Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | |

| ¨ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x |

Definitive Proxy Statement | |

| ¨ |

Definitive Additional Materials | |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 | |

MYERS INDUSTRIES, INC.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. | |||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) |

Total fee paid:

| |||

|

| ||||

| ¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount previously paid:

| |||

|

| ||||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) |

Filing Party:

| |||

|

| ||||

| (4) |

Date Filed:

| |||

|

| ||||

Table of Contents

|

1293 South Main Street — Akron, Ohio 44301

March 21, 2014

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders to be held on Friday, April 25, 2014, at 9:00 A.M. at the Louis S. Myers Training Center, 1554 South Main Street, Akron, Ohio 44301.

At the Annual Meeting you will be asked to elect the ten director candidates nominated by our Board of Directors and ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm. You will also cast a non-binding advisory vote to approve executive compensation (“say-on-pay”). Enclosed with this letter is a Notice of Annual Meeting together with a Proxy Statement which contains information with respect to the nominees for director and the other proposals.

The proposals discussed in the Proxy Statement are very important to our shareholders and the Company, and we hope that you will be able to personally attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting in person, I urge you to complete and return the enclosed white proxy card as soon as possible.

If you have any questions or need assistance in voting your shares, please contact our Investor Relations Department at (330) 761-6212.

Sincerely,

JOHN C. ORR

President and Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on April 25, 2014: This Proxy Statement and the Company’s 2013 Annual Report to Shareholders are available on Myers’ website at www.myersindustries.com/investor-relations/annual-reports-proxy-statements.aspx.

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 4 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| Interested Parties’ Communications with the Board of Directors |

10 | |||

| 10 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| Policies and Procedures with Respect to Related Party Transactions |

32 | |||

| PROPOSAL NO. 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

33 | |||

| Matters Relating to the Independent Registered Public Accounting Firm |

33 | |||

| 34 | ||||

| PROPOSAL NO. 3 — ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

35 | |||

| 36 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

36 | |||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

Table of Contents

1293 South Main Street — Akron, Ohio 44301

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held Friday, April 25, 2014

The Annual Meeting of Shareholders of Myers Industries, Inc., an Ohio corporation (“Myers” or the “Company”), will be held at the Louis S. Myers Training Center, 1554 South Main Street, Akron, Ohio 44301, on Friday, April 25, 2014 at 9:00 A.M. (local time), for the following purposes:

| 1. | To elect the ten candidates nominated by the Board of Directors to serve as directors until the next Annual Meeting of Shareholders; |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2014; |

| 3. | To cast a non-binding advisory vote to approve executive compensation; and |

| 4. | To consider such other business as may be properly brought before the meeting or any adjournments thereof. |

The Board of Directors has fixed the close of business on March 3, 2014 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. This Proxy Statement, together with the related proxy card and our 2013 Annual Report to Shareholders, is being mailed to our shareholders on or about March 21, 2014. All shareholders are cordially invited to attend the Annual Meeting in person. To be sure that your shares are properly represented at the Annual Meeting, whether or not you intend to attend the Annual Meeting in person, please complete and return the enclosed white proxy card as soon as possible.

If you have any questions or need assistance in voting your shares, please contact our Investor Relations Department at (330) 761-6212.

| By Order of the Board of Directors, |

|

| GREGGORY W. BRANNING Chief Financial Officer, Senior Vice President and Corporate Secretary |

Akron, Ohio

March 21, 2014

THE 2013 ANNUAL REPORT TO SHAREHOLDERS ACCOMPANIES THIS NOTICE

1

Table of Contents

Matters Related to the Proxy Statement.

Meeting Time and Applicable Dates. This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of Myers Industries, Inc., an Ohio corporation, of the accompanying proxy to be voted at the Annual Meeting of Shareholders (“Annual Meeting”) to be held on Friday, April 25, 2014, at 9:00 A.M. (local time), and at any adjournment thereof. The close of business on March 3, 2014, has been fixed as the record date for the determination of the shareholders entitled to notice of and to vote at the meeting.

Participants in the Proxy Solicitation. This Proxy Statement is furnished in connection with the solicitation of proxies by the Company, the current directors and the nominees for election as director to be used at the Annual Meeting and any adjournment thereof.

Outstanding Shares and Quorum. On the record date, Myers had outstanding 33,433,069 shares of common stock, without par value (“Common Stock”). Each share of Common Stock is entitled to one vote. For information concerning our “Principal Shareholders” see the section titled “Security Ownership of Certain Beneficial Owners and Management” below. In accordance with the Company’s Amended and Restated Code of Regulations, the holders of shares of Common Stock entitling them to exercise a majority of the voting power of the Company, present in person or by proxy, shall constitute a quorum for the Annual Meeting. Shares of Common Stock represented by signed proxies will be counted toward the establishment of a quorum on all matters even though they represent broker non-votes or they are signed but otherwise unmarked, or marked “Abstain”, “Against” or “Withhold Authority.”

Votes Required. With respect to Proposal No. 1, to elect the ten director candidates nominated by the Board, if a quorum is present at the Annual Meeting, the nominees for election as directors who receive the greatest number of votes cast will be elected as directors. Abstentions and broker non-votes will not affect the outcome of the election of directors. Proposal No. 2, to ratify the appointment of the independent registered public accounting firm, is a non-binding proposal, but its approval requires the affirmative vote of the holders of a majority of the Common Stock represented in person or by proxy at the Annual Meeting. Abstentions will act as a vote “Against” Proposal No. 2, while broker non-votes, if any, will have no effect on Proposal No. 2. Even if the selection is ratified, the Audit Committee and the Board, in their discretion, may change the appointment at any time during the year if we determine that such a change would be in the best interests of the Company and our shareholders. Proposal No. 3 is a non-binding advisory vote to approve the Company’s executive compensation, and its approval requires the affirmative vote of the holders of a majority of the Common Stock represented in person or by proxy at the Annual Meeting. Abstentions will act as a vote “Against” Proposal No. 3, while broker non-votes will have no effect on Proposal No. 3.

Proxy Instructions. All shares of Common Stock represented by properly executed proxies which are returned and not revoked will be voted in accordance with the instructions, if any, given therein. If no instructions are provided in a proxy, the shares of Common Stock represented by such proxy will be voted “For” the Board’s nominees for director, “For” the ratification of the appointment of Ernst & Young LLP, “For” the approval of the Company’s executive compensation, and in accordance with the proxy-holder’s best judgment as to other matters, if any, which may be properly raised at the Annual Meeting.

2

Table of Contents

Proxy Voting. If your shares are registered directly in your name with our transfer agent, then you are a shareholder of record with respect to those shares and you may either vote in person at the Annual Meeting or by using the enclosed white proxy card to vote by telephone, by internet, or by signing, dating and returning the white proxy card in the envelope provided. Whether or not you plan to attend the Annual Meeting in person, you should submit your white proxy card as soon as possible. If your shares are held in “street name” through a broker, bank or other nominee, then you must instruct them to vote on your behalf, otherwise your shares cannot be voted at the Annual Meeting. You should follow the directions provided by your broker, bank or other nominee regarding how to instruct such party to vote. If you have any questions or need assistance in voting your shares, please contact our Investor Relations Department at the address and phone number below.

MYERS INDUSTRIES, INC.

INVESTOR RELATIONS

1293 SOUTH MAIN STREET

AKRON OH 44301

(330) 761-6212

Proxy Revocation and Voting in Person. A shareholder who has given a proxy may revoke it at any time prior to its exercise by: (1) giving written notice of such revocation to the Corporate Secretary of the Company, (2) executing and delivering to the Corporate Secretary of the Company a later dated proxy reflecting contrary instructions, or (3) appearing at the Annual Meeting and taking appropriate steps to vote in person.

