Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02224

| MML Series Investment Fund |

(Exact name of registrant as specified in charter)

| 1295 State Street, Springfield, MA 01111 |

(Address of principal executive offices) (Zip code)

| Richard J. Byrne 1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: 413-788-8411

Date of fiscal year end: 12/31/2010

Date of reporting period: 12/31/2010

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 24 | ||||

| 27 | ||||

| 29 | ||||

| 36 | ||||

| 39 | ||||

| 41 | ||||

| 46 | ||||

| 50 | ||||

| 52 | ||||

| 56 | ||||

| 63 | ||||

| 83 | ||||

| 84 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

| 90 | ||||

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the MML Series Investment Fund. Investors should consider a Fund’s investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

Table of Contents

MML Series Investment Fund – President’s Letter to Shareholders

| 1 | Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment. |

| 2 | Systematic investing and asset allocation do not ensure a profit or protect against loss in a declining market. Systematic investing involves continuous investment in securities regardless of fluctuating price levels. Investors should consider their ability to continue investing through periods of low price levels. |

1

Table of Contents

MML Series Investment Fund – President’s Letter to Shareholders (Continued)

| • | Choose investments that work for you and monitor your account regularly. No one knows your financial goals and objectives better than you. So be sure to select the stock, bond and short-term/money market investments that you feel will help you reach your goals. One of the greatest advantages you have when you diversify your investment choices is that these three distinct investment types tend to behave differently under various economic conditions. Consequently, many financial professionals hold the view that individuals can help reduce their risk of overexposure to one or two poorly performing investment types by diversifying across multiple types. |

Keep your eye on the future and stay current with your plan

We believe doing business with MassMutual is the sign of a good decision – as is focusing on the long term when it comes to planning for retirement. As you can see from the S&P 500 example noted above, short-term changes in the markets don’t necessarily have to result in a long-term impact on your retirement account. MassMutual’s view is that a retirement investment plan tailored to your time horizon and your tolerance for risk can help you navigate short-term gyrations in the markets. By monitoring your plan regularly and adjusting your retirement planning strategy when appropriate, you can help yourself as you pursue your long-term financial objectives.

As always, thank you for your confidence and trust in MassMutual.

Sincerely,

Richard J. Byrne

President

The information provided is the opinion of MassMutual Retirement Services Investment Services as of 1/1/11 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

Table of Contents

MML Series Investment Fund – Economic and Market Review

December 31, 2010

A challenging year, with emerging signs of recovery

The turnaround in the financial markets that began in March 2009 continued during the year ended December 31, 2010, although there were numerous – and some significant – bumps along the way. The stock market in the United States was largely positive throughout the year, despite notable periods of underperformance. Foreign equity markets also overcame difficulties and did well overall, despite generally lagging their U.S. counterparts. Many of the debt-related problems that had plagued some of the more highly leveraged countries in the euro zone (particularly Greece and Ireland) underwent short-term resolution through government intervention, but European debt issues continued to hinder the investing environment as the period ended.

The U.S. dollar remained strong throughout much of the year, although late in the period, investor fears over the Federal Reserve’s (the “Fed”) announced purchase of U.S. Treasury bonds caused the dollar to weaken – against the backdrop of an ongoing run-up in commodity (specifically, gold and oil) prices, which commonly occurs when the dollar declines in value. Crude oil finished the year at roughly $91 per barrel (versus $79 on December 31, 2009) and gold continued to trade higher, closing the year at approximately $1,422 per ounce (versus $1,096 on December 31, 2009).

Key pieces of legislation passed in the year included health care reform (March), which did not have much of an immediate impact on the markets, and the extension of the Bush-era income-tax cuts (December), which linked a two-year extension of the Bush tax cuts (initially signed into law in 2001, but slated to expire without Congressional action on December 31, 2010) to a one-year extension of unemployment benefits and other aid to middle-income earners. Also in politics, the mid-term elections delivered a Republican majority in the U.S. House of Representatives, but the U.S. Senate continued to hold a Democratic majority.

The Fed kept interest rates low, holding the federal funds rate at 0.0% to 0.25%, in its continued focus on stimulating the economy. The federal funds rate is the interest rate that banks and other financial institutions charge each other for borrowing funds overnight.

Certain economic indicators were troubling during the period and seemed mainly to show more bad news than good until the end of the year, when some bright spots appeared on the horizon. Indeed, December economic reports indicated that consumer confidence rose, initial jobless claims fell, and Gross Domestic Product (“GDP”) for the third quarter of the year was revised to reflect a gain of 2.6%, after an initial estimated advance of 2.0%. GDP reflects the total value of goods and services produced in the United States.

Market performance

Both bonds and equities advanced for the 12-month period ended December 31, 2010, although stocks generally outperformed their fixed-income counterparts. The Dow Jones Industrial AverageSM (the “Dow”), a well-known measure of blue-chip stock performance, advanced 11.02%. In a similar fashion, the S&P 500® Index of U.S. large-cap stocks returned 15.06%. The small-cap Russell 2000® Index outpaced both of the aforementioned indexes, with a return of 26.85% for the period. The barometer for technology stocks, the NASDAQ Composite® Index, posted a 16.91% return for the period. Performance was also positive in worldwide equity markets. The MSCI® EAFE® Index, a benchmark for foreign stocks in developed markets, advanced 7.75%. The foreign market winner, however, was the MSCI Emerging Markets Index, a benchmark that represents the performance of emerging stock markets throughout the world, which advanced 18.88%.

Fixed-income investments generally trailed their equity counterparts during the 12-month period. The Barclays Capital U.S. Aggregate Bond Index, a broad measure of the U.S. investment-grade bond markets, gained 6.54%. Treasury bills gained just 0.13%. The outstanding performer in the fixed-income arena was the Barclays Capital U.S. Corporate High Yield Index, a measure of the performance of fixed-rate, non-investment-grade debt from corporate sectors, which advanced 15.12%. Conversely, the Barclays Capital U.S. 1-3 Year Government Bond Index, which measures the performance of short-term U.S. government bonds, returned 2.40%.*

| * | Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment. |

3

Table of Contents

MML Series Investment Fund – Economic and Market Review (Continued)

First quarter of 2010: A ‘mixed’ start to the year

Despite struggling in January and into the early part of February, the U.S. stock market turned in a solid performance during the first three months of 2010. In the bond market, yields of U.S. Treasury securities were lower, and prices higher, for most of the first quarter. Bond prices move in the opposite direction of interest rates (or yields); when yields rise, the prices of existing bonds fall – and vice versa.

Concerns over the sovereign debt problems of Greece, Portugal, Italy, Ireland, and Spain hindered U.S. and foreign stock performance early in the quarter, but efforts by the European Union to find a sustainable solution helped the markets rally in February and March. These debt concerns increased the attractiveness of the U.S. dollar, which rose against the euro and other key foreign currencies.

Financial news for the quarter was decidedly mixed. On the positive side, the final estimate for fourth-quarter 2009 GDP came in at a healthy 5.6%, and fourth-quarter 2009 corporate earnings benefited from aggressive cost-cutting and favorable comparisons with the weak fourth quarter of 2008. Unemployment, at 9.7% for February, remained stubbornly high, and the residential real estate market remained hampered by a large supply of homes for sale, weak demand and widespread borrower defaults. On the bright side, U.S. corporate earnings reports were generally strong.

Second quarter of 2010 marred by stock market downturn, mixed economic indicators

U.S. and foreign stock markets pulled back sharply during the second quarter of 2010 – after a vigorous rally that had lasted more than 13 months. This selloff was largely due to deepening fears about the European debt crisis as well as growing concerns about a possible double-dip recession in the United States. The April 20 explosion of the BP-licensed Deepwater Horizon oil-drilling rig and the resulting oil spill contributed to the uncertainty of the economic environment and held the media’s attention until the spill was stopped and the well capped later in the summer. May was especially challenging, with most of the major indexes giving up substantial ground. May 6 was particularly memorable, when the Dow, down more than 300 points already for the day, dropped more than 600 additional points and recovered most of the additional loss in about 20 minutes in what was subsequently termed a “flash crash” by market pundits (due to the market’s quick descent and recovery). The flash crash set a Dow record for the largest-ever intraday decline: almost 1,000 points.

During this period, bonds responded well to signs that the U.S. economy might be facing slower growth than previously expected. Treasury yields dropped sharply and prices posted healthy advances, with the largest gains occurring in longer maturities. The U.S. dollar continued to appreciate, and emerging markets equities suffered shallower declines than most developed markets. Economic data releases pointed to a still-expanding, but fragile, U.S. economy. In June, the third and final estimate of GDP growth for the first quarter was revised downward to 2.7% from 3.0%. Also noteworthy was the unemployment rate, which remained at 9.7%.

Third quarter of 2010: Stocks rebound; recession officially ‘ends’

U.S. stocks delivered solid gains in the third quarter of 2010, although the up-down-up pattern of the major indexes left many investors perplexed. Solid second-quarter earnings and economic reports that were not as bad as expected helped fuel the advance. Bond prices rose, and yields of U.S. Treasury securities continued the precipitous decline that began in April, taking the yield of the bellwether 10-year note from 2.97% at the end of the second quarter down to 2.53% at the end of the third quarter. The yield of the 10-year note is an important factor in determining mortgage rates, so the historically low rates drove significant mortgage refinancing activity.

The U.S. economy had expanded in the second quarter of 2010, but at a slower pace than in the first quarter, so the Commerce Department’s final estimate of second-quarter GDP released in the third quarter was a tepid 1.7% on an annualized basis. The third quarter’s report on unemployment, released at the beginning of September, revealed a jobless rate of 9.6%. Concern about the euro zone’s sovereign debt crisis eased further, as Spain’s issuance of 6 billion euros of debt at the beginning of July met strong demand and offered better-than-expected pricing. The U.S. dollar weakened against most key developed market currencies. Finally, in September, the National Bureau of Economic Research issued a statement identifying June 2009 as the end of the Great Recession (which began in December 2007) – a conclusion that was questioned by many, since so many economic problems remained unresolved.

4

Table of Contents

MML Series Investment Fund – Economic and Market Review (Continued)

Fourth quarter of 2010: Signs of recovery continue

The stock market continued its upward march in the final quarter of the year – although November proved challenging for most domestic equities. Equity markets regained momentum in December; all broad domestic stock indexes advanced for the quarter and turned in double-digit returns for the full year. Conversely, bonds struggled during the fourth quarter of 2010. After falling precipitously for much of the year, yields in the Treasury market reversed course and surged higher from early October through mid-December, pressuring bond prices. For example, the yield of the bellwether 10-year Treasury note rose from 2.52% to 3.31% during the quarter. As a result, most bond indexes finished the quarter with losses, with the longer maturities suffering the most. Losses in corporate bonds were cushioned somewhat by growing optimism about the U.S. economy and corporate profits. High-yield bonds, which tend to correlate more with the fortunes of the issuing company or the issuer’s industry, rather than interest rates, managed solid gains for the quarter.

Although the extension of the Bush-era tax cuts passed by Congress in December – a legislative package estimated to be worth $858 billion – undoubtedly helped the stock market to finish the year on a positive note, it may also be that the Fed’s decision to engage in another round of quantitative easing – referred to as “QE2” – was the main driver of the financial markets during the second half of 2010.

Formally announced on November 3, 2010, QE2 included plans for the Fed to purchase $600 billion of longer-term Treasuries, at a pace of roughly $75 billion per month, by the end of the second quarter of 2011. The plan also called for the reinvestment of $250 billion to $300 billion of proceeds from earlier investments. The stated goal of QE2, as characterized in the Fed’s minutes released on November 3, was to “promote a stronger pace of economic recovery and to help insure that inflation, over time, is at levels consistent with [the Fed’s] mandate.”

While 2010 ended on a positive note, the U.S. economy must still prove itself in 2011. Specifically, investors will be watching to see if the economy can generate enough momentum to meaningfully reduce unemployment and begin to heal the battered residential real estate market. For long-term investors, as always, the challenge is staying disciplined amid constantly shifting markets and avoiding the temptation to buy or sell based on short-term developments.

The information provided is the opinion of MassMutual Retirement Services Investment Services as of 1/1/11 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

5

Table of Contents

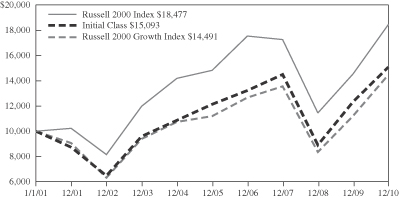

MML Blue Chip Growth Fund – Portfolio Manager Report

What is the investment approach of MML Blue Chip Growth Fund, and who is the Fund’s subadviser?

The Fund seeks long-term capital growth. Income is a secondary objective. Under normal circumstances, the Fund invests at least 80% of its net assets in the common stocks of large- and medium-sized blue chip growth companies. The Fund’s subadviser currently defines blue chip growth companies to mean firms that, in its view, are well-established in their industries and have the potential for above-average earnings growth. The Fund’s subadviser is T. Rowe Price Associates, Inc. (T. Rowe Price).

How did the Fund perform during the 12 months ended December 31, 2010?

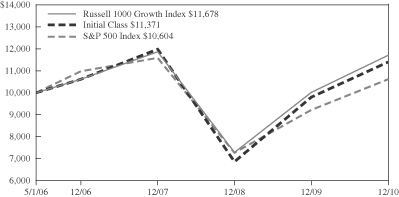

The Fund’s Initial Class shares returned 16.17%, modestly trailing the 16.71% return of the Russell 1000® Growth Index (the “benchmark”), an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater than average growth orientation that tend to exhibit higher price-to-book ratios and higher forecasted growth rates than securities in the value universe. Conversely, the Fund outperformed the 15.06% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Sector weighting was the primary reason for the Fund’s strong absolute performance in 2010, but stock selection was also positive. The information technology (“IT”), consumer discretionary, and energy sectors were the leading relative outperformers. The financials and materials sectors were primary relative detractors.

The Fund’s results in the IT sector benefited from strong stock selection. Apple, the top absolute portfolio contributor, experienced sales growth in all three major products (iPhones, iPods, and Macs) and appeared, at year-end, poised to benefit strongly from the new iPad. The share price of Baidu, operator of China’s most popular Web site, more than doubled on continued earnings growth, benefiting from the effective withdrawal of Google from the Chinese market. Baidu is the dominant search engine in the world’s largest Internet market. Limiting exposure to several significant benchmark holdings that underperformed, such as Cisco Systems, Hewlett-Packard, and Microsoft, also aided the Fund’s performance, relative to the benchmark.

The portfolio’s overweight position in the consumer discretionary sector, relative to the benchmark, also contributed to performance. Marriott, the largest U.S. hotel chain, benefited from a rebound in travel after occupancies hit a 30-year low in 2009. The company turned a profit in the third quarter of 2010 and announced plans to increase the number of rooms, including a significant increase in Brazil. Shares of Starbucks rose steadily on continuing stronger sales. In addition to improving sales in the United States, the coffee chain showed potential for notable international growth, announcing that it would triple the number of stores in China over five years. Amazon.com continued to outperform, due to strong earnings results and a positive impact from the introduction of a new version of its Kindle eReader. The company continued to gain Internet retail market share, as Internet retailers continued to acquire market share at the expense of traditional retailers.

The Fund’s energy position outperformed on stock selection, offsetting an unfavorable underweighting in the strong-performing sector. Schlumberger, the global oilfield services firm, was a top absolute portfolio contributor.

On the downside, the financials sector was by far the Fund’s biggest relative detractor in 2010, largely due to stock selection. Investment banker Goldman Sachs suffered from charges related to its mortgage securities sales. Shares fell sharply after the U.S. Securities and Exchange Commission filed fraud charges against the firm. Consequently, the portfolio reduced its position in the stock. Sector results were also negatively affected by portfolio holdings in bank stocks. Banks are facing regulatory challenges and net interest margins are squeezed by the low interest rate environment.

Subadviser outlook

For 2011, we hold a modestly positive view of the equities market. In our view, earnings and cash flow should improve, boosting investor confidence and thus strengthening equity markets. We are particularly focused on exposure to companies positioned to

6

Table of Contents

MML Blue Chip Growth Fund – Portfolio Manager Report (Continued)

benefit from high overseas exposure to emerging markets, as we expect economic growth in these areas to outpace growth in developed markets. There is also a good chance for multiple expansions in U.S. equities, as cash sitting on the sidelines is reallocated back into stocks. The Fund is poised to capitalize on the improving market environment, with overweight investments in the consumer discretionary, industrials, and business services sectors.

