Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2018

OR

|

| | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition period from to to

Commission File No. 1-11288

ACTUANT CORPORATION

(Exact name of Registrant as specified in its charter)

|

| | |

Wisconsin | | 39-0168610 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

N86 W12500 WESTBROOK CROSSING

MENOMONEE FALLS, WISCONSIN 53051

Mailing address: P.O. Box 3241, Milwaukee, Wisconsin 53201

(Address of principal executive offices)

(262) 293-1500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | |

| (Title of each class) | | (Name of each exchange on which registered) | |

| Class A Common Stock, par value $0.20 per share | | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15d of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Emerging growth company | | ¨ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ¨ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

As of February 28, 2018, the end of the Registrant's second fiscal quarter, the aggregate market value of the shares of Common Stock (based upon the closing price on the New York Stock Exchange on February 28, 2018) held by non-affiliates of the Registrant was approximately $1.37 billion.

There were 61,016,012 shares of the Registrant’s Class A Common Stock outstanding as of September 30, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Annual Meeting of Shareholders to be held on January 22, 2019 are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

|

| | |

| | |

| | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

| | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

| | |

| | |

Item 15. | | |

Actuant Corporation provides free-of-charge access to our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments thereto, through our website, www.actuant.com, as soon as reasonably practical after such reports are electronically filed with the Securities and Exchange Commission.

FORWARD LOOKING STATEMENTS AND CAUTIONARY FACTORS

This annual report on Form 10-K contains certain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “estimate,” “expect,” “objective,” “plan,” “project” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to inherent risks and uncertainties that may cause actual results or events to differ materially from those contemplated by such forward-looking statements. In addition to the assumptions and other factors referred to specifically in connection with such statements, factors that may cause actual results or events to differ materially from those contemplated by such forward-looking statements include, without limitation, general economic uncertainty, market conditions in the industrial, oil & gas, energy, power generation, infrastructure, commercial construction, truck, automotive, specialty vehicle and agriculture industries, market acceptance of existing and new products, successful integration of acquisitions and related restructuring, operating margin risk due to competitive pricing and operating efficiencies, supply chain risk, material, labor, or overhead cost increases, foreign currency risk, interest rate risk, commodity risk, the impact of geopolitical activity, tariffs, litigation matters, impairment of goodwill or other intangible assets, the Company’s ability to access capital markets and other factors that may be referred to or noted in the Company’s reports filed with the Securities and Exchange Commission from time to time, including those described under "Item 1A. Risk Factors" of this annual report on Form 10-K. We disclaim any obligation to publicly update or revise any forward-looking statements as a result of new information, future events or any other reason.

When used herein, the terms “Actuant,” “we,” “us,” “our,” and the “Company” refer to Actuant Corporation and its subsidiaries.

PART I

Item 1. Business

General

Actuant Corporation, headquartered in Menomonee Falls, Wisconsin, was incorporated in 1910. We are a global diversified company that designs, manufactures and distributes a broad range of industrial products and systems to various end markets. As part of our ongoing assessment of segment reporting, during the fourth quarter of fiscal 2018, the Company’s financial reporting segments were modified to reflect changes in the operating structure of the Company, with the combination of our tools and services businesses and all OEM-related businesses into two operating segments: Industrial Tools & Services and Engineered Components & Systems. All prior period disclosures have been adjusted to reflect the two reportable segments. The Industrial Tools & Services segment is primarily engaged in the design, manufacture and distribution of branded hydraulic and mechanical tools as well as providing services and tool rentals to the industrial, maintenance, infrastructure, oil & gas, energy and other markets. The Engineered Components & Systems segment provides highly engineered components for on-highway, off-highway, agriculture, energy, medical, construction and other vertical markets. Financial information related to the Company's segments is included in Note 15, "Business Segment, Geographic and Customer Information" in the notes to the consolidated financial statements.

