10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) |

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended July 25, 2015 |

|

| |

¨

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________ to ________ |

Commission File Number 001-10613

DYCOM INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Florida | | 59-1277135 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

11780 US Highway 1, Suite 600, Palm Beach Gardens, FL | | 33408 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (561) 627-7171

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.33 1/3 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy of information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common stock, par value $0.33 1/3 per share, held by non-affiliates of the registrant, computed by reference to the closing price of such stock on the New York Stock Exchange on January 24, 2015, was $1,068,731,432.

There were 33,236,463 shares of common stock with a par value of $0.33 1/3 outstanding at September 1, 2015.

DOCUMENTS INCORPORATED BY REFERENCE |

| |

Document | Part of Form 10-K into which incorporated |

Portions of the registrant's Proxy Statement to be filed by November 21, 2015 | Parts II and III |

| |

Such Proxy Statement, except for the portions thereof which have been specifically incorporated by reference, shall not be deemed "filed" as part of this Annual Report on Form 10-K. |

Dycom Industries, Inc. Table of Contents |

| | |

| | |

| | |

| | |

| | |

| PART I | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART IV | |

| | |

| | |

| | |

| | |

Cautionary Note Concerning Forward-Looking Statements

This Annual Report on Form 10-K, including any documents incorporated by reference or deemed to be incorporated by reference herein, contains forward-looking statements relating to future events, financial performance, strategies, expectations, and competitive environment. Words such as "outlook," "believe," "expect," "anticipate," "estimate," "intend," "forecast," "may," "should," "could," "project," "target," and similar expressions, as well as statements written in the future tense, identify forward-looking statements. They will not necessarily be accurate indications of whether or at what time such performance or results will be achieved. You should not consider forward-looking statements as guarantees of future performance or results. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences include, but are not limited to:

| |

• | anticipated outcomes of contingent events, including litigation; |

| |

• | projections of revenues, income or loss, or capital expenditures; |

| |

• | determinations as to whether the carrying value of our assets is impaired; |

| |

• | expected benefits and synergies of businesses acquired and future opportunities for the combined businesses; |

| |

• | plans for future operations, growth and acquisitions, dispositions, or financial needs; |

| |

• | outcomes of our plans for future operations, growth and services, including contract backlog; |

| |

• | restrictions imposed by our credit agreement and the indenture governing our senior subordinated notes; |

| |

• | use of our cash flow to service our debt; |

| |

• | future economic conditions and trends in the industries we serve; |

| |

• | assumptions relating to any of the foregoing; |

and other factors discussed within Item 1, Business, Item 1A, Risk Factors and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in this Annual Report on Form 10-K and other risks outlined in our periodic filings with the Securities and Exchange Commission ("SEC"). Our forward-looking statements are expressly qualified in their entirety by this cautionary statement. Our forward-looking statements are only made as of the date of this Annual Report on Form 10-K, and we undertake no obligation to update them to reflect new information or events or circumstances arising after such date.

Available Information

Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are available free of charge at our website, www.dycomind.com, as soon as reasonably practicable after we file these reports with, or furnish these reports to, the SEC. All references to www.dycomind.com in this report are inactive textual references only and the information on our website is not incorporated into this Annual Report on Form 10-K.

PART I

Item 1. Business.

Dycom Industries, Inc. ("Dycom") is a leading provider of specialty contracting services throughout the United States and in Canada. Our subsidiary companies provide engineering, construction, maintenance, and installation services to telecommunications providers, underground facility locating services to various utilities, including telecommunications providers, and other construction and maintenance services to electric and gas utilities. Our consolidated revenues for fiscal 2015 were $2.022 billion.

Dycom was incorporated in the State of Florida in 1969 and has since expanded its geographic scope and service offerings, both organically and through acquisitions. Our established footprint and decentralized workforce provide the scale needed to quickly execute on opportunities to service existing and new customers.

Specialty Contracting Services

Our subsidiaries supply telecommunication providers with a broad range of specialty contracting services, from program management, engineering, construction, maintenance, and installation to underground facility locating. Engineering services include the design of aerial, underground, and buried fiber optic, copper, and coaxial cable systems that extend from the telephone company central office, or cable operator headend, to the consumer's home or business. We also obtain rights of way and permits in support of our engineering activities and those of our customers as well as provide construction management and inspection personnel in conjunction with engineering services or on a stand-alone basis.

Construction, maintenance, and installation services include the placement and splicing of fiber, copper, and coaxial cables. In addition, we excavate trenches in which to place these cables; place related structures such as poles, anchors, conduits, manholes, cabinets, and closures; place drop lines from main distribution lines to the consumer's home or business; and maintain and remove these facilities. We provide these services to both telephone companies and cable multiple system operators in connection with the deployment, expansion, or maintenance of new and existing networks. We also provide tower construction, lines and antenna installation, and foundation and equipment pad construction for wireless carriers, as well as equipment installation and material fabrication and site testing services. For cable television system operators, we install and maintain customer premise equipment such as digital video recorders, set top boxes and modems.

We also perform construction and maintenance services for electric and gas utilities and other customers. In addition, we provide underground facility locating services to a variety of utility companies, including telecommunication providers. Our underground facility locating services include locating telephone, cable television, power, water, sewer, and gas lines.

Business Strategy

Capitalize on Long-Term Growth Drivers. We are well positioned to benefit from the increased demand for network bandwidth that is necessary to ensure reliable video, voice, and data services. Significant developments in consumer applications, such as advanced digital and video service offerings, continue to increase the demands for greater capacity and reliability on the wireline and wireless networks of our customers. Additionally, demand for mobile broadband remains strong, driven by the proliferation of smart phones, tablets and other wireless data devices. The service offerings of telephone and cable companies continue to converge, with each offering reliable, competitively priced services to consumers and businesses. These accelerating developments have heightened the importance of network performance.

Selectively Increase Market Share. We believe our reputation for high quality and our ability to provide services nationally creates opportunities to expand our market share. Our decentralized operating structure and numerous points of contact within customer organizations position us favorably to win new opportunities with existing customers. Our significant financial resources enable us to address larger opportunities that some of our relatively capital-constrained competitors may be unable to perform. We do not intend to increase market share by pursuing unprofitable work.

Pursue Disciplined Financial and Operating Strategies. We manage the financial aspects of our business by centralizing certain activities that allow us to reduce costs through leveraging our scope and scale. We have centralized functions such as treasury, tax and risk management, the approval of capital equipment procurements, and the design and administration of employee benefit plans. We also centralize our information technology structure to provide enhanced operating efficiency. In contrast, we decentralize the recording of transactions and the financial reporting necessary for timely operational decisions. Decentralization promotes greater accountability for business outcomes from our local decision makers. We also maintain a decentralized approach to marketing, field operations, and ongoing customer service, empowering local managers to capture

new business and execute contracts on a timely and cost-effective basis. Our approach enables us to utilize capital resources efficiently while retaining the organizational agility necessary to compete with smaller, privately owned competitors.

