ENTERGY STATISTICAL REPORT |

AND INVESTOR GUIDE |

2015 |

Our Vision: We Power Life | |

Our Mission: We exist to operate a world-class energy business that creates sustainable value for our four stakeholders – owners, customers, employees and the communities in which we operate. | |

For our owners, we create value by aspiring to provide top-quartile returns through the relentless pursuit of opportunities to optimize our business. | |

For our customers, we create value by delivering top-quartile customer satisfaction through anticipating customer needs and exceeding their expectations while keeping rates reasonable. | |

For our employees, we create value by achieving top-quartile organizational health, providing a safe, rewarding, engaging, diverse and inclusive work environment, fair compensation and benefits, and opportunities to advance their careers. | |

For our communities, we create value through economic development, philanthropy, volunteerism and advocacy, and by operating our business safely and in a socially and environmentally responsible way. | |

Entergy Corporation (NYSE: ETR) is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, including nearly 10,000 megawatts of nuclear power. Entergy delivers electricity to 2.8 million utility customers in Arkansas, Louisiana, Mississippi and Texas. Entergy has annual revenues of approximately $11.5 billion and more than 13,000 employees. | |

We have assembled the statistics and facts in this report to support your review and analysis of Entergy’s results over the last five years. This information is available in two electronic files, Excel and PDF in order to facilitate easier access and analysis. | |

Entergy Investor Relations | |

TABLE OF CONTENTS | Note: The Excel Tab labels correspond to the page numbers | |||

in the PDF version of the 2015 Statistical Report. | ||||

Excel Tab | Excel Tab | |||

ABOUT THIS PUBLICATION | Page 2 | UTILITY SECURITIES DETAIL | Page 31 | |

FORWARD-LOOKING INFORMATION | Page 2 | Utility Long-Term Debt and Preferred Stock | Page 31 | |

REGULATION G COMPLIANCE | Page 2 | Entergy Arkansas, Inc. | Page 31 | |

ENTERGY AT A GLANCE | Pages 3 – 4 | Entergy Louisiana, LLC | Page 32 | |

Entergy Mississippi, Inc. | Page 33 | |||

ENTERGY CORPORATION AND SUBSIDIARIES | Entergy New Orleans, Inc. | Page 33 | ||

Selected Financial and Operating Data | Page 5 | Entergy Texas, Inc. | Page 34 | |

Selected Financial Data | Page 5 | System Energy Resources, Inc. | Page 34 | |

Utility Electric Operating Data | Page 5 | UTILITY STATISTICAL INFORMATION | Page 35 | |

Entergy Wholesale Commodities Operating Data | Page 5 | Utility Total Capability | Page 35 | |

Employees | Page 5 | Utility Selected Operating Data | Page 35 | |

Owned and Leased Capability | Page 5 | Utility Consolidating Information | Page 36 | |

Consolidated Quarterly Financial Metrics | Page 6 | Entergy Arkansas, Inc. | Pages 37 – 38 | |

Consolidated Annual Financial Metrics | Page 6 | Entergy Louisiana, LLC | Pages 39 – 40 | |

Financial Results | Page 7 | Entergy Mississippi, Inc. | Pages 41 – 42 | |

Consolidated Quarterly Results | Page 7 | Entergy New Orleans, Inc. | Pages 43 – 44 | |

Consolidated Quarterly Special Items | Pages 8 – 9 | System Energy Resources, Inc. | Page 44 | |

Consolidated Annual Results | Page 10 | Entergy Texas, Inc. | Pages 45 – 46 | |

Consolidated Annual Special Items | Pages 11 – 12 | Utility Nuclear Plant Statistics | Page 47 | |

Consolidated Statements of Income | Page 13 | UTILITY REGULATORY INFORMATION | Page 48 | |

Consolidating Income Statement | Page 14 | Regulatory Commissions | Page 48 | |

Consolidated Balance Sheets | Pages 15 – 16 | Commission/Council Members | Page 48 | |

Consolidating Balance Sheet | Pages 17 – 18 | Utility Electric and Gas Fuel Recovery Mechanisms | Page 49 | |

Consolidated Statements of Cash Flow | Pages 19 – 20 | |||

Cash Flow Information by Business | Page 20 | ENTERGY WHOLESALE COMMODITIES | ||

Consolidated Statements of Changes in Equity | Page 21 | EWC Quarterly Financial Metrics | Page 50 | |

Consolidated Statements of Comprehensive | Page 22 | EWC Annual Financial Metrics | Page 50 | |

Income | EWC Quarterly Operational Metrics | Page 50 | ||

Consolidated Capital Expenditures | Page 23 | EWC Annual Operational Metrics | Page 50 | |

Entergy Corporation Securities Detail | Page 23 | EWC Total Capacity | Page 50 | |

Entergy Corporation Long-Term Debt | Page 23 | EWC Nuclear Plant Statistics | Page 51 | |

Securities Ratings (Outlook) | Page 23 | EWC Non-Nuclear Wholesale Assets | Page 51 | |

Preferred Member Interests | Page 23 | Plant Statistics | ||

EWC Non-Nuclear Wholesale Assets | Page 51 | |||

UTILITY | Plant Emissions | |||

Utility Quarterly Financial Metrics | Page 24 | EWC Nuclear Securities Detail | Page 52 | |

Utility Annual Financial Metrics | Page 24 | EWC Non-Nuclear Wholesale Assets | Page 52 | |

Utility Securities Ratings (Outlook) | Page 24 | Securities Detail | ||

Utility Historical Capital Expenditures | Page 24 | |||

DEFINITIONS OF OPERATIONAL MEASURES AND | ||||

Utility Financial Results | Page 25 | GAAP AND NON-GAAP FINANCIAL MEASURES | Page 53 | |

Utility Consolidating Income Statement | Page 25 | |||

Utility Consolidating Balance Sheet | Pages 26 – 27 | REG G RECONCILIATIONS | ||

Utility Selected Annual Financial Metrics | Pages 28 – 30 | Financial Measures | Pages 54 – 70 | |

INVESTOR INFORMATION | Page 71 | |||

ABOUT THIS PUBLICATION | • uncertainty regarding the establishment of interim or permanent sites for |

This publication is unaudited and should be used in conjunction with Entergy’s | spent nuclear fuel and nuclear waste storage and disposal and the level of |

2015 Annual Report to Shareholders and Form 10-K filed with the Securities | spent fuel and nuclear waste, disposal fees charged by the U.S. |

and Exchange Commission. It has been prepared for information purposes and | government or other providers related to such sites |

is not intended for use in connection with any sale or purchase of, or any offer | • variations in weather and the occurrence of hurricanes and other storms |

to buy, any securities of Entergy Corporation or its subsidiaries. | and disasters, including uncertainties associated with efforts to remediate |

the effects of hurricanes, ice storms, or other weather events and the recovery | |

FORWARD-LOOKING INFORMATION | of costs associated with restoration, including accessing funded storm reserves, |

In this report and from time to time, Entergy Corporation makes statements concerning | federal and local cost recovery mechanisms, securitization, and insurance |

its expectations, beliefs, plans, objectives, goals, strategies, and future | • effects of climate change |

events or performance. Such statements are “forward-looking statements” | • changes in the quality and availability of water supplies and the related |

within the meaning of the Private Securities Litigation Reform Act of 1995. | regulation of water use and diversion |

Words such as “may,” “will,” “could,” “project,” “believe,” “anticipate,” “intend,” | • Entergy’s ability to manage its capital projects and operation |

“expect,” “estimate,” “continue,” “potential,” “plan,” “predict,” “forecast,” | and maintenance costs |

and other similar words or expressions are intended to identify forward-looking | • Entergy’s ability to purchase and sell assets at attractive prices |

statements but are not the only means to identify these statements. Although Entergy | and on other attractive terms |

believes that these forward-looking statements and the underlying assumptions are | • the economic climate, and particularly economic conditions in Entergy’s |

reasonable, it cannot provide assurance that they will prove correct. Any | Utility service area and the Northeast United States and events and |

forward-looking statement is based on information current as of the date of this | circumstances that could influence economic conditions in those areas, |

report and speaks only as of the date on which such statement is made. | including power prices and the risk that anticipated load growth |

Except to the extent required by the federal securities laws, Entergy undertakes | may not materialize |

no obligation to publicly update or revise any forward-looking statements, | • the effects of Entergy’s strategies to reduce tax payments |

whether as a result of new information, future events, or otherwise. | • changes in the financial markets, particularly those affecting |

Forward-looking statements involve a number of risks and uncertainties. | the availability of capital and Entergy’s ability to refinance existing debt, execute |

There are factors that could cause actual results to differ materially from those | share repurchase programs, and fund investments and acquisitions |

expressed or implied in the forward-looking statements, including those | • actions of rating agencies, including changes in the ratings of |

factors discussed or incorporated by reference in (a) Item 1A. Risk Factors | debt and preferred stock, changes in general corporate ratings, |

in the 2015 Form 10-K, (b) Management’s Financial Discussion and Analysis | and changes in the rating agencies’ ratings criteria |

in the 2015 Form 10-K, and (c) the following factors (in addition to others | • changes in inflation and interest rates |

described elsewhere in this report and in subsequent securities filings): | • the effect of litigation and government investigations or proceedings |

• resolution of pending and future rate cases and negotiations, | • changes in technology, including with respect to new, developing, or |

including various performance-based rate discussions, | alternative sources of generation |

Entergy’s utility supply plan, and recovery of fuel and purchased power costs | • the effects of threatened or actual terrorism, cyber attacks or data |

• the termination of Entergy Arkansas’s participation in the System Agreement, | security breaches, including increased security costs, accidents and war or a |

which occurred in December 2013, the termination of Entergy Mississippi's | catastrophic event such as a nuclear accident or a natural gas pipeline |

participation in the System Agreement which occurred in November 2015, and the | explosion |

termination of Entergy Texas's, Entergy Gulf States Louisiana's, and Entergy Louisiana's | • Entergy’s ability to attract and retain talented management and directors |

participation in the System Agreement which will occur on August 31, 2016, and | • changes in accounting standards and corporate governance |

result in the termination of the System Agreement in its entirety pursuant to | • declines in the market prices of marketable securities and resulting funding |

a settlement agreement approved by FERC in December 2015 | requirements and the effects on benefit costs for Entergy’s defined benefit |

• regulatory and operating challenges and uncertainties and economic risks | pension and other postretirement benefit plans |

associated with the Utility operating companies’ move to MISO, which occurred | • future wage and employee benefit costs, including changes |

in December 2013, including the effect of current or projected MISO market rules and | in discount rates and returns on benefit plan assets |

market and system conditions in the MISO markets, the allocation of MISO system | • changes in decommissioning trust fund values or earnings or in the |

transmission upgrade costs, and the effect of planning decisions that MISO makes | timing of, requirement for, or cost to decommission nuclear plant sites |

with respect to future transmission investments by the Utility operating companies | • the implementation of the planned shutdown of Pilgrim and FitzPatrick and the |

• changes in utility regulation, including the beginning or end of retail and wholesale | related decommissioning of those plants and Vermont Yankee |

competition, the ability to recover net utility assets and other potential stranded | • the effectiveness of Entergy’s risk management policies and |

costs, and the application of more stringent transmission reliability requirements | procedures and the ability and willingness of its counterparties |

or market power criteria by the FERC | to satisfy their financial and performance commitments |