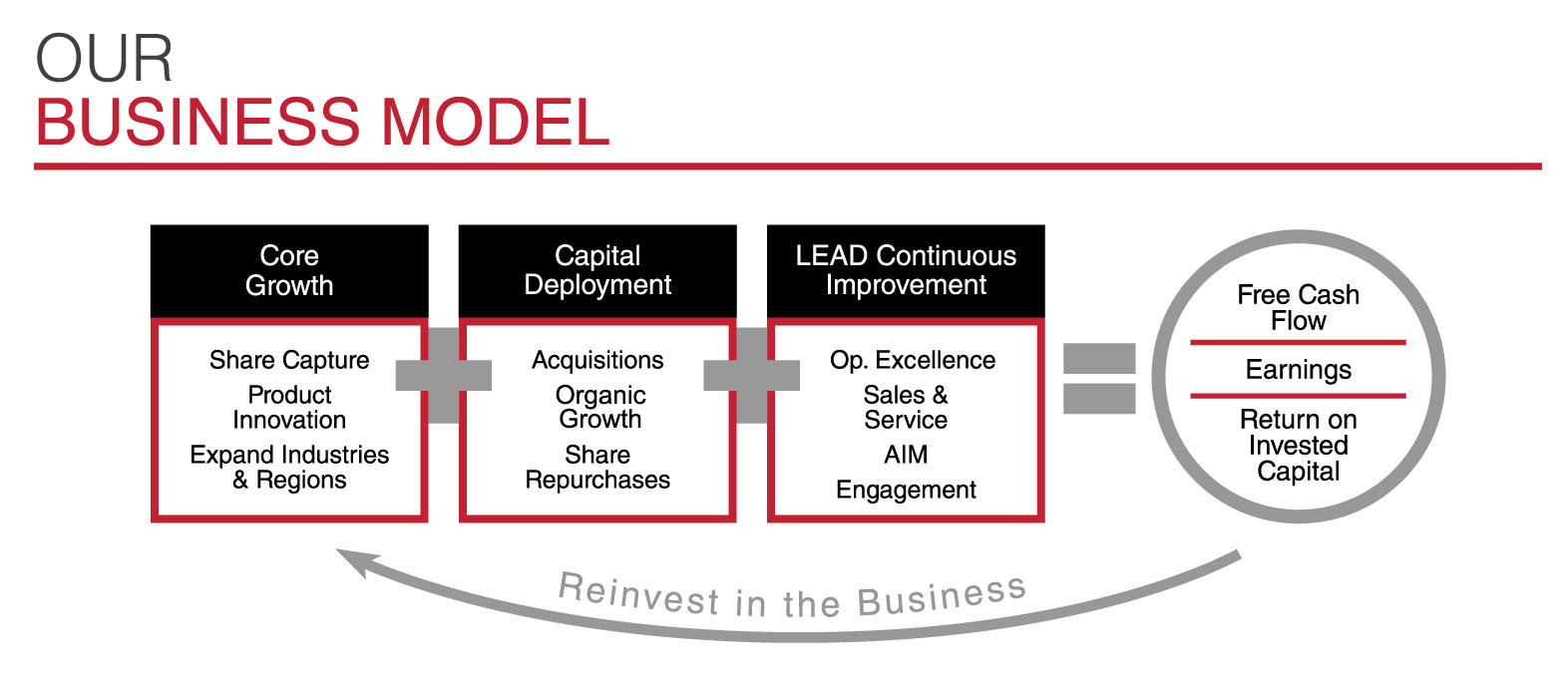

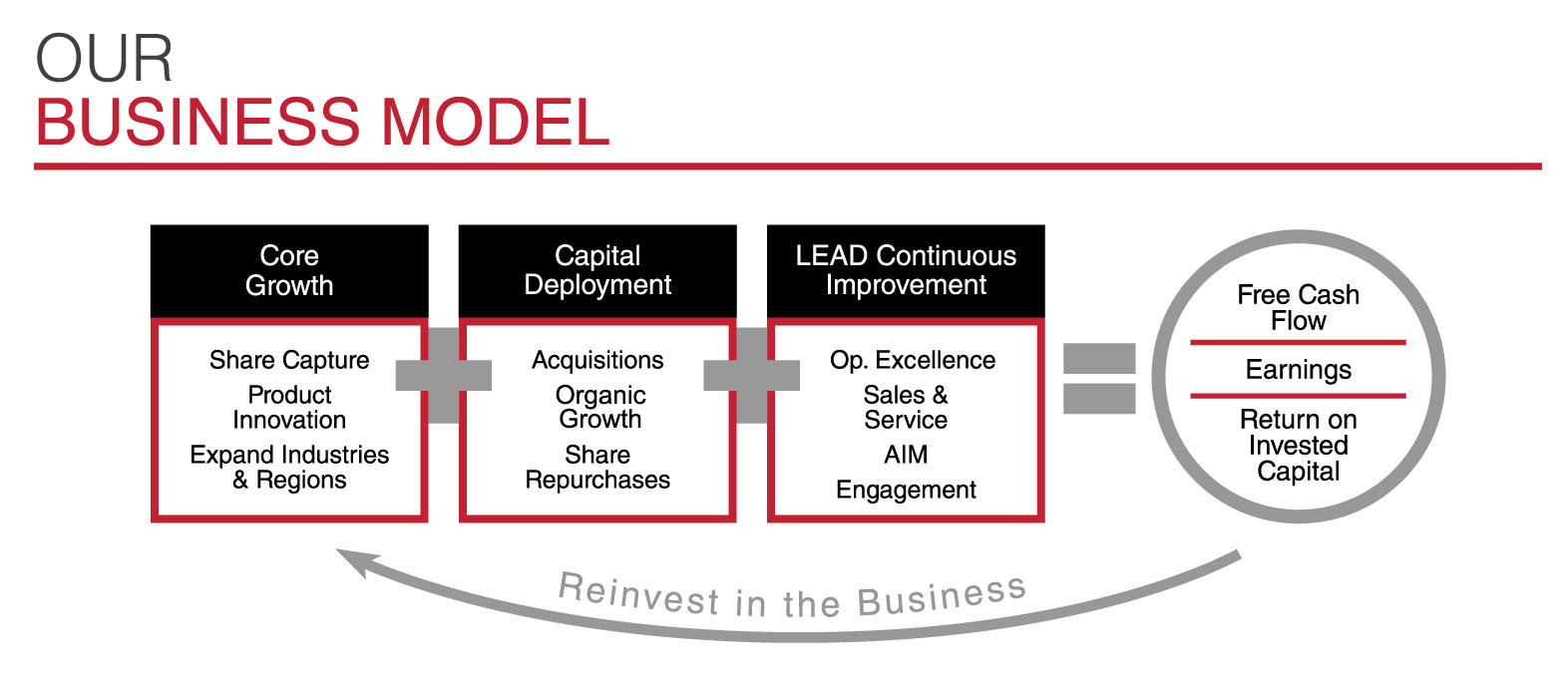

Our long-term goal is to grow diluted earnings per share faster than other multi-industry peers. We intend to leverage our strong market positions to generate organic core sales growth that exceeds end-market growth rates. Organic growth is accomplished through a combination of share capture, product innovation and market expansion into emerging industries and geographic regions. In addition to organic growth, strong cash flow generation is achieved by maximizing returns on assets and minimizing primary working capital needs. The cash flow that results from efficient asset management and improved profitability is used to fund internal growth opportunities, strategic acquisitions and common stock repurchases. We also focus on profit margin expansion and cash flow generation to achieve our financial objectives. Our LEAD (“Lean Enterprise Across Disciplines”) Business System utilizes continuous improvement techniques to reduce costs, improve efficiencies and drive operational excellence across all locations and functions worldwide, thereby expanding profit margins and improving the customer experience. Our LEAD efforts also support our core sales growth.

Our businesses provide an array of products and services across multiple end markets and geographies, which results in significant diversification. The long-term sales growth and profitability of our business is dependent not only on increased demand in end markets and the overall economic environment, but also on our ability to identify, consummate and integrate strategic acquisitions, develop and market innovative new products, expand our business activity geographically and continuously improve operational excellence. We remain focused on improving our financial position and flexibility by adjusting our cost structure to reflect changes in demand levels and by proactively managing working capital and cash flow generation.

Description of Business Segments

Industrial Tools & Services

The Industrial Tools & Services segment is a global supplier of both products and services to a broad array of end markets, including industrial, energy, mining and production automation markets. Our primary products include branded tools, highly engineered heavy lifting technology solutions, connectors for oil & gas and hydraulic torque wrenches. On the services side of the segment, we provide energy maintenance and manpower services to meet customer-specific needs and rental capabilities for certain of our products. Our branded tools and services are marketed primarily through the Enerpac, Hydratight, Larzep, Simplex, Biach, Equalizer and Mirage brand names.

Our Industrial Tools & Services segment includes high-force hydraulic and mechanical tools (cylinders, pumps, valves and specialty tools) which are designed to allow users to apply controlled force and motion to increase productivity, reduce labor costs and make work safer and easier to perform. These tools operate at very high pressures of approximately 5,000 to 12,000 pounds per square inch and are generally sold by a diverse group of industrial and specialty fluid power distributors to customers in various industries. Examples of industrial distributors include W.W. Grainger, MSC and Blackwoods.

Our products also include bolt tensioners, connectors for oil & gas and other miscellaneous products. With our products used in a wide variety of end markets, they are often deployed in harsh operating conditions, such as oil & gas production, machining and infrastructure maintenance and repair, where safety is a key differentiator. As a result, we hold ourselves to a world class safety standard to ensure both our employees and our customers are safe.

In addition to providing a comprehensive line of tools and other products, the Industrial Tools & Services segment sustains a services and rental network providing highly trained technicians to perform bolting, machining and joint integrity work for our customers. The segment delivers products and services through a localized infrastructure of product, rental and maintenance depots.

We will also focus on acquiring complementary businesses that provide product line and regional expansion opportunities, while leveraging existing and new distribution channels.

Engineered Components & Systems

The Engineered Components & Systems segment is a leading global designer, manufacturer and assembler of system critical position and motion control systems, high performance ropes, cables and umbilicals and other customized industrial components to various vehicle, construction, agricultural and other niche markets. The segment focuses on providing technical and highly engineered products, including actuation systems, mechanical power transmission products, engine air flow management systems, human to machine interface ("HMI") solutions and other rugged electronic instrumentation. Products in the Engineered Components & Systems segment are primarily marketed directly to original equipment manufacturers (“OEMs”) and other diverse customers through a technical sales organization. Within this segment, engineering capabilities, technical service, price, quality and established customer relationships are key competitive advantages.

Approximately forty percent of the Engineered Components & Systems segment's revenue comes from our On-Highway product line (Power-Packer and Gits brands), with sales to the heavy duty truck, automotive and specialty vehicle markets. Products include hydraulic cab-tilt and latching systems which are sold to global heavy duty truck OEMs such as Volvo, Scania, Paccar-DAF, FAW and CNHTC, as well as automotive electro-hydraulic convertible top latching and actuation systems.

The automotive convertible top actuation systems are utilized on both retractable soft and hard top vehicles manufactured by OEMs such as Daimler, General Motors, Volkswagen and BMW. Our diesel engine air flow solutions, such as exhaust gas recirculation (“EGR”) systems and air flow actuators, are used by diesel engine and turbocharger manufacturers to reduce emissions, improve fuel efficiency and increase horsepower. Primary end markets include heavy duty truck and equipment serving customers such as Caterpillar, Cummins, MAN, Honeywell and Borg Warner.

The Agriculture, Off-Highway and Other product line within the segment includes severe-duty electronic instrumentation (including displays and clusters, machine controls and sensors), HMI solutions and power transmission products (highly engineered power transmission components including drive shafts, torque limiters, gearboxes, torsional dampers and flexible shafts). These products are sold to a variety of niche markets including agricultural, lawn & turf, construction, forestry, industrial, aerospace, material handling and security. Representative customers include John Deere, Caterpillar, AGCO, MacDon, CNH, Stihl and MTD Products.