Pursue Selective Acquisitions. We pursue acquisitions that are operationally and financially beneficial for the Company as a whole. In particular, we pursue acquisitions that will provide us with incremental revenue and geographic diversification while complementing our existing operations. We generally target companies for acquisition that have defensible leadership positions in their market niches, profitability that meets or exceeds industry averages, proven operating histories, sound management and certain clearly identifiable cost synergies.

Acquisitions

Fiscal 2015 - During the first quarter of fiscal 2015, we acquired Hewitt Power & Communications, Inc. ("Hewitt") for $8.0 million, net of cash acquired. Hewitt provides specialty contracting services primarily for telecommunications providers in the Southeastern United States. We acquired the assets of two cable installation contractors for an aggregate purchase price of $1.5 million during the second quarter of fiscal 2015. During the fourth quarter of fiscal 2015, we acquired Moll's Utility Services, LLC ("Moll's") for $6.5 million, net of cash acquired. Moll's provides specialty contracting services primarily for utilities in the Midwest United States. We also acquired the assets of Venture Communications Group, LLC ("Venture") for $15.6 million during the fourth quarter of fiscal 2015. Venture provides specialty contracting services primarily for telecommunications providers in the Midwest and Southeastern United States. See Note 21, Subsequent Events, in the Notes to Consolidated Financial Statements regarding businesses acquired subsequent to fiscal 2015.

Fiscal 2014 - During the third quarter of fiscal 2014, we acquired a telecommunications specialty construction contractor in Canada for $0.7 million. Additionally, during the fourth quarter of fiscal 2014, we acquired Watts Brothers Cable Construction, Inc. ("Watts Brothers") for $16.4 million. Watts Brothers provides specialty contracting services primarily for telecommunications providers in the Midwest and Southeastern United States.

Fiscal 2013 - On December 3, 2012, we acquired substantially all of the telecommunications infrastructure services subsidiaries (the "Acquired Subsidiaries") of Quanta Services, Inc. for the sum of $275.0 million in cash, an adjustment of approximately $40.4 million for working capital received in excess of a target amount, and approximately $3.7 million for other specified items. The Acquired Subsidiaries provide specialty contracting services, including engineering, construction, maintenance and installation services to telecommunications providers, and other construction and maintenance services to electric and gas utilities and others. Principal business facilities are located in Arizona, California, Florida, Georgia, Minnesota, New York, Pennsylvania, and Washington.

During the fourth quarter of fiscal 2013, we acquired Sage Telecommunications Corp. of Colorado, LLC ("Sage") and certain assets of a tower construction and maintenance company for a combined total of $11.3 million, net of cash acquired. Sage provides telecommunications construction and project management services primarily for cable operators in the Western United States.

Customer Relationships

We have established relationships with many leading telecommunications providers, including telephone companies, cable television multiple system operators, wireless carriers, telecommunication equipment and infrastructure providers, and electric and gas utilities and others. Our customer base is highly concentrated, with our top five customers accounting for approximately 61.1%, 58.3% and 58.5% of our total revenues in fiscal 2015, 2014, and 2013, respectively. During fiscal 2015, we derived approximately 20.8% of our total revenues from AT&T Inc., 14.2% from CenturyLink, Inc., 12.9% from Comcast Corporation, 7.6% from Verizon Communications, Inc. and 5.6% from another significant customer. We believe that a substantial portion of our total revenues and operating income will continue to be generated from a concentrated group of customers.

We serve our markets locally through dedicated and experienced personnel. Our sales and marketing efforts are the responsibility of our subsidiaries' management teams who possess intimate knowledge of their particular markets, allowing us to be responsive to customer needs. Our executive management team supplements these efforts, both at the local and national levels, focusing on contact with the appropriate managers within our customers' organizations.

We perform a majority of our services under master service agreements and other arrangements that contain customer-specified service requirements, such as discrete pricing for individual tasks. We generally have multiple agreements with each of our significant customers. To the extent that such agreements specify exclusivity, there are often a number of exceptions, including the customer's ability to issue work orders valued above a specified dollar amount to other service providers, the

performance of work with the customer's own employees, and the use of other service providers when jointly placing facilities with another utility. In most cases, a customer may terminate an agreement for convenience with written notice. Historically, multi-year master service agreements have been awarded primarily through a competitive bidding process; however, we are occasionally able to extend a portion of these agreements through negotiations. We provide the remainder of our services pursuant to contracts for specific projects. These contracts may be long-term (with terms greater than one year) or short-term (with terms generally three to four months in duration) and often include customary retainage provisions under which the customer may withhold 5% to 10% of the invoiced amounts pending project completion.

Cyclicality and Seasonality

The cyclical nature of the industry we serve may affect demand for our services. The capital expenditure and maintenance budgets of our customers, and the related timing of approvals and seasonal spending patterns, influence our revenues and results of operations. The business demands of our customers and the demands of their consumers, the introduction of new communication technologies, the physical maintenance needs of customer infrastructure, the actions of our government and the Federal Communications Commission, and overall economic conditions may affect the capital expenditures and maintenance budgets of our telecommunications customers. Changes in our mix of customers, contracts, and business activities, as well as changes in the general level of construction activity also drive variations in revenues and results of operations.

Our revenues and results of operations exhibit seasonality as we perform a significant portion of our work outdoors. Consequently, extended periods of adverse weather, which are more likely to occur during the winter season, impact our operations during our second and third fiscal quarters. In addition, a disproportionate percentage of paid holidays fall within our second fiscal quarter, which decreases the number of available workdays. Because of these factors, we may experience reduced revenue and profitability in the second and/or third quarters of our fiscal year.

Backlog

Our backlog consists of the estimated uncompleted portion of services to be performed under contractual agreements with our customers and totaled $3.680 billion and $2.331 billion at July 25, 2015 and July 26, 2014, respectively. The increase in backlog from July 26, 2014 primarily relates to new awards and extensions during fiscal 2015. We expect to complete 44.0% of the July 25, 2015 backlog during the next twelve months. Our backlog estimates represent amounts under master service agreements and other contractual agreements for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. The significant majority of our backlog estimates comprise services under master service agreements and long-term contracts.

Revenue estimates included in our backlog can be subject to change because of project accelerations, cancellations, or delays due to various factors, including but not limited to commercial issues and adverse weather. These factors can also cause revenue to be realized in different periods or in different amounts from those originally reflected in backlog. In many instances, our customers are not contractually committed to procure specific volumes of services under a contract. While we did not experience any material cancellations during fiscal 2015, 2014, or 2013, many of our customers may cancel our contracts upon notice regardless of whether or not we are in default. The amount of backlog related to uncompleted projects in which a provision for estimated losses was recorded is not material.

Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others.