• changes in the regulation or regulatory oversight of Entergy’s nuclear generating | • factors that could lead to impairment of long-lived assets |

facilities and nuclear materials and fuel, including with respect to the planned, potential | • the ability to successfully complete merger, acquisition, or |

or actual shutdown of nuclear generating facilities owned or operated by | divestiture plans, regulatory or other limitations imposed as a |

Entergy Wholesale Commodities and the effects of new or existing safety or | result of merger, acquisition, or divestiture, and the success of |

environmental concerns regarding nuclear power plants and nuclear fuel | the business following a merger, acquisition, or divestiture |

• resolution of pending or future applications, and related regulatory proceedings | |

and litigation, for license renewals or modifications or other authorizations required | REGULATION G COMPLIANCE |

of nuclear generating facilities and the effect of public and political opposition on | Financial performance measures shown in this report include those |

these applications, regulatory proceedings and litigation | calculated and presented in accordance with generally accepted |

• the performance of and deliverability of power from Entergy’s generation | accounting principles (GAAP), as well as those that are considered |

resources, including the capacity factors at its nuclear generating facilities | non-GAAP measures. This report includes non-GAAP measures |

• Entergy’s ability to develop and execute on a point of view regarding future | of operational earnings; operational earnings per share; |

prices of electricity, natural gas, and other energy-related commodities | operational adjusted EBITDA; operational return |

• prices for power generated by Entergy’s merchant generating | on average invested capital; operational return on average common or |

facilities and the ability to hedge, meet credit support requirements for hedges, | members’ equity; operational price to earnings ratio; |

sell power forward or otherwise reduce the market price risk associated | operational non-fuel operation and maintenance expense; |

with those facilities, including the Entergy Wholesale Commodities nuclear plants | operational common dividend payout ratio; gross liquidity; net debt to |

• the prices and availability of fuel and power Entergy must purchase | net capital ratio; debt to capital ratio, excluding securitization debt; |

for its Utility customers, and Entergy’s ability to meet credit support | net debt to net capital ratio, excluding securitization debt; |

requirements for fuel and power supply contracts | parent debt to total debt ratio, excluding securitization debt; |

• volatility and changes in markets for electricity, natural gas, | debt to operational adjusted EBITDA, excluding securitization debt; |

uranium, emissions allowances, and other energy-related commodities, | operational FFO to debt ratio, excluding securitization debt; |

and the effect of those changes on Entergy and its customers | adjusted average total revenue per MWh; adjusted average total revenue per |

• changes in law resulting from federal or state energy legislation or | per MWH, excluding VY; and operational non-fuel O&M per MWh |

legislation subjecting energy derivatives used in hedging and risk | when describing Entergy’s results of operations and financial |

management transactions to governmental regulation | performance. We have prepared reconciliations of these measures to the |

• changes in environmental, tax, and other laws and regulations, including requirements | most directly comparable GAAP measures. Reconciliations can be found |

for reduced emissions of sulfur dioxide, nitrogen oxide, greenhouse gases, mercury, | on pages 7, 10, and 54 – 70. |

thermal energy and other regulated air and water emissions, and changes in costs of | |

compliance with environmental and other laws and regulations | |

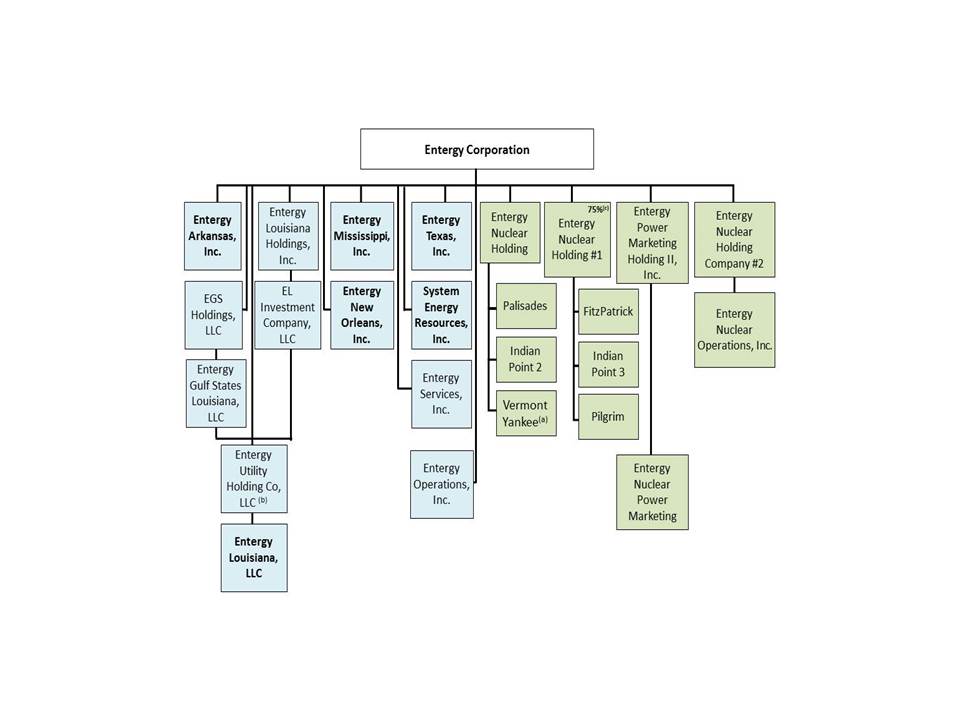

ENTERGY AT A GLANCE | ||

BUSINESS SEGMENT AND LEGAL ENTITY STRUCTURE OVERVIEW | ||

Above diagram represents business segment structure and does not necessarily represent complete legal entity organization structure. | ||

Only Entergy Wholesale Commodities plants with greater than 500 MWs of owned capacity are shown. | ||

(a) Vermont Yankee plant ceased power production on 12/29/14 | ||

(b) Entergy Corp. owns 5%, Entergy Gulf States Louisiana, LLC owns 31.5%, and EL Investment Co., LLC owns 42.5% | ||

Unaffiliated third parties own 21% | ||

(c) Remaining 25% is owned by another Entergy affiliate | ||

CORPORATE PROFILE | BUSINESS SEGMENTS | |

Entergy Corporation is a Fortune 500 integrated energy company | Entergy’s five year results in this report are presented in | |

engaged primarily in electric power production and retail | three business segments: | |

distribution operations. | ||

• Approximately 30,000 MW electric generating capacity | • Utility | |

• Nearly 10,000 MW nuclear power | • Entergy Wholesale Commodities | |

• 2.8 million utility customers | • Parent and Other | |

• Approximately $11.5 billion annual revenues | ||

• More than 13,000 employees | In fourth quarter 2012, Entergy included subsidiaries | |

• 83 electric generating units operated | previously included and reported in the | |

Parent & Other segment in the Entergy Wholesale | ||

Commodities segment to improve the alignment of certain | ||

intercompany items. The prior period financial information | ||

in this report has been restated to reflect this change. | ||

On October 1, 2015, the businesses formerly conducted by Entergy Louisiana and Entergy Gulf States Louisiana were combined into a single public utility. With the completion of the business combination, Entergy Louisiana holds substantially all of the assets, and has assumed the liabilities, of Entergy Louisiana and Entergy Gulf States Louisiana. The combination was accounted for as a transaction between entities under common control. The effect of the business combination has been retrospectively applied to Entergy Louisiana's data presented in this report. | ||

ENTERGY CORPORATION AND SUBSIDIARIES | ||

BUSINESS SEGMENTS (CONTINUED) | ||

UTILITY | ENTERGY WHOLESALE COMMODITIES | |

Entergy’s utility companies generate, transmit, distribute, and sell | Entergy’s Wholesale Commodities business owns, operates and decommissions | |

electric power, and operate a small natural gas distribution business. | nuclear plants in the northern United States. This business is focused on | |

• Five electric utilities with 2.8 million customers | selling power produced by its operating plants to wholesale customers. | |

• Four states – Arkansas, Louisiana, Mississippi, Texas | Entergy’s Wholesale Commodities business also owns interests in non-nuclear | |

• 22,000 MW generating capacity | power plants that sell the electric power produced by those plants to | |

• Two gas utilities with 199,000 customers | wholesale customers. This business also provides services to other nuclear | |

power plant owners. | ||

ENTERGY ARKANSAS, INC. (EAI) | • 4,406 MW nuclear-owned generating capacity in five units in northern U.S. | |

Entergy Arkansas generates, transmits, distributes, and sells electric | • Pilgrim Nuclear Power Station in Plymouth, Massachusetts | |

power to 705,000 retail customers in portions of Arkansas. | • James A. FitzPatrick in Oswego, New York | |

• Indian Point Units 2 and 3 in Buchanan, New York | ||

ENTERGY LOUISIANA, LLC (ELL) | • Palisades Nuclear Energy Plant in Covert, Michigan | |

Entergy Louisiana generates, transmits, distributes, and sells electric | • 474 net MW non-nuclear generating capacity | |

power to 1,064,000 retail customers in portions of Louisiana. Entergy | • 800 MW under management services contract | |

Louisiana also provides natural gas service to 94,000 customers in | • Cooper Nuclear Station located near Brownville, Nebraska | |

the Baton Rouge, Louisiana area. | • Contracts (ongoing and completed) with other nuclear facility owners to | |

provide decommissioning and license renewal services | ||

ENTERGY MISSISSIPPI, INC. (EMI) | ||

Entergy Mississippi generates, transmits, distributes, and sells electric | On Dec. 29, 2014, Entergy Wholesale Commodities’ Vermont Yankee | |

power to 445,000 retail customers in portions of Mississippi. | nuclear plant ceased power production and entered its decommissioning | |

phase. | ||

ENTERGY NEW ORLEANS, INC. (ENOI) | ||

Entergy New Orleans generates, transmits, distributes, and sells | In 2015, Entergy determined that shutdown of FitzPatrick is planned | |

electric power to 197,000 retail customers in the city of New Orleans, | for 1/27/17, and Pilgrim shutdown is planned for 5/31/19. | |

Louisiana. Entergy New Orleans also provides natural gas utility | ||

service to 105,000 customers in the city of New Orleans. | ||

ENTERGY TEXAS, INC. (ETI) | ||

Entergy Texas generates, transmits, distributes, and sells electric power | ||

to 434,000 retail customers in portions of Texas. | ||

SYSTEM ENERGY RESOURCES, INC. (SERI) | ||

System Energy owns or leases 90% of the Grand Gulf 1 nuclear | ||

generating facility. System Energy sells energy and capacity from | ||

Grand Gulf 1 at wholesale to Entergy Arkansas (36%), Entergy Louisiana (14%), | ||

Entergy Mississippi (33%) and Entergy New Orleans (17%). | ||

UTILITY NUCLEAR PLANTS | ||

Entergy owns and operates five nuclear units at four plant sites to serve | ||

its regulated utility business: Arkansas Nuclear One (ANO) Units 1 and 2 | ||

near Russellville, Arkansas; Grand Gulf Nuclear Station in Port Gibson, | ||

Mississippi; River Bend Station in St. Francisville, Louisiana and | ||

Waterford 3 in Killona, Louisiana. | ||

SELECTED FINANCIAL AND OPERATING DATA

SELECTED FINANCIAL DATA | ||||||||||||||||

(In millions, except percentages, per share amounts, and ratios) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

