|

|

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

|

|

Form 10-K |

|

|

|

(Mark One) |

|

|

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the fiscal year ended: December 31, 2011 |

|

|

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

|

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from______________to________________ |

|

|

|

Commission file number 0-5703 |

|

|

|

|

|

Siebert Financial Corp. |

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

New York |

|

11-1796714 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

885 Third Avenue, New York, New York |

|

10022 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(212) 644-2400

Registrant’s telephone number

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

Title of each class |

Name of each exchange on which registered |

|

COMMON STOCK, PAR VALUE $.01 PER SHARE |

THE NASDAQ CAPITAL MARKET |

Securities registered under Section 12(g) of the Exchange Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well- known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of the Common Stock held by non-affiliates of the registrant (based upon the last sale price of the Common Stock reported on the NASDAQ Capital Market as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2011)), was $3,641,491.

The number of shares of the registrant’s outstanding Common Stock, as of March 13, 2012, was 22,103,176 shares.

Documents Incorporated by Reference: Definitive Proxy Statement to be filed pursuant to Regulation 14A of the Exchange Act on or before April 29, 2012 is incorporated by reference into Part III.

Special Note Regarding Forward-Looking Statements

Statements in this Annual Report on Form 10-K, as well as oral statements that may be made by the Company or by officers, directors or employees of the Company acting on the Company’s behalf, that are not statements of historical or current fact constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve risks and uncertainties and known and unknown factors that could cause the actual results of the Company to be materially different from historical results or from any future results expressed or implied by such forward looking statements, including without limitation: changes in general economic and market conditions; changes and prospects for changes in interest rates; fluctuations in volume and prices of securities; demand for brokerage and investment banking services; competition within and without the discount brokerage business, including the offer of broader services; competition from electronic discount brokerage firms offering greater discounts on commissions than the Company; the prevalence of a flat fee environment; decline in participation in corporate or municipal finance underwritings; limited trading opportunities; the method of placing trades by the Company’s customers; computer and telephone system failures; the level of spending by the Company on advertising and promotion; trading errors and the possibility of losses from customer non-payment of amounts due; other increases in expenses and changes in net capital or other regulatory requirements. We undertake no obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date when such statements were made or to reflect the occurrence of unanticipated events. An investment in us involves various risks, including those mentioned above and those which are detailed from time to time in our Securities and Exchange Commission filings.

- 2 -

PART I

|

|

|

|

Item 1. |

BUSINESS |

General

Siebert Financial Corp. is a holding company that conducts its retail discount brokerage and investment banking business through its wholly-owned subsidiary, Muriel Siebert & Co., Inc., a Delaware corporation. Muriel F. Siebert, the first woman member of the New York Stock Exchange, is our Chairwoman, Chief Executive Officer and President and owns approximately 90% of our outstanding common stock, par value $.01 per share (the “Common Stock”). For purposes of this Annual Report, the terms “Siebert,” “Company,” “we,” “us” and “our” refer to Siebert Financial Corp. and its consolidated subsidiaries, unless the context otherwise requires.

Our principal offices are located at 885 Third Avenue, New York, New York 10022, and our phone number is (212) 644-2400. Our Internet address is www.siebertnet.com. Our SEC filings are available through our website at www.siebertnet.com, where you are able to obtain copies of the Company’s public filings free of charge. Our Common Stock trades on the NASDAQ Capital Market under the symbol “SIEB”.

Business Overview

Siebert’s principal activity is providing Internet and traditional discount brokerage and related services to retail investors and, through its wholly owned subsidiary, Siebert Women’s Financial Network, Inc. (“WFN”), providing products, services and information devoted to women’s financial needs. Through its Capital Markets division, Siebert also offers institutional clients equity execution services on an agency basis, as well as equity and fixed income underwriting and investment banking services. We believe that we are the largest Woman-Owned Business Enterprise (“WBE”) in the capital markets business in the United States. In addition, Siebert, Brandford, Shank & Co., L.L.C. (“SBS”), a company in which Siebert holds a 49% ownership interest, is the largest Minority and Women’s Business Enterprise (“MWBE”) in the tax-exempt underwriting business in the United States.

The Retail Division

Discount Brokerage and Related Services. Siebert became a discount broker on May 1, 1975. Siebert believes that it has been in business and a member of The New York Stock Exchange, Inc. (the “NYSE”) longer than any other discount broker. In 1998, Siebert began to offer its customers access to their accounts through SiebertNet, its Internet website. Siebert’s focus in its discount brokerage business is to serve retail clients seeking a wide selection of quality investment services, including trading through a broker on the telephone, through a wireless device or via the Internet, at commissions that are substantially lower than those of full-commission firms. Siebert clears its securities transactions on a fully disclosed basis through National Financial Services Corp. (“NFS”), a wholly owned subsidiary of Fidelity Investments.

Siebert serves investors who make their own investment decisions. Siebert seeks to assist its customers in their investment decisions by offering a number of value added services, including easy access to account information. Siebert’s representatives are available to assist customers with information via toll-free 800 service Monday through Friday between 7:30 a.m. and 7:30 p.m. Eastern Time. Through its SiebertNet, Mobile Broker, inter-active voice recognition and Siebert MarketPhone services, 24-hour access is available to customers.

Independent Retail Execution Services. Siebert and our clearing agent monitor order flow in an effort to ensure that we are getting the best possible trade executions for customers. Siebert does not make markets in securities, nor does it take positions against customer orders.

Siebert’s equity orders are routed by its clearing agent in a manner intended to afford its customers the opportunity for price improvement on all orders. The firm also offers customers execution services through various electronic communication networks (“ECNs”) for an additional fee. These systems give customers access to numerous ECNs before and after regular market hours. Siebert believes that its over-the counter executions consistently afford its customers the opportunity for price improvement.

Customers may also indicate online interest in buying or selling fixed income securities, including municipal bonds, corporate bonds, mortgage-backed securities, government sponsored enterprises, unit investment trusts or certificates of deposit. These transactions are serviced by registered representatives.

Retail Customer Service. Siebert believes that superior customer service enhances its ability to compete with larger discount brokerage firms and therefore provides retail customers, at no additional charge, with personal service via toll-free access to dedicated customer support personnel for all of its products and services. Customer service personnel are located in each of Siebert’s branch offices. Siebert has retail offices in New York, New York; Jersey City, New Jersey; Boca Raton, and West Palm Beach, Florida; and Beverly Hills, California. Siebert uses a proprietary Customer Relationship Management System that enables representatives, no matter where located, to view a customer’s service requests and the response thereto. Siebert’s telephone system permits the automatic routing of calls to the next available agent having the appropriate skill set.

