| UNITED

STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

Form 10-K

(Mark One)

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2016

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from______________to________________

Commission file number 0-5703

Siebert Financial Corp. (Exact name of registrant as specified in its charter) |

| New York | 11-1796714 |

| (State or other

jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| 120 Wall Street,

New York, NY (Address of principal executive offices) |

10005 (Zip Code) |

| (212) 644-2400 | ||

| Registrant’s telephone number, including area code | ||

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| COMMON STOCK, PAR VALUE $.01 PER SHARE | THE NASDAQ CAPITAL MARKET |

Securities registered under Section 12(g) of the Exchange Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well- known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by

check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of the Common Stock held by non-affiliates of the registrant (based upon the last sale price of the Common Stock reported on the NASDAQ Capital Market as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2016), was $2,625,647.

The number of shares of the registrant’s outstanding Common Stock, as of March 24, 2017, was 22,085,126 shares.

Documents Incorporated by Reference: None.

Special Note Regarding Forward-Looking Statements

Statements in this Annual Report on Form 10-K, as well as oral statements that may be made by the Company or by officers, directors or employees of the Company acting on the Company’s behalf, that are not statements of historical or current fact constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve risks and uncertainties and known and unknown factors that could cause the actual results of the Company to be materially different from historical results or from any future results expressed or implied by such forward looking statements, including without limitation: changes in general economic and market conditions; changes and prospects for changes in interest rates; fluctuations in volume and prices of securities; changes in demand for brokerage services; competition within and without the brokerage business, including the offer of broader services; competition from electronic discount brokerage firms offering greater discounts on commissions than the Company; the prevalence of a flat fee environment; the method of placing trades by the Company’s customers; computer and telephone system failures; the level of spending by the Company on advertising and promotion; trading errors and the possibility of losses from customer non-payment of amounts due; other increases in expenses and changes in net capital or other regulatory requirements. We undertake no obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date when such statements were made or to reflect the occurrence of unanticipated events. An investment in us involves various risks, including those mentioned above and those which are detailed from time to time in our Securities and Exchange Commission filings.

PART I

| Item 1. | BUSINESS |

General

Siebert Financial Corp. (“SFC”), a New York corporation, incorporated in 1934, is a holding company that conducts its retail discount brokerage business through its wholly-owned subsidiary, Muriel Siebert & Co., Inc., (“MSCO”) a Delaware corporation and a registered broker-dealer, and its investment advisory business through its wholly-owned subsidiary Siebert Investment Advisors, Inc. (“SIA”) a New York corporation which is registered with the Securities and Exchange Commission as a Registered Investment Advisor (“RIA”). For purposes of this Annual Report on Form 10-K, the terms “Siebert,” “Company,” “we,” “us” and “our” refer to Siebert Financial Corp., MSCO and SIA collectively, unless the context otherwise requires.

Our principal offices are located at 120 Wall Street, New York, New York 10005, and our phone number is (212) 644-2400. Our Internet address is www.siebertnet.com. Our SEC filings are available through our website at www.siebertnet.com, where you are able to obtain copies of the Company’s public filings free of charge. Our common stock, par value $.01 per share (the “Common Stock”) trades on the NASDAQ Capital Market under the symbol “SIEB.”

Recent Developments

In December 2016, pursuant to the terms of an Acquisition Agreement, dated September 1, 2016, as amended (the “Acquisition Agreement”) by and among the Company, Kennedy Cabot Acquisition, LLC (“KCA”), a Nevada limited liability company and the Estate of Muriel F. Siebert (the “Majority Shareholder”), KCA acquired 677,283 shares of Common Stock in a cash tender offer and 19,310,000 Shares owned by the Majority Shareholder (the “Acquisition”). As a result of the Acquisition, effective December 16, 2016, KCA became the owner of approximately 90% of the Company’s outstanding Common Stock. See discussion under “Historical Developments - Change in Control.”

Effective December 16, 2016, upon the closing of the Acquisition Agreement, Patricia L. Francy, Nancy Peterson Hearn, Jane H. Macon and Robert P. Mazzarella resigned as directors and Gloria E. Gebbia, Charles A. Zabatta, Francis Cuttita and Andrew H. Reich were appointed as directors. Effective December 29, 2016, Jerry Schneider, CPA, was appointed as a director of the Company and Chairman of the Audit Committee. In addition, effective December 16, 2016, Joseph Ramos Jr. resigned from all offices he held with Siebert and Andrew H. Reich was appointed Executive Vice President, Chief Operating Officer and Chief Financial Officer and Secretary of SFC and Director, Chief Executive Officer, Chief Operating and Financial Officer of MSCO.

Effective February 7, 2017, John J. Gebbia, Gloria E. Gebbia’s husband, was appointed as an unsalaried special advisor to the Company’s board of directors. John J. Gebbia commenced his employment in the brokerage industry in 1959. In 1962, Mr. Gebbia became an executive vice president of Walston & Company. After becoming CEO of Jesup & Lamont, an institutional brokerage firm, Mr. Gebbia purchased the company in 1983. Thereafter, Mr. Gebbia owned various brokerage firms including Kennedy Cabot & Co. which was sold in 1997 to Toronto Dominion Bank for $160,000,000. Mr. Gebbia through Gebbia Family controlled entities controls various companies in the insurance, sports management and home building industries.

Following the Acquisition, the Company’s new owners and management have been focusing on improving the Company’s results of operations by reducing costs and introducing new products.

Cost Improvement Efforts

Steps taken to increase cost efficiencies include closing the Company’s offices located at 885 Third Avenue, New York, NY at the end of the lease for that location and relocating most of the functions that were located there to newly leased space at 15 Exchange Place, Suite 615, Jersey City, New Jersey 07302 and moving our principal executive offices to a space located at 120 Wall Street, New York, New York 10005. Prior to the acquisition the Company closed its office in Beverly Hills, California. The Company intends to reopen an office in Beverly Hills, California.

| 1 |

New management is continuing its analysis of various vendor contracts with a view to reducing costs.

Gloria E. Gebbia along with other members of the Gebbia family, control a privately owned broker dealer, StockCross Financial Services, Inc. (“StockCross”). StockCross is a self-clearing discount broker dealer that has many business lines that are similar to MSCO’s. New management is analyzing the business lines of StockCross and MSCO in order to identify those lines of business where MSCO and StockCross may be able to realize certain economies of scale and collective benefit which is intended to increase revenue and reduce relative costs for MSCO. Management of the Company is currently exploring various alternatives to accomplish these goals.

In connection with such analysis and determination, Richard Gebbia and John M. Gebbia, Gloria E. Gebbia’s sons, have both become registered as general securities principals of MSCO and remain in their executive roles at StockCross. Richard Gebbia is a Director and the CEO and President of StockCross and John M. Gebbia is a Director and the Executive Vice President of StockCross.

New Product

New management is working on developing and marketing a new “Robo” investment advisor platform which will utilize a proprietary trading algorithm licensed from an affiliate, KCA Technologies, LLC, a wholly-owned subsidiary of Kennedy Cabot Acquisition, LLC. The Company, consistent with industry developments, intends to offer access to this technology to its customers as a registered investment advisor.

