UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10 – K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2016

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 001-11703

GENCOR INDUSTRIES, INC.

| Incorporated in the State of Delaware |

I.R.S. Employer Identification No. 59-0933147 |

5201 North Orange Blossom Trail

Orlando, Florida 32810

Registrant’s Telephone Number, Including Area Code: (407) 290-6000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Common Stock ($.10 Par Value)

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act ☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | |||

| Non-Accelerated Filer | ☐ (Do not check if a smaller reporting Company) | Smaller Reporting Company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the most recently completed second fiscal quarter was $97,608,600.

Indicate the number of shares outstanding of each of the Registrant’s classes of Common Stock, as of the latest practicable date: 12,111,079 shares of Common Stock ($.10 par value) and 2,263,857 shares of Class B Stock ($.10 par value) as of November 25, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K is incorporated by reference from the Registrant’s 2017 Proxy Statement for the Annual Meeting of the Stockholders.

Introductory Note: Caution Concerning Forward-Looking Statements

This annual report on Form 10-K (“Report”) and the Company’s other communications and statements may contain “forward-looking statements,” including statements about the Company’s beliefs, plans, objectives, goals, expectations, estimates, projections and intentions. These statements are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond the Company’s control. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. The Company’s actual future results may differ materially from those set forth in the Company’s forward-looking statements. For information concerning these factors and related matters, see “Risk Factors” in Part I, Item 1A in this Report, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 in this Report. However, other factors besides those referenced could adversely affect the Company’s results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this Report. The Company does not undertake to update any forward-looking statement, except as required by law.

PART I

| ITEM 1. | BUSINESS |

General

Gencor Industries, Inc. and its subsidiaries (the “Company”, “Gencor”, “we”, “us” or “our”) is a leading manufacturer of heavy machinery used in the production of highway construction materials, synthetic fuels, and environmental control equipment. The Company’s products are manufactured in two facilities in the United States. The Company’s products are sold through a combination of Company sales representatives and independent dealers and agents located throughout the world.

The Company designs, manufactures and sells machinery and related equipment used primarily for the production of asphalt and highway construction materials. The Company’s principal core products include asphalt plants, combustion systems and fluid heat transfer systems. The Company believes that its technical and design capabilities, environmentally friendly process technology, and wide range of products have enabled it to become a leading producer of highway construction materials, synthetic fuels and environmental control equipment worldwide. The Company believes it has the largest installed base of asphalt production plants in the United States.

Because the Company’s products are sold primarily to the highway construction industry, the business is seasonal in nature. Traditionally, the Company’s customers do not purchase new equipment for shipment during the summer and fall months to avoid disrupting their peak season for highway construction and repair work. The majority of orders for the Company’s products are typically received between October and February, with a significant volume of shipments occurring prior to June. The principal factors driving demand for the Company’s products are the level of government funding for domestic highway construction and repair, replacement of existing plants, the need for spare parts, and a continuing trend towards larger plants.

In 1968, the Company was formed by the merger of Mechtron Corporation with General Combustion, Inc. and Genco Manufacturing, Inc. The new entity reincorporated in Delaware in 1969 and adopted the name Mechtron International Corporation in 1970. In 1985, the Company began a series of acquisitions into related fields starting with the Beverley Group Ltd. in the United Kingdom (the “UK”). Hy-Way Heat Company, Inc. and the Bituma Group were acquired in 1986. In 1987, the Company changed its name to Gencor Industries, Inc. and acquired Davis Line Inc. and its subsidiaries in 1988.

2

In 1998, the Company entered into agreements with Carbontronics, LLC (“CLLC”) pursuant to which the Company designed, manufactured, sold and installed four synthetic fuel production plants. In addition to payment for the plants, the Company received membership interests in two synthetic fuel entities. These derived significant cash flow from the sale of synthetic fuel and tax credits (Internal Revenue Code, Section 29) and consequently distributed significant cash to the Company beginning in 2001 and through 2010.

The tax credit legislation expired at the end of calendar year 2007. Consequently, the four synthetic fuel plants were decommissioned. The plants were sold or transferred to site owners in exchange for a release of all contracted liabilities related to the removal of plants from the sites. Gencor no longer has any ownership in the two synthetic fuel entities.

Products

Asphalt Plants. The Company manufactures and produces hot-mix asphalt plants used in the production of asphalt paving materials. The Company also manufactures related asphalt plant equipment, including hot mix storage silos, fabric filtration systems, cold feed bins and other plant components. The Company’s H&B (Hetherington and Berner) product line is the world’s oldest asphalt plant line, first manufactured in 1894. The Company’s subsidiary, Bituma Corporation, formerly known as Boeing Construction Company, developed the first continuous process for asphalt production. Gencor developed and patented the first counter flow drum mix technology, several adaptations of which have become the industry standard, which recaptures and burns emissions and vapors, resulting in a cleaner and more efficient process. The Company also manufactures a very comprehensive range of fully mobile batch plants.

Combustion Systems and Industrial Incinerators. The Company manufactures combustion systems, which are large burners that can transform most solid, liquid or gaseous fuels into usable energy, or burn multiple fuels, alternately or simultaneously. Through its subsidiary General Combustion, the Company has been a significant source of combustion systems for the asphalt and aggregate drying industries since the 1950’s. The Company also manufactures soil remediation machinery, as well as combustion systems for rotary dryers, kilns, fume and liquid incinerators and fuel heaters. The Company believes maintenance and fuel costs are lower for its burners because of their superior design.

Fluid Heat Transfer Systems. The Company’s General Combustion subsidiary also manufactures the Hy-Way heat and Beverley lines of thermal fluid heat transfer systems and specialty storage tanks for a wide array of industry uses. Thermal fluid heat transfer systems are similar to boilers, but use high temperature oil instead of water. Thermal fluid heaters have been replacing steam pressure boilers as the best method of heat transfer for storage, heating and pumping viscous materials (i.e., asphalt, chemicals, heavy oils, etc.) in many industrial and petrochemical applications worldwide. The Company believes the high efficiency design of its thermal fluid heaters can outperform competitive units in many types of process applications.

Product Engineering and Development

The Company is engaged in product engineering and development efforts to expand its product lines and to further develop more energy-efficient and environmentally compatible systems.

Product engineering and development activities are directed toward more efficient methods of producing asphalt and lower cost fluid heat transfer systems. In addition, efforts are also focused on developing combustion systems that operate at higher efficiency and offer a higher level of environmental compatibility.

