UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For

the fiscal year ended |

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from _____________ to ______________ |

Commission

File No.

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ |

| Smaller

reporting company |

Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of March 28, 2020

was approximately $

As of January 27, 2021, there were shares of common stock outstanding.

MTS Systems Corporation

Annual Report on Form 10-K/A

For the Year Ended October 3, 2020

| Table of Contents | ||

| EXPLANATORY NOTE | 3 | |

| PART III | 4 | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 4 |

| Item 11. | Executive Compensation | 8 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 32 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 33 |

| Item 14. | Principal Accountant Fees and Services | 34 |

| PART IV | 35 | |

| Item 15. | Exhibits and Financial Statement Schedules | 35 |

| Signatures | 36 | |

| 2 |

EXPLANATORY NOTE

MTS Systems Corporation is filing this Amendment No. 1 on Form 10-K/A (this Amendment) to amend our Annual Report on Form 10-K for the fiscal year ended October 3, 2020 that was filed with the Securities and Exchange Commission (SEC) on December 15, 2020 (the Original Filing). We are filing this Amendment for the purpose of including information required by Part III of Form 10-K as discussed further below. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in Part III to be incorporated in Form 10-K by reference to our definitive proxy statement if such statement is filed no later than 120 days after the end of our fiscal year. Our definitive proxy statement for our 2021 Annual Meeting of Shareholders will not be filed within 120 days of October 3, 2020. The inclusion of the definitive proxy statement on the cover page of the Original Filing as a document incorporated by reference has been deleted. This Amendment amends and restates in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Original Filing.

As required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 12b-15 under the Securities Exchange Act of 1934, as amended, Item 15 of Part IV of the Original Filing has been amended to add currently dated certifications from our Chief Executive Officer and Chief Financial Officer. The currently dated certifications are attached hereto as Exhibits 31.3 and 31.4. Because no financial statements are contained in this Amendment, and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. Because no financial statements are contained in this Amendment, we are not including certifications pursuant to 18 U.S.C. 1350.

Except as set forth in Parts III and IV below and the change to the cover page expressly described above, we are making no other changes to the Original Filing. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Filing, nor does it modify or update in any way the disclosures contained in the Original Filing. Accordingly, this Amendment should be read together with our Original Filing and our other filings made with the SEC subsequent to the filing of the Original Filing.

The terms “MTS,” “we,” “us,” “the Company” or “our” in this Amendment, unless the context otherwise requires, refer to MTS Systems Corporation and its wholly owned subsidiaries.

| 3 |

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

The Board of Directors and Executive Officers

The following table provides information about our directors and executive officers as of January 27, 2021. Directors are elected to serve for a term of one year until their successors are duly elected and qualified or until their earlier death, disqualification, resignation or removal from office.

| Name | Age | Position | ||||

| David J. Anderson | 73 | Chairman of the Board of Directors | ||||

| Randy J. Martinez(1) | 65 | Director, President and Chief Executive Officer | ||||

| Nancy A. Altobello(2)(3)(4) | 63 | Director | ||||

| David D. Johnson(2)(3) | 64 | Director | ||||

| Michael V. Schrock(3)(4) | 67 | Director | ||||

| Chun Hung (Kenneth) Yu(3)(4) | 71 | Director | ||||

| Linda K. Zukauckas(2)(4) | 59 | Director | ||||

| Steven B. Harrison | 54 | Executive Vice President and President, Test & Simulation | ||||

| David T. Hore | 55 | Executive Vice President and President, Sensors | ||||

| Brian T. Ross | 44 | Executive Vice President and Chief Financial Officer | ||||

| Todd J. Klemmensen | 47 | Senior Vice President, General Counsel and Corporate Secretary | ||||

| (1) | Mr. Martinez was appointed President and Chief Executive Officer effective December 17, 2020, after serving as Interim President and Chief Executive Officer from May 23, 2020 to December 16, 2020. | |

| (2) | Member, Audit Committee | |

| (3) | Member, Compensation and Leadership Development Committee | |

| (4) | Member, Nominating and Governance Committee |

Directors

David J. Anderson, a director since 2009, is the Chairman of our Board of Directors, a position he has held since 2011. Mr. Anderson previously served as the Co-Vice Chairman of Sauer-Danfoss, Inc. (developer and manufacturer of fluid power and electronic components and systems for mobile equipment applications) from 2008 until his retirement in June 2009. Mr. Anderson was the President, Chief Executive Officer and a director of Sauer-Danfoss, Inc. from 2002 until June 2009 and had previously held various senior management positions with Sauer-Danfoss, Inc. beginning in 1984. Prior to 1984, he held various positions in business development, strategic planning, sales, and marketing at several industrial manufacturing and distribution businesses. Mr. Anderson also previously served as a director of Schnitzer Steel Industries, Inc. (a steel manufacturing and scrap metal recycling company) from 2009 to January 2018 and a member of its Audit Committee, Compensation Committee and Nominating & Corporate Governance Committee at various times during that period and as a director of Modine Manufacturing Company (developer and manufacturer of thermal management systems and components) from 2010 to July 2020 and a member of is Corporate Governance and Nominating Committee, Audit Committee, and Technology Committee at various times during that period.

Mr. Anderson’s qualifications to serve on our Board and to serve as the Chair of the Board include his more than 40 years of international, industrial business experience and his chief executive officer and operations experience. He also has technology and engineering experience, the ability to formulate and execute strategy and financial expertise.

| 4 |

Randy J. Martinez, a director since March 2014, was appointed our President and Chief Executive Officer on December 17, 2020, after serving as our Interim President and Chief Executive Office from May 23, 2020 to December 16, 2020. Prior to joining MTS, Mr. Martinez served in several leadership roles at AAR Corporation, a provider of aviation services to the worldwide commercial aviation and aerospace & defense industries from 2009 until his retirement in 2017, most notably as President & CEO of the Airlift Group and Group Vice President, Aviation Services. Before joining AAR Corporation, Mr. Martinez was the CEO and a director at World Air Holdings, Inc. As a graduate of the United States Air Force Academy, Mr. Martinez served with distinction in the U.S. Air Force for 21 years, retiring as a Colonel and Command Pilot and having held a wide variety of leadership roles, including command and senior staff positions.

Mr. Martinez’s qualifications to serve on our Board include his experience as a chief executive officer at a public company and his particular knowledge of the aviation and defense industries. His diverse industry experience assists us and the Board in helping to understand our customers who are also diverse by industry and geography.

Nancy A. Altobello, a director since 2019, was most recently Global Vice Chair, Talent of Ernst & Young (EY), a professional services firm, where she was responsible for EY’s talent and people strategy worldwide from July 2014 until her retirement in June 2018. Previously, Ms. Altobello held a number of senior positions at EY, including Americas Vice Chair, Talent from 2008 to 2014; Managing Partner, Northeast Region Audit and Advisory Practices from 2003 to 2008; and Managing Partner, North American Audit Practice from 1999 to 2003. Throughout this time, Ms. Altobello also served as an audit partner for a number of leading global organizations. Ms. Altobello is currently a trustee of the Fidelity Charitable board of trustees. She also served on the board of directors of CA, Inc., a global leader in software development, from August 2018 until it was acquired by Broadcom in November 2018. She has served on the board of directors of MarketAxess Holdings, Inc. since April 2019 and currently serves as Chair of its Audit Committee and on its Compensation Committee, and she has served on the board of directors of Cornerstone OnDemand, Inc. since December 2020.

Ms. Altobello’s qualifications include extensive executive leadership experience at a large, complex, global firm; deep understanding of accounting, auditing, financial reporting, and compliance and regulatory matters; and extensive experience with human resources matters and diversity initiatives.

David D. Johnson, a director since 2013, also served as a director of Nuvectra Corporation (a neurostimulation medical device company) from March 2016 to May 2020 and served as Chair of its Audit Committee. He previously served as Executive Vice President, Treasurer and Chief Financial Officer of Molex LLC (a manufacturer of electronic connectors and components) from 2005 to February 2016; Vice President, Treasurer and Chief Financial Officer of Sypris Solutions, Inc., from 1996 to 2005; Regional Controller for Molex’s Far East Region; Financial Director for New Ventures and Acquisitions; and Financial Director for the Far East South Region from 1984 to 1996. From 1978 to 1984, Mr. Johnson worked for the public accounting firm KPMG LLP.

