SSI-2015.01.31_10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 10-K

(Mark One)

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2015

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File No. 1-14035

Stage Stores, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

NEVADA (State or Other Jurisdiction of Incorporation or Organization) | 91-1826900 (I.R.S. Employer Identification No.) |

| |

10201 MAIN STREET, HOUSTON, TEXAS (Address of Principal Executive Offices) | 77025 (Zip Code) |

Registrant's telephone number, including area code: (800) 579-2302

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class Common Stock ($0.01 par value) | Name of each exchange on which registered New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer þ Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of August 1, 2014 (the last business day of the registrant's most recently completed second quarter), the aggregate market value of the voting and non-voting common stock of the registrant held by non-affiliates of the registrant was $505,510,489 (based upon the closing price of the registrant's common stock as reported by the New York Stock Exchange on August 1, 2014).

As of March 24, 2015, there were 31,659,842 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to the registrant's Annual Meeting of Shareholders to be held on June 11, 2015, which will be filed within 120 days of the end of the registrant's fiscal year ended January 31, 2015 ("Proxy Statement"), are incorporated by reference into Part III of this Form 10-K to the extent described therein.

References to a particular year are to Stage Stores, Inc.'s fiscal year, which is the 52- or 53-week period ending on the Saturday closest to January 31st of the following calendar year. For example, a reference to "2012" is a reference to the fiscal year ended February 2, 2013, "2013" is a reference to the fiscal year ended February 1, 2014 and "2014" is a reference to the fiscal year ended January 31, 2015. 2013 and 2014 consisted of 52 weeks, while 2012 consisted of 53 weeks.

PART I

ITEM 1. BUSINESS

Our Business

Stage Stores, Inc. and its subsidiary ("we," "us" or "our") operate specialty department stores primarily in small and mid-sized towns and communities. We provide customers a welcoming and comfortable shopping experience in our stores and direct-to-consumer business. Our merchandise assortment is a well-edited selection of moderately priced brand name and private label apparel, accessories, cosmetics, footwear and home goods. As of January 31, 2015, we operated 854 specialty department stores in 40 states under the BEALLS, GOODY'S, PALAIS ROYAL, PEEBLES and STAGE nameplates and a direct-to-consumer business.

On March 7, 2014, we divested Steele's, an off-price concept that we launched in November 2011, in order to focus solely on our core specialty department store business. Accordingly, the results of operations of Steele's and loss on the sale are reflected in discontinued operations for all periods presented.

Our History

Stage Stores, Inc. was formed in 1988 when the management of Palais Royal, together with several venture capital firms, acquired the family-owned Bealls and Palais Royal chains, both of which were originally founded in the 1920s. At the time of the acquisition, Palais Royal operated primarily larger stores, located in and around the Houston metropolitan area, while Bealls operated primarily smaller stores, principally located in rural Texas towns.

Our Market and Target Customer

Our distinct store environment and well-edited offerings of name brand and trend-right assortments attract a wide demographic. Our merchandise combination of apparel, accessories, cosmetics, footwear and home allows us participate in a number of market segments. While our broad assortment appeals to a wide array of people of varying ages and diverse backgrounds, our primary target customers are style and value savvy women over the age of 35 who are married, employed full time and have an average household income of $55,000. Our customer research reveals our target customer loves to shop for fun, and enjoys a shopping experience that brings her style, value and inspiration where she lives.

Competition

The retail industry is highly competitive and we compete in our stores and in our e-commerce business. However, as a result of our small and mid-sized market focus, our stores generally face less competition for our brand name merchandise since branded merchandise is typically available only in regional malls, which are often located more than 30 miles away from our nearest store. Due to minimal branded merchandise overlap, we generally do not directly compete for branded merchandise sales with national discounters such as Wal-Mart. In small and mid-sized markets where we do compete for brand name merchandise sales, competition generally comes from local retailers, small regional chains and, to a lesser extent, national department stores. In the more competitive markets where we compete against other national department store chains, we offer consumers a high level of customer service and the advantage of generally being in neighborhood locations with convenient parking and easy access. We believe we have a competitive advantage over local retailers and small regional chains due to our (i) broader selection of brand name merchandise, (ii) distinctive retail concept, (iii) economies of scale, (iv) strong vendor relationships and (v) private label credit card program. We also believe we have a competitive advantage in small and mid-sized markets over national department stores due to our experience with smaller markets.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and are key drivers of our success:

Unique Real Estate Positioning and Powerful Store Economics. Our stores are predominantly located in small towns and communities with populations of less than 150,000. We predominantly lease our locations and are generally secondary users of space, allowing us to secure advantageous occupancy terms. Our average store is 18,000 square feet, which is a small-format footprint for a specialty department store concept. We believe this creates an opportunity to offer a selection that feels comprehensive and curated in an inviting environment.

Trend-Right, Brand Name Merchandise Delivered at a Compelling Value. Our stores and direct-to-consumer business carry a broad selection of trend-right, brand name apparel, accessories, cosmetics, footwear and home goods for the entire family. Our buyers identify and purchase nationally recognized, quality brands and trend-right styles our customers find compelling from respected brands such as Levi Strauss, Nike, Calvin Klein, Chaps, Izod, Dockers, Carters, Jockey, Estee Lauder, Clinique, Nautica, Skechers and DKNY. Our value proposition for moderately priced, brand name merchandise includes routine discount and promotional offers. We believe our use of discount and promotional offers generates customer excitement and drives loyalty and repeat shopping.

Experienced Management Team with a Disciplined Operating Philosophy. Our senior management team has extensive experience across a wide range of disciplines in the retail industry, including merchandising, marketing, human resources, information systems and finance. Our management team has built a solid operating foundation based on sound retail principles and is focused on taking care of our customers to provide great merchandise and a great experience.

Stores

Store Openings and Closures. During 2014, we opened 18 new stores and closed 12 stores. In 2015, we plan to slow our new store growth as we embark on a multi-year initiative to increase investments in our direct-to-consumer business and existing stores. We anticipate opening 2 new stores in 2015. We continually review the profitability of each store and look to close a store if the expected store performance does not meet our financial hurdle rates. We expect to close 10-20 stores, where lease terms permit, in 2015.

Expansion, Relocation and Remodeling. During 2014, we expanded 13 stores and relocated 7 stores. In 2015, we plan to increase our investment in the expansion, relocation and remodeling of our existing stores. We believe that remodeling improves the store environment and helps us create an inviting and differentiated shopping experience. Our remodeling projects are designed to create a bright, fun and comfortable store experience and may include upgrades ranging from improving lighting, flooring, paint, fixtures, fitting rooms, visual merchandising and signage, to more extensive expansion projects. Relocations are intended to improve the store's location and to help it capitalize on incremental sales productivity potential.

In 2014, we undertook an initiative to measure selling square footage for each store. Historically, selling square footage for our stores was based on a percentage of gross square footage. The changes as a result of that initiative are included in the beginning balance in the following tables.

