UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-2340

Montgomery Street Income Securities, Inc.

(Exact name of registrant as specified in charter)

225 W. Wacker Drive, Suite 1200

Chicago, IL 60606

(Address of principal executive offices)

Mark D. Nerud, President

225 W. Wacker Drive, Suite 1200

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 338-5801

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 – June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Stockholders.

Montgomery Street

Income Securities, Inc. (MTS)

Semiannual Report to Stockholders

June 30, 2014 (Unaudited)

Montgomery Street Income Securities, Inc. (Unaudited)

Portfolio Manager Review

Portfolio Return

Montgomery Street Income Street Securities, Inc. (the “Fund”) had a total return based on net asset value (“NAV”) of 4.63% for the six-month period ended June 30, 2014. The total return of the Fund, based on the market price of its New York Stock Exchange traded shares, was 8.32% for the same period.1 The Fund’s NAV total return outperformed the Barclays U.S. Aggregate Bond Index, the Fund’s benchmark, which posted a total return of 3.93% for the six-month period.2

Market Review

Both uncertainty and volatility increased at the start of 2014 amid geopolitical tensions and weak economic data. An uncharacteristically cold winter took a toll on the U.S. economy, resulting in a weak first quarter U.S. gross domestic product rate of -2.9%. On the global front, rising geopolitical tensions between Russia and Ukraine at the outset of the year led to volatile swings in financial markets, particularly in equities.

Central banks across the globe continued — and in certain instances increased — their accommodative stance during the first half of the year. Despite the weak first quarter, the U.S. Federal Reserve (“Fed”) continued tapering its asset purchases and remained on track to conclude its purchases by year-end. The Fed also took considerable steps to strengthen its forward guidance on the policy rate. In Fed Chair Janet Yellen’s first statement in March, the Fed dropped references to a 6.5% unemployment target and placed greater emphasis on inflation and other “measures of labor market conditions” as more appropriate barometers for determining the timing of the first interest rate hike. In Europe, the European Central Bank announced new easing measures, including a historic negative rate on deposits, policy rate cut, and targeted long-term refinancing operations to spur business lending.

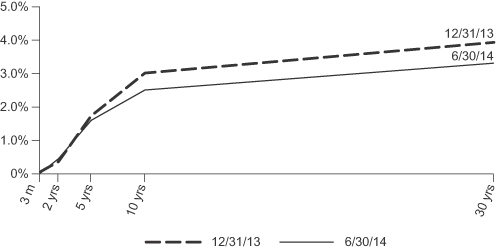

Financial markets, despite the volatility early on, ended the first half of the year in positive territory. Improving global economic data in the second quarter, supportive central banks, and easing of global political risks led to sizable equity market gains overall, with the S&P 500 Index rising 6.05% and hitting an all-time high. Global fixed income markets also posted strong returns, with the Barclays Aggregate Bond index returning 3.93%, benefitting from rate declines across most maturities (e.g., U.S. 10-year Treasury rates declined 50 basis points), and investors began to embrace the view that policy rates will remain lower than historical norms suggest.

U.S. Treasury Bond Yield Curve (Unaudited)

Source: Bloomberg

Performance is historical and does not guarantee future results.

| 1 | Total return based on NAV reflects changes in the Fund’s net asset value during the period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund’s shares traded during the period. Past results are not necessarily indicative of the future performance of the Fund. Investment return and principal value will fluctuate. |

| 2 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage backed securities (agency fixed-rate and hybrid adjustable rate mortgage pass-throughs), asset backed securities and commercial mortgage backed securities. The Index does not include exposure to high yield securities, non-dollar securities or cash. Index returns assume reinvestment of dividends and interest, but, unlike Fund returns, do not reflect fees or expenses. It is not possible to invest directly in an index. |

1

Montgomery Street Income Securities, Inc. (Unaudited)

Portfolio Manager Review

Fund Performance

Given its primary focus on income generation, the Fund remained overweight investment grade credit throughout the period, which contributed to performance as spreads continued to tighten. The yield to maturity for the Fund as of June 30 was 2.96%, versus 2.23% for the benchmark. As seen in the table below, the Fund was focused on the investment grade sector and had a 43 percent allocation to BBB rated securities. Tactical positioning within the high yield sector also added to returns, as high yield securities continued to post strong gains. From an interest rate positioning standpoint, the Fund was focused on short and intermediate maturities and was underweight the long end of the yield curve, which detracted from returns given the rally in longer-dated maturities. An out-of-benchmark allocation to non-Agency mortgage backed securities (“MBS”), included under “Other” in the Sector Distribution Table, which were supported by limited supply and an ongoing housing recovery, continued to add to performance. An underweight to Agency MBS, however, more than offset this positive impact, as they outperformed like-duration Treasuries. An overweight to emerging markets (“EM”), a detractor in 2013, has contributed to returns year-to-date as spreads have tightened. In Latin America, exposure to local interest rates in Mexico and Brazil also added to returns, as yields rallied in these regions.

Quality Distribution (Unaudited)

As of June 30, 2014.

Quality distribution is subject to change.

Portfolio percentages are based on total value of the investment portfolio.

As specified in the investment guidelines, the quality ratings represent the higher of Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Corporation (“S&P”) or Fitch Inc. (“Fitch”) (“Rating Agencies”) credit ratings. The ratings of Moody’s, S&P and Fitch represent these companies’ opinions as to the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality. The Fund may hold unrated securities which are not rated by a Rating Agency if the Investment Adviser determines based on its own independent analysis of the security that the security is of comparable quality to a rated security. A bond’s credit quality does not remove the risk of an increase in interest rates or illiquidity in the market.

2

Montgomery Street Income Securities, Inc. (Unaudited)

Portfolio Manager Review

The investment concentration differences relative to the benchmark included an overweight to investment grade credit and EM, and out-of-index exposure to the high yield sector and non-U.S. developed market bonds, as seen in the sector distribution table below.

Derivatives were used in the Fund and were instrumental in attaining specific exposures targeted to gain from anticipated market developments. The Fund’s exposure to U.S. interest rates, which was negative for returns due to a flattening yield curve, was partly facilitated through the use of interest rate swaps. In Mexico and Brazil, exposure to local interest rates via the use of interest rate swaps and zero coupon swaps contributed to returns, as rates fell in these countries. A portion of the Fund’s credit positioning, which was positioned to take advantage of lower volatility and tightening spreads, added to returns and was implemented via the use of credit default swaps.

Sector Distribution (Unaudited)

As of June 30, 2014.

Sector distribution is subject to change.

Percentages represent total investment, which include the market value of derivative instruments.

3

Montgomery Street Income Securities, Inc. (Unaudited)

Portfolio Manager Review

Outlook and Strategy

The key output from PIMCO’s annual secular forum in May 2014 was an economic framework called The New Neutral, which reflects expectations for low real policy rates and has important implications for global financial markets.

The New Neutral reflects global aggregate demand that is still insufficient to absorb bountiful aggregate supply five years after the financial crisis and despite extraordinary monetary policies. Total global debt outstanding remains at peak levels around the globe, and this combined with subpar growth is constraining central bankers and the process of policy normalization. While we anticipate an upward path for interest rates, the market (and the Fed’s) expectations for future interest rates are likely too aggressive.

This material contains the current opinions of the investment adviser only through the end of the period of the report as stated on the cover. Such opinions are subject to change without notice and should not be construed as a recommendation.

The Fund may not be suitable for all investors and investment in the Fund involves risk. The Fund may be affected by risks that include specific issuer credit risk, sector concentration risk, market capitalization risk and international investing risk. The Fund invests in individual bonds whose yields and value fluctuate so that an investment in the Fund may be worth more or less than its original cost. Bond investments are subject to interest rate risk such that when interest rates rise, the price of the bonds, and thus the value of the Fund, can decline and the investor can lose principal value. The Fund’s investments are also subject to credit risk and liquidity risk. Additionally, investing in foreign securities presents certain unique risks not associated with domestic investments, such as currency fluctuation, political and economic changes, and market risks. Derivative investments are subject to a number of risks such as liquidity risk, regulatory risk, interest rate risk, market risk, leverage risk, counterparty risk, valuation risk, correlation or basis risk, credit risk and management risk. Emerging markets investments may involve greater risk resulting from; less developed and stable economic and political systems, restrictions on investment by foreigners, liquidity and price volatility, exchange controls, confiscations of private property and other government restrictions, security registration, settlement and custody issues. High-yield bonds, lower-rated bonds and unrated securities are typically more sensitive due to adverse economic or political changes or individual developments specific to the issuer, which may result in higher default risk, volatility, lower interest income and market values. Mortgage-related and other asset-backed securities include interest rate risk, legal and documentation risk, extension or contraction/prepayment risk making them more sensitive to change in interest rates. All of these factors may result in greater share price volatility. Closed-end funds, unlike open-end funds, are not continuously offered or redeemed and often trade at a discount to their net asset value.

NOT FDIC/NCUA INSURED. NO BANK GUARANTEE. MAY LOSE VALUE. NOT A DEPOSIT.

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY.

Past performance is no guarantee of future results.

This report is sent to stockholders of Montgomery Street Income Securities, Inc., for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report.