Mr. Johnson’s qualifications to serve on our Board include his chief financial officer experience for a global industrial company. Mr. Johnson has had executive-level responsibility for financial and accounting matters in a number of settings, including international contexts.

Michael V. Schrock, a director since 2014, has been an advisor for Oak Hill Capital Partners (a private equity investment firm) since March 2014. He also served as the President and Chief Operating Officer of Pentair LLC (a global water, fluid, thermal management and equipment protection company) from 2006 through 2013. Prior to that role, Mr. Schrock held several leadership positions at Pentair LLC over his 16-year career, including President of Water Technologies Americas, President of the Pump and Pool Group and President/COO of Pentair Technical Products. Before joining Pentair LLC, Mr. Schrock held numerous senior leadership roles in both the US and Europe at Honeywell International, Inc. Mr. Schrock has served on the board of directors of Plexus Corporation since 2006 and as its lead director since 2013, and has served on the board of directors of Atkore International Group, Inc. since May 2018 and as its Chairman since August 2018.

Mr. Schrock’s experience includes more than 35 years in senior roles at major industrial companies. His deep management and operating experience both domestically and internationally and strong track record leading and integrating strategic acquisitions give our Board valuable insight into global business and acquisition matters.

Chun Hung (Kenneth) Yu, a director since 2013, is retired. Prior to Mr. Yu’s retirement, he was Vice President, Global Channel Services, International Operations for 3M Company (diversified manufacturer of consumer, industrial and health products) from May 2013 to December 2013; President, China Region and 3M China from 2000 to May 2013; and President, 3M Taiwan from 1999 to 2000. He also served in several director and leadership roles within the 3M organization from 1969 to 1999, located in St. Paul, Minnesota and the Asian-Pacific region.

| 5 |

Mr. Yu’s qualifications to serve on our Board include his extensive operations experience in the Asian-Pacific region, a market we have identified as a growth opportunity for our Company’s products and services. Mr. Yu also contributes significant leadership, planning and management skills developed during his long tenure with a successful and growing global manufacturing company.

Linda K. Zukauckas, a director since 2019, has served as the Chief Financial Officer for Nielsen Holdings plc (a global measurement and data analytics company) since February 2020. Prior to joining Nielsen Holdings plc, she was the Executive Vice President and Deputy Chief Financial Officer for American Express from February 2018 to January 2020. She had previously served as EVP/Controller and Chief Accounting Officer of American Express since November 2011. From 2000 to 2011, Ms. Zukauckas held various senior finance roles at Ally Financial, including strategy/M&A, divisional CFO, head of corporate planning, global controller and global auditor. From 1997 to 2000, Ms. Zukauckas held various positions at Deutsche Bank, where she rose to the position of chief auditor for the Global Investment Bank. She began her career with PricewaterhouseCoopers LLP in 1984 and held progressive leadership roles there.

Ms. Zukauckas’s qualifications to serve on our Board include her financial expertise and demonstrated ability to create and lead high performance, diverse global organizations.

Executive Officers

Randy J. Martinez’s biography is set forth under the heading “Directors” above.

Steven B. Harrison has served as Executive Vice President and President, Test & Simulation since February 2017. Prior to joining MTS in 2017, Mr. Harrison served as President (August 2015 to December 2016) and Chief Commercial Officer (August 2012 to August 2015) of AAR Airlift Group, Inc., a NYSE-listed provider of products and services to the worldwide aviation and government and defense markets, as well as President and CEO of National Air Cargo, Inc., an international provider of on demand cargo and passenger services, from September 2010 through July 2012. During a distinguished 22-year career in the United States Air Force, Mr. Harrison commanded at the wing, group, and squadron level, including three deployed commands. He also held senior staff positions at Headquarters US Air Force, the Joint Staff and US Transportation Command. Mr. Harrison is a command pilot with more than 3,400 flight hours in the C-32A, C-5B, C-17A, KC-10A, T-38A, and T-37B. A Rhodes Scholar, he holds Masters Degrees in Engineering Science as well as Politics, Philosophy, and Economics, from Oxford University, England. He also earned a Bachelor of Science in Aeronautical Engineering from the United States Air Force Academy and a Masters of National Security Strategy from the United States Air War College.

David T. Hore has served as Executive Vice President and President, Sensors since July 2016. Mr. Hore joined MTS through the acquisition of PCB Group, Inc. (PCB). Mr. Hore initially led PCB, a manufacturer of piezoelectric quartz sensors, accelerometers, and associated electronics for the measurement of dynamic pressure, force, and vibration, as its Co-President and later its President, from 2003 to 2016. Prior to joining PCB, Mr. Hore was Founder and Managing Partner of the CPA firm Tronconi Segarra & Hore LLP, where he served as strategic consultant and outsourced CFO for PCB from 1995-2003. Prior to that, Mr. Hore was a CPA at Price Waterhouse from 1987-1994. Mr. Hore holds a bachelor’s degree in business administration with a concentration in accounting from the State University of New York at Buffalo.

Brian T. Ross has served as Executive Vice President and Chief Financial Officer since May 2017. Prior to joining MTS as Corporate Controller in 2014, Mr. Ross was the Director of Financial Planning and Analysis at Digi International Inc. (NASDAQ: DGII), where he gained valuable global experience ranging from strategic planning and acquisitions to operational execution and internal control. Earlier in his career, Mr. Ross served as Controller at Restore Medical, following a seven-year tenure at PricewaterhouseCoopers LLP. Mr. Ross holds a BA in Accounting from the University of Northern Iowa and is a licensed CPA (inactive) in Minnesota.

Todd J. Klemmensen has served as Senior Vice President, General Counsel and Secretary since July 2018. Mr. Klemmensen directs MTS’s global legal affairs, including corporate governance, commercial and strategic agreements, U.S. Government contracting, litigation, and intellectual property. Previously, Mr. Klemmensen served within MTS as Acting General Counsel (April 2017 to July 2018), Associate General Counsel (November 2015 to March 2017) and Director of Contracts & Senior Counsel (January 2012 to October 2015). Mr. Klemmensen served in various roles at Alliant Techsystems, Inc., including Sr. Manager – Contracts and providing legal counsel within its Armament Systems Group. Prior to transitioning into industry, Mr. Klemmensen practiced business and corporate law in Minneapolis, MN. He holds a Bachelor of Arts degree from Gustavus Adolphus College and a Juris Doctor degree from Hamline University School of Law. Mr. Klemmensen is a former board member of the National Contract Management Association (NCMA) Twin Cities Chapter and a graduate of the NCMA – Leadership Development Program.

| 6 |

Other Information

Relationships and Arrangements. Executive officers serve at the discretion of and are elected by our Board. There are no family relationships amongst any of the directors or executive officers named. There are no undisclosed arrangements or understandings pursuant to which any person was selected as a director or an officer.

Audit Committee. During fiscal year 2020, the Audit Committee of the Board was composed of Mr. Johnson (Chair), Ms. Altobello, Mr. Martinez, Ms. Steinel and Ms. Zukauckas. Ms. Steinel’s term on the Board expired on February 11, 2020. On May 22, 2020, Mr. Martinez stepped down from the Audit Committee in connection with his appointment as Interim CEO. The Audit Committee held ten meetings during fiscal year 2020. All members of the Audit Committee during fiscal year 2020 satisfied the Nasdaq Stock Market listing standards for Audit Committee membership at the time each member served on the Audit Committee. The Board determined that Ms. Altobello, Mr. Johnson and Ms. Zukauckas are each an “audit committee financial expert” under the Sarbanes-Oxley Act of 2002. The Nominating and Governance Committee of the Board determined that each of Ms. Altobello, Mr. Johnson and Ms. Zukauckas satisfies applicable Nasdaq rules regarding the independence of audit committee members. Among other duties, the Audit Committee:

| ● | selects our independent registered public accounting firm; | |

| ● | reviews and evaluates significant matters relating to our internal controls; | |

| ● | reviews the scope and results of the audits by, and the recommendations of, our independent registered public accounting firm; | |

| ● | is responsible for monitoring risks related to financial assets, accounting, legal and corporate compliance, discusses legal and compliance matters and assesses the adequacy of Company risk-related internal controls; | |

| ● | pre-approves, in accordance with its pre-approval policy, all audit and permissible non-audit services and fees provided by our independent registered public accounting firm; | |

| ● | reviews our audited consolidated financial statements and meets prior to public release of quarterly and annual financial information; and | |

| ● | meets with our management prior to filing our quarterly and annual reports containing financial statements with the SEC. |

The Audit Committee operates under a written charter adopted by the Board. This charter is available to shareholders on our website at www.mts.com (select “Investor Relations” and click on “Corporate Governance”).