The Company believes that its Robo investment advisor platform will provide clients with a cost-efficient, competitively priced, easy to use automated wealth management solution intended to maximize portfolio returns based on a client’s specific risk tolerance. The platform utilizes Nobel Prize winning Modern Portfolio Theory techniques to create optimal portfolios for each client. We will provide web and smartphone based tools to enable our clients to monitor and interact with the Robo investment advisor platform’s automated portfolio manager application. Access to the platform will be provided to clients that have established advisory accounts with SIA. It is intended that clients utilizing the Robo investment advisor platform will also have access to traditional wealth managers to either enhance or replace the Robo investment advisor platform where appropriate.

Modern Portfolio Theory optimizes expected portfolio returns for specific levels of risk. The technique is referred to as Mean Variance Optimization (MVO) and it requires a series of highly complicated calculations in which all possible combinations of the potential asset classes are evaluated to determine the optimal blend of allocations for each individual client. Due to the complexity of the analysis, services like this have historically only been available to clients with large account balances who were willing to pay high fees in excess of 1% of assets under management. By combining state-of-the-art technology with rigorous quantitative research, we intend to provide the same quality of service to clients with smaller account sizes at lower cost.

Research shows that historically, risk-optimized, diversified portfolios containing uncorrelated asset classes outperform individual holdings. The Robo investment advisor platform selects low-cost, well-managed exchange traded funds (ETF’s) and exchanged trade notes (ETN’s) that represent the asset classes that we believe will provide our clients the necessary risk-adjusted exposure given current market conditions. In order to determine a client’s risk tolerance, a prospective client answers a series of objective questions posed in the form of an interactive digital interview. Once a client’s risk tolerance is determined, the Robo investment advisor platform algorithm will utilize “Modern Portfolio Theory” to create a theoretically optimal allocation across a diverse selection of assets classes, thus tailoring a portfolio to a client’s specific investment objectives and risk tolerance. The Robo investment advisor platform program will continuously monitor client accounts and periodically adjust portfolios to address changes in market and economic conditions.

| 2 |

The Company expects that beta testing of the Robo investment advisor platform will take approximately six months to complete. The costs of developing the Robo investment advisor platform are being borne by the Company’s affiliate and principal shareholder, Kennedy Cabot Acquisition, LLC. (“Acquisition”) and/or its subsidiary, KCA Technologies, LLC. It is expected that licensing and related fees and expenses shall be charged by Acquisition to the Company’s subsidiary, SIA. While specific licensing and related fees and expenses have not yet been determined, they are expected to be consistent with industry norms. The Company believes that its customers will be interested in the Robo investment advisor platform’s advisory and investment services that replace the subjective personal choices of trading with non-subjective algorithmic based and directed trading replacing human bias and subjective determinations with non-emotional calculable precision.

Business Overview

Muriel Siebert & Co., Inc.

Discount Brokerage and Related Services. MSCO became a discount broker on May 1, 1975 and the Company believes that MSCO has been in business and a member of The New York Stock Exchange, Inc. (the “NYSE”) longer than any other discount broker. In 1998, MSCO began to offer its customers access to their accounts through SiebertNet, its Internet website. MSCO’s focus in its discount brokerage business is to serve retail clients seeking a wide selection of quality investment services, including trading through a broker on the telephone, through a wireless device or via the Internet, at commissions that are substantially lower than those of full-commission firms. MSCO clears its securities transactions on a fully disclosed basis through National Financial Services Corp. (“NFS”), a wholly owned subsidiary of Fidelity Investments. MSCO’s contract with NFS expires on or about July 31, 2017. Management intends to negotiate a new contract with NFS and management expects to realize economic benefit from the new contract with NFS.

MSCO serves investors who generally make their own investment decisions and seeks to assist its customers in their investment decisions by offering a number of value added services, including easy access to account information. MSCO’s representatives are available to assist customers with information via toll-free 800 service Monday through Friday between 7:30 a.m. and 7:30 p.m. Eastern Time. Customers have 24-hour access to MSCO’s SiebertNet and Mobile Broker services.

Independent Retail Execution Services. MSCO and NFS monitor order flow in an effort to ensure that customers are getting the best possible trade executions. MSCO does not make markets in securities, nor does it take positions against customer orders.

MSCO’s equity orders are routed by NFS in a manner intended to afford MSCO’s customers the opportunity for price improvement on all orders. MSCO also offers customers execution services through various market centers for an additional fee, providing customers access to numerous market centers before and after regular market hours.

Customers may also indicate online interest in buying or selling fixed income securities, including municipal bonds, corporate bonds, mortgage-backed securities, government sponsored enterprises, unit investment trusts or certificates of deposit. These transactions are serviced by registered representatives.

Retail Customer Service. Siebert believes that superior customer service enhances its ability to compete with larger discount brokerage firms and therefore provides retail customers with personal service via toll-free access to dedicated customer support personnel for all of its products and services. Customer service personnel are located in each of Siebert’s offices. Siebert has retail offices in Jersey City, New Jersey, Boca Raton, Florida and New York, New York. Siebert uses a proprietary Customer Relationship Management System that enables representatives, no matter where located, to view a customer’s service requests and the response thereto. Siebert’s telephone system permits the automatic routing of calls to the next available agent having the appropriate skill set.

Retirement Accounts. Siebert offers customers a variety of self-directed retirement accounts for which it acts as agent on all transactions. Custodial services are provided through an affiliate of NFS, the firm’s clearing agent, which also serves as trustee for such accounts. Each IRA, SEP IRA, ROTH IRA, 401(k) and KEOGH account can be invested in mutual funds, stocks, bonds and other investments in a consolidated account. StockCross is a qualified IRA custodian. Management intends to explore economies of scale and a relationship between the Company and StockCross as an IRA Custodian.

Customer Financing. Customer margin accounts are carried through NFS which lends customers a portion of the market value of certain securities held in the customer’s account. Margin loans are collateralized by these securities. Customers also may sell securities short in a margin account, subject to minimum equity and applicable margin requirements, and the availability of such securities to be borrowed. In permitting customers to engage in margin, short sale or any other transaction, Siebert assumes the risk of its customers’ failure to meet their obligations in the event of adverse changes in the market value of the securities positions. Both Siebert and NFS reserve the right to set margin requirements higher than those established by the Federal Reserve Board.

| 3 |

Siebert has established policies with respect to maximum purchase commitments for new customers or customers with inadequate collateral to support a requested purchase. Managers have some flexibility in the allowance of certain transactions. When transactions occur outside normal guidelines, Siebert monitors accounts closely until their payment obligations are completed; if the customer does not meet the commitment, Siebert takes steps to close out the position and minimize any loss. In the last five years, Siebert has not had any significant losses as a result of customers failing to meet commitments.

Information and Communications Systems. Siebert relies heavily on the data technology platform provided by its clearing agent, NFS. This platform offers an interface to NFS’ main frame computing system where all customer account records are kept and is accessible through Siebert’s data technology platform. Siebert’s systems also utilize browser based access and other types of data communications. Siebert’s representatives use NFS systems, by way of Siebert’s data technology platform, to perform daily operational functions which include trade entry, trade reporting, clearing related activities, risk management and account maintenance.