4

Montgomery Street Income Securities, Inc. (Unaudited)

Other Information

June 30, 2014

Market Price and Net Asset Value

The Fund’s market price was $16.68 as of June 30, 2014, compared with $15.54 as of December 31, 2013. The Fund’s shares traded at a 9.0% discount to NAV of $18.33 at June 30, 2014, compared to a 12.1% discount to NAV of $17.68 at December 31, 2013. Shares of closed-end funds frequently trade at a discount to NAV. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of Fund management. The Fund, therefore, cannot predict whether its shares will trade at, below or above its NAV.

The Fund’s market price is published daily in The New York Times and on The Wall Street Journal’s website at www.wsj.com. The Fund’s NAV is available daily on its website at www.montgomerystreetincome.com and published weekly in Barron’s.

Dividends Paid

The Fund paid dividends of $0.15 per share on May 12, 2014 and $0.15 per share on August 11, 2014.

Dividend Reinvestment and Cash Purchase Option

The Fund maintains an optional Dividend Reinvestment and Cash Purchase Plan (“Plan”) for the automatic reinvestment of your dividends and capital gain distributions in shares of the Fund. Stockholders who participate in the Plan also can purchase additional shares of the Fund through the Plan’s voluntary cash investment feature. We recommend that you consider enrolling in the Plan to build your investment. The Plan’s features, including the voluntary cash investment feature, are described on page 33 of this report.

Limited Share Repurchases

The Fund is authorized to repurchase a limited number of shares of the Fund’s common stock from time to time when the shares are trading at less than 95% of their NAV. Repurchases are limited to a number of shares each calendar quarter approximately equal to the number of new shares issued under the Plan with respect to income distributed for the second preceding calendar quarter. There were 4,000 shares repurchased in the first quarter of 2014 and 4,000 shares repurchased in the second quarter of 2014. During the third quarter of 2014, 4,000 shares are expected to be repurchased.

Investment Portfolio

Following the Fund’s first and third quarter ends, a complete Investment Portfolio is filed with the U.S. Securities and Exchange Commission (“SEC”) on Form N-Q. The form is available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com, or on the SEC’s website at www.sec.gov, and it also may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) SEC-0330.

Proxy Voting

Information about how the Fund voted any proxies related to its portfolio securities during the twelve-month period ended June 30, 2014 is available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or on the SEC’s website at www.sec.gov. A description of the policies that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (877) 437-3938 or on the SEC’s website at www.sec.gov.

Under the Fund’s current policy, it is the intention of the Fund to invest exclusively in non-voting securities. Under normal circumstances, the Fund does not intend to hold voting securities. In the event that the Fund does come into possession of any voting securities, the Fund intends to dispose of such securities as soon as it is reasonably practicable and prudent to do so. The Fund’s Board of Directors (the “Board”) may change this policy at any time.

Montgomery Street Income Securities, Inc. (Unaudited)

Other Information

June 30, 2014

Reports to Stockholders

The Fund’s annual and semiannual reports to stockholders will be mailed to stockholders, and also are available in the “Financial Reports” tab on the Fund’s website at www.montgomerystreetincome.com or by calling (877) 437-3938. Those stockholders who wish to view the Fund’s complete Investment Portfolio for the first and third quarters may view the Fund’s Form N-Q, as described above in “Investment Portfolio.”

Investment Objectives

The primary investment objective of the Fund is to seek as high a level of current income as is consistent with prudent investment risks, from a diversified portfolio primarily of debt securities. Capital appreciation is a secondary objective. The investment objectives of the Fund may be changed by the Board without stockholder approval. There can be no assurance that the investment objectives of the Fund will be attained. More information on the Fund’s Investment Objectives, Policies, Restrictions and Strategies is available at http://www.montgomerystreetincome.com, in the 2010 and latter annual reports under “Financial Reports”.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Bonds 59.3% |

| |||||||

| Consumer Discretionary 3.9% |

||||||||

| Cablevision Systems Corp. Term Loan B, 2.65%, 04/09/20 (a) |

134,670 | 133,064 | ||||||

| COX Communications Inc., 6.25%, 06/01/18 (b) |

263,000 | 298,991 | ||||||

| CSC Holdings LLC, 8.63%, 02/15/19 |

2,000,000 | 2,377,500 | ||||||

| Daimler Finance North America LLC, 1.30%, 07/31/15 (b) |

200,000 | 201,613 | ||||||

| Daimler Finance North America LLC, 3.00%, 03/28/16 (b) |

300,000 | 310,482 | ||||||

| NBCUniversal Media LLC, 2.88%, 04/01/16 |

300,000 | 311,341 | ||||||

| Nissan Motor Acceptance Corp., 2.65%, 09/26/18 (c) (d) |

400,000 | 410,449 | ||||||

| Numericable U.S. LLC Term Loan B-1, 4.50%, 04/23/20 (a) |

193,062 | 194,178 | ||||||

| Numericable U.S. LLC Term Loan B-2, 4.50%, 04/23/20 (a) |

167,025 | 167,990 | ||||||

| TCI Communications Inc., 8.75%, 08/01/15 |

35,000 | 38,138 | ||||||

| Time Warner Cable Inc., 8.75%, 02/14/19 |

100,000 | 127,885 | ||||||

| Time Warner Cable Inc., 8.25%, 04/01/19 |

290,000 | 367,419 | ||||||

| Venetian Casino Resort LLC Term Loan, 3.25%, 12/16/20 (a) |

1,200,000 | 1,199,316 | ||||||

| Viacom Inc., 4.25%, 09/15/15 |

200,000 | 208,590 | ||||||

| Wynn Las Vegas LLC, 5.38%, 03/15/22 |

500,000 | 520,625 | ||||||

| Wynn Macau Ltd., 5.25%, 10/15/21 (b) |

500,000 | 513,750 | ||||||

|

|

|

|||||||

| 7,381,331 | ||||||||

| Consumer Staples 1.9% |

||||||||

| Altria Group Inc., 9.70%, 11/10/18 (e) |

664,000 | 869,955 | ||||||

| Altria Group Inc., 9.25%, 08/06/19 (e) |

111,000 | 147,486 | ||||||

| ConAgra Foods Inc., 1.90%, 01/25/18 |

800,000 | 801,839 | ||||||

| Kraft Foods Group Inc., 2.25%, 06/05/17 |

600,000 | 615,907 | ||||||

| Kraft Foods Group Inc., 5.38%, 02/10/20 |

268,000 | 304,786 | ||||||

| Reynolds American Inc., 1.05%, 10/30/15 |

950,000 | 949,768 | ||||||

|

|

|

|||||||

| 3,689,741 | ||||||||

| Energy 11.8% |

||||||||

| AK Transneft OJSC Via TransCapitalInvest Ltd., 8.70%, 08/07/18 |

2,150,000 | 2,558,500 | ||||||

| Anadarko Petroleum Corp., 6.45%, 09/15/36 |

800,000 | 1,018,706 | ||||||

| Canadian Natural Resources Ltd., 0.61%, 03/30/16 (a) |

50,000 | 50,108 | ||||||

| Canadian Oil Sands Ltd., 7.75%, 05/15/19 (b) |

1,000,000 | 1,230,440 | ||||||

| Canadian Oil Sands Ltd., 4.50%, 04/01/22 (b) |

1,000,000 | 1,055,931 | ||||||

| CNOOC Nexen Finance 2014 ULC, 1.63%, 04/30/17 |

400,000 | 400,968 | ||||||

| CNPC General Capital Ltd., 1.13%, 05/14/17 (a) (b) |

600,000 | 601,681 | ||||||

| Dolphin Energy Ltd., 5.50%, 12/15/21 (b) |

800,000 | 909,000 | ||||||

| El Paso Pipeline Partners Operating Co. LLC, 6.50%, 04/01/20 |

1,000,000 | 1,171,186 | ||||||

| Energy Future Intermediate Holding Company LLC Term Loan, 4.25%, 04/28/16 (a) |

1,742,057 | 1,752,631 | ||||||

| MarkWest Energy Partners LP, 5.50%, 02/15/23 |

500,000 | 533,750 | ||||||

| MarkWest Energy Partners LP, 4.50%, 07/15/23 |

200,000 | 204,000 | ||||||

| Midcontinent Express Pipeline LLC, 6.70%, 09/15/19 (b) |

400,000 | 442,000 | ||||||

| Novatek OAO via Novatek Finance Ltd., 6.60%, 02/03/21 (b) |

800,000 | 856,000 | ||||||

| Petrobras Global Finance BV, 2.59%, 03/17/17 (a) |

1,200,000 | 1,214,280 | ||||||

| Petrobras Global Finance BV, 3.11%, 03/17/20 (a) |

400,000 | 410,980 | ||||||

| Petrobras International Finance Co., 7.88%, 03/15/19 |

300,000 | 349,752 | ||||||

| Pioneer Natural Resources Co., 6.88%, 05/01/18 |

2,000,000 | 2,363,178 | ||||||

| Pioneer Natural Resources Co., 7.20%, 01/15/28 |

200,000 | 254,916 | ||||||

| Plains All American Pipeline LP, 8.75%, 05/01/19 |

1,000,000 | 1,287,260 | ||||||

| Pride International Inc., 6.88%, 08/15/20 |

621,000 | 754,478 | ||||||

| Ras Laffan Liquefied Natural Gas Co. Ltd. III, 5.30%, 09/30/20 |

665,200 | 723,405 | ||||||

| Rockies Express Pipeline LLC, 3.90%, 04/15/15 (b) |

200,000 | 202,000 | ||||||

| Rosneft Finance SA, 7.88%, 03/13/18 |

500,000 | 570,625 | ||||||

| Sinopec Group Overseas Development Ltd., 1.01%, 04/10/17 (a) (b) |

900,000 | 900,736 | ||||||

| Targa Resources Partners LP, 5.25%, 05/01/23 |

400,000 | 418,000 | ||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| Principal Amount ($) |

