mlkn-202212030000066382false2023Q2June 300000663822022-05-292022-12-0300000663822023-01-06xbrli:shares00000663822022-09-042022-12-03iso4217:USD00000663822021-08-292021-11-2700000663822021-05-302021-11-27iso4217:USDxbrli:shares00000663822022-12-0300000663822022-05-2800000663822021-05-2900000663822021-11-270000066382us-gaap:CommonStockMember2022-05-280000066382us-gaap:AdditionalPaidInCapitalMember2022-05-280000066382us-gaap:RetainedEarningsMember2022-05-280000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-280000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2022-05-280000066382us-gaap:RetainedEarningsMember2022-05-292022-09-0300000663822022-05-292022-09-030000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-292022-09-030000066382us-gaap:CommonStockMember2022-05-292022-09-030000066382us-gaap:AdditionalPaidInCapitalMember2022-05-292022-09-030000066382us-gaap:CommonStockMember2022-09-030000066382us-gaap:AdditionalPaidInCapitalMember2022-09-030000066382us-gaap:RetainedEarningsMember2022-09-030000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-030000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2022-09-0300000663822022-09-030000066382us-gaap:RetainedEarningsMember2022-09-042022-12-030000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-042022-12-030000066382us-gaap:CommonStockMember2022-09-042022-12-030000066382us-gaap:AdditionalPaidInCapitalMember2022-09-042022-12-030000066382us-gaap:CommonStockMember2022-12-030000066382us-gaap:AdditionalPaidInCapitalMember2022-12-030000066382us-gaap:RetainedEarningsMember2022-12-030000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-030000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2022-12-030000066382us-gaap:CommonStockMember2021-05-290000066382us-gaap:AdditionalPaidInCapitalMember2021-05-290000066382us-gaap:RetainedEarningsMember2021-05-290000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-05-290000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2021-05-290000066382us-gaap:RetainedEarningsMember2021-05-302021-08-2800000663822021-05-302021-08-280000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-05-302021-08-280000066382us-gaap:AdditionalPaidInCapitalMember2021-05-302021-08-280000066382us-gaap:CommonStockMember2021-05-302021-08-280000066382us-gaap:CommonStockMember2021-08-280000066382us-gaap:AdditionalPaidInCapitalMember2021-08-280000066382us-gaap:RetainedEarningsMember2021-08-280000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-280000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2021-08-2800000663822021-08-280000066382us-gaap:RetainedEarningsMember2021-08-292021-11-270000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-08-292021-11-270000066382us-gaap:AdditionalPaidInCapitalMember2021-08-292021-11-270000066382us-gaap:CommonStockMember2021-08-292021-11-270000066382us-gaap:CommonStockMember2021-11-270000066382us-gaap:AdditionalPaidInCapitalMember2021-11-270000066382us-gaap:RetainedEarningsMember2021-11-270000066382us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-11-270000066382us-gaap:DeferredCompensationShareBasedPaymentsMember2021-11-270000066382us-gaap:ProductMembermlkn:SinglePerformanceObligationMember2022-09-042022-12-030000066382us-gaap:ProductMembermlkn:SinglePerformanceObligationMember2021-08-292021-11-270000066382us-gaap:ProductMembermlkn:SinglePerformanceObligationMember2022-05-292022-12-030000066382us-gaap:ProductMembermlkn:SinglePerformanceObligationMember2021-05-302021-11-270000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ProductMember2022-09-042022-12-030000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ProductMember2021-08-292021-11-270000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ProductMember2022-05-292022-12-030000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ProductMember2021-05-302021-11-270000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ServiceMember2022-09-042022-12-030000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ServiceMember2021-08-292021-11-270000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ServiceMember2022-05-292022-12-030000066382mlkn:MultiplePerformanceObligationsMemberus-gaap:ServiceMember2021-05-302021-11-270000066382mlkn:OtherMember2022-09-042022-12-030000066382mlkn:OtherMember2021-08-292021-11-270000066382mlkn:OtherMember2022-05-292022-12-030000066382mlkn:OtherMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:WorkplaceMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:WorkplaceMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:WorkplaceMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:WorkplaceMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:PerformanceSeatingMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:PerformanceSeatingMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:PerformanceSeatingMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:PerformanceSeatingMember2021-05-302021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2022-09-042022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2021-08-292021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2022-05-292022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:OtherProductsMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:OtherProductsMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:OtherProductsMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:OtherProductsMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:WorkplaceMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:WorkplaceMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:WorkplaceMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:WorkplaceMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:PerformanceSeatingMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:PerformanceSeatingMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:PerformanceSeatingMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:PerformanceSeatingMember2021-05-302021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2022-09-042022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2021-08-292021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2022-05-292022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:OtherProductsMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:OtherProductsMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:OtherProductsMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:OtherProductsMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:WorkplaceMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:WorkplaceMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:WorkplaceMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:WorkplaceMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:PerformanceSeatingMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:PerformanceSeatingMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:PerformanceSeatingMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:PerformanceSeatingMember2021-05-302021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2022-09-042022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2021-08-292021-11-270000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2022-05-292022-12-030000066382mlkn:LifestyleMemberus-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:OtherProductsMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:OtherProductsMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:OtherProductsMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:OtherProductsMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMember2021-05-302021-11-270000066382mlkn:KnollMember2021-05-302022-05-280000066382mlkn:KnollMember2021-08-292021-11-270000066382mlkn:KnollMember2021-05-302021-11-270000066382mlkn:KnollMember2021-07-19xbrli:pure0000066382mlkn:KnollMember2021-07-192021-07-190000066382mlkn:KnollMember2021-07-190000066382mlkn:KnollMemberus-gaap:RestrictedStockMember2021-07-190000066382mlkn:KnollMembermlkn:KnollMember2021-07-190000066382mlkn:KnollMemberus-gaap:OrderOrProductionBacklogMember2021-07-192021-07-190000066382mlkn:KnollMemberus-gaap:OrderOrProductionBacklogMember2021-07-190000066382mlkn:KnollMemberus-gaap:TradeNamesMember2021-07-190000066382us-gaap:TradeNamesMembermlkn:KnollMembersrt:MinimumMember2021-07-192021-07-190000066382us-gaap:TradeNamesMembermlkn:KnollMembersrt:MaximumMember2021-07-192021-07-190000066382us-gaap:TradeNamesMembermlkn:KnollMember2021-07-190000066382mlkn:KnollMembermlkn:DesignsMembersrt:MinimumMember2021-07-192021-07-190000066382mlkn:KnollMembermlkn:DesignsMembersrt:MaximumMember2021-07-192021-07-190000066382mlkn:KnollMembermlkn:DesignsMember2021-07-190000066382mlkn:KnollMemberus-gaap:CustomerRelationshipsMembersrt:MinimumMember2021-07-192021-07-190000066382mlkn:KnollMemberus-gaap:CustomerRelationshipsMembersrt:MaximumMember2021-07-192021-07-190000066382mlkn:KnollMemberus-gaap:CustomerRelationshipsMember2021-07-190000066382mlkn:AmericasContractMember2022-05-280000066382mlkn:InternationalContractSpecialtyMember2022-05-280000066382mlkn:RetailSegmentMember2022-05-280000066382mlkn:AmericasContractMember2022-05-292022-12-030000066382mlkn:InternationalContractSpecialtyMember2022-05-292022-12-030000066382mlkn:RetailSegmentMember2022-05-292022-12-030000066382mlkn:AmericasContractMember2022-12-030000066382mlkn:InternationalContractSpecialtyMember2022-12-030000066382mlkn:RetailSegmentMember2022-12-030000066382country:US2022-09-042022-12-030000066382us-gaap:ForeignPlanMember2022-09-042022-12-030000066382country:US2021-08-292021-11-270000066382us-gaap:ForeignPlanMember2021-08-292021-11-270000066382country:US2022-05-292022-12-030000066382us-gaap:ForeignPlanMember2022-05-292022-12-030000066382country:US2021-05-302021-11-270000066382us-gaap:ForeignPlanMember2021-05-302021-11-270000066382us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-030000066382us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-05-280000066382us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-030000066382us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-05-280000066382us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-12-030000066382us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-12-030000066382us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-05-280000066382us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-05-280000066382us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-12-030000066382us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-05-280000066382us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:OtherLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382us-gaap:OtherLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-030000066382us-gaap:OtherLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-05-280000066382mlkn:September2016InterestRateSwapMember2022-12-030000066382mlkn:September2016InterestRateSwapMember2022-05-292022-12-030000066382mlkn:June2017InterestRateSwapMember2022-12-030000066382mlkn:June2017InterestRateSwapMember2022-05-292022-12-030000066382mlkn:January2022InterestRateSwapMember2022-12-030000066382mlkn:January2022InterestRateSwapMember2022-05-292022-12-030000066382mlkn:HAYASMember2022-05-280000066382mlkn:HAYASMember2021-05-290000066382mlkn:HAYASMember2022-05-292022-12-030000066382mlkn:HAYASMember2021-05-302021-11-270000066382mlkn:HAYASMember2022-12-030000066382mlkn:HAYASMember2021-11-270000066382srt:RestatementAdjustmentMember2021-05-290000066382us-gaap:PerformanceGuaranteeMembersrt:MinimumMember2022-05-292022-12-030000066382us-gaap:PerformanceGuaranteeMembersrt:MaximumMember2022-05-292022-12-030000066382us-gaap:PerformanceGuaranteeMember2022-12-030000066382us-gaap:PerformanceGuaranteeMember2022-05-280000066382us-gaap:FinancialStandbyLetterOfCreditMember2022-12-030000066382us-gaap:FinancialStandbyLetterOfCreditMember2022-05-280000066382mlkn:SyndicatedRevolvingLineOfCreditDueJuly2026Memberus-gaap:DomesticLineOfCreditMember2022-12-030000066382mlkn:SyndicatedRevolvingLineOfCreditDueJuly2026Memberus-gaap:DomesticLineOfCreditMember2022-05-280000066382mlkn:TermLoanADueJuly2026Member2022-12-030000066382mlkn:TermLoanADueJuly2026Member2022-05-280000066382mlkn:TermLoanBDueJuly2028Member2022-12-030000066382mlkn:TermLoanBDueJuly2028Member2022-05-280000066382mlkn:PrivatePlacementNotesMemberus-gaap:NotesPayableOtherPayablesMember2021-07-31mlkn:loan0000066382us-gaap:DomesticLineOfCreditMember2021-07-310000066382us-gaap:DomesticLineOfCreditMember2021-06-300000066382us-gaap:SecuredDebtMembermlkn:TermLoanADueJuly2026Member2021-07-012021-07-310000066382us-gaap:SecuredDebtMembermlkn:TermLoanADueJuly2026Member2021-07-310000066382mlkn:TermLoanBDueJuly2028Memberus-gaap:SecuredDebtMember2021-07-012021-07-310000066382mlkn:TermLoanBDueJuly2028Memberus-gaap:SecuredDebtMember2021-07-310000066382mlkn:PrivatePlacementNotesMemberus-gaap:NotesPayableOtherPayablesMember2021-05-302021-11-270000066382mlkn:TermLoanADueJuly2026Member2022-05-292022-12-030000066382mlkn:TermLoanBDueJuly2028Member2022-05-292022-12-030000066382us-gaap:AccumulatedTranslationAdjustmentMember2022-05-280000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-05-280000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-05-280000066382us-gaap:AccumulatedTranslationAdjustmentMember2022-05-292022-12-030000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-05-292022-12-030000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-05-292022-12-030000066382us-gaap:AccumulatedTranslationAdjustmentMember2022-12-030000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-030000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-030000066382us-gaap:AccumulatedTranslationAdjustmentMember2021-05-290000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-05-290000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-05-290000066382us-gaap:AccumulatedTranslationAdjustmentMember2021-05-302021-11-270000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-05-302021-11-270000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-05-302021-11-270000066382us-gaap:AccumulatedTranslationAdjustmentMember2021-11-270000066382us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-11-270000066382us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-11-27mlkn:segment0000066382us-gaap:CorporateMemberus-gaap:CorporateNonSegmentMember2022-09-042022-12-030000066382us-gaap:CorporateMemberus-gaap:CorporateNonSegmentMember2021-08-292021-11-270000066382us-gaap:CorporateMemberus-gaap:CorporateNonSegmentMember2022-05-292022-12-030000066382us-gaap:CorporateMemberus-gaap:CorporateNonSegmentMember2021-05-302021-11-270000066382mlkn:KnollMembermlkn:KnollIntegrationMember2022-12-030000066382mlkn:KnollIntegrationMember2022-05-292022-12-030000066382mlkn:KnollIntegrationMemberus-gaap:EmployeeSeveranceMember2022-05-292022-12-030000066382mlkn:KnollIntegrationMemberus-gaap:FacilityClosingMember2022-05-292022-12-030000066382us-gaap:OtherRestructuringMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382mlkn:KnollIntegrationMember2021-05-302021-11-270000066382mlkn:KnollIntegrationMemberus-gaap:EmployeeSeveranceMember2021-05-302021-11-270000066382mlkn:NonCashAssetImpairmentsMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382mlkn:NonCashDebtExtinguishmentMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382us-gaap:OtherRestructuringMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382mlkn:KnollIntegrationMemberus-gaap:EmployeeSeveranceMember2022-05-280000066382mlkn:KnollIntegrationMemberus-gaap:FacilityClosingMember2022-05-280000066382mlkn:SeveranceAndEmployeeBenefitsAndExitAndDisposalActivitiesMembermlkn:KnollIntegrationMember2022-05-280000066382mlkn:SeveranceAndEmployeeBenefitsAndExitAndDisposalActivitiesMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382mlkn:KnollIntegrationMemberus-gaap:EmployeeSeveranceMember2022-12-030000066382mlkn:KnollIntegrationMemberus-gaap:FacilityClosingMember2022-12-030000066382mlkn:SeveranceAndEmployeeBenefitsAndExitAndDisposalActivitiesMembermlkn:KnollIntegrationMember2022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:KnollIntegrationMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:KnollIntegrationMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:AmericasContractMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:KnollIntegrationMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:KnollIntegrationMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:InternationalContractSpecialtyMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:KnollIntegrationMember2022-09-042022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:KnollIntegrationMember2021-08-292021-11-270000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382us-gaap:OperatingSegmentsMembermlkn:RetailSegmentMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382us-gaap:CorporateNonSegmentMembermlkn:KnollIntegrationMember2022-09-042022-12-030000066382us-gaap:CorporateNonSegmentMembermlkn:KnollIntegrationMember2021-08-292021-11-270000066382us-gaap:CorporateNonSegmentMembermlkn:KnollIntegrationMember2022-05-292022-12-030000066382us-gaap:CorporateNonSegmentMembermlkn:KnollIntegrationMember2021-05-302021-11-270000066382mlkn:KnollIntegrationMember2022-09-042022-12-030000066382mlkn:KnollIntegrationMember2021-08-292021-11-270000066382mlkn:A2023RestructuringPlanMemberus-gaap:EmployeeSeveranceMembersrt:MinimumMember2022-05-292022-12-030000066382srt:MaximumMembermlkn:A2023RestructuringPlanMemberus-gaap:EmployeeSeveranceMember2022-05-292022-12-030000066382mlkn:A2023RestructuringPlanMemberus-gaap:EmployeeSeveranceMember2022-09-042022-12-030000066382mlkn:A2023RestructuringPlanMemberus-gaap:EmployeeSeveranceMember2022-05-292022-12-030000066382us-gaap:EmployeeSeveranceMember2022-05-280000066382us-gaap:EmployeeSeveranceMember2022-05-292022-12-030000066382us-gaap:EmployeeSeveranceMember2022-12-030000066382mlkn:AmericasContractMember2022-09-042022-12-030000066382mlkn:AmericasContractMember2021-08-292021-11-270000066382mlkn:AmericasContractMember2021-05-302021-11-270000066382mlkn:InternationalContractSpecialtyMember2022-09-042022-12-030000066382mlkn:InternationalContractSpecialtyMember2021-08-292021-11-270000066382mlkn:InternationalContractSpecialtyMember2021-05-302021-11-270000066382mlkn:RetailSegmentMember2022-09-042022-12-030000066382mlkn:RetailSegmentMember2021-08-292021-11-270000066382mlkn:RetailSegmentMember2021-05-302021-11-270000066382us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-030000066382us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-05-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 3, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-15141

