UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 0-5703

Siebert Financial Corp.

(Exact name of registrant as specified in its charter)

|

New York

|

|

11-1796714

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

120 Wall Street, New York, NY

|

|

10005

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock - $0.01 par value

|

|

SIEB

|

|

The Nasdaq Capital Market

|

Securities registered under Section 12(g) of the Exchange Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer,” smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the Common Stock held by non-affiliates of the registrant (based upon the last sale price of the Common Stock reported on the Nasdaq Capital

Market as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2019), was approximately $54,998,000.

The number of shares of the registrant’s outstanding Common Stock, as of March 23, 2020, was 30,455,962 shares.

Documents Incorporated by Reference: None

SIEBERT FINANCIAL CORP.

INDEX

Overview of Company

Siebert Financial Corp. (“Siebert”), a New York corporation, incorporated in 1934, is a holding company that conducts the following lines of business through its wholly-owned subsidiaries:

|

•

|

Retail discount brokerage business through Muriel Siebert & Co., Inc. (“MSCO”), a registered broker-dealer

|

|

•

|

Investment advisory business through Siebert AdvisorNXT, Inc. (“SNXT”), a Registered Investment Advisor (“RIA”)

|

|

•

|

Insurance services through Park Wilshire Companies, Inc. (“PWC”), a licensed insurance agency

|

|

•

|

Robo-advisory technology development through Siebert Technologies, LLC (“STCH”)

|

|

•

|

Prime brokerage business through Weeden Prime Services, LLC (“Weeden Prime”)

|

For purposes of this Annual Report on Form 10-K, the terms “Siebert,” “Company,” “we,” “us” and “our” refer to Siebert Financial Corp., and its subsidiaries collectively, unless the context otherwise

requires.

Our headquarters are located at 120 Wall Street, New York, New York, 10005, with primary operations in New Jersey and California. Our phone number is (212) 644-2400 and our Internet address is

www.siebertnet.com. Our Securities and Exchange Commission (“SEC”) filings are available through our website at www.siebertnet.com, where investors are able to obtain copies of our public filings free of charge. Our common stock, par value $.01 per

share (the “Common Stock”) trades on the Nasdaq Capital Market under the symbol “SIEB.”

Muriel Siebert & Co., Inc.

Discount Brokerage and Related Services

MSCO became a discount broker on May 1, 1975 and is a member of The New York Stock Exchange, Inc. (“NYSE”). In 1998, MSCO began to offer its customers access to their accounts through

www.siebertnet.com, its website. MSCO’s focus of its discount brokerage business is to serve retail clients seeking a wide selection of quality investment services, including traditional trading through a broker on the telephone or via the Internet.

As of December 31, 2019, MSCO cleared part of its securities transactions on a fully disclosed basis through its affiliate StockCross Financial Services, Inc. (“StockCross”), as well as National

Financial Services Corp. (“NFS”), a wholly-owned subsidiary of Fidelity Investments. MSCO's clearing agreement contract with NFS which was set to expire in July 2017 has been extended on a month-to-month basis.

As of January 1, 2020, StockCross was merged with and into MSCO, and consequently all clearing services provided by StockCross are now performed by MSCO. See “Note

20 – Subsequent Events” for additional detail on the transaction with StockCross.

MSCO serves customers who generally make their own equity investment decisions by offering a number of value-added services, including easy access to account information. MSCO’s representatives are

available to assist customers Monday through Friday and customers also have 24-hour access to MSCO’s services through wireless devices and over the Internet at www.siebertnet.com.

Independent Retail Execution Services

MSCO and its clearing firms NFS and StockCross monitor order flow in an effort to ensure that customers are getting the best possible trade executions. MSCO does not make markets in securities, nor

does it take positions against customer orders.

All equity orders are routed in a manner intended to afford MSCO’s customers the opportunity for price improvement on all orders. MSCO also offers customers execution services through various market

centers for an additional fee, providing customers access to numerous market centers before and after regular market hours.

Customers may also indicate online interest in buying or selling fixed income securities, including municipal bonds, corporate bonds, mortgage-backed securities, government sponsored enterprises,

unit investment trusts or certificates of deposit. These transactions are serviced by MSCO’s registered representatives.

Retail Customer Service

MSCO believes that its superior customer service enhances its ability to compete with larger discount brokerage firms and provides retail customers with personal service via toll-free access to

dedicated customer service personnel for all of its products and services. Customer service personnel are located in each of MSCO’s offices. MSCO has 18 offices and uses a variety of customer relationship management systems that enables

representatives, no matter where located, to review a customer’s requests. MSCO’s telephone system permits the automatic routing of calls to the next available qualified agent having the appropriate skill set.

Retirement Accounts

MSCO offers customers a variety of self-directed retirement accounts. Each IRA, SEP IRA, ROTH IRA, 401(k) and KEOGH account can be invested in mutual funds, stocks, bonds and other investments in a

consolidated account.

Customer Financing

Customer margin accounts are carried whereby money is lent to customers for a portion of the market value of marginable securities held in the customer’s account. Margin loans are collateralized by

these securities. Customers also may sell securities short in a margin account, subject to minimum equity and applicable margin requirements, and the availability of such securities to be borrowed. In permitting customers to engage in margin

financing, short sale or any other transaction, MSCO assumes the risk of its customers’ failure to meet their obligations in the event of adverse changes in the market effecting the value of the margined securities positions. MSCO, StockCross and NFS

reserve the right to set margin requirements higher than those established by the Federal Reserve System.

MSCO has established policies with respect to maximum purchase commitments for new customers or customers with inadequate collateral to support a requested purchase. Managers have some flexibility in

the allowance of certain transactions. When transactions occur outside normal guidelines, MSCO monitors accounts closely until their payment obligations are completed; if the customer does not meet the commitment, MSCO takes steps to close out the

position and minimize any loss. In the last five years, MSCO has not had any significant losses as a result of customers failing to meet commitments.

Information and Communications Systems

MSCO relies heavily on its data technology platform and the platform provided by its clearing agents. These platforms offer interfaces to its clearing service providers’ mainframe computing system

where all customer account records are kept and are accessible through MSCO’s data technology platform. MSCO’s systems also utilize browser-based access and other types of data communications. MSCO’s representatives use NFS systems, by way of MSCO’s

data technology platform, to perform daily operational functions which include trade entry, trade reporting, clearing-related activities, risk management and account maintenance.

MSCO’s data technology platform offers services used in direct relation to customer activities as well as support for corporate use. Some of these services include email and messaging, market data

systems and third-party trading systems, business productivity tools and customer relationship management systems. MSCO’s data network is designed with redundancies in case a significant business disruption occurs.