7

Table of Contents

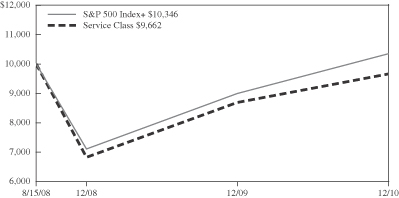

MML Blue Chip Growth Fund – Portfolio Manager Report (Continued)

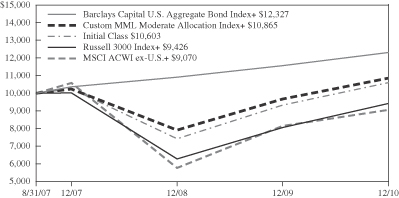

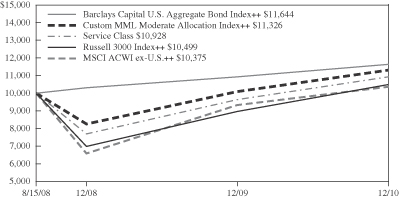

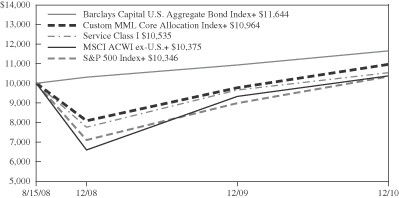

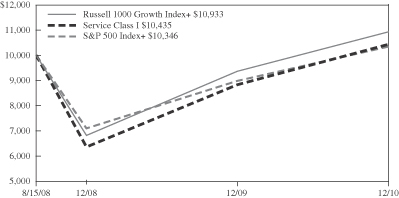

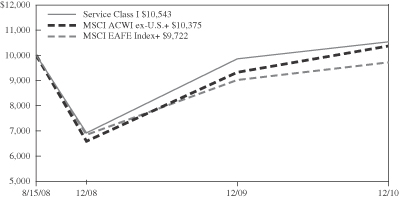

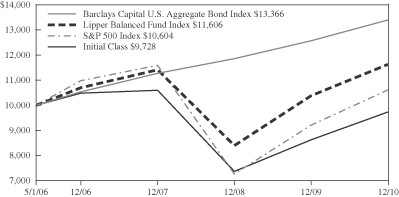

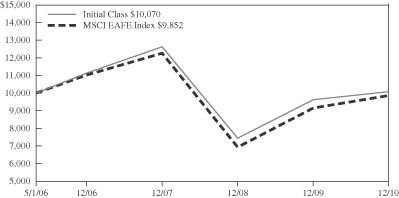

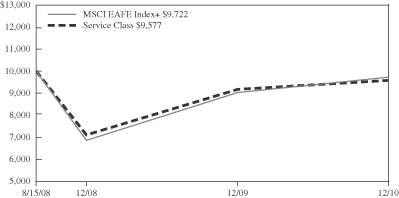

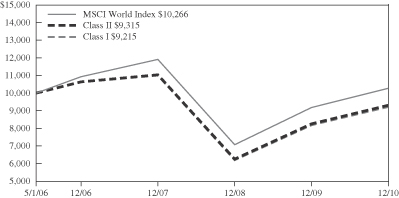

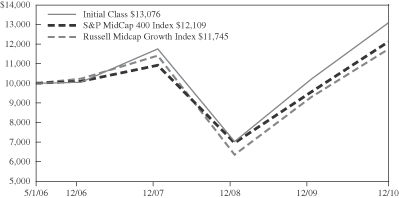

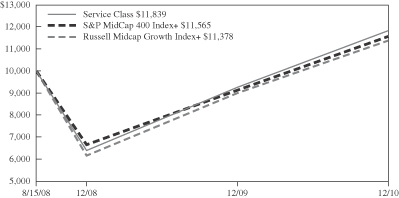

* Benchmark

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Growth Index and the S&P 500 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

8

Table of Contents

MML Emerging Growth Fund – Portfolio Manager Report

What is the investment approach of MML Emerging Growth Fund, and who is the Fund’s subadviser?

The Fund seeks capital appreciation by investing primarily in smaller, rapidly growing emerging growth companies, which may include companies growing earnings per share and/or revenues at above average rates. Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities (primarily common stocks) of emerging growth companies. Effective August 20, 2010, Insight Capital Research & Management, Inc. (Insight Capital) was removed as co-subadviser to the Fund, leaving Essex Investment Management Company, LLC (Essex) as the sole subadviser of the Fund.

How did the Fund perform during the 12 months ended December 31, 2010?

The Fund’s Initial Class shares returned 25.26%, underperforming the 29.09% return of the Russell 2000® Growth Index (the “benchmark”), a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and higher forecasted growth rates than securities in the value universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

From Essex, which subadvised the Fund for all of 2010:

Although industrials lagged at the beginning of 2010, an improved global economic outlook led to a return of confidence in industrial stocks. Notably, the portfolio posted strong gains in industrial holdings connected to growth in the alternative energy market, including Power-One, Inc., which provides renewable energy and energy-efficient power conversion and management solutions. Adding significant value to the portfolio’s full-year performance was stock selection in producer durables, which benefited from alternative energy and mining exposure, as well as merger and acquisition (M&A) activity within the sector. The portfolio lagged the benchmark early in the year in the materials sector, but gained ground in the second half of 2010, thanks to stock selection within the sector. For example, Interface, Inc. was a bright spot, with increased demand for the company’s carpeting tiles boosting the stock.

Despite a difficult second quarter following the Gulf oil spill, energy shares posted robust gains in the second half of the year on strong oil prices. The portfolio’s traditional energy holdings added value, although alternative energy and natural gas-exposed names were detractors. Alternative energy returns were weak early in the period, as investors worried about changes to government subsidies. Technology posted market-leading returns during the year, as investors cheered strong demand trends and acquisition activity in the sector. The portfolio’s underweight position, relative to the benchmark, in the energy sector dampened returns; however, and strong selection in communications technology was outweighed by mixed returns in software.

The health care sector was challenged during the year, weighed down by reform uncertainty and the mid-term congressional elections. However, the portfolio outperformed the benchmark in the health care sector, thanks to stock selection that focused on companies with solid fundamentals and positive product cycles. Consumer discretionary posted solid returns for the year, with a second-quarter slowdown trumped by a strong second half, which was driven by increasingly optimistic expectations for consumer spending. Finally, the portfolio outperformed the benchmark in retail, but lost ground, relative to the benchmark, in the consumer services segment.

From Insight Capital, which co-subadvised the Fund from January 1 – August 19, 2010:

Earlier in 2010, positive reactions to strong earnings revisions resulted in the most significant contributions to the portfolio’s performance. Advancing stocks included Lululemon Athletica (which designs and develops innovative athletic apparel) and SXC Health Solutions, a pharmacy benefit manager that taps into a wide cross-section of markets. Conversely, the portfolio experienced disappointing performance from a few positions – the most notable being DragonWave, which develops and sells microwave backhaul solutions for wireless network operators.

As 2010 progressed, positive reactions to strong earnings revisions was a significant performance driver, with individual contributions coming from Acme Packet, a leading telecommunications equipment vendor with little true competition within its market segment; and Cirrus Logic, which produces high-precision analog and mixed-signal integrated circuits for audio and

9

Table of Contents

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

energy markets (its largest customer is Apple). On the other hand, disappointing performance came from portfolio holdings such as Northern Oil & Gas (an independent oil and natural gas exploration company) and Power-One.

Subadviser outlook

We believe the advancement set forth by the Federal Reserve’s second round of monetary easing in the fourth quarter of 2010 will be strengthened by continued expansion in lending. As interest rates continue to move upward, we expect a continuation in the shift to equities as investors look for higher rates of return. While our view is that high unemployment and the threat of inflation from rising commodity prices will keep financial markets on edge, further easing in financials, along with M&A activity, should remain key drivers for stock prices in 2011.

10

Table of Contents

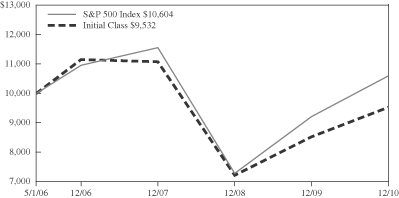

MML Emerging Growth Fund – Portfolio Manager Report (Continued)

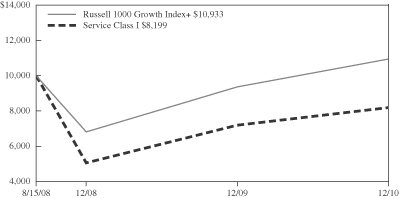

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

11

Table of Contents

MML Equity Index Fund – Portfolio Manager Report

What is the investment approach of MML Equity Index Fund, and who is the Fund’s subadviser?

The Fund’s investment objective is to provide investment results that correspond to the price and yield performance of publicly traded common stocks in the aggregate as represented by the S&P 500® Index. Under normal circumstances, the Fund invests at least 80% (and, typically, substantially all) of its net assets in the equity securities of companies included within the S&P 500 Index. The Fund’s subadviser is Northern Trust Investments, Inc. (NTI).