__________________________________________

MillerKnoll, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| Michigan | | 38-0837640 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

855 East Main Avenue

Zeeland, MI 49464

(Address of principal executive offices and zip code)

(616) 654-3000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.20 per share | MLKN | Nasdaq Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of January 6, 2023, MillerKnoll, Inc. had 75,587,055 shares of common stock outstanding.

MillerKnoll, Inc.

Form 10-Q

Table of Contents

| | | | | |

| | Page No. |

| Part I — Financial Information | |

| Item 1 Financial Statements (Unaudited) | |

| Condensed Consolidated Statements of Comprehensive Income (Loss) — Three and Six Months Ended December 3, 2022 and November 27, 2021 | |

| Condensed Consolidated Balance Sheets — December 3, 2022 and May 28, 2022 | |

| Condensed Consolidated Statements of Cash Flows — Six Months Ended December 3, 2022 and November 27, 2021 | |

| |

| Condensed Consolidated Statements of Stockholders' Equity — Six Months Ended December 3, 2022 and November 27, 2021 | |

| Notes to Condensed Consolidated Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Item 2 Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3 Quantitative and Qualitative Disclosures about Market Risk | |

| Item 4 Controls and Procedures | |

| Part II — Other Information | |

| Item 1 Legal Proceedings | |

| Item 1A Risk Factors | |

| Item 2 Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 6 Exhibits | |

| Signatures | |

PART I - FINANCIAL INFORMATION

Item 1: Financial Statements

MillerKnoll, Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions, except share data) | Three Months Ended | | Six Months Ended |

| (Unaudited) | December 3, 2022 | | November 27, 2021 | | December 3, 2022 | | November 27, 2021 |

| Net sales | $ | 1,066.9 | | | $ | 1,026.3 | | | $ | 2,145.7 | | | $ | 1,816.0 | |

| Cost of sales | 699.3 | | | 673.3 | | | 1,406.0 | | | 1,185.3 | |

| Gross margin | 367.6 | | | 353.0 | | | 739.7 | | | 630.7 | |

| Operating expenses: | | | | | | | |

| Selling, general and administrative | 290.8 | | | 318.6 | | | 587.7 | | | 625.5 | |

| Restructuring expense | 14.7 | | | — | | | 15.2 | | | — | |

| Design and research | 23.4 | | | 28.2 | | | 47.3 | | | 51.6 | |

| Total operating expenses | 328.9 | | | 346.8 | | | 650.2 | | | 677.1 | |

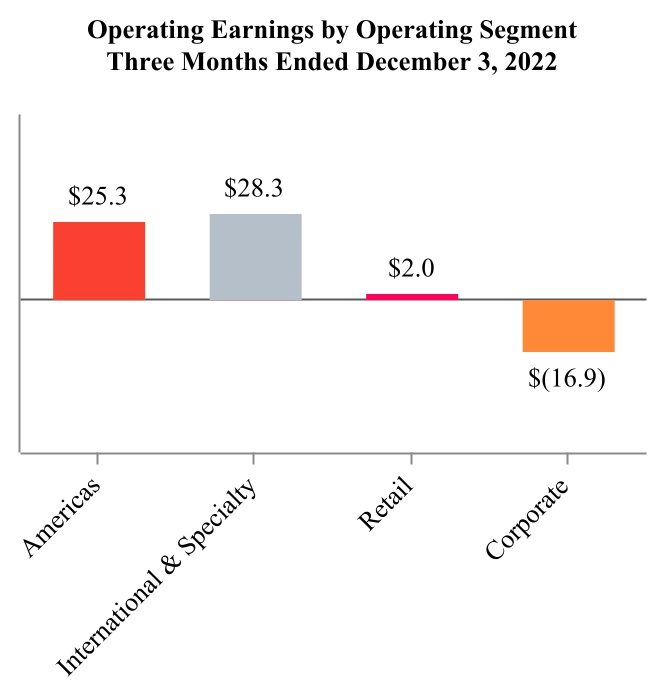

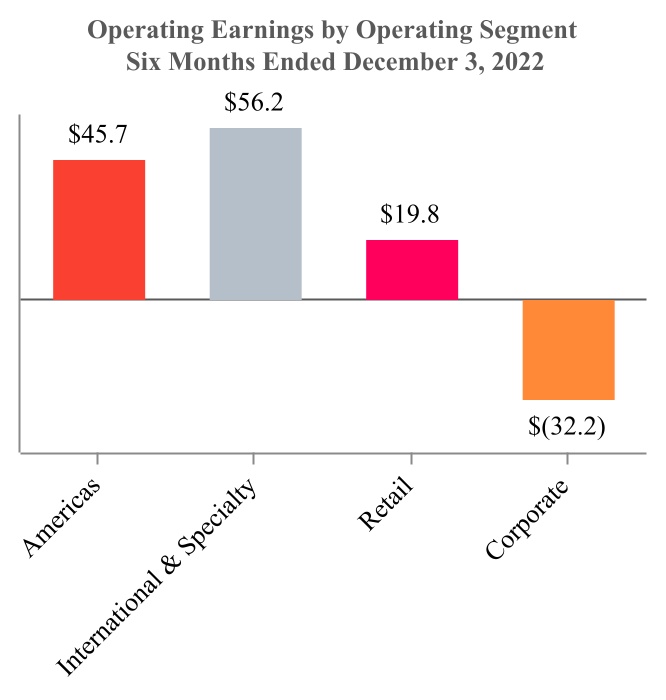

| Operating earnings (loss) | 38.7 | | | 6.2 | | | 89.5 | | | (46.4) | |

| | | | | | | |

| Interest expense | 18.3 | | | 9.2 | | | 35.0 | | | 14.8 | |

| Interest and other investment income | 0.7 | | | 0.3 | | | 1.1 | | | 0.5 | |

| Other (income) expense, net | (0.5) | | | (0.7) | | | 0.3 | | | 11.8 | |

| Earnings (loss) before income taxes and equity income | 21.6 | | | (2.0) | | | 55.3 | | | (72.5) | |

| Income tax expense (benefit) | 4.3 | | | (2.7) | | | 10.6 | | | (13.3) | |

| Equity income from nonconsolidated affiliates, net of tax | 0.2 | | | (0.1) | | | 0.2 | | | — | |

| Net earnings (loss) | 17.5 | | | 0.6 | | | 44.9 | | | (59.2) | |

| Net earnings attributable to redeemable noncontrolling interests | 1.5 | | | 2.3 | | | 3.1 | | | 3.9 | |

| Net earnings (loss) attributable to MillerKnoll, Inc. | $ | 16.0 | | | $ | (1.7) | | | $ | 41.8 | | | $ | (63.1) | |

| | | | | | | |

| Earnings (loss) per share — basic | $ | 0.21 | | | $ | (0.02) | | | $ | 0.55 | | | $ | (0.94) | |

| Earnings (loss) per share — diluted | $ | 0.21 | | | $ | (0.02) | | | $ | 0.55 | | | $ | (0.94) | |

| | | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustments | $ | 44.2 | | | $ | (60.9) | | | $ | (28.3) | | | $ | (52.1) | |

| Pension and post-retirement liability adjustments | 0.4 | | | 1.8 | | | 0.8 | | | 4.1 | |

| Unrealized gain on interest rate swap agreement | 7.2 | | | 4.0 | | | 21.5 | | | 3.0 | |

| | | | | | | |

| Other comprehensive income (loss), net of tax | $ | 51.8 | | | $ | (55.1) | | | $ | (6.0) | | | $ | (45.0) | |

| Comprehensive income (loss) | 69.3 | | | (54.5) | | | 38.9 | | | (104.2) | |

| Comprehensive income (loss) attributable to redeemable noncontrolling interests | 1.4 | | | (0.2) | | | 3.1 | | | 1.9 | |

| Comprehensive income (loss) attributable to MillerKnoll, Inc. | $ | 67.9 | | | $ | (54.3) | | | $ | 35.8 | | | $ | (106.1) | |

See accompanying notes to Condensed Consolidated Financial Statements.

MillerKnoll, Inc.

