UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e) (2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

METHODE ELECTRONICS, INC.

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

METHODE ELECTRONICS, INC.

7401 West Wilson Avenue

Chicago, Illinois 60706

(708) 867-6777

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 15, 2016

To the Shareholders of Methode Electronics, Inc.:

Notice is hereby given that the annual meeting of shareholders of Methode Electronics, Inc. will be held on Thursday, September 15, 2016 at 11:00 a.m., Chicago time, at Methode’s corporate offices at 7401 West Wilson Avenue, Chicago, Illinois, 60706 for the following purposes:

| 1. | To elect a Board of Directors; |

| 2. | To ratify the Audit Committee’s selection of Ernst & Young LLP to serve as our independent registered public accounting firm for the fiscal year ending April 29, 2017; |

| 3. | To provide advisory approval of Methode’s named executive officer compensation; and |

| 4. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

The Board of Directors recommends that you vote “FOR” each of Methode’s nominees for director, “FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm, and “FOR” advisory approval of Methode’s named executive officer compensation.

Our Board of Directors has fixed the close of business on July 18, 2016 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and at any adjournment or postponement thereof.

We are furnishing materials for our annual meeting on the Internet. You may vote your shares in person by attending our annual meeting, or by proxy. To vote by proxy, you may vote using the Internet, by toll-free telephone number or, if you request and receive a paper copy of the proxy card by mail, by signing, dating and mailing the proxy card in the self-addressed, postage-paid envelope provided. Information regarding voting by using the Internet or by telephone is contained in the Notice of Internet Availability of Proxy Materials. Instructions regarding voting by mail are contained on the proxy card.

It is important that your shares be represented and voted at the annual meeting. Whether or not you plan to attend the annual meeting, please vote on the matters to be considered. Thank you for your interest and cooperation.

| By Order of the Board of Directors, | |

| Walter J. Aspatore | |

| Chairman | |

| Chicago, Illinois | |

| July 27, 2016 |

METHODE ELECTRONICS, INC.

7401 West Wilson Avenue

Chicago, Illinois 60706

(708) 867-6777

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

September 15, 2016

GENERAL INFORMATION

We are furnishing this proxy statement to you in connection with the solicitation of proxies on behalf of Methode Electronics, Inc. (“Methode” or the “Company”) for use at our annual meeting of shareholders to be held on Thursday, September 15, 2016 at 11:00 a.m., Chicago time, at Methode’s corporate offices at 7401 West Wilson Avenue, Chicago, Illinois, 60706 and at any adjournment or postponement of the annual meeting. On July 27, 2016, we mailed our Notice of Internet Availability of Proxy Materials, which contains instructions for our shareholders to access our proxy statement and annual report over the Internet or request a paper copy of the proxy materials.

At the annual meeting, we will ask our shareholders to (i) elect our Board of Directors, (ii) ratify the Audit Committee’s selection of Ernst & Young LLP (“Ernst & Young”) to serve as our independent registered public accounting firm for fiscal 2017, (iii) provide advisory approval of Methode’s named executive officer compensation, and (iv) consider and vote upon any other business which properly comes before the annual meeting.

The Board of Directors recommends that you vote “FOR” each of Methode’s nominees for director, “FOR” the ratification of Ernst & Young as our independent registered public accounting firm, and “FOR” advisory approval of Methode’s named executive officer compensation.

You may vote your shares in person, by attending our annual meeting, or by proxy. To vote by proxy, you may vote using the Internet, by toll-free telephone number or, if you request and receive a paper copy of the proxy card by mail, by signing, dating and mailing the proxy card in the self-addressed, postage-paid envelope provided. Information regarding voting by using the Internet or by telephone is contained in the Notice of Internet Availability of Proxy Materials. Instructions regarding voting by mail are contained on the proxy card. Please do not submit a proxy card if you have voted by telephone or the Internet.

It is important that your shares be represented and voted at the annual meeting. Whether or not you plan to attend the annual meeting in person, please vote on the matters to be considered.

Record Date; Shares Outstanding

Our Board of Directors has fixed the close of business on July 18, 2016 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and at any adjournment or postponement thereof. As of the record date, there were 36,926,433 shares of our common stock outstanding and entitled to vote at the annual meeting.

Quorum; Votes Required

In deciding all questions, assuming a quorum is present, a holder of Methode’s common stock is entitled to one vote, in person or by proxy, for each share held in such holder’s name on the record date. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Methode’s common stock is necessary to constitute a quorum at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum at the annual meeting. Generally, broker non-votes occur when shares held by a broker or nominee for a beneficial owner are not voted with respect to a particular proposal because the broker or nominee lacks discretionary power to vote such shares.

With respect to the election of directors, shareholders may vote (a) “for”; (b) “against”; or (c) to “abstain” from voting for each nominee. The election of our Board of Directors requires approval by a majority of the shares of common stock represented at the meeting and entitled to vote. With respect to the proposals to ratify the selection of Ernst & Young as our independent registered public accounting firm and provide advisory approval of our executive compensation, shareholders may vote (1) “for”; (2) “against”; or (3) to “abstain” from voting on each matter and each such matter requires approval by a majority of the shares of common stock represented at the meeting and entitled to vote. Both abstentions and broker non-votes will be considered as present but will not be considered as votes in favor of any matter. Broker non-votes are excluded from the “for,” “against” and “abstain” counts, and instead are reported as simply “broker non-votes.” Consequently, abstentions have the effect of voting against these matters, while broker non-votes have no effect as to voting for or against any such matter.

Under New York Stock Exchange rules, the proposal to ratify the selection of Ernst & Young is considered a routine item. Therefore, brokers may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions to the broker. In contrast, all other proposals set forth in this proxy statement are considered non-routine items, and brokers who have not received voting instructions from their clients may not vote on these proposals.

All properly executed and timely delivered proxies will be voted in accordance with the instructions provided. Unless contrary instructions are indicated, proxies will be voted “FOR” each of Methode’s nominees for director, “FOR” the ratification of the selection of Ernst & Young, and “FOR” advisory approval of Methode’s named executive officer compensation. The Board of Directors knows of no other business that will be presented for consideration at the annual meeting. If any other matter is properly presented, it is the intention of the persons named in the proxy to vote in accordance with their best judgment.

Voting Procedures

It is important that your shares be represented at the annual meeting. You may vote your shares in person, by attending our annual meeting, or by proxy. To vote by proxy, you may vote using the Internet, by toll-free telephone number or, if you request and receive a paper copy of the proxy card by mail, by signing, dating and mailing the enclosed proxy card in the self-addressed, postage-paid envelope provided. Information regarding voting by using the Internet or by telephone is contained in the Notice of Internet Availability of Proxy Materials. Instructions regarding voting by mail are contained on the proxy card. Please do not submit a proxy card if you have voted by telephone or the Internet. You may revoke your proxy as described below.

Revoking Your Proxy

If you decide to change your vote, you may revoke your proxy at any time before the annual meeting. You may revoke your proxy by notifying our Corporate Secretary in writing that you wish to revoke your proxy at the following address: Methode Electronics, Inc., 7401 West Wilson Avenue, Chicago, Illinois 60706, attention: Corporate Secretary. You may also revoke your proxy by submitting a later-dated and properly executed proxy (including by means of the telephone or Internet) or by voting in person at the annual meeting. Attendance at the annual meeting will not, by itself, revoke a proxy.

