SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Section 240.14a-12 |

THE MEXICO FUND, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) |

Title of each class of securities to which transaction applies:

| |

| (2) |

Aggregate number of securities to which transaction applies:

| |

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) |

Proposed maximum aggregate value of transaction:

| |

| (5) |

Total fee paid:

| |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) |

Amount Previously Paid

| |

| (2) |

Form, Schedule or Registration Statement No.:

| |

| (3) |

Filing Party:

| |

| (4) |

Date Filed:

| |

THE MEXICO FUND, INC.

6700 Alexander Bell Drive, Suite 200, Columbia, Maryland 21046

Notice of Annual Meeting of Stockholders

February 1, 2019

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of The Mexico Fund, Inc., a Maryland corporation (the “Fund”), will be held in the John Jacob Boardroom on the Mezzanine Level of the St. Regis Hotel, located at 1919 Briar Oaks Lane, Houston, Texas 77027, on March 12, 2019 at 10:00 am CST for the following purposes:

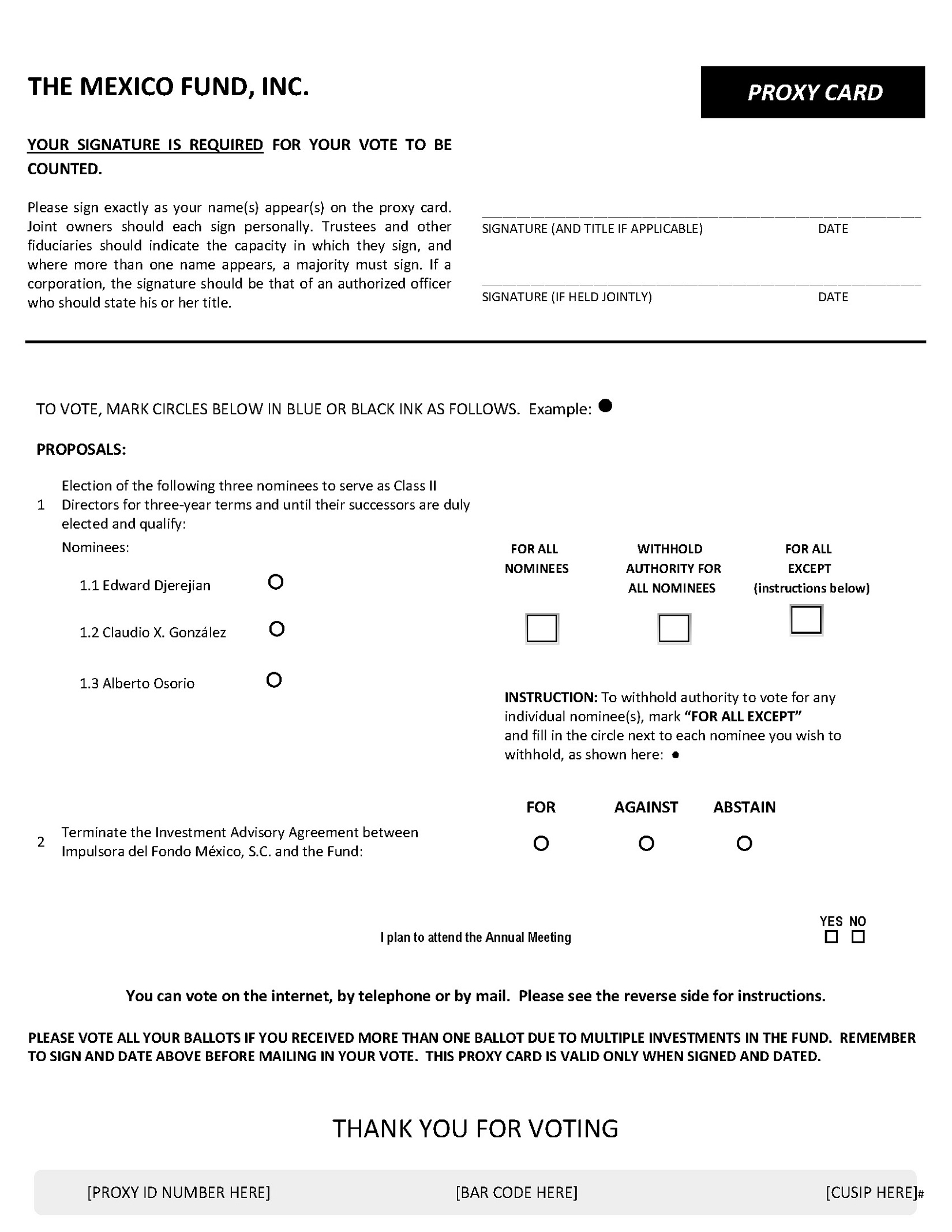

(1) To elect three Directors to serve as Class II Directors for three year terms and until their successors are duly elected and qualify (Proposal 1);

(2) To consider and act upon a stockholder proposal to terminate the Investment Advisory Agreement between Impulsora del Fondo México, S.C. and the Fund (Proposal 2); and

(3) To transact such other business that may properly come before the Meeting or any adjournment or postponement thereof.

The Board of Directors has fixed January [ ], 2019 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof, and only holders of record of shares at the close of business on that date are entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

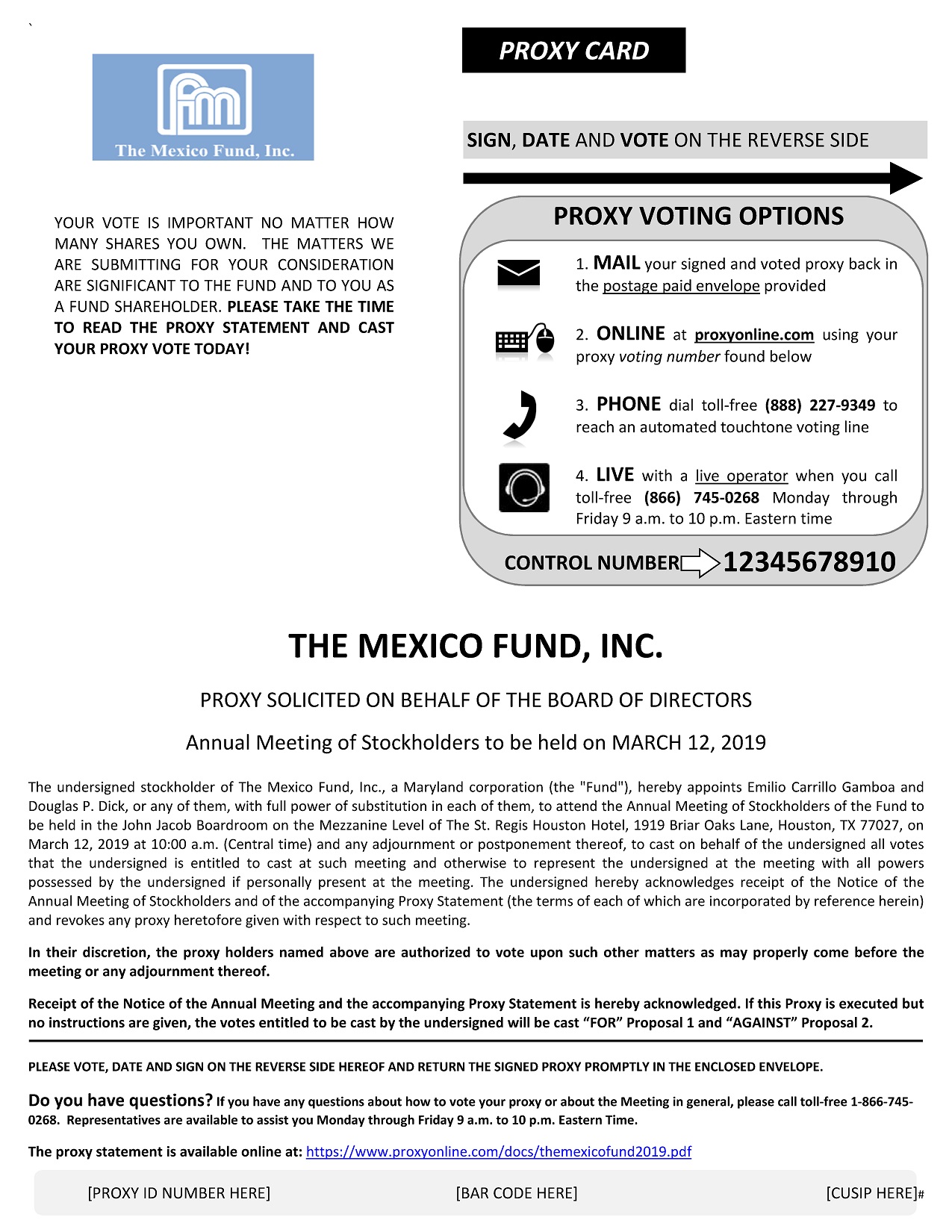

You are cordially invited to attend the Meeting. All stockholders are requested to complete, date and sign the enclosed form of proxy and return it promptly in the envelope provided for that purpose, or authorize the proxy vote by telephone or internet pursuant to instructions on the enclosed proxy card. The enclosed proxy is being solicited on behalf of the Board of Directors of the Fund.