Sources of Supply and Manufacturing

Substantially all products and components sold by the Company and its subsidiaries are manufactured and assembled by the Company, except for procured raw materials and hardware. The Company purchases a large quantity of steel, raw materials and hardware used to manufacture its products from hundreds of suppliers and is not dependent on any single supplier. Periodically, the Company reviews the cost effectiveness of internal

3

manufacturing versus outsourcing to independent third parties. The Company believes it has the internal capability to produce the highest quality products at the lowest cost. The Company may augment internal production by outsourcing some of its production when demand for its products exceeds its manufacturing capacity.

Seasonality

The Company is concentrated in the manufacturing of asphalt plants and related components which is typically subject to a seasonal slow-down during the third and fourth quarters of the calendar year.

Competition

The markets for the Company’s products are highly competitive. The industry remains fairly concentrated, with a small number of companies competing for the majority of the Company’s product lines’ sales. The principal competitive factors include quality and technology. The Company believes it manufactures the highest quality and heaviest equipment in the industry. Its products’ performance reliability, brand recognition, pricing and after-the-sale technical support are other important factors.

Sales and Marketing

The Company’s products and services are marketed through a combination of Company-employed sales representatives and independent dealers and agents.

Sales Backlog

The size of the Company’s backlog should not be viewed as an indicator of the Company’s quarterly or annualized revenues due to the timing of order fulfillment of asphalt plants. The Company’s backlog, which includes orders received through the date of this filing, was $32.1 million and $20.3 million as of December 1, 2016 and December 1, 2015, respectively.

Financial Information about Geographic Areas Reporting Segments

For a geographic breakdown of revenues and long-term assets see the table captioned Reporting Segments in Note 1 to the Consolidated Financial Statements.

Licenses, Patents and Trademarks

The Company holds numerous patents covering technology and applications related to various products, equipment and systems, and numerous trademarks and trade names registered with the U.S. Patent and Trademark Office and in various foreign countries. In general, the Company depends upon technological capabilities, manufacturing quality control and application know-how, rather than patents or other proprietary rights in the conduct of its business. The Company believes the expiration of any one of these patents, or a group of related patents, would not have a material adverse effect on the overall operations of the Company.

Government Regulations

The Company believes its design and manufacturing processes meet all industry and governmental agency standards that may apply to its entire line of products, including all domestic and foreign environmental, structural, electrical and safety codes. The Company’s products are designed and manufactured to comply with U.S. Environmental Protection Agency regulations. Certain state and local regulatory authorities have strong environmental impact regulations. While the Company believes that such regulations have helped, rather than restricted its marketing efforts and sales results, there is no assurance that changes to federal, state, local, or foreign laws and regulations will not have a material adverse effect on the Company’s products and earnings in the future.

Environmental Matters

The Company is subject to various federal, state, local and foreign laws and regulations relating to the protection of the environment. The Company believes it is in material compliance with all applicable environmental laws and regulations. The Company does not expect any material impact on future operating costs as a result of compliance with currently enacted environmental regulations.

4

Employees

As of September 30, 2016, the Company had a total of 273 full-time employees. The Company has a collective bargaining agreement covering production and maintenance employees at its Marquette, Iowa facility. No other employees are represented by a labor union or collective bargaining agreement.

Available Information

For further discussion concerning the Company’s business, see the information included in Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) and Item 8 (Financial Statements and Supplementary Data) of this Report.

The Company makes available free of charge through its website at www.gencor.com the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, if applicable, filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information posted on the website is not incorporated into this Annual Report on Form 10-K.

5

| ITEM 1A. | RISK FACTORS |

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company, or that the Company presently deems less significant, may also impair the Company’s operations. If any of the following risks actually occur, the Company’s business operating results and financial condition could be materially adversely affected. The order of these risk factors does not reflect their relative importance or likelihood of occurrence.

The business may be adversely affected by current economic conditions.

The Company’s sales to contractors are dependent on construction and infrastructure spending and availability of credit to its customers. Changes in construction and governmental spending have had and could continue to have a material adverse effect on the Company’s results of operations.

The business is affected by the seasonal and cyclical nature of the markets it serves.

The demand for the Company’s products and service is dependent on general economic conditions and more specifically, the commercial highway construction industry. Adverse economic conditions may cause customers to forego or delay new purchases and rely more on repairing existing equipment thus negatively impacting the Company’s sales and profits. Rising gas and oil prices, increasing steel prices and shortage of qualified workers may have adverse effects on the Company. Market conditions could limit the Company’s ability to raise selling prices to offset increases in material and labor costs.

The business is affected by the level of government funding for highway construction in the United States and Canada.

Many contractors depend on funding by federal and state agencies for highway, transit and infrastructure programs. Future legislation may increase or decrease government spending, which, if decreased, could have a negative effect on the Company’s financial condition or results of operations. Federal funding allocated to infrastructure may be decreased in the future.

In fiscal years 2016 and 2015, the Company depended on one customer for a significant portion of its revenue. The loss of this relationship could have adverse consequences on the Company’s future business.

The percentage of the Company’s net revenue that was derived from sales to one customer was 14% in fiscal 2016 and 15% in fiscal 2015.

If the Company fails to comply with requirements relating to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act, the business could be harmed and its stock price could decline.

Rules adopted by the Securities and Exchange Commission pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require the Company to assess its internal control over financial reporting annually. The rules governing the standards that must be met for management to assess its internal control over financial reporting are complex. They require significant documentation, testing, and possible remediation of any significant deficiencies in and/or material weaknesses of internal controls in order to meet the detailed standards under these rules. The Company has evaluated its internal control over financial reporting as effective as of September 30, 2016. See Item 9A – Controls and Procedures – Management’s Annual Report on Internal Control over Financial Reporting. Although the Company has evaluated its internal control over financial reporting as effective as of September 30, 2016, in future fiscal years, the Company may encounter unanticipated delays or problems in assessing its internal control over financial reporting as effective or in completing its assessments by the required dates. In addition, the Company cannot assure you that its independent registered public accountants will attest that internal control over financial reporting are effective in future fiscal years. If the Company cannot assess its internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

6

The Company may be required to reduce its profit margins on contracts on which it uses the percentage-of-completion accounting method.

The Company records revenues and profits on many of its contracts using the percentage-of-completion method of accounting. As a result, revisions made to the estimates of revenues and profits are recorded in the period in which the conditions that require such revisions become known and can be estimated. Although the Company believes that its profit margins are fairly stated and that adequate provisions for losses for its fixed-price contracts are recorded in the financial statements, as required under U.S. generally accepted accounting principles (GAAP), the Company cannot assure you that its contract profit margins will not decrease or its loss provisions will not increase materially in the future.

The Company may encounter difficulties with future acquisitions.