MSCO’s voice network offers a call center feature that can route and queue calls for certain departments within the organization. Additionally, the system’s call manager offers reporting and tracking

features which enable staff to determine how calls are being managed, such as time on hold, call duration and total calls by agent.

To ensure reliability and to conform to regulatory requirements related to business continuity, MSCO maintains backup systems and backup data, leverages cloud-based technology, and has a full-time

offsite disaster recovery site to ensure business continuity during a potential wide-spread disruption. However, despite the preventive and protective measures in place, in the event of a wide-spread disruption, MSCO’s ability to satisfy the

obligations to customers and other securities firms may be significantly hampered or completely disrupted. For more information regarding our Business Continuity Plan, refer to the Business Continuity Statement on our website.

Client Service and Support

We provide retail customers with personal service via toll-free access to dedicated customer service personnel for all of our products and services. Customer service personnel are located in all of

our 18 offices across the country.

We use a variety of customer relationship management systems and utilize telephone routing systems to direct customers to the first available customer service representative regardless of office

location to reduce wait times. We serve our customers through our phone and in-person outlets, and customers can access their account information and retrieve various forms on our website.

Cybersecurity

Cybersecurity presents significant challenges to the business community in general, as well as to the financial services industry. Increasingly, bad

actors, both domestically and internationally, attempt to steal personal data and/or interrupt the normal functioning of businesses through accessing individuals’ and companies’ files and equipment connected to the Internet. Recently, intruders

have become increasingly sophisticated and use deceptive methods to steal funds and personally identifiable information which they either take for their own purposes, release to the Internet, or hold for ransom. Regulators are increasingly

requiring companies to provide more advanced levels of cybersecurity measures. We continue to maintain systems and ongoing planning measures to prevent any such attack from disrupting our services to clients as well as to prevent any loss of data

concerning our clients, their financial affairs, and company-privileged information. We contract cybersecurity consultants as well as other vendors to oversee detection and defense from such attacks. See “Item 1A. Risk Factors – We may be exposed to damage to our business or our reputation by cybersecurity breaches” for

additional detail.

Siebert AdvisorNXT, Inc.

During the first quarter of 2018, we started the preliminary rollout of our Robo-Advisor, our proprietary robo-advisory technology which utilizes trading algorithms initially developed by STCH. The

Robo-Advisor provides clients with cost-efficient, competitively priced, automated wealth management solutions intended to maximize portfolio returns based on their specific risk tolerance. The platform utilizes Nobel Prize-winning Modern Portfolio

Theory (“MPT”) to create optimal portfolios for each client. We provide web-based tools to enable clients to monitor and interact with the Robo-Advisor’s automated portfolio manager application. In addition, clients who opt for the “Premier” line of

service also have access to traditional wealth managers to supplement the Robo-Advisor where appropriate.

MPT was developed by the economist Harry Markowitz and optimizes expected portfolio returns for specific levels of risk. The technique is referred to as Mean Variance Optimization and requires a

series of calculations in which all possible combinations of potential asset classes are evaluated to determine the optimal blend of allocations for each individual client. Due to the complexity of the analysis, services like this have historically

only been available to clients with large account balances who were willing to pay high fees. By combining state-of-the-art technology with rigorous quantitative research, we provide the same quality of service to clients with smaller account sizes

at a lower cost.

The Robo-Advisor selects low-cost, well-managed, exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”) that represent the asset classes that provides clients the necessary risk-adjusted

exposure given current market conditions. In order to determine a client’s risk tolerance, a prospective client answers a series of objective questions posed in the form of an interactive digital interview. Once a client’s risk tolerance is

determined, the Robo-Advisor’s algorithm utilizes MPT to create a theoretically optimal allocation across a diverse selection of asset classes, thus tailoring a portfolio to a client’s specific investment objectives and risk tolerance. The

Robo-Advisor continuously monitors and periodically rebalances portfolios to address changes in market and economic conditions.

An upgraded version of our Robo-Advisor went live in mid-2019, and since then there has been an increase in the number of accounts and the amount of assets on the platform. We plan to add new

features and functionality to enhance the platform and continue growth. An upgrade to the Robo-Advisor is planned to launch in mid-2020, complete with a fully integrated mobile app targeting a new generation of investors.

Park Wilshire Companies, Inc.

PWC is a full-service insurance agency founded in 2010 that we acquired in March 2018. Our acquisition of PWC has expanded our product offering to include various insurance products such as fixed

annuities and property and casualty insurance.

Siebert Technologies, LLC.

In August 2018, we acquired STCH which is a technology company initially tasked with developing a Robo-Advisor platform. With the acquisition of STCH,

we expanded our products and services by offering a Robo-Advisor through SNXT that provides clients with an automated wealth management solution intended to maximize portfolio returns based on a client’s specific risk tolerance. In September 2019, the name of this subsidiary was changed from KCA Technologies, LLC. to Siebert Technologies, LLC.

Weeden Prime Services, LLC

In December 2019, we acquired Weeden Prime, a leading prime brokerage services provider. Founded in 2007, Weeden Prime is a prime brokerage business focused on providing institutional quality

services to hedge funds. With a focus on capital raising and cutting-edge technology, Weeden Prime has created a platform which clients can leverage in seeking to grow their businesses. Weeden Prime’s platform offers clients a scalable solution for

prime brokerage, capital raising solutions, automated separately managed account infrastructure, exceptional client service and access to custody and clearing partners. Weeden Prime offers a comprehensive global platform that includes institutional

equity, outsourced trading, automated allocation technology and sophisticated portfolio reporting.

As of December 31, 2019, Weeden Prime cleared its securities transactions on a fully disclosed basis through its clearing broker dealers, The Goldman Sachs

Group, Inc. (“Goldman Sachs”) and Pershing LLC (“Pershing”).

StockCross Financial Services, Inc.

In January 2019, we acquired approximately 15% ownership of StockCross, a clearing broker dealer that was under common ownership with Siebert. Effective January 1, 2020, we acquired the remaining 85%

of StockCross’ outstanding shares, and StockCross was merged with and into MSCO. As of January 1, 2020, all clearing services provided by StockCross are now performed by MSCO.

The acquisition of StockCross provides new business lines such as market-making, equity stock plan services, self-clearing and custody, IRA custodianship and securities lending. Merging StockCross

into MSCO increases our total net capital and assets under management as well as adds two retail branches. StockCross provides an equity stock plan service business line that offers integrated and comprehensive solutions to corporate service clients

and employee participants. See “Note 20 – Subsequent Events” for additional detail on the transaction with StockCross.

Key Event - Joining Russell 2000

As part of the 2019 Russell U.S. Indexes reconstitution, we were included in the Russell 2000® Index, effective after the U.S. market opened on July 1, 2019. Russell U.S. indexes are

widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies. Approximately $9 trillion in assets are benchmarked against Russell U.S. indexes. Russell indexes are part of FTSE

Russell, a leading global index provider.

