|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

Large Accelerated Filer ☐

|

|

|

Non-accelerated Filer ☐

|

Smaller reporting company

|

|

Emerging growth company

|

|

Incorporated Document

|

Location in Form 10-K

|

|

Proxy Statement for the 2022 Annual

Meeting of Shareholders

|

Part III of Form 10-K

(Items 10, 11, 12, 13, 14)

|

|

PART I

|

|||

|

ITEM 1.

|

1

|

||

|

ITEM 1A.

|

10

|

||

|

ITEM 1B.

|

19

|

||

|

ITEM 2.

|

19

|

||

|

ITEM 3.

|

19

|

||

|

ITEM 4.

|

19

|

||

|

20

|

|||

|

PART II

|

|||

|

ITEM 5.

|

21

|

||

|

ITEM 7.

|

23

|

||

|

ITEM 7A.

|

41

|

||

|

ITEM 8.

|

44

|

||

|

ITEM 9.

|

87

|

||

|

ITEM 9A.

|

87

|

||

|

ITEM 9B.

|

87 | ||

|

ITEM 9C.

|

87 | ||

|

PART III

|

|||

|

ITEM 10.

|

88 | ||

|

ITEM 11.

|

88

|

||

|

ITEM 12.

|

89 | ||

|

ITEM 13.

|

89 | ||

|

ITEM 14.

|

89 | ||

|

PART IV

|

|||

|

ITEM 15.

|

89 | ||

|

ITEM 16.

|

89 | ||

| 90 | |||

| 91 | |||

| 95 | |||

| − |

Heating, ventilation and cooling OEMs;

|

| − |

Construction architects and contractors;

|

| − |

Wholesalers of heating equipment;

|

| − |

Agricultural, industrial and construction equipment OEMs;

|

| − |

Commercial and industrial equipment OEMs; and

|

| − |

Automobile, truck, bus, and specialty vehicle OEMs.

|

|

Fiscal 2022

|

Fiscal 2021

|

|||||||

|

Commercial HVAC&R

|

38

|

%

|

34

|

%

|

||||

|

Automotive and light vehicle

|

18

|

%

|

25

|

%

|

||||

|

Off-highway

|

16

|

%

|

15

|

%

|

||||

|

Commercial vehicle

|

16

|

%

|

15

|

%

|

||||

|

Data center cooling

|

5

|

%

|

4

|

%

|

||||

|

Industrial cooling

|

3

|

%

|

4

|

%

|

||||

|

Other

|

4

|

%

|

3

|

%

|

||||

|

North America

|

South America

|

Europe

|

Asia

|

|

United States

|

Brazil

|

Germany |

China

|

|

Mexico

|

|

Hungary

|

India

|

|

Italy

|

South Korea

|

||

|

Netherlands

|

United Arab Emirates

|

||

|

Serbia

|

|||

|

Spain

|

|||

|

Sweden

|

|||

|

United Kingdom

|

Export sales from the U.S. to foreign countries, as a percentage of consolidated net sales, were 7 percent in fiscal 2022, 2021, and 2020.

Customer Dependence

Our operating segments maintain their own inventories and production schedules. We believe that our current production capacity is capable of handling our expected sales volume in fiscal 2023 and beyond.

We purchase aluminum, nickel and steel from several domestic and foreign suppliers. In general, we do not rely on any one supplier for these materials, which are, for the most part, available from numerous sources in quantities required by us. The supply of copper and brass material is concentrated between two global suppliers, with other suppliers qualified and supplying lesser amounts to mitigate risk. While our suppliers may become constrained due to global demand, we typically do not experience raw material shortages and believe that our suppliers’ production of these metals will be adequate throughout the next fiscal year. We typically adjust metals pricing with our raw material suppliers on a monthly basis and our major fabricated component suppliers on a quarterly basis. When possible, we have included provisions within our long-term customer contracts which provide for adjustments to customer prices, on a prospective basis, based upon increases and decreases in the cost of key raw materials. When applicable, however, these contract provisions are typically limited to the underlying cost of the material based upon the London Metal Exchange, and do not include related premiums or fabrication costs. In addition, there can often be a three-month to one-year lag until the time that the price adjustments take effect.

We protect our intellectual property through patents, trademarks, trade secrets and copyrights. As a part of our ongoing R&D activities, we routinely seek patents on new products and processes. Our Patent Review Committee manages our intellectual property strategy and portfolio. We own or license numerous patents related to our products and operations. Also, because we have many product lines, we believe that our business as a whole is not materially dependent upon any particular patent or license, or any particular group of patents or licenses. We consider each of our patents, trademarks, and licenses to be of value and aggressively defend our rights throughout the world against infringement. We have over 500 active patents and pending patent applications worldwide.

We are committed to creating value through technology and innovation. We focus our engineering and R&D efforts on solutions that meet challenging heat transfer needs of OEMs and other customers within the commercial, industrial, and building HVAC&R and commercial vehicle, construction, agricultural, powersports and automotive and light vehicle markets. Our products and systems are often aimed at solving difficult and complex heat transfer challenges requiring advanced thermal management. Typical market demands are for products and systems that are more efficient, lighter weight, more compact, and more durable to meet customer standards as customers work to ensure compliance with increasingly stringent energy efficiency and emissions requirements. Our heritage includes a depth and breadth of expertise in thermal management that, combined with our global manufacturing presence, standardized processes, and state-of-the-art technical resources, enables us to rapidly bring customized solutions to our customers.