As part of its growth strategy, the Company intends to evaluate the acquisitions of other companies, assets or product lines that would complement or expand the Company’s existing business or broaden its customer relationships. Although the Company conducts due diligence reviews of potential acquisition candidates, it may not be able to identify all material liabilities or risks related to potential acquisition candidates. There can be no assurance that the Company will be able to locate and acquire any business, retain key personnel and customers of an acquired business or integrate any acquired business successfully. Additionally, there can be no assurance that financing for any acquisition, if necessary, will be available on acceptable terms, if at all, or that the Company will be able to accomplish its strategic objectives in connection with any acquisition. Although the Company periodically considers possible acquisitions, no specific acquisitions are probable as of the date of this Report on Form 10-K.

Demand for the Company’s products is seasonal and cyclical in nature.

Orders for the Company’s products typically slow down during the summer and fall months since its customers generally do not purchase new equipment for shipment in their peak season for highway construction and repair work. In addition, demand for the Company’s products depends in part upon the level of capital and maintenance expenditures by the highway construction industry. The highway construction industry historically has been cyclical in nature and vulnerable to general downturns in the economy. Decreases in industry spending could have a material adverse effect upon demand for the Company’s products and negatively impact its business, financial condition, results of operations and the market price of its common stock.

The Company’s marketable securities are comprised of cash and money funds, equities, mutual funds, exchange-traded funds, and government securities invested through a professional investment management firm and are subject to various risks such as interest rates, markets, and credit.

Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of securities, changes in these risk factors could have a material adverse impact on the Company’s results of operations.

There are and will continue to be quarterly fluctuations of the Company’s operating results.

The Company’s operating results historically have fluctuated from quarter to quarter as a result of a number of factors, including the value, timing and shipment of individual orders and the mix of products sold. Revenues from certain large contracts are recognized using the percentage-of-completion method of accounting. The Company recognizes product revenues upon shipment for the rest of its products. The Company’s asphalt production equipment operations are subject to seasonal fluctuation, which may lower revenues and result in possible losses in the first and fourth fiscal quarters of each year. Traditionally, asphalt producers do not purchase new equipment for shipment during the summer and fall months to avoid disruption of their activities during peak periods of highway construction.

7

If the Company is unable to attract and retain key personnel, its business could be adversely affected.

The success of the Company will continue to depend substantially upon the efforts, abilities and services of its management team and certain other key employees. The loss of one or more key employees could adversely affect the Company’s operations. The Company’s ability to attract and retain qualified personnel, either through direct hiring, or acquisition of other businesses employing such persons, will also be an important factor in determining its future success.

The Company may be required to defend its intellectual property against infringement or against infringement claims of others.

The Company holds numerous patents covering technology and applications related to various products, equipment and systems, and numerous trademarks and trade names registered with the U.S. Patent and Trademark Office and in various foreign countries. There can be no assurance as to the breadth or degree of protection that existing or future patents or trademarks may afford the Company, or that any pending patent or trademark applications will result in issued patents or trademarks, or that the Company’s patents, registered trademarks or patent applications, if any, will be upheld if challenged, or that competitors will not develop similar or superior methods or products outside the protection of any patents issued, licensed or sublicensed to the Company. Although the Company believes that none of its patents, technologies, products or trademarks infringe upon the patents, technologies, products or trademarks of others, it is possible that the Company’s existing patents, trademarks or other rights may not be valid or that infringement of existing or future patents, trademarks or proprietary rights may occur. In the event that the Company’s products are deemed to infringe upon the patent or proprietary rights of others, the Company could be required to modify the design of its products, change the name of its products or obtain a license for the use of certain technologies incorporated into its products. There can be no assurance that the Company would be able to do any of the foregoing in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do so could have a material adverse effect on the Company. In addition, there can be no assurance that the Company will have the financial or other resources necessary to enforce or defend a patent, registered trademark or other proprietary right, and, if the Company’s products are deemed to infringe upon the patents, trademarks or other proprietary rights of others, the Company could become liable for damages, which could also have a material adverse effect on the Company.

The Company may be subject to substantial liability for the products it produces.

The Company is engaged in a business that could expose it to possible liability claims for personal injury or property damage due to alleged design or manufacturing defects in its products. The Company believes that it meets existing professional specification standards recognized or required in the industries in which it operates, and there are no material product liability claims pending against the Company as of the date hereof. Although the Company currently maintains product liability coverage which it believes is adequate for the continued operation of its business, such insurance may prove inadequate or become difficult to obtain or unobtainable in the future on terms acceptable to the Company.

The Company is subject to extensive environmental laws and regulations, and the costs related to compliance with, or the Company’s failure to comply with, existing or future laws and regulations, could adversely affect the business and results of operations.

The Company’s operations are subject to federal, state, local and foreign laws and regulations relating to the protection of the environment. Sanctions for noncompliance may include revocation of permits, corrective action orders, significant administrative or civil penalties and criminal prosecution. The Company’s business involves environmental management and issues typically associated with historical manufacturing operations. To date, the Company’s cost of complying with environmental laws and regulations has not been material, but the fact that such laws or regulations are changed frequently makes predicting the cost or impact of such laws and regulations on the Company’s future operations uncertain.

8

The loss of one or more of the Company’s raw materials suppliers, or increase in prices, could cause production delays, a reduction of revenues or an increase in costs.

The principal raw materials the Company uses are steel and related products. The Company has been able to obtain sufficient supplies of raw materials for its operations. Although the Company believes that such raw materials are readily available from alternate sources, an interruption in the supply of steel and related products or a substantial increase in the price of any of these raw materials could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Company is subject to significant government regulations.

The Company is subject to a variety of governmental regulations relating to the manufacturing of its products. Any failure by the Company to comply with present or future regulations could subject it to future liabilities, or the suspension of production that could have a material adverse effect on the Company’s results of operations. Such regulations could also restrict the Company’s ability to expand its facilities, or could require the Company to acquire costly equipment or to incur other expenses to comply with such regulations. Although the Company believes it has the design and manufacturing capability to meet all industry or governmental agency standards that may apply to its product lines, including all domestic and foreign environmental, structural, electrical and safety codes, there can be no assurance that governmental laws and regulations will not become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with a violation. The cost to the Company of such compliance to date has not materially affected its business, financial condition or results of operations. There can be no assurance, however, that violations will not occur in the future as a result of human error, equipment failure or other causes. The Company’s customers are also subject to extensive regulations, including those related to the workplace. The Company cannot predict the nature, scope or effect of governmental legislation, or regulatory requirements that could be imposed or how existing or future laws or regulations will be administered, or interpreted. Compliance with more stringent laws or regulations, as well as more vigorous enforcement policies of regulatory agencies, could require substantial expenditures by the Company and could adversely affect its business, financial condition and results of operations.

The Company’s management has effective voting control.

