| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

|

| ||

Dear Fellow Motorola Solutions Shareholder:

At Motorola Solutions, we are driven by our conviction that everyone should not only feel safe but be safe, in their community, school and workplace. In 2023 we launched our new brand narrative, “Solving for safer,” highlighting our sharpened focus on safety and security and commitment to solving for safer communities, safer schools and safer businesses. Envision a schoolteacher during an emergency pressing a button on their phone to automatically notify law enforcement, activate a lockdown, send mass notifications and share live video feeds with first responders. The powerful collaboration of connecting those in need with those who can help is what “Solving for safer” is all about.

Our technology investments bridge our rich history of breakthrough innovations with our expectations for an even more successful future, and reinforce our belief that people and technology are stronger when they work together. For nearly a century, our company has advanced the technologies needed to help pave the way for a safer future, and today, as we continue to see threats around the world increasing in number, scale and complexity, our work is more critical than ever.

2023 was a defining year for Motorola Solutions as we entered into a new and exciting chapter of our growth, reaching new heights and achieving significant milestones. I’m incredibly proud of all that our team accomplished, including:

| • | Continuing to prioritize the safety and welfare of our people and those we serve. |

| • | Investing $858 million in research and development, delivering next-generation technologies and expanding our offerings in high-value areas with our portfolio of intellectual property, which stands at approximately 6,560 granted patents with approximately 775 patents pending. |

| • | Advancing specialized artificial intelligence capabilities that heighten decision-making and help increase the focus, accuracy and speed of emergency response, while working alongside communities, policymakers and public safety organizations to help ensure the responsible use of these technologies. |

| • | Implementing enhanced data collection and reporting tools to further identify opportunities to reduce greenhouse gas emissions and establishing a “Green Team” to promote volunteerism and education to be a more sustainable organization. |

| • | Giving back to communities with employees volunteering nearly 100,000 hours in 2023, an increase of 30% from last year and a company record, in addition to the majority of the Motorola Solutions Foundation’s $10.3 million in strategic grants directly benefiting underserved and underrepresented communities, as well as first responders, students and teachers. |

| • | Growing a more diverse recruitment pipeline through partnerships with diverse organizations and offering initiatives that enable employees to reflect, recognize and reward inclusive behaviors. |

| • | Maintaining our disciplined and strategic approach to capital allocation, with a focus on investing for the long term and delivering superior value to shareholders, including $804 million in share repurchases and $589 million in dividends. |

Underscoring the importance of global safety and security, we continue to see robust demand for our products and services, allowing us to not only meet, but exceed our expectations for success. We achieved record sales, operating cash flow and earnings per share in 2023, and our continued focus on public safety and enterprise security has led to a sizable increase in our total addressable market, which is currently $66 billion.

Our global workforce of approximately 21,000 strong is driven by their passion for being a positive force for change. United in our pursuit to help keep people, property and places safer, and grounded in our people-first culture and commitment to operate responsibly, we’re well-positioned to continue growing and delivering strong returns for our shareholders.

Gregory Q. Brown

Chairman and CEO

|

|

PRINCIPAL EXECUTIVE OFFICES: 500 West Monroe Street Chicago, Illinois 60661 | |||

March 28, 2024

NOTICE OF 2024 VIRTUAL ANNUAL MEETING OF SHAREHOLDERS

Annual Meeting Date: Tuesday, May 14, 2024

Time: 9:30 a.m. Central Time

Virtual Meeting Site: www.virtualshareholdermeeting.com/MSI2024

This year’s virtual annual meeting (the “Annual Meeting”) will be held entirely online via live audio webcast. The Annual Meeting will begin promptly at 9:30 a.m. Central Time. For more information regarding how to attend the Annual Meeting online, please see the section titled “User’s Guide” on page 87 of this Proxy Statement. Shareholders will be able to listen, vote, and submit questions from their home or from any remote location that has internet connectivity. There will be no physical location for shareholders to attend. Shareholders may only attend, vote, and submit questions during the Annual Meeting by logging in at www.virtualshareholdermeeting.com/MSI2024 and entering the 16-digit control number included in their Notice of Internet Availability of Proxy Materials (the “Notice”), voting instruction form, or proxy card.

The purpose of the meeting is to:

| 1. | elect the eight director nominees named in this Proxy Statement for a one-year term; |

| 2. | ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024; |

| 3. | hold a shareholder advisory vote to approve the Company’s executive compensation; |

| 4. | approve an amendment to the Company’s Restated Certificate of Incorporation to provide for the exculpation of certain officers; and |

| 5. | act upon such other matters as may properly come before the Annual Meeting. |

Only Motorola Solutions shareholders of record at the close of business on March 15, 2024 (the “record date”) will be entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. The Notice, which contains instructions regarding how to access this Proxy Statement, the proxy card and the Company’s 2023 Annual Report, is first being mailed to shareholders on or about March 28, 2024. In addition, this Proxy Statement, the proxy card and the Company’s 2023 Annual Report will be available on or about March 28, 2024 at www.ProxyVote.com.

If you are a “street name” shareholder (meaning that your shares are registered in the name of your broker, bank or other nominee), you will receive instructions from such bank, broker or other nominee describing how to vote your shares.

By order of the Board of Directors,

Kristin L. Kruska

Secretary

|

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

|

||||||||

|

|

ONLINE BEFORE THE MEETING

|

|

BY MAIL

|

|||||

| visit www.proxyvote.com

|

If you received a printed copy of the proxy card, mark, sign, date and return the proxy card using the postage-paid envelope provided.

|

|||||||

|

|

BY TELEPHONE

|

|

ONLINE AT THE VIRTUAL ANNUAL MEETING

|

|||||

| Use the toll-free telephone number listed on your proxy card.

|

Attend the virtual Annual Meeting at www.virtualshareholdermeeting.com/MSI2024

|

|||||||

THIS MEETING WILL TAKE PLACE ONLINE ONLY. THERE IS NO PHYSICAL LOCATION. In order to attend the meeting as a shareholder, you will need the 16-digit control number included on your Notice, proxy card or voting instruction form.

| TABLE OF CONTENTS |

PROXY STATEMENT

| PROXY STATEMENT SUMMARY |

This proxy statement (the “Proxy Statement”) is being furnished to holders of common stock, $0.01 par value per share (the “Common Stock”) of Motorola Solutions, Inc. (“we,” “our,” “Motorola Solutions,” “MSI” or the “Company”). Proxies are being solicited on behalf of the Board of Directors of the Company (the “Board”) to be used at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held virtually at www.virtualshareholdermeeting.com/MSI2024 on Tuesday, May 14, 2024 at 9:30 a.m. Central Time, for the purposes set forth in the Notice of 2024 Virtual Annual Meeting of Shareholders. This Proxy Statement is dated March 28, 2024 and is being distributed to shareholders on or about March 28, 2024.

WHAT IS MOTOROLA SOLUTIONS?

Motorola Solutions is solving for safer. Every day our approximately 21,000 employees come to work solving for safer communities, safer schools, safer hospitals, safer businesses, safer everywhere. We are a global leader in public safety and enterprise security, grounded in nearly 100 years of close customer and community collaboration. Headquartered in Chicago, we design and advance technology for more than 100,000 public safety and enterprise customers in over 100 countries. We are driven by our commitment to help make everywhere safer for all.