GAAP MEASURES | ||||||||||||||||

Operating Revenues | $11,513 | $12,495 | $11,391 | $10,302 | $11,229 | |||||||||||

As-Reported Net Income | ($177 | ) | $941 | $712 | $847 | $1,346 | ||||||||||

As-Reported Earnings Per Share | ($0.99 | ) | $5.22 | $3.99 | $4.76 | $7.55 | ||||||||||

Shares of Common Stock Outstanding | ||||||||||||||||

End of Year | 178.4 | 179.2 | 178.4 | 177.8 | 176.4 | |||||||||||

Weighted Average – Diluted | 179.2 | 180.3 | 178.6 | 177.7 | 178.4 | |||||||||||

Return on Average Invested Capital – As-Reported | 1.0 | % | 5.6 | % | 4.7 | % | 5.5 | % | 8.0 | % | ||||||

Return on Average Common Equity – As-Reported | (1.8 | )% | 9.6 | % | 7.6 | % | 9.3 | % | 15.4 | % | ||||||

Net Cash Flow Provided by Operating Activities | $3,291 | $3,889 | $3,189 | $2,940 | $3,129 | |||||||||||

Year-End Closing Market Price Per Share of Common Stock | $68.36 | $87.48 | $63.27 | $63.75 | $73.05 | |||||||||||

Book Value Per Share at End of Year | $51.89 | $55.83 | $54.00 | $51.72 | $50.81 | |||||||||||

Market Value of Equity at End of Year | $12,195 | $15,680 | $11,286 | $11,335 | $12,883 | |||||||||||

Price to Earnings Ratio – As-Reported | (69.37 | ) | 16.77 | 15.87 | 13.39 | 9.68 | ||||||||||

Common Dividend Paid Per Share | $3.34 | $3.32 | $3.32 | $3.32 | $3.32 | |||||||||||

Common Dividend Payout Ratio – As-Reported | (339 | )% | 64 | % | 83 | % | 70 | % | 44 | % | ||||||

NON-GAAP MEASURES | ||||||||||||||||

Operational Earnings | $1,076 | $1,050 | $957 | $1,109 | $1,359 | |||||||||||

Operational Earnings Per Share | $6.00 | $5.83 | $5.36 | $6.23 | $7.62 | |||||||||||

Special Items Per Share | ($6.99 | ) | ($0.61 | ) | ($1.37 | ) | ($1.47 | ) | ($0.07 | ) | ||||||

Return on Average Invested Capital – Operational | 6.3 | % | 6.1 | % | 5.8 | % | 6.6 | % | 8 | % | ||||||

Return on Average Common Equity – Operational | 11.2 | % | 10.7 | % | 10.2 | % | 12.2 | % | 15.6 | % | ||||||

Price to Earnings Ratio – Operational | 11.38 | 15.02 | 11.80 | 10.23 | 9.59 | |||||||||||

Common Dividend Payout Ratio – Operational | 56 | % | 57 | % | 62 | % | 53 | % | 44 | % | ||||||

Certain prior year data has been reclassified to conform with current year presentation. | ||||||||||||||||

UTILITY ELECTRIC OPERATING DATA | ||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||

Retail Kilowatt-Hour Sales (millions) | 112,312 | 110,910 | 107,781 | 107,004 | 108,688 | |||||||||||

Peak Demand (megawatts) | 21,730 | 20,472 | 21,581 | 21,866 | 22,387 | |||||||||||

Retail Customers – Year End (thousands) | 2,845 | 2,818 | 2,800 | 2,778 | 2,757 | |||||||||||

ENTERGY WHOLESALE COMMODITIES OPERATING DATA | ||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||

Operating Revenues (millions)(a) | $2,062 | $2,719 | $2,313 | $2,326 | $2,414 | |||||||||||

Billed Electric Energy Sales (gigawatt hours) | 39,745 | 44,424 | 45,127 | 46,178 | 43,497 | |||||||||||

(a) Includes revenue associated with below-market PPA for Palisades of $15,199,380 for 2015, $16,496,061 for 2014, $17,654,839 for 2013, $16,724,963 for 2012, and $42,996,197 for 2011. | ||||||||||||||||

EMPLOYEES | ||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||

Total Employees – Year End | 13,579 | 13,393 | 13,808 | 14,625 | 14,682 | |||||||||||

OWNED AND LEASED CAPABILITY (MW)(a) | |||||||||||||||||

As of December 31, 2015 | |||||||||||||||||

Entergy | Entergy | Entergy | Entergy | Entergy | System | Entergy Wholesale | |||||||||||

Arkansas | Louisiana | Mississippi | New Orleans | Texas | Energy | Commodities(c)(d) | Total | ||||||||||

Gas/Oil | 1,646 | 6,770 | 3,116 | 781 | 2,272 | — | 213 | 14,798 | |||||||||

Coal | 1,197 | 360 | 420 | — | 266 | — | 181 | 2,424 | |||||||||

Total Fossil | 2,843 | 7,130 | 3,536 | 781 | 2,538 | — | 394 | 17,222 | |||||||||

Nuclear | 1,809 | 2,128 | — | — | — | 1,261 | 4,406 | 9,604 | |||||||||

Other(b) | 74 | — | — | — | — | — | 80 | 154 | |||||||||

Total | 4,726 | 9,258 | 3,536 | 781 | 2,538 | 1,261 | 4,880 | 26,980 | |||||||||

(a) Owned and Leased Capability is the dependable load carrying capability as demonstrated under actual operating conditions based on the primary fuel (assuming no curtailments) that each station was designed to utilize. | |||||||||||||||||

(b) Other includes Hydro (EAI) and Wind (EWC). | |||||||||||||||||

(c) Reflects Net MW in Operation. Net MW in Operation is the installed capacity owned and operated. Excludes management services contract for Cooper Nuclear Station. | |||||||||||||||||

(d) Reflects nameplate rating of generating unit and excludes capacity under contract. | |||||||||||||||||

CONSOLIDATED ENTERGY CORPORATION AND SUBSIDIARIES DATA | ||||||||||||||||||||||

CONSOLIDATED QUARTERLY FINANCIAL METRICS | ||||||||||||||||||||||

2015 | 2014 | YTD % | ||||||||||||||||||||

1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | CHANGE | ||||||||||||

GAAP MEASURES | ||||||||||||||||||||||

As-Reported Net Income ($ millions) | 298 | 149 | (723 | ) | 100 | (177 | ) | 401 | 189 | 230 | 120 | 941 | (118.8 | ) | ||||||||

As-Reported Non-Fuel O&M ($ millions) | 835 | 895 | 921 | 955 | 3,606 | 795 | 882 | 914 | 988 | 3,578 | 0.8 | |||||||||||

Return on Average Invested Capital – | ||||||||||||||||||||||

As-Reported (%)(a) | 5.1 | 5.0 | 1.1 | 1.0 | 1.0 | 5.7 | 5.8 | 5.8 | 5.6 | 5.6 | (82.1 | ) | ||||||||||

Return on Average Common Equity – | ||||||||||||||||||||||

As-Reported (%)(a) | 8.3 | 7.9 | (1.6 | ) | (1.8 | ) | (1.8 | ) | 9.9 | 10.1 | 9.9 | 9.6 | 9.6 | (118.8 | ) | |||||||

Revolver Capacity ($ millions) | 3,779 | 4,158 | 3,869 | 3,582 | 3,582 | 4,077 | 4,003 | 3,975 | 3,592 | 3,592 | (0.3 | ) | ||||||||||

Total Debt ($ millions) | 14,044 | 13,858 | 14,144 | 13,850 | 13,850 | 13,860 | 13,692 | 13,673 | 13,917 | 13,917 | (0.5 | ) | ||||||||||

Debt to Capital Ratio (%) | 57.4 | 57.0 | 60.2 | 59.1 | 59.1 | 57.5 | 56.9 | 56.7 | 57.4 | 57.4 | 3.0 | |||||||||||

NON-GAAP MEASURES | ||||||||||||||||||||||

Operational Earnings ($ millions) | 303 | 150 | 341 | 283 | 1,076 | 410 | 200 | 304 | 135 | 1,050 | 2.5 | |||||||||||

Operational Non-Fuel O&M ($ millions) | 842 | 897 | 923 | 961 | 3,623 | 807 | 898 | 925 | 1,009 | 3,637 | (0.4 | ) | ||||||||||

Return on Average Invested Capital – | ||||||||||||||||||||||

Operational (%)(a) | 5.6 | 5.4 | 5.6 | 6.3 | 6.3 | 6.8 | 6.8 | 6.3 | 6.1 | 6.1 | 3.3 | |||||||||||

Return on Average Common Equity – | ||||||||||||||||||||||

Operational (%)(a) | 9.4 | 8.8 | 9.6 | 11.2 | 11.2 | 12.5 | 12.6 | 11.2 | 10.7 | 10.7 | 4.7 | |||||||||||

Total Gross Liquidity ($ millions) | 4,960 | 5,068 | 4,910 | 4,933 | 4,933 | 4,985 | 4,653 | 5,044 | 5,014 | 5,014 | (1.6 | ) | ||||||||||

Debt to Capital Ratio, Excluding Securitization Debt (%) | 56.0 | 55.6 | 58.7 | 57.7 | 57.7 | 55.9 | 55.4 | 55.2 | 56.0 | 56.0 | 3.0 | |||||||||||

Net Debt to Net Capital Ratio, Excluding Securitization Debt (%) | 53.7 | 53.9 | 56.7 | 55.0 | 55.0 | 54.1 | 54.1 | 53.0 | 53.2 | 53.2 | 3.4 | |||||||||||

Parent Debt to Total Debt Ratio, Excluding Securitization Debt (%) | 20.9 | 20.3 | 20.9 | 21.9 | 21.9 | 20.6 | 20.2 | 19.6 | 20.4 | 20.4 | 7.4 | |||||||||||

Debt to Operational EBITDA, Excluding Securitization Debt | 3.9 | 3.9 | 3.9 | 4.1 | 4.1 | 3.7 | 3.5 | 3.6 | 3.7 | 3.7 | 10.8 | |||||||||||

Operational FFO to Debt Ratio, Excluding Securitization Debt (%) | 28.2 | 28.4 | 25.4 | 25.7 | 25.7 | 26.9 | 28.9 | 29.4 | 27.8 | 27.8 | (7.6 | ) | ||||||||||

(a) Rolling twelve months. Totals may not foot due to rounding. | ||||||||||||||||||||||

Certain prior year data has been reclassified to conform with current year presentation. | ||||||||||||||||||||||

CONSOLIDATED ANNUAL FINANCIAL METRICS | ||||||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||||

GAAP MEASURES | ||||||||||||||||||||||

As-Reported Net Income ($ millions) | (177 | ) | 941 | 712 | 847 | 1,346 | ||||||||||||||||

As-Reported Non-Fuel O&M ($ millions) | 3,606 | 3,578 | 3,589 | 3,291 | 3,123 | |||||||||||||||||

Return on Average Invested Capital – As-Reported (%) | 1.0 | 5.6 | 4.7 | 5.5 | 8.0 | |||||||||||||||||

Return on Average Common Equity – As-Reported (%) | (1.8 | ) | 9.6 | 7.6 | 9.3 | 15.4 | ||||||||||||||||

Revolver Capacity ($ millions) | 3,582 | 3,592 | 3,977 | 3,462 | 2,001 | |||||||||||||||||

Total Debt ($ millions) | 13,850 | 13,917 | 13,562 | 13,358 | 12,283 | |||||||||||||||||