Siebert’s data technology platform offers services used in direct relation to customer related activities as well as support for corporate use. Some of these services include email and messaging, market data systems and third party trading systems, business productivity tools and customer relationship management systems. Siebert’s offices are connected to the office in Jersey City, New Jersey. Siebert’s data network is designed with redundancy in case a significant business disruption occurs.

Siebert’s voice network offers a call center feature that can route and queue calls for certain departments within the organization. Additionally, the system’s call manager offers reporting and tracking features which enable staff to determine how calls are being managed, such as time on hold, call duration and total calls by agent.

To ensure reliability and to conform to regulatory requirements related to business continuity, Siebert maintains backup systems and backup data. However, in the event of a wide-spread disruption, such as a massive natural disaster, Siebert’s ability to satisfy the obligations to customers and other securities firms could be significantly hampered or completely disrupted. For more information regarding Siebert’s Business Continuity Plan, please review the Business Continuity Statement on our website at www.siebertnet.com or write to us at Muriel Siebert & Co., Inc., Compliance Department, 15 Exchange Place, Jersey City, NJ 07302.

Website. Our website has design, navigation, and functionality features such as:

| ▪ | Informative trading screens: Customers can stay in touch while trading, double-check balances, positions and order status, see real time quotes, intraday and annual charts and news headlines – automatically – as they place orders. |

| ▪ | Multiple orders: Customers can place as many as 10 orders at one time. |

| ▪ | Tax-lot trading: Our online equity order entry screen allows customers to specify tax lots which display with cost basis and current gain/loss on a real-time positions page. |

| ▪ | Trailing stop orders: Customers can enter an order that trails the market as a percentage of share price or with a flat dollar value and the system will execute their instructions automatically. |

| ▪ | Contingent orders: Customers can place One-Triggers-Two Bracket and One-Cancels-Other Bracket orders. |

| ▪ | An easy-to-install desktop security program that may be installed to help protect against certain types of online fraud such as “keylogging” and “phishing.” |

MSCO intends to explore order flow payment issues in conformity with industry practices, providing best execution for its customers.

| 4 |

Advertising, Marketing and Promotion

Siebert develops and maintains its retail customer base through internet advertising and social media. Additionally, a significant number of the firm’s new accounts are developed directly from referrals by satisfied customers.

Competition

Siebert encounters significant competition from full-commission, online and discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations, many of which are significantly larger and better capitalized than Siebert. Although there has been consolidation in the industry in both the online and traditional brokerage business during recent years, Siebert believes that additional competitors such as banks, insurance companies, providers of online financial and information services and others will continue to be attracted to the online brokerage industry. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Some of these firms are offering their services over the Internet and have devoted more resources to and have more elaborate websites than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert believes that its main competitive advantages are high quality customer service, responsiveness, cost and products offered, the breadth of product line and excellent executions.

Regulation

The securities industry in the United States is subject to extensive regulation under both Federal and state laws. The Securities and Exchange Commission (“SEC”) is the Federal agency charged with administration of the Federal securities laws. Siebert is registered as a broker-dealer with the SEC, and is a member of the New York Stock Exchange (“NYSE”) and the Financial Industry Regulatory Authority (“FINRA”). Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, principally FINRA and national securities exchanges such as the NYSE, which is Siebert’s primary regulator with respect to financial and operational compliance. These self-regulatory organizations adopt rules (subject to approval by the SEC) governing the industry and conduct periodic examinations of broker-dealers. Securities firms are also subject to regulation by state securities authorities in the states in which they do business. Siebert is registered as a broker-dealer in 50 states, and the District of Columbia.

The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets, rather than protection of creditors and stockholders of broker-dealers. The regulations to which broker-dealers are subject cover all aspects of the securities business, including training of personnel, sales methods, trading practices among broker-dealers, uses and safekeeping of customers’ funds and securities, capital structure of securities firms, record keeping, fee arrangements, disclosure to clients, and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and by self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules may directly affect the method of operation and profitability of broker-dealers. The SEC, self-regulatory organizations and state securities authorities may conduct administrative proceedings which can result in censure, fine, cease and desist orders or suspension or expulsion of a broker-dealer, its officers or its employees.

As a registered broker-dealer and FINRA member organization, Siebert is required by Federal law to belong to the Securities Investor Protection Corporation (“SIPC”) which provides, in the event of the liquidation of a broker-dealer, protection for securities held in customer accounts held by the firm of up to $500,000 per customer, subject to a limitation of $250,000 on claims for cash balances. SIPC is funded through assessments on registered broker-dealers. In addition, Siebert’s clearing firm NFS, has purchased from private insurers additional account protection in the amount of $1 billion dollars in the event of liquidation up to the net asset value, as defined, of each account. Stocks, bonds, mutual funds and money market funds are included at net asset value for purposes of SIPC protection and the additional protection. Neither SIPC protection nor the additional protection insures against fluctuations in the market value of securities.

| 5 |

Siebert is also authorized by the Municipal Securities Rulemaking Board (the “MSRB”) to effect transactions in municipal securities on behalf of its customers and has obtained certain additional registrations with the SEC and state regulatory agencies necessary to permit it to engage in certain other activities incidental to its brokerage business.

Margin lending arranged by Siebert through third parties is subject to the margin rules of the Board of Governors of the Federal Reserve System and the NYSE. Under such rules, broker-dealers are limited in the amount they may lend in connection with certain purchases and short sales of securities and are also required to impose certain maintenance requirements on the amount of securities and cash held in margin accounts. In addition, those rules and rules of the Chicago Board Options Exchange govern the amount of margin customers must provide and maintain in writing uncovered options.

Net Capital Requirements

As a registered broker-dealer MSCO is subject to the requirements of the Securities Exchange Act of 1934 (the “Exchange Act”) relating to broker-dealers, including, among other things, minimum net capital requirements under the SEC Uniform Net Capital Rule (Rule 15c3-1), “best execution” requirements for client trades under SEC guidelines and FINRA rules and segregation of client funds under the SEC Customer Protection Rule (Rule 15c3-3), administered by the SEC and FINRA.

Net capital rules are designed to protect clients, counterparties and creditors by requiring a broker-dealer to have sufficient liquid resources available to satisfy its financial obligations. Net capital is a measure of a broker-dealers readily available liquid assets, reduced by its total liabilities other than approved subordinated debt. Under the Uniform Net Capital Rule, a broker-dealer may not repay any subordinated borrowings, pay cash dividends or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount below required levels. Failure to maintain the required regulatory net capital may subject a firm to suspension or expulsion by the NYSE and FINRA, certain punitive actions by the SEC and other regulatory bodies ultimately may require a firm’s liquidation.

Under applicable regulations, MSCO is required to maintain regulatory net capital of at least $250,000. At December 31, 2016 MSCO had net capital of $1.1 million. At December 31, 2015, MSCO had net capital of $8.1 million. During the last quarter of 2016 the Company paid cash dividends of approximately $4.5 million to its shareholders. The source of the dividend payment was MSCO. MSCO claims exemption from the reserve requirement under Section 15c3-3(k)(2)(ii).

Adjustments as audited by the Company’s auditors required certain adjustments which impacted the Company’s year end performance and MSCO’s net capital. MSCO’s net capital as reported in its Focus Report filed with FINRA for the period ended February 28, 2017 reflected that MSCO’s net capital was approximately $2 million with excess net capital of approximately $1.75 million.

