Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02224

MML Series Investment Fund

(Exact name of registrant as specified in charter)

100 Bright Meadow Blvd., Enfield, CT 06082

(Address of principal executive offices) (Zip code)

Richard J. Byrne

100 Bright Meadow Blvd., Enfield, CT 06082

(Name and address of agent for service)

Registrant’s telephone number, including area code:(860) 562-1000

Date of fiscal year end: 12/31/2013

Date of reporting period: 12/31/2013

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 60 | ||||

| 63 | ||||

| 66 | ||||

| 73 | ||||

| 74 | ||||

| 77 | ||||

| 79 | ||||

| 81 | ||||

| 84 | ||||

| 87 | ||||

| 90 | ||||

| MML Managed Volatility Fund (formerly known as MML Large Cap Value Fund) |

92 | |||

| 100 | ||||

| 103 | ||||

| 106 | ||||

| 115 | ||||

| 120 | ||||

| 124 | ||||

| 128 | ||||

| 140 | ||||

| 146 | ||||

| 158 | ||||

| 177 | ||||

| 216 | ||||

| 217 | ||||

| 221 | ||||

| 222 | ||||

| 222 | ||||

| 223 | ||||

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the MML Series Investment Fund. Investors should consider a Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

Table of Contents

MML Series Investment Fund – President’s Letter to Shareholders (Unaudited)

| * | Systematic investing and asset allocation do not ensure a profit or protect against loss in a declining market. Systematic investing involves continuous investment in securities regardless of fluctuating price levels. Investors should consider their ability to continue investing through periods of low price levels. |

(Continued)

1

Table of Contents

MML Series Investment Fund – President’s Letter to Shareholders (Unaudited) (Continued)

Who Matters Most

MassMutual believes “Who Matters Most to You Says the Most About You.” Our customers matter most to us, and our primary focus is to help you take the necessary steps to plan appropriately for your retirement – one that you aspire to enjoy on your terms. The calendar page turning from one year to the next can be a good time for you to assess your financial situation, focus on your strategy for the future, and meet with your financial professional, if you work with one. Whatever decisions you make with regard to your personal retirement plan, MassMutual believes you are wise to maintain a strategy that is suited to how comfortable you are with the markets’ ups and downs, how long you have to save and invest, and what your specific financial goals are. Thank you for putting your trust in MassMutual.

Sincerely,

Richard J. Byrne

President

The information provided is the opinion of MassMutual Retirement Services Investments Marketing as of 1/1/14 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

Table of Contents

MML Series Investment Fund – Economic and Market Overview (Unaudited)

December 31, 2013

Stock investors flourish amid central bank support

Investors drove many U.S. stock indexes to record highs in 2013 – and domestic bonds had a negative year for the first time since 1999 – in an environment that featured the continuation of the Federal Reserve’s (the “Fed”) Quantitative Easing program (“QE”) and brought multiple political standoffs over fiscal legislation, a partial government shutdown, improvement in economic indicators in the U.S., and varying degrees of economic and market strength in Europe and the Far East.

The Fed continued its ongoing effort to foster an environment accommodative to economic growth. The central bank helped keep short-term interest rates at historically low levels by maintaining the federal funds rate at 0.0% to 0.25% – the level the rate has occupied since December 2008. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight. The Fed’s QE purchases of mortgage-backed securities and longer-dated Treasuries totaled $85 billion per month, which helped support the prices of bonds by helping keep demand high for much of the year and contributed to the positive environment for stocks.

The Fed kept QE in full force for the entire year and spurred considerable disruption in both the stock and bond markets when Fed Chairman Bernanke appeared before Congress on May 22 and indicated that the central bank was considering some near-term “tapering” or reduction of its bond purchases. The Fed’s policy announcement on September 18 offered a positive surprise to markets by indicating there would be no imminent changes to QE, as most observers had anticipated the implementation of at least a token decrease in the Fed’s monthly purchases. A market-moving event occurred on December 18, when the Fed unveiled its decision to reduce the monthly bond purchases in QE from $85 billion to $75 billion starting in January 2014. Although improving economic conditions had put the possibility of tapering QE on the front burner once again, many observers expected the central bank to postpone the move, as it had in September. The Fed’s proposed cutback of $10 billion per month was near the low end of expectations for the initial reduction, which helped soften the blow. The Fed also reiterated that short-term rates would remain at current levels, saying the central bank won’t raise short-term rates until well past the time that the unemployment rate declines below 6.5%. The Fed’s December 18 statement indicated Fed officials expect short-term rates to be lower than 1% through the end of 2015, which brought some clarity to the Fed’s near-term plans, and investors drove up stocks in response.

Oil started 2013 at nearly $92 per barrel, dipped to less than $85 in April, crested above $110 in early September, and closed the year at about $98. Gas prices rose substantially in the first quarter of 2013, but declined throughout the fourth quarter of 2013, giving consumers some relief at the pumps at the end of the year. The average price moved in a range between approximately $3.55 and $3.75 per gallon for much of the second and third quarters before dropping to around $3.40 by the end of the year. Gold lost much of its luster with investors who sought the higher returns generated by equities and other investments in the positive market environment. The precious metal led off the year at around $1,657 per ounce, headed downward until early July, staged a summer rally that lost steam as the third quarter drew to a close, and finished the year lower at $1,205.

Market performance

Equity markets rewarded investors substantially in 2013, with U.S. stocks showcasing their best performance since 1995. The NASDAQ Composite® Index, the major technology stock benchmark, returned 40.12% for the year and was the leader among U.S. broad-market indexes. The Russell 2000® Index, representing small-capitalization stocks, finished the year near the top of the pile with a 38.82% increase. The S&P 500® Index of large-capitalization U.S. stocks posted a 32.39% advance, while the blue-chip Dow Jones Industrial AverageSM rose 29.65%. The Morgan Stanley Capital International (“MSCI®”) Europe, Australasia, Far East (EAFE®) Index, a barometer for foreign stocks in developed markets, gained 22.78%, benefiting from the strong performance of Japanese stocks, which rose 57% and had their best performance in 40 years. Stocks from developing economies did not fare as well, and the MSCI Emerging Markets Index, a measure of the performance of emerging stock markets throughout the world, lost 2.60% during 2013.