Our overall operating performance is generally not subject to a significant degree of seasonality. Both our BHVAC and CIS segments experience some seasonality, as demand for HVAC&R products can be affected by heating and cooling seasons, weather patterns, construction, and other factors. Sales volume within the BHVAC segment is generally stronger in our second and third fiscal quarters, corresponding with demand for heating products. We generally expect sales volume within our CIS segment to be higher during our first and second fiscal quarters due to the construction seasons in the northern hemisphere. Sales to vehicular OEM customers are dependent upon market demand for new vehicles. However, our second fiscal quarter production schedules are typically impacted by customer summer shutdowns and our third fiscal quarter is affected by holiday schedules.

We manufacture products for the majority of customers in our CIS, HDE, and Automotive segments on an as-ordered basis, which makes large inventories of finished products unnecessary. In Brazil, within our HDE segment, we maintain aftermarket product inventory in order to timely meet customer needs in the Brazilian automotive and commercial vehicle aftermarkets. In our BHVAC segment, we maintain varying levels of finished goods inventory due to seasonal demand and the timing of sales programs. We have not experienced a significant number of returned products within any of our operating segments.

Through our website, www.modine.com (Investors link), we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, other Securities Exchange Act reports and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Our reports are also available free of charge on the SEC’s website, www.sec.gov. Also available free of charge on our website are the following corporate governance documents, among others:

| − |

Code of Conduct, which is applicable to all Modine directors and employees, including our executive officers;

|

| − |

Corporate Governance Guidelines;

|

| − |

Audit Committee Charter;

|

| − |

Human Capital and Compensation Committee Charter;

|

| − |

Corporate Governance and Nominating Committee Charter; and

|

| − |

Technology Committee Charter.

|

| A. |

MARKET RISKS

|

| B. |

OPERATIONAL RISKS

|

| C. |

STRATEGIC RISKS

|

| D. |

FINANCIAL RISKS

|

| E. |

GENERAL RISKS

|

|

Americas

|

Europe

|

Asia

|

Total

|

|||||||||||||

|

BHVAC

|

2

|

4

|

-

|

6

|

||||||||||||

|

CIS

|

9

|

6

|

1

|

16

|

||||||||||||

|

HDE

|

6

|

2

|

4

|

12

|

||||||||||||

|

Automotive

|

1

|

5

|

2

|

8

|

||||||||||||

|

Total manufacturing facilities

|

18

|

17

|

7

|

42

|

||||||||||||

|

Name

|

Age

|

Position

|

||

|

Brian J. Agen

|

53

|

Vice President, Human Resources (October 2012 – Present).

|

||

|

Neil D. Brinker

|

46

|

President and Chief Executive Officer (December 2020 – Present). Prior to joining Modine, Mr. Brinker served as President and Chief Operating Officer of Advanced Energy Industries, Inc. after serving as its Executive Vice President

and Chief Operating Officer. Prior to joining Advanced Energy Industries, Inc, Mr. Brinker served as a Group President at IDEX Corporation.

|

||

|

Michael B. Lucareli

|

53

|

Executive Vice President, Chief Financial Officer (May 2021 – Present); previously Vice President, Finance and Chief Financial Officer for the Company.

|

||

|

Eric S. McGinnis

|

51

|

President, Climate Solutions (April 2022 – Present); previously Vice President, Building HVAC upon joining Modine in August 2021. Prior to joining Modine, Mr. McGinnis served as President, Industrial Systems at Regal Beloit.

|

||

|

Adrian I. Peace

|

54

|

President, Performance Technologies (April 2022 – Present); previously Vice President, Commercial & Industrial Solutions upon joining Modine in August 2021. Prior to joining Modine, Mr. Peace served as a Strategy Advisor for AIP

LLC. Prior to AIP LLC, Mr. Peace served as Senior Vice President, Emerging Business Operations for Republic Services. Prior to Republic Services, Mr. Peace served as the Vice President of the International Business and Specialty Brands

at W.W. Grainger, Inc.

|

||

|

Sylvia A. Stein

|

55

|

Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer (February 2020 – Present); previously Vice President, General Counsel and Corporate Secretary for the Company. Prior to joining Modine, Ms. Stein served

as the Associate General Counsel, Marketing & Regulatory at the Kraft Heinz Foods Company.

|

There are no family relationships among the executive officers and directors. There are no arrangements or understandings between any of the executive officers and any other person pursuant to which he or she was elected an officer of Modine.

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

|

Period

|

Total Number of

Shares Purchased

|

Average

Price Paid

Per Share

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

|

Maximum

Number (or

Approximate Dollar

Value) of Shares

that May Yet Be

Purchased Under the

Plans or Programs (a)

|

|

January 1 – January 31, 2022

|

_______

|

_______

|

_______

|

$50,000,000

|

|

February 1 – February 28, 2022

|

17,169 (b)

|

$10.12

|

_______

|

$50,000,000

|

|

March 1 – March 31, 2022

|

10,630 (b)

|

$9.70

|

_______

|

$50,000,000

|

|

Total

|

27,799 (b)

|

$9.96

|

_______

|

|

(a)

|

Effective November 5, 2020, the Board of Directors approved a two-year, $50.0 million share repurchase program. This program allows the Company to repurchase Modine common stock at such times and prices deemed appropriate by the

authorized officers of the Company.

|

|

(b)

|

Consists of shares delivered back to the Company by employees and/or directors to satisfy tax withholding obligations that arise upon the vesting of stock awards. The Company, pursuant to its equity compensation plans, gives

participants the opportunity to turn back to the Company the number of shares from the award sufficient to satisfy tax withholding obligations that arise upon the termination of restrictions. These shares are held as treasury shares.