Store count and selling square footage by nameplate are as follows:

|

| | | | | | | | | | | | | | | | | |

| Number of Stores | | Selling Square Footage (in thousands) |

| February 1, 2014 | | 2014 Activity Net Changes | | January 31, 2015 | | February 1, 2014 | | 2014 Activity Net Changes | | January 31, 2015 |

Bealls | 215 |

| | 4 |

| | 219 |

| | 4,332 |

| | 71 |

| | 4,403 |

|

Goody's | 268 |

| | (2 | ) | | 266 |

| | 4,238 |

| | (13 | ) | | 4,225 |

|

Palais Royal | 53 |

| | — |

| | 53 |

| | 1,135 |

| | — |

| | 1,135 |

|

Peebles | 191 |

| | 6 |

| | 197 |

| | 3,497 |

| | 67 |

| | 3,564 |

|

Stage | 121 |

| | (2 | ) | | 119 |

| | 2,111 |

| | (29 | ) | | 2,082 |

|

| 848 |

| | 6 |

| | 854 |

| | 15,313 |

| | 96 |

| | 15,409 |

|

Utilizing a ten-mile radius from each store, approximately 58% of our stores are located in communities with populations below 50,000 people, while an additional 26% of our stores are located in communities with populations between 50,000 and 150,000 people. The remaining 16% of our stores are located in higher-density markets with populations greater than 150,000, such as Houston, San Antonio and Lubbock, Texas. The store count and selling square footage by market area population are as follows:

|

| | | | | | | | | | | | | | | | | |

| Number of Stores | | Selling Square Footage (in thousands) |

| February 1, 2014 | | 2014 Activity Net Changes | | January 31, 2015 | | February 1, 2014 | | 2014 Activity Net Changes | | January 31, 2015 |

Less than 50,000 | 491 |

| | 5 |

| | 496 |

| | 7,793 |

| | 100 |

| | 7,893 |

|

50,000 to 150,000 | 217 |

| | 3 |

| | 220 |

| | 4,303 |

| | 51 |

| | 4,354 |

|

Greater than 150,000 | 140 |

| | (2 | ) | | 138 |

| | 3,217 |

| | (55 | ) | | 3,162 |

|

| 848 |

| | 6 |

| | 854 |

| | 15,313 |

| | 96 |

| | 15,409 |

|

Direct-to-Consumer

Our direct-to-consumer business consists of our e-commerce website and Send program. Since launching our e-commerce website in 2010, we have made growing our direct-to-consumer business a high priority. Our e-commerce

website features a broader assortment of the merchandise categories found in our stores, as well as additional product offerings. Entering the 2013 holiday season, we replatformed our e-commerce website which improved functionality and enhanced the customer experience. Our in-store Send program allows customers to have merchandise shipped directly to their homes from another store if the preferred size or color is not available in their local store. Our direct-to-consumer business enables us to reach customers outside of store operating hours, acquire customers in all states and further build our brand. We believe there is significant potential to expand our direct-to-consumer business over time.

Merchandising

We offer a well-edited selection of moderately priced, branded merchandise within distinct merchandise categories, such as women's, men's and children's apparel, as well as accessories, cosmetics, footwear and home goods. Our direct-to-consumer business allows us to extend the breadth of our assortments and offer additional products.

The following table sets forth the distribution of net sales among our various merchandise categories:

|

| | | | | | | | | |

| | Fiscal Year |

Department | | 2014 | | 2013 | | 2012 |

Women's (a) | | 38 | % | | 38 | % | | 39 | % |

Men's (b) | | 17 |

| | 17 |

| | 17 |

|

Children's | | 11 |

| | 11 |

| | 12 |

|

Footwear | | 13 |

| | 13 |

| | 13 |

|

Accessories | | 8 |

| | 8 |

| | 8 |

|

Cosmetics/Fragrances | | 9 |

| | 9 |

| | 8 |

|

Home/Gifts/Other | | 4 |

| | 4 |

| | 3 |

|

| | 100 | % | | 100 | % | | 100 | % |

(a) Women's includes misses sportswear, junior sportswear, dresses, special sizes, intimates, outerwear and swim.

(b) Men's includes men's and young men's.

Merchandise selections reflect current styles and trends and merchandise mix may also vary from store to store to accommodate differing demographic, regional and climatic characteristics. Our buying and planning team use technology tools such as size pack optimization and store level markdown optimization to localize assortments.

Approximately 87% of sales consist of nationally recognized brands such as Levi Strauss, Nike, Calvin Klein, Chaps, Izod, Dockers, Carters, Nine West, Estee Lauder, Clinique, Nautica, Skechers and DKNY, while the remaining 13% of sales consist of our private label merchandise.

Our private label portfolio brands are developed and sourced through agreements with third party vendors. We believe our private label and exclusive brands offer a compelling mix of style, quality and excellent value. We continue to refine the positioning of our private brands and we see them as an avenue for growth.

We are also focused on growing our cosmetics business. In 2014, we installed Estee Lauder counters in 75 stores and Clinique counters in 76 stores.

Merchandise Distribution

We currently distribute all merchandise to our stores through distribution centers located in Jacksonville, Texas, South Hill, Virginia and Jeffersonville, Ohio. Incoming merchandise received at the distribution centers is inspected for quality control purposes.

Integrated merchandising and warehouse management systems support all corporate and distribution center locations. All of our distribution centers are equipped with modern sortation equipment which enables us to meet specific store merchandise assortment needs. The configurations of the distribution centers permit scheduled shipments to stores, with the majority of stores receiving merchandise within three days of shipment from the distribution centers. We utilize third party contract carriers to deliver merchandise from the distribution centers to our stores.

Direct-to-consumer orders are filled both from our distribution centers and our stores.

Marketing

We use a multi-media advertising approach, including broadcast media, digital media, mobile media, local newspaper inserts and direct mail. In addition, we leverage our private label credit card to create strong customer loyalty through continuous one-on-one communication.

Our marketing strategy is designed to establish and reward brand loyalty and support each store's position as the destination for desirable styles and nationally recognized brands at an attractive value in a comfortable and welcoming environment. Our marketing strategy leverages (i) consumer insight from brand and customer research, (ii) identified customer purchase history to plan and execute targeted omni-channel marketing to our customers and (iii) emerging technology and trends in retail marketing.

Maintaining a connection to the communities we serve is important to us and we have started a locally based giving campaign called 30 Days of Giving under our Community Counts program. In 2014, through our Community Counts program, we helped raise over $3.0 million for the communities we serve.

Brand image is an important part of our marketing program. Our principal trademarks, including the BEALLS, GOODY'S, PALAIS ROYAL, PEEBLES, and STAGE trademarks, have been registered with the U.S. Patent and Trademark Office. We have also registered trademarks used in connection with our private label merchandise. We regard our trademarks and their protection as important to our success.

Private Label Credit Card Program. We consider our private label credit card program to be a vital component of our business because it (i) enhances customer loyalty, (ii) allows us to identify and regularly contact our best customers and (iii) creates a comprehensive database that enables us to implement targeted and personalized marketing messages. Our Premier Rewards customer loyalty program provides significantly enhanced benefits and incentives for our private label credit card holders. Customers earn reward certificates redeemable for merchandise based on purchases, free shipping on direct-to-consumer purchases, special promotional discounts and invitations to private sales. The percentage of sales that are paid for using the private label credit card is our "penetration rate." The penetration rate for our private label credit card was 40% in 2014, an increase of more than 400 basis points compared to the prior year. In 2013 and 2012, the penetration rate was 36% and 33%, respectively.

Customer Service

We strive to provide exceptional customer service through conveniently located stores staffed with well-trained and motivated sales associates. In order to ensure consistency of execution, each sales associate is evaluated based on the attainment of specific customer service standards, such as offering a friendly greeting, providing prompt assistance, helping open private label credit card accounts, thanking customers and inviting return visits. We also conduct customer satisfaction surveys to measure and monitor attainment of customer service expectations. The results of customer surveys are used to provide feedback to reinforce and improve customer service. To further reinforce our focus on customer service, we have various programs in place to recognize our sales associates for providing outstanding customer service.

Information Systems

We support our business by using multiple, highly integrated systems in areas such as merchandising, store operations, distribution, sales promotion, personnel management, store design and accounting. Our core merchandising systems assist in planning, ordering, allocating and replenishing merchandise assortments for each store, based on specific characteristics and recent sales trends. Our price change management system allows us to identify and mark down slow moving merchandise. Our replenishment/fulfillment system allows us to maintain planned levels of in-stock positions in basic items such as jeans and underwear. In addition, a fully integrated warehouse management system is in place in all three distribution centers.

We have a markdown optimization tool, which is focused on pricing items on a style-by-style basis at the appropriate price, based on inventory levels and sales history, in order to maximize revenue and profitability. We continue to expand the utilization and effectiveness of our merchandise planning system in order to maximize the generation of sales and gross margin. In 2014, we implemented markdown optimization at the store level and continued to make progress on size pack optimization to better tailor assortments at the store level.

We utilize a point-of-sale ("POS") platform with bar code scanning, electronic credit authorization, instant credit, returns database and gift card processing in all our stores. The POS platform allows us to capture customer specific sales data for use in our merchandising, marketing and loss prevention systems, while quickly servicing our customers. The POS platform also manages coupon and deal-based pricing, which streamlines the checkout process and improves store associate adherence to promotional markdown policies.