In addition, our Concrete Tensioning and Rope & Cable product lines provide customized solutions and products to our diverse customer base. Our Concrete Tensioning product line (chucks and wedges, stressing jacks and anchors) is used by concrete tensioning designers, fabricators and installers for residential and commercial construction and bridge, infrastructure and mining markets. We also develop highly-engineered rope, umbilical and cable solutions that maximize performance, safety, and efficiency for our customers in various markets including oil & gas, heavy marine, medical and aerospace defense. Until the fiscal 2018 divestiture of our Viking business, this segment also offered a comprehensive range of marine mooring equipment such as chains, anchors and fiber rope.

International Business

Our products and services are generally available globally, with our principal markets outside the United States being Europe and Asia. In fiscal 2018, we derived 43% of our net sales from the United States, 35% from Europe, 9% from Asia, 5% from the Middle East and 8% from other geographic areas. We have operations around the world and our geographic diversity allows us to draw on the skills of a global workforce, provides flexibility to our operations, allows us to drive economies of scale, provides revenue streams that may help offset economic trends that are specific to individual countries and offers us an opportunity to access new markets. Although international operations are subject to certain risks, we continue to believe that a global presence is key to maintaining strong relationships with many of our global customers. Financial information related to the Company's geographic footprint is included in Note 15, "Business Segment, Geographic and Customer Information" in the notes to the consolidated financial statements.

Product Development and Engineering

We conduct research and development activities to develop new products, enhance the functionality, effectiveness, ease of use and reliability of our existing products and expand the applications for our products. We believe that our engineering and research and development efforts have been and continue to be key drivers of our success in the marketplace. Our advanced design and engineering capabilities contribute to the development of innovative and highly engineered products, maintain our technological leadership in each segment and enhance our ability to provide customers with unique and customized solutions and products. We anticipate that we will continue to make significant expenditures for research and development as we seek to provide innovative products to maintain and improve our competitive position. Research and development costs are expensed as incurred and were $26 million in fiscal 2018, an increase of 18% from $22 million in fiscal 2017 and an increase of 41% from $18 million in fiscal 2016. We also incur costs in connection with fulfilling custom orders and developing unique solutions for distinct customer needs, which are not included in these expense totals.

The Company holds numerous patents and trademarks; however, no individual patent or trademark is believed to be of such importance that its termination would have a material adverse effect on our business.

Competition

The markets for our products are highly competitive. We provide a diverse and broad range of industrial products and systems to numerous global end markets, many of which are highly fragmented. Although we face larger competitors in several served markets, some of our competition is comprised of smaller companies which may lack the global footprint or financial resources to serve global customers. We compete for business principally on the basis of customer service, product quality and availability, engineering, research and development expertise and price. In addition, we believe that our cost structure, strategic global sourcing capabilities and global distribution support our competitive position.

Manufacturing and Operations

While we do have extensive manufacturing capabilities including machining, stamping, injection molding and fabrication, our manufacturing consists primarily of light assembly of components we source from a network of global suppliers. We have implemented single piece flow processes in most of our manufacturing plants, which reduces inventory levels, lowers “re-work” costs and shortens lead times to customers. Components are built to our highly engineered specifications by a variety of suppliers, including those in low cost countries such as China, Turkey, India and Mexico. We have built strong relationships with our key suppliers and, while we single source certain of our components, in most cases there are several qualified alternative sources.

Raw Material Costs and Inflation

We source materials and components from a network of global suppliers. These items are typically available from multiple suppliers. Raw materials that go into the components we source, such as steel and plastic resin, are subject to price fluctuations and tariffs, which could have an impact on our results. While no meaningful measures of inflation specific to our products are available because we have significant operations in countries with diverse rates of inflation and currency rate movements, we have more than offset the impact of inflation in recent years with manufacturing efficiencies, cost reductions and annual pricing actions.

Order Backlogs and Seasonality

Our Industrial Tools & Services segment has a relatively short order-to-ship cycle, while our OEM-oriented Engineered Components & Systems segment has a longer cycle, and therefore typically has a larger backlog. We had order backlogs of $197 million and $195 million at August 31, 2018 and 2017, respectively. Substantially all orders are expected to be filled within twelve months. While we typically experience a stronger second half to our fiscal year, our consolidated sales are not subject to significant seasonal fluctuations.

Sales Percentages by Fiscal Quarter

|

| | | | | | | | |

| | | 2018 | | 2017 | |

| Quarter 1 (September - November) | | 24 | % | | 24 | % | |

| Quarter 2 (December - February) | | 23 | % | | 24 | % | |

| Quarter 3 (March - May) | | 27 | % | | 27 | % | |

| Quarter 4 (June - August) | | 26 | % | | 25 | % | |

| | | 100 | % | | 100 | % | |

Employees

At August 31, 2018, we had approximately 5,300 employees. Our employees generally are not subject to collective bargaining agreements, with the exception of approximately 300 U.S. production employees and certain international employees covered by government mandated collective labor agreements. We believe we have a good working relationship with our employees globally.

Environmental Matters

Our operations, like those of most industrial businesses, are subject to federal, state, local and foreign laws and regulations relating to the protection of the environment, including those regulating discharges of hazardous materials into the air and water, the storage and disposal of such hazardous materials and the clean-up of soil and groundwater contamination. We believe that we are in material compliance with applicable environmental regulations. Compliance with these laws requires expenditures on an ongoing basis. However, environmental expenditures over the last three years have not been material. Soil and groundwater contamination has been identified at certain facilities that we operate or formerly owned or operated. We are also a party to certain state and local environmental matters, have provided environmental indemnifications for certain divested businesses and retain responsibility for certain potential environmental liabilities. For further information, see Note 16, “Commitments and Contingencies” in the notes to consolidated financial statements.

Executive Officers of the Registrant

The names, ages and positions of all of the executive officers of the Company as of October 15, 2018 are listed below.

|

| | | | |

Name | | Age | | Position |

Randal W. Baker | | 55 | | President and Chief Executive Officer |

Rick T. Dillon | | 47 | | Executive Vice President and Chief Financial Officer |

Fabrizio R. Rasetti | | 52 | | Executive Vice President—General Counsel and Secretary |

Roger A. Roundhouse | | 53 | | Executive Vice President—Engineered Components & Systems Segment |

J. Jeffrey Schmaling | | 59 | | Executive Vice President—Industrial Tools & Services Segment |

Andre L. Williams | | 59 | | Executive Vice President—Global Human Resources |

Randal W. Baker, President, Chief Executive Officer. Mr. Baker was appointed President and Chief Executive Officer of the Company in March 2016. Prior to joining the Company, Mr. Baker held multiple roles during a six year tenure at Joy Global, including most recently as Chief Operating Officer. Prior to Joy Global, Mr. Baker was an executive with Case New Holland Inc., holding a variety of roles including President and CEO of its agricultural equipment business. Mr. Baker also held diverse leadership roles in marketing, sales, product development and engineering at Komatsu America Corporation, Ingersoll-Rand and Sandvik Corporation.

Rick T. Dillon, Executive Vice President and Chief Financial Officer, joined the Company in December 2016. Prior to joining the Company, Mr. Dillon served as Executive Vice President and Chief Financial Officer of Century Aluminum Co. Prior to that, Mr. Dillon served as Vice President-Finance Global Surface Mining Group and Vice President-Controller and Chief Accounting Officer of Joy Global Inc. from 2009 to 2014. Prior to Joy Global, Mr. Dillon served as Vice President-Business Planning and Analysis and Vice President-Controller and Chief Accounting Officer at Newell Brands, and Vice President-Controller and Chief Accounting Officer at Briggs & Stratton Corporation.

Fabrizio R. Rasetti, Executive Vice President—General Counsel and Secretary, joined Actuant in May 2018 from Boart Longyear where he held the position of Senior Vice President, General Counsel and Secretary since 2006. For the ten years prior he worked at SPX Corporation in roles of increasing responsibility including Segment General Counsel & Vice President, Business Development, Flow Segment. Earlier in his career he worked in private law practice.