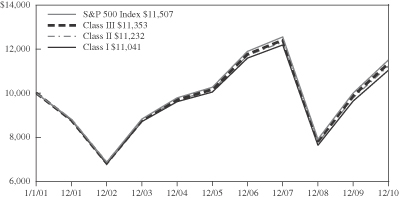

How did the Fund perform during the 12 months ended December 31, 2010?

The Fund’s Class I shares returned 14.51%, lagging the 15.06% return of the S&P 500 Index (the “benchmark”), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For the year ended December 31, 2010, large-capitalization stocks underperformed both mid- and small-capitalization stocks. All sectors in the benchmark posted positive returns for the year. The largest gain was in consumer discretionary, which returned 27.66% for the year. Information technology, the largest sector in the benchmark, returned 10.19% for the year. Other strong performers were the industrials and materials sectors, which posted returns of 26.71% and 22.20%, respectively. Conversely, health care returned just 2.90%, the smallest sector gain for the year.

The year started in negative territory, as U.S. equity markets suffered losses in January, fueled by mixed corporate earnings and continued concerns around jobless data and consumer confidence levels. In February and March, the equity markets advanced, as many U.S. corporations posted unexpected positive earnings, in tandem with increased corporate activity.

The second quarter started with a better-than-expected earnings season and multiple merger and acquisition (“M&A”) announcements; however, disappointing macroeconomic data and Securities and Exchange Commission (SEC) fraud charges against Goldman Sachs in mid-April helped reverse the market. Multiple sovereign credit downgrades in Europe placed further downward pressure on performance. In mid-June, M&A activity and comments from the Federal Reserve (the “Fed”) provided a brief rally, but the market quickly reverted after disappointing U.S. home sales, Gross Domestic Product (GDP), and several lower-than-expected corporate earnings and guidance announcements.

U.S. markets rallied in the third quarter, driven by better-than-expected earnings reports, increased M&A activity, and speculation concerning the Fed’s quantitative easing efforts, which ultimately resulted in the announcement of further quantitative easing in the form of $600 billion in U.S. Treasury purchases. Share repurchases and/or dividend increases by Microsoft, MasterCard, and Thermo Fisher were seen as positive news by the markets.

A better-than-anticipated start to the earnings season helped equity markets early in the fourth quarter, along with further M&A activity and better-than-expected macroeconomic data. The year ended on a positive note, as December provided positive performance on strong manufacturing data, both in the U.S. and internationally.

Subadviser outlook

In our view, growing new orders in the industrials sector, against a backdrop of falling inventories, bode well for 2011 growth, and many have embraced this more robust outlook. In addition to the economic check-up, policy discussions have focused on two key risks: the European credit crisis and U.S. state and local financial deterioration. With regard to the European credit crisis, while we expect a journey toward greater fiscal unity to be bumpy, we do expect the European Union to work its way through this crisis – predicated on an expectation for reluctant (but forthcoming) German support. Importantly, we see limited systemic risk in the U.S., as meaningful intervention by Fed authorities seems unlikely and potential losses will likely be immaterial to aggregate net worth.

“Standard & Poor’s®,” “S&P®,” “S&P 500®,” “Standard & Poor’s 500” and “500” are trademarks of The McGraw-Hill Companies and have been licensed for use by the Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in the Fund.

12

Table of Contents

MML Equity Index Fund – Portfolio Manager Report (Continued)

13

Table of Contents

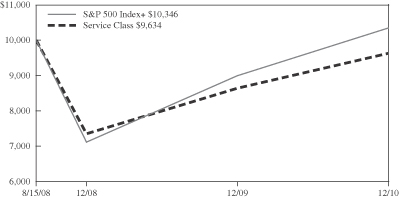

MML Equity Index Fund – Portfolio Manager Report (Continued)

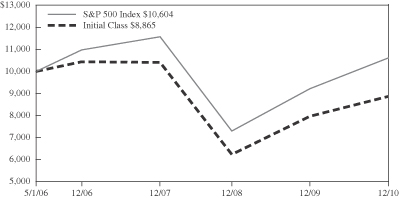

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

14

Table of Contents

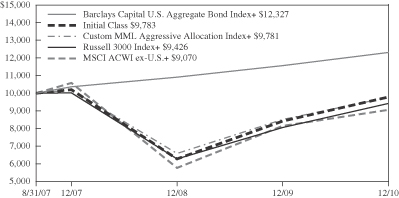

MML Large Cap Value Fund – Portfolio Manager Report

What is the investment approach of MML Large Cap Value Fund, and who is the Fund’s subadviser?

The Fund seeks both capital growth and income by investing primarily in large-capitalization companies that the Fund’s subadviser believes are undervalued. Under normal circumstances, the Fund will invest at least 80% of its net assets in common stocks of companies with market capitalizations at the time of purchase of at least $5 billion. The Fund’s subadviser is Davis Selected Advisers, L.P. (Davis).

How did the Fund perform during the 12 months ended December 31, 2010?

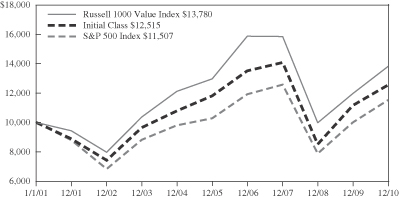

The Fund’s Initial Class shares returned 12.38%, trailing the 15.06% return of the S&P 500® Index (the “benchmark”), a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. Similarly, the Fund underperformed the 15.51% return of the Russell 1000® Value Index, an unmanaged index consisting of those Russell 1000 securities (representing the 1,000 largest U.S. companies based on market capitalization) with greater than average value orientation that tend to exhibit lower price-to-book ratios and lower forecasted growth rates than securities in the growth universe.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

All sectors of the market registered increases in 2010. Consumer discretionary, industrials, and materials were the sectors within benchmark that increased the most. Conversely, health care and utilities were the benchmark sectors that increased the least.

The portfolio had more of an allocation to the financials sector than any other sector in the benchmark – and this was the most important contributor to the Fund’s performance. The Fund’s financial holdings outperformed the corresponding sector within the benchmark and had a higher relative average weighting than the benchmark. Berkshire Hathaway, Wells Fargo, and Julius Baer were among the most important contributors to the Fund’s full-year performance.

Consumer staples companies were also an important reason for the Fund’s performance in 2010. The portfolio’s consumer staples holdings outperformed the corresponding sector within the benchmark – and had a higher relative average weighting than did the benchmark. From this sector, Costco was among the most important contributors to performance for the year.

While energy companies made positive contributions to absolute performance, they were the most important reason that the Fund lagged the benchmark for the year. The Fund’s energy companies underperformed the corresponding benchmark sector, but these firms occupied a higher relative average weighting in the portfolio (when compared to the benchmark). Occidental Petroleum and Canadian Natural Resources were some of the strongest contributors to Fund results from within the energy sector, whereas EOG Resources, Transocean, and China Coal Energy were among the most significant detractors from this sector.

Portfolio holdings within the industrials sector also contributed to absolute performance; however, they were another important reason that the Fund’s performance lagged the benchmark. The Fund’s industrial companies underperformed the benchmark sector and had a lower relative average weighting in industrials than did the benchmark. China Shipping Development was a significant detractor. Elsewhere, three companies – Hewlett-Packard, Microsoft, and Visa – were noteworthy detractors.

Subadviser outlook

Our long-term focus usually results in low fund turnover. We do not overreact to past short-term performance from individual holdings on either the upside or the downside. The Fund’s investment strategy is to perform extensive research to buy durable companies at a discount to their intrinsic values and to hold them for the long term. We focus on the future, considering each company’s long-term business fundamentals.

Consistent with our low-turnover strategy, as of December 31, 2010, only two companies had dropped out of the Fund’s top 10 holdings from the end of 2009: Berkshire Hathaway and JPMorgan Chase. The Fund continues to own both of these companies, but in reduced amounts. The two new additions to the Fund’s top 10 holdings, CVS Caremark and Bank of New York Mellon, were among the Fund’s top 20 holdings as of December 31, 2009.

