|

|

|

|

|

UNITED STATES |

||

|

SECURITIES AND EXCHANGE COMMISSION |

||

|

Washington, D.C. 20549 |

||

|

|

|

|

|

Form 10-K |

||

|

|

||

|

(Mark One) |

||

|

|

||

|

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

||

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

||

|

|

||

|

For the fiscal year ended: December 31, 2014 |

||

|

|

||

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

||

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

||

|

|

||

|

For the transition period from______________to________________ |

||

|

|

||

|

Commission file number 0-5703 |

||

|

|

|

|

|

Siebert Financial Corp. |

||

|

(Exact name of registrant as specified in its charter) |

||

|

|

|

|

|

|

|

|

New York |

11-1796714 |

|

|

|

|

885 Third Avenue, New York, New York |

10022 |

|

|

|

|

|

(212) 644-2400 |

||

|

Registrant’s telephone number, including area code |

||

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act: |

||

|

|

|

|

Title of each class |

Name of each exchange on which registered |

|

COMMON STOCK, PAR VALUE $.01 PER SHARE |

THE NASDAQ CAPITAL MARKET |

Securities registered under Section 12(g) of the Exchange Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well- known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the Common Stock held by non-affiliates of the registrant (based upon the last sale price of the Common Stock reported on the NASDAQ Capital Market as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2014), was $5,517,182.

The number of shares of the registrant’s outstanding Common Stock, as of March 13, 2015, was 22,085,126 shares.

Documents Incorporated by Reference: Definitive Proxy Statement to be filed pursuant to Regulation 14A of the Exchange Act on or before April 30, 2015 is incorporated by reference into Part III.

Special Note Regarding Forward-Looking Statements

Statements in this Annual Report on Form 10-K, as well as oral statements that may be made by the Company or by officers, directors or employees of the Company acting on the Company’s behalf, that are not statements of historical or current fact constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve risks and uncertainties and known and unknown factors that could cause the actual results of the Company to be materially different from historical results or from any future results expressed or implied by such forward looking statements, including without limitation: changes in general economic and market conditions; changes and prospects for changes in interest rates; fluctuations in volume and prices of securities; demand for brokerage and investment banking services; competition within and without the discount brokerage business, including the offer of broader services; competition from electronic discount brokerage firms offering greater discounts on commissions than the Company; the prevalence of a flat fee environment; decline in participation in corporate or municipal finance underwritings; limited trading opportunities; the method of placing trades by the Company’s customers; computer and telephone system failures; the level of spending by the Company on advertising and promotion; trading errors and the possibility of losses from customer non-payment of amounts due; other increases in expenses and changes in net capital or other regulatory requirements. We undertake no obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date when such statements were made or to reflect the occurrence of unanticipated events. An investment in us involves various risks, including those mentioned above and those which are detailed from time to time in our Securities and Exchange Commission filings.

- 2 -

PART I

|

|

|

|

Item 1. |

BUSINESS |

General

Siebert Financial Corp. is a holding company that conducts its retail discount brokerage and investment banking business through its wholly-owned subsidiary, Muriel Siebert & Co., Inc., a Delaware corporation. In addition, in 2014 we began business as a registered investment advisor through our wholly-owned subsidiary, Siebert Investment Advisors, Inc. The estate of Muriel F. Siebert, our former Chairwoman, Chief Executive Officer and President, owns approximately 90% of our outstanding common stock, par value $.01 per share (the “Common Stock”). For purposes of this Annual Report, the terms “Siebert,” “Company,” “we,” “us” and “our” refer to Siebert Financial Corp. and its consolidated subsidiaries, unless the context otherwise requires.

Our principal offices are located at 885 Third Avenue, New York, New York 10022, and our phone number is (212) 644-2400. Our Internet address is www.siebertnet.com. Our SEC filings are available through our website at www.siebertnet.com, where you are able to obtain copies of the Company’s public filings free of charge. Our Common Stock trades on the NASDAQ Capital Market under the symbol “SIEB”.

Business Overview

Siebert’s principal activity is providing online and traditional discount brokerage and related services to retail investors. In addition, Siebert, Brandford, Shank Financial, L.L.C. (“SBSF”), a company in which Siebert holds a 49% ownership interest, is the largest Minority and Women’s Business Enterprise (“MWBE”) in the tax-exempt underwriting business in the United States.

The Retail Division

Discount Brokerage and Related Services. Siebert became a discount broker on May 1, 1975. Siebert believes that it has been in business and a member of The New York Stock Exchange, Inc. (the “NYSE”) longer than any other discount broker. In 1998, Siebert began to offer its customers access to their accounts through SiebertNet, its Internet website. Siebert’s focus in its discount brokerage business is to serve retail clients seeking a wide selection of quality investment services, including trading through a broker on the telephone, through a wireless device or via the Internet, at commissions that are substantially lower than those of full-commission firms. Siebert clears its securities transactions on a fully disclosed basis through National Financial Services Corp. (“NFS”), a wholly owned subsidiary of Fidelity Investments.

Siebert serves investors who make their own investment decisions. Siebert seeks to assist its customers in their investment decisions by offering a number of value added services, including easy access to account information. Siebert’s representatives are available to assist customers with information via toll-free 800 service Monday through Friday between 7:30 a.m. and 7:30 p.m. Eastern Time. Through its SiebertNet, Mobile Broker, inter-active voice recognition and Siebert Brokerage Express services, 24-hour access is available to customers.

Independent Retail Execution Services. Siebert and our clearing agent monitor order flow in an effort to ensure that we are getting the best possible trade executions for customers. Siebert does not make markets in securities, nor does it take positions against customer orders.

Siebert’s equity orders are routed by its clearing agent in a manner intended to afford its customers the opportunity for price improvement on all orders. The firm also offers customers execution services through various electronic communication networks (“ECNs”) for an additional fee. These systems give customers access to numerous ECNs before and after regular market hours. Siebert believes that its over-the counter executions consistently afford its customers the opportunity for price improvement.

Customers may also indicate online interest in buying or selling fixed income securities, including municipal bonds, corporate bonds, mortgage-backed securities, government sponsored enterprises, unit investment trusts or certificates of deposit. These transactions are serviced by registered representatives.

Retail Customer Service. Siebert believes that superior customer service enhances its ability to compete with larger discount brokerage firms and therefore provides retail customers, at no additional charge, with personal service via toll-free access to dedicated customer support personnel for all of its products and services. Customer service personnel are located in each of Siebert’s branch offices. Siebert has retail offices in New York, New York; Jersey City, New Jersey; Boca Raton, Florida; and Beverly Hills, California. Siebert uses a proprietary Customer Relationship Management System that enables representatives, no matter where located, to view a customer’s service requests and the response thereto. Siebert’s telephone system permits the automatic routing of calls to the next available agent having the appropriate skill set.