Proxy Solicitation Expenses

The proxy is being solicited on behalf of Methode. We will bear the entire cost of this solicitation. Our directors, officers or other regular employees may solicit proxies by telephone, by e-mail, by fax or in person. No additional compensation will be paid to directors, officers and other regular employees for such services. We have retained the services of Innisfree M&A Incorporated (“Innisfree”) to serve as our proxy solicitor in connection with the annual meeting. Innisfree may assist us in soliciting proxies by telephone, email and by other means, and we expect to pay Innisfree a fee of $20,000, plus reasonable expenses.

| 2 |

In the event that beneficial owners of our shares request paper copies of our proxy materials, banks, brokerage houses, fiduciaries and custodians holding shares of our common stock beneficially owned by others as of the record date will be requested to forward such proxy soliciting material to the beneficial owners of such shares and will be reimbursed by Methode for their reasonable out-of-pocket expenses.

Householding of Annual Meeting Materials

We are sending only one copy of our Notice of Internet Availability of Proxy Materials and, if applicable, our proxy materials, to shareholders who share the same last name and address, unless they have notified us that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce duplicate mailings and save printing and postage costs. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. If you received a householded mailing this year and you would like to have additional copies of our Notice of Internet Availability of Proxy Materials and, if applicable, our proxy materials, mailed to you or you would like to opt out of this practice for future mailings, you may do so at any time by contacting us at: Methode Electronics, Inc., 7401 West Wilson Avenue, Chicago, Illinois 60706, Attention: Corporate Secretary.

3

CORPORATE GOVERNANCE

We are committed to maintaining high standards of corporate governance in order to serve the long-term interests of Methode and our shareholders.

Director Independence

Our Board of Directors has considered the independence of the nominees for director under the applicable standards of the U.S. Securities and Exchange Commission (“SEC”) and the New York Stock Exchange. Our Board has determined that all of the nominees for director are independent under the applicable standards, except for Donald Duda, our President and Chief Executive Officer. Mr. Duda’s lack of independence relates solely to his service as an executive officer and is not due to any other transactions or relationships.

In addition, our Board of Directors has determined that each member of our Audit Committee, our Compensation Committee and our Nominating and Governance Committee satisfies the independence requirements of the applicable standards, if any, of the SEC and the New York Stock Exchange.

Board Committees

The following chart sets forth the committees of our Board for fiscal 2016. On June 16, 2016, our Board, upon the recommendation of the Nominating and Governance Committee, appointed Martha Goldberg Aronson to the Compensation Committee and the Technology Committee.

| Committee | Members | Principal Functions | Number of Meetings in Fiscal 2016 | ||||

| Audit | Lawrence B. Skatoff (Chair) Walter J. Aspatore Stephen F. Gates Isabelle C. Goossen Paul G. Shelton |

● ● ● ● ● ● ● |

Oversees accounting and financial reporting and audits of financial

statements. Monitors performance of internal audit function and our system of internal control. Monitors performance, qualifications and independence of our independent registered public accounting firm and makes decisions regarding retention, termination and compensation of the independent registered public accounting firm and approves services provided by the independent registered public accounting firm. Monitors compliance with legal and regulatory requirements pertaining to financial statements. Reviews our press releases and certain SEC filings. Discusses with management major financial risk exposures and the steps taken to monitor and control such exposures, and reviews the process by which risk assessment and risk management is undertaken. If applicable, reviews related party transactions and potential conflict of interest situations. |

8 | |||

| Compensation | Isabelle C. Goossen (Chair) Darren M. Dawson Stephen F. Gates Christopher J. Hornung Paul G. Shelton |

● ● ● ● ● |

Oversees our executive compensation policies and plans. Approves goals and incentives for the compensation of our Chief Executive Officer and, with the advice of the Chief Executive Officer, the other executive officers. Approves grants under our stock and bonus plans. Makes decisions regarding the retention, compensation and termination of any compensation consultants, and monitors their independence. Evaluates whether risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect. |

8 | |||

| Nominating and Governance |

Christopher J. Hornung (Chair) Walter J. Aspatore Warren L. Batts Stephen F. Gates Lawrence B. Skatoff |

● ● ● ● ● ● ● |

Recommends director candidates for election to our Board at the

annual meeting or to fill vacancies. Recommends Board committee assignments. Recommends compensation and benefits for directors. Reviews our Corporate Governance Guidelines. Conducts an annual assessment of Board and committee performance. Reviews our risk management policies and practices. Reviews succession planning for our Chief Executive Officer. |

4 | |||

| Technology | Darren M. Dawson (Chair) Walter J. Aspatore Warren L. Batts Christopher J. Hornung |

● ● |

Reviews with management our technology assets and future needs. Reviews technology research and development activities and possible acquisitions of technology. |

4 | |||

| 4 |

If applicable, our Audit Committee reviews related party transactions and potential conflict of interest situations in accordance with the Audit Committee Charter and our Code of Business Conduct. We do not have a separate written policy regarding related party transactions and potential conflict of interest situations. Our Code of Business Conduct states that conflicts of interest are prohibited, except as approved by our Board of Directors. In reviewing any such transaction, our Audit Committee and Board of Directors would consider Methode’s rationale for entering into the transaction, alternatives to the transaction, whether the transaction is on terms at least as fair to Methode as would be the case were the transaction entered into with a third party and other relevant factors.

During the 2016 fiscal year, our Board of Directors held fifteen meetings, and no director attended less than 75% of the aggregate of the total number of meetings of our Board and the total number of meetings held by the respective committees on which he or she served. Under our Corporate Governance Guidelines, our directors are expected to attend Board and shareholder meetings and meetings of committees on which they serve. Our directors are expected to meet as frequently as necessary to properly discharge their responsibilities.

Our independent directors hold regularly scheduled executive sessions at which only independent directors are present. Pursuant to our Corporate Governance Guidelines, our Chairman of the Board is the Presiding Director of such sessions.

Our Audit, Compensation, Nominating and Governance and Technology Committees operate pursuant to charters adopted by the Board, which are available on our website at www.methode.com or in print upon any shareholder’s request. Our Corporate Governance Guidelines are also available on our website at www.methode.com or in print upon any shareholder’s request.

Board Leadership Structure, Evaluations, Risk Oversight and Compensation Policy Risks

The Board of Directors has determined that having an independent director serve as Chairman of the Board is in the best interests of our shareholders. This structure provides for a greater role for the independent directors in the oversight of Methode and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.

The Nominating and Governance Committee oversees the annual Board and committee evaluation process. Each year, our independent directors complete a written evaluation which focuses on Board practices, processes and skills, and seeks input on opportunities for improvement. To protect the directors’ anonymity and the integrity of the process, the directors send their completed evaluations directly to outside legal counsel. Legal counsel compiles the responses into a written report, which is then distributed to, and discussed by, the Nominating and Governance Committee and the full Board.

Our Board of Directors oversees Methode’s risk management practices. Our Board and committees review information regarding Methode’s market, competition and financial risks, as well as risks associated with Methode’s operations, employees and political risks encountered by Methode throughout the globe. Our Audit Committee discusses with management Methode’s major financial risk exposures and the steps management has taken to monitor and control such exposures, and reviews the process by which risk is managed and assessed. Our Audit Committee also reviews the Company’s cyber-security practices and policies. Our Compensation Committee evaluates risks arising from Methode’s compensation practices and policies. Our Nominating and Governance Committee reviews and evaluates Methode’s policies and practices with respect to risk management and risk assessment in areas such as business operations, human resources, international operations, intellectual property and information technology. The entire Board of Directors is regularly informed about the risk management policies and practices monitored by the various committees. The Board of Directors also receives reports directly from officers responsible for assessing and managing particular risks within Methode.

| 5 |

We believe that risks arising from our compensation policies and practices for our employees are not reasonably likely to have a material adverse effect on Methode. The Compensation Committee monitors the mix and design of the elements of executive compensation and believes that our compensation programs do not encourage management to assume excessive risks.