Code of Conduct. We adhere to a code of ethics, known as the “MTS Code of Conduct.” It applies to our directors, officers, employees and contractors. The MTS Code of Conduct sets forth guidelines for ensuring that all personnel act in accordance with the highest standards of integrity. The MTS Code of Conduct, as well as any waivers from and amendments to it, are posted on our website at www.mts.com (select “Investor Relations” and click on “Corporate Governance”).

Delinquent Section 16(a) Filings. The rules of the SEC require us to disclose the identity of directors, executive officers and beneficial owners of more than 10% of our common stock who did not file on a timely basis reports required by Section 16(a) of the Exchange Act. Based solely on a review of copies of such reports and written representations from reporting persons, we believe that all directors and executive officers complied with all filing requirements applicable to them during fiscal year 2020, with the exception of a late Form 4 filing in December 2019 covering one transaction for each of Dr. Graves, Mr. Harrison, Mr. Hore, Mr. Klemmensen, Mr. Ross, and Ms. Zukauckas.

| 7 |

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

Overview and Impact of Merger Agreement

As previously disclosed, on December 8, 2020, the Company, Amphenol Corporation, a Delaware corporation (Parent) and Moon Merger Sub Corporation, a Minnesota corporation and a wholly-owned subsidiary of Parent (Sub), entered into an Agreement and Plan of Merger (as may be amended from time to time and including the plan of merger attached as Exhibit A thereto, the merger agreement). On the terms and subject to the conditions of the merger agreement, Sub will be merged with and into the Company (the merger), with the Company surviving the merger as a wholly-owned subsidiary of Parent. Following the completion of the merger, the Company will cease to be a publicly traded company. The merger agreement provides that, as of immediately prior to the effective time and contingent upon the merger:

| ● | each outstanding option to purchase shares granted under a stock plan of the Company (other than any option granted under the Company’s 2012 Employee Stock Purchase Plan) will be fully vested and cancelled in exchange for an amount in cash equal to the product of (i) the total number of shares of Company common stock subject to such cancelled Company option multiplied by (ii) the excess, if any, of (a) the merger consideration over (b) the exercise price per share of the Company common stock subject to such cancelled Company option, without interest and less any required tax withholdings; | |

| ● | any Company option with an exercise price per share equal to or greater than the merger consideration will be cancelled in exchange for no consideration; and | |

| ● | each outstanding restricted stock unit award (including each restricted stock unit award that is subject to a deferral election) granted under a stock plan of the Company will be fully vested, with each restricted stock unit award that is subject to performance-based vesting conditions deemed to be vested at the greater of (i) actual performance determined as of immediately prior to the effective time of the merger and (ii) target level, and will be cancelled in exchange for an amount in cash equal to the product obtained by multiplying (a) the aggregate number of vested restricted stock units subject to such award by (b) the merger consideration, without interest and less any required tax withholdings |

Because this Compensation Discussion and Analysis (CD&A) explains the compensation programs for our Named Executive Officers (NEOs) and the role of the Compensation and Leadership Development Committee (for purposes of this CD&A, the Committee) in setting executive pay for fiscal year 2020, it does not address the compensation that may be paid or become payable to the Company’s NEOs and that is based on, or otherwise relates to, the merger of Sub with and into the Company, as contemplated by the merger agreement (the merger). Additionally, this CD&A does not address any potential changes to our compensation programs or other plans that may occur upon consummation of the merger. This CD&A should be read together with the compensation tables and related disclosures that follow this CD&A.

Our fiscal year 2020 NEOs are:

| ● | Randy J. Martinez, President and Chief Executive Officer; | |

| ● | Jeffrey A. Graves, Former President and Chief Executive Officer; | |

| ● | Brian T. Ross, Executive Vice President and Chief Financial Officer; | |

| ● | Steven B. Harrison, Executive Vice President and President, Test & Simulation; | |

| ● | David T. Hore, Executive Vice President and President, Sensors; and | |

| ● | Todd J. Klemmensen, Senior Vice President, General Counsel and Corporate Secretary. |

Dr. Graves resigned from the Company effective May 22, 2020. Mr. Martinez was appointed as Interim President and Chief Executive Officer effective May 23, 2020 and was appointed President and Chief Executive Officer effective December 17, 2020.

This CD&A is organized into the following sections:

| CD&A Section | Summary | Page | ||

| Executive Summary | Highlights our philosophy, governance practices, and the fiscal year 2020 executive compensation program | 8 | ||

| Say-on-Pay Results | Recaps previous results and existing processes | 11 | ||

| Our Compensation Process | Details how the Committee governs the executive pay program | 11 | ||

| Components of Pay | Provides the key components of fiscal year 2020 executive pay | 12 | ||

Changes Subsequent to Year-End |

Discusses certain compensation changes put in place after the end of fiscal year 2020 |

17 | ||

| Other Compensation and Policies | Discusses other aspects of our executive pay | 17 |

Executive Summary

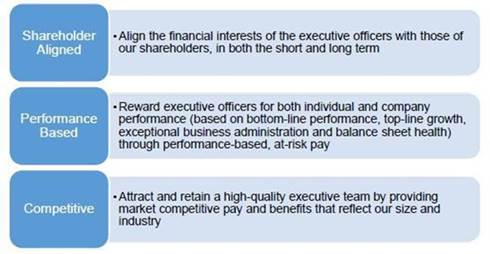

We consider our executive pay program to be instrumental in helping us achieve our business objectives and effective in rewarding our overall financial and operational performance.

Our overarching philosophy is that we should structure executive pay to be consistent with market competitive practices and to align the long-term interests of our executive officers, shareholders, and customers so that pay appropriately reflects the executive officers’ performance. We believe that a significant portion of an executive officer’s pay should be at risk in the form of performance-based incentive awards.

| 8 |

The Committee leverages the following commonly viewed best practices in designing, administering and governing our executive compensation programs:

| We Do | We Don’t | |||

| ● | Target executive pay around the market median, while also considering retention, tenure, experience, and other factors | ● | Provide single trigger change-in-control cash severance payments | |

| ● | Emphasize the majority of our program in variable pay | ● | Allow stock option repricing or discounted stock option granting | |

| ● | Require executive officers to hold MTS stock through stock ownership guidelines | ● | Offer tax gross-ups related to 280G parachute payments upon change-in-control | |

| ● | Mitigate risk associated with compensation by using multiple performance metrics, caps on potential incentive payments, and a clawback policy |

● | Pay accumulated dividends on unearned equity-based compensation until and unless shares are earned | |

| ● | Allow our executive officers or directors to hedge or pledge MTS stock |

| 9 |

The primary components of our fiscal year 2020 executive compensation program were base salary, short-term incentives, and long-term incentives, as summarized in the following table, along with the Committee’s decisions for fiscal year 2020:

| Element | Key Features | Decisions for Fiscal Year 2020 | ||||

Base Salary

Purpose: Attract and retain executive officers, reward talent development |

● | Fixed pay that changes only as a result of the Committee’s annual process for assessing market and executive talent | ● | Our former CEO received a 4.75% increase in base salary, Mr. Ross received a 12.5% increase in base salary, and Mr. Klemmensen received a 10.9% increase in base salary. Mr. Harrison and Mr. Hore did not receive a base salary increase.

| ||

| ● | Effective April 12, 2020 through October 10, 2020, all NEO base salaries were temporarily reduced by at least 10% as a part of our response to the COVID-19 pandemic.