Voting Confidentiality. Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed except as required by law.

Inspector of Election. The inspector of election for the Annual Meeting shall determine the number of votes cast by holders of Common Stock for all matters. The Board will appoint an inspector of election to serve at the Annual Meeting. Preliminary voting results will be announced at the Annual Meeting, if practicable. Final voting results will be filed on a Current Report on Form 8-K, which will be filed with the Securities and Exchange Commission (the “SEC”).

Address of Company. The mailing address of the principal executive offices of the Company is 1293 South Main Street, Akron, Ohio 44301.

Mailing Date. This Proxy Statement, together with the related proxy card and our 2013 Annual Report to Shareholders, is being mailed to our shareholders on or about March 21, 2014.

Trademark. Myers Industries, Inc.® is a registered trademark of the Company.

Availability on the Internet. This Proxy Statement and the Company’s 2013 Annual Report to Shareholders are available on Myers’ website at www.myersindustries.com/investor-relations/annual-reports-proxy-statements.aspx.

3

Table of Contents

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Nominees. Set forth below for each nominee for election as a director is a brief statement, including the age, principal occupation and business experience for at least the past five years, and any directorships held with public companies.

The members of the Corporate Governance and Nominating Committee of the Board (“Governance Committee”) have recommended, and the independent members of the Board of Directors have nominated, the persons listed below as nominees for the Board of Directors, all of whom presently are directors of the Company.

The Governance Committee reviews and evaluates individuals for nomination to stand for election as a director who are recommended to the Governance Committee in writing by any of our shareholders pursuant to the procedure outlined below in the section titled “Shareholder Nominations of Director Candidates” on the same basis as candidates who are suggested by our current or past directors, executive officers, or other sources, which may, from time-to-time, include professional search firms retained by the Governance Committee. In March 2011, the Governance Committee adopted Board Member Recruiting Guidelines that outline the process for the Governance Committee to recruit and evaluate potential director candidates. These guidelines are available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Company’s website at www.myersind.com. In considering these potential candidates for nomination to stand for election, the Governance Committee will consider: (1) the current composition of the Board and how it functions as a group; (2) the talents, personalities, strengths, and weaknesses of current directors; (3) the value of contributions made by individual directors; (4) the need for a person with specific skills, experiences or background to be added to the Board; (5) any anticipated vacancies due to retirement or other reasons; and (6) other factors which may enter into the nomination decision. The Governance Committee endeavors to select nominees that contribute unique skills and professional experiences in order to advance the performance of the Board of Directors and establish a well-rounded Board with diverse views that reflect the interests of our shareholders. The Governance Committee considers diversity as one of a number of factors in identifying nominees for directors, however, there is no formal policy in this regard. The Governance Committee views diversity broadly to include diversity of experience, skills and viewpoint, in addition to traditional concepts of diversity such as race and gender.

When considering an individual candidate’s suitability for the Board, the Governance Committee will evaluate each individual on a case-by-case basis. The Governance Committee does not prescribe minimum qualifications or standards for directors, however, the Governance Committee looks for directors who have personal characteristics, educational backgrounds and relevant experience that would be expected to help further the goals of both the Board and the Company. In addition, the Governance Committee will review the extent of the candidate’s demonstrated excellence and success in his or her chosen business, profession, or other career and the skills and talents that the candidate would be expected to add to the Board. The Governance Committee may choose, in individual cases, to conduct interviews with the candidate and/or contact references, business associates, other members of boards on which the candidate serves or other appropriate persons to obtain additional information. The Governance Committee will make its determinations on whether to nominate an individual candidate based on the Board’s then-current needs, the merits of that candidate and the qualifications of other available candidates. The Governance Committee believes that each of the nominees possess certain key attributes that the Governance Committee believes to be important for an effective Board.

Each of the below nominees has consented (i) to serve as a nominee, (ii) to being named as a nominee in this Proxy Statement and (iii) to serve as a director if elected. If any nominee should become unavailable for any reason, it is intended that votes will be cast for a substitute nominee designated by the Board. There is no reason to believe that the nominees named will be unable to serve if elected. Proxies cannot be voted for a greater number of nominees than the number named in this Proxy Statement.

4

Table of Contents

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF THESE NOMINEES

| Name |

Age |

Principal Occupation for Past Five Years and Other Information | ||||

| Vincent C. Byrd |

59 | President and Chief Operating Officer, The J. M. Smucker Company (“J. M. Smucker”) (NYSE), Orrville, Ohio, a manufacturer and marketer of branded food products; Director of J. M. Smucker; Director of Dick’s Sporting Goods, Inc. (NYSE), Coraopolis, Pennsylvania, a sporting goods retailer; formerly President, U.S. Retail, Coffee, of J. M. Smucker; former Director of Spangler Candy Company, Bryan, Ohio, a manufacturer of confectionery products. Served as Director of Myers since 2006.

By virtue of his more than 37 years of work experience with a Fortune 500 company in the consumer packaged goods industry and over ten years of experience serving on the board of directors of The J. M. Smucker Company, Mr. Byrd brings to the Board key insights into the strategic, marketing, and operational requirements of a public company. In addition, Mr. Byrd’s international experience and finance and accounting background provides valuable business acumen and financial skills to the Board. | ||||

| Sarah R. Coffin |

62 | Former Chief Executive Officer of Aspen Growth Strategies, LLC, Wooster, Ohio, an investment company; Director of FLEXcon, Spencer Massachusetts, a privately held manufacturer of pressure-sensitive films and adhesives; former Director and Chair of the Compensation Committee of SPX Corporation (NYSE), Charlotte, North Carolina, a global industrial equipment and manufacturing company; former Director of Huttenes-Albertus International, Chicago, Illinois, an international manufacturer of chemical products for the foundry industry. Served as Executive Vice President, Hexion Specialty Chemicals (now Momentive) and Senior Vice President, Noveon, Inc. (now Lubrizol), both specialty chemical and polymer producers in the industrial market space. Served as Director of Myers since 2010.

As a former division and global leader in several companies, Ms. Coffin has substantial senior level executive experience in marketing, distribution and operations, and adds a unique perspective to the Board. Her background in the polymer and specialty chemicals industry, coupled with her knowledge and insight from her prior service on the boards of other companies, allows Ms. Coffin to provide valuable contributions to the Board. | ||||

| John B. Crowe |

67 | President, Crowe Consulting International, Germantown, Tennessee; formerly Chief Executive Officer and Chairman of Buckeye Technologies Inc. (NYSE), Memphis, Tennessee, a producer of absorbent products, chemical cellulose products and customized paper. Previously, Mr. Crowe served as Buckeye Technologies Inc.’s President and Chief Operating Officer and has been a Director of that company since 2003. He has held executive positions as Executive Vice President and General Manager at Alabama River Pulp Co., Inc. and Alabama Pine Pulp Co., Inc. and as Vice President of the Flint River Operations for the Weyerhaeuser Co. Served as a Director of Myers since 2009.

