UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-K

(Mark one)

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to __________________.

Commission File No.: 000-09273

____________________

Mocon, inc.

(Exact name of registrant as specified in its charter)

|

Minnesota (State or other jurisdiction of incorporation or organization)

|

41-0903312 (I.R.S. Employer Identification No.) |

|

7500 Mendelssohn Avenue North Minneapolis, Minnesota (Address of principal executive offices) |

55428 (Zip Code) |

Registrant’s telephone number, including area code: (763) 493-6370

Securities registered under Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common Stock, par value $0.10 per share |

The NASDAQ Stock Market LLC (NASDAQ Global Market) |

Securities registered under Section 12(g) of the Act: None

____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer (do not check if a smaller reporting company) ☐ Smaller reporting company ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the registrant’s common stock, excluding outstanding shares beneficially owned by directors and executive officers, computed by reference to the price at which the common stock was last sold as of June 30, 2015 (the last business day of the registrant’s second quarter) as reported by the Nasdaq Global Market System, was $85,797,902.

As of February 26, 2016, 5,792,126 shares of common stock of the registrant were deemed outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this annual report on Form 10-K incorporates by reference information (to the extent specific sections are referred to herein) from the registrant’s Proxy Statement for its 2016 Annual Meeting of Shareholders to be held May 26, 2016.

part i

This annual report on Form 10-K contains or incorporates by reference not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections. We refer you to the information under the heading “Part I. Item 1. Business – Forward-Looking Statements.”

As used in this annual report on Form 10-K, references to “MOCON,” the “Company,” “we,” “our” or “us,” unless the context otherwise requires, refer to MOCON, Inc. and our subsidiaries.

All trademarks or trade names referred to in this report are the property of their respective owners.

|

Item 1. |

BUSINESS |

MOCON, Inc. designs, manufactures, markets and services products, and provides consulting services, primarily in the test and measurement, analytical instrument and services markets. Our products include instruments that detect, measure and monitor gases and other chemical compounds which help our customers improve the quality of their products, as well as develop new products.

Our gas and vapor permeation instruments were first used in the food packaging industry, starting in the 1970s, to measure small amounts of moisture which can adversely affect dry cereals and other food packaging. Today our core business is involved in, the detection, measurement and analysis of vapors and gases, serves industries far beyond food packaging. Our products serve markets such as foods, beverages, pharmaceuticals and consumer products, oil and gas exploration and industrial and environmental safety.

Our principal business strategy is to employ our product development and technological capabilities, manufacturing processes and revenue and marketing skills where we can successfully penetrate the market and become a leader in the segment. Our management team continually emphasizes product innovation, product performance, quality improvements, cost reductions and other value-adding activities. We seek growth opportunities through technological and product improvement, by acquiring and developing new products, by acquiring companies or new product lines, or by purchasing the rights to existing technologies.

MOCON, Inc. was incorporated as a Minnesota corporation in February 1966 as Modern Controls, Inc., and was initially involved in the commercialization of technology developed for the measurement of water vapor permeating through food packaging materials. Today, the key drivers in the industries we serve are food and beverage product safety and quality, improving workplace safety, supplying testing equipment for oil and gas exploration, and analyzing the quality of air both indoors and outdoors as well as water.

Our current plans for growth include continued substantial funding for research and development to foster new product development and to pursue strategic acquisitions and investments where appropriate.

Our principal executive offices and worldwide headquarters are located at 7500 Mendelssohn Avenue North, Minneapolis, Minnesota 55428, USA, and our telephone number is (763) 493-6370. Our website address is www.mocon.com. The information contained on our website or connected to our website is not incorporated by reference into this annual report on Form 10-K and should not be considered part of this report.

We make available, free of charge on our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. We also make available, free of charge and through our website, to any shareholder who requests, the charters of our Board committees and our Code of Ethics. Requests for copies can be directed to our Chief Financial Officer at the address and phone number above.

Products and Services

We develop, manufacture, market and service test and measurement, analytical and monitoring instruments and systems used to detect, measure and analyze gases and other chemical compounds, as well as provide related consulting services. Please see our consolidated financial statements beginning on page F-1 for financial information concerning our business, including our revenue, net income and net assets.

Package Testing Products and Services

We manufacture and sell three primary products in this group: headspace analyzers, leak detection equipment and gas mixers. Our headspace analyzer products are used to analyze the amount and type of gas present in the headspace of flexible and rigid packages, as applied to gas flushing in modified or controlled atmosphere packaging. The principal market for these products consists of packagers of foods, beverages and pharmaceuticals. Our headspace analyzer products include the PAC CHECK®, CheckMateTM and CheckPointTM series of off-line headspace analyzers and the MAP Check 3TM series of on-line analyzers for continuous and intermittent monitoring of Modified Atmosphere Packaging (MAP) and other gas flushing operations.

Our leak detection products detect leaks in sterile medical trays, food pouches, blister packs and a wide range of other sealed packages. We currently manufacture three types of leak detection instruments. The first type is a non-destructive leak detector that senses small amounts of carbon dioxide escaping from a package or tray. The second type of instrument detects leaks and checks for seal integrity by applying and measuring pressure within a package. The third type pulls a vacuum on a package and looks for vacuum or gas flow changes. The principal markets for these products are packagers of sterile medical items, pharmaceuticals and food products. Our leak detection products include the LeakMatic IITM and LeakPointer IITM series of instruments.

Our gas mixers are used in the food production environment to assure that the package has been properly flushed with the correct mixture of gases. Our gas mixer products include the MAP Mix Provectus and MAP Mix 9001 on-line instruments.

Our package testing products and services group accounted for 43 percent, 44 percent and 44 percent of our consolidated revenue in 2015, 2014 and 2013, respectively.

Permeation Products and Services

Our permeation products consist of systems and services that measure the rate at which various gases and vapors transmit through a variety of materials. These products perform measurements under precise temperature, pressure and relative humidity conditions. The principal market for these products consists of manufacturers of packaging materials, including manufacturers of papers, plastic films, coatings and containers and the users of such packaging materials, such as companies in the food, beverage, pharmaceutical and consumer product industries. Other customers include manufacturers of flat panel displays, solar panels, electronics, and many other sophisticated materials.

We also provide certain laboratory testing services to companies that have a need for permeation data. These services consist primarily of testing film and package permeation for companies that:

|

|

● |

wish to outsource their testing needs to us; |

|

|

● |

are interested in evaluating our instrumentation prior to purchase; or |

|

|

● |

have purchased our products but have a need for additional capacity. |

Our permeation products and services accounted for approximately 41 percent, 36 percent and 38 percent of our consolidated revenue in 2015, 2014 and 2013, respectively. Permeation instruments that we currently manufacture include OX-TRAN® systems for oxygen transmission rates, PERMATRAN-W® systems for water vapor transmission rates, and PERMATRAN-C® systems for carbon dioxide transmission rates. Our AQUATRAN® ultra-high sensitivity, trace moisture permeation analyzer has been increasingly accepted as the standard test instrument of choice in the flat panel, solar cell and electronics industries. Our systems are available in a wide range of options for our customers, including high or low throughput, price, sensitivity and ease of use. They are primarily marketed to research and development departments, as well as production and quality assurance groups.