The Company’s officers and directors beneficially own an aggregate of approximately 96.8% of the outstanding shares of the Company’s $.10 par value Class B stock. The Class B stock is entitled to elect 75% (calculated to the nearest whole number, rounding five-tenths to next highest whole number) of the members of its Board of Directors. Further, approval of a majority of the Class B stock is generally required to effect a sale of the Company and certain other corporate transactions. As a result, these shareholders can elect more than a majority of the Board of Directors and exercise significant influence over most matters requiring approval by the Company’s shareholders. This concentration of control may also have the effect of delaying or preventing a change in control.

The issuance of preferred stock may impede a change of control or may be dilutive to existing shareholders.

The Company’s Certificate of Incorporation, as amended, authorizes the Company’s Board of Directors, without shareholder vote, to issue up to 300,000 shares of preferred stock in one or more series and to determine for any series the dividend, liquidation, conversion, voting or other preferences, rights and terms that are senior, and not available, to the holders of the Company’s common stock. Thus, issuances of series of preferred stock could adversely affect the relative voting power, distributions and other rights of the common stock. The issuance of preferred stock could deter or impede a merger, tender offer or other transaction that some, or a majority of the Company’s common shareholders might believe to be in their best interest or in which the Company’s common shareholders might receive a premium for their shares over the then current market price of such shares.

The Company may be required to indemnify its directors and executive officers.

The Company has authority under Section 145 of the Delaware General Corporation Law to indemnify its directors and officers to the extent provided in that statute. The Company’s Certificate of Incorporation, as

9

amended, provides that a director shall not be personally liable to the Company for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the Delaware General Corporation Law. The Company’s Bylaws provide in part that it indemnify each of its directors and officers against liabilities imposed upon them (including reasonable amounts paid in settlement) and expenses incurred by them in connection with any claim made against them or any action, suit or proceeding to which they may be a party by reason of their being or having been a director or officer. The Company maintains officer’s and director’s liability insurance coverage. There can be no assurance that such insurance will be available in the future, or that if available, it will be available on terms that are acceptable to the Company. Furthermore, there can be no assurance that the insurance coverage provided will be sufficient to cover the amount of any judgment awarded against an officer or director (either individually or in the aggregate). Consequently, if such judgment exceeds the coverage under the policy, the Company may be forced to pay such difference.

The Company enters into indemnification agreements with each of its executive officers and directors containing provisions that may require the Company, among other things, to indemnify them against certain liabilities that may arise by reason of their status or service as officers or directors (other than liabilities arising from willful misconduct of a culpable nature) and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified. Management believes that such indemnification provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers.

The Company does not expect to pay cash dividends for the foreseeable future.

For the foreseeable future, the Company intends to retain any earnings to finance its business requirements, and it does not anticipate paying any cash dividends on its common stock or Class B stock. Any future determination to pay cash dividends will be at the discretion of the Company’s Board of Directors and will be dependent upon then existing conditions, including the financial condition and results of operations, capital requirements, contractual restrictions, business prospects, and other factors that the Board of Directors considers relevant.

Competition could reduce revenue from the Company’s products and services and cause it to lose market share.

The Company currently faces strong competition in product performance, price and service. Some of the Company’s national competitors have greater financial, product development and marketing resources than the Company. If competition in the Company’s industry intensifies or if the current competitors enhance their products or lower their prices for competing products, the Company may lose sales or be required to lower the prices it charges for its products. This may reduce revenues from the Company’s products and services, lower its gross margins, or cause it to lose market share.

The Company’s quarterly operating results are likely to fluctuate, which may decrease its stock price.

The Company’s quarterly operating results have varied significantly in the past and are likely to vary significantly from quarter to quarter in the future. As a result, the Company’s operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of its common stock. The reasons the Company’s quarterly results may fluctuate include:

| • | General competitive and economic conditions |

| • | Delays in, or uneven timing in, delivery of customer orders |

| • | The seasonal nature of the industry |

| • | The fluctuations in market value of its securities portfolio |

| • | The introduction of new products by the Company or its competitors |

| • | Product supply shortages |

| • | Reduced demand due to adverse weather conditions |

| • | Expiration or renewal of Federal highway programs, and |

| • | Changes to state or Canadian provincial programs. |

Period-to-period comparisons of such items should not be relied on as indications of future performance.

10

The Company’s stock has been, and likely will continue to be, subject to substantial price and volume fluctuations due to a number of factors, many of which will be beyond the Company’s control.

The market price of the Company’s common stock may be significantly affected by various factors such as:

| • | Quarterly variations in operating results |

| • | Changes in revenue growth rates as a whole or for specific geographic areas or products |

| • | Changes in earnings estimates by market analysts |

| • | The announcement of new products or product enhancements by the Company or its competitors |

| • | Speculation in the press or analyst community of potential acquisitions by the Company, and |

| • | General market conditions or market conditions specific to particular industries. |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

| ITEM 2. | PROPERTIES |

The following table lists the operating properties owned by the Company as of September 30, 2016:

| Location |

Owned Acreage | Building Square Footage |

Principal Function | |||||||

| Marquette, Iowa |

72.0 | 137,000 | Offices and manufacturing | |||||||

| Orlando, Florida |

27.0 | 215,000 | Corporate offices and manufacturing | |||||||

| ITEM 3. | LEGAL PROCEEDINGS |

The Company has various litigation and claims, either as a plaintiff or defendant, pending as of the date of this Form 10-K which have occurred in the ordinary course of business, and which may be covered in whole or in part by insurance. Management has reviewed all litigation matters arising in the ordinary course of business and, upon advice of legal counsel, has made provisions, not deemed material, for any estimable losses and expenses of litigation.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted during the fourth quarter of this fiscal year to a vote of security holders.

11

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER’S PURCHASES OF EQUITY SECURITIES |

The Company’s stock has been traded on the NASDAQ Global Market under the symbol “GENC” since December 20, 2007.

Stock Split

On July 11, 2016, the Company’s Board of Directors approved a three-for-two split of the Company’s common and Class B stock to be effected in the form of a 50% stock dividend. As a result, shareholders received one additional share of common or Class B stock for every two shares they held of the respective class of stock as of the record date. These shares were distributed on August 1, 2016, to shareholders of record as of the end of business on July 22, 2016.