|

|

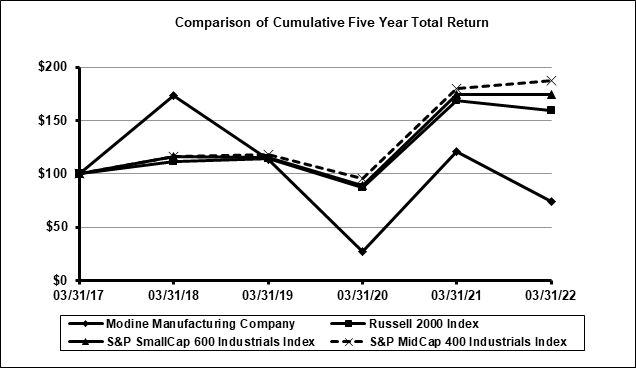

Indexed Returns

|

||||||||||||||||||||||||

|

Initial Investment

|

Years ended March 31,

|

|||||||||||||||||||||||

|

Company / Index

|

March 31, 2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

||||||||||||||||||

|

Modine Manufacturing Company

|

$

|

100

|

$

|

173.36

|

$

|

113.69

|

$

|

26.64

|

$

|

121.07

|

$

|

73.85

|

||||||||||||

|

Russell 2000 Index

|

100

|

111.79

|

114.09

|

86.72

|

168.96

|

159.19

|

||||||||||||||||||

|

S&P SmallCap 600 Industrials Index

|

100

|

116.52

|

115.17

|

89.24

|

174.33

|

174.34

|

||||||||||||||||||

|

S&P MidCap 400 Industrials Index

|

100

|

116.46

|

117.90

|

95.87

|

179.84

|

187.64

|

||||||||||||||||||

|

Years ended March 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

2020

|

||||||||||||||||||||||

|

(in millions)

|

$’s

|

% of sales

|

$’s

|

% of sales

|

$’s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$

|

2,050

|

100.0

|

%

|

$

|

1,808

|

100.0

|

%

|

$

|

1,976

|

100.0

|

%

|

||||||||||||

|

Cost of sales

|

1,741

|

84.9

|

%

|

1,515

|

83.8

|

%

|

1,668

|

84.4

|

%

|

|||||||||||||||

|

Gross profit

|

309

|

15.1

|

%

|

293

|

16.2

|

%

|

308

|

15.6

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

215

|

10.5

|

%

|

211

|

11.7

|

%

|

250

|

12.6

|

%

|

|||||||||||||||

|

Restructuring expenses

|

24

|

1.2

|

%

|

13

|

0.7

|

%

|

12

|

0.6

|

%

|

|||||||||||||||

|

Impairment charges (reversals) - net

|

(56

|

)

|

-2.7

|

%

|

167

|

9.2

|

%

|

9

|

0.4

|

%

|

||||||||||||||

|

Loss (gain) on sale of assets

|

7

|

0.3

|

%

|

-

|

-

|

(1

|

)

|

-

|

||||||||||||||||

|

Operating income (loss)

|

119

|

5.8

|

%

|

(98

|

)

|

-5.4

|

%

|

38

|

1.9

|

%

|

||||||||||||||

|

Interest expense

|

(16

|

)

|

-0.8

|

%

|

(19

|

)

|

-1.1

|

%

|

(23

|

)

|

-1.1

|

%

|

||||||||||||

|

Other expense – net

|

(2

|

)

|

-0.1

|

%

|

(2

|

)

|

-0.1

|

%

|

(5

|

)

|

-0.2

|

%

|

||||||||||||

|

Earnings (loss) before income taxes

|

101

|

5.0

|

%

|

(119

|

)

|

-6.6

|

%

|

10

|

0.5

|

%

|

||||||||||||||

|

Provision for income taxes

|

(15

|

)

|

-0.7

|

%

|

(90

|

)

|

-5.0

|

%

|

(12

|

)

|

-0.6

|

%

|

||||||||||||

|

Net earnings (loss)

|

$

|

86

|

4.2

|

%

|

$

|

(209

|

)

|

-11.6

|

%

|

$

|

(2

|

)

|

-0.1

|

%

|

||||||||||

|

Years ended March 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

2020

|

||||||||||||||||||||||

|

(in millions)

|

$’s

|

% of sales

|

$’s

|

% of sales

|

$’s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$

|

337

|

100.0

|

%

|

$

|

263

|

100.0

|

%

|

$

|

307

|

100.0

|

%

|

||||||||||||

|

Cost of sales

|

243

|

72.2

|

%

|

178

|

67.6

|

%

|

206

|

67.3

|

%

|

|||||||||||||||

|

Gross profit

|

94

|

27.8

|

%

|

85

|

32.4

|

%

|

100

|

32.7

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

48

|

14.1

|

%

|

40

|

15.2

|

%

|

42

|

13.7

|

%

|

|||||||||||||||

|

Operating income

|

$

|

46

|

13.6

|

%

|

$

|

45

|

17.2

|

%

|

$

|

58

|

19.0

|

%

|

||||||||||||

|

Years ended March 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

2020

|

||||||||||||||||||||||

|

(in millions)

|

$’s

|

% of sales

|

$’s

|

% of sales

|

$’s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$

|

627

|

100.0

|

%

|

$

|

512

|

100.0

|

%

|

$

|

541

|

100.0

|

%

|

||||||||||||

|

Cost of sales

|

539

|

85.9

|

%

|

448

|

87.5

|

%

|

477

|

88.1

|

%

|

|||||||||||||||

|

Gross profit

|

88

|

14.1

|

%

|

64

|

12.5

|

%

|

64

|

11.9

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

51

|

8.1

|

%

|

49

|

9.5

|

%

|

51

|

9.3

|

%

|

|||||||||||||||

|

Restructuring expenses

|

2

|

0.4

|

%

|

5

|

1.0

|

%

|

2

|

0.4

|

%

|

|||||||||||||||

|

Impairment charge

|

-

|

-

|

-

|

-

|

1

|

0.1

|

%

|

|||||||||||||||||

|

Operating income

|

$

|

35

|

5.6

|

%

|

$

|

10

|

2.0

|

%

|

$

|

11

|

2.1

|

%

|

||||||||||||

|

Years ended March 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

2020

|

||||||||||||||||||||||

|

(in millions)