- 3 -

Retirement Accounts. Siebert offers customers a variety of self-directed retirement accounts for which it acts as agent on all transactions. Custodial services are provided through an affiliate of NFS, the firm’s clearing agent, which also serves as trustee for such accounts. Each IRA, SEP IRA, ROTH IRA, 401(k) and KEOGH account can be invested in mutual funds, stocks, bonds and other investments in a consolidated account.

Customer Financing. Customers margin accounts are carried through Siebert’s clearing agent which lends customers a portion of the market value of certain securities held in the customer’s account. Margin loans are collateralized by these securities. Customers also may sell securities short in a margin account, subject to minimum equity and applicable margin requirements, and the availability of such securities to be borrowed. In permitting customers to engage in margin, short sale or any other transaction, Siebert assumes the risk of its customers’ failure to meet their obligations in the event of adverse changes in the market value of the securities positions. Both Siebert and its clearing agents reserve the right to set margin requirements higher than those established by the Federal Reserve Board.

Siebert has established policies with respect to maximum purchase commitments for new customers or customers with inadequate collateral to support a requested purchase. Managers have some flexibility in the allowance of certain transactions. When transactions occur outside normal guidelines, Siebert monitors accounts closely until their payment obligations are completed; if the customer does not meet the commitment, Siebert takes steps to close out the position and minimize any loss. Siebert has not had significant credit losses in the last five years.

Information and Communications Systems. Siebert relies heavily on the data technology platform provided by its clearing agent, NFS LLC (“NFS”). This platform offers an interface to NFS’ main frame computing system where all customer account records are kept and is accessible by Siebert’s network. Siebert’s systems also utilize browser based access and other types of data communications. Siebert’s representatives use NFS systems, by way of Siebert’s technology platform, to perform daily operational functions which include trade entry, trade reporting, clearing related activities, risk management and account maintenance.

Siebert’s data technology platform offers services used in direct relation to customer related activities as well as support for corporate use. Some of these services include email and messaging, market data systems and third party trading systems, business productivity tools and customer relationship management systems. Siebert’s branch offices are connected to the main offices in New York, New York and Jersey City, New Jersey via a virtual private network. Siebert’s data network is designed with redundancy in case a significant business disruption occurs.

Siebert’s voice network offers a call center feature that can route and queue calls for certain departments within the organization. Additionally, the systems call manager offers reporting and tracking features which enable staff to determine how calls are being managed, such as time on hold, call duration and total calls by agent.

To ensure reliability and to conform to regulatory requirements related to business continuity, Siebert maintains backup systems and backup data. However, in the event of a wide-spread disruption, such as a massive natural disaster, Siebert’s ability to satisfy the obligations to customers and other securities firms could be significantly hampered or completely disrupted. For more information regarding Siebert’s Business Continuity Plan, please visit our website at www.siebertnet.com or write to us at Muriel Siebert & Co., Inc., Compliance Department, 885 Third Avenue, Suite 1720, New York, NY 10022.

Our website has design, navigation, and functionality features such as:

|

|

|

|

|

|

▪ |

Informative trading screens: Customers can stay in touch while trading, double-check balances, positions and order status, see real time quotes, intraday and annual charts and news headlines – automatically – as they place orders. |

|

|

|

|

|

|

▪ |

Multiple orders: Customers can place as many as 10 orders at one time. |

|

|

|

|

|

|

▪ |

Tax-lot trading: Our online equity order entry screen allows customers to specify tax lots which display with cost basis and current gain/loss on a real-time positions page. |

|

|

|

|

|

|

▪ |

Trailing stop orders: Customers can enter an order that trails the market as a percentage of share price or with a flat dollar value and the system will execute their instructions automatically. |

|

|

|

|

|

|

▪ |

Contingent orders: Customers can place One-Triggers-Two Bracket and One-Cancels-Other Bracket orders. |

|

|

|

|

|

|

▪ |

Options Wizard and Strategy Builder: Customers can review single and complex options combinations and components of each along with profit/risk potential and impact of time. The Strategy Builder presents real-time debit/credit amounts, potential maximum gain/loss and potential breakeven points by strike price. |

|

|

|

|

|

|

▪ |

An easy-to-install desktop security program that may be installed to help protect against certain types of online fraud such as “keylogging” and “phishing.” |

- 4 -

The Capital Markets Division

Siebert’s Capital Markets Group (“SCM”) division serves as a co-manager, underwriting syndicate member, or selling group member on a wide spectrum of securities offerings for corporations and Federal agencies. The principal activities of the Capital Markets Division are investment banking and institutional equity execution services. SCM provides high-quality brokerage service to both institutional investors and issuers of equity and fixed-income securities.

Siebert, Brandford, Shank & Co., L.L.C.

Muriel Siebert & Co., Inc. (“Siebert”) owns 49% of Siebert, Brandford, Shank & Co., L.L.C. (“SBS”). The remaining 51% is owned by Napoleon Brandford III and Suzanne F. Shank. SBS has been serving the public sector and growing the firm since 1996. SBS provides municipal underwriting and financial advisory services to state and local governments across the nation for the funding of education, housing, health services, transportation, utilities, capital facilities, redevelopment and general infrastructure projects, serving important issuers across the nation. SBS has offices across the nation.

Effective April 19, 2005, Siebert Financial Corp. (“SFC”) entered into an Operating Agreement with Suzanne Shank and Napoleon Brandford III, the two individual principals (the “Principals”) of SBS Financial Products Company, LLC, a Delaware limited liability company (“SBSFPC”). Pursuant to the terms of the Operating Agreement, SFC and each of the Principals made an initial capital contribution of 33.33% initial interest in SBSFPC. SBSFPC engages in derivatives transactions related to the municipal underwriting business.

Certain risks are involved in the underwriting of securities. Underwriting syndicates agree to purchase securities at a discount from the initial public offering price. An underwriter is exposed to losses on the securities that it has committed to purchase if the securities must be sold below the cost to the syndicate. In the last several years, investment banking firms have increasingly underwritten corporate and municipal offerings with fewer syndicate participants or, in some cases, without an underwriting syndicate. In these cases, the underwriter assumes a larger part or all of the risk of an underwriting transaction. Under Federal securities laws, other laws and court decisions, an underwriter is exposed to substantial potential liability for material misstatements or omissions of fact in the prospectus used to describe the securities being offered.

Advertising, Marketing and Promotion

Siebert develops and maintains its retail customer base through printed advertising in financial publications, broadcast commercials over national and local cable TV channels, as well as promotional efforts and public appearances by Ms. Siebert. Additionally, a significant number of the firm’s new accounts are developed directly from referrals by satisfied customers.