Competition

The specialty contracting services industry in which we operate is highly fragmented and includes a large number of participants. We compete with several large corporations and numerous small, privately owned companies. We also face competition from the in-house service organizations of our existing and prospective customers, particularly telecommunications providers that employ personnel who perform some of the same services we provide. Relatively few barriers to entry exist in the markets in which we operate. As a result, any organization that has adequate financial resources, access to technical expertise, and the necessary equipment and materials may become a competitor. The principal competitive factors for our services include geographic presence, breadth of service offerings, worker and general public safety, price, quality of service, and industry reputation. We believe that we meet or exceed the abilities of our competitors when evaluated against these factors.

Employees

We employed approximately 11,159 persons as of July 25, 2015. Our workforce includes a core group of technical and managerial personnel to supervise our projects and fluctuates in size to meet the demands of our customers. We consider our relations with employees to be good and believe our future success will depend, in part, on our continuing ability to attract, hire, and retain skilled and experienced personnel.

Materials and Subcontractors

For a majority of the contract services we perform, our customers provide all materials required, while we provide the necessary personnel, tools, and equipment. Because our customers retain the financial and performance risk associated with materials they provide, we do not include associated amounts in our revenue or costs of sales. Under contracts that require us to supply part or all of the required materials, we are not dependent upon any one source for materials and do not anticipate experiencing procurement difficulties.

We contract with independent subcontractors to help manage fluctuations in work volumes and reduce the amount that we may otherwise be required to expend on fixed assets and working capital. These independent subcontractors are typically small, locally owned companies, that provide their own employees, vehicles, tools and insurance coverage. There are no individual independent subcontractors that are significant to the Company.

Safety and Risk Management

We are committed to instilling safe work habits within our employees through proper training and supervision and expect adherence to safety practices that ensure a safe work environment. Our safety program requires employees to participate in safety training relevant to the work they perform and that which is required by law. The safety directors of our businesses review safety incidents and claims for our operations, examine trends, and implement changes in procedures to address safety issues. Claims arising in our business generally include workers' compensation claims, various general liability and damage claims, and claims related to motor vehicle collisions, including personal injury and property damage. For claims within our insurance program, we retain the risk of loss, up to certain limits, for matters related to automobile liability, general liability, workers' compensation, employee group health, and damages associated with underground facility locating services.

We carefully monitor claims and actively participate with our insurers in determining claims estimates and adjustments. We accrue the estimated costs of claims as liabilities, and include estimates for claims incurred but not reported. Due to fluctuations in our loss experience from year to year, insurance accruals have varied and can affect the consistency of our operating margins. Our business could be materially and adversely affected if we experience insurance claims in excess of our umbrella coverage limit. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 8, Accrued Insurance Claims, in the Notes to Consolidated Financial Statements.

Environmental Matters

A significant portion of the work we perform is associated with the underground networks of our customers. We could be subject to potential material liabilities in the event we cause a release of hazardous substances or other environmental damage resulting from underground objects we encounter. Liabilities for contamination or exposure to hazardous materials, or failure to comply with environmental laws and regulations could result in significant costs including clean-up costs, fines, criminal sanctions for violations, and third party claims for property damage or personal injury. These costs as well as any direct impact to ongoing operations could adversely affect our results of operations and cash flows.

Executive Officers of the Registrant

The following table sets forth certain information concerning the Company's executive officers, all of whom serve at the pleasure of the Board of Directors.

|

| | | | | | |

Name | | Age | | Office | | Executive Officer Since |

Steven E. Nielsen | | 52 | | Chairman, President and Chief Executive Officer | | February 26, 1996 |

Timothy R. Estes | | 61 | | Executive Vice President and Chief Operating Officer | | September 1, 2001 |

H. Andrew DeFerrari | | 46 | | Senior Vice President and Chief Financial Officer | | November 22, 2005 |

Richard B. Vilsoet | | 62 | | Vice President, General Counsel and Corporate Secretary | | June 11, 2005 |

Kimberly Dickens | | 53 | | Vice President and Chief Human Resources Officer | | March 24, 2014 |

Rebecca Brightly Roach | | 40 | | Vice President and Chief Accounting Officer | | August 25, 2015 |

There are no arrangements or understandings between any executive officer of the Company and any other person pursuant to which any executive officer was selected as an officer of the Company. There are no family relationships among the Company's executive officers.

Steven E. Nielsen has been the Company's President and Chief Executive Officer since March 1999. Prior to that, Mr. Nielsen was President and Chief Operating Officer of the Company from August 1996 to March 1999, and Vice President from February 1996 to August 1996.

Timothy R. Estes has been the Company's Executive Vice President and Chief Operating Officer since September 2001. Prior to that, Mr. Estes was the President of Ansco & Associates, Inc., one of the Company's subsidiaries, from 1997 until 2001 and Vice President from 1994 until 1997.

H. Andrew DeFerrari has been the Company's Senior Vice President and Chief Financial Officer since April 2008. Prior to that, Mr. DeFerrari was the Company's Vice President and Chief Accounting Officer since November 2005 and was the Company's Financial Controller from July 2004 through November 2005. Mr. DeFerrari was previously a senior audit manager with Ernst & Young Americas, LLC.

Richard B. Vilsoet has been the Company's General Counsel and Corporate Secretary since June 2005 and Vice President since November 2005. Before joining the Company, Mr. Vilsoet was a partner with Shearman & Sterling LLP. Mr. Vilsoet was with Shearman & Sterling LLP for over fifteen years.

Kimberly Dickens has been the Company's Vice President and Chief Human Resources Officer since March 2014. Before joining the Company, Ms. Dickens was the Vice President, Global Human Resources of Cooper Standard Automotive, Inc. from 2008 to 2013. Prior to this, she held a similar position at Federal Signal Corporation from 2004 to 2008 and spent over fifteen years in a variety of human resources leadership roles at Borg Warner Corporation.

Rebecca Brightly Roach has been the Company's Vice President and Chief Accounting Officer since August 2015. Ms. Brightly Roach joined the Company in January 2005 as Manager of SEC Reporting and has served as Director of Financial Reporting since 2010. Ms. Brightly Roach has over 15 years of experience in accounting and financial reporting.

Item 1A. Risk Factors.

Our business is subject to a variety of risks and uncertainties, including, but not limited to, the risks and uncertainties described below. You should read the following risk factors carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. If any of the risks described below, or elsewhere in this Annual Report on Form 10-K were to occur, our financial condition and results of operations could suffer and the trading price of our common stock could decline. Additionally, if other risks not presently known to us, or that we do not currently believe to be significant, occur or become significant, our financial condition and results of operations could suffer and the trading price of our common stock could decline.