|

$’s

|

% of sales

|

$’s

|

% of sales

|

$’s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$

|

824

|

100.0

|

%

|

$

|

682

|

100.0

|

%

|

$

|

746

|

100.0

|

%

|

||||||||||||

|

Cost of sales

|

737

|

89.4

|

%

|

594

|

87.0

|

%

|

649

|

87.0

|

%

|

|||||||||||||||

|

Gross profit

|

87

|

10.6

|

%

|

88

|

13.0

|

%

|

97

|

13.0

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

51

|

6.2

|

%

|

49

|

7.1

|

%

|

56

|

7.4

|

%

|

|||||||||||||||

|

Restructuring expenses

|

1

|

0.2

|

%

|

3

|

0.4

|

%

|

3

|

0.4

|

%

|

|||||||||||||||

|

Operating income

|

$

|

35

|

4.2

|

%

|

$

|

37

|

5.4

|

%

|

$

|

38

|

5.1

|

%

|

||||||||||||

|

Years ended March 31,

|

||||||||||||||||||||||||

|

2022

|

2021

|

2020

|

||||||||||||||||||||||

|

(in millions)

|

$’s

|

% of sales

|

$’s

|

% of sales

|

$’s

|

% of sales

|

||||||||||||||||||

|

Net sales

|

$

|

313

|

100.0

|

%

|

$

|

398

|

100.0

|

%

|

$

|

445

|

100.0

|

%

|

||||||||||||

|

Cost of sales

|

274

|

87.5

|

%

|

342

|

85.9

|

%

|

396

|

89.1

|

%

|

|||||||||||||||

|

Gross profit

|

39

|

12.5

|

%

|

56

|

14.1

|

%

|

48

|

10.9

|

%

|

|||||||||||||||

|

Selling, general and administrative expenses

|

40

|

12.6

|

%

|

36

|

9.1

|

%

|

45

|

10.1

|

%

|

|||||||||||||||

|

Restructuring expenses

|

20

|

6.5

|

%

|

4

|

1.0

|

%

|

6

|

1.5

|

%

|

|||||||||||||||

|

Impairment charges (reversals) - net

|

(56

|

)

|

-17.9

|

%

|

167

|

41.9

|

%

|

8

|

1.8

|

%

|

||||||||||||||

|

Gain on sale of assets

|

-

|

-

|

-

|

-

|

(1

|

)

|

-0.2

|

%

|

||||||||||||||||

|

Operating income (loss)

|

$

|

35

|

11.3

|

%

|

$

|

(151

|

)

|

-37.9

|

%

|

$

|

(10

|

)

|

-2.3

|

%

|

||||||||||

| • |

The impact of potential adverse developments or disruptions in the global economy and financial markets, including impacts related to tariffs, sanctions and other trade issues or cross-border trade restrictions (and any potential

resulting trade war), inflation and supply chain challenges, and including impacts associated with the military conflict between Russia and Ukraine;

|

| • |

The impact of the COVID-19 pandemic on the national and global economy, our business, suppliers, customers, and employees;

|

| • |

The impact of other economic, social and political conditions, changes, challenges and unrest, particularly in the geographic, product and financial markets where we and our customers operate and compete, including foreign currency

exchange rate fluctuations; changes in interest rates; recession and recovery therefrom; and the general uncertainties about the impact of regulatory and/or policy changes, including those related to tax and trade that have been or may be

implemented in the U.S. or abroad;

|

| • |

The impact of potential price increases associated with raw materials, including aluminum, copper, steel and stainless steel (nickel), and other purchased component inventory including, but not limited to, increases in the underlying

material cost based upon the London Metal Exchange and related premiums or fabrication costs. These prices may be impacted by a variety of factors, including changes in trade laws and tariffs, the behavior of our suppliers and

significant fluctuations in demand. This risk includes our ability to successfully manage our exposure and our ability to adjust product pricing in response to price increases, including through our quotation process or through contract

provisions for prospective price adjustments, as well as the inherent lag in timing of such contract provisions;

|

| • |

Our ability to mitigate increased labor costs and labor shortages; and

|

| • |

The impact of current and future environmental laws and regulations on our business and the businesses of our customers, including our ability to take advantage of opportunities to supply alternative new technologies to meet

environmental and/or energy standards and objectives.

|

| • |

The impact of problems, including logistic and transportation challenges, associated with suppliers meeting our quantity, quality, price and timing demands, and the overall health of our suppliers, including their ability and

willingness to supply our volume demands if their production capacity becomes constrained;

|

| • |

The overall health of and price-reduction pressure from our vehicular customers in light of economic and market-specific factors, and the potential impact on us from any deterioration in the stability or performance of any of our major

customers;

|

| • |

Our ability to maintain current customer relationships and compete effectively for new business, including our ability to achieve profit margins acceptable to us by offsetting or otherwise addressing any cost increases associated with

supply chain challenges and inflationary market conditions;

|

| • |

The impact of product or manufacturing difficulties or operating inefficiencies, including any program launch and product transfer challenges and warranty claims;

|

| • |

The impact of delays or modifications initiated by major customers with respect to program launches, product applications or requirements;

|

| • |

Our ability to consistently structure our operations in order to develop and maintain a competitive cost base with appropriately skilled and stable labor, while also positioning ourselves geographically, so that we can continue to