Competition

Siebert encounters significant competition from full-commission, online and discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations, many of which are significantly larger and better capitalized than Siebert. Although there has been consolidation in the industry in both the online and traditional brokerage business during recent years, Siebert believes that additional competitors such as banks, insurance companies, providers of online financial and information services and others will continue to be attracted to the online brokerage industry. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Some of these firms are offering their services over the Internet and have devoted more resources to and have more elaborate websites than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert believes that its main competitive advantages are high quality customer service, responsiveness, cost and products offered, the breadth of product line and excellent executions.

Regulation

The securities industry in the United States is subject to extensive regulation under both Federal and state laws. The Securities and Exchange Commission (“SEC”) is the Federal agency charged with administration of the Federal securities laws. Siebert is registered as a broker-dealer with the SEC, and is a member of the New York Stock Exchange (“NYSE”) and the Financial Industry Regulatory Authority (“FINRA”). Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, principally FINRA and national securities exchanges such as the NYSE, which is Siebert’s primary regulator with respect to financial and operational compliance. These self-regulatory organizations adopt rules (subject to approval by the SEC) governing the industry and conduct periodic examinations of broker-dealers. Securities firms are also subject to regulation by state securities authorities in the states in which they do business. Siebert is registered as a broker-dealer in 50 states, the District of Columbia and Puerto Rico.

- 5 -

The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets, rather than protection of creditors and stockholders of broker-dealers. The regulations to which broker-dealers are subject cover all aspects of the securities business, including training of personnel, sales methods, trading practices among broker-dealers, uses and safekeeping of customers’ funds and securities, capital structure of securities firms, record keeping, fee arrangements, disclosure to clients, and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and by self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules may directly affect the method of operation and profitability of broker-dealers. The SEC, self-regulatory organizations and state securities authorities may conduct administrative proceedings which can result in censure, fine, cease and desist orders or suspension or expulsion of a broker-dealer, its officers or its employees.

As a registered broker-dealer and FINRA member organization, Siebert is required by Federal law to belong to the Securities Investor Protection Corporation (“SIPC”) which provides, in the event of the liquidation of a broker-dealer, protection for securities held in customer accounts held by the firm of up to $500,000 per customer, subject to a limitation of $250,000 on claims for cash balances. SIPC is funded through assessments on registered broker-dealers. In addition, Siebert, through its clearing agent, has purchased from private insurers additional account protection in the event of liquidation up to the net asset value, as defined, of each account. Stocks, bonds, mutual funds and money market funds are included at net asset value for purposes of SIPC protection and the additional protection. Neither SIPC protection nor the additional protection insures against fluctuations in the market value of securities.

Siebert is also authorized by the Municipal Securities Rulemaking Board to effect transactions in municipal securities on behalf of its customers and has obtained certain additional registrations with the SEC and state regulatory agencies necessary to permit it to engage in certain other activities incidental to its brokerage business.

Margin lending arranged by Siebert is subject to the margin rules of the Board of Governors of the Federal Reserve System and the NYSE. Under such rules, broker-dealers are limited in the amount they may lend in connection with certain purchases and short sales of securities and are also required to impose certain maintenance requirements on the amount of securities and cash held in margin accounts. In addition, those rules and rules of the Chicago Board Options Exchange govern the amount of margin customers must provide and maintain in writing uncovered options.

Net Capital Requirements

As a registered broker-dealer, Siebert is subject to the SEC’s Uniform Net Capital Rule (Rule 15c3-1) (the “Net Capital Rule”), which has also been adopted by the NYSE. The Net Capital Rule specifies minimum net capital requirements for all registered broker-dealers and is designed to measure financial integrity and liquidity. Failure to maintain the required regulatory net capital may subject a firm to suspension or expulsion by the NYSE and FINRA, certain punitive actions by the SEC and other regulatory bodies and, ultimately, may require a firm’s liquidation.

Regulatory net capital is defined as net worth (assets minus liabilities), plus qualifying subordinated borrowings, less certain deductions that result from excluding assets that are not readily convertible into cash and from conservatively valuing certain other assets. These deductions include charges that discount the value of security positions held by Siebert to reflect the possibility of adverse changes in market value prior to disposition.

The Net Capital Rule requires notice of equity capital withdrawals to be provided to the SEC prior to and subsequent to withdrawals exceeding certain sizes. The Net Capital Rule also allows the SEC, under limited circumstances, to restrict a broker-dealer from withdrawing equity capital for up to 20 business days. The Net Capital Rule of the NYSE also provides that equity capital may not be drawn or cash dividends paid if resulting net capital would be less than 5 percent of aggregate debits.

Under applicable regulations, Siebert is required to maintain regulatory net capital of at least $250,000. At December 31, 2011 and 2010, Siebert had net capital of $17.8 million and $20.4 million, respectively. Siebert claims exemption from the reserve requirement under Section 15c3-3(k)(2)(ii).

Employees

As of March 14, 2012, we had approximately 62 full-time employees, six of whom were corporate officers. None of our employees is represented by a union, and we believe that relations with our employees are good.

- 6 -

|

|

|

|

Item 1A. |

RISK FACTORS |

Securities market volatility and other securities industry risk could adversely affect our business

Most of our revenues are derived from our securities brokerage business. Like other businesses operating in the securities industry, our business is directly affected by volatile trading markets, fluctuations in the volume of market activity, economic and political conditions, upward and downward trends in business and finance at large, legislation and regulation affecting the national and international business and financial communities, currency values, inflation, market conditions, the availability and cost of short-term or long-term funding and capital, the credit capacity or perceived credit-worthiness of the securities industry in the marketplace and the level and volatility of interest rates. We also face risks relating to trading losses, losses resulting from the ownership or underwriting of securities, counterparty failure to meet commitments, customer fraud, employee fraud, issuer fraud, errors and misconduct, failures in connection with the processing of securities transactions and litigation. A reduction in our revenues or a loss resulting from our underwriting or ownership of securities or sales or trading of securities could have a material adverse effect on our business, results of operations and financial condition. In addition, as a result of these risks, our revenues and operating results may be subject to significant fluctuations from quarter to quarter and from year to year.

Lower price levels in the securities markets may reduce our profitability.

Lower price levels of securities may result in (i) reduced volumes of securities, options and futures transactions, with a consequent reduction in our commission revenues, and (ii) losses from declines in the market value of securities we held in investment and underwriting positions. In periods of low volume, our levels of profitability are further adversely affected because certain of our expenses remain relatively fixed. Sudden sharp declines in market values of securities and the failure of issuers and counterparties to perform their obligations can result in illiquid markets which, in turn, may result in our having difficulty selling securities. Such negative market conditions, if prolonged, may also lower our revenues from investment banking and other activities. A reduction in our revenues from investment banking or other activities could have a material adverse affect on our business, results of operations and financial condition.

There is intense competition in the brokerage industry.