PERFORMANCE AND ACCOMPLISHMENTS

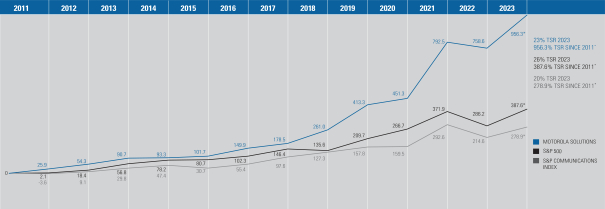

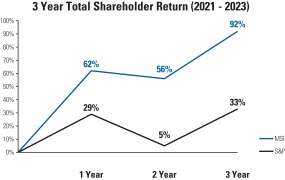

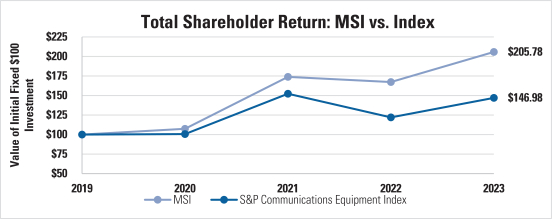

TOTAL SHAREHOLDER RETURN (in percent)

PERFORMANCE HIGHLIGHTS SINCE 2011

|

956% TOTAL SHAREHOLDER RETURN*

|

52% REDUCTION IN SHARE COUNT

|

$20.1 BILLION IN CAPITAL RETURN

|

| * | Based on the split adjusted closing price of MSI common stock on December 31, 2010 and the closing price of MSI common stock on December 31, 2023, illustrating the growth of an initial investment of $100 on December 31, 2010, including payment of dividends. |

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 1 |

| 2023 HIGHLIGHTS

|

||||||

|

• Grew sales 10% to record $10 billion

• Achieved record sales in both segments and all three technologies

• Increased earnings per share by 25%

• Increased quarterly dividend 11% to $0.98 per share

• Generated $2 billion of operating cash flow

|

• Capital allocation of cash included $804 million of share repurchases, $589 million of dividends and $170 million for an acquisition

• Acquired IPVideo, creator of the HALO Smart Sensor

• Announced $2 billion increase to the share repurchase program

• Added approximately 275 new patents bringing our current patent portfolio to approximately 6,560 patents

|

• Employees volunteered a record of nearly 100,000 hours during the year

• Launched “GO ALL INclusive,” an initiative aimed at celebrating and promoting our inclusive corporate value

• Named to TIME’s 2023 World’s Best Companies

• Named to Forbes 2023 World’s Top Companies for Women

• Named to Fortune’s 2023 World’s Most Admired Companies

• Named to Fast Company’s Best Workplaces for Innovators

|

||||

2024 ANNUAL MEETING OF SHAREHOLDERS

| • | Date and Time: Tuesday, May 14, 2024, 9:30 a.m. Central Time |

| • | Virtual Meeting Site: www.virtualshareholdermeeting.com/MSI2024 |

| • | Record Date: March 15, 2024 |

| • Voting: | Shareholders as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

| • | Online meeting only: No physical location |

| Items to be Voted On | Our Board’s Recommendation | |

| Election of Eight Director Nominees Named in this Proxy Statement for a One-Year Term (page 12) |

FOR | |

| Ratification of the Appointment of PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for 2024 (page 34) |

FOR | |

| Advisory Approval of the Company’s Executive Compensation (page 35) |

FOR | |

| Approval of an Amendment to the Company’s Restated Certificate of Incorporation to Provide for the Exculpation of Certain Officers (page 80) |

FOR | |

| 2 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

| DIRECTOR NOMINEE HIGHLIGHTS (page 12)

|

Board Committees (as of March 28, 2024)* | |||||||||||||||||

| Name | Director Since |

Indep. | Other Public Co. Boards |

Position | Audit | Comp. | Gov. & Nom. |

Exec. | ||||||||||

| Gregory Q. Brown |

2007 | 0 |

Chairman and CEO, Motorola Solutions, Inc.

|

| ||||||||||||||

| Nicole Anasenes |

2024 |

|

|

|

0 |

Former Chief Financial Officer and Senior Vice President, Finance, ANSYS, Inc.

|

|

|||||||||||

| Kenneth D. Denman |

2017 |

|

|

|

1 | General Partner, Sway Ventures |

|

|

| |||||||||

| Dr. Ayanna M. Howard |

2022 |

|

|

|

1 |

Dean of the College of Engineering at The Ohio State University

|

|

|||||||||||

| Clayton M. Jones |

2015 |

|

|

|

1 |

Former Chairman, CEO and President, Rockwell Collins, Inc.

|

|

|||||||||||

| Judy C. Lewent |

2011 |

|

|

|

0 |

Former EVP and CFO, Merck & Co., Inc.

|

|

| ||||||||||

| Gregory K. Mondre |

2015 |

|

|

|

1 | Co-CEO and Managing Partner of Silver Lake |

|

|||||||||||

| Joseph M. Tucci |

2017 |

|

|

|

1 |

Chairman of Bridge Growth Partners

|

|

|

| |||||||||

= Chair of Committee

= Chair of Committee

| * | Mr. Durban, who has been one of Silver Lake’s designees to our Board, has not been nominated for re-election at the Annual Meeting, and his term on the Board will expire at the conclusion of the Annual Meeting. As such, Mr. Durban is not included in the director tables in the “Proxy Statement Summary” section of this Proxy Statement. For further information, see the section of this Proxy Statement titled “Agreement with Silver Lake” on page 19. Tables in this section include Nicole Anasenes, who joined the Board on February 21, 2024. |

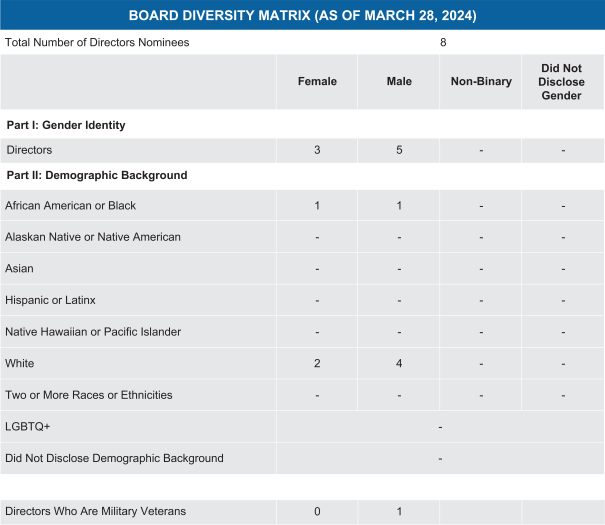

DIRECTOR NOMINEE STATISTICS

|

Independence 88%

|

Average Tenure 7.5 Years

|

Gender and/or Racial Diversity 50%

|

Average Age 63 Years

|

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 3 |

| 4 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

DIVERSITY OF SKILLS AND EXPERIENCE OF DIRECTOR NOMINEES

| Skills & Experience Summary | Gregory Q. Brown |

Nicole Anasenes |

Kenneth D. Denman |

Dr. Ayanna M. Howard |

Clayton M. Jones |

Judy C. Lewent |

Gregory K. Mondre |

Joseph M. Tucci | ||||||||

| Relevant industry experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

| Public company CEO, division CEO or CFO |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Financial and accounting expertise |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| Technology experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| Cybersecurity and privacy experience |

✓ | ✓ | ✓ | ✓ | ||||||||||||

| Software and services business experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Global business experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

| Government, public policy or regulatory experience |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Private equity, investment banking or capital allocation experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| Public company board experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| Human capital management experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Skills and Experience Detail:

Relevant industry experience – We value directors who possess an understanding of financial, operational and strategic issues facing public safety agencies and enterprises.

Public company CEO, division CEO or CFO – Directors who have served in relevant public company senior leadership positions bring unique experience and perspective to our business.

Financial and accounting expertise – Directors with a deep understanding of financial markets, accounting principles and methodologies and financial reporting processes are well-suited to oversee our financial position, results of operations and related financial reporting.

Technology experience – Directors with experience in innovation and technology, including engineering, artificial intelligence or video and physical security, are strategically equipped to help our business in “Solving for safer” to help protect people, property and places.

Cybersecurity and privacy experience – As a provider of mission-critical communications systems for customers in critical infrastructure sectors facing related cybersecurity and privacy risks, we seek directors with experience in cybersecurity and data privacy.

Software and services business experience – Our business has evolved in recent years to increase its focus on software and recurring services, and directors with experience in software and services are uniquely positioned to manage this progression.