Value ($) | |||||||

| Transcontinental Gas Pipe Line Co. LLC, 6.40%, 04/15/16 |

250,000 | 273,234 | ||||||

|

|

|

|||||||

| 22,507,745 | ||||||||

| Financials 29.0% |

||||||||

| Ally Financial Inc., 3.50%, 01/27/19 |

800,000 | 807,760 | ||||||

| American Tower Corp., 3.40%, 02/15/19 |

300,000 | 313,803 | ||||||

| Banco de Credito del Peru, 4.25%, 04/01/23 (b) |

200,000 | 200,500 | ||||||

| Banco do Brasil SA, 6.00%, 01/22/20 (b) |

500,000 | 551,250 | ||||||

| Banco Santander Brasil SA, 4.50%, 04/06/15 (b) |

600,000 | 613,500 | ||||||

| Banco Santander Brasil SA, 4.50%, 04/06/15 |

300,000 | 306,750 | ||||||

| Banco Santander Chile, 3.75%, 09/22/15 (b) |

500,000 | 514,952 | ||||||

| Banco Votorantim SA, 5.25%, 02/11/16 (b) |

400,000 | 417,000 | ||||||

| Bank of America Corp., 6.00%, 09/01/17 |

115,000 | 129,899 | ||||||

| Bank of America Corp., 2.65%, 04/01/19 |

800,000 | 810,762 | ||||||

| Bank of America NA, 0.64%, 05/08/17 (a) |

600,000 | 599,654 | ||||||

| Barclays Bank Plc, 10.18%, 06/12/21 (b) |

1,400,000 | 1,936,494 | ||||||

| Barclays Bank Plc, 7.63%, 11/21/22 |

300,000 | 341,250 | ||||||

| BBVA Bancomer SA, 4.50%, 03/10/16 (b) |

500,000 | 526,250 | ||||||

| BBVA Bancomer SA, 6.50%, 03/10/21 (b) |

400,000 | 451,000 | ||||||

| Bear Stearns Cos. LLC, 6.40%, 10/02/17 |

400,000 | 461,098 | ||||||

| BNP Paribas, 7.78% (callable at 100 beginning 07/02/18) (f) (g), EUR |

300,000 | 488,061 | ||||||

| BPCE SA, 0.86%, 06/17/17 (a) |

500,000 | 499,850 | ||||||

| CBA Capital Trust II, 6.02% (callable at 100 beginning 03/15/16) (b) (f) (g) |

200,000 | 210,500 | ||||||

| Citigroup Inc., 0.84%, 05/31/17 (a), EUR |

800,000 | 1,079,009 | ||||||

| Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, 11.00% (callable at 100 beginning |

1,000,000 | 1,342,690 | ||||||

| Credit Agricole SA, 7.88% (callable at 100 beginning 01/23/24) (f) (g) |

200,000 | 218,500 | ||||||

| Credit Suisse AG, 5.75%, 09/18/25, EUR |

300,000 | 458,031 | ||||||

| Export-Import Bank of Korea, 4.00%, 01/11/17 |

2,700,000 | 2,881,545 | ||||||

| Export-Import Bank of Korea, 4.00%, 01/29/21 |

200,000 | 212,411 | ||||||

| Ford Motor Credit Co. LLC, 5.63%, 09/15/15 |

2,000,000 | 2,115,794 | ||||||

| Ford Motor Credit Co. LLC, 3.98%, 06/15/16 |

500,000 | 528,297 | ||||||

| Goldman Sachs Group Inc., 5.95%, 01/18/18 |

650,000 | 739,550 | ||||||

| Goldman Sachs Group Inc., 6.15%, 04/01/18 |

600,000 | 687,316 | ||||||

| Goldman Sachs Group Inc., 6.00%, 06/15/20 |

2,000,000 | 2,330,822 | ||||||

| HBOS Plc, 6.75%, 05/21/18 (b) |

700,000 | 806,329 | ||||||

| Host Hotels & Resorts LP, 6.00%, 11/01/20 |

450,000 | 491,065 | ||||||

| HSBC Finance Corp., 6.68%, 01/15/21 |

300,000 | 358,630 | ||||||

| ICICI Bank Ltd., 4.75%, 11/25/16 (b) |

300,000 | 315,897 | ||||||

| International Lease Finance Corp., 7.13%, 09/01/18 (b) |

1,700,000 | 1,972,000 | ||||||

| Intesa Sanpaolo SpA, 3.13%, 01/15/16 |

200,000 | 205,569 | ||||||

| IPIC GMTN Ltd., 5.88%, 03/14/21, EUR |

200,000 | 341,640 | ||||||

| JPMorgan Chase & Co., 0.78%, 04/25/18 (a) |

1,000,000 | 999,997 | ||||||

| JPMorgan Chase & Co., 6.30%, 04/23/19 |

2,500,000 | 2,955,395 | ||||||

| JPMorgan Chase Bank NA, 0.86%, 05/31/17 (a), EUR |

100,000 | 136,300 | ||||||

| JPMorgan Chase Bank NA, 0.65%, 06/02/17 (a) |

400,000 | 400,228 | ||||||

| JPMorgan Chase Bank NA, 6.00%, 10/01/17 |

600,000 | 681,964 | ||||||

| Korea Exchange Bank, 3.13%, 06/26/17 (b) |

400,000 | 415,730 | ||||||

| Lazard Group LLC, 6.85%, 06/15/17 |

500,000 | 567,179 | ||||||

| LBG Capital No.2 Plc, 15.00%, 12/21/19 (h), GBP |

100,000 | 248,152 | ||||||

| LeasePlan Corp NV, 3.00%, 10/23/17 (b) |

500,000 | 520,523 | ||||||

| Lloyds Banking Group Plc, 7.50% (callable at 100 beginning 06/27/24) (f) (g) |

477,000 | 507,528 | ||||||

| Merrill Lynch & Co. Inc., 6.88%, 04/25/18 |

2,400,000 | 2,825,414 | ||||||

| Morgan Stanley, 6.63%, 04/01/18 |

1,000,000 | 1,168,844 | ||||||

| Morgan Stanley, 7.30%, 05/13/19 |

800,000 | 978,063 | ||||||

| Morgan Stanley, 5.50%, 01/26/20 |

2,850,000 | 3,261,500 | ||||||

| Rabobank Capital Funding Trust III, 5.25% (callable at 100 beginning 10/21/16) (c) (d) (f) (g) |

800,000 | 840,000 | ||||||

| Russian Agricultural Bank OJSC Via RSHB Capital SA, 6.30%, 05/15/17 |

300,000 | 316,500 | ||||||

| Sberbank of Russia Via SB Capital SA, 5.50%, 07/07/15 |

700,000 | 725,914 | ||||||

| Sberbank Via SB Capital SA, 5.40%, 03/24/17 |

600,000 | 638,280 | ||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| Principal Amount ($) |