Siebert encounters significant competition from full-commission, online and other discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations many of which are significantly larger and better capitalized than Siebert. SBS also encounters significant competition from firms engaged in the municipal finance business. Over the past several years, price wars and lower commission rates in the discount brokerage business in general have strengthened our competitors. Siebert believes that such changes in the industry will continue to strengthen existing competitors and attract additional competitors such as banks, insurance companies, providers of online financial and information services, and others. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert may not be able to compete effectively with current or future competitors.

Some competitors in the discount brokerage business offer services which we do not, including financial advice and investment management. In addition, some competitors have continued to offer lower flat rate execution fees that are difficult for any conventional discount firm to meet. Industry-wide changes in trading practices are expected to cause continuing pressure on fees earned by discount brokers for the sale of order flow. Many of the flat fee brokers impose charges for services such as mailing, transfers and handling exchanges which Siebert does not and also direct their execution to captive market makers. Continued or increased competition from ultra low cost, flat fee brokers and broader service offerings from other discount brokers could limit our growth or lead to a decline in Siebert’s customer base which would adversely affect our business, results of operations and financial condition.

We are subject to extensive government regulation.

Our business is subject to extensive regulation in the United States, at both the Federal and state level. We are also subject to regulation by self–regulatory organizations and other regulatory bodies in the United States, such as the SEC, the NYSE, FINRA and the Municipal Securities Rulemaking Board (the “MSRB”). We are registered as a broker-dealer in 50 states, the District of Columbia and Puerto Rico. The regulations to which we are subject as a broker-dealer cover all aspects of the securities business including: training of personnel, sales methods, trading practices, uses and safe keeping of customers’ funds and securities, capital structure, record keeping, fee arrangements, disclosure and the conduct of directors, officers and employees. Failure to comply with any of these laws, rules or regulations, which may be subject to the uncertainties of interpretation, could result in civil penalties, fines, suspension or expulsion and have a material adverse effect on our business, results of operations and financial condition.

- 7 -

The laws, rules and regulations, as well as governmental policies and accounting principles, governing our business and the financial services and banking industries generally have changed significantly over recent years and are expected to continue to do so. We cannot predict which changes in laws, rules, regulations, governmental policies or accounting principles will be adopted. Any changes in the laws, rules, regulations, governmental policies or accounting principles relating to our business could materially and adversely affect our business, results of operations and financial condition.

We are subject to net capital requirements.

The SEC, FINRA, and various other securities and commodities exchanges and other regulatory bodies in the United States have rules with respect to net capital requirements which affect us. These rules have the effect of requiring that at least a substantial portion of a broker-dealer’s assets be kept in cash or highly liquid investments. Our compliance with the net capital requirements could limit operations that require intensive use of capital, such as underwriting or trading activities. These rules could also restrict our ability to withdraw our capital, even in circumstances where we have more than the minimum amount of required capital, which, in turn, could limit our ability to implement growth strategies. In addition, a change in such rules, or the imposition of new rules, affecting the scope, coverage, calculation or amount of such net capital requirements, or a significant operating loss or any unusually large charge against net capital, could have similar adverse effects.

Our customers may fail to pay us.

A principal credit risk to which we are exposed on a regular basis is that our customers may fail to pay for their purchases or fail to maintain the minimum required collateral for amounts borrowed against securities positions maintained by them. We cannot assure you that the policies and procedures we have established will be adequate to prevent a significant credit loss.

We face risks relating to our investment banking activities.

Certain risks are involved in the underwriting of securities. Investment banking and underwriting syndicates agree to purchase securities at a discount from the public offering price. If the securities must be sold below the syndicate cost, an underwriter is exposed to losses on the securities that it has committed to purchase. In the last several years, investment banking firms increasingly have underwritten corporate and municipal offerings with fewer syndicate participants or, in some cases, without an underwriting syndicate. In these cases, the underwriter assumes a larger part or all of the risk of an underwriting transaction.

Under Federal securities laws, other laws and court decisions, an underwriter is exposed to substantial potential liability for material misstatements or omissions of fact in the prospectus used to describe the securities being offered. While municipal securities are exempt from the registration requirements of the Securities Act of 1933, underwriters of municipal securities are exposed to substantial potential liability for material misstatements or omissions of fact in the offering documents prepared for these offerings.

An increase in volume on our systems or other events could cause them to malfunction.

During 2011, we received and processed up to 60% of our trade orders electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether. Any significant degradation or failure of our systems or the systems of third parties involved in the trading process (e.g., online and Internet service providers, record keeping and data processing functions performed by third parties, and third party software), even for a short time, could cause customers to suffer delays in trading. These delays could cause substantial losses for customers and could subject us to claims from these customers for losses. There can be no assurance that our network structure will operate appropriately in the event of a subsystem, component or software failure. In addition, we cannot assure you that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, an earthquake, terrorist attack, fire or any act of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and operating results.

We rely on information processing and communications systems to process and record our transactions.

Our operations rely heavily on information processing and communications systems. Our system for processing securities transactions is highly automated. Failure of our information processing or communications systems for a significant period of time could limit our ability to process a large volume of transactions accurately and rapidly. This could cause us to be unable to satisfy our obligations to customers and other securities firms, and could result in regulatory violations. External events, such as an earthquake, terrorist attack or power failure, loss of external information feeds, such as security price information, as well as internal malfunctions such as those that could occur during the implementation of system modifications, could render part or all of these systems inoperative.

- 8 -

We may not be able to keep up pace with continuing changes in technology.

Our market is characterized by rapidly changing technology. To be successful, we must adapt to this rapidly changing environment by continually improving the performance, features and reliability of our services. We could incur substantial costs if we need to modify our services or infrastructure or adapt our technology to respond to these changes. A delay or failure to address technological advances and developments or an increase in costs resulting from these changes could have a material and adverse effect on our business, financial condition and results of operations.

We depend on our ability to attract and retain key personnel.

Our continued success is principally dependent on our founder, Muriel F. Siebert, Chairwoman, Chief Executive Officer and President, and our senior management. In addition, the continued success of SBS may be dependent on the services of Napoleon Brandford III and Suzanne Shank. The loss of the services of any of these individuals could significantly harm our business, financial condition and operating results.

Our principal shareholder may control many key decisions.

Ms. Muriel F. Siebert currently owns approximately 90% of our outstanding common stock. Ms. Siebert will have the power to elect the entire Board of Directors and, except as otherwise provided by law or our Certificate of Incorporation or by-laws, to approve any action requiring shareholder approval without a shareholders meeting.

There may be no public market for our common stock.