| By Order of the Board of Directors, | |

| |

| Douglas P. Dick | |

| Secretary |

New York, New York

Dated: February 1, 2019

| PLEASE RESPOND—YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND MAIL THE ENCLOSED PROXY CARD IN THE MANNER PROVIDED, OR AUTHORIZE THE PROXY VOTE BY TELEPHONE OR INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. IT IS IMPORTANT THAT YOU RETURN YOUR PROXY AS SOON AS POSSIBLE TO ASSURE THAT YOUR PROXY WILL BE VOTED AND TO AVOID ANY ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION. FOR MORE INFORMATION, PLEASE CALL 866-620-9554 FROM WITHIN THE UNITED STATES, OR +1-212-400-2605 FROM OUTSIDE THE UNITED STATES. |

PROXY STATEMENT

THE MEXICO FUND, INC.

6700 Alexander Bell Drive, Suite 200

Columbia, Maryland 21046

Annual Meeting of Stockholders

March 12, 2019

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (“Board”) of The Mexico Fund, Inc., a Maryland corporation (the “Fund”), to be exercised at the Annual Meeting of Stockholders of the Fund (the “Meeting”) to be held in the John Jacob Boardroom on the Mezzanine Level of the St. Regis Hotel, located at 1919 Briar Oaks Lane, Houston, Texas 77027, at 10:00 am CST and at any adjournment or postponement thereof. The approximate mailing date of this Proxy Statement is February 1, 2019 or as soon as practicable thereafter.

All properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, a properly executed proxy will be voted FOR Proposal 1 and AGAINST Proposal 2. The appointed proxy holders will vote in their discretion on any other business that may properly come before the Meeting or any adjournment or postponements thereof. Any stockholder giving a proxy has the right to attend the Meeting to vote his or her shares in person (thereby revoking any prior proxy), and also the right to revoke the proxy at any time prior to its exercise by submitting a properly executed, subsequently dated proxy, received by the Fund addressed to American Stock Transfer and Trust Company, LLC at 6201 15th Avenue Brooklyn, NY 11219, Attn: Proxy Department. Stockholders may vote using the enclosed proxy card along with the enclosed postage-paid envelope. Stockholders may also authorize proxy voting by telephone or internet. To authorize proxy voting by telephone or internet, stockholders should follow the instructions contained on their proxy card.

The presence at the Meeting in person or by proxy of the stockholders entitled to cast a majority of all votes entitled to be cast at the Meeting is necessary to constitute a quorum for the transaction of business. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker non-votes (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present.

Approval of Proposal 1 requires the affirmative vote of the holders of a majority of the shares of common stock outstanding and entitled to vote provided a quorum is present. An abstention as to Proposal 1 will be treated as present and will have the effect of a vote “Against” Proposal 1. Proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on the proposal will be voted “For” Proposal 1.

Approval of Proposal 2 requires the affirmative vote of the holders of a “majority of the outstanding voting securities,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Fund, provided a quorum is present. The vote of a majority of the outstanding voting securities of the Fund means the vote of (A) 67% or more of the voting securities present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy, or (B) of more than 50% of the outstanding voting securities of the Fund, whichever is the less. An abstention as to Proposal 2 will be treated as present and will have the effect of a vote “Against” Proposal 2.

In the event that the necessary quorum to transact business at the Meeting is not obtained, the chairman of the Meeting or the stockholders may adjourn the Meeting from time to time to a date not more than 120 days after the original record date without notice other than announcement at the Meeting. If a quorum is present at the Meeting but sufficient votes to approve a Proposal are not received, the chairman of the Meeting may adjourn the Meeting, or may permit the persons named as proxies to propose one or more adjournments of the Meeting to permit further solicitation of proxies. If submitted to stockholders, any such adjournment will require the affirmative vote of holders of a majority of those shares represented at the Meeting in person or by proxy (or a majority of votes cast if a quorum is present). The persons named as proxies will vote those proxies which they are entitled to vote FOR any proposal in favor of such an adjournment, and will vote those proxies marked WITHHOLD or AGAINST, as applicable, on any such proposal “Against” such adjournment. For purposes of votes with respect to adjournment, broker non-votes will not be counted as votes cast and will have no effect on the result of the vote.

Only stockholders can attend the Meeting and any adjournment or postponement thereof. To gain admittance, if you are a stockholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against our stockholder list. If a broker or other nominee holds your shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the shares, as well as a form of personal identification. If you are a beneficial owner and plan to vote at the Meeting, you should also bring a proxy card from your broker.

The Board has fixed January [ ], 2019 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof. Stockholders on the record date will be entitled to one vote for each share held. As of December 31, 2018, the Fund had outstanding 15,005,224 shares of common stock, par value $1.00 per share. Based on filings made with the U.S. Securities and Exchange Commission (“SEC”), below are persons known to the Fund to be the beneficial owner of more than five percent (5%) of the Fund’s shares as of the record date.

|

Title of Class |

Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

| Common Stock |

City of London Investment Group PLC and City of London Investment Management Company Limited 77 Gracechurch London EC3V 0A England |

3,589,124 | 23.9% |

The Board knows of no other business that will be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named on the enclosed proxy card to vote in accordance with their discretion.

The Fund will furnish, without charge, a copy of the Fund’s annual report for its fiscal year ended October 31, 2018, and any more recent reports, to any Fund stockholder upon request. To request a copy, please visit the Fund’s web site at www.themexicofund.com or contact AST Fund Solutions at 55 Challenger Road, Suite 201, Ridgefield Park, NJ 07660-2102, or by telephone from within the United States at 866-745-0269, or from outside the United States at +1-201-806-7300.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors of the Fund is divided into three classes of Directors, as nearly equal in number as possible, each of which serves for three years with one class being elected each year. Each year the term of office of one class will expire. The terms of office of Mr. Edward P. Djerejian, Mr. Claudio X. González and Mr. Alberto Osorio expire this year, and Mr. Edward P. Djerejian, Mr. Claudio X. González and Mr. Alberto Osorio have decided to stand for re-election at this Annual Meeting. The Board of Directors, including the Directors who are not interested persons of the Fund, upon the recommendation of the Fund’s Nominating and Corporate Governance Committee which is comprised solely of Directors who are not “interested persons” of the Fund (as defined in Section 2(a)(19) of the 1940 Act, have nominated Mr. Edward P. Djerejian, Mr. Claudio X. González and Mr. Alberto Osorio to serve as Class II Directors for a three year term expiring in 2022 and until their successors are duly elected and qualify. The nominees have indicated an intention to serve if elected and have consented to be named in this Proxy Statement. Directors who are not interested persons are referred to in the Proxy Statement as “Independent Directors.”

It is the intention of the persons named on the enclosed proxy card to vote for the nominees listed below for a three-year term. The Board of Directors of the Fund knows of no reason why a nominee would be unable to serve, but in the event of any such unavailability, the proxies received will be voted for such substituted nominees as the Board of Directors may recommend. None of the current Directors, with the exception of Mr. Alberto Osorio, is an “interested person” of the Fund as defined in the 1940 Act. The names of the Fund’s nominees for election as Directors and each other Director of the Fund, their addresses, ages and principal occupations during the past five years and other directorships held by the nominee or Director are provided in the tables below. Information is provided as of December 31, 2018.