Bonds largely struggled during the 12 months, with the Barclays U.S. Aggregate Bond Index, a broad measure of the U.S. investment-grade bond markets, declining 2.02%. The yield of the 10-year U.S. Treasury note advanced (and its price declined) over the course of the year from 1.83% to 3.02%, taking a very choppy route to make the climb, as wary investors sold notes in reaction to signals from the Fed about the reduction of QE. The yield of the 10-year note is a key benchmark in determining

3

Table of Contents

MML Series Investment Fund – Economic and Market Overview (Unaudited) (Continued)

mortgage rates, and its advance caused a slowdown in mortgage sales. Conversely, unrelenting low shorter-term interest rates continued to take their toll, with shorter-term debt investments barely managing to stay in positive territory. In this environment, the Barclays U.S. 1-3 Year Government Bond Index, which measures the performance of short-term U.S. government bonds, returned just 0.37%; and Treasury bills, as measured by the Citigroup 3-Month Treasury Bill Index, gained only 0.05%. Fixed-income investors sought the higher returns offered by high-yield bonds, which helped the Barclays U.S. Corporate High-Yield Index, a measure of the performance of fixed-rate, non-investment-grade debt from corporate sectors, advance 7.44% for the year.*

First quarter 2013: stocks outperform bonds to start the year

Congressional votes to secure passage of a deal to avert the “fiscal cliff” were confirmed late on January 1, 2013. (The fiscal cliff was a large reduction of the federal budget deficit through significant tax increases and spending cuts, which were scheduled to become effective on January 1, 2013, unless Congress could strike an alternate plan.) In February, equity investors focused on the specter of sequestration – the automatic, across-the-board series of spending cuts to government agencies set to go into effect March 1, 2013. Ultimately, in March, Congress passed a stopgap spending bill to keep the federal government running through September 2013. Also in March, the Department of Labor reported that the U.S. unemployment rate fell to its lowest level since December 2008, and the Fed continued its commitment to keep the federal funds rate between 0% and 0.25% – announcing at the same time that it would maintain QE.

U.S. and foreign stocks rose in the first quarter of 2013, outperforming their fixed-income counterparts. Treasury yields traded in a relatively narrow range until mid-March, when they spiked higher on growing optimism about the U.S. economy. (Bond prices move in the opposite direction to interest rates [or yields]; when yields rise, the prices of existing bonds fall – and vice versa.)

Overseas, the Japanese Cabinet approved a ¥20 trillion (yen) ($224 billion) stimulus package in January 2013, which was expected to create 600,000 jobs and help repair tsunami-ravaged coastland. Evidence of a possible slowdown in China caused concern over the world’s second-largest economy, but Chinese lending reached a two-year high and aggregate financing increased substantially, which indicated improving conditions. In March, banks in Cyprus, experiencing hard times because of their investments in Greek sovereign debt, took a $10 billion bailout from the European Union and the International Monetary Fund to resolve the country’s banking crisis – although the deal restricted Cyprus’s financial industry and limited its status as an offshore tax haven.

Second quarter 2013: prospect of Fed tapering gives investors pause

While stock prices advanced during April and much of May, they gave up a significant portion of those gains following Ben Bernanke’s May 22 remarks to Congress about tapering QE. The Fed chairman stated that the central bank might begin tapering bond purchases in its QE program later in 2013 if warranted by U.S. economic data. Despite the jitters this announcement sent through the markets, U.S. stocks ultimately managed to move higher during the second quarter.

Interest rates rose in the wake of Bernanke’s QE comments when investors sold bonds on the belief that demand would decline if the Fed were to stop its bond purchases, and ensuing price declines drove interest rates higher. Interestingly, concern about the end of QE gave new life to investors’ “bad news is good news” response to economic data. For example, the Commerce Department’s third and final estimate of first-quarter economic growth, released on June 26, came in at 1.8%, well below the previous estimate of 2.4%. Under normal circumstances, weaker-than-expected economic growth would tend to drive down stock prices. However, the news helped shares advance, as investors were hopeful that the disappointing data might convince the Fed to continue with QE for a while longer.

Also weighing on U.S. stocks late in the period was a swoon in Japanese equity prices. Japan’s stock market had been on a tear since mid-November 2012, and when the Bank of Japan announced a massive QE program of its own in April, the rally in that nation’s stocks accelerated, only to reverse sharply along with U.S. shares following Bernanke’s congressional testimony. Emerging markets, including Brazil and China, struggled with lackluster economic growth.

| * | Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment. |

4

Table of Contents

MML Series Investment Fund – Economic and Market Overview (Unaudited) (Continued)

Third quarter 2013: stocks on top; Fed comes to the rescue

U.S. stocks posted strong returns in the third quarter of 2013. Share prices moved higher in July, but backed off in August, as investors remained uncertain of the Fed’s tapering timetable. Disappointing quarterly news from companies regarded as bellwethers for the broader economy, including Wal-Mart Stores and Cisco Systems, weighed on the market in August, as did the growing likelihood of U.S. military strikes in Syria in retaliation for the Assad regime’s alleged use of chemical weapons there.

Stocks rebounded again in September in the midst of talk of a possible diplomatic solution to the crisis in Syria. The market also got a lift from news that former U.S. Treasury Secretary Larry Summers was withdrawing from consideration as a possible replacement for Fed Chairman Bernanke, who would step down in January 2014. Summers’ decision cleared the field for Fed Vice Chair Janet Yellen, a stronger proponent of QE. President Obama ultimately nominated Yellen for the post in early October.

On the heels of the big boost stocks and bonds got from the Fed’s September 18 announcement that QE would continue, the final week of the quarter brought stock-price declines attributable to investor concerns about two looming issues. The first was a federal government shutdown that ultimately came to pass on October 1 due to Congress’s inability to reach a funding agreement prior to the September 30 deadline, and the second was a political stalemate over the U.S. debt ceiling, which needed resolution by mid-October to prevent a default.

Fourth quarter 2013: stocks power ahead through government shutdown, possible Fed tapering

Investors largely stood their ground through the political fiscal wrangling and potential Fed actions, and U.S. stocks notched impressive gains in the fourth quarter of 2013 to cap a banner year that saw most of the popular equity benchmarks record a series of new all-time highs.

Sixteen days into the shutdown, Congress finally approved a measure on October 16 that provided funding for the government until mid-January, along with a temporary extension of the U.S. debt ceiling until February 7, 2014. President Obama signed the bill into law in the early hours of October 17, and most federal workers returned to work that same day. The move alleviated fears that the nation would not pay its bills and ended the shutdown, which had been in effect since October 1. The stock market responded with strong gains during the month of October, and the momentum carried over into November, bolstered by upward revisions to economic growth figures, improved consumer confidence, and a reduction in a key interest rate by the European Central Bank, which also sent European equities higher.

In December, equities rose, but the results did not come easily. The major equity market indexes experienced losses in the first two weeks of the month, reflecting investor concerns that the market might be overpriced and lingering questions about the Fed’s timeline for the tapering of QE. In fact, the S&P 500’s decline of 1.6% in the second week of December was its worst weekly performance since August. Sentiment improved in the third week of the month, as the market received clear communication from the Fed of its plans to reduce its bond purchases and, more importantly, its commitment to keep short-term rates very low as it does so.