Demand for our services is cyclical and vulnerable to economic downturns affecting the industries we serve. Demand for our services has been, and will likely continue to be, cyclical in nature and vulnerable to downturns in the economy and telecommunications industry. During times of uncertain or slowing economic conditions, our customers often reduce their

capital expenditures and defer or cancel pending projects. In addition, uncertain or adverse economic conditions that create volatility in the credit and equity markets may reduce the availability of debt or equity financing for our customers causing them to reduce capital spending. Any reduction in capital spending or deferral or cancellation of projects by our customers could reduce demand for our services, adversely affecting our operations, cash flows, and liquidity. These conditions make it difficult to estimate our customers' demand for our services and add uncertainty to the determination of our backlog.

We derive a significant portion of our revenues from master service agreements and long-term contracts which may be canceled by our customers upon notice, may not guaranty a specific amount of work, or which we may be unable to renew on negotiated terms. During fiscal 2015, we derived approximately 79.9% of our revenues from master service agreements and long-term contracts. The majority of these contracts are cancellable by our customers upon notice regardless of whether or not we are in default. In addition, our customers generally have no obligation to assign a specific amount of work to us under these agreements. Consequently, projected expenditures by customers are not assured until a definitive work order is placed with us and the work completed. This makes it difficult to estimate our customers' demand for our services. Furthermore, our customers generally require competitive bidding of these contracts upon expiration of their terms. We may not be able to renew a contract if our competitors reduce their prices and underbid us in order to procure business, or we could be required to lower the price charged for work under the contract being rebid in order to retain the contract. The loss of work obtained through master service agreements and long-term contracts or the reduced profitability of such work could adversely affect our results of operations, cash flows, and liquidity.

The telecommunications industry has experienced, and may continue to experience, rapid technological, structural, and competitive changes that could reduce the need for our services and adversely affect our revenues. We generate the majority of our revenues from customers in the telecommunications industry. The telecommunications industry is characterized by rapid technological change, intense competition and changing consumer demands. New technologies, or upgrades to existing technologies by customers could reduce the need for our services by enabling telecommunication companies to improve their networks without physically upgrading them. New, developing, or existing services could displace the wireline or wireless systems that we install and that our customers use to deliver services to consumers and businesses. Reduced demand for our services or a loss of a significant customer due to technological changes could adversely affect our results of operations, cash flows, and liquidity.

We derive a significant portion of our revenues from a limited number of customers, and the loss of one or more of these customers through industry consolidation or otherwise could adversely affect our revenues and profitability. Our customer base is highly concentrated, with our top five customers accounting for approximately 61.1%, 58.3% and 58.5% of our total revenues in fiscal 2015, 2014, and 2013, respectively. Revenues under our contracts with significant customers may vary from period to period depending on the timing or volume of work that those customers order or perform with their in-house service organizations. Our revenue could significantly decline if we were to lose one or more of our significant customers or if one or more of our customers elect to do the work we provide with their in-house service teams. Additionally, the telecommunications industry has been characterized by consolidation. In the case of a consolidation, merger or acquisition of an existing customer, the amount of work we receive could be reduced if procurement strategies employed by the surviving entity changes from that of the existing customer or the surviving entity uses a different service provider. The loss of work from a significant customer could adversely affect our results of operations, cash flows, and liquidity.

The specialty contracting services industry in which we operate is highly competitive. We compete with other specialty contractors, including numerous small, privately owned companies, as well as several large corporations that may have financial, technical, and marketing resources exceeding ours. Relatively few barriers to entry exist in the markets in which we operate. Any organization may become a competitor if they have adequate financial resources, access to technical expertise, and the necessary equipment and materials. Additionally, our competitors may develop expertise, experience and resources to provide services that are equal or superior to our services in both price and quality, and we may not be able to maintain or enhance our competitive position. We also face competition from the in-house service organizations of our customers whose personnel perform some of the services that we provide. We can offer no assurance that our existing or prospective customers will continue to outsource specialty contracting services in the future. Our results of operations, cash flows, and liquidity could be materially and adversely affected if we are unsuccessful in bidding on projects, if our ability to win projects requires that we settle for lesser margins or if our customers reduce the amount of specialty contracting services that are outsourced.

Our profitability is based on our delivering services within the estimated costs established when pricing our contracts. We recognize revenues under the percentage of completion method of accounting using the units-of-delivery or cost-to-cost measures. For the majority of our contracts, we recognize revenue as each unit is completed under the units-of-delivery percentage of completion method. Due to the fixed price nature of these contracts, our profitability could decline if our actual cost to complete each unit exceeds our original estimates. Under the cost-to-cost measure of completion, we recognize revenue based on the ratio of contract costs incurred to date to total estimated contract costs. Application of the percentage of

completion method of accounting requires the use of estimates of costs to be incurred for the performance of the contract. The cost estimation process is based on the knowledge and experience of our project managers and financial professionals. Any changes in original cost estimates, or the assumptions underpinning such estimates, may result in changes to costs and income. We recognize these changes in the period in which they are determined, potentially resulting in significant changes to previously reported results.

We have a significant amount of accounts receivable and costs and estimated earnings in excess of billings, which could become uncollectible. We extend credit to our customers as a result of performing work under contract prior to billing for that work. We periodically assess the credit risk of our customers and regularly monitor the timeliness of their payments. However, slowing conditions in the industries we serve, bankruptcies or financial difficulties within the telecommunications sector may impair the financial condition of one or more of our customers and hinder their ability to pay us on a timely basis or at all. As of July 25, 2015, we had net accounts receivable of $315.1 million and costs and estimated earnings in excess of billings of $274.7 million. The failure or delay in payment by our customers could reduce our expected cash flows and adversely affect our liquidity and profitability.

We retain the risk of loss for certain insurance related liabilities. Within our insurance program, we retain the risk of loss, up to certain limits, for matters related to automobile liability, general liability, workers' compensation, employee group health, and damages associated with underground facility locating services. We are self-insured for the majority of all claims because most claims against us do not exceed the deductibles under our insurance policies. We estimate and develop our accrual for these claims, including losses incurred but not reported, based on facts, circumstances and historical evidence. However, the estimate for accrued insurance claims remains subject to uncertainty as it depends in part on factors not known with precision. These factors include the estimated development of claims, the payment pattern of claims incurred, changes in the medical condition of claimants, and other factors such as inflation, tort reform or other legislative changes, unfavorable jury decisions and court interpretations. Should the cost of actual claims exceed what we have anticipated, our recorded reserves may not be sufficient, and we could incur substantial additional unanticipated charges. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Accrued Insurance Claims, and Note 8, Accrued Insurance Claims, of Notes to the Consolidated Financial Statements in this Annual Report on Form 10-K.