Competition

We encounter significant competition from full-commission, online and discount brokerage firms, including zero commission firms, as well as from financial institutions, mutual fund sponsors and other

organizations. Although there has been consolidation in the industry in both the online and traditional brokerage business during recent years, we believe that additional competitors such as banks, insurance companies, providers of online financial

and information services, and others will continue to be attracted to the brokerage industry. We compete with a wide variety of vendors of financial services for the same customers; however, our success in the financial services industry is a result

of our high-quality customer service, responsiveness, products offered, and excellent executions.

Regulations

The securities industry in the U.S. is subject to extensive regulation under both federal and state laws. The SEC is the federal agency charged with administration of the federal securities laws.

MSCO is registered as a broker-dealer with the SEC and is a member of the NYSE and the Financial Industry Regulatory Authority (“FINRA”). Much of the regulation of broker-dealers has been delegated to self-regulatory organizations (“SROs”),

principally FINRA and national securities exchanges such as the NYSE, which is MSCO’s primary regulator with respect to financial and operational compliance. These SROs adopt rules (subject to approval by the SEC) governing the industry and conduct

periodic examinations of broker-dealers. Securities firms are also subject to regulation by state securities authorities in the states in which they do business. MSCO is registered as a broker-dealer in 50 states, the District of Columbia, and Puerto

Rico. These regulations affect our business operations and impose capital, client protection, and market conduct requirements.

Dodd-Frank Act of 2010

As a result of the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 (“Dodd-Frank”), the adoption of implementing regulations by the federal regulatory agencies as

well as other recent regulatory reforms, we have experienced significant changes in the laws and regulations that apply to us, how we are regulated, and regulatory expectations in the areas of compliance, risk management, corporate governance,

operations, capital and liquidity.

Regulation Best Interest

Pursuant to the Dodd-Frank Act, the SEC was charged with considering whether broker-dealers should be subject to a standard of care similar to the fiduciary standard applicable to RIAs. In June 2019,

the SEC adopted a package of rulemakings and interpretations related to the provision of advice by broker-dealers and investment advisers, including Regulation Best Interest and Form CRS. Among other things, Regulation Best Interest requires a

broker-dealer to act in the best interest of a retail customer when making a recommendation to that customer of any securities transaction or investment strategy involving securities. Form CRS requires that broker-dealers and investment advisers

provide retail investors with a brief summary document containing simple, easy-to-understand information about the nature of the relationship between the parties. Regulation Best Interest and Form CRS have a compliance date of June 30, 2020, and we

anticipate that implementation of the regulations will require us to review and modify our policies and procedures, as well as the associated supervisory and compliance controls, which may lead to additional costs.

In addition to the SEC, various states have proposed or are considering adopting laws and regulations seeking to impose new standards of conduct on broker-dealers that, as written, differ from the

SEC’s new regulations and may lead to additional implementation costs if adopted.

Conduct and Training

The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets. The regulations to which broker-dealers are subject cover all aspects

of the securities business, including training of personnel, sales methods, trading practices among broker-dealers, uses and safekeeping of customers’ funds and securities, capital structure of securities firms, record keeping, fee arrangements,

disclosure to clients, and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and by SROs or changes in the interpretation or enforcement of existing laws and rules may directly affect

the method of operation and profitability of broker-dealers. The SEC, SROs and state securities authorities may conduct administrative proceedings which can result in censure, fine, cease and desist orders or suspension or expulsion of a

broker-dealer, its officers or its employees.

SIPC

As a registered broker-dealer and FINRA member organization, MSCO is required by federal law to belong to the Securities Investor Protection Corporation (“SIPC”) which provides, in the event of the

liquidation of a broker-dealer, protection for securities held in customer accounts held by the firm of up to $500,000 per customer, subject to a limitation of $250,000 on claims for cash balances. SIPC is principally funded through assessments on

registered broker-dealers. In addition, NFS has purchased from private insurers additional account protection in the amount of $1 billion in the event of liquidation up to the net asset value, as defined, of each account. MSCO maintains $50 million

additional account protection above SIPC coverage. Equities, bonds, mutual funds and money market funds are included at net asset value for purposes of SIPC protection and the additional protection. Neither SIPC protection nor the additional

protection insures against fluctuations in the market value of securities.

MSRB

MSCO is also authorized by the Municipal Securities Rulemaking Board (“MSRB”) to affect transactions in municipal securities on behalf of its customers and has obtained certain additional

registrations with the SEC and state regulatory agencies necessary to permit it to engage in certain other activities incidental to its brokerage business.

Margin Lending

Margin lending activities are subject to limitations imposed by regulations of the Federal Reserve System and FINRA. In general, these regulations provide that, in the event of a significant decline

in the value of securities collateralizing a margin account, we are required to obtain additional collateral from the borrower or liquidate securities positions. Margin lending arranged by MSCO through third parties is subject to the margin rules of

the Board of Governors of the Federal Reserve System and the NYSE. Under such rules, broker-dealers are limited in the amount they may lend in connection with certain purchases and short sales of securities and are also required to impose certain

maintenance requirements on the amount of securities and cash held in margin accounts. In addition, those rules and rules of the Chicago Board Options Exchange govern the amount of margin customers must provide and maintain in writing uncovered

options.

Investment Advisers Act of 1940

SNXT is registered with the SEC as an investment adviser pursuant to the Investment Advisers Act of 1940, as amended (“Advisers Act”). The Advisers Act, together with the SEC’s regulations and

interpretations thereunder, is a highly prescriptive regulatory statute. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from fines and censures to termination of an adviser’s

registration and, in the case of willful violations, can refer a matter to the Unites States Department of Justice for criminal prosecution.

Under the Advisers Act, an investment adviser (whether or not registered under the Advisers Act) owes fiduciary duties to its clients. These duties impose standards, requirements and limitations on,

among other things, trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; use of “soft dollar arrangements,” a practice that involves using client brokerage commissions to purchase research or

other services that help managers make investment decisions; execution of transactions; and recommendations to clients.

As an RIA, SNXT is subject to additional requirements that cover, among other things, disclosure of information about its business to clients; maintenance of written policies and procedures;

maintenance of extensive books and records; restrictions on the types of fees SNXT may charge; custody of client assets; client privacy; advertising; and solicitation of clients. The SEC has legal authority to inspect any investment adviser and

typically inspects an RIA periodically to determine whether the adviser is conducting its activities in compliance with (i) applicable laws and regulations, (ii) disclosures made to clients and (iii) adequate systems, policies and procedures

reasonably designed to prevent and detect violations.