Global business experience – Our business has customers in over 100 countries around the world, and directors with experience overseeing non-U.S. operations, global business cultures and multicultural customer preferences assist in managing our global operations and supply chain.

Government, public policy or regulatory experience – Directors with an understanding of these areas are uniquely qualified to provide guidance to our business, as the majority of our business is with governmental entities.

Private equity, investment banking or capital allocation experience – Our business involves complex financial transactions which directors with private equity, investment banking or capital allocation experience are particularly skilled to address.

Public company board experience – Directors who currently serve, or have served, on other public company boards, maintain a thorough understanding of corporate governance practices and policies and assist in maintaining relationships between the corporate board and senior management.

Human capital management experience – Directors with experience managing people and teams, including with respect to recruitment, retention, development and compensation, provide strategic value in overseeing our human capital management efforts, as we operate in a competitive talent market, particularly with respect to software and cloud computing infrastructure engineers, as well as employees in data science and artificial intelligence.

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 5 |

GOVERNANCE HIGHLIGHTS (page 17)

| • | Broad-reaching environmental, social and governance (“ESG”) program with Governance and Nominating Committee oversight of ESG matters as well as Audit Committee oversight of ESG-related risks |

| • | 7 of our 8 director nominees are independent, including all committee members |

| • | All members of our Audit Committee qualify as “audit committee financial experts” |

| • | Lead Independent Director |

| • | Regular executive session meetings of independent directors |

| • | Annual election of directors |

| • | Annual director self-assessment process |

| • | No supermajority voting provisions in our organizational documents |

| • | No “poison pill” |

| • | Robust oversight of risk |

| • | Director Independence Guidelines |

| • | Majority voting standard in uncontested director elections |

| • | 20% threshold for shareholder right to call special meeting |

| • | Shareholder right to act by written consent |

| • | Succession planning |

| • | Proactive shareholder engagement |

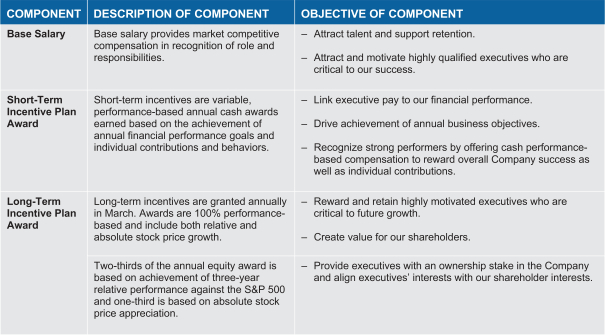

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS (page 36)

| • | Pay-for-performance and at-risk compensation |

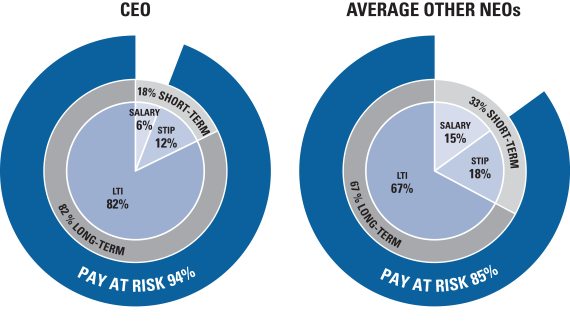

| • | A significant portion of our targeted annual compensation is performance-based and/or subject to forfeiture (“at-risk”), with emphasis on variable pay to reward short- and long-term performance measured against pre-established objectives informed by the Company’s strategy. For 2023, performance-based compensation comprised approximately 94% of the targeted annual compensation for our CEO and, on average, approximately 85% of the targeted annual compensation for our other NEOs. |

| • | Compensation aligned with shareholder interests |

| • | Performance measures for incentive compensation are linked to the overall performance of the Company and are designed to be aligned with the creation of long-term shareholder value. |

| • | Emphasis on future pay opportunity vs. current pay |

| • | Our long-term incentive awards are equity-based, use multi-year vesting provisions to encourage retention, and are designed to align our NEOs’ interests with long-term shareholder interests. For 2023, long-term equity compensation comprised approximately 82% of the targeted annual compensation for our CEO and, on average, approximately 67% of the targeted annual compensation for the other NEOs. |

| • | Retention of independent compensation consultant |

| • | Annual “say on pay” vote |

| • | No excise tax gross-up provisions |

| • | A recoupment “clawback” policy for compensation paid to certain officers, which we amended and restated in 2023 to comply with the new Securities and Exchange Commission (“SEC”) and New York Stock Exchange (“NYSE”) requirements |

| • | Robust stock ownership guidelines for directors and officers |

| • | An anti-hedging policy |

| • | “Double trigger” severance benefits in the event of a change in control |

| • | No repricing of options without shareholder approval |

| • | No excessive perquisites |

| 6 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

| MOTOROLA SOLUTIONS’ ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) PROGRAM |

Corporate responsibility is embedded in our strategy and operations. Our Vice President, Legal and ESG, works closely with the Executive Management ESG Governance Team (which is led by two members of our Executive Committee) to develop and implement our ESG-related strategies and programs across our global organization to shape our culture and corporate handprint. We aim for responsible and inclusive growth through our ESG program, which centers around the following six pillars:

We are proud of the various recognitions that we have received in the ESG space, such as those noted below.

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 7 |

The following table describes our 2023 ESG highlights, organized across our six pillars:

| E |

Environment |

• We developed an internal product carbon footprint database to help us better identify areas for reduction in greenhouse gas emissions associated with the use of our products.

• We defined product carbon footprint attributes across our product portfolio and added these attributes to our engineering product lifecycle management (PLM) system. Adding these into our design process helps to ensure that sustainability attributes are considered in our product development.

• We deployed an “Emissions Management Tool” from the RBA to track our suppliers’ greenhouse gas emissions, emission reduction goals and environmental performance.

• We provided a “green building survey” to certain of our facilities across the globe to help assess the sustainability of our sites.

• We continued to transition our leased fleet of vehicles to electric or hybrid vehicles to help reduce carbon emissions. As of the end of 2023, thirty percent of our leased fleet of vehicles in the UK was comprised of electric vehicles.

• We established the Motorola Solutions Green Team, an internal employee-driven resource group that promotes green volunteerism, environmental education and sustainability opportunities organization-wide.

| ||

| S |

Supply Chain |

• We further enhanced business continuity and resiliency in our supply chain by continuing to move supply and operations to locations that are closer in proximity to our customers. This movement of operations reduced lead times between manufacturing and distribution locations and resulted in reduced reliance on both ocean and air freight.

• We introduced a single-box packaging solution that reduces air space and foam packaging, which we expect to yield a packaging material reduction of up to approximately 450 tons in 2024.

• Our commitment to providing economic opportunities to small businesses remained steadfast. We conducted more than $400 million in business with small and diverse businesses in 2023.

• More than sixty of our suppliers were required to take training to develop their knowledge of sustainability topics, including carbon footprint, recognizing and preventing forced labor, transparency and ethics, and waste management.

• In observance of Anti-Slavery Day, we hosted an event in October 2023 that included panel discussions and presentations from expert speakers from the UK House of Lords, the US Bureau of International Labor Affairs at the US Department of Labor, and Anti-Slavery International.

| ||

| 8 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

| S |

Human Capital Management |

Recruitment, Retention, and Development:

• Our Emerging Leaders Acceleration Program (E-LAP) is a three-month professional development program designed to advance the careers of our emerging leaders. It combines self-assessment, coaching, and classroom learning that covers a range of leadership principles to give more insight on how to better lead themselves, lead others, and lead the business. In 2023, 72 employees participated in the program, compared to 24 participants in 2022.

• Our human resources team led approximately 70 virtual training sessions with more than 2,000 manager-level employees across the globe focused on understanding our global organization and values, rewards and compensation, recruiting and hiring practices as well as performance management and employee development.

• We continued to grow our recruiting pipeline through partnerships with several diverse organizations, including the National Society of Black Engineers (NSBE), the Society of Hispanic Professional Engineers (SHPE), the Society of Women Engineers (SWE) and Women in Cybersecurity (WiCyS). In addition, we entered into a new partnership with Out and Equal, a nonprofit organization focused on LGBTQ+ workplace equality, inclusion and belonging.