support our customers with the technical expertise and market-leading products they demand and expect from Modine;

|

| • |

Our ability to effectively and efficiently manage our cost structure in response to sales volume increases or decreases and to complete restructuring activities and realize the anticipated benefits of those activities;

|

| • |

Costs and other effects of the investigation and remediation of environmental contamination; particularly when related to the actions or inactions of others and/or facilities over which we have no control;

|

| • |

Our ability to recruit and maintain talent, including personnel in managerial, leadership, operational and administrative functions, in light of tight global labor markets;

|

| • |

Our ability to protect our proprietary information and intellectual property from theft or attack by internal or external sources;

|

| • |

The impact of a substantial disruption or material breach of our information technology systems, and any related delays, problems or costs;

|

| • |

Increasingly complex and restrictive laws and regulations, including those associated with being a U.S. public company and others present in various jurisdictions in which we operate, and the costs associated with compliance therewith;

|

| • |

Work stoppages or interference at our facilities or those of our major customers and/or suppliers;

|

| • |

The constant and increasing pressures associated with healthcare and associated insurance costs; and

|

| • |

Costs and other effects of litigation, claims, or other obligations.

|

| • |

Our ability to successfully realize anticipated benefits from strategic initiatives and our application of 80/20 principles to our business,

through which we are focused on reducing complexity and growing businesses with strong market drivers;

|

| • |

Our ability to successfully execute strategies to reduce costs and improve operating margins; and

|

| • |

The potential impacts from actions by activist shareholders, including disruption of our business and related costs.

|

| • |

Our ability to fund our global liquidity requirements efficiently for our current operations and meet our long-term commitments in the event of disruption in or tightening of the credit markets or

extended recessionary conditions in the global economy;

|

| • |

The impact of increases in interest rates in relation to our variable-rate debt obligations;

|

| • |

The impact of changes in federal, state or local taxes that could have the effect of increasing our income tax expense;

|

| • |

Our ability to comply with the financial covenants in our credit agreements, including our leverage ratio (net debt divided by Adjusted EBITDA, as defined in our credit agreements) and our interest coverage ratio (Adjusted EBITDA

divided by interest expense, as defined in our credit agreements);

|

| • |

The potential unfavorable impact of foreign currency exchange rate fluctuations on our financial results; and

|

| • |

Our ability to effectively realize the benefits of deferred tax assets in various jurisdictions in which we operate.

|

| • |

Cash and investments – We review cash deposits and short-term investments to

ensure banks have acceptable credit ratings, and short-term investments are maintained in secured or guaranteed instruments. We consider our holdings in cash and investments to be stable and secure at March 31, 2022;

|

| • |

Trade accounts receivable – Prior to granting credit, we evaluate each

customer, taking into consideration the customer’s financial condition, payment experience and credit information. After credit is granted, we actively monitor the customer’s financial condition and applicable business news;

|

| • |

Pension assets – We have retained outside advisors to assist in the

management of the assets in our pension plans. In making investment decisions, we utilize an established risk management protocol that focuses on protection of the plan assets against downside risk. We ensure that investments within

these plans provide appropriate diversification, the investments are monitored by investment teams, and portfolio managers adhere to the established investment policies. We believe the plan assets are subject to appropriate investment

policies and controls; and

|

| • |

Insurance – We monitor our insurance providers to ensure they maintain

financial ratings that are acceptable to us. We have not identified any concerns in this regard based upon our reviews.

|

We use derivative financial instruments as a tool to manage certain financial risks. We prohibit the use of leveraged derivatives.

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

|

2022

|

2021

|

2020

|

||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of sales

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Selling, general and administrative expenses

|

|

|

|

|||||||||

|

Restructuring expenses

|

|

|

|

|||||||||

|

Impairment charges (reversals) – net

|

(

|

)

|

|

|

||||||||

|

Loss (gain) on sale of assets

|

|

|

(

|

)

|

||||||||

|

Operating income (loss)

|

|

(

|

)

|

|

||||||||

|

Interest expense

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Other expense – net

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Earnings (loss) before income taxes

|

|

(

|

)

|

|

||||||||

|

Provision for income taxes

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings (loss)

|

|

(

|

)

|

(

|

)

|

|||||||

|

Net earnings attributable to noncontrolling interest

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net earnings (loss) attributable to Modine

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Net earnings (loss) per share attributable to Modine shareholders:

|

||||||||||||

|

Basic

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Diluted

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Weighted-average shares outstanding:

|

||||||||||||

|

Basic

|

|

|

|

|||||||||

|

Diluted

|

|

|

|

|||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net earnings (loss)

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Foreign currency translation

|

(

|

)

|

|

(

|

)

|

|||||||

|

Defined benefit plans, net of income taxes of $

|

|

|

(

|

)

|

||||||||

|

Cash flow hedges, net of income taxes of $

|

|

|

(

|

)

|

||||||||

|

Total other comprehensive income (loss)

|

|

|

(

|

)

|

||||||||

|

Comprehensive income (loss)

|

|

(

|

)

|

(

|

)

|

|||||||

|

Comprehensive (income) loss attributable to noncontrolling interest

|

(

|

)

|

(

|

)

|

|

|||||||

|

Comprehensive income (loss) attributable to Modine

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

2022

|

2021

|

|||||||

|

ASSETS

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Trade accounts receivable – net

|

|

|

||||||

|

Inventories

|

|

|

||||||

|

Assets held for sale

|

|

|

||||||

|

Other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Property, plant and equipment – net

|

|

|

||||||

|

Intangible assets – net

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Deferred income taxes

|

|

|

||||||

|

Other noncurrent assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Short-term debt

