Exhibit 13

ANNUAL REPORT

OF THE TRUSTEES OF

MESABI TRUST

For The Year Ended January 31, 2012

ADDRESS

Mesabi Trust

c/o Deutsche Bank Trust Company Americas

Trust & Securities Services — GDS

60 Wall Street, 27th Floor

New York, NY 10005

(904) 271-2520 (telephone)

www.mesabi-trust.com

REGISTRAR AND TRANSFER AGENT

Deutsche Bank Trust Company Americas

LEGAL COUNSEL

Oppenheimer Wolff & Donnelly LLP

REGISTRANT INFORMATION

Mesabi Trust maintains a website that provides access to its annual, quarterly, and other reports it files with the Securities and Exchange Commission. Such reports can be accessed at www.mesabi-trust.com. Mesabi Trust will provide, upon the written request of any Unitholder addressed to the Trustees at the above address and without charge to such Unitholder, (i) a paper copy of Mesabi Trust’s Annual Report on Form 10-K for the fiscal year ended January 31, 2012 as filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, and (ii) the Trustees Code of Ethics.

Special Note Regarding Forward-Looking Statements

Certain statements contained in this document are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All such forward-looking statements, including those statements estimating calendar year 2012 production or shipments, are based on input from the lessee/operator (and its parent corporation) of the mine located on the lands owned and held in trust for the benefit of the holders of units of beneficial interest of Mesabi Trust. These statements may be identified by the use of forward-looking words, such as “may,” “will,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other similar words. Such forward-looking statements are inherently subject to known and unknown risks and uncertainties. Actual results and future developments could differ materially from the results or developments expressed in or implied by these forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to, volatility of iron ore and steel prices, market supply and demand, regulation or government action, litigation and uncertainties about estimates of reserves, and those described under the caption “Risk Factors” in this annual report. Mesabi Trust undertakes no obligation to make any revisions to the forward-looking statements contained in this filing or to update them to reflect circumstances occurring after the date of this filing.

OVERVIEW

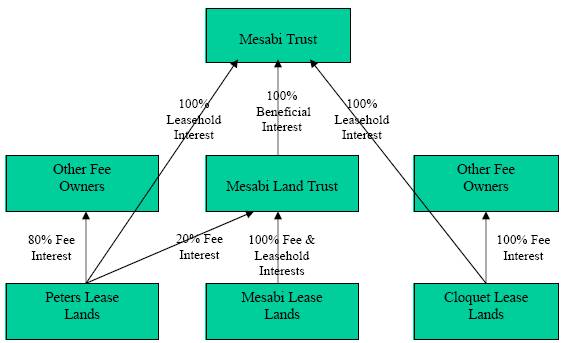

Mesabi Trust (“Mesabi Trust” or the “Trust”), formed pursuant to an Agreement of Trust dated July 18, 1961 (the “Agreement of Trust”), is a trust organized under the laws of the State of New York. Mesabi Trust holds all of the interests formerly owned by Mesabi Iron Company, including all right, title and interest in the Amendment of Assignment, Assumption and Further Assignment of Peters Lease (the “Amended Assignment of Peters Lease”), the Amendment of Assignment, Assumption and Further Assignment of Cloquet Lease (the “Amended Assignment of Cloquet Lease” and together with the Amended Assignment of Peters Lease, the “Amended Assignment Agreements”), the beneficial interest in the Mesabi Land Trust (as such term is defined below) and all other assets and property identified in the Agreement of Trust. The Amended Assignment of Peters Lease relates to an Indenture made as of April 30, 1915 among East Mesaba Iron Company (“East Mesaba”), Dunka River Iron Company (“Dunka River”) and Claude W. Peters (the “Peters Lease”) and the Amended Assignment of Cloquet Lease relates to an Indenture made May 1, 1916 between Cloquet Lumber Company and Claude W. Peters (the “Cloquet Lease”).

The Agreement of Trust specifically prohibits the Trustees from entering into or engaging in any business. This prohibition seemingly applies even to business activities the Trustees may deem necessary or proper for the preservation and protection of the Trust Estate. Accordingly, the Trustees’ activities in connection with the administration of Trust assets are limited to collecting income, paying expenses and liabilities, distributing net income to the holders of Certificates of Beneficial Interest in Mesabi Trust (“Unitholders”) after the payment of, or provision for, such expenses and liabilities, and protecting and conserving the assets held. Because the Units of the Trust are registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 and are listed on the New York Stock Exchange, the Trustees are also responsible for ensuring that the Trust maintains compliance with all applicable laws, rules and regulations. Deutsche Bank Trust Company Americas, the Corporate Trustee, performs certain administrative functions for the Trust.

The Trustees do not intend to expand their responsibilities beyond those permitted or required by the Agreement of Trust, the Amendment to the Agreement of Trust dated October 25, 1982 (the “Amendment”), and those required under applicable law. The Trust has no employees, but it engages independent consultants to assist the Trustees in, among other things, monitoring the amount and sales prices of iron ore products shipped from Silver Bay, Minnesota, based on information supplied to the Trustees by Northshore Mining Company (“Northshore”), the lessee/operator of the Mesabi Trust lands, and its parent company Cliffs Natural Resources Inc (“Cliffs”). References to Northshore in this Annual Report, unless the context requires otherwise, are applicable to Cliffs as well.

The information regarding amounts and sales prices of shipped iron ore products is used to compute the royalties payable to the Trust by Northshore. The Trustees request material information, from time to time, for use in the Trust’s periodic reports and as part of their evaluation of the Trust’s disclosure controls and procedures. The Trustees rely on Northshore to provide accurate and timely information for use in the Trust’s current, periodic and annual reports filed with the Securities and Exchange Commission.

Pursuant to a ruling from the Internal Revenue Service, which ruling was based on the terms of the Agreement of Trust including the prohibition against entering into any business, the Trust is not taxable as a corporation for Federal income tax purposes. Instead, the Unitholders are considered “owners” of the Trust and the Trust’s income is taxable directly to the Unitholders. In accordance with the Agreement of Trust, the Trust will terminate twenty-one years after the death of the survivor of twenty-five persons named in an exhibit to the Agreement of Trust, the youngest of whom is believed to be fifty-one years old.

RISK FACTORS

The results of operations and financial condition of the Trust are subject to various risks. Some of these risks are described below, and you should take such risks into account in evaluating the Trust or any investment decision involving the Trust. This section does not describe all risks that may be applicable to the Trust and it is intended only as a summary of certain material risk factors. More detailed information concerning the risk factors described below is contained in other sections of this Annual Report.

The Trustees have no control over the operations and activities of Cliffs or Northshore.

Except within the framework of the Amended Assignment Agreements, neither the Trust nor the Trustees have any control over the operations and activities of Cliffs or its wholly-owned subsidiary, Northshore. Accordingly, the income of the Trust is highly dependent upon the activities and operations of Northshore, and the terms and conditions of the Amended Assignment Agreements. Northshore together with Cliffs, without any influence from the Trust, control: (i) historical operating data, including iron ore production volumes, marketing of iron ore products, operating and capital expenditures as they relate to Northshore, environmental and other liabilities and the effects of regulatory changes; (ii) plans for Northshore’s future production, operations and capital expenditures; (iii) geological data relating to iron ore reserve estimates; (iv) shipments of iron ore products to customers of Cliffs; and (v) the provisions and pricing under the Cliffs Pellet Agreements. Any substantial alteration of Cliffs’ business or the operations, production and shipments by Northshore could adversely affect the income of the Trust.

The stability of Cliffs’ North American iron ore operations and the price adjustment provisions in the North American iron ore supply agreements with Cliffs’ customers could have a significant effect on the cash available for distribution to the Trust’s Unitholders.

In its Form 10-K filed February 16, 2012, Cliffs reported that virtually all of its North American iron ore sales volume will be sold under term supply agreements to a limited number of customers. According to the Form 10-K filed by Cliffs, sales volume under these agreements is largely dependent on customer requirements, and in some cases, Cliffs is the sole supplier of iron ore pellets to its customers. Contractual disputes with any of Cliffs’ significant customers or failure to renew or replace such agreements with similar agreements could result in lower sales volume and lower sales prices, which could adversely affect the royalties received by the Trust.