Only approximately 2,200,000 shares, or approximately 10% of our shares outstanding, are currently held by the public. Although our common stock is traded in The NASDAQ Capital Market, there can be no assurance that an active public market will continue.

|

|

|

|

Item 1B. |

UNRESOLVED STAFF COMMENTS |

Not applicable.

|

|

|

|

Item 2. |

PROPERTIES |

Siebert currently maintains five retail discount brokerage offices. Customers can visit the offices to obtain market information, place orders, open accounts, deliver and receive checks and securities, and obtain related customer services in person. Nevertheless, most of Siebert’s activities are conducted on the Internet or by telephone and mail.

- 9 -

Siebert operates its business out of the following five leased offices:

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

Approximate |

|

Expiration Date |

|

Renewal |

|

|||

|

|

|

|

|

|||||||

|

|

||||||||||

|

Corporate Headquarters, Retail and Investment Banking Office |

|

|

|

|

|

|

|

|

|

|

|

885 Third Ave. |

|

|

|

|

|

|

|

|

|

|

|

New York, NY 10022 |

|

|

8,514 |

|

|

1/14/13 |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail Offices |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9701 Wilshire Boulevard, Suite 1111 |

|

|

|

|

|

|

|

|

|

|

|

Beverly Hills, CA 90212 |

|

|

1,189 |

|

|

Month to Month |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4400 North Federal Highway |

|

|

|

|

|

|

|

|

|

|

|

Boca Raton, FL 33431 |

|

|

2,438 |

|

|

Month to Month |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

111 Pavonia Avenue(1) |

|

|

|

|

|

|

|

|

|

|

|

Jersey City, NJ 07310 |

|

|

8,141 |

|

|

6/30/12 |

|

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1217 South Flagler Drive, 3rd Floor |

|

|

|

|

|

|

|

|

|

|

|

West Palm Beach, FL 33401 |

|

|

3,000 |

|

|

9/30/12 |

|

|

None |

|

|

|

|

|

(1) |

Certain of our administrative and back office functions are performed at this location. We believe that our properties are in good condition and are suitable for our operations. |

|

|

|

|

Item 3. |

LEGAL PROCEEDINGS |

In a prior year, Siebert had been named as one of the defendants in a class action pending in the United States District Court, Southern District of New York. Among other claims, the third amended complaint in the action asserted on behalf of a class of purchases in a public offering of $1,500,000,000, 6.75% Subordinated Notes due 2017 (the “Notes”), issued by Lehman Brothers Holdings, Inc., (“LBHI”) and certain smaller issuances of other securities that Siebert and other underwriters of the Notes violated Section 11 of the Securities Act of 1933, and other applicable law in that relevant offering materials were false and misleading. Siebert had purchased $15 million of the Notes and $462,953 of other securities as an underwriter in the offerings. Siebert and other underwriters moved to dismiss the third amended complaint on various grounds. The Court granted in part and denied in part the motion by an order dated July 27, 2011. On November 3, 2011, Siebert and the plaintiffs class agreed to resolve all claims against Siebert in consideration of a $1 million payment by Siebert. The settlement is subject to court approval. As certain defendants did not agree to a settlement, additional liability to the Company is possible. At present, we are uncertain as to the potential liability, if any, in connection with the non-settling defendants.

Siebert is party to certain claims, suits and complaints arising in the ordinary course of business including individual actions related to various offerings of notes by LBHI. In the opinion of management, all such claims, suits and complaints are without merit, or involve amounts which would not have a significant effect on the financial position or results of operations of the Company.

|

|

|

|

Item 4. |

MINE SAFETY DISCLOSURES |

Not applicable

- 10 -

PART II

|

|

|

|

Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock traded on the NASDAQ Global Market until June 29, 2011 when our common stock started trading on the NASDAQ Capital Market, under the symbol “SIEB”. The high and low sales prices of our common stock reported by NASDAQ during the following calendar quarters were:

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

Low |

|

||

|

|

|

|

|

||||

|

First Quarter - 2010 |

|

$ |

2.49 |

|

$ |

2.25 |

|

|

|

|

|

|

|

|

|

|

|

Second Quarter - 2010 |

|

$ |

2.37 |

|

$ |

2.12 |

|

|

|

|

|

|

|

|

|

|

|

Third Quarter - 2010 |

|

$ |

2.20 |

|

$ |

1.31 |

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter - 2010 |

|

$ |

2.49 |

|

$ |

1.59 |

|

|

|

|

|

|

|

|

|

|

|

First Quarter – 2011 |

|

$ |

1.99 |

|

$ |

1.70 |

|

|

|

|

|

|

|

|

|

|

|

Second Quarter – 2011 |

|

$ |

1.94 |

|

$ |

1.52 |

|

|

|

|

|

|

|

|

|

|

|

Third Quarter – 2011 |

|

$ |

1.84 |

|

$ |

1.26 |

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter – 2011 |

|

$ |

1.69 |

|

$ |

1.32 |

|

On March 14, 2012, the closing price of our common stock on the NASDAQ Capital Market was $1.77 per share. There were 130 holders of record of our common stock and more than 1,500 beneficial owners of our common stock on March 14, 2012.

On January 4, 2011, we received notice from The NASDAQ Stock Market stating that for more than 30 consecutive business days, the market value of publicly held shares closed below the minimum $5 million required for continued listing on The NASDAQ Global Market under NASDAQ Rule 5450(b)(1)(C). Market value of publicly held shares is calculated by multiplying the publicly held shares, which is total shares outstanding less any shares held by officers, directors, or beneficial owners of more than 10%, by the closing bid price. Ms. Muriel F. Siebert owns approximately 90% of our outstanding common stock. The value of shares beneficially owned by Ms. Siebert, and the value of shares beneficially owned by other officers and directors of the Company, is therefore excluded from the market value of publicly held shares of the Company.

NASDAQ Rule 5810(c)(3)(D) provided the Company a grace period of 180 calendar days, or until July 5, 2011, to regain compliance with The NASDAQ Stock Market requirement. As the market value of publicly held shares did not reach the required value during the grace period, our common stock was transferred to the NASDAQ Capital Market on June 29, 2011.

Dividend Policy

Our Board of Directors periodically considers whether to declare dividends. In considering whether to pay such dividends, our Board of Directors will review our earnings capital requirements, economic forecasts and such other factors as are deemed relevant. Some portion of our earnings will be retained to provide capital for the operation and expansion of our business.

Issuer Purchases Of Equity Securities

On January 23, 2008, our Board of Directors authorized the repurchase of up to 300,000 shares of our common stock. We will purchase shares from time to time, in our discretion, in the open market and in private transactions. We purchased 1,018 shares at an average price of $1.51 in the fourth quarter of 2011.