Our backlog is subject to reduction or cancellation. Our backlog consists of the estimated uncompleted portion of services to be performed under contractual obligations with our customers. Our backlog estimates represent amounts under master service agreements and other contractual agreements for services projected to be performed over the terms of the contracts and are based on contract terms, our historical experience with customers and, more generally, our experience in similar procurements. The significant majority of our backlog estimates comprise services under master service agreements and long-term contracts. Revenue estimates included in our backlog can be subject to change because of project accelerations, cancellations, or delays due to various factors, including but not limited to commercial issues and adverse weather. These factors can also cause revenue to be realized in different periods or in different amounts from those originally reflected in backlog. In many instances, our customers are not contractually committed to procure specific volumes of services under a contract and may cancel a contract for convenience. Our estimates of a customer's requirements during a particular future period may prove to be inaccurate. As a result, our backlog as of any particular date is an uncertain indicator of future revenues and earnings.

We may incur impairment charges on goodwill or other intangible assets. We account for goodwill and other intangibles in accordance with Financial Accounting Standards Board ("FASB") Accounting Standard Codification ("ASC") Topic 350, Intangibles-Goodwill and Other ("ASC Topic 350"). Our goodwill resides in multiple reporting units. We assess goodwill and other indefinite-lived intangible assets for impairment annually, as of the first day of the fourth fiscal quarter of each year in order to determine whether their carrying value exceeds their fair value. In addition, reporting units are tested on an interim basis if an event occurs or circumstances change between annual tests that would more likely than not reduce their fair value below carrying value. If we determine the fair value of the goodwill or other indefinite-lived intangible assets is less than their carrying value as a result of the tests, an impairment loss is recognized. Any such write-down would adversely affect our results of operations.

The profitability of individual reporting units may suffer periodically due to downturns in customer demand and the level of overall economic activity, including in particular construction and housing activity. Our customers may reduce capital expenditures and defer or cancel pending projects during times of slowing economic conditions. Additionally, adverse conditions in the economy and future volatility in the equity and credit markets could impact the valuation of our reporting units. The cyclical nature of our business, the high level of competition existing within our industry, and the concentration of our revenues from a limited number of customers may also cause results to vary. These factors may affect individual reporting units disproportionately, relative to the Company as a whole. As a result, the performance of one or more of the reporting units

could decline, resulting in an impairment of goodwill or intangible assets. In addition, adverse changes to the key valuation assumptions contributing to the fair value of our reporting units could result in an impairment of goodwill or intangible assets.

We may be subject to periodic litigation and regulatory proceedings, including Fair Labor Standards Act and state wage and hour class action lawsuits, which may adversely affect our business and financial performance. From time to time, we may be involved in lawsuits and regulatory actions brought or threatened against us in the ordinary course of business. These actions and proceedings may involve claims for, among other things, compensation for alleged personal injury, workers' compensation, employment discrimination, breach of contract or property damage. In addition, we may be subject to class action lawsuits involving allegations of violations of the Fair Labor Standards Act and state wage and hour laws. Due to the inherent uncertainties of litigation, we cannot accurately predict the ultimate outcome of any such actions or proceedings. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify, as plaintiffs may seek recovery of very large or indeterminate amounts in these types of lawsuits, and the magnitude of the potential loss may remain unknown for substantial periods of time. In addition, plaintiffs in many types of actions may seek punitive damages, civil penalties, consequential damages or other losses, or injunctive or declaratory relief. The ultimate resolution of these matters through settlement, mediation, or court judgment could have a material impact on our financial condition, results of operations, and cash flows. These proceedings could result in substantial cost and may require us to devote substantial resources to defend ourselves. For a description of current legal proceedings, see Item 3, Legal Proceedings, and Note 18, Commitments and Contingencies, of Notes to the Consolidated Financial Statements in this Annual Report on Form 10-K.

The loss of one or more of our executive officers or other key employees could adversely affect our business. We depend on the services of our executive officers and the senior management of our subsidiaries who have many years of experience in our industry. The loss of any one of them could negatively affect our customer relationships or the ability to execute our business strategy, adversely affecting our operations. Although we have entered into employment agreements with certain of our executive officers and other key employees, we cannot guarantee that any of them or other key management personnel will remain employed by us for any length of time. We do not carry "key-person" life insurance on any of our employees.

Our business is labor intensive, and we may be unable to attract and retain qualified employees. Our ability to employ, train, and retain skilled personnel is necessary to operate our business and maintain productivity and profitability. We cannot be certain that we will be able to maintain the skilled labor force necessary to operate efficiently and support our growth strategy. Our ability to do so depends on a number of factors, such as general rates of employment, competitive demands for employees possessing the skills we need and the level of compensation required to hire and retain qualified employees. In addition, our labor costs may increase when there is a shortage in the supply of skilled personnel and these increases may not be able to be passed on to our customers due to the long term nature of our contracts, thereby adversely affecting our results of operations.

We may be unable to secure sufficient independent subcontractors to fulfill our obligations, or our independent subcontractors may fail to satisfy their obligations. We contract with independent subcontractors to help manage fluctuations in work volumes and reduce the amount that we may otherwise be required to expend on fixed assets and working capital. If we are unable to secure independent subcontractors at a reasonable cost or at all, we may be delayed in completing work under a contract or the cost of completing the work may increase. In addition, we may have disputes with these independent subcontractors arising from, among other things, the quality and timeliness of the work they have performed. We may incur additional costs in order to correct such shortfalls in the work performed by subcontractors. Any of these factors could adversely affect the quality of our service, our ability to perform under certain contracts and the relationship with our customers, which could have an adverse effect on our results of operations, cash flows, and liquidity.

The nature of our business exposes us to warranty claims, which may reduce our profitability. We typically warrant the services we provide, guaranteeing the work performed against defects in workmanship and the material we supply. Historically, warranty claims have not been material as our customers evaluate much of the work we perform for defects shortly after work is completed. However, if warranty claims occur, we could be required to repair or replace warrantied items at our cost. In addition, our customers may elect to repair or replace the warrantied item by using the services of another provider and require us to pay for the cost of the repair or replacement. Costs incurred as a result of warranty claims could adversely affect our operating results and financial condition.

Higher fuel prices may increase our cost of doing business, and we may not be able to pass along added costs to customers. Fuel prices fluctuate based on market events outside of our control. Most of our contracts do not allow us to adjust our pricing for higher fuel costs during a contract term and we may be unable to secure price increases reflecting rising costs when renewing or bidding contracts. As a result, higher fuel costs may negatively affect our financial condition and results of operations. Although we may hedge our anticipated fuel purchases with the use of financial instruments, underlying commodity costs have been volatile in recent periods. Accordingly, there can be no assurance that, at any given time, we will have financial instruments in place to hedge against the impact of increased fuel costs. To the extent we enter into hedge transactions, declines

in fuel prices below the levels established in the financial instruments may require us to make payments, which could have an adverse impact on our financial condition and results of operations.

Our results of operations fluctuate seasonally. Our revenues and results of operations exhibit seasonality as we perform a significant portion of our work outdoors. Consequently, extended periods of adverse weather impact our operations. Adverse weather is most likely to occur during the winter, our second and third fiscal quarters. In addition, a disproportionate percentage of paid holidays fall within our second fiscal quarter, which decreases the number of available workdays. Because of these factors, we may experience periods of reduced revenue and profitability. These periods are most likely to occur in the second and/or third quarters of our fiscal year.