As former Chairman and Chief Executive Officer of Buckeye Technologies Inc., Mr. Crowe brings valuable insight and international experience into the operational requirements, investor relations and strategic planning processes of a public company. Mr. Crowe provides significant experience in manufacturing, sales, implementation of growth | ||||

5

Table of Contents

| Name |

Age |

Principal Occupation for Past Five Years and Other Information | ||||

| strategies, and building organizational capability. In addition, Mr. Crowe draws on his considerable leadership experience, including his service as a United States Air Force Reserve Lt. Colonel and as a Vietnam veteran, in his service to the Board. | ||||||

| William A. Foley |

66 | Chairman of the Board of Libbey Inc. (NYSE), Toledo, Ohio, a producer of consumer and industrial glassware. Retired Chairman and Chief Executive Officer of Blonder Home Accents, Cleveland, Ohio, a distributor of wallcoverings and home accents; Formerly Chairman and Chief Executive Officer of Thinkwell Incorporated, Cleveland, Ohio, President of Arhaus Incorporated, Cleveland, Ohio, a private brand name furniture company, and Chairman, President and Chief Executive Officer of Lesco Incorporated, Cleveland, Ohio, a manufacturer, distributor and retailer of professional lawn care and golf course management products. Served as Director of Myers since 2011.

As a leader of numerous companies, Mr. Foley has over 30 years of senior management experience, both domestic and international. He has wide-ranging acquisition, joint venture, business and market development experience. Extensive experience in broad scale plastics manufacturing as well as consumer and distribution segments of the lawn and garden industry provide Board input in product areas germane to Myers’ reporting segments. Mr. Foley’s experience with best practice on public company boards, particularly in governance, compensation and leadership, make him a valuable member of the Board. | ||||

| Robert B. Heisler, Jr. |

65 | Retired dean of the Kent State University Business School; Director of FirstEnergy Corp. (NYSE), Akron, Ohio, an energy company; Director of TFS Financial Corporation (NASDAQ), Cleveland, Ohio, a retail consumer banking services company; Director of The J. M. Smucker Company (NYSE), Orrville, Ohio, a manufacturer and marketer of branded food products; Formerly Chief Financial Officer of Kent State University and Chairman and Chief Executive Officer of KeyBank, N.A. (NYSE) and McDonald Financial Group; Former Director of KeyBank, N.A. and McDonald Investments. Served as Director of Myers since 2011.

Mr. Heisler has over 40 years of business experience. His decades of experience have allowed him to be a valuable member of the board of directors of other public companies and numerous non-profit organizations, including serving on the Compensation Committee of FirstEnergy and as Chair of the Risk Committee of TFS Financial Corporation. Mr. Heisler brings vast leadership and financial management experience that permits him to be a successful contributor to the Board. | ||||

| Richard P. Johnston |

83 | A retired Certified Public Accountant State of Ohio; Chairman of the Board of Myers; Chairman of the Board of Dismal River Golf Club, Mullen, Nebraska; Director of Results Radio, Inc., Sonoma, California; formerly a Founder and Director of AGCO, Inc. (NYSE), Duluth, Georgia, a manufacturer and distributor of agricultural equipment; formerly Director of Communications Properties (NASDAQ), Austin, Texas, a cable television company; a Director of Royal Precision (NASDAQ), Torrington, Connecticut, a manufacturer of golf club components. He was Founder, Chairman, President and CEO of Buckhorn Inc. (AMEX) which was acquired by Myers Industries in 1986. Served as Director of Myers since 1992 and is currently Chairman of the Board of Myers. | ||||

6

Table of Contents

| Name |

Age |

Principal Occupation for Past Five Years and Other Information | ||||

| With his many years of management experience and service on the board of directors with a number of public companies in a wide range of businesses, Mr. Johnston brings critical financial and investor experiences and insight regarding best practices for a public company. In addition, over 20 years of experience as a Director of Myers gives him a deep understanding of the Company and its operations and makes him particularly qualified to serve as Chairman of the Board. | ||||||

| Edward W. Kissel |

72 | President and Managing Partner of Kissel Group Ltd., Akron, Ohio, a holding company with interests in property, consulting and mold manufacturing; Director of Smithers Scientific Services, Inc., Akron, Ohio, a provider of testing services for materials; formerly President, Chief Operating Officer and Director of OM Group, Inc. (NYSE), Cleveland, Ohio, a specialty chemical company; formerly Director of Weda Bay Minerals, Inc. (Toronto Stock Exchange), Toronto, Canada, a mineral exploration company; formerly Managing Director of Kane & Co., Los Angeles, California, an investment banking firm. Served as Director of Myers since 2000.

Mr. Kissel has broad global experience in the manufacturing, chemical and commodity industries. He has had executive assignments in strategy, operations, sales and marketing, and research and development, including both growth and turnaround situations that include divestitures and acquisitions. Extensive consulting for Myers in operations and strategy prior to joining the Board, combined with current business involvement in markets served by Myers position Mr. Kissel to give the Board and management knowledgeable perspectives on Board issues impacting shareholder value. Mr. Kissel actively serves the Board as a member of the Audit Committee and Chairman of the Governance and Nominating Committee. | ||||

| Daniel R. Lee |

57 | CEO and Chairman of the Board of Managers of FP Holding, LP and Fiesta ParentCo, LLC, which together own and operate The Palms Casino Resort, Las Vegas, Nevada, an owner and operator of hotel casinos; Managing Member of Creative Casinos, LLC, Las Vegas, Nevada, a developer of casino resorts; Director of ICTC Group Inc. (Pink Sheets), Nome, North Dakota, a telecommunications services company; Director of Gabelli Securities, Rye, New York, an investment manager and general partner to investment partnerships; formerly director of LICT Corp., Rye, New York, a telecommunications services company; formerly Chairman and Chief Executive Officer of Pinnacle Entertainment (NYSE), Las Vegas, Nevada, a casino operator and developer; formerly Chief Financial Officer of Homegrocer.com, Kirkland, Washington, an internet service business; formerly Chief Financial Officer, Treasurer, and Senior Vice President of Development of Mirage Resorts, Las Vegas, Nevada, an owner and operator of hotel casinos.

Mr. Lee has several decades of management experience. With prior experience on the board of directors of several other public companies, Mr. Lee is well versed in the governance requirements for a public company. Mr. Lee’s financial expertise, including as a former Chartered Financial Analyst, makes him a valuable member of the Board. | ||||

| John C. Orr |

63 | President and Chief Executive Officer of Myers; formerly President and Chief Operating Officer of Myers; formerly General Manager

of | ||||

7

Table of Contents

| Name |

Age |

Principal Occupation for Past Five Years and Other Information | ||||

| Buckhorn Inc., a subsidiary of Myers; formerly Vice President of Manufacturing — North American Tire Division, The Goodyear Tire and Rubber Company; Director of Libbey Inc. (NYSE), Toledo, Ohio, a producer of consumer and industrial glassware; Director of the Akron Children’s Hospital, Akron, Ohio; Director of United Way of Summit County, Akron, Ohio. Served as Director of Myers since 2005.

Mr. Orr’s extensive leadership experience in the manufacturing industry, in addition to his years of service to Myers in management, position him well to serve on the Board. His service as a director and in management for other public companies provides Mr. Orr with a variety of perspectives that he contributes to the Board. | ||||||

| Robert A. Stefanko |

71 | Currently retired, formerly Chairman of the Board and Executive Vice President of Finance & Administration of A. Schulman, Inc. (NASDAQ), Akron, Ohio, an international supplier of plastic compounds and resins; Director and member of Audit Committee of OMNOVA Solutions, Inc. (NYSE), Fairlawn, Ohio, an innovator of emulsion polymers, specialty chemicals and decorative and functional surfaces; former director of The Davey Tree Expert Company, Kent, Ohio, a tree, shrub and lawn care company. Served as Director of Myers since 2007. | ||||

| As a former Chief Financial Officer and director of A. Schulman, Inc. from 1979 through 2006 and as a director of other public company boards, Mr. Stefanko has extensive involvement in public company matters, including international, compensation, audit, financial, legal, and various other matters. Mr. Stefanko also serves on the Board of Akron General Health System, which employs over 5,000 people, where he serves on the Finance Committee. In addition, Mr. Stefanko’s extensive experience with boards and compensation and audit committees gives him valuable knowledge and insight that he brings to the Company. | ||||||

Each of the foregoing nominees was recommended by the Governance Committee. There are, and during the past ten years there have been, no legal proceedings material to an evaluation of the ability of any director, nominee, or executive officer of Myers to act in such capacity or concerning his integrity. There are no family relationships among any of the directors and executive officers.