Following are the high and low closing prices for the Company’s common stock for the periods indicated:

| 2016 |

HIGH * | LOW * | ||||||

| First Quarter |

$ | 9.25 | $ | 6.07 | ||||

| Second Quarter |

$ | 10.29 | $ | 7.00 | ||||

| Third Quarter |

$ | 10.62 | $ | 9.19 | ||||

| Fourth Quarter |

$ | 13.41 | $ | 9.84 | ||||

| 2015 |

HIGH * | LOW * | ||||||

| First Quarter |

$ | 6.78 | $ | 5.93 | ||||

| Second Quarter |

$ | 6.73 | $ | 6.01 | ||||

| Third Quarter |

$ | 6.68 | $ | 6.13 | ||||

| Fourth Quarter |

$ | 6.73 | $ | 5.94 | ||||

| * | Adjusted for three-for-two stock split |

As of September 30, 2016, there were 243 holders of common stock of record and 5 holders of Class B stock of record. The Company has not paid any cash dividends during the last two fiscal years and there is no intention to pay cash dividends in the foreseeable future.

12

EQUITY COMPENSATION PLANS

The following table includes information about the Company’s common stock that may be issued upon exercise of options, warrants and rights under all of the existing equity compensation plans and arrangements previously approved by security holders as of September 30, 2016:

| Plan |

Number of Securities to be Issued upon Exercise of Outstanding Options * |

Weighted-Average Exercise Price of Outstanding Options * |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans |

|||||||||

| 2009 Incentive Compensation Plan |

483,750 | $ | 5.684 | 582,000 | ** | |||||||

| * | Adjusted for three-for-two stock split |

| ** | Includes 100,000 of Class B securities |

13

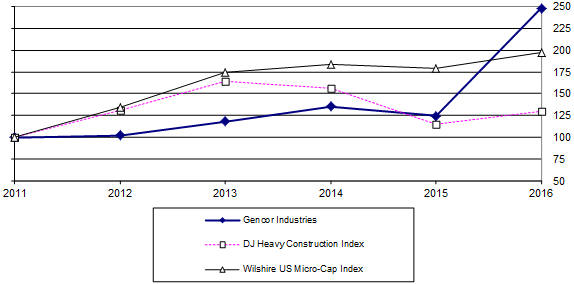

COMPARATIVE 5-YEAR CUMULATIVE RETURN GRAPH

The following graph sets forth the cumulative total return to the Company’s shareholders during the five-year period ended September 30, 2016, as well as the Wilshire US Micro-Cap Price Index and the Dow Jones Heavy Construction Index. The stock performance assumes $100 was invested on October 1, 2011.

Comparison of Cumulative Total Return among Gencor Industries, Inc.,

the Wilshire US Micro-Cap Price Index and the Dow Jones Heavy Construction Index

| With Base Year of 2011: |

9/30/2011 | 9/30/2012 | 9/30/2013 | 9/30/2014 | 9/30/2015 | 9/30/2016 | ||||||||||||||||||

| Gencor Industries, Inc. |

100.00 | 102.07 | 118.34 | 135.45 | 124.69 | 247.86 | ||||||||||||||||||

| DJ Heavy Construction Index |

100.00 | 131.23 | 164.53 | 156.33 | 115.36 | 129.88 | ||||||||||||||||||

| Wilshire US Micro-Cap Index |

100.00 | 134.29 | 175.01 | 183.06 | 179.34 | 197.90 | ||||||||||||||||||

On December 1, 2016, the Company’s stock was available for trading on the NASDAQ Global Market under the symbol “GENC”.

14

| ITEM 6. | SELECTED FINANCIAL DATA |

| Years Ended September 30 | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net Revenue |

$ | 69,991,000 | $ | 39,230,000 | $ | 40,017,000 | $ | 48,943,000 | $ | 63,182,000 | ||||||||||

| Operating Income (Loss) |

7,816,000 | (794,000 | ) | (26,000 | ) | 2,578,000 | 393,000 | |||||||||||||

| Net Income (Loss) |

7,043,000 | (1,819,000 | ) | 3,473,000 | 6,725,000 | 4,472,000 | ||||||||||||||

| Per Share Data: |

||||||||||||||||||||

| Basic – Net Income (Loss) * |

$ | 0.49 | $ | (0.13 | ) | $ | 0.24 | $ | 0.47 | $ | 0.31 | |||||||||

| Diluted – Net Income (Loss) * |

$ | 0.48 | $ | (0.13 | ) | $ | 0.24 | $ | 0.47 | $ | 0.31 | |||||||||

| Selected Balance Sheet Data: | September 30 | |||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Current Assets |

$ | 123,420,000 | $ | 112,366,000 | $ | 110,619,000 | $ | 108,791,000 | $ | 102,090,000 | ||||||||||

| Current Liabilities |

8,191,000 | 7,399,000 | 2,960,000 | 6,036,000 | 5,878,000 | |||||||||||||||

| Total Assets |

128,712,000 | 120,144,000 | 117,828,000 | 116,948,000 | 110,312,000 | |||||||||||||||

| Long Term Debt |

— | — | — | — | — | |||||||||||||||

| Shareholders’ Equity |

120,205,000 | 112,745,000 | 114,175,000 | 110,428,000 | 103,460,000 | |||||||||||||||

| * | Adjusted for three-for-two stock split |

15

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

“Forward-Looking” Information

This Form 10-K contains certain “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which represent the Company’s expectations and beliefs, including, but not limited to, statements concerning gross margins, sales of the Company’s products and future financing plans, income from investees and litigation. These statements by their nature involve substantial risks and uncertainties, certain of which are beyond the Company’s control. Actual results may differ materially depending on a variety of important factors, including the financial condition of the Company’s customers, changes in the economic and competitive environments, the performance of the investment portfolio and the demand for the Company’s products.

For information concerning these factors and related matters, see “Risk Factors” in Part I, Item 1A in this Report. However, other factors besides those referenced could adversely affect the Company’s results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by the Company herein speak as of the date of this Report. The Company does not undertake to update any forward-looking statement, except as required by law.

Overview

Gencor Industries, Inc. (the “Company”), is a leading manufacturer of heavy machinery used in the production of highway construction materials, synthetic fuels, and environmental control equipment. The Company’s core products include asphalt plants, combustion systems and fluid heat transfer systems. The Company’s products are manufactured in two facilities in the United States.

Because the Company’s products are sold primarily to the highway construction industry, the business is seasonal in nature. Traditionally, the Company’s customers do not purchase new equipment for shipment during the summer and fall months to avoid disrupting their peak season for highway construction and repair work. The majority of orders for the Company’s products are thus received between October and February, with a significant volume of shipments occurring prior to June. The principal factors driving demand for the Company’s products are the overall economic conditions, the level of government funding for domestic highway construction and repair, Canadian infrastructure spending, the need for spare parts, fluctuations in the price of crude oil (liquid asphalt as well as fuel costs), and a trend towards larger plants resulting from industry consolidation.