Nominees Independent Directors/Nominees

| Name, Address and Age | Position(s) Held With the Fund* |

Term of and Time |

Principal Occupation for Past Five Years |

Other Directorships Held by Director or Nominee for Director† |

|

Claudio X. González+ c/o Aristóteles 77, 3rd Floor Col. Polanco 11560 México, D.F. México

Age: 84 |

Class II Director |

Term expires 2019; Director since 1981. |

Mr. González is Chairman of the Board of Kimberly-Clark de México, a consumer products company, since March 1973; he served as Chief Executive Officer of this company from March 1973 to March 2007. Mr. González was President of the Mexican Business Council and has served on the boards of directors of several prominent U.S. and Mexican companies. | None. |

|

Edward P. Djerejian+ 4899 Montrose Boulevard

Age: 79 |

Class II Director |

Term expires 2019; Director since 2013. | Amb. Djerejian is the Director of the James A. Baker III Institute for Public Policy at Rice University since August 1994. He served as Chairman of the Board of Occidental Petroleum Corporation (2013 - 2015). | Director, Magnolia Oil & Gas. |

| * | There are no other funds in the Fund Complex. |

| + | Audit Committee, Contract Review Committee, and Nominating and Corporate Governance Committee member. Member or alternate member of the Valuation Committee. |

| † | The directorships required to be reported under this column are those held in a company with a class of securities (1) registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), (2) subject to the reporting requirements of Section 15(d) of the Exchange Act, or (3) registered as an investment company under the 1940 Act. |

Nominees Interested Director/Nominee

| Name, Address and Age | Position(s) Held With the Fund* |

Term of and Time |

Principal Occupation for Past Five Years |

Other Directorships Held by Director or Nominee for Director† |

|

Alberto Osorio**+ Aristóteles 77, 3rd Floor Col. Polanco 11560 México, D.F. México

Age: 51 |

Class II

President and Chief Executive Officer (formerly, Senior Vice President; Treasurer) |

Term expires 2019; Director since 2016.

Since March 2014.

From 2002 to March 2014. |

Mr. Osorio currently serves as Director General and Chairman of the Board of the Fund’s investment adviser, Impulsora del Fondo México, S.C., where he is the controlling shareholder. | None. |

| * | There are no other funds in the Fund Complex. |

| ** | Director is an “interested person” (as defined in the 1940 Act). Mr. Osorio is deemed to be an interested Director by reason of his affiliation with the investment adviser. |

| + | Alternate member of the Valuation Committee. |

| † | The directorships required to be reported under this column are those held in a company with a class of securities (1) registered pursuant to Section 12 of the Exchange Act, (2) subject to the reporting requirements of Section 15(d) of the Exchange Act, or (3) registered as an investment company under the 1940 Act. |

Other Directors

The balance of the current Directors consists of two Class I Directors and two Class III Directors, none of whom is a nominee for election at the Meeting and all of whom will continue in office after the Meeting for the terms shown below. The Board of Directors currently maintains a composition of at least seventy-five (75) percent Directors who are not “interested persons” of the Fund (“Independent Directors”), thereby exceeding the 1940 Act requirement that a majority of the Directors be Independent Directors. The Chairman of the Board, Mr. Carrillo Gamboa, is also an Independent Director. The remaining Directors are as follows:

Independent Directors

| Name, Address and Age | Position(s) Held With the Fund* |

Term of and Time |

Principal Occupation for Past Five Years |

Other Directorships Held by Director † |

|

Marc J. Shapiro+ 707 Travis, 11th Floor Houston, TX 77002

Age: 71 |

Class I Director |

Term expires 2021; Director since 2006. |

From 2003 to 2017, Mr. Shapiro served as Non-Executive Chairman of Chase Bank of Texas. Prior to that time, he was Vice Chairman of JPMorgan Chase (banking and financial services). | Director, Kimberly-Clark Corporation (consumer goods); Director, Weingarten Realty Investors (real estate investment); Director, Cadence Bancorp. |

|

Jaime Serra Puche+ Edificio Plaza Prolongación Paseo de la Reforma 600-103 Santa Fe Peña Blanca 01210 México, D.F.

Age: 67 |

Class I Director |

Term expires 2021; Director since 1997. |

Dr. Serra is a Senior Partner of the law and economics consulting firm SAI Consultores, S.C. Dr. Serra is a former Secretary of Trade and Industry as well as former Secretary of Finance for Mexico. He was the minister in charge of negotiations for NAFTA and five other trade agreements. He serves also as Chairman of the Board of Bbva Bancomer, the Mexican subsidiary of Bbva. Dr. Serra has a Ph.D. in economics from Yale University and also serves as Co-Chairman of the President’s Council on International Activities of Yale University. |

Director, Tenaris (tube producer). |

| Name, Address and Age | Position(s) Held With the Fund* |

Term of and Time |

Principal Occupation for Past Five Years |

Other Directorships Held by Director † |

|

Emilio Carrillo Gamboa+ Campos Eliseos 400 Piso 16 Col. Lomas De Chapultepec 11000 México, D.F. México Age: 81 |

Class III Director |

Term expires 2020; Director 1981-1987 and since 2002. | Mr. Carrillo Gamboa is a prominent lawyer in Mexico with extensive business experience as partner of Bufete Carrillo Gamboa, S.C. since 1989. He was Mexico’s Ambassador to Canada and has also served or currently serves on the boards of several Mexican and U.S. companies. | None. |

|

Jonathan Davis Arzac+ c/o Aristóteles 77, 3rd Floor Col. Polanco 11560 México, D.F. México

Age: 66 |

Class III Director | Term expires 2020; Director since 2011. | Mr. Davis serves as Chairman of the Macquarie Mexican Infrastructure Fund and as Financial Expert to the Audit Committee of Vitro, S.A.B. de C.V. (glassmaker). From December 2000 to December 2006, Mr. Davis served as President of Mexico’s National Banking and Securities Commission. He has also served or currently serves on the boards of several Mexican companies. | None. |

| * | There are no other funds in the Fund Complex. |

| + | Audit Committee, Contract Review Committee, and Nominating and Corporate Governance Committee member. Member or alternate member of the Valuation Committee. |

| † | The directorships required to be reported under this column are those held in a company with a class of securities (1) registered pursuant to Section 12 of the Exchange Act, (2) subject to the reporting requirements of Section 15(d) of the Exchange Act, or (3) registered as an investment company under the 1940 Act. |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES TO THE FUND’S BOARD OF DIRECTORS.

In addition to the information provided in the table above, the following is a brief discussion of the specific experience, qualifications, attributes, or skills that support the conclusion, as of the date of this Proxy Statement, that each person listed below is qualified to serve as a Director in light of the Fund’s business and structure. The disclosure below regarding the current Directors and nominees is not intended to state or imply that any Director has any title, expertise or experience that would impose a higher degree of individual responsibility or obligation on such Director with respect to the Fund, either as compared to the other Directors or to board members of other investment companies generally.

Current Directors and Nominees

Mr. Carrillo Gamboa. Mr. Carrillo Gamboa served as a Director of the Fund for six years following its inception and since 2002, and also serves as the Chairman of the Board. He is a prominent lawyer in Mexico with extensive business experience, and has been a partner of the Bufete Carrillo Gamboa, S.C. law firm since 1989. He has also served or currently serves on the boards of many Mexican charitable organizations. Mr. Carrillo Gamboa’s substantial legal and business experience qualify him as a Director of the Fund.

Dr. Serra. Dr. Serra has served as a Director of the Fund since 1997, and also serves as chairman of the Fund’s Contract Review Committee. He currently serves as a Senior Partner of the law and economics consulting firm SAI Consultores, S.C. He previously served as a former Secretary of Finance for Mexico, in charge of negotiations for NAFTA and trade agreements between Mexico and Chile, Bolivia, Venezuela, Colombia and Costa Rica; as Secretary of Trade and Industry (Mexico); as a Visiting Professor at Princeton, Stanford, and New York Universities; and as a Distinguished Visiting Associate at the Carnegie Endowment for International Peace. Dr. Serra also serves as Co-Chairman of the President’s Counsel on International Activities at Yale University and as Chairman of the Board of Bbva Bancomer, the Mexican subsidiary of Bbva. Dr. Serra’s background as an economist, as well as his government service, qualify him as a Director of the Fund.

Mr. Shapiro. Mr. Shapiro has served as a Director of the Fund since 2006, and also serves as chairman of the Fund’s Audit Committee. He previously served as Vice Chairman of JPMorgan Chase from 1997 to 2003. He has over thirty years of experience in the financial services industry. The depth of Mr. Shapiro’s financial and managerial background qualifies him as a Director of the Fund.

Mr. González. Mr. González has served as a Director of the Fund since its inception in 1981, and also serves as chairman of the Fund’s Nominating and Corporate Governance Committee. He currently serves as Chairman of the Board of Kimberly-Clark de México S.A.B. de C.V., a consumer products company, and previously served as Chief Executive Officer from March 1973 to March 2007. He also holds positions as a director emeritus of the board of General Electric Co. He served as Chairman of the Mexican Business Council. Mr. González’s broad business experience qualifies him as a Director of the Fund.