The Board recommends that you vote “FOR” each of the director nominees listed above.

Director Independence. The Board has determined that each of the following current directors and nominees are “independent” and that each of these nominees has no material relationship with us that would impact their independence: Vincent C. Byrd, Sarah R. Coffin, John B. Crowe, William A. Foley, Robert B. Heisler, Jr., Richard P. Johnston, Edward W. Kissel, Daniel R. Lee, and Robert A. Stefanko. The determination of whether a director is “independent” is based upon the Board’s review of the relationships between each director and the Company, if any, under the Company’s “Board of Directors Independence Criteria” policy adopted by the Board on April 20, 2004, as amended, and the corporate governance listing standards of the New York Stock Exchange (“NYSE”). In connection with the Board’s determination regarding the independence of each non-management director, the Board considered any transactions, relationships and arrangements as required by our independence guidelines. In particular, the Board considered the following relationships: (1) the relationship between A. Schulman, Inc. (“A. Schulman”) and the Company in connection with its independence determination of Robert A. Stefanko and concluded Mr. Stefanko met the independence requirement; and (2) the relationship between FirstEnergy Corp. (“FirstEnergy”) and the Company in connection with its independence determination of Robert B. Heisler, Jr. and concluded Mr. Heisler met the independence requirement. Mr. Stefanko is a stockholder of A. Schulman, holding less than 1% of A. Schulman’s

8

Table of Contents

shares of stock. In fiscal 2013, the Company purchased $866,201 of materials from A. Schulman during the ordinary course of operations, which is less than 1% of the annual revenues of both companies. Mr. Heisler is a shareholder and director of FirstEnergy, holding less than 1% of FirstEnergy’s shares of stock. In fiscal 2013, we purchased $4,314,751 of materials from FirstEnergy during the ordinary course of operations, which is less than 1% of the annual revenues of both companies. All members of the Audit Committee, the Compensation Committee, and the Governance Committee were determined to be independent, and in addition, the Board determined that the members of the Audit Committee are also independent as defined in the SEC regulations.

Committees of the Board. The Board has three standing committees, the Audit Committee, the Compensation Committee, and the Governance Committee, whose members were appointed in April 2013 following the Annual Meeting.

Audit Committee. The Audit Committee is currently comprised of five independent directors: Robert A. Stefanko (Chairman and Presiding Director), Richard P. Johnston, Edward W. Kissel, Sarah R. Coffin, and Robert B. Heisler, Jr. The functions of the Audit Committee, which met eight times in 2013, are to: (1) engage the independent registered public accounting firm, (2) approve all audit and related engagements (audit and non-audit), (3) review the results of the audit and interim reviews, (4) evaluate the independence of the independent registered public accounting firm, (5) review with the independent registered public accounting firm the financial results of the Company prior to their public release and filing of reports with the SEC, (6) direct and supervise special investigations and (7) oversee our accounting, internal accounting controls and auditing matters reporting hotline (discussed below) and our corporate compliance program. The Audit Committee also has oversight of our system of internal auditing functions and controls, as well as our internal control procedures. None of our Audit Committee members serve on more than two other public company audit committees.

The Board has identified Robert A. Stefanko as the Audit Committee “financial expert”.

Compensation Committee. The Compensation Committee establishes and administers the Company’s policies, programs and procedures for compensating its executive officers and directors. The Compensation Committee has the authority to retain outside consultants regarding executive compensation and other matters. The Compensation Committee, which met five times in 2013, is currently comprised of five independent directors: Vincent C. Byrd (Chairman and Presiding Director), Robert A. Stefanko, John B. Crowe, William A. Foley, and Sarah R. Coffin.

Corporate Governance and Nominating Committee. The Governance Committee is responsible for, among other things, evaluating new director candidates and incumbent directors, and recommending nominees to serve on the Board as well as members of the Board’s committees to the independent directors of the Board. The Governance Committee is also responsible for recommending and monitoring participation in continuing education programs by the members of the Board. The Governance Committee, which met nine times in 2013, is currently comprised of five independent directors: Edward W. Kissel (Chairman and Presiding Director), John B. Crowe, Richard P. Johnston, Robert B. Heisler, Jr., and William A. Foley.

Committee Charters and Policies. The Board has adopted written charters for the Audit Committee, the Compensation Committee, and the Governance Committee. Each Committee reviews and evaluates the adequacy of its charter at least annually and recommends any proposed changes to the Board for approval. Each of the written charters and policies of the Committees of the Board are available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Company’s website at www.myersind.com.

Board Role in Risk Oversight. The Board annually reviews the Company’s strategic plan, which addresses, among other things, the risks and opportunities facing the Company. The Board also has overall responsibility for executive officer succession planning and reviews succession plans each year. Certain areas of oversight are delegated to the relevant Committees of the Board and the Committees regularly report back on their deliberations. This oversight is enabled by reporting processes that are designed to provide visibility to the Board about the identification, assessment, monitoring and

9

Table of Contents

management of enterprise-wide risks. In May 2013, management conducted its most recent enterprise-wide risk assessment of the Company and each of its business segments, and in July 2013 presented the assessment results to the Board for review. The focus of this assessment included a review of strategic, financial, operational, compliance and technology objectives and risks for the Company. In addition, on an ongoing basis: (a) the Audit Committee maintains primary responsibility for oversight of risks and exposures pertaining to the accounting, auditing and financial reporting processes of the Company; (b) the Compensation Committee maintains primary responsibility for risks and exposures associated with oversight of the administration and implementation of our compensation policies; and (c) the Governance Committee maintains primary responsibility for risks and exposures associated with corporate governance and succession planning.

Board Attendance. There were a total of eleven regularly scheduled and special meetings of the Board of Directors in 2013. During 2013, all directors attended at least 75% of the aggregate total number of the meetings of the Board and Committees on which they served. In 2013, all of our directors attended our Annual Meeting. Although we do not have a formal policy requiring directors to attend the Annual Meeting, our directors are encouraged to attend.

Interested Parties’ Communications with the Board of Directors. Our Board provides the following methods for interested parties and shareholders to send communications to a director, to a Committee of the Board, to the non-management directors, or to the Board:

Written Communication. Interested parties may send such communications by mail or courier delivery addressed as follows: Board of Directors (or Committee Chairman, Board Member or Non-Management Directors, as the case may be), c/o Greggory W. Branning, Corporate Secretary, Myers Industries, Inc., 1293 South Main Street, Akron, Ohio 44301. All communications directed to the “Board of Directors” or to the “Non-Management Directors” will be forwarded unopened to the Chairman of the Governance Committee. The Chairman of the Governance Committee in turn determines whether the communications should be forwarded to the appropriate members of the Board and, if so, forwards them accordingly. For communications addressed to a particular director or the Chairman of a particular Committee of the Board, however, the Corporate Secretary will forward those communications, unopened, directly to the person or Committee Chairman in question.