Our financial results include certain estimates and assumptions that may differ from actual results. In preparing our consolidated financial statements in conformity with accounting principles generally accepted in the United States of America, a number of estimates and assumptions are made by management that affect the amounts reported in the financial statements. These estimates and assumptions must be made because certain information that is used in the preparation of our financial statements is either dependent on future events or cannot be calculated with a high degree of precision from available data. In some instances, these estimates are particularly uncertain and we must exercise significant judgment. Estimates are primarily used in our assessment of the recognition of revenue for costs and estimated earnings under the percentage of completion method of accounting, allowance for doubtful accounts, the fair value of reporting units for goodwill impairment analysis, the assessment of impairment of intangibles and other long-lived assets, the purchase price allocations of businesses acquired, accrued insurance claims, income taxes, asset lives used in computing depreciation and amortization, stock-based compensation expense for performance-based stock awards, and accruals for contingencies, including legal matters. At the time they are made, we believe that such estimates are fair when considered in conjunction with our consolidated financial position and results of operations taken as a whole. However, actual results could differ from those estimates and such differences may be material to our financial statements.

Failure to integrate future acquisitions successfully could adversely affect our business and results of operations. As part of our growth strategy, we may acquire companies that expand, complement, or diversify our business. We regularly review various opportunities and periodically engage in discussions regarding possible acquisitions. Future acquisitions may divert management's attention from our existing business and expose us to operational challenges and risks, including retaining management and other key employees; unanticipated issues in integrating information, communications and other systems; assumption of unknown liabilities or liabilities for which inadequate reserves have been established; consolidating corporate and administrative infrastructures; and failure to manage successfully and coordinate the growth of the combined company. These factors could result in increased costs, decreases in the amount of expected revenues and diversion of management's time and energy which could materially affect our business, financial condition, and results of operations.

Unanticipated changes in our tax rates or exposure to additional income and other tax liabilities could affect our profitability. We are subject to income taxes in many different jurisdictions of the United States and Canada and certain of our tax liabilities are subject to the apportionment of income to different jurisdictions. Changes in the mix of earnings in locations with differing tax rates, the valuation of deferred tax assets and liabilities or tax laws may adversely affect our effective tax rate. An increase to our effective tax rate may increase our tax obligations. In addition, the amount of income and other taxes we pay is subject to ongoing audits in various jurisdictions, and a material assessment by a governing tax authority could affect our profitability.

The indenture under which our senior subordinated notes were issued and our bank credit facility impose restrictions that may prevent us from engaging in beneficial transactions. As of July 25, 2015, we had outstanding an aggregate principal amount of $277.5 million in senior subordinated notes due 2021. We also have a credit agreement with a syndicate of banks, which provides for a $150 million term loan and a $450 million revolving facility, including a sublimit of $200 million for the issuance of letters of credit. As of July 25, 2015, we had $95.3 million of outstanding borrowings under the revolving facility, $150.0 million outstanding under the term loan and $54.4 million of outstanding letters of credit issued under the credit agreement. The terms of our indebtedness contain covenants that restrict our ability to, among other things: make certain payments, including the payment of dividends, redeem or repurchase our capital stock, incur additional indebtedness and issue preferred stock, make investments or create liens, enter into sale and leaseback transactions, merge or consolidate with another entity, sell certain assets, and enter into transactions with affiliates. In addition, the credit agreement requires us to comply with a consolidated leverage ratio and a consolidated interest coverage ratio. A default under our credit agreement or the indenture governing the senior subordinated notes could result in the acceleration of our obligations under either or both of those instruments as a result of cross acceleration and cross default provisions. In addition, these covenants may prevent us from engaging in transactions that benefit us, including responding to changing business and economic conditions or securing additional financing, if needed.

Many of our telecommunications customers are highly regulated, and new regulations or changes to existing regulations may adversely impact their demand for and the profitability of our specialty contracting service. The Federal Communications Commission (“FCC”) regulates many of our telecommunications customers and may alter its application of current regulations and impose additional regulations. If existing or new regulations adversely affect our telecommunications customers and the profitability of the services they provide, our customers may reduce expenditures, which could affect the demand for specialty contracting services.

We may incur liabilities or suffer negative financial impact relating to occupational health and safety matters. Our operations are subject to stringent laws and regulations governing workplace safety. Our workers frequently operate heavy machinery and work near high voltage lines, subjecting them and others to potential injury or death. If any of our workers or other persons are injured or killed in the course of our operations, we could be found to have violated relevant safety regulations, resulting in a fine or, in extreme cases, criminal sanction. In addition, if our safety record were to deteriorate substantially over time, customers could decide to cancel our contracts or not award us future business.

Our failure to comply with environmental laws could result in significant liabilities. A significant portion of the work we perform is associated with the underground networks of our customers. We could be subject to potential material liabilities in the event we cause or are responsible for a release of hazardous substances or other environmental damage. Liabilities for contamination or exposure to hazardous materials, or failure to comply with environmental laws and regulations could result in significant costs including clean-up costs, fines, criminal sanctions for violations, and third party claims for property damage or personal injury. These costs as well as any direct impact to ongoing operations could adversely affect our results of operations and cash flows. In addition, new laws and regulations, altered enforcement of existing laws and regulations, the discovery of previously unknown contamination or leaks, or the imposition of new clean-up requirements could require us to incur significant costs or create new or increased liabilities that could harm our financial condition and results of operations.

We may not have access in the future to sufficient funding to finance desired growth. Using cash for operational growth, capital expenditures, share repurchases, or acquisitions may limit our financial flexibility and make us more likely to seek additional capital through future debt or equity financings. Our existing debt agreements contain significant restrictions on our operational and financial flexibility, including our ability to incur additional debt. In addition, if we seek to incur more debt, we may be required to agree to additional covenants that further limit our operational and financial flexibility. If we pursue additional debt or equity financings, we cannot be certain that such funding will be available on terms acceptable to us or at all.

Our capital expenditures may fluctuate because of changes in business requirements. Our anticipated capital expenditure requirements may vary from time to time because of changes in our business. Increased capital expenditures will use cash flow and may increase our borrowing costs if cash for capital expenditures is not available from operations.

Increases in our health insurance costs could adversely affect our results of operations and cash flows. The costs of employee health care insurance have been increasing in recent years due to rising health care costs, legislative changes, and general economic conditions. Additionally, we may incur additional costs because of the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the "Health Care Reform Laws"). Provisions of these laws have become and will become effective in calendar 2015 and at various dates over the next several years. Because of the breadth and complexity of these laws, the lack of regulations and guidance on implementation, and the phased-in nature of the new regulations, as well as other health care reform legislation considered by Congress and state legislations, we cannot predict with certainty the future effect of these laws on us. A continued increase in health care costs or additional costs incurred as a result of the Health Care Reform Laws or other future health care reform laws imposed by Congress or state legislations could have a negative impact on our financial position and results of operations.