Section 28(e) of the Exchange Act provides a “safe harbor” to investment managers who use commission dollars generated by their advised accounts to obtain investment research and brokerage services

that provide lawful and appropriate assistance to the manager in the performance of investment decision-making responsibilities. SNXT, as a matter of policy, does not use “soft dollars” and as such, it has no incentive to select or recommend a broker

or dealer based on any interest in receiving research or related services. Rather, as a fiduciary, SNXT selects brokers based on its clients’ interests in receiving best execution.

Bank Secrecy Act of 1970

SNXT conducts financial services activities that are subject to the Bank Secrecy Act of 1970 (“BSA”), as amended by the USA PATRIOT Act of 2001 (“PATRIOT Act”), which require financial institutions

to develop and implement programs reasonably designed to achieve compliance with these regulations. The BSA and PATRIOT Act include a variety of monitoring, recordkeeping and reporting requirements (such as currency transaction reporting and

suspicious activity reporting) as well as identity verification and client due diligence requirements, which are intended to detect, report and/or prevent money laundering, and the financing of terrorism. In addition, SNXT is subject to U.S.

sanctions programs administered by the Office of Foreign Assets Control.

Net Capital and Best Execution

As a registered broker-dealer, MSCO is subject to the requirements of the Exchange Act relating to broker-dealers, including, among other things, minimum net capital requirements under the SEC

Uniform Net Capital Rule (Rule 15c3-1), “best execution” requirements for client trades under SEC guidelines and FINRA rules, and segregation of fully paid client funds and securities under the SEC Customer Protection Rule (Rule 15c3-3), administered

by the SEC and FINRA.

Net capital rules are designed to protect clients, counterparties and creditors by requiring a broker-dealer to have sufficient liquid resources available to satisfy its financial obligations. Net

capital is a measure of a broker-dealer’s readily available liquid assets, reduced by its total liabilities other than approved subordinated debt. Under the SEC Uniform Net Capital Rule, a broker-dealer may not repay any subordinated borrowings, pay

cash dividends or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount below required levels. Failure to maintain the required regulatory net capital may subject a firm to

suspension or expulsion by the NYSE or FINRA, as well as certain punitive actions by the SEC and other regulatory bodies, which ultimately could require a firm’s liquidation.

Under applicable regulations, MSCO is required to maintain regulatory net capital of at least $250,000. As of December 31, 2019, and 2018, MSCO had net capital of approximately $4.4 million and $8.9

million, respectively.

As explained in SEC guidelines and FINRA rules, brokers are required to seek the “best execution” reasonably available for their clients’ orders. In part, this requires brokers to use reasonable

diligence so that the price to the client is as favorable as possible under prevailing market conditions. MSCO sends client orders to a number of market centers, including market makers and exchanges, which encourages competition and ensures

redundancy. For non-directed client orders, it is our policy to route orders to market centers based on a number of factors that are more fully discussed in the Supplemental Materials of FINRA Rule 5310, including, where applicable, but not

necessarily limited to, speed of execution, price improvement opportunities, differences in price disimprovement, likelihood of executions, the marketability of the order, size guarantees, service levels and support, the reliability of order handling

systems, client needs and expectations, transaction costs, and whether the firm will receive remuneration for routing order flow to such market centers. Price improvement is available under certain market conditions and for certain order types and

MSCO regularly monitors executions to ensure best execution standards are met.

Employees

As of March 23, 2020, we had 132 employees, one of whom was a corporate officer. None of our employees are represented by a union, and we believe that relations with our employees are good.

Securities market volatility and other securities industry risk could adversely affect our business.

Most of our revenues are derived from our securities brokerage business. Like other businesses operating in the securities industry, our business is directly affected by volatile trading markets,

fluctuations in the volume of market activity, economic and political conditions, upward and downward trends in business and finance at large, legislation and regulation affecting the national and international business and financial communities,

currency values, inflation, market conditions, the availability and cost of short-term or long-term funding and capital, the credit capacity or perceived credit-worthiness of the securities industry in the marketplace and the level and volatility of

interest rates. We also face risks relating to losses resulting from the ownership of securities, counterparty failure to meet commitments, customer fraud, employee fraud, issuer fraud, errors and misconduct, failures in connection with the

processing of securities transactions and litigation. A reduction in our revenues or a loss resulting from our ownership of securities or sales or trading of securities could have a material adverse effect on our business, results of operations and

financial condition. In addition, as a result of these risks, our revenues and operating results may be subject to significant fluctuations from quarter to quarter and from year to year.

Lower price levels in the securities markets may reduce our profitability.

Lower price levels of securities may result in (i) reduced volumes of securities, options and futures transactions, with a consequent reduction in our commission revenues, and (ii) losses from

declines in the market value of securities we hold in investment. In periods of low volume, our levels of profitability are further adversely affected because certain of our expenses remain relatively fixed. Sudden sharp declines in market values of

securities and the failure of issuers and counterparties to perform their obligations can result in illiquid markets which, in turn, may result in our having difficulty selling securities. Such negative market conditions, if prolonged, may lower our

revenues. A reduction in our revenues could have a material adverse effect on our business, results of operations and financial condition.

There is intense competition in the brokerage industry.

We encounter significant competition from full-commission, no commission, online and other discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other

organizations many of which are significantly larger and better capitalized than we are. Over the past several years, price wars and lower or no commission rates in the discount brokerage business in general have strengthened our competitors. In

addition, while the decline of commissions has been ongoing for decades, some of our competitors charging zero commissions on trades could potentially have an adverse effect on our commission revenue.

The securities brokerage industry has experienced significant consolidation, which may continue in the future, likely increasing competitive pressures in the industry. Consolidation could enable

other firms to offer a broader range of products and services than we do, or offer them on better terms, such as higher interest rates paid on cash held in client accounts. We believe that such changes in the industry will continue to strengthen

existing competitors and attract additional competitors such as banks, insurance companies, providers of online financial and information services, and others. Many of these competitors are larger, more diversified, have greater capital resources,

and offer a wider range of services and financial products than we do. We compete with a wide variety of vendors of financial services for the same customers. We may not be able to compete effectively with current or future competitors.

Some competitors in the discount brokerage business offer services which we may not offer. In addition, some competitors have continued to offer flat rate execution fees that are lower than some of

our published rates. Industry-wide changes in trading practices are expected to cause continuing pressure on fees earned by discount brokers for the sale of order flow. Continued or increased competition from ultra-low cost, flat-fee brokers and

broader service offerings from other discount brokers could limit our growth or lead to a decline in our customer base which would adversely affect our business, results of operations and financial condition.

Failure to protect client data or prevent breaches of our information systems could expose us to liability or reputational damage.

We are dependent on information technology networks and systems to securely process, transmit and store electronic information and to communicate among our locations and with our clients and vendors.