Value ($) | |||||||

| Shinhan Bank, 4.13%, 10/04/16 (b) |

200,000 | 212,720 | ||||||

| SLM Corp., 3.88%, 09/10/15 |

1,000,000 | 1,020,000 | ||||||

| SLM Corp., 8.45%, 06/15/18 |

500,000 | 591,250 | ||||||

| SLM Corp., 5.50%, 01/15/19 |

200,000 | 212,500 | ||||||

| Springleaf Finance Corp., 6.90%, 12/15/17 |

500,000 | 555,000 | ||||||

| State Bank of India, 3.25%, 04/18/18 (b) |

800,000 | 804,720 | ||||||

| Sumitomo Mitsui Financial Group Inc., 4.44%, 04/02/24 (c) (d) |

350,000 | 365,558 | ||||||

| Sydney Airport Finance Co. Pty Ltd., 5.13%, 02/22/21 (b) (e) |

2,100,000 | 2,330,191 | ||||||

| UBS AG, 7.63%, 08/17/22 |

300,000 | 361,059 | ||||||

| UBS AG Stamford, 5.88%, 12/20/17 |

175,000 | 199,844 | ||||||

| Union Bank NA, 0.98%, 09/26/16 (a) |

500,000 | 505,004 | ||||||

| Union Bank NA, 0.62%, 05/05/17 (a) |

700,000 | 699,604 | ||||||

| USB Capital IX, 3.50% (callable at 100 beginning 02/07/13) (f) (g) |

625,000 | 532,813 | ||||||

| Ventas Realty LP, 3.13%, 11/30/15 |

100,000 | 103,211 | ||||||

| Weyerhaeuser Co., 7.38%, 10/01/19 |

1,000,000 | 1,231,205 | ||||||

|

|

|

|||||||

| 55,177,618 | ||||||||

| Health Care 1.7% |

||||||||

| Boston Scientific Corp., 6.40%, 06/15/16 |

1,200,000 | 1,323,187 | ||||||

| HCA Inc., 6.50%, 02/15/20 |

1,700,000 | 1,912,500 | ||||||

|

|

|

|||||||

| 3,235,687 | ||||||||

| Industrials 1.8% |

||||||||

| Asciano Finance Ltd., 5.00%, 04/07/18 (b) |

300,000 | 326,625 | ||||||

| Aviation Capital Group Corp., 7.13%, 10/15/20 (b) |

600,000 | 691,275 | ||||||

| AWAS Aviation Capital Ltd., 7.00%, 10/17/16 (b) |

664,000 | 683,920 | ||||||

| Masco Corp., 4.80%, 06/15/15 |

400,000 | 414,033 | ||||||

| Masco Corp., 6.13%, 10/03/16 |

300,000 | 330,375 | ||||||

| Masco Corp., 5.85%, 03/15/17 |

450,000 | 496,125 | ||||||

| Masco Corp., 6.63%, 04/15/18 |

400,000 | 449,000 | ||||||

|

|

|

|||||||

| 3,391,353 | ||||||||

| Information Technology 1.2% |

||||||||

| Activision Blizzard Inc. Term Loan B, 3.25%, 09/15/20 (a) |

84,750 | 84,894 | ||||||

| Baidu Inc., 2.75%, 06/09/19 |

400,000 | 401,497 | ||||||

| Dell Inc. Term Loan B, 3.75%, 09/24/18 (a) |

950,000 | 948,594 | ||||||

| Tencent Holdings Ltd., 3.38%, 05/02/19 (b) |

900,000 | 920,001 | ||||||

|

|

|

|||||||

| 2,354,986 | ||||||||

| Materials 2.4% |

||||||||

| ALROSA Finance SA, 7.75%, 11/03/20 (b) |

500,000 | 553,150 | ||||||

| Anglo American Capital Plc, 1.18%, 04/15/16 (a) (c) (d) |

400,000 | 401,270 | ||||||

| Dow Chemical Co., 8.55%, 05/15/19 (e) |

990,000 | 1,272,336 | ||||||

| Georgia-Pacific LLC, 5.40%, 11/01/20 (b) |

1,600,000 | 1,846,463 | ||||||

| Metalloinvest Finance Ltd., 5.63%, 04/17/20 (b) |

400,000 | 388,000 | ||||||

|

|

|

|||||||

| 4,461,219 | ||||||||

| Telecommunication Services 4.1% |

||||||||

| AT&T Inc., 0.65%, 03/30/17 (a) |

500,000 | 500,951 | ||||||

| Crown Castle International Co. New Term Loan B, 3.00%, 01/31/21 (a) |

400,000 | 399,804 | ||||||

| Crown Castle International Corp., 5.25%, 01/15/23 |

500,000 | 521,250 | ||||||

| Orange SA, 2.13%, 09/16/15 |

600,000 | 609,201 | ||||||

| Qtel International Finance Ltd., 4.75%, 02/16/21 (b) |

300,000 | 325,950 | ||||||

| Rogers Communications Inc., 7.50%, 03/15/15 |

179,000 | 187,643 | ||||||

| Telecom Italia Capital SA, 7.00%, 06/04/18 |

100,000 | 114,750 | ||||||

| Telecom Italia SpA, 7.38%, 12/15/17, GBP |

650,000 | 1,250,620 | ||||||

| Telecom Italia SpA, 6.38%, 06/24/19, GBP |

300,000 | 558,742 | ||||||

| Telefonica Emisiones SAU, 3.73%, 04/27/15 |

1,400,000 | 1,434,201 | ||||||

| Verizon Communications Inc., 1.76%, 09/15/16 (a) |

700,000 | 719,283 | ||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| Principal Amount ($) |

Value ($) | |||||||

| Verizon Communications Inc., 4.50%, 09/15/20 |

1,000,000 | 1,099,796 | ||||||

|

|

|

|||||||

| 7,722,191 | ||||||||

| Utilities 1.5% |

||||||||

| Centrais Eletricas Brasileiras SA, 6.88%, 07/30/19 |

400,000 | 444,000 | ||||||

| Duquesne Light Holdings Inc., 6.40%, 09/15/20 (b) |

400,000 | 474,864 | ||||||

| Florida Power Corp., 5.80%, 09/15/17 |

195,000 | 222,896 | ||||||

| Korea East-West Power Co. Ltd., 2.50%, 07/16/17 (b) |

1,400,000 | 1,428,214 | ||||||

| Saudi Electricity Global Sukuk Co. 2, 5.06%, 04/08/43 (b) |

200,000 | 194,750 | ||||||

|

|

|

|||||||

| 2,764,724 | ||||||||

|

|

||||||||

| Total Corporate Bonds (cost $106,017,731)

|

|

|

112,686,595

|

| ||||

| Non-U.S. Government Agency Asset-Backed Securities 5.4% |

| |||||||

| Aegis Asset Backed Securities Trust REMIC, (2005, 3, M1), 0.62%, 08/25/35 (a) |

952,841 | 938,333 | ||||||

| American Airlines Pass-Through Trust, (2013, 2, A), 4.95%, 01/15/23 (b) |

388,160 | 420,669 | ||||||

| Banc of America Funding Trust REMIC, (2004, A, 1A3), 5.14%, 09/20/34 (a) |

230,487 | 230,731 | ||||||

| Banc of America Mortgage Securities Inc. REMIC, (2005, H, 2A5), 2.77%, 09/25/35 (a) |

758,746 | 720,058 | ||||||

| Bayview Commercial Asset Trust, Interest Only REMIC, (2007, 2A, IO), 4.13%, 07/25/37 (a) (b) |

3,301,404 | — | ||||||

| Bayview Commercial Asset Trust, Interest Only REMIC, (2007, 4A, IO), 3.53%, 09/25/37 (a) (b) |

3,670,511 | 232,050 | ||||||

| Bear Stearns Adjustable Rate Mortgage Trust REMIC, (2004, 6, 2A1), 2.82%, 09/25/34 (a) |

513,806 | 484,081 | ||||||

| Citigroup Mortgage Loan Trust Inc. REMIC, (2004, NCM2, 1CB2), 6.75%, 08/25/34 |

123,861 | 133,151 | ||||||

| Continental Airlines Inc. Pass-Through Trust, (2009, 1, A), 9.00%, 07/08/16 |

1,549,954 | 1,751,448 | ||||||

| Credit Suisse First Boston Mortgage Securities Corp. REMIC, (2004, AR8, 2A1), 2.58%, 09/25/34 (a) |

704,092 | 709,177 | ||||||

| Credit-Based Asset Servicing and Securitization LLC REMIC, (2006, SC1, A), 0.42%, 05/25/36 (a) (b) |

61,675 | 57,471 | ||||||

| Holmes Master Issuer Plc, (2011, 1A, A3), 1.68%, 10/15/54 (a) (b), EUR |

259,528 | 355,506 | ||||||

| IndyMac INDX Mortgage Loan Trust REMIC, (2005, AR14, 2A1A), 0.45%, 07/25/35 (a) |

53,314 | 47,380 | ||||||

| Inwood Park CDO Ltd., (2006, 1A, A1A), 0.45%, 01/20/21 (a) (b) |

98,000 | 97,335 | ||||||

| Nationstar NIM Ltd. Trust, (2007, A, A), 9.79%, 03/25/37 (i) (j) |

22,008 | — | ||||||

| Truman Capital Mortgage Loan Trust REMIC, (2006, 1, A), 0.41%, 03/25/36 (a) (b) |

1,223,129 | 1,141,358 | ||||||

| United Air Lines Inc. Pass-Through Trust, (2009, 1A, O), 10.40%, 11/01/16 |

787,020 | 895,235 | ||||||

| Washington Mutual Mortgage Pass-Through Certificates REMIC, (2005, AR16, 1A3), 2.36%, 12/25/35 (a) |

1,087,288 | 1,048,163 | ||||||

| Washington Mutual Mortgage Pass-Through Certificates REMIC, (2006, 5, 2CB1), 6.00%, 07/25/36 |

1,098,081 | 843,378 | ||||||

| Wells Fargo Mortgage Backed Securities Trust REMIC, (2006, 1, A3), 5.00%, 03/25/21 |