• We celebrated and promoted our core value of “inclusive” by launching the “GO ALL INclusive” initiative which highlights ways in which all employees can reflect, recognize and reward inclusive behaviors. We shared resources and training materials on inclusive behaviors and mobilized our business councils and various diversity, equity and inclusion (“DEI”) volunteer groups to host cultural events.

• In October 2023, nearly 375 employees across seven countries convened both in-person in Los Angeles and virtually to attend the Women in Engineering Conference 2023 (WE23), a conference focused on the professional development of women engineers. Motorola Solutions was one of the companies that sponsored the largest number of in-person attendees in 2023.

• Our human resources team and Veterans Business Council continued to support the Department of Defense SkillBridge program, which is a six-month internship for active-duty service members to help them gain valuable civilian work experience and transition to civilian employment.

Health, Safety, and Employee Wellbeing:

• In 2023, we took steps to consolidate our regional and local wellbeing initiatives into a global program. Those steps included the formation of a global wellbeing steering committee to implement program enhancements, development of a formal strategy, recruitment of executive sponsors to actively endorse the global program, review of current Company and industry offerings to determine practices to leverage globally, and the creation of a global wellness calendar to allow for a coordinated approach across the regions and functional areas.

• In 2023, we designated Juneteenth and National Day for Truth and Reconciliation as paid Company holidays for all U.S. and Canadian employees, respectively. The new Company holidays will be observed beginning in 2024.

• During Mental Health Awareness Month, we issued a paid mental health day for all employees globally, encouraging them to pause and re-energize.

• The Office of DEI, human resources, our Business Councils and the Motorola Solutions Foundation partnered on a Movember campaign to raise awareness and funds for men’s health issues including mental health and suicide prevention, and prostate and testicular cancers.

| ||

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 9 |

| S |

Community Engagement |

Volunteerism:

• Our employees logged nearly 100,000 volunteer hours in 2023, a 30% increase over 2022.

• Approximately one in three employees logged at least one volunteer hour in 2023, compared to one in four employees in 2022.

• The number of employee -created volunteer projects grew to more than 500 spanning across 38 countries.

Grants and Giving:

• Through the Motorola Solutions Foundation (the “Foundation”), our charitable and philanthropic arm, we launched two new Foundation programs this year – the “Bright Minds, Bold Futures” scholarship and “Grant Partner Summit on First Responder Wellness”, both of which provide greater support to our nonprofit beneficiaries:

• The “Bright Minds, Bold Futures” scholarship provides financial support, throughout their college educations, to deserving students from underserved and underrepresented Chicagoland communities who are pursuing degrees in technology and engineering. The Foundation awarded approximately $100,000 in renewable scholarships to thirty-seven students in 2023.

• The Foundation hosted its first-ever “Grant Partner Summit on First Responder Wellness” at our headquarters in Chicago to help our grant partners enhance the capacity and effectiveness of their programs and make valuable connections. Representatives from 17 nonprofit organizations from across North America who support first responders’ mental health and wellness convened at the summit for an opportunity to learn from one another, share best practices and network across organizations to make an even greater impact for first responders and their families.

• We received Benevity’s 2023 Community Impact Award in recognition of our best-in-class approach to community investment and creating impact with our nonprofit partners. The Community Impact Award is part of Benevity’s Goodies Awards, which celebrate inclusive and creative ways brands are making a difference in the world through their corporate purpose plans.

• Through the Foundation, we continued to see increased funding in key areas of focus:

• 18% increase in funding to programs that promote diversity among first responders.

• 23% increase in funding to programs that support first responders’ mental health.

• 8% increase in funding to programs that support families of fallen first responders.

• 9% increase in funding for technology and engineering programs focused on female persons.

• 60% of our grants to technology and engineering education programs directly supported women.

• In 2023, the Foundation awarded over $2.6 million in educational scholarships to children of fallen first responders, female persons and other underserved populations, an 18% increase year over year.

• We created 150 employee-initiated giving opportunities which raised more than $300,000 for causes around the world.

| ||

| 10 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

| S |

Our Business |

• Our ISO 22301 business continuity management system certification continued to expand. In 2023, five additional sites achieved compliance to the standard, bringing our total number of certified sites to twelve. Further, an additional three sites achieved compliance to the ISO 22301 standard according to our own internal audit, and we anticipate seeking certification for such sites in the coming years.

• Our Enterprise Information Security program launched various company-wide information security initiatives:

• We launched an initiative requiring employees to use Company-trusted devices to access core applications within the Company.

• We implemented a policy framework to guide our engagement with generative artificial intelligence (“AI”).

• To bolster our authentication security we expanded the use of biometrics for employee authentication, reducing our reliance on passwords, and migrated employees to updated forms of multi-factor authentication in an effort to further protect our employees.

• We updated our corporate cybersecurity policies and procedures to support customer contracts.

• We revised our vendor risk assessment strategy to align with increased awareness of risks associated with the use of cloud environments and solutions in our offerings.

• We placed our source code repositories behind trusted device enforcement.

| ||

| G |

Governance and Compliance |

• In February 2023, the Board appointed Mr. James A. Niewiara, Senior Vice President, General Counsel, and Ms. Karen E. Dunning, Senior Vice President, Human Resources, to the Company’s management Executive Committee.

• We reinforced our commitment to conducting business ethically with a public statement published to our website that outlines the policies, processes, controls and oversight that are the foundation of our anti-corruption compliance program.

• In collaboration with the Motorola Solutions Technology Advisory Committee, we continued to expand upon and mature our processes for how we control for and review sales opportunities of products involving certain products and technologies. These processes include, for example, requiring an internal multidisciplinary review of such sales opportunities against our sensitive technologies policy to help ensure that our products are used responsibly and in accordance with their intended use. We also expanded our focus to more directly address specific considerations addressing the rapid growth and use of AI.

| ||

We anticipate that our 2023 corporate responsibility report will be available on our corporate website during the summer of 2024. For more details on our employee demographics, including our most recent EEO-1 summary report, please consult the Diversity Equity and Inclusion page of our corporate website. The information accessible through our corporate website is not incorporated by reference into and is not a part of this Proxy Statement.

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 11 |

|

OUR BOARD

|

| PROPOSAL NO. 1 — ELECTION OF EIGHT DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT FOR A ONE-YEAR TERM |

Proposal Number 1 of this Proxy Statement enables you to vote on the members of your Board.* We open the Proxy Statement with this proposal because we believe there is no more important vote than that of electing the fiduciaries who oversee Motorola Solutions on your behalf.

To inform that vote, we provide you information here on, among other topics:

| • | Who our Board is – including their qualifications |

| • | How our Board is selected and assessed |

| • | How our Board governs the Company |

| • | How our Board is organized |

| • | How you can communicate with our Board |

| • | How our Board is compensated |

OUR BOARD – WHO WE ARE

Our Board has nominated and recommends eight individuals for election to our Board at the Annual Meeting. These individuals are as follows:

|

|

|

|

|

|

|

| |||||||

| Gregory Q. Brown | Nicole Anasenes | Kenneth D. Denman | Ayanna M. Howard | Clayton M. Jones | Judy C. Lewent | Gregory K. Mondre | Joseph M. Tucci |

Our Board believes that each nominee has the skills, experience and personal qualities our Board seeks in its directors, and that the combination of these nominees creates an effective and well-functioning Board, with a diversity of perspectives, viewpoints, backgrounds and professional experiences that best serves our Board, the Company and our shareholders.

Each of the nominees named is currently a director of the Company. The ages shown are current as of the date of this Proxy Statement.