| |||||

| ● | Mr. Martinez’s base salary as Interim CEO was set at $720,000. | |||||

Short-Term Incentives

Purpose: Provide formulaic incentives to achieve or exceed annual operating objectives; encourage a balanced approach to profitability, growth, and strengthening of balance sheet |

● | Executive Variable Compensation Plan (EVC Plan) | ● | Three performance metrics were utilized for fiscal year 2020: Adjusted EBITDA, Adjusted Revenue, and Leverage Ratio or Working Capital Rate to Revenue (depending on the individual executive officer) (1)

| ||

| ● | Incentive payouts range from threshold to maximum levels, depending on level of performance | ● | Fiscal year 2020 target incentives were increased for all NEOs, other than our former CEO, based on a review of market competitive pay, and ranged from 50%-65% of base salary.

| |||

| ● | Performance below the threshold level will result in zero payout | ● | As Interim CEO, Mr. Martinez did not participate in the EVC Plan. | |||

Long-Term Incentives (LTI)

Purpose: Create alignment to shareholders via a longer-term shareholder return perspective; retain top talent |

● | Stock options with three-year graded vesting and a seven-year term | ● | There were no changes to the LTI design for fiscal year 2020 | ||

| ● | Time-based restricted stock units with three-year graded vesting | ● | The total LTI grant values for our then-serving NEOs were increased based on a review of market competitive pay.

| |||

| ● | Performance-based restricted stock units that vest based on average Adjusted ROIC for LTIs measured over a three-year period | ● | Upon appointment as Interim CEO, Mr. Martinez was initially granted time-based restricted stock units with a value of $450,000, effective June 15, 2020, and, from September 15, 2020 through December 15, 2020, he received additional monthly grants of time-based restricted stock units with a value of $150,000 per monthly grant. | |||

| (1) | Adjusted EBITDA, Adjusted Revenue, and Leverage Ratio are each a non-GAAP financial measure. For more information on how these non-GAAP financial measures are derived from our audited financial statements, see page 18 of this Amendment. |

| 10 |

The following chart shows the relative weighting of target pay (for Mr. Martinez, as Interim CEO, and for Mr. Ross, Mr. Harrison, Mr. Hore and Mr. Klemmensen, collectively, as the other continuing NEOs) across these three components for fiscal year 2020:

Say-on-Pay Results

At our annual shareholder meeting in February 2020, our shareholders continued to show strong support of our executive pay program, with 98.4 percent of the votes cast approving the say-on-pay resolution.

The Committee believes this result affirms our shareholders’ continuing support of the Committee’s approach to executive pay and the Committee did not make any changes to the Company’s executive compensation program in response to the 2020 say-on-pay vote. We continue to solicit and accept shareholder feedback regarding our compensation programs, and we take this input into consideration along with market trends and our business environment, both internal and external.

Our Compensation Process

Independent Compensation Consultant

Under the Committee’s charter, the Committee has the authority to select, retain and compensate executive compensation consultants and other advisors as it deems necessary to carry out its responsibilities. For fiscal year 2020, the Committee engaged Willis Towers Watson to provide information regarding compensation of our executive officers. Specifically, Willis Towers Watson was asked by the Committee to:

| ● | Review and provide information on our compensation peers; | |

| ● | Provide market competitive data on executive compensation for base salary, short-term incentives, and long-term incentives; and | |

| ● | Provide market competitive data on incentive design structures and performance measures. |

Determining Competitive Compensation

The Committee works with Willis Towers Watson to analyze competitive market data to determine appropriate base salary levels, short-term incentive target pay, and long-term incentive grant values for all our executive officers. When making comparisons to the market data, the Committee generally seeks to establish compensation levels that approximate the market median.

With respect to our former CEO’s pay, the Committee conducted an annual performance assessment of our former CEO and determined appropriate adjustments to all elements of his pay based on his individual performance and the Company’s performance. The Committee then recommended his pay to the Board for approval. The former CEO did not participate in these Committee or Board deliberations and did not vote on matters concerning his pay. For our Interim CEO, the Committee and the Board set his base salary to be comparable with the amount payable to our former CEO, while taking into account the interim nature of his appointment in the other aspects of his compensation.

| 11 |

For other executive officers, the CEO makes recommendations to the Committee for all elements of pay based on individual and Company performance and market data. The Committee reviews, discusses, modifies, and approves the recommendations, as appropriate.

Market Data Sources and Analysis

The Committee annually assesses “competitive market” compensation for each element of executive compensation using a number of sources. A primary source is our peer group and the related data provided by Willis Towers Watson. In determining our peer group, we recognize that many of our direct competitors are either privately-owned companies, or divisions of much larger, more diversified, public companies. However, by considering relevant industries (e.g., industrial, manufacturing, engineering and electrical components) and size parameters (e.g., revenue, earnings and market capitalization), we developed the following list of peer companies, which was the same peer group as used to evaluate fiscal 2019 compensation decisions:

| Badger Meter Inc. | KEMET Corporation |

| Brooks Automation Inc. | Kimball Electronics, Inc. |

| Cognex Corporation | Littelfuse, Inc. |

| Coherent Inc. | Methode Electronics, Inc. |

| CTS Corporation | MKS Instruments, Inc. |

| Daktronics Inc. | National Instruments Corporation |

| ESCO Technologies Inc. | Novanta Inc. |

| Fabrinet | OSI Systems, Inc. |

| FARO Technologies Inc. | RBC Bearings Inc. |

| HEICO Corporation | Rogers Corporation |

| John Bean Technologies Corporation | Standex International Corporation |

In addition to the data from these peer companies, market competitive data was obtained from the 2019 Willis Towers Watson General Industry Executive Compensation Survey.

The Committee does not have a set policy or formula for weighting the elements of compensation (i.e., base salary, short-term incentives, and long-term incentives) for each executive officer. Instead, the Committee considers market factors relevant to each executive officer and their tenure, role within the Company and contributions to the Company’s performance. In general, as executive officers assume greater responsibility, a larger portion of their total cash compensation is payable as short-term cash incentive, which is variable based on performance, as opposed to base salary, and a larger portion of their total direct compensation comes in the form of long-term equity incentives.

Components of Pay

Fiscal Year 2020 Base Salaries

The Committee reviews executive officer base salaries annually and may choose to make adjustments. The following table outlines fiscal year 2020 base salary increases for our NEOs as approved by the Committee:

| Named Executive Officer | Fiscal Year 2020 Base Salary (1) | Fiscal Year 2019 Base Salary | Increase Percentage | |||||||||

| Randy J. Martinez | $ | 720,000 | N/A | - | (2) | |||||||

| Jeffrey A. Graves | $ | 750,000 | $ | 716,000 | 4.75 | % | ||||||

| Brian T. Ross | $ | 450,000 | $ | 400,000 | 12.5 | %(3) | ||||||

| Steven B. Harrison | $ | 480,000 | $ | 480,000 | - | |||||||

| David T. Hore | $ | 500,000 | $ | 500,000 | - | |||||||

| Todd J. Klemmensen | $ | 355,000 | N/A | - | (4) | |||||||

| 12 |

| (1) | Effective April 12, 2020, each of the Company’s NEOs took a temporary reduction in their base salaries of at least 10%. On October 5, 2020, the Board approved base salaries of the Company’s NEOs at the levels previously in effect, to be effective on October 10, 2020. The amounts reported in this column do not reflect the temporary reductions in base salaries. | |

| (2) | Mr. Martinez was appointed Interim President and Chief Executive Officer effective May 23, 2020 and was appointed President and Chief Executive Officer effective December 17, 2020. His initial base salary level was determined based on the competitive market and consideration the compensation paid to our former CEO. In connection with his appointment as President and Chief Executive Officer, we entered into a new offer letter with Mr. Martinez, which provides for his base salary to remain at $720,000. | |

| (3) | Mr. Ross’s increase takes into account alignment with market data for his position and internal parity with other Company NEOs. | |

| (4) | Mr. Klemmensen was not a NEO for fiscal year 2019. His fiscal year 2020 base salary represents a 10.9% increase from his base salary prior to becoming a NEO and takes into account alignment with market data for his position and internal parity with other Company NEOs. |

Fiscal Year 2020 Short-Term Incentives

Under the EVC Plan, all the NEOs, other than Mr. Martinez, employed by the Company at the end of fiscal year 2020 were eligible for cash payments as determined based upon our financial performance as compared to set performance standards. As Interim CEO, Mr. Martinez did not participate in the EVC Plan. As a part of our response to the COVID-19 pandemic for fiscal year 2020, the Committee cancelled all opportunities for a payout under the EVC Plan.