Debt to Capital Ratio (%) | 59.1 | 57.4 | 57.7 | 58.5 | 57.1 | |||||||||||||||||

Off-Balance Sheet Liabilities ($ millions) | ||||||||||||||||||||||

Debt of Joint Ventures – Entergy’s Share | 77 | 81 | 86 | 90 | 94 | |||||||||||||||||

Leases – Entergy’s Share | 359 | 422 | 456 | 505 | 508 | |||||||||||||||||

Power Purchase Agreements Accounted for as Leases (a) | 195 | 224 | 253 | 282 | 307 | |||||||||||||||||

Total | 631 | 727 | 795 | 877 | 909 | |||||||||||||||||

NON-GAAP MEASURES | ||||||||||||||||||||||

Operational Earnings ($ millions) | 1,076 | 1,050 | 957 | 1,109 | 1,359 | |||||||||||||||||

Operational Non-Fuel O&M ($ millions) | 3,623 | 3,637 | 3,690 | 3,330 | 3,136 | |||||||||||||||||

Return on Average Invested Capital – Operational (%) | 6.3 | 6.1 | 5.8 | 6.6 | 8.0 | |||||||||||||||||

Return on Average Common Equity – Operational (%) | 11.2 | 10.7 | 10.2 | 12.2 | 15.6 | |||||||||||||||||

Total Gross Liquidity ($ millions) | 4,933 | 5,014 | 4,716 | 3,995 | 2,695 | |||||||||||||||||

Debt to Capital Ratio, Excluding Securitization Debt (%) | 57.7 | 56.0 | 56.1 | 56.6 | 54.8 | |||||||||||||||||

Net Debt to Net Capital Ratio, Excluding Securitization Debt (%) | 55.0 | 53.2 | 54.6 | 55.6 | 53.2 | |||||||||||||||||

Parent Debt to Total Debt, Excluding Securitization Debt (%) | 21.9 | 20.4 | 21.9 | 23.7 | 25.8 | |||||||||||||||||

Debt to Operational EBITDA, Excluding Securitization Debt | 4.1 | 3.7 | 4.0 | 4.1 | 3.3 | |||||||||||||||||

Operational FFO to Debt Ratio, Excluding Securitization Debt (%) | 25.7 | 27.8 | 27.0 | 24.0 | 22.6 | |||||||||||||||||

Totals may not foot due to rounding. | ||||||||||||||||||||||

Certain prior year data has been reclassified to conform with current year presentation. | ||||||||||||||||||||||

(a) For further detail, see Note 10 on page 164 of the 2015 SEC Form 10-K. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED QUARTERLY RESULTS – GAAP TO NON-GAAP RECONCILIATION | ||||||||||||||||||||||

2015 | 2014 | YTD | ||||||||||||||||||||

($/share) | 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | CHANGE | |||||||||||

AS-REPORTED | ||||||||||||||||||||||

Utility | 1.24 | 1.11 | 2.01 | 1.75 | 6.12 | 1.12 | 1.15 | 1.72 | 0.60 | 4.60 | 1.52 | |||||||||||

Entergy Wholesale Commodities | 0.68 | (0.02 | ) | (5.76 | ) | (0.86 | ) | (5.96 | ) | 1.35 | 0.14 | (0.18 | ) | 0.31 | 1.62 | (7.58 | ) | |||||

Parent & Other | (0.27 | ) | (0.26 | ) | (0.29 | ) | (0.33 | ) | (1.15 | ) | (0.23 | ) | (0.24 | ) | (0.27 | ) | (0.25 | ) | (1.00 | ) | (0.15 | ) |

CONSOLIDATED AS-REPORTED EARNINGS | 1.65 | 0.83 | (4.04 | ) | 0.56 | (0.99 | ) | 2.24 | 1.05 | 1.27 | 0.66 | 5.22 | (6.21 | ) | ||||||||

LESS SPECIAL ITEMS | ||||||||||||||||||||||

Utility | — | — | — | — | — | (0.01 | ) | (0.02 | ) | — | (0.01 | ) | (0.04 | ) | 0.04 | |||||||

Entergy Wholesale Commodities | (0.03 | ) | — | (5.94 | ) | (1.02 | ) | (6.99 | ) | (0.04 | ) | (0.04 | ) | (0.41 | ) | (0.08 | ) | (0.57 | ) | (6.42 | ) | |

Parent & Other | — | — | — | — | — | — | — | — | — | — | — | |||||||||||

TOTAL SPECIAL ITEMS | (0.03 | ) | — | (5.94 | ) | (1.02 | ) | (6.99 | ) | (0.05 | ) | (0.06 | ) | (0.41 | ) | (0.09 | ) | (0.61 | ) | (6.38 | ) | |

OPERATIONAL | ||||||||||||||||||||||

Utility | 1.24 | 1.11 | 2.01 | 1.75 | 6.12 | 1.13 | 1.17 | 1.72 | 0.61 | 4.64 | 1.48 | |||||||||||

Entergy Wholesale Commodities | 0.71 | (0.02 | ) | (0.29 | ) | 0.16 | 1.03 | 1.39 | 0.18 | 0.23 | 0.39 | 2.19 | (1.16 | ) | ||||||||

Parent & Other | (0.27 | ) | (0.26 | ) | 0.18 | (0.33 | ) | (1.15 | ) | (0.23 | ) | (0.24 | ) | (0.27 | ) | (0.25 | ) | (1.00 | ) | (0.15 | ) | |

CONSOLIDATED OPERATIONAL EARNINGS | 1.68 | 0.83 | 1.90 | 1.58 | 6.00 | 2.29 | 1.11 | 1.68 | 0.75 | 5.83 | 0.17 | |||||||||||

Weather Impact | 0.08 | (0.02 | ) | 0.16 | (0.03 | ) | 0.19 | 0.18 | (0.05 | ) | (0.11 | ) | 0.05 | 0.07 | 0.12 | |||||||

SHARES OF COMMON STOCK | ||||||||||||||||||||||

OUTSTANDING (in millions) | ||||||||||||||||||||||

End of Period | 179.5 | 179.5 | 178.4 | 178.4 | 178.4 | 179.1 | 179.6 | 179.6 | 179.2 | 179.2 | (0.8) | |||||||||||

Weighted Average - Diluted | 180.5 | 180 | 180.5 | 179.1 | 179.2 | 179.1 | 180.0 | 180.5 | 181.6 | 180.3 | (1.1) | |||||||||||

Totals may not foot due to rounding. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED QUARTERLY SPECIAL ITEMS - BY ITEM TYPE | ||||||||||||||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||||||||||||||

2015 | 2014 | YTD | ||||||||||||||||||||

($/share) | 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | CHANGE | |||||||||||

UTILITY | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

HCM implementation expenses | — | — | — | (0.01 | ) | (0.02 | ) | — | (0.01 | ) | (0.04 | ) | 0.04 | |||||||||

Total | — | — | — | — | — | (0.01 | ) | (0.02 | ) | — | (0.01 | ) | (0.04 | ) | 0.04 | |||||||

ENTERGY WHOLESALE COMMODITIES | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Decisions to close VY, FitzPatrick, and Pilgrim | (0.03 | ) | — | (5.94 | ) | (0.02 | ) | (5.99 | ) | (0.03 | ) | (0.04 | ) | (0.41 | ) | (0.08 | ) | (0.56 | ) | (5.43 | ) | |

Palisades asset impairment and related write-offs | — | — | — | (1.43 | ) | (1.43 | ) | — | — | — | — | — | (1.43 | ) | ||||||||

Top Deer investment impairment | — | — | — | (0.13 | ) | (0.13 | ) | — | — | — | — | — | (0.13 | ) | ||||||||

Gain on the sale of RISEC | — | — | — | 0.56 | 0.56 | — | — | — | — | — | 0.56 | |||||||||||

HCM implementation expenses | — | — | — | — | — | (0.01 | ) | — | — | — | (0.01 | ) | 0.01 | |||||||||

Total | (0.03 | ) | — | (5.94 | ) | (1.02 | ) | (6.99 | ) | (0.04 | ) | (0.04 | ) | (0.41 | ) | (0.08 | ) | (0.57 | ) | (6.42 | ) | |

TOTAL SPECIAL ITEMS | (0.03 | ) | — | (5.94 | ) | (1.02 | ) | (6.99 | ) | (0.05 | ) | (0.06 | ) | (0.41 | ) | (0.09 | ) | (0.61 | ) | (6.38 | ) | |

2015 | 2014 | YTD | ||||||||||||||||||||

($ millions) | 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | CHANGE | |||||||||||

UTILITY | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

HCM implementation expenses | — | — | — | — | — | (2.3 | ) | (3.5 | ) | (0.3 | ) | (1.5 | ) | (7.6 | ) | 7.6 | ||||||

Total | — | — | — | — | — | (2.3 | ) | (3.5 | ) | (0.3 | ) | (1.5 | ) | (7.6 | ) | 7.6 | ||||||

ENTERGY WHOLESALE COMMODITIES | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Decisions to close VY, FitzPatrick, and Pilgrim | (4.6 | ) | (1.1 | ) | (1,063.7 | ) | (3.3 | ) | (1,072.7 | ) | (5.9 | ) | (6.9 | ) | (73.7 | ) | (13.2 | ) | (99.7 | ) | (973.0 | ) |

Palisades asset impairment and related write-offs | — | — | — | (255.9 | ) | (255.9 | ) | — | — | — | — | — | (255.9 | ) | ||||||||

Top Deer investment impairment | — | — | — | (23.9 | ) | (23.9 | ) | — | — | — | — | — | (23.9 | ) | ||||||||

Gain on the sale of RISEC | — | — | — | 100.1 | 100.1 | — | — | — | — | — | 100.1 | |||||||||||

HCM implementation expenses | — | — | — | — | — | (0.7 | ) | (0.6 | ) | (0.3 | ) | (0.5 | ) | (2.1 | ) | 2.1 | ||||||

Total | (4.6 | ) | (1.1 | ) | (1,063.7 | ) | (183.0 | ) | (1,252.4 | ) | (6.6 | ) | (7.5 | ) | (74.0 | ) | (13.7 | ) | (101.8 | ) | (1,150.6 | ) |

TOTAL SPECIAL ITEMS | (4.6 | ) | (1.1 | ) | (1,063.7 | ) | (183.0 | ) | (1,252.4 | ) | (8.9 | ) | (11.0 | ) | (74.3 | ) | (15.2 | ) | (109.4 | ) | (1,143.0 | ) |

Totals may not foot due to rounding. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS - BY INCOME STATEMENT LINE ITEM | ||||||||||||||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||||||||||||||

2015 | 2014 | |||||||||||||||||||||

(Pre-tax except for Income taxes, $ millions) | 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | CHANGE | |||||||||||

UTILITY SPECIAL ITEMS | ||||||||||||||||||||||

Other operation and maintenance | — | — | — | — | — | (3.9 | ) | (5.6 | ) | (0.7 | ) | (2.4 | ) | (12.6 | ) | 12.6 | ||||||

Taxes other than income taxes | — | — | — | — | — | (0.2 | ) | (0.3 | ) | — | (0.1 | ) | (0.6 | ) | 0.6 | |||||||

Income taxes | — | — | — | — | — | 1.8 | 2.4 | 0.4 | 1.0 | 5.6 | (5.6 | ) | ||||||||||