145,963 | 149,293 | ||||||

|

|

||||||||

| Total Non-U.S. Government Agency Asset-Backed Securities (cost $10,250,219)

|

|

|

10,254,817

|

| ||||

| Government and Agency Obligations 29.8% |

| |||||||

| Government Securities 29.8% |

||||||||

| Sovereign 7.7% |

||||||||

| Australia Government Bond, 5.50%, 04/21/23, AUD |

386,000 | 419,926 | ||||||

| Banco Nacional de Desenvolvimento Economico e Social, 5.50%, 07/12/20 (b) |

400,000 | 433,380 | ||||||

| Brazil Notas do Tesouro Nacional, 10.00%, 01/01/21, BRL |

4,730,000 | 1,956,075 | ||||||

| Brazil Notas do Tesouro Nacional, 10.00%, 01/01/23, BRL |

190,000 | 76,958 | ||||||

| Brazil Notas do Tesouro Nacional, 10.00%, 01/01/25, BRL |

3,810,000 | 1,508,929 | ||||||

| Italy Buoni Poliennali Del Tesoro, 3.75%, 05/01/21, EUR |

800,000 | 1,214,876 | ||||||

| Italy Buoni Poliennali Del Tesoro, 5.50%, 11/01/22, EUR |

2,200,000 | 3,694,753 | ||||||

| Slovenia Government International Bond, 4.70%, 11/01/16 (b), EUR |

400,000 | 593,011 | ||||||

| Spain Government Bond, 2.75%, 04/30/19, EUR |

2,365,000 | 3,456,987 | ||||||

| Spain Government Bond, 5.85%, 01/31/22, EUR |

685,000 | 1,180,399 | ||||||

|

|

|

|||||||

| 14,535,294 | ||||||||

| U.S. Treasury Securities 22.1% |

||||||||

| U.S. Treasury Bond, 3.63%, 08/15/43 |

2,500,000 | 2,635,155 | ||||||

| U.S. Treasury Bond, 0.00%, 11/15/43 (k) |

1,800,000 | 642,636 | ||||||

| U.S. Treasury Bond, 3.75%, 11/15/43 |

4,400,000 | 4,742,373 | ||||||

| U.S. Treasury Bond, 3.63%, 02/15/44 |

800,000 | 842,500 | ||||||

| U.S. Treasury Note, 0.25%, 09/15/14 (l) |

100,000 | 100,035 | ||||||

| U.S. Treasury Note, 0.25%, 09/30/14 (l) |

331,000 | 331,155 | ||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| Contracts/ Principal |

Value ($) | |||||||

|

|

|

|||||||

| U.S. Treasury Note, 0.25%, 10/31/14 (l) |

26,000 | 26,016 | ||||||

| U.S. Treasury Note, 1.75%, 05/15/23 (l) |

10,100,000 | 9,561,074 | ||||||

| U.S. Treasury Note, 2.50%, 08/15/23 |

7,590,000 | 7,630,918 | ||||||

| U.S. Treasury Note, 2.75%, 11/15/23 (l) |

1,800,000 | 1,843,735 | ||||||

| U.S. Treasury Note, 2.75%, 02/15/24 |

9,600,000 | 9,811,498 | ||||||

| U.S. Treasury Note, 2.50%, 05/15/24 |

3,900,000 | 3,892,079 | ||||||

|

|

|

|||||||

| 42,059,174 | ||||||||

| U.S. Government Agency Mortgage-Backed Securities 0.0% |

||||||||

| Federal Home Loan Mortgage Corp. 0.0% |

||||||||

| Federal Home Loan Mortgage Corp. REMIC, 7.00%, 08/15/21 |

9,262 | 10,165 | ||||||

|

|

||||||||

| Total Government and Agency Obligations (cost $55,287,283)

|

56,604,633 | |||||||

| Purchased Options 0.1% |

||||||||

| Interest Rate Put Swaption, 3 month LIBOR versus 3.45% fixed, Expiration 09/21/15, BBP (c) |

22 | 129,985 | ||||||

|

|

||||||||

| Total Purchased Options (cost $174,446) |

129,985 | |||||||

| Short Term Investments 4.6% |

||||||||

| Repurchase Agreements 1.1% |

||||||||

| Repurchase Agreement with CGM, 0.10% (Collateralized by $2,175,000 U.S. Treasury Note, 1.88%, due 09/30/17, value $2,234,897) acquired 06/30/14, due 07/02/14 at $2,200,006 |

2,200,000 | 2,200,000 | ||||||

| Certificates of Deposit 3.5% |

||||||||

| Banco Bilbao Vizcaya Argentaria, 0.98%, 10/23/15 |

500,000 | 499,869 | ||||||

| Banco Bilbao Vizcaya Argentaria, 1.08%, 05/16/16 (a) |

500,000 | 499,806 | ||||||

| Credit Suisse, 0.55%, 08/24/15 (a) |

500,000 | 499,713 | ||||||

| Credit Suisse, 0.60%, 01/28/16 (a) |

800,000 | 800,194 | ||||||

| Intesa Sanpaolo SpA, 1.61%, 04/11/16 (a) |

400,000 | 403,716 | ||||||

| Intesa Sanpaolo SpA, 1.65%, 04/07/15 |

1,500,000 | 1,502,640 | ||||||

| Itau Unibanco, 1.51%, 05/31/16 (a) |

2,400,000 | 2,396,827 | ||||||

|

|

||||||||

| Total Short Term Investments (cost $8,799,956) |

8,802,765 | |||||||

|

|

||||||||

| Total Investments - 99.2% (cost $180,529,635) |

188,478,795 | |||||||

| Total Forward Sales Commitments - (0.9%) (proceeds $1,665,391) |

(1,678,595) | |||||||

| Other Assets and Liabilities, Net 1.7% |

3,239,232 | |||||||

|

|

||||||||

| Total Net Assets - 100%

|

$

|

190,039,432

|

| |||||

| Forward Sales Commitments (0.9%) |

||||||||

| U.S. Government Agency Mortgage-Backed Securities (0.9%) |

||||||||

| Federal National Mortgage Association, 5.50%, 07/15/44, TBA (m) |

$ | (1,500,000) | $ | (1,678,595) | ||||

|

|

||||||||

| Total Forward Sales Commitments (proceeds $1,665,391) |

$ | (1,678,595) | ||||||

| (a) | Floating rate note. Floating rate notes are securities whose yields vary with a designated market index or market rate. Rate stated was in effect as of June 30, 2014. |

| (b) | The Fund’s investment advisor has deemed this security, which is exempt from registration under the Securities Act of 1933 security to be liquid based on procedures approved by the Fund’s Board of Directors. As of June 30, 2014, the aggregate value of these liquid securities was $32,828,861, which represented 17.3% of net assets. |

| (c) | The Fund’s investment advisor has deemed this security to be illiquid based on procedures approved by the Fund’s Board of Directors. |

| (d) | Security is restricted to resale to institutional investors. See Restricted Securities in the Notes to the Investment Portfolio. |

| (e) | The interest rate for this security is inversely affected by upgrades or downgrades to the credit rating of the issuer. |

| (f) | Perpetual maturity security. |

| (g) | Interest rate is fixed until stated call date and variable thereafter. |

| (h) | Convertible security. |

| (i) | Security is in default relating to principal and/or interest. |

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Investment Portfolio

June 30, 2014

| (j) | Non-income producing security. |

| (k) | Security issued with a zero coupon. Income is recognized through the accretion of discount. |

| (l) | All or a portion of the security is pledged or segregated as collateral. See the Notes to Financial Statements. |

| (m) | All or a portion of the investment was sold on a delayed delivery basis. As of June 30, 2014, the total proceeds of investments sold on a delayed delivery basis was $1,665,391. |

| Currencies: |

||

| AUD - Australian Dollar |

INR - Indian Rupee | |

| BRL - Brazilian Real |

JPY - Japanese Yen | |

| EUR - European Currency Unit (Euro) |

MXN - Mexican Peso | |

| GBP - British Pound |

USD - United States Dollar |

| Abbreviations: |

||

| ABS - Asset Backed Securities |

NIM - Net Interest Margin | |

| CDO - Collateralized Debt Obligation |

OTC - Over the counter | |

| Euribor - Europe Interbank Offered Rate Grade |

REMIC - Real Estate Mortgage Investment Conduit | |

| iTraxx - Group of international credit derivative indices |

TBA - To Be Announced (Securities purchased | |

| monitored by the International Index Company |

on a delayed delivery basis) | |

| LIBOR - London Interbank Offered Rate |

| Counterparty Abbreviations: |

||

| BBP - Barclays Bank Plc |

||

| CGM - Citigroup Global Markets |

||

| GSB - Goldmans Sachs Bank |

||

| GSI - Goldman Sachs International |

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Notes to Investment Portfolio

June 30, 2014

Restricted Securities. The Fund invests in securities that are restricted under the Securities Act of 1933 or which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted securities are often purchased in private placement transactions and cannot be sold without prior registration unless the sale is pursuant to an exemption under the Securities Exchange Act of 1933, as amended. As of June 30, 2014, the Fund held investments in restricted securities, excluding certain securities exempt from registration under the 1933 Act which are deemed to be liquid, as follows:

| Initial Acquisition Date |

Cost | Ending Value |

Percent of Net Assets |

|||||||||||||

| Anglo American Capital Plc , 1.18%, 04/15/16 |

04/09/2014 | $ | 400,000 | $ | 401,270 | 0.2% | ||||||||||

| Nissan Motor Acceptance Corp. , 2.65%, 09/26/18 |

03/24/2014 | 405,911 | 410,449 | 0.2 | ||||||||||||

| Rabobank Capital Funding Trust III , 5.25% (callable at 100 beginning 10/21/16) |