Industrial Analyzer Products and Services

We manufacture and distribute advanced gas analysis and monitoring instrumentation used in applications such as oil and gas exploration, process and beverage gas analysis, industrial hygiene, safety, environmental air monitoring and indoor air quality.

In this group, we manufacture and sell two types of gas analyzer instruments: gas chromatographs (GCs) and total hydrocarbon analyzers (THAs). These instruments are typically installed in fixed locations at the monitoring sites and perform their functions of detecting and measuring various gases continually or at regular intervals. We also make miniaturized gas sensors and detectors which are sold to original equipment manufacturers (OEMs) of mobile gas safety equipment.

Our industrial analyzer products, sensors and detectors are for use in industrial hygiene (detection of hazardous gases in the workplace), hydrocarbon gas analysis for oil and gas exploration, contaminant detection in the manufacture of specialty gases, and environmental monitoring (tracking the release, or the presence, of toxic substances). Our newest GC offering measures trace levels of contaminants in beverage grade carbon dioxide which is used to carbonate soft drinks, beer and water.

Revenue for our Industrial Analyzer business’ products accounted for approximately 16 percent, 20 percent and 18 percent of our consolidated revenue in each of the years 2015, 2014 and 2013. We market some of these products under the names PetroAlert®, piD-TECH®, and BevAlert®.

Microbial Detection Products

Our microbial detection products are designed to rapidly detect microbial growth in food and beverage samples. Using the total viable count (TVC) method, our GreenLight® series of instruments perform rapid and precise measurements to determine the presence or absence of aerobic bacteria in food products or ingredients. There are two models of the GreenLight product line currently available; the Greenlight 930 and the Greenlight 910. While revenue for these two models are increasing, for the year ended December 31, 2015, revenue from these products do not contribute to our total revenue at a meaningful level.

Competition

We have several competitors for all of our products and services in both foreign and domestic markets. The principal competitive factors for our products and services are:

|

|

● |

product quality and performance; |

|

|

● |

product reliability; |

|

|

● |

product support; and |

|

|

● |

price. |

We compete with a variety of companies in each market in which we sell our products. Some of our competitors have greater assets and resources than we do, and some are smaller than we are. To remain competitive, we must continue to invest in research and development, marketing, customer service and support, and manage our operating expenses. We believe that we have strategies in place to develop technological and other advantages that will give us a competitive advantage over our competitors. However, there can be no assurance that we will have sufficient resources to execute these strategies, or that our competitors will not develop new technologies or other advantages which would require us to reduce our prices, result in lost orders or otherwise adversely affect our financial results.

Manufacturing and Supplies

Our manufacturing capabilities include electro-mechanical assembly, testing, integration of components and systems, calibration and validation of systems. Certain components that we use in our products are currently purchased from single source suppliers. Although we maintain an inventory of these components, an interruption or delay in supply from one of these sources could result in delays in our production while we locate an alternative supplier, which in turn could result in a loss of sales and income.

Patents, Trademarks and Other Intellectual Property Rights

We believe that the protection afforded us by our patent rights is important to our business, and we will continue to seek patent protection for our technology and products. We require all of our employees and consultants to assign to us all inventions that are conceived and developed during their employment, except to the extent prohibited by applicable law. To protect our proprietary information, we have entered into confidentiality and non-compete agreements with those of our employees and consultants who have access to sensitive information. We hold both U.S. and international patents and have U.S. and international patents pending. We currently hold 47 active U.S. patents and 66 foreign patents which will expire during the period from 2016 through 2034, and have another 55 patents pending. We do not believe that the expiration of our patents on their scheduled expiration dates will have a material adverse effect on our business.

We own, have the right to use, or have applied for certain trademarks which protect and identify our products. Our trademarks and service marks include the following: MOCON®, APCHECK®, AQUATRACE®, AQUATRAN, AROMATRAN®, AROMATRAX®, BASELINE®, BEVALERT, CALCARD®, CAL-SMART®, CheckPoint, CMV-2, COULOX®, DANSENSOR®, FLO SMART®, GREENLIGHT, HERSCH®, IMPULSE®, ISM-3, LeakMatic, LeakPointer, LIPPKE®, LUXCEL, MAP Check 3, MAP Mix, MICROANALYTICS®, MULTICHECK®, OPTECH®, OX-TRAN, PAC CHECK, PAC GUARD®, PERMATRAN-C, PERMATRAN-W, PETROALERT, piD-TECH, QUICK START®, SKYE®, TRU SEAL® and VOC-TRAQ®. Our trademarks and service marks have a life of 5 to 20 years, and are subject to periodic maintenance which may be extended in accordance with applicable law.

Marketing and Customers; Distribution Methods

We market our products and services throughout the United States and in over 60 foreign markets. We use a direct sales force of approximately 35 employees and 100 independent sales representatives and distributors to market and sell our products and services to end users throughout the world. To our knowledge, none of our independent sales representatives sell a material amount of product manufactured by any of our competitors.

For information concerning our export sales by geographic area, see Note 14 of the notes to consolidated financial statements. We market products and services to research laboratories, production departments and quality control groups in the life science, medical, food, pharmaceutical, plastics, paper, electronics, oil and gas and other industries. We do not believe that the loss of any single customer would have a material adverse effect on our business or financial performance.

Backlog

As of December 31, 2015, our total backlog was $5.3 million for all of our products as compared to $7.6 million and $7.0 million, as of December 31, 2014 and 2013, respectively. We anticipate shipping substantially all of the December 31, 2015 backlog in 2016.

Research and Development

We are committed to an ongoing engineering program dedicated to innovating new products and improving the quality and performance of our existing products. Our engineering expenses are primarily incurred in connection with the improvement of existing products, cost reduction efforts, and the development of new products that may have additional applications or represent extensions of existing product lines. None of these costs are borne directly by our customers.

We incurred expenses of approximately $4.3 million, $4.2 million and $4.0 million during the fiscal years ended December 31, 2015, 2014 and 2013, respectively, for research and development (R&D) of our products. These amounts were 6 percent to 7 percent of our consolidated revenue for each of those three fiscal years. On an annual basis, we currently intend to spend 6 percent to 8 percent of our consolidated revenue on R&D in the future.

Working Capital Practices

We strive to maintain a level of inventory that is appropriate given our projected revenue. Our domestic and international payment terms vary, however, generally ranging between 30 and 90 days. International revenue is, in some cases, transacted pursuant to letters of credit.

Seasonality

Our business is not seasonal in nature.

Employees

As of December 31, 2015, we had approximately 256 full-time employees. Included in this total are approximately 25 scientists and engineers who research and develop potential new products. None of our employees are represented by a labor union, and we consider our employee relations to be satisfactory.