Stocks in the U.S. also rose during the latter part of December following the passage of a two-year budget agreement that appeared to reduce the risk of another government shutdown, which represented a welcome departure from the political brinksmanship that has characterized most Congressional budget debates over the past few years. A sizable upward revision in the government’s December 20 release of estimated third-quarter economic growth to a healthy 4.1% from 3.6% was another positive catalyst.

As 2013 transitioned into 2014, stock investors focused on the factors likely to impact the markets in the year ahead, with the imminent reduction of QE at the top of the list. As we prepared this report in early January 2014, the Senate confirmed Janet L. Yellen as the first woman to lead the Federal Reserve. Ms. Yellen will succeed outgoing Chairman Ben Bernanke on February 1, 2014, coming in at a time when the Fed is looking to balance economic growth with the tapering of QE. Investors will also keep an eye out for improving economic growth here and abroad to help create a favorable environment for stocks and bonds. We believe these important issues and numerous others will come into play as investors navigate the world’s financial markets in the year ahead.

The information provided is the opinion of MassMutual Retirement Services Investment Services as of 1/1/14 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

5

Table of Contents

MML Blue Chip Growth Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Blue Chip Growth Fund, and who is the Fund’s subadviser?

The Fund seeks long-term capital growth. Income is a secondary objective. Under normal circumstances, the Fund invests at least 80% of net assets in the common stocks of large- and medium-sized blue chip growth companies. The Fund’s subadviser currently defines blue chip growth companies to mean firms that, in its view, are well-established in their industries and have the potential for above-average earnings growth. The Fund’s subadviser is T. Rowe Price Associates, Inc. (T. Rowe Price).

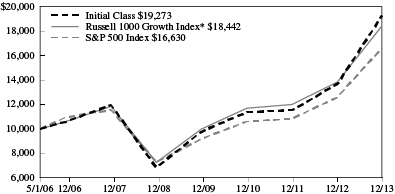

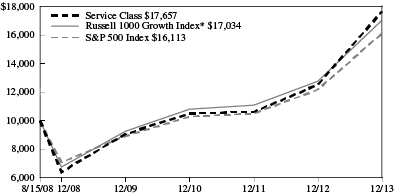

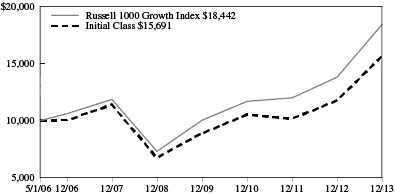

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Initial Class shares returned 41.33%, significantly outpacing the 33.48% return of the Russell 1000® Growth Index (the “benchmark”), an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater than average growth orientation that tend to exhibit higher price-to-book ratios and higher forecasted growth rates than securities in the value universe. The Fund also substantially outperformed the 32.39% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Overall, stock selection drove the Fund’s relative performance for the year, but sector weighting also contributed, as Fund holdings in the information technology, health care, and consumer discretionary sectors were the leading relative outperformers. Conversely, Fund investments in the materials sector were significant detractors during the year.

The Fund’s stock selection in the information technology sector benefited performance, as the price of Internet giant Google rose due to the continued popularity of smartphones running its Android operating system – and increased advertising revenues. Global payment networks MasterCard and Visa were two Fund holdings that experienced gains from better cost controls and an increase in consumer credit card use in Europe, Asia, and Latin America. Baidu, China’s dominant Internet search company, benefited from becoming the primary application (“app”) distributor in that country after acquiring mobile app store 91 Wireless in July. This Fund holding also reported strong growth from increased mobile advertising revenues.

Stock selection in health care, the best-performing sector in the benchmark, benefited Fund performance during the year. The Fund’s biotechnology industry holdings notably outperformed. Gilead Sciences rose due to broader approval of its HIV treatment, Stribild. The company also benefited as its treatments for certain types of cancer showed positive results during early trials. Shares of Fund holding Celgene, a biotechnology company specializing in the treatment of cancer and immune-system diseases, rose as a result of positive trial results for a multiple myeloma treatment. The company also received Food and Drug Administration approval for Abraxane, a drug used to treat pancreatic cancer.

The Fund benefited from stock selection and an overweight position, relative to the benchmark, in the consumer discretionary sector. Shares of online travel company Priceline.com rose due to increased travel-related spending and the popularity of its smartphone apps. Shares of Amazon.com moved higher during the second half of 2013, led by investor optimism for a strong holiday shopping season, particularly in the online sector – and Amazon Web Services’ growth in the cloud-computing and storage markets.

On the downside, stock selection in, and the Fund’s allocation to, the materials sector detracted from relative performance for the year. Shares of paint company Sherwin-Williams rose more than 20%, but this Fund holding lagged the overall materials sector after losing both a lead-paint lawsuit in California and its bid to acquire Comex Mexico. Shares of Fund holding Praxair, an industrial gases producer which generates more than half of its sales outside the United States, rose – but still underperformed the overall sector due to currency exchange challenges.

6

Table of Contents

MML Blue Chip Growth Fund – Portfolio Manager Report (Unaudited) (Continued)

Subadviser outlook

Equities rose substantially in 2013 as investors moved out of safer assets and into riskier areas of the market. We expect a continuation of this trend may be likely in 2014, although on a more moderate scale. We are generally optimistic about the environment for equities. In our view, improving global economic growth, attractive stock valuations (despite 2013’s notable performance), and restrained inflation may have the potential to permit large-capitalization growth stocks perform strongly. While a moderate stock market correction is always a possibility, we do not believe there is likely to be a significant selloff in 2014.

7

Table of Contents

MML Blue Chip Growth Fund – Portfolio Manager Report (Unaudited) (Continued)

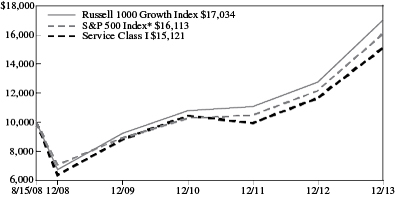

* Benchmark

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Growth Index and the S&P 500 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

8

Table of Contents

MML Equity Income Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Equity Income Fund, and who is the Fund’s subadviser?

The Fund seeks dividend income and long-term capital growth by investing primarily in the common stocks of established companies. Under normal circumstances, the Fund invests at least 80% of its net assets in common stocks, with 65% in the common stocks of well-established companies paying above-average dividends. The Fund’s subadviser currently considers well-established companies to mean companies that it considers to be seasoned companies with relatively long operating histories. The Fund’s subadviser is T. Rowe Price Associates, Inc. (T. Rowe Price).