Condensed Consolidated Balance Sheets

| | | | | | | | | | | |

| (Dollars in millions, except share data) | | | |

| (Unaudited) | December 3, 2022 | | May 28, 2022 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 197.5 | | | $ | 230.3 | |

| | | |

Accounts receivable, net of allowances of $6.9 and $9.7 | 365.6 | | | 348.9 | |

| Unbilled accounts receivable | 32.4 | | | 32.0 | |

| Inventories, net | 587.1 | | | 587.3 | |

| Prepaid expenses | 115.1 | | | 112.1 | |

| Other current assets | 12.2 | | | 7.3 | |

| Total current assets | 1,309.9 | | | 1,317.9 | |

| Property and equipment, at cost | 1,531.2 | | | 1,509.7 | |

| Less — accumulated depreciation | (976.6) | | | (928.2) | |

| Net property and equipment | 554.6 | | | 581.5 | |

| Right of use assets | 407.4 | | | 425.8 | |

| Goodwill | 1,217.4 | | | 1,226.2 | |

| Indefinite-lived intangibles | 498.5 | | | 501.0 | |

Other amortizable intangibles, net of accumulated amortization of $153.4 and $134.7 | 341.4 | | | 362.4 | |

| Other noncurrent assets | 118.9 | | | 99.2 | |

| Total Assets | $ | 4,448.1 | | | $ | 4,514.0 | |

| | | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS & STOCKHOLDERS' EQUITY |

| Current Liabilities: | | | |

| Accounts payable | $ | 281.6 | | | $ | 355.1 | |

| Short-term borrowings and current portion of long-term debt | 28.8 | | | 29.3 | |

| Accrued compensation and benefits | 100.9 | | | 128.6 | |

| Short-term lease liability | 78.8 | | | 79.9 | |

| Accrued warranty | 22.8 | | | 18.8 | |

| Customer deposits | 102.7 | | | 125.3 | |

| Other accrued liabilities | 157.6 | | | 140.4 | |

| Total current liabilities | 773.2 | | | 877.4 | |

| Long-term debt | 1,434.8 | | | 1,379.2 | |

| Pension and post-retirement benefits | 13.7 | | | 25.0 | |

| Lease liabilities | 382.2 | | | 398.2 | |

| Other liabilities | 303.3 | | | 300.2 | |

| Total Liabilities | 2,907.2 | | | 2,980.0 | |

| Redeemable noncontrolling interests | 106.6 | | | 106.9 | |

| Stockholders' Equity: | | | |

Preferred stock, no par value (10,000,000 shares authorized, none issued) | — | | | — | |

Common stock, $0.20 par value (240,000,000 shares authorized, 75,603,106 and 75,824,241 shares issued and outstanding in fiscal 2023 and 2022, respectively) | 15.1 | | | 15.2 | |

| Additional paid-in capital | 825.7 | | | 825.7 | |

| Retained earnings | 706.6 | | | 693.3 | |

| Accumulated other comprehensive loss | (113.1) | | | (107.1) | |

| | | |

| | | |

| | | |

| Total Stockholders' Equity | 1,434.3 | | | 1,427.1 | |

| Total Liabilities, Redeemable Noncontrolling Interests, and Stockholders' Equity | $ | 4,448.1 | | | $ | 4,514.0 | |

See accompanying notes to Condensed Consolidated Financial Statements.

MillerKnoll, Inc.

Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| (Dollars in millions) | Six Months Ended |

| (Unaudited) | December 3, 2022 | | November 27, 2021 |

| Cash Flows from Operating Activities: | | | |

| Net earnings (loss) | $ | 44.9 | | | $ | (59.2) | |

| Adjustments to reconcile net earnings to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 77.7 | | | 109.9 | |

| Stock-based compensation | 10.9 | | | 22.1 | |

| Amortization of deferred financing costs | 2.3 | | | 1.4 | |

| Pension and post-retirement expenses | (10.1) | | | (4.2) | |

| | | |

| | | |

| | | |

| Deferred taxes | (0.3) | | | (13.6) | |

| | | |

| | | |

| | | |

| Restructuring expense | 15.2 | | | — | |

| | | |

| Impairment | — | | | 15.5 | |

| | | |

| Loss on extinguishment of debt | — | | | 13.4 | |

| (Increase) decrease in current assets | (34.7) | | | (169.3) | |

| | | |

| (Decrease) increase in current liabilities | (111.9) | | | 34.9 | |

| (Decrease) increase in non-current liabilities | (3.1) | | | (5.3) | |

| Other, net | 3.8 | | | (3.2) | |

| Net Cash Used in Operating Activities | (5.3) | | | (57.6) | |

| | | |

| Cash Flows from Investing Activities: | | | |

| | | |

| | | |

| Notes receivables issued | (4.5) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Capital expenditures | (40.3) | | | (46.3) | |

| | | |

| | | |

| Acquisitions, net of cash received | — | | | (1,088.5) | |

| | | |

| Proceeds from loan on cash surrender value of life insurance | 13.5 | | | — | |

| Other, net | (0.7) | | | 1.0 | |

| Net Cash Used in Investing Activities | (32.0) | | | (1,133.8) | |

| | | |

| Cash Flows from Financing Activities: | | | |

| | | |

| Repayments of long-term debt | (13.1) | | | (50.0) | |

| Proceeds from issuance of debt, net of discounts | — | | | 1,007.0 | |

| Payments of deferred financing costs | — | | | (9.3) | |

| Proceeds from credit facility | 559.3 | | | 587.5 | |

| Repayments of credit facility | (492.3) | | | (449.4) | |

| Payment of make whole premium on debt | — | | | (13.4) | |

| Dividends paid | (28.4) | | | (25.4) | |

| Common stock issued | 2.5 | | | 4.3 | |

| Common stock repurchased and retired | (14.3) | | | (14.4) | |

| Other, net | (2.1) | | | (1.4) | |

| Net Cash Provided by Financing Activities | 11.6 | | | 1,035.5 | |

| | | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (7.1) | | | (13.2) | |

| Net Decrease in Cash and Cash Equivalents | (32.8) | | | (169.1) | |

| | | |

| Cash and Cash Equivalents, Beginning of Period | 230.3 | | | 396.4 | |

| Cash and Cash Equivalents, End of Period | $ | 197.5 | | | $ | 227.3 | |

See accompanying notes to Condensed Consolidated Financial Statements.

MillerKnoll, Inc.

Condensed Consolidated Statements of Stockholders' Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended December 3, 2022 | | |

| (Dollars in millions, except share data) | | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Deferred Compensation Plan | | MillerKnoll, Inc. Stockholders' Equity | | | | | | |

| (Unaudited) | | Shares | | Amount | | | | | | | | | |

| May 28, 2022 | | | 75,824,241 | | | $ | 15.2 | | | $ | 825.7 | | | $ | 693.3 | | | $ | (107.1) | | | $ | — | | | $ | 1,427.1 | | | | | | | |

| Net earnings | | | — | | | — | | | — | | | 25.8 | | | — | | | — | | | 25.8 | | | | | | | |

| Other comprehensive loss net of tax | | | — | | | — | | | — | | | — | | | (57.8) | | | — | | | (57.8) | | | | | | | |

| Stock-based compensation expense | | | (13,474) | | | — | | | 5.4 | | | — | | | — | | | — | | | 5.4 | | | | | | | |

| Exercise of stock options | | | 43,469 | | | — | | | 1.0 | | | — | | | — | | | — | | | 1.0 | | | | | | | |

| Restricted and performance stock units released | | | 160,551 | | | — | | | 0.1 | | | — | | | — | | | — | | | 0.1 | | | | | | | |

| Employee stock purchase plan issuances | | | 35,753 | | | — | | | 0.8 | | | — | | | — | | | — | | | 0.8 | | | | | | | |

| Repurchase and retirement of common stock | | | (494,509) | | | (0.1) | | | (14.2) | | | — | | | — | | | — | | | (14.3) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Dividends declared ($0.1875 per share) | | | — | | | — | | | — | | | (14.3) | | | — | | | — | | | (14.3) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Other | | | — | | | — | | | 0.5 | | | 0.5 | | | — | | | — | | | 1.0 | | | | | | | |

| September 3, 2022 | | | 75,556,031 | | | $ | 15.1 | | | $ | 819.3 | | | $ | 705.3 | | | $ | (164.9) | | | $ | — | | | $ | 1,374.8 | | | | | | | |

| Net earnings | | | — | | | — | | | — | | | 16.0 | | | — | | | — | | | 16.0 | | | | | | | |

| Other comprehensive income, net of tax | | | — | | | — | | | — | | | — | | | 51.8 | | | — | | | 51.8 | | | | | | | |

| Stock-based compensation expense | | | (2,476) | | | — | | | 5.5 | | | — | | | — | | | — | | | 5.5 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Restricted and performance stock units released | | | 8,763 | | | — | | | 0.1 | | | — | | | — | | | — | | | 0.1 | | | | | | | |

| Employee stock purchase plan issuances | | | 44,010 | | | — | | | 0.7 | | | — | | | — | | | — | | | 0.7 | | | | | | | |