As the breadth and complexity of this infrastructure continues to grow, the potential risk of security breaches and cyber-attacks increases. As a financial services company, we are continuously subject to cyber-attacks by third parties. Any such

security breach could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information. In addition, vulnerabilities of our external service providers and other third parties could pose security risks

to client information. The secure transmission of confidential information over public networks is also a critical element of our operations.

In providing services to clients, we manage, utilize and store sensitive and confidential client data, including personal data. As a result, we are subject to numerous laws and regulations designed

to protect this information, such as U.S. federal and state laws governing the protection of personally identifiable information. These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. If any

person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to client data, or otherwise mismanages or misappropriates that data, we could be subject to significant monetary damages,

regulatory enforcement actions, fines and/or criminal prosecution in one or more jurisdictions. Unauthorized disclosure of sensitive or confidential client data, whether through systems failure, employee negligence, fraud or misappropriation, could

damage our reputation and cause us to lose clients. Similarly, unauthorized access to or through our information systems, whether by our employees or third parties, including a cyber-attack by third parties who may deploy viruses, worms or other

malicious software programs, could result in negative publicity, significant remediation costs, legal liability, and damage to our reputation and could have a material adverse effect on our results of operations. In addition, our liability insurance

might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches.

We may be exposed to damage to our business or our reputation by cybersecurity breaches.

As the world becomes more interconnected through the use of the Internet and users rely more extensively on the Internet and the cloud for the transmission and storage of data, such information

becomes more susceptible to incursion by hackers and other parties intent on stealing or destroying data on which we or our customers rely. We face an evolving landscape of cybersecurity threats in which hackers use a complex array of means to

perpetrate cyber-attacks, including the use of stolen access credentials, malware, ransomware, phishing, structured query language injection attacks, and distributed denial-of-service attacks, among other means. These cybersecurity incidents have

increased in number and severity and it is expected that these trends will continue. Should we be affected by such an incident, we may incur substantial costs and suffer other negative consequences, which may include:

|

•

|

Remediation costs, such as liability for stolen assets or information, repairs of system damage, and incentives to customers or business partners in an effort to maintain relationships after an attack;

|

|

•

|

Increased cybersecurity protection costs, which may include the costs of making organizational changes, deploying additional personnel and protection technologies, training employees, and engaging third party

experts and consultants;

|

|

•

|

Lost revenues resulting from the unauthorized use of proprietary information or the failure to retain or attract customers following an attack;

|

|

•

|

Litigation and legal risks, including regulatory actions by state and federal regulators; and

|

Increasingly, intruders attempt to steal significant amounts of data, including personally identifiable data and either hold such data for ransom or release it onto the Internet, exposing our clients

to financial or other harm and thereby significantly increasing our liability in such cases. Our regulators have introduced programs to review our protections against such incidents which, if they determined that our systems do not reasonably protect

our clients’ assets and their data, could result in enforcement activity and sanctions.

We have and continue to introduce systems and software to prevent any such incidents and review and increase our defenses to such issues through the use of various services, programs and outside

vendors. We contract cybersecurity consultants and also review and revise our cybersecurity policy to ensure that it remains up to date. In the event that we experience a material cybersecurity incident or identify a material cybersecurity threat, we

will make all reasonable efforts to properly disclose it in a timely fashion. It is impossible, however, for us to know when or if such incidents may arise or the business impact of any such incident.

As a result of such risks, we have and are likely to incur significant costs in preparing our infrastructure and maintaining it to resist any such attacks.

Our advisory services subject us to additional risks.

We provide investment advisory services to investors. Through our RIA, SNXT, we offer robo-advisory and investment services. The risks associated with these investment advisory activities include

those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud. Realization of these risks could lead to liability for client losses, regulatory fines, civil

penalties and harm to our reputation and business.

We are subject to extensive government regulation.

Our business is subject to extensive regulation in the U.S., at both the federal and state level. We are also subject to regulation by SROs and other regulatory bodies in the U.S., such as the SEC,

the NYSE, FINRA, MSRB, the Commodity Futures Trading Commission (“CFTC”) and the National Futures Association (“NFA”). MSCO is registered as a broker-dealer in 50 states, the District of Columbia, and Puerto Rico. The regulations to which MSCO is

subject as a broker-dealer cover all aspects of the securities business including training of personnel, sales methods, trading practices, uses and safe keeping of customers’ funds and securities, capital structure, record keeping, fee arrangements,

disclosure and the conduct of directors, officers and employees.

SNXT is registered as an investment adviser with the SEC under the Advisers Act, and its business is highly regulated. The Advisers Act imposes numerous obligations on RIAs, including fiduciary,

record keeping, operational and disclosure obligations. Moreover, the Advisers Act grants broad administrative powers to regulatory agencies such as the SEC to regulate investment advisory businesses. If the SEC or other government agencies believe

that SNXT has failed to comply with applicable laws or regulations, these agencies have the power to impose fines, suspensions of a registrant and individual employees or other sanctions, which could include revocation of SNXT’s registration under

the Advisers Act. SNXT is also subject to the provisions and regulations of the Employee Retirement Income Security Act of 1974 (“ERISA”), to the extent that SNXT acts as a “fiduciary” under ERISA with respect to certain of its clients. ERISA and the

applicable provisions of the federal tax laws impose a number of duties on persons who are fiduciaries under ERISA and prohibit certain transactions involving the assets of each ERISA plan which is a client, as well as certain transactions by the

fiduciaries (and certain other related parties) to such plans. Additionally, like other investment advisers, SNXT also faces the risks of lawsuits by clients. The outcome of regulatory proceedings and lawsuits is uncertain and difficult to predict.

An adverse resolution of any regulatory proceeding or lawsuit against SNXT could result in substantial costs or reputational harm to SNXT and, therefore, could have an adverse effect on the ability of SNXT to retain key investment advisers and wealth

managers, and to retain existing clients or attract new clients, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects.

The laws, rules and regulations, as well as governmental policies and accounting principles, governing our business and the financial services and banking industries generally have changed

significantly over recent years and are expected to continue to do so. We cannot predict which changes in laws, rules, regulations, governmental policies or accounting principles will be adopted. Any changes in the laws, rules, regulations,

governmental policies or accounting principles relating to our business could materially and adversely affect our business, results of operations and financial condition.

Our subsidiary, Weeden Prime, is also regulated by the National Futures Association (“NFA”) and functions as a registered introducing broker.

Legislation has and may continue to result in changes to rules and regulations applicable to our business, which may negatively impact our business and financial results.