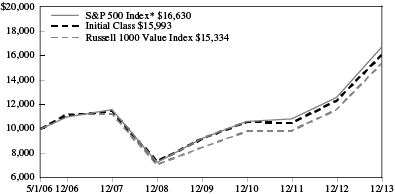

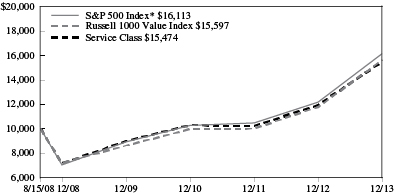

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Initial Class shares returned 29.93%, trailing the 32.39% return of the S&P 500® Index (the “benchmark”), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. Similarly, the Fund underperformed the 32.53% return of the Russell 1000® Value Index, an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies, based on market capitalization) with greater than average value orientation that tend to exhibit lower price-to-book ratios and lower forecasted growth rates than securities in the growth universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The Fund underperformed the benchmark, despite delivering double-digit absolute returns for the year. Stock selection detracted from Fund results, relative to the benchmark, while sector weightings proved positive. The leading detractors from relative performance were Fund holdings in the energy and materials sectors. Conversely, the Fund’s investments in the financials and industrials and business services sectors contributed.

In the energy sector, the share price of Fund holding oil giant Royal Dutch Shell fell, as strong earnings results in the first half of 2013 were overshadowed by weaker-than-expected earnings in the second half. During the last six months of 2013, shares of Fund holding Diamond Offshore, an offshore drilling company, fell on concerns over rising downtime and rig delays. In the materials sector, falling gold prices drove declines in the shares of Fund holding Newmont Mining.

Conversely, stock selection in the financial services sector was the largest single contributor to the Fund’s positive absolute results for the year. Lincoln National shares moved higher, as this Fund holding benefited from a growing annuity business with margins and earnings that exceeded estimates. Another Fund holding, American Express, rose on historically low credit losses and solid expense management. Shares of Fund holding Legg Mason also jumped due to better-than-expected earnings announcements.

An overweight position, relative to the benchmark, and favorable stock selection in the industrials and business services sector contributed to the Fund’s full-year results. Fund holding Boeing benefited from increased orders and revenue growth. Shares of United Continental Holdings – the company that resulted from the merger of airlines United and Continental – moved higher during 2013’s first half, as positive merger-related investor sentiment drove the price of this Fund holding.

Subadviser outlook

We are cautiously optimistic about domestic stocks in 2014, but are tempering our expectations after a year of nearly uninterrupted market strength. Although corporate balance sheets are healthy, sales growth has been tepid and we believe profit margins may be peaking. Earnings growth has lagged equity returns since the most recent market bottom, creating an environment where positive sentiment is outpacing the improvement in fundamentals. We would therefore not be surprised to encounter a cyclical pullback in the near term. Despite this cautionary view, the long term looks positive, in our opinion, due to strong corporate fundamentals and positive economic data. We are poised to take advantage of opportunities for the Fund should valuations become more attractive.

9

Table of Contents

MML Equity Income Fund – Portfolio Manager Report (Unaudited) (Continued)

10

Table of Contents

MML Equity Income Fund – Portfolio Manager Report (Unaudited) (Continued)

* Benchmark

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

11

Table of Contents

MML Equity Index Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Equity Index Fund, and who is the Fund’s subadviser?

The Fund’s investment objective is to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index* (the “Index”). Under normal circumstances, the Fund invests at least 80% (and, typically, substantially all) of its net assets in the equity securities of companies included within the Index. The Fund’s subadviser is Northern Trust Investments, Inc. (NTI).

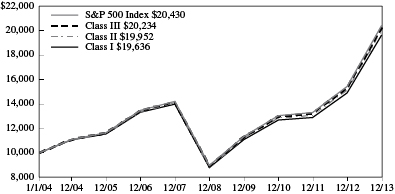

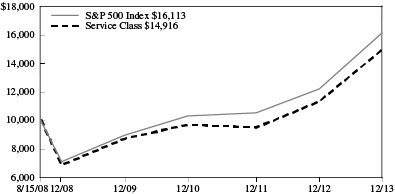

How did the Fund perform during the 12 months ended December 31, 2013?

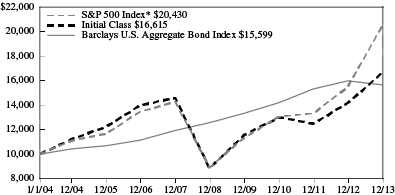

The Fund’s Class I shares returned 31.84%, lagging the 32.39% return of the Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The Fund’s underperformance versus the Index is mainly attributable to the impact of fees and expenses necessary for the management and operation of the Fund. The Index is not subject to fees or expenses, and it is not possible to invest directly in the Index.

Large-capitalization domestic equities outperformed developed equities outside of the United States. The Index rose to new record highs repeatedly over the course of the year on the way to posting its strongest annual return since 1997. During the year, consumer discretionary and health care were the strongest-performing sectors within the Index. Conversely, the telecommunication services and utilities sectors experienced the worst performance of the year, but all 10 sectors of the Index finished 2013 with double-digit returns.

Global developed markets performed positively in 2013, and stocks in the U.S. outperformed their international counterparts. The year began with a late deal that avoided the most significant portions of the so-called “fiscal cliff,” sparking an early rally in U.S. markets – as earnings, housing, and employment data continued to support growth expectations. Despite the positive economic data, central banks’ continuation of easy monetary policies helped drive the performance of global stock markets.

During his testimony before Congress on May 22, outgoing Federal Reserve (the “Fed”) Chairman Ben Bernanke mentioned the possibility of tapering bond purchases towards the end of the year. The news sparked a widespread stock selloff, but some share prices recovered after several Fed officials suggested that tapering of the asset purchase program known as QE might not come as soon as many feared. Toward the end of the summer, investor concerns surfaced over the possibility of an announcement of Fed tapering at the central bank’s September meeting. Consequently, markets reacted positively to the announcement that Fed tapering was not imminent – and the assurance from Bernanke that the Fed would not cut the asset purchasing program until the central bank had enough evidence to support the sustainability of economic growth.

U.S. equities ended the year strongly, partly due to positive market reactions to monetary and fiscal policy activity in Washington. Congress reached a long-term budget agreement in December, further reducing fiscal uncertainty. President Obama nominated Janet Yellen as the next Fed Chairperson, and her testimony before Congress assured markets that Fed policy would remain appropriately accommodative. (Ms. Yellen received Senate confirmation as we prepared this report.) As the year wound down, markets initially reacted positively to the Fed announcement that tapering would ultimately begin in January 2014, as

* The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by MassMutual. Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by MassMutual. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

12

Table of Contents

MML Equity Index Fund – Portfolio Manager Report (Unaudited) (Continued)

investors viewed the move favorably – and perceived it as the Fed signaling confidence in the strength and sustainability of the economic recovery.