|

$

|

|

$

|

|

||||

|

Long-term debt – current portion

|

|

|

||||||

|

Accounts payable

|

|

|

||||||

|

Accrued compensation and employee benefits

|

|

|

||||||

|

Liabilities held for sale

|

|

|

||||||

|

Other current liabilities

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Long-term debt

|

|

|

||||||

|

Deferred income taxes

|

|

|

||||||

|

Pensions

|

|

|

||||||

|

Other noncurrent liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and contingencies (see Note 20)

|

|

|

||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred stock, $

|

|

|

||||||

|

Common stock, $

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

||||

|

Treasury stock, at cost,

|

(

|

)

|

(

|

)

|

||||

|

Total Modine shareholders’ equity

|

|

|

||||||

|

Noncontrolling interest

|

|

|

||||||

|

Total equity

|

|

|

||||||

|

Total liabilities and equity

|

$

|

|

$

|

|

||||

|

2022

|

2021

|

2020

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net earnings (loss)

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Adjustments to reconcile net earnings (loss) to net cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Impairment charges (reversals) – net

|

(

|

)

|

|

|

||||||||

|

Loss (gain) on sale of assets

|

|

|

(

|

)

|

||||||||

|

Stock-based compensation expense

|

|

|

|

|||||||||

|

Deferred income taxes

|

(

|

)

|

|

|

||||||||

|

Other – net

|

|

|

|

|||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Trade accounts receivable

|

(

|

)

|

(

|

)

|

|

|||||||

|

Inventories

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Accounts payable

|

|

|

(

|

)

|

||||||||

|

Accrued compensation and employee benefits

|

|

|

(

|

)

|

||||||||

|

Other assets

|

(

|

)

|

|

|

||||||||

|

Other liabilities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash provided by operating activities

|

|

|

|

|||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Expenditures for property, plant and equipment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from (payments for) dispositions of assets

|

(

|

)

|

|

|

||||||||

|

Disbursements for loan origination (see Note 1)

|

(

|

)

|

|

|

||||||||

|

Proceeds from maturities of short-term investments

|

|

|

|

|||||||||

|

Purchases of short-term investments

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds from sale of investment in affiliate (see Note 1)

|

|

|

|

|||||||||

|

Other – net

|

|

|

|

|||||||||

|

Net cash used for investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Borrowings of debt

|

|

|

|

|||||||||

|

Repayments of debt

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Borrowings (repayments) on bank overdraft facilities – net

|

(

|

)

|

|

|

||||||||

|

Dividend paid to noncontrolling interest

|

(

|

)

|

|

(

|

)

|

|||||||

|

Financing fees paid

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Purchase of treasury stock under share repurchase program

|

|

|

(

|

)

|

||||||||

|

Other – net

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net cash provided by (used for) financing activities

|

|

(

|

)

|

|

||||||||

|

Effect of exchange rate changes on cash

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net (decrease) increase in cash, cash equivalents, restricted cash and cash held for sale

|

(

|

)

|

(

|

)

|

|

|||||||

|

Cash, cash equivalents, restricted cash and cash held for sale – beginning of year

|

|

|

|

|||||||||

|

Cash, cash equivalents, restricted cash and cash held for sale – end of year

|

$

|

|

$

|

|

$

|

|

||||||

|

Common stock

|

Additional

paid-in

|

Retained

|

Accumulated other

comprehensive

|

Treasury

stock, at

|

Non-

controlling

|

|||||||||||||||||||||||||||

|

Shares

|

Amount

|

capital

|

earnings

|

loss

|

cost

|

interest

|

Total

|

|||||||||||||||||||||||||

|

Balance, March 31, 2019

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

|||||||||||||||

|

Net (loss) earnings

|

-

|

|

|

(

|

)

|

|

|

|

(

|

)

|

||||||||||||||||||||||

|

Other comprehensive loss

|

-

|

|

|

|

(

|

)

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||||

|

Stock options and awards

|

|

|

(

|

)

|

|

|

|

|

|

|||||||||||||||||||||||

|

Purchase of treasury stock

|

-

|

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||||||

|

Stock-based compensation expense

|

-

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Dividend paid to noncontrolling interest

|

-

|

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||

|

Balance, March 31, 2020

|

|

|

|

|

(

|

)

|

(

|

)

|

|

|

||||||||||||||||||||||

|

Net (loss) earnings

|

-

|

|

|

(

|

)

|

|

|

|

(

|

)

|

||||||||||||||||||||||

|

Other comprehensive income

|

-

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Stock options and awards

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Purchase of treasury stock

|

-

|

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||||||

|

Stock-based compensation expense

|

-

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Balance, March 31, 2021

|

|

|

|

|

(

|

)

|

(

|

)

|

|

|

||||||||||||||||||||||

|

Net earnings

|

-

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Other comprehensive income (loss)

|

-

|

|

|

|

|

|

(

|

)

|

|

|||||||||||||||||||||||

|

Stock options and awards

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Purchase of treasury stock

|

-

|

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||||||||

|

Stock-based compensation expense

|

-

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Dividend paid to noncontrolling interest

|

-

|

|

|

|

|

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||

|

Balance, March 31, 2022

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

$

|

|

|||||||||||||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Interest paid

|

$

|

|

$

|

|

$

|

|

||||||

|

Income taxes paid

|

|

|

|

|||||||||

|

March 31, 2021

|

||||

|

ASSETS

|

||||

|

Cash and cash equivalents

|

$

|

|

||

|

Trade accounts receivables – net

|

|

|||

|

Inventories

|

|

|||

|

Other current assets

|

|

|||

|

Property, plant and equipment – net

|

|

|||

|

Other noncurrent assets

|

|

|||

|

Impairment of carrying value

|

(

|

)