Executive Officers of the Registrant

Our executive officers, their ages and their offices held, as of March 4, 2016 are as follows:

|

Name |

Age |

Title |

|

Robert L. Demorest |

70 |

Chairman of the Board, President and Chief Executive Officer, MOCON, Inc. |

|

Donald N. DeMorett |

57 |

Chief Operating Officer, MOCON, Inc. |

|

Elissa Lindsoe |

49 |

Chief Financial Officer, MOCON, Inc. |

There are no family relationships among any of our directors and executive officers. Information regarding the business experience of our executive officers is set forth below.

Mr. Robert L. Demorest has been our President, Chief Executive Officer, and Chairman of the Board since April 2000. Mr. Demorest is also a director of Marten Transport, Ltd., a publicly traded company located in Mondovi, Wisconsin, and is a member of its audit committee.

Mr. Donald N. DeMorett has been our Chief Operating Officer since January 2013. Prior to that time, Mr. DeMorett had been the President and Chief Executive Officer of GearGrid Corporation, a manufacturer of commercial storage systems, for more than five years.

Ms. Elissa Lindsoe has been our Chief Financial Officer since October 2014. Ms. Lindsoe was previously the CFO of Galil Medical Ltd., a private equity owned medical device manufacturing firm.

Forward-Looking Statements

This Annual Report on Form 10-K contains or incorporates by reference not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections. In addition, we or others on our behalf may make forward-looking statements from time to time in oral presentations, including telephone conferences and/or web casts open to the public, in press releases or reports, on our website or otherwise. All statements other than statements of historical facts included in this Annual Report on Form 10-K that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our plans, objectives, strategies and prospects regarding, among other things, our financial condition, results of operations, addressable market size estimates and business. We have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “might,” “forecast,” “possible,” “potential,” “project,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “approximate” or “continue” and other words and terms of similar meaning. These forward-looking statements may be contained in the notes to our consolidated financial statements and elsewhere in this Annual Report on Form 10-K, including under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Forward-looking statements involve risks and uncertainties. These uncertainties include factors that affect all businesses as well as matters specific to us. The following are some of the uncertainties and factors known to us that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements: realizing the expected financial benefits from the acquisition of Dansensor and the Realignment Plan; general economic conditions; failing to comply with the terms of our credit agreement; restrictions in our credit agreement, growth in the markets we serve, successfully competing against competitors; the decline in the value of the Euro and the price of oil; factors impacting the stock market and share price; ability of the Company’s manufacturing facilities to meet customer demand; regulatory matters; timing and success of new product introductions; adequate protection of intellectual property rights; and currency and other economic risks inherent in selling products internationally.

For more information regarding these and other uncertainties and factors that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements or otherwise could materially adversely affect our business, financial condition or operating results, refer to this Annual Report on Form 10-K under Part I, Item 1A, “Risk Factors.”

All forward-looking statements included in this Annual Report on Form 10-K are expressly qualified in their entirety by the foregoing cautionary statements. We wish to caution readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described in this Annual Report on Form 10-K under the heading “Item 1A. Risk Factors” below, as well as others that we may consider immaterial or do not anticipate at this time. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. The expectations reflected in our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including those described below under the heading “Item 1A. Risk Factors.” The risks and uncertainties described under the heading “Item 1A. Risk Factors” below are not exclusive and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time. We assume no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to consult any further disclosures we make on related subjects in our quarterly reports on Form 10-Q and current reports on Form 8-K we file with or furnish to the Securities and Exchange Commission.

|

ITEM 1A. |

RISK FACTORS |

The following are significant factors known to us that could have material adverse effects on our business, financial condition or operating results and should be considered carefully in connection with any evaluation of an investment in our common stock. Additionally, the following risk factors could cause our actual results to materially differ from those reflected in any forward-looking statements.

If economic conditions decline, this could adversely affect our business, operating results and financial condition.

Our operations and performance depend significantly on worldwide economic conditions. Uncertainty about global economic conditions poses a risk as consumers and businesses postpone spending in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values, which could have a material negative effect on demand for our products and services. Our customers include pharmaceutical, food, medical and chemical companies, laboratories, government agencies and public and private research institutions. The capital spending of these entities can have a significant effect on the demand for our products. Decreases in capital spending by any of these customer groups could have a material adverse effect on our revenue, business and results of operations.

Further, our customers’ and independent representatives’ ability to borrow money from their existing lenders or to obtain credit from other sources to purchase our products may be impaired. Although we maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments and such losses have historically been within our expectations and the provisions established, we cannot guarantee that we will continue to experience the same loss rates that we have in the past, especially given the current turmoil in the worldwide economy. A significant change in the liquidity or financial condition of our customers could cause unfavorable trends in our receivable collections and additional allowances may be required, which could adversely affect our operating results. If investors have concerns that our business, operating results and financial condition will be negatively impacted by a worldwide economic downturn, our share price could decrease.

If we violate the terms of our credit agreement and financial covenants, it could cause our lender to demand immediate repayment of our credit facilities.

We have a credit agreement with Wells Fargo Bank, our primary lender, with which we entered into a line of credit through August 26, 2018. Our credit agreement with Wells Fargo Bank includes various financial and restrictive covenants. Our current internal projections indicate that we will be in compliance with our financial and restrictive covenants for the next 12 months. However, unforeseen circumstances may develop which could result in us violating our loan covenants. If we violate the terms of our credit agreement, including our financial and restrictive covenants, Wells Fargo Bank could deem us to be in default and require us to immediately repay the entire outstanding balance of our credit facilities. If we do not have the funds available to repay the credit facilities or we cannot find another source of financing, we may fail to meet the terms of our agreement which could decrease the value of our common stock or have other material adverse consequences for us.

Some of the markets in which we operate have experienced minimal growth in recent years, and in the case of the oil and gas market has experienced declines, and our ability to increase our revenue will depend in part on our ability to develop new products, develop new applications for our existing products or acquire complementary businesses and product lines.

We have identified a number of strategies that we believe will allow us to grow our business and increase our revenue in markets experiencing minimal growth. This includes developing new products and technologies, entering new markets such as food safety, developing new applications for our technologies, acquiring complementary businesses and product lines, and strengthening our sales force. However, we can make no assurance that we will be able to successfully implement these strategies, or that these strategies will result in the growth of our business or an increase in our revenue. Acquisitions that we may find attractive may be subject to the consent of Wells Fargo Bank under the credit agreement we have executed with them.

If we fail to attract and retain qualified managerial and technical personnel, we may fail to remain competitive.

Our future success depends, in significant part, upon the continued service and performance of our senior management and other key personnel. We rely on knowledgeable, experienced and skilled technical personnel, particularly engineers, scientists and service personnel, to design, assemble, sell and service our products. The loss of the services of our management team, some of whom have significant experience in our industry, and other key personnel could impair our ability to effectively manage our company and to carry out our business plan. Our inability to attract or retain qualified personnel could have a significant negative effect and thereby materially harm our business.