| Repurchase and retirement of common stock | | | (3,222) | | | — | | | (0.1) | | | — | | | — | | | — | | | (0.1) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Dividends declared ($0.1875 per share) | | | — | | | — | | | — | | | (14.3) | | | — | | | — | | | (14.3) | | | | | | | |

| Other | | | — | | | — | | | 0.2 | | | (0.4) | | | — | | | — | | | (0.2) | | | | | | | |

| December 3, 2022 | | | 75,603,106 | | | $ | 15.1 | | | $ | 825.7 | | | $ | 706.6 | | | $ | (113.1) | | | $ | — | | | $ | 1,434.3 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended November 27, 2021 | | |

| (Dollars in millions, except share data) | | | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Deferred Compensation Plan | | MillerKnoll, Inc. Stockholders' Equity | | | | | | |

| (Unaudited) | | Shares | | Amount | | | | | | | | | |

| May 29, 2021 | | | 59,029,165 | | | $ | 11.8 | | | $ | 94.7 | | | $ | 819.3 | | | $ | (65.1) | | | $ | (0.2) | | | $ | 860.5 | | | | | | | |

| Net earnings | | | — | | | — | | | — | | | (61.3) | | | — | | | — | | | (61.3) | | | | | | | |

| Other comprehensive income, net of tax | | | — | | | — | | | — | | | — | | | (15.2) | | | — | | | (15.2) | | | | | | | |

| Stock-based compensation expense | | | — | | | — | | | 15.1 | | | — | | | — | | | — | | | 15.1 | | | | | | | |

| Exercise of stock options | | | 49,584 | | | — | | | 1.3 | | | — | | | — | | | — | | | 1.3 | | | | | | | |

| Restricted and performance stock units released | | | 358,016 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | |

| Employee stock purchase plan issuances | | | 19,020 | | | — | | | 0.7 | | | — | | | — | | | — | | | 0.7 | | | | | | | |

| Repurchase and retirement of common stock | | | (267,522) | | | — | | | (11.0) | | | — | | | — | | | — | | | (11.0) | | | | | | | |

| Shares issued for the acquisition of Knoll | | | 15,843,921 | | | 3.2 | | | 685.1 | | | — | | | — | | | — | | | 688.3 | | | | | | | |

| Pre-combination expense from Knoll rollover | | | 751,907 | | | 0.2 | | | 22.4 | | | — | | | — | | | — | | | 22.6 | | | | | | | |

Dividends declared ($0.1875 per share) | | | — | | | — | | | — | | | (14.3) | | | — | | | — | | | (14.3) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| August 28, 2021 | | | 75,784,091 | | | $ | 15.2 | | | $ | 808.3 | | | $ | 743.7 | | | $ | (80.3) | | | $ | (0.2) | | | $ | 1,486.7 | | | | | | | |

| Net earnings | | | — | | | — | | | — | | | (1.7) | | | — | | | — | | | (1.7) | | | | | | | |

| Other comprehensive income, net of tax | | | — | | | — | | | — | | | — | | | (27.8) | | | — | | | (27.8) | | | | | | | |

| Stock-base compensation expense | | | — | | | — | | | 7.0 | | | — | | | — | | | — | | | 7.0 | | | | | | | |

| Exercise of stock options | | | 52,697 | | | — | | | 1.5 | | | — | | | — | | | — | | | 1.5 | | | | | | | |

| Restricted and performance stock units released | | | 91,443 | | | — | | | 0.2 | | | — | | | — | | | — | | | 0.2 | | | | | | | |

| Employee stock purchase plan issuances | | | 18,813 | | | — | | | 0.6 | | | — | | | — | | | — | | | 0.6 | | | | | | | |

| Repurchase and retirement of common stock | | | (76,246) | | | — | | | (3.3) | | | — | | | — | | | — | | | (3.3) | | | | | | | |

| Forfeiture of shares | | | (130,410) | | | (0.1) | | | — | | | — | | | — | | | — | | | (0.1) | | | | | | | |

| NCI adjustment | | | — | | | — | | | 0.5 | | | — | | | — | | | — | | | 0.5 | | | | | | | |

Dividends declared ($0.1875 per share) | | | — | | | — | | | — | | | (14.4) | | | — | | | — | | | (14.4) | | | | | | | |

| November 27, 2021 | | | 75,740,388 | | | $ | 15.1 | | | $ | 814.8 | | | $ | 727.6 | | | $ | (108.1) | | | $ | (0.2) | | | $ | 1,449.2 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to Condensed Consolidated Financial Statements.

Notes to Condensed Consolidated Financial Statements

(Dollars in millions, except share data)

(unaudited)

1. Description of Business

MillerKnoll, Inc. (the "Company") researches, designs, manufactures, sells, and distributes interior furnishings for use in various environments including office, healthcare, educational, and residential settings and provides related services that support companies all over the world. The Company's products are sold through independent contract office furniture dealers, retail studios, the Company’s eCommerce platforms, direct mail catalogs, as well as direct customer sales and independent retailers.

On July 19, 2021, the Company acquired Knoll, Inc. ("Knoll") (See Note 4. "Acquisitions"). Knoll is a leading global manufacturer of commercial and residential furniture, accessories, lighting and coverings. The Company has included the financial results of Knoll in the condensed consolidated financial statements from the date of acquisition. On October 11, 2021, the Company's shareholders approved an amendment to our Restated Articles of Incorporation to change our corporate name from Herman Miller, Inc. to MillerKnoll, Inc. On November 1, 2021, the change in corporate name and change in the ticker symbol to MLKN became effective.

MillerKnoll is a collective of dynamic brands that comes together to design the world we live in. A global leader in design, MillerKnoll includes Herman Miller® and Knoll®, as well as Colebrook Bosson Saunders®, DatesWeiser®, Design Within Reach®, Edelman® Leather, Fully®, Geiger®, HAY®, Holly Hunt®, KnollTextiles®, Maars® Living Walls, Maharam®, Muuto®, NaughtOne®, and Spinneybeck®|FilzFelt®. MillerKnoll represents over 100 years of design research and exploration in service of humanity. The Company is united by a belief in design as a tool to create positive impact and shape a more sustainable, caring, and beautiful future for all people and the planet.

Basis of Presentation

The Condensed Consolidated Financial Statements have been prepared by MillerKnoll, Inc. in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. Management believes the disclosures made in this document are adequate with respect to interim reporting requirements. Unless otherwise noted or indicated by the context, all references to "MillerKnoll," "we," "our," "Company" and similar references are to MillerKnoll, Inc., its predecessors, and controlled subsidiaries.

The accompanying unaudited Condensed Consolidated Financial Statements, taken as a whole, contain all adjustments that are of a normal recurring nature necessary to present fairly the financial position of the Company as of December 3, 2022. Operating results for the three and six months ended December 3, 2022 are not necessarily indicative of the results that may be expected for the year ending June 3, 2023 ("fiscal 2023"). These Condensed Consolidated Financial Statements should be read in conjunction with the financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended May 28, 2022 ("fiscal 2022"). All intercompany transactions have been eliminated in the Condensed Consolidated Financial Statements. The financial statements of equity method investments are not consolidated.

Segment Reorganization

Effective as of May 29, 2022, the beginning of fiscal year 2023, the Company implemented an organizational change that resulted in a change in the reportable segments. The Company has recast historical results to reflect this change. See Note 15 "Operating Segments" for additional information.

The Company's fiscal year is the 52 or 53 week period ending on the Saturday closest to May 31. The fiscal year ended May 28, 2022 ("fiscal 2022") was a 52 week period while the fiscal year ending June 3, 2023 ("fiscal 2023") will be a 53 week period. The first quarter of fiscal 2022 contained 13 weeks and the first quarter of fiscal 2023 contained 14 weeks.

Change in Accounting Principle

In the fourth quarter of fiscal 2022, the Company elected to change the method of accounting for the cost of certain inventories within the Americas segment from the last-in, first-out method (“LIFO”) to first-in, first-out method (“FIFO”). With this change

there are no longer any inventories accounted for under the LIFO method. The Company has retrospectively adjusted the Consolidated Financial Statements for the prior period presented to reflect this change.

2. Recently Issued Accounting Standards

The Company evaluates all Accounting Standards Updates ("ASUs") issued by the Financial Accounting Standards Board ("FASB") for consideration of their applicability to our consolidated financial statements. We have assessed all ASUs issued but not yet adopted and concluded that those not disclosed are not relevant to the Company or are not expected to have a material impact.