Several of our subsidiaries participate in multiemployer pension plans under which we could incur material liabilities in certain circumstances. Pursuant to collective bargaining agreements, several of our subsidiaries participate in various multiemployer pension plans that generally provide defined pension benefits to covered employees. Because of the nature of multiemployer plans, there are risks associated with participation in these plans that differ from single-employer plans. Assets contributed by an employer to a multiemployer plan are not segregated into a separate account and are not restricted to provide benefits only to employees of that contributing employer. Under the Employee Retirement Income Security Act, absent an applicable exception, a contributing employer to an underfunded multiemployer plan is liable upon termination or withdrawal from a plan, for its proportionate share of the plan's unfunded vested liability. We currently do not intend to withdraw from any multiemployer plan in which we participate. However, a future withdrawal from a multiemployer pension plan in which we participate could result in a material withdrawal liability to the extent that any unfunded vested liability under such plan is allocable to the Company. In addition, if any of the plans in which we participate becomes underfunded as defined by the Pension Protection Act of 2006, we may be required to make additional cash contributions related to the underfunding of those plans.

Failure to protect critical data and technology systems adequately could materially affect our operations. We use our own information technology systems as well as those of our business partners to maintain certain data and provide reports. Third-party security breaches, employee error, malfeasance or other irregularity may compromise our measures to protect these systems and may result in persons obtaining unauthorized access to our or our customers' data or accounts. The occurrence of any such event could have a material adverse effect on our business.

The market price of our common stock has been, and may continue to be, highly volatile. During fiscal 2015, our common stock fluctuated from a low of $25.67 per share to a high of $69.62. We may continue to experience significant volatility in the market price of our common stock due to numerous factors, including, but not limited to:

•fluctuations in our operating results or the operating results of one or more of our competitors;

•announcements by us or our competitors of significant contracts, acquisitions or capital commitments;

•changes in recommendations or earnings estimates by securities analysts; and

•the impact of economic conditions on the credit and stock markets and on our customers’ demand for our services.

In addition, factors unrelated to our operating performance, such as market disruptions, industry outlook, general economic conditions, and political events, could decrease the market price of our common stock and, as a result, investors could lose some or all of their investments.

Anti-takeover provisions of Florida law and provisions in our articles of incorporation and by-laws could make it more difficult to effect an acquisition of our company or a change in our control. Certain provisions of our articles of incorporation and by-laws could delay or prevent an acquisition or change in control and the replacement of our incumbent directors and management. For example, our board of directors is divided into three classes. At any annual meeting of our shareholders, our shareholders only have the right to appoint approximately one-third of the directors on our board of directors. In addition, our articles of incorporation authorize our board of directors, without further shareholder approval, to issue up to 1,000,000 shares of preferred stock on such terms and with such rights as our board of directors may determine. The issuance of preferred stock could dilute the voting power of the holders of common stock, including by the grant of voting control to others. Our by-laws also restrict the right of stockholders to call a special meeting of stockholders. Lastly, we are subject to certain anti-takeover provisions of the Florida Business Corporation Act. These anti-takeover provisions could discourage or prevent a change in control.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We lease our executive offices located in Palm Beach Gardens, Florida. Our subsidiaries operate from owned or leased administrative offices, district field offices, equipment yards, shop facilities, and temporary storage locations throughout the United States and Canada. Our leased properties operate under both non-cancellable and cancellable leases. We believe that our facilities are adequate for our current operations and additional facilities would be available on commercially reasonable terms, if necessary.

Item 3. Legal Proceedings.

In May 2013, CertusView Technologies, LLC (“CertusView”), a wholly-owned subsidiary of the Company, filed suit against S & N Communications, Inc. and S & N Locating Services, LLC (“defendants”) in the United States District Court for the Eastern District of Virginia alleging infringement of certain United States patents. In January 2015, the District Court granted defendants’ motion for judgment on the pleadings for failure to claim patent-eligible subject matter, and entered final judgment on those claims the same day. CertusView filed a Notice of Appeal in February 2015 with the Court of Appeals for the Federal Circuit. In May 2015, the District Court re-opened the case to allow defendants to proceed with inequitable conduct counterclaims. In July 2015, the Court of Appeals dismissed the appeal in that court pending resolution of proceedings in the District Court. An unfavorable outcome for the inequitable conduct counterclaims may result in an award of attorneys’ fees, costs, and expenses. It is too early to evaluate the likelihood of an outcome to this matter. We intend to vigorously defend ourselves against the remaining counterclaims and appeal the judgment.

In November 2013, the wife of a former employee of Nichols Construction, LLC (“Nichols”), a wholly-owned subsidiary of the Company, commenced a lawsuit against Nichols in the Circuit Court of Barbour County, West Virginia. The lawsuit, filed on behalf of the former employee’s estate, is based upon a “deliberate intent” claim pursuant to West Virginia Code in connection with the employee's death at work. The plaintiff seeks unspecified damages and other relief. In December 2013, Nichols removed the case to the United States District Court for the Northern District of West Virginia, and in January 2015, filed a motion for summary judgment with respect to certain of the “deliberate intent” issues in the lawsuit. In May 2015, the parties agreed to settle the matter for $0.6 million. The Court has vacated the pending trial schedule and ordered the parties to file a Petition with the Court for a hearing to approve the settlement considering that the primary beneficiary is a minor. The proposed settlement is included in insurance recoveries/receivables related to accrued claims as of July 25, 2015. The hearing date has not been set, but it is expected to take place in September 2015.

From time to time, we are party to various other claims and legal proceedings. It is the opinion of management, based on information available at this time, that such other pending claims or proceedings will not have a material effect on our financial statements.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information for Our Common Stock

Our common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "DY". The following table shows the range of high and low closing sales prices for each quarter within the last two fiscal years as reported on the NYSE:

|

| | | | | | | | | | | | | | | |

| Fiscal 2015 | | Fiscal 2014 |

| High | | Low | | High | | Low |

First Quarter | $ | 33.68 |

| | $ | 26.17 |

| | $ | 31.39 |

| | $ | 24.77 |

|

Second Quarter | $ | 35.65 |

| | $ | 25.67 |

| | $ | 30.50 |

| | $ | 27.05 |

|

Third Quarter | $ | 49.89 |

| | $ | 30.81 |

| | $ | 33.52 |

| | $ | 25.05 |

|

Fourth Quarter | $ | 69.62 |

| | $ | 45.84 |

| | $ | 32.81 |

| | $ | 27.98 |

|

Holders

As of September 1, 2015, there were approximately 589 holders of record of our $0.33 1/3 par value per share common stock.