Retirement Accounts. Siebert offers customers a variety of self-directed retirement accounts for which it acts as agent on all transactions. Custodial services are provided through an affiliate of NFS, the firm’s clearing agent, which also serves as trustee for such accounts. Each IRA, SEP IRA, ROTH IRA, 401(k) and KEOGH account can be invested in mutual funds, stocks, bonds and other investments in a consolidated account.

Customer Financing. Customer’s margin accounts are carried through Siebert’s clearing agent which lends customers a portion of the market value of certain securities held in the customer’s account. Margin loans are collateralized by these securities.

- 3 -

Customers also may sell securities short in a margin account, subject to minimum equity and applicable margin requirements, and the availability of such securities to be borrowed. In permitting customers to engage in margin, short sale or any other transaction, Siebert assumes the risk of its customers’ failure to meet their obligations in the event of adverse changes in the market value of the securities positions. Both Siebert and its clearing agents reserve the right to set margin requirements higher than those established by the Federal Reserve Board.

Siebert has established policies with respect to maximum purchase commitments for new customers or customers with inadequate collateral to support a requested purchase. Managers have some flexibility in the allowance of certain transactions. When transactions occur outside normal guidelines, Siebert monitors accounts closely until their payment obligations are completed; if the customer does not meet the commitment, Siebert takes steps to close out the position and minimize any loss. Siebert has not had significant credit losses in the last five years.

Information and Communications Systems. Siebert relies heavily on the data technology platform provided by its clearing agent, NFS. This platform offers an interface to NFS’ main frame computing system where all customer account records are kept and is accessible by Siebert’s network. Siebert’s systems also utilize browser based access and other types of data communications. Siebert’s representatives use NFS systems, by way of Siebert’s technology platform, to perform daily operational functions which include trade entry, trade reporting, clearing related activities, risk management and account maintenance.

Siebert’s data technology platform offers services used in direct relation to customer related activities as well as support for corporate use. Some of these services include email and messaging, market data systems and third party trading systems, business productivity tools and customer relationship management systems. Siebert’s branch offices are connected to the main offices in New York, New York and Jersey City, New Jersey via a virtual private network. Siebert’s data network is designed with redundancy in case a significant business disruption occurs.

Siebert’s voice network offers a call center feature that can route and queue calls for certain departments within the organization. Additionally, the systems call manager offers reporting and tracking features which enable staff to determine how calls are being managed, such as time on hold, call duration and total calls by agent.

To ensure reliability and to conform to regulatory requirements related to business continuity, Siebert maintains backup systems and backup data. However, in the event of a wide-spread disruption, such as a massive natural disaster, Siebert’s ability to satisfy the obligations to customers and other securities firms could be significantly hampered or completely disrupted. For more information regarding Siebert’s Business Continuity Plan, please visit our website at www.siebertnet.com or write to us at Muriel Siebert & Co., Inc., Compliance Department, 885 Third Avenue, Suite 3100, New York, NY 10022.

Our website has design, navigation, and functionality features such as:

|

|

|

|

|

|

▪ |

Informative trading screens: Customers can stay in touch while trading, double-check balances, positions and order status, see real time quotes, intraday and annual charts and news headlines – automatically – as they place orders. |

|

|

|

|

|

|

▪ |

Multiple orders: Customers can place as many as 10 orders at one time. |

|

|

|

|

|

|

▪ |

Tax-lot trading: Our online equity order entry screen allows customers to specify tax lots which display with cost basis and current gain/loss on a real-time positions page. |

|

|

|

|

|

|

▪ |

Trailing stop orders: Customers can enter an order that trails the market as a percentage of share price or with a flat dollar value and the system will execute their instructions automatically. |

|

|

|

|

|

|

▪ |

Contingent orders: Customers can place One-Triggers-Two Bracket and One-Cancels-Other Bracket orders. |

|

|

|

|

|

|

▪ |

An easy-to-install desktop security program that may be installed to help protect against certain types of online fraud such as “keylogging” and “phishing.” |

- 4 -

The Capital Markets Division

Siebert’s Capital Markets Group (“SCM”) division served the Company as a co-manager, underwriting syndicate member, or selling group member on a wide spectrum of securities offerings for corporations and Federal agencies. The principal activities of SCM were investment banking and institutional equity execution services. SCM provided Muriel Siebert & Co., Inc. high-quality brokerage service to both institutional investors and issuers of equity and fixed-income securities.

On November 4, 2014, the Company, which held a 49% membership interest in, and the other members of, Siebert Brandford Shank & Co., LLC (“SBS”), contributed their SBS membership interests into a newly formed Delaware limited liability company, Siebert Brandford Shank Financial, L.L.C. (“SBSF”), in exchange for the same percentage interests in SBSF. On the same day, the Company entered into an Asset Purchase Agreement (the “Purchase Agreement”) with SBS and SBSF, pursuant to which the Company sold substantially all of the SCM assets to SBSF. Pursuant to the Purchase Agreement, SBSF assumed post-closing liabilities relating to the transferred business.

The Purchase Agreement provides for an aggregate purchase price for the disposition of $3,000,000, payable by SBSF after closing in annual installments commencing on March 1, 2016 and continuing on each of March 1, 2017, 2018, 2019 and 2020. The transferred business was contributed by SBSF to, and operated by SBS. The amount payable to the Company on each annual payment date will equal 50% of the net income attributable to the transferred business recognized by SBS in accordance with generally accepted accounting principles during the fiscal year ending immediately preceding the applicable payment date; provided that, if net income attributable to the transferred business generated prior to the fifth annual payment date is insufficient to pay the remaining balance of the purchase price in full on the fifth annual payment date, then the unpaid amount of the purchase price will be paid in full on March 1, 2021.

Transferred assets of SCM, consisted of customer accounts and goodwill, which had no carrying value to the Company, and the Company recorded a gain on sale of $1,820,000, which reflected the fair value of the purchase obligation. Such fair value was based on the present value of estimated annual installments to be received during 2016 through 2020 from forecasted net income of the transferred business plus a final settlement in 2021, discounted at 11.5% (representing SBS’s weighted average cost of capital).

The discount recorded for the purchase obligation will be amortized as interest income using an effective yield initially calculated based on the original carrying amount of the obligation and estimated annual installments to be received and adjusted in future periods to reflect actual installments received and changes in estimates of future installments. Interest income recognized on the obligation for the period from November 4, 2014 to December 31, 2014 amounted to approximately $37,000 based on a yield of approximately 12%.

As a result of the Company’s continuing involvement in the capital markets business through its 49% ownership in SBSF, results of operations of the capital market business and the gain on sale were not reflected as discontinued operations in the accompanying financial statements.

Siebert, Brandford, Shank Financial, L.L.C.