We face risks of technological changes that may render our products obsolete.

The markets for our products and services are characterized by technological change and evolving industry standards. As a result of such changes and evolving standards, our products may become noncompetitive or obsolete and we may have to develop new products in order to maintain or increase our revenue. New product introductions that are responsive to these factors require significant planning, design, development and testing at the technological, product and manufacturing process levels, and we may not be able to timely develop new products. In addition, industry acceptance of new technologies that we may develop may be slow due to, among other things, existing regulations or standards written specifically for older technologies and general unfamiliarity of users with new technologies. As a result, any new products that we may develop may not generate any meaningful revenue or profits for us for a number of years, if at all.

A significant portion of our revenue is generated from foreign countries and selling in foreign countries entails a number of risks which could result in a decrease in our revenue or an increase in our operating expenses.

Revenue outside the United States accounted for approximately 66 percent of our revenue in 2015, 69 percent in 2014 and 67 percent in 2013, and we expect that foreign revenue will continue to account for a significant portion of our revenues in the future. Revenue to customers in foreign countries are subject to a number of risks including, among others:

● agreements may be difficult to enforce;

● receivables may be difficult to collect;

● certain regions may experience political unrest and conflict and economic instability;

● foreign customers may have longer payment cycles;

● the countries into which we sell may impose tariffs or adopt other restrictions on foreign trade;

● currency fluctuations could reduce reported profitability in future periods;

● fluctuations in exchange rates may affect product demand;

● legal and regulatory requirements may be difficult to monitor and comply with, especially if inconsistent with U.S. laws and regulations;

● customizing products for foreign countries and managing and staffing international operations may lead to increased costs; and

● protection of intellectual property in foreign countries may be more difficult to enforce.

If any of these risks were to materialize, our revenue into foreign countries could decline, or our operating costs could increase, which would adversely affect our financial results.

A portion of our revenue is derived from third party distributors and a disruption to our relationship with them could adversely impact our business. In addition, a portion of our international revenue is derived through third party distributors. As a result, we are dependent upon the financial health of our distributors. We also are dependent upon the compliance of our distributors with foreign laws and the U.S. Foreign Corrupt Practices Act, or the FCPA. If a distributor were to go out of business, it would take substantial time, cost and resources to find a suitable replacement.

We hold a majority of our cash outside the United States and we could incur costs and additional tax liability if we were to bring this cash into the United States.

A significant amount of our cash was generated from our activities outside of the United States and is being held outside of the United States. If these funds were repatriated to the United States or used for operations in the United States in 2016, the amount would be subject to taxation within the United States. Should we require more cash in the United States than is generated by our United States operations, we could elect to repatriate this cash and pay the associated taxes, seek additional borrowing capacity in the United States or seek to raise additional capital in the United States. These alternatives could result in higher effective income tax rates, additional interest expense or other negative impacts to our earnings.

The recent decline in the value of the Euro against the United States dollar has caused a decline in our reported revenue and earnings.

A substantial portion of our revenue outside the United States is generated in Europe. Some of our sales in Europe are denominated in U.S. dollars. For customers that are located in Europe to whom we sell products priced in U.S. dollars, the recent decline in the value of the Euro against the United States dollar will make our products more expensive to these customers which often use their native currency (Euros) to purchase U.S. dollars to pay for our products, and the additional Euros that it will take to pay for our products is an effective price increase to these customers. This could reduce the demand or increase pressure to reduce prices by these customers for our products.

We also have sales to customers located in Europe and elsewhere that are denominated in Euros. For purposes of preparing our consolidated financial statements, these amounts are converted into U.S. dollars and the decrease in the value of the Euro relative to the U.S. dollar means that we will receive less in U.S. dollars from the sales than before the decrease in the exchange rate, which has negatively impacted our operating results. Although some of our costs are denominated in Euros which are also converted into U.S. dollars for purposes of preparing our consolidated financial statements, the reduction in costs on an as converted basis has not offset the reduction in revenue on an as converted basis which has lowered our earnings.

In addition to the decline in the value of the Euro, other fluctuations in foreign currency exchange rates could result in declines in our reported revenue and earnings.

Because the functional currency of our foreign operations is the applicable local currency, we are exposed to foreign currency transaction risk arising from transactions in the normal course of business, such as revenue to third party customers and purchases from suppliers denominated in foreign currencies. From time to time, we have elected to engage in hedging activity to mitigate our risk in this area. At December 31, 2015, there were no forward contract hedge instruments in place in our foreign operations.

Some of our competitors have greater resources than we do, which may provide our competitors with an advantage in the development and marketing of new products.

We currently encounter, and expect to continue to encounter, competition in the sale of our products. We believe that the principal competitive factors affecting the market for our products include product quality and performance, price, reliability and customer service. Our competitors include large multinational corporations. Some of our competitors have substantially greater financial, marketing and other resources than we do. As a result, they may be able to adapt more quickly to new or emerging technologies and changes in customer requirements, or to devote greater resources to the promotion and sale of their products than we can. In addition, competition could increase if new companies enter the market or if existing competitors expand their product lines or intensify efforts within existing product lines. Our current products, products under development and our ability to discover new technologies may be insufficient to enable us to compete effectively with our competitors.

Our reliance upon patents, domestic trademark laws, trade secrets and contractual provisions to protect our proprietary rights may not be sufficient to protect our intellectual property from others who may sell similar products.

We hold patents relating to various aspects of our products and believe that proprietary technical know-how is critical to many of our products. Proprietary rights relating to our products are protected from unauthorized use by third parties only to the extent that they are covered by valid and enforceable patents or are maintained in confidence as trade secrets. We cannot be certain that we will be issued any patents from any pending or future patent applications owned by or licensed to us or that the claims allowed under any issued patents will be sufficiently broad enough to protect our technology. In the absence of patent protection, we may be vulnerable to competitors who attempt to copy our products or gain access to our trade secrets and proprietary know-how. Our competitors may initiate litigation to challenge the validity of our patents, or they may use their resources to design comparable products that do not infringe our patents. We may incur substantial costs if our competitors initiate litigation to challenge the validity of our patents or if we initiate any proceedings to protect our proprietary rights. If the outcome of any such litigation is unfavorable to us, it could have a material adverse effect on our business and results of operations. There may also be pending or issued patents held by parties not affiliated with us that relate to our products or technologies and we may need to acquire licenses to any such patents to continue selling some or all of our products. If we are required to obtain any such license in order to be able to continue to sell some or all of our products, we may not be able to do so on terms that are favorable to us, if at all.

In addition, we rely on trade secrets and proprietary know-how that we seek to protect, in part, by confidentiality agreements with our collaborators, employees and consultants. These agreements may be breached and we may not have adequate remedies for any such breach. Even if these confidentiality agreements are not breached, our trade secrets may otherwise become known or be independently developed by competitors.