15

Table of Contents

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

16

Table of Contents

MML Large Cap Value Fund – Portfolio Manager Report (Continued)

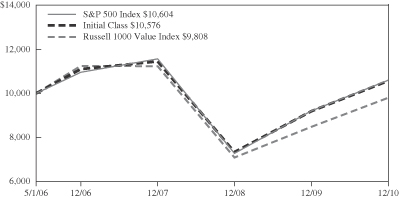

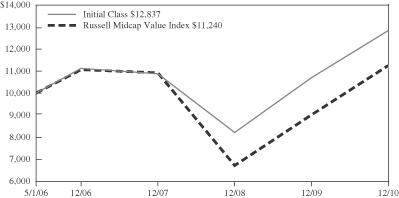

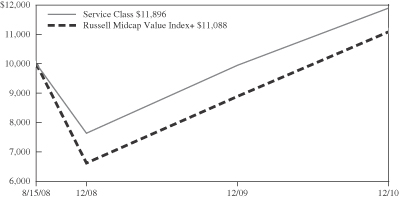

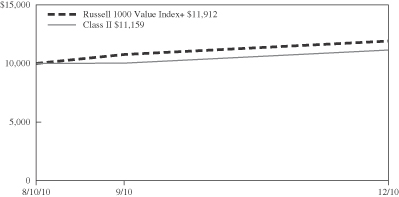

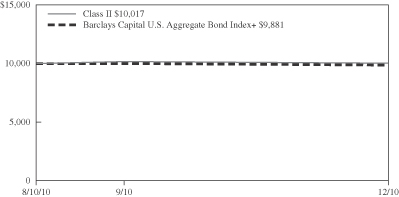

* Benchmark

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

17

Table of Contents

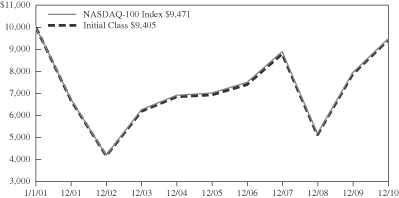

MML NASDAQ-100® Fund – Portfolio Manager Report

What is the investment approach of MML NASDAQ-100® Fund, and who is the Fund’s subadviser?

The Fund seeks to approximate as closely as practicable (before fees and expenses) the total return of the NASDAQ-100 Index®. Under normal circumstances, the Fund invests at least 80% (and, typically, substantially all) of its net assets in the equity securities of companies included in the NASDAQ-100 Index. The Fund’s subadviser is Northern Trust Investments, Inc. (NTI).

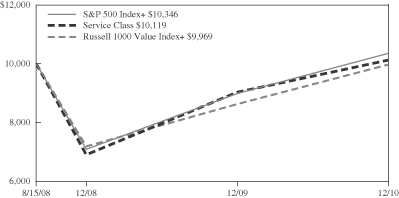

How did the Fund perform during the 12 months ended December 31, 2010?

The Fund’s Initial Class shares returned 19.58%, moderately outperforming the 19.22% return of the NASDAQ-100 Index (the “benchmark”). The benchmark is a modified capitalization-weighted index composed of the 100 largest non-financial companies listed on the National Association of Securities Dealers Automated Quotations System (NASDAQ).

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Sector performance was positive for the year ended December 31, 2010. Information technology, the largest weight in the benchmark, returned 20.49%; consumer discretionary returned 26.89%.

The year started in negative territory, as U.S. equity markets suffered losses in January, fueled by mixed corporate earnings and continued concerns around jobless data and consumer confidence levels. In February and March, the equity markets advanced, as many U.S. corporations posted unexpected positive earnings, in tandem with increased corporate activity.

The second quarter started with a better-than-expected earnings season and multiple merger and acquisition (“M&A”) announcements; however, disappointing macroeconomic data and Securities and Exchange Commission (SEC) fraud charges against Goldman Sachs in mid-April helped reverse the market. Multiple sovereign credit downgrades in Europe placed further downward pressure on performance. In mid-June, M&A activity and comments from the Federal Reserve (the “Fed”) provided a brief rally, but the market quickly reverted after disappointing U.S. home sales, Gross Domestic Product (GDP), and several lower-than-expected corporate earnings and guidance announcements.

U.S. markets rallied in the third quarter, driven by better-than-expected earnings reports, increased M&A activity, and speculation concerning the Fed’s quantitative easing efforts, which ultimately resulted in the announcement of further quantitative easing in the form of $600 billion in U.S. Treasury purchases. Share repurchases and/or dividend increases by Microsoft, MasterCard, and Thermo Fisher were seen as positive news by the markets.

A better-than-anticipated start to the earnings season helped equity markets early in the fourth quarter, along with further M&A activity and better-than-expected macroeconomic data. The year ended on a positive note, as December provided positive performance on strong manufacturing data, both in the U.S. and internationally.

Subadviser outlook

In our view, growing new orders in the industrials sector, against a backdrop of falling inventories, bode well for 2011 growth, and many have embraced this more robust outlook. In addition to the economic check-up, policy discussions have focused on two key risks: the European credit crisis and U.S. state and local financial deterioration. With regard to the European credit crisis, while we expect a journey toward greater fiscal unity to be bumpy, we do expect the European Union to work its way through this crisis – predicated on an expectation for reluctant (but forthcoming) German support. Importantly, we see limited systemic risk in the U.S., as meaningful intervention by Fed authorities seems unlikely and potential losses will likely be immaterial to aggregate net worth.

NASDAQ®, NASDAQ-100® and NASDAQ-100 Index® are trademarks of The NASDAQ Stock Market, Inc. (together with its affiliates, “NASDAQ”) and are licensed for use by the Fund. The Fund has not been passed on by NASDAQ as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by NASDAQ. NASDAQ MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE FUND.

18

Table of Contents

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

19

Table of Contents

MML NASDAQ-100® Fund – Portfolio Manager Report (Continued)

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the NASDAQ-100 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

20

Table of Contents

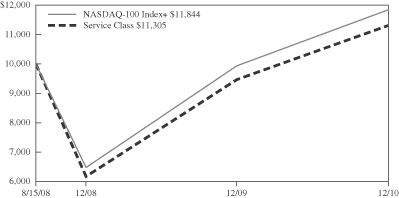

MML Small Cap Growth Equity Fund – Portfolio Manager Report

What is the investment approach of MML Small Cap Growth Equity Fund, and who are the Fund’s subadvisers?

The Fund seeks long-term capital appreciation by investing primarily in equity securities of smaller companies that the Fund’s subadvisers believe offer potential for long-term growth. Under normal circumstances, the Fund invests at least 80% of its net assets in the securities of companies whose market capitalizations at the time of purchase are within the market capitalization range of companies included in the Russell 2000® Index or the S&P SmallCap 600 Index. The Fund’s two subadvisers are Wellington Management Company, LLP (Wellington Management), which managed approximately 49% of the Fund’s portfolio; and Waddell & Reed Investment Management Company (Waddell & Reed), which was responsible for approximately 51% of the Fund’s portfolio, as of December 31, 2010.

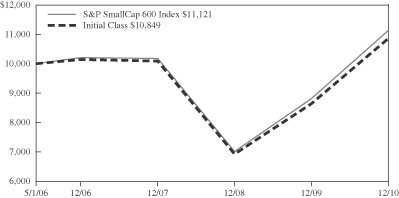

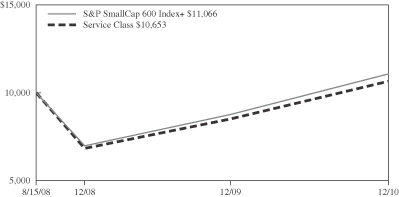

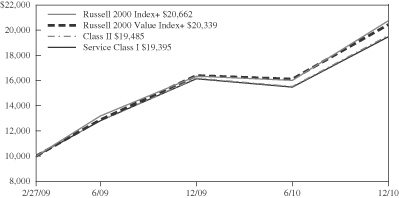

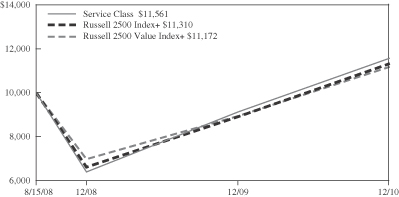

How did the Fund perform during the 12 months ended December 31, 2010?

The Fund’s Initial Class shares returned 22.24%, significantly underperforming the 29.09% return of the Russell 2000 Growth Index (the “benchmark”), a widely recognized, unmanaged index that measures the performance of those Russell 2000 Index companies (representing small-capitalization U.S. common stocks) with higher price-to-book ratios and higher forecasted growth rates than securities in the value universe. Similarly, the Fund’s 22.24% return trailed the 26.85% return of the Russell 2000 Index, a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

For a discussion on the economic and market environment during the 12-month period ended December 31, 2010, please see the Economic and Market Review, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The Fund’s Waddell & Reed component experienced strong absolute performance for the year, despite lagging the benchmark, with all sectors except health care posting double-digit gains. Over the course of the year, the largest sector allocation increases were in cyclical sectors, such as industrials and energy, as mounting economic evidence and stimulative monetary and fiscal policy led to the market’s conviction that a “double-dip” recession would be avoided. An overweight position in the energy sector, relative to the benchmark, contributed to performance for the year, but stock selection within this sector trailed the benchmark. Despite the fact that the energy sector was, in 2010, a benefactor of the resurgence in global economic activity, holdings within the portfolio were concentrated in the deep-water drilling service industry, which generally underperformed.