Total | — | — | — | — | — | (2.3 | ) | (3.5 | ) | (0.3 | ) | (1.5 | ) | (7.6 | ) | 7.6 | ||||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||||||||||||||

Other operation and maintenance | (7.5 | ) | (1.6 | ) | (1.7 | ) | (6.2 | ) | (17.0 | ) | (7.8 | ) | (9.6 | ) | (10.2 | ) | (19.1 | ) | (46.8 | ) | 29.8 | |

Asset write-offs, impairments, and related charges | — | — | (1,642.2 | ) | (394.0 | ) | (2,036.2 | ) | (2.3 | ) | (1.7 | ) | (103.0 | ) | (0.6 | ) | (107.5 | ) | (1,928.7 | ) | ||

Taxes other than income taxes | 0.3 | — | (0.1 | ) | (0.5 | ) | (0.3 | ) | (0.6 | ) | (0.8 | ) | (0.8 | ) | (1.4 | ) | (3.6 | ) | 3.3 | |||

Gain on sale of asset | — | — | — | 154.0 | 154.0 | — | — | — | — | — | 154.0 | |||||||||||

Miscellaneous net (other income) | — | — | — | (36.8 | ) | (36.8 | ) | — | — | — | — | — | (36.8 | ) | ||||||||

Income taxes | 2.5 | 0.6 | 580.3 | 100.4 | 683.8 | 4.1 | 4.6 | 39.9 | 7.4 | 56.1 | 627.7 | |||||||||||

Total | (4.6 | ) | (1.1 | ) | (1,063.7 | ) | (183.0 | ) | (1,252.4 | ) | (6.6 | ) | (7.5 | ) | (74.0 | ) | (13.7 | ) | (101.8 | ) | (1,150.6 | ) |

TOTAL SPECIAL ITEMS | (4.6 | ) | (1.1 | ) | (1,063.7 | ) | (183.0 | ) | (1,252.4 | ) | (8.9 | ) | (11.0 | ) | (74.3 | ) | (15.2 | ) | (109.4 | ) | (1,143.0 | ) |

*Operating revenue less fuel, fuel related expenses, purchased power and other regulatory charges (credits) – net. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL RESULTS – GAAP TO NON-GAAP RECONCILIATION | ||||||||||

($/share) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||

AS-REPORTED | ||||||||||

Utility | 6.12 | 4.60 | 4.64 | 5.30 | 6.20 | |||||

Entergy Wholesale Commodities | (5.96 | ) | 1.62 | 0.24 | 0.23 | 2.74 | ||||

Parent & Other | (1.15 | ) | (1.00 | ) | (0.89 | ) | (0.77 | ) | (1.39 | ) |

CONSOLIDATED AS-REPORTED EARNINGS | (0.99 | ) | 5.22 | 3.99 | 4.76 | 7.55 | ||||

LESS SPECIAL ITEMS | ||||||||||

Utility | — | (0.04 | ) | (0.16 | ) | (0.21 | ) | — | ||

Entergy Wholesale Commodities | (6.99 | ) | (0.57 | ) | (1.23 | ) | (1.26 | ) | — | |

Parent & Other | — | — | 0.02 | — | (0.07 | ) | ||||

TOTAL SPECIAL ITEMS | (6.99 | ) | (0.61 | ) | (1.37 | ) | (1.47 | ) | (0.07 | ) |

OPERATIONAL | ||||||||||

Utility | 6.12 | 4.64 | 4.80 | 5.51 | 6.20 | |||||

Entergy Wholesale Commodities | 1.03 | 2.19 | 1.47 | 1.49 | 2.74 | |||||

Parent & Other | (1.15 | ) | (1.00 | ) | (0.91 | ) | (0.77 | ) | (1.32 | ) |

CONSOLIDATED OPERATIONAL EARNINGS | 6.00 | 5.83 | 5.36 | 6.23 | 7.62 | |||||

Weather Impact | 0.19 | 0.07 | — | (0.09 | ) | 0.52 | ||||

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS - BY ITEM TYPE | ||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||

($/share) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | (0.05 | ) | (0.21 | ) | — | |||

HCM implementation expenses | — | (0.04 | ) | (0.11 | ) | — | — | |||

Total | — | (0.04 | ) | (0.16 | ) | (0.21 | ) | — | ||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Decisions to close VY, FitzPatrick, and Pilgrim | (5.99 | ) | (0.56 | ) | (1.15 | ) | (1.26 | ) | — | |

Palisades asset impairment and related write-offs | (1.43 | ) | — | — | — | — | ||||

Top Deer investment impairment | (0.13 | ) | — | — | — | — | ||||

Gain on the sale of RISEC | 0.56 | — | — | — | — | |||||

HCM implementation expenses | — | (0.01 | ) | (0.08 | ) | — | — | |||

Total | (6.99 | ) | (0.57 | ) | (1.23 | ) | (1.26 | ) | — | |

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | 0.03 | — | (0.07 | ) | ||||

HCM implementation expenses | — | — | (0.01 | ) | — | — | ||||

Total | — | — | 0.02 | — | (0.07 | ) | ||||

TOTAL SPECIAL ITEMS | (6.99 | ) | (0.61 | ) | (1.37 | ) | (1.47 | ) | (0.07 | ) |

($ millions) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | (8.7 | ) | (37.1 | ) | — | |||

HCM implementation expenses | — | (7.6 | ) | (20.3 | ) | — | — | |||

Total | — | (7.6 | ) | (29.0 | ) | (37.1 | ) | — | ||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Decisions to close VY, FitzPatrick, and Pilgrim | (1,072.7 | ) | (99.7 | ) | (204.8 | ) | (223.5 | ) | — | |

Palisades asset impairment and related write-offs | (255.9 | ) | — | — | — | |||||

Top Deer investment impairment | (23.9 | ) | — | — | — | — | ||||

Gain on the sale of RISEC | 100.1 | — | — | — | — | |||||

HCM implementation expenses | — | (2.1 | ) | (15.0 | ) | — | — | |||

Total | (1,252.4 | ) | (101.8 | ) | (219.8 | ) | (223.5 | ) | — | |

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | 5.5 | (1.0 | ) | (13.0 | ) | |||

HCM implementation expenses | — | — | (1.9 | ) | — | — | ||||

Total | — | — | 3.6 | (1.0 | ) | (13.0 | ) | |||

TOTAL SPECIAL ITEMS | (1,252.4 | ) | (109.4 | ) | (245.2 | ) | (261.6 | ) | (13.0 | ) |

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS - BY INCOME STATEMENT LINE ITEM | ||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||

(Pre-tax except for Income taxes, $ millions) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Net revenue* | — | — | 5.7 | — | — | |||||

Non-fuel O&M | — | (12.6 | ) | (64.0 | ) | (38.2 | ) | — | ||

Asset write-offs, impairments, and related charges | — | — | (9.4 | ) | — | — | ||||

Taxes other than income taxes | — | (0.6 | ) | (1.0 | ) | — | — | |||

Income taxes - other | — | 5.6 | 39.7 | 1.0 | — | |||||

Total | — | (7.6 | ) | (29.0 | ) | (37.1 | ) | — | ||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Non-fuel O&M | (17.0 | ) | (46.8 | ) | (37.1 | ) | — | — | ||

Asset write-offs, impairments, and related charges | (2,036.2 | ) | (107.5 | ) | (329.3 | ) | (355.5 | ) | — | |

Taxes other than income taxes | (0.3 | ) | (3.6 | ) | (1.1 | ) | — | |||

Gain on sale of asset | 154.0 | — | — | — | — | |||||

Miscellaneous net (other income) | (36.8 | ) | — | — | — | — | ||||

Income taxes - other | 683.8 | 56.1 | 147.7 | 132.1 | — | |||||

Total | (1,252.4 | ) | (101.8 | ) | (219.8 | ) | (223.5 | ) | — | |

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Non-fuel O&M | — | — | (0.3 | ) | (1.0 | ) | (13.0 | ) | ||

Asset write-offs, impairments, and related charges | — | — | (2.8 | ) | — | — | ||||

Income taxes - other | — | — | 6.7 | — | — | |||||

Total | — | — | 3.6 | (1.0 | ) | (13.0 | ) | |||

TOTAL SPECIAL ITEMS | (1,252.4 | ) | (109.4 | ) | (245.2 | ) | (261.6 | ) | (13.0 | ) |

*Operating revenue less fuel, fuel related expenses, purchased power and other regulatory charges (credits) – net. | ||||||||||

Totals may not foot due to rounding. | ||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED STATEMENTS OF INCOME (unaudited) | |||||||||||||||

In thousands, except share data, for the years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

OPERATING REVENUES: | |||||||||||||||

Electric | $ | 9,308,678 | $ | 9,591,902 | $ | 8,942,360 | $ | 7,870,649 | $ | 8,673,517 | |||||

Natural gas | 142,746 | 181,794 | 154,353 | 130,836 | 165,819 | ||||||||||

Competitive businesses | 2,061,827 | 2,721,225 | 2,294,234 | 2,300,594 | 2,389,737 | ||||||||||

Total | 11,513,251 | 12,494,921 | 11,390,947 | 10,302,079 | 11,229,073 | ||||||||||

OPERATING EXPENSES: | |||||||||||||||

Operating and maintenance: | |||||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 2,452,171 | 2,632,558 | 2,445,818 | 2,036,835 | 2,492,714 | ||||||||||

Purchased power | 1,390,805 | 1,915,414 | 1,554,332 | 1,255,800 | 1,564,967 | ||||||||||

Nuclear refueling outage expenses | 251,316 | 267,679 | 256,801 | 245,600 | 255,618 | ||||||||||

Other operation and maintenance | 3,354,981 | 3,310,536 | 3,331,934 | 3,045,392 | 2,867,758 | ||||||||||

Asset write-offs, impairments, and related charges | 2,104,906 | 179,752 | 341,537 | 355,524 | — | ||||||||||

Decommissioning | 280,272 | 272,621 | 242,104 | 184,760 | 190,595 | ||||||||||

Taxes other than income taxes | 619,422 | 604,606 | 600,350 | 557,298 | 536,026 | ||||||||||

Depreciation and amortization | 1,337,276 | 1,318,638 | 1,261,044 | 1,144,585 | 1,102,202 | ||||||||||

Other regulatory charges (credits) – net | 175,304 | (13,772 | ) | 45,597 | 175,104 | 205,959 | |||||||||

Total | 11,966,453 | 10,488,032 | 10,079,517 | 9,000,898 | 9,215,839 | ||||||||||

Gain on sale of asset / business | 154,037 | — | 43,569 | — | — | ||||||||||

OPERATING INCOME (LOSS) | (299,165 | ) | 2,006,889 | 1,354,999 | 1,301,181 | 2,013,234 | |||||||||

OTHER INCOME (DEDUCTIONS): | |||||||||||||||

Allowance for equity funds used during construction | 51,908 | 64,802 | 66,053 | 92,759 | 84,305 | ||||||||||

Interest and investment income | 187,062 | 147,686 | 199,300 | 127,776 | 128,994 | ||||||||||

Miscellaneous – net | (95,997 | ) | (42,016 | ) | (59,762 | ) | (53,214 | ) | (59,271 | ) | |||||