Cliffs also reported in its Form 10-K filed February 16, 2012, that its North American iron ore term supply agreements contain a number of price adjustment provisions, including adjustments based on general industrial inflation rates, the price of steel and the international price of iron ore pellets, among other factors, that allow Cliffs to adjust the prices under those agreements generally on an interim and annual basis. Mesabi Trust is not a party to any of the supply agreements Cliffs has with its customers. Factors that could result in price adjustments include measures of general industrial inflation (e.g., the producers price index), steel prices and international pellet prices. These market prices are dependent upon supply and demand relationships and a variety of other factors over which the Trust has no control. Cliffs’ price adjustment provisions are weighted and some are subject to annual collars, which limit Cliffs’ ability to raise prices to match international levels and fully capitalize on strong demand for iron ore.

Additionally, Cliffs has reported that during the first quarter of 2010, the world’s largest iron ore producers began to move away from the annual international benchmark pricing mechanism in favor of a shorter-term, more flexible pricing system. According to Cliffs’ Form 10-K, Cliffs reached final pricing settlements with a majority of its U.S. Iron Ore customers through the end of 2011 for the 2011 contract year.

However, in some cases Cliffs is still working to revise components of the pricing calculations referenced within its supply agreements to incorporate new pricing mechanisms as a result of the changes to historical benchmark pricing. The Trust has been informed that the supply agreements that Cliffs has with ArcelorMittal that involve iron ore products shipped from Northshore do not use a world market-based iron ore pricing mechanism. As discussed elsewhere in this Annual Report on Form 10-K, the price adjustments mechanisms under Cliffs’ North American term supply agreements, which can be positive or negative, may result in significant variations in royalties received by Mesabi Trust from quarter to quarter and year to year. These variations could adversely affect the royalties received by the Trust and, in turn, the resulting cash available for distribution to Unitholders.

Royalties received by the Trust, and distributions paid to Unitholders, in any particular quarter are not necessarily indicative of royalties or distributions that will be paid in any subsequent quarter or for a full year.

Royalties received by the Trust can fluctuate significantly from quarter to quarter and year to year based upon market prices for iron ore products, the level of orders for iron ore products from Cliffs’ customers, the consumption of inventory by Cliffs’ customers, and production decisions made by Northshore. Moreover, because the royalties paid to the Trust in any particular quarter include payments made with respect to pellets shipped and sold at estimated prices that are subject to future interim and final multi-year adjustments in accordance with Cliff’s Customer Agreements, a downward trend in demand and market prices for iron and steel products could result in negative adjustments to royalties in future quarters, some of which may be significant. These negative price adjustments could have a material adverse effect on the Trust’s royalty income, which in turn could result in lower quarterly distributions, and possibly reduce or even eliminate funds available for distribution in any quarter and in some quarters may completely offset royalties otherwise payable to the Trust. Because of this, cash available for distribution to Unitholders in future quarters could be reduced, potentially materially, and in some cases, such reduction could result in no cash being available for distribution to Unitholders. As a result, the royalties received by the Trust, and the distributions paid to Unitholders, in any particular quarter are not necessarily indicative of royalties that will be received, or distributions that will be paid, in any subsequent quarter or for a full year. Based on the foregoing and the current uncertainty in the economic environment, the Trust cannot ensure that there will be adequate cash available to make a distribution to Unitholders in any particular quarter.

The Trust does not control the portion of Northshore’s shipments that will come from ore mined from Mesabi Trust lands.

The Trustees do not exert any influence over mining operational decisions and Northshore alone determines whether to mine from lands owned by the Trust or state-owned lands, based on its current production estimates and engineering plan. Northshore’s mining operations (the Peter Mitchell Mine) include mineral-producing land owned by the Trust, the State of Minnesota and others. Ore mined by Northshore from non-Trust owned lands is processed, along with ore mined from Trust-owned lands, in Northshore-owned crushing, concentrating and pelletizing facilities and is separately accounted for on a periodic basis. Northshore also has the ability to process and ship iron ore products from lands other than Mesabi Trust lands. In certain circumstances, the Trust may be entitled to royalties on those other shipments, but not in all cases. In general, the Trust will receive higher royalties (assuming all other factors are equal) if a higher percentage of shipments are from Mesabi Trust lands. The percentages of shipments from Mesabi Trust lands were 88.5%, 89.9%, 93.6%, 90.2% and 88.2% in calendar years 2011, 2010, 2009, 2008 and 2007, respectively. If Northshore decides to materially reduce the percentage of ore mined, or pellets shipped, from Mesabi Trust lands, the income of the Trust could be adversely affected.

Uncertainty or weakness in the global economic climate could adversely affect the royalties received by the Trust.

The volatile global economic climate could have a material adverse effect on the royalties received by the Trust. Uncertainties or weaknesses in global economic conditions and national or regional economic or political instability or other events could produce major changes in demand patterns and consumption of raw materials used in steel production. Moreover, such conditions could impact the hot band steel prices and various Producer Price Indexes which may affect the royalties payable to the Trust. The Trustees are not able to predict the impact the volatile global economic climate will have on future royalties payable to the Trust.

The world price of iron ore and steel are strongly influenced by international demand and global market conditions which are uncertain. Domestic demand for iron ore and steel products, which is influenced by international markets, is also uncertain. Supply and demand of iron ore products in these markets and therefore pricing can change rapidly and materially at any time. In recent years, many major iron ore suppliers increased their capacity to meet the increased demand for iron ore and steel products, particularly from China. There is a high degree of uncertainty concerning the overall demand for steel and iron ore products. Reduced demand for iron ore, especially due to a deceleration of economic growth in China, would likely result in decreased sales of products to Cliffs’ customers and decreasing prices, all of which would adversely affect royalties received by the Trust. Since the Trust is not party to any specific customer contracts that Cliffs has with its customers and because these macroeconomic forces are difficult to forecast, the Trustees are not able to predict the extent to which reduced demand and lower prices for iron ore products will adversely affect royalties payable to the Trust.

The royalties payable to the Trust could be adversely affected by the failure of the Trust’s independent consultants to competently perform.

As permitted by the terms of the Agreement of Trust and the Amendment, the Trustees are entitled to, and in fact do rely, upon certain independent consultants to assist the Trustees in carrying out and fulfilling their obligations as Trustees. Independent consultants perform services, render advice and produce reports with respect to monthly production and shipments, which include figures on crude ore production, iron ore pellet production, iron ore pellet shipments, and discussions concerning the condition and accuracy of the scales used to weigh iron ore pellets produced at Northshore’s facilities. The Trustees have also retained an accounting firm to provide non-audit services, including preparing financial statements, reviewing financial data related to shipping and sales reports provided by Northshore and reviewing the schedule of leasehold and fee royalties payable to the Trust. The Trustees believe that the independent consultants are qualified to perform the services and functions assigned to them. Nevertheless, any negligence or the failure of any such independent consultants to competently perform could adversely affect the royalties received by the Trust.

The Trust relies on Cliffs’ estimates of recoverable reserves and if those estimates are inaccurate the total potential future royalty stream to the Trust and distributions payable to each Unitholder may be adversely affected.

The Trustees do not participate in preparing the ore reserve estimate reported by Cliffs. According to Cliffs’ Form 10-K, Cliffs regularly evaluates its iron ore reserves based on revenues and costs and updates them as required in accordance with Securities Act Industry Guide 7, promulgated by the U.S. Securities and Exchange Commission. In 2010, the Trustees engaged an independent firm of geological experts to evaluate the process Cliffs uses to estimate the mineral reserves at the Peter Mitchell Mine. Still, there are numerous uncertainties inherent in estimating quantities of reserves of mineral producing lands and such estimates

necessarily depend upon a number of variable factors and assumptions, such as production capacity, effects of regulations by governmental agencies, future prices for iron ore, future industry conditions and operating costs, severance and excise taxes, development costs and costs of extraction and reclamation costs, all of which may in fact vary considerably from actual results. For these reasons, estimates of the economically recoverable quantities of mineralized deposits attributable to the lands owned by Mesabi Trust and the classifications of such reserves based on the risk of recovery prepared by different engineers or by the same engineers at different times may vary substantially as the criteria change. Cliffs’ estimate of the ore reserves could be negatively affected by future industry conditions, geological conditions and ongoing mine planning at the Peter Mitchell Mine. Actual reserves and therefore actual royalties will likely vary from estimates, and if such variances are negative and material, the expected royalties of the Trust could be adversely affected and the value of the Trust’s Units could decline.