3. Revenue from Contracts with Customers

Disaggregated Revenue

Revenue disaggregated by contract type is provided in the table below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (In millions) | December 3, 2022 | | November 27, 2021 | | December 3, 2022 | | November 27, 2021 |

| Net Sales: | | | | | | | |

| Single performance obligation | | | | | | | |

| Product revenue | $ | 996.6 | | | $ | 942.3 | | | $ | 2,004.3 | | | $ | 1,678.7 | |

| Multiple performance obligations | | | | | | | |

| Product revenue | 66.3 | | | 78.5 | | | 132.8 | | | 128.0 | |

| Service revenue | 0.6 | | | 2.9 | | | 1.8 | | | 4.8 | |

| Other | 3.4 | | | 2.6 | | | 6.8 | | | 4.5 | |

| Total | $ | 1,066.9 | | | $ | 1,026.3 | | | $ | 2,145.7 | | | $ | 1,816.0 | |

The Company internally reports and evaluates products based on the categories Workplace, Performance Seating, Lifestyle and Other. A description of these categories is included below.

The Workplace category includes products centered on creating highly functional and productive settings for both groups and individuals. This category focuses on the development of products, beyond seating, that define boundaries, support work and enable productivity.

The Performance Seating category includes products centered on seating ergonomics, productivity and function across an evolving and diverse range of settings. This category focuses on the development of ergonomic seating solutions for specific use cases requiring more than basic utility.

The Lifestyle category includes products focused on bringing spaces to life through beautiful yet functional products. This category focuses on the development of products that support a way of living, in thoughtful yet elevated ways. The products in this category help create emotive and visually appealing spaces via a portfolio that offers diversity in aesthetics, price and performance.

The Other category primarily consists of textiles, uncategorized product sales, and service sales.

Revenue disaggregated by product type and reportable segment is provided in the table below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (In millions) | December 3, 2022 | | November 27, 2021 | | December 3, 2022 | | November 27, 2021 |

| Americas Contract: | | | | | | | |

| Workplace | $ | 342.1 | | | $ | 320.3 | | | $ | 680.8 | | | $ | 554.0 | |

| Performance Seating | 115.0 | | | 114.6 | | | 233.9 | | | 207.2 | |

| Lifestyle | 68.4 | | | 53.1 | | | 139.5 | | | 97.8 | |

| Other | 4.2 | | | 11.3 | | | 12.9 | | | 21.6 | |

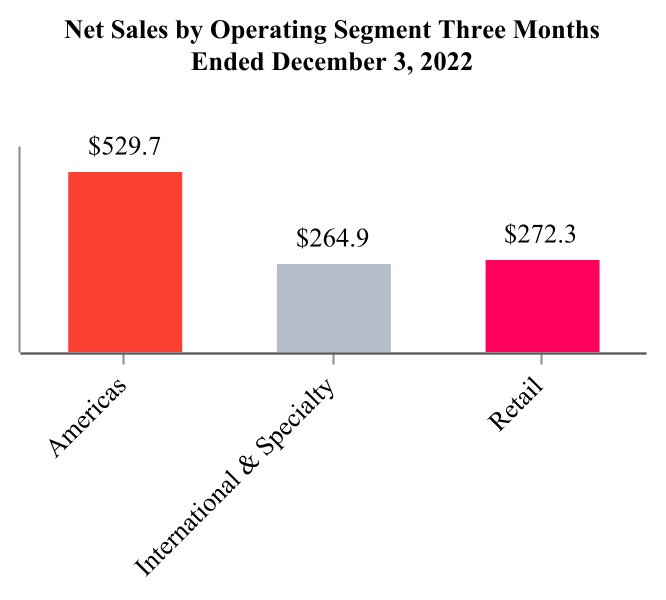

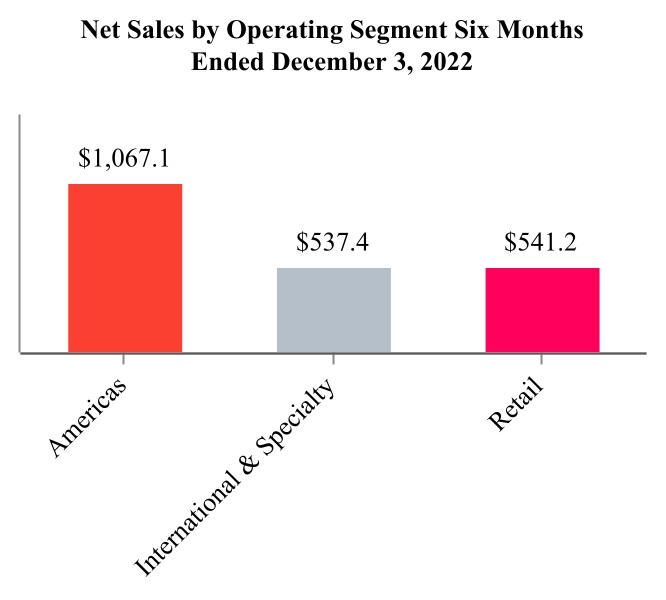

| Total Americas Contract | $ | 529.7 | | | $ | 499.3 | | | $ | 1,067.1 | | | $ | 880.6 | |

| | | | | | | |

| International Contract & Specialty: | | | | | | | |

| Workplace | $ | 49.5 | | | $ | 40.5 | | | $ | 93.8 | | | $ | 68.7 | |

| Performance Seating | 65.7 | | | 58.5 | | | 134.7 | | | 108.2 | |

| Lifestyle | 99.6 | | | 99.0 | | | 206.6 | | | 153.0 | |

| Other | 50.1 | | | 49.0 | | | 102.3 | | | 84.2 | |

| Total International Contract & Specialty | $ | 264.9 | | | $ | 247.0 | | | $ | 537.4 | | | $ | 414.1 | |

| | | | | | | |

| Global Retail: | | | | | | | |

| Workplace | $ | 21.9 | | | $ | 32.8 | | | $ | 49.4 | | | $ | 51.8 | |

| Performance Seating | 50.9 | | | 64.9 | | | 102.1 | | | 128.3 | |

| Lifestyle | 198.8 | | | 181.8 | | | 388.6 | | | 340.3 | |

| Other | 0.7 | | | 0.5 | | | 1.1 | | | 0.9 | |

| Total Global Retail | $ | 272.3 | | | $ | 280.0 | | | $ | 541.2 | | | $ | 521.3 | |

| | | | | | | |

| Total | $ | 1,066.9 | | | $ | 1,026.3 | | | $ | 2,145.7 | | | $ | 1,816.0 | |

Refer to Note 15 of the Condensed Consolidated Financial Statements for further information related to our reportable segments.

Contract Balances

Customers may make payments before the satisfaction of the Company's performance obligation and recognition of revenue. These payments represent contract liabilities and are included within the caption “Customer deposits” in the Condensed Consolidated Balance Sheets. During the three and six months ended December 3, 2022, the Company recognized Net sales of $25.7 million and $104.8 million respectively, related to customer deposits that were included in the balance sheet as of May 28, 2022.

4. Acquisitions

Knoll, Inc.

On July 19, 2021, the Company completed the acquisition of Knoll, a leader in the design, manufacture, marketing and sale of high-end furniture products and accessories for workplace and residential markets. The Company has included the financial results of Knoll in the condensed consolidated financial statements from the date of acquisition. The transaction costs associated with the acquisition, which included financial advisory, legal, proxy filing, regulatory and financing fees, were approximately $30.0 million for the twelve months ended May 28, 2022 and were recorded in general and administrative expenses. Of the total transaction costs, $0.9 million and $27.6 million were recorded in the three and six months ended November 27, 2021.