03/25/2010 | 728,316 | 840,000 | 0.5 | ||||||||||||

| Sumitomo Mitsui Financial Group Inc. , 4.44%, 04/02/24 |

03/27/2014 | 350,000 | 365,558 | 0.2 | ||||||||||||

|

|

|

|||||||||||||||

| $ | 1,884,227 | $ | 2,017,277 | 1.1% | ||||||||||||

|

|

|

|||||||||||||||

Schedule of Written Options

| Expiration Date |

Exercise Price |

Contracts/ Notional Contracts |

Value | |||||||||||||||||

| Foreign Currency Options |

||||||||||||||||||||

| Brazilian Real versus USD Call Option, GSB |

06/02/2015 | BRL | 2.70 | 500,000 | $ | (9,881) | ||||||||||||||

| Indian Rupee versus USD Call Option, GSB |

06/02/2015 | INR | 67.00 | 400,000 | (7,591) | |||||||||||||||

| Index Options |

||||||||||||||||||||

| iTraxx Europe Main Series 21 Put Option, GSI |

06/20/2019 | 1.00 | 56 | (4,240) | ||||||||||||||||

| Interest Rate Swaptions |

||||||||||||||||||||

| Put Swaption, 3-Month LIBOR versus 2.50% fixed, BBP |

09/21/2015 | N/A | 92 | (139,782) | ||||||||||||||||

|

|

|

|||||||||||||||||||

| 900,148 | $ | (161,494) | ||||||||||||||||||

|

|

|

|||||||||||||||||||

Summary of Written Options

| Contracts/ Notional Contracts |

Premiums | |||||||

| Options outstanding at December 31, 2013 |

1,823 | $ | 541,431 | |||||

| Options written during the period |

900,501 | 172,899 | ||||||

| Options closed during the period |

(1,015 | ) | (138,212) | |||||

| Options expired during the period |

(1,161 | ) | (368,274) | |||||

|

|

|

|||||||

| Options outstanding at June 30, 2014 |

900,148 | $ | 207,844 | |||||

|

|

|

|||||||

Schedule of Exchange Traded Futures Options

| Expiration Date |

Exercise Price |

Variation Margin (Payable) |

Written Contracts |

Unrealized (Depreciation) |

||||||||||||||||

| 3-Month Euro Euribor Interest Rate Future Call Option |

12/15/2014 | EUR 99.50 | $ | (2,259) | 66 | $ | (31,851) | |||||||||||||

| 3-Month Euro Euribor Interest Rate Future Put Option |

12/15/2014 | EUR 99.50 | — | 66 | 59,896 | |||||||||||||||

|

|

|

|||||||||||||||||||

| $ | (2,259) | 132 | $ | 28,045 | ||||||||||||||||

|

|

|

|||||||||||||||||||

Schedule of Open Futures Contracts

| Contracts Long |

Unrealized Appreciation |

|||||

| 5-Year USD Deliverable Interest Rate Swap Future, Expiration September 2014 |

19 | $ | 6,510 | |||

| 90-Day Eurodollar Future, Expiration March 2015 |

129 | 50,078 | ||||

|

|

|

|||||

| $ | 56,588 | |||||

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Notes to Investment Portfolio

June 30, 2014

Schedule of Open Forward Foreign Currency Contracts

| Counterparty | Currency Purchased/Sold |

Settlement Date |

Notional Amount |

Currency Value |

Unrealized Gain/(Loss) | |||||||

| GSB |

BRL/USD | 07/02/2014 | BRL | 1,569,645 | $ 710,407 | $ 17,407 | ||||||

| GSB |

BRL/USD | 07/02/2014 | BRL | 1,571,031 | 711,035 | 18,035 | ||||||

| BBP |

INR/USD | 07/23/2014 | INR | 32,048,660 | 529,980 | (8,020) | ||||||

| BBP |

INR/USD | 07/23/2014 | INR | 17,982,000 | 297,363 | (2,637) | ||||||

| GSB |

MXN/USD | 08/25/2014 | MXN | 2,975,000 | 228,435 | 2,586 | ||||||

| GSB |

MXN/USD | 09/23/2014 | MXN | 8,556,328 | 655,736 | (348) | ||||||

| GSB |

USD/AUD | 07/02/2014 | AUD | (428,000) | (403,583) | (5,904) | ||||||

| GSB |

USD/AUD | 08/05/2014 | AUD | (428,000) | (402,501) | (1,344) | ||||||

| BBP |

USD/BRL | 07/02/2014 | BRL | (552,894) | (250,235) | (3,187) | ||||||

| BBP |

USD/BRL | 07/02/2014 | BRL | (1,203,000) | (544,467) | (11,978) | ||||||

| BBP |

USD/BRL | 07/02/2014 | BRL | (4,263,770) | (1,929,744) | (148,051) | ||||||

| BBP |

USD/BRL | 08/04/2014 | BRL | (1,310,000) | (586,876) | (41,747) | ||||||

| BBP |

USD/BRL | 08/04/2014 | BRL | (2,878,988) | (1,289,779) | 9,785 | ||||||

| GSB |

USD/BRL | 10/02/2014 | BRL | (124,818) | (55,011) | (1,080) | ||||||

| GSB |

USD/BRL | 10/02/2014 | BRL | (125,447) | (55,289) | (1,289) | ||||||

| GSB |

USD/BRL | 10/02/2014 | BRL | (50,699) | (22,345) | (345) | ||||||

| GSB |

USD/BRL | 01/05/2015 | BRL | (1,651,558) | (709,700) | (16,700) | ||||||

| GSB |

USD/BRL | 01/05/2015 | BRL | (1,653,082) | (710,355) | (17,355) | ||||||

| BBP |

USD/EUR | 08/21/2014 | EUR | (6,210,000) | (8,505,024) | (24,075) | ||||||

| GSB |

USD/EUR | 08/21/2014 | EUR | (820,000) | (1,123,047) | (13,280) | ||||||

| BBP |

USD/EUR | 08/21/2014 | EUR | (1,052,000) | (1,440,787) | (11,279) | ||||||

| GSB |

USD/EUR | 08/21/2014 | EUR | (1,516,000) | (2,076,267) | (16,849) | ||||||

| BBP |

USD/EUR | 08/21/2014 | EUR | (871,000) | (1,192,895) | (6,248) | ||||||

| BBP |

USD/GBP | 09/11/2014 | GBP | (1,163,000) | (1,989,195) | (37,089) | ||||||

| BBP |

USD/JPY | 07/02/2014 | JPY | (190,000,000) | (1,875,524) | (6,584) | ||||||

| BBP |

USD/JPY | 08/05/2014 | JPY | (190,000,000) | (1,876,035) | (4,770) | ||||||

| GSB |

USD/MXN | 08/25/2014 | MXN | (3,715,403) | (285,287) | (287) | ||||||

| BBP |

USD/MXN | 08/25/2014 | MXN | (4,709,460) | (361,616) | (1,616) | ||||||

|

| ||||||||||||

| $ (24,552,606) | $ (334,249) | |||||||||||

|

| ||||||||||||

Schedule of Interest Rate Swap Agreements

| Counterparty | Floating Rate Index | Paying Floating Rate |

Fixed Rate | Expiration Date | Notional Amount1 |

Premiums Paid |

Unrealized Appreciation / (Depreciation) |

|||||||||||||||||

| Over the Counter Interest Rate Swap Agreements |

| |||||||||||||||||||||||

| GSB |

Brazil Interbank Rate | Paying | 12.06% | 01/04/2021 | BRL | 2,700,000 | $ | 9,651 | $ | (5,976) | ||||||||||||||

| BBP |

Mexican Interbank Rate | Paying | 6.80% | 12/26/2023 | MXN | 7,100,000 | 1,206 | 33,032 | ||||||||||||||||

| BBP |

Mexican Interbank Rate | Paying | 6.80% | 12/26/2023 | MXN | 3,000,000 | 2,757 | 11,710 | ||||||||||||||||

| BBP |

Mexican Interbank Rate | Paying | 6.80% | 12/26/2023 | MXN | 34,000,000 | 43,512 | 120,446 | ||||||||||||||||

| GSB |

Mexican Interbank Rate | Paying | 6.80% | 12/26/2023 | MXN | 5,700,000 | 1,787 | 25,700 | ||||||||||||||||

|

|

|

|||||||||||||||||||||||

| $ | 58,913 | $ | 184,912 | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Counterparty | Floating Rate Index | Paying/ Receiving Floating Rate |

Fixed Rate | Expiration Date | Notional Amount1 |

Unrealized Appreciation / (Depreciation) |

||||||||||||||

| Centrally Cleared Interest Rate Swap Agreements |

| |||||||||||||||||||

| N/A |

3-Month Euribor | Receiving | 0.40% | 03/16/2015 | EUR | 5,500,000 | $ | (10,808) | ||||||||||||

| N/A |

3-Month LIBOR | Paying | 2.00% | 12/18/2018 | 3,300,000 | 72,108 | ||||||||||||||

| N/A |

3-Month LIBOR | Paying | 2.65% | 07/31/2023 | 1,500,000 | 18,641 | ||||||||||||||

| N/A |

6-Month Euribor | Receiving | 2.00% | 09/17/2024 | EUR | 3,800,000 | (170,077) | |||||||||||||

| N/A |

British Bankers’ Association Yen LIBOR | Paying | 1.00% | 09/18/2023 | JPY | 256,300,000 | (56,454) | |||||||||||||

| N/A |

London-Interbank Offered Rate | Receiving | 3.00% | 09/17/2024 | GBP | 1,000,000 | (9,577) | |||||||||||||

|

|

|

|||||||||||||||||||

| $ | (156,167) | |||||||||||||||||||

|

|

|

|||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Notes to Investment Portfolio