Our Employees

At January 31, 2015, we employed approximately 14,300 hourly and salaried employees. Employee levels will vary during the year as we traditionally hire additional sales associates and increase the hours of part-time sales associates during peak seasonal selling periods. We consider our relationship with our employees to be good, and there are no collective bargaining agreements in effect with respect to any of our employees.

Seasonality

Our business is seasonal and sales are traditionally lower during the first three quarters of the fiscal year (February through October) and higher during the last quarter of the fiscal year (November through January). The fourth quarter usually accounts for approximately 30% of our annual sales, with each of the other quarters accounting for approximately 22% to 24%. Working capital requirements fluctuate during the year as well and generally reach their highest levels during the third and fourth quarters.

Available Information

We make available, free of charge, through the "Investor Relations" section of our website (www.stagestoresinc.com)

under the "SEC Filings" caption, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended ("Exchange Act") as soon as reasonably practicable after we file such material with, or furnish it to the Securities and Exchange Commission ("SEC"). In this Form 10-K, we incorporate by reference certain information from parts of our Proxy Statement for our 2015 Annual Meeting of Shareholders ("Proxy Statement").

Also in the "Investor Relations" section of our website (www.stagestoresinc.com) under the "Corporate Governance" and "SEC Filings" captions, the following information relating to our corporate governance may be found: Corporate Governance Guidelines; charters of our Board of Directors' Audit, Compensation, and Corporate Governance and Nominating Committees; Code of Ethics and Business Conduct; Code of Ethics for Senior Officers; Chief Executive Officer and Chief Financial Officer certifications related to our SEC filings; and transactions in our securities by our directors and executive officers. The Code of Ethics and Business Conduct applies to all of our directors and employees. The Code of Ethics for Senior Officers applies to our Chief Executive Officer, Chief Financial Officer, Controller and other individuals performing similar functions, and contains provisions specifically applicable to the individuals serving in those positions. We intend to post amendments to and waivers from, if any, our Code of Ethics and Business Conduct (to the extent applicable to our directors and executive officers) and our Code of Ethics for Senior Officers in the "Investor Relations" section of our website (www.stagestoresinc.com) under the "Corporate Governance" caption. We will provide any of the foregoing information without charge upon written request to our Secretary. The contents of our websites are not part of this report.

ITEM 1A. RISK FACTORS

Cautionary Statement Concerning Forward-Looking Statements for Purposes of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995

The Private Securities Litigation Reform Act of 1995 ("Act") provides a safe harbor for forward-looking statements to encourage companies to provide prospective information, so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that may cause actual results to differ materially from those discussed in the statements. We wish to take advantage of the "safe harbor" provisions of the Act.

Certain statements in this report are forward-looking statements within the meaning of the Act, and such statements are intended to qualify for the protection of the safe harbor provided by the Act. The words "anticipate," "estimate," "expect," "objective," "goal," "project," "intend," "plan," "believe," "will," "should," "may," "target," "forecast," "guidance," "outlook," and similar expressions generally identify forward-looking statements. Similarly, descriptions of our objectives, strategies, plans, goals or targets are also forward-looking statements. Forward-looking statements relate to the expectations of management as to future occurrences and trends, including statements expressing optimism or pessimism about future operating results or events and projected sales, earnings, capital expenditures and business strategy.

Forward-looking statements are based upon a number of assumptions and factors concerning future conditions that may ultimately prove to be inaccurate and may cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements that are made herein and in other reports and releases are not guarantees of future performance and actual results may differ materially from those discussed in such forward-looking statements as a result of various factors. These factors include, but are not limited to, the ability for us to maintain normal trade terms with vendors, the ability for us to comply with the various covenant requirements contained in the Revolving Credit Facility agreement (as defined in "Liquidity and Capital Resources"), the demand for apparel, and other factors. The demand for apparel and sales volume can be affected by significant changes in economic conditions, including an economic downturn, employment levels in our markets, consumer confidence, energy and gasoline prices and other factors influencing discretionary consumer spending. Other factors affecting the demand for apparel and sales volume include unusual weather patterns, an increase in the level of competition in our market areas, competitors' marketing strategies, changes in fashion trends, changes in the average cost of merchandise purchased for resale, availability of product on normal payment terms and the failure to achieve the expected results of our merchandising and marketing plans as well as our store opening or relocation plans. Additional assumptions, factors and risks concerning future conditions are discussed in the Risk Factors section of this Form 10-K, and may be discussed from time to time in our other filings with the SEC, including Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Most of these factors are difficult to predict accurately and are generally beyond our control.

Forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Although management believes the expectations expressed in forward-looking statements are based on reasonable assumptions within the bounds of our knowledge, forward-looking statements, by their nature, involve risks, uncertainties and other factors, any one or a combination of which may materially affect our business, financial condition, results of operations or liquidity.

Readers should carefully review this Form 10-K in its entirety, including, but not limited to our financial statements and the accompanying notes, and the risks and uncertainties described in this Item 1A. Readers should consider these risks, uncertainties and other factors carefully in evaluating forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. Forward-looking statements contained in this Form 10-K are made as of the date of this Form 10-K. We undertake no obligation to publicly update forward-looking statements whether as a result of new information, future events or otherwise. Readers are advised, however, to consult any further disclosures we make on related subjects in our public announcements and SEC filings.

Our ability to achieve the results contemplated by forward-looking statements is subject to a number of factors, any one, or a combination, of which may materially affect our business, financial condition, results of operations, or liquidity. Described below are certain risk factors that management believes are applicable to our business and the industry in which we operate. There may also be additional risks that are presently immaterial or unknown.

If we are unable to successfully execute our strategies, our operating performance may be significantly impacted. There is a risk that we will be unable to meet or exceed our operating performance targets and goals in the future if our strategies and initiatives are unsuccessful. Our ability to develop and execute our strategic plan and to execute the business activities associated with our strategic and operating plans, may impact our ability to meet our operating performance targets.

Our failure to anticipate and respond to changing customer preferences in a timely manner may adversely affect our operations. Our success depends, in part, upon our ability to anticipate and respond to changing consumer preferences and fashion trends in a timely manner. We attempt to stay abreast of emerging lifestyles and consumer preferences affecting our merchandise. However, any sustained failure on our part to identify and respond to such trends may have a material and adverse effect on our business, financial condition and cash flows.

Failure to successfully operate our e-commerce website or fulfill customer expectations may adversely impact our business and sales. Our e-commerce platform provides another channel to generate sales. We believe that the e-commerce website will drive incremental sales by providing existing customers another opportunity to shop with us and also allowing us to reach new customers. If we do not successfully meet the challenges of operating an e-commerce website or fulfilling customer expectations, our business and sales may be adversely affected.

We face the risk of significant competition in the retail apparel industry which may result in the loss of customers and adversely affect revenues. The retail apparel business is highly competitive. Although competition varies widely from market to market, we face the risk of increased competition, particularly in our more highly populated markets from national, regional and local department and specialty stores. Some of our competitors are considerably larger than us and have substantially greater resources. Although we offer a unique product mix and brands that are not available at certain other retailers, including regional and national department stores, there is no assurance that our existing or new competitors will not carry similar branded merchandise in the future. This may have a material and adverse effect on our business, financial condition and cash flows. In addition to traditional store-based retailers, we also face e-commerce competition, which may materially affect our revenues and profitability.

An economic downturn or decline in consumer confidence may negatively impact our business and financial condition. Our results of operations are sensitive to changes in general economic conditions that impact consumer discretionary spending, such as employment levels, taxes, energy and gasoline prices and other factors influencing consumer confidence. We have extensive operations in the South Central, Southeastern and Mid-Atlantic states. In addition, many stores are located in small towns and rural environments that are substantially dependent upon the local economy. If there is an economic downturn or decline in consumer confidence, particularly in the South Central, Southeastern and Mid-Atlantic states and any state from which we derive a significant portion of our net sales (such as Texas or Louisiana), our business, financial condition and cash flows will be negatively impacted and such impact may be material.