On July 6, 2012, President Obama signed a $118 billion transportation bill, Moving Ahead for Progress in the 21st Century Act (“MAP-21”). MAP-21 included a final three-month extension of the previous SAFETEA-LU bill at then current spending levels combined with a new two-year, $105 billion authorization of the federal highway, transit, and safety programs effective October 1, 2012. The bill provided states with two years of funding to build roads, bridges, and transit systems. On August 8, 2014, President Obama signed a $10.8 billion ten month bill to fund Federal highway and mass-transit programs through May 31, 2015. On May 29, 2015, MAP-21 was extended through July 31, 2015. On July 31, 2015, President Obama signed a three month extension of MAP-21 which provided $8 billion in funding for the Highway Trust Fund from August 1, 2015 through October 29, 2015. Two additional short-term extensions were approved between October 29, 2015 and December 4, 2015.

On December 4, 2015, President Obama signed into law a five-year, $305 billion transportation bill, Fixing America’s Surface Transportation Act (the “FAST Act”). The FAST Act reauthorized the collection of the 18.4 cents per gallon gas tax that is typically used to pay for transportation projects. It also included $70 billion from other areas of the federal budget to close a $16 billion annual funding deficit. The bill includes spending of more than $205 billion on roads and highways over five years. The 2016 funding levels are approximately 5% above 2015 projected funding, with annual increases between 2.0% and 2.5% from 2016 through 2020.

The Canadian government has also enacted major infrastructure stimulus programs. In 2007, the Building Canada Plan provided $33 billion in infrastructure funding through 2014. The 2014 New Building Canada Fund is one component within the $53 billion 2014 New Building Canada Plan. The 2014 New Building Canada Fund provided funding for infrastructure projects at the national, provincial and local levels.

16

In addition to government funding and overall economic conditions, fluctuations in the price of oil, which is a major component of asphalt mix, may affect the Company’s financial performance. An increase in the price of oil increases the cost of liquid asphalt and could, therefore, decrease demand for hot mix asphalt paving materials and certain of the Company’s products. Increases in oil prices also drive up the cost of gasoline and diesel, which results in increased freight costs. Where possible, the Company will pass increased freight costs on to its customers. However, the Company may not be able to recapture all of the increased costs and thus could have a negative impact on the Company’s financial performance.

Steel is a major component used in manufacturing the Company’s equipment. The Company is subject to fluctuations in market prices for raw materials such as steel. If the Company is unable to purchase materials it requires or is unable to pass on price increases to its customers or otherwise reduce its cost of goods sold, its business results of operations and financial condition may be adversely affected.

The Company believes its strategy of continuing to invest in product engineering and development and its focus on delivering the highest quality products and superior service will strengthen the Company’s market position. The Company continues to review its internal processes to identify inefficiencies and cost-reduction opportunities. The Company will continue to scrutinize its relationships with external suppliers to ensure it is achieving the highest quality materials and services at the most competitive cost.

Results of Operations

Year ended September 30, 2016 compared with the year ended September 30, 2015

Net revenues for the year ended September 30, 2016 were $70.0 million, an increase of 78.4% or $30.8 million from $39.2 million for the year ended September 30, 2015. Net revenues for the fourth quarter of 2016 were up 79.3% or $6.5 million over the fourth quarter of 2015. On December 4, 2015, President Obama signed the FAST Act which gave our U.S. customers the confidence to invest in new asphalt equipment for production capacity expansion and replacement of older, less efficient equipment. The Company’s increased net revenues reflect a significantly improved demand for its equipment due to the passing of the FAST Act. In Canada, orders were weak in fiscal 2016 due to low oil prices impacting the Canadian economy and the increase in the US-Canada exchange rate.

Gross margins for fiscal 2016 were 25.0% of net revenues versus 19.1% of net revenues in fiscal 2015. The gross margin increase in 2016 was due to efficient operations and overall higher net revenues and improved overhead absorption from increased production volumes.

Product engineering and development expenses increased $145,000 or 10.2% from fiscal 2015 due to increased headcount. Selling, general and administrative (“SG&A”) expenses increased $1,264,000 or 18.4% to $8,142,000 from $6,878,000 in fiscal 2015. SG&A expenses increased due to increased headcount, increased sales commissions due to higher revenues and increased trade show expenses to capitalize on the renewed optimism within the highway construction industry. As a percentage of net revenues, SG&A expenses declined to 11.6%, compared to 17.5% in the prior year.

Fiscal 2016 had operating income of $7,816,000 versus an operating loss of $(794,000) in fiscal 2015. As compared to fiscal 2015, the improved operating results were due to significantly higher net revenues, resulting in improved cost absorption, partially offset by a moderate increase in SG&A.

As of September 30, 2016 and 2015, the cost basis of the investment portfolio was $86.2 million and $87.1 million, respectively. For the years ended September 30, 2016 and 2015, net investment interest and dividend income (“Investment Income”) was $0.8 million and $0.9 million, respectively. The net realized and unrealized gains on marketable securities were $0.8 million in fiscal 2016 versus net losses of $(3.6) million in fiscal 2015. Total cash and investment balance at September 30, 2016 was $104.2 million compared to the September 30, 2015 cash and investment balance of $95.5 million, an increase of $8.6 million.

17

The effective income tax rate for fiscal 2016 was 25.1% versus a benefit of (48.7%) in fiscal 2015. As of September 30, 2015, the Company had $900,000 in research and development tax credits (“R&D Credits”) carry-forwards. In fiscal 2016, there was a net usage of R&D Credits of $253,000 bringing the total R&D Credits carry-forwards to $647,000 at September 30, 2016. The $647,000 of R&D Credits carry-forwards, which are included in net deferred and other income tax liabilities of $(316,000) at September 30, 2016, expire in fiscal years 2031 through 2035.

As of September 30, 2015, the Company had $214,000 in Florida state research and development tax credits (“Florida R&D Credits”) carry-forwards. The Company received additional net Florida R&D Credits of $10,000 in fiscal 2016. The $224,000 of Florida R&D Credits, which are included in net deferred and other income tax liabilities of $(316,000) at September 30, 2016, expire in fiscal 2020.

Net income for the year ended September 30, 2016 was $7,043,000 or $0.49 per diluted share versus a net loss of $(1,819,000) or $(0.13) per diluted share for the year ended September 30, 2015 (adjusted for three-for-two stock split). The increase in net income was primarily due to the improved net revenues and higher gross margins.

Liquidity and Capital Resources

The Company generates capital resources through operations and returns on its investments.

The Company had no long-term debt outstanding at September 30, 2016 or 2015. The Company does not currently require a credit facility but continues to review and evaluate its needs and options for such a facility. As of September 30, 2016, the Company has funded $135,000 in cash deposits at insurance companies to cover collateral needs.