The following table shows the fiscal year 2020 target incentive opportunity for the EVC Plan:

| Named Executive Officer | 2020 EVC Plan Target Incentive (% of Base Salary) | |||

| Randy J. Martinez (1) | N/A | |||

| Jeffrey A. Graves (2) | 100 | % | ||

| Brian T. Ross | 65 | % | ||

| Steven B. Harrison | 60 | % | ||

| David T. Hore | 60 | % | ||

| Todd J. Klemmensen | 50 | % | ||

| (1) | As Interim CEO, Mr. Martinez did not participate in the EVC Plan. | |

| (2) | Dr. Graves resigned from the Company effective May 22, 2020 and ceased to be a participant in the EVC Plan as of such date. |

The following diagram shows the fiscal year 2020 EVC Plan Metrics and Weightings for our NEOs:

2020 EVC Plan Metrics and Weightings for NEOs

For Dr. Graves, Mr. Ross and Mr. Klemmensen, the Adjusted EBITDA, Adjusted Revenue, and Leverage Ratio performance metrics were based on total Company performance. For Mr. Harrison and Mr. Hore, the Adjusted EBITDA, Adjusted Revenue, and Working Capital Rate to Revenue (WCRR) performance metrics were based upon achievement of financial targets for their respective business segments, with slightly different weightings for Mr. Hore as described below. The Committee established these Adjusted EBITDA, Adjusted Revenue and WCRR metrics based on segment (rather than total Company) performance for these executive officers to reflect their accountability for the performance of that segment. The Committee believes that the leader of the segment has a meaningful opportunity to directly impact the achievement of the performance goals through his individual performance as the leader of that segment.

| 13 |

The Committee established minimum, target and maximum levels of achievement for each of the performance metrics, as shown in the following table:

| Corporate Goal (1) | Weight (2) | Threshold | Target | Maximum | Result | Percent of Target Performance Achieved | ||||||||||||||||||

| Adjusted EBITDA (000s) (3) | 50 | % | $ | 113,925 | $ | 142,406 | $ | 170,887 | $ | 111,401 | 78 | % | ||||||||||||

| Adjusted Revenue (000s) (3) | 30 | % | $ | 792,912 | $ | 932,838 | $ | 1,072,764 | $ | 781,000 | 84 | % | ||||||||||||

| Leverage Ratio (3) | 20 | % | 4.1 | 3.5 | 3.0 | 4.9 | 71 | % | ||||||||||||||||

| Payout as % of Target Incentive | — | 50 | % | 100 | % | 200 | % | — | 0 | % | ||||||||||||||

| (1) | Specific Adjusted EBITDA, Adjusted Revenue and WCRR performance metrics for the Test & Simulation and Sensors segments and the corresponding minimum, target and maximum amounts are not disclosed due to the potential competitive harm of such disclosure. For fiscal year 2020, the Committee followed the same pattern in setting segment-specific performance levels as for setting the corporate performance levels: for Adjusted EBITDA, minimum is equal to 80% of the expected results under the applicable segment’s annual plan, target is equal to expected results, and maximum is equal to 115% of expected results; for Adjusted Revenue, minimum is equal to 85% of the expected results under the applicable segment’s annual plan, target is equal to expected results, and maximum is equal to 120% of expected results; and for WCRR, minimum is equal to 90% of the expected results under the applicable segment’s annual plan, target is equal to expected results, and maximum is equal to 110% of expected results. Other than as noted below for Adjusted EBITDA in the Sensors segment, no performance metrics were achieved at threshold level for fiscal year 2020. | |

| (2) | For Mr. Hore, the Adjusted EBITDA performance metric was weighted at 30% and the Adjusted Revenue performance metric was weighted at 50%. | |

| (3) | Adjusted EBITDA, Adjusted Revenue, Leverage Ratio and WCRR are each a non-GAAP financial measure. For more information on how these non-GAAP financial measures are derived from our audited financial statements, see page 18 of this Amendment. |

In addition to the performance metrics set forth above, the Committee believes that Earnings Per Share (EPS) provides a strong link between the EVC Plan and shareholder value, and therefore, if the target level of EPS is not met, participants are limited to target payouts under the EVC Plan regardless of the results of other performance goals. This year’s EPS target level was $2.23, and the achieved level was $2.03. As a result, any payouts under the EVC Plan in excess of target level based on achievement of performance metrics would have been limited to target level. As target level was not achieved for any performance metrics this year, this EPS limit had no impact.

As noted above, the Committee cancelled all opportunities for a payout under the EVC Plan for fiscal year 2020, so no payouts were made. Even if the EVC Plan had not been cancelled, no NEOs other than Mr. Hore would have received a payout for fiscal year 2020. Mr. Hore would have received a payout of $34,736 based on achievement of 69% of the target incentive for the Adjusted EBITDA performance metric in the Sensors segment.

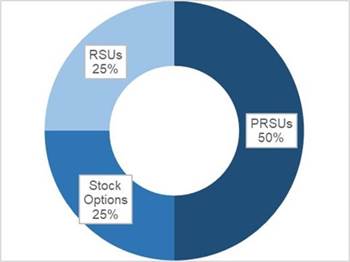

Fiscal Year 2020 Long-Term Incentives

The LTIs granted to each NEO in fiscal year 2020 consisted of stock options, time-based restricted stock units (RSUs), and performance-based restricted stock units (PRSUs), according to the following mix:

2020 LTI Type Mix

(% of total grant dollar value)

| 14 |

| LTI Type | Key Features | |||

| Stock Options | ● | Non-qualified stock options | ||

| ● | Vest one-third per year commencing on the first anniversary of the date of grant | |||

| ● | Seven-year term | |||

| RSUs | ● | Restricted stock units | ||

| ● | Vest one-third per year commencing on the first anniversary of the date of grant(1) | |||

| PRSUs | ● | Performance-based restricted stock units | ||

| ● | Adjusted ROIC for LTIs over a three-year performance period is the performance measure, emphasizing profitability with a longer-term view, with the goal designed to be challenging but achievable with strong Company performance | |||

| ● | The performance range has threshold, target and maximum performance expectations for each three-year cycle | |||

| ● | Payouts are 50%, 100%, and 200% at threshold, target, and maximum performance, respectively |

| (1) | Mr. Martinez received time-based RSUs in June 2020 and September 2020 in connection with his appointment as Interim CEO, which RSUs were scheduled to vest on the earlier of May 23, 2021 (the first anniversary of his appointment as Interim CEO) or upon appointment of a full-time, permanent President and CEO. These RSUs vested on December 17, 2020 in connection with Mr. Martinez’s appointment as our Chief Executive Officer. |

The fiscal year 2020 LTIs are summarized for each NEO in the following table (except as noted below, all LTIs were granted in December 2019):

| Named Executive Officer | Number of Stock Options | Number of RSUs | Number

of | Aggregate Value Awards | ||||||||||||

| Randy J. Martinez (1) | - | 24,168 | - | $ | 450,000 | |||||||||||

| Randy J. Martinez (1) | - | 6,897 | - | $ | 150,000 | |||||||||||

| Jeffrey A. Graves | 48,418 | 11,505 | 23,010 | $ | 2,142,000 | |||||||||||

| Brian T. Ross | 13,562 | 3,223 | 6,445 | $ | 600,000 | |||||||||||

| Steven B. Harrison | 11,302 | 2,686 | 5,371 | $ | 500,000 | |||||||||||

| Steven B. Harrison (2) | 4,521 | 1,986 | 3,973 | $ | 200,000 | |||||||||||

| David T. Hore | 11,302 | 2,686 | 5,371 | $ | 500,000 | |||||||||||

| Todd J. Klemmensen | 8,024 | 1,907 | 3,814 | $ | 355,000 | |||||||||||

| 15 |

| (1) | Amounts for Mr. Martinez do not include any compensation paid to him for his service as a director prior to his appointment as Interim CEO. In connection with his appointment as Interim CEO, Mr. Martinez received an initial time-based RSU grant with a value of $450,000 in June 2020 and monthly time-based RSU grants with a monthly value of $150,000 beginning in September 2020 and ending in December 2020. | |

| (2) | Reflects awards granted in March 2020. |

In determining the number of stock options to grant, 25% of the aggregate value of the award is divided by the average of the Black Scholes values over the 90 days prior to the end of the fiscal year. We believe that this methodology, versus determining the number of stock options to grant based on the closing price of the Company’s common stock on the date of grant, better represents the value of the Company’s equity over a period of time prior to the date of the award and signals that pay realized from stock option grants will be more sensitive to future stock price appreciation and less sensitive to past stock price volatility. In determining the number of RSUs and PRSUs to grant, 25% and 50%, respectively, of the aggregate value of the award is divided by the closing price of the Company’s common stock on the date of grant.