Nominating Process of the Nominating and Governance Committee

Our Nominating and Governance Committee is responsible for identifying and recommending to our Board of Directors individuals qualified to become directors consistent with criteria approved by our Board. In considering potential candidates for our Board, including with respect to nominations for re-election of incumbent directors, the Committee considers the potential candidate’s integrity and business ethics; strength of character, judgment and experience consistent with our needs; specific areas of expertise and leadership roles; and the ability to bring diversity to our Board. While the Nominating and Governance Committee charter and our Corporate Governance Guidelines do not prescribe diversity standards, the Committee considers diversity in the context of the Board as a whole, including whether the potential candidate brings complementary skills and viewpoints. The Committee also considers the ability of the individual to allocate the time necessary to carry out the tasks of Board membership, including membership on appropriate committees.

The Committee identifies potential nominees by asking current directors and others to notify the Committee if they become aware of persons, meeting the criteria described above, who may be available to serve on our Board. The Committee has sole authority to retain and terminate any search firm used to identify director candidates and has sole authority to approve the search firm’s fees and other retention terms. Historically, the Committee has not engaged third parties to assist in identifying and evaluating potential nominees, but would do so in those situations where particular qualifications are required to fill a vacancy and our Board’s contacts are not sufficient to identify an appropriate candidate.

The Committee will consider suggestions from our shareholders. Any recommendations received from shareholders will be evaluated in the same manner that potential nominees suggested by Board members are evaluated. Upon receiving a shareholder recommendation, the Committee will initially determine the need for additional or replacement Board members and evaluate the candidate based on the information the Committee receives with the shareholder recommendation or may otherwise acquire, and may, in its discretion, consult with the other members of our Board. If the Committee determines that a more comprehensive evaluation is warranted, the Committee may obtain additional information about the director candidate’s background and experience, including by means of interviews with the candidate.

Our shareholders may recommend candidates at any time, but the Committee requires recommendations for election at an annual meeting of shareholders to be submitted to the Committee no later than 120 days before the first anniversary of the date of the proxy statement in connection with the previous year’s annual meeting. The Committee believes this deadline is appropriate and in the best interests of Methode and our shareholders because it ensures that the Committee has sufficient time to properly evaluate all proposed candidates. Therefore, to submit a candidate for consideration for nomination at the 2017 annual meeting of shareholders, a shareholder must submit the recommendation, in writing, by March 29, 2017. The written notice must include:

| ● | the name, age, business address and residential address of each proposed nominee and the principal occupation or employment of each nominee; | |

| ● | the number of shares of our common stock that each nominee beneficially owns; | |

| ● | a statement that each nominee is willing to be nominated; and | |

| ● | any other information concerning each nominee that would be required under the rules of the SEC in a proxy statement soliciting proxies for the election of those nominees. |

Recommendations must be sent to the Nominating and Governance Committee, Methode Electronics, Inc., 7401 West Wilson Avenue, Chicago, Illinois 60706. Information regarding the requirements to nominate a director at our 2017 Annual Meeting are set forth below under “Other Information -- Shareholder Proposals and Director Nominations.”

| 6 |

Communications with Directors

Our annual meeting of shareholders provides an opportunity each year for shareholders to ask questions of, or otherwise communicate directly with, members of our Board of Directors on appropriate matters. All of our directors serving at such time attended the 2015 annual meeting. We anticipate that all of our directors will attend the 2016 annual meeting.

In addition, interested parties may, at any time, communicate in writing with any particular director, or our independent directors as a group, by sending such written communication to the Corporate Secretary of Methode Electronics, Inc. at 7401 West Wilson Avenue, Chicago, Illinois 60706. Copies of written communications received at such address will be provided to the relevant director or the independent directors as a group unless such communications are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s). Examples of shareholder communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to us or our business or communications that relate to other improper or irrelevant topics.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct that applies to our directors, principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions, as well as other employees. The code is available on our website at www.methode.com or in print upon any shareholder’s request.

If we make any substantive amendments to the Code of Business Conduct or grant any waiver, including any implicit waiver, from a provision of the Code of Business Conduct to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, we will disclose the nature of such amendment or waiver on our website or in a report on Form 8-K in accordance with applicable rules and regulations.

Stock Ownership Guidelines

Our Compensation Committee considers stock ownership by directors to be an important means of linking their interests with those of our shareholders. We maintain stock ownership guidelines for our directors. All directors are expected to own stock with a value equal to at least five times the annual cash retainer paid to Methode directors. The requirements are subject to a five year phase-in period. All of our directors were in compliance with our stock guidelines for fiscal 2016.

| 7 |

DIRECTOR COMPENSATION

We use a combination of cash and common stock to compensate our non-employee directors. Directors who are also our full-time employees are not paid for their services as directors or for attendance at meetings.

For the fiscal year ended April 30, 2016, our non-employee directors received an annual cash retainer of $44,000 and an attendance fee of $1,000 per committee meeting and for each board meeting other than the regularly scheduled quarterly meetings. In addition, in September 2015, the Compensation Committee, upon the recommendation of the Nominating and Governance Committee, granted each non-employee director serving at such time a stock award for 3,000 shares of common stock. Our Chairman of the Board and the Chair of each of our board committees received supplemental annual retainers in the following amounts: Chairman of the Board, $30,000; Chair of each of the Audit Committee and the Compensation Committee, $24,000; and Chair of each of the Nominating and Governance Committee and the Technology Committee, $12,000. In addition, members of our Audit Committee and Compensation Committee (other than the Chair) received an additional annual retainer of $10,000. Pursuant to our Deferred Compensation Plan, our directors may elect to defer up to 100% of their retainers and attendance fees per year. Additional information regarding the Deferred Compensation Plan is described under “Executive Compensation — Nonqualified Deferred Compensation,” below.

The following table sets

forth certain information regarding compensation earned by our non-employee directors during the fiscal year ended April 30, 2016.

| Name | Fees

Earned or Paid in Cash ($) | Stock

Awards ($) (1) | Total ($) | |||||||||

| Walter J. Aspatore | 111,000 | 98,250 | 209,250 | |||||||||

| Warren L. Batts | 70,500 | 98,250 | 168,750 | |||||||||

| Darren M. Dawson | 86,500 | 98,250 | 184,750 | |||||||||

| Stephen F. Gates | 96,500 | 98,250 | 194,750 | |||||||||

| Martha Goldberg Aronson (2) | — | — | — | |||||||||

| Isabelle C. Goossen | 107,000 | 98,250 | 202,250 | |||||||||

| Christopher J. Hornung | 92,000 | 98,250 | 190,250 | |||||||||

| Paul G. Shelton | 90,000 | 98,250 | 188,250 | |||||||||

| Lawrence B. Skatoff | 91,000 | 98,250 | 189,250 | |||||||||

| (1) | The reported amounts reflect the fair value at the date of grant calculated in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 (“ASC 718”). Details of the assumptions used in valuing these awards are set forth in Note 4 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2016. |

| (2) | Ms. Goldberg Aronson was elected to the Board on April 19, 2016 and did not earn any compensation during the fiscal year ended April 30, 2016. |

| 8 |

SECURITY OWNERSHIP

Five Percent Shareholders

The following table sets forth information regarding all persons known by Methode to be the beneficial owners of more than 5% of Methode’s common stock as of July 18, 2016.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership |

Percent of Class (%) | ||||||

| BlackRock, Inc. (1) 55 East 52nd Street New York, New York 10055 |

3,538,210 | 9.3 | ||||||

| The Vanguard Group (2) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

2,824,402 | 7.4 | ||||||

| The Bank of New York Mellon Corporation (3) 225 Liberty Street New York, New York 10286 |