The operations at Northshore are largely dependent on a single-source energy supplier.

The operations at Northshore are largely dependent on Silver Bay Power Company, a 115 megawatt power plant, for its electrical supply. Silver Bay Power Company, which is wholly owned by Northshore, had an interconnection agreement with Minnesota Power, Inc. for backup power, and sells 40 megawatts of excess power capacity to Xcel Energy under a contract that ended in 2011. In March 2008, Northshore reactivated one of its furnaces, resulting in a shortage of electrical power of approximately 10 megawatts. As a result, supplemental electric power is purchased by Northshore from Minnesota Power under an agreement that is renewable yearly with one-year termination notice required. The contract expired on June 30, 2011, which coincided with the expiration of Silver Bay Power’s 40 megawatt sales agreement with Xcel Energy. A significant interruption in service from Silver Bay Power Company due to vandalism, terrorism, weather conditions, natural disasters, or any other cause could cause a decrease in production capacity or require a temporary shutdown of Northshore’s operations. In addition, one natural gas pipeline serves all of Cliffs’ Minnesota mines, and a pipeline failure could idle or substantially impair the operations at Northshore. Any substantial interruption of, or material reduction in, Northshore’s operations could adversely affect the royalties received by the Trust.

The mining operations of Northshore are subject to extensive governmental regulation and Northshore is subject to risks related to its compliance with federal and state environmental regulations.

Northshore, as the owner/operator of the Peter Mitchell Mine, is subject to various federal, state and local laws and regulations on matters such as employee health and safety, air quality, water pollution, plant and wildlife protection, reclamation and restoration of mining properties, the discharge of materials into the environment, and the effects that mining has on groundwater quality and availability. Northshore is required to maintain permits and approvals issued by federal and state regulatory agencies and its mining operations are subject to inspection and regulation by the Mine Safety and Health Administration of the United States Department of Labor (“MSHA”) under the provisions of the Mine Safety and Health Act of 1977. The Occupational Safety and Health Administration (“OSHA”) also has jurisdiction over safety and health standards not covered by MSHA and the Minnesota Pollution Control Agency (“MPCA”) regulates various aspects of Northshore’s operations. Northshore may from time to time be involved in litigation with the MPCA over certain aspects of its operation but because the Trust has no control over Northshore’s operations, the potential impact of these proceedings cannot be determined. Moreover, Northshore is solely responsible for its compliance with any laws, regulations or permits applicable to Northshore’s operations and therefore the Trust cannot determine whether Northshore has been or will continue to be in compliance with such laws and regulations. If Northshore fails to comply with these laws, regulations or permits, it could be subject to fines or

other sanctions, any of which could have an adverse effect on its operations and its ability to ship iron ore products from Silver Bay, Minnesota, which could, in turn, have an adverse effect on the royalties paid to the Trust.

Equipment failures and other unexpected events at Northshore may lead to production curtailments or shutdowns.

Interruptions in production capabilities at the mine operated by Northshore may have an adverse impact on the royalties payable to the Trust. In addition to planned production shutdowns and curtailments, equipment failures, the Northshore facilities are also subject to the risk of loss due to unanticipated events such as fires, explosions or extreme weather conditions. The manufacturing processes that take place in Northshore’s mining operations, as well as in its crushing, concentrating and pelletizing facilities, depend on critical pieces of equipment, such as drilling and blasting equipment, crushers, grinding mills, pebble mills, thickeners, separators, filters, mixers, furnaces, kilns and rolling equipment, as well as electrical equipment, such as transformers. It is possible that this equipment may, on occasion, be out of service because of unanticipated failures or unforeseeable acts of vandalism or terrorism. In addition, because the Northshore mine and processing facilities have been in operation for several decades, some of the equipment is aged. Because the Trustees have no control over the operations or maintenance of the equipment at Northshore, a shutdown or reduction in capacity may come with little or no advance warning. The remediation of any interruption in production capability at Northshore could require Cliffs to make large capital expenditures which may take place over an extended period of time. A shutdown or reduction in operations at Northshore could adversely affect the royalties paid to the Trust.

If steelmakers use methods other than blast furnace production to produce steel, shut down or reduce production using blast furnaces, the demand for iron ore pellets may decrease.

Demand for iron ore pellets is determined by the operating rates for the blast furnaces of steel companies. However, not all finished steel is produced by blast furnaces; finished steel also may be produced by other methods that do not require iron ore pellets. For example, steel “mini-mills,” which are steel recyclers, generally produce steel by using scrap steel, not iron ore pellets, in their electric furnaces. North American steel producers also can produce steel using imported iron ore or semi-finished steel products, which eliminates the need for domestic iron ore. Environmental restrictions on the use of blast furnaces also may reduce the use of their blast furnaces in steel production. Because the maintenance of blast furnaces can require substantial capital expenditures, manufacturers may choose not to maintain their blast furnaces, and some of them may not have the resources necessary to adequately maintain their blast furnaces. If steel manufacturers significantly alter the methods they use to produce steel or otherwise substantially reduce their use of iron ore pellets, demand for iron ore pellets will decrease, which could adversely affect the royalties paid to the Trust.

Risk factors affecting Cliffs’ North American Iron Ore Business and Operations at Northshore could have a material adverse effect on the royalties of the Trust.

Because substantially all of the Trust’s revenue is derived from iron ore products shipped by Northshore from Silver Bay, Northshore’s iron ore pellet processing and shipping activities directly impact the Trust’s revenues in each quarter and each year. A number of factors affect Cliffs’ operations, including Northshore’s production and shipment volume. These risk factors, which are described in Cliffs’ Form 10-K filed February 16, 2012, include, among others, the global economic climate and financial market conditions, economic conditions in the iron ore industry, extensive governmental regulation relating to environmental matters and the costs and risks related thereto, availability of substitute materials, pricing by domestic and international

competitors, long-term customer contracts or arrangements by Northshore or its competitors, price adjustment provisions in Cliffs’ North American term supply agreements (which take into account various price indexes), availability of ore boats, production at Northshore’s mining operations, natural disasters, shipping conditions in the Great Lakes and production at Northshore’s pelletizing/processing facility. Specifically, if any portion of Northshore’s pelletizing lines becomes idle for any reason, production, shipments and, consequently, the royalties paid to the Trust could be adversely affected.

The Trustees are not subject to annual election and, as a result, the ability of the holders of Certificates of Beneficial Interest to influence the policies of the Trust may be limited.

Directors of a corporation are generally subject to election at each annual meeting of stockholders or, in the case of staggered boards, at regular intervals. Under the Agreement of Trust, however, the Trust is not required to hold annual meetings of holders of Certificates of Beneficial Interest to elect Trustees and Trustees generally hold office until their death, resignation or disqualification. As a result, the ability of holders of Certificates of Beneficial Interest to effect changes in the composition of the Board of Trustees and the policies of the Trust is significantly more limited than that of the stockholders of a corporation.