Each of the director nominees (other than Ms. Anasenes) was elected at the Annual Meeting of Shareholders held on May 16, 2023. As previously announced, on February 21, 2024, the Board increased the number of directors of the Company from eight to nine, and elected Ms. Anasenes to serve as a director, effective immediately. Egon P. Durban, who has been one of Silver Lake’s designees to our Board, has not been nominated for re-election at the Annual Meeting, and the Board thanks him for his years of service. For further information, see the section of this Proxy Statement titled “Agreement with Silver Lake” on page 19. The size of the Board will be reduced to eight members effective as of, and contingent upon, the election of the eight director nominees at the Annual Meeting. Judy C. Lewent has reached the age of 75 and Clayton M. Jones will have reached the age of 75 prior to the date of our Annual Meeting; however, given each of Ms. Lewent’s and Mr. Jones’s continued significant contributions to the Board (including Ms. Lewent in her role as Chair of the Audit Committee), and their meaningful knowledge of the Company, our Board has granted a one-year waiver of the retirement age for each of Ms. Lewent and Mr. Jones. In addition, given Mr. Tucci’s extensive industry knowledge and his position as Chair of the Compensation and Leadership Committee, our Board has granted an additional one-year waiver of the retirement age for Mr. Tucci.

Included in each nominee’s biography is a description of select key qualifications, experience and characteristics, including each nominee’s self-identified race, that led our Board to conclude that each nominee is qualified to serve as a member of our Board.

| * | The number of directors of the Company to be elected at the Annual Meeting is eight. If elected by our shareholders at the Annual Meeting, each director nominee will serve a one-year term ending at the 2025 Annual Meeting of Shareholders. Each director will hold office until such director’s respective successor is elected and qualified or until such director’s earlier death or resignation. Each of the nominees has consented to being named in this Proxy Statement and to serve as a director if elected. However, if any nominee is not available to serve as a director for any reason at the time of the Annual Meeting, the proxies will be voted for the election of such other person or persons as the Board may designate, unless the Board, in its discretion, reduces the number of directors. The Board has the authority under our amended and restated bylaws (“Bylaws”) to increase or decrease the size of the Board and to fill vacancies between Annual Meetings of Shareholders. |

| 12 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

|

GREGORY Q. BROWN |

Mr. Brown joined the Company in 2003, was appointed as Chief Executive Officer of Motorola, Inc. in January 2008, and since May 2011 has been the Chairman and Chief Executive Officer of Motorola Solutions, Inc.

Other Public Company Boards: In the last five years, Mr. Brown served on the board of Xerox Corporation from January 2017 to May 2019.

Board Committees: Executive (Chair)

Director Qualifications:

● Public company CEO, relevant industry, technology, software and services business, cybersecurity and privacy, and human capital management experience as Chairman and CEO of the Company and former Chairman and CEO of Micromuse, Inc.

● Financial and accounting expertise, global business, capital allocation, government, public policy, and regulatory experience as Chairman and CEO of the Company, former chair and board member of the Federal Reserve Bank of Chicago, former Vice Chair of the U.S. – China Business Council, and former member of the President of the United States’ Management Advisory Board

● Government, public policy, and regulatory experience as a member of The Business Council, Council on Foreign Relations, Co-chair of Prium, and former member of the Business Roundtable and of the President’s National Security Telecommunications Advisory Committee (NSTAC)

● Public company board experience | |

|

| ||

| Principal Occupation: Chairman and Chief Executive Officer, Motorola Solutions, Inc. | ||

|

Age: 63 Race: White Director since: 2007 Chairman since: 2011 | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

|

NICOLE ANASENES |

Ms. Anasenes served as Chief Financial Officer and Senior Vice President, Finance of ANSYS, Inc., a developer and provider of engineering simulation software and services, from March 2021 and December 2020, respectively, until February 2024. As ANSYS, Inc. previously disclosed, Ms. Anasenes will continue to remain an employee of ANSYS, Inc. until June 7, 2024. She was Chief Financial Officer and Chief Operating Officer of Squarespace, Inc., a company which sells subscription software to help customers establish and manage their online presence and stores, from 2016 to 2020, and also served as Chief Financial Officer of Infor, a cloud application software company from 2013 to 2015. Before joining Infor, Ms. Anasenes spent 11 years with IBM in various leadership positions in corporate finance, M&A and market development.

Other Public Company Boards: In the last five years, Ms. Anasenes served on the boards of ANSYS, Inc. from July 2018 until December 2020 and VMware, Inc. from April 2022 to November 2023.

Board Committees: Audit

Director Qualifications:

● Public company CFO, as former Chief Financial Officer of ANSYS, Inc. and former Chief Financial Officer of Squarespace, Inc.

● Relevant industry, technology, software and services business, and human capital management experience as former Chief Financial Officer of ANSYS, Inc., former Chief Financial Officer and Chief Operating Officer of Squarespace, Inc. and former Chief Financial Officer of Infor

● Financial and accounting expertise, global business, private equity, investment banking or capital allocation experience as former Chief Financial Officer of ANSYS, Inc., former Chief Financial Officer and Chief Operating Officer of Squarespace, Inc. and former Chief Financial Officer of Infor

● Public company board experience

In addition to the qualifications listed above, the Board also values Ms. Anasenes’s diverse perspective as a woman. Ms. Anasenes was recommended as a potential director nominee by Russell Reynolds, as part of our director nominating process that is managed by our Governance and Nominating Committee. Refer to “How Our Board is selected and Assessed-Director Nominating Process” on page 17 of this Proxy Statement for additional information. | |

|

| ||

| Principal Occupation: Former Chief Financial Officer and Senior Vice President, Finance, ANSYS, Inc. | ||

|

Age: 50 Race: White Director since: 2024 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 13 |

|

KENNETH D. DENMAN |

Mr. Denman is a General Partner at Sway Ventures, a venture capital firm that invests in early to mid-stage technology companies. He was the CEO and President of Emotient, Inc., a company that uses artificial intelligence to analyze facial expressions to detect emotions, from 2012 to 2016. He also served as the Chief Executive Officer of Openwave Systems Inc. from 2008 to 2011 and as a director from 2004 to 2011. He served as the Chief Executive Officer and President and director of iPass, Inc. from 2001 to 2008 and as its Chairman from 2003 to 2008. Mr. Denman is also a member of the Board of Trustees of Seattle Children’s Hospital.

Other Public Company Boards: Costco Wholesale Corporation. In the last five years, Mr. Denman served on the boards of LendingClub Corporation from July 2017 to February 2021, Mitek Solutions, Inc. from December 2016 to December 2019, and VMware, Inc. from January 2021 to November 2023.

Board Committees: Compensation and Leadership, Governance and Nominating (Chair), Executive

Director Qualifications:

● Relevant industry, technology, and human capital management experience, and financial and accounting expertise as former CEO and President of Emotient, Inc. and iPass, Inc. and former CEO of Openwave Systems Inc.

● Software and services business, and cybersecurity and privacy experience as former CEO and President of Emotient, Inc. and iPass, Inc. and former CEO of Openwave Systems Inc.

● Public company CEO, and global business experience as former CEO and President of iPass, Inc. and former CEO of Openwave Systems Inc.

● Private equity, investment banking, and capital allocation experience as a General Partner of Sway Ventures

● Public company board experience | |

|

| ||

| Principal Occupation: General Partner, Sway Ventures | ||

|

Age: 65 Race: Black Director since: 2017 Lead Independent Director since: 2019 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

|

AYANNA M. HOWARD |

Dr. Howard is the dean of the College of Engineering at The Ohio State University, as well as a tenured professor in the college’s Department of Electrical and Computer Engineering with a joint appointment in Computer Science and Engineering, positions that she has held since 2021. Dr. Howard is also the founder and board president of Zyrobotics, Inc., a non-profit organization that provides AI-powered STEM tools for early childhood education. Dr. Howard held various positions at the Georgia Institute of Technology (“Georgia Tech”) from 2005 to 2021, including as the Chair of the School of Interactive Computing from 2018 to 2021, and as the Linda J. and Mark C. Smith Professor, School of Electrical & Computer Engineering from 2015 to 2021. Prior to her time at Georgia Tech, Dr. Howard worked at NASA’s Jet Propulsion Laboratory in various roles from 1993 to 2005.