Total | 142,973 | 170,472 | 205,591 | 167,321 | 154,028 | ||||||||||

INTEREST EXPENSE: | |||||||||||||||

Interest expense | 670,096 | 661,083 | 629,537 | 606,596 | 551,521 | ||||||||||

Allowance for borrowed funds used during construction | (26,627 | ) | (33,576 | ) | (25,500 | ) | (37,312 | ) | (37,894 | ) | |||||

Total | 643,469 | 627,507 | 604,037 | 569,284 | 513,627 | ||||||||||

INCOME (LOSS) BEFORE INCOME TAXES | (799,661 | ) | 1,549,854 | 956,553 | 899,218 | 1,653,635 | |||||||||

Income taxes | (642,927 | ) | 589,597 | 225,981 | 30,855 | 286,263 | |||||||||

CONSOLIDATED NET INCOME (LOSS) | (156,734 | ) | 960,257 | 730,572 | 868,363 | 1,367,372 | |||||||||

Preferred dividend requirements of subsidiaries | 19,828 | 19,536 | 18,670 | 21,690 | 20,933 | ||||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO ENTERGY CORPORATION | $ | (176,562 | ) | $ | 940,721 | $ | 711,902 | $ | 846,673 | $ | 1,346,439 | ||||

Basic earnings (loss) per average common share | $ (0.99) | $5.24 | $3.99 | $4.77 | $7.59 | ||||||||||

Diluted earnings (loss) per average common share | $ (0.99) | $5.22 | $3.99 | $4.76 | $7.55 | ||||||||||

Average number of common shares outstanding: | |||||||||||||||

Basic average number of common shares outstanding | 179,176,356 | 179,506,151 | 178,211,192 | 177,324,813 | 177,430,208 | ||||||||||

Diluted average number of common shares outstanding | 179,176,356 | 180,296,885 | 178,570,400 | 177,737,565 | 178,370,695 | ||||||||||

Certain prior year data has been reclassified to conform with current year presentation. | |||||||||||||||

FINANCIAL RESULTS | ||||||||||||

2015 CONSOLIDATING INCOME STATEMENT (unaudited) | ||||||||||||

ENTERGY | ||||||||||||

WHOLESALE | PARENT & | |||||||||||

In thousands, except share data, for the year ended December 31, 2015. | UTILITY | COMMODITIES | OTHER | CONSOLIDATED | ||||||||

OPERATING REVENUES: | ||||||||||||

Electric | $ | 9,308,740 | $ | — | $ | (62 | ) | $ | 9,308,678 | |||

Natural gas | 142,746 | — | — | 142,746 | ||||||||

Competitive businesses | — | 2,061,827 | — | 2,061,827 | ||||||||

Total | 9,451,486 | 2,061,827 | (62 | ) | 11,513,251 | |||||||

OPERATING EXPENSES: | ||||||||||||

Operating and maintenance: | ||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 2,137,122 | 315,111 | (62 | ) | 2,452,171 | |||||||

Purchased power | 1,310,175 | 80,564 | 66 | 1,390,805 | ||||||||

Nuclear refueling outage expenses | 117,545 | 133,771 | — | 251,316 | ||||||||

Other operation and maintenance | 2,443,075 | 899,373 | 12,533 | 3,354,981 | ||||||||

Asset write-offs, impairments, and related charges | 68,672 | 2,036,234 | — | 2,104,906 | ||||||||

Decommissioning | 142,744 | 137,528 | — | 280,272 | ||||||||

Taxes other than income taxes | 507,739 | 110,533 | 1,150 | 619,422 | ||||||||

Depreciation and amortization | 1,096,088 | 239,032 | 2,156 | 1,337,276 | ||||||||

Other regulatory charges (credits) - net | 175,304 | — | — | 175,304 | ||||||||

Total | 7,998,464 | 3,952,146 | 15,843 | 11,966,453 | ||||||||

Gain on sale of asset / business | — | 154,037 | — | 154,037 | ||||||||

OPERATING INCOME (LOSS) | 1,453,022 | (1,736,282 | ) | (15,905 | ) | (299,165 | ) | |||||

OTHER INCOME (DEDUCTIONS): | ||||||||||||

Allowance for equity funds used during construction | 51,908 | — | — | 51,908 | ||||||||

Interest and investment income | 191,546 | 148,654 | (153,138 | ) | 187,062 | |||||||

Miscellaneous – net | (22,067 | ) | (61,580 | ) | (12,350 | ) | (95,997 | ) | ||||

Total | 221,387 | 87,074 | (165,488 | ) | 142,973 | |||||||

INTEREST EXPENSE: | ||||||||||||

Interest expense | 569,759 | 26,788 | 73,549 | 670,096 | ||||||||

Allowance for borrowed funds used during construction | (26,627 | ) | — | — | (26,627 | ) | ||||||

Total | 543,132 | 26,788 | 73,549 | 643,469 | ||||||||

INCOME (LOSS) BEFORE INCOME TAXES | 1,131,277 | (1,675,996 | ) | (254,942 | ) | (799,661 | ) | |||||

Income taxes | 16,761 | (610,339 | ) | (49,349 | ) | (642,927 | ) | |||||

CONSOLIDATED NET INCOME (LOSS) | 1,114,516 | (1,065,657 | ) | (205,593 | ) | (156,734 | ) | |||||

Preferred dividend requirements of subsidiaries | 17,641 | 2,187 | — | 19,828 | ||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO ENTERGY CORPORATION | $ | 1,096,875 | $ | (1,067,844 | ) | $ | (205,593 | ) | $ | (176,562 | ) | |

Basic earnings (loss) per average common share | $6.12 | $ (5.96) | $ (1.15) | $ (0.99) | ||||||||

Diluted earnings (loss) per average common share | $6.12 | $ (5.96) | $ (1.15) | $ (0.99) | ||||||||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED BALANCE SHEETS (unaudited) | |||||||||||||||

In thousands, as of December 31, | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

ASSETS | |||||||||||||||

CURRENT ASSETS: | |||||||||||||||

Cash and cash equivalents: | |||||||||||||||

Cash | $ | 63,497 | $ | 131,327 | $ | 129,979 | $ | 112,992 | $ | 81,468 | |||||

Temporary cash investments | 1,287,464 | 1,290,699 | 609,147 | 419,577 | 612,970 | ||||||||||

Total cash and cash equivalents | 1,350,961 | 1,422,026 | 739,126 | 532,569 | 694,438 | ||||||||||

Securitization recovery trust account | — | — | — | 46,040 | 50,304 | ||||||||||

Accounts receivable: | |||||||||||||||

Customer | 608,491 | 596,917 | 670,641 | 568,871 | 568,558 | ||||||||||

Allowance for doubtful accounts | (39,895 | ) | (35,663 | ) | (34,311 | ) | (31,956 | ) | (31,159 | ) | |||||

Other | 178,364 | 220,342 | 195,028 | 161,408 | 166,186 | ||||||||||

Accrued unbilled revenues | 321,940 | 321,659 | 340,828 | 303,392 | 298,283 | ||||||||||

Total accounts receivable | 1,068,900 | 1,103,255 | 1,172,186 | 1,001,715 | 1,001,868 | ||||||||||

Deferred fuel costs | — | 155,140 | 116,379 | 150,363 | 209,776 | ||||||||||

Accumulated deferred income taxes | — | 27,783 | 175,073 | 306,902 | 9,856 | ||||||||||

Fuel inventory – at average cost | 217,810 | 205,434 | 208,958 | 213,831 | 202,132 | ||||||||||

Materials and supplies – at average cost | 873,357 | 918,584 | 915,006 | 928,530 | 894,756 | ||||||||||

Deferred nuclear refueling outage costs | 211,512 | 214,188 | 192,474 | 243,374 | 231,031 | ||||||||||

System agreement cost equalization | — | — | — | 16,880 | 36,800 | ||||||||||

Prepayments and other | 344,872 | 343,223 | 410,489 | 242,922 | 291,742 | ||||||||||

Total | 4,067,412 | 4,389,633 | 3,929,691 | 3,683,126 | 3,622,703 | ||||||||||

OTHER PROPERTY AND INVESTMENTS: | |||||||||||||||

Investment in affiliates – at equity | 4,341 | 36,234 | 40,350 | 46,738 | 44,876 | ||||||||||

Decommissioning trust funds | 5,349,953 | 5,370,932 | 4,903,144 | 4,190,108 | 3,788,031 | ||||||||||

Non-utility property – at cost (less accumulated depreciation) | 219,999 | 213,791 | 199,375 | 256,039 | 260,436 | ||||||||||

Other | 468,704 | 405,169 | 210,616 | 436,234 | 416,423 | ||||||||||

Total | 6,042,997 | 6,026,126 | 5,353,485 | 4,929,119 | 4,509,766 | ||||||||||

PROPERTY, PLANT AND EQUIPMENT: | |||||||||||||||

Electric | 44,467,159 | 44,881,419 | 42,935,712 | 41,944,567 | 39,385,524 | ||||||||||

Property under capital lease | 952,465 | 945,784 | 941,299 | 935,199 | 809,449 | ||||||||||

Natural gas | 392,032 | 377,565 | 366,365 | 353,492 | 343,550 | ||||||||||

Construction work in progress | 1,456,735 | 1,425,981 | 1,514,857 | 1,365,699 | 1,779,723 | ||||||||||

Nuclear fuel | 1,345,422 | 1,542,055 | 1,566,904 | 1,598,430 | 1,546,167 | ||||||||||

Total property, plant and equipment | 48,613,813 | 49,172,804 | 47,325,137 | 46,197,387 | 43,864,413 | ||||||||||

Less – accumulated depreciation and amortization | 20,789,452 | 20,449,858 | 19,443,493 | 18,898,842 | 18,255,128 | ||||||||||

Property, plant and equipment – net | 27,824,361 | 28,722,946 | 27,881,644 | 27,298,545 | 25,609,285 | ||||||||||

DEFERRED DEBITS AND OTHER ASSETS: | |||||||||||||||

Regulatory assets: | |||||||||||||||

Regulatory asset for income taxes - net | 775,528 | 836,064 | 849,718 | 742,030 | 799,006 | ||||||||||

Other regulatory assets (includes securitization property of | |||||||||||||||

$714,044 as of December 31, 2015, $724,839 as | |||||||||||||||

of December 31, 2014, $822,218 as of December 31, 2013, | |||||||||||||||

$914,751 as of December 31, 2012, and | |||||||||||||||

$1,009,103 as of December 31, 2011) | 4,704,796 | 4,968,553 | 3,893,363 | 5,025,912 | 4,636,871 | ||||||||||

Deferred fuel costs | 238,902 | 238,102 | 172,202 | 172,202 | 172,202 | ||||||||||

Goodwill | 377,172 | 377,172 | 377,172 | 377,172 | 377,172 | ||||||||||

Accumulated deferred income taxes | 54,903 | 48,351 | 62,011 | 37,748 | 19,003 | ||||||||||

Other | 561,610 | 807,508 | 771,004 | 821,485 | 851,668 | ||||||||||

Total | 6,712,911 | 7,275,750 | 6,125,470 | 7,176,549 | 6,855,922 | ||||||||||

TOTAL ASSETS | $ | 44,647,681 | $ | 46,414,455 | $ | 43,290,290 | $ | 43,087,339 | $ | 40,597,676 | |||||

Certain prior year data has been reclassified to conform with current year presentation. | |||||||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED BALANCE SHEETS (unaudited) | |||||||||||||||

In thousands, as of December 31, | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