Muriel Siebert & Co., Inc. (“Siebert”) owns 49% of Siebert, Brandford, Shank Financial, L.L.C. (“SBSF”). The remaining 51% is owned by Napoleon Brandford III and Suzanne F. Shank. SBSF has been serving the public sector and growing the firm since 1996. SBSF provides municipal underwriting and financial advisory services to state and local governments across the nation for the funding of education, housing, health services, transportation, utilities, capital facilities, redevelopment and general infrastructure projects, serving important issuers across the nation. SBSF has offices across the nation. With the purchase discussed above SBSF will serve as a co-manager, underwriting syndicate member, or selling group member on a wide spectrum of securities offerings for corporations and Federal agencies. The principal activities of SCM, purchased as described above, are investment banking and institutional equity execution services which provide high-quality brokerage service to both institutional investors and issuers of equity and fixed-income securities.

Effective April 19, 2005, Siebert Financial Corp. (“SFC”) entered into an Operating Agreement with Suzanne Shank and Napoleon Brandford III, the two individual principals (the “Principals”) of SBS Financial Products Company, LLC, a Delaware limited liability company (“SBSFPC”). Pursuant to the terms of the Operating Agreement, SFC and each of the Principals made an initial capital contribution of 33.33% initial interest in SBSFPC. SBSFPC engaged in derivatives transactions related to the municipal underwriting business. SBSFPC closed down operations as of December 31, 2014.

Certain risks are involved in the underwriting of securities. Underwriting syndicates agree to purchase securities at a discount from the initial public offering price. An underwriter is exposed to losses on the securities that it has committed to purchase if the securities must be sold below the cost to the syndicate. In the last several years, investment banking firms have increasingly underwritten corporate and municipal offerings with fewer syndicate participants or, in some cases, without an underwriting syndicate.

In these cases, the underwriter assumes a larger part or all of the risk of an underwriting transaction. Under Federal securities laws, other laws and court decisions, an underwriter is exposed to substantial potential liability for material misstatements or omissions of fact in the prospectus used to describe the securities being offered.

Siebert Investment Advisors, Inc.

Siebert Investment Advisors Inc. (“SIA”) is a registered investment adviser that began business in 2014. SIA is a wholly owned subsidiary of Siebert Financial Corp and affiliated with Muriel Siebert & Co., a registered broker dealer. SIA is a boutique investment management firm that greatly extends our ability to meet our customer’s investment needs.

SIA offers advice to clients regarding asset allocation and the selection of investments. Our investment management services include the design, implementation, and continued monitoring of client accounts on a discretionary or non-discretionary basis. Investment selections and recommendation are guided by the stated objectives of the customer, other considerations include the customer’s risk profile and financial status.

SIA offers to its clients a number of Asset Management Programs (“Managed Programs”) consisting of asset allocation, flexible asset management and focused or completion strategies. In these Managed Programs, SIA acts as the co-adviser to clients. IA Representatives will assist each client in reviewing information about the programs, completing a client questionnaire to determine the client's risk tolerance, financial situation and investment objectives and selecting an investment strategy. SIA does not ever act as portfolio manager directly; SIA selects other investment advisers to act as portfolio manager on behalf of its clients.

- 5 -

Advertising, Marketing and Promotion

Siebert develops and maintains its retail customer base through printed advertising in financial publications, broadcast commercials over national and local cable TV channels. Additionally, a significant number of the firm’s new accounts are developed directly from referrals by satisfied customers.

Competition

Siebert encounters significant competition from full-commission, online and discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations, many of which are significantly larger and better capitalized than Siebert. Although there has been consolidation in the industry in both the online and traditional brokerage business during recent years, Siebert believes that additional competitors such as banks, insurance companies, providers of online financial and information services and others will continue to be attracted to the online brokerage industry. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Some of these firms are offering their services over the Internet and have devoted more resources to and have more elaborate websites than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert believes that its main competitive advantages are high quality customer service, responsiveness, cost and products offered, the breadth of product line and excellent executions.

Regulation

The securities industry in the United States is subject to extensive regulation under both Federal and state laws. The Securities and Exchange Commission (“SEC”) is the Federal agency charged with administration of the Federal securities laws. Siebert is registered as a broker-dealer with the SEC, and is a member of the New York Stock Exchange (“NYSE”) and the Financial Industry Regulatory Authority (“FINRA”). Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, principally FINRA and national securities exchanges such as the NYSE, which is Siebert’s primary regulator with respect to financial and operational compliance. These self-regulatory organizations adopt rules (subject to approval by the SEC) governing the industry and conduct periodic examinations of broker-dealers. Securities firms are also subject to regulation by state securities authorities in the states in which they do business. Siebert is registered as a broker-dealer in 50 states, the District of Columbia and Puerto Rico.

The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets, rather than protection of creditors and stockholders of broker-dealers. The regulations to which broker-dealers are subject cover all aspects of the securities business, including training of personnel, sales methods, trading practices among broker-dealers, uses and safekeeping of customers’ funds and securities, capital structure of securities firms, record keeping, fee arrangements, disclosure to clients, and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and by self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules may directly affect the method of operation and profitability of broker-dealers. The SEC, self-regulatory organizations and state securities authorities may conduct administrative proceedings which can result in censure, fine, cease and desist orders or suspension or expulsion of a broker-dealer, its officers or its employees.

As a registered broker-dealer and FINRA member organization, Siebert is required by Federal law to belong to the Securities Investor Protection Corporation (“SIPC”) which provides, in the event of the liquidation of a broker-dealer, protection for securities held in customer accounts held by the firm of up to $500,000 per customer, subject to a limitation of $250,000 on claims for cash balances. SIPC is funded through assessments on registered broker-dealers. In addition, Siebert, through its clearing agent, has purchased from private insurers additional account protection in the event of liquidation up to the net asset value, as defined, of each account. Stocks, bonds, mutual funds and money market funds are included at net asset value for purposes of SIPC protection and the additional protection. Neither SIPC protection nor the additional protection insures against fluctuations in the market value of securities.

Siebert is also authorized by the Municipal Securities Rulemaking Board (the “MSRB”) to effect transactions in municipal securities on behalf of its customers and has obtained certain additional registrations with the SEC and state regulatory agencies necessary to permit it to engage in certain other activities incidental to its brokerage business.

Margin lending arranged by Siebert is subject to the margin rules of the Board of Governors of the Federal Reserve System and the NYSE. Under such rules, broker-dealers are limited in the amount they may lend in connection with certain purchases and short sales of securities and are also required to impose certain maintenance requirements on the amount of securities and cash held in margin accounts. In addition, those rules and rules of the Chicago Board Options Exchange govern the amount of margin customers must provide and maintain in writing uncovered options.