There can be no assurance that our liquidity will not be affected by changes in economic conditions. Recent economic conditions have not had, nor do we anticipate that current economic conditions will have, a significant impact on our liquidity. Due to our significant operating cash flow and availability under our Revolving Credit Facility, we continue to believe that we have the ability to meet our financing needs for the foreseeable future. However, there can be no assurance that our liquidity will not be materially and adversely affected by changes in economic conditions.

Failure to obtain merchandise product on normal trade terms and/or our inability to pass on any price increases related to our merchandise may adversely impact our business, financial condition and cash flows. We are highly dependent on obtaining merchandise product on normal trade terms. Failure to meet our performance objectives may cause key vendors and factors to become more restrictive in granting trade credit. The tightening of credit, such as a reduction in our lines of credit or payment terms from the vendor or factor community, may have a material adverse impact on our business, financial condition and cash flows. We are also highly dependent on obtaining merchandise at competitive and predictable prices. In the event we experience rising prices related to our merchandise, whether due to cost of materials, inflation, transportation costs, or otherwise, and are unable to pass on those rising prices to our customers, our business, financial condition and cash flows may be adversely and materially affected.

Risks associated with our vendors from whom our products are sourced may have a material adverse effect on our business and financial condition. Our merchandise is sourced from a variety of domestic and international vendors. All of our vendors must comply with applicable laws, including our required standards of conduct. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs and other factors relating to foreign trade, the ability to access suitable merchandise on acceptable terms and the financial viability of our vendors are beyond our control and may adversely impact our performance.

Risks associated with our carriers, shippers and other providers of merchandise transportation services may have a material adverse effect on our business and financial condition. Our vendors rely on shippers, carriers and other merchandise transportation service providers (collectively "Transportation Providers") to deliver merchandise from their manufacturers, both in the United States and abroad, to the vendors' distribution centers in the United States. Transportation Providers are also responsible for transporting merchandise from their vendors' distribution centers to our distribution centers. We also rely on Transportation Providers to transport merchandise from our distribution centers to our stores and to our customers in the case of e-commerce sales. However, if work slowdowns, stoppages, weather or other disruptions affect the transportation of merchandise between the vendors and their manufacturers, especially those manufacturers outside the United States, between the vendors and us, or between us and our e-commerce customers, our business, financial condition and cash flows may be adversely affected.

Unusual weather patterns or natural disasters, whether due to climate change or otherwise, may negatively impact our financial condition. Our business depends, in part, on normal weather patterns in our markets. We are susceptible to unseasonable and severe weather conditions, including natural disasters, such as hurricanes and tornadoes. Any unusual or severe weather, especially in states such as Texas and Louisiana, whether due to climate change or otherwise, may have a material and adverse impact on our business, financial condition and cash flows. In addition, our business, financial condition and cash flow may be adversely affected if the businesses of our key vendors and their merchandise manufacturers, shippers, carriers and other merchandise transportation service providers, including those outside of the United States, are disrupted due to severe weather, such as, but not limited to, hurricanes, typhoons, tornadoes, tsunamis or floods, whether due to climate change or otherwise.

A catastrophic event adversely affecting any of our buying, distribution or other corporate facilities may result in reduced revenues and loss of customers. Our buying, distribution and other corporate operations are in highly centralized locations. Our operations may be materially and adversely affected if a catastrophic event (such as, but not limited to, fire, hurricanes, tornadoes or floods) impacts the use of these facilities. While we have developed contingency plans that would be implemented in the event of a catastrophic event, there are no assurances that we would be successful in obtaining alternative servicing facilities in a timely manner in the event of such a catastrophe.

War, acts of terrorism, Mexican border violence, public health issues and natural disasters may create uncertainty and may result in reduced revenues. We cannot predict, with any degree of certainty, what effect, if any, war, acts of terrorism, Mexican border violence, public health issues and natural disasters, if any, will have on us, our operations, the other risk factors discussed herein and the forward-looking statements we make in this Form 10-K. However, the consequences of these events may have a material adverse effect on our business, financial condition and cash flows.

A disruption of our information technology systems may have a material adverse impact on our business and financial condition. We are heavily dependent on our information technology systems for day to day business operations. In addition, as part of our normal course of business, we collect, process and retain sensitive and confidential customer information. Today's information technology risks are largely external and their consequences may affect us. Potential risks include, but are not limited to, the following: (i) an intrusion by a hacker, (ii) the introduction of malware (virus, Trojan horse, spyware), (iii) hardware failure, (iv) outages due to software defects and (v) human error. Although we run anti-virus and anti-spyware software and take other steps to ensure that our information technology systems will not be disabled or otherwise disrupted, there are no assurances that disruptions will not occur. The consequences of a disruption, depending on the severity, may have a material adverse effect on our business and financial condition and may expose us to civil, regulatory and industry actions and possible judgments, fees and fines.

A security breach that results in unauthorized disclosure of our, employee or customer information may adversely impact our business, reputation and financial condition. The protection of customer, employee, and company data is critical to us. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential customer, employee or company information may severely damage our reputation, expose us to the risks of legal proceedings, disrupt our operations, attract a substantial amount of negative media attention, damage our customer relationships, and otherwise have a material adverse impact on our business and financial condition. While we have taken significant steps to protect confidential information, there is no assurance that advances in computer capabilities, new discoveries in the field of cryptography, or other developments will prevent the compromise of customer transaction processing capabilities and personal data. If any such compromise of our information security were to occur, it may have a material adverse effect on our reputation, business, operating results, financial condition and cash flows.

Our failure to attract, develop and retain qualified employees may deteriorate the results of our operations. We believe that our competitive advantage is providing well-trained and motivated sales associates in order to provide customers exceptional customer service. Our success depends in part upon our ability to attract, develop and retain a sufficient number of qualified employees, including store, service and administrative personnel. Competition for key personnel in the retail industry is intense and our future success will depend on our ability to recruit, train, and retain our senior executives and other qualified personnel.

Laws and regulations may adversely impact our business, financial condition and cash flows. We, like other businesses, are subject to various federal, state and local government laws and regulations including, but not limited to, tax laws. These may change periodically in response to economic or political conditions. We cannot predict whether existing laws or regulations, as currently interpreted or as reinterpreted in the future, or future laws and regulations, may have a material and adverse impact on our operations, financial condition and cash flows.

We may be subject to periodic litigation and regulatory proceedings which may adversely affect our business and financial performance. From time to time, we are involved in lawsuits and regulatory proceedings. Due to the inherent uncertainties of such matters, we may not be able to accurately determine the impact on us of any future adverse outcome of such matters. The ultimate resolution of these matters may have a material adverse impact on our financial condition, results of operations and liquidity. In addition, regardless of the outcome, these matters may result in substantial cost to us and may require us to devote substantial attention and resources to defend ourselves.

If our trademarks are successfully challenged, the outcome of those disputes may require us to abandon one or more of our trademarks. We regard our trademarks and their protection as important to our success. However, we cannot be sure that any trademark held by us will provide us a competitive advantage or will not be challenged by third parties. Although we intend to vigorously protect our trademarks, the cost of litigation to uphold the validity and prevent infringement of trademarks can be substantial and the outcome of those disputes may require us to abandon one or more of our trademarks.

Our dependence upon cash flows and net earnings generated during the fourth quarter, including the holiday season, may have a disproportionate impact on our results of operations. The seasonal nature of the retail industry causes a heavy dependence on earnings in the fourth quarter. A large fluctuation in economic or weather conditions occurring during the fourth quarter may adversely impact our earnings. In preparation for our peak season, we may carry a significant amount of inventory in advance. If, however, we do not manage inventory appropriately or customer preferences change we may need to increase markdowns or promotional sales to dispose of inventory which will negatively impact our financial results.