The table below sets forth the threshold, target and maximum levels for the three-year average Adjusted ROIC for LTIs performance goal for the performance period of fiscal year 2018 through fiscal year 2020 as well as the actual achievement of that performance goal and the percentage of the target level of that achievement.

| Performance Goal | Threshold | Target | Maximum | Result | Percent of Target Performance Achieved | Percent of Target Payout Achieved | ||||||||||||||||||

| Adjusted ROIC for LTIs* | 7.0 | % | 8.8 | % | 10.6 | % | 8.0 | % | 91 | % | 77 | % | ||||||||||||

| * | Represents a non-GAAP financial measure. For more information on how this non-GAAP financial measure is derived from our audited financial statements, see page 18 of this Amendment. |

The payout for the PRSUs granted on April 17, 2018 was calculated as follows based upon fiscal years 2018 through 2020 performance.

| Target PRSUs | Actual PRSUs | |||||||||||||||||||

| Named Executive Officer | Performance Period | Vesting and Payout Date | Number of Shares Awarded (#) | Grant Date Fair Value (1) ($) | Number of Shares Acquired (2) (#) | Value Realized at Vest (3) ($) | ||||||||||||||

| Jeffrey A. Graves (4) | Fiscal Years 2018-2020 | 12/15/2020 | 16,616 | $ | 869,017 | - | - | |||||||||||||

| Brian T. Ross | Fiscal Years 2018-2020 | 12/15/2020 | 2,390 | $ | 124,997 | 1,837 | $ | 107,262 | ||||||||||||

| Steven B. Harrison | Fiscal Years 2018-2020 | 12/15/2020 | 2,151 | $ | 112,497 | 1,653 | $ | 96,519 | ||||||||||||

| David T. Hore | Fiscal Years 2018-2020 | 12/15/2020 | 2,151 | $ | 112,497 | 1,653 | $ | 96,519 | ||||||||||||

| (1) | Target PRSU value represents number of shares granted multiplied by the share price of $52.30 on the date of the grant (April 17, 2018). | |

| (2) | The number of shares acquired includes the number of shares of stock withheld by the Company to cover tax obligations. The number of shares delivered to each NEO following such withholding was: Mr. Ross 1,274; Mr. Harrison 1,147; and Mr. Hore 1,091. Mr. Klemmensen did not participate in the 2018-2020 PRSU program. | |

| (3) | The value realized on the vesting of the PRSUs is the fair market value of our common stock at the time of vesting (December 15, 2020). | |

| (4) | Dr. Graves resigned from the Company effective May 22, 2020 and, as a result, forfeited all unvested PRSUs as of such date. |

| 16 |

Changes Subsequent to Year-End

Chief Executive Officer Offer Letter

On December 13, 2020, in connection with Mr. Martinez’s appointment as President and Chief Executive Officer, the Committee approved a one-time equity award to Mr. Martinez equal in value to approximately $2,000,000 on the date of grant, which was granted as 50% RSUs and 50% PRSUs. Mr. Martinez’s base salary will remain at $720,000. On December 17, 2020, in connection with his appointment as President and Chief Executive Officer, we entered into an offer letter with Mr. Martinez, as previously approved by the Committee, reflecting such terms. As noted above in connection with Mr. Martinez’s appointment as our Chief Executive Officer, Mr. Martinez vested in the 2020 RSU grants that he received as an employee, which RSUs were scheduled to vest on the earlier of May 23, 2021 (the first anniversary of his appointment as Interim CEO) or upon appointment of a full-time permanent President and CEO.

Retention Agreements

On December 18, 2020, each of the then-serving NEOs entered into a retention agreement with us regarding a grant under a retention bonus pool relating to the contemplated merger that was previously approved by the Committee with allocations of awards under such bonus pool in the following amounts: Mr. Martinez, $1,440,000; Mr. Ross, $500,000; Mr. Harrison, $500,000; Mr. Hore, $500,000; and Mr. Klemmensen, $375,000. Each retention bonus is subject to the terms and conditions of the retention agreement, including: (i) 50% of the retention bonus was paid in December 2020, but is subject to a clawback obligation in the event the executive resigns without “good reason” or is terminated for “cause”, but no clawback will be required if the merger does not occur, and (ii) 50% of the retention bonus will be payable on or around the first anniversary of the closing of the merger, subject to the executive’s continued employment through such anniversary or, in the case of Mr. Martinez, an earlier qualifying termination (including resignation for “good reason” or termination “without cause”) on or after the closing of the merger. Mr. Martinez’s retention agreement also includes a requirement for the execution and non-revocation of a release of claims in favor of the Company on certain terminations of employment.

Other Compensation and Policies

Benefits and Perquisites

Our executive officers are provided retirement and health benefits that are generally available to our other salaried employees, including:

| ● | Retirement savings plan with a Company match (not available to Mr. Martinez or Mr. Hore); | |

| ● | Disability and life insurance (not available to Mr. Martinez); and | |

| ● | Medical, vision and dental insurance (not available to Mr. Hore). |

Our executive officers, other than Mr. Martinez and Mr. Hore, are eligible to participate in our Executive Deferred Compensation Plan, which allows us to provide non-qualified retirement benefits that are identical to the tax-qualified benefits but on income above the allowable level under the Internal Revenue Code for qualified plans.

We provide limited executive perquisites, based upon competitive market data and, in the case of physical examinations, to promote vitality and succession in the executive team, including:

| ● | A car allowance, except for Mr. Hore, who has use of a Company-owned vehicle, and Mr. Martinez; | |

| ● | A club membership for Mr. Hore; and | |

| ● | Reimbursement for an executive physical examination for amounts not covered by insurance, up to $3,000 (not available to Mr. Martinez or Mr. Hore). |

Additionally, starting upon his appointment as Interim CEO, we cover the housing and transportation expenses for Mr. Martinez because his home is not in Minnesota where his office is located. We expect this arrangement to continue during Mr. Martinez’s service as President and Chief Executive Officer.

Executive Compensation Clawback Policy

The EVC Plan, the 2011 Stock Incentive Plan (the 2011 Plan) and the 2017 Stock Incentive Plan (the 2017 Plan) include clawback provisions. The provisions require an executive officer to forfeit and allow us to recoup from the executive officer any payments or benefits received by the executive officer under the EVC Plan, the 2011 Plan or the 2017 Plan under certain circumstances, such as certain restatements of our financial statements, termination of employment for cause, violation of the MTS Code of Conduct and breach of an agreement between us and the executive officer.

Stock Ownership Guidelines

To align our executive officers’ and directors’ interests with our shareholders’ interests, the Committee expects our executive officers and directors to acquire significant equity ownership in the Company. Accordingly, we have adopted stock ownership guidelines requiring each executive officer and independent director to achieve an equity ownership level equal to a specified multiple of his or her base salary or annual cash retainer, respectively, within five years of being appointed as an executive officer, within five years of a change in executive officer status resulting in an increased required level of ownership, or within five years of being elected as a director, as applicable.