- 6 -

Net Capital Requirements

As a registered broker-dealer, Siebert is subject to the SEC’s Uniform Net Capital Rule (Rule 15c3-1) (the “Net Capital Rule”), which has also been adopted by the NYSE. The Net Capital Rule specifies minimum net capital requirements for all registered broker-dealers and is designed to measure financial integrity and liquidity. Failure to maintain the required regulatory net capital may subject a firm to suspension or expulsion by the NYSE and FINRA, certain punitive actions by the SEC and other regulatory bodies and, ultimately, may require a firm’s liquidation.

Regulatory net capital is defined as net worth (assets minus liabilities), plus qualifying subordinated borrowings, less certain deductions that result from excluding assets that are not readily convertible into cash and from conservatively valuing certain other assets. These deductions include charges that discount the value of security positions held by Siebert to reflect the possibility of adverse changes in market value prior to disposition.

The Net Capital Rule requires notice of equity capital withdrawals to be provided to the SEC prior to and subsequent to withdrawals exceeding certain sizes. The Net Capital Rule also allows the SEC, under limited circumstances, to restrict a broker-dealer from withdrawing equity capital for up to 20 business days. The Net Capital Rule of the NYSE also provides that equity capital may not be drawn or cash dividends paid if resulting net capital would be less than 5 percent of aggregate debits.

Under applicable regulations, Siebert is required to maintain regulatory net capital of at least $250,000. At December 31, 2014 and 2013, Siebert had net capital of $5.1 million and $13.0 million, respectively. Siebert claims exemption from the reserve requirement under Section 15c3-3(k)(2)(ii).

Employees

As of March 13, 2015, we had approximately 48 full-time employees, one of whom was a corporate officer. None of our employees is represented by a union, and we believe that relations with our employees are good.

- 7 -

|

|

|

|

Item 1A. |

RISK FACTORS |

Securities market volatility and other securities industry risk could adversely affect our business

Most of our revenues are derived from our securities brokerage business. Like other businesses operating in the securities industry, our business is directly affected by volatile trading markets, fluctuations in the volume of market activity, economic and political conditions, upward and downward trends in business and finance at large, legislation and regulation affecting the national and international business and financial communities, currency values, inflation, market conditions, the availability and cost of short-term or long-term funding and capital, the credit capacity or perceived credit-worthiness of the securities industry in the marketplace and the level and volatility of interest rates. We also face risks relating to trading losses, losses resulting from the ownership or underwriting of securities, counterparty failure to meet commitments, customer fraud, employee fraud, issuer fraud, errors and misconduct, failures in connection with the processing of securities transactions and litigation. A reduction in our revenues or a loss resulting from our underwriting or ownership of securities or sales or trading of securities could have a material adverse effect on our business, results of operations and financial condition. In addition, as a result of these risks, our revenues and operating results may be subject to significant fluctuations from quarter to quarter and from year to year.

Lower price levels in the securities markets may reduce our profitability.

Lower price levels of securities may result in (i) reduced volumes of securities, options and futures transactions, with a consequent reduction in our commission revenues, and (ii) losses from declines in the market value of securities we held in investment and underwriting positions. In periods of low volume, our levels of profitability are further adversely affected because certain of our expenses remain relatively fixed. Sudden sharp declines in market values of securities and the failure of issuers and counterparties to perform their obligations can result in illiquid markets which, in turn, may result in our having difficulty selling securities. Such negative market conditions, if prolonged, may also lower our revenues from investment banking and other activities. A reduction in our revenues from investment banking or other activities could have a material adverse affect on our business, results of operations and financial condition.

There is intense competition in the brokerage industry.

Siebert encounters significant competition from full-commission, online and other discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations many of which are significantly larger and better capitalized than Siebert. SBS also encounters significant competition from firms engaged in the municipal finance business. Over the past several years, price wars and lower commission rates in the discount brokerage business in general have strengthened our competitors. Siebert believes that such changes in the industry will continue to strengthen existing competitors and attract additional competitors such as banks, insurance companies, providers of online financial and information services, and others. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert may not be able to compete effectively with current or future competitors.

Some competitors in the discount brokerage business offer services which we may not. In addition, some competitors have continued to offer lower flat rate execution fees that are difficult for any conventional discount firm to meet. Industry-wide changes in trading practices are expected to cause continuing pressure on fees earned by discount brokers for the sale of order flow. Many of the flat fee brokers impose charges for services such as mailing, transfers and handling exchanges which Siebert does not and also direct their execution to captive market makers. Continued or increased competition from ultra low cost, flat fee brokers and broader service offerings from other discount brokers could limit our growth or lead to a decline in Siebert’s customer base which would adversely affect our business, results of operations and financial condition.

We are subject to extensive government regulation.

Our business is subject to extensive regulation in the United States, at both the Federal and state level. We are also subject to regulation by self–regulatory organizations and other regulatory bodies in the United States, such as the SEC, the NYSE, FINRA and the MSRB. We are registered as a broker-dealer in 50 states, the District of Columbia and Puerto Rico. The regulations to which we are subject as a broker-dealer cover all aspects of the securities business including: training of personnel, sales methods, trading practices, uses and safe keeping of customers’ funds and securities, capital structure, record keeping, fee arrangements, disclosure and the conduct of directors, officers and employees. Failure to comply with any of these laws, rules or regulations, which may be subject to the uncertainties of interpretation, could result in civil penalties, fines, suspension or expulsion and have a material adverse effect on our business, results of operations and financial condition.

- 8 -

The laws, rules and regulations, as well as governmental policies and accounting principles, governing our business and the financial services and banking industries generally have changed significantly over recent years and are expected to continue to do so. We cannot predict which changes in laws, rules, regulations, governmental policies or accounting principles will be adopted. Any changes in the laws, rules, regulations, governmental policies or accounting principles relating to our business could materially and adversely affect our business, results of operations and financial condition.

We are subject to net capital requirements.

The SEC, FINRA, and various other securities and commodities exchanges and other regulatory bodies in the United States have rules with respect to net capital requirements which affect us. These rules have the effect of requiring that at least a substantial portion of a broker-dealer’s assets be kept in cash or highly liquid investments. Our compliance with the net capital requirements could limit operations that require intensive use of capital, such as underwriting or trading activities. These rules could also restrict our ability to withdraw our capital, even in circumstances where we have more than the minimum amount of required capital, which, in turn, could limit our ability to implement growth strategies. In addition, a change in such rules, or the imposition of new rules, affecting the scope, coverage, calculation or amount of such net capital requirements, or a significant operating loss or any unusually large charge against net capital, could have similar adverse effects.

Our customers may fail to pay us.

A principal credit risk to which we are exposed on a regular basis is that our customers may fail to pay for their purchases or fail to maintain the minimum required collateral for amounts borrowed against securities positions maintained by them. We cannot assure you that the policies and procedures we have established will be adequate to prevent a significant credit loss.

We face risks relating to our investment banking activities.