Dividend Policy

We have not paid cash dividends since 1982. Our Board of Directors periodically evaluates our dividend policy based on our financial condition, profitability, cash flow, capital requirements, and the outlook of our business. We currently intend to retain any earnings for use in the business, including for investment in acquisitions, and consequently, do not anticipate paying any cash dividends on our common stock in the foreseeable future. Additionally, the indenture governing our senior subordinated notes contains covenants that restrict our ability to make certain payments, including the payment of dividends.

Securities Authorized for Issuance Under Equity Compensation Plans

The information required by this item is hereby incorporated by reference from our definitive proxy statement to be filed with the SEC pursuant to Regulation 14A.

Issuer Purchases of Equity Securities During the Fourth Quarter of Fiscal 2015

The following table summarizes the Company's purchases of its common stock during the three months ended July 25, 2015:

|

| | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

April 26, 2015 - May 23, 2015 | | 6,860 (a) | | $ | 55.57 |

| | — |

| | (b) |

May 24, 2015 - June 20, 2015 | | 70,000 | | $ | 58.49 |

| | — |

| | (b) |

June 21, 2015 - July 25, 2015 | | 836,156 | | $ | 62.62 |

| | — |

| | (b) |

| |

(a) | Represents shares withheld to meet payroll tax withholdings obligations arising from the vesting of restricted share units. All shares withheld have been canceled and do not reduce our total share repurchase authority. |

| |

(b) | On February 24, 2015, the Company announced that its Board of Directors authorized $40.0 million to repurchase shares of the Company's outstanding common stock through August 2016 in open market or private transactions. During the third and fourth quarters of fiscal 2015, the Company repurchased 718,403 shares for $40.0 million under this authorization. On July 1, 2015, the Company announced that its Board of Directors authorized an additional $40.0 million to repurchase shares of the Company's outstanding common stock through December 2016 in open market or private transactions. During the fourth quarter of fiscal 2015, the Company repurchased 462,753 shares for $30.0 million under this authorization. As of July 25, 2015, approximately $10.0 million remained available for repurchases. During August 2015, the Company repurchased 149,224 shares of its common stock in open market transactions, at an average price of $67.01 per share, for approximately $10.0 million under its share repurchase program authorized on July 1, 2015. On August 25, 2015, the Company announced that its Board of Directors authorized an additional $50.0 million to repurchase shares of the Company's outstanding common stock through February 2017 in open market or private transactions. As of September 4, 2015, $50.0 million remained available for repurchases. |

Performance Graph

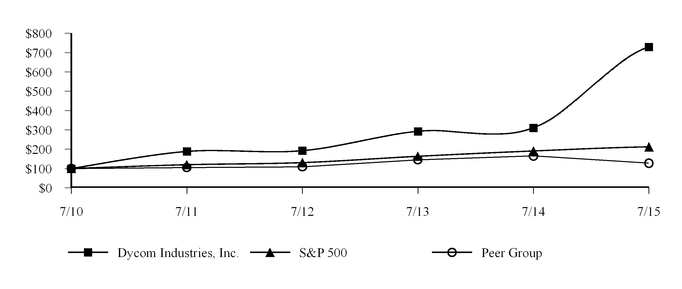

The performance graph below compares the five year cumulative total return for our common stock with the cumulative total return (including reinvestment of dividends) of the Standard & Poor’s (S&P) 500 Composite Stock Index and that of a selected peer group consisting of MasTec, Inc., Quanta Services, Inc., MYR Group, Inc., and Willbros Group, Inc. The graph assumes an investment of $100 in our common stock and in each of the respective indices noted on July 31, 2010. The comparisons in the graph are required by the Securities and Exchange Commission and are not intended to forecast or be indicative of the possible future performance of our common stock.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Dycom Industries, Inc., the S&P 500 Index, and a Selected Peer Group

___________

*$100 invested on 7/31/10 in stock or index, including reinvestment of dividends. Fiscal year ending July 31.

Copyright © 2015 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

Item 6. Selected Financial Data.

Our fiscal year ends on the last Saturday in July. As a result, each fiscal year consists of either fifty-two weeks or fifty-three weeks of operations (with an additional week of operations occurring in the fourth quarter). Fiscal 2015, 2014, 2013, 2012 and 2011 all consisted of 52 weeks. Fiscal 2016 will consist of fifty-three weeks of operations. The following selected financial data is derived from the audited consolidated financial statements for the applicable fiscal year.

The results of operations of businesses acquired are included in our selected financial data from their dates of acquisition. This data should be read in conjunction with our consolidated financial statements and notes thereto, and with Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal Year |

| 2015 (2) | | 2014 | | 2013 (3) | | 2012 | | 2011 (4) |

| (Dollars in thousands, except per share amounts) |

Operating Data: | | | | | | | | | |

Revenues | $ | 2,022,312 |

| | $ | 1,811,593 |

| | $ | 1,608,612 |

| | $ | 1,201,119 |

| | $ | 1,035,868 |

|

Net income | $ | 84,324 |

| | $ | 39,978 |

| | $ | 35,188 |

| | $ | 39,378 |

| | $ | 16,107 |

|

Earnings Per Common Share: | | | | | | | | | |

Basic | $ | 2.48 |

| | $ | 1.18 |

| | $ | 1.07 |

| | $ | 1.17 |

| | $ | 0.46 |

|

Diluted | $ | 2.41 |

| | $ | 1.15 |

| | $ | 1.04 |

| | $ | 1.14 |

| | $ | 0.45 |

|

Balance Sheet Data (at end of period): | | | | | | | | | |

Total assets | $ | 1,358,864 |

| | $ | 1,212,354 |

| | $ | 1,154,208 |

| | $ | 772,193 |

| | $ | 724,755 |

|

Long-term liabilities | $ | 624,954 |

| | $ | 530,888 |

| | $ | 526,032 |

| | $ | 264,699 |

| | $ | 254,391 |

|

Stockholders' equity (1) | $ | 507,200 |

| | $ | 484,934 |

| | $ | 428,361 |

| | $ | 392,931 |

| | $ | 351,851 |

|

| |

(1) | We repurchased shares of our common stock as follows: |

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal Year |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Shares | 1,669,924 |

| | 360,900 |

| | 1,047,000 |

| | 597,700 |

| | 5,389,500 |

|

Amount Paid (Dollars in millions) | $ | 87.1 |

| | $ | 10.0 |

| | $ | 15.2 |

| | $ | 13.0 |

| | $ | 64.5 |

|

Average Price Per Share | $ | 52.19 |

| | $ | 27.71 |

| | $ | 14.52 |

| | $ | 21.68 |

| | $ | 11.98 |

|

| |

(2) | On April 24, 2015, we amended our existing credit agreement to extend its maturity date to April 24, 2020. The amendment increased the maximum revolver commitment from $275 million to $450 million, increased the term loan facility to $150 million, and increased the sublimit for the issuance of letters of credit from $150 million to $200 million. See Note 10, Debt, in Notes to the Consolidated Financial Statements. |

| |