Mr. Davis. Mr. Davis has served as a Director of the Fund since 2011 and also serves as Chairman of the Fund’s Valuation Committee. He currently serves as Chairman of the Macquarie Mexican Infrastructure Fund, an unlisted, peso-denominated fund focused solely on investment opportunities in Mexican infrastructure projects. He has also been retained by the Audit Committee of Vitro S.A.B. de C.V. as a Financial Expert to the Committee. Mr. Davis previously served as President of Mexico’s National Banking and Securities Commission from December 2000 to December 2006. He has also served or currently serves on the boards of several Mexican companies. Mr. Davis’ regulatory and public service background qualify him as a Director of the Fund.

Ambassador Djerejian. Amb. Edward Djerejian currently serves as the Director of the James A. Baker III Institute for Public Policy at Rice University and as a Director of Magnolia Oil and Gas. He also served as Chairman of the Board of Occidental Petroleum Co. from 2013 to 2015. Amb. Djerejian previously served as U.S. ambassador to Israel from 1993 to 1994; as assistant secretary of state for Near Eastern affairs from 1991 to 1993; and as U.S. ambassador to the Syrian Arab Republic from 1988 to 1991. From 1985 to 1986, he served as deputy press secretary for foreign affairs in the White House. He has also served or currently serves on the boards of several U.S. public and non-profit organizations. Amb. Djerejian’s public policy, government service and private sector background qualify him as a Director of the Fund.

Mr. Osorio. Mr. Osorio has served as the President and Principle Executive Officer of the Fund since March 2014. From 2002 to March 2014, he served as Senior Vice President and Treasurer of the Fund. In addition, he currently serves as Director General and Chairman of the Board of the Fund’s investment adviser, Impulsora del Fondo México, S.C., in which he has been involved since 1991, and now he is the controlling shareholder. Mr. Osorio’s extensive investment management experience and oversight of Fund operations qualify him as a Director of the Fund.

Board Structure and Leadership

The Board of Directors oversees the business and affairs of the Fund, including oversight of certain aspects of the services that Impulsora del Fondo México, S.C. (the “Adviser”), and the Fund’s other service providers provide to the Fund. Subject to the provisions of the Fund’s Articles of Incorporation, its Bylaws and Maryland law, the Directors shall have all powers necessary and convenient to carry out this responsibility, including the election and removal of the Fund’s officers.

The Board of Directors holds regularly scheduled in-person meetings three times a year, one regularly scheduled telephonic meeting, and other special in-person and telephonic meetings on an as-needed basis. There are seven Directors, six of whom are considered not to be “interested persons” of the Fund (“Independent Directors”) in accordance with 1940 Act and rules adopted by the SEC thereunder. The Board of Directors has appointed an Independent Director to serve as Chairman of the Board, whose primary role is to set the agendas of all regular and special Board meetings, to assist in identifying the information to be presented to the Board with respect to matters to be acted upon by the Board, and to preside over all Board meetings. In between meetings, the Chairman is responsible for communicating with other Directors, Fund officers, and personnel of the Adviser and other service providers as necessary to enable the Board to carry out its primary responsibility of overseeing the Fund and its operations. The Independent Directors also regularly convene executive sessions without the presence of management or the interested Director.

As discussed further below, the Board of Directors has established various Committees through which the Directors focus on matters relating to particular aspects of the Fund’s operations, such as Fund audits and financial reporting, nominations of Directors and officers, and the valuation of portfolio investments. The Directors routinely review the effectiveness of the Committee structure and each Committee’s responsibilities and membership.

The Directors believe that the Board’s leadership and committee structure is appropriate in light of the nature and size of the Fund, because among other things, it fosters strong communication between the Board, its individual members, the Adviser and other service providers, allocates responsibilities among the Committees and permits Committee members to focus on particular areas involving the Fund. In addition, the Committees support and promote the Independent Directors in their oversight of all aspects of the Fund’s operations and their independent review of proposals made by the Adviser.

Risk Oversight

While responsibility for most day-to-day Fund operations, including certain risk management functions addressed in policies and procedures relating to the Fund, resides with the Adviser and other service providers selected by the Directors, the Board actively performs a risk oversight function, both directly and through its Committees, as described below. The Board and its Committees exercise a risk oversight function through regular and ad hoc Board and Committee meetings during which the Board and its Committees meet with representatives of the Adviser and other key service providers. The Board also periodically receives reports regarding Fund and other service provider policies and procedures, and reviews and approves changes to Fund policies and procedures. The Audit Committee also meets regularly with the Fund’s independent registered public accounting firm and Principal Financial and Accounting Officer to discuss internal controls and financial reporting matters, among other things. The Board and the Committees regularly require senior management of the Adviser and senior officers of the Fund to report to the Board and Committees on a variety of other risk areas relating to the Fund, including, without limitation, investment risks, liquidity risks, valuation risks and operational risks, as well as more general business risks. In addition, the Board has engaged independent counsel to the Independent Directors and consults with such counsel both during and between meetings of the Board and the Committees.

The Board also meets regularly with the Fund’s Chief Compliance Officer (“CCO”), who reports directly to the Board. The CCO has responsibility for testing the compliance procedures of the Fund and its service providers. The CCO regularly discusses issues related to compliance and provides a quarterly report to the Board regarding the Fund’s compliance program. In order to maintain a robust risk management and compliance program for the Fund, the Board and its Committees also regularly review and approve, as necessary, the Fund’s compliance policies and procedures and updates to these procedures, as well as review and approve the compliance policies and procedures of the Fund’s service providers to the extent that those policies and procedures relate to the operations of the Fund. In addition to the meetings with various parties to oversee the risk management of the Fund, the Board and its Committees also receive regular written reports from these and other parties which assist the Board and the Committees in exercising their risk oversight function.

Fund Committees

Current Committees and Members

The Fund has a standing Audit Committee, Valuation Committee, Contract Review Committee and a Nominating and Corporate Governance Committee. The Audit Committee, Contract Review Committee and Nominating and Corporate Governance Committee are composed entirely of Directors who are not “interested persons” of the Fund or the Fund’s investment adviser within the meaning of the 1940 Act and who are “independent” as defined in the New York Stock Exchange listing standards. All Directors are members, or alternate members, of the Valuation Committee.

Audit and Valuation Committees

The Audit Committee is responsible for the selection and engagement of the Fund’s independent public accountants (subject to ratification by the Board of Directors), pre-approves and reviews both the audit and non-audit work of the Fund’s independent public accountants, and reviews compliance of the Fund with regulations of the SEC and the Internal Revenue Service, and other related matters. The members of the Fund’s Audit Committee are Messrs. Carrillo Gamboa, Davis, González, Djerejian, Serra and Shapiro. Mr. Shapiro is the Chairman of the Audit Committee and the Committee’s Audit Committee Financial Expert.

The Valuation Committee oversees the implementation of the Fund’s Pricing and Valuation Procedures and the activities of the Fund’s Pricing Committee. The Board of Directors has delegated to the Valuation Committee the responsibility of determining the fair value of the Fund’s securities or other assets in connection with “significant events,” as described in the procedures adopted by the Board of Directors. The members of the Fund’s Valuation Committee are Messrs. Davis, González, Serra and Shapiro. The Alternate Members of the Fund’s Valuation Committee are Messrs. Carrillo Gamboa, Osorio and Djerejian. Mr. Davis is the Chairman of the Valuation Committee.

Contract Review Committee

The Contract Review Committee reviews and makes recommendations to the Board of Directors with respect to entering into, renewing or amending the Fund’s investment management and advisory agreement, administrative services agreement and other agreements. The members of the Fund’s Contract Review Committee are Messrs. Davis, Carrillo Gamboa, González, Djerejian, Serra and Shapiro. Dr. Serra is the Chairman of the Contract Review Committee.

Nominating and Corporate Governance Committee; Consideration of Potential Director Nominees

The Nominating and Corporate Governance Committee makes recommendations to the Board regarding nominations for membership on the Board of Directors. It evaluates candidates’ qualifications for Board membership and, with respect to nominees for positions as independent directors, their independence from the Fund’s investment adviser and other principal service providers. The Committee periodically reviews director compensation and will recommend any appropriate changes to the Board as a group. This Committee also reviews and may make recommendations to the Board relating to those issues that pertain to the effectiveness of the Board in carrying out its responsibilities in governing the Fund and overseeing the management of the Fund. The members of the Fund’s Nominating and Corporate Governance Committee are Messrs. Davis, Carrillo Gamboa, González, Djerejian, Serra and Shapiro. Mr. González is the Chairman of the Nominating and Corporate Governance Committee.