OVERVIEW OF TRUST’S ROYALTY STRUCTURE

Leasehold royalty income constitutes the principal source of the Trust’s revenue. Royalty rates are determined in accordance with the terms of Mesabi Trust’s leases and assignments of leases. Three types of royalties, as well as royalty bonuses, comprise the Trust’s royalty income:

· Base overriding royalties. Base overriding royalties have historically constituted the majority of Mesabi Trust’s royalty income. Base overriding royalties are determined by both the volume and selling price of iron ore products shipped. Northshore is obligated to pay Mesabi Trust base overriding royalties in varying amounts, based on the volume of iron ore products shipped. Base overriding royalties are calculated as a percentage of the gross proceeds of iron ore products produced at Mesabi Trust lands (and to a limited extent other lands) and shipped from Silver Bay, Minnesota. The percentage ranges from 2-1/2% of the gross proceeds for the first one million tons of iron ore products so shipped annually to 6% of the gross proceeds for all iron ore products in excess of 4 million tons so shipped annually. Base overriding royalties are subject to interim and final price adjustments under the Cliffs Pellet Agreements and, as described elsewhere in this report, such adjustments may be positive or negative.

· Royalty bonuses. The Trust earns royalty bonuses when iron ore products shipped from Silver Bay are sold at prices above a threshold price per ton. The royalty bonus is based on a percentage of the gross proceeds of product shipped from Silver Bay and sold at prices above a threshold price. The threshold price is adjusted (but not below $30.00 per ton) on an annual basis for inflation and deflation (the “Adjusted Threshold Price”). The Adjusted Threshold Price was $48.81 per ton for calendar year 2010, $49.35 per ton for calendar year 2011 and will be $50.54 per ton for calendar year 2012. The royalty bonus percentage ranges from 1/2 of 1% of the gross proceeds (on all tonnage shipped for sale at prices between the Adjusted Threshold Price and $2.00 above the Adjusted Threshold Price) to 3% of the gross proceeds (on all tonnage shipped for sale at prices $10.00 or more above the Adjusted Threshold Price). Royalty bonuses are subject to price adjustments under the Cliffs Pellet Agreements (described elsewhere in this Annual Report); such adjustments may be positive or negative. See the section entitled “Comparison of Financial Results

for Fiscal Years ended January 31, 2012 and January 31, 2011” beginning on page 12 of this Annual Report for more information.

· Fee royalties. Fee royalties have historically constituted a smaller component of the Trust’s total royalty income. Fee royalties are payable to the Mesabi Land Trust, a Minnesota land trust, which holds a 20% interest as fee owner in the Amended Assignment of Peters Lease. Mesabi Trust holds the entire beneficial interest in the Mesabi Land Trust for which U.S. Bank N.A. acts as the corporate trustee. Mesabi Trust receives the net income of the Mesabi Land Trust, which is generated from royalties on the amount of crude ore mined after the payment of expenses to U.S. Bank N.A. for its services as corporate trustee. Crude ore is the source of iron oxides used to make iron ore pellets and other products. The fee royalty on crude ore is based on an agreed price per ton, subject to certain indexing.

· Minimum advance royalties. Northshore’s obligation to pay base overriding royalties and royalty bonuses with respect to the sale of iron ore products generally accrues upon the shipment of those products from Silver Bay. However, regardless of whether any shipment has occurred, Northshore is obligated to pay to Mesabi Trust a minimum advance royalty. Each year, the amount of the minimum advance royalty is adjusted (but not below $500,000 per annum) for inflation and deflation. The minimum advance royalty was $813,729 for calendar year 2010, $822,783 for calendar year 2011 and will be $844,452 for calendar year 2012. Until overriding royalties (and royalty bonuses, if any) for a particular year equal or exceed the minimum advance royalty for the year, Northshore must make quarterly payments of up to 25% of the minimum advance royalty for the year. Because minimum advance royalties are essentially prepayments of base overriding royalties and royalty bonuses earned each year, any minimum advance royalties paid in a fiscal quarter are recouped by credits against base overriding royalties and royalty bonuses earned in later fiscal quarters during the year.

The current royalty rate schedule became effective on August 17, 1989 pursuant to the Amended Assignment Agreements, which the Trust entered into with Cyprus Northshore Mining Corporation (“Cyprus NMC”). Pursuant to the Amended Assignment Agreements, overriding royalties are determined by both the volume and selling price of iron ore products shipped. In 1994, Cyprus NMC was sold by its parent corporation to Cliffs and renamed Northshore Mining Company. Cliffs now operates Northshore as a wholly owned subsidiary.

Under the relevant agreements, Northshore has the right to mine and ship iron ore products from lands other than Mesabi Trust lands. Northshore alone determines whether to conduct mining operations on Trust and/or such other lands based on its current mining and engineering plan. The Trustees do not exert any influence over mining operational decisions. To encourage the use of iron ore products from Mesabi Trust lands, Mesabi Trust receives royalties on stated percentages of iron ore shipped from Silver Bay, whether or not the iron ore products are from Mesabi Trust lands. Mesabi Trust receives royalties at the greater of (i) the aggregate quantity of iron ore products shipped that were mined from Mesabi Trust lands, and (ii) a portion of the aggregate quantity of all iron ore products shipped from Silver Bay that were mined from any lands, such portion being 90% of the first four million tons shipped from Silver Bay during such year, 85% of the next two million tons shipped during such year, and 25% of all tonnage shipped during such year in excess of six million tons.

Royalty income, which constitutes the principal source of the Trust’s revenue, comprised 99.9% of the Trust’s total revenue of the Trust in each of the fiscal years ended January 31, 2012, January 31, 2011 and

January 31, 2010. A more complete discussion of royalty rates and the manner in which they are determined is set forth under the headings “Leasehold Royalties” and “Land Trust and Fee Royalties,” beginning on pages 27 and 29, respectively, of this Annual Report.

During the course of its fiscal year some portion of royalties expected to be paid to Mesabi Trust is based in part on estimated prices for iron ore products sold under term contracts between Northshore, Cliffs and certain of their customers (the “Cliffs Pellet Agreements”). The Cliffs Pellet Agreements use estimated prices which are subject to interim and final pricing adjustments, which can be positive or negative, and which adjustments are dependent in part on multiple price and inflation index factors that are not known until after the end of a contract year. Even though Mesabi Trust is not a party to the Cliffs Pellet Agreements, these adjustments can result in significant variations in royalties received by Mesabi Trust (and in turn the resulting amount available for distribution to Unitholders by the Trust) from quarter to quarter and on a comparative historical basis, and these variations, which can be positive or negative, cannot be predicted by Mesabi Trust. In either case, these price adjustments will impact future royalties received by the Trust that become available for distribution to Unitholders.

As described elsewhere in this Annual Report, the royalty percentage paid to the Trust increases as the aggregate tonnage of iron ore products shipped, attributable to the Trust, in any calendar year increases past each of the first four one-million ton volume thresholds. Assuming a consistent sales price per ton throughout a calendar year, shipments of iron ore product attributable to the Trust later in the year generate a higher royalty to the Trust, as total shipments for the year exceed increasing levels of royalty percentages and pass each of the first four one-million ton volume thresholds.

As also described elsewhere in this Annual Report, the Trust receives a bonus royalty equal to a percentage of the gross proceeds of iron ore products (mined from Mesabi Trust lands) shipped from Silver Bay and sold at prices above the Adjusted Threshold Price. Although all of the iron ore products shipped from Silver Bay during calendar 2011 were sold at prices higher than the Adjusted Threshold Price, the Trustees are unable to project whether Cliffs will continue to be able to sell iron ore products at prices above the applicable Adjusted Threshold Price, entitling the Trust to any future bonus royalty payments.

SELECTED FINANCIAL DATA

|

Years ended on |

|

2012 |

|

2011 |

|

2010 |

|

2009 |

|

2008 |

| |||||

|

Royalty and interest income |

|

$ |

34,158,326 |

|

$ |

33,341,871 |

|

$ |

13,241,669 |

|

$ |

35,469,105 |

|

$ |

18,866,511 |

|

|

Trust expenses |

|

920,994 |

|

878,677 |

|

818,007 |

|

799,320 |

|

634,151 |

| |||||

|

Net income(1) |

|

$ |

33,237,332 |

|

$ |

32,463,194 |

|

$ |

12,423,662 |

|

$ |

34,669,785 |

|

$ |

18,232,360 |

|

|

Net income per Unit(2) |

|

$ |

2.53 |

|

$ |

2.47 |

|

$ |

0.95 |

|

$ |

2.64 |

|

$ |

1.39 |

|

|

Distributions declared Per unit(2)(3) |

|

$ |

2.53 |

|

$ |

2.485 |

|

$ |

1.15 |

|

$ |

2.48 |

|

$ |

1.35 |

|

|

Years ended on |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total Assets |

|

$ |

11,169,040 |

|

$ |

9,645,576 |

|

$ |

11,199,575 |

|

$ |

5,346,932 |

|

$ |

8,488,509 |

|

(1) The Trust, as a grantor trust, is exempt from federal and state income taxes.