As of September 30, 2016, the Company had $18.2 million in cash and cash equivalents, and $85.9 million in marketable securities. The marketable securities are invested through a professional investment management firm. The securities may be liquidated at any time into cash and cash equivalents.

The Company’s backlog, which includes orders received through the date of this filing, was $43.2 million at September 30, 2016 versus $18.7 million at September 30, 2015. The Company’s working capital (defined as current assets less current liabilities) was $115.2 million at September 30, 2016 versus $105.0 million at September 30, 2015. The significant purchases, sales and maturities of marketable securities shown on the consolidated statements of cash flows reflects the recurring purchase and sale of United States treasury bills. The change in deferred income taxes between years is primarily due to the tax impact on net unrealized losses on marketable securities which were an unrealized loss of $(0.3) million at September 30, 2016 versus an unrealized loss of $(2.7) million at September 30, 2015. Costs and estimated earnings in excess of billings increased $2.5 million reflecting the composition of open percentage-of-completion towards larger plants as of September 30, 2016 versus plant components at September 30, 2015. Prepaid expenses increased $0.8 million over prior year reflecting an overpayment on estimated federal income taxes for fiscal 2016. Inventories decreased $1.1 million as prior year stock build was used to fulfill current year orders. Accrued expenses increased $0.8 million as payroll and related accruals and sales commissions increased due to increased headcount and significantly improved revenues.

Cash provided by operations during the year ended September 30, 2016 was $6,993,000. Cash used in investing activities during the year ended September 30, 2016 of $306,000 related to capital expenditures for manufacturing equipment. Cash provided by financing activities of $380,000 in fiscal 2016 related to proceeds from the exercise of stock options.

18

Critical Accounting Policies, Estimates and Assumptions

The Company believes the following discussion addresses it’s most critical accounting policies, which are those that are most important to the portrayal of the Company’s financial condition and results of operations and require management’s most difficult, subjective, or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Accounting policies, in addition to the critical accounting policies referenced below, are presented in Note 1 to the Consolidated Financial Statements, “Accounting Policies.”

Estimates and Assumptions

In preparing the Consolidated Financial Statements, the Company uses certain estimates and assumptions that may affect reported amounts and disclosures. Estimates and assumptions are used, among other places, when accounting for certain revenue (e.g. contract accounting), expense, and asset and liability valuations. The Company believes that the estimates and assumptions made in preparing the Consolidated Financial Statements are reasonable, but are inherently uncertain. Assumptions may be incomplete or inaccurate and unanticipated events may occur. The Company is subject to risks and uncertainties that may cause actual results to differ from estimated results.

Revenues & Expenses

Revenues from contracts for the design, manufacture and sale of asphalt plants are recognized under the percentage-of-completion method. The percentage-of-completion method of accounting for these contracts recognizes revenue, net of any promotional discounts, and costs in proportion to actual labor costs incurred as compared with total estimated labor costs expected to be incurred during the entire contract. Pre-contract costs are expensed as incurred. Changes to total estimated contract costs or losses, if any, are recognized in the period in which they are determined. Revenue recognized in excess of amounts billed is classified as current assets under “costs and estimated earnings in excess of billings.” The Company anticipates that all incurred costs associated with these contracts at September 30, 2016, will be billed and collected within one year.

Revenues from all other contracts for the design and manufacture of custom equipment, for service and for parts sales, net of any discounts and return allowances, are recorded when the following four revenue recognition criteria are met: product is delivered/ownership is transferred or service is performed, persuasive evidence of an arrangement exists, the selling price is fixed or determinable, and collectability is reasonably assured.

Provisions for estimated returns and allowances and other adjustments, are provided for in the same period the related sales are recorded. Returns and allowances, which reduce product revenue, are estimated using historical experience.

Product warranty costs are estimated using historical experience and known issues and are charged to production costs as revenue is recognized.

All product engineering and development costs, and selling, general and administrative expenses are charged to operations as incurred. Provision is made for any anticipated contract losses in the period that the loss becomes evident.

The allowance for doubtful accounts is determined by performing a specific review of all account balances greater than 90 days past due and other higher risk amounts to determine collectability and also adjusting for any known customer payment issues with account balances in the less-than-90-day past due aging buckets. Account balances are charged off against the allowance for doubtful accounts when they are determined to be uncollectable. Any recoveries of account balances previously considered in the allowance for doubtful accounts reduce future additions to the allowance for doubtful accounts.

19

Inventories

Inventories are valued at the lower of cost or market, with cost being determined principally by using the last-in, first-out (“LIFO”) method and market defined as replacement cost for raw materials and net realizable value for work in process and finished goods (see Note 2 to Consolidated Financial Statements). Appropriate consideration is given to obsolescence, excessive levels, deterioration, possible alternative uses and other factors in determining net realizable value. The cost of work in process and finished goods includes materials, direct labor, variable costs and overhead. The Company evaluates the need to record inventory adjustments on all inventories, including raw material, work in process, finished goods, spare parts and used equipment. Used equipment acquired by the Company on trade-in from customers is carried at estimated net realizable value. Unless specific circumstances warrant different treatment regarding inventory obsolescence, the cost basis of inventories three to four years old are reduced by 50%, while the cost basis of inventories four to five years old are reduced by 75%, and the cost basis of inventories greater than five years old are reduced to zero. Inventory is typically reviewed for obsolescence on an annual basis computed as of September 30th, the Company’s fiscal year end. If significant known changes in trends, technology or other specific circumstances that warrant consideration occur during the year, then the impact on obsolescence is considered at that time.

Investments

Marketable debt and equity securities are categorized as trading securities and are thus marked to market and stated at fair value. Fair value is determined using the quoted closing or latest bid prices for Level 1 investments and market standard valuation methodologies for Level 2 investments. Realized gains and losses on investment transactions are determined by specific identification and are recognized as incurred in the consolidated statements of operations. Net unrealized gains and losses are reported in the consolidated statements of operations and represent the change in the fair value of investment holdings during the period.

Long Lived Asset Impairment

Property and equipment and intangible assets subject to amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset (or asset group) may not be recoverable. An impairment loss would be recognized when the carrying amount of an asset exceeds the estimated undiscounted cash flows expected to result from the use of the asset and its eventual disposition. The amount of the impairment loss to be recorded is calculated by the excess over its fair value of the asset’s carrying value. Fair value is generally determined using a discounted cash flow analysis.

Inflation

The overall effects of inflation on the Company’s business during the periods discussed have not been significant. The Company monitors the prices it charges for its products and services on an ongoing basis and believes that it will be able to adjust those prices to take into account future changes in the rate of inflation.