Subadviser outlook

Although it is impossible to predict the direction that the equity markets will take throughout 2014 after their spectacular rise in 2013, numerous forces will continue to influence the direction that the market takes moving forward – such as Fed policy, inflation, housing, and unemployment, to name just a few. We believe, however, that the Fund continues to be well positioned to pursue returns that are consistent with those of the S&P 500 Index.

13

Table of Contents

MML Equity Index Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

14

Table of Contents

MML Focused Equity Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Focused Equity Fund, and who is the Fund’s subadviser?

The Fund seeks growth of capital over the long-term by investing primarily in equity securities of U.S. companies that the Fund’s subadviser believes are undervalued. Under normal circumstances, the Fund invests at least 80% of its net assets in equity securities. The Fund’s subadviser is Harris Associates L.P. (Harris).

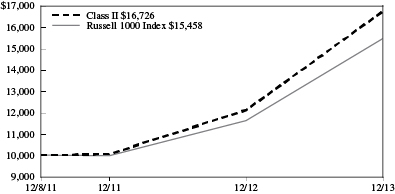

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Class II shares returned 38.05%, outperforming the 33.11% return of the Russell 1000® Index (the “benchmark”), a widely recognized, unmanaged index representing the performance of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For the year, stock selection was the main driver of the Fund’s outperformance, relative to the benchmark, and sector allocations also contributed.

The consumer discretionary sector produced the largest returns for the Fund, on both a relative and an absolute basis. Within the sector, eight of the nine Fund holdings contributed substantially to performance for the year. Top performers included apparel firm Fifth & Pacific, jewelry producer and retailer Tiffany, and auto technology and electronics provider Delphi Automotive. The standout performer in this group was Fifth & Pacific, which advanced 158% during the reporting period, driven by robust results in its Kate Spade brand. Revenues from Kate Spade have been increasing, with comparable store sales growing, on average, about 45% over the past three years – and increasing more than 30% in the past six months. For full-year 2013, Kate Spade accounted for approximately $742 million of net sales and $130 million of earnings based on the company’s preliminary calculations. Another Fund holding that was a performance driver in 2013 was technology firm Applied Materials, a corporation that provides equipment, services, and software used to manufacture smartphones, flat screen TVs, and solar panels.

On the downside, the energy and industrials sectors, along with a lack of exposure to health care shares, were the primary factors that detracted from the Fund’s relative performance for the year.

The energy sector supplied the smallest cumulative absolute returns for the Fund in 2013. Nevertheless, two of three Fund holdings in the energy sector added value: National Oilwell Varco, a worldwide leader in the design, manufacture and sale of equipment and components used in oil and gas drilling and production; and Dresser-Rand Group, a global supplier of custom-engineered rotating equipment solutions for applications in the oil, gas, process, power, and other industries. A third Fund holding in the energy sector, Apache (a multinational oil and gas corporation) underperformed during the year. The Fund exited the stock in the first quarter after learning that its full-year 2012 finding costs were 45% higher than we anticipated and management’s 2013 production forecast was well below five-year production guidance. After considering these factors, we felt that the assets the Fund had invested in this holding could be deployed to other stocks that could have better upside potential. Another Fund holding that was a performance detractor during 2013 was technology company Diebold, which is the largest U.S. manufacturer of ATMs. The Fund also sold out of Diebold during the reporting period.

Subadviser outlook

Our fundamental outlook for 2014 is there may be continued company-specific progress on profitability, albeit at a more moderate pace than in 2013. Although equity markets already reflect some of this improved performance and outlook, such as the breadth and strength of the underlying economy, we believe there are plenty of reasons why a reversal is not warranted. Our belief is that the stock market may have more room to grow, based on our review of current stock valuations. If the stock market were fully priced, we would be much more concerned and poised to take action. Finally, many financial experts have declared the market to be expensive, which reinforces one of the clear distinctions and advantages we have in not “following the crowd”: We focus on fundamental valuations across market cycles and not on simple price activity in our management of the Fund.

15

Table of Contents

MML Focused Equity Fund – Portfolio Manager Report (Unaudited) (Continued)

16

Table of Contents

MML Focused Equity Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

17

Table of Contents

MML Foreign Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Foreign Fund, and who is the Fund’s subadviser?

The Fund seeks long-term capital growth by investing, under normal circumstances, at least 80% of its net assets in investments of issuers located outside of the U.S., including those in emerging markets. Under normal market conditions, the Fund invests predominantly in equity securities, primarily common stocks, and, while there are no set percentage targets, the Fund invests predominantly in large- to medium-capitalization companies with market capitalization values greater than $2 billion and may invest a portion in smaller companies. The Fund’s subadviser is Templeton Investment Counsel, LLC (Templeton).

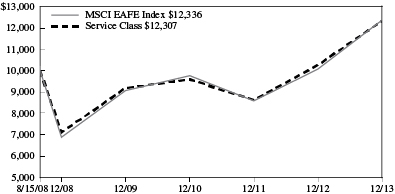

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Initial Class shares returned 20.80%, underperforming the 22.78% return of the Morgan Stanley Capital International (MSCI®) Europe, Australasia, Far East (EAFE®) Index (the “benchmark”), a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For 2013, stock selection in Japan and the Fund’s exposure to out-of-benchmark countries South Korea, Brazil, China, and Canada detracted from the Fund’s performance relative to the benchmark. The Fund’s exposure to India also weighed on relative results for the year.

Stock selection and an underweight position, relative to the benchmark, in the consumer discretionary sector – in tandem with stock selection in the telecommunication services sector – hindered the Fund’s relative performance. Fund holdings that were major detractors included Japanese automaker Nissan Motor, Japanese optical and precision technologies company Nikon, and diversified telecommunication provider China Telecom (which is not included in the benchmark). Stock selection in information technology and an overweight position in energy also detracted from results. Fund holdings in South Korean electronic products manufacturer Samsung Electronics, German software maker Software AG, Brazilian oil and natural gas company Petroleo Brasileiro, and Norwegian oil and natural gas production company Statoil (the only benchmark constituent of the four) detracted the most. Fund holdings in other sectors that hampered Fund performance included out-of-benchmark companies such as Brazilian metals and mining firm Vale, Indian commercial bank ICICI Bank, and Canadian fertilizer company Potash Corporation of Saskatchewan.

Conversely, stock selection in Europe – particularly in the U.K., Switzerland, the Netherlands, and France – benefited the Fund’s relative performance. A lack of exposure to Australian stocks, exposure to the out-of-benchmark United States, and favorable stock selection in Hong Kong and Singapore also contributed to the Fund’s relative returns for the year.