As explained in SEC guidelines and FINRA rules, brokers are required to seek the “best execution” reasonably available for their clients’ orders. In part, this requires brokers to use reasonable diligence so that the price to the client is as favorable as possible under prevailing market conditions. MSCO sends client orders to a number of market centers, including market makers and exchanges, which encourages competition and ensures redundancy. For non-directed client orders, it is our policy to route orders to market centers based on a number of factors that are more fully discussed in the Supplemental Materials of FINRA Rule 5310, including, where applicable, but not necessarily limited to, speed of execution, price improvement opportunities, differences in price disimprovement, likelihood of executions, the marketability of the order, size guarantees, service levels and support, the reliability of order handling systems, client needs and expectations, transaction costs and whether the firm will receive remuneration for routing order flow to such market centers. Price improvement is available under certain market conditions and for certain order types and we regularly monitor executions to test for such improvement if available.

Employees

As of March 23, 2017, we had approximately 31 employees, one of whom was a corporate officer. None of our employees are represented by a union, and we believe that relations with our employees are good. Since new management acquired control of the Company on December 16, 2016, 11 former employees are no longer associated with the Company and 3 new employees have been hired, resulting in an annual net savings of approximately $600,000.

| 6 |

Historical Developments

Former Capital Markets Division

Prior to November 2014, we operated a division referred to as Siebert Capital Markets Group (“SCM”), through which the Company acted as a co-manager, underwriting syndicate member, or selling group member on a wide spectrum of securities offerings for corporations and Federal agencies. The principal activities of SCM were investment banking and institutional equity execution services. In addition, prior to November 2014, the Company held a 49% membership interest in Siebert Brandford Shank & Co., LLC (“SBS”). The principal activities of SBS were municipal investment banking.

On November 4, 2014, the Company and the other members of SBS contributed their SBS membership interests to a newly formed Delaware limited liability company, Siebert Brandford Shank Financial, L.L.C. (“SBSF”) (now known as Siebert Cisneros Shank Financial, LLC) in exchange for the same percentage membership interests in SBSF. On the same day, the Company entered into an Asset Purchase Agreement (the “Capital Markets Agreement”) with SBS and SBSF, pursuant to which the Company sold substantially all of the SCM assets to SBSF. Pursuant to the Capital Markets Agreement, SBSF assumed post-closing liabilities relating to the transferred business and agreed to pay to the Company an aggregate of $3,000,000, payable in annual installments commencing on March 1, 2016 and continuing on each of March 1, 2017, 2018, 2019 and 2020. The amount payable to the Company on each annual payment date was equal to 50% of the net income attributable to the transferred business recognized by SBSF in accordance with generally accepted accounting principles during the fiscal year ending immediately preceding the applicable payment date; provided that, if net income attributable to the transferred business generated prior to the fifth annual payment date was insufficient to pay the remaining balance of the purchase price in full on the fifth annual payment date, then the unpaid amount of the purchase price will be paid in full on March 1, 2021. The annual installment payable on March 1, 2016 is based on the net income attributable to the capital markets business for the year ended December 31, 2015, amounted to $493,000 (the “SBSF Receivable”).

Transferred assets of SCM, consisted of customer accounts and goodwill, which had no carrying value to the Company, and the Company recorded a gain on sale of $1,820,000, which reflected the fair value of the purchase obligation. Such fair value was based on the present value of estimated annual installments to be received during 2016 through 2020 from forecasted net income of the transferred business plus a final settlement in 2021, discounted at 11.5% (representing SBS’s weighted average cost of capital).

The discount recorded for the purchase obligation is being amortized as interest income using an effective yield initially calculated based on the original carrying amount of the obligation and estimated annual installments to be received and adjusted in future periods to reflect actual installments received and changes in estimates of future installments. Interest income recognized on the obligation for the year ended December 31, 2016 amounted to $207,000 based on a yield of approximately 12%.

On November 9, 2015, the Company sold its 49% membership investment in SBSF back to SBSF for $8,000,000 of which $4,000,000 was paid in cash and the balance of which was paid in the form of a secured junior subordinated promissory note of $4,000,000 (the “SBSF Junior Note”). The sale of the investment in SBSF, which was accounted for by the equity method, represented a strategic shift for the Company based on its significance to the Company’s financial condition and results of operations and the major effect it had on the Company’s operations and financial results and, accordingly, the Company’s share of operating results of the investment are reflected as discontinued operations in the accompanying statement of operations. The investment was sold for approximately $448,000 less than the carrying value of the investment at November 9, 2015, after adjusting the carrying value of the investment for the Company’s equity in SBSF’s results of operations through such date. Such loss is also included in discontinued operations.

The Company no longer has a relationship with its former affiliate, Siebert Cisneros Shank Financial, LLC.

| 7 |

Change in Control

In December 2016, pursuant to the terms of an acquisition agreement, dated September 1, 2016 (the “Acquisition Agreement”), by and among the Company, Kennedy Cabot Acquisition, LLC (the “KCA”), a Nevada limited liability company and the Estate of Muriel F. Siebert (the “Majority Shareholder”), KCA acquired 677,283 shares of Common Stock in a cash tender offer (the “Tender Offer Shares”) and 19,310,000 shares of Common Stock owned by the Majority Shareholder (the “Majority Shares”). As a result of the acquisition of the Tender Offer Shares and Majority Shares, effective December 16, 2016, KCA became the owner of 19,987,283 shares of Common Stock representing approximately 90% of the Company’s outstanding Common Stock.

The purchase price paid by KCA in the tender offer to the minority shareholders for the Tender Offer Shares was approximately $812,740. The purchase paid by KCA to the Majority Shareholder for the Majority Shares was approximately $6,994,342 (the “Majority Share Purchase Price”). Of the amount payable to the Majority Shareholder, $1 million was placed in escrow for one year and will be used to fund the Majority Shareholder’s indemnification obligations to the Purchaser. In addition, the Majority Share Purchase Price is subject to adjustment for fluctuations in SFC’s working capital and reduction for SFC’s transaction expenses in connection with the Acquisition.

In addition, pursuant to the Acquisition Agreement, SFC’s Board of Directors declared a special dividend in the amount of $.20 per share of outstanding Common Stock (an aggregate of $4,492,735) payable on October 24, 2016, to the shareholders of record on October 13, 2016.

In accordance with the Acquisition Agreement, pursuant to the terms of an assignment agreement (the “Assignment”) dated December 16, 2016, SFC assigned to the Majority Shareholder, among other things, all of SFC’s rights to receive the remaining amounts of the SBSF Receivables and the remaining amounts payable pursuant to the SBSF Junior Note. The Company received approximately $610,000 from the Majority Shareholder to adjust for the non-Estate controlled shares.

| Item 1A. | RISK FACTORS |

Securities market volatility and other securities industry risk could adversely affect our business

Most of our revenues are derived from our securities brokerage business. Like other businesses operating in the securities industry, our business is directly affected by volatile trading markets, fluctuations in the volume of market activity, economic and political conditions, upward and downward trends in business and finance at large, legislation and regulation affecting the national and international business and financial communities, currency values, inflation, market conditions, the availability and cost of short-term or long-term funding and capital, the credit capacity or perceived credit-worthiness of the securities industry in the marketplace and the level and volatility of interest rates. We also face risks relating to trading losses, losses resulting from the ownership or underwriting of securities, counterparty failure to meet commitments, customer fraud, employee fraud, issuer fraud, errors and misconduct, failures in connection with the processing of securities transactions and litigation. A reduction in our revenues or a loss resulting from our ownership of securities or sales or trading of securities could have a material adverse effect on our business, results of operations and financial condition. In addition, as a result of these risks, our revenues and operating results may be subject to significant fluctuations from quarter to quarter and from year to year.