The market price of our common stock has fluctuated significantly in the past, and will likely continue to do so in the future, and any broad market fluctuations may materially adversely affect the market price of our common stock.

The market price of our common stock has been volatile in the past, with closing prices ranging from a high of $17.99 and a low of $13.03 during 2015. Several factors could cause the price to fluctuate substantially in the future. Some of these factors include:

● announcements of new products by us or our competitors;

● quarterly fluctuations in our financial results;

● merger and acquisition activity in our industry segment;

● customer contract awards;

● a change to the rates at which we have historically paid dividends, which could be impacted by our credit agreement with Wells Fargo Bank;

● changes in regulation; and

● general economic and political conditions in the various markets where our products are sold.

In addition, the share prices of instrumentation companies have experienced significant fluctuations that often have been unrelated to the operating performance of such companies. This market volatility may adversely affect the market price of our common stock.

Complying with securities laws and regulations is costly for us.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including regulations promulgated by the SEC and Nasdaq, are creating particular challenges for smaller publicly-held companies like us. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

We are exposed to risks relating to its evaluation of its internal control over financial reporting as required by Section 404 of the Sarbanes-Oxley Act.

Our efforts to comply with Section 404 of the Sarbanes-Oxley Act of 2002 and the related regulations regarding our assessment of its internal control over financial reporting have required and will continue to require the expenditure of significant financial and managerial resources. Although our management has concluded that our internal control over financial reporting was effective as of December 31, 2015 and our independent registered public accounting firm agreed, no assurance can be provided that our management or independent registered public accounting firm will reach a similar conclusion as of any later date. Our failure to maintain effective internal control over financial reporting may have an adverse effect on our stock price.

If we experience any increase in the cost of raw materials or supplies, we may experience a decrease in profit margins.

In the past, the overall cost of the materials that we purchase has not risen much more than the rate of inflation. We believe that the price of our products and the prices of our competitors’ products is a significant factor affecting our customers’ buying decisions and consequently, we may not be able to pass along any cost increases in raw materials and supplies in the form of price increases or sustain profit margins that we have achieved in prior years.

We have spent significant resources to develop new products, and the realized revenue from these products may be minimal for a time frame after each new product is being introduced to the marketplace.

In recent years we began to market new products including next generation of existing products such as the OX-TRAN 2/22 and the PERMATRAN-W 3/34. We believe that there are significant markets for our new products and while we believe these products are superior in many respects to similar products being sold by our competitors, each one is new to the marketplace and may not gain the market acceptance necessary to allow us to capitalize on what we believe will be an increasing demand in the industries for which products are utilized. While we have realized increasing revenue of products introduced in the marketplace historically, there can be no assurance that revenue of these products will continue. While we believe our recent new product offerings represent a dramatic improvement over existing technology being used in the respective applications, for some of them, we have not realized significant revenue to date.

If we are not able to successfully market new products, we will not recover the significant research and development and other expenses we have incurred to bring these products to market.

Declining oil prices have resulted in decreased revenue in our Industrial Analyzers and Other segment and may continue to put pressure on this business segment.

Increased oil and gas drilling activity in periods prior to 2015 had been a positive driver for our revenue of monitoring instruments. Worldwide oil prices have recently declined which has led to a decrease in drilling and other exploration activities, which has negatively affected demand for our gas analyzers, sensors and detectors. A further decrease in oil prices may also lead to our customers further decreasing capital spending in anticipation of decreased profitability which could also further negatively affect demand for these products. As a result of decreased spending in the oil and gas drilling markets, our Industrial Analyzers and Other segment experienced a decline in revenue in 2015 and in recent periods and if revenue in this segment continues to decline, our share price could decline.

We recently implemented a realignment plan (“Realignment Plan”), which may result in additional or unanticipated non-recurring charges, and we may not be able to achieve the cost savings expected from these realignment efforts.

Throughout 2015, we completed an initiative to reduce the number of legal entities by merging those entities into other legal entities we have. This initiative is intended to reduce the complexity and administrative burden and cost of maintaining those legal entities. Further, to improve our profitability, during the fourth quarter of 2015, we brought the Package Testing and Permeation segment sales and marketing functions under common leadership and decreased our U.S. headcount by 5 percent. These changes were also designed to strengthen our market presence and provide a cost-effective approach to achieving our objectives.

However, we may not be able to achieve the level of benefits that we expect to realize from these or any future realignment activities, within expected timeframes, or at all. Changes in the amount, timing and character of charges related to our current or future realignment activities and the failure to complete, or a substantial delay in completing, our current and any future realignment plan could have a material adverse effect on our financial results.

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

Not applicable.

|

Item 2. |

PROPERTIES |

We lease an aggregate of 113,175 square feet of office, engineering, laboratory and production space in Minnesota, Texas, Germany, Denmark, Spain, Italy, France and China. We believe that all of our facilities are generally adequate for their present operations and that suitable space is readily available if any of our leases are not extended.

In March 2011, we signed a 15-year lease for our Minneapolis headquarters and operations center. The lease commenced July 1, 2011 and is for a location consisting of approximately 60,000 square feet of space. This space is leased until October 2025. This location is our corporate headquarters from which a portion of all reporting segments conduct operations.

Dansensor A/S, based in Denmark, and operating subsidiaries located in Germany, France, Spain, and Italy lease an aggregate of approximately 39,000 square feet. These buildings are leased through various dates until December 2021. These properties are utilized for the operations of the Package Testing segment.

Our operations located in Neuwied, Germany occupy approximately 8,075 square feet. This space is leased until July 2018. This property is utilized for the operations of the Permeation segment.

The MOCON (Shanghai) Trading Co., Ltd. operations are located in Shanghai, China, and occupy approximately 1,000 square feet. This space is leased until December 2016. This property is utilized in the operations of the Permeation segment.

In addition to our leased facilities described above, we own approximately two acres of land and a building located near Boulder, Colorado that consists of approximately 9,300 square feet of office and production space for our Industrial Analyzers and Other segment.

|

Item 3. |

LEGAL PROCEEDINGS |

There are no material pending legal, governmental, administrative or other proceedings to which we are a party or of which any of our property is the subject.

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

Not applicable.