Toll Free Hotline. In 2003, the Audit Committee established a “hotline” for receiving, retaining and treating complaints from any interested party regarding accounting, internal accounting controls and auditing matters, and procedures for the anonymous submission of these concerns. The hotline is maintained by a company which is independent of Myers. Interested parties may also use this hotline to communicate with the Board. Any interested party may contact a director, a Committee of the Board, the non-management directors, or the Board through the toll free hotline at (877) 285-4145. The hotline is available worldwide, 24 hours a day, seven days a week. Note that all reports made through the hotline are directed to either or both the Chairman of the Audit Committee and the Corporate Secretary. We do not permit any retaliation of any kind against any person who submits a complaint or concern under these procedures.

Shareholder Nominations of Director Candidates.

Shareholder Recommendation Policy. The Governance Committee will consider individuals for nomination to stand for election as a director who are recommended to it in writing by any of our shareholders that strictly follow the procedures outlined in the next paragraph below and that send a signed letter of recommendation to the following address: Corporate Governance and Nominating Committee, c/o Mr. Greggory W. Branning, Chief Financial Officer, Senior Vice President and Corporate Secretary, Myers Industries, Inc., 1293 South Main Street, Akron, Ohio 44301.

Recommendation letters must certify that the person making the recommendation is a shareholder of the Company (including the number of shares held as of the date of the recommendation), and further state the reasons for the recommendation, the full name and address of the proposed nominee as well as a biographical history setting forth past and present directorships, employment, occupations and

10

Table of Contents

civic activities for at least the past five years. Any such recommendation should be accompanied by a signed written statement from the proposed nominee consenting to be named as a candidate and, if nominated and elected, consenting to serve as a director. The letter must also include a signed written statement that the nominating shareholder and the candidate will make available to the Governance Committee all information reasonably requested in furtherance of the Governance Committee’s evaluation. The letter must be received before the close of business on or before November 15th of the year prior to our next annual meeting of shareholders.

The Governance Committee reviews and evaluates individuals for nomination to stand for election as a director who are recommended to the Governance Committee in writing by any of our shareholders pursuant to the procedures outlined in the paragraph above on the same basis as candidates who are suggested by our current or past directors, executive officers, or other sources, which may, from time-to-time, include professional search firms retained by the Governance Committee. In considering individuals for nomination to stand for election, the Governance Committee will consider: (1) the current composition of the Board of Directors and how it functions as a group; (2) the talents, personalities, strengths, and weaknesses of current directors; (3) the value of contributions made by individual directors; (4) the need for a person with specific skills, experiences or background to be added to the Board; (5) any anticipated vacancies due to retirement or other reasons; and (6) other factors which may enter into the nomination decision.

When considering an individual candidate’s suitability for the Board, the Governance Committee will evaluate each individual on a case-by-case basis. The Governance Committee does not prescribe minimum qualifications or standards for directors, however, the Governance Committee looks for directors who have personal characteristics, educational backgrounds and relevant experience that would be expected to help further the goals of both the Board and the Company. In addition, the Governance Committee will review the extent of the candidate’s demonstrated excellence and success in his or her chosen business, profession, or other career and the skills and talents that the candidate would be expected to add to the Board. The Governance Committee may choose, in individual cases, to conduct interviews with the candidate and/or contact references, business associates, other members of boards on which the candidate serves or other appropriate persons to obtain additional information. The Governance Committee will make its determinations on whether to nominate an individual candidate based on the Board’s then-current needs, the merits of that candidate and the qualifications of other available candidates.

Shareholder Nomination Policy. In accordance with our Amended and Restated Code of Regulations, a shareholder may directly nominate a candidate for election as a director of the Company only if written notice of such intention is received by the Corporate Secretary not less than sixty (60) days nor more than ninety (90) days prior to the date of such annual meeting of shareholders or special meeting of shareholders for the election of directors. In the event that the date of such meeting to elect directors is not publicly disclosed at least seventy (70) days prior to the date of such meeting, written notice of such shareholder’s intent to nominate a candidate must be received by the Corporate Secretary not later than the close of business on the tenth (10th) day following the date on which notice of such meeting is first provided to the shareholders. A shareholder wishing to directly nominate an individual to serve as a director must follow the procedure outlined in Article I, Section 12 of our Amended and Restated Code of Regulations, titled “Advance Notice of Director Nomination” and then send a signed letter of nomination to the following address: Corporate Governance and Nominating Committee, c/o Mr. Greggory W. Branning, Corporate Secretary, Myers Industries, Inc., 1293 South Main Street, Akron, Ohio 44301. Our Amended and Restated Code of Regulations is available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Company’s website at www.myersind.com.

Corporate Governance Policies.

Implementation. The Board of Directors has implemented the corporate governance initiatives required by the NYSE rules and the Sarbanes-Oxley Act of 2002. These initiatives include, among

11

Table of Contents

others, “Corporate Governance Guidelines” and a “Code of Business Conduct and Ethics” for the Company’s directors, officers and employees. These corporate governance policies and procedures are discussed in various places within this Proxy Statement. In March 2011, the Board incorporated a director resignation policy into its Corporate Governance Guidelines. Pursuant to this director resignation policy, in an uncontested election, any incumbent director who receives a greater number of votes “Withheld” or “Against” his or her election than votes “For” his or her election (and with respect to such incumbent director’s election at least 25% of the Company’s shares outstanding and entitled to vote thereon were “Withheld” or voted “Against” the election of such director) shall submit an offer of resignation to the Board of Directors. The Governance Committee will then recommend to the Board whether to accept or reject any tendered resignations, and the Board will decide whether to accept or reject such tendered resignations. The Board’s decision will be publicly disclosed in a Current Report on Form 8-K filed with the SEC. If an incumbent director’s tendered resignation is rejected, then he or she will continue to serve until his or her successor is elected, or until his or her earlier resignation, removal from office, or death. If an incumbent director’s tendered resignation is accepted, then the Board will have the sole discretion to fill any resulting vacancy to the extent permitted by the Company’s Amended and Restated Code of Regulations.

Availability of Corporate Governance Policies. Each of our corporate governance policies is available on the “Corporate Governance” page accessed from the “Investor Relations” page of our website at www.myersind.com.

Code of Ethics. We have a “Code of Business Conduct and Ethics” which incorporates into it a “Code of Ethical Conduct for the Finance Officers and Finance Department Personnel”, which embodies our commitment to ethical and legal business practices, as well as satisfying the NYSE requirements to implement and maintain such policies. The Board expects all of our officers, directors and other members of our workforce to act ethically at all times. This policy is available on our website at www.myersind.com on the “Corporate Governance” page accessed from the “Investor Relations” page.

Stock Ownership Guidelines. In 2010, we implemented, and in January of 2013 we amended, “Stock Ownership Guidelines” whereby our executive officers and non-employee directors are expected to hold a specified amount of our Common Stock. The Chief Executive Officer is expected to hold an investment position in our Common Stock equal to five times his annual base salary. The Chief Operating Officer and Chief Financial Officer are both expected to hold an investment position equal to three times their respective annual base salaries. The non-employee Directors are expected to hold five times their annual cash Board retainer in our Common Stock. The executive officers and non-employee directors have five years from the effective date of the guidelines to attain the ownership requirement. These “Stock Ownership Guidelines” are available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Company’s website at www.myersind.com.

Board Member Recruiting Guidelines. In March 2011, the Governance Committee adopted Board Member Recruiting Guidelines that outline the process for existing Board members to nominate potential director candidates to the Governance Committee. These recruiting guidelines are available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Company’s website at www.myersind.com.