June 30, 2014

Schedule of Credit Default Swap Agreements

| Counter- party |

Reference Obligation | Implied Credit Spread 3 |

Fixed Received Rate 6 |

Expiration Date |

Notional Amount 1,5 |

Value | Premiums Paid / (Received) |

Unrealized Appreciation / (Depreciation) |

||||||||||||||||||

| Over the Counter Credit Default Swap Agreements |

| |||||||||||||||||||||||||

| Credit default swap agreements - sell protection 2 |

| |||||||||||||||||||||||||

| BBP |

Anadarko Petroleum Corp., 1.00%, 06/20/17 | 0.18% | 1.00 | % | 06/20/2017 | $ | (100,000) | $ | 2,426 | $ | (3,337 | ) | $ | 5,793 | ||||||||||||

| GSI |

Canadian Natural Resources Ltd., 6.25%, 03/15/38 | 0.05% | 1.00 | % | 12/20/2015 | (500,000) | 7,048 | 1,713 | 5,487 | |||||||||||||||||

| GSI |

Carlsberg Breweries A/S, 3.38%, 10/13/17 | 0.65% | 1.00 | % | 03/20/2019 | (136,930) | 2,245 | 601 | 1,686 | |||||||||||||||||

| BBP |

Federative Republic of Brazil, 12.25%, 03/06/30 | 0.58% | 1.00 | % | 06/20/2016 | (1,800,000) | 15,059 | (5,979 | ) | 21,588 | ||||||||||||||||

| GSI |

Federative Republic of Brazil, 12.25%, 03/06/30 | 1.96% | 1.00 | % | 03/20/2024 | (1,300,000) | (101,609 | ) | (134,804 | ) | 33,592 | |||||||||||||||

| GSI |

Finmeccanica Finance S.A., 5.75%, 12/12/18 | 1.38% | 5.00 | % | 03/20/2018 | (273,860) | 36,144 | 16,724 | 19,839 | |||||||||||||||||

| GSI |

Forest Oil Corp., 7.25%, 06/15/19 | 5.23% | 5.00 | % | 06/20/2017 | (500,000) | (3,064 | ) | (13,125 | ) | 10,825 | |||||||||||||||

| GSI |

Gazprom International BV, 5.63%, 07/22/13 | 1.88% | 1.00 | % | 03/20/2017 | (2,000,000) | (46,500 | ) | (166,265 | ) | 120,376 | |||||||||||||||

| GSI |

KB Home, 9.10%, 09/15/17 | 2.58% | 5.00 | % | 06/20/2019 | (300,000) | 33,331 | 24,549 | 9,241 | |||||||||||||||||

| BBP |

Kingdom of Spain, 5.50%, 07/30/17 | 0.60% | 1.00 | % | 12/20/2018 | (300,000) | 5,288 | (17,663 | ) | 23,043 | ||||||||||||||||

| GSI |

Kingdom of Spain, 5.50%, 07/30/17 | 0.60% | 1.00 | % | 12/20/2018 | (900,000) | 15,864 | (40,979 | ) | 57,119 | ||||||||||||||||

| GSI |

NRG Energy Inc., 8.50%, 06/15/19 | 1.09% | 5.00 | % | 03/20/2017 | (200,000) | 21,083 | (14,306 | ) | 35,694 | ||||||||||||||||

| BBP |

Petrobas International Finance Co., 8.38%, 12/10/18 | 1.82% | 1.00 | % | 06/20/2018 | (400,000) | (12,486 | ) | (18,434 | ) | 6,070 | |||||||||||||||

| BBP |

Republic of Italy, 6.88%, 09/27/23 | 0.85% | 1.00 | % | 12/20/2018 | (600,000) | 3,842 | (46,024 | ) | 50,050 | ||||||||||||||||

| GSI |

Republic of Italy, 6.88%, 09/27/23 | 0.85% | 1.00 | % | 12/20/2018 | (200,000) | 1,281 | (13,026 | ) | 14,368 | ||||||||||||||||

| GSI |

Republic of Italy, 6.88%, 09/27/23 | 0.92% | 1.00 | % | 06/20/2019 | (200,000) | 769 | (1,360 | ) | 2,190 | ||||||||||||||||

| GSI |

Republic of Italy, 6.88%, 09/27/23 | 0.92% | 1.00 | % | 06/20/2019 | (1,300,000) | 4,999 | 9,915 | (4,519) | |||||||||||||||||

| GSI |

Russian Federation, 7.50%, 03/31/30 | 1.32% | 1.00 | % | 09/20/2017 | (700,000) | (7,058 | ) | (39,779 | ) | 32,935 | |||||||||||||||

| BBP |

United Mexican States, 7.50%, 04/08/33 | 0.22% | 1.00 | % | 06/20/2016 | (1,200,000) | 18,670 | 1,067 | 17,970 | |||||||||||||||||

| BBP |

United Mexican States, 5.95%, 03/19/19 | 0.59% | 1.00 | % | 03/20/2019 | (300,000) | 5,645 | (586 | ) | 6,322 | ||||||||||||||||

| GSI |

United Mexican States, 5.95%, 03/19/19 | 0.33% | 1.00 | % | 09/20/2017 | (1,600,000) | 34,470 | (25,181 | ) | 60,140 | ||||||||||||||||

| GSI |

United Mexican States, 5.95%, 03/19/19 | 0.59% | 1.00 | % | 03/20/2019 | (1,300,000) | 24,462 | 5,532 | 19,327 | |||||||||||||||||

| BBP |

Virgin Media Finance Plc, 4.88%, 02/15/22 | 2.81% | 5.00 | % | 03/20/2021 | (410,790) | 53,924 | 16,623 | 37,928 | |||||||||||||||||

| BBP |

Whirlpool Corp., 7.75%, 07/15/16 | 0.68% | 1.00 | % | 03/20/2019 | (350,000) | 5,215 | 505 | 4,818 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| $ | (16,871,580) | $ | 121,048 | $ | (463,619 | ) | $ | 591,882 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Counterparty | Reference Obligation | Implied Credit Spread 3 |

Fixed Received Rate 6 |

Expiration Date |

Notional Amount 1,5 |

Value 4 | Unrealized Appreciation |

|||||||||||||||||||

| Centrally Cleared Credit Default Swap Agreements |

|

|||||||||||||||||||||||||

| Credit default swap agreements - sell protection 2 |

|

|||||||||||||||||||||||||

| N/A |

CDX.NA.IG.17 | N/A | 1.00 | % | 12/20/2016 | $ | (600,000 | ) | $ | 10,990 | $ | 1,387 | ||||||||||||||

| N/A |

CDX.NA.IG.18 | N/A | 1.00 | % | 06/20/2017 | (7,100,000 | ) | 143,811 | 39,090 | |||||||||||||||||

| N/A |

CDX.NA.IG.19 | N/A | 1.00 | % | 12/20/2017 | (43,400,000 | ) | 924,587 | 865,012 | |||||||||||||||||

| N/A |

iTraxx Europe Series 21 | N/A | 1.00 | % | 06/20/2019 | (7,668,082 | ) | 141,100 | 59,892 | |||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| $ | (58,768,082 | ) | $ | 1,220,488 | $ | 965,381 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

1Notional amount is stated in USD unless otherwise noted.

2If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay the buyer of protection an amount equal to the notional amount of the referenced obligation and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap agreement less the recovery value of the reference obligation or underlying securities comprising the referenced index.

3Implied credit spreads, represented in absolute terms, utilized in determining the value of credit default swap agreements on corporate issues and sovereign issues serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the applicable agreement.

4The prices and resulting values for credit default swap agreements on credit indices serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. Increasing market values, in absolute terms when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement.

5The maximum potential amount the Fund could be required to pay as a seller of credit protection if a credit event occurs is limited to the total notional amount which is defined under the terms of each swap agreement.

6If the Fund is a seller of protection, the Fund receives the fixed rate.