LIABILITIES AND EQUITY | |||||||||||||||

CURRENT LIABILITIES: | |||||||||||||||

Currently maturing long-term debt | $ | 214,374 | $ | 899,375 | $ | 457,095 | $ | 718,516 | $ | 2,192,733 | |||||

Notes payable and commercial paper | 494,348 | 598,407 | 1,046,887 | 796,002 | 108,331 | ||||||||||

Accounts payable | 1,071,798 | 1,166,431 | 1,173,313 | 1,217,180 | 1,069,096 | ||||||||||

Customer deposits | 419,407 | 412,166 | 370,997 | 359,078 | 351,741 | ||||||||||

Taxes accrued | 210,077 | 128,108 | 191,093 | 333,719 | 278,235 | ||||||||||

Accumulated deferred income taxes | — | 38,039 | 28,307 | 13,109 | 99,929 | ||||||||||

Interest accrued | 194,565 | 206,010 | 180,997 | 184,664 | 183,512 | ||||||||||

Deferred fuel costs | 235,986 | 91,602 | 57,631 | 96,439 | 255,839 | ||||||||||

Obligations under capital leases | 2,709 | 2,508 | 2,323 | 3,880 | 3,631 | ||||||||||

Pension and other postretirement liabilities | 62,513 | 57,994 | 67,419 | 95,900 | 44,031 | ||||||||||

System agreement cost equalization | — | — | — | 25,848 | 80,090 | ||||||||||

Other | 184,181 | 248,251 | 484,510 | 261,986 | 283,531 | ||||||||||

Total | 3,089,958 | 3,848,891 | 4,060,572 | 4,106,321 | 4,950,699 | ||||||||||

NON-CURRENT LIABILITIES: | |||||||||||||||

Accumulated deferred income taxes and taxes accrued | 8,306,865 | 9,133,161 | 8,724,635 | 8,311,756 | 8,096,452 | ||||||||||

Accumulated deferred investment tax credits | 234,300 | 247,521 | 263,765 | 273,696 | 284,747 | ||||||||||

Obligations under capital leases | 27,001 | 29,710 | 32,218 | 34,541 | 38,421 | ||||||||||

Other regulatory liabilities | 1,414,898 | 1,383,609 | 1,295,955 | 898,614 | 728,193 | ||||||||||

Decommissioning and asset retirement cost liabilities | 4,790,187 | 4,458,296 | 3,933,416 | 3,513,634 | 3,296,570 | ||||||||||

Accumulated provisions | 460,727 | 418,128 | 115,139 | 362,226 | 385,512 | ||||||||||

Pension and other postretirement liabilities | 3,187,357 | 3,638,295 | 2,320,704 | 3,725,886 | 3,133,657 | ||||||||||

Long-term debt (includes securitization bonds | |||||||||||||||

of $774,696 as of December 31, 2015, $776,817 as of | |||||||||||||||

December 31, 2014, $883,013 as of December 31, 2013, | |||||||||||||||

$973,480 as of December 31, 2012, and | |||||||||||||||

$1,070,556 as of December 31, 2011) | 13,111,556 | 12,386,710 | 12,022,993 | 11,805,155 | 9,939,690 | ||||||||||

Other | 449,856 | 557,649 | 583,667 | 577,910 | 501,954 | ||||||||||

Total | 31,982,747 | 32,253,079 | 29,292,492 | 29,503,418 | 26,405,196 | ||||||||||

Commitments and Contingencies | |||||||||||||||

Subsidiaries' preferred stock without sinking fund | 318,185 | 210,760 | 210,760 | 186,511 | 186,511 | ||||||||||

EQUITY: | |||||||||||||||

Common shareholders' equity: | |||||||||||||||

Common stock, $.01 par value, authorized 500,000,000 | |||||||||||||||

shares; issued 254,752,788 shares in 2015, 2014, 2013, | |||||||||||||||

2012, and 2011 | 2,548 | 2,548 | 2,548 | 2,548 | 2,548 | ||||||||||

Paid-in capital | 5,403,758 | 5,375,353 | 5,368,131 | 5,357,852 | 5,360,682 | ||||||||||

Retained earnings | 9,393,913 | 10,169,657 | 9,825,053 | 9,704,591 | 9,446,960 | ||||||||||

Accumulated other comprehensive income (loss) | 8,951 | (42,307 | ) | (29,324 | ) | (293,083 | ) | (168,452 | ) | ||||||

Less – treasury stock, at cost (76,363,763 shares in 2015, | |||||||||||||||

75,512,079 shares in 2014, 76,381,936 shares in 2013, | |||||||||||||||

76,945,239 shares in 2012, and 78,396,988 shares in 2011) | 5,552,379 | 5,497,526 | 5,533,942 | 5,574,819 | 5,680,468 | ||||||||||

Total common shareholders' equity | 9,256,791 | 10,007,725 | 9,632,466 | 9,197,089 | 8,961,270 | ||||||||||

Subsidiaries' preferred stock without sinking fund | — | 94,000 | 94,000 | 94,000 | 94,000 | ||||||||||

Total | 9,256,791 | 10,101,725 | 9,726,466 | 9,291,089 | 9,055,270 | ||||||||||

TOTAL LIABILITIES AND EQUITY | $ | 44,647,681 | $ | 46,414,455 | $ | 43,290,290 | $ | 43,087,339 | $ | 40,597,676 | |||||

Certain prior year data has been reclassified to conform with current year presentation. | |||||||||||||||

FINANCIAL RESULTS | ||||||||||||

2015 CONSOLIDATING BALANCE SHEET (unaudited) | ||||||||||||

ENTERGY | ||||||||||||

WHOLESALE | ||||||||||||

In thousands, as of December 31, 2015. | UTILITY | COMMODITIES | PARENT & OTHER | CONSOLIDATED | ||||||||

ASSETS | ||||||||||||

CURRENT ASSETS: | ||||||||||||

Cash and cash equivalents: | ||||||||||||

Cash | $ | 57,098 | $ | 5,717 | $ | 682 | $ | 63,497 | ||||

Temporary cash investments | 561,970 | 713,285 | 12,208 | 1,287,464 | ||||||||

Total cash and cash equivalents | 619,068 | 719,002 | 12,890 | 1,350,961 | ||||||||

Notes receivable | — | 513,778 | (513,778 | ) | — | |||||||

Accounts receivable: | ||||||||||||

Customer | 440,869 | 167,622 | — | 608,491 | ||||||||

Allowance for doubtful accounts | (39,895 | ) | — | — | (39,895 | ) | ||||||

Associated companies | 30,948 | 3,230 | (34,177 | ) | — | |||||||

Other | 169,447 | 8,917 | — | 178,364 | ||||||||

Accrued unbilled revenues | 321,940 | — | — | 321,940 | ||||||||

Total accounts receivable | 923,309 | 179,769 | (34,177 | ) | 1,068,900 | |||||||

Fuel inventory – at average cost | 210,861 | 6,949 | — | 217,810 | ||||||||

Materials and supplies – at average cost | 627,702 | 245,654 | — | 873,357 | ||||||||

Deferred nuclear refueling outage costs | 140,423 | 71,089 | — | 211,512 | ||||||||

Prepayments and other | 141,096 | 212,352 | (8,576 | ) | 344,872 | |||||||

Total | 2,662,459 | 1,948,593 | (543,641 | ) | 4,067,412 | |||||||

OTHER PROPERTY AND INVESTMENTS: | ||||||||||||

Investment in affiliates – at equity | 1,390,786 | 4,228 | (1,390,673 | ) | 4,341 | |||||||

Decommissioning trust funds | 2,515,066 | 2,834,887 | — | 5,349,953 | ||||||||

Non-utility property – at cost (less accumulated depreciation) | 212,997 | 7,012 | (10 | ) | 219,999 | |||||||

Other | 460,322 | 8,382 | — | 468,704 | ||||||||

Total | 4,579,171 | 2,854,509 | (1,390,683 | ) | 6,042,997 | |||||||

PROPERTY, PLANT AND EQUIPMENT: | ||||||||||||

Electric | 41,079,998 | 3,383,581 | 3,579 | 44,467,159 | ||||||||

Property under capital lease | 952,465 | — | — | 952,465 | ||||||||

Natural gas | 392,032 | — | — | 392,032 | ||||||||

Construction work in progress | 1,326,728 | 129,659 | 349 | 1,456,735 | ||||||||

Nuclear fuel | 856,573 | 488,850 | — | 1,345,422 | ||||||||

Total property, plant and equipment | 44,607,796 | 4,002,090 | 3,928 | 48,613,813 | ||||||||

Less – accumulated depreciation and amortization | 19,654,374 | 1,134,880 | 198 | 20,789,452 | ||||||||

Property, plant and equipment – net | 24,953,422 | 2,867,210 | 3,730 | 27,824,361 | ||||||||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||||||

Regulatory assets: | ||||||||||||

Regulatory asset for income taxes - net | 775,528 | — | — | 775,528 | ||||||||

Other regulatory assets (includes securitization property of | ||||||||||||

$714,044 as of December 31, 2015) | 4,704,796 | — | — | 4,704,796 | ||||||||

Deferred fuel costs | 238,902 | — | — | 238,902 | ||||||||

Goodwill | 374,099 | 3,073 | — | 377,172 | ||||||||

Accumulated deferred income taxes | 15,888 | 37,809 | 1,206 | 54,903 | ||||||||

Other | 52,641 | 498,989 | 9,980 | 561,610 | ||||||||

Total | 6,161,854 | 539,871 | 11,186 | 6,712,911 | ||||||||

TOTAL ASSETS | $ | 38,356,906 | $ | 8,210,183 | $ | (1,919,408 | ) | $ | 44,647,681 | |||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | ||||||||||||

2015 CONSOLIDATING BALANCE SHEET (unaudited) | ||||||||||||

ENTERGY | ||||||||||||

WHOLESALE | ||||||||||||

In thousands, as of December 31, 2015. | UTILITY | COMMODITIES | PARENT & OTHER | CONSOLIDATED | ||||||||

LIABILITIES AND EQUITY | ||||||||||||

CURRENT LIABILITIES: | ||||||||||||

Currently maturing long-term debt | $ | 209,374 | $ | 5,000 | $ | — | $ | 214,374 | ||||

Notes payable and commercial paper: | ||||||||||||

Associated companies | — | 324,315 | (324,315 | ) | — | |||||||

Other | 72,047 | — | 422,302 | 494,348 | ||||||||

Accounts payable: | ||||||||||||

Associated companies | 25,119 | 25,433 | (50,553 | ) | — | |||||||

Other | 877,395 | 193,810 | 593 | 1,071,798 | ||||||||

Customer deposits | 419,407 | — | — | 419,407 | ||||||||

Taxes accrued | 159,650 | 155,893 | (105,466 | ) | 210,077 | |||||||

Interest accrued | 163,391 | 13 | 31,161 | 194,565 | ||||||||

Deferred fuel costs | 235,986 | — | — | 235,986 | ||||||||

Obligations under capital leases | 2,709 | — | — | 2,709 | ||||||||

Pension and other postretirement liabilities | 53,143 | 9,370 | — | 62,513 | ||||||||

Other | 150,308 | 31,937 | 1,936 | 184,181 | ||||||||

Total | 2,368,529 | 745,771 | (24,342 | ) | 3,089,958 | |||||||

NON-CURRENT LIABILITIES: | ||||||||||||

Accumulated deferred income taxes and taxes accrued | 7,459,787 | 546,835 | 300,243 | 8,306,865 | ||||||||