Roger A. Roundhouse, Executive Vice President—Engineered Components & Systems segment. Mr. Roundhouse joined the Company in 2014, from General Cable, where he most recently held the position of Senior Vice President and General Manager Utility Products. Mr. Roundhouse brings extensive automotive, industrial and OEM knowledge, as well as over 20 years of experience with global operations and mergers & acquisitions.

J. Jeffrey Schmaling, Executive Vice President—Industrial Tools & Services segment joined Actuant in his current role in February 2018. Prior to Actuant he held the position of President, North America for Komatsu Mining Corporation (formerly Joy Global Inc.) since 2010. Prior to that, he served as Senior Director Dealer Development and Account Management at Case International Harvester, a Division of Fiat S.p.A. Earlier in his 30 plus year career he held various sales, marketing and product development roles.

Andre L. Williams, Executive Vice President—Global Human Resources. Mr. Williams joined the Company in January 2017 as Vice President Human Resources within our segments and was promoted to Executive Vice President—Global Human Resources in September 2017. Prior to joining the Company, Mr. Williams was the Vice President Human Resources for Global Sales & Marketing and Control Products & Solutions at Rockwell Automation. Prior to Rockwell Automation, Mr. Williams held Human Resource roles of increasing responsibility at Joy Global, Accenture, Best Buy, Beloit Corporation, Morton International and South African Breweries.

Item 1A. Risk Factors

The risks and uncertainties described below are those that we have identified as material, but are not the only risks and uncertainties facing the Company. If any of the events contemplated by the following risks actually occurs, our business, financial condition, or results of operations could be materially adversely affected. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may adversely impact our business.

Deterioration of, or instability in, the domestic and international economy and challenging end market conditions could impact our ability to grow the business and adversely impact our financial condition, results of operations and cash flows.

Our businesses and operating results have been, and will continue to be, affected by domestic and international economic conditions. The level of demand for our products depends, in part, on general economic conditions in our served end markets. A substantial portion of our revenues is derived from customers in cyclical industries (vehicles, industrial, oil & gas, agriculture

and mining) that typically are adversely affected by downward economic cycles. As global economic uncertainty continues, our customers may experience deterioration of their businesses, which may delay or lengthen sales cycles. Beginning in fiscal 2016, we experienced challenging and inconsistent demand in several of our served markets, including oil & gas, mining, infrastructure, commercial and off-highway vehicles and agriculture markets. As a result of these and other factors, we implemented various restructuring initiatives aimed at reducing our cost structure and improving operational performance. While we have seen recovery in those end markets, we are still executing on restructuring initiatives previously announced. Further, we may implement additional restructuring initiatives in response to further market challenges to achieve additional efficiencies. Such initiatives could result in restructuring costs, including facility consolidations, workforce reductions and structural realignment. Although we expect that the related cost savings and realization of efficiencies will offset the restructuring related costs over time, we may not achieve the desired net benefits of these efforts (see Note 3, "Restructuring Charges" and "Business Update" within Item 7 for further discussion of our restructuring activities and future anticipated cost savings).

The integration of our three historic operating segments into two segments could negatively impact our business.

We have reorganized our operations, in the fourth quarter of fiscal 2018, into two new operating segments: the Industrial Tools & Services and the Engineered Components & Systems segments. The segment realignment may not yield expected benefits and also could result in unexpected negative impacts, including, without limitation, loss of key employees, integration difficulties, loss of key customers or other adverse effects.

Our growth strategy includes strategic acquisitions. We may not be able to consummate future acquisitions or successfully integrate them.

A significant portion of our growth has come from strategic acquisitions of businesses. We plan to continue making acquisitions to enhance our global market position and broaden our product offerings. Our ability to successfully execute acquisitions will be impacted by a number of factors, including the availability of financing on terms acceptable to us, our ability to identify acquisition candidates that meet our valuation parameters and increased competition for acquisitions. The process of integrating acquired businesses into our existing operations also may result in unforeseen operating difficulties and may require additional financial resources and attention from management that would otherwise be available for the ongoing development or expansion of our existing operations. Although we expect to successfully integrate any acquired businesses, we may not achieve the desired net benefit in the time-frame planned. Failure to effectively execute our acquisition strategy or successfully integrate the acquired businesses could have an adverse effect on our financial condition, results of operations, cash flows and liquidity.

We may not be able to realize planned benefits from acquired companies.

We may not be able to realize planned benefits from acquired companies. Achieving those benefits depends on the timely, efficient and successful execution of a number of post-acquisition events, including integrating the acquired business into the Company. Factors that could affect our ability to achieve these benefits include:

| |

• | difficulties in integrating and managing personnel, financial reporting and other systems used by the acquired businesses; |

| |

• | the failure of acquired businesses to perform in accordance with our expectations; |

| |

• | failure to achieve anticipated synergies between our business units and the business units of acquired businesses; |

| |

• | the loss of customers of acquired businesses; |

| |

• | the loss of key managers of acquired businesses; or |

| |

• | other material adverse events in the acquired businesses. |

If acquired businesses do not operate as we anticipate, it could materially impact our business, financial condition and results of operations. In addition, acquired businesses may operate in niche markets in which we have little or no experience. In such instances, we will be highly dependent on existing managers and employees to manage those businesses, and the loss of any key managers or employees of the acquired business could have a material adverse effect on our financial condition, results of operations, cash flows and liquidity.

The indemnification provisions of acquisition agreements may result in unexpected liabilities.

Certain acquisition agreements from past and current acquisitions require the former owners to indemnify us against certain liabilities related to the operation of each of their companies. In most of these agreements, the liability of the former owners is limited to specific warranties given in the agreement, as well as, in amount and duration and certain former owners may not be able to meet their indemnification responsibilities. These indemnification provisions may not fully protect us, and as a result we may face unexpected liabilities that adversely affect our profitability and financial position.

Our goodwill and other intangible assets represent a substantial amount of our total assets.

Our total assets reflect substantial intangible assets, primarily goodwill. At August 31, 2018, goodwill and other intangible assets totaled $693 million, or 47% of our total assets. The goodwill results from acquisitions, representing the excess of the purchase price over the fair value of the net tangible and other identifiable intangible assets we have acquired. We assess annually whether there has been impairment in the value of our goodwill or indefinite-lived intangible assets. If future operating performance at one or more of our reporting units were to fall below current levels, we could be required to recognize a non-cash charge to operating earnings to impair the related goodwill or other intangible assets. We recognized $34 million,$16 million, and $187 million in non-cash impairment charges in fiscal 2018, 2017 and 2016, respectively, related to the goodwill, intangible assets and long-lived assets of several of our businesses (see Note 6, "Goodwill, Intangible Assets and Long-Lived Assets" and "Critical Accounting Policies" for further discussion on goodwill, intangible asset and long-lived asset impairments). Any future goodwill or intangible asset impairments could negatively affect our financial condition and results of operations.

Divestitures and discontinued operations could negatively impact our business, and retained liabilities from businesses that we sell could adversely affect our financial results.

As part of our portfolio management process, we review our operations for businesses which may no longer be aligned with our strategic initiatives and long-term objectives. For example, over the past three years, we have divested our Sanlo product line and Viking business and currently are marketing our Cortland Fibron business for sale. We continue to review our portfolio and may pursue additional divestitures. Divestitures pose risks and challenges that could negatively impact our business, including required separation or carve-out activities and costs, disputes with buyers or potential impairment charges. We may also dispose of a business at a price or on terms that are less than we had previously anticipated. During the past three years, we have recognized charges related to divestitures and loss on product line divestiture of $49 million, $117 million and $5 million in fiscal 2018, 2017 and 2016, respectively (see Note 5, "Divestiture Activities" for further discussion on divestiture activities and related charges). After reaching an agreement with a buyer for the disposition of a business, we are also subject to satisfaction of pre-closing conditions, as well as necessary regulatory and governmental approvals on acceptable terms, which may prevent us from completing a transaction. Dispositions may also involve continued financial involvement, as we may be required to retain responsibility for, or agree to indemnify buyers against contingent liabilities related to a businesses sold, such as lawsuits, tax liabilities, lease payments, product liability claims or environmental matters. Under these types of arrangements, performance by the divested businesses or other conditions outside of our control could affect future financial results.