Contractual Obligations

The following table summarizes the outstanding borrowings and long-term contractual obligations at September 30, 2016:

| Total | Less than 1 Year | 1 – 2 Years | ||||||||||

| Operating leases |

$ | 186,000 | $ | 66,000 | $ | 120,000 | ||||||

The Company had no long-term or short-term debt as of September 30, 2016. There was no long-term debt facility in place and there were no outstanding letters of credit at September 30, 2016.

Off-Balance Sheet Arrangements

None

20

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

The Company operates manufacturing facilities and sales offices at two locations in the United States. The Company is subject to business risks inherent in non-U.S. activities, including political and economic uncertainty, import and export limitations, and market risk related to changes in interest rates and foreign currency exchange rates. Periodically, the Company may use derivative financial instruments consisting primarily of interest rate hedge agreements to manage exposures to interest rate changes. The Company’s objective in managing its exposure to changes in interest rates on any future variable rate debt is to limit the impact on earnings and cash flow and reduce overall borrowing costs.

At September 30, 2016 and 2015, the Company had no debt outstanding. At September 30, 2016, there was no credit facility in place. The Company does not currently require a credit facility but continues to evaluate its needs and options for such a facility.

The Company’s marketable securities are invested in cash and money funds, equities, mutual funds, exchange-traded funds, and government securities through a professional investment advisor. Investment securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of securities, it is possible that changes in these risk factors could have an adverse material impact on the Company’s results of operations or equity.

21

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

INDEX TO FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES

GENCOR INDUSTRIES, INC.

All other schedules are omitted because they are not applicable or the required information is shown in the consolidated financial statements or notes thereto.

22

GENCOR INDUSTRIES, INC.

The management of Gencor Industries, Inc. (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. The Company’s internal control system is designed to provide reasonable assurance to the Company’s management and board of directors regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. There are inherent limitations in the effectiveness of all internal control systems no matter how well designed. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to the preparation and presentation of financial statements. Furthermore, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of a change in circumstances or conditions.

In order to ensure that the Company’s internal control over financial reporting is effective, management regularly assesses such controls and did so most recently as of September 30, 2016. This assessment was based on criteria for effective internal control over financial reporting described in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management believes the Company maintained effective internal control over financial reporting as of September 30, 2016. Moore Stephens Lovelace, P.A., the Company’s independent registered public accountant firm, has issued an attestation report on the Company’s internal control over financial reporting as of September 30, 2016.

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Gencor Industries, Inc.:

We have audited the accompanying consolidated balance sheets of Gencor Industries, Inc. (the “Company”) as of September 30, 2016 and 2015, and the related consolidated statements of operations, shareholders’ equity, and cash flows for each of the years in the two-year period ended September 30, 2016. We have also audited the Company’s internal control over financial reporting as of September 30, 2016, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). The Company’s management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Annual Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on these consolidated financial statements and on the Company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and the receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Gencor Industries, Inc. as of September 30, 2016 and 2015, and the consolidated results of its operations, changes in shareholders’ equity, and its cash flows for each of the years in the two-year period ended September 30, 2016 in conformity with accounting principles generally accepted in the United States of America. Also, in our opinion, Gencor Industries, Inc. maintained, in all material respects, effective internal control over financial reporting as of September 30, 2016, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).

/s/ MOORE STEPHENS LOVELACE, P.A.

MOORE STEPHENS LOVELACE, P.A.

Certified Public Accountants

Orlando, Florida

December 2, 2016

24

Part I. Financial Information

GENCOR INDUSTRIES, INC.

As of September 30, 2016 and 2015

| ASSETS | 2016 | 2015 | ||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 18,219,000 | $ | 11,152,000 | ||||

| Marketable securities at fair value (cost of $86,203,000 at September 30, 2016 and $87,123,000 at September 30, 2015) |

85,938,000 | 84,357,000 | ||||||

| Accounts receivable, less allowance for doubtful accounts of $195,000 at September 30, 2016 and $357,000 at September 30, 2015 |

1,110,000 | 874,000 | ||||||

| Costs and estimated earnings in excess of billings |

4,921,000 | 2,396,000 | ||||||

| Inventories, net |

11,634,000 | 12,770,000 | ||||||

| Prepaid expenses |

1,598,000 | 817,000 | ||||||

|

|

|

|

|

|||||

| Total current assets |

123,420,000 | 112,366,000 | ||||||

|

|

|

|

|

|||||

| Property and equipment, net |

5,239,000 | 6,388,000 | ||||||

| Deferred and other income taxes |

— | 1,331,000 | ||||||

| Other assets |

53,000 | 59,000 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 128,712,000 | $ | 120,144,000 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 1,443,000 | $ | 1,529,000 | ||||

| Customer deposits |

4,484,000 | 4,418,000 | ||||||

| Accrued expenses |

2,264,000 | 1,452,000 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

8,191,000 | 7,399,000 | ||||||

|

|

|

|

|

|||||

| Deferred and other income taxes |

316,000 | — | ||||||

|

|

|

|

|

|||||

| Total liabilities |

8,507,000 | 7,399,000 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Shareholders’ equity: |

||||||||

| Preferred stock, par value $.10 per share; 300,000 shares authorized; none issued |

— | — | ||||||

| Common stock, par value $.10 per share; 15,000,000 shares authorized; 12,111,079 shares and 12,043,204 shares issued and outstanding at September 30, 2016 and 2015, respectively * |

1,211,000 | 1,205,000 | ||||||

| Class B Stock, par value $.10 per share; 6,000,000 shares authorized; |

||||||||

| 2,263,857 shares issued and outstanding at September 30, 2016 and 2015 * |

226,000 | 226,000 | ||||||

| Capital in excess of par value * |

10,887,000 | 10,476,000 | ||||||

| Retained earnings |

107,881,000 | 100,838,000 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

120,205,000 | 112,745,000 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders’ Equity |

$ | 128,712,000 | $ | 120,144,000 | ||||

|

|

|

|

|

|||||

See accompanying Notes to Consolidated Financial Statements

| * | Adjusted for three-for-two stock split |

25

GENCOR INDUSTRIES, INC.

Consolidated Statements of Operations

For the Years Ended September 30, 2016 and 2015

| 2016 | 2015 | |||||||

| Net revenue |

$ | 69,991,000 | $ | 39,230,000 | ||||

| Costs and expenses: |

||||||||

| Production costs |

52,466,000 | 31,724,000 | ||||||

| Product engineering and development |

1,567,000 | 1,422,000 | ||||||

| Selling, general and administrative |

8,142,000 | 6,878,000 | ||||||

|

|

|

|

|

|||||

| 62,175,000 | 40,024,000 | |||||||

|

|

|

|

|

|||||

| Operating income (loss) |