The current minimum equity ownership levels as a multiple of base pay or annual cash retainer, as applicable, are as follows:

| ● | Five times for the Chief Executive Officer and all independent directors; | |

| ● | Four times for the Chief Financial Officer; and | |

| ● | A multiple equal to their executive salary grade level for any other President, Executive Vice President, and Senior Vice President (ranging from one time to four times) and one-half time for a senior level executive. |

| 17 |

The policy requires that our executive officers and independent directors hold equity acquired through our equity compensation plans in a minimum amount of 75% of the net shares acquired (net of taxes) until ownership levels are met. The policy also provides that failure by a participant to meet the required ownership level within the time period established will result in a requirement that such participant retain 100% of the net shares acquired (net of taxes) through our equity compensation programs until ownership levels are met.

The Committee reviews the progress of our executive officers and independent directors toward the ownership guidelines on a regular basis. Mr. Graves and Mr. Hore met the ownership guideline requirement. All of our continuing NEOs are within the initial five-year compliance period for meeting the ownership guidelines and we expect that they will each meet the ownership guidelines within the established timeframes with the exception of Mr. Ross. Mr. Ross’s ability to reach the ownership guideline was hindered by a combination of base salary times the guideline multiple in relation to the annual equity grant size and the timing and value of equity settlements. All our independent directors have either met the ownership guidelines or are within the initial five-year compliance period for meeting the ownership guidelines. For those within the initial five-year compliance period, we expect that they will each meet the ownership guidelines within the established timeframes.

Non-GAAP Financial Measures and Performance Metrics

Below is information on how we calculate target levels and actual results for certain metrics discussed above:

| ● | Adjusted Revenue: Adjusted Revenue is a non-GAAP financial measure and is calculated by excluding the impact of business acquisitions completed during fiscal year 2020 from GAAP revenue. For Messrs. Harrison and Hore, Adjusted Revenue is calculated using financial information for their respective business segments according to the definition described above. | |

| ● | Adjusted EBITDA: Adjusted EBITDA is a non-GAAP financial measure. We calculate EBITDA by adding back interest, taxes, depreciation and amortization expense to GAAP net income. Adjusted EBITDA is calculated by adding back stock-based compensation, impairment of assets, acquisition-related expenses, acquisition inventory fair value adjustment, the contingent consideration fair value adjustment, and restructuring / other expenses to EBITDA. In addition, we exclude the EBITDA from business acquisitions completed during fiscal year 2020. For Messrs. Harrison and Hore, Adjusted EBITDA is calculated using financial information for their respective business segments according to the definition described above. | |

| ● | Adjusted ROIC for LTIs: Adjusted ROIC for LTIs is a non-GAAP financial measure and is calculated by dividing Adjusted Performance Net Income (as defined below) by Average Adjusted Invested Capital (as defined below) over a three-year time period. Adjusted Performance Net Income is a non-GAAP financial measure and is calculated by excluding the following from net income: after-tax interest expense and the estimated impact to net income from business acquisitions completed during fiscal year 2020 and fiscal year 2019. Average Adjusted Invested Capital is a non-GAAP financial measure and is defined as the aggregate of average interest-bearing debt, excluding interest-bearing debt incurred as a result of business acquisitions completed during fiscal year 2020 and fiscal year 2019, and average shareholders’ equity, excluding equity incurred as a result of the business acquisitions completed during fiscal year 2020 and fiscal year 2019, and is calculated as the sum of current and prior year ending amounts divided by two. | |

| ● | Leverage Ratio: Leverage Ratio is a non-GAAP financial measure and is calculated as the ratio of our Adjusted Total Interest-Bearing debt for Leverage Ratio (as defined below) to our Adjusted EBITDA. | |

| ● | Adjusted Total Interest-Bearing Debt for Leverage Ratio: Adjusted Total Interest-Bearing Debt for Leverage Ratio is a non-GAAP financial measure. We calculate Adjusted Total Interest-Bearing Debt for Leverage Ratio by excluding interest-bearing debt incurred as a result of business acquisitions completed during fiscal year 2020. | |

| ● | Working Capital Rate to Revenue (WCRR): WCRR is a non-GAAP financial measure and is calculated by dividing the Average Working Capital (as defined below) by revenue. We calculate working capital at the end of each quarter by adding together net inventory, accounts receivable and net unbilled accounts receivable; and then subtracting accounts payable and advance payments from customers using GAAP results. Average Working Capital is calculated by adding the total working capital from each quarter and then dividing this sum by four. WCRR and Average Working Capital both exclude the impact of business acquisitions completed during fiscal year 2020. For Messrs. Harrison and Hore, WCCR is calculated using financial information for their respective business segments according to the definition described above. |

| 18 |

Compensation and Leadership Development Committee Report

The Compensation and Leadership Development Committee has discussed and reviewed the Compensation Discussion and Analysis set forth above with management. Based upon this review and discussion, the Compensation and Leadership Development Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Amendment.

SUBMITTED BY THE COMPENSATION AND LEADERSHIP DEVELOPMENT

COMMITTEE OF THE COMPANY’S BOARD OF DIRECTORS

Michael V. Schrock (Chair)

Nancy Altobello

David D. Johnson

Chun Hung (Kenneth) Yu

Risk Considerations in Our Compensation Programs

In fiscal year 2020, management and the Compensation and Leadership Development Committee continued to focus on responsible pay practices designed to produce positive results for the Company and its shareholders without encouraging excessive or inappropriate risk-taking. The Compensation and Leadership Development Committee’s analysis identified the following components of our compensation programs that it believes effectively reduce risk without reducing incentives:

| ● | Our use of different types of compensation (cash salary, cash incentive compensation and equity) provides an appropriate balance of short-term and long-term incentives with fixed and variable components; | |

| ● | Our compensation plan design and the governance processes work together to minimize exposure to excessive risk, while creating a focus on operational activities that contribute to long-term shareholder value creation; | |

| ● | Our metrics used to determine the amount of a participant’s incentive compensation under our short-term incentive plans focus on a combination of Company-wide and business unit performance using a balance of top and bottom-line growth measures; | |

| ● | Our metric used to determine the amount of a participant’s award under our long-term incentive plan focuses on our ability to create value for investors from our operating activities; | |

| ● | Our incentive compensation plans impose threshold and maximum payout levels on awards to ensure that we are rewarding desired performance and limiting windfalls; | |

| ● | Our commission-based plans are aligned to drive business growth and support achievement of short- and long-term strategic objectives; | |

| ● | Our incentive programs include clawback provisions and allow the use of negative discretion for NEOs; | |

| ● | Our stock ownership guidelines encourage prudent contribution to shareholder value and discourage excessive risk taking; and | |

| ● | Our system of internal controls places a strong focus on avoiding undue financial risk through well-developed design and administrative review processes. |

Based on the Company’s use of these programmatic safeguards and on the Compensation and Leadership Development Committee’s continued review of the Company’s incentive compensation policies and practices for all of the Company’s worldwide locations, the Compensation and Leadership Development Committee concluded in fiscal year 2020 that any risks arising from the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

| 19 |

Conflict of Interest Analysis

Our Compensation and Leadership Development Committee has considered the relationships that its independent compensation consultants have had with the Company, the members of the Compensation and Leadership Development Committee and our executive officers, as well as the policies that the consultants have in place to maintain their independence and objectivity and has determined that the work performed by its compensation consultants has raised no conflicts of interest.