New laws, rules, regulations and guidance, or changes in the interpretation and enforcement of existing federal, state, foreign and self-regulatory organization ("SRO") laws, rules, regulations and

guidance may directly affect our business and the profitability of the Company or the operation of specific business lines. In addition, new and changing laws, rules, regulation and guidance could result in limitations on the lines of business we

conduct, modifications to our business practices, more stringent capital and liquidity requirements or other costs and could limit our ability to return capital to stockholders.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), enacted in 2010, required many federal agencies to adopt new rules and regulations applicable to the financial

services industry and called for many studies regarding various industry practices. In particular, the Dodd-Frank Act gave the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail

customers.

The Dodd-Frank Act, enacted in 2010, requires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various

industry practices. In particular, the Dodd-Frank Act gives the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. The U.S. Department of Labor (“DOL”) has enacted

regulations changing the definition of who is an investment advice fiduciary under ERISA and how such advice can be provided to account holders in retirement accounts such as 401(k) plans and IRAs. The DOL's final rule defining the term "fiduciary"

and exemptions related to it in the context of ERISA and retirement accounts was vacated in June 2018 by the U.S. Court of Appeals for the Fifth Circuit. The SEC and several states then proposed heightened standard of conduct regulations, with the

SEC adopting such regulations in June 2019.

The rules and interpretations adopted by the SEC in June 2019 include Regulation Best Interest and the new Form CRS Relationship Summary, which are intended to enhance the quality and transparency of

retail investors' relationships with broker-dealers and investment advisers. Regulation Best Interest enhances the broker-dealer standard of conduct beyond existing suitability obligations, requiring compliance with disclosure, care, conflict of

interest and compliance obligations. The regulation requires that a broker-dealer or natural person who is an associated person of the broker-dealer shall act in the best interest of the retail customer at the time it makes a recommendation of any

securities transaction or investment strategy involving securities, prioritizing the interests of the customer above any interests of the broker-dealer or its associated persons. Among other things, this requires the broker-dealer to mitigate

conflicts of interest arising from financial incentives in selling securities products. The compliance date for Regulation Best Interest and Form CRS is June 30, 2020.

It is unclear whether Regulation Best Interest will have any preemptive effect on similar existing or forthcoming state-level standard of conduct regulations. These regulations may have a material

impact on the provision of investment services to retail investors, including imposing additional compliance, reporting and operational requirements, which could negatively affect our business. These regulations also continue to subject us to an

increased risk of class actions and other litigation and regulatory risks. It is not certain what the scope of future rulemaking or interpretive guidance from the SEC and other regulatory agencies may be, how the courts and regulators might interpret

these rules and what impact this will have on our compliance costs, business, operations and profitability.

Our profitability could also be affected by new or modified laws that impact the business and financial communities generally, including changes to the laws governing banking, the securities market,

fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data.

We expect that our business will be materially adversely affected by the recent coronavirus (COVID-19) pandemic.

As of the date of this Annual Report on Form 10-K, COVID-19 coronavirus has been declared a pandemic by the World Health Organization, has been declared a National Emergency by the United States

Government and has resulted in several states being designated disaster zones. COVID-19 coronavirus caused significant volatility and losses in US and global financial markets. The spread of COVID-19 coronavirus has caused public health officials to

recommend precautions to mitigate the spread of the virus, especially as to travel and congregating in large numbers. In addition, certain states and municipalities have enacted, and additional cities are considering, quarantining and

“shelter-in-place” regulations which severely limit the ability of people to move and travel, and require non-essential businesses and organizations to close. We believe that such restrictions will contribute to a general slowdown in the US and

global economy, which will adversely affect our business, results of operations, financial condition and our future strategic plans.

A prolonged economic slowdown, volatility in the markets, a recession, and uncertainty in the markets could impair our business and harm our operating results.

Our businesses are, and will continue to be, susceptible to economic slowdowns, recessions and volatility in the markets, which may lead to financial losses for our customers, and a decrease in

revenues and operating results. In addition, global macroeconomic conditions and U.S. financial markets remain vulnerable to the potential risks posed by exogenous shocks, which could include, among other things, political and financial uncertainty

in the U.S. and the European Union, renewed concern about China’s economy, complications involving terrorism and armed conflicts around the world, or other challenges to global trade or travel, such as might occur in the event of a wider pandemic

involving COVID-19, the illness caused by the novel coronavirus which was identified at the end of 2019. More generally, because our business is closely correlated to the macroeconomic outlook, a significant deterioration in that outlook or an

exogenous shock would likely have an immediate negative impact on our overall results of operations.

We are subject to net capital requirements.

The SEC, FINRA, and various other securities and commodities exchanges and other regulatory bodies in the U.S. have rules with respect to net capital requirements which affect us. These rules have

the effect of requiring that at least a substantial portion of a broker-dealer’s assets be kept in cash or highly liquid investments. Our compliance with the net capital requirements could limit operations that require intensive use of capital, such

as underwriting or trading activities. These rules could also restrict our ability to withdraw our capital, even in circumstances where we have more than the minimum amount of required capital, which, in turn, could limit our ability to implement

growth strategies. In addition, a change in such rules, or the imposition of new rules, affecting the scope, coverage, calculation or amount of such net capital requirements, or a significant operating loss or any unusually large charge against net

capital, could have similar adverse effects.

Our customers may fail to pay us.

A principal credit risk to which we are exposed on a regular basis is that our customers may fail to pay for their purchases or fail to maintain the minimum required collateral for amounts borrowed

against securities positions maintained by them. We cannot assure that our practices and/or the policies and procedures we have established will be adequate to prevent a significant credit loss.

An increase in volume on our systems or other events could cause them to malfunction.

Most of our trade orders are received and processed electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never

experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether. Any significant degradation or failure of our

systems or the systems of third parties involved in the trading process (e.g., online and Internet service providers, record keeping and data processing functions performed by third parties, and third party software), even for a short time, could

cause customers to suffer delays in trading. These delays could cause substantial losses for customers and could subject us to claims from these customers for losses. There can be no assurance that our network structure will operate appropriately in

the event of a subsystem, component or software failure. In addition, we cannot assure that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, an earthquake, terrorist attack, fire or any act

of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and operating results.

We rely on information processing and communications systems to process and record our transactions.

Our operations rely heavily on information processing and communications systems. Our system for processing securities transactions is highly automated. Failure of our information processing or

communications systems for a significant period of time could limit our ability to process a large volume of transactions accurately and rapidly. This could cause us to be unable to satisfy our obligations to customers and other securities firms and

could result in regulatory violations. External events, such as an earthquake, terrorist attack or power failure, loss of external information feeds, such as security price information, as well as internal malfunctions such as those that could occur

during the implementation of system modifications, could render part or all of these systems inoperative.

Rapid market or technological changes may render our technology obsolete or decrease the attractiveness of our products and services to our clients.