2,388,049 | 6.3 | ||||||

| (1) | Information is based on a Schedule 13G/A filed with the SEC on January 26, 2016. In the Schedule 13G/A, BlackRock, Inc. reported that, as of December 31, 2015, it had sole voting power with respect to 3,456,742 shares and sole dispositive power with respect to 3,538,210 shares. |

| (2) | Information is based on a Schedule 13G/A filed with the SEC on February 10, 2016. In the Schedule 13G/A, The Vanguard Group reported that, as of December 31, 2015, it had sole voting power with respect to 83,909 shares, shared voting power with respect to 3,000 shares, sole dispositive power with respect to 2,739,393 shares and shared dispositive power with respect to 85,009 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 82,009 shares of the Company’s common stock as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 4,900 shares of the Company’s common stock as a result of its serving as investment manager of Australian investment offerings. |

| (3) | Information is based on a Schedule 13G filed with the SEC on January 26, 2016. In the Schedule 13G, The Bank of New York Mellon Corporation reported that, as of December 31, 2015, it had sole voting power with respect to 2,331,218 shares, sole dispositive power with respect to 2,332,349 shares and shared dispositive power with respect to 55,700 shares. The Schedule 13G reported that all of the shares are beneficially owned by The Bank of New York Mellon Corporation and its direct or indirect subsidiaries in their various fiduciary capacities (including as an investment adviser or a broker or dealer). |

Directors and Executive Officers

The following table sets forth information regarding our common stock beneficially owned as of July 18, 2016 by (i) each director and nominee, (ii) each of the named executive officers, and (iii) all current directors and executive officers as a group.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (%) | ||||||

| Walter J. Aspatore | 24,000 | (2) | * | |||||

| Warren L. Batts | 73,000 | * | ||||||

| Darren M. Dawson | 16,000 | * | ||||||

| Donald W. Duda | 746,658 | (3) | 2.0 | |||||

| Stephen F. Gates | 26,860 | * | ||||||

| Martha Goldberg Aronson | 3,000 | * | ||||||

| Isabelle C. Goossen | 44,000 | * | ||||||

| Christopher J. Hornung | 134,850 | * | ||||||

| Paul G. Shelton | 61,000 | * | ||||||

| Lawrence B. Skatoff | 42,850 | (4) | * | |||||

| Timothy R. Glandon | 85,109 | (5) | * | |||||

| Joseph E. Khoury | 244,600 | (6) | * | |||||

| Theodore P. Kill | 215,830 | (7) | * | |||||

| Douglas A. Koman | 290,436 | (8) | * | |||||

| All current directors and executive officers as a group (14 individuals) | 2,140,953 | (9) | 5.8 | |||||

| 9 |

| * | Percentage represents less than 1% of the total shares of common stock outstanding. |

| (1) | Beneficial ownership arises from sole voting and dispositive power unless otherwise indicated by footnote. |

| (2) | Includes 15,000 shares held jointly with Mr. Aspatore’s wife. |

| (3) | Includes 119,552 shares held jointly with Mr. Duda’s wife, options to purchase 53,334 shares of common stock exercisable within 60 days, 1,960 shares of common stock held in our 401(k) Plan, 201,812 shares of vested restricted stock units for which common stock will be delivered to Mr. Duda at such time as the value of the award is deductible by us or Mr. Duda’s employment terminates, 100,000 shares of vested restricted stock units for which common stock will be delivered to Mr. Duda in the event of termination from Methode under any circumstance and 270,000 shares of performance-based restricted stock subject to forfeiture. |

| (4) | Shares are held in a trust pursuant to which Mr. Skatoff shares voting and investment power with his wife. |

| (5) | Includes 38,030 shares held jointly with Mr. Glandon’s wife, options to purchase 16,000 shares of common stock exercisable within 60 days, 1,079 shares of common stock held in our 401(k) Plan and 30,000 shares of vested restricted stock units for which common stock will be delivered to Mr. Glandon in the event of termination from Methode under any circumstance. |

| (6) | Includes options to purchase 16,000 shares of common stock exercisable within 60 days, 30,000 shares of vested restricted stock units for which common stock will be delivered to Mr. Khoury in the event of termination from Methode under any circumstance and 135,000 shares of performance-based restricted stock subject to forfeiture. |

| (7) | Includes 34,830 shares held jointly with Mr. Kill’s wife, options to purchase 16,000 shares of common stock exercisable within 60 days, 30,000 shares of vested restricted stock units for which common stock will be delivered to Mr. Kill in the event of termination from Methode under any circumstance and 135,000 shares of performance-based restricted stock subject to forfeiture. |

| (8) | Includes 93,714 shares held jointly with Mr. Koman’s wife, options to purchase 31,999 shares of common stock exercisable within 60 days, 34,723 shares of common stock held in our 401(k) Plan, 40,000 shares of vested restricted stock units for which common stock will be delivered to Mr. Koman in the event of termination from Methode under any circumstance and 90,000 shares of performance-based restricted stock subject to forfeiture. |

| (9) | Includes 301,126 shares held jointly, 42,850 shares held in trust with voting and investment power shared with a spouse, options to purchase 133,333 shares of common stock exercisable within 60 days, 37,762 shares of common stock held in our 401(k) Plan, 431,812 shares of vested restricted stock units and 630,000 shares of performance-based restricted stock subject to forfeiture. |

| 10 |

PROPOSAL ONE

ELECTION OF DIRECTORS

A Board of ten directors will be elected at the annual meeting. Each director will hold office until the next annual meeting of shareholders and until his or her successor is elected and qualified. All of the nominees listed below currently serve as directors. All of the nominees were recommended unanimously to our Board of Directors by our Nominating and Governance Committee and were nominated by our Board of Directors. If any of these nominees is not a candidate for election at the annual meeting, an event which our Board of Directors does not anticipate, the proxies will be voted for a substitute nominee recommended to our Board of Directors by our Nominating and Governance Committee and nominated by our Board of Directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE FOLLOWING NOMINEES.

| Walter J. Aspatore, Chairman Chairman Emeritus, Amherst Partners, LLC Director since 2008 Age 73 Mr. Aspatore has served as Chairman Emeritus of Amherst Partners, LLC, a business consulting firm, since 2010. Prior thereto, Mr. Aspatore was Chairman of Amherst Partners from 1994 through 2010. Mr. Aspatore has served as Chairman of our Board since September, 2012. Prior to co-founding Amherst Partners, Mr. Aspatore served in various officer positions at diversified manufacturing and technology businesses, including Cross and Trecker Corporation, the Warner and Swasey Company, Bendix Corporation and TRW Corporation. He also served as Vice Chairman and President of Onset BIDCO, a venture capital and subordinated debt fund, from 1992 to 1994. Mr. Aspatore also serves as a director of Mackinac Financial Corporation, a bank holding company. Mr. Aspatore’s consulting experience and service at various consulting, manufacturing and technology businesses has resulted in continued contributions to the Board. |

| Warren L. Batts Retired Chairman and Chief Executive Officer, Tupperware Corporation Director since 2001 Age 83 Mr. Batts is the retired Chairman and Chief Executive Officer of Tupperware Corporation, a diversified consumer products company. Mr. Batts is also the retired Chairman of Premark International, Inc., a diversified consumer products company, where he also served as Chief Executive Officer from 1986 until 1996. Mr. Batts has taught as an Adjunct Professor of Strategic Management at the University of Chicago Graduate School of Business since 1998. Mr. Batts has served in the following key leadership positions: Chairman of the Board, Cook County Health & Hospital System; Life Director and Chairman, Lurie Children’s Hospital; Life Trustee, Art Institute of Chicago; Chairman, School of the Art Institute of Chicago; Life Trustee, Northwestern University; Director and Chairman, the National Association of Manufacturers; and Director, National Association of Corporate Directors. Mr. Batts served as Chairman of our Board from 2004 to 2012. Mr. Batts has used his corporate governance expertise, significant leadership experience and vast business knowledge to make contributions while on the Board. |

| 11 |

Dr. Darren M. Dawson

Leroy C. and Aileen H. Paslay Dean,

College of Engineering,

Kansas State University

Director since 2004

Age 53

Dr. Dawson has served as the Dean of the College of Engineering of Kansas

State University since July 1, 2014. Prior thereto, Dr. Dawson served as a Professor in the Electrical and Computer Engineering