PART II

|

Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED ShareHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information and Dividends

Our common stock is quoted on the Nasdaq Global Market System under the symbol MOCO. The following table sets forth, for the fiscal periods indicated, the high and low closing sales prices for our common stock as reported by the Nasdaq Global Market System. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. The following table also sets forth, for the fiscal periods indicated, the amount of cash dividends declared on our common stock:

| 2015 | 2014 | |||||||||||||||||||||||

|

Fiscal Period |

High |

Low |

Dividend |

High |

Low |

Dividend |

||||||||||||||||||

|

1st Quarter |

$ | 17.29 | $ | 15.86 | $ | 0.11 | $ | 17.43 | $ | 15.72 | $ | 0.11 | ||||||||||||

|

2nd Quarter |

$ | 17.99 | $ | 15.90 | $ | 0.11 | $ | 17.12 | $ | 15.07 | $ | 0.11 | ||||||||||||

|

3rd Quarter |

$ | 16.25 | $ | 13.03 | $ | 0.11 | $ | 16.44 | $ | 14.88 | $ | 0.11 | ||||||||||||

|

4th Quarter |

$ | 15.20 | $ | 13.54 | $ | 0.11 | $ | 18.50 | $ | 13.00 | $ | 0.11 | ||||||||||||

We have been consistently paying dividends since 1984. Cash dividends paid in 2015, 2014 and 2013 were approximately $2.5 million, $2.5 million and $2.4 million, respectively. Our Board of Directors monitors and evaluates our dividend practice quarterly, and the Board may elect at any time to increase, decrease or not pay a dividend on our common stock based upon our financial condition, results of operations, cash requirements and future prospects and other factors deemed relevant by the Board. Under the loan agreement we have with Wells Fargo Bank, we are required to maintain certain financial ratios. One of these ratios will be impacted by the amount of dividends we pay. If paying dividends at our historical rate were to cause us to be out of compliance with this ratio, or otherwise cause us to be in breach of our covenants under our loan agreement with Wells Fargo Bank, we may be required to reduce or eliminate dividends until such time as we are able to repay our loan, regain compliance with the financial ratios and other covenants in the loan agreement, or negotiate a waiver or amendment with Wells Fargo Bank.

For information concerning securities authorized for issuance under equity compensation plans, please see Part III – Item 12.

Holders

As of February 26, 2016, there were approximately 309 holders of record and 3,400 beneficial holders of our common stock.

Issuer Repurchases of Equity Securities

Other than the withholding of 56,601 shares of our common stock in connection with the cashless net exercise of stock options to pay the exercise price of such options, we did not repurchase any shares of our common stock or other equity securities of MOCON registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, during the fourth quarter ended December 31, 2015. We currently are not authorized by our Board of Directors to make repurchases of our common stock, and we are restricted from doing so under our credit agreement with Wells Fargo Bank.

Recent Sales of Unregistered Securities

During the fourth quarter and year ended December 31, 2015, we did not issue or sell any shares of our common stock or other equity securities of MOCON without registration under the Securities Act of 1933, as amended.

Stock Performance Graph

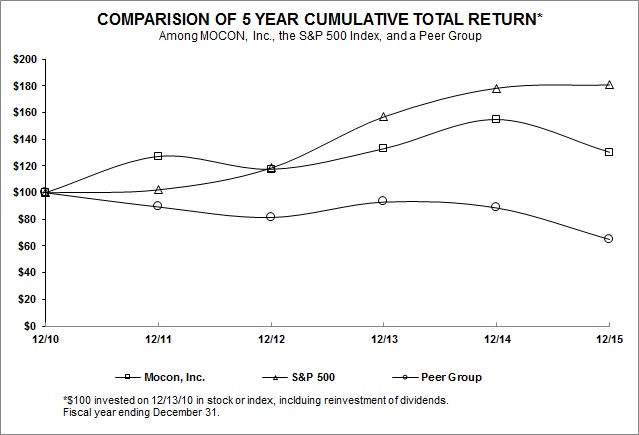

The following graph compares the cumulative shareholder return on MOCON’s common stock to the S&P 500 Index and a peer group consisting of five companies with a market capitalization similar to MOCON. The peer companies were selected from the scientific and technical instruments industry within the technology sector. The graph compares the performance for the last five fiscal years, assuming an investment of $100 on December 31, 2010, including the reinvestment of all dividends. The peer group consists of the following companies: CyberOptics Corporation, eMagin Corporation, Perceptron, Inc., Sypris Solutions, Inc. and Transcat, Inc. We chose these five companies because they operate in similar technology sectors that we do and have a market capitalization similar to ours.

|

12/10 |

12/11 |

12/12 |

12/13 |

12/14 |

12/15 |

|||||||||||||||||||

|

Mocon, Inc. |

100.00 | 127.17 | 117.54 | 132.99 | 154.83 | 130.28 | ||||||||||||||||||

|

S&P 500 |

100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | ||||||||||||||||||

|

Peer Group |

100.00 | 89.33 | 81.40 | 92.99 | 88.52 | 64.93 | ||||||||||||||||||

Source: Research Data Group, Inc.

|

Item 6. |

SELECTED FINANCIAL DATA |

| Years Ended December 31, | ||||||||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||

|

(in thousands, except per share data) |

||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME DATA: |

||||||||||||||||||||

|

Revenue |

$ | 61,224 | $ | 64,475 | $ | 57,108 | $ | 49,941 | $ | 37,361 | ||||||||||

|

Net income |

2,972 | 1,536 | 3,461 | 2,002 | 5,451 | |||||||||||||||

|

Net income per common share: |

||||||||||||||||||||

|

Basic |

0.52 | 0.27 | 0.62 | 0.37 | 1.02 | |||||||||||||||

|

Diluted |

0.51 | 0.27 | 0.61 | 0.35 | 0.98 | |||||||||||||||

|

Cash dividends declared per share |

0.44 | 0.44 | 0.44 | 0.42 | 0.40 | |||||||||||||||

| As of December 31, | ||||||||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||

|

(in thousands) |

||||||||||||||||||||

|

CONSOLIDATED BALANCE SHEET DATA: |

||||||||||||||||||||

|

Current assets |

$ | 24,702 | $ | 27,501 | $ | 27,570 | $ | 26,913 | $ | 23,357 | ||||||||||

|

Total assets |

47,419 | 52,509 | 58,704 | 57,220 | 39,705 | |||||||||||||||

|

Current liabilities |

9,600 | 15,449 | 16,935 | 16,494 | 6,140 | |||||||||||||||

|

Noncurrent liabilities |

4,348 | 2,587 | 4,300 | 6,845 | 325 | |||||||||||||||

|

Shareholders' equity |

33,471 | 34,473 | 37,469 | 33,881 | 33,240 | |||||||||||||||

|

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAl CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis provides material historical and prospective disclosures intended to enable investors and other users to assess our financial condition and results of operations. Statements that are not historical are forward-looking and involve risks and uncertainties including those discussed under the heading “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K. For more information, see “Part I Item 1 Business — Forward-Looking Statements” of this Annual Report on Form 10-K. The following discussion of the results of the operations and financial condition of MOCON should be read in conjunction with our consolidated financial statements and the related notes thereto included elsewhere in this Annual Report on Form 10-K.

Overview

MOCON, Inc. designs, manufactures, markets and services products and provides consulting and testing services primarily in the measurement and analytical instrument and services markets. Our products include instruments that detect, measure and monitor gases and chemical compounds. We continually seek growth opportunities through technological and product improvement, by developing new products, and by acquiring new companies, new product lines, or rights to technologies.