Executive Sessions of the Board. Effective in December 2002, the Board adopted a policy requiring the non-management directors, both as to the Board and in their respective Committees, to meet regularly in executive session without any management personnel or employee directors present. During 2013, the Board and each Committee met regularly in executive session as follows: Board, eight times; Audit Committee, six times; Compensation Committee, five times; and the Governance Committee, four times.

Independent Chairman. Effective in October 2009, the Board appointed Richard P. Johnston independent Chairman of the Board. The Company believes this leadership structure is appropriate for the Company as it further aligns the interests of the Company and our shareholders by ensuring

12

Table of Contents

independent leadership of the Board. The independent Chairman serves as a liaison between our directors and our management and helps to maintain open communication and discussion by the Board. Duties of the Chairman are specified in the Charter of the Chairman of the Board of Directors, adopted October 28, 2009, and include serving in a presiding capacity, coordinating the activities of the Board, and such other duties and responsibilities as the Board may determine from time-to-time. This charter is available on our website at www.myersind.com on the “Corporate Governance” page accessed from the “Investor Relations” page.

Presiding Directors. The independent directors reported that in 2013 they selected Presiding Directors to preside during executive sessions. The Chairman of the Governance Committee acts as the Presiding Director for the executive sessions of the Board, and the Chairman of each Committee was selected as the Presiding Director for the executive sessions of the applicable Committee of the Board.

Anonymous Reporting. The Audit Committee maintains procedures, including a worldwide telephone “hotline”, which allows employees and interested parties to report any financial or other concerns anonymously as further detailed under “Interested Parties’ Communications with the Board of Directors” above.

Annual Board and Committee Self-Assessments. In 2004, the Board, through the Governance Committee, instituted annual self-assessments of the Board, as well as of the Audit Committee, the Compensation Committee, and the Governance Committee, to assist in determining whether the Board and its Committees are functioning effectively. In early 2013, the Board and each of its Committees conducted the most recent self-evaluations and discussed the results of the self-evaluations.

NYSE and SEC Certifications. In 2013, we submitted to the NYSE an unqualified Section 12(a) certification by our Chief Executive Officer. Further, each applicable filing with the SEC contained the Section 302 and 906 Certifications of both our Chief Executive Officer and Chief Financial Officer.

Director Compensation. In 2012, the Compensation Committee engaged a compensation consultant who conducted an assessment of the market competitiveness of the Company’s non-employee director compensation program. In conducting the assessment, the compensation consultant reviewed data from a comparable group of companies. The results of this assessment were considered by the Compensation Committee in setting the non-employee director compensation rates for 2013.

The annual retainer for non-employee directors is $40,000. In addition, Committee members receive $10,000 per year per Committee of the Board. The Chairman of the Audit Committee and Chairman of the Compensation Committee each receive an additional $8,000 per year. The Chairman of the Governance Committee receives an additional $4,000 per year. The Chairman of the Board receives an additional annual retainer of $20,000. Directors who are employees of the Company do not receive the annual retainer.

Under our 2008 Incentive Stock Plan, each non-employee director who holds such position on the date of the annual meeting of the shareholders and has been a director for the entire period since the annual meeting of shareholders of Myers that was held in the immediately preceding calendar year will be awarded annually, on the date of the annual meeting of shareholders, shares of our Common Stock valued at $60,000 on such date. Effective for awards granted on or after the April 25, 2014, a director may elect to receive an equivalent number of stock units rather than shares of common stock, with payment to be made with respect to such stock unit when such director ceases to be a member of the Board.

Our Amended and Restated Code of Regulations provides that we will indemnify, to the fullest extent then permitted by law, any of our directors or former directors who was or is a party or is threatened to be made a party to any matter, whether civil or criminal, by reason of the fact that the individual is or was a director of the Company, or serving at our request as a director of another entity. We have entered into indemnity agreements with each of our directors contractually obligating us to provide such protection. We also currently have in effect director and officer insurance coverage.

13

Table of Contents

The following table shows the compensation paid to each of the non-employee directors during fiscal 2013. Mr. Orr, who is our President and Chief Executive Officer, does not receive any additional compensation for his services as a director.

NON-EMPLOYEE DIRECTOR COMPENSATION TABLE

FOR FISCAL 2013

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(4) |

Option Awards ($)(5) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Vincent C. Byrd(1) |

58,000 | 60,005 | — | — | — | — | 118,005 | |||||||||||||||||||||

| Sarah R. Coffin |

60,000 | 60,005 | — | — | — | — | 120,005 | |||||||||||||||||||||

| John B. Crowe |

60,000 | 60,005 | — | — | — | — | 120,005 | |||||||||||||||||||||

| William A. Foley |

55,000 | 60,005 | — | — | — | — | 115,005 | |||||||||||||||||||||

| Robert B. Heisler, Jr. |

55,000 | 60,005 | — | — | — | — | 115,005 | |||||||||||||||||||||

| Richard P. Johnston(8) |

90,000 | 60,005 | — | — | — | 25,549 | (6) | 175,554 | ||||||||||||||||||||

| Edward W. Kissel(2) |

64,000 | 60,005 | — | — | — | — | 124,005 | |||||||||||||||||||||

| Daniel R. Lee(7) |

20,000 | — | — | — | — | — | 20,000 | |||||||||||||||||||||

| Robert A. Stefanko(3) |

68,000 | 60,005 | — | — | — | — | 128,005 | |||||||||||||||||||||

| (1) | Mr. Byrd served as the Chairman and Presiding Director of the Compensation Committee. |

| (2) | Mr. Kissel served as the Chairman and Presiding Director of the Governance Committee. |

| (3) | Mr. Stefanko served as the Chairman and Presiding Director of the Audit Committee. |

| (4) | Stock Award amounts shown in this Non-Employee Director Compensation Table do not reflect compensation actually received by the directors. The amounts shown reflect the fair market value of 4,144 shares of common stock awarded to the non-employee directors on April 26, 2013. |

| (5) | No stock option awards were provided to the non-employee directors in 2013. The number of stock options held by the directors at December 31, 2013 was as follows: Mr. Byrd (0), Ms. Coffin (0), Mr. Crowe (0), Mr. Foley (0), Mr. Heisler (0), Mr. Johnston (2,500), Mr. Kissel (7,750), and Mr. Stefanko (0). |

| (6) | The amount of $25,549 for Mr. Johnston reflects an annual pension benefit that he is entitled to under the terms of an employment agreement with our subsidiary Buckhorn Inc. He resigned as an employee in 1990. The pension benefits commenced under the employment agreement following his resignation. |

| (7) | Mr. Lee became a member of the Board effective as of the annual meeting held April 26, 2013. |

| (8) | Mr. Johnston served as Chairman of the Board. |

Risk Assessment of Compensation Practices. In establishing compensation policies and practices for all of our employees, we utilize a balanced mix of salary, bonus and, in some cases, equity-based compensation that supports the enhancement of revenue, earnings and cash performance of the Company for our shareholders without creating undue risk. Under our long term incentive program adopted in 2010 (the “LTIP”), we utilize a blend of stock options, service-based awards and performance-based awards with a greater emphasis on performance-based awards than service-based awards that we believe will further align the interests of our employees with those of our shareholders. Our risk oversight and overall compensation structure has features that guard against excessive risk taking, including:

| • | Our Board’s and its Committees’ role in risk oversight, including internal control over financial reporting and other strategic, financial, operational, compliance and technology policies and practices (see the section titled “Board’s Role in Risk Oversight” above for a complete description); |

| • | Diversified nature of our business segments with respect to industries and markets served, products and services sold, and geographic footprint; |

| • | Establishment and annual review of base salaries to be consistent with an employee’s responsibilities; |

14

Table of Contents

| • | Determination and award of incentive awards based on a review of a variety of indicators of performance that diversifies the risks associated with any single indicator of performance; |

| • | A mixture of fixed and variable, annual and long-term, and cash and equity compensation are provided to our employees to encourage strategy and actions that are in the long-term interests of the Company and our shareholders; and |

| • | Awards of incentive compensation with performance vesting criteria to reward employees for driving sustainable, profitable growth for shareholders. |

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Discussion and Analysis.