The Committee will consider potential director candidates recommended by Fund stockholders provided that the proposed candidates satisfy the director qualification requirements provided in the Fund’s Bylaws; are not “interested persons” of the Fund or the Fund’s investment adviser within the meaning of the 1940 Act; and are “independent” as defined in the New York Stock Exchange listing standards.

Potential director nominees recommended by stockholders must satisfy the following requirements:

(a) The nominee may not be the nominating stockholder, a member of the nominating stockholder group, or a member of the immediate family of the nominating stockholder or any member of the nominating stockholder group;

(b) Neither the nominee nor any member of the nominee’s immediate family may be currently employed or employed within the last year by any nominating stockholder entity or entity in a nominating stockholder group;

(c) Neither the nominee nor any immediate family member of the nominee is permitted to have accepted directly or indirectly, during the year of the election for which the nominee’s name was submitted, during the immediately preceding calendar year, or during the year when the nominee’s name was submitted, any consulting, advisory, or other compensatory fee from the nominating stockholder or any member of a nominating stockholder group;

(d) The nominee may not be an executive officer, director (or person performing similar functions) of the nominating stockholder or any member of the nominating stockholder group, or of an affiliate of the nominating stockholder or any such member of the nominating stockholder group; and

(e) The nominee may not control (as “control” is defined in the 1940 Act) the nominating stockholder or any member of the nominating stockholder group (or in the case of a holder or member that is a fund, an “interested person” of such holder or member as defined by Section 2(a)(19) of the 1940 Act).

The nominating stockholder or stockholder group must meet the following requirements:

(a) Any stockholder or stockholder group submitting a proposed nominee must beneficially own, either individually or in the aggregate, more than 5% of the Fund’s securities that are eligible to vote at the time of submission of the nominee and at the time of the annual meeting where the nominee may be elected. Each of the securities used for purposes of calculating this ownership must have been held continuously for at least two years as of the date of the nomination. In addition, such securities must continue to be held through the date of the meeting. The nominating stockholder or stockholder group must also bear the economic risk of the investment and the securities used for purposes of calculating the ownership cannot be held “short;”

(b) The nominating stockholder or stockholder group must also submit a certification which provides the number of shares which the person or group has (i) sole power to vote or direct the vote; (ii) shared power to vote or direct the vote; (iii) sole power to dispose or direct the disposition of such shares; and (iv) shared power to dispose or direct the disposition of such shares. In addition, the certification shall provide that the shares have been held continuously for at least 2 years.

A nominating stockholder or stockholder group may not submit more nominees than the number of Board positions open each year. As set forth in the Fund’s Bylaws, to be timely, all stockholder recommended nominee submissions must be received by the Fund not earlier than the 150th day or later than 5:00 p.m., Eastern time, on the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the date of the preceding year’s annual meeting, notice by the stockholder must be delivered not earlier than the 150th day prior to the date of such annual meeting and not later than the close of business on the later of the 120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made. The deadline for any stockholder recommended nominee submissions to be considered for the 2020 Annual Meeting is not later than October 4, 2019 but no earlier than September 4, 2019, as prescribed in the Fund’s Bylaws.

Stockholders recommending potential director candidates must substantiate compliance with these requirements at the time of submitting their proposed director candidate to the attention of the Fund’s Secretary. Notice to the Fund’s Secretary should be provided in accordance with the deadline specified in the Fund’s Bylaws; (Article II, Section 10) and include, as specified in the same section of the Fund’s Bylaws:

(i) for each director candidate:

(a) the director candidate’s name, address, date of birth, business and residence addresses and nationality;

(b) whether the stockholder believes the director candidate is an “interested person” within the meaning of the 1940 Act and, if not believed to be an “interested person,” sufficient information to enable the Board, any Committee thereof, or a Fund officer to make that determination;

(c) sufficient information to enable the Nominating and Corporate Governance Committee to determine whether the director candidate meets the qualification requirements set forth in the Fund’s Bylaws;

(d) the director candidate’s written, signed and notarized statement confirming his or her consent to be named in the proxy statement and intention to serve as a director if elected;

(ii) for the proposing stockholder, each “Stockholder Associated Person” as such term is defined in the Fund’s Bylaws, and each director candidate:

(a) the class, series and number of any Fund shares owned beneficially or of record, the date on which such shares were acquired and the investment intent of such acquisition and an explicit description of each “Derivative Instrument” (as such term is defined in the Fund’s Bylaws) entered into, or to which the proposing stockholder, Stockholder Associated Person or director candidate is a party or beneficiary and the number, class and series to which such Derivative Instrument relates;

(b) the nominee holder for and number of any Fund shares, and the nominee holder for each Derivative Instrument owned beneficially but not of record and evidence establishing such indirect ownership and, if applicable, entitlement to vote such shares or Derivative Instrument;

(c) whether and the extent to which such proposing stockholder, Stockholder Associated Person or director candidate directly or indirectly (though brokers, nominees or otherwise) is subject to or during the last six months has engaged in any hedging, derivative or other transaction or series of transactions or entered into any other agreement, arrangement or understanding (including any short interest, any borrowing or lending of securities or any proxy or voting agreement), the effect or intent of which is to (1) manage risk or benefit from changes in the price of (i) Fund shares or (ii) any combination of securities owned by the Fund representing more than 30% by value of the Fund’s assets, as reported in the most recent schedule of investments filed by the Fund with the SEC or as the Fund otherwise makes publicly available (“Portfolio Securities”) or (2) increase or decrease the voting power of such proposing stockholder, Stockholder Associated Person or director candidate in the Fund or any affiliate thereof (or in any issuer of Portfolio Securities, as applicable) disproportionately to such person’s economic interest in Fund shares (or in Portfolio Securities, as applicable) and, if applicable, the number, class and series of shares (or Portfolio Securities, as applicable) to which such transaction, agreement, arrangement or understanding relates;

(d) any economic interest, direct or indirect (including without limitation any existing or prospective commercial, business or contractual relationship with the Fund), individually or in the aggregate, in the Fund, other than an interest arising from the ownership of Fund shares conferring no extra or special benefit not shared on a pro rata basis by all stockholders;

(iii) for the proposing stockholder, each Stockholder Associated Person with an interest or ownership described under Section (ii) above, and each director candidate:

(a) such proposing stockholder’s name, address and telephone number as they appear on the Fund’s stock ledger, and the current name, business and residence address and telephone number of such proposing stockholder, each Stockholder Associated Person and each director candidate, if different;

(b) all other information relating to such proposing stockholder, Stockholder Associated Person and director nominee that would be required to be disclosed in the solicitation of proxies for election of directors in an election contest (even if an election contest is not involved) and all other documents, materials or information relating to such proposing stockholder, Stockholder Associated Person and director nominee that would otherwise be required in connection with any such solicitation pursuant to Regulation 14A (or any successor provision) under the Exchange Act and rules thereunder;

(c) the investment strategy or objective, if any, of such proposing stockholder and Stockholder Associated Person that is not an individual, and a copy of the most recent prospectus, offering memorandum or similar document, if any, provided to investors or potential investors in such stockholder and each such Stockholder Associated Person; and

(d) to the extent known by such proposing stockholder, the name and address of any other stockholder supporting any director candidate or any other proposal of business on the date of such proposing stockholder’s notice.

The Nominating and Corporate Governance Committee identifies prospective candidates from any reasonable source and has the ability to engage third-party services for the identification and evaluation of potential nominees. The Fund’s Bylaws (Article III, Section 2(c)) provide a list of minimum qualifications for Fund directors which include expertise, experience or relationships that are relevant to the Fund’s business; educational qualifications; and interaction with business in Mexico. The Committee may recommend that the Board modify these minimum qualifications from time to time. The Committee meets at least twice annually, typically in June and December, to identify and evaluate nominees for director and makes its recommendations to the Board at the time of the Board’s December meeting. Other than compliance with the requirements mentioned above for submission of a director candidate, the Nominating and Corporate Governance Committee does not otherwise evaluate stockholder director nominees in a different manner. The standard of the Nominating and Corporate Governance Committee is to treat all equally qualified nominees in the same manner.

No nominee recommendations have been received from stockholders.