We are headquartered in Minnesota and have operating locations in Minnesota, Denmark, and Colorado. We have offices and laboratories in Texas, Germany, France, Italy, Spain and China. We use a mix of a direct sales force and independent sales representatives to market our products and services in the United States, Canada, Europe and China, and we use a network of independent sales representatives and distributors to market and service our products and services in most other foreign countries.

Our ongoing plans for growth include continued substantial funding for research and development to drive new product introductions, together with strategic acquisitions and investments where appropriate.

Significant Transactions and Financial Trends

Throughout these financial sections, you will read about significant transactions or events that materially contribute to, or reduce our earnings, and materially affect our financial results and financial position.

Our research and development costs were approximately 6 percent to 7 percent of our consolidated revenue in 2015, 2014 and 2013. On an annual basis, we intend to spend 6 percent to 8 percent of our revenue on research and development in the future.

During 2015, we implemented a series of initiatives, including a reduction in workforce and simplification of business structures (“Realignment Plan”). Substantially all Realignment Plan activities were completed by December 31, 2015. These actions are intended to increase operating efficiencies and provide additional resources to execute our long-term growth strategy.

In January 2016, we entered into an agreement to sell substantially all the assets of the business formerly known as Microanalytics which is located in Round Rock, Texas. The sale is expected to be finalized and closed during the first half of 2016. The assets of this business primarily consists of lab equipment used in the analytical chemistry services, formulation, product development and consulting services focused on the identification of odors and aromas. The revenue related to this business was $0.7 million, $0.9 million and $0.8 million for the years ended December 31, 2015, 2014 and 2013, respectively. The gross profit contribution related to the Microanalytics business was $0.2 million, $0.4 million and $0.3 million for the years ended December 31, 2015, 2014 and 2013, respectively.

While these items are important in understanding and evaluating our financial results, certain trends, such as our international revenue accounting for a significant portion of our revenue, and other transactions or events such as those discussed later in this Management’s Discussion and Analysis, may also have a material impact on our financial results.

Critical Accounting Policies

Our significant accounting policies are described in Note 1 to our consolidated financial statements included in Item 8 of this Annual Report on Form 10-K. This Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires management to make estimates and judgments that affect the reported amount of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The Securities and Exchange Commission has defined a company’s most critical accounting policies as those that are most important to the portrayal of its financial condition and results of operations, and which require us to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition, we have identified the following critical accounting policies. Although we believe that our estimates and assumptions are reasonable, they are based upon information available when they are made. Actual results may differ significantly from these estimates under different assumptions or conditions.

Revenue Recognition

We recognize revenue when it is realized or realizable and earned. We consider product revenue realized or realizable when persuasive evidence of an arrangement exists, the product has been shipped or the services have been provided to the customer, title and risk of loss of products has passed to the customer, the sales price is fixed or determinable, and collectability is reasonably assured. We recognize service and consulting revenue upon delivery of the services. The revenue recognition policy does not differ among the various product lines, the marketing venues, or various geographic destinations. We do not have distributors who stock our equipment. We do not offer rebates, price protection, or other similar incentives, and discounts when offered, are recorded as a reduction in revenue. We record revenue net of sales tax charged to the customer.

Revenue for service arrangements such as maintenance, repair, technical support are recognized either as the service is provided or ratably over the defined contractual period for service maintenance. Revenue for preventive maintenance agreements is recognized on a per visit basis and extended warranties on a straight-line basis over the life of the contracts. Unearned revenue related to these contracts is recorded in current liabilities in the consolidated balance sheets.

Periodically, we have shipments of products to customers where we are required to recognize revenue under the accounting guidance related to multiple element arrangements. This guidance provides that the overall arrangement fee will be allocated to each element (both delivered and undelivered items) based on their relative selling price, as demonstrated by vendor-specific objective evidence (VSOE) or third-party evidence (TPE). Where VSOE or TPE is not available, revenue will be assigned using an estimated selling price.

Reserve for Doubtful Accounts and Returns

Our allowance for doubtful accounts and returns is for accounts receivable balances that are estimated to be uncollectible as well as anticipated returns. The reserve is based on a number of factors, including: (1) an analysis of customer accounts and (2) our historical experience with accounts receivable write-offs and returns. The analysis includes the age of the receivable, the financial condition of a customer or industry and general economic conditions. We believe our financial results could be materially different if historical trends are not predictive of future results or if economic conditions worsened for our customers. In the event we determined that a smaller or larger allowance for doubtful accounts is appropriate, we would record a credit or charge to selling, general and administrative expense in the period that we made such a determination. As of December 31, 2015 and 2014, we had approximately $141,000 and $181,000, respectively, reserved against our accounts receivable for doubtful accounts and returns.

Accrual for Excess and Obsolete Inventories

We perform an analysis to identify excess and obsolete inventory. We record a charge to cost of revenue for amounts identified. Our analysis includes inventory levels, the nature of the components and their inherent risk of obsolescence, and the on-hand quantities relative to the sales history of that component. We believe that our financial results could be materially different if historical trends are not predictive of future results or if demand for our products decreased because of economic or competitive conditions or otherwise. As of December 31, 2015 and 2014, we had approximately $511,000 and $526,000, respectively, accrued for excess and obsolete inventories.

Recoverability of Long-Lived Assets

We assess the recoverability of definite-lived intangibles and other long-lived assets periodically whenever events or changes in circumstances indicate that expected future undiscounted cash flows might not be sufficient to support the carrying amount of an asset. We deem an asset to be impaired if a forecast of undiscounted future operating cash flows is less than an asset’s carrying amount. If an asset is determined to be impaired, the loss is measured as the amount by which the carrying value of the asset exceeds its fair value. Changes in our business strategies, changes in the economic environment in which we operate, competitive conditions, and other factors could result in future impairment charges.

During 2014 we identified an impairment indicator and concluded that the carrying value of our investment in an affiliated company, Luxcel Biosciences Limited (Luxcel) exceeded its fair value. The impairment was determined to be other-than-temporary. As a result, a non-cash, non-tax deductible impairment charge of $3.2 million, representing 100 percent of the carrying value, has been recognized within operating expenses of the consolidated statements of income in 2014.

Goodwill

We assess the recoverability of goodwill on our annual measurement date or whenever events or changes in circumstances indicate that expected future undiscounted cash flows might not be sufficient to support the carrying amount of an asset. Goodwill is considered to be impaired if it is determined that the carrying amount of the reporting unit exceeds its fair value. Assessing the impairment of goodwill requires us to make judgments regarding the fair value of the net assets of our reporting units and the allocation of the carrying amount of shared assets to the reporting units. Our annual assessment included comparison of the carrying amount of the net assets of a reporting unit, including goodwill, to the fair value of the reporting unit. A significant change in our market capitalization or in the carrying amount of net assets of a reporting unit could result in an impairment charge in future periods. We performed our annual 2015 assessment during the fourth quarter, and determined there was no impairment of goodwill for any of our reporting units as their related fair values were in excess of their carrying values.