Department at Clemson University, where he held various professor positions since 1990. His research interests include nonlinear

control techniques for mechatronic systems, robotic manipulator systems and vision-based systems. Dr. Dawson’s work has

been recognized by several awards, including the Clemson University Centennial Professorship in 2000. Dr. Dawson’s academic

and technical background has provided the basis for continued contributions to the Board’s operations and deliberations.

| Donald W. Duda Chief Executive Officer and President, Methode Electronics, Inc. Director since 2001 Age 61 Mr. Duda has served as our Chief Executive Officer since May 2004 and our President since 2001. Mr. Duda joined us in 2000 and served as our Vice President - Interconnect Products Group. Prior to joining Methode, Mr. Duda held several positions with Amphenol Corporation, a manufacturer of electronic connectors, most recently as General Manager of its Fiber Optic Products Division from 1988 through 1998. Mr. Duda continues to use his executive background and unique understanding of Methode to contribute to the Board. |

| Stephen F. Gates Special Counsel, Mayer Brown LLP Director since 2010 Age 70 Mr. Gates has served as Special Counsel at Mayer Brown LLP, a global law firm, since 2008. From 2003 through 2007, Mr. Gates served as Senior Vice President and General Counsel of ConocoPhillips, a large energy company and refiner. From 2002 through 2003, Mr. Gates was a Partner at Mayer Brown LLP, and from 2000 through 2002, Mr. Gates served as Senior Vice President and General Counsel of FMC Corporation, a diversified chemicals company. Mr. Gates’ legal background and corporate governance expertise have led to unique contributions to the Board. Martha Goldberg Aronson Former Executive Vice President and President of Global Healthcare Ecolab, Inc. Director since April 2016 Age 48 Ms. Goldberg Aronson served from 2012 to 2015 as Executive Vice President and President, Global Healthcare, at Ecolab, Inc., a specialty chemical company. From 2010 to 2012, Ms. Goldberg Aronson was President, North America at Hill-Rom Holdings, Inc., a global medical technology company. Prior to Hill-Rom, Ms. Goldberg Aronson spent 18 years at Medtronic, Inc., a medical technology provider, most recently serving as Senior Vice President and Chief Talent Officer. Ms. Goldberg Aronson is currently a member of the Board of Directors of Conmed Corporation, Hutchinson Technology, Inc. and the Guthrie Theater. Based on her extensive leadership experience and experience in the global health care markets, Ms. Goldberg Aronson is expected to provide valuable insights to the Board. |

| 12 |

| Isabelle C. Goossen Vice President and Chief Financial Officer, Chicago Symphony Orchestra Association Director since 2004 Age 64 Ms. Goossen has served as the Chief Financial Officer for the Chicago Symphony Orchestra Association since March, 2011. Ms. Goossen has served as the Vice President for Finance and Administration for the Chicago Symphony Orchestra Association since 2001. From 1986 through 1999, Ms. Goossen held several management positions with Premark International, Inc., a diversified consumer products company, most recently as Vice President and Treasurer from 1996 through 1999. Ms. Goossen also serves as a director of Columbian Mutual Life Insurance, a New York domestic life insurance company, and its subsidiary Columbian Life Insurance Company, an Illinois domestic life insurance company. Ms. Goossen has used her financial expertise and management background to make continued contributions to the Board. |

| Christopher J. Hornung, Vice Chairman Co-Founder, Sturbridge Capital Director since 2004 Age 64 Mr. Hornung co-founded Sturbridge Capital, an investment fund, in January 2011, and has served as Chairman of Doskocil Manufacturing Company Inc., doing business as Petmate, a producer and distributor of pet products, since January 1, 2014. Prior thereto, Mr. Hornung served as Chief Executive Officer of Next Testing, Inc., a provider of comprehensive, sport-specific athletic testing programs, from January 2007 to November 2013. From February 2004 through December 2006, Mr. Hornung served as President of the Pacific Cycle Division of Dorel Industries, Inc., a global consumer products company. Prior to the acquisition of Pacific Cycle by Dorel Industries Inc., Mr. Hornung served as the Chairman and Chief Executive Officer of Pacific Cycle. Mr. Hornung is a recipient of the Ernst & Young Entrepreneur of the Year Award and serves on an advisory board of the University of Wisconsin School of Business. His executive and entrepreneurial experience as well as his expertise regarding international sourcing and distribution has resulted in continued contributions to the Board. |

| Paul G. Shelton Retired Vice President and Chief Financial Officer, FleetPride, Inc. Director since 2004 Age 66 Mr. Shelton retired in 2003 as Vice President and Chief Financial Officer of FleetPride Inc., an independent heavy-duty truck parts distributor. From 1981 through 2001, Mr. Shelton served in various management positions at AMCOL International Corporation, a supplier of specialty minerals and chemicals, most recently as Senior Vice President from 1994 through 2001 and Chief Financial Officer from 1984 through 2001. Mr. Shelton serves on two private company boards and was a former member of the board of directors of AMCOL International Corporation and four private companies. Mr. Shelton has used his executive, financial and board experience to contribute to the operations and deliberations of the Board. |

| 13 |

| Lawrence B. Skatoff Retired Executive Vice President and Chief Financial Officer, BorgWarner Inc. Director since 2004 Age 76 Mr. Skatoff retired in 2001 as Executive Vice President and Chief Financial Officer of BorgWarner Inc., a manufacturer of highly engineered systems and components for the automotive industry. Prior to joining BorgWarner Inc., Mr. Skatoff was Senior Vice President and Chief Financial Officer of Premark International, Inc., a diversified consumer products company, from 1991 through 1999. Before joining Premark, Mr. Skatoff was Vice President-Finance of Monsanto Company, a worldwide manufacturer of chemicals and pharmaceuticals. Mr. Skatoff’s executive experience and financial background has led to continued contributions to the Board. |

| 14 |

PROPOSAL

TWO

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors is directly responsible for the appointment, termination, compensation, evaluation and oversight of our independent registered public accounting firm. Our Audit Committee has selected Ernst & Young to serve as our independent registered public accounting firm for the fiscal year ending April 29, 2017, subject to ratification of the selection by our shareholders. Ernst & Young has served as our independent registered public accounting firm for many years and is considered to be well qualified.

Representatives of Ernst & Young will be present at the annual meeting, will have the opportunity to make a statement and will be available to respond to appropriate questions.

If our shareholders do not ratify the selection of Ernst & Young, our Audit Committee will reconsider the selection. Even if the selection is ratified, our Audit Committee may select a different independent registered public accounting firm at any time during the year if it determines that a change would be in the best interests of Methode and our shareholders.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF OUR AUDIT COMMITTEE’S SELECTION OF ERNST & YOUNG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

| 15 |

proposal

THREE

advisorY APPROVAL OF METHODE’S executive compensation

Section 14A of the Securities Exchange Act of 1934 requires that we provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s compensation disclosure rules.