Under the terms of the Agreement and Plan of Merger, each issued and outstanding share of Knoll common stock (excluding shares exercising dissenters rights, shares owned by Knoll as treasury stock, shares owned by the deal parties or their subsidiaries, or shares subject to Knoll restricted stock awards) was converted into a right to receive 0.32 shares of Herman Miller, Inc. (now MillerKnoll, Inc.) common stock and $11.00 in cash, without interest. The acquisition date fair value of the consideration transferred for Knoll was $1,887.3 million, which consisted of the following (in millions, except share amounts):

| | | | | | | | | | | | | | | | | |

| Knoll Shares | | Herman Miller, Inc (now MillerKnoll, Inc.) Shares Exchanged | | Fair Value |

| Cash Consideration: | | | | | |

| Shares of Knoll Common Stock issued and outstanding at July 19, 2021 | 49,444,825 | | | | | $ | 543.9 | |

| Knoll equivalent shares for outstanding option awards, outstanding awards of restricted common stock held by non-employee directors and outstanding awards of performance units held by individuals who are former employees of Knoll and remain eligible to vest at July 19, 2021 | 184,857 | | | | | 1.4 | |

| Total number of Knoll shares for cash consideration | 49,629,682 | | | | | |

| | | | | |

| Shares of Knoll Preferred Stock issued and outstanding at July 19, 2021 | 169,165 | | | | | 254.4 | |

| | | | | |

| Consideration for payment to settle Knoll's outstanding debt | | | | | 376.9 | |

| | | | | |

| Share Consideration: | | | | | |

| Shares of Knoll Common Stock issued and outstanding at July 19, 2021 | 49,444,825 | | | | | |

| Knoll equivalent shares for outstanding awards of restricted common stock held by non-employee directors and outstanding awards of performance units held by individuals who are former employees of Knoll and remain eligible to vest at July 19, 2021 | 74,857 | | | | | |

| Total number of Knoll shares for share consideration | 49,519,682 | | | 15,843,921 | | | 688.3 | |

| | | | | |

| Replacement Share-Based Awards: | | | | | |

| Outstanding awards of Knoll Restricted Stock and Performance units relating to Knoll Common Stock at July 19, 2021 | | | | | 22.4 | |

| | | | | |

| | | | | |

| Total acquisition date fair value of consideration transferred | | | | | $ | 1,887.3 | |

| | | | | |

The aggregate cash paid in connection with the Knoll acquisition was $1,176.6 million. MillerKnoll funded the acquisition through cash on-hand and debt proceeds, as described in "Note 13. Short-Term Borrowings and Long-Term Debt."

Outstanding unvested restricted stock awards, performance stock awards, performance stock units and restricted stock units with a fair value of $53.4 million converted into Company awards. Of the total fair value, $22.4 million was allocated to purchase consideration and $31.0 million was allocated to future services and is being expensed over the remaining service periods on a straight-line basis. Per the terms of the converted awards any qualifying termination within the twelve months subsequent to the acquisition resulted in accelerated vesting and related recognition of expense.

The transaction was accounted for as a business combination which requires that assets and liabilities assumed be recognized at their fair value as of the acquisition date. The following table summarizes the fair value of assets acquired and liabilities assumed as of the date of acquisition:

| | | | | |

| (In millions) | Fair Value |

| Cash | $ | 88.0 | |

| Accounts receivable | 82.3 | |

| Inventories | 219.9 | |

| Other current assets | 29.2 | |

| Property and equipment | 296.5 | |

| Right-of-use assets | 202.7 | |

| Intangible assets | 756.6 | |

| Goodwill | 903.5 | |

| Other noncurrent assets | 25.1 | |

| Total assets acquired | 2,603.8 | |

| |

| Accounts payable | 144.0 | |

| Other current liabilities | 153.1 | |

| Lease liabilities | 177.8 | |

| Other liabilities | 241.6 | |

| Total liabilities assumed | 716.5 | |

| Net Assets Acquired | $ | 1,887.3 | |

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets acquired was recorded as goodwill. Goodwill is attributed to the assembled workforce of Knoll and anticipated operational synergies. Goodwill related to the acquisition was allocated to each of the reporting segments with a total value as of the opening balance sheet date of $903.5 million. Goodwill arising from the acquisition is not deductible for tax reporting purposes.

The following table summarizes the acquired identified intangible assets, valuation method employed, useful lives and fair value, as determined by the Company as of the acquisition date:

| | | | | | | | | | | | | | | | | |

| (In millions) | Valuation Method | | Useful Life (years) | | Fair Value |

| Backlog | Multi-Period Excess Earnings | | Less than 1 Year | | $ | 27.6 | |

| Trade name - indefinite lived | Relief from Royalty | | Indefinite | | 418.0 | |

| Trade name - amortizing | Relief from Royalty | | 5-10 Years | | 14.0 | |

| Designs | Relief from Royalty | | 9-15 years | | 40.0 | |

| Customer Relationships | Multi-Period Excess Earnings | | 2-15 years | | 257.0 | |

| Total | | | | | $ | 756.6 | |

Unaudited Pro Forma Results of Operations

The results of Knoll's operations have been included in the Consolidated Financial Statements beginning on July 19, 2021. The following table provides pro forma results of operations for the three and six months ended November 27, 2021, as if Knoll had been acquired as of May 31, 2020. The pro forma results include certain purchase accounting adjustments such as the estimated change in depreciation and amortization expense on the acquired tangible and intangible assets. The pro forma results also include the impact of incremental interest expense incurred to finance the Knoll acquisition. Transaction related costs, including debt extinguishment costs related to the transaction, have been eliminated from the pro forma amounts presented in both periods. Pro forma results do not include any anticipated cost savings from the integration of this acquisition. Accordingly, such amounts are not necessarily indicative of the results that would have occurred if the acquisition had occurred on the date indicated or that may result in the future.

| | | | | | | | | | | |

| | | |

| (In millions) | | Three Months Ended November 27, 2021 | Six Months Ended November 27, 2021 |

| Net sales | | $ | 1,026.3 | | $ | 1,970.2 | |

| Net income (loss) attributable to MillerKnoll, Inc. | | $ | 6.6 | | $ | (17.7) | |

5. Inventories, net

| | | | | | | | | | | |

| (In millions) | December 3, 2022 | | May 28, 2022 |

| Finished goods and work in process | $ | 434.3 | | | $ | 441.6 | |

| Raw materials | 152.8 | | | 145.7 | |

| Total | $ | 587.1 | | | $ | 587.3 | |

Inventories are primarily valued using the first-in first-out method.

6. Goodwill and Indefinite-Lived Intangibles

Goodwill and other indefinite-lived intangible assets included in the Condensed Consolidated Balance Sheets consisted of the following as of December 3, 2022 and May 28, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Americas Contract | | International Contract & Specialty | | Global Retail | | Total | | |

| May 28, 2022 | | | | | | | | | |

| Goodwill | $ | 530.1 | | | $ | 341.0 | | | $ | 480.6 | | | $ | 1,351.7 | | | |

| Foreign currency translation adjustments | (3.2) | | | (2.6) | | | (3.0) | | | (8.8) | | | |

| Accumulated impairment losses | — | | | (36.7) | | | (88.8) | | | (125.5) | | | |

| December 3, 2022 | $ | 526.9 | | | $ | 301.7 | | | $ | 388.8 | | | $ | 1,217.4 | | | |

Other indefinite-lived assets included in the Consolidated Balance Sheets consist of the following:

| | | | | | | | |

| (In millions) | | Indefinite-lived Intangible Assets |

| May 28, 2022 | | $ | 501.0 | |

| Foreign currency translation adjustments | | (2.5) | |

| December 3, 2022 | | $ | 498.5 | |

Goodwill is tested for impairment at the reporting unit level annually, or more frequently when events or changes in circumstances indicate that the fair value of a reporting unit has more likely than not declined below its carrying value. When testing goodwill for impairment, the Company may first assess qualitative factors. If an initial qualitative assessment identifies that it is more likely than not that the carrying value of a reporting unit exceeds its estimated fair value, additional quantitative testing is performed. The Company may also elect to bypass the qualitative testing and proceed directly to the quantitative testing. If the quantitative testing indicates that goodwill is impaired, the carrying value of goodwill is written down to fair value.

Each of the reporting units was reviewed for impairment using a qualitative assessment as of March 31, 2022, our annual testing date. In performing the qualitative impairment test for fiscal year 2022, the Company determined that the fair value of its reporting units exceeded the carrying amount and, as such, these reporting units were not impaired.

In connection with the segment reorganization, the Company’s reporting units have changed in composition, and goodwill was reallocated between such reporting units using a relative fair value approach. Accordingly, the Company performed interim goodwill impairment tests in the first quarter of 2023 for each reporting unit. Based on the results of the tests performed, the Company determined that the fair value of each reporting unit, both before and after the reorganization, exceeded its respective carrying amount.

Intangible assets with indefinite useful lives are not subject to amortization and are evaluated annually for impairment, or more frequently when events or changes in circumstances indicate that the fair value of an intangible asset may not be recoverable.