Accumulated deferred investment tax credits | 234,300 | — | — | 234,300 | ||||||||

Obligations under capital leases | 27,001 | — | — | 27,001 | ||||||||

Other regulatory liabilities | 1,414,898 | — | — | 1,414,898 | ||||||||

Decommissioning and asset retirement cost liabilities | 2,720,676 | 2,069,511 | — | 4,790,187 | ||||||||

Accumulated provisions | 458,366 | 2,361 | — | 460,727 | ||||||||

Pension and other postretirement liabilities | 2,423,018 | 764,339 | — | 3,187,357 | ||||||||

Long-term debt (includes securitization bonds | ||||||||||||

of $774,696 as of December 31, 2015) | 10,643,726 | 41,259 | 2,426,571 | 13,111,556 | ||||||||

Other | 736,685 | 307,694 | (594,523 | ) | 449,856 | |||||||

Total | 26,118,457 | 3,731,999 | 2,132,291 | 31,982,747 | ||||||||

Commitments and Contingencies | ||||||||||||

Subsidiaries' preferred stock without sinking fund | 293,936 | 24,249 | — | 318,185 | ||||||||

EQUITY: | ||||||||||||

Common shareholders' equity: | ||||||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; | ||||||||||||

issued 254,752,788 shares in 2015 | 2,091,268 | 201,103 | (2,289,823 | ) | 2,548 | |||||||

Paid-in capital | 2,548,659 | 1,680,843 | 1,174,256 | 5,403,758 | ||||||||

Retained earnings | 5,185,328 | 1,687,996 | 2,520,589 | 9,393,913 | ||||||||

Accumulated other comprehensive income (loss) | (129,271 | ) | 138,222 | — | 8,951 | |||||||

Less – treasury stock, at cost (76,363,763 shares in 2015) | 120,000 | — | 5,432,379 | 5,552,379 | ||||||||

Total common shareholders' equity | 9,575,984 | 3,708,164 | (4,027,357 | ) | 9,256,791 | |||||||

Subsidiaries' preferred stock without sinking fund | — | — | — | — | ||||||||

Total | 9,575,984 | 3,708,164 | (4,027,357 | ) | 9,256,791 | |||||||

TOTAL LIABILITIES AND EQUITY | $ | 38,356,906 | $ | 8,210,183 | $ | (1,919,408 | ) | $ | 44,647,681 | |||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOW (unaudited) | |||||||||||||||

In thousands, for the years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

OPERATING ACTIVITIES: | |||||||||||||||

Consolidated net income | $ | (156,734 | ) | $ | 960,257 | $ | 730,572 | $ | 868,363 | $ | 1,367,372 | ||||

Adjustments to reconcile consolidated net income | |||||||||||||||

to net cash flow provided by operating activities: | |||||||||||||||

Depreciation, amortization, and decommissioning, including nuclear fuel amortization | 2,117,236 | 2,127,892 | 2,012,076 | 1,771,649 | 1,745,455 | ||||||||||

Deferred income taxes, investment tax credits, and non-current taxes accrued | (820,350 | ) | 596,935 | 311,789 | (26,479 | ) | (280,029 | ) | |||||||

Asset write-offs, impairments, and related charges | 2,104,906 | 123,527 | 341,537 | 355,524 | — | ||||||||||

Gain on sale of asset / business | (154,037 | ) | — | (43,569 | ) | — | — | ||||||||

Changes in working capital: | |||||||||||||||

Receivables | 38,152 | 98,493 | (180,648 | ) | (14,202 | ) | 28,091 | ||||||||

Fuel inventory | (12,376 | ) | 3,524 | 4,873 | (11,604 | ) | 5,393 | ||||||||

Accounts payable | (135,211 | ) | (12,996 | ) | 94,436 | (6,779 | ) | (131,970 | ) | ||||||

Prepaid taxes and taxes accrued | 81,969 | (62,985 | ) | (142,626 | ) | 55,484 | 580,042 | ||||||||

Interest accrued | (11,445 | ) | 25,013 | (3,667 | ) | 1,152 | (34,172 | ) | |||||||

Deferred fuel costs | 298,725 | (70,691 | ) | (4,824 | ) | (99,987 | ) | (55,686 | ) | ||||||

Other working capital accounts | (113,701 | ) | 112,390 | (66,330 | ) | (151,989 | ) | 41,875 | |||||||

Changes in provisions for estimated losses | 42,566 | 301,871 | (248,205 | ) | (24,808 | ) | (11,086 | ) | |||||||

Changes in other regulatory assets | 262,317 | (1,061,537 | ) | 1,105,622 | (398,428 | ) | (673,244 | ) | |||||||

Changes in other regulatory liabilities | 61,241 | 87,654 | 397,341 | 170,421 | 189,167 | ||||||||||

Changes in pensions and other postretirement liabilities | (446,418 | ) | 1,308,166 | (1,433,663 | ) | 644,099 | 962,461 | ||||||||

Other | 134,344 | (647,952 | ) | 314,505 | (192,131 | ) | (604,852 | ) | |||||||

Net cash flow provided by operating activities | 3,291,184 | 3,889,561 | 3,189,219 | 2,940,285 | 3,128,817 | ||||||||||

INVESTING ACTIVITIES: | |||||||||||||||

Construction/capital expenditures | (2,500,860 | ) | (2,119,191 | ) | (2,287,593 | ) | (2,674,650 | ) | (2,040,027 | ) | |||||

Allowance for equity funds used during construction | 53,635 | 68,375 | 69,689 | 96,131 | 86,252 | ||||||||||

Nuclear fuel purchases | (493,604 | ) | (537,548 | ) | (517,825 | ) | (557,960 | ) | (641,493 | ) | |||||

Payment for purchase of plant | — | — | (17,300 | ) | (456,356 | ) | (646,137 | ) | |||||||

Proceeds from sale of assets and businesses | 487,406 | 10,100 | 147,922 | — | 6,531 | ||||||||||

Insurance proceeds received for property damages | 24,399 | 40,670 | — | — | — | ||||||||||

Changes in securitization account | (5,806 | ) | 1,511 | 155 | 4,265 | (7,260 | ) | ||||||||

NYPA value sharing payment | (70,790 | ) | (72,000 | ) | (71,736 | ) | (72,000 | ) | (72,000 | ) | |||||

Payments to storm reserve escrow account | (69,163 | ) | (276,057 | ) | (7,716 | ) | (8,957 | ) | (6,425 | ) | |||||

Receipts from storm reserve escrow account | 5,916 | — | 260,279 | 27,884 | — | ||||||||||

Decrease (increase) in other investments | 571 | 46,983 | (82,955 | ) | 15,175 | (11,623 | ) | ||||||||

Litigation proceeds for reimbursement of spent nuclear fuel storage costs | 18,296 | — | 21,034 | 109,105 | — | ||||||||||

Proceeds from nuclear decommissioning trust fund sales | 2,492,176 | 1,872,115 | 2,031,552 | 2,074,055 | 1,360,346 | ||||||||||

Investment in nuclear decommissioning trust funds | (2,550,958 | ) | (1,989,446 | ) | (2,147,099 | ) | (2,196,489 | ) | (1,475,017 | ) | |||||

Net cash flow used in investing activities | (2,608,782 | ) | (2,954,488 | ) | (2,601,593 | ) | (3,639,797 | ) | (3,446,853 | ) | |||||

FINANCING ACTIVITIES: | |||||||||||||||

Proceeds from the issuance of: | |||||||||||||||

Long-term debt | 3,502,189 | 3,100,069 | 3,746,016 | 3,478,361 | 2,990,881 | ||||||||||

Preferred stock of subsidiary | 107,426 | — | 24,249 | — | — | ||||||||||

Mandatorily redeemable preferred membership units of subsidiary | — | — | — | 51,000 | — | ||||||||||

Treasury stock | 24,366 | 194,866 | 24,527 | 62,886 | 46,185 | ||||||||||

Retirement of long-term debt | (3,461,518 | ) | (2,323,313 | ) | (3,814,666 | ) | (3,130,233 | ) | (2,437,372 | ) | |||||

Repurchase of common stock | (99,807 | ) | (183,271 | ) | — | — | (234,632 | ) | |||||||

Repurchase / redemptions of preferred stock | (94,285 | ) | — | — | — | (30,308 | ) | ||||||||

Changes in credit borrowings and commercial paper – net | (104,047 | ) | (448,475 | ) | 250,889 | 687,675 | (6,501 | ) | |||||||

Other | (9,136 | ) | 23,579 | — | — | — | |||||||||

Dividends paid: | |||||||||||||||

Common stock | (598,897 | ) | (596,117 | ) | (593,037 | ) | (589,209 | ) | (589,605 | ) | |||||

Preferred stock | (19,758 | ) | (19,511 | ) | (18,802 | ) | (22,329 | ) | (20,933 | ) | |||||

Net cash flow used in financing activities | (753,467 | ) | (252,173 | ) | (380,824 | ) | 538,151 | (282,285 | ) | ||||||

Effect of exchange rates on cash and cash equivalents | — | — | (245 | ) | (508 | ) | 287 | ||||||||

Net increase (decrease) in cash and cash equivalents | (71,065 | ) | 682,900 | 206,557 | (161,869 | ) | (600,034 | ) | |||||||

Cash and cash equivalents at beginning of period | 1,422,026 | 739,126 | 532,569 | 694,438 | 1,294,472 | ||||||||||

Cash and cash equivalents at end of period | $ | 1,350,961 | $ | 1,422,026 | $ | 739,126 | $ | 532,569 | $ | 694,438 | |||||

FINANCIAL RESULTS | ||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOW (unaudited) | ||||||||||

$ thousands, for the years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 | |||||

SUPPLEMENTAL DISCLOSURE OF | ||||||||||

CASH FLOW INFORMATION: | ||||||||||

Cash paid (received) during the period for: | ||||||||||

Interest – net of amount capitalized | 663,630 | 611,376 | 570,212 | 546,125 | 532,271 | |||||

Income taxes | 103,589 | 77,799 | 127,735 | 49,214 | (2,042 | ) | ||||

CASH FLOW INFORMATION BY BUSINESS | ||||||||||

ENTERGY | ||||||||||

WHOLESALE | ||||||||||

For the years ended December 31, 2015, 2014, 2013, 2012 and 2011. | UTILITY | COMMODITIES | PARENT & OTHER | CONSOLIDATED | ||||||

($ thousands) | ||||||||||

2015 | ||||||||||

Net cash flow provided by operating activities | 2,906,716 | 461,842 | (77,374 | ) | 3,291,184 | |||||

Net cash flow provided by (used in) investing activities | (2,565,963 | ) | (46,527 | ) | 3,709 | (2,608,782 | ) | |||

Net cash flow provided by (used in) financing activities | (695,099 | ) | (129,012 | ) | 70,643 | (753,467 | ) | |||

2014 | ||||||||||

Net cash flow provided by operating activities | 3,318,660 | 1,034,278 | (463,377 | ) | 3,889,561 | |||||

Net cash flow provided by (used in) investing activities | (2,635,690 | ) | (612,227 | ) | 293,429 | (2,954,488 | ) | |||

Net cash flow provided by (used in) financing activities | (260,772 | ) | (165,840 | ) | 174,440 | (252,173 | ) | |||

2013 | ||||||||||