We must continue to enhance and improve our technology and electronic services. The electronic financial services industry is characterized by significant structural changes, increasingly complex

systems and infrastructures, changes in clients’ needs and preferences, and new business models. If new industry standards and practices emerge and our competitors release new technology before us, our existing technology, systems and electronic

trading services may become obsolete or our existing business may be harmed.

Our future success will depend on our ability to:

|

•

|

Enhance our existing products and services;

|

|

•

|

Develop and/or license new products and technologies that address the increasingly sophisticated and varied needs of our clients and prospective clients;

|

|

•

|

Continue to attract highly-skilled technology personnel; and

|

|

•

|

Respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis.

|

Developing our electronic services, our implementation and utilization of SNXT’s Robo-Advisor and other technology entails significant technical and business risks. We may use new technologies

ineffectively or we may fail to adapt our electronic trading platform, information databases and network infrastructure to client requirements or emerging industry standards. If we face material delays in introducing new services, products and

enhancements, our clients may forego the use of our products and use those of our competitors.

Further, the adoption of new Internet, networking or telecommunications technologies may require us to devote substantial resources to modify and adapt our services. We cannot assure that we will be

able to successfully implement new technologies or adapt our proprietary technology and transaction-processing systems to client requirements or emerging industry standards. We cannot assure that we will be able to respond in a timely manner to

changing market conditions or client requirements.

We depend on our ability to attract and retain key personnel.

We are dependent upon our new and continuing senior management for our success and the loss of the services of any of these individuals could significantly harm our business, financial condition and

operating results.

We may be unable to realize the anticipated benefits of our cost cutting efforts or it may take longer than anticipated for us to realize any benefits from increased cost

efficiencies or economies of scale, if at all.

Our realization of the benefits anticipated as a result of cost cutting efforts and other business efforts and changes will depend in part on the ability of our management team, to implement our

business plan. We cannot assure shareholders that there will not be substantial costs associated with these activities, our new products or other negative consequences as a result of these changes. These effects, including, but not limited to,

incurring unexpected costs or delays in connection with implementation of a modified business model, or the failure of our business to perform as expected, could harm our results of operations.

Our principal shareholder has the ability to control key decisions submitted to a vote of our shareholders.

Gloria E. Gebbia, who is a director of the Company, and the managing member of Kennedy Cabot Acquisition, LLC (“KCA”), has along with other family members, the power to elect the entire Board of

Directors and, except as otherwise provided by law or our Certificate of Incorporation or by-laws, to approve any action requiring shareholder approval without a shareholders meeting.

There may be no public market for our Common Stock.

Only 8,333,960 shares of Common Stock, or approximately 27% of our shares of Common Stock outstanding, are currently held by non-affiliates as of March 23, 2020. Although our Common Stock is traded

on the Nasdaq Capital Market, there can be no assurance that an active public market will continue.

Our future ability to pay dividends to holders of our Common Stock is subject to the discretion of our Board of Directors and will be limited by our ability to generate sufficient

earnings and cash flows.

Payment of future cash dividends on our Common Stock will depend on our ability to generate earnings and cash flows. However, sufficient cash may not be available to pay such dividends. Payment of

future dividends, if any, will be at the discretion of our Board of Directors and will depend upon a number of factors that the Board of Directors deems relevant, including future earnings, the success of our business activities, capital

requirements, the general financial condition and future prospects of our business and general business conditions. If we are unable to generate sufficient earnings and cash flows from our business, we may not be able to pay dividends on our Common

Stock.

Our ability to pay cash dividends on our Common Stock is also dependent on the ability of our subsidiaries to pay dividends to the Company. MSCO is subject to requirements of the SEC and FINRA

relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the Company.

Potential strategic acquisitions and other business growth could increase costs and regulatory and integration risks.

Acquisitions involve risks that could adversely affect our business. We may pursue acquisitions of businesses and technologies. Acquisitions entail numerous risks, including:

|

•

|

Difficulties in the integration of acquired operations, services and products;

|

|

•

|

Failure to achieve expected synergies;

|

|

•

|

Diversion of management’s attention from other business concerns;

|

|

•

|

Assumption of unknown material liabilities of acquired companies;

|

|

•

|

Amortization of acquired intangible assets, which could reduce future reported earnings;

|

|

•

|

Potential loss of clients or key employees of acquired companies; and

|

|

•

|

Dilution to existing stockholders.

|

As part of our growth strategy, we regularly consider, and from time to time engage in, discussions and negotiations regarding transactions, such as acquisitions, mergers and combinations within our

industry. The purchase price for possible acquisitions could be paid in cash, through the issuance of Common Stock or other securities, borrowings or a combination of these methods.

We cannot be certain that we will be able to identify, consummate and successfully integrate acquisitions, and no assurance can be given with respect to the timing, likelihood or business effect of

any possible transaction. For example, we could begin negotiations that we subsequently decide to suspend or terminate for a variety of reasons. However, opportunities may arise from time to time that we will evaluate. Any transactions that we

consummate would involve risks and uncertainties to us. These risks could cause the failure of any anticipated benefits of an acquisition to be realized, which could have a material adverse effect on our business, financial condition, results of

operations and prospects.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We currently maintain 18 offices, one of which is our corporate headquarters. Customers can visit our offices to obtain market information, place orders, open accounts, deliver and receive checks and

securities, and obtain related customer services in person. Nevertheless, most of our activities are conducted on the Internet or by telephone and mail. We operate our business out of the following offices:

| |

Approximate

Square Feet

|

|

Corporate Headquarters

|

|

|

New York, NY – 120 Wall Street

|

250

|

| |

|

|

Service and Other Office Spaces

|

|

|

Beverly Hills, CA – 9464 Wilshire*

|

4,000

|

|

Beverly Hills, CA – 190 N Canon

|

900

|

|

Seal Beach, CA

|

800

|

|

Calabasas, CA

|

3,200

|

|

Tustin, CA

|

400

|

|

Jersey City, NJ

|

11,000

|

|

Boca Raton, FL

|

1,600

|

|

Miami, FL

|

11,600

|

|

Houston, TX

|

3,200

|

|

Dallas, TX

|

250

|

|

Horsham, PA

|

2,000

|

|

New York, NY – 1500 Broadway

|

5,300

|

|

Rye Brook, NY

|

4,000

|

|

Tarrytown, NY

|

250

|

|

Omaha, NE

|

2,900

|

As a result of our acquisition of StockCross, we acquired the below leases effective January 1, 2020.

| |

Approximate

Square Feet

|

|

Boston, MA

|

1,700

|

|

Tampa, FL

|

1,000

|

|

Beverly Hills, CA – 9464 Wilshire*

|

4,700

|

*Prior to the acquisition of StockCross, Beverly Hills, CA - 9464 Wilshire was a shared office space in which Siebert occupied 4,000 square feet and StockCross occupied 4,700 square

feet out of the 8,700 total square feet.