The Board of Directors has adopted charters for each of the Audit, Valuation, Contract Review and Nominating and Corporate Governance Committees the latter of which is available on the Fund’s website at www.themexicofund.com under “Publications—Corporate Governance/Legal.”

Board and Committee Meetings in fiscal year 2018

During the Fund’s fiscal year ended October 31, 2018, the Board held three (3) regular meetings, one (1) telephonic meeting, two (2) Audit Committee meetings, one (1) Valuation Committee meeting, one (1) Contract Review Committee meeting, and two (2) Nominating and Corporate Governance Committee meetings. Each Director then in office attended 75% or more of the aggregate number of regular and special meetings of the Board and those Committees of which each Director is a member.

Governance principles and practices observed by the Board

The Board regularly convenes in executive session without management present, both with and without the Fund’s Chief Compliance Officer. Each Committee also convenes in executive session without management present as necessary in order to carry out Committee responsibilities. The Audit Committee regularly convenes with the Fund’s independent registered public accounting firm without management present (both with and without the Fund’s Chief Compliance Officer), and the Chairman of the Audit Committee communicates directly with the independent registered public accounting firm as deemed necessary. The Board and the Independent Directors are advised by independent legal counsel.

The Board discusses, reviews and evaluates on a regular basis the performance of the Fund as well as actions which may contribute to reducing the Fund’s stock price discount, if any. The Board is also subject to conflicts of interest provisions in the Fund’s Code of Ethics that require Directors to be free of any relationships, interests and activities that conflict with, or appear to conflict with, the interests of the Fund.

In addition, the Board has adopted a policy, effective June 30, 2019, by which (i) no Director shall serve on more than five public company boards and (ii) no Director who is a chief executive officer of a public company shall serve on more than two public company boards besides the company for which that Director is the chief executive officer.

Communications with the Board of Directors

The Fund provides a means for stockholders to communicate with the Board of Directors. Stockholders may address correspondence to the Board as a whole or individual Board members relating to the Fund via e-mail at investor-relations@themexicofund.com. The Fund’s Investor Relations Vice President will then promptly forward the correspondence to the addressee. Correspondence may also be directed via the Fund’s address, The Mexico Fund, Inc., 6700 Alexander Bell Drive, Suite 200, Columbia Maryland 21046 and it will be directed to the attention of the addressee.

Director Attendance at Stockholder Meetings

Although the Fund has no formal policy regarding Director attendance at stockholder meetings, typically, the Chairman of the Fund attends the Annual Meeting or another Director attends if he is not available. At the convening of the Fund’s 2018 annual meeting on March 6, 2018, all Directors were present.

Beneficial Ownership of Shares of the Fund

As of December 31, 2018, the Fund’s Directors and executive officers, as a group, owned [ ]% of the Fund’s outstanding shares. The Fund’s Directors and executive officers maintain positions in Fund shares to closely align their personal interest with oversight of the Fund. The information as to ownership of securities that appears below is based on statements furnished to the Fund by its Directors, nominees and executive officers. The percentages of beneficial ownership set forth below are based on 15,005,224 shares of common stock outstanding as of December 31, 2018.

| Title of Class | Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| Interested Director | |||

| Alberto Osorio | 71,922 | * | |

| Independent Directors | |||

| Jonathan Davis Arzac | 5,663 | * | |

| Emilio Carrillo Gamboa | 5,308 | * | |

| Jaime Serra | 12,095 | * | |

| Claudio X. González | [174,999] | [1.17%] | |

| Edward P. Djerejian | [4,660] | * | |

| Marc J. Shapiro | 46,227 | * |

| * | Less than 1%. |

As of December 31, 2018, the dollar range of equity securities in the Fund owned beneficially by each Director or nominee was as follows:

| Name of Director or Nominee | Dollar Range of Equity Securities in the Fund |

Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen or to be Overseen by Director or Nominee in Family of Investment Companies* |

| Interested Director | ||

| Alberto Osorio | Over $100,000 | Over $100,000 |

| Independent Directors | ||

| Jonathan Davis Arzac | $50,001 - $100,000 | $50,001 - $100,000 |

| Emilio Carrillo Gamboa | $50,001 - $100,000 | $50,001 - $100,000 |

| Jaime Serra | Over $100,000 | Over $100,000 |

| Claudio X. González | [Over $100,000 | Over $100,000] |

| Edward P. Djerejian | $50,001 - $100,000 | $50,001 - $100,000 |

| Marc J. Shapiro | Over $100,000 | Over $100,000 |

| * | There are no other funds in the family of investment companies. |

As of December 31, 2018, none of the Independent Directors, nominees, or their immediate family members owned any shares of the Adviser or in any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with Impulsora del Fondo Mexico, S.C., the Fund’s Adviser.

| Name of Director or Nominee | Name of Owners and Relationships to Director or Nominee |

Company | Title of Class | Value of Securities | Percentage of Class |

| Jonathan Davis Arzac | None | None | None | None | None |

| Edward P. Djerejian | None | None | None | None | None |

| Emilio Carrillo Gamboa | None | None | None | None | None |

| Claudio X. González | None | None | None | None | None |

| Jaime Serra | None | None | None | None | None |

| Marc J. Shapiro | None | None | None | None | None |

Compensation of Directors

Effective December 3, 2015, the Fund pays each Director an annual retainer of $40,000. Mr. Alberto Osorio is not compensated for his services as Director. The Fund pays the Chairman of the Board an additional annual retainer of $10,000 and the Chairman of the Audit Committee an additional annual retainer of $7,500. In addition, the Fund pays each Director $2,000 per in-person Board meeting attended. The Fund also reimburses all Directors and officers of the Fund for out-of-pocket expenses relating to attendance at meetings. In addition, each Independent Director receives $2,000 for each Committee meeting or telephonic special Board meeting attended. Furthermore, effective March 7, 2017, the Board approved a policy such that Director fees shall be capped to the extent such fees in the aggregate exceed 0.14% of Fund assets under management for such period of time as in its discretion the Board deems advisable. The aggregate amount of fees paid and expenses reimbursed to the Directors and officers for the fiscal year ended October 31, 2018 was $459,269.

The following table sets forth the aggregate compensation (not including expense reimbursements) paid by the Fund to each Director during the fiscal year ended October 31, 2018, as well as the total compensation paid by the Fund to each Director.

| Name of Director | Aggregate Compensation from Fund |

Pension or Retirement Benefits Accrued as Part of Fund Expenses |

Estimated Annual Benefits Upon Retirement |

Total Compensation from Fund and Fund Complex Paid to Directors* |

| Marc J. Shapiro | $67,500 | None | None | $67,500 |

| Emilio Carrillo Gamboa | $70,000 | None | None | $70,000 |

| Jonathan Davis Arzac | $60,000 | None | None | $60,000 |

| Claudio X. González | $60,000 | None | None | $60,000 |

| Edward P. Djerejian | $60,000 | None | None | $60,000 |

| Jaime Serra | $60,000 | None | None | $60,000 |

| Alberto Osorio | None | None | None | None |

| * | There are no other funds in the Fund Complex. |

The Fund has a policy that half of the annual retainer paid by the Fund to its Directors is to be used by each Director to purchase Fund shares on the secondary market until a Director attains an ownership position valued at $100,000 based on the market value of Fund shares as of a particular date (“Retained Shares”). Directors are not required to purchase additional shares if the value of their Retained Shares declines below $100,000 due to market fluctuations. As part of the policy, Directors are to retain ownership of their Retained Shares during their tenure on the Board. Directors are permitted to buy additional Fund shares or sell any Fund shares held in excess of their Retained Shares. The Board may, from time to time, approve waivers from this policy.

Officers of the Fund1

| Name, Address and Age | Position(s) Held With the Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

|

Alberto Osorio Aristóteles 77, 3rd Floor Col. Polanco 11560 México, D.F. México

Age: 51 |

President and Chief Executive Officer

(formerly, Senior Vice President; Treasurer) |

Since March 2014.

From 2002 to March 2014. |

Mr. Osorio currently serves as Director General and Chairman of the Board of the Fund’s investment adviser, Impulsora del Fondo México, S.C., where he is the controlling shareholder. |

|

Alberto Gómez Pimienta Aristóteles 77, 3rd Floor Col. Polanco 11560 México, D.F. México Age: 52 |

Treasurer

(formerly, Vice President of Operations) |

Since March 2014.