If we do not realize the expected benefits or synergies of any divestiture transaction, our consolidated financial position, results of operations and cash flows could be negatively impacted. Any divestiture may result in a dilutive impact to our future earnings if we are unable to offset the dilutive impact from the loss of revenue associated with the divestiture, as well as significant write-offs, including those related to goodwill and other intangible assets, which could have a material adverse effect on our results of operations and financial condition.

If we fail to develop new products, or customers do not accept our new products, our business could be adversely affected.

Our ability to develop innovative new products can affect our competitive position and often requires the investment of significant resources. Difficulties or delays in research, development, production or commercialization of new products, or failure to gain market acceptance of new products and technologies, may reduce future sales and adversely affect our competitive position. Operational excellence processes including effective product sourcing, lean manufacturing, acquisition integration and leadership development, along with other continuous improvement activities, are utilized to improve our businesses. There can be no assurance that we will have sufficient resources to make such investments, that we will be able to make the technological advances necessary to maintain competitive advantages or that we can recover major research and development expenses. If we fail to make innovations, launch products with quality problems, experience development cost overruns, or the market does not accept our new products, then our financial condition, results of operations, cash flows and liquidity could be adversely affected.

Uncertainty over global tariffs, or the financial impact of tariffs, may negatively affect our results.

Recent changes in U.S. domestic and global tariff frameworks have increased our costs of producing goods and resulted in additional risks to our supply chain. More tariff changes also are possible. We have developed strategies to mitigate previously implemented and, in some cases, proposed tariff increases, but there is no assurance we will be able to continue to mitigate tariff increases in substantial part. Further, uncertainties about future tariff changes could result in mitigation actions that prove to be detrimental to our business.

Our indebtedness could harm our operating flexibility and competitive position.

We have incurred, and may in the future incur, significant indebtedness in connection with acquisitions and share repurchases. We have, and will continue to have, a substantial amount of debt which requires interest and principal payments. Our level of debt and the limitations imposed on us by our debt agreements could adversely affect our operating flexibility and put us at a competitive disadvantage.

Our ability to make scheduled principal and interest payments, refinance our indebtedness and satisfy our other debt and lease obligations will depend upon our future operating performance and credit market conditions, which could be adversely affected by factors beyond our control. In addition, there can be no assurance that future borrowings or equity financings will be available to us on favorable terms, or at all, for the payment or refinancing of our indebtedness. If we are unable to service our indebtedness, our business, financial condition and results of operations will be adversely affected.

The financial and other covenants in our debt agreements may adversely affect us.

Our senior credit agreement and our other debt agreement contain financial and other restrictive covenants. These covenants could adversely affect us by limiting our financial and operating flexibility as well as our ability to plan for and react to market conditions and to meet our capital needs. Our failure to comply with these covenants could result in events of default which, if not cured or waived, could result in us being required to repay indebtedness before its due date and we may not have the financial resources or be able to arrange alternative financing to do so. Borrowings under our senior credit facility are secured by most domestic personal property assets and are guaranteed by most of our domestic subsidiaries and by a pledge of the stock of most of our domestic and certain foreign subsidiaries. If borrowings under our senior credit facility were declared or became due and payable immediately as the result of an event of default and we were unable to repay or refinance those borrowings, the lenders could foreclose on the pledged assets and stock. Any event that requires us to repay any of our debt before it is due could require us to borrow additional amounts at unfavorable borrowing terms, cause a significant reduction in our liquidity and impair our ability to pay amounts due on our indebtedness. Moreover, if we are required to repay any of our debt before it becomes due, we may be unable to borrow additional amounts or otherwise obtain the cash necessary to repay that debt, when due, which could seriously harm our business.

Our businesses operate in highly competitive markets, so we may be forced to cut prices or incur additional costs.

Our businesses generally face substantial competition, domestically and internationally, in each of their respective markets. We may lose market share in certain businesses or be forced to reduce prices or incur increased costs to maintain existing business. We compete globally on the basis of product design, quality, availability, performance, customer service and price. The entry of a new, well-capitalized large company into one of our markets, or its acquisition of an existing competitor, could adversely impact our competitiveness due to the new entrant's greater financial or other resources. Present or future competitors may have greater financial, technical or other resources which could put us at a competitive disadvantage. In addition, some of our competitors may be willing to reduce prices and accept lower margins in order to compete with us.

Our international operations pose currency and other risks.

We continue to focus on penetrating global markets as part of our overall growth strategy and expect sales from and into foreign markets to continue to represent a significant portion of our revenue. Approximately 57% of our sales in fiscal 2018 were outside the United States. In addition, many of our manufacturing operations and suppliers are located outside the United States. Our international operations present special risks, primarily from currency exchange rate fluctuations, exposure to local economic and political conditions, export and import restrictions, controls on repatriation of cash and exposure to local political conditions. Changes in foreign currency exchange rates will continue to add volatility as over one-half of our sales are generated outside of the United States in currencies other than the U.S. dollar. In addition, United States tax reform has significantly changed how foreign operations are taxed in the United States. We are monitoring new regulations related to tax reform as they become available and continue to review how tax reform will impact our tax rate going forward. We earn a substantial portion of our income from international operations and therefore changes to United States international tax rules may have a material adverse effect on future results of operations or liquidity. To the extent that we expand our international presence, these risks may increase.

Geopolitical unrest and terrorist activities may cause the economic conditions in the U.S. or abroad to deteriorate, which could harm our business.

Terrorist attacks against targets in the U.S. or abroad, rumors or threats of war, other geopolitical activity or trade disruptions may impact our operations or cause general economic conditions in the U.S. and abroad to deteriorate. A prolonged economic slowdown or recession in the U.S. or in other areas of the world could reduce the demand for our products and, therefore, negatively affect our future sales. Any of these events could have a significant impact on our business, financial condition or results of operations.

Our significant reliance on third-party suppliers for components for the manufacture, assembly and sale of our products involves risks.

We rely on suppliers to secure component products and finished goods required for the manufacture and assembly of our products. A disruption in deliveries to or from key suppliers, or decreased availability of components or commodities, could have an adverse effect on our ability to meet our commitments to customers or increase our operating costs. Further, poor supplier quality or an insecure supply chain could adversely affect the reliability, performance and reputation of our products. Additionally, if demand for our products is less than we expect, we may experience excess inventories and be forced to incur additional charges and our profitability may suffer. Our business, competitive position, results of operations or financial condition could be negatively impacted if supply is insufficient for our operations, if we experience excess inventories or if we are unable to adjust our production schedules or our purchases from suppliers to reflect changes in customer demand and market fluctuations on a timely basis.

A material disruption at a significant manufacturing facility could adversely affect our ability to generate sales and meet customer demand.

Our financial performance could be adversely affected as a result of our inability to meet customer demand for our products in the event of a material disruption at one of our significant manufacturing facilities. Equipment failures, natural disasters, power outages, fires, explosions, terrorism, adverse weather conditions, labor disputes or other influences could create a material disruption. Interruptions to production could increase our cost of sales, harm our reputation and adversely affect our ability to attract or retain our customers. Our business continuity plans may not be sufficient to address disruptions attributable to such risks. Any interruption in production capability could require us to make substantial capital expenditures to remedy the situation, which could adversely affect our financial condition and results of operations.

Large or rapid increases in the costs of commodities and raw materials, including impact of tariffs, or substantial decreases in their availability could adversely affect our operations.