Certain risks are involved in the underwriting of securities. Investment banking and underwriting syndicates agree to purchase securities at a discount from the public offering price. If the securities must be sold below the syndicate cost, an underwriter is exposed to losses on the securities that it has committed to purchase. In the last several years, investment banking firms increasingly have underwritten corporate and municipal offerings with fewer syndicate participants or, in some cases, without an underwriting syndicate. In these cases, the underwriter assumes a larger part or all of the risk of an underwriting transaction.

Under Federal securities laws, other laws and court decisions, an underwriter is exposed to substantial potential liability for material misstatements or omissions of fact in the prospectus used to describe the securities being offered. While municipal securities are exempt from the registration requirements of the Securities Act of 1933, underwriters of municipal securities are exposed to substantial potential liability for material misstatements or omissions of fact in the offering documents prepared for these offerings.

An increase in volume on our systems or other events could cause them to malfunction.

During 2014, we received and processed up to approximately 67% of our trade orders electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether. Any significant degradation or failure of our systems or the systems of third parties involved in the trading process (e.g., online and Internet service providers, record keeping and data processing functions performed by third parties, and third party software), even for a short time, could cause customers to suffer delays in trading. These delays could cause substantial losses for customers and could subject us to claims from these customers for losses. There can be no assurance that our network structure will operate appropriately in the event of a subsystem, component or software failure. In addition, we cannot assure you that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, an earthquake, terrorist attack, fire or any act of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and operating results.

We rely on information processing and communications systems to process and record our transactions.

Our operations rely heavily on information processing and communications systems. Our system for processing securities transactions is highly automated. Failure of our information processing or communications systems for a significant period of time could limit our ability to process a large volume of transactions accurately and rapidly. This could cause us to be unable to satisfy our obligations to customers and other securities firms, and could result in regulatory violations. External events, such as an earthquake, terrorist attack or power failure, loss of external information feeds, such as security price information, as well as internal malfunctions such as those that could occur during the implementation of system modifications, could render part or all of these systems inoperative.

- 9 -

We may not be able to keep up pace with continuing changes in technology.

Our market is characterized by rapidly changing technology. To be successful, we must adapt to this rapidly changing environment by continually improving the performance, features and reliability of our services. We could incur substantial costs if we need to modify our services or infrastructure or adapt our technology to respond to these changes. A delay or failure to address technological advances and developments or an increase in costs resulting from these changes could have a material and adverse effect on our business, financial condition and results of operations.

We depend on our ability to attract and retain key personnel.

Our continued success was principally dependent on our founder, Muriel F. Siebert, our former Chairwoman, Chief Executive Officer and President, and our senior management. In addition, the continued success of SBSF may be dependent on the services of Napoleon Brandford III and Suzanne Shank. The loss of the services of any of these individuals could significantly harm our business, financial condition and operating results. However the appointment of Suzanne Shank as Acting Chief Executive Officer and Joseph Ramos as Chief Operating Officer has stabilized the Company as a result of our loss of Ms. Siebert. On March 3, 2015 Suzanne Shank completed her role as acting Chief Executive Officer of our Company to devote full time to her continuing position as Chief Executive Officer of SBSF.

Our principal shareholder may control many key decisions.

The estate of Ms. Muriel F. Siebert currently owns approximately 90% of our outstanding common stock. The executors of the estate, Jane Macon and Patricia Francy, who are both directors of the Company, have the power to elect the entire Board of Directors and, except as otherwise provided by law or our Certificate of Incorporation or by-laws, to approve any action requiring shareholder approval without a shareholders meeting.

There may be no public market for our common stock.

Only approximately 2,200,000 shares, or approximately 10% of our shares outstanding, are currently held by the public. Although our common stock is traded in The NASDAQ Capital Market, there can be no assurance that an active public market will continue.

|

|

|

|

Item 1B. |

UNRESOLVED STAFF COMMENTS |

None.

|

|

|

|

Item 2. |

PROPERTIES |

Siebert currently maintains four retail discount brokerage offices. Customers can visit these offices to obtain market information, place orders, open accounts, deliver and receive checks and securities, and obtain related customer services in person. Nevertheless, most of Siebert’s activities are conducted on the Internet or by telephone and mail.

- 10 -

Siebert operates its business out of the following four leased offices:

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

Approximate |

|

Expiration Date |

|

Renewal |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Headquarters, Retail and Investment Banking Office |

|

|

|

|

|

|

|

|

|

|

|

885 Third Avenue |

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10022 |

|

|

8,585 |

|

|

2/28/17 |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail Offices |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9701 Wilshire Boulevard, Suite 1111 |

|

|

|

|

|

|

|

|

|

|

|

Beverly Hills, CA 90212 |

|

|

1,189 |

|

|

10/31/15 |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4400 North Federal Highway |

|

|

|

|

|

|

|

|

|

|

|

Boca Raton, FL 33431 |

|

|

2,438 |

|

|

Month to Month |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

111 Pavonia Avenue(1) |

|

|

|

|

|

|

|

|

|

|

|

Jersey City, NJ 07310 |

|

|

8,141 |

|

|

6/30/15 |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Certain of our administrative and back office functions are performed at this location. We believe that our properties are in good condition and are suitable for our operations. |

|

|

|

|

|

Item 3. |

LEGAL PROCEEDINGS |

In 2012, Siebert was named as one of the defendants in a class action pending in the United States District Court, Southern District of New York. The complaint was brought on behalf of a class of purchasers in a public offering by Lehman Brothers Holdings, Inc. of $1,500,000,000 of 6.75% Subordinated Notes due 2017 (the “Notes”) as to Siebert and certain smaller issuances of other securities. The complaint asserted that Siebert and other underwriters of the Notes violated Section 11 of the Securities Act of 1933 in that relevant offering materials were false and misleading. Siebert had agreed to purchase $15 million of the Notes and $462,953 of the other securities as an underwriter in the offerings. Siebert and the plaintiffs’ class agreed to resolve all claims against Siebert in consideration of a $1 million payment by Siebert in the prior year. Certain plaintiffs did not agree to a settlement or purchased securities which were not covered by the settlement. In 2013 all such claims were either dismissed or settled for an amount that was not material.

In July 2014, the Company entered into a settlement agreement in regards to a dispute with a former employee, in which the former employee sought, among other things, damages arising from his separation from the Company. The Company asserted counter claims in the arbitration. Pursuant to the settlement, the Company paid $4,300,000 to the former employee, and the claims and counterclaims have been dismissed and released. The accompanying statement of operations reflects a change to give effect to the settlement.