As described under “Executive Compensation – Compensation Discussion and Analysis,” we seek to align the interests of our executives with the interests of our shareholders and reward performance.

The advisory vote on this resolution is not intended to address any specific element of compensation, but rather the overall compensation of our named executive officers as disclosed in this proxy statement. The vote is advisory, which means that the vote is not binding on Methode, our Board of Directors or our Compensation Committee. Although this vote is nonbinding, our Board of Directors and our Compensation Committee value the opinions of our shareholders and will consider the outcome of the vote when making decisions concerning executive compensation.

Shareholders may vote for or against the following resolution, or may abstain from voting. The affirmative vote of a majority of the shares present or represented at the annual meeting and entitled to vote is required to approve the proposed resolution.

We ask our shareholders to approve the following resolution:

“RESOLVED, that the compensation of Methode’s named executive officers, as disclosed in Methode’s Proxy Statement for the 2016 Annual Meeting of Shareholders pursuant to the SEC’s compensation disclosure rules, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosure, is hereby approved.”

Our Board of Directors recommends a vote “FOR” the approval of the FOREGOING RESOLUTION.

| 16 |

AUDIT COMMITTEE MATTERS

Report of the Audit Committee

The Audit Committee oversees our financial reporting process on behalf of our Board of Directors. Our management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. Our Board has determined that each member of our Audit Committee meets the requirements as to independence, experience and expertise established by the New York Stock Exchange. Our Board has designated Mr. Skatoff, Ms. Goossen and Mr. Shelton as audit committee financial experts as defined by the SEC. In fulfilling its oversight responsibilities, our Audit Committee reviewed and discussed the audited financial statements in the Annual Report on Form 10-K for the year ended April 30, 2016 with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements.

Our Audit Committee reviewed and discussed with our independent registered public accounting firm, Ernst & Young, which is responsible for expressing an opinion on the conformity of the audited financial statements with U.S. generally accepted accounting principles, the firm’s judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed under the standards of the Public Company Accounting Oversight Board (United States).

The Committee has received the written disclosures and the letter from Ernst & Young required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young’s communications with the Committee concerning independence, and has discussed with Ernst & Young the firm’s independence from management and Methode and considered the compatibility of nonaudit services with the firm’s independence.

Our Audit Committee discussed with our internal auditors and Ernst & Young the overall scope and plans for their respective audits. Our Audit Committee met with the internal auditors and Ernst & Young, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting. The Committee also discussed with Ernst & Young the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees - Public Company Accounting Oversight Board.

In reliance on the reviews and discussions referred to above, the Committee recommended to our Board of Directors (and our Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended April 30, 2016 filed with the SEC.

| AUDIT COMMITTEE | |

| Lawrence B. Skatoff, Chairman | |

| Walter J. Aspatore | |

| Stephen F. Gates | |

| Isabelle C. Goossen | |

| Paul G. Shelton |

| 17 |

Auditing and Related Fees

Our Audit Committee engaged Ernst & Young to examine our consolidated financial statements for the fiscal year ended April 30, 2016. Fees paid to Ernst & Young for services performed during the 2016 and 2015 fiscal years were as follows:

| Fiscal 2016 | Fiscal 2015 | |||||||

| Audit Fees (1) | $ | 1,960,702 | $ | 1,823,909 | ||||

| Tax Fees (2) | $ | 52,039 | $ | 42,161 | ||||

| All Other Fees | — | — | ||||||

| Total | $ | 2,012,741 | $ | 1,866,070 | ||||

| (1) | Audit fees represent aggregate fees billed for professional services rendered by Ernst & Young for the audit of our annual financial statements and review of our quarterly financial statements, audit services provided in connection with other statutory and regulatory filings and consultation with respect to various accounting and financial reporting matters. |

| (2) | Tax fees primarily include fees for consultations regarding intercompany transfer pricing. |

Pre-Approval Policy

Our Audit Committee is responsible for reviewing and pre-approving all audit and non-audit services provided by Ernst & Young and shall not engage Ernst & Young to perform non-audit services proscribed by law or regulation. In fiscal 2016, 100% of audit and non-audit services were approved by the Audit Committee.

| 18 |

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis describes the key elements of our executive compensation program, including an analysis of compensation awarded to, earned by or paid to our named executive officers in fiscal 2016. For fiscal 2016, our named executive officers included Donald Duda, Chief Executive Officer; Douglas Koman, Chief Financial Officer; Joseph E. Khoury, Senior Vice President; Theodore P. Kill, Vice President, Worldwide Sales; and Timothy Glandon, Vice President. Mr. Koman retired as our Chief Executive Officer as of July 25, 2016.

Executive Summary

Our Compensation Committee strives to provide compensation programs that align our executives’ interests with those of our shareholders, and appropriately reward our executives for performance against annual and multi-year objectives. The Company’s fiscal 2016 revenue, income from operations and net income were the second highest in our Company’s history.

Following the completion of the five-year, long-term incentive program which concluded as of the end of fiscal 2015 (the “Fiscal 2011 LTI Program”), the Compensation Committee adopted a new five-year, long-term incentive program in October 2015 (the “Fiscal 2016 LTI Program”). A key consideration of the Compensation Committee in developing the Fiscal 2016 LTI Program was the success of the Fiscal 2011 LTI Program. During the five-year period of the Fiscal 2011 LTI Program, revenues grew at an annualized rate of 18.5%, which supported annualized pre-tax profit growth and diluted earnings per share growth of 73.0% and 47.5%, respectively. In addition, we realized strong annualized total shareholder return of 34.0% during the period. During this period, our industry-leading performance reflected the introduction of numerous new products and technologies, the benefits of selective licensing and other business arrangements, the expansion of lower-cost manufacturing facilities and further vertical integration. The Fiscal 2016 LTI Program is intended to continue creating value for our shareholders using a long-term program that aligns pay with performance and includes a strong retention feature.

The Fiscal 2016 LTI Program consists of a mix of 60% performance-based restricted stock awards (“RSAs”), at target performance, and 40% time-based restricted stock units (“RSUs”). The Compensation Committee expects the Fiscal 2016 LTI Program to cover all long-term incentive grants to the participants through the end of fiscal 2020 (i.e., five fiscal years). The number of RSAs earned will be based on the achievement of established goals for the Company’s earnings before net interest, taxes, fixed asset depreciation and intangible asset amortization (“EBITDA”) for fiscal 2020. The EBITDA performance goals under the Fiscal 2016 LTI Program were designed to align with the Company’s targeted annual growth rate for EBITDA of 9% to 10% for the period. The RSUs are subject to a five-year vesting period based on continued service with no RSUs vesting prior to the end of fiscal 2018. See “Fiscal 2016 Long-Term Incentive Program” below for additional information regarding this program.