- 11 -

A summary of our repurchase activity for the three months ended December 31, 2011 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Total |

|

Average Price |

|

Cumulative Number |

|

Maximum |

|

||||

|

|

|

|

|

|

|||||||||

|

October 2011 |

|

|

231 |

|

$ |

1.62 |

|

|

107,977 |

|

|

192,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 2011 |

|

|

— |

|

$ |

— |

|

|

107,977 |

|

|

192,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 2011 |

|

|

787 |

|

$ |

1.47 |

|

|

108,764 |

|

|

191,236 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

1,018 |

|

$ |

1.51 |

|

|

108,764 |

|

|

191,236 |

|

Equity Compensation Plan Information

The following table sets forth information as of December 31, 2011 with respect to our equity compensation plans.

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan Category |

|

Number of Securities to be |

|

Weighted- |

|

Number of Securities |

|

|||

|

|

|

|

|

|||||||

|

|

|

(a) |

|

(b) |

|

(c) |

|

|||

|

Equity compensation plans approved by security holders(1) |

|

|

1,228,200 |

|

$ |

3.88 |

|

|

1,700,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans not approved by security holders(2) |

|

|

41,400 |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

1,269,600 |

|

$ |

3.88 |

|

|

1,700,000 |

|

|

|

|

|

|

|

||

|

|

||

|

(1) |

Consists of our 2007 Long-Term Incentive Plan. |

|

|

|

|

|

|

(2) |

Consists of our 1998 Restricted Stock Award Plan. |

|

Material Terms of the 1998 Restricted Stock Award Plan

Our 1998 Restricted Stock Award Plan provides for awards to key employees of not more than an aggregate of 60,000 shares of our common stock, subject to adjustments for stock splits, stock dividends and other changes in our capitalization, to be issued either immediately after the award or at a future date. As of December 31, 2011, 41,400 shares of our common stock under the Restricted Stock Award Plan had been awarded and were outstanding. As provided in the plan and subject to restrictions, shares awarded may not be disposed of by the recipients for a period of one year from the date of the award. Cash dividends on shares awarded are held by us for the benefit of the recipients, subject to the same restrictions as the award. These dividends, without interest, are paid to the recipients upon lapse of the restrictions.

- 12 -

|

|

|

|

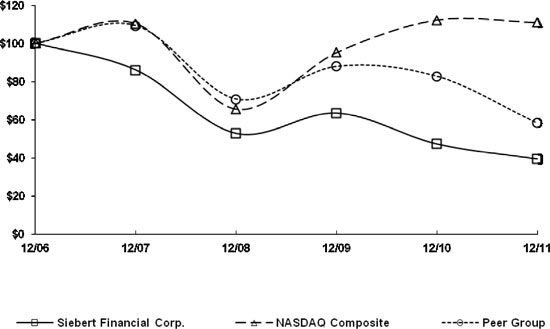

Our Performance: |

The graph below compares our performance from December 31, 2006 through December 31, 2011 against the performance of the NASDAQ Composite Index and a peer group. The peer group consists of A.B. Watley Group Inc., Ameritrade Holding Corporation, E*Trade Financial Corporation and The Charles Schwab Corporation. |

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Siebert Financial Corp., the NASDAQ Composite Index, and a Peer Group

*$100 invested on 12/31/06 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

- 13 -

|

|

|

|

Item 6. |

SELECTED FINANCIAL DATA |

(In thousands except share and per share data)

The Following Selected Financial Information

Should Be Read In Conjunction With Our Consolidated

Financial Statements And The Related Notes Thereto.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

2010 |

|

2009 |

|

2008 |

|

2007 |

|

|||||

|

|

|

|

|

|

|

|

||||||||||

|

Income statement data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues |

|

$ |

20,199 |

|

$ |

20,770 |

|

$ |

25,390 |

|

$ |

29,750 |

|

$ |

31,890 |

|

|

Net (loss) income |

|

$ |

(5,379 |

) |

$ |

(2,640 |

) |

$ |

(1,183 |

) |

$ |

(1,760 |

) |

$ |

2,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.24 |

) |

$ |

(0.12 |

) |

$ |

(0.05 |

) |

$ |

(0.08 |

) |

$ |

0.10 |

|

|

Diluted |

|

$ |

(0.24 |

) |

$ |

(0.12 |

) |

$ |

(0.05 |

) |

$ |

(0.08 |

) |

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (basic) |

|

|

22,114,121 |

|

|

22,167,218 |

|

|

22,193,845 |

|

|

22,208,372 |

|

|

22,206,346 |

|

|

Weighted average shares outstanding (diluted) |

|

|

22,114,121 |

|

|

22,167,218 |

|

|

22,193,845 |

|

|

22,208,372 |

|

|

22,273,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of financial condition data (at year- end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

34,823 |

|

$ |

40,103 |

|

$ |

44,083 |

|

$ |

45,579 |

|

$ |

47,924 |

|

|

Total liabilities excluding subordinated borrowings |

|

$ |

3,599 |

|

$ |

3,477 |

|

$ |

4,695 |

|

$ |

4,995 |

|

$ |

5,704 |

|

|

Stockholders’ equity |

|

$ |

31,224 |

|

$ |

36,626 |

|

$ |

39,388 |

|

$ |

40,584 |

|

$ |

42,220 |

|

|

Cash dividends declared on common shares (1) |

|

$ |

0 |

|

$ |

0 |

|

$ |

0 |

|

$ |

466 |

|

$ |

559 |

|

|

|

|

|

(1) |

The Chief Executive Officer of the Company waived the right to receive the dividend in excess of the aggregate amount paid to other shareholders |

|

|

|

|

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion should be read in conjunction with our audited Consolidated Financial Statements and the Notes thereto contained elsewhere in this Annual Report.

Our working capital is invested primarily in money market funds, so that liquidity has not been materially affected. The crisis did have the effect of reducing participation in the securities market by our retail and institutional customers, which has had an adverse effect on our revenues. Income of our affiliate, Siebert, Brandford, Shank & Co., L.L.C. (“SBS”), decreased in 2011 to $17,000 as a result of a sharp decline in the number of offerings by municipalities due to investor concerns over defaults by municipalities at the state and local level and the expiration of the Build America Bonds program. As a result, the Company’s income from SBS decreased in 2011 to $8,000. The Company’s expenses during 2011, 2010 and 2009 include the costs of an arbitration proceeding commenced by a former employee following the termination of his employment, which remains unresolved. The Company believes that the action is without merit, but the costs of defense, which are included as professional expenses, have adversely affected the Company’s results of operations and may continue to affect the results of operations until the action is completed. Competition in the brokerage industry remains intense.

The following table sets forth certain metrics as of December 31, 2011 and 2010 and for the twelve months ended December 31, 2011 and 2010, respectively, which we use in evaluating our business.