(2) Based on 13,120,010 Units of Beneficial Interest outstanding during all years.

(3) The Trust declares distributions in January of each year and pays such distributions in February which is in the Trust’s next fiscal year. Because of this, distributions declared generally do not equal the amount of cash distributed in the same fiscal year. During the Trust’s fiscal year ended January 31, 2012, the Trustees distributed $2.42 per Unit (including $0.65 per Unit declared in fiscal 2011 but distributed in fiscal 2012 (February 2011)) and in fiscal 2012 declared a distribution of $0.76 per

Unit payable in February 2012, the next fiscal year. During the Trust’s fiscal year ended January 31, 2011, the Trustees distributed $2.385 per Unit (including $0.55 per Unit declared in fiscal 2010 but distributed in fiscal 2011 (February 2010)) and in fiscal 2011 declared a distribution of $0.65 per Unit payable in February 2011, the next fiscal year. During the Trust’s fiscal year ended January 31, 2010, the Trustees distributed $0.71 per Unit (including $0.11 per Unit declared in fiscal 2009 but distributed in fiscal 2010 (February 2009)) and in fiscal 2010 declared a distribution of $0.55 per Unit payable in February 2010, the next fiscal year. During the Trust’s fiscal year ended January 31, 2009, the Trustees distributed $2.885 per Unit (including $0.515 per Unit declared in fiscal 2008 but distributed in fiscal 2009 (February 2008)) and in fiscal 2009 declared a distribution of $0.11 per Unit payable in February 2009, the next fiscal year. During the Trust’s fiscal year ended January 31, 2008, the Trustees distributed $1.15 per Unit (including $0.315 per Unit declared in fiscal 2007 but distributed in fiscal 2008 (February 2007)) and in fiscal 2008 declared a distribution of $0.515 per Unit payable in February 2008, the next fiscal year. During the Trust’s fiscal year ended January 31, 2007, the Trustees distributed $1.755 per Unit (including $0.47 per Unit declared in fiscal 2006 but distributed in fiscal 2007 (February 2006)) and in fiscal 2007 declared a distribution of $0.315 per Unit payable in February 2007, the next fiscal year.

TRUSTEES’ DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Results of Operations

Comparison of Iron Ore Pellet Production and Shipments for the Fiscal Years Ended January 31, 2012, January 31, 2011 and January 31, 2010

During fiscal 2012, production attributed to Trust lands totaled approximately 5.1 million tons, an increase of 11.8% and 63.1% as compared to production for fiscal year 2011 and 2010, respectively. Shipments to Northshore’s customers attributed to the Trust totaled approximately 5 million tons during fiscal 2012. This represents a decrease of 9.7% as compared to shipments for fiscal year 2011 and an increase of 53.1% as compared to shipments for fiscal year 2010. The table below, which is based on information provided to the Trust by Northshore, shows the total production and total shipments of iron ore pellets from Mesabi Trust lands during the prior three fiscal years.

|

Fiscal Year Ended |

|

Pellets Produced from |

|

Pellets Shipped from |

|

|

January 31, 2012 |

|

5,122,249 |

|

4,961,602 |

|

|

January 31, 2011 |

|

4,580,384 |

|

5,491,700 |

|

|

January 31, 2010 |

|

3,141,395 |

|

3,241,237 |

|

Production of iron ore pellets was slightly higher for the fourth quarter of fiscal 2012 as compared to the fourth quarter of fiscal 2011, increasing 2.2%. Shipments of iron ore pellets by Northshore during the fourth quarter of fiscal 2012 increased by 43.1% as compared to the fourth quarter of fiscal 2011. The increase in shipments in the fourth quarter of fiscal 2012 was caused by an increase in orders from Northshore’s customers.

|

Three Months Ended |

|

Pellets Produced from |

|

Pellets Shipped from |

|

|

January 31, 2012 |

|

1,095,606 |

|

1,102,476 |

|

|

|

|

|

|

|

|

|

January 31, 2011 |

|

1,071,865 |

|

770,668 |

|

The table below shows the change in the percentages of production and shipments from lands owned or leased by Mesabi Trust versus the percentages of production and shipments from lands owned by the State of Minnesota and others for the most recent three fiscal years.

|

Fiscal Year Ended |

|

Percentage of |

|

Percentage of |

|

Percentage of |

|

Percentage of |

|

|

January 31, 2012 |

|

89.8 |

% |

10.2 |

% |

89.2 |

% |

10.8 |

% |

|

January 31, 2011 |

|

88.2 |

% |

11.8 |

% |

89.3 |

% |

10.7 |

% |

|

January 31, 2010 |

|

95.9 |

% |

4.1 |

% |

93.0 |

% |

7.0 |

% |

As is the case with the volume of shipments from Silver Bay, Minnesota, the Trustees cannot predict what percentage of production or shipments will be attributable to iron ore mined from Mesabi Trust lands in fiscal 2012. However, pursuant to the Amendment, Mesabi Trust will be credited with at least 90% of the first four million tons of iron ore pellets shipped from Silver Bay, Minnesota in each calendar year, at least 85% of the next two million tons of pellets shipped from Silver Bay, Minnesota in each calendar year, and at least 25% of all tons of pellets shipped from Silver Bay, Minnesota in each calendar year in excess of six million tons.

Comparison of Financial Results for Fiscal Years ended January 31, 2012 and January 31, 2011

Royalty Income

As shown in the table below, in fiscal 2012 base royalties were consistent with prior year, bonus royalties increased 5.8% and fee royalties increased 19.1%, each as compared to fiscal 2011. Accordingly, the Trust’s total royalty income increased 2.5% in fiscal 2012 as compared to fiscal 2011. The increase in royalties received by the Trust is primarily the result of higher average selling prices for each ton of iron ore products shipped from Silver Bay, Minnesota in fiscal 2012, as compared to fiscal 2011, offset by lower shipments in fiscal 2012 as compared to fiscal 2011.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2012 |

|

2011 |

|

(decrease) |

| ||

|

Base overriding royalties |

|

$ |

19,981,329 |

|

$ |

19,999,089 |

|

(0.001 |

)% |

|

Bonus royalties |

|

13,485,824 |

|

12,752,121 |

|

5.8 |

% | ||

|

Minimum advance royalty paid (recouped) |

|

— |

|

— |

|

|

| ||

|

Fee royalties |

|

687,029 |

|

576,428 |

|

19.1 |

% | ||

|

Total royalty income |

|

$ |

34,154,182 |

|

$ |

33,327,638 |

|

2.5 |

% |

The royalty amounts set forth in the table above include pricing adjustments made to royalty payments previously received by the Trust based on shipments from Silver Bay, Minnesota during prior calendar years. Depending on the year, the volume of shipments, and the interim and final price paid to the Trust for shipments from Silver Bay, Minnesota, the price adjustments provisions of the Cliffs Pellet Agreements may increase or decrease, in some cases materially, the distributions payable to Unitholders. Because the Trust is not a party to the Cliffs Pellet Agreements, the Trustees are unable to determine the extent of any pricing adjustments that may occur under the Cliffs Pellet Agreements or whether the adjustments will increase or decrease royalties received by the Trust. With the current volatility in demand and prices for iron ore and steel products, the price adjustment provisions in the Cliffs Pellet Agreements may have a significant impact on future royalties received by the Trust and the adjustments, depending on whether they are positive or negative, may increase or decrease the distributions payable to Unitholders.