The Company is party to certain claims, suits and complaints arising in the ordinary course of business. In the opinion of management, all such matters are without merit, or involve amounts which would not have a significant effect on the financial position of the Company.

|

|

|

|

Item 4. |

MINE SAFETY DISCLOSURES |

Not applicable

- 11 -

PART II

|

|

|

|

Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock traded on the NASDAQ Global Market until June 29, 2011 when our common stock started trading on the NASDAQ Capital Market, under the symbol “SIEB”. The high and low sales prices of our common stock reported by NASDAQ during the following calendar quarters were:

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

Low |

|

||

|

First Quarter - 2013 |

|

$ |

1.81 |

|

$ |

1.27 |

|

|

|

|

|

|

|

|

|

|

|

Second Quarter - 2013 |

|

$ |

1.75 |

|

$ |

1.35 |

|

|

|

|

|

|

|

|

|

|

|

Third Quarter - 2013 |

|

$ |

1.82 |

|

$ |

1.39 |

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter - 2013 |

|

$ |

1.77 |

|

$ |

1.43 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter – 2014 |

|

$ |

4.45 |

|

$ |

1.61 |

|

|

|

|

|

|

|

|

|

|

|

Second Quarter – 2014 |

|

$ |

3.44 |

|

$ |

2.67 |

|

|

|

|

|

|

|

|

|

|

|

Third Quarter – 2014 |

|

$ |

2.85 |

|

$ |

2.05 |

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter – 2014 |

|

$ |

2.90 |

|

$ |

2.03 |

|

On March 13, 2015, the closing price of our common stock on the NASDAQ Capital Market was $1.70 per share. There were 130 holders of record of our common stock and more than 1,500 beneficial owners of our common stock on March 13, 2015.

On January 4, 2011, we received notice from The NASDAQ Stock Market stating that for more than 30 consecutive business days, the market value of publicly held shares closed below the minimum $5 million required for continued listing on The NASDAQ Global Market under NASDAQ Rule 5450(b)(1)(C). Market value of publicly held shares is calculated by multiplying the publicly held shares, which is total shares outstanding less any shares held by officers, directors, or beneficial owners of more than 10%, by the closing bid price. The estate of Muriel F. Siebert owns approximately 90% of our outstanding common stock. The value of shares by the estate of Muriel F. Siebert’s estate, and the value of shares beneficially owned by other officers and directors of the Company, is therefore excluded from the market value of publicly held shares of the Company.

NASDAQ Rule 5810(c)(3)(D) provided the Company a grace period of 180 calendar days, or until July 5, 2011, to regain compliance with The NASDAQ Stock Market requirement. As the market value of publicly held shares did not reach the required value during the grace period, our common stock was transferred to the NASDAQ Capital Market on June 29, 2011.

Dividend Policy

Our Board of Directors periodically considers whether to declare dividends. In considering whether to pay such dividends, our Board of Directors will review our earnings capital requirements, economic forecasts and such other factors as are deemed relevant. Some portion of our earnings will be retained to provide capital for the operation and expansion of our business.

Issuer Purchases of Equity Securities

On January 23, 2008, our Board of Directors authorized the repurchase of up to 300,000 shares of our common stock. We will purchase shares from time to time, in our discretion, in the open market and in private transactions. No shares were purchased in 2014.

- 12 -

A summary of our repurchase activity for the three months ended December 31, 2014 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Total |

|

Average Price |

|

Cumulative Number |

|

Maximum |

|

||||

|

October 2014 |

|

|

— |

|

$ |

— |

|

|

129,137 |

|

|

170,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 2014 |

|

|

— |

|

$ |

— |

|

|

129,137 |

|

|

170,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 2014 |

|

|

— |

|

$ |

— |

|

|

129,137 |

|

|

170,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

0 |

|

$ |

0 |

|

|

129,137 |

|

|

170,863 |

|

Equity Compensation Plan Information

The following table sets forth information as of December 31, 2014 with respect to our equity compensation plans.

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan Category |

|

Number of Securities to be |

|

Weighted- |

|

Number of Securities |

|

|||

|

|

|

(a) |

|

(b) |

|

(c) |

|

|||

|

Equity compensation plans approved by security holders (1) |

|

|

265,000 |

|

$ |

3.02 |

|

|

1,760,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

265,000 |

|

$ |

3.02 |

|

|

1,760,000 |

|

|

|

|

|

(1) Consists of our 1997 and 2007 compensation plans. |

|

- 13 -

|

|

|

|

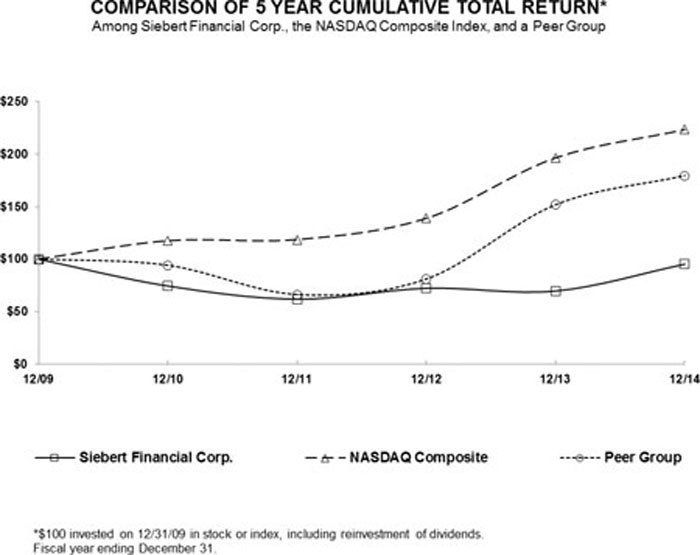

Our Performance |

The graph below compares our performance from December 31, 2009 through December 31, 2014 against the performance of the NASDAQ Composite Index and a peer group. The peer group consists of A.B. Watley Group Inc., Ameritrade Holding Corporation, E*Trade Financial Corporation and The Charles Schwab Corporation. |

- 14 -

|

|

|

|

Item 6. |

SELECTED FINANCIAL DATA |

(In thousands except share and per share data)

The Following Selected Financial Information

Should Be Read In Conjunction with Our Consolidated Financial

Statements and the Related Notes Thereto.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

|

|||||

|

Income statement data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues |

|

$ |

15,852 |

|

$ |

16,401 |

|

$ |

20,983 |

|

$ |

20,199 |

|

$ |

20,770 |

|

|

Net loss |

|

$ |

(6,557 |

) |

$ |

(5,912 |

) |

$ |

(171 |

) |

$ |

(5,379 |

) |

$ |

(2,640 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.30 |

) |

$ |

(0.27 |

) |

$ |

(0.01 |

) |

$ |

(0.24 |

) |

$ |

(0.12 |

) |

|

Diluted |

|

$ |

(0.30 |

) |

$ |

(0.27 |

) |

$ |

(0.01 |

) |

$ |

(0.24 |

) |

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (basic) |

|

|

22,085,126 |

|

|

22,087,324 |

|

|

22,100,759 |

|

|

22,114,121 |

|

|

22,167,218 |

|

|

Weighted average shares outstanding (diluted) |

|

|

22,085,126 |

|

|

22,087,324 |

|

|

22,100,759 |

|

|

22,114,121 |

|

|

22,167,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of financial condition data (at year end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

20,728 |

|

$ |

27,970 |

|

$ |

33,456 |

|

$ |

34,823 |

|

$ |

40,103 |

|

|

Total liabilities excluding subordinated borrowings |

|

$ |

2,176 |

|

$ |

2,861 |

|

$ |

2,416 |

|

$ |

3,599 |

|

$ |

3,477 |

|

|

Stockholders’ equity |

|

$ |

18,552 |

|

$ |

25,109 |

|

$ |

31,040 |

|

$ |

31,224 |

|

$ |

36,626 |

|

|

Cash dividends declared on common shares |

|

$ |

0 |

|

$ |

0 |

|

$ |

0 |

|

$ |

0 |

|

$ |

0 |

|

|

|

|

|

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion should be read in conjunction with our audited Consolidated Financial Statements and the Notes thereto contained elsewhere in this Annual Report.