The primary raw materials that are used in our products include steel, plastic resin, brass, steel wire and rubber. Most of our suppliers are not currently parties to long-term contracts with us. Consequently, we are vulnerable to fluctuations in prices of such raw materials, including the impact of tariffs. Factors such as supply and demand, freight costs and transportation availability, inventory levels, the level of imports and general economic conditions may affect the prices of raw materials that we need. If we experience a significant increase in raw material prices, or if we are unable to pass along increases in raw material prices to our customers, our results of operations could be adversely affected. In addition, an increasing portion of our products are sourced from low cost regions. Changes in export laws, taxes, tariffs and disruptions in transportation routes could adversely impact our results of operations.

We are subject to a wide variety of laws and regulations that may change in ways that are detrimental to our competitiveness or results.

Our businesses are subject to regulation under a broad range of U.S. and foreign laws and regulations. There is no assurance that such laws, regulations and policies will not be changed in ways that will require us to modify our business models and objectives or affect our results by restricting existing activities and products, subjecting them to escalating costs or prohibiting them outright. Particular legislative, regulatory or other areas that may have an effect on our structure, operations, markets, sales, liquidity, tax rate or the results of our businesses include exports controls, anti-corruption law, competition law, data privacy regulations, currency controls and economic or political sanctions.

Costs and liabilities arising from legal proceedings, including from divested or discontinued businesses, could be material and adversely impact our financial results.

We are subject to a variety of legal and regulatory proceedings. We maintain insurance and have established reserves for these matters as appropriate and in accordance with applicable accounting standards and practices. Insurance coverage, to the extent it is available, may not cover all losses arising from such contingencies. Also, estimating legal reserves or possible losses involves significant judgment and may not reflect the full range of uncertainties and unpredictable outcomes inherent in litigation and investigations, and the actual losses arising from particular matters may exceed our current estimates and

adversely affect our results of operations. We also expect that additional legal proceedings and other contingencies will arise from time to time, and we cannot predict the magnitude and outcome of such additional matters. Moreover, we operate in jurisdictions where claims involving us may be adjudicated within legal systems that are less developed and less reliable than those of the U.S. or other more developed markets, and this can create additional uncertainty about the outcome of proceedings before courts or other governmental bodies in such markets.

Legal compliance risks could result in significant costs to our business or cause us to restrict current activities or curtail growth plans.

We and our representatives operate in industries, markets and jurisdictions in which we are exposed to inherent compliance risks and that are subject to significant scrutiny by regulators, governmental authorities and other persons. We continue to strengthen our risk management and compliance programs to mitigate such risks and operate in compliance with applicable laws, but the global and diverse nature of our operations, the complex and high-risk nature of some of our markets and the current enforcement environment mean that legal and compliance risks will continue to exist throughout our operations. The consequences of compliance risks could include enforcement actions or private litigation resulting in significant defense and investigation costs, fines and penalties, and a broad range of remedial actions, including potential restrictions on our operations and other adverse changes to our business plans. See Note 16, "Commitments and Contingencies" in the notes to the consolidated financial statements for additional information about compliance risks.

Health, Safety and Environmental laws and regulations may result in additional costs.

We are subject to federal, state, local and foreign laws and regulations governing public and worker health and safety. Violations of these laws could cause us to incur unanticipated liabilities that could harm our operating results. Pursuant to such laws, governmental authorities have required us to contribute to the cost of investigating or remediating certain matters at current or previously owned and operated sites. In addition, we provided environmental indemnities in connection with the sale of certain businesses and product lines. Liability as an owner or operator, or as an arranger for the treatment or disposal of hazardous substances, can be joint and several and can be imposed without regard to fault. There is a risk that costs relating to these matters could be greater than what we currently expect or exceed our insurance coverage, or that additional remediation and compliance obligations could arise which require us to make material expenditures. In particular, more stringent environmental laws, unanticipated remediation requirements or the discovery of previously unknown conditions could materially harm our financial condition and operating results. We are also required to comply with various environmental laws and maintain permits, some of which are subject to discretionary renewal from time to time, for many of our businesses, and our business operations could be restricted if we are unable to renew existing permits or to obtain any additional permits that we may require.

Our inability to attract, develop and retain qualified employees could have a material adverse impact on our operations.

Our ability to deliver financial results and drive growth and pursue competitive advantages in our business substantially depends on our ability to retain key employees and continually attract new talent to the business. If we experience losses of key employees, such as our Chief Executive Officer and Chief Financial Officer, or experience significant delays or difficulty in replacing them, our operations, competitive positions and financial results may be adversely affected. Competition for highly qualified personnel is intense and our competitors and others can be expected to attempt to hire our skilled employees from time to time. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience to operate our businesses successfully. From time to time there may be shortages of skilled labor which may make it more difficult and expensive for us to attract and retain qualified employees or lead to increased labor costs.

Cyber security vulnerabilities, threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions, services and data.

Increased global cyber security vulnerabilities, threats, computer viruses and more sophisticated and targeted cyber-related attacks, as well as cyber security failures resulting from human error and technological errors, pose a risk to our systems, products and data as well as potentially to our employees’, customers', partners', suppliers' and third-party service providers' data. We attempt to mitigate these risks by employing a number of measures, including employee training, monitoring and testing, and maintenance of protective systems and contingency plans, but we remain potentially vulnerable to additional known or unknown threats. There is no assurance the impact from such threats will not be material and it could result in security breaches, theft, lost or corrupted data, misappropriation of sensitive, confidential or personal data or information, loss of trade secrets and commercially valuable information, production downtimes and operational disruptions.

Our intellectual property portfolio may not prevent competitors from developing products and services similar to or duplicative to ours, and the value of our intellectual property may be negatively impacted by external dependencies.

Our patents, trademarks and other intellectual property may not prevent competitors from independently developing or selling products and services similar to or duplicative of ours or that our intellectual property portfolio will adequately deter misappropriation or improper use of our innovations and technology. In addition, additional steps we take to protect our intellectual property, including non-disclosure agreements, may not prevent the misappropriation of our business critical secrets and information. In such circumstances, our competitive position and the value of our brand may be negatively impacted.

Our competitors or other persons could assert that we have infringed their intellectual property rights.

We may be the target of enforcement of patents or other intellectual property rights by third parties. Regardless of the merit of such claims, responding to infringement claims can be expensive and time-consuming. If we are found to infringe any third-party rights, we could be required to pay substantial damages or we could be enjoined from offering some of our products and services.

Our customers and other business partner often require terms and conditions that expose us to significant risks and liabilities.

We operate in end-markets and industries in which our customers and business partners seek to contractually shift significant risks associated with their operations or projects to us. We continue to review and improve our commercial and contracting practices to manage the risks we are assuming, but we cannot assure that material liabilities will not arise from our contracts with our business partners. Also, as we impose more stringent contracting standards on our operations, we may experience market share losses or the reduction in growth opportunities.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of August 31, 2018, we operated the following facilities (square footage in thousands):

|

| | | | | | | | | | | | | | | | | | |

| | Number of Locations | | Square Footage |

| | | | Distribution / Sales / Admin | | | | |

| | Manufacturing | | Total | | Owned | | Leased | | Total |

Industrial Tools & Services | | 13 |

| | 31 |

| | 44 |

| | 228 |

| | 1,102 |

| | 1,330 |

|

Engineered Components & Systems | | 17 |

| | 6 |

| | 23 |

| | 823 |

| | 1,013 |

| | 1,836 |

|

Corporate and other | | 1 |

| | 5 |

| | 6 |

| | 353 |

| | 165 |

| | 518 |

|

| | 31 |

| | 42 |

| | 73 |

| | 1,404 |

| | 2,280 |

| | 3,684 |

|

We consider our facilities suitable and adequate for the purposes for which they are used and do not anticipate difficulty in renewing existing leases as they expire or in finding alternative facilities. Our largest facilities are located in the United States, the United Kingdom, Turkey, China, the Netherlands, Mexico and Spain. We also maintain a presence in Australia, Azerbaijan, Brazil, Finland, France, Germany, Hungary, India, Italy, Japan, Kazakhstan, Norway, Singapore, South Africa, South Korea, Sweden and the United Arab Emirates. See Note 10, “Leases” in the notes to the consolidated financial statements for information regarding our lease commitments.