Covenants in our Revolving Credit Facility agreement may impose operating restrictions, impede or adversely affect our ability to pay dividends or repurchase common shares and raise capital through the sale of stock and other securities. Our Revolving Credit Facility agreement contains covenants which, among other things, restrict (i) the amount of additional debt or capital lease obligations we may incur, (ii) our payment of dividends and repurchase of common stock under certain circumstances and (iii) related party transactions. A violation of any of these covenants may permit the lenders to restrict our ability to further access loans and letters of credit and may require the immediate repayment of any outstanding loans. Our failure to comply with these covenants may have a material adverse effect on our capital resources, financial condition, results of operations and liquidity. In addition, any material or adverse developments affecting our business may significantly limit our ability to meet our obligations as they become due or to comply with the various covenant requirements contained in our Revolving Credit Facility agreement.

The inability or unwillingness of one or more lenders to fund their commitment under our Revolving Credit Facility may have a material adverse impact on our business and financial condition. Our Revolving Credit Facility, which matures on October 6, 2019, is a $350.0 million senior secured revolving credit facility. We use the Revolving Credit Facility to provide financing for working capital, capital expenditures and other general corporate purposes, as well as to support our outstanding letters of credit requirements. The lenders under the Revolving Credit Facility are: Wells Fargo Bank, National Association, JPMorgan Chase Bank, N.A, Regions Bank and Bank of America, N.A. Notwithstanding that we may be in full compliance with all covenants contained in the Revolving Credit Facility, the inability or unwillingness of one or more of those lenders to fund their commitment under our Revolving Credit Facility may have a material adverse impact on our business and financial condition.

Unexpected costs may arise from our current insurance program and our financial performance may be affected. Our insurance coverage is subject to deductibles, self-insured retentions, limits of liability and similar provisions that we believe are prudent based on the dispersion of our operations. However, we may incur certain types of losses that we cannot insure or which we believe are not economically reasonable to insure, such as losses due to acts of war, employee and certain other crime and some natural disasters. If we incur these losses and they are material, our business could suffer. Certain material events may result in sizable losses for the insurance industry and adversely impact the availability of adequate insurance coverage or result in excessive premium increases. To offset negative cost trends in the insurance market, we may elect to self-insure, accept higher deductibles or reduce the amount of coverage in response to these market changes. In addition, we self-insure a portion of expected losses under our workers' compensation, general liability and group health insurance programs. Unanticipated changes in any applicable actuarial assumptions and management estimates underlying our recorded liabilities for these losses, including potential increases in medical and indemnity costs, could result in materially different amounts of expense than expected under these programs, which may have a material adverse effect on our financial condition and results of operations. Although we continue to maintain property insurance for catastrophic events, we are self-insured for losses up to the amount of our deductibles. If we experience a greater number of self-insured losses than we anticipate, our financial performance may be adversely affected.

The price of our common stock as traded on the New York Stock Exchange may be volatile. Our stock price may fluctuate substantially as a result of factors beyond our control, including but not limited to, general economic and stock market conditions, risks relating to our business and industry as discussed above, strategic actions by us or our competitors, variations in our quarterly operating performance, our future sales or purchases of our common stock and investor perceptions of the investment opportunity associated with our common stock relative to other investment alternatives.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

Our corporate headquarters occupies approximately 195,000 square feet of leased space in Houston, Texas. We own our distribution centers in Jacksonville, Texas and South Hill, Virginia and lease our distribution center in Jeffersonville, Ohio, which have square footages and provide capacity of servicing stores as follows:

|

| | |

Location | Square Footage (in thousands) | Number of Stores Capable of Servicing |

Jacksonville, Texas | 437 | 600 |

South Hill, Virginia | 162 | 240 |

Jeffersonville, Ohio | 202 | 310 |

| 801 | 1,150 |

We also lease a 176,000 square foot facility in Jacksonville, Texas to provide capacity expansion for our growing e-commerce business.

Our stores are primarily located in strip shopping centers. We own six of our stores and lease the balance. The majority of leases, which are typically for an initial 10-year term and often with two renewals of five years each, provide for a base rent plus payments for expenses incurred by the landlord, such as common area maintenance and insurance. Certain leases provide for contingent rents that are not measurable at inception. These contingent rents are primarily based on a percentage of sales that are in excess of a predetermined level. Stores range in size from approximately 5,000 to 57,000 selling square feet, with the average being approximately 18,000 selling square feet. At January 31, 2015, we operated 854 stores, in 40 states located within 7 regions, as follows:

|

| | | | | | |

| | Number of Stores | | | | Number of Stores |

South Central Region | | | | Midwestern Region | | |

Arkansas | | 23 | | Illinois | | 6 |

Louisiana | | 53 | | Indiana | | 24 |

Oklahoma | | 38 | | Iowa | | 2 |

Texas | | 231 | | Kansas | | 9 |

| | 345 | | Michigan | | 15 |

Mid-Atlantic Region | | | | Minnesota | | 1 |

Delaware | | 3 | | Missouri | | 19 |

Maryland | | 8 | | Ohio | | 30 |

New Jersey | | 5 | | Wisconsin | | 4 |

Pennsylvania | | 35 | | | | 110 |

Virginia | | 34 | | Northeastern Region | | |

West Virginia | | 11 | | Connecticut | | 1 |

| | 96 | | Massachusetts | | 2 |

Southeastern Region | | | | New Hampshire | | 2 |

Alabama | | 35 | | New York | | 23 |

Florida | | 6 | | Vermont | | 4 |

Georgia | | 38 | | | | 32 |

Kentucky | | 34 | | Northwestern Region | | |

Mississippi | | 25 | | Colorado | | 6 |

North Carolina | | 30 | | Idaho | | 3 |

South Carolina | | 21 | | Oregon | | 4 |

Tennessee | | 34 | | Wyoming | | 1 |

| | 223 | | | | 14 |

Southwestern Region | | | | Total Stores | | 854 |

Arizona | | 7 | | | | |

Nevada | | 5 | | | | |

New Mexico | | 19 | | | | |

Utah | | 3 | | | | |

| | 34 | | | | |

| | | | | | |

ITEM 3. LEGAL PROCEEDINGS

No response is required under Item 103 of Regulation S-K.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

| |

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market and Dividend Information

Our common stock trades on the New York Stock Exchange under the symbol "SSI". The following table sets forth the high and low market prices per share of our common stock as reported by the New York Stock Exchange and the amount of cash dividends per common share we paid during each quarter in 2014 and 2013:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year |

| 2014 | | 2013 |

| High | | Low | | Dividend | | High | | Low | | Dividend |

1st Quarter | $ | 25.39 |

| | $ | 18.39 |

| | $ | 0.125 |

| | $ | 29.59 |

| | $ | 22.65 |

| | $ | 0.100 |

|

2nd Quarter | 20.46 |

| | 17.63 |

| | 0.125 |

| | 28.50 |

| | 21.53 |

| | 0.125 |

|

3rd Quarter | 19.33 |

| | 15.79 |

| | 0.140 |

| | 25.31 |

| | 18.41 |

| | 0.125 |

|

4th Quarter | 22.52 |

| | 15.71 |

| | 0.140 |

| | 22.99 |

| | 19.35 |

| | 0.125 |

|

On June 11, 2014, we announced that our Board of Directors ("Board") approved a 12% increase in our quarterly cash dividend rate to $0.14 per share from the previous quarterly rate of $0.125 per share. The new quarterly rate of $0.14 per share is applicable to dividends declared by the Board beginning on August 21, 2014.

We paid aggregate cash dividends in 2014 and 2013 of $17.0 million and $15.5 million, respectively. While we expect to continue payment of quarterly cash dividends, the declaration and payment of future dividends are subject to the discretion of our Board. Any future determination to pay dividends will depend on our results of operations and financial condition, as well as meeting certain criteria under our Revolving Credit Facility (as defined in "Liquidity and Capital Resources") and other factors deemed relevant by our Board.

Holders

As of the close of trading on the New York Stock Exchange on March 24, 2015 there were approximately 258 holders of record of our common stock.