ITEM 3. LEGAL PROCEEDINGS

We are party to certain claims, suits and complaints arising in the ordinary course of business. In the opinion of management, all such matters are without merit, or involve amounts which would not

have a significant effect on our financial position.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock traded on the Nasdaq Global Market until June 29, 2011 when our Common Stock started trading on the Nasdaq Capital Market, under the symbol “SIEB”. The high and low sales prices of

our Common Stock reported by Nasdaq during the following calendar quarters were as follows:

| |

|

2019

|

|

|

2018

|

|

| |

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

14.54

|

|

|

$

|

10.80

|

|

|

$

|

17.75

|

|

|

$

|

7.26

|

|

|

Second Quarter

|

|

$

|

12.00

|

|

|

$

|

8.17

|

|

|

$

|

12.65

|

|

|

$

|

7.14

|

|

|

Third Quarter

|

|

$

|

12.36

|

|

|

$

|

8.71

|

|

|

$

|

20.80

|

|

|

$

|

10.25

|

|

|

Fourth Quarter

|

|

$

|

12.10

|

|

|

$

|

8.18

|

|

|

$

|

14.90

|

|

|

$

|

10.44

|

|

The closing sale price of our Common Stock as reported on the Nasdaq Capital Market on March 23, 2020 was $7.94 per share. As of March 23, 2020, there were 79 holders of record of our Common Stock

based on information provided by our transfer agent. The number of stockholders of record does not reflect the number of individual or institutional stockholders that beneficially own our stock because most stock is held in the name of nominees.

Based on information available to us, we believe there are approximately 1,503 beneficial holders of our Common Stock as of March 23, 2020.

Dividend Policy

Our Board of Directors periodically considers whether to declare dividends. In considering whether to pay such dividends, our Board of Directors will review our earnings, capital requirements,

economic forecasts and such other factors as are deemed relevant. Some portion of our earnings will be retained to provide capital for the operation and expansion of our business.

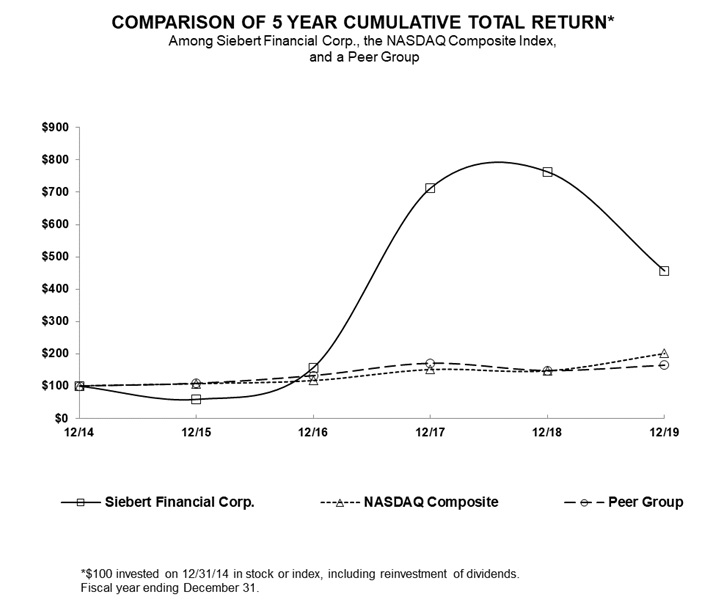

Performance Graph

The graph below compares our Common Stock performance from December 31, 2014 through December 31, 2019 against the performance of the Nasdaq Composite Index and a peer group. The peer group consists

of TD Ameritrade Holding Corporation, E*TRADE Financial Corporation and The Charles Schwab Corporation.

| |

Cumulative Total Return*

|

| |

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|

Siebert Financial Corp.

|

100.00

|

58.64

|

157.13

|

711.82

|

762.44

|

456.09

|

|

Nasdaq Composite

|

100.00

|

106.96

|

116.45

|

150.96

|

146.67

|

200.49

|

|

Peer Group

|

100.00

|

107.92

|

132.19

|

170.87

|

147.90

|

164.84

|

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial information should be read in conjunction with our consolidated financial statements and the related notes thereto.

(In thousands except share and per share data)

| |

|

Year Ended December 31,

|

|

| |

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

2015

|

|

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

28,593

|

|

|

$

|

30,036

|

|

|

$

|

13,110

|

|

|

$

|

9,812

|

|

|

$

|

10,096

|

|

|

Net income / (loss)

|

|

$

|

3,607

|

|

|

$

|

11,962

|

|

|

$

|

2,157

|

|

|

$

|

(5,578

|

)

|

|

$

|

(2,869

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income / (loss) per share of Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

0.13

|

|

|

$

|

0.44

|

|

|

$

|

0.10

|

|

|

$

|

(0.25

|

)

|

|

$

|

(0.13

|

)

|

|

Weighted average shares outstanding (basic and diluted)*

|

|

|

27,157,188

|

|

|

|

27,157,188

|

|

|

|

22,507,798

|

|

|

|

22,085,126

|

|

|

|

22,085,126

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Metrics:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year over year revenue increase / (decrease)

|

|

|

(5

|

%)

|

|

|

129

|

%

|

|

|

34

|

%

|

|

|

(3

|

%)

|

|

|

(36

|

%)

|

|

Income / (loss) before income taxes margin

|

|

|

17

|

%

|

|

|

25

|

%

|

|

|

18

|

%

|

|

|

(57

|

%)

|

|

|

(31

|

%)

|

| |

|

|

|

| |

|

As of December 31,

|

|

|

Consolidated Statements of Financial Condition Data:

|

|

|

2019

|

|

|

|

2018

|

|

|

|

2017

|

|

|

|

2016

|

|

|

|

2015

|

|

|

Cash and cash equivalents

|

|

$

|

3,082

|

|

|

$

|

7,229

|

|

|

$

|

3,765

|

|

|

$

|

2,730

|

|

|

$

|

9,420

|

|

|

Total Assets

|

|

$

|

28,473

|

|

|

$

|

18,177

|

|

|

$

|

6,025

|

|

|

$

|

3,816

|

|

|

$

|

17,785

|

|

|

Total Liabilities

|

|

$

|

7,692

|

|

|

$

|

1,003

|

|

|

$

|

813

|

|

|

$

|

1,563

|

|

|

$

|

2,102

|

|

|

Total Stockholders’ equity

|

|

$

|

20,781

|

|

|

$

|

17,174

|

|

|

$

|

5,212

|

|

|

$

|

2,253

|

|

|

$

|

15,683

|

|

|

Cash dividends declared on common shares

|

|

|

—

|

|

|

|

—