Fiscal Year 2020 Summary Compensation Table

The following table sets forth the cash and non-cash compensation with respect to each NEO during the prior three fiscal years, as applicable.

| Name

and Principal Position |

Year | Salary

(1) ($) |

Bonus

(2) ($) |

Stock ($) |

Option Awards (3) ($) |

Non- Equity Incentive Plan Compensation (4) ($) |

All

Other Compensation (5) ($) |

Total ($) |

||||||||||||||||||||||

Randy J. Martinez (6) President and Chief Executive Officer |

2020

|

199,383 | — | 720,053 | — | — | 84,178 | 1,003,614 | ||||||||||||||||||||||

Jeffrey A. Graves (7) Former President and Chief Executive Officer |

2020 2019 |

541,540 712,006 691,348

|

— — — |

1,606,673 1,396,510 1,303,525

|

535,503 465,501 431,988

|

— 597,544 415,683

|

18,253 21,117 20,892

|

2,701,969 3,192,678 2,863,436

|

||||||||||||||||||||||

Brian T. Ross Executive Vice President and Chief Financial Officer |

2020 2019 |

426,539 391,349 351,415

|

— — — |

449,997 367,464 237,518

|

149,996 122,502 62,133

|

— 180,640 116,124

|

22,012 21,117 20,892

|

1,048,544 1,083,072 788,082

|

||||||||||||||||||||||

Steven B. Harrison Executive Vice President and President, Test & Simulation |

2020 2019 |

465,228 379,430 335,005

|

— — —

|

525,001 887,524 168,772

|

175,002 62,494 55,921

|

— 184,993 25,752

|

22,012 46,117 21,685

|

1,187,243 1,560,558 607,135

|

||||||||||||||||||||||

David T. Hore Executive Vice President and President, Sensors |

2020 2019 |

290,409 500,000 500,000

|

— — 107,100

|

375,013 206,278 268,763

|

125,000 68,754 55,921

|

— 103,514 — |

32,417 34,329 35,813

|

822,839 912,874 967,597

|

||||||||||||||||||||||

Todd J. Klemmensen (8) Senior Vice President, General Counsel and Corporate Secretary |

2020

|

345,541 | — | 266,284 | 88,745

|

— | 22,012 | 722,582 | ||||||||||||||||||||||

| 20 |

| (1) | Reflects the temporary reduction in base salaries that was effective from April 12, 2020 through October 10, 2020. | |

| (2) | Amount for Mr. Hore represents a discretionary cash bonus. | |

| (3) | Amounts represent the aggregate grant date fair value of RSUs and stock options that were granted in each fiscal year as computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718 utilizing the assumptions discussed in Note 10 to our Notes to Consolidated Financial Statements for the fiscal year ended October 3, 2020 included in our Annual Report on Form 10-K for fiscal year 2020. Assuming that maximum performance is achieved for PRSUs, total amounts under “Stock Awards” for fiscal year 2020 would be as follows: Dr. Graves, $2,677,789; Mr. Ross, $749,980; Mr. Harrison, $874,995; Mr. Hore, $625,006; and Mr. Klemmensen, $443,807. | |

| (4) | As a part of our response to the COVID-19 pandemic for fiscal year 2020, the Committee cancelled all opportunities for a payout under the EVC Plan. | |

| (5) | The supplemental table below describes the fiscal year 2020 amounts in the “All Other Compensation” column above. | |

| (6) | Mr. Martinez was appointed Interim President and Chief Executive Officer effective May 23, 2020 and was appointed President and Chief Executive Officer effective December 17, 2020. Cash compensation he received for service as a director prior to his appointment as Interim CEO is reflected in the “All Other Compensation” column of this table. Stock awards granted to Mr. Martinez for service as a director prior to his appointment as Interim CEO is reflected in the “Stock Awards” column of this table. Mr. Martinez was not a NEO for fiscal years 2019 or 2018. | |

| (7) | Dr. Graves resigned from the Company effective May 22, 2020. | |

| (8) | Mr. Klemmensen was not a NEO for fiscal years 2019 or 2018. |

Supplemental Table to the “All Other Compensation” Column for Fiscal Year 2020

| Retirement Plan | Life Insurance Premiums, Executive Physical and Health | |||||||||||||||||||||||||||||||

| Name | Match ($) | Fiscal Year Contribution (1) ($) | Car ($) | Memberships ($) | Saving Account Contributions ($) | Living Expenses (2) ($) | Director Compensation (3) ($) | Total ($) | ||||||||||||||||||||||||

| Randy J. Martinez | — | — | — | 405 | — | 42,272 | 41,501 | 84,178 | ||||||||||||||||||||||||

| Jeffrey A. Graves | 12,600 | — | 5,360 | — | 293 | — | — | 18,253 | ||||||||||||||||||||||||

| Brian T. Ross | 12,600 | — | 8,710 | — | 702 | — | — | 22,012 | ||||||||||||||||||||||||

| Steven B. Harrison | 12,600 | — | 8,710 | — | 702 | — | — | 22,012 | ||||||||||||||||||||||||

| David T. Hore | — | — | 23,898 | 7,529 | 990 | — | — | 32,417 | ||||||||||||||||||||||||

| Todd J. Klemmensen | 12,600 | — | 8,710 | — | 702 | — | — | 22,012 | ||||||||||||||||||||||||

| 21 |

| (1) | No discretionary Fiscal Year Contribution was made in fiscal year 2020 given overall Company performance. | |

| (2) | Includes expenses for Mr. Martinez related to housing, meals, and transportation starting upon his appointment as Interim CEO because his home is not in Minnesota where his office is located. The amounts reflected are based on the aggregate incremental cost to the Company and represent amounts directly reimbursed to Mr. Martinez or the service provider, as applicable. | |

| (3) | Includes cash compensation paid to Mr. Martinez for his service as a director prior to his appointment as Interim CEO. See “Non-Employee Director Compensation” on page 30 of this Amendment for more information. |

Grants of Plan-Based Awards in Fiscal Year 2020

As reflected in the table below, the NEOs generally received four types of plan-based awards for their service in fiscal year 2020: a cash award under the EVC Plan, payable in the first quarter of fiscal year 2021; stock options granted on December 4, 2019 under the 2017 Plan; RSUs granted on December 4, 2019 under the 2017 Plan; and PRSUs granted on December 4, 2019 under the 2017 Plan. In addition, Mr. Harrison received stock options granted on March 15, 2020 under the 2017 Plan; RSUs granted on March 15, 2020 under the 2017 Plan; and PRSUs granted on March 15, 2020 under the 2017 Plan. Mr. Martinez also received grants of RSUs on June 15 and September 15, 2020, in connection with his service as Interim CEO.

EVC Awards

Under our EVC Plan, the NEOs may receive cash payouts after the completion of each fiscal year if specified performance goals established at the beginning of the fiscal year are attained. For each NEO, a cash incentive amount, expressed as a percentage of base salary, is established for performance at each of the target and maximum levels. The EVC Plan awards for fiscal year 2020 were structured so that the cash incentive paid to each NEO would be 0% to 200% of the payout level established for performance at the target level for each goal.

Information about the potential payout levels established for each NEO and the nature and weighting of the goals selected for fiscal year 2020 can be found under “Compensation Discussion and Analysis.” As a part of our response to the COVID-19 pandemic for fiscal year 2020, the Committee cancelled all opportunities for a payout under the EVC Plan, so no amounts were paid pursuant to the EVC Plan for fiscal year 2020 performance.

Stock Options

Unless an option holder is terminated for cause, vested stock options are exercisable for 90 days after the termination of the option holder’s employment, or 180 days upon death, disability or retirement. If an option holder’s employment is terminated for “Cause,” as such term is defined in our 2011 Plan or 2017 Plan, as applicable, all unexercised options will immediately terminate. The Committee may, at any time after the award is granted, accelerate the vesting of some or all the unvested options as it deems appropriate.

Stock options become fully exercisable upon the occurrence of a “Change in Control,” as such term is defined in our 2011 Plan or 2017 Plan, as applicable, unless the acquiring entity assumes or provides a substitute for the award. The Committee may require options be exercised prior to the Change in Control and may pay cash or other securities to cancel awards in connection with the Change in Control. Please see the “Overview and Impact of Merger Agreement” section in the “Compensation Discussion and Analysis” for further information regarding the impact of the merger on outstanding stock options.

Restricted Stock Units

If a unit holder’s employment is terminated, the unvested units will be forfeited. The Committee may, at any time after the award is granted, accelerate the vesting of some or all the unvested units as it deems appropriate. All unvested RSUs will fully vest upon the occurrence of a “Change in Control,” as such term is defined in our 2017 Plan unless the acquiring entity assumes or provides a substitute for the award. The Committee may pay cash or other securities to cancel awards in connection with the Change in Control. Please see the “Overview and Impact of Merger Agreement” section in the “Compensation Discussion and Analysis” for further information regarding the impact of the merger on outstanding RSUs.

| 22 |

Performance Restricted Stock Units