In addition to our Fiscal 2016 LTI Program, the fiscal 2016 compensation program for our named executive officers included a base salary and performance-based annual bonus as described below.

| ● | The Compensation Committee considered fiscal 2016 salaries for our named executive officers. The Compensation Committee discussed retention issues, reviewed advice from its compensation consultant regarding market practices and considered Mr. Duda’s recommendations (for officers other than himself). The Compensation Committee also considered other relevant factors, including the individual performance, skills and experience of each executive, internal pay equity issues, and the Company’s performance. The Compensation Committee decided to increase Mr. Duda’s and Mr. Koman’s salary by 3.0%, to increase Mr. Khoury’s salary by 7.0% and to increase Mr. Kill’s salary by 5.0%. The Compensation Committee decided to maintain Mr. Glandon’s salary at the same level for fiscal 2016 as fiscal 2015. | |

| ● | The Compensation Committee made fiscal 2016 annual performance-based cash bonus awards. For Messrs. Duda, Koman and Khoury, 70% of the annual performance-based cash bonus continued to be based on a pre-tax income measure (as adjusted for acquisitions and related expenses and divestitures and related gains/losses and expenses) and 30% was based on sales objectives and/or individual objectives. For Mr. Kill, the pre-tax income measure represents 30% of the annual performance-based cash bonus with 70% tied to sales objectives. The maximum amount payable with respect to the pre-tax income measure was set at 200% of the amount payable at the target level of performance in order to align the award with competitive practice among the peer group. |

| 19 |

Our executive compensation program contains the following components and features that are designed to align the interests of our named executive officers and shareholders.

| ● | No excessive post-termination benefits: Our executives do not participate in pension plans or receive other post-retirement benefits, nor do they generally have employment or severance agreements (other than in connection with a change of control). | |

| ● | No “single trigger” change of control benefits: We maintain “double-trigger” change of control agreements, and the executives are only entitled to a severance payment if an executive is terminated without cause or an executive terminates for good reason subsequent to a change of control. In addition, awards under our Fiscal 2016 LTI Program do not automatically vest upon a change in control. | |

| ● | No excise tax gross ups: We do not provide for gross-up payments for excise taxes our executive officers may incur in connection with a change of control. | |

| ● | Robust performance-based incentives: In general, a significant amount of each of our named executive officer’s compensation is variable compensation and “at risk” for non-payment if we fail or the executive fails to meet performance targets. Consistent with our pay-for-performance philosophy, approximately 49.6% of our Chief Executive Officer’s fiscal 2016 compensation is composed of performance-based compensation, consisting of one-fifth of the grant date fair value of the fiscal 2016 performance-based RSAs (at target performance), and the annual performance-based cash bonus. | |

| ● | Disclosure of performance measures: We disclose the performance measures for the RSAs awarded pursuant to the Fiscal 2016 LTI Program and our fiscal 2016 performance-based annual bonuses in this Compensation Discussion and Analysis. | |

| ● | Equity compensation best practices: Our 2014 Omnibus Incentive Plan contains certain restrictions that reflect sound corporate governance principles, including the following: |

| − | dividends on performance-based stock awards and dividend equivalents on performance-based stock unit awards are paid only to the extent the underlying awards vest; and | |

| − | awards to employees are subject to the following minimum vesting requirements: (i) stock options, performance-based restricted stock, restricted stock units or performance units − at least one year; and (ii) time-based restricted stock, restricted stock units or performance units − at least three years, with no more frequent than ratable vesting over the vesting period. The minimum vesting requirements are not applicable in the event vesting is accelerated under certain circumstances such as death or disability, and the plan provides for an exception to the minimum vesting requirement for up to ten percent (10%) of the number of shares authorized for issuance under the plan. |

| ● | Use of an independent compensation consultant: The Compensation Committee directly engages an independent compensation consultant to review the competitiveness and effectiveness of our executive compensation program. | |

| ● | Executive officer stock ownership requirements: We require all of our executive officers to hold substantial amounts of our common stock. Our Chief Executive Officer is expected to own stock with a value at least equal to six (6) times his base salary. In addition, shares of common stock underlying the RSUs awarded under the Fiscal 2011 LTI Program and the Fiscal 2016 LTI Program will not be delivered to the executive until the earlier of the executive’s termination of employment or a change of control of Methode. |

| 20 |

| ● | Incentive “clawback” policy. In the event we are required to restate our financial statements due to material noncompliance, our Incentive Compensation Recoupment Policy requires us to recover from our current or former executive officers certain amounts of incentive-based compensation paid within the prior three years. | |

| ● | Policy prohibiting hedging or pledging our stock: Our Insider Trading Policy prohibits our directors, executive officers and certain key employees from engaging in certain transactions involving our common stock, including options trading, short sales, derivative transactions and hedging transactions. In addition, these directors, executive officers and key employees are prohibited from holding our common stock in a margin account or otherwise pledging our common stock as collateral for a loan. |

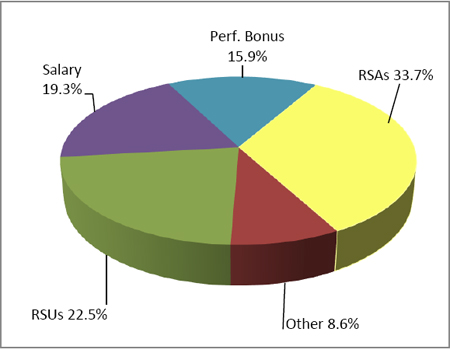

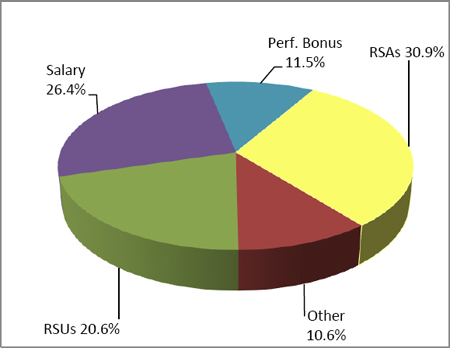

As noted above, a significant amount of our named executive officers’ compensation is “at risk” for non-payment if we fail or the executive fails to meet performance targets. The following charts illustrate the components of fiscal 2016 compensation for our Chief Executive Officer and for our other named executive officers.*

Chief Executive Officer

Other Named Executive Officers

*We have included one-fifth of the grant date fair value of the performance-based RSAs (at target performance) and RSUs as reflected in the Alternative Summary Compensation Table on page 33 as a component of fiscal 2016 compensation.

| 21 |

We encourage you to read this Compensation Discussion and Analysis for a detailed discussion and analysis of our executive compensation program.

Objectives and Measurement Principles

Our executive compensation program supports our objective of enhancing shareholder value through a competitive program that attracts and retains high-quality talent and rewards executives for demonstrating strong leadership and delivering results. Our executive compensation program is designed to:

| ● | Provide executives with a competitive pay arrangement. | |

| ● | Link short-term cash incentive pay to achievement of company objectives for pre-tax income and new sales, and in certain cases, individual objectives. | |

| ● | Link long-term equity incentives to achievement of EBITDA objectives, as adjusted for certain acquisitions and divestitures. | |

| ● | Align executive interests with shareholder interests by providing for capital accumulation through awards of RSAs and RSUs and encourage significant ownership of our common stock by our executive officers. |

Our Compensation Process

Our Overall Process. Our Compensation Committee is comprised entirely of independent directors and meets as often as necessary to perform its duties. In fiscal 2016, our Compensation Committee met 8 times. Our Compensation Committee typically meets with Donald Duda, Chief Executive Officer, and, where appropriate, Douglas Koman, Chief Financial Officer.

Our Compensation Committee annually engages a compensation consultant to review the competitiveness and effectiveness of our executive compensation program and annually reviews summaries of our named executive officers’ compensation. Our Compensation Committee also annually reviews company performance relative to peers and survey data.

Our Chief Executive Officer’s compensation is determined by our Compensation Committee. Management does not make recommendations to our Compensation Committee regarding compensation elements with respect to Mr. Duda’s compensation. For named executive officers other than Mr. Duda, compensation packages are developed and recommended by Mr. Duda, in consultation with Mr. Koman, based on guidelines provided by our Compensation Committee. Our Compensation Committee determines whether to approve these recommendations, subject to any modifications that it may deem appropriate.