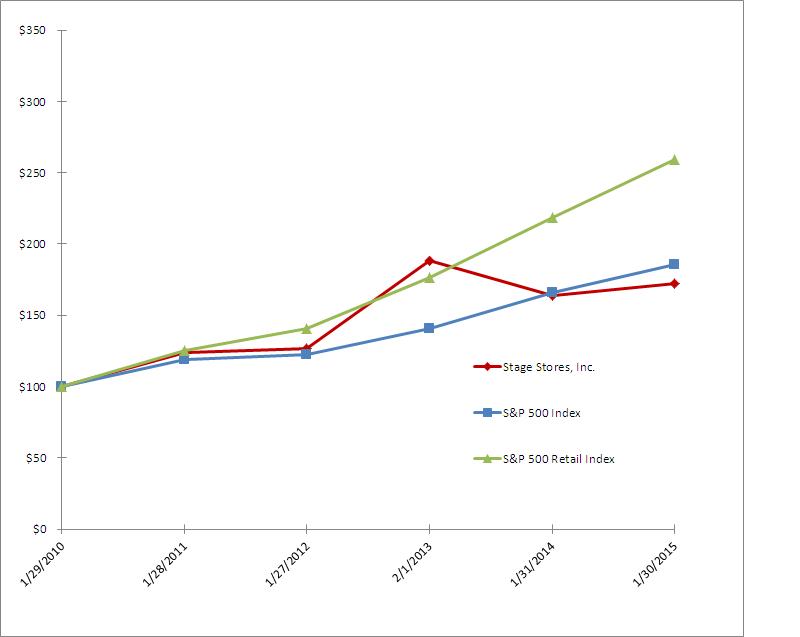

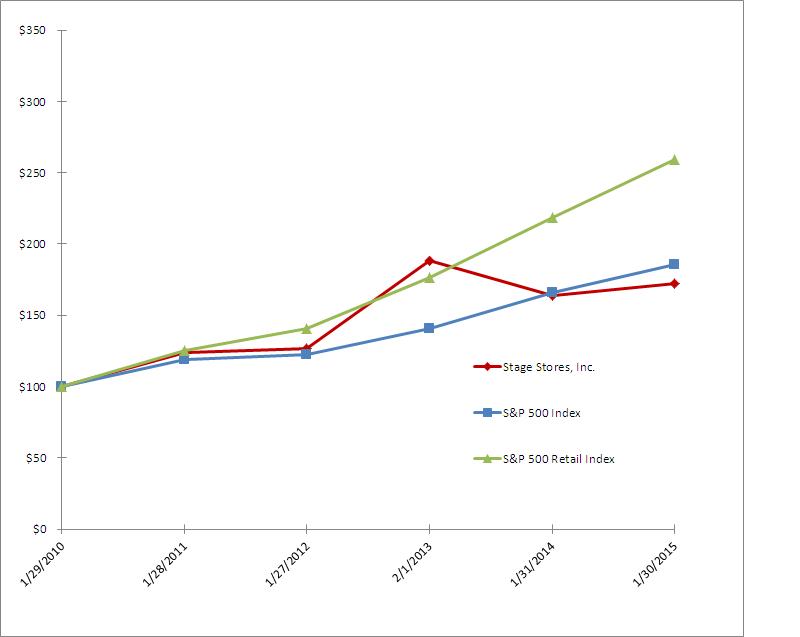

Performance Graph

The annual changes for the five-year period shown in the following graph are based on the assumption that $100 had been invested in each of our common stock, the S&P 500 Index and the S&P 500 Retail Index on January 29, 2010 (the last trading date of 2009), and that all quarterly dividends were reinvested at the average of the closing prices at the beginning and end of the quarter. Subsequent measurement points are the last trading days of 2010, 2011, 2012, 2013 and 2014. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on January 30, 2015 (the last trading date of 2014). The calculations exclude trading commissions and taxes. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

|

| | | | | | |

Date |

| Stage Stores, Inc. |

| S&P 500 Index |

| S&P 500 Retail Index |

1/29/2010 |

| $100.00 |

| $100.00 |

| $100.00 |

1/28/2011 |

| 123.96 |

| 118.85 |

| 125.46 |

1/27/2012 |

| 127.01 |

| 122.58 |

| 140.39 |

2/1/2013 |

| 188.25 |

| 140.91 |

| 176.18 |

1/31/2014 |

| 164.01 |

| 166.00 |

| 218.28 |

1/30/2015 |

| 172.25 |

| 185.78 |

| 259.21 |

Stock Repurchase Program

On March 7, 2011, our Board approved a stock repurchase program ("2011 Stock Repurchase Program") which authorized us to repurchase up to $200.0 million of our outstanding common stock. The 2011 Stock Repurchase Program will expire when we have repurchased $200.0 million of our outstanding common stock, unless terminated earlier by our Board. Through June 10, 2012, we repurchased approximately $100.1 million of our outstanding common stock under the 2011 Stock Repurchase Program. On June 11, 2012, we announced that our Board had chosen not to spend additional capital under the 2011 Stock Repurchase Program for the time being. In addition, our Board authorized us to repurchase shares of our outstanding common stock equal to the amount of the proceeds and related tax benefits from the exercise of stock options, stock appreciation rights ("SARs") and other equity grants. Purchases of shares of our common stock under this authorization may be made from time to time, either on the open market or through privately negotiated transactions and are financed by our existing cash, cash flow and other liquidity sources, as appropriate.

The table below sets forth information regarding our repurchases of our common stock during the fourth quarter of 2014:

|

| | | | | | | | | | | | | | |

ISSUER PURCHASES OF EQUITY SECURITIES |

Period | | Total Number of Shares Purchased (a) | | Average Price Paid Per Share (a) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (b) |

| | | | | | | | |

November 2, 2014 to November 29, 2014 | | 174,187 |

| | $ | 16.04 |

| | — |

| | $ | 99,938,428 |

|

| | | | | | | | |

November 30, 2014 to January 3, 2015 | | 1,579 |

| | 19.82 |

| | — |

| | 99,938,428 |

|

| | | | | | | | |

January 4, 2015 to January 31, 2015 | | 1,264 |

| | 21.67 |

| | — |

| | 99,938,428 |

|

| | | | | | | | |

Total | | 177,030 |

| | $ | 16.11 |

| | — |

| | |

|

| | | | | | | | |

(a) Although we did not repurchase any of our common stock during the fourth quarter of 2014 under the 2011 Stock Repurchase Program:

| |

• | We repurchased 171,914 shares of common stock for approximately $2.7 million at a weighted average price of $15.99 associated with the proceeds and related tax benefits from the exercise of stock options, SARs and other equity grants; |

| |

• | We reacquired 3,333 shares of common stock from certain employees to cover tax withholding obligations from exercises of SARs at a weighted average acquisition price of $20.49 per share; and |

| |

• | The trustee of the grantor trust established by us for the purpose of holding assets under our deferred compensation plan purchased an aggregate of 1,783 shares of our common stock in the open market at a weighted average price of $19.51 in connection with the option to invest in our stock under the deferred compensation plan and reinvestment of dividends paid on our common stock held in trust in the deferred compensation plan. |

(b) Reflects the $200.0 million authorized under the 2011 Stock Purchase Program, less the $100.1 million repurchased using our existing cash, cash flow and other liquidity sources since March 2011.

ITEM 6. SELECTED FINANCIAL DATA

The following sets forth selected consolidated financial data for the periods indicated. Financial results for 2014, 2013, 2011, and 2010 are based on a 52-week period. Financial results for 2012 are based on a 53-week period. The selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements included herein. All amounts are stated in thousands, except for per share data, percentages and number of stores.