Gross Income, Expenses, Net Income and Distributions

As set forth in the table below, net income for fiscal 2012 increased 2.4%, as compared to fiscal 2011, primarily due to an increase in selling prices of iron ore pellets. Total expenses for fiscal 2012 increased 4.8% as compared to fiscal 2011 due to an increase in total compensation paid to the Corporate Trustee, additional insurance expenses and higher legal fees and other fees related to the administration of the Trust. A more detailed summary of the Trust’s expenses, including legal and accounting expenses, is set forth under the heading “Trust Expenses” on page 30 of this Annual Report.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2012 |

|

2011 |

|

(decrease) |

| ||

|

Gross Income |

|

$ |

34,158,326 |

|

$ |

33,341,871 |

|

2.5 |

% |

|

Expenses |

|

920,994 |

|

878,677 |

|

4.8 |

% | ||

|

Net Income |

|

$ |

33,237,332 |

|

$ |

32,463,194 |

|

2.4 |

% |

As discussed in the paragraph above, the Trust’s total royalty income and net income for fiscal 2012 increased 2.5% and 2.4% respectively, due to higher prices paid to the Trust for shipments, offset by lower shipping activity during fiscal 2012, both as compared to fiscal year 2011. The increase in the Trust’s net income, combined with a decrease in the Trust’s cash reserve resulted in a 1.5% increase in total distributions paid to Unitholders in fiscal 2012, as compared to fiscal year 2011.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2012 |

|

2011 |

|

(decrease) |

| ||

|

Total Cash Distributions |

|

$ |

31,750,424 |

|

$ |

31,291,223 |

|

1.5 |

% |

|

Distributions Paid per Unit |

|

$ |

2.42 |

|

$ |

2.385 |

|

1.5 |

% |

Unallocated Reserve

As set forth in the table below, the Unallocated Reserve increased $43,706 or 4.4% to $1,031,508, as of January 31, 2012, as compared to $987,802 as of January 31, 2011. As of January 31, 2012, the Unallocated Reserve consisted of $643,528 in unallocated cash and U.S. Government securities and $387,980 of accrued income receivable. Comparatively, as of January 31, 2011, the Unallocated Reserve consisted of $755,016 in unallocated cash and U.S. Government securities and $232,786 of accrued income receivable.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2012 |

|

2011 |

|

(decrease) |

| ||

|

Accrued Income Receivable |

|

$ |

387,980 |

|

$ |

232,786 |

|

66.7 |

% |

|

Cash Reserve |

|

643,528 |

|

755,016 |

|

(14.8 |

)% | ||

|

Unallocated Reserve |

|

$ |

1,031,508 |

|

$ |

987,802 |

|

4.4 |

% |

The 4.4% increase in the Unallocated Reserve for the fiscal year ended January 31, 2012 as compared the fiscal year ended January 31, 2011, is the result of a $155,194 increase in the Trust’s accrued income receivable due to a higher volume of shipments during the month of January 2012 as compared to January 2011. The increase in the unallocated reserve was reduced by a $111,488 decrease in the cash reserve and the accrual of certain negative price adjustments as a result of the impact of the April 2011 negotiated settlement between Cliffs and ArcelorMittal, which is discussed below under the heading “Accrued Income Receivable.”

Accrued Income Receivable. The $155,194, or 66.7%, increase in the accrued income receivable portion of the Unallocated Reserve is the result an increased volume of shipments offset by pricing adjustments for the fiscal year ended January 31, 2012, as compared to the fiscal year ended January 31, 2011. In accordance with the Cliffs Pellet Agreements, for fiscal 2012 there were positive and negative price adjustments which are determined and finalized by Cliffs each calendar year with respect to shipments by the Trust in earlier calendar years. For the fiscal year ended January 31, 2012, the Trust accrued for $644,971 of negative price adjustments related to shipments by Northshore from Mesabi Trust lands during calendar 2010 and 2009, as a result the negotiated settlement agreement between Cliffs and its customer, ArcelorMittal. This negative price adjustment was combined with other negative price adjustments and reduced the accrued income receivable as of January 31, 2012 by a total of $984,546. See the discussion under the heading “Recent Developments” beginning on page 18 of this Annual Report for further information.

As described elsewhere in this Annual Report on Form 10-K, pricing estimates are adjusted on a quarterly basis as updated pricing information is received from Northshore. It is possible that future negative price adjustments could offset, or even eliminate, royalties or royalty income that would otherwise be payable to the Trust in any particular quarter, or at year end, thereby potentially reducing cash available for distribution to the Trust’s Unitholders in future quarters. See discussion under the heading “Risk Factors” beginning on page 3 of this Annual Report.

Cash Reserve. The Trust’s cash reserve for unexpected losses decreased 14.8% to $643,528 as of January 31, 2012 from $755,016 as of January 31, 2011. The $111,488 decrease in the Trust’s cash reserve resulted from the Trustee’s decision to use a portion of the cash reserve to pay cash distributions to Unitholders during the year ended January 31, 2012 rather than add to the Trust’s cash reserve. The Trust’s current cash reserve as of January 31, 2012 is within the range contemplated by the policy set by the Trustees.

The Trustees have determined that the unallocated cash and U.S. Government securities portion of the Unallocated Reserve should be maintained at a prudent level, usually within the range of $500,000 to $1,000,000, to meet present or future liabilities of the Trust. The actual amount of the Unallocated Reserve will fluctuate from time to time and may increase or decrease from its current level. Future distributions will be highly dependent upon royalty income as it is received, changes in estimated pricing, potential for future price adjustments and the level of Trust expenses. The amount of future royalty income available for distribution will be subject to the volume of iron ore product shipments and the dollar level of sales by Northshore. Shipping activity is greatly reduced during the winter months and economic conditions, particularly those affecting the steel industry, may adversely affect the amount and timing of such future shipments and sales. The Trustees will continue to monitor the economic and other circumstances of the Trust to strike a responsible balance between distributions to Unitholders and the need to maintain a reserve for unexpected loss contingencies at a prudent level, given the unpredictable nature of the iron ore industry, the Trust’s dependence on the actions of the lessee/operator, and the fact that the Trust essentially has no other liquid assets.

Comparison of Financial Results for Fiscal Years ended January 31, 2011 and January 31, 2010

Royalty Income

As shown in the table below, in fiscal 2011 there was a 165.9% increase in base royalties, a 136.1% increase in bonus royalties and an 88.7% increase in fee royalties, each as compared to fiscal 2010. Accordingly, the Trust’s total royalty income increased 151.9% in fiscal 2011 as compared to fiscal 2010. The significant increase in royalties received by the Trust is the result of a 72% increase in shipments during fiscal

2011 as compared to fiscal 2010 combined with a 22% increase in the average realized selling prices of iron ore products shipped from Silver Bay, Minnesota in fiscal 2011, as compared to fiscal 2010.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2011 |

|

2010 |

|

(decrease) |

| ||

|

Base overriding royalties |

|

$ |

19,999,089 |

|

$ |

7,522,767 |

|

165.9 |

% |

|

Bonus royalties |

|

12,752,121 |

|

5,401,563 |

|

136.1 |

% | ||

|

Minimum advance royalty paid (recouped) |

|

— |

|

— |

|

|

| ||

|

Fee royalties |

|

576,428 |

|

305,407 |

|

88.7 |

% | ||

|

Total royalty income |

|

$ |

33,327,638 |

|

$ |

13,229,737 |

|

151.9 |

% |

Gross Income, Expenses, Net Income and Cash Distributions

As set forth in the table below, net income for fiscal 2011 increased 161.3%, as compared to fiscal 2010, primarily due to an increase in gross income related to the increase in shipments and selling prices of iron ore pellets. Total expenses for fiscal 2011 increased 7.4% as compared to fiscal 2010 due to an increase in total compensation paid to the Corporate Trustee, additional insurance expenses and slightly higher legal and accounting fees and other fees related to the administration of the Trust. A more detailed summary of the Trust’s expenses, including legal and accounting expenses, is set forth under the heading “Trust Expenses” on page 30 of this Annual Report.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2011 |

|

2010 |

|

(decrease) |

| ||

|

Gross Income |

|

$ |

33,341,871 |

|

$ |

13,241,669 |

|

151.8 |

% |

|

Expenses |

|

878,677 |

|

818,007 |

|

7.4 |

% | ||

|

Net Income |

|

$ |

32,463,194 |

|

$ |

12,423,662 |

|

161.3 |

% |

As discussed in the paragraph above, the Trust’s total royalty income and net income for fiscal 2011 increased 151.8% and 161.3% respectively, due to increased shipping activity during fiscal 2011 and the higher prices paid to the Trust for shipments, both as compared to fiscal year 2010. The increase in the Trust’s net income, combined with a decrease in the Trust’s cash reserve resulted in a 235.9% increase in total distributions paid to Unitholders in fiscal 2011, as compared to fiscal year 2010.