Role of Compensation Consultant. Since 2013, Frederic W. Cook & Co., Inc. (“FWC”) has provided independent executive compensation consulting services to the Compensation Committee. FWC is retained by and reports to the Compensation Committee. During fiscal 2016, FWC provided the following services:

| ● | participated in the design of the Company’s executive compensation program and assisted the Compensation Committee in evaluating the linkage between pay and performance; | |

| ● | assisted the Compensation Committee in developing a compensation peer group to be used for evaluating compensation decisions; | |

| ● | provided and reviewed market data and advised the Compensation Committee on setting executive compensation and the competitiveness and reasonableness of the Company’s executive compensation program; | |

| ● | reviewed and advised the Compensation Committee regarding the elements of the Company’s executive compensation program, each as relative to the Company’s peers and survey data; |

| 22 |

| ● | reviewed and advised the Compensation Committee with respect to the Fiscal 2016 LTI Program; and | |

| ● | reviewed and advised the Committee regarding regulatory, governance, disclosure and other technical matters. |

The Compensation Committee reviewed information provided by FWC addressing the independence of FWC and the representatives serving the Committee. Based on this information, the Compensation Committee concluded that the work performed by FWC and its representatives involved in the engagement did not raise any conflict of interest and that FWC and such representatives are independent from the Company’s management.

Consideration of 2015 Say-on-Pay Vote Results. At our 2015 annual meeting, our shareholders approved our fiscal 2015 executive compensation, with approximately 98% of voted shares cast in favor of the say-on-pay resolution. Our Compensation Committee considered the results of the 2015 say-on-pay vote along with other factors when making executive compensation decisions.

Market Benchmarking and Positioning of Fiscal 2016 Executive Compensation

We strive to provide compensation opportunities that are market competitive. In order to assist the Compensation Committee in achieving this objective for fiscal 2016, FWC was retained to conduct a review of our executive compensation peer group and benchmark our executive compensation program using a custom peer group and third-party survey data. The Compensation Committee considers this benchmarking information in reviewing each element of our compensation program.

After considering the advice of FWC, the Compensation Committee adopted a new peer group to be used in executive compensation benchmarking for fiscal 2016 pay decisions. The peer group was changed in light of the Company’s significant growth over the prior two years. Based on the advice of FWC, the Compensation Committee approved using the fiscal 2015 peer group for fiscal 2016, subject to a few modifications. One former peer company, Measurement Specialties, was eliminated since it had been acquired and another former peer company, Powell Industries, was eliminated since it no longer satisfied the Compensation Committee’s criteria for the peer group as summarized below. Two new peer companies, OSI Systems and TTM Technologies, were added which satisfy the relevant criteria.

The peer group used for benchmarking purposes in fiscal 2016 was selected using the following criteria:

| ● | Size as measured by revenue – we generally targeted companies with revenue not less than half nor more than two times our annual revenue. | |

| ● | Size as measured by market capitalization – we generally targeted companies with market capitalization not less than one-third nor more than three times our market capitalization. | |

| ● | Similar-type businesses – we generally targeted companies that are multinational and engage in businesses with similar technology, products and markets. |

For compensation decisions affecting fiscal 2016 compensation, the peer group included the following companies:

| CTS Corporation | IPG Photonics Corporation | Rogers Corporation | |

| Dorman Products, Inc. | Littelfuse, Inc. | Standard Motor Products, Inc. | |

| Drew Industries, Incorporated | MTS Systems Corporation | Stoneridge, Inc. | |

| Franklin Electric Company, Inc. | OSI Systems, Inc. | TTM Technologies, Inc. | |

| Gentherm Incorporated | Remy International, Inc. | Universal Electronics Inc. |

In benchmarking our compensation program for fiscal 2016, the Compensation Committee reviewed information compiled by FWC from the following third-party executive pay surveys: (i) 2014 Mercer Executive Benchmark; (ii) 2014 Hewitt Total Compensation Management; (iii) 2014 Towers Watson U.S. Compensation Data Bank; and (iv) 2014 Towers Watson Top Management.

| 23 |

As a general policy, we targeted fiscal 2016 executive officer total direct compensation (salary, annual cash bonus and long-term incentive compensation) and each component thereof in the 50th to 75th percentile range of competitive practice, which aligned with the Company’s relative positioning in terms of revenues, net income and market capitalization versus its peer group. In making benchmarking determinations for fiscal 2016 compensation, the Compensation Committee assumed that each executive would achieve the target level of performance under all performance-based awards. In addition, in valuing the fiscal 2016 RSA and RSU awards, the Compensation Committee assumed each executive would achieve the target level of performance under the RSAs and included one-fifth of the grant date fair value of these shares in these comparative calculations since the Fiscal 2016 LTI Program is intended to cover all long-term incentive grants to the participants through fiscal 2020.

In setting each compensation component for our executive officers, the Compensation Committee considered the competitive market data, together with other relevant factors, including the individual performance and experience of each executive, retention issues, internal pay equity and consistency issues, the Company’s performance, expected future contributions of each executive, historical compensation levels, tenure and industry conditions. These and other factors may affect whether one or more of the compensation components for any of our executive officers falls outside of the benchmark range. In addition, the total direct compensation, annual cash bonus and long-term incentive compensation for one or more of our executive officers could be above or below this target range depending on the amounts earned under the performance-based awards.

Consistent with our pay-for-performance philosophy, our executive compensation program is generally structured so that a significant amount of each of our named executive officers’ compensation is variable compensation and “at risk” for non-payment if we fail or the executive fails to meet performance targets.

Components of Fiscal 2016 Compensation

Salary. Our Compensation Committee establishes salaries on an annual basis, taking into account the guideline benchmark target, levels of responsibility, prior experience and breadth of knowledge, potential for advancement, recent promotions, past performance, internal equity issues and external pay practices. In setting fiscal 2016 salary levels, the Compensation Committee reviewed advice from FWC regarding market practices and considered Mr. Duda’s recommendations for officers other than himself.

After deliberation, the Compensation Committee decided to increase Mr. Duda’s and Mr. Koman’s salary by 3.0%, to increase Mr. Khoury’s salary by 7.0% and to increase Mr. Kill’s salary by 5.0%. The Compensation Committee decided to maintain Mr. Glandon’s salary at the same level for fiscal 2016 as fiscal 2015.

Annual Performance-Based Bonuses. In July 2015, our Compensation Committee established fiscal 2016 annual performance-based cash bonus opportunities for certain of our executive officers after considering the guideline benchmark target, the individual performance and experience of each executive, retention issues, internal pay equity and industry conditions. The Compensation Committee reviewed advice from FWC regarding market practices and considered Mr. Duda’s recommendations for officers other than himself. In setting the performance measures, our Compensation Committee considered, among other matters, past performance, the fiscal 2016 operating budget, Methode’s strategic plan, product development matters and general economic conditions. The Compensation Committee determined that 70% of the annual performance-based cash bonus for Messrs. Duda, Koman and Khoury would continue to be based on a pre-tax income measure (as adjusted for acquisitions and related expenses and divestitures and related gains/losses and expenses) and 30% based on sales objectives and/or individual objectives. For Mr. Kill, the pre-tax income measure represents 30% of the annual performance-based cash bonus and 70% is tied to sales objectives. The maximum amount payable with respect to the pre-tax income measure was set at 200% of the amount payable at the target level of performance in order to align the award with competitive practice among the peer group. After considering Mr. Glandon’s transition to a new role within the Company, the Compensation Committee decided not to award him an annual performance-based bonus for fiscal 2016.

| 24 |

Set forth below is an outline of the annual performance-based cash bonus awards for fiscal 2016 performance, including the maximum bonus, the relevant performance measures and the bonus paid.

Executive |

Maximum Bonus | Performance Measures and Amounts Payable* | Bonus Earned | |||