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months |

|

||||

|

Retail Customer Activity: |

|

2011 |

|

2010 |

|

||

|

|

|

|

|

|

|

|

|

|

Total retail trades: |

|

|

423,501 |

|

|

414,485 |

|

|

Average commission per retail trade: |

|

$ |

20.71 |

|

$ |

20.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

||||

|

|

|

|

|||||

|

|

|

2011 |

|

2010 |

|

||

|

|

|

|

|

||||

|

Retail customer balances: |

|

|

|

|

|

|

|

|

Retail customer net worth (in billions): |

|

$ |

6.3 |

|

$ |

6.7 |

|

|

Retail customer money market fund value (in billions): |

|

$ |

1.0 |

|

$ |

1.0 |

|

|

Retail customer margin debit balances (in millions): |

|

$ |

243.5 |

|

$ |

204.8 |

|

|

Retail customer accounts with positions: |

|

|

44,834 |

|

|

49,296 |

|

- 14 -

Description:

|

|

|

|

|

|

• |

Total retail trades represents retail trades that generate commissions. |

|

|

|

|

|

|

• |

Average commission per retail trade represents the average commission generated for all types of retail customer trades. |

|

|

|

|

|

|

• |

Retail customer net worth represents the total value of securities and cash in the retail customer accounts before deducting margin debits. |

|

|

|

|

|

|

• |

Retail customer money market fund value represents all retail customers accounts invested in money market funds. |

|

|

|

|

|

|

• |

Retail customer margin debit balances represents credit extended to our customers to finance their purchases against current positions. |

|

|

|

|

|

|

• |

Retail customer accounts with positions represents retail customers with cash and/or securities in their accounts. |

We, like other securities firms, are directly affected by general economic and market conditions including fluctuations in volume and prices of securities, changes and the prospect of changes in interest rates, and demand for brokerage and investment banking services, all of which can affect our profitability. In addition, in periods of reduced financial market activity, profitability is likely to be adversely affected because certain expenses remain relatively fixed, including salaries and related costs, portions of communications costs and occupancy expenses. Accordingly, earnings for any period should not be considered representative of earnings to be expected for any other period.

Competition continues to intensify among all types of brokerage firms, including established discount brokers and new firms entering the on-line brokerage business. Electronic trading continues to account for an increasing amount of trading activity, with some firms charging very low trading execution fees that are difficult for any conventional discount firm to meet. Some of these brokers, however, impose asset based charges for services such as mailing, transfers and handling exchanges which we do not currently impose, and also direct their orders to market makers where they have a financial interest. Continued competition could limit our growth or even lead to a decline in our customer base, which would adversely affect our results of operations. Industry-wide changes in trading practices, such as the continued use of Electronic Communications Networks, are expected to put continuing pressure on commissions/fees earned by brokers while increasing volatility.

We are a party to an Operating Agreement (the “Operating Agreement”), with Suzanne Shank and Napoleon Brandford III, the two individual principals (the “Principals”) of SBS Financial Products Company, LLC, a Delaware limited liability company (“SBSFPC”). Pursuant to the terms of the Operating Agreement, the Company and each of the Principals made an initial capital contribution of $400,000 in exchange for a 33.33% initial interest in SBSFPC. SBSFPC engages in derivatives transactions related to the municipal underwriting business. The Operating Agreement provides that profit and loss will be shared 66.66% by the Principals and 33.33% by us. Operations from SBSFPC is considered to be integral to our operations.

On January 23, 2008, our Board of Directors authorized a buy back of up to 300,000 shares of our common stock. Under this program, shares are purchased from time to time, at our discretion, in the open market and in private transactions. During 2011 we repurchased 17,179 shares of common stock for an average price of $1.68.

Critical Accounting Policies

We generally follow accounting policies standard in the brokerage industry and believe that our policies appropriately reflect our financial position and results of operations. Our management makes significant estimates that affect the reported amounts of assets, liabilities, revenues and expenses and the related disclosure of contingent assets and liabilities included in the financial statements. The estimates relate primarily to revenue and expense items in the normal course of business as to which we receive no confirmations, invoices, or other documentation, at the time the books are closed for a period. We use our best judgment, based on our knowledge of revenue transactions and expenses incurred, to estimate the amount of such revenue and expenses. We are not aware of any material differences between the estimates used in closing our books for the last five years and the actual amounts of revenue and expenses incurred when we subsequently receive the actual confirmations, invoices or other documentation. Estimates are also used in determining the useful lives of intangibles assets, and the fair market value of intangible assets. Our management believes that its estimates are reasonable.

- 15 -

Results of Operations

Year Ended December 31, 2011 Compared To Year Ended December 31, 2010

Revenues. Total revenues for 2011 were $20.2 million, a decrease of $571,000, or 2.8%, from 2010. Commission and fee income decreased $2.8 million, or 16.5%, from the prior year to $14.3 million primarily due to recording $3 million as commission and fee income as part of our negotiations with our primary clearing firm for a three year Fully disclosed Clearing Agreement in the second quarter of 2010.

Investment banking revenues increased $1.6 million, or 69.8%, from the prior year to $3.8 million in 2011 due to our participation in more new issues in the equity and debt capital markets.

Trading profits increased $768,000, or 62.1%, from the prior year to $2.0 million primarily due to an increase in trading volume primarily in the debt markets and the addition of debt sales-traders in the first quarter of 2011.

Income from interest and dividends decreased $72,000, or 47.7%, from the prior year to $79,000 primarily due to lower yields on investments in money market funds and lower cash balances and interest earned in 2010 for a subordinated loan that was provided to an affiliate.

Expenses. Total expenses for 2011 were $25.6 million, a decrease of $295,000, or 1.1%, from the prior year.

Employee compensation and benefit costs increased $804,000, or 8.8%, from the prior year to $10.0 million. This increase was due to increases in commissions paid based on production and the cost of health insurance offset by an across the board reduction in headcount.

Clearing and floor brokerage fees decreased $297,000, or 9.5%, from the prior year to $2.8 million primarily due to the execution of a Fully Disclosed Clearing Agreement with our primary clearing firm in the second quarter of 2010 which reduced our fees for clearing costs.

Professional fees decreased $1.5 million, or 22.4% from the prior year to $5.1 million in 2011 primarily due to a decrease in legal fees relating to a dispute with a former employee and consulting fees relating to Sarbanes-Oxley compliance offset by an increase in consulting fees relating to commission recapture business.

Advertising and promotion expense increased $2,000, or 0.5%, from the prior year to $402,000 due to an increase in online advertising.

Communications expense decreased $215,000, or 9.1%, from the prior year to $2.1 million primarily due to a decrease in hosting and communication costs associated with our website.

Occupancy costs decreased $179,000, or 14.1%, from the prior year to $1.1 million due to a decrease in rents in the New York and New Jersey offices and the closing of our Boston office in 2010.

Impairment of intangibles were the result of the Company writing down the carrying value of its unamortized intangible assets to fair value and recording a related impairment loss in 2010.