Executive Summary:

Our executive pay program is managed by the Compensation Committee. The role of the Compensation Committee is to oversee our executive pay plans and policies, administer our stock plans and annually review and make recommendations to the Board for all pay decisions relating to our executives, including the Named Executive Officers (“NEOs”):

| • | John C. Orr, President and Chief Executive Officer |

| • | Greggory W. Branning, Chief Financial Officer, Senior Vice President and Corporate Secretary |

| • | David B. Knowles, Executive Vice President and Chief Operating Officer (through March 22, 2013) |

Messrs. Orr and Branning are our only NEOs. Mr. Knowles was also an NEO during part of 2013.

As shareholders consider the effectiveness of our executive pay program for our NEOs in the most recent year and their support of our executive pay program, they should take into account the following:

| • | The Company’s financial position remains solid, with a strong balance sheet and financial liquidity to pursue strategic goals which enhance shareholder value. This is evidenced by an increase of 6.4% in our adjusted earnings per share from 2012 to 2013. Additionally, we had positive cash flow from operating activities of $96.1 million in 2013. |

| • | The base salary for Mr. Orr was subject to an increase of approximately 5.1% and the base salary for Mr. Branning was subject to an increase of approximately 7.7%. |

| • | We continue to utilize a long-term incentive portfolio of options, service-based restricted stock and stock units, and long-term cash incentives tied to financial results to provide greater reward balance, more effectively manage share dilution and offer us greater flexibility to reward for long-term results. |

| • | We have several pay practices and policies that are in the best interests of our shareholders, including modest perquisites, limited executive retirement benefits, and stock ownership guidelines. |

| • | We concluded that our pay programs do not encourage excessive or unnecessary risk taking. |

15

Table of Contents

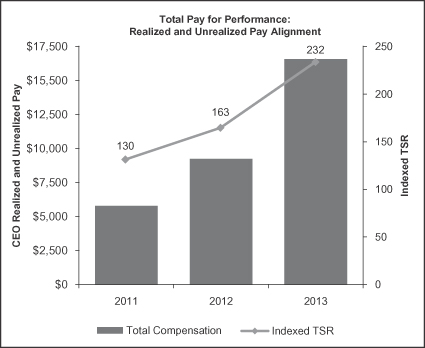

| • | Finally, we believe the pay actually earned by our Chief Executive Officer has been aligned with the Company’s total shareholder return performance. The realized pay of our Chief Executive Officer (salary, actual bonuses, long-term performance cash earned, options exercised, stock vested, and all other compensation) and unrealized pay (the value of outstanding equity awards and in-cycle cash performance awards at target) aligned closely with total shareholder return. |

|

Realized and Unrealized Compensation | ||||||

| 2011 | 2012 | 2013 | ||||

| Total Value |

$5,754 | $9,196 | $16,493 | |||

| Realized Compensation1 |

$1,772 | $2,897 | $3,458 | |||

| Unrealized Compensation2 |

$3,982 | $6,298 | $13,035 | |||

| Indexed TSR |

130 | 163 | 232 | |||

| 1-Year TSR |

30.0% | 25.3% | 42.4% | |||

| 1 | Includes salary, bonus, options exercised, stock vested, and all other compensation |

| 2 | Includes outstanding equity awards and in-cycle long-term cash at target |

16

Table of Contents

The remainder of this report provides details of each of these conclusions and examines our pay philosophy and objectives, the process used to set pay for 2013, the elements of pay awarded and other policies affecting our executive pay program.

Pay Philosophy and Practices.

Our success depends largely on the contributions of motivated, focused and energized executives all working to achieve our strategic objectives. The Compensation Committee and senior management, with assistance from our independent compensation advisor, develop competitive pay programs for our executives and we follow the basic tenets set forth below:

What We Do:

| • | Pay for Performance |

| • | Reasonable Post-Employment/Change in Control Provisions |

| • | Double Trigger Change in Control Provisions |

| • | Modest Perquisites |

| • | Share Ownership Guidelines |

| • | Independent Compensation Advisors |

| • | Tally Sheets to Evaluate and Monitor NEO Compensation |

What We Don’t Do:

| • | Enter into Employment Contracts |

| • | Offer Tax Gross-Ups |

| • | Reprice Underwater Options |

| • | Allow Cash Buyouts of Underwater Options |

| • | Permit Short Sales by Executive Officers or Directors |

Process Used to Set Pay for 2013.

Interactions between multiple parties established our executive pay program for 2013:

| • | Compensation Committee; |

| • | Senior management; |

| • | Independent compensation advisor; and |

| • | Outside advisors, including legal counsel. |

Role of Compensation Committee:

Five independent directors comprise our Compensation Committee, which is responsible for establishing and administering our compensation policies, programs and procedures. In dispensing its duties, the Compensation Committee may request information from senior management regarding the Company’s performance, pay and programs to assist it in its actions. Moreover, the Compensation Committee has the authority to retain outside advisors as needed to assist it in reviewing the Company’s programs, revising them and providing competitive pay levels. In arriving at its decision on executive compensation, the Compensation Committee takes into account the shareholder “say-on-pay” vote at the previous annual meeting of shareholders.

17

Table of Contents

The Compensation Committee annually reviews and establishes the goals used for our incentive plans. In addition, it annually assesses the performance of the Company and the Chief Executive Officer. Based on this evaluation, the Compensation Committee then recommends the Chief Executive Officer’s compensation for the next year to the Board for its consideration and approval. In addition, the Compensation Committee reviews the Chief Executive Officer’s compensation recommendations for the Chief Financial Officer, providing appropriate input and approving final awards. Finally, the Compensation Committee provides guidance and final approval to the Chief Executive Officer with regard to the determination of the compensation of other key executives.

Role of Senior Management:

The Company’s management serves in an advisory or support capacity as the Compensation Committee carries out its charter. Typically, the Company’s Chief Executive Officer participates in meetings of the Compensation Committee. The Company’s other NEOs may participate as necessary or at the Compensation Committee’s request. The NEOs normally provide the Compensation Committee with information regarding the Company’s performance as well as information regarding executives who participate in the Company’s various plans. Such data is usually focused on the executives’ historical pay and benefit levels, plan costs, context for how programs have changed over time and input regarding particular management issues that need to be addressed. In addition, management normally furnishes similar information to the Compensation Committee’s independent compensation advisor.

Management provides input regarding the recommendations made by outside advisors or the Compensation Committee. Management implements, communicates and administers the programs approved by the Compensation Committee, reporting back to it any questions, concerns or issues.

The Chief Executive Officer annually evaluates the performance of the Company and its other NEOs. Based on his evaluation, he provides the Compensation Committee with his recommendations regarding the pay for the Chief Financial Officer for its consideration, input and approval. The Compensation Committee, in turn, authorizes the Chief Executive Officer to establish the pay for the Company’s other executives based on terms consistent with those used to establish the pay of the NEOs. Members of management present at meetings when pay is discussed are recused from such discussions when the Compensation Committee focuses on their individual pay.