From 2009 to March 2014. |

Mr. Alberto Gómez Pimienta has served as Finance Director of the Fund’s investment adviser, Impulsora del Fondo México, S.C., since March 2014 and has been an employee of the Adviser since 2009. |

|

Douglas P. Dick 1900 K Street, N.W. Washington, DC 20006

Age: 49 |

Secretary

(formerly, Assistant Secretary) |

Since December 2016.

From May 2015 to December 2016. |

Partner of Dechert LLP, U.S. counsel to the Fund and the Independent Directors. |

|

Jean Michel Enríquez D. Pedregal No. 24, 24th Floor Col. Molino Del Rey 11040 México, D.F. México

Age: 48 |

Assistant Secretary |

Since June 2017. |

Partner of Creel, García-Cuéllar, Aiza y Enriquez, S.C., Mexican counsel to the Fund. |

Compensation of Officers

The Fund does not pay its officers for the services they provide to the Fund as such, other than reimbursing expenses incurred in connection with Fund Board or stockholder meetings. The Fund reimburses the Adviser with respect to the portion of Mr. Alamillo’s compensation for his services as Chief Compliance Officer (“CCO”) to the Fund. The President and Chief Executive Officer and Treasurer are each solely compensated by the Adviser. Other than as described above, the Fund does not grant any options or any compensation plans to its officers.

| 1 | Mr. Jorge Alamillo (60), pursuant to a Professional Services Agreement, serves as an independent contractor to the Fund in the role of Chief Compliance Officer since May 2015. Prior to May 2015, Mr. Alamillo served as a partner at Deloitte México. |

Report of the Audit Committee; Information About the Fund’s Independent Auditor

The Audit Committee is responsible for the selection and engagement of the Fund’s independent auditors (subject to ratification by the Fund’s Board of Directors); reviews and pre-approves both the audit and non-audit work of the Fund’s independent public accountants; and reviews compliance of the Fund with regulations of the SEC and the Internal Revenue Service, and other related matters. The Fund adopted an Audit Committee Charter on December 6, 1999. The Charter was last amended on December 1, 2017.

Although the members of the Audit Committee have the responsibilities set forth in the Audit Committee Charter and described above, they are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. In fulfilling their responsibilities under the Fund’s Audit Committee Charter, it is recognized that members of the Committee are entitled to rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Fund’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Fund’s auditors are in fact “independent.”

The Audit Committee has: (a) reviewed and discussed the audited financial statements with Fund management; (b) discussed with PricewaterhouseCoopers LLP (“PwC”) the matters required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 16; and (c) received certain written disclosures and the letter from PwC required by applicable requirements of PCAOB regarding PwC’s communications with the Audit Committee concerning independence, and has discussed with PwC its independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the Fund’s audited financial statements be included in the Fund’s Annual Report for the fiscal year ended October 31, 2018. The members of the Audit Committee are Emilio Carrillo Gamboa, Jonathan Davis Arzac, Claudio X. Gónzalez, Marc J. Shapiro (Chairman and Audit Committee Financial Expert), Jaime Serra and Edward P. Djerejian.

During the fiscal years ended October 31, 2017 and October 31, 2018, the Fund incurred the following fees for services provided by PwC:

| Audit Fees | Tax Fees | Other Fees | Total | |

| Fiscal Year 2017 | $141,000 | $27,800 | $0 | $168,800 |

| Fiscal Year 2018 | $141,000 | $27,300 | $0 | $168,300 |

All of the services described in the table above were approved by the Audit Committee pursuant to its pre-approval policies and procedures which are summarized further below. The Tax Fees consist of fees billed in connection with preparing and signing the federal regulated investment company income tax returns for the Fund for the years indicated.

There were no non-audit fees billed by PwC to the Fund’s investment adviser. In addition, PwC did not provide any non-audit services to any entity controlling, controlled by, or under common control with the Fund’s investment adviser that provides ongoing services to the Fund.

The Audit Committee pre-approves all audit and non-audit services provided by PwC or any independent auditor engaged by the Fund and any non-audit or audit-related services provided to its service affiliates (at this time only the Fund’s investment adviser qualifies as a Service Affiliate) that have an impact on the Fund in accordance with certain pre-approval policies and procedures. Audit services include those typically associated with the annual audit such as evaluation of internal controls. Non-Audit Services include certain services that are audit-related such as consultations regarding financial accounting and reporting standards, and tax services. Certain services may not be provided by the auditor to the Fund or to the Fund’s investment adviser without jeopardizing the auditor’s independence. These services are deemed prohibited services and include certain management functions; human resources services; broker-dealer, investment adviser or investment banking services; legal services; and expert services unrelated to the audit. Other services are conditionally prohibited and may be provided if the Audit Committee reasonably concludes that the results of the services will not be subject to audit procedures during an audit of the client’s financial statements. These types of services include bookkeeping; financial information systems design and implementation; valuation services; actuarial services; and internal audit outsourcing services.

The policies and procedures require Audit Committee approval of the engagement of the auditor for each fiscal year and approval of the engagement by a majority of the Fund’s Independent Directors. The policies and procedures permit the Audit Committee to pre-approve the provisions of types or categories of non-audit services for the Fund and permissible non-audit services for Service Affiliates on an annual basis at the time of the auditor’s engagement and on a project-by-project basis. At the time of the annual engagement of the Fund’s independent auditor, the Audit Committee is to receive a list of the categories of expected services with a description and an estimated budget of fees. In its pre-approval, the Audit Committee should determine that the provision of the service is consistent with, and will not impair, the ongoing independence of the auditor and set any limits on fees or other conditions it finds appropriate. Non-audit services may also be approved on a project-by-project basis by the Audit Committee consistent with the same standards for determination and information.

The Audit Committee may also appoint a Designated Member of the Committee to pre-approve non-audit services that have not been pre-approved or changes in non-audit services previously pre-approved. Any actions by the Designated Member are to be ratified by the Audit Committee by the time of its next regularly scheduled meeting. The Fund’s pre-approval procedures are reviewed annually by the Audit Committee and the Fund maintains a record of the decisions made by the Committee pursuant to the procedures.

The Board of Directors, upon recommendation of the Audit Committee, has selected PwC as independent public accountants to examine the financial statements of the Fund for the fiscal year ending October 31, 2019. Audit services performed by PwC during the most recent fiscal year included examination of the financial statements of the Fund and the review of certain filings with the SEC. PwC will prepare and sign the Fund’s tax returns for the fiscal year ending October 31, 2019.

The Fund knows of no direct or indirect interest of PwC in the Fund. Representatives of PwC are not expected to be present at the Meeting, but have been given the opportunity to make a statement if they so desire, and will be available should any matter arise requiring their response.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

FOR THE ELECTION OF EACH OF

THE NOMINEES TO THE FUND’S BOARD OF DIRECTORS.

PROPOSAL 2: STOCKHOLDER PROPOSAL

A stockholder of the Fund, Matisse Capital (the “Proponent”), has submitted a proposal, set forth below, for inclusion in this Proxy Statement for consideration by stockholders of the Fund. The proponent’s address and the number of the Fund’s voting securities that the Proponent holds may be obtained promptly by calling or writing the Fund. The Fund is not responsible for the contents of the Proponent’s proposal or the Proponent’s supporting statement.

The Board of Directors Recommends that you vote AGAINST the Proponent’s proposal. The reasons for the Board’s recommendation are set forth below the Proponent’s supporting statement.

Proposal

Resolved: All investment advisory and management agreements between The Mexico Fund, Inc. and Impulsora del Fondo México, S.C. shall be terminated by the Fund, pursuant to the right of stockholders as embodied in Section 15(a)(3) of the 1940 Act and as required to be included in such agreements, at the earliest date the Fund is legally permitted to do so. If, however, the Board proposes, and stockholders approve, at this Meeting, a plan to liquidate or open-end the Fund within one year, then the investment advisory and management agreements between The Mexico Fund, Inc. and Impulsora del Fondo México, S.C. shall remain in effect as long as necessary to implement these actions.

Supporting Statement

Despite implementing a Managed Distribution Plan, The Mexico Fund, Inc. continues to trade at a large discount to its net asset value (“NAV”). Over the past three years, this discount has averaged 12%, and has recently been even wider. The Fund has repurchase authorization, but only repurchased 20,686 shares during the six months through April 30, 2018. The Fund’s large discount to NAV means that over the five years through April 30, 2018, although the at-NAV performance in USD was -3.79% per year (slightly ahead of benchmarks), stockholders lost over 33% at market! In our view, stockholders deserve the opportunity to receive full value for their shares. The Fund’s small size leads to unnecessarily high expenses and means that attempts to narrow the discount using other means than liquidation or open-ending are likely not in the best interest of stockholders.