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Notes to Investment Portfolio

June 30, 2014

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Statements of Assets and Liabilities

June 30, 2014

| Assets |

||||

| Investments in securities, at value (cost $180,529,635) |

$ | 188,478,795 | ||

| Cash |

193,564 | |||

| Foreign currency (cost $201,424) |

203,392 | |||

| Receivables: |

||||

| Investments sold |

8,900,220 | |||

| Receivable for treasury roll transactions |

2,196,563 | |||

| Forward foreign currency contracts |

47,813 | |||

| Interest |

2,036,385 | |||

| Variation margin on financial derivative instruments |

14,715 | |||

| Deposits with brokers and counterparties |

1,031,045 | |||

| Unrealized appreciation on OTC swap agreements |

787,289 | |||

| OTC swap premiums paid |

136,142 | |||

| Other assets |

52,907 | |||

|

|

|

|||

| Total assets |

204,078,830 | |||

|

|

|

|||

| Liabilities |

||||

| Accrued management and investment advisory fee |

117,444 | |||

| Accrued administrative fee |

73,116 | |||

| Written options, at value (premiums $207,844) |

161,494 | |||

| Payables: |

||||

| Investment securities purchased |

8,639,181 | |||

| Payable for treasury roll transactions |

2,196,417 | |||

| Variation margin on financial derivative instruments |

31,867 | |||

| Investment forward sales commitments, at value (cost $1,665,391) |

1,678,595 | |||

| Forward foreign currency contracts |

382,062 | |||

| Deposits from brokers and counterparties |

152,045 | |||

| Unrealized depreciation on OTC swap agreements |

10,495 | |||

| OTC swap premiums received |

540,848 | |||

| Other liabilities |

55,834 | |||

|

|

|

|||

| Total liabilities |

14,039,398 | |||

|

|

|

|||

| Net Asset Value |

$ | 190,039,432 | ||

|

|

|

|||

| Net assets consist of: |

||||

| Paid-in capital |

202,069,475 | |||

| Undistributed net investment income |

751,605 | |||

| Net unrealized appreciation on investments and foreign currency related items |

9,319,054 | |||

| Accumulated net realized loss |

(22,100,702 | ) | ||

|

|

|

|||

| Net Asset Value |

$ | 190,039,432 | ||

|

|

|

|||

| Net Asset Value per share ($190,039,432/10,365,142 shares of common stock outstanding, $.01 par value, 30,000,000 shares authorized) |

$ | 18.33 | ||

|

|

|

|||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Statements of Operations

For the Period ended June 30, 2014

| Investment income |

| |||

| Income: |

||||

| Interest |

$ | 3,411,705 | ||

|

|

|

|||

| Total income |

3,411,705 | |||

|

|

|

|||

| Expenses: |

||||

| Management and investment advisory fee |

231,878 | |||

| Administrative fee |

220,298 | |||

| Directors’ fees and expenses |

49,552 | |||

| Legal |

41,713 | |||

| Stockholder reporting |

24,748 | |||

| Insurance |

23,509 | |||

| Audit fees |

21,973 | |||

| Stockholder services |

15,082 | |||

| Interest expense |

13,601 | |||

| NYSE listing fee |

12,025 | |||

| Custodian fees |

5,375 | |||

| Other |

4,851 | |||

|

|

|

|||

| Total expenses |

664,605 | |||

|

|

|

|||

| Net investment income |

2,747,100 | |||

|

|

|

|||

| Realized and unrealized gain (loss) on investment transactions and foreign currency related items |

||||

| Net realized gain (loss) from: |

||||

| Investment transactions |

704,525 | |||

| Futures contracts |

(204,215 | ) | ||

| Swap agreements |

117,282 | |||

| Written options contracts |

467,324 | |||

| Foreign currency related items |

(31,563 | ) | ||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments |

3,639,576 | |||

| Futures contracts and centrally cleared swap agreements |

159,439 | |||

| OTC swap agreements |

800,952 | |||

| Written options contracts |

267,146 | |||

| Foreign currency related items |

(336,821 | ) | ||

|

|

|

|||

| Net gain on investment transactions and foreign currency related items |

5,583,645 | |||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ | 8,330,745 | ||

|

|

|

|||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Statement of Changes in Net Assets

| Increase (decrease) in net assets | Six Months Ended June 30, 2014 |

Year Ended December 31, 2013 |

||||||

| Operations: | ||||||||

| Net investment income | $ | 2,747,100 | $ | 5,154,722 | ||||

| Net realized gain (loss) on investment transactions and foreign currency related items |

1,053,353 | (71,832) | ||||||

| Net change in unrealized appreciation (depreciation) on investment transactions and foreign currency related items | 4,530,292 | (5,166,818) | ||||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

8,330,745 | (83,928) | ||||||

| Distributions to stockholders from net investment income |

(1,554,836 | ) | (6,738,806) | |||||

| Distributions to stockholders from return of capital |

— | (310,870) | ||||||

|

|

|

|||||||

| Total distributions |

(1,554,836 | ) | (7,049,676) | |||||

| Fund share transactions: |

||||||||

| Reinvestment of distributions |

58,230 | 290,146 | ||||||

| Cost of shares repurchased |

(129,894 | ) | (397,989) | |||||

|

|

|

|||||||

| Net decrease in net assets from fund share transactions |

(71,664 | ) | (107,843) | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

6,704,245 | (7,241,447) | ||||||

| Net assets at beginning of period |

183,335,187 | 190,576,634 | ||||||

|

|

|

|||||||

| Net assets at end of period (including undistributed (excess of distributions over) net investment income of $751,605 and $(440,659), respectively) | $ | 190,039,432 | $ | 183,335,187 | ||||

|

|

|

|||||||

| Other information |

||||||||

| Shares outstanding at beginning of period |

10,369,576 | 10,375,675 | ||||||

| Shares issued to stockholders in reinvestment of distributions |

3,566 | 17,901 | ||||||

| Shares repurchased |

(8,000 | ) | (24,000) | |||||

|

|

|

|||||||

| Net decrease in fund shares outstanding |

(4,434 | ) | (6,099) | |||||

|

|

|

|||||||

| Shares outstanding at end of period |

10,365,142 | 10,369,576 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Financial Highlights

| Years Ended December 31, | 2014e | 2013 | 2012 | 2011 | 2010c | 2009 | ||||||||||||||||||

| Selected Per Share Data |

|

|||||||||||||||||||||||

| Net asset value, beginning of period |

$17.68 | $18.37 | $17.11 | $17.12 | $16.42 | $15.13 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from investment operations: |

||||||||||||||||||||||||

| Income a |

0.32 | 0.63 | 0.73 | 0.86 | 0.86 | 0.85 | ||||||||||||||||||

| Operating expenses a |

(0.06) | (0.13) | (0.13) | (0.12) | (0.14) | (0.12) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income a |

0.26 | 0.50 | 0.60 | 0.74 | 0.72 | 0.73 | ||||||||||||||||||

| Net realized and unrealized gain (loss) on investment transactions |

0.54 | (0.51) | 1.51 | (0.04) | 0.71 | 1.33 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.80 | (0.01) | 2.11 | 0.70 | 1.43 | 2.06 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(0.15) | (0.68)g | (0.85) | (0.71) | (0.73) | (0.77) | ||||||||||||||||||

| Net asset value, end of period |

$18.33 | $17.68 | $18.37 | $17.11 | $17.12 | $16.42 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Per share market value, end of period |

$16.68 | $15.54 | $16.90 | $15.43 | $15.78 | $14.68 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Closing price range on New York Stock Exchange for each share of Common Stock outstanding: |

||||||||||||||||||||||||

| High ($) |

16.70 | 17.76 | 17.30 | 16.03 | 16.78 | 15.10 | ||||||||||||||||||

| Low ($) |

15.54 | 15.32 | 15.38 | 15.05 | 14.67 | 13.19 | ||||||||||||||||||

| Total Return |

||||||||||||||||||||||||

| Based on market value (%) b |

8.32 f | (4.12) | 15.22 | 2.28 | 12.50 | 12.04 | ||||||||||||||||||

| Based on net asset value (%) b |

4.63 f | 0.35 | 12.94 | 4.54 | 9.12 | 14.47 | ||||||||||||||||||

| Ratio to Average Net Assets and Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of year ($ millions) |

190 | 183 | 191 | 177 | 178 | 170 | ||||||||||||||||||

| Ratio of net expenses (%) |

0.72 d | 0.70 | 0.72 | 0.71 | 0.82 | 0.76 | ||||||||||||||||||

| Ratio of net investment income (%) |

2.96 d | 2.74 | 3.35 | 4.24 | 4.28 | 4.64 | ||||||||||||||||||

| Portfolio turnover rate (%) |

61 f | 219 | 246 | 49 | 132 | 175 | ||||||||||||||||||

| a | Based on average shares outstanding during the period. |

| b | Total return based on net asset value reflects changes in the Fund’s net asset value during the year. Total return based on market value reflects changes in market price. Each figure includes reinvestment of dividends. These figures will differ depending upon the level of any discount or premium between market price and net asset value. |

| c | The Fund changed investment adviser effective March 15, 2010. |

| d | Annualized. |

| e | For the six months ended June 30, 2014. |

| f | Not annualized. |

| g | Includes a return of capital distribution of (0.03) per share. |

The accompanying notes are an integral part of the financial statements.

Montgomery Street Income Securities, Inc. (Unaudited)

Notes to Financial Statements

June 30, 2014

A. Significant Accounting Policies

Montgomery Street Income Securities, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, diversified management investment company. Pacific Investment Management Company LLC (“PIMCO” or “Adviser”) serves as the investment adviser to the Fund.

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The Fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which requires the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Under the Fund’s valuation policy and procedures, the Fund’s Board of Directors (the “Board”) has delegated the daily operational oversight of the securities valuation function to Jackson Fund Services (“JFS” or “Administrator”), a division of Jackson National Asset Management, LLC. The Board has delegated to the Pricing Committee of JFS (“Pricing Committee”), the authority to approve determinations of fair valuations of securities for which market quotations are not readily available as well as to supervise JFS in the performance of its responsibilities pursuant to the valuation policy and procedures. The Pricing Committee consists of the Fund’s Chief Executive Officer, Chief Financial Officer and Chief Compliance Officer. For those securities fair valued under procedures adopted by the Board, the Pricing Committee reviews and affirms the reasonableness of the fair valuation determinations after considering all relevant information that is reasonably available. The Pricing Committee’s fair valuation determinations are subject to review by the Chair of the Fund’s Valuation Committee on a monthly basis and the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.