|

||

|

Total assets held for sale

|

$

|

|

||

|

LIABILITIES

|

||||

|

Short-term debt

|

$

|

|

||

|

Accounts payable

|

|

|||

|

Accrued compensation and employee benefits

|

|

|||

|

Other current liabilities

|

|

|||

|

Pensions

|

|

|||

|

Other noncurrent liabilities

|

|

|||

|

Total liabilities held for sale

|

$

|

|

||

|

Year ended March 31, 2022

|

||||||||||||||||||||

|

BHVAC

|

CIS

|

HDE

|

Automotive

|

Segment

Total

|

||||||||||||||||

|

Primary end market:

|

||||||||||||||||||||

|

Commercial HVAC&R

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Data center cooling

|

|

|

|

|

|

|||||||||||||||

|

Industrial cooling

|

|

|

|

|

|

|||||||||||||||

|

Commercial vehicle

|

|

|

|

|

|

|||||||||||||||

|

Off-highway

|

|

|

|

|

|

|||||||||||||||

|

Automotive and light vehicle

|

|

|

|

|

|

|||||||||||||||

|

Other

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Geographic location:

|

||||||||||||||||||||

|

Americas

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Europe

|

|

|

|

|

|

|||||||||||||||

|

Asia

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Timing of revenue recognition:

|

||||||||||||||||||||

|

Products transferred at a point in time

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Products transferred over time

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Year ended March 31, 2021

|

||||||||||||||||||||

|

BHVAC

|

CIS

|

HDE

|

Automotive

|

Segment

Total

|

||||||||||||||||

|

Primary end market:

|

||||||||||||||||||||

|

Commercial HVAC&R

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Data center cooling

|

|

|

|

|

|

|||||||||||||||

|

Industrial cooling

|

|

|

|

|

|

|||||||||||||||

|

Commercial vehicle

|

|

|

|

|

|

|||||||||||||||

|

Off-highway

|

|

|

|

|

|

|||||||||||||||

|

Automotive and light vehicle

|

|

|

|

|

|

|||||||||||||||

|

Other

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Geographic location:

|

||||||||||||||||||||

|

Americas

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Europe

|

|

|

|

|

|

|||||||||||||||

|

Asia

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Timing of revenue recognition:

|

||||||||||||||||||||

|

Products transferred at a point in time

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Products transferred over time

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Year ended March 31, 2020

|

||||||||||||||||||||

|

BHVAC

|

CIS

|

HDE

|

Automotive

|

Segment

Total

|

||||||||||||||||

|

Primary end market:

|

||||||||||||||||||||

|

Commercial HVAC&R

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Data center cooling

|

|

|

|

|

|

|||||||||||||||

|

Industrial cooling

|

|

|

|

|

|

|||||||||||||||

|

Commercial vehicle

|

|

|

|

|

|

|||||||||||||||

|

Off-highway

|

|

|

|

|

|

|||||||||||||||

|

Automotive and light vehicle

|

|

|

|

|

|

|||||||||||||||

|

Other

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Geographic location:

|

||||||||||||||||||||

|

Americas

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Europe

|

|

|

|

|

|

|||||||||||||||

|

Asia

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Timing of revenue recognition:

|

||||||||||||||||||||

|

Products transferred at a point in time

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

Products transferred over time

|

|

|

|

|

|

|||||||||||||||

|

Net sales

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||

|

March 31, 2022

|

March 31, 2021

|

|||||||

|

Contract assets

|

$

|

|

$

|

|

||||

|

Contract liabilities

|

|

|

||||||

| • |

Level 1 – Quoted prices for identical instruments in active markets.

|

| • |

Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and

model-derived valuations in which all significant inputs are observable in active markets.

|

| • |

Level 3 – Model-derived valuations in which one or more significant inputs are not observable.

|

|

March 31, 2022

|

||||||||||||

|

Level 1

|

Level 2

|

Total

|

||||||||||

|

Money market investments

|

$

|

|

$

|

|

$

|

|

||||||

|

Fixed income securities

|

|

|

|

|||||||||

|

Pooled equity funds

|

|

|

|

|||||||||

|

U.S. government and agency securities

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Fair value excluding investments measured at net asset value

|

|

|

|

|||||||||

|

Investments measured at net asset value

|

|

|||||||||||

|

Total fair value

|

$

|

|

||||||||||

|

March 31, 2021

|

||||||||||||

|

Level 1

|

Level 2

|

Total

|

||||||||||

|

Money market investments

|

$

|

|

$

|

|

$

|

|

||||||

|

Fixed income securities

|

|

|

|

|||||||||

|

Pooled equity funds

|

|

|

|

|||||||||

|

U.S. government and agency securities

|

|

|

|

|||||||||

|

Other

|

|

|

|

|||||||||

|

Fair value excluding investment measured at net asset value

|

|

|

|

|||||||||

|

Investments measured at net asset value

|

|

|||||||||||

|

Total fair value

|

$

|

|

||||||||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Fair value of options

|

$

|

|

$

|

|

$

|

|

||||||

|

Expected life of awards in years

|

|

|

|

|||||||||

|

Risk-free interest rate

|

|

%

|

|

%

|

|

%

|

||||||

|

Expected volatility of the Company’s stock

|

|

%

|

|

%

|

|

%

|

||||||

|

Expected dividend yield on the Company’s stock

|

|

%

|

|

%

|

|

%

|

||||||

|

Shares

|

Weighted-average

exercise price

|

Weighted-average

remaining contractual

term (years)

|

Aggregate

intrinsic value

|

|||||||||||||

|

Outstanding, beginning of year

|

|

$

|

|

|||||||||||||

|

Granted

|

|

|

||||||||||||||

|

Exercised

|

(

|

)