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2011 |

|

2010 |

|

(decrease) |

| ||

|

Total Cash Distributions |

|

$ |

31,291,223 |

|

$ |

9,315,207 |

|

235.9 |

% |

|

Distributions Paid per Unit |

|

$ |

2.385 |

|

$ |

0.71 |

|

235.9 |

% |

Unallocated Reserve

As set forth in the table below, the Unallocated Reserve decreased $140,030 or 12.4% to $987,802, as of January 31, 2011, as compared to $1,127,832 as of January 31, 2010. As of January 31, 2011, the Unallocated Reserve consisted of $755,016 in unallocated cash and U.S. Government securities and $232,786 of accrued income receivable, primarily representing royalties earned but not yet received by the Trust and anticipated to be received in fiscal 2012. Comparatively, as of January 31, 2010, the Unallocated Reserve consisted of $3,023,894 in unallocated cash and U.S. Government securities, $873,938 of accrued income receivable, primarily representing royalties earned but not yet received by the Trust, which were received in fiscal 2011, less deferred royalty revenue of ($2,770,000).

|

|

|

Fiscal Years Ended on January 31, |

|

% increase |

| ||||

|

|

|

2011 |

|

2010 |

|

(decrease) |

| ||

|

Accrued Income Receivable |

|

$ |

232,786 |

|

$ |

873,938 |

|

(73.4 |

)% |

|

Deferred Royalty Revenue |

|

— |

|

(2,770,000 |

) |

(100 |

)% | ||

|

Cash Reserve |

|

755,016 |

|

3,023,894 |

|

(75.0 |

)% | ||

|

Unallocated Reserve |

|

$ |

987,802 |

|

$ |

1,127,832 |

|

(12.4 |

)% |

To the extent that the Trust has recorded a deferred royalty revenue liability, generally such amounts are carried forward to subsequent quarters until there are sufficient positive royalty payments and/or future positive price adjustments to fully offset any negative price adjustments. Depending on future adjustments to iron ore pellet pricing pursuant to Cliffs’ customer contracts, the deferred royalty revenue could increase or decrease and may result in a cumulative negative price adjustment related to shipments of pellets during prior periods. These potential future price adjustments can cause the Trust to experience partial or even complete offsets to future royalty income to be received by the Trust, therefore reducing cash available for distribution to the Trust’s unitholders in future periods.

Liquidity and Capital Resources

The Trust’s activities are limited to the collection of royalty income, payment of expenses and liabilities, distribution of net income to the Trust’s Unitholders and protection and conservation of Trust assets. Distributions of net income to Unitholders are based on the amount of total royalty income after providing for the payment of expenses and, to the extent deemed prudent by the Trustees, reserving funds in the Unallocated Reserve to provide for potential fixed or contingent future liabilities. See the discussion of the Trustees’ management of liquidity set forth under the heading “Unallocated Reserve” beginning on page 31 of this Annual Report.

The Trust’s primary short-term liquidity needs are to fund the distributions to Unitholders following the Trust’s receipt of the royalty payments from Northshore each calendar quarter. After the Trust receives the royalty payments, the Trust’s current assets are invested in U.S. government securities, either through direct purchases of U.S. government securities or through investments in a money market fund that invests its assets in U.S. Treasury securities and securities guaranteed by the U.S. government its agencies or instrumentalities, or the FDIC. Due to the short-term duration and investment grade nature of these investments, the Trustees believe that the Trust’s current assets are adequate to meet the Trust’s currently foreseeable liquidity needs. As of January 31, 2012, the Trust held $10,253,474 in cash and cash equivalents of which was invested in a money market fund that exclusively invests in obligations of the U.S. Treasury. In February 2012, the Trust distributed $9,971,208 to Unitholders of record on January 30, 2012.

Off-Balance Sheet Arrangements

The Trust has no off-balance sheet arrangements.

Contractual Obligations

The Trust has no payment obligations under any long-term borrowings, capital lease, operating lease, or purchase agreement.

Critical Accounting Estimates

This “Trustees’ Discussion and Analysis of Financial Condition and Results of Operations” is based upon the Trust’s financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires the Trustees to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. These estimates form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. The Trustees base their estimates and judgments on historical experience and on various other assumptions that the Trustees believe are reasonable under the circumstances. However, because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such differences could be material. Critical accounting policies are those that have meaningful impact on the reporting of the Trust’s financial condition and results of operations, and that require significant judgment and estimates. For a complete description of the Trust’s significant accounting policies, please see Note 2 to the financial statements on pages F-9 through F-12.

Revenue Recognition

Royalty income under the amended lease agreements with Northshore is recognized as it is earned. Under such agreements, royalties are earned upon shipment from Silver Bay, Minnesota, regardless of whether the actual sales proceeds for any shipment are received by Northshore. The amount of base overriding royalties and royalty bonuses payable to the Trust are determined based on the volume of iron ore tonnage shipped from Silver Bay, Minnesota during each calendar quarter and the proceeds to Cliffs resulting from shipments by Cliffs to its customers in accordance with the iron ore pellet sales agreements between Cliffs and its customers.

The Trust’s royalty income includes accrued income receivable. Accrued income receivable represents royalty income earned but not yet received by the Trust. Accrued income receivable is calculated using estimated prices and includes (i) shipments during the last month of Mesabi Trust’s fiscal year, if any, and (ii) net positive adjustments (which may include the sum of positive and negative price adjustments) calculated using the pricing adjustment mechanisms in the iron ore pellet sales agreements between Cliffs and its customers that determine the final sales price of the shipments from Silver Bay, Minnesota.

Deferred royalty revenue, if any, represents an estimate of potential decreases in the Trust’s royalty revenue due to negative price adjustments anticipated to be applied to tons of iron ore that were shipped by Northshore, but for which Northshore has indicated that final pricing is not yet known. The royalty revenue received by the Trust for certain tons of iron ore shipped by Northshore is subject to adjustment in accordance with the Trust’s revenue recognition policy each quarter as updated pricing information is received from Northshore. Accordingly, it is possible that changes in iron ore pellet pricing for shipments made in prior periods and reflected in royalty reports previously provided to the Trust by Northshore may have a significant impact on the Trust’s deferred royalty revenue, if any, and royalty income.

Adjustments to royalty income may result from changes in final reconciliations of tonnage shipped by Northshore with the final amounts received from Cliffs’ customers. Adjustments may also result from revisions to estimated prices previously used to record revenue for tonnage shipped. Pricing decreases may give rise to negative price adjustments which may be applied against future royalty income recognized by the Trust and changes in iron ore pellet prices may have a significant impact on the revenue recognized by the Trust

During the fourth quarter of fiscal 2011, positive price adjustments were recorded by Mesabi Trust as

accrued income receivable due to price adjustment mechanisms in the agreements between Cliffs and its customers that determine the final sales price of the shipments from Northshore with respect to certain shipments during calendar 2010. During the fourth quarter of fiscal 2012, negative price adjustments were recorded by Mesabi Trust and offset against accrued income receivable due to price adjustment mechanisms in the agreements between Cliffs and its customers that determine the final sales price of the shipments from Northshore with respect to shipments during calendar 2009, 2010 and 2011. As of January 31, 2012, the Trust recognized revenue as accrued income receivable related to approximately 667,000 tons of iron ore that were shipped by Northshore as of December 31, 2011, but for which Cliffs has indicated that final pricing is not yet known. Pricing related to these tons is expected to be finalized in the first quarter of calendar 2013.