7. Employee Benefit Plans

The following table summarizes the components of net periodic benefit cost for the Company's defined benefit pension plans:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pension Benefits | | | | | | |

| Three Months Ended December 3, 2022 | | Three Months Ended November 27, 2021 | | | | |

| (In millions) | Domestic | | International | | Domestic | | International | | | | | | | | |

| Service cost | $ | — | | | $ | — | | | $ | 0.1 | | | $ | — | | | | | | | | | |

| Interest cost | 1.5 | | | 0.8 | | | 1.1 | | | 0.8 | | | | | | | | | |

Expected return on plan assets(1) | (2.0) | | | (1.1) | | | (2.2) | | | (1.8) | | | | | | | | | |

| Net amortization loss | — | | | 0.6 | | | — | | | 1.7 | | | | | | | | | |

| Net periodic benefit (income) cost | $ | (0.5) | | | $ | 0.3 | | | $ | (1.0) | | | $ | 0.7 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Six Months Ended December 3, 2022 | | Six Months Ended November 27, 2021 | | | | | | | | |

| (In millions) | Domestic | | International | | Domestic | | International | | | | | | | | |

| Service cost | $ | — | | | $ | — | | | $ | 0.2 | | | $ | — | | | | | | | | | |

| Interest cost | 3.0 | | | 1.6 | | | 1.5 | | | 1.7 | | | | | | | | | |

Expected return on plan assets(1) | (4.0) | | | (2.3) | | | (3.1) | | | (3.6) | | | | | | | | | |

| Net amortization loss | — | | | 1.2 | | | — | | | 3.3 | | | | | | | | | |

| Net periodic benefit (income) cost | $ | (1.0) | | | $ | 0.5 | | | $ | (1.4) | | | $ | 1.4 | | | | | | | | | |

(1)The weighted-average expected long-term rate of return on plan assets is 4.99%.

8. Earnings Per Share

The following table reconciles the numerators and denominators used in the calculations of basic and diluted earnings per share ("EPS") for the three and six months ended:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| December 3, 2022 | | November 27, 2021 | | December 3, 2022 | | November 27, 2021 |

Numerators: | | | | | | | |

| Numerator for both basic and diluted EPS, Net earnings (loss) attributable to MillerKnoll, Inc. - in millions | $ | 16.0 | | | $ | (1.7) | | | $ | 41.8 | | | $ | (63.1) | |

| | | | | | | |

Denominators: | | | | | | | |

| Denominator for basic EPS, weighted-average common shares outstanding | 75,370,514 | | | 75,304,752 | | | 75,458,089 | | | 70,803,483 | |

| Potentially dilutive shares resulting from stock plans | 507,564 | | | — | | | 584,551 | | | — | |

| Denominator for diluted EPS | 75,878,078 | | | 75,304,752 | | | 76,042,640 | | | 70,803,483 | |

| Antidilutive equity awards not included in weighted-average common shares - diluted | 2,654,297 | | | 1,518,161 | | | 1,171,951 | | | 1,438,374 | |

9. Stock-Based Compensation

The following table summarizes the stock-based compensation expense and related income tax effect for the three and six months ended:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (In millions) | December 3, 2022 | | November 27, 2021 | | December 3, 2022 | | November 27, 2021 |

| Stock-based compensation expense | $ | 5.5 | | | $ | 7.0 | | | $ | 10.9 | | | $ | 22.1 | |

| Related income tax effect | $ | 1.3 | | | $ | 1.6 | | | $ | 2.6 | | | $ | 5.3 | |

The decrease in stock-based compensation expense in the current three and six month periods as compared to the same periods of the prior year was driven primarily by the prior year's acceleration of stock-based compensation award expense related to the targeted workforce reductions implemented subsequent to the Knoll integration.

Certain Company equity-based compensation awards contain provisions that allow for continued vesting into retirement. Stock-based awards are considered fully vested for expense attribution purposes when the employee's retention of the award is no longer contingent on providing subsequent service.

10. Income Taxes

The Company's process for determining the provision for income taxes for the three and six months ended December 3, 2022 involved using an estimated annual effective tax rate which was based on expected annual income and statutory tax rates across the various jurisdictions in which it operates. The effective tax rates were 19.8% and 77.6%, respectively, for the three month periods ended December 3, 2022 and November 27, 2021. The year over year change in the effective tax rate for the three months ended December 3, 2022 resulted from the current year quarter reporting pre-tax book income with favorable foreign tax credit impacts in the United States. The same quarter of the prior year had no comparable impacts. For the three months ended December 3, 2022, the effective tax rate is lower than the United States federal statutory rate due to the favorable impact of increased foreign tax credits in the United States resulting from the recapture of prior year overall domestic loss. For the three months ended November 27, 2021, the effective tax rate is higher than the United States federal statutory rate due to the impact of applying the estimated annual effective tax rate to the year to date pre-tax loss.

The effective tax rates were 19.2% and 18.8%, respectively, for the six months ended December 3, 2022 and November 27, 2021. The year over year increase in the effective rate for the six months ended December 3, 2022 resulted from pre-tax book income reported for the six months with favorable foreign tax credit impacts in the United States and the same six months in the prior year resulted from an overall pre-tax book loss reported for the six months coupled with non-deductible discrete compensation and acquisition costs in connection with the Knoll acquisition. For the six months ended December 3, 2022, the effective tax rate is lower than the United States federal statutory rate due to the favorable impact of increased foreign tax credits in the United States resulting from the recapture of prior year overall domestic loss. For the six months ended November 27, 2021, the effective tax rate is lower than the United States federal statutory rate due to the impact of applying the estimated annual effective tax rate to the year to date pre-tax loss, which included an adjustment impacted by non-deductible Knoll acquisition related costs.

The Company recognizes interest and penalties related to uncertain tax benefits through income tax expense in its Condensed Consolidated Statements of Comprehensive Income. Interest and penalties recognized in the Company's Condensed Consolidated Statements of Comprehensive Income were negligible for the three and six months ended December 3, 2022 and November 27, 2021.

The Company's recorded liability for potential interest and penalties related to uncertain tax benefits was:

| | | | | | | | | | | |

| (In millions) | December 3, 2022 | | May 28, 2022 |

| Liability for interest and penalties | $ | 0.9 | | | $ | 0.9 | |

| Liability for uncertain tax positions, current | $ | 2.0 | | | $ | 2.3 | |

| | | |

The Company is subject to periodic audits by domestic and foreign tax authorities. Currently, the Company is undergoing routine periodic audits in both domestic and foreign tax jurisdictions. It is reasonably possible that the amounts of unrecognized tax benefits could change in the next twelve months because of the audits. Tax payments related to these audits, if any, are not expected to be material to the Company's Condensed Consolidated Statements of Comprehensive Income.

For the majority of tax jurisdictions, the Company is no longer subject to state, local, or non-United States income tax examinations by tax authorities for fiscal years before 2019.

11. Fair Value Measurements

The Company's financial instruments consist of cash equivalents, marketable securities, accounts and notes receivable, a deferred compensation plan, accounts payable, debt, interest rate swaps, foreign currency exchange contracts, redeemable noncontrolling interests, indefinite-lived intangible assets and right-of-use assets. The Company's financial instruments, other than long-term debt, are recorded at fair value.

The carrying value and fair value of the Company's long-term debt, including current maturities, is as follows for the periods indicated:

| | | | | | | | | | | |

| (In millions) | December 3, 2022 | | May 28, 2022 |

| Carrying value | $ | 1,481.3 | | | $ | 1,427.9 | |

| Fair value | $ | 1,380.9 | | | $ | 1,364.7 | |

The following describes the methods the Company uses to estimate the fair value of financial assets and liabilities recorded in net earnings, which have not significantly changed in the current period:

Cash and cash equivalents — The Company invests excess cash in short term investments in the form of money market funds, which are valued using net asset value ("NAV").

Deferred compensation plan — The Company's deferred compensation plan primarily includes various domestic and international mutual funds that are recorded at fair value using quoted prices for similar securities.

Foreign currency exchange contracts — The Company's foreign currency exchange contracts are valued using an approach based on foreign currency exchange rates obtained from active markets. The estimated fair value of forward currency exchange contracts is based on month-end spot rates as adjusted by market-based current activity. These forward contracts are not designated as hedging instruments.

The following table sets forth financial assets and liabilities measured at fair value through net income and the respective pricing levels to which the fair value measurements are classified within the fair value hierarchy as of December 3, 2022 and May 28, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | December 3, 2022 | | | | May 28, 2022 |

| Financial Assets | NAV | | Quoted Prices with Other