Our working capital is invested primarily in money market funds, so that liquidity has not been materially affected. The recent financial crisis did have the effect of reducing participation in the securities market by our retail and institutional customers, which had an adverse effect on our revenues. While the stock market improved in 2014 our revenues did not. In 2012 we did have one customer account generate commissions that accounted for 12% of the total revenue. Income of our affiliate, SBSF, decreased in 2014 to $171,000 as a result of a decrease in the number of offerings by municipalities. As a result, the Company’s income from SBSF decreased in 2014 to $84,000. The Company’s professional expenses during 2014, 2013 and 2012 include the costs of an arbitration proceeding commenced by a former employee following the termination of his employment, which was resolved in 2014 resulting in a $4,300,000 settlement payment. The action has adversely affected the Company’s results of operations. Competition in the brokerage industry remains intense.

On November 4, 2014, the Company, which held a 49% membership interest in, and the other members of, Siebert Brandford Shank & Co., LLC (“SBS”), contributed their SBS membership interests into a newly formed Delaware limited liability company, Siebert Brandford Shank Financial, L.L.C. (“SBSF”), in exchange for the same percentage interests in SBSF. On the same day, the Company entered into an Asset Purchase Agreement (the “Purchase Agreement”) with SBS and SBSF, pursuant to which the Company sold substantially all of the assets relating to the Company’s capital markets business to SBSF. Pursuant to the Purchase Agreement, SBSF assumed post-closing liabilities relating to the transferred business.

The Purchase Agreement provides for an aggregate purchase price for the disposition of $3,000,000, payable by SBSF after closing in annual installments commencing on March 1, 2016 and continuing on each of March 1, 2017, 2018, 2019 and 2020. The transferred business was contributed by SBSF to, and operated by SBS. The amount payable to the Company on each annual payment date will equal 50% of the net income attributable to the transferred business recognized by SBS in accordance with generally accepted accounting principles during the fiscal year ending immediately preceding the applicable payment date; provided that, if net income attributable to the transferred business generated prior to the fifth annual payment date is insufficient to pay the remaining

- 15 -

balance of the purchase price in full on the fifth annual payment date, then the unpaid amount of the purchase price will be paid in full on March 1, 2021.

Transferred assets of the Company’s capital markets business consisted of issuer relationships and goodwill, which assets had no carrying value to the Company, and the Company recorded a gain on sale of $ 1,820,000, which reflected the fair value of the purchase obligation. Such fair value (Level 3) was based on the present value of estimated annual installments to be received during 2016 through 2020 from forecasted net income of the transferred business plus a final settlement in 2021, discounted at 11.5% (representing SBS’s weighted average cost of capital),

The discount recorded for the purchase obligation will be amortized as interest income using an effective yield, initially calculated based on the original carrying amount of the obligation and estimated annual installments to be received and adjusted in future periods to reflect actual installments received and changes in estimates of future installments. Interest income recognized on the obligation for the period from November 4, 2014 to December 31, 2014, amounted to approximately $37,000 based on a yield of approximately 12%.

As a result of the Company’s continuing involvement in the capital markets business through its 49% ownership in SBSF, results of operations of the capital markets business and the gain on sale were not reflected as discontinued operations in the accompanying statement of operations.

The following table sets forth certain metrics as of December 31, 2014, 2013 and 2012, respectively, which we use in evaluating our business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months |

|

|||||||

|

Retail Customer Activity: |

|

2014 |

|

2013 |

|

2012 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Total retail trades: |

|

|

293,419 |

|

|

327,285 |

|

|

321,687 |

|

|

Average commission per retail trade: |

|

$ |

19.50 |

|

$ |

21.70 |

|

$ |

27.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

||||

|

|

|

2014 |

|

2013 |

|

||

|

|

|

|

|

|

|

|

|

|

Retail customer balances: |

|

|

|

|

|

|

|

|

Retail customer net worth (in billions): |

|

$ |

7.3 |

|

$ |

7.3 |

|

|

Retail customer money market fund value (in billions): |

|

$ |

1.0 |

|

$ |

1.1 |

|

|

Retail customer margin debit balances (in millions): |

|

$ |

232.3 |

|

$ |

215.7 |

|

|

Retail customer accounts with positions: |

|

|

32,962 |

|

|

35,591 |

|

Description:

|

|

|

|

|

|

• |

Total retail trades represents retail trades that generate commissions. |

|

|

|

|

|

|

• |

Average commission per retail trade represents the average commission generated for all types of retail customer trades. |

|

|

|

|

|

|

• |

Retail customer net worth represents the total value of securities and cash in the retail customer accounts before deducting margin debits. |

|

|

|

|

|

|

• |

Retail customer money market fund value represents all retail customers accounts invested in money market funds. |

|

|

|

|

|

|

• |

Retail customer margin debit balances represents credit extended to our customers to finance their purchases against current positions. |

|

|

|

|

|

|

• |

Retail customer accounts with positions represent retail customers with cash and/or securities in their accounts. |

We, like other securities firms, are directly affected by general economic and market conditions including fluctuations in volume and prices of securities, changes and the prospect of changes in interest rates, and demand for brokerage and investment banking services, all of which can affect our profitability. In addition, in periods of reduced financial market activity, profitability is likely to be adversely affected because certain expenses remain relatively fixed, including salaries and related costs, portions of communications costs and occupancy expenses. Accordingly, earnings for any period should not be considered representative of earnings to be expected for any other period.

- 16 -

Competition continues to intensify among all types of brokerage firms, including established discount brokers and new firms entering the on-line brokerage business. Electronic trading continues to account for an increasing amount of trading activity, with some firms charging very low trading execution fees that are difficult for any conventional discount firm to meet. Some of these brokers, however, impose asset based charges for services such as mailing, transfers and handling exchanges which we do not currently impose, and also direct their orders to market makers where they have a financial interest. Continued competition could limit our growth or even lead to a decline in our customer base, which would adversely affect our results of operations. Industry-wide changes in trading practices, such as the continued use of Electronic Communications Networks, are expected to put continuing pressure on commissions/fees earned by brokers while increasing volatility.