Role of Independent Compensation Advisor:

In 2013, the Compensation Committee engaged Exequity, LLP (“Exequity”) to assist the Compensation Committee. The Compensation Committee has the authority to retain Exequity or to engage other independent advisors and compensation consultants to assist in carrying out its responsibilities. Exequity’s lead consultant reported directly to the Compensation Committee Chairman, who approved Exequity’s work plan. In addition, the lead consultant interacted with management as needed to complete the work requested by the Compensation Committee. Exequity did not provide other services to the Company during 2013 and received no compensation other than with respect to the services provided to the Compensation Committee.

To support the Compensation Committee in this effort, Exequity provided information regarding how other companies in the plastics, packaging/container and distribution industries compensate its senior executives. Companies selected for this analysis were proposed by Exequity, reviewed by management and the Compensation Committee, and ultimately approved by the Compensation Committee.

18

Table of Contents

The Compensation Committee approved two separate peer groups, a proxy peer group and a broader general industry survey peer group, to determine the competitive pay positioning of our NEOs’ pay. The proxy peer group included the following companies:

| A. Schulman, Inc. | Lawson Products | |

| AEP Industries Inc. | Multi-Color Corporation | |

| American Biltrite Inc. | NN, Inc. | |

| AptarGroup, Inc. | OMNOVA Solutions Inc. | |

| Boise Inc. | Park-Ohio Holdings Corp. | |

| Crocs, Inc. | Tredegar Corporation | |

| Dorman Products, Inc. | Trex Company, Inc. | |

| Intertape Polymer Group Inc. | TriMas Corporation | |

| Kapstone Paper and Packaging | West Pharmaceutical Services, Inc. |

Associated Materials LLC, Graham Packaging Company, Packaging Corporation of America, and Tupperware Brands Corporation were eliminated from the proxy peer group used in 2012, and TriMas Corporation and Intertape Polymer Group Inc. were added to the proxy peer group. The general industry peer group companies were selected based on the following parameters: (1) participant in the Equilar Top 25 Survey; (2) publicly traded U.S.-based companies with a focus on manufacturing and other asset-based companies; and (3) size-appropriate companies with revenues within a range of roughly one-half to two times the Company’s revenue with median revenues for the group near the Company’s revenue. The general industry peer group companies included:

| Apogee Enterprises, Inc. | lululemon athletica inc. | |

| Barnes Group Inc. | Neenah Paper, Inc. | |

| Coherent, Inc. | Nordson Corporation | |

| Cymer, Inc. | ResMed Inc. | |

| Deckers Outdoor Corporation | Tecumseh Products Company | |

| Entegris, Inc. | Tempur-Pedic International Inc. | |

| ESCO Technologies Inc. | TriMas Corporation | |

| FEI Company | U.S. Concrete, Inc. | |

| Graco Inc. | West Pharmaceutical Services, Inc. | |

| H.B. Fuller Company | Zep Inc. | |

| Integra LifeSciences Holdings Corporation |

Based on this information, Exequity offered its recommendations for the NEOs’ pay program for 2013 and presented them in meetings and conference calls with the Compensation Committee. Exequity also reviewed the Company’s 2013 proxy statement.

Myers believes its practices are consistent with the practices for other companies of its size, reflects best practices regarding the governance of executive pay programs and reflects the executive pay program’s objectives of delivering competitive and appropriate pay aligned with our shareholders’ interests.

The work of Exequity has not raised any conflicts of interest.

Elements of Pay for 2013.

The basic elements of our compensation package include:

| • | Base salary; |

| • | Annual bonus opportunities; |

19

Table of Contents

| • | Long-term incentives in the form of cash, options, and restricted stock units; |

| • | Retirement and other benefits generally available to all other Company employees; and |

| • | Modest executive perquisites. |

Consistent with the objectives of our executive pay philosophy, we target total compensation to approximate the 50th percentile (or median) for executives in similar roles at companies of similar size and complexity. We believe targeting median pay levels is appropriate as it is sufficient to attract and retain key executives, but does not position our compensation costs out of line with other companies of similar size. Pay can vary from target levels to the degree the Company’s performance or stock price increases or decreases, affecting the value our executives realize from Myers’ annual bonus and long-term incentive awards.

While we do not have a prescribed mix of pay, the following table indicates the percentage of each NEO’s total target direct compensation that is attributable to base salary, target bonus, and long-term incentives (Mr. David B. Knowles is excluded because he was not an NEO for the entire year):

| Component of Pay |

Mr. John C. Orr | Mr. Greggory W. Branning | ||

| Salary |

21% | 38% | ||

| Target Bonus |

21% | 27% | ||

| Long-Term Incentives |

58% | 35% |

Base Salaries:

Base salaries are the guaranteed part of our executives’ pay. We pay base salaries to recognize the skills, competencies, experience, and individual performance an executive brings to his or her role. As a result, changes in base salary result primarily from changes in the executive’s responsibilities, an assessment of their annual performance, and our financial ability to pay base salaries and provide increases to them.

Salaries for our executives are based on the scope of their responsibilities and their relevant background, training and experience. Data on compensation practices of companies similar to ours is also considered in setting base salaries. The Compensation Committee targets base salaries at approximately the 50th percentile, but also considers an individual’s experience, performance, and external market conditions. Under the terms of our NEOs’ severance agreements, their base salaries may not be materially decreased.

Based on external market conditions, company performance, and senior management’s recommendations, the Compensation Committee decided to increase the base salary of Mr. Orr by 5.1% and the base salary of Mr. Branning by 7.7%. This positioned the base salary between approximately the 50th and 75th percentile of the peer group for Mr. Orr. Mr. Branning’s base salary ranks below the 50th percentile of the peer group as he is new to the CFO position.

Annual Bonuses:

In keeping with our policy of rewarding our executive officers for performance, executives, including our NEOs, were eligible to earn annual incentives under our annual incentive plan. Bonuses under the plan increase each executive’s focus on specific short-term corporate operational goals. As a result, it balances the objectives of our other pay programs, which concentrate on individual performance (base salaries), long-term financial results, and stock price growth. Finally, annual bonuses allow us to manage fixed compensation costs, while still providing executives with competitive cash compensation consisting of salaries and bonuses.

Each year, the Compensation Committee approves a target bonus opportunity for each NEO. We intend for our target bonuses to be at least at median levels to place more emphasis on achieving annual operating results and to support more demanding annual performance objectives. For 2013, our

20

Table of Contents

target bonuses were 100% of salary for Mr. Orr, 75% of salary for Mr. Knowles, and 70% of salary for Mr. Branning. Actual bonuses can range from 0% to 200% of target depending on actual performance, practices that are consistent with the range of annual bonus opportunities of peers and those of other companies our size. In this manner, we can reward our executives with higher levels of cash compensation for results that substantially exceed target results. Conversely, we pay relatively lower levels of cash compensation for results that fail to meet minimally acceptable standards.

Annual bonuses are based on results in two areas:

| • | Earnings before interest, taxes, depreciation and amortization (“EBITDA”), as adjusted for special income and expenses approved by the Compensation Committee. In 2013, these adjustments, equaling $12.8 million, were one-time non-recurring costs incurred by the Company that were not budgeted. EBITDA results determine 50% of an NEO’s annual bonus. |

| • | Cash flow before capital expenditures, which determines the remaining 50% of an NEO’s bonus. |