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal Year |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Statement of operations data: | | | | | | | | | |

Net sales | $ | 1,638,569 |

| | $ | 1,609,481 |

| | $ | 1,627,702 |

| | $ | 1,511,220 |

| | $ | 1,470,590 |

|

Cost of sales and related buying, occupancy and distribution expenses | 1,188,763 |

| | 1,172,995 |

| | 1,168,907 |

| | 1,099,982 |

| | 1,053,766 |

|

Gross profit | 449,806 |

| | 436,486 |

| | 458,795 |

| | 411,238 |

| | 416,824 |

|

| | | | | | | | | |

Selling, general and administrative expenses | 383,616 |

| | 390,224 |

| | 387,332 |

| | 353,055 |

| | 350,865 |

|

Store opening costs | 2,488 |

| | 2,902 |

| | 2,163 |

| | 5,305 |

| | 3,192 |

|

Interest expense, net | 3,002 |

| | 2,744 |

| | 3,011 |

| | 3,821 |

| | 3,875 |

|

Income from continuing operations before income tax | 60,700 |

| | 40,616 |

| | 66,289 |

| | 49,057 |

| | 58,892 |

|

| | | | | | | | | |

Income tax expense | 22,847 |

| | 15,400 |

| | 24,373 |

| | 16,930 |

| | 21,252 |

|

Income from continuing operations | 37,853 |

| | 25,216 |

| | 41,916 |

| | 32,127 |

| | 37,640 |

|

Loss from discontinued operations, net | (7,003 | ) | | (8,574 | ) | | (3,737 | ) | | (1,167 | ) | | — |

|

Net income | $ | 30,850 |

| | $ | 16,642 |

| | $ | 38,179 |

| | $ | 30,960 |

| | $ | 37,640 |

|

Adjusted earnings (non-GAAP) (a) | $ | 37,853 |

| | $ | 39,986 |

| | $ | 46,296 |

| | $ | 32,127 |

| | $ | 37,640 |

|

| | | | | | | | | |

Basic earnings per share data | | | | | | | | | |

Continuing operations | $ | 1.18 |

| | $ | 0.78 |

| | $ | 1.32 |

| | $ | 0.96 |

| | $ | 1.00 |

|

Discontinued operations | $ | (0.22 | ) | | $ | (0.27 | ) | | $ | (0.12 | ) | | $ | (0.04 | ) | | $ | — |

|

Basic earnings per share (b) | $ | 0.96 |

| | $ | 0.51 |

| | $ | 1.20 |

| | $ | 0.93 |

| | $ | 1.00 |

|

Basic weighted average common shares outstanding | 31,675 |

| | 32,034 |

| | 31,278 |

| | 33,021 |

| | 37,656 |

|

| | | | | | | | | |

Diluted earnings per share data | | | | | | | | | |

Continuing operations | $ | 1.18 |

| | $ | 0.77 |

| | $ | 1.31 |

| | $ | 0.95 |

| | $ | 0.99 |

|

Discontinued operations | $ | (0.22 | ) | | $ | (0.26 | ) | | $ | (0.12 | ) | | $ | (0.03 | ) | | $ | — |

|

Diluted earnings per share | $ | 0.96 |

| | $ | 0.51 |

| | $ | 1.19 |

| | $ | 0.92 |

| | $ | 0.99 |

|

Adjusted diluted earnings per share (non-GAAP) (a) | $ | 1.18 |

| | $ | 1.22 |

| | $ | 1.44 |

| | $ | 0.95 |

| | $ | 0.99 |

|

Diluted weighted average common shares outstanding | 31,763 |

| | 32,311 |

| | 31,600 |

| | 33,278 |

| | 38,010 |

|

| | | | | | | | | |

Margin and other data: | |

| | |

| | |

| | |

| | |

|

Gross profit margin | 27.5 | % | | 27.1 | % | | 28.2 | % | | 27.2 | % | | 28.3 | % |

Selling, general and administrative expense rate | 23.4 | % | | 24.2 | % | | 23.8 | % | | 23.4 | % | | 23.9 | % |

Capital expenditures | $ | 70,580 |

| | $ | 61,263 |

| | $ | 49,489 |

| | $ | 45,731 |

| | $ | 36,990 |

|

Construction allowances from landlords | 5,538 |

| | 4,162 |

| | 4,193 |

| | 4,499 |

| | 5,476 |

|

Stock repurchases | 4,599 |

| | 33,748 |

| | 387 |

| | 110,919 |

| | 31,976 |

|

Cash dividends per share | 0.53 |

| | 0.48 |

| | 0.38 |

| | 0.33 |

| | 0.25 |

|

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

Store data: | |

| | |

| | |

| | |

| | |

|

Comparable sales growth (decline) (c) | 1.4 | % | | (1.5 | )% | | 5.7 | % | | 0.5 | % | | 0.2 | % |

Store openings (d) | 18 |

| | 28 |

| | 25 |

| | 34 |

| | 33 |

|

Store closings (d) | 12 |

| | 10 |

| | 5 |

| | 10 |

| | 5 |

|

Number of stores open at end of period (d) | 854 |

| | 848 |

| | 830 |

| | 810 |

| | 786 |

|

Total selling area square footage at end of period (d) | 15,409 |

| | 15,313 |

| | 15,255 |

| | 15,027 |

| | 14,681 |

|

| | | | | | | | | |

| January 31, | | February 1, | | February 2, | | January 28, | | January 29, |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Balance sheet data: | |

| | |

| | |

| | |

| | |

|

Working capital | $ | 299,279 |

| | $ | 293,995 |

| | $ | 259,260 |

| | $ | 213,700 |

| | $ | 262,100 |

|

Total assets | 824,677 |

| | 810,837 |

| | 794,871 |

| | 735,339 |

| | 796,084 |

|

Debt obligations | 47,388 |

| | 63,225 |

| | 12,329 |

| | 49,503 |

| | 38,492 |

|

Stockholders' equity | 475,930 |

| | 454,444 |

| | 464,870 |

| | 412,706 |

| | 489,509 |

|

(a) See Non-GAAP Financial Measures following below for additional information and reconciliation to the most directly comparable U.S. GAAP financial measure.

(b) Earnings per share may not foot due to rounding.

(c) We follow the retail reporting calendar, which included an extra week of sales in the fourth quarter of 2012. However, many retailers report comparable sales on a shifted calendar, which excludes the first week of 2012 rather than the fifty-third week. On this shifted basis, comparable sales decreased 1.1% for 2013.

(d) Excludes Steele's stores that are now reflected in discontinued operations.

Non-GAAP Financial Measures

The following supplemental information presents the results of operations for 2014, 2013 and 2012 on a basis in conformity with accounting principles generally accepted in the United States of America ("GAAP") and on a non-GAAP basis to show earnings with and without charges associated with the South Hill Consolidation (see Note 16) and our former Chief Executive Officer's resignation. We believe this supplemental financial information enhances an investor's understanding of our financial performance as it excludes those items which impact comparability of operating trends. The non-GAAP financial information should not be considered in isolation or viewed as a substitute for net income, cash flow from operations, diluted earnings per common share or other measures of performance as defined by GAAP. Moreover, the inclusion of non-GAAP financial information as used herein is not necessarily comparable to other similarly titled measures of other companies due to the potential inconsistencies in the method of presentation and items considered. The following tables set forth the supplemental financial information and the reconciliation of GAAP disclosures to non-GAAP financial measures (in thousands, except diluted earnings per share):

|

| | | | | | | | | | | |

| Fiscal Year |

| 2014 | | 2013 | | 2012 |

Net income (GAAP) | $ | 30,850 |

| | $ | 16,642 |

| | $ | 38,179 |

|

Loss from discontinued operations, net of tax benefit of $4,228, $5,237 and $2,172, respectively | (7,003 | ) | | (8,574 | ) | | (3,737 | ) |

Income from continuing operations | 37,853 |

| | 25,216 |

| | 41,916 |

|

South Hill Consolidation related charges, net of tax of $9,019 and $1,330, respectively | — |

| | 14,770 |

| | 2,288 |

|

Former Chief Executive Officer resignation related charges, net of tax of $1,216 | — |

| | — |

| | 2,092 |

|

Adjusted earnings (non-GAAP)(a) | $ | 37,853 |

| | $ | 39,986 |

| | $ | 46,296 |

|

| | | | | |

Diluted earnings per share (GAAP) | $ | 0.96 |

| | $ | 0.51 |

| | $ | 1.19 |

|

Loss from discontinued operations | (0.22 | ) | | (0.26 | ) | | (0.12 | ) |

Income from continuing operations | 1.18 |

| | 0.77 |

| | 1.31 |

|

South Hill Consolidation related charges | — |

| | 0.45 |

| | 0.07 |

|

Former Chief Executive Officer resignation related charges | — |

| | — |

| | 0.07 |

|

Adjusted diluted earnings per share (non-GAAP) (a) (b) | $ | 1.18 |

| | $ | 1.22 |

| | $ | 1.44 |

|

| | | | | |

(a) 2014 amounts are not adjusted.

| | | | | |

(b) Earnings per share may not foot due to rounding.

| | | | | |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The results of operations for 2014 and 2013 are based on 52-week periods and for 2012 is based on a 53-week period.

