is recognized if the carrying amount or, for goodwill, the carrying amount of its reporting unit, is greater than its fair value.

Income Taxes

Our effective income tax rate is based on estimates of taxes which will ultimately be payable. Deferred taxes are recorded to give recognition to temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Valuation allowances are established to reduce the carrying amounts of deferred tax assets when it is deemed, more likely than not, that the benefit of deferred tax assets will not be realized.

Insurance Programs

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Accordingly, we accrue for known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience. At May 2, 2015 and May 3, 2014, other liabilities included accruals of $5.9 million and $6.1 million, respectively, for estimated non-current risk retention exposures, of which $4.7 million and $5.1 million were covered by insurance.

Intangible Assets

Intangible assets as of May 2, 2015 and May 3, 2014 consisted of non-amortizable trademarks.

Inventories

Inventories are stated at the lower of first-in, first-out cost or market. Inventories at May 2, 2015 were comprised of finished goods of $24.9 million and raw materials of $18.0 million. Inventories at May 3, 2014 were comprised of finished goods of $27.2 million and raw materials of $16.7 million.

Marketing Costs