The consumer discretionary sector performed well, but occupied a larger position in the portfolio early in 2010. Waddell & Reed reduced the portfolio’s allocation in consumer discretionary in the latter half of the year, taking profits in some positions. Detracting from the portfolio’s performance, relative to the benchmark, was stock selection within the health care sector, where continued regulatory pressure on reimbursements and uncertainty on insurance coverage led to a great deal of investor uncertainty. Toward the second half of the year, Waddell & Reed leveraged some opportunities to increase exposure to specific health care device companies – after which time the sector’s performance improved. The technology sector performed well for the year, although Waddell & Reed trimmed some software holdings on profit-taking. Waddell & Reed increased the portfolio’s exposure within the technology sector in some areas that could be more prone to benefit from the economic rebound – such as semi-conductors.

With respect to the Fund’s Wellington Management component, weak stock selection in the consumer discretionary, energy, information technology (“IT”), financials, health care, and industrials sectors hampered the portfolio’s performance for the year – which more than offset Wellington Management’s strong stock selection in the health care, consumer discretionary, and industrials sectors.

Stocks that detracted the most from relative returns during the period were Equinix (IT), a commercial data center and Internet exchange services company (eliminated from the portfolio); SunPower (IT), an integrated solar products company; DreamWorks Animation (consumer discretionary), a computer-generated, animated feature film company; NutriSystem (consumer discretionary), a provider of weight-loss products and services (eliminated from the portfolio); Comstock Resources (energy), which engages in the acquisition, development, production, and exploration of oil and natural gas; and VistaPrint (IT), an online provider of customized marketing products and services to small businesses worldwide.

Top contributors to relative performance during the period included Netezza (IT), an innovative provider of data warehouse and analytic appliances; Skyworks Solutions (IT), a wireless handset chip supplier; OSI Pharmaceuticals (health care), a

21

Table of Contents

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

biotechnology company (eliminated from the portfolio); Tenneco (consumer discretionary), a supplier of emissions and ride control components for automobiles and commercial vehicles; TRW Automotive (consumer discretionary), an auto parts supplier that was eliminated from the portfolio, as the stock’s market capitalization rose out of the portfolio’s range; and ArvinMeritor (industrials), a commercial vehicle components manufacturer with market-leading positions in axles and brakes.

Subadviser outlook

We believe that strong profits, low interest rates, and stimulative federal and monetary actions should continue to drive the momentum in the market and economy at least over the near term. Margin improvement has helped support profit growth and consequently, our view is that revenue growth will become a bigger factor in driving earnings growth going forward. Our view is that a recent improvement in bank lending is a strong positive, as the money supply has grown, although velocity has been lacking. Employment and housing continue to be in an elongated recovery process, with prospects for gradual improvement. Finally, we believe that if bond flows reverse direction, this could provide another boost for equities.

22

Table of Contents

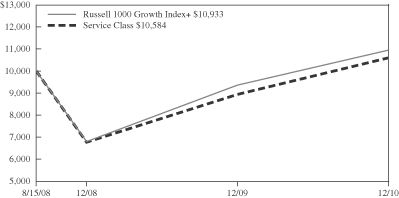

MML Small Cap Growth Equity Fund – Portfolio Manager Report (Continued)

* Benchmark

+ From 9/2/08.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by accessing the website www.massmutual.com.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 2000 Growth Index and the Russell 2000 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks and charges and expenses in conjunction with these financial statements. The Fund’s return reflects changes in the net asset value per share without the deduction of any product charges (e.g., cost of insurance, mortality and expense risk charges, administrative fees, and CDSL). The inclusion of these charges would have reduced the performance shown here.

23

Table of Contents

MML Blue Chip Growth Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

24

Table of Contents

MML Blue Chip Growth Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

25

Table of Contents

MML Blue Chip Growth Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

26

Table of Contents

MML Emerging Growth Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

27

Table of Contents

MML Emerging Growth Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

28

Table of Contents

MML Equity Index Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

29

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

30

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

31

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

32

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

33

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

34

Table of Contents

MML Equity Index Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

35

Table of Contents

MML Large Cap Value Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

36

Table of Contents

MML Large Cap Value Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

37

Table of Contents

MML Large Cap Value Fund – Portfolio of Investments (Continued)

Notes to Portfolio of Investments (Continued)

| (c) | This security is valued in good faith under procedures established by the Board of Trustees. |

| (d) | Restricted security. Certain securities are restricted as to resale. At December 31, 2010, these securities amounted to a value of $481,509 or 0.20% of net assets. The Fund generally bears the costs, if any, associated with the disposition of restricted securities. |

| (e) | Maturity value of $11,343,459. Collateralized by U.S. Government Agency obligations with a rate of 4.000%, maturity date of 8/15/39, and an aggregate market value, including accrued interest, of $11,570,330. |

| (f) | See Note 6 for aggregate cost for federal tax purposes. |

The accompanying notes are an integral part of the financial statements.

38

Table of Contents

MML NASDAQ-100 Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

39

Table of Contents

MML NASDAQ-100 Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

40

Table of Contents

MML Small Cap Growth Equity Fund – Portfolio of Investments

December 31, 2010

The accompanying notes are an integral part of the financial statements.

41

Table of Contents

MML Small Cap Growth Equity Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

42

Table of Contents

MML Small Cap Growth Equity Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

43

Table of Contents

MML Small Cap Growth Equity Fund – Portfolio of Investments (Continued)

The accompanying notes are an integral part of the financial statements.

44

Table of Contents

THIS PAGE INTENTIONALLY LEFT BLANK

Table of Contents

MML Series Investment Fund – Financial Statements

Statements of Assets and Liabilities

December 31, 2010

| MML Blue Chip Growth Fund |

MML Emerging Growth Fund |

|||||||

| Assets: | ||||||||

| Investments, at value (Note 2) (a) |

$ | 342,940,654 | $ | 13,542,934 | ||||

| Short-term investments, at value (Note 2) (b) |

2,018,988 | 749,910 | ||||||

| Total investments |

344,959,642 | 14,292,844 | ||||||

| Foreign currency, at value (c) |

- | - | ||||||

| Receivables from: |

||||||||

| Investments sold |

226,160 | - | ||||||

| Open forward foreign currency contracts (Note 2) |

- | - | ||||||

| Investment adviser (Note 3) |

- | 864 | ||||||

| Fund shares sold |

13,312 | 12,065 | ||||||

| Interest and dividends |

212,875 | 1,529 | ||||||

| Foreign taxes withheld |

7,844 | - | ||||||

| Total assets |

345,419,833 | 14,307,302 | ||||||

| Liabilities: | ||||||||

| Payables for: |

||||||||

| Investments purchased |

504,363 | 63,932 | ||||||

| Open forward foreign currency contracts (Note 2) |

- | - | ||||||

| Fund shares repurchased |

555,151 | 94,991 | ||||||

| Variation margin on open futures contracts (Note 2) |

- | - | ||||||

| Trustees’ fees and expenses (Note 3) |

33,941 | 6,384 | ||||||

| Affiliates (Note 3): |

||||||||

| Investment management fees |

218,944 | 12,479 | ||||||

| Administration fees |

- | - | ||||||

| Service fees |

4,791 | 530 | ||||||

| Due to custodian |

3,738 | - | ||||||

| Accrued expense and other liabilities |

51,008 | 30,575 | ||||||

| Total liabilities |

1,371,936 | 208,891 | ||||||

| Net assets |

$ | 344,047,897 | $ | 14,098,411 | ||||

| Net assets consist of: | ||||||||

| Paid-in capital |

$ | 287,495,275 | $ | 17,261,844 | ||||

| Undistributed (accumulated) net investment income (loss) |

119,414 | (6,287 | ) | |||||

| Accumulated net realized gain (loss) on investments and foreign currency transactions |

(27,971,330 | ) | (5,788,710 | ) | ||||

| Net unrealized appreciation (depreciation) on investments and foreign currency translations |

84,404,538 | 2,631,564 | ||||||

| Net assets |

$ | 344,047,897 | $ | 14,098,411 | ||||

| (a) Cost of investments: |

$ | 258,537,510 | $ | 10,911,370 | ||||

| (b) Cost of short-term investments: |

$ | 2,018,988 | $ | 749,910 | ||||

| (c) Cost of foreign currency: |

$ | - | $ | - | ||||

The accompanying notes are an integral part of the financial statements.