Income Taxes

In the preparation of our consolidated financial statements, management is required to estimate income taxes in each of the jurisdictions in which we operate. This process involves estimating actual current tax exposures together with assessing temporary differences resulting from differing treatment of items for tax and accounting purposes. These differences result in deferred tax assets and liabilities, which are included in our Consolidated Balance Sheets.

Management reviews the deferred tax assets for recoverability on a quarterly basis and assesses the need for valuation allowances. These deferred tax assets are evaluated by considering historical levels of income, estimates of future taxable income streams and the impact of tax planning strategies. A valuation allowance is recorded to reduce deferred tax assets when it is determined that it is more likely than not that we would not be able to realize all or part of our deferred tax assets. We provided a valuation allowance in the amount of $1.3 million at December 31, 2015 and 2014, against our net deferred tax assets.

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 740 requires application of a more-likely-than-not threshold to the recognition and de-recognition of uncertain tax positions. Under ASC 740, once the more-likely-than-not threshold is met, the amount of benefit to be recognized is the largest amount of tax benefit that is greater than 50 percent likely of being ultimately realized upon settlement. It further requires that a change in judgment related to the expected ultimate resolution of uncertain tax positions be recognized in earnings in the period of such a change. We have unrecognized tax benefits in the amount of $201,000 and $357,000 in 2015 and 2014, respectively, for estimated exposures associated with uncertain tax positions. However, due to the complexity of some of these uncertainties, the ultimate settlement may result in payments that are different from our current estimate of tax liabilities, resulting in the recognition of additional charges or benefits to income tax expense.

Results of Operations

The following table sets forth the relationship between various components of our results of operations, stated as a percent of revenue, for fiscal years ended December 31, 2015, 2014 and 2013. Our historical financial data were derived from our consolidated financial statements and related notes included in Item 8 of this Annual Report on Form 10-K.

|

Percent of Revenue |

||||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Revenue |

100.0 | 100.0 | 100.0 | |||||||||

|

Cost of revenue |

45.7 | 44.0 | 45.2 | |||||||||

|

Gross profit |

54.3 | 56.0 | 54.8 | |||||||||

|

Selling, general and administrative expenses |

38.3 | 38.8 | 39.3 | |||||||||

|

Research and development expenses |

7.1 | 6.5 | 7.1 | |||||||||

|

Realignment Expense |

1.7 | - | - | |||||||||

|

Impairment of investment in affiliated company |

- | 4.9 | - | |||||||||

|

Operating income |

7.2 | 5.8 | 8.4 | |||||||||

|

Other income (expense), net |

0.1 | (0.5 | ) | (0.6 | ) | |||||||

|

Income before income taxes |

7.3 | 5.3 | 7.8 | |||||||||

|

Income taxes |

2.4 | 3.0 | 1.7 | |||||||||

|

Net income |

4.9 | 2.3 | 6.1 | |||||||||

The following table summarizes total revenue by segment for 2015, 2014 and 2013 (expressed in thousands):

| Years Ended December 31, | ||||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Package Testing |

$ | 26,583 | $ | 28,071 | $ | 25,241 | ||||||

|

Permeation |

25,069 | 23,380 | 21,395 | |||||||||

|

Industrial Analyzers and Other |

9,572 | 13,024 | 10,472 | |||||||||

|

Total revenue |

$ | 61,224 | $ | 64,475 | $ | 57,108 | ||||||

The following table sets forth the relationship between various components of domestic and foreign revenue for 2015, 2014 and 2013 (expressed in thousands):

| Years Ended December 31, | ||||||||||||

|

2015 |

2014 |

2013 |

||||||||||

|

Domestic revenue |

$ | 20,872 | $ | 19,836 | $ | 19,052 | ||||||

|

Foreign revenue: |

||||||||||||

|

Europe |

23,673 | 26,324 | 23,966 | |||||||||

|

Asia |

12,762 | 14,166 | 10,481 | |||||||||

|

Other |

3,917 | 4,149 | 3,609 | |||||||||

|

Total foreign revenue |

40,352 | 44,639 | 38,056 | |||||||||

|

Total revenue |

$ | 61,224 | $ | 64,475 | $ | 57,108 | ||||||

Revenue

Fiscal 2015 vs. Fiscal 2014

Revenue in 2015 was $61.2 million, a decrease of 5 percent compared to $64.5 million for 2014. Foreign currency translation had an unfavorable impact of $5.3 million compared to the prior year. When excluding the effect of the currency rate impact, revenue grew 3 percent and continues to meet growth targets for the Package Testing and Permeation segments. The growth in our Package Testing and Permeation segments on a constant currency basis was offset by the decline in revenue for our Industrial Analyzers and Other segment. We believe future revenue results depend primarily upon our ability to continue to introduce new products, retain and attract market demand and grow in the markets we serve, including oil and gas markets.

Package Testing Products and Services

Revenue in our Package Testing segment accounted for 43 percent and 44 percent of our consolidated revenue in each of 2015 and 2014, respectively. Revenue decreased 5 percent in the year ended December 31, 2015 to $26.6 million compared to same period in 2014. Revenue in our Package Testing segment was negatively impacted by $4.4 million during 2015 due to currency rate fluctuations as compared to the prior year. Excluding the impact of the currency rate fluctuations, revenue for our Package Testing segment grew 11 percent compared to the prior year. This growth on a constant currency basis is a result of a continued revenue increase in our headspace and mixer products as we increase our market share. Revenue to foreign destinations comprised 74 percent and 77 percent of total revenue in this segment for the years ended December 31, 2015 and 2014, respectively.

Permeation Testing Products and Services

Revenue in our Permeation segment increased 7 percent for the current year as compared to the prior year, and accounted for 41 percent and 36 percent of our consolidated revenue for the years ended December 31, 2015 and 2014, respectively. Permeation segment revenue was negatively impacted by $897,000 due to currency rate fluctuations compared to the prior year. Excluding the impact of the currency rate fluctuations, revenue for our Permeation segment grew 11 percent compared to the prior year. This increase is due to strong demand for our new generation of oxygen permeation instrumentation. Foreign revenue comprised 63 percent of the revenue in this segment in 2015, compared to 70 percent from the prior year.

Industrial Analyzer Products and Services and Other

Revenue in our Industrial Analyzers and Other segment accounted for 16 percent and 20 percent of our consolidated revenue for the years ended December 31, 2015 and 2014, respectively. Revenue decreased 27 percent to $9.6 million during the year ended December 31, 2015 compared to $13.0 million for the same period in 2014. The decline in revenue compared to the prior year is primarily due to a 77 percent, or $3.9 million, decline in instrument revenue from the oil and gas exploration markets partially offset by an increase in demand from the environmental monitoring, in which instrument sales were up 5 percent, and beverage safety markets. Revenue to foreign destinations comprised 49 percent and 50 percent of total revenue in this segment for the years ended December 31, 2015 and 2014, respectively.

Fiscal 2014 vs. Fiscal 2013