Item 3. Legal Proceedings

We are a party to various legal proceedings that have arisen in the normal course of business. These legal proceedings typically include claims for product liability, labor and employment, patent and breach of contract.

We have recorded reserves for estimated losses based on the specific circumstances of each case. Such reserves are recorded when it is probable that a loss has been incurred as of the balance sheet date and the amount of the loss can be reasonably estimated. In our opinion, the resolution of these contingencies is not likely to have a material adverse effect on our financial condition, results of operations or cash flows. For further information refer to Note 16, “Commitments and Contingencies” in the notes to consolidated financial statements.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

| |

Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

The Company’s Class A common stock is traded on the New York Stock Exchange under the symbol ATU. At September 30, 2018, there were 1,215 shareholders of record of Actuant Corporation Class A common stock. The high and low closing prices of the common stock were as follows for the previous two fiscal years:

|

| | | | | | | | | | |

Fiscal Year | | Period | | High | | Low |

2018 | | June 1, 2018 to August 31, 2018 | | $ | 29.75 |

| | $ | 23.55 |

|

| | March 1, 2018 to May 31, 2018 | | 25.05 |

| | 22.05 |

|

| | December 1, 2017 to February 28, 2018 | | 27.50 |

| | 22.50 |

|

| | September 1, 2017 to November 30, 2017 | | 27.00 |

| | 24.30 |

|

2017 | | June 1, 2017 to August 31, 2017 | | $ | 27.40 |

| | $ | 22.25 |

|

| | March 1, 2017 to May 31, 2017 | | 28.90 |

| | 24.55 |

|

| | December 1, 2016 to February 28, 2017 | | 29.30 |

| | 21.60 |

|

| | September 1, 2016 to November 30, 2016 | | 24.19 |

| | 21.68 |

|

Dividends

In fiscal 2018, the Company declared a dividend of $0.04 per common share payable on October 15, 2018 to shareholders of record on September 28, 2018. In fiscal 2017, the Company declared a dividend of $0.04 per common share payable on October 16, 2017 to shareholders of record on September 29, 2017.

Share Repurchases

The Company's Board of Directors has authorized the repurchase of shares of the Company's common stock under publicly announced share repurchase programs. Since the inception of the initial share repurchase program in fiscal 2012, the Company has repurchased 20,439,434 shares of common stock for $618 million. There were no share repurchases during the fiscal year ended August 31, 2018.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by Item 201(d) of Regulation S-K is provided under Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, which is incorporated herein by reference.

Performance Graph:

The graph below compares the cumulative 5-year total return of Actuant Corporation’s common stock with the cumulative total returns of the S&P 500 index and the Dow Jones US Diversified Industrials index. The graph tracks the performance of a $100 investment in our common stock and in each of the indexes (assuming the reinvestment of all dividends) from August 31, 2013 to August 31, 2018.

Copyright© 2018 Standard & Poor's, a division of S&P Global. All rights reserved.

Copyright© 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 8/13 | | 8/14 | | 8/15 | | 8/16 | | 8/17 | | 8/18 |

Actuant Corporation | | $ | 100.00 |

| | $ | 94.53 |

| | $ | 60.16 |

| | $ | 67.02 |

| | $ | 67.75 |

| | $ | 83.10 |

|

S&P 500 | | 100.00 |

| | 125.25 |

| | 125.84 |

| | 141.64 |

| | 164.64 |

| | 197.01 |

|

Dow Jones US Diversified Industrials | | 100.00 |

| | 119.37 |

| | 119.23 |

| | 150.89 |

| | 149.18 |

| | 133.71 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

Item 6. Selected Financial Data

The following selected historical financial data have been derived from the consolidated financial statements of the Company. The data should be read in conjunction with these financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended August 31, |

| | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| | (in millions, except per share data) |

Statement of Earnings Data(1)(2): | | | | | | | | | | |

Net sales | | $ | 1,183 |

| | $ | 1,096 |

| | $ | 1,149 |

| | $ | 1,249 |

| | $ | 1,400 |

|

Gross profit | | 415 |

| | 380 |

| | 403 |

| | 462 |

| | 547 |

|

Selling, administrative and engineering expenses | | 292 |

| | 278 |

| | 274 |

| | 300 |

| | 332 |

|

Amortization of intangible assets | | 21 |

| | 20 |

| | 23 |

| | 24 |

| | 25 |

|

Loss (gain) on product line divestiture | | — |

| | — |

| | 5 |

| | — |

| | (13 | ) |

Director & officer transition charges | | — |

| | 8 |

| | — |

| | — |

| | — |

|

Restructuring charges | | 12 |

| | 7 |

| | 15 |

| | — |

| | — |

|

Impairment & divestiture charges | | 73 |

| | 117 |

| | 187 |

| | 84 |

| | — |

|

Operating profit (loss) | | 18 |

| | (50 | ) | | (100 | ) | | 54 |

| | 203 |

|

(Loss) earnings from continuing operations | | (22 | ) | | (66 | ) | | (105 | ) | | 20 |

| | 141 |

|

| | | | | | | | | | |

Diluted (loss) earnings per share from continuing operations | | $ | (0.36 | ) | | $ | (1.11 | ) | | $ | (1.78 | ) | | $ | 0.32 |

| | $ | 1.95 |

|

Cash dividends per share declared | | $ | 0.04 |

| | $ | 0.04 |

| | $ | 0.04 |

| | $ | 0.04 |

| | $ | 0.04 |

|

| | | | | | | | | | |

Diluted weighted average common shares | | 60,441 |

| | 59,436 |

| | 59,010 |

| | 62,055 |

| | 72,486 |

|

| | | | | | | | | | |

Balance Sheet Data (at end of period)(2): | | | | | | | | | | |

Cash | | $ | 250 |

| | $ | 230 |

| | $ | 180 |

| | $ | 169 |

| | $ | 109 |

|

Assets | | 1,481 |

| | 1,517 |

| | 1,439 |

| | 1,637 |

| | 1,857 |

|

Debt | | 533 |

| | 562 |

| | 580 |

| | 588 |

| | 390 |

|

Net debt (debt less cash) | | 283 |

| | 332 |

| | 400 |

| | 419 |

| | 281 |

|

_______________________

| |

(1) | Results are from continuing operations and exclude the financial results of previously divested businesses reported as discontinued operations (former Electrical segment) in fiscal 2014. |

| |

(2) | We have completed various acquisitions that impact the comparability of the selected financial data. The results of operations for these acquisitions are included in our financial results for all periods subsequent to their acquisition date. The following table summarizes the acquisitions that were completed during the last five fiscal years (amounts in millions): |

|

| | | | | | | | | | | |

| | | | | | | | |

Acquisition | | Segment | | Date Completed | | Sales (a) | | Purchase Price |

Equalizer | | Industrial Tools & Services | | May 2018 | | $ | 6 |

| | 6 |

|

Mirage Machines | | Industrial Tools & Services | | December 2017 | | 12 |

| | 17 |

|

Pipeline and Process Services (b) | | Industrial Tools & Services | | March 2016 | | 32 |

| | 66 |

|

Larzep, S.A. | | Industrial Tools & Services | | February 2016 | | 8 |

| | 16 |

|

Hayes Industries, Ltd. | | Engineered Components & Systems | | May 2014 | | 25 |

| | 31 |

|

_______________________

(a)Represents approximate annual sales at the time of the acquisition.