Lower price levels in the securities markets may reduce our profitability.

Lower price levels of securities may result in (i) reduced volumes of securities, options and futures transactions, with a consequent reduction in our commission revenues, and (ii) losses from declines in the market value of securities we held in investment. In periods of low volume, our levels of profitability are further adversely affected because certain of our expenses remain relatively fixed. Sudden sharp declines in market values of securities and the failure of issuers and counterparties to perform their obligations can result in illiquid markets which, in turn, may result in our having difficulty selling securities. Such negative market conditions, if prolonged, may lower our revenues. A reduction in our revenues could have a material adverse effect on our business, results of operations and financial condition.

| 8 |

There is intense competition in the brokerage industry.

Siebert encounters significant competition from full-commission, online and other discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations many of which are significantly larger and better capitalized than Siebert. Over the past several years, price wars and lower commission rates in the discount brokerage business in general have strengthened our competitors. Siebert believes that such changes in the industry will continue to strengthen existing competitors and attract additional competitors such as banks, insurance companies, providers of online financial and information services, and others. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert may not be able to compete effectively with current or future competitors.

Some competitors in the discount brokerage business offer services which we may not. In addition, some competitors have continued to offer flat rate execution fees that are lower than our published rates. Industry-wide changes in trading practices are expected to cause continuing pressure on fees earned by discount brokers for the sale of order flow. Continued or increased competition from ultra-low cost, flat fee brokers and broader service offerings from other discount brokers could limit our growth or lead to a decline in Siebert’s customer base which would adversely affect our business, results of operations and financial condition.

Failure to protect client data or prevent breaches of our information systems could expose us to liability or reputational damage.

We are dependent on information technology networks and systems to securely process, transmit and store electronic information and to communicate among our locations and with our clients and vendors. As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. As a financial services company, we are continuously subject to cyber-attacks by third parties. Any such security breach could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information. In addition, vulnerabilities of our external service providers and other third parties could pose security risks to client information. The secure transmission of confidential information over public networks is also a critical element of our operations.

In providing services to clients, we manage, utilize and store sensitive and confidential client data, including personal data. As a result, we are subject to numerous laws and regulations designed to protect this information, such as U.S. federal and state laws and foreign regulations governing the protection of personally identifiable information. These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to client data, or otherwise mismanages or misappropriates that data, we could be subject to significant monetary damages, regulatory enforcement actions, fines and/or criminal prosecution in one or more jurisdictions. Unauthorized disclosure of sensitive or confidential client data, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. Similarly, unauthorized access to or through our information systems, whether by our employees or third parties, including a cyber-attack by third parties who may deploy viruses, worms or other malicious software programs, could result in negative publicity, significant remediation costs, legal liability, and damage to our reputation and could have a material adverse effect on our results of operations. In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches.

Our advisory services subject us to additional risks.

We have provided investment advisory services to investors through our registered Registered Investment Advisor, SIA. SIA intends to offer Robo advisory and investment services. The risks associated with these investment advisory activities include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud. Realization of these risks could lead to liability for client losses, regulatory fines, civil penalties and harm to our reputation and business.

| 9 |

We are subject to extensive government regulation.

Our business is subject to extensive regulation in the United States, at both the Federal and state level. We are also subject to regulation by self–regulatory organizations and other regulatory bodies in the United States, such as the SEC, the NYSE, FINRA and the MSRB. We are registered as a broker-dealer in 50 states and the District of Columbia. The regulations to which we are subject as a broker-dealer cover all aspects of the securities business including: training of personnel, sales methods, trading practices, uses and safe keeping of customers’ funds and securities, capital structure, record keeping, fee arrangements, disclosure and the conduct of directors, officers and employees. Failure to comply with any of these laws, rules or regulations, which may be subject to the uncertainties of interpretation, could result in civil penalties, fines, suspension or expulsion and have a material adverse effect on our business, results of operations and financial condition.

The laws, rules and regulations, as well as governmental policies and accounting principles, governing our business and the financial services and banking industries generally have changed significantly over recent years and are expected to continue to do so. We cannot predict which changes in laws, rules, regulations, governmental policies or accounting principles will be adopted. Any changes in the laws, rules, regulations, governmental policies or accounting principles relating to our business could materially and adversely affect our business, results of operations and financial condition.

Legislation has and may continue to result in changes to rules and regulations applicable to our business, which may negatively impact our business and financial results.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in 2010, requires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various industry practices. In particular, the Dodd-Frank Act gives the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. The U.S. Department of Labor (“DOL”) has enacted regulations changing the definition of who is an investment advice fiduciary under the Employee Retirement Income Security Act of 1974 (ERISA) and how such advice can be provided to account holders in retirement accounts such as 401(k) plans and Individual Retirement Arrangements (IRAs). The DOL regulations will deem many of the investment, rollover and asset management recommendations from us to our clients regarding their retirement accounts fiduciary “investment advice” under ERISA. One of the most significant impacts on our business from the DOL regulations and related prohibited transaction exemptions will be the impact on our fee and compensation practices. For example, the regulations make investment advisors to retirement account clients subject to an ERISA fiduciary duty standard and the exemptions seek to reduce conflicts of interest stemming from fee differentials and compensation incentives that could lead to a misalignment of the interests of advisors and their retirement investor clients. The exemptions, when used, will also require certain new client contracts, adherence to “impartial conduct standards” (including a requirement to act in the “best interest” of retirement clients when providing investment advice), the adoption of related policies and procedures and the making of extensive website and other disclosures to retirement investors and the DOL. One way to comply is to use the best interest contract exemption in connection with certain advice activities, which will subject us to an increased risk of class actions and other litigation and regulatory risks. Additional rulemaking or legislative action could negatively impact our business and financial results. While we have not yet been required to make other material changes to our business or operations as a result of the Dodd-Frank Act or other rulemaking or legislative action, it is not certain what the scope of future rulemaking or interpretive guidance from the SEC, FINRA, DOL, banking regulators and other regulatory agencies may be, how the courts and regulators might interpret these rules and what impact this will have on our compliance costs, business, operations and profitability.

Our profitability could also be affected by new or modified laws that impact the business and financial communities generally, including changes to the laws governing banking, the securities market, fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data.

| 10 |

We are subject to net capital requirements.