In addition to voting for our proposal, we also hope that all Fund stockholders will join us in asking Fund management for, and voting in favor of, a proposal to liquidate or open-end the Fund. Liquidation is a viable option, and we note that (per the April 30, 2018 reported holdings) the Fund owns fewer than 10 trading days volume in all of its positions.

Who are we? We are an open-end mutual fund (Matisse Discounted Closed-End Fund Strategy, MDCEX) which has owned shares of The Mexico Fund, Inc. continuously for the past year. Our interests are aligned solely with that of all other stockholders, and the remedy we are suggesting would benefit all stockholders equally. Feel free to contact us about this matter; we are happy to discuss. Contact Eric Boughton, CFA, at (503) 210-3005.

The Board recommends that stockholders vote AGAINST the Proponent’s proposal for the reasons discussed below.

1. Stockholders benefit from the experience and resources of the Adviser.

Impulsora del Fondo México, S.C., the Fund’s Adviser, has managed the Fund since its inception in 1981. The Board believes that the Adviser’s expertise and resources coupled with its long history of investment in the Mexican market enable it to provide the Fund with first rate research, trading and investment management support.

As a result of declarations and decisions made by the new government in Mexico, volatility and risk aversion towards Mexican financial assets increased significantly since the last week of October 2018. To replace the Fund’s EXPERIENCED adviser under these circumstances would NOT be in the best interests of Fund stockholders.

The Fund has consistently outperformed the MSCI Mexico Index, the Fund’s benchmark, as shown in the table below.

Fund Performance for the periods ended December 31, 2018

| Fund Return | 1-Year | 3-Year | 5-Year | 10-Year |

| MXF NAV | -12.10% | -9.98% | -27.77% | 95.30% |

| MSCI Mexico Index * | -14.94% | -11.14% | -31.11% | 57.07% |

| Difference | 2.84% | 1.16% | 3.34% | 38.23% |

| * | Source: Impulsora del Fondo México, S.C. |

The Proponent’s assertion that Fund stockholders experience “unnecessarily high expenses” is baseless. As of January 2018, the Fund had a competitive expense ratio compared to the average and median of 57 comparable closed-end funds, including the Fund, provided by Lipper, as shown in the table below.

Peer Group Total Expense Ratio Comparison

| Total Expense Ratio* | |

| MXF | 1.62% |

| Average | 1.77% |

| Median | 1.52% |

| * | Source: Lipper. |

2. The Adviser and the Board have taken measures to make the Fund more competitive.

As stockholders are aware, the Adviser does not control the Director selection process, and all of the Directors have been nominated by the Board and elected by stockholders. The Board is always mindful of its fiduciary duties to stockholders and regularly considers actions (including tender offers and share buy-backs) to address the Fund’s discount and improve stockholder value.

Since the Fund’s inception, the Board has authorized a series of in-kind tender offers for a total of approximately $897 million in Fund assets and open market repurchases for a total of approximately $123 million of Fund assets. Beginning in 2008, the Fund implemented a Managed Distribution Plan approved by the Board that has resulted in total distributions of $339 million (comprising income and capital gains and, to a limited extent, return of capital) through 2018, equivalent to $22.85 per share. Under the current Managed Distribution Plan, in September 2018, the Board authorized a significant increase of 67% to the Fund’s quarterly distribution amount to $0.25 per share. This amount is equivalent to an annualized distribution rate of 7.5%, considering the Fund’s market price of $13.25 as of December 31, 2018.

The Board and the Adviser believe that these actions help support the market value of the Fund’s shares and increase the value of stockholders’ investments. The Board considered and balanced many factors over a number of meetings in determining to pursue the foregoing discount management efforts. The Board will continue to periodically monitor whether any additional action with respect to the Fund’s trading discount is necessary and in the best interests of the Fund and its stockholders.

3. Under the Proponent’s proposal, the Fund could be left without a manager.

The Board also opposes the Proponent’s proposal because it offers no viable alternative if the Adviser is removed as the Fund’s investment adviser, raising the possibility that the Fund could eventually be orphaned without any adviser at all. If the Proponent’s proposal is approved, the Board would, of course, use its best efforts to search for a replacement investment adviser that would be willing and able to manage the Fund. The 1940 Act provides a mechanism for the Board to retain Impulsora del Fondo México, S.C. as the Fund’s investment adviser for an additional 150 days following the termination. There is no guarantee, however, that the Board would be able to find and retain a qualified investment adviser that would agree to assume the management of the Fund for a reasonable cost and obtain stockholder approval of the new adviser during this time period. The Fund invests in a market in which there are few comparably experienced managers of pure actively-managed single-country Mexican equity funds and, under the circumstances, a replacement adviser could demand a premium for taking over management of the Fund. If a new adviser is not approved within this time period, the Fund will have no investment adviser, making it impossible for the Fund to carry out any portfolio management, research or trading. In that event, the Fund’s investment program would be completely paralyzed.

The Proponent’s proposal also ignores the significant expenses that the Fund and its stockholders could incur in replacing the Adviser. Not only could the search process for a replacement investment adviser itself prove costly, but given the limited number of managers with comparable experience to Impulsora del Fondo México, S.C., the Fund may be further forced to pay higher advisory fees to attract a replacement adviser that is qualified and willing to manage the Fund. The Fund’s expenses could also increase if it must bear the replacement adviser’s costs of establishing portfolio management, research and trading facilities dedicated to the Fund — resources that the Adviser already provides. The Fund’s costs could escalate even further depending on other integration expenses that come with a replacement investment adviser, such as the expenses of obtaining stockholder approval of a new investment advisory agreement with a replacement investment adviser or brokerage costs due to increased portfolio turnover from a replacement investment adviser implementing its new strategy. In light of these significant management continuity and expense issues, the Board believes that the Proponent’s proposal is not in the best interest of the Fund’s stockholders.

4. The Proponent’s proposal is a poor approach to reducing the Fund’s discount and an indirect and costly method to open-end or liquidate the Fund.

The Proponent has offered no evidence that management of the Fund by a different investment adviser would improve the Fund’s discount or add stockholder value. Further, the Board is concerned that the uncertainty surrounding a dismissal of Impulsora del Fondo México, S.C. could seriously undermine the Fund’s market share price.

Additionally, the Proponent suggests that removing Impulsora del Fondo México, S.C. as the Fund’s investment adviser will lead to an open-ending or liquidation of the Fund, but the decision to open-end or liquidate the Fund requires the vote of stockholders and the Board. Obtaining stockholder approval of a Fund liquidation or conversion to an open-end structure is uncertain and the vote can take significant time even if a quorum can be achieved. In the event that stockholder approval of liquidation or conversion of the Fund is not obtained after termination of the investment management agreement, the Fund would be exposed to market movements without an investment adviser, with the potential for significant investor losses, as discussed above. Open-ending or liquidating the Fund requires the approval of the vote of the holders of two-thirds of the outstanding shares of the Fund, a threshold difficult to achieve.

The Board will consider any Stockholder proposal appropriately given to the Fund; however, rather than present a proposal to open-end or liquidate the Fund directly, the Proponent’s indirect attempt to effect these changes would incur the expenses of a difficult to obtain additional stockholder vote and the costs and problems associated with potentially leaving the Fund without an investment adviser.

5. There are negative consequences of open-ending or liquidating the Fund.

Open-end funds are subject to periodic inflows and outflows of cash that can complicate portfolio management and reduce investment performance. In particular, open-end funds may need to maintain cash reserves to provide for stockholder redemptions or, otherwise, liquidate holdings the manager would prefer to retain. Conversely, open-end funds with capacity constrained strategies or that otherwise are having difficulty finding attractive investment opportunities may be forced to choose between closing to new money and potentially diluting their investment returns by investing new inflows.

One significant risk of open-ending a closed-end fund is that this could lead to substantial redemptions, particularly in the period immediately following conversion, and diminished fund size. The threat of significant redemptions could adversely affect deployment of portfolio strategies and the fund’s expense ratio. A converted fund may also need to hold significant amounts of cash in the period following the conversion in order to satisfy such redemptions.

Because the SEC has not to date permitted open-end funds to operate “managed distribution” plans, it is more difficult for open-end funds to maintain a level targeted dividend of the type sought by many closed-end fund investors. Also, because all shares issued by an open-end fund must be issued at a price based on their current NAV, open-end funds cannot offer stockholders the opportunity to reinvest their dividends at a discount to their NAV.