Our Business

We are a retailer operating specialty department stores primarily in small and mid-sized towns and communities. We provide customers a welcoming and comfortable shopping experience in our stores and direct-to-consumer business. Our merchandise assortment is a well-edited selection of moderately priced brand name and private label apparel, accessories, cosmetics, footwear and home goods. As of January 31, 2015, we operated 854 specialty department stores located in 40 states under the BEALLS, GOODY'S, PALAIS ROYAL, PEEBLES and STAGE nameplates and a direct-to-consumer business.

On March 7, 2014, we divested Steele's, an off-price concept that we launched in November 2011, in order to focus solely on our core specialty department store business. Accordingly, the results of operations of Steele's and loss on the sale are reflected in discontinued operations for all periods presented. Our results of operations for all periods presented within Management's Discussion and Analysis reflect continuing operations. For additional information regarding discontinued operations, see Note 15 to the consolidated financial statements.

Results of Operations

Our strategy for 2014 was to build on our prior year achievements and to pursue meaningful sales and earnings growth. Reflecting the successful implementation of our business strategy, we achieved the following results in 2014 (comparisons are to 2013):

Financial Highlights

| |

• | Net sales increased $29.1 million, or 1.8%. |

| |

• | Comparable sales increased 1.4%. |

| |

• | Direct-to-consumer sales, included in comparable sales, increased 25.7%. |

| |

• | Gross profit increased $13.3 million, or 3.1%. |

| |

• | Income from continuing operations improved $12.6 million, or 50.1%. |

| |

• | We grew the penetration rate of our private label credit card to 40%. |

| |

• | In August 2014, we increased our quarterly dividend rate by 12.0% to $0.14 per common share |

| |

• | We paid cash dividends of $17.0 million ($0.53 per share). |

| |

• | On October 6, 2014, we entered into a $350.0 million senior secured revolving credit facility that replaced our previous facility and increased our borrowing capacity by $100.0 million. |

Strategic Highlights

| |

• | To enhance our focus on our core specialty department store business, we completed the sale of off-price concept Steele’s in the first quarter of 2014. |

| |

• | We expanded direct-to-consumer assortments and broadened our centralized fulfillment. |

| |

• | We grew our cosmetics business with the installation of new Estee Lauder counters in 75 stores and new Clinique counters in 76 stores. |

| |

• | We refined our assortments with updated styles, new brands, additional categories within existing brands and the expansion of existing brands to additional stores. |

| |

• | We implemented store-level mark down optimization and continued to make progress on size pack optimization. |

| |

• | We re-launched our home category with a focus on offering a highly curated selection of kitchen, textile and gift assortments. |

| |

• | We continued to install new fixtures in our stores to improve product presentation and the shopping experience. New fixtures are now in approximately 20% of our stores. |

| |

• | We opened 18 new stores. |

2015 Strategy and Outlook

Our strategy in 2015 will be focused on driving sales productivity and expanding our direct-to-consumer business. We plan to refine our assortments, in-store experience and marketing communications. We believe we can grow our revenue and earnings by executing on the following strategies:

Drive Sales Productivity. We intend to drive sales productivity in existing stores and our direct-to-consumer business by featuring quality, trend-right merchandise at a compelling value and refining our experience in the store environment, our direct-to-consumer business and our marketing touch points. We intend to lead with trend-right and style driven assortments and friendly service to foster a fun, comfortable shopping experience that translates to higher units sold and higher average unit retails.

Expand the Penetration and Presence of our Direct-to-Consumer Business. We expect to improve our brand experience with a growing direct-to-consumer business. Our direct-to-consumer business reinforces and builds further brand awareness and grew by 25.7% in 2014, representing 2.3% of our total sales. We have expanded assortments, implemented functionality enhancements and broadened centralized fulfillment, and we plan to continue making significant investments in our direct-to-consumer business that will further enhance our customers’ shopping experience from an assortment, technology and fulfillment perspective.

In 2015, we plan to slow our new store growth as we embark on a multi-year initiative to increase investments in our direct-to-consumer business and existing stores. We anticipate opening 2 new stores in 2015. We continually review the profitability of each store and look to close a store if the expected store performance does not meet our financial hurdle rates. We expect to close 10-20 stores, where lease terms permit, in 2015.

The financial information, discussion and analysis that follow should be read in conjunction with our Consolidated Financial Statements and accompanying footnotes included in this Form 10-K.

2014 Compared to 2013

|

| | | | | | | | | | | | | | | | | | | | |

| Fiscal Year Ended | | | | |

| January 31, 2015 | | February 1, 2014 | | Change |

| Amount | | % to Sales (a) | | Amount | | % to Sales (a) | | Amount | | % |

Net sales | $ | 1,638,569 |

| | 100.0 | % | | $ | 1,609,481 |

| | 100.0 | % | | $ | 29,088 |

| | 1.8 | % |

Cost of sales and related buying, occupancy and distribution expenses | 1,188,763 |

| | 72.5 | % | | 1,172,995 |

| | 72.9 | % | | 15,768 |

| | 1.3 | % |

Gross profit | 449,806 |

| | 27.5 | % | | 436,486 |

| | 27.1 | % | | 13,320 |

| | 3.1 | % |

Selling, general and administrative expenses | 383,616 |

| | 23.4 | % | | 390,224 |

| | 24.2 | % | | (6,608 | ) | | (1.7 | )% |

Store opening costs | 2,488 |

| | 0.2 | % | | 2,902 |

| | 0.2 | % | | (414 | ) | | (14.3 | )% |

Interest expense | 3,002 |

| | 0.2 | % | | 2,744 |

| | 0.2 | % | | 258 |

| | 9.4 | % |

Income before income tax | 60,700 |

| | 3.7 | % | | 40,616 |

| | 2.5 | % | | 20,084 |

| | 49.4 | % |

Income tax expense | 22,847 |

| | 1.4 | % | | 15,400 |

| | 1.0 | % | | 7,447 |

| | 48.4 | % |

Income from continuing operations | 37,853 |

| | 2.3 | % | | 25,216 |

| | 1.6 | % | | 12,637 |

| | 50.1 | % |

Loss from discontinued operations, net of tax benefit of $4,228 and $5,237 | (7,003 | ) | | (0.4 | )% | | (8,574 | ) | | (0.5 | )% | | 1,571 |

| | (18.3 | )% |

Net income | $ | 30,850 |

| | 1.9 | % | | $ | 16,642 |

| | 1.0 | % | | $ | 14,208 |

| | 85.4 | % |

| | | | | | | | | | | |

(a) Percentages may not foot due to rounding. | | | | | | | | |

Net Sales

Sales for 2014 increased 1.8% to $1,638.6 million from $1,609.5 million for 2013. Comparable sales, which are sales in stores that are open for at least 14 full months prior to the reporting period, including direct-to-consumer sales, increased by 1.4% in 2014 as compared to a 1.5% decrease in 2013. Excluding direct-to-consumer sales, comparable sales increased 0.9% in 2014, as compared to a 2.0% decrease in 2013. The 1.4% increase in comparable sales was driven primarily by a 4.9% gain in average unit retail, which was partially offset by a decline in units per transaction and in the number of transactions. The higher average selling price was achieved through effectively managing inventory levels, resulting in an improved balance between regular priced and clearance goods.

Comparable sales increase (decrease) by quarter is presented below:

|

| | | | | |

| Fiscal Year |

| 2014 | | 2013 |

1st Quarter | (0.2 | )% | | 0.7 | % |

2nd Quarter | (4.2 | ) | | 1.7 |

|

3rd Quarter | 2.3 |