Recent Developments

Northshore Production and Shipping Estimates. In its Form 10-K filed February 16, 2012, Cliffs reported that Northshore was operating all of its four furnaces during calendar year 2011, compared to the three furnaces that were operated during most of 2010 as the fourth furnace was not restarted until September 2010. The annual production capacity at Northshore as reported by Cliffs is 6.0 million tons of combined iron ore pellets and concentrate.

Production of iron ore pellets at Northshore from Mesabi Trust lands during the calendar quarter ended March 31, 2012 totaled 1,178,201 tons, and shipments credited to the Trust over the same period totaled 388,094 tons. Neither Cliffs nor Northshore has provided the Trust with an estimate of production or shipments of iron ore pellets or concentrate for the remainder of calendar year 2012. During calendar years 2011, 2010, 2009 and 2008, the percentage of shipments of iron ore products from Mesabi Trust lands was approximately 89.3%, 93.0%, 90.2% and 88.2%, respectively, of total shipments. Northshore has not advised the Trustees as to the percentage of iron ore products from Mesabi Trust lands it anticipates shipping in calendar year 2012. See the description of the uncertainty of market conditions in the iron ore and steel industry under the heading “Risk Factors” above.

According to a report received by the Trust from the Eveleth Fee Office, crude ore production was down in the month of February 2012 due to a power plant failure that shut down the Silver Bay facilities during the last week of the month. The power plant failure resulted in a temporary curtailment of production for one day due to visibility problems on Highway 61 caused by the precipitators. The Northshore production facilities at Silver Bay are back in operation using one of the two power plant units and additional power purchased from Minnesota Power.

Cliffs Settlement Agreement with ArcelorMittal. As previously reported in the Trust’s Form 10-Q filed December 7, 2011, Cliffs reported in a news release and in its Form 10-Q filed April 29, 2011, that it reached a negotiated settlement with ArcelorMittal USA Inc., and related parties, with respect to multiple arbitration and litigation proceedings. Based on information received by Mesabi Trust from Cliffs, even though Northshore shipped small volumes of pellets to ArcelorMittal’s steelmaking facilities involved in the Cliffs-ArcelorMittal negotiated settlement during 2009 and 2010, only shipments during calendar year 2009 were included in the ArcelorMittal-Cliffs Settlement Agreement because ArcelorMittal limited its nomination of shipments from Northshore to calendar year 2009. ArcelorMittal did not nominate any shipments in calendar year 2010. The final iron ore pricing as agreed to under the price reopener provisions of the ArcelorMittal-Cliffs Settlement Agreement was below the 2009 pricing of iron ore shipped from Silver Bay, which prices were finalized following a volatile period in the iron ore and steel markets. This resulted in a negative adjustments to royalty payments previously received by the Trust.

In the annual certified statement of iron ore shipments and royalties paid to the Trust, which Cliffs provided to the Trust in March 2012, the Trust was informed that the negotiated settlement resulted in final negative adjustments of $644,971 to royalties previously paid to the Trust. Mesabi Trust was not a party to the Cliffs-ArcelorMittal negotiated settlement. The Trustees are unable to determine what impact, if any, the Cliffs-ArcelorMittal negotiated settlement may have on future shipments of iron ore pellets by Northshore or royalties payable to the Trust based on future shipments of iron ore products mined from Mesabi Trust lands.

Elevated Levels of PM-10 at Northshore Mining Silver Bay Plant Site. In its Form 10-Q filed November 1, 2011, Cliffs reported that for the period from November 2010 to June 2011, Northshore disclosed five elevated measurements of the particulate matter (PM-10) at an internal air monitor. Cliffs also reported that during the spring of 2011, Northshore received external comments regarding a perceived increase in dust fallout from the facility and that a complaint was reported to the Minnesota Pollution Control Agency (“MPCA”) in early June 2011 to the same effect. According to Cliffs, Northshore and the MPCA entered into a Stipulation Agreement dated January 20, 2012. Cliffs reported that the Stipulation Agreement pertains to alleged violations at Northshore’s Silver Bay facility that were discovered during a review of ambient air monitoring results and in response to complaints to the MPCA. The allegations include violations of National and State Ambient Air Quality Standards for PM-10. As part of the Stipulation Agreement, the MPCA will assess a civil penalty in the amount of approximately $240,000 and a Supplemental Environmental Project to cost at least $80,000. The Trust does not have any responsibility to pay any amounts agreed to by Northshore under the Stipulation Agreement. The Trustees are unable to predict what impact, if any, the Stipulation Agreement will have on production and shipments from Northshore or future royalties payable to the Trust.

Securities Regulation. The Trust is a publicly-traded trust with its units of beneficial interest listed on the New York Stock Exchange (“NYSE”) and is therefore subject to extensive regulation under, among others, the Securities Act of 1933, the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the rules and regulations of the NYSE. Issuers failing to comply with such authorities risk serious consequences, including criminal as well as civil and administrative penalties. In most instances, these laws, rules and regulations do not specifically address their applicability to publicly-traded trusts such as Mesabi Trust. In particular, Sarbanes-Oxley mandated the adoption by the Securities and Exchange Commission (the “SEC”) and NYSE of certain rules and regulations that are impossible for the Trust to literally satisfy because of its nature as a pass-through trust. Pursuant to NYSE rules the Trust is exempt from many of the corporate governance requirements that apply to other publicly traded corporations. The Trust does not have, nor does the Agreement of Trust, as amended, provide for, a board of directors, an audit committee, a corporate governance committee, a compensation committee or executive officers. The Trustees intend to closely monitor the SEC’s and NYSE’s rulemaking activity and will comply with their rules and regulations to the extent applicable.

Other Information. Mesabi Trust has no employees. Each year the Trust engages independent consultants to assist the Trustees in monitoring, among other things, the volume and sales prices of iron ore products shipped by Northshore from Silver Bay, Minnesota and in reviewing all records and calculations of the same each quarter. As noted above, the information regarding volume and sales prices of shipped iron ore products is used to compute the royalties payable to Mesabi Trust by Northshore. Deutsche Bank Trust Company Americas, the Corporate Trustee, also performs certain administrative functions for Mesabi Trust.

TO THE HOLDERS OF

CERTIFICATES OF BENEFICIAL INTEREST IN

MESABI TRUST

THE TRUST ESTATE

The principal assets of Mesabi Trust consist of two different interests in certain properties in the Mesabi Iron Range: (i) Mesabi Trust’s interest as assignor in the Amended Assignment of Peters Lease and the Amended Assignment of Cloquet Lease, which together cover properties aggregating approximately 9,750 largely contiguous acres in St. Louis County, Minnesota (the “Peters Lease Lands” and the “Cloquet Lease Lands,” respectively), and (ii) Mesabi Trust’s ownership of the entire beneficial interest in the Mesabi Land Trust, which has a 20% interest as fee owner in the Peters Lease Lands and a 100% fee ownership in certain non-mineral-bearing lands adjacent to the Peters and Cloquet Lease Lands (the “Mesabi Lease Lands,” together with the Peters Lease Lands and the Cloquet Lease Lands, the “Trust Estate”). The map below shows the approximate location of the Trust Estate.

|

o |

The boxed area indicates the approximate location of Mesabi Trust’s Trust Estate (not drawn to scale), as defined above under “The Trust Estate,” which is a small part of the region known as the Mesabi Iron Range. The Mesabi Trust does not own any property interests other than in the Trust Estate. |

Under the Amended Assignment Agreements, Northshore produces iron ore from the Trust Estate for the manufacture of iron ore products to be sold to various customers of Cliffs. Mesabi Trust receives royalties on the crude ore extracted from such Lands and the pellets produced from such crude ore, and in each case the royalties are based upon the volume of iron ore products shipped and the prices charged to Cliffs’ customers.