The SEC, FINRA, and various other securities and commodities exchanges and other regulatory bodies in the United States have rules with respect to net capital requirements which affect us. These rules have the effect of requiring that at least a substantial portion of a broker-dealer’s assets be kept in cash or highly liquid investments. Our compliance with the net capital requirements could limit operations that require intensive use of capital, such as underwriting or trading activities. These rules could also restrict our ability to withdraw our capital, even in circumstances where we have more than the minimum amount of required capital, which, in turn, could limit our ability to implement growth strategies. In addition, a change in such rules, or the imposition of new rules, affecting the scope, coverage, calculation or amount of such net capital requirements, or a significant operating loss or any unusually large charge against net capital, could have similar adverse effects.

Our customers may fail to pay us.

A principal credit risk to which we are exposed on a regular basis is that our customers may fail to pay for their purchases or fail to maintain the minimum required collateral for amounts borrowed against securities positions maintained by them. We cannot assure you that our practices and/or the policies and procedures we have established will be adequate to prevent a significant credit loss.

An increase in volume on our systems or other events could cause them to malfunction.

During 2016, we received and processed approximately 61% of our trade orders electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether. Any significant degradation or failure of our systems or the systems of third parties involved in the trading process (e.g., online and Internet service providers, record keeping and data processing functions performed by third parties, and third party software), even for a short time, could cause customers to suffer delays in trading. These delays could cause substantial losses for customers and could subject us to claims from these customers for losses. There can be no assurance that our network structure will operate appropriately in the event of a subsystem, component or software failure. In addition, we cannot assure you that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, an earthquake, terrorist attack, fire or any act of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and operating results.

We rely on information processing and communications systems to process and record our transactions.

Our operations rely heavily on information processing and communications systems. Our system for processing securities transactions is highly automated. Failure of our information processing or communications systems for a significant period of time could limit our ability to process a large volume of transactions accurately and rapidly. This could cause us to be unable to satisfy our obligations to customers and other securities firms, and could result in regulatory violations. External events, such as an earthquake, terrorist attack or power failure, loss of external information feeds, such as security price information, as well as internal malfunctions such as those that could occur during the implementation of system modifications, could render part or all of these systems inoperative.

Rapid market or technological changes may render our technology obsolete or decrease the attractiveness of our products and services to our clients.

We must continue to enhance and improve our technology and electronic services. The electronic financial services industry is characterized by significant structural changes, increasingly complex systems and infrastructures, changes in clients’ needs and preferences and new business models. If new industry standards and practices emerge and our competitors release new technology before us, our existing technology, systems and electronic trading services may become obsolete or our existing business may be harmed. Our future success will depend on our ability to:

| • | enhance our existing products and services; |

| • | develop and/or license new products and technologies that address the increasingly sophisticated and varied needs of our clients and prospective clients; |

| 11 |

| • | continue to attract highly-skilled technology personnel; and |

| • | respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. |

Developing our electronic services, our implementation and utilization of our use of the Robo investment advisor platform and other technology entails significant technical and business risks. We may use new technologies ineffectively or we may fail to adapt our electronic trading platform, information databases and network infrastructure to client requirements or emerging industry standards. If we face material delays in introducing new services, products and enhancements, our clients may forego the use of our products and use those of our competitors.

Further, the adoption of new Internet, networking or telecommunications technologies may require us to devote substantial resources to modify and adapt our services. We cannot assure you that we will be able to successfully implement new technologies or adapt our proprietary technology and transaction-processing systems to client requirements or emerging industry standards. We cannot assure you that we will be able to respond in a timely manner to changing market conditions or client requirements.

We depend on our ability to attract and retain key personnel.

We are dependent upon our new and continuing senior management for our success and the loss of the services of any of these individuals could significantly harm our business, financial condition and operating results.

We may be unable to realize the anticipated benefits of the change in control or it may take longer than anticipated for us to realize any benefits from increased cost efficiencies or economies of scale, if at all.

Our realization of the benefits anticipated as a result of the Acquisition Agreement and change in control will depend in part on the ability of our new management team, led by our new Executive Vice President and Chief Financial Officer, Andrew H. Reich, to implement the Company’s business plan (See Recent Events). We cannot assure shareholders that there will not be substantial costs associated with the transition process, the Company’s new products or other negative consequences as a result of the change in management. These effects, including, but not limited to, incurring unexpected costs or delays in connection with implantation of a modified business model, or the failure of our business to perform as expected, could harm our results of operations.

Our principal shareholder has the ability to control key decisions submitted to a vote of our shareholders.

KCA currently owns approximately 90% of our outstanding common stock and Gloria E. Gebbia, who is a director of the Company, and the managing member of KCA, has the power to elect the entire Board of Directors and, except as otherwise provided by law or our Certificate of Incorporation or by-laws, to approve any action requiring shareholder approval without a shareholders meeting.

There may be no public market for our common stock.

Only approximately 1,900,000 shares of common stock, or approximately 9% of our shares of Common Stock outstanding, are currently held by the public. Although our Common Stock is traded in The NASDAQ Capital Market, there can be no assurance that an active public market will continue.

Our future ability to pay dividends to holders of our Common Stock is subject to the discretion of our board of directors and will be limited by our ability to generate sufficient earnings and cash flows.

Payment of future cash dividends on our Common Stock will depend on our ability to generate earnings and cash flows. However, sufficient cash may not be available to pay such dividends. Payment of future dividends, if any, will be at the discretion of our board of directors and will depend upon a number of factors that the board of directors deems relevant, including future earnings, the success of our business activities, capital requirements, the general financial condition and future prospects of our business and general business conditions. If we are unable to generate sufficient earnings and cash flows from our business, we may not be able to pay dividends on our Common Stock.

| 12 |

Our ability to pay cash dividends on our common stock is also dependent on the ability of our subsidiaries to pay dividends to SFC. MSCO is subject to requirements of the SEC and FINRA relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to SFC.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

Siebert currently maintains three retail discount brokerage offices. Customers can visit these offices to obtain market information, place orders, open accounts, deliver and receive checks and securities, and obtain related customer services in person. Nevertheless, most of Siebert’s activities are conducted on the Internet or by telephone and mail.

Siebert operates its business out of the following leased offices:

| Location | Approximate Office Area in Square Feet | Expiration

Date of Current Lease | Renewal Terms | |||||||||

| Corporate Headquarters / Retail Office | ||||||||||||

| 120 Wall Street New York, NY 10005 | 250 | 9/2018 | None | |||||||||

| Retail Offices | ||||||||||||

| 15 Exchange Place, Suite 615 Jersey City, NJ 07302 | 5,000 | 9/2018 | None | |||||||||

| 4400 North Federal Highway Boca Raton, FL 33431 | 2,438 | Month to Month | None | |||||||||

| Item 3. | LEGAL PROCEEDINGS |

In December 2015, a former employee of MSCO commenced an arbitration before FINRA against MSCO, alleging a single cause of action for employment retaliation under the Sarbanes-Oxley Act of 2002. In February 2016, the employee amended his claim to replace the Sarbanes-Oxley claim with a substantially identical claim arising under the Dodd-Frank Act of 2010. The matter was settled in February 2017.