Other Public Company Boards: Autodesk, Inc.

Board Committees: Audit

Director Qualifications:

● Financial and accounting expertise and private equity, investment banking, and capital allocation experience as the founder of Zyrobotics, Inc., and from her receipt of her M.B.A. from the Drucker Graduate School of Management

● Government, public policy and regulatory experience as the dean of the College of Engineering at The Ohio State University and former roles at NASA’s Jet Propulsion Laboratory

● Relevant industry, technology, cybersecurity and privacy, software and services business, and human capital management experience as the founder of Zyrobotics, Inc., dean of the College of Engineering at The Ohio State University and former roles at NASA’s Jet Propulsion Laboratory

● Public company board experience | |

|

| ||

| Principal Occupation: Dean of the College of Engineering, The Ohio State University | ||

|

Age: 52 Race: Black Director since: 2022 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

| 14 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

|

CLAYTON M. JONES |

Mr. Jones served as Chairman of the Board of Rockwell Collins from 2002 through July 2014, and as Chief Executive Officer from June 2001 until his retirement in July 2013. Mr. Jones also served as President of Rockwell Collins and Corporate Officer and Senior Vice President of Rockwell International, which he joined in 1979. Mr. Jones is also a U.S. Air Force veteran.

Other Public Company Boards: Deere & Company.

Board Committees: Audit

Director Qualifications:

● Public company CEO, financial and accounting expertise, and global business experience as former CEO of Rockwell Collins

● Relevant industry, technology, cybersecurity and privacy, private equity, investment banking and capital allocation, and human capital management experience as former CEO of Rockwell Collins and Corporate Officer and Senior Vice President of Rockwell International

● Government, public policy and regulatory experience as a former member of The Business Council, the Business Roundtable and the President’s National Security Telecommunications Advisory Committee

● Public company board experience | |

|

| ||

|

Principal Occupation: Retired; Formerly Chairman, Chief Executive Officer and President, Rockwell Collins, Inc. (“Rockwell Collins”) | ||

|

Age: 74 Race: White Director since: 2015 Independent

|

|

JUDY C. LEWENT |

Ms. Lewent served as Chief Financial Officer of Merck, a pharmaceutical company, from 1990 until her retirement in 2007. Prior roles at Merck include Executive Vice President from 2001 to 2007 and President, Human Health Asia from 2003 to 2005.

Other Public Company Boards: In the last 5 years, Ms. Lewent served on the boards of GlaxoSmithKline plc from April 2011 to May 2021, and Thermo Fisher Scientific, Inc. from May 2008 to May 2021. Ms. Lewent also served on the board of Motorola, Inc. from May 1995 to May 2010.

Board Committees: Audit (Chair), Executive

Director Qualifications:

● Public company CFO, financial and accounting expertise, capital allocation, global business, and human capital management experience as the former CFO of Merck

● Technology experience as a life member of the Massachusetts Institute of Technology

● Government, public policy, and regulatory experience as former CFO at Merck and former board member of GlaxoSmithKline and Thermo Fisher

● Public company board experience | |

|

| ||

|

Principal Occupation: Retired; Formerly Executive Vice President & Chief Financial Officer, Merck & Co., Inc. (“Merck”) | ||

|

Age: 75 Race: White Director since: 2011 Independent

|

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 15 |

|

GREGORY K. MONDRE |

Mr. Mondre is Co-CEO and Managing Partner of Silver Lake, a global technology investment firm, and is based in New York. Mr. Mondre joined Silver Lake in 1999 and was previously Managing Partner and Managing Director from January 2013 to December 2019. Prior to his time at Silver Lake, Mr. Mondre was a principal at TPG, where he focused on private equity investments across a wide range of industries, with a particular focus on technology.

Other Public Company Boards: GoodRx Holdings, Inc. In the last five years, Mr. Mondre served on the boards of Expedia Group from May 2020 to October 2021 and GoDaddy, Inc. from May 2014 to February 2020.

Board Committees: Governance and Nominating

Director Qualifications:

● Relevant industry, technology, global business, and software and services business experience as Co-CEO and Managing Partner of Silver Lake

● Financial and accounting expertise and private equity, investment banking, and capital allocation, and human capital management experience as Co-CEO and Managing Partner of Silver Lake and as former principal at TPG

● Public company board experience | |

|

| ||

|

Principal Occupation: Co-CEO and Managing Partner, Silver Lake | ||

|

Age: 49 Race: White Director since: 2015 Independent

|

|

JOSEPH M. TUCCI |

Mr. Tucci is the Chairman of Bridge Growth Partners. He is a founder, served as director from September 2016 to July 2022, and as the Co-Chairman and Co-Chief Executive Officer from September 2016 to February 2019, of GTY Technology Holdings, Inc., a software-as-a-service company that offers a cloud-based suite of solutions for the public sector in North America. Mr. Tucci was the Chairman and Chief Executive Officer of EMC Corporation, a provider of enterprise storage systems, software, and networks. He was EMC’s Chairman from January 2006 and CEO from January 2001 until September 2016, when Dell Technologies acquired the company.

Other Public Company Boards: Paychex, Inc. In the last five years, Mr. Tucci also served on the board of GTY Technology Holdings, Inc. from September 2016 to July 2022.

Board Committees: Compensation and Leadership (Chair), Governance and Nominating, Executive

Director Qualifications:

● Public company CEO, technology, global business, software and services business, and human capital management experience, and financial and accounting expertise as former Chairman, CEO and President of EMC Corporation

● Relevant industry, and private equity experience as former Co-CEO and Co-Chairman of GTY Technology Holdings, Inc. and founding member and current Chairman of Bridge Growth Partners

● Government, public policy, and regulatory experience as a former member of the Business Roundtable and Chair of its Task Force on Education and the Workforce and as a former member of the Technology CEO Council

● Public company board experience | |

|

| ||

|

Principal Occupation: Chairman of Bridge Growth Partners | ||

|

Age: 76 Race: White Director since: 2017 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

RECOMMENDATION OF THE BOARD

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF THE EIGHT NOMINEES NAMED HEREIN AS DIRECTORS. UNLESS OTHERWISE INDICATED ON YOUR PROXY, YOUR SHARES WILL BE VOTED FOR THE ELECTION OF SUCH EIGHT NOMINEES AS DIRECTORS.

| 16 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

OUR BOARD’S QUALIFICATIONS

We believe our Board should be comprised of individuals with appropriate skills and experiences to meet its board governance responsibilities and contribute effectively to the Company. Our Governance and Nominating Committee carefully considers the skills and experiences of current directors and new candidates to ensure that they meet the needs of the Company before nominating directors for election to our Board. All of our non-employee directors serve on Board committees, further supporting our Board by providing expertise to those committees. The needs of the committees also are reviewed when considering nominees to our Board. Our Board has a deep working knowledge of matters common to large companies and is comprised of individuals with a mix of attributes, skills and qualifications which include, with respect to our eight director nominees:

| • | Independence: Seven of eight director nominees |

| • | Gender and/or racial diversity: Four of eight director nominees |

| • | Relevant industry experience: Seven of eight director nominees |

| • | Public company CEO, division CEO or CFO: Six of eight director nominees |

| • | Financial and accounting expertise: All director nominees |

| • | Technology experience: All director nominees |

| • | Cybersecurity and privacy experience: Four of eight director nominees |

| • | Software and services business experience: Six of eight director nominees |

| • | Global business experience: Seven of eight director nominees |

| • | Government, public policy or regulatory experience: Five of eight director nominees |

| • | Private equity, investment banking or capital allocation experience: All director nominees |

| • | Public company board experience: All director nominees |

| • | Human capital management experience: All director nominees |

Specific experience, qualifications, attributes and skills of our nominees are listed in the biographies above.