46

Table of Contents

| MML Equity Index Fund |

MML Large Cap Value Fund |

MML NASDAQ-100 Fund |

MML Small Cap Growth Equity Fund |

|||||||||||

| $ | 303,709,383 | $ | 226,140,113 | $ | 11,982,020 | $ | 265,184,776 | |||||||

| 2,268,951 | 11,343,449 | 314,957 | 3,397,256 | |||||||||||

| 305,978,334 | 237,483,562 | 12,296,977 | 268,582,032 | |||||||||||

| - | - | - | 2,030 | |||||||||||

| 50,757 | 12,293 | - | 561,166 | |||||||||||

| - | - | - | 10,911 | |||||||||||

| 9,290 | - | 2,584 | - | |||||||||||

| 28,048 | 11,370 | 17,369 | 13,132 | |||||||||||

| 356,629 | 207,604 | 3,161 | 95,642 | |||||||||||

| - | 30,490 | - | - | |||||||||||

| 306,423,058 | 237,745,319 | 12,320,091 | 269,264,913 | |||||||||||

| - | 69,608 | - | 1,246,212 | |||||||||||

| - | - | - | 14,257 | |||||||||||

| 125,359 | 2,213,179 | 60,642 | 4,369,560 | |||||||||||

| 3,365 | - | 887 | - | |||||||||||

| 148,101 | 63,813 | 4,995 | 56,437 | |||||||||||

| 25,678 | 153,252 | 4,598 | 246,373 | |||||||||||

| 44,176 | - | - | - | |||||||||||

| 1,593 | 9,373 | 728 | 2,473 | |||||||||||

| - | - | - | - | |||||||||||

| 55,581 | 50,395 | 30,980 | 56,881 | |||||||||||

| 403,853 | 2,559,620 | 102,830 | 5,992,193 | |||||||||||

| $ | 306,019,205 | $ | 235,185,699 | $ | 12,217,261 | $ | 263,272,720 | |||||||

| $ | 269,849,022 | $ | 223,664,400 | $ | 12,691,970 | $ | 205,168,887 | |||||||

| 5,170,342 | 1,319,809 | 30,748 | (65,759 | ) | ||||||||||

| (15,182,162 | ) | (32,791,641 | ) | (4,175,903 | ) | 9,033,418 | ||||||||

| 46,182,003 | 42,993,131 | 3,670,446 | 49,136,174 | |||||||||||

| $ | 306,019,205 | $ | 235,185,699 | $ | 12,217,261 | $ | 263,272,720 | |||||||

| $ | 257,584,885 | $ | 183,151,987 | $ | 8,311,984 | $ | 216,045,324 | |||||||

| $ | 2,268,951 | $ | 11,343,449 | $ | 314,957 | $ | 3,397,256 | |||||||

| $ | - | $ | - | $ | - | $ | 2,005 | |||||||

47

Table of Contents

MML Series Investment Fund – Financial Statements (Continued)

Statements of Assets and Liabilities

December 31, 2010

| MML Blue Chip Growth Fund |

MML Emerging Growth Fund |

|||||||

| Initial Class shares: | ||||||||

| Net assets |

$ | 336,210,984 | $ | 13,145,707 | ||||

| Shares outstanding (a) |

29,821,266 | 2,174,394 | ||||||

| Net asset value, offering price and redemption price per share |

$ | 11.27 | $ | 6.05 | ||||

| Class I shares: | ||||||||

| Net assets |

$ | - | $ | - | ||||

| Shares outstanding (a) |

- | - | ||||||

| Net asset value, offering price and redemption price per share |

$ | - | $ | - | ||||

| Class II shares: | ||||||||

| Net assets |

$ | - | $ | - | ||||

| Shares outstanding (a) |

- | - | ||||||

| Net asset value, offering price and redemption price per share |

$ | - | $ | - | ||||

| Class III shares: | ||||||||

| Net assets |

$ | - | $ | - | ||||

| Shares outstanding (a) |

- | - | ||||||

| Net asset value, offering price and redemption price per share |

$ | - | $ | - | ||||

| Service Class shares: | ||||||||

| Net assets |

$ | 7,836,913 | $ | 952,704 | ||||

| Shares outstanding (a) |

698,560 | 158,502 | ||||||

| Net asset value, offering price and redemption price per share |

$ | 11.22 | $ | 6.01 | ||||

| Service Class I shares: | ||||||||

| Net assets |

$ | - | $ | - | ||||

| Shares outstanding (a) |

- | - | ||||||

| Net asset value, offering price and redemption price per share |

$ | - | $ | - | ||||

(a) Authorized unlimited number of shares with no par value.

The accompanying notes are an integral part of the financial statements.

48

Table of Contents

| MML Equity Index Fund |

MML Large Cap Value Fund |

MML NASDAQ-100 Fund |

MML Small Cap Growth Equity Fund |

|||||||||||

| $ | - | $ | 218,666,274 | $ | 10,913,325 | $ | 258,832,600 | |||||||

| - | 1,926,606 | 14,621,601 | ||||||||||||

| $ | - | $ | 11.54 | $ | 5.66 | $ | 17.70 | |||||||

| $ | 81,198,697 | $ | - | $ | - | $ | - | |||||||

| 5,160,971 | - | - | - | |||||||||||

| $ | 15.73 | $ | - | $ | - | $ | - | |||||||

| $ | 115,520,952 | $ | - | $ | - | $ | - | |||||||

| 7,331,459 | - | - | - | |||||||||||

| $ | 15.76 | $ | - | $ | - | $ | - | |||||||

| $ | 106,015,262 | $ | - | $ | - | $ | - | |||||||

| 6,732,521 | - | - | - | |||||||||||

| $ | 15.75 | $ | - | $ | - | $ | - | |||||||

| $ | - | $ | 16,519,425 | $ | 1,303,936 | $ | 4,440,120 | |||||||

| - | 1,437,943 | 231,260 | 252,372 | |||||||||||

| $ | - | $ | 11.49 | $ | 5.64 | $ | 17.59 | |||||||

| $ | 3,284,294 | $ | - | $ | - | $ | - | |||||||

| 210,615 | - | - | - | |||||||||||

| $ | 15.59 | $ | - | $ | - | $ | - | |||||||

49

Table of Contents

MML Series Investment Fund — Financial Statements (Continued)

For the Year Ended December 31, 2010

| MML Blue Chip Growth Fund |

MML Emerging Growth Fund |

|||||||

| Investment income (Note 2): | ||||||||

| Dividends (a) |

$ | 2,267,518 | $ | 38,672 | ||||

| Interest |

405 | 44 | ||||||

| Total investment income |

2,267,923 | 38,716 | ||||||

| Expenses (Note 3): | ||||||||

| Investment management fees |

1,979,140 | 122,001 | ||||||

| Custody fees |

36,905 | 8,490 | ||||||

| Audit fees |

29,762 | 31,294 | ||||||

| Legal fees |

5,459 | 236 | ||||||

| Proxy fees |

969 | 969 | ||||||

| Shareholder reporting fees |

32,415 | 4,066 | ||||||

| Trustees’ fees |

24,158 | 1,153 | ||||||

| 2,108,808 | 168,209 | |||||||

| Administration fees: |

||||||||

| Class I |

- | - | ||||||

| Class II |

- | - | ||||||

| Class III |

- | - | ||||||

| Service Class I |

- | - | ||||||

| Service fees: |

||||||||

| Service Class |

16,128 | 1,569 | ||||||

| Service Class I |

- | - | ||||||

| Total expenses |

2,124,936 | 169,778 | ||||||

| Expenses waived (Note 3): |

||||||||

| Initial Class fees waived by advisor |

- | (21,729 | ) | |||||

| Service Class fees waived by advisor |

- | (1,239 | ) | |||||

| Class II administrative fees waived |

- | - | ||||||

| Class III administrative fees waived |

- | - | ||||||

| Net expenses |

2,124,936 | 146,810 | ||||||

| Net investment income (loss) |

142,987 | (108,094 | ) | |||||

| Realized and unrealized gain (loss): | ||||||||

| Net realized gain (loss) on: |

||||||||

| Investment transactions |

11,980,089 | 1,391,605 | ||||||

| Futures contracts |

- | - | ||||||

| Foreign currency transactions |

(401 | ) | - | |||||

| Net realized gain (loss) |

11,979,688 | 1,391,605 | ||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||

| Investment transactions |

36,997,751 | 1,477,981 | ||||||

| Futures contracts |

- | - | ||||||

| Translation of assets and liabilities in foreign currencies |

478 | - | ||||||

| Net change in unrealized appreciation (depreciation) |

36,998,229 | 1,477,981 | ||||||

| Net realized gain (loss) and change in unrealized appreciation (depreciation) |

48,977,917 | 2,869,586 | ||||||

| Net increase (decrease) in net assets resulting from operations |

$ | 49,120,904 | $ | 2,761,492 | ||||

| (a) Net of withholding tax of: |

$ | 4,330 | $ | 88 | ||||

The accompanying notes are an integral part of the financial statements.