The Company is party to certain claims, suits and complaints arising in the ordinary course of business. In the opinion of management, all such matters are without merit, or involve amounts which would not have a significant effect on the financial position of the Company.

| Item 4. | MINE SAFETY DISCLOSURES |

Not applicable

| 13 |

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock traded on the NASDAQ Global Market until June 29, 2011 when our common stock started trading on the NASDAQ Capital Market, under the symbol “SIEB”. The high and low sales prices of our common stock reported by NASDAQ during the following calendar quarters were:

| High | Low | |||||||

| First Quarter – 2015 | $ | 2.62 | $ | 1.44 | ||||

| Second Quarter – 2015 | $ | 2.11 | $ | 1.45 | ||||

| Third Quarter – 2015 | $ | 1.95 | $ | 1.35 | ||||

| Fourth Quarter – 2015 | $ | 1.56 | $ | 1.14 | ||||

| First Quarter – 2016 | $ | 1.40 | $ | 1.15 | ||||

| Second Quarter – 2016 | $ | 1.34 | $ | 1.17 | ||||

| Third Quarter – 2016 | $ | 2.20 | $ | 1.00 | ||||

| Fourth Quarter – 2016 | $ | 3.25 | $ | 1.19 | ||||

On March 24, 2017, the closing price of our common stock on the NASDAQ Capital Market was $3.08 per share. There were 86 holders of record of our common stock and approximately 1,000 beneficial owners of our common stock.

Dividend Policy

Our Board of Directors periodically considers whether to declare dividends. In considering whether to pay such dividends, our Board of Directors will review our earnings capital requirements, economic forecasts and such other factors as are deemed relevant. Some portion of our earnings will be retained to provide capital for the operation and expansion of our business.

Pursuant to the Acquisition Agreement, our Board of Directors declared a special dividend in the amount of $.20 per share of outstanding Common Stock (an aggregate of $4,492,735) payable on October 24, 2016, to the shareholders of record on October 13, 2016. This dividend was a one-time event made pursuant to the terms of the Acquisition Agreement. No other special dividends are currently contemplated.

Issuer Purchases of Equity Securities

Effective February 28, 2017, our Board of Directors terminated the stock repurchase program authorized on January 23, 2008. No shares were purchased in 2016.

Equity Compensation Plan Information

In December 2016, our Board of Directors authorized the termination of our equity compensation plans. Accordingly, as of December 31, 2016, we had no equity compensation plans.

| 14 |

Our Performance

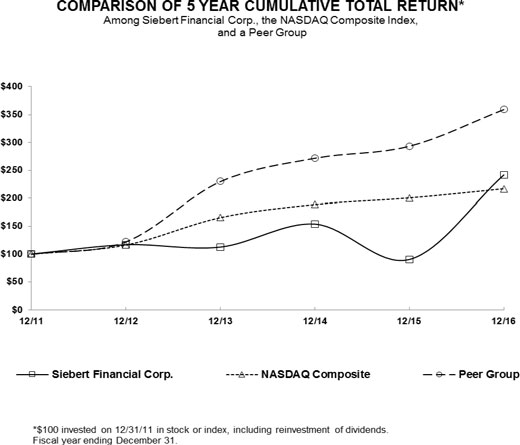

The graph below compares our performance from December 31, 2011 through December 31, 2016 against the performance of the NASDAQ Composite Index and a peer group. The peer group consists of Ameritrade Holding Corporation, E*Trade Financial Corporation and the Charles Schwab Corporation.

| Cumulative Total Return | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||

| Siebert Financial Corp. | 100.00 | 116.78 | 112.59 | 153.85 | 90.21 | 241.73 | ||||||||||||||||||

| Nasdaq Composite | 100.00 | 116.41 | 165.47 | 188.69 | 200.32 | 216.54 | ||||||||||||||||||

| Peer Group | 100.00 | 122.36 | 230.03 | 272.01 | 293.54 | 359.57 | ||||||||||||||||||

| 15 |

| Item 6. | SELECTED FINANCIAL DATA |

(In thousands except share and per share data)

The

Following Selected Financial Information Should Be Read In Conjunction with Our Consolidated

Financial Statements and the Related

Notes Thereto.

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Income statement data: | ||||||||||||||||||||

| Total Revenues | $ | 9,812 | 10,096 | $ | 15,815 | $ | 16,401 | $ | 20,983 | |||||||||||

| Net loss | $ | (5,578 | ) | (2,869 | ) | $ | (6,557 | ) | $ | (5,912 | ) | $ | (171 | ) | ||||||

| Net loss per share of common stock | ||||||||||||||||||||

| Basic | $ | (.25 | ) | (.13 | ) | $ | (0.30 | ) | $ | (0.27 | ) | $ | (0.01 | ) | ||||||

| Diluted | $ | (.25 | ) | (.13 | ) | $ | (0.30 | ) | $ | (0.27 | ) | $ | (0.01 | ) | ||||||

| Weighted average shares outstanding (basic) | 22,085,126 | 22,085,126 | 22,085,126 | 22,087,324 | 22,100,759 | |||||||||||||||

| Weighted average shares outstanding (diluted) | 22,085,126 | 22,085,126 | 22,085,126 | 22,087,324 | 22,100,759 | |||||||||||||||

| Statement of financial condition data (at year end): | ||||||||||||||||||||

| Total assets | $ | 3,816 | 17,785 | $ | 20,728 | $ | 27,970 | $ | 33,456 | |||||||||||

| Total liabilities excluding subordinated borrowings | $ | 1,563 | 2,102 | $ | 2,176 | $ | 2,861 | $ | 2,416 | |||||||||||

| Stockholders’ equity | $ | 2,253 | 15,683 | $ | 18,552 | $ | 25,109 | $ | 31,040 | |||||||||||

| Cash dividends declared on common shares | $ | .20 | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion should be read in conjunction with our audited Consolidated Financial Statements and the Notes thereto contained elsewhere in this Annual Report.

Our working capital is invested primarily in bank accounts. In November 2015, Siebert sold its 49% equity interest in SBSF to our former affiliate resulting in discontinued operations. A loss resulted from the disposal of this equity investment in the amount of $52,000 for 2015 which includes equity earnings of former affiliate of $671,000, net of $448,000 loss related to disposal of investment in 2015, net of income tax of $275,000. Siebert also earned interest income from the receivable from the SCM sale to SBSF of $207,000 in 2016. The receivable was sold by Siebert in December 2016 in connection with the Acquisition Agreement. The Company’s professional expenses during 2016 include the costs of associated with the Acquisition.

| 16 |

The following table sets forth certain metrics as of December 31, 2016, 2015 and 2014, respectively, which we use in evaluating our business.

| For the Twelve Months ended December 31, | ||||||||||||

| Retail Customer Activity: | 2016 | 2015 | 2014 | |||||||||

| Total retail trades: | 229,720 | 259,624 | 293,419 | |||||||||

| Average commission per retail trade: | $ | 20.27 | * | $ | 22.29 | $ | 19.50 | |||||

| As of December 31, | ||||||||

| 2016 | 2015 | |||||||

| Retail customer balances: | ||||||||

| Retail customer net worth (in billions): | $ | 7.0 | $ | 6.8 | ||||

| Retail customer money market fund value (in billions): | $ | 1.0 | $ | .9 | ||||

| Retail customer margin debit balances (in millions): | $ | 214.0 | $ | 254.7 | ||||

| Retail customer accounts with positions: | 28,430 | 30,851 | ||||||

| * | Based on new management’s analysis. |

Description:

| • | Total retail trades represents retail trades that generate commissions. | |

| • | Average commission per retail trade represents the average commission generated for all types of retail customer trades. | |

| • | Retail customer net worth represents the total value of securities and cash in the retail customer accounts before deducting margin debits. | |

| • | Retail customer money market fund value represents all retail customers accounts invested in money market funds. | |

| • | Retail customer margin debit balances represents credit extended to our customers to finance their purchases against current positions. | |

| • | Retail customer accounts with positions represent retail customers with cash and/or securities in their accounts. |

We, like other securities firms, are directly affected by general economic and market conditions including fluctuations in volume and prices of securities, changes and the prospect of changes in interest rates, and demand for brokerage and investment banking services, all of which can affect our profitability. In addition, in periods of reduced financial market activity, profitability is likely to be adversely affected because certain expenses remain relatively fixed, including salaries and related costs, portions of communications costs and occupancy expenses. Accordingly, earnings for any period should not be considered representative of earnings to be expected for any other period.