From a sector perspective, the Fund’s relative performance benefited from stock selection in financials. Several Fund holdings were notable contributors, including commercial banks Lloyds Banking Group (U.K.) and BNP Paribas (France), financial services providers ING U.S. and ING Groep (Netherlands-based, non-benchmark members), and French insurer AXA. Stock selection in industrials and health care also aided performance, as Fund holdings such as Dutch human resources consulting firm Randstad Holding, Swiss life sciences company Lonza Group, and German pharmaceuticals manufacturer Bayer all advanced for the year. Two other Fund holdings, wireless communications provider Vodafone Group (U.K.) and mail and German freight services company Deutsche Post, also contributed to the Fund’s full-year results.

Subadviser outlook

The global economy continued to improve in 2013, enhancing the positive impact of corporate restructuring of the past few years. With fundamental improvements now coming to fruition and valuations still selectively attractive, we believe the potential for further gains likely exists, particularly in Europe. Financial conditions continued to normalize in 2013 with support from policy makers. Rising domestic demand, improving competitiveness, and a current account surplus in the peripheral countries helped Europe exit its worst recession on record. Yet, even after such notable improvements, euro zone companies traded at a material

18

Table of Contents

MML Foreign Fund – Portfolio Manager Report (Unaudited) (Continued)

discount relative to their historical average and to their U.S.-based peers. Although significant political and economic risks remain, low-valued European companies with globally diversified revenues remain attractive, in our opinion, and we believe there could be potential for their earnings to increase over the Fund’s long-term investment horizon. Outside of Europe, we have less geographical conviction, as different regions are progressing with reform and recovery at varying paces.

19

Table of Contents

MML Foreign Fund – Portfolio Manager Report (Unaudited) (Continued)

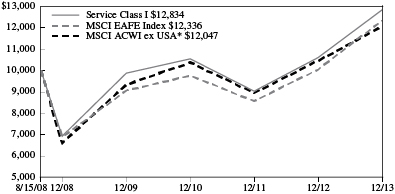

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the MSCI EAFE Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

20

Table of Contents

MML Fundamental Growth Fund – Portfolio Manager Report (Unaudited)

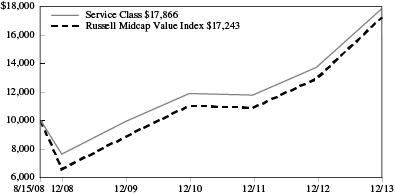

What is the investment approach of MML Fundamental Growth Fund, and who is the Fund’s subadviser?

The Fund seeks long-term growth of capital by investing primarily in domestic equity securities that the Fund’s subadviser believes offer the potential for long-term growth. The Fund’s subadviser is Wellington Management Company, LLP (Wellington Management).

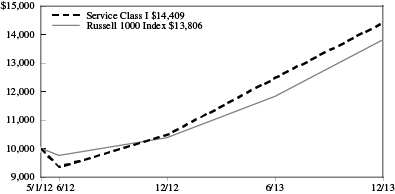

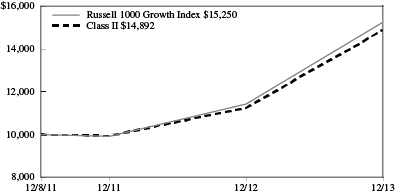

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Class II shares returned 32.29%, underperforming the 33.48% return of the Russell 1000® Growth Index (the “benchmark”), an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater than average growth orientation that tend to exhibit higher price-to-book ratios and higher forecasted growth rates than securities in the value universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

During the year, the Fund advanced substantially on an absolute basis, but underperformed the benchmark, as unfavorable stock selection offset positive results from sector positioning. Stock selection within the consumer discretionary, materials, and information technology sectors detracted from the Fund’s results, relative to the benchmark during 2013. Fund holdings that were top detractors from relative performance included Altera, Cisco Systems, and Broadcom – all in information technology. Shares of Altera, a programmable logic semiconductor device manufacturer, declined after the company posted better-than-expected quarterly earnings, but slightly missed revenue expectations. Additionally, the company’s fourth-quarter sales outlook was well below consensus estimates. Cisco Systems, a networking systems and communication products provider, saw its shares decline after management provided an updated outlook that disappointed investors, primarily as a result of a muted growth outlook in Asia. Finally, after shares of Broadcom, a provider of semiconductor solutions for wired and wireless communications, fell based on disappointing earnings results, we eliminated the Fund’s position in the stock. Other notable Fund holdings that detracted from performance were Allied Nevada Gold in the materials sector and Facebook in the information technology sector. The Fund’s cash position also detracted amid 2013’s broad-based equity rally.

Turning to the positive side, an underweight position, relative to the benchmark, in the lagging consumer staples sector, as well as an overweight stake in health care stocks, contributed to the Fund’s relative performance during the year. Stock selection within the industrials and financials sectors, however, proved positive for the Fund’s full-year performance.

Fund holdings that were top contributors to the Fund’s relative returns included Yahoo! (information technology), Celgene (health care), and Boeing (industrials). Shares of Yahoo!, a U.S.-based Internet company, climbed due to signs of improvement in pricing, volumes, and display advertising during the period (when we initiated the Fund’s position). Celgene, a global biopharmaceutical firm focused on developing drugs that target cancer and immune-inflammatory diseases, got a lift from strong earnings results and a better-than-expected outlook. Shares of aerospace company Boeing rose as concerns over electrical issues with its 787 Dreamliner subsided – and the company continued to see strong demand for commercial aircraft in the U.S. and abroad. Finally, the Fund’s underweight positions in information technology giants International Business Machines (IBM) and Apple also contributed to the Fund’s benchmark-relative performance.

Subadviser outlook

The Fund continues to have balance with respect to growth, quality, and valuation metrics. From a sector perspective, we increased the Fund’s information technology exposure during the period – and as of December 31, 2013, it represented the Fund’s largest overweight position. We believe that, broadly speaking, the sector may have good organic growth prospects and attractive quality characteristics, such as potentially high returns on capital and strong balance sheets. At year-end, the Fund also had overweight stakes in the health care and industrials sectors. We believe the valuations for many companies within the consumer staples sector are not justified by their modest growth rates, and the Fund’s underweight positions in the materials and telecommunication services sectors heading into 2014 reflect our near-term outlook for companies in those sectors.

21

Table of Contents

MML Fundamental Growth Fund – Portfolio Manager Report (Unaudited) (Continued)

22

Table of Contents

MML Fundamental Growth Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Growth Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund's return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

23

Table of Contents

MML Fundamental Value Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Fundamental Value Fund, and who is the Fund’s subadviser?

The Fund seeks long-term total return by investing primarily in equity securities of issuers that the Fund’s subadviser believes are undervalued. Under normal circumstances, the Fund invests at least 80% of its net assets in equity securities, with a focus on companies with large market capitalizations (which the subadviser believes are generally above $2 billion). The Fund’s subadviser is Wellington Management Company, LLP (Wellington Management).