50

Table of Contents

| MML Equity Index Fund |

MML Large Cap Value Fund |

MML NASDAQ- 100 Fund |

MML Small Cap Growth Equity Fund |

|||||||||||

| $ | 6,192,239 | $ | 3,400,920 | $ | 95,821 | $ | 1,219,054 | |||||||

| 1,802 | 158,044 | 97 | 781 | |||||||||||

| 6,194,041 | 3,558,964 | 95,918 | 1,219,835 | |||||||||||

| 302,121 | 1,697,873 | 46,867 | 2,629,587 | |||||||||||

| 38,873 | 38,324 | 4,712 | 68,833 | |||||||||||

| 31,770 | 31,179 | 32,404 | 32,773 | |||||||||||

| 3,603 | 2,670 | 206 | 3,096 | |||||||||||

| 969 | 968 | 969 | 969 | |||||||||||

| 41,974 | 30,610 | 3,899 | 34,105 | |||||||||||

| 30,848 | 22,553 | 1,017 | 25,133 | |||||||||||

| 450,158 | 1,824,177 | 90,074 | 2,794,496 | |||||||||||

| 229,047 | - | - | - | |||||||||||

| 244,644 | - | - | - | |||||||||||

| 47,678 | - | - | - | |||||||||||

| 4,970 | - | - | - | |||||||||||

| - | 31,780 | 2,240 | 8,295 | |||||||||||

| 4,141 | - | - | - | |||||||||||

| 980,638 | 1,855,957 | 92,314 | 2,802,791 | |||||||||||

| - | - | (29,019 | ) | - | ||||||||||

| - | - | (2,731 | ) | - | ||||||||||

| (64,380 | ) | - | - | - | ||||||||||

| (47,678 | ) | - | - | - | ||||||||||

| 868,580 | 1,855,957 | 60,564 | 2,802,791 | |||||||||||

| 5,325,461 | 1,703,007 | 35,354 | (1,582,956 | ) | ||||||||||

| 247,745 | 6,339,660 | 1,912 | 34,892,344 | |||||||||||

| 435,862 | - | 35,320 | - | |||||||||||

| (1,538 | ) | - | (67,586 | ) | ||||||||||

| 6,338,122 | 37,232 | 34,824,758 | ||||||||||||

| 18,395,707 | 1,909,986 | 20,039,782 | ||||||||||||

| - | (17,033 | ) | - | |||||||||||

| 2,787 | - | (2,682 | ) | |||||||||||

| 18,398,494 | 1,892,953 | 20,037,100 | ||||||||||||

| 24,736,616 | 1,930,185 | 54,861,858 | ||||||||||||

| $ | 26,439,623 | $ | 1,965,539 | $ | 53,278,902 | |||||||||

| $ | - | $ | 47,120 | $ | 960 | $ | 13,108 | |||||||

51

Table of Contents

MML Series Investment Fund – Financial Statements (Continued)

Statements of Changes in Net Assets

| MML Blue Chip Growth Fund |

||||||||

| Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

|||||||

| Increase (Decrease) in Net Assets: |

||||||||

| Operations: | ||||||||

| Net investment income (loss) |

$ | 142,987 | $ | 228,260 | ||||

| Net realized gain (loss) on investment transactions |

11,979,688 | (18,646,199 | ) | |||||

| Net change in unrealized appreciation (depreciation) on investments |

36,998,229 | 88,600,456 | ||||||

| Net increase (decrease) in net assets resulting from operations |

49,120,904 | 70,182,517 | ||||||

| Distributions to shareholders (Note 2): |

||||||||

| From net investment income: |

||||||||

| Initial Class |

(233,055 | ) | (241,496 | ) | ||||

| Class I |

- | - | ||||||

| Class II |

- | - | ||||||

| Class III |

- | - | ||||||

| Service Class |

- | (7,049 | ) | |||||

| Service Class I |

- | - | ||||||

| Total distributions from net investment income |

(233,055 | ) | (248,545 | ) | ||||

| Net fund share transactions (Note 5): |

||||||||

| Initial Class |

105,421,315 | (53,912,108 | ) | |||||

| Class I |

- | - | ||||||

| Class II |

- | - | ||||||

| Class III |

- | - | ||||||

| Service Class |

1,155,540 | 2,186,924 | ||||||

| Service Class I |

- | - | ||||||

| Increase (decrease) in net assets from fund share transactions |

106,576,855 | (51,725,184 | ) | |||||

| Total increase (decrease) in net assets |

155,464,704 | 18,208,788 | ||||||

| Net assets |

||||||||

| Beginning of year |

188,583,193 | 170,374,405 | ||||||

| End of year |

$ | 344,047,897 | $ | 188,583,193 | ||||

| Undistributed (accumulated) net investment income (loss) included in net assets at end of year |

$ | 119,414 | $ | 209,883 | ||||

The accompanying notes are an integral part of the financial statements.

52

Table of Contents

| MML Emerging Growth Fund |

MML Equity Index Fund |

|||||||||||||||||||||

| Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

|||||||||||||||||||

| $ | (108,094 | ) | $ | (92,680 | ) | $ | 5,325,461 | $ | 5,142,123 | |||||||||||||

| 1,391,605 | (1,635,614 | ) | 683,607 | (3,633,320 | ) | |||||||||||||||||

| 1,477,981 | 2,934,703 | 35,126,179 | 60,518,550 | |||||||||||||||||||

| 2,761,492 | 1,206,409 | 41,135,247 | 62,027,353 | |||||||||||||||||||

| - | - | - | - | |||||||||||||||||||

| - | - | (1,198,204 | ) | (1,403,134 | ) | |||||||||||||||||

| - | - | (2,245,451 | ) | (3,118,953 | ) | |||||||||||||||||

| - | - | (1,702,367 | ) | (2,163,050 | ) | |||||||||||||||||

| - | - | - | - | |||||||||||||||||||

| - | - | (28,744 | ) | (23,510 | ) | |||||||||||||||||

| - | - | (5,174,766 | ) | (6,708,647 | ) | |||||||||||||||||

| (10,765 | ) | (457,974 | ) | - | - | |||||||||||||||||

| - | - | (3,051,896 | ) | 14,076,632 | ||||||||||||||||||

| - | - | (35,685,394 | ) | (6,174,695 | ) | |||||||||||||||||

| - | - | 4,218,185 | (3,233,978 | ) | ||||||||||||||||||

| 284,563 | 260,921 | - | - | |||||||||||||||||||

| - | - | 1,819,674 | 453,186 | |||||||||||||||||||

| 273,798 | (197,053 | ) | (32,699,431 | ) | 5,121,145 | |||||||||||||||||

| 3,035,290 | 1,009,356 | 3,261,050 | 60,439,851 | |||||||||||||||||||

| 11,063,121 | 10,053,765 | 302,758,155 | 242,318,304 | |||||||||||||||||||

| $ | 14,098,411 | $ | 11,063,121 | $ | 306,019,205 | $ | 302,758,155 | |||||||||||||||

| $ | (6,287 | ) | $ | (5,957 | ) | $ | 5,170,342 | $ | 5,010,988 | |||||||||||||

53

Table of Contents

MML Series Investment Fund – Financial Statements (Continued)

Statements of Changes in Net Assets

| MML Large Cap Value Fund |

||||||||

| Year Ended December 31, 2010 |

Year Ended December 31, 2009 |

|||||||

| Increase (Decrease) in Net Assets: |

||||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ | 1,703,007 | $ | 1,457,067 | ||||

| Net realized gain (loss) on investment transactions |

6,338,122 | (29,255,457 | ) | |||||

| Net change in unrealized appreciation (depreciation) on investments |

18,398,494 | 82,638,534 | ||||||

| Net increase (decrease) in net assets resulting from operations |

26,439,623 | 54,840,144 | ||||||

| Distributions to shareholders (Note 2): |

||||||||

| From net investment income: |

||||||||

| Initial Class |

(1,687,136 | ) | (2,119,042 | ) | ||||

| Service Class |

(90,042 | ) | (101,036 | ) | ||||

| Total distributions from net investment income |

(1,777,178 | ) | (2,220,078 | ) | ||||

| Net fund share transactions (Note 5): |

||||||||

| Initial Class |

(16,256,458 | ) | (13,460,500 | ) | ||||

| Service Class |

4,114,295 | 3,369,669 | ||||||

| Increase (decrease) in net assets from fund share transactions |

(12,142,163 | ) | (10,090,831 | ) | ||||

| Total increase (decrease) in net assets |

12,520,282 | 42,529,235 | ||||||

| Net assets |