|

|

|||||||||||||

|

Forfeited or expired

|

(

|

)

|

|

|||||||||||||

|

Outstanding, end of year

|

|

$

|

|

|

$

|

|

||||||||||

|

Exercisable, March 31, 2022

|

|

$

|

|

|

$

|

|

||||||||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Intrinsic value of stock options exercised

|

$

|

|

$

|

|

$

|

|

||||||

|

Proceeds from stock options exercised

|

|

|

|

|||||||||

|

Shares

|

Weighted-average

price

|

|||||||

|

Non-vested balance, beginning of year

|

|

$

|

|

|||||

|

Granted

|

|

|

||||||

|

Vested

|

(

|

)

|

|

|||||

|

Forfeited

|

(

|

)

|

|

|||||

|

Non-vested balance, end of year

|

|

$

|

|

|||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Employee severance and related benefits

|

$

|

|

$

|

|

$

|

|

||||||

|

Other restructuring and repositioning expenses

|

|

|

|

|||||||||

|

Total

|

$

|

|

$

|

|

$

|

|

||||||

|

Years ended March 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Beginning balance

|

$

|

|

$

|

|

||||

|

Additions

|

|

|

||||||

|

Payments

|

(

|

)

|

(

|

)

|

||||

|

Reclassified from (to) held for sale

|

|

(

|

)

|

|||||

|

Effect of exchange rate changes

|

(

|

)

|

|

|||||

|

Ending balance

|

$

|

|

$

|

|

||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Interest income

|

$

|

|

$

|

|

$

|

|

||||||

|

Foreign currency transactions (a)

|

(

|

)

|

|

(

|

)

|

|||||||

|

Net periodic benefit cost (b)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Equity in earnings of non-consolidated affiliate (c)

|

|

|

|

|||||||||

|

Total other expense - net

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

|||

|

(a)

|

Foreign currency transactions primarily

consist of foreign currency transaction gains and losses on the re-measurement or settlement of foreign currency-denominated assets and liabilities, including intercompany loans and transactions denominated in a foreign currency, along

with gains and losses on foreign currency exchange contracts.

|

|

(b)

|

|

| (c) |

|

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Components of earnings (loss) before income taxes:

|

||||||||||||

|

United States

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Foreign

|

|

(

|

)

|

|

||||||||

|

Total earnings (loss) before income taxes

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||

|

Income tax provision (benefit):

|

||||||||||||

|

Federal:

|

||||||||||||

|

Current

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

||||

|

Deferred

|

|

|

(

|

)

|

||||||||

|

State:

|

||||||||||||

|

Current

|

|

|

(

|

)

|

||||||||

|

Deferred

|

|

|

(

|

)

|

||||||||

|

Foreign:

|

||||||||||||

|

Current

|

|

|

|

|||||||||

|

Deferred

|

(

|

)

|

|

|

||||||||

|

Total income tax provision

|

$

|

|

$

|

|

$

|

|

||||||

|

Years ended March 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Statutory federal tax

|

|

%

|

|

%

|

|

%

|

||||||

|

State taxes, net of federal benefit

|

|

|

(

|

)

|

||||||||

|

Taxes on non-U.S. earnings and losses

|

|

(

|

)

|

|

||||||||

|

Valuation allowances

|

(

|

)

|

(

|

)

|

|

|||||||

|

Tax credits

|

(

|

)

|

|

(

|

)

|

|||||||

|

Compensation

|

|

(

|

)

|

|

||||||||

|

Tax rate or law changes

|

|

(

|

)

|

|

||||||||

|

Uncertain tax positions, net of settlements

|

(

|

)

|

|

(

|

)

|

|||||||

|

Notional interest deductions

|

(

|

)

|

|

(

|

)

|

|||||||

|

Dividends and taxable foreign inclusions

|

|

|

(

|

)

|

||||||||

|

Other

|

|

(

|

)

|

|

||||||||

|

Effective tax rate

|

|

%

|

(

|

%)

|

|

%

|

||||||

|

March 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Deferred tax assets:

|

||||||||

|

Accounts receivable

|

$

|

|

$

|

|

||||

|

Inventories

|

|

|

||||||

|

Plant and equipment

|

|

|

||||||

|

Lease liabilities

|

|

|

||||||

|

Pension and employee benefits

|

|

|

||||||

|

Net operating and capital losses

|

|

|

||||||

|

Credit carryforwards

|

|

|

||||||

|

Other, principally accrued liabilities

|

|

|

||||||

|

Total gross deferred tax assets

|

|

|

||||||

|

Less: valuation allowances

|

(

|

)

|

(

|

)

|

||||

|

Net deferred tax assets

|

|

|

||||||

|

Deferred tax liabilities:

|

||||||||

|

Plant and equipment

|

|

|

||||||

|

Lease assets

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Intangible assets

|

|

|

||||||

|

Other

|

|

|

||||||

|

Total gross deferred tax liabilities

|

|

|

||||||

|

Net deferred tax assets

|

$

|

|

$

|

|

||||

|

Years ended March 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Beginning balance

|

$

|

|

$

|

|

||||

|

Gross increases - tax positions in prior period

|

|

|

||||||

|

Gross decreases - tax positions in prior period

|

(

|

)

|

(

|

)

|

||||

|

Gross increases - tax positions in current period

|

|

|

||||||

|

Lapse of statute of limitations

|

(

|

)

|

(

|

)

|

||||

|

Ending balance

|

$

|

|

$

|

|

||||

|

Germany

|

Fiscal - Fiscal

|

|

Italy

|

Fiscal - Fiscal

|

|

United States