Competition continues to intensify among all types of brokerage firms, including established discount brokers and new firms entering the on-line brokerage business. Electronic trading continues to account for an increasing amount of trading activity, with some firms charging very low trading execution fees that are difficult for any conventional discount firm to meet. Some of these brokers, however, impose asset based charges for services such as mailing, transfers and handling exchanges which we do not currently impose, and also direct their orders to market makers where they have a financial interest. Continued competition could limit our growth or even lead to a decline in our customer base, which would adversely affect our results of operations. Industry-wide changes in trading practices, such as the continued use of Electronic Communications Networks, are expected to put continuing pressure on commissions/fees earned by brokers while increasing volatility.

The Company’s SIA subsidiary offers to its clients a number of Asset Management Programs (“Managed Programs”) consisting of asset allocation, flexible asset management and focused or completion strategies. In these Managed Programs, SIA acts as the co-adviser to clients. IA Representatives will assist each client in reviewing information about the programs, completing a client questionnaire to determine the client’s risk tolerance, financial situation and investment objectives and selecting an investment strategy. SIA does not ever act as portfolio manager directly, SIA selects other investment advisers to act as portfolio manager on behalf of its clients. During 2016, the results of SIA operations are immaterial to the operations of the Company.

| 17 |

Critical Accounting Policies

We generally follow accounting policies standard in the brokerage industry and believe that our policies appropriately reflect our financial position and results of operations. Our management makes significant estimates that affect the reported amounts of assets, liabilities, revenues and expenses and the related disclosure of contingent assets and liabilities included in the financial statements. The estimates relate primarily to revenue and expense items in the normal course of business as to which we receive no confirmations, invoices, or other documentation, at the time the books are closed for a period. We use our best judgment, based on our knowledge of revenue transactions and expenses incurred, to estimate the amount of such revenue and expenses. We are not aware of any material differences between the estimates used in closing our books for the last five years and the actual amounts of revenue and expenses incurred when we subsequently receive the actual confirmations, invoices or other documentation. Estimates are also used in determining the useful lives of intangibles assets, and the fair market value of intangible assets. Our management believes that its estimates are reasonable.

Results of Operations

Year Ended December 31, 2016 Compared to Year Ended December 31, 2015

Revenues. Total revenues for 2016 were $9.8 million, a decrease of $284,000, or 2.8%, from 2015. Commission and fee income decreased $861,000, or 9.4%, from the prior year to $8.3 million primarily due to a decrease in retail trading.

Trading gains increased $346,000 or 60.2% to $921,000 primarily as a result of liquidating the Company’s securities.

Income from interest and dividends increased $225,000, or 69%, from the prior year to $551,000 in 2016 primarily due to accrued interest on our receivable from business sold to affiliate and interest from a subordinated note from our former affiliate.

Expenses. Total expenses for 2016 were $15.4 million, an increase of $2.2 million or 16.7% from the prior year primarily due to expenses associated with the sale of the Company.

Employee compensation and benefit costs decreased $503,000, or 9.3%, from the prior year to $4.9 million in 2016. This decrease was primarily due to a reduction in head count from the previous year.

Clearing and floor brokerage fees decreased $373,000, or 30.1%, from the prior year to $866,000 in 2016 primarily due to lower retail trading volume.

Professional fees increased $258,000, or 8.1% form the prior year to $3.5 million in 2016. This increase was primarily due to increased professional fees incurred as a result of the change in control of the Company in additional to the professional fees discussed below.

In December 2015, a then current employee of the Company commenced an arbitration before FINRA against the Company alleging a single cause of action for employment retaliation under the Sarbanes-Oxley Act of 2002. In February 2016, the employee amended his claim to replace the Sarbanes-Oxley claim with a substantially identical claim arising under the Dodd-Frank Act of 2010. In February 2017, a settlement agreement was entered into pursuant to which the arbitration was dismissed with prejudice and the employee was paid $825,000 which was funded by Kennedy Cabot Acquisition, LLC.

Effective December 2016, the Company entered into an acquisition agreement with Kennedy Cabot Acquisition, LLC. As a result of this transaction, the Company incurred $2,206,000 of professional fees and other expenses related to change in control.

Communications expense decreased $133,000, or 22.4% from the prior year to $462,000 in 2016 primarily due to a reduction in expenses associated with quote usage.

Occupancy costs decreased $30,000, or 3.9% from the prior year to $746,000 in 2016.

Other general and administrative expenses decreased $30,000, or 2.2%, from the prior year to $1.7 million in 2016 due to expenses associated with the sale of the Company.

Income tax benefit for the year ended December 31, 2015 was $275,000. The benefit for income taxes for 2015 represents the utilization of the loss from continuing operations against income from discontinued operations, exclusive in 2015 of the capital loss from disposal of the investment in former affiliate. The Company has recorded a valuation allowance to fully offset our deferred tax asset at December 31, 2016 and 2015.

| 18 |

Results of Operations

Year Ended December 31, 2015 Compared to Year Ended December 31, 2014

Revenues. Total revenues for 2015 were $10.1 million, a decrease of $5.8 million, or 36.3%, from 2014. Commission and fee income decreased $1.6 million, or 14.9%, from the prior year to $9.2 million primarily due to a decrease in retail trading. The Capital Markets Division was sold to our former affiliate SBSF on November 4, 2014 resulting in reduced institutional trading commissions and investment banking revenues. Commission recapture operations were shut down on September 30, 2014.

Investment banking revenues decreased $1.8 million or 97.8%, from the prior year to $40,000 in 2015 due to the Capital Markets division being sold on November 4, 2014 to our former affiliate.

Trading profits decreased $776,000, or 57.4%, from the prior year to $575,000 in 2015 primarily due to an overall decrease in trading volume primarily in the debt markets.

The Company recorded a gain on the sale of our Capital Markets Segment of $1,820,000, which reflected the fair value of the purchase obligation (transferred assets of the Company’s capital markets business, consisted of customer accounts and goodwill, which had no carrying value to the Company. Such fair value was based on the present value of estimated annual installments to be received during 2016 through 2020 from forecasted net income of the transferred business plus a final settlement in 2021, discounted at 11.5% (representing SBS’s weighted average cost of capital), the sale was for $3,000,000 recorded at a discount.