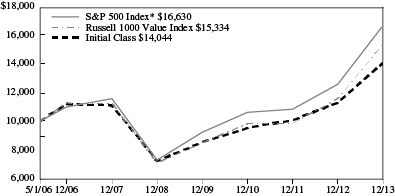

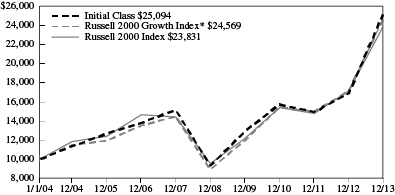

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Class II shares returned 30.91%, underperforming the 32.53% return of the Russell 1000® Value Index (the “benchmark”), an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies, based on market capitalization) with greater than average value orientation that tend to exhibit lower price-to-book ratios and lower forecasted growth rates than securities in the growth universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Despite the Fund’s strong absolute return for 2013, it still underperformed the benchmark, as unfavorable stock selection offset positive results from sector positioning. Hampering the Fund’s full-year performance was its overweight position, relative to the benchmark, in the materials sector, which lagged the overall benchmark. Security selection also detracted from relative performance, especially weak selection among information technology and health care stocks. Fund holdings that were primary detractors from the Fund’s relative performance included Mosaic (in the materials sector), Baxter International (health care), and Barrick Gold (materials). Shares of Mosaic, a large producer of phosphate and potash fertilizer, declined after the company faced lower pricing due to an aggressive marketing strategy by a Russian competitor. The Fund exited the stock during the period. Baxter International, a diversified global health care company, underwent price declines as competitive pressures to the hemophilia franchise weighed on the stock during the year. Shares of Barrick Gold, the world’s largest gold producer, fell as lower gold prices reduced earnings forecasts for all miners. We eliminated the stock from the Fund during the year. The Fund’s position in Verizon Communications (telecommunication services) was a notable detractor, and the Fund’s decision to not hold Apple (information technology), a benchmark constituent, also hampered results. The Fund’s cash position also detracted amid 2013’s broad-based equity rally.

On the positive side, an underweight position in the lagging utilities sector and an overweight stake in the strong-performing information technology sector contributed to the Fund’s relative performance for the year. Another performance driver was strong stock selection within the financials sector. Fund holdings that were among the top contributors to relative results for the year included Spirit Aerosystems (industrials), Ameriprise Financial (financials), and Boeing (industrials). Shares of Spirit Aerosystems, an aerospace and defense company, moved higher after the company reported better-than-expected quarterly earnings, driven by operating performance improvements in its mature programs. Ameriprise Financial, a diversified financial services company, saw its shares rise when good performance in asset growth in the advice and wealth management division combined with strong equity markets to lead to solid earnings growth. Shares of aerospace company Boeing climbed as concerns over electrical issues with its 787 Dreamliner subsided – and the company experienced strong demand for commercial aircraft in the U.S. and abroad. Other notable contributors to the Fund’s relative full-year performance included Fund holdings IntercontinentalExchange, a leading operator of regulated exchanges and clearing houses in the financials sector, and weak-performing ExxonMobil (energy), in which the Fund held an underweight position.

Subadviser outlook

In the U.S. in 2014, we expect there may be a “Goldilocks” environment, with an economy that is “not too hot and not too cold.” We believe gross domestic product growth may exceed 3%, driven by less tax drag on the consumer. The employment picture is moderately improving, and our view is that housing could remain constructive. While housing did take a pause in late 2013 in part due to an uptick in mortgage rates, we believe it may have the potential to reaccelerate in the spring selling season. Mortgage rates are still very low, on a historical basis, and we believe that the increased confidence from better employment and wage

24

Table of Contents

MML Fundamental Value Fund – Portfolio Manager Report (Unaudited) (Continued)

growth figures may help offset higher rates. Our view is that the Federal Reserve is likely to remain accommodative with a zero interest rate policy through 2014 – and implement only modest tapering of bond-buying throughout the year. We believe unwinding Quantitative Easing (QE) may be healthy for the economy because it caused a lot of investor uncertainty during 2013. As 2014 started, the Fund’s largest overweight positions were in the consumer discretionary and information technology sectors, with its largest underweight stakes in the utilities and energy sectors, reflecting our outlook.

25

Table of Contents

MML Fundamental Value Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Value Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

26

Table of Contents

MML Global Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Global Fund, and who is the Fund’s subadviser?

The Fund seeks long-term capital appreciation by investing primarily in the equity securities of U.S. and foreign companies, including companies in developed and emerging markets. Equity securities may include common stocks, depositary receipts, preferred stocks, securities convertible into common or preferred stock, rights, and warrants. The Fund’s subadviser is Massachusetts Financial Services Company (MFS).

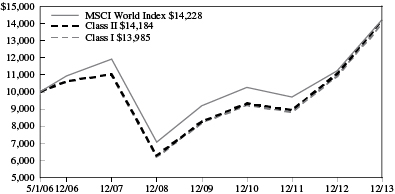

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Class I shares returned 28.13%, outpacing the 26.68% return of the Morgan Stanley Capital International (MSCI®) World IndexSM (the “benchmark”), an unmanaged index of issuers listed on the stock exchanges of 20 foreign countries and the U.S.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Among the notable factors contributing to the Fund’s performance in 2013 was stock selection in the basic materials sector, which was beneficial to results relative to the benchmark. An overweight position, compared to the benchmark, in diversified technology company 3M also burnished the Fund’s relative results when the stock significantly outpaced the benchmark in 2013. Stock selection in the health care sector was an additional positive factor for the Fund’s relative returns, as overweight positions in strong-performing American life sciences supply company Thermo Fisher Scientific, American cardiovascular medical device maker St. Jude Medical, and German health care products manufacturer Bayer boosted relative returns.

An overweight position in the leisure sector further supported the Fund’s relative performance for the year, and the Fund’s greater-than-benchmark allocations to American media conglomerate Walt Disney and advertising and marketing firm WPP Group (U.K.) benefited relative results. Overweight positions in other Fund holdings – including American custody bank State Street, building and American aircraft controls manufacturer Honeywell International, and U.S.-based global payments technology company Visa – also drove performance during the year. The Fund did not own computer and personal electronics maker Apple (U.S.), which also contributed to the Fund’s relative results, as the stock lagged the benchmark in 2013. During the year, the Fund’s relative currency exposure was another contributor to the Fund’s relative performance, resulting primarily from differences between the Fund’s and the benchmark’s exposures to holdings of securities denominated in foreign currencies.