HOW OUR BOARD IS SELECTED AND ASSESSED

Director Nominating Process

The Governance and Nominating Committee recommends candidates to our Board it believes are qualified and suitable to become members of our Board. The Governance and Nominating Committee also considers the performance of incumbent directors in determining whether to recommend them for re-election. The Governance and Nominating Committee considers recommendations from many sources, including members of our Board, management and search firms. From time to time, Motorola Solutions hires search firms to help identify and facilitate the screening and interview process of director candidates. In 2023, we continued our retention of Russell Reynolds to assist with this process. Russell Reynolds compiles a list of candidates (which may include candidates recommended by other search firms), evaluates each candidate and makes recommendations to the Governance and Nominating Committee (e.g., Ms. Anasenes). They screen candidates based on our Board’s criteria, perform reference checks, prepare a biography of each candidate for the Governance and Nominating Committee’s review and help arrange interviews if necessary. The Governance and Nominating Committee and the Chairman of the Board will conduct interviews with candidates who meet our Board’s criteria. The Governance and Nominating Committee has full discretion in considering potential candidates and making its nominations to our Board. As described further in the section of this Proxy Statement titled “Agreement with Silver Lake” on page 19, the provisions of the Investment Agreement (as defined herein) entered into with affiliates of Silver Lake relating to Silver Lake’s Board nomination rights and voting obligations are no longer in effect and, as such, Silver Lake no longer has any Board nomination rights.

The Governance and Nominating Committee will consider nominees recommended by Motorola Solutions shareholders as described below. A description of certain considerations our Governance and Nominating Committee reviews in evaluating director nominees is described in “Skills, Experience, and Commitment to Diversity” on page 18 of this Proxy Statement. A shareholder wishing to propose a candidate for consideration should forward the candidate’s name and information about the candidate’s qualifications in writing to Secretary, Motorola Solutions, Inc., 500 West Monroe Street, Chicago, IL 60661. Our Secretary will forward all recommendations received to the Chair of our Governance and Nominating Committee for discussion and consideration. A shareholder who wishes to directly nominate an individual as a director candidate, rather than recommending the individual to the Governance and Nominating Committee as a nominee, must comply with the advance notice requirements for shareholder nominations set forth in Article III, Section 13 of our Bylaws (including the requirement to provide reasonable evidence that such shareholder has complied with the requirements of Rule 14a-19 of the Securities Exchange Act, as amended (the “Exchange Act”)) or the proxy access process set forth in Article III, Section 17 of our Bylaws. See the section titled “Important Dates for the 2025 Annual Meeting” on page 91 of this Proxy Statement for further information on these procedures.

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 17 |

Governance and Nominating Committee Director Commitment Level Assessment

Our Board recognizes that a robust evaluation and assessment process is an essential component of strong corporate governance practices and promoting Board effectiveness. The Governance and Nominating Committee oversees an annual assessment of our director nominees’ director commitment levels with respect to service on other public company boards. Our director commitment policy in our Board Governance Guidelines provides that the Chairman of the Board and the Lead Independent Director may serve on no more than four public boards (including our own, unless the Chairman of the Board is a “named executive officer,” in which case such limit shall be three public boards), and all other director nominees may serve on no more than five public boards (including our own), in each case with consideration given to public company leadership roles (the “Director Commitment Policy”).

With respect to the Governance and Nominating Committee’s annual review of director commitment levels, the Governance and Nominating Committee affirms that all director nominees are compliant with the Director Commitment Policy as of the date of this Proxy Statement.

Skills, Experience, and Commitment to Diversity

Our Board seeks members with varying professional backgrounds and other differentiating personal characteristics who combine a broad spectrum of experience and expertise with a reputation for integrity. Our Board believes that maintaining a diverse membership enhances our Board’s discussions and enables the Board to better represent all of the Company’s constituents. As stated in our Board Governance Guidelines, when selecting directors, our Board and the Governance and Nominating Committee review and consider many factors, including: experience in the context of the Board’s needs; integrity; leadership qualities; diversity; ability to exercise sound judgment; existing time commitments; years to retirement age; and independence. They also consider ethical standards. Our Board Governance Guidelines maintain that diversity is one of the many factors considered by our Board and the Governance and Nominating Committee when selecting director nominees. Our Board and the Governance and Nominating Committee recognize the importance of a Board representing diverse knowledge and experiences and strive to nominate directors with a variety of complementary skills, backgrounds and perspectives so that, as a group, the Board will possess the appropriate talent, skills, experience and expertise to oversee the Company’s businesses. The Governance and Nominating Committee annually assesses the effectiveness of its director nomination process and the Board Governance Guidelines.

Board Assessment and Director Peer Review and Process

Our Board recognizes that a robust evaluation and assessment process is an essential component of strong corporate governance practices and promoting Board effectiveness. The Governance and Nominating Committee oversees an annual assessment process of our director nominees. Our Board Governance Guidelines provide that, at a minimum, the annual assessment of director nominees will address the overall effectiveness, achievement of mission, discharge of responsibilities, structure, meetings, processes, relationships with management and Board and committee development. Such assessment process also includes the following steps:

| 1 | The Governance and Nominating Committee reviews the format of the Board assessment and director peer review process as necessary to help ensure that the solicited feedback remains relevant and appropriate. | |

| ||

| 2 | Each director completes an annual self-assessment of the Board and the committees on which such director serves. These self-assessments are designed to help assess the skills, qualifications, and experience represented on the Board and its committees, and to determine whether the Board and its committees are functioning effectively. | |

| ||

| 3 | The results of this annual self-assessment are discussed by the full Board and each committee, as applicable, and changes to the Board’s and its committees’ practices are implemented as appropriate. | |

| ||

| 4 | The Lead Independent Director also conducts a confidential director peer review process. As part of this process, the Lead Independent Director speaks with each other director individually to obtain insights regarding the contributions of other directors (and the Chairman of the Board may speak with each other director regarding the contributions of the Lead Independent Director), and to discuss issues in greater depth and obtain more targeted feedback with respect to Board, committee and individual director effectiveness.

| |

| 18 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

With respect to Mr. Brown, the Compensation and Leadership Committee also conducts an annual review of his performance as CEO, as described in our Board Governance Guidelines and the charter of the Compensation and Leadership Committee.

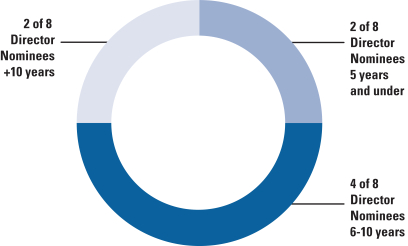

Board Refreshment

Our Board believes that a degree of Board refreshment is important to ensure that Board composition is aligned with the changing needs of the Company and the Board, and that fresh viewpoints and perspectives are regularly considered. Our Board also believes that directors develop an understanding of the Company and an ability to work effectively as a group over time that provides significant value, and therefore a significant degree of continuity year-over-year should be expected. Our current director nominee tenure and board refreshment statistics (which take into account Mr. Durban, as he has not been nominated for re-election at the Annual Meeting) are as follows:

| DIRECTOR NOMINEE TENURE DIVERSITY

|

BOARD REFRESHMENT

|

|||||||

|

+5

Directors added |

-6

Directors retired |

||||||

| over the last 8 years

|

||||||||

Our Board does not have absolute limits on the length of time that a director may serve, but considers the tenure of directors as one of several factors in re-nomination decisions. As set forth in our Board Governance Guidelines, the Board requires that a director must offer to resign if a significant change in personal circumstances, including job responsibilities, occurs, and has established a retirement age of 75 for non-executive directors, requiring such directors to tender their resignation from the Board at the annual meeting of shareholders following their 75th birthday. Directors who are members of management will retire from the Board upon retirement from the Company. The CEO may remain on the Board after retirement from the Company with the approval of the Board. There are no additional exemptions or conditions to this retirement policy other than what is set forth in our Board Governance Guidelines. Judy C. Lewent has reached the age of 75 and Clayton M. Jones will have reached the age of 75 prior to the date of our Annual Meeting; however, given each of Ms. Lewent’s and Mr. Jones’s continued significant contributions to the Board (including Ms. Lewent in her role as Chair of the Audit Committee), and their meaningful knowledge of the Company, our Board has granted a one-year waiver of the retirement age for each of Ms. Lewent and Mr. Jones. In addition, given Mr. Tucci’s extensive industry knowledge and position as chair of the Compensation and Leadership Committee, our Board has granted an additional one-year waiver of the retirement age for Mr. Tucci.