We are a party to an Operating Agreement (the “Operating Agreement”), with Suzanne Shank and Napoleon Brandford III, the two individual principals (the “Principals”) of SBSFPC. Pursuant to the terms of the Operating Agreement, the Company and each of the Principals made an initial capital contribution of $400,000 in exchange for a 33.33% initial interest in SBSFPC. SBSFPC engages in derivatives transactions related to the municipal underwriting business. The Operating Agreement provides that profit and loss will be shared 66.66% by the Principals and 33.33% by us. The Company and principals closed down the operations of SBSFPC in 2014.

In 2014, we began business as a registered investment advisor through our wholly-owned subsidiary, Siebert Investment Advisors, Inc. (“SIA”). SIA is a boutique investment management firm that greatly extends our ability to meet our customer’s investment needs. SIA offers advice to clients regarding asset allocation and the selection of investments. Our investment management services include the design, implementation, and continued monitoring of client accounts on a discretionary or non-discretionary basis. Investment selections and recommendation are guided by the stated objectives of the customer, other considerations include the customer’s risk profile and financial status.

SIA offers to its clients a number of Asset Management Programs (“Managed Programs”) consisting of asset allocation, flexible asset management and focused or completion strategies. In these Managed Programs, SIA acts as the co-adviser to clients. IA Representatives will assist each client in reviewing information about the programs, completing a client questionnaire to determine the client's risk tolerance, financial situation and investment objectives and selecting an investment strategy. SIA does not ever act as portfolio manager directly, SIA selects other investment advisers to act as portfolio manager on behalf of its clients. During 2014, the results of SIA operations are immaterial to the operations of the Company.

On January 23, 2008, our Board of Directors authorized a buy back of up to 300,000 shares of our common stock. Under this program, shares are purchased from time to time, at our discretion, in the open market and in private transactions. No shares were purchased during 2014.

Critical Accounting Policies

We generally follow accounting policies standard in the brokerage industry and believe that our policies appropriately reflect our financial position and results of operations. Our management makes significant estimates that affect the reported amounts of assets, liabilities, revenues and expenses and the related disclosure of contingent assets and liabilities included in the financial statements. The estimates relate primarily to revenue and expense items in the normal course of business as to which we receive no confirmations, invoices, or other documentation, at the time the books are closed for a period. We use our best judgment, based on our knowledge of revenue transactions and expenses incurred, to estimate the amount of such revenue and expenses. We are not aware of any material differences between the estimates used in closing our books for the last five years and the actual amounts of revenue and expenses incurred when we subsequently receive the actual confirmations, invoices or other documentation. Estimates are also used in determining the useful lives of intangibles assets, and the fair market value of intangible assets. Our management believes that its estimates are reasonable.

- 17 -

Results of Operations

Year Ended December 31, 2014 Compared to Year Ended December 31, 2013

Revenues. Total revenues for 2014 were $15.9 million, a decrease of $549,000, or 3.3%, from 2013. Commission and fee income decreased $1.2 million, or 9.9%, from the prior year to $10.8 million primarily due to a decrease in retail trading and in the average commission charged per retail trade. Capital Markets Division was sold to our affiliate SBSF on November 4, 2014 resulting in reduced institutional trading commissions and investment banking revenues. Commission recapture operations were shut down on September 30, 2014.

Investment banking revenues decreased $588,000 or 24.3%, from the prior year to $1.8 million in 2014 due to our participation in fewer new issues in the equity and debt capital markets. The Capital Markets division was sold on November 4, 2014 to our affiliate.

Trading profits decreased $625,000, or 31.6%, from the prior year to $1.4 million in 2014 primarily due to an overall decrease in trading volume primarily in the debt markets.

The Company recorded a gain on the sale of our Capital Markets Segment of $ 1,820,000, which reflected the fair value of the purchase obligation (transferred assets of the Company’s capital markets business, consisted of customer accounts and goodwill, which had no carrying value to the Company. Such fair value was based on the present value of estimated annual installments to be received during 2016 through 2020 from forecasted net income of the transferred business plus a final settlement in 2021, discounted at 11.5% (representing SBS’s weighted average cost of capital), the sale was for $3,000,000 recorded at a discount.

The discount recorded for the purchase obligation will be amortized as interest income using an effective yield initially calculated based on the original carrying amount of the obligation and estimated annual installments to be received and adjusted in future periods to reflect actual installments received and changes in estimates of future installments. Interest income recognized on the obligation for the period from November 4, 2014 to December 31, 2014 amounted to $36,641 based on a yield of approximately 12%.

Income from interest and dividends increased $32,000, or 51.6%, from the prior year to $94,000 in 2014 primarily due to accrued interest on our receivable from business sold to affiliate (see above paragraph).

Expenses. Total expenses for 2014 were $22.5 million, an increase of $247,000, or 1.1%, from the prior year.

Employee compensation and benefit costs decreased $995,000, or 10.7%, from the prior year to $8.3 million in 2014. This decrease was due a reduction in head count from the previous year.

Clearing and floor brokerage fees decreased $717,000, or 30.1%, from the prior year to $1.7 million in 2014 primarily due to lower retail trading volumes, lower execution charges for institutional equity trading, as well as shutting down our rebate recapture business on September 30, 2014.

Professional fees decreased $1.0 million, or 18.6% from the prior year to $4.3 million in 2014 primarily due to a decrease in legal fees relating to a dispute with a former employee (see settlement of case below).

In July 2014, the Company entered into a settlement agreement in regard to a dispute with a former employee, in which the former employee sought, among other things, damages arising from his separation from the Company. The Company asserted counter claims in the arbitration. Pursuant to the settlement, the Company paid $4,300,000 to the former employee, and the claims and counterclaims have been dismissed and released.

Advertising and promotion expense decreased $157,000, or 38.8%, from the prior year to $248,000 in 2014 due to a decrease in online and print advertising.

Communications expense decreased $431,000, or 33.3%, from the prior year to $865,000 in 2014 due to a new phone system and phone vendor. Quote fees were down as well due to the reduction in Bloomberg terminals due to the sale of our Capital Markets segment on November 4, 2014. Retail trading revenues were down causing quotes to go down.

Occupancy costs decreased $258,000, or 24.7%, from the prior year to $788,000 in 2014 due to our Palm Beach branch closing on March 31, 2014, reduction in our Jersey City branch operating expenses, and New York rent rebates as per our lease.

Impairment of intangibles of $300,000 in 2013 was the result of the Company writing down the carrying value of its unamortized intangible assets to zero.

Other general and administrative expenses decreased $212,000, or 9.4%, from the prior year to $2.0 million in 2014 due decreases in office expense in travel, entertainment, computer security updates, and registration expense.

- 18 -