Other general and administrative expenses increased $200,000, or 7.0%, from the prior year to $3.1 million primarily due to a reserve accrued for relating to any additional loss due to settlement of litigation offset by a decrease in office expense, placement fees, depreciation, registration fees, travel and entertainment, supplies and transportation.

Provision for loss related to settlement of litigation for the year ended December 31, 2011 amounted to $1 million. In a prior year, Siebert had been named as one of the defendants in a class action pending in the United States District Court, Southern District of New York. Among other claims, the third amended complaint in the action asserted on behalf of a class of purchasers in a public offering of $1,500,000,000, 6.75% Subordinated Notes due 2017 (the “Notes”), issued by Lehman Brothers Holdings, Inc., and certain smaller issuances of other securities that Siebert and other underwriters of the Notes violated Section 11 of the Securities Act of 1933 and other applicable law in that relevant offering materials were false and misleading. Siebert had purchased $15 million of the Notes and $462,953 of other securities as an underwriter in the offerings. Siebert and the other underwriters moved to dismiss the third amended complaint on various grounds. The Court granted in part and denied in part the motion by an order dated July 27, 2011. On November 3, 2011, Siebert and the plaintiffs class agreed to resolve all claims against Siebert in consideration of a $1 million payment by Siebert. The settlement is subject to court approval. As of December 31, 2011, the Company had accrued a $1 million provision for loss to reflect the settlement. As certain defendants did not agree to a settlement, additional liability to the Company is possible. At present, we are uncertain as to the potential liability, if any, in connection with the non-settling defendants.

Income from our equity investment in Siebert, Brandford, Shank & Co., L.L.C., an entity in which Siebert holds a 49% equity interest (“SBS”), for 2011 was $8,000 compared to income of $4.1 million for 2010, a decrease of $4.0 million, primarily due to SBS participating in fewer municipal bond offerings as senior- and co-manager. This decrease was attributable to a sharp decline in the number of offerings by municipalities due to investor concerns over defaults by municipalities at the state and local level and the expiration of the Build America Bonds program. Income from our equity investment in SBS

- 16 -

Financial Products Company, LLC, an entity in which we hold a 33% equity interest (“SBSFPC”), for 2011 was $21,000 as compared to a loss of $24,000 from the same period in 2010. This increase was principally due to a gain recorded by SBSFPC on termination of a swap position. Results of operations of equity investees is considered to be integral to our operations and material to the results of operations.

Taxes. The tax provision for the year ended December 31, 2011and 2010 was $23,000 and $1.6 million, respectively. The tax provision for 2011 of $23,000 represents various minimum state income taxes. The Company increased its valuation allowance in 2011 by $2.2 million to fully offset any tax benefit resulting from the 2011 loss before benefit of $5.4 million. The tax provision for the year ended December 31, 2010 was incurred due to the recording of a full valuation allowance on deferred taxes of $2.1 million based on recent losses and the likelihood of realization.

Year Ended December 31, 2010 Compared To Year Ended December 31, 2009

Revenues. Total revenues for 2010 were $20.8 million, a decrease of $4.6 million, or 18.2%, from 2009. Commission and fee income decreased $1.1 million, or 6.0%, from the prior year to $17.1 million due to a decrease in revenues from institutional trading, commission recapture and retail customer trading. Institutional equity trading decreased due to a reduction of institutional customers participating in fewer buyback programs and an overall decrease in institutional customer transactions. Retail customer volumes decreased as well as the average retail commission charged per trade due to price compression to maintain and attract new retail customers offset by an increase in fees from margin debits due to increased customer margin debits balances and 12b-1 fees and due to recording $3 million as commission and fee income as part of our negotiations with our primary clearing firm for a three year Fully Disclosed Clearing Agreement in the second quarter of 2010.

Investment banking revenues decreased $3.2 million, or 58.5%, from the prior year to $2.2 million in 2010 due to our participation in fewer new issues in the equity and debt capital markets and the loss of a debt investment banker.

Trading profits decreased $399,000, or 24.4%, from the prior year to $1.2 million primarily due to the loss of a debt sales-trader and an overall decrease in customer trading volume in the debt markets.

Income from interest and dividends increased $28,000, or 22.8%, from the prior year to $151,000 primarily due to slightly higher yields on investments in money market funds.

Expenses. Total expenses for 2010 were $25.9 million, a decrease of $6.2 million, or 19.4%, from the prior year.

Employee compensation and benefit costs decreased $3.0 million, or 24.8%, from the prior year to $9.2 million. This decrease was due to decreases in commissions paid based on production, a reduction in headcount for registered representatives and staff and the elimination of the staff bonus program.

Clearing and floor brokerage fees decreased $2.4 million, or 43.4%, from the prior year to $3.1 million primarily due to the execution of a Fully Disclosed Clearing Agreement with our primary clearing firm in the second quarter of 2010 which reduced our fees for clearing costs as well as a decrease in volume of trade executions for retail customers and a decrease in execution charges for institutional debt and equity customers.

Professional fees decreased $209,000, or 3.1%, from the prior year to $6.5 million primarily due to a decrease in consulting fees relating to the commission recapture business and Sarbanes-Oxley compliance.

Advertising and promotion expense decreased $413,000, or 50.8%, from the prior year to $400,000 primarily due to a decrease in print advertising, production and airing of television commercials in the Florida region.

Communications expense decreased $247,000, or 9.5%, from the prior year to $2.4 million primarily due to a decrease in hosting and communication costs associated with our website.

Occupancy costs decreased $5,000 from the prior year to $1.3 million due to a decrease in rents in the New Jersey office and electric costs offset by an increase in rents in our Florida branches.

Impairment of intangibles were the result of the Company writing down the carrying value of its unamortized intangible assets to fair value and recorded a related impairment loss in 2010.

Other general and administrative expenses decreased $75,000, or 2.6%, from the prior year to $2.9 million primarily due to an increase in office expense, computer costs, placement fees, depreciation, registration fees and dues relating to the Securities Investor Protection Corporation offset by decreases in travel and entertainment, supplies and transportation.

Income from our equity investment in Siebert, Brandford, Shank & Co., L.L.C., an entity in which Siebert holds a 49% equity interest (“SBS”), for 2010 was $4.1 million compared to income of $4.3 million for 2009, a decrease of $185,000, or 4.3%, primarily due to increased employee compensation offset by increased revenues as SBS participated in more and larger municipal bond offerings as senior- and co-manager. Loss from our equity investment in SBS Financial Products Company, LLC, an entity in

- 17 -

which we hold a 33% equity interest (“SBSFPC”), for 2010 was $24,000 as compared to a loss of $63,000 from the same period in 2009. This decrease was due to a change in mark to market loss in positions in 2010. Results of operations of equity investees is considered to be integral to our operations and material to the results of operations.