While our Board believes that refreshment is an important consideration in assessing Board composition, it also believes the best interests of the Company are served by being able to take advantage of all available talent. Therefore, our Board does not make determinations with regard to its membership based solely on age or tenure.

Agreement with Silver Lake

On September 5, 2019, in connection with the Company’s continuing relationship with Silver Lake and the Company’s repurchase and settlement of the outstanding principal amount of 2.00% senior convertible notes due 2020 issued to Silver Lake, the Company entered into an investment agreement with affiliates of Silver Lake (the “Investment Agreement”), relating to the issuance to Silver Lake (references to Silver Lake in this section “Agreement with Silver Lake” refer to such affiliates of Silver Lake mentioned above) of $1 billion in aggregate principal amount of 1.75% senior convertible notes due September 2024 (the “2024 Notes”). On February 14, 2024, the Company agreed with Silver Lake to purchase the 2024 Notes. The 2024 Notes have now been canceled. Accordingly, the provisions of the Investment Agreement relating to Silver Lake’s Board nomination rights and voting obligations are no longer in effect. Although the Board nomination rights are no longer in effect, the Board has determined to nominate Gregory K. Mondre for re-election at the Annual Meeting.

For further information regarding the Investment Agreement (including a copy of such Investment Agreement) and the Company’s transactions with Silver Lake, please refer to the Company’s Current Reports on Form 8-K filed with the SEC on September 5, 2019 and February 15, 2024, as well as Note 5, “Debt and Credit Facilities” of our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023.

| Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | 19 |

HOW OUR BOARD GOVERNS THE COMPANY

We believe that the governance tone of a company is set at the top. Our Board has:

| • | Responsibility for overseeing management and providing strategic guidance |

| • | A belief in the steady refreshment of our Board to bring new and diverse perspectives |

| • | A belief in the importance of staying well informed |

| • | A willingness to manage risks, seize opportunities and embrace leadership |

Board Governance Practices and Principles

We adhere to a number of good board governance practices and principles:

| • | Governance and Nominating Committee oversight of ESG matters as well as Audit Committee oversight of ESG-related risks |

| • | 7 of our 8 director nominees are independent, including all committee members |

| • | A Lead Independent Director |

| • | All members of our Audit Committee qualify as “audit committee financial experts” |

| • | Regular executive session meetings of independent directors |

| • | Annual director self-assessment process |

| • | Robust oversight of risk |

| • | Board Governance Guidelines |

| • | Director Independence Guidelines |

Corporate Governance Practices and Principles

We maintain a strong foundation of corporate governance practices and principles:

| • | Proxy access provision in our Bylaws |

| • | Annual election of directors |

| • | No super majority voting provisions in our organizational documents |

| • | No “poison pill” |

| • | Majority voting standard in uncontested director elections |

| • | 20% threshold for shareholder right to call special meeting |

| • | Shareholder right to act by written consent |

| • | Succession planning (for additional information, see “Human Capital Management and Succession Planning” on page 21 of this Proxy Statement) |

| • | Proactive shareholder engagement (for additional information, see “Shareholder Engagement” on page 23 of this Proxy Statement) |

Compensation Governance Practices and Principles

We maintain a robust compensation governance framework:

| • | Pay-for-performance and at-risk compensation |

| • | A significant portion of our targeted annual compensation is performance-based and/or subject to forfeiture (“at-risk”), with emphasis on variable pay to reward short- and long-term performance measured against pre-established objectives informed by the Company’s strategy. For 2023, performance-based compensation comprised approximately 94% of the targeted annual compensation for our CEO and, on average, approximately 85% of the targeted annual compensation for our other NEOs. |

| • | Compensation aligned with shareholder interests |

| • | Performance measures for incentive compensation are linked to the overall performance of the Company and are designed to be aligned with the creation of long-term shareholder value. |

| • | Emphasis on future pay opportunity vs. current pay |

| • | Our long-term incentive awards are equity-based, use multi-year vesting provisions to encourage retention, and are designed to align our NEOs’ interests with long-term shareholder interests. For 2023, long-term equity compensation comprised approximately 82% of the targeted annual compensation for our CEO and, on average, approximately 67% of the targeted annual compensation for the other NEOs. |

| 20 | Motorola Solutions Notice of 2024 Annual Meeting of Shareholders and Proxy Statement |

| • | Retention of independent compensation consultant |

| • | Annual “say on pay” vote |

| • | No excise tax gross-up provisions |

| • | A recoupment “clawback” policy for compensation paid to certain officers, which we amended and restated in 2023 to comply with the new SEC and NYSE requirements |

| • | Robust stock ownership guidelines for directors and officers |

| • | An anti-hedging policy |

| • | “Double trigger” severance benefits in the event of a change in control |

| • | No repricing of options without shareholder approval |

| • | No excessive perquisites |

Governance of Risks and Corporate Controls

We maintain comprehensive governance of risks and corporate controls:

| • | Code of Business Conduct |

| • | Supplier Code of Conduct and regular supplier audits |

| • | Annual training programs for employees addressing information security, intellectual property protection and data protection and privacy |

| • | Anti-Human Trafficking Compliance Plan |

| • | Robust oversight of risk (for additional information, see “Risk Oversight” on page 21 of this Proxy Statement) |

We encourage you to visit www.motorolasolutions.com/investors/corporate-governance.html to obtain more information and view our governance documents, including our Code of Business Conduct and our Board Governance Guidelines, which are publicly available on such website. The information contained on or accessible through our corporate website is not incorporated by reference into and is not a part of this Proxy Statement. Any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Business Conduct will be posted on our website within four business days following the date of the amendment or waiver. There were no waivers in 2023.

Human Capital Management and Succession Planning

Our Board believes that human capital management and succession planning are critical to the Company’s success. Our Board’s involvement in leadership development and succession planning is ongoing throughout the year, and our Board provides input on important decisions in each of these areas. Our Board has primary responsibility for succession planning for the CEO and oversight of other senior management positions. The Compensation and Leadership Committee oversees the development of the process and will periodically report to our Board on succession planning, as described in our Board Governance Guidelines. The entire Board will work with the Compensation and Leadership Committee, or a special committee designated by our Board, to nominate and evaluate potential successors to the CEO. In 2023, our Board reviewed short and long-term succession plans for the CEO and other members of management who are part of our Executive Committee. When assessing possible CEO candidates, our Board identified skills and behavioral characteristics it considers a requirement for the Company’s CEO. Our Board evaluates these succession plans with the overall business strategy in mind. When possible, potential leaders are introduced to our Board through presentations or separate events. The Compensation and Leadership Committee is also regularly updated on key talent indicators for the overall workforce, including recruiting, attrition and development programs.

Risk Oversight

Our approach to enterprise risk management is designed to effectively identify, assess, prioritize, mitigate, and monitor the Company’s principal risks. Management is responsible for the Company’s day-to-day risk management activities. Our Board’s role is to exercise informed risk oversight, which is done both directly and indirectly through its committees. Our Board oversees the business of the Company, including CEO and senior management performance and risk management, to assure that the long-term interests of the shareholders are being served. Each committee of the Board is also responsible for reviewing the risk exposure of the Company related to the committee’s areas of responsibility and providing input to management on such risks. Management and our Board have a robust process embedded throughout the Company to identify, analyze, manage and report all significant risks facing the Company. Our CEO and other senior managers regularly report to our Board on significant risks facing the Company, including financial, ESG, cybersecurity and data privacy, operational, strategic, reputational, M&A/integration and regulatory and compliance risks. Each of the Board committees reviews with management significant risks related to the committee’s area of responsibility and reports to the Board on such risks.