(b)Acquired the Middle East, Caspian and North Africa operations of Four Quest Energy Inc.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Background

As discussed in Item 1, “Business,” during the fourth quarter of fiscal 2018, we realigned our Company’s financial reporting segments to reflect changes in our go to market strategy, the operating structure and leadership of the Company, resulting in two reportable segments: Industrial Tools & Services ("IT&S") and Engineered Components & Systems ("EC&S"). The Industrial Tools & Services segment is primarily engaged in the design, manufacture and distribution of branded hydraulic and mechanical tools, as well as providing services and tool rental to the industrial, maintenance, infrastructure, oil & gas, energy and other markets. The Engineered Components & Systems segment provides highly engineered components on-highway, off-highway, agriculture, energy, medical, construction and other vertical markets. Financial information related to the Company's segments is included in Note 15, "Business Segment, Geographic and Customer Information" in the notes to the consolidated financial statements.

Business Update

Our businesses provide an array of products and services across multiple markets and geographies which results in significant diversification. Industrial Tools & Services and Engineered Components & Systems segments continue to benefit from improvements within the broad industrial landscape, mining, infrastructure, commercial and off-highway vehicle and agriculture markets. We expect continued growth, though at a moderated pace, in these markets in fiscal 2019. Reduced capital and maintenance spending in the oil & gas and energy markets in the form of project cancellations, deferrals and scope reductions were headwinds throughout much of fiscal 2018. However, we are expecting to see stabilization of the oil & gas and energy markets in fiscal 2019, which should result in modest improvement in maintenance spending. As a result, we expect consolidated fiscal 2019 core sales (sales growth excluding the impact of acquisitions, divestitures and changes in foreign currency exchange rates) growth of 3% to 5%, compared to a 6% core sales growth in fiscal 2018.

We remain focused on pursuing both organic and inorganic growth opportunities aligned with our strategic objectives. This includes the advancement of our commercial effectiveness initiatives along with new product development efforts. We also remain focused on our lean efforts across our manufacturing, assembly and service operations. Our Industrial Tools & Services segment is focused on accelerating global sales growth through geographic expansion, continuing emphasis on sales and marketing efforts, new product introductions and regional growth via second tier brands. In addition, we remain focused on redirecting sales, marketing and engineering resources to non-oil & gas vertical markets and providing new and existing customers with critical products, rentals, services and solutions in a dynamic energy environment. We expect IT&S segment year-over-year core sales growth of 3% to 5% in fiscal 2019. The EC&S segment is capitalizing on their served end market demand recovery, while also expanding content and engineering capabilities across customers and geographies, resulting in an expected 2% to 5% core sales growth in fiscal 2019.

We continue to analyze our businesses in line with our strategic objectives and are taking portfolio management and segment consolidation actions that are anticipated to improve the operational performance of the Company. During the second quarter of fiscal 2018, we completed the divestiture of our Viking business, thus exiting the offshore mooring business and substantially reducing our exposure to the upstream, offshore oil & gas market. The expected divestiture of our Cortland Fibron business in fiscal 2019 will further limit our exposure to the upstream oil & gas market. During fiscal 2018, we also completed the acquisition of Equalizer and Mirage, both niche providers of industrial and energy maintenance tools, to further strengthen our product and solutions offerings in the IT&S segment.

Across the Company, we are continuing the cost reduction programs initiated at the beginning of 2016. During fiscal 2018, 2017, and 2016 we incurred $13 million, $7 million and $15 million of restructuring costs, respectively. These restructuring costs related primarily to facility consolidation, headcount reductions and operational improvement. We continue to execute on previously announced restructuring initiatives; however, we do not expect associated costs to be material to fiscal 2019 operating results.

Pre-tax cost savings realized from executing these restructuring initiatives totaled approximately $27 million in fiscal 2018, 2017 and 2016 combined. Realized cost savings were comprised of $9 million within the Industrial Tools & Services segment, $15 million within the Engineered Components & Systems segment and $3 million within Corporate. The Company anticipates realizing an incremental $4 million to $7 million in pre-tax cost savings in fiscal 2019 for all previously executed restructuring initiatives. Sixty percent of the anticipated future cost savings are expected to benefit the IT&S segment, another 30% are expected to benefit the EC&S segment and the remaining 10% are expected to benefit Corporate. The annual benefit of these gross cost savings may be impacted by a number of factors, including sales and production volume variances and annual bonus expense differential.

Historical Financial Data (in millions)

|

| | | | | | | | | | | | | | | | | | | | | |

| | Year Ended August 31, |

| | 2018 | | 2017 | | 2016 |

Statements of Earnings Data: | | | | | | | | | | | | |

Net sales | | $ | 1,183 |

| | 100 | % | | $ | 1,096 |

| | 100 | % | | $ | 1,149 |

| | 100 | % |

Cost of products sold | | 767 |

| | 65 | % | | 716 |

| | 65 | % | | 746 |

| | 65 | % |

Gross profit | | 416 |

| | 35 | % | | 380 |

| | 35 | % | | 403 |

| | 35 | % |

Selling, administrative and engineering expenses | | 292 |

| | 25 | % | | 278 |

| | 25 | % | | 274 |

| | 24 | % |

Amortization of intangible assets | | 21 |

| | 2 | % | | 20 |

| | 2 | % | | 23 |

| | 2 | % |

Loss on product line divestiture | | — |

| | 0 | % | | — |

| | 0 | % | | 5 |

| | 0 | % |

Director & officer transition charges | | — |

| | 0 | % | | 8 |

| | 1 | % | | — |

| | 0 | % |

Restructuring charges | | 12 |

| | 1 | % | | 7 |

| | 1 | % | | 15 |

| | 1 | % |

Impairment & divestiture charges | | 73 |

| | 6 | % | | 117 |

| | 11 | % | | 187 |

| | 16 | % |

Operating profit (loss) | | 18 |

| | 2 | % | | (50 | ) | | (5 | )% | | (100 | ) | | (9 | )% |

Financing costs, net | | 31 |

| | 3 | % | | 30 |

| | 3 | % | | 29 |

| | 3 | % |

Other (income) expense, net | | (1 | ) | | 0 | % | | 3 |

| | 0 | % | | 1 |

| | 0 | % |

Loss before income tax expense (benefit) | | (12 | ) | | (1 | )% | | (83 | ) | | (8 | )% | | (130 | ) | | (11 | )% |

Income tax expense (benefit) | | 9 |

| | 1 | % | | (17 | ) | | (2 | )% | | (25 | ) | | (2 | )% |

Net loss | | $ | (21 | ) | | (2 | )% | | $ | (66 | ) | | (6 | )% | | $ | (105 | ) | | (9 | )% |

| | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | |

Depreciation | | $ | 20 |

| | | | $ | 23 |

| | | | $ | 25 |

| | |

Capital expenditures | | 21 |

| | | | 28 |

| | | | 20 |

| | |

Fiscal 2018 compared to Fiscal 2017

Consolidated sales in fiscal 2018 were $1.18 billion, 8% higher than the prior year sales of $1.10 billion. Core sales were up $65 million (6%), with solid core sales growth in both the Industrial Tools & Services and Engineered Components & Systems segments. Changes in foreign currency exchange rates favorably impacted sales comparisons by $29 million, while the net impact from the Mirage and Equalizer acquisitions, net of the Viking divestiture, reduced core sales by $7 million. In addition to changes in foreign currency exchange rates, acquisitions, divestitures and end market conditions, the comparability of results between periods is impacted by sales levels, product mix and the timing and amount of restructuring costs and related benefits. Gross profit margins remained consistent year-over-year as a result of a balanced sales mix and the realization of benefits from restructuring activities was offset by project overruns and production inefficiencies. Additionally, fiscal 2018 results included $46 million of impairment and divestiture charges related to the anticipated sale of the Cortland Fibron business, impairment charges of $24 million on our Precision Hayes International business and $3 million of divestiture charges related to the sale of our Viking business, while fiscal 2017 results included $8 million of director and officer transition charges as well as $117 million of impairment and divestiture charges related to the then pending sale of Viking. Fiscal 2018 included an increase in our effective income tax rate compared to the prior year due to provisional tax charges for the U.S. Tax Reform, the non-recurrence of fiscal 2017 income tax planning benefits and the deductibility and timing related to impairment and divestiture charges in both comparable years.

Fiscal 2017 compared to Fiscal 2016