On the downside, stock selection and an overweight position in the consumer staples sector held back relative returns. Overweight stakes in Dutch brewer Heineken and wine and alcoholic beverage producer Pernod Ricard (France) hindered relative results, as both of these Fund holdings lagged the benchmark during the year. Stock selection in the technology sector further weighed on relative performance. Holdings of South Korean microchip and electronics manufacturer Samsung Electronics (not a benchmark member) and Japanese digital camera and office equipment manufacturer Canon were among the Fund’s top relative detractors during the year. Elsewhere, Italian oil and gas turnkey contractor Saipem proved a drag on performance. Additionally, the U.K.’s Standard Chartered, Brazil’s Itau Unibanco Holding (not a benchmark constituent), and India’s ICICI Bank (also not a benchmark member) – all in the banking business – worked against the Fund’s success in 2013 along with luxury goods company LVMH (France).

The Fund’s cash and/or cash equivalents position during the period also detracted from relative performance. Under normal market conditions, the Fund strives to be fully invested and generally holds cash to buy new holdings and to provide liquidity. In a rising equity market, such as we experienced in 2013, holding cash hurt the Fund’s relative performance since the benchmark has no cash position.

Subadviser outlook

After slow but improving economic growth, subdued inflation and robust equity performance in 2013, our view is that the financial markets may have already priced in optimism about another good year in 2014. Other scenarios, however, could challenge this outlook – including weaker macro-economic conditions, deeper debt burdens, or greater inflationary pressures.

27

Table of Contents

MML Global Fund – Portfolio Manager Report (Unaudited) (Continued)

Nevertheless, our belief is that in an environment of modestly rising interest rates, a slow-but-steady tapering of U.S. Federal Reserve asset purchases could be positive for equities. With respect to emerging markets, we believe they should be considered not as one block, but individually, with each having its own reaction to tapering and the political uncertainty created by upcoming elections in India, Thailand, and Indonesia, for example. Overall, we believe that many 2013 themes could be repeated in 2014, including that fixed-income investments may continue to face challenges throughout the year, which may be similar to those they encountered in 2013. We also believe that developed markets may have the potential to continue experiencing generally positive equity returns in 2014 and some emerging markets may recover, but that overall, global equity returns could be lower this year than in 2013.

28

Table of Contents

MML Global Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the MSCI World Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

29

Table of Contents

MML Growth & Income Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Growth & Income Fund, and who is the Fund’s subadviser?

The Fund seeks capital appreciation and income by investing, under normal circumstances, at least 80% of its net assets in equity securities and equity-related securities, including convertible securities, preferred stocks, options, and warrants, of U.S. companies with market capitalizations at the time of purchase greater than $1 billion. The Fund’s subadviser is Massachusetts Financial Services Company (MFS).

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Initial Class shares returned 32.53%, outperforming the 32.39% return of the S&P 500® Index (the “benchmark”), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Stock selection in both the financial services and health care sectors contributed to the Fund’s relative performance for the year. In the financial services sector, the Fund’s overweight positions, relative to the benchmark, in asset management firm BlackRock and transaction processing- and payments-related service providers MasterCard and American Express benefited relative performance, as all three of these Fund holdings outperformed the benchmark. Within the health care sector, the Fund’s overweight positions in strong-performing life sciences supply company Thermo Fisher Scientific and cardiovascular medical device maker St. Jude Medical, as well as its investment in specialty pharmaceutical company Valeant Pharmaceuticals (not a benchmark constituent), also supported the Fund’s relative results.

The Fund’s underweight position in the poorly performing utilities and communications sector also benefited relative performance. Within this sector, an underweight position in telecommunications company AT&T was among the top relative contributors. The Fund eliminated this underperforming position by year-end. The Fund’s overweight position in strong-performing computer products and services provider Hewlett-Packard and media conglomerate Walt Disney also boosted relative performance when the two companies advanced substantially in 2013. The Fund’ avoidance of shares of diversified technology products and services company International Business Machines (IBM) also contributed to the Fund’s relative performance, as the stock lagged the benchmark during the period.

Stock selection in the consumer staples, retailing, and energy sectors was detrimental to the Fund’s full-year relative performance. In the consumer staples sector, international food producer Danone and wine and alcoholic beverage producer Pernod Ricard were two Fund holdings that held back relative returns, as both stocks (which are not benchmark constituents) underperformed the benchmark. Within the retailing sector, holdings of luxury goods company LVMH (which is not represented in the benchmark) and an overweight position in general merchandise store operator Target dampened relative performance. Similarly, in the energy sector, two Fund holdings detracted from relative results: engineering company Dresser Rand Group (not a benchmark member) and an overweight position in oil and gas equipment company Cameron International.

The Fund’s cash and/or cash equivalents position during the period also detracted from relative performance. Under normal market conditions, the Fund strives to be fully invested and generally holds cash to buy new holdings and to provide liquidity. In a rising equity market, such as we experienced in 2013, holding cash hurt the Fund’s relative performance since the benchmark has no cash position.

Subadviser outlook

After slow but improving economic growth, subdued inflation, and robust equity performance in 2013, our view is that the financial markets may have already priced in optimism about another good year in 2014. Other scenarios, however, could challenge this outlook – including weaker macro-economic conditions, deeper debt burdens, or greater inflationary pressures. Nevertheless, our belief is that in an environment of modestly rising interest rates, a slow-but-steady tapering of U.S. Federal Reserve asset purchases could be positive for equities. Our view is that many 2013 themes could carry forward into 2014,

30

Table of Contents

MML Growth & Income Fund – Portfolio Manager Report (Unaudited) (Continued)

including the fact that fixed-income investments may continue to face challenges throughout the year, similar to those they encountered in 2013. We also believe that developed markets may have the potential to continue experiencing generally positive equity returns in 2014 and some emerging markets may recover, but that overall, global equity returns could be lower this year than in 2013.

31

Table of Contents

MML Growth & Income Fund – Portfolio Manager Report (Unaudited) (Continued)

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

32

Table of Contents

MML Income & Growth Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MML Income & Growth Fund, and who is the Fund’s subadviser?

The Fund seeks long-term total return and current income by investing primarily in equity securities of dividend paying companies that the Fund’s subadviser believes will both increase in value over the long term and provide current income. Equity securities may include common stocks, preferred stocks, securities convertible into common or preferred stock, rights, and warrants. The Fund’s subadviser is BlackRock Investment Management, LLC (BlackRock).

How did the Fund perform during the 12 months ended December 31, 2013?

The Fund’s Initial Class shares returned 24.62%, underperforming the 32.39% return of the S&P 500® Index (the “benchmark”), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. The Fund also trailed the 32.53% return of the Russell 1000® Value Index, an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater than average value orientation that tend to exhibit lower price-to-book ratios and lower forecasted growth rates than securities in the growth universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2013, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance