UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240. 14a-12 |

SOLUNA HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(B) per Exchange Act Rules 14(a)-6(i)(1) and 0-11 |

SOLUNA HOLDINGS, INC.

325 WASHINGTON AVENUE EXTENSION

ALBANY, NEW YORK 12205

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Soluna Holdings, Inc.:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Soluna Holdings, Inc., a Nevada corporation formerly known as Mechanical Technology, Incorporated (the “Company”), will be held on Thursday June 29, 2023, at 10:00 a.m. The Annual Meeting will be held completely virtually. You will be able to participate in the Annual Meeting as well as vote and submit your questions and examine our stockholder list during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/SLNH2023 and entering the 16-digit control number included on your proxy card (the “Proxy Card”). At the Annual Meeting, stockholders will be asked to consider and act upon the following matters:

| 1. | To elect three directors to serve for a three-year term ending at the Company’s annual meeting of stockholders to be held in 2026 and until each such director’s successor is duly elected and qualified. | |

| 2. | To ratify the appointment of UHY LLP as the Company’s registered independent public accounting firm for fiscal year 2023. | |

| 3. | To approve an amendment to the Company’s articles of incorporation, as amended, to effect a reverse stock split of our Common Stock outstanding or issued and held in treasury at a ratio of between 1-for-5 and 1-for-25, inclusive, which ratio will be selected at the sole discretion of our Board of Directors or a duly authorized committee thereof at any whole number in the above range (the “Reverse Stock Split”), with any fractional shares that would otherwise be issued as a result of the Reverse Stock Split rounded up to the next whole share; provided, that our Board of Directors may effect the Reverse Stock Split at any time during the one-year period following stockholder approval or may abandon the Reverse Stock Split in its sole discretion. | |

| 4. | To approve the Soluna Holdings, Inc. Amended and Restated 2023 Stock Incentive Plan | |

| 5. | To approve a non-binding advisory proposal to approve the compensation paid to the Company’s named executive officers. | |

| 6. | To select a frequency for future non-binding proposals on executive compensation. | |

| 7. | To transact such other business as may properly come before the meeting. |

The Board of Directors has fixed the close of business on May 26, 2023 as the record date for determining stockholders entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of the Company’s common stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors recommends that you vote in favor of the proposal for the election of the nominees as directors of the Company, the ratification of UHY LLP as our independent registered public accounting firm, the reverse stock split proposal and the non-binding advisory proposal on executive compensation.

By Order of the Board of Directors,

| /s/ Jessica L. Thomas |

Jessica L. Thomas

Corporate Secretary

Albany, New York

May 30, 2023

It is important that your shares are represented and voted at the Annual Meeting. Whether or not you intend to be present (virtually) at the meeting, please vote your shares according to the instructions on the accompanying Proxy Card. The proxy is revocable and will not be used if you attend and vote at the Annual Meeting and vote “in person” at the meeting or otherwise provide notice of your revocation.

SOLUNA HOLDINGS, INC.

325 WASHINGTON AVENUE EXTENSION

ALBANY, NEW YORK 12205

PROXY STATEMENT

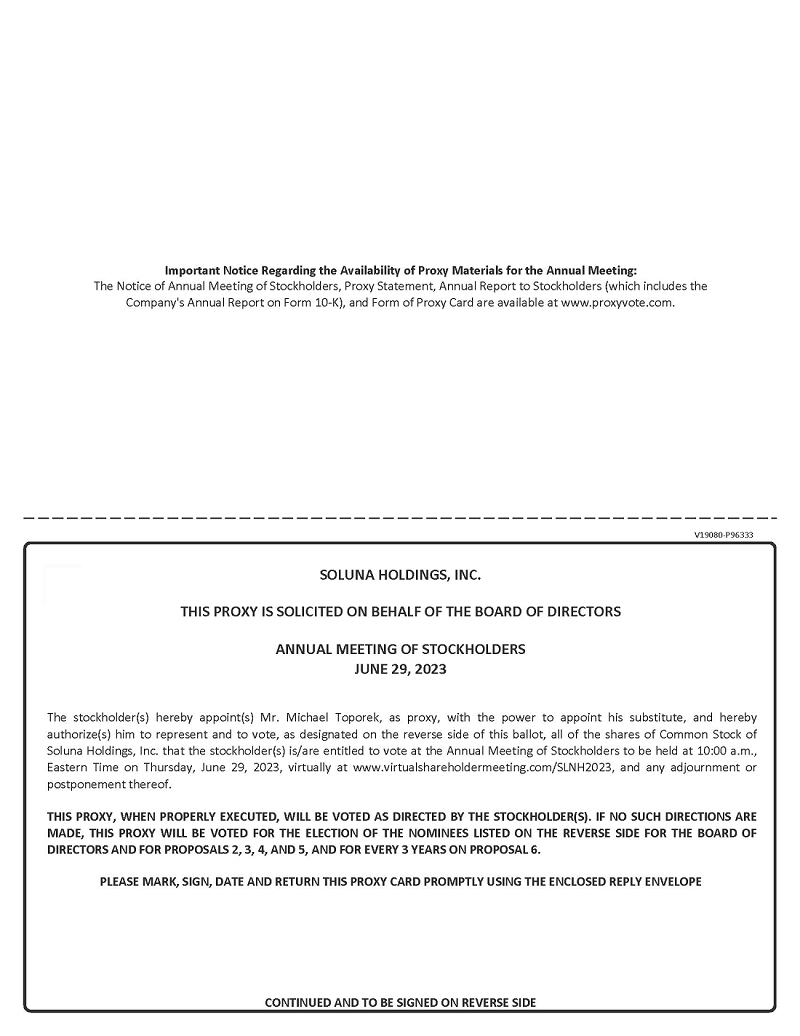

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Soluna Holdings, Inc., a Nevada corporation formerly known as Mechanical Technology, Incorporated (referred to in this Proxy Statement as the “Company,” “we,” or “us”), to be voted at the 2023 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held virtually on Thursday June 29, 2023 at 10:00 a.m., local time. This Proxy Statement and the form of proxy relating to the Annual Meeting are first being made available to stockholders on or about June 1, 2023.

Record Date and Voting Securities

The Notice of Annual Meeting, Proxy Statement and Proxy Card are first being mailed to stockholders of the Company on or about June 1, 2023 in connection with the solicitation of proxies for the Annual Meeting. The Board has fixed the close of business on May 26, 2023 as the date of record (the “Record Date”) for the determination of stockholders entitled to notice of, and entitled to vote at, the Annual Meeting. On the Record Date, there were 29,637,516 shares of common stock outstanding and one (1) share of Series X Preferred Stock. Each share of common stock represents one vote that may be voted on each proposal that may come before the Annual Meeting. The Series X Preferred Stock does not have any voting rights except with respect to the reverse split proposal. Each share of Series X Preferred Stock represents 50,000,000 votes that may be voted on Proposal 3; provided that such votes must be counted in the same proportion as the shares of common stock voted on Proposal 3. As an example, if 50.5% of the shares of common stock are voted FOR Proposal 3, 50.5% of the votes cast by the holder of the Series X Preferred Stock will be cast as votes FOR Proposal 3. Holders of common stock and Series X Preferred Stock will vote on Proposal 3 as a single class. Each holder of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held as of the Record date with respect to each matter submitted to the stockholders at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 29, 2023.

The Notice of 2023 Annual Meeting, Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 2022 are available at www.proxyvote.com.

Proxies; Voting of Proxies

The Board is soliciting proxies for use at the Annual Meeting, and such proxy will not be voted at any other meeting. Michael Toporek is the person selected by the Board to serve as proxy with respect to the Annual Meeting. Mr. Toporek is the Executive Committee Chairman of the Company.

Your vote is important. If you are a stockholder of record, whether or not you plan to attend the Annual Meeting via the live webcast, we urge you to submit your proxy to ensure that your vote is counted. You may still view the live webcast of the Annual Meeting and vote in person even if you have already voted by proxy. You may vote in one of the following ways:

| ● | Vote electronically at the Annual Meeting by attending the live webcast at www.virtualshareholdermeeting. Com/SLNH2023 and follow the instructions on how to vote electronically. | |

| ● | Vote online by going to www.proxyvote.com and follow the instructions provided. | |

| ● | Vote by phone by calling 1-800-690-6903 and follow the recorded instructions. | |

| ● | Vote by mail by voting, signing, and timely mailing your proxy card. |

The shares represented by each proxy will be voted in accordance with the directions specified thereby. If you return a properly executed proxy card but do not fill out the voting instructions on the proxy card or if you indicate when voting on the Internet or over the telephone that you wish to vote as recommended by the Board, the shares represented by your proxy, assuming it is not properly revoked pursuant to the instructions below, will be voted by the person named as proxy in accordance with the recommendations of the Board contained in this Proxy Statement.

The Board knows of no matters to be presented at the Annual Meeting other than those described in this Proxy Statement. In the event that other business properly comes before the meeting, the person named as proxy will have discretionary authority to vote the shares represented by any properly provided proxy in accordance with his own judgment.

Revocation of Proxies

Each stockholder giving a proxy has the power to revoke it at any time before the shares represented by that proxy are voted. A proxy may be revoked, prior to its exercise, by (i) executing and delivering a later-dated proxy via the Internet, via telephone, or by mail; (ii) delivering written notice of revocations of the proxy to our Secretary prior to the Annual Meeting; or (iii) logging on to the live webcast of the Annual Meeting and voting as directed at the Annual Meeting. Please note that a stockholder’s attendance at the live webcast of the Annual Meeting will not, by itself, revoke such stockholder’s proxy.

Subject to the terms and conditions set forth herein, all proxies received by us will be effective, notwithstanding any transfer of the shares to which such proxies relate, unless at or prior to the Annual Meeting we receive a written notice of revocation signed by the person who, as of the Record Date, was the registered holder of such shares. The notice of revocation must indicate the certificate number(s) and number of shares to which such revocation relates and the aggregate number of shares represented by such certificate(s).

If your shares are held in “street name,” as discussed below under the heading “Beneficial Owner: Shares Registered in the Name of Broker, Bank, or other Nominee,” you must contact your broker, bank, or other nominee to revoke any prior voting instructions.

Beneficial Owner: Shares Registered in the Name of Broker, Bank, or other Nominee

Many shares of Common Stock are held in “street name,” meaning that a depository, broker-dealer, or other financial institution holds the shares in its name, but such shares are beneficially owned by another person. If your shares of Common Stock are held in street name as of the Record Date, you should receive instructions from the holder of record that you must follow in order for you to specify how your shares will be voted at the Annual meeting; alternatively, you can use the voting information form provided by Broadridge to instruct your record owner on how to vote your shares. Generally, a street name holder that is a broker must receive direction from the beneficial owner of the shares to vote on issues other than certain limited routine, uncontested matters, such as the ratification of auditors. In the case of non-routine or contested items, the brokerage institution holding street name shares cannot vote the shares if it has not received voting instructions from the beneficial holder thereof. A broker “non-vote” occurs when a proxy is received from a broker but the shares represented by such proxy are not voted on a particular matter because the broker has not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the broker does not have discretionary power to vote the shares.

If your shares are held of record by a person or institution other than a broker, whether such nominee can exercise discretionary authority to vote your shares on any matter at the Annual Meeting in the absence of instructions from you will depend on your individual arrangement with that nominee record holder, in particular, whether you have granted such record holder discretionary authority to vote your shares. In the absence of an arrangement with your record holder granting such discretionary authority, your record holder nominee will not have discretionary authority to vote your shares on any matter at the Annual Meeting in the absence of specific voting instructions from you.

If, as of the Record Date, your shares of Common Stock were held in an account at a broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and the proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record. As a beneficial owner, you may direct your broker, bank, or nominee how to vote the shares in your account or “vote” (provide instructions) online at the Annual Meeting using the 16-digit control number included on your voting instruction form or otherwise provided by the organization that is the record holder of your shares.

| 2 |

Quorum and Method of Tabulation

The presence, in person or by proxy, of holders of 33 1/3% of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. A quorum being present, the affirmative vote of a plurality of the votes cast is necessary to elect the nominees as directors of the Company, as set forth in Proposal No. 1. In other words, the nominees to receive the greatest number of votes cast, up to the number of nominees up for election, will be elected.

Assuming a quorum is present, Proposal 2 (ratification of UHY LLP as the registered independent public accounting firm), Proposal 4 (an amendment to the 2023 Stock Incentive Plan to increase the number of shares which may be used to settle RSUs to 23.75%), Proposal 5 (non-binding advisory vote on executive compensation) and Proposal 6 (frequency of non-binding proposals on executive compensation) will be approved by our stockholders if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal.

Proposal 3 (proposal to grant the Board authority to effect a reverse stock split) requires the affirmative vote of a majority of the voting power of the outstanding shares of common stock and Series X preferred stock, voting together as a single class.

One or more inspectors of election appointed for the meeting will tabulate the votes cast in person or by proxy at the Annual Meeting and will determine whether or not a quorum is present. The inspectors of election will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as not cast for purposes of determining the vote on any matter submitted to stockholders. As abstentions are not included in calculating votes cast with respect to any proposal, abstentions will have no effect on the outcome of the election of directors or any other proposal submitted to stockholders at the Annual Meeting.

If a broker submits a proxy indicating that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will be treated as shares that are present and entitled to vote for purposes of determining quorum, but as not cast for purposes of determining the vote on such matter submitted to the stockholders for a vote. As a result, broker non-votes will have no effect on the outcome of the election of directors or on Proposals 2, 4, 5 and 6.

Format of and Admission to the Annual Meeting

This year we will hold the Annual Meeting in a virtual-only format, which will be conducted over the internet via live webcast. In addition, we may continue to hold our annual meetings using a virtual-only format in future years, even after the pandemic, as we believe that a virtual format is more environmentally-friendly, allows greater stockholder participation, and decreases the costs of holding the annual meeting. We intend to hold our virtual annual meetings in a manner that affords stockholders the same general rights and opportunities to participate, to the greatest extent possible, as they would have at an in-person meeting.

The Annual Meeting will be held live via the Internet on Thursday, June 29, 2023 at 10:00 a.m. Eastern Time, at www.virtualshareholdermeeting.com/SLNH2023. You will not be able to attend the meeting in person. Participation in and attendance at the Annual Meeting is limited to our stockholders of record as of the close of business on May 26, 2023, and other persons holding valid proxies for the Annual Meeting. Online access will begin at 9:45 a.m. Eastern Time, on June 29, 2023, and we encourage you to access the Annual Meeting prior to the start time. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/SLNH2023, you must enter the 16-digit control number included on your proxy card or, for beneficial owners of shares held in “street name” as discussed above the heading “Beneficial Owner: Shares Registered in the Name of Broker, Bank, or other Nominee,” on your voter information form. If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/SLNH2023.

Stockholders will be able to submit questions via the online platform during a portion of the Annual Meeting. You may submit questions by signing into the virtual meeting platform at www.virtualshareholdermeeting.com/ SLNH2023, typing a question into the “Ask a Question” field, and clicking “submit.” Only questions that are pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters or matters not relevant to the Annual Meeting will not be answered. If we receive substantially similar questions, we will group them together to avoid repetition. If there are questions pertinent to meeting matters that cannot be answered during the meeting due to time constraints, we will post answers to a representative set of such questions at https://www.solunacomputing.com/investors/. The questions and answers will be available as soon as practicable after the Annual Meeting.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our Proxy Statement or annual report to stockholders may have been sent to multiple stockholders who share an address unless we have received instructions to the contrary. We will promptly deliver a separate copy of either document to any stockholder upon written or oral request. Requests may be made by mail to: Soluna Holdings, Inc, ATTN: Investor Relations Department, 325 Washington Avenue Extension, Albany, New York 12205; by e-mail: hello@soluna.io; or by telephone: (518) 218-2550. Any stockholder who would like to receive separate copies of our annual proxy statement and/or annual report to stockholders in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household in the future, should contact their bank, broker, or other nominee record holder, or us directly at the address, e-mail address or phone number listed above.

Proxy Solicitation Expense

We have retained Morrow Sodali to assist with the solicitation of proxies for the Annual Meeting. SHI will pay the fees of Morrow, plus reimbursement of out-of-pocket expenses. Our directors, officers, and employees, without receiving any additional compensation, may solicit proxies personally or by telephone, facsimile, or email. The Company will pay all costs and expenses incurred in the solicitation of proxies for the Annual Meeting. We will also reimburse banks, brokers, and other nominees for reasonable expenses incurred in forwarding proxy materials to their customers or principals who are the beneficial owners of shares of Common Stock held in street name.

| 3 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We currently have nine directors on the Board.

Upon the recommendation of our Nominating and Corporate Governance Committee, the Board has nominated William Hazelip, Thomas J. Marusak, and Michael Toporek for election as directors at the Annual Meeting. William Hazelip, Thomas J. Marusak, and Michael Toporek each currently serve on the Board with terms expiring at the Annual Meeting. If elected at the Annual Meeting, they will each be elected to hold office until our 2026 annual meeting of stockholders and until their successors are elected and qualified or until their earlier death, retirement, disqualification, resignation or removal.

All of our directors bring to the Board significant leadership experience derived from their professional experience and service as executives or board members of other corporations. The process undertaken by the Nominating and Corporate Governance Committee in recommending qualified director candidates is described below under “Board of Directors Meetings and Committees – Nominating and Corporate Governance Committee.” Certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole are described under “Information about Our Directors.”

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR ALL” OF THE NOMINEES LISTED ABOVE AS DIRECTORS OF THE COMPANY.

Information about Our Directors

Set forth below is certain information regarding the directors of the Company, including the nominees for election at the Annual Meeting.

| Name | Age | Director Since | ||||||

Nominees for Election for a Term Expiring at the 2026 Annual Meeting | ||||||||

| William Hazelip(1)(3) | 44 | 2021 | ||||||

| Thomas J. Marusak(2)(3) | 72 | 2004 | ||||||

| Michael Toporek(4) | 58 | 2016 | ||||||

| Terms Expiring at the 2025 Annual Meeting | ||||||||

| Matthew E. Lipman(4) | 44 | 2016 | ||||||

| David C. Michaels(5) | 67 | 2013 | ||||||

| Terms Expiring at the 2024 Annual Meeting | ||||||||

| Edward R. Hirshfield(2)(3) | 51 | 2016 | ||||||

| William P. Phelan(1)(2)(4) | 66 | 2004 | ||||||

| John Bottomley(2)(4) | 55 | 2021 | ||||||

| John Belizaire | 51 | 2021 | ||||||

| (1) | Member of the Compensation Committee. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

| (4) | Member of the Executive Committee. |

| (5) | Effective April 21,2023, Mr. Michaels began service as Chief Financial Officer of the Company and resigned from the Audit Committee. |

| 4 |

The Board has determined that Messrs. Bottomley, Hazelip, Hirshfield, Marusak, and Phelan are “independent directors,” as defined by the rules and listing standards of The Nasdaq Stock Market LLC (“Nasdaq”). In making this determination, the Board considered the transactions and relationships disclosed under “Certain Relationships and Related Transactions” below. In April 2023 Mr. Michaels was appointed interim chief financial officer and accordingly is no longer an “independent director.”

William Hazelip has served as a member of the Board since February 2021. Since 2015, he has served as Vice President of National Grid PLC, a multinational electricity and gas utility company headquartered in London, England. He has also served as National Grid PLC’s President, Global Transmission (US) from 2017 to 2019 and President of Strategic Growth for National Grid Ventures since August 2019, developing new business opportunities in electric transmission, energy storage, and renewable energy. Prior to joining National Grid, PLC, he was the Managing Director, Business Development at Duke Energy Corporation and the President of Path 15 Transmission, LLC, an independent electric transmission company in California, where he led the acquisition for Duke Energy Corporation. Mr. Hazelip also has extensive experience serving on the board of directors of companies. He currently serves as member of the board of directors of Millennium Pipeline Corporation, a multi-billion dollar natural gas pipeline company, the Vice-Chairman of the board of directors of New York Transco, a growing electric transmission company, and a member of the board of directors representative of Community Offshore Wind, a clean energy joint venture of RWE AG and National Grid plc. Mr. Hazelip began his career as an Area Director for CWL Investments, LLC, a Michigan investor group that owns and operates restaurant franchises including Jimmy John’s Gourmet Sandwich Shops. Mr. Hazelip earned a Bachelor of Arts from Emory University, Atlanta, GA, and an International Master of Business Administration (IMBA) from the Darla Moore School of Business at the University of South Carolina. Mr. Hazelip is an accomplished leader in the energy industry, with deep experience in utility project development, financing, regulation, and operations, which the Board believes, particularly in light of the Company’s involvement with the renewable energy sector as it relates to their cryptocurrency mining subsidiary, qualifies him to serve as a director.

Thomas J. Marusak has served as a member of the Board since December 2004. Additionally, Mr. Marusak served as a member of the Board of Directors of our former subsidiary, MTI Instruments, since April 2011 and has served as a member of the Board of Directors of our subsidiary, SCI, since January 2020. Since 1986, Mr. Marusak has served as President of Comfortex Corporation, a manufacturer of window blinds and specialty shades. Mr. Marusak was a member of the Advisory Board of Directors for Key Bank of New York from 1996 through 2004 and served on the Board of Directors of the New York Energy Research and Development Authority from 1998 through 2006. In 2019, Mr. Marusak retired from the Board of Directors of the Capital District Physician’s Health Plan, Inc., in Albany, where he had served for the prior eight years and had participated as a member of the board’s Finance, Compensation, Audit, Investment, and Executive Committees. Additionally, Mr. Marusak has served as a Board member for the following entities in the course of his professional career: Center for Economic Growth (past Chair), Dynabil Corp. (Advisory Board), and the Albany Chamber of Commerce (Executive Board). Mr. Marusak received a B.S. in Engineering from Pennsylvania State University and an M.S. in Engineering from Stanford University. Mr. Marusak brings technical development, manufacturing experience, product development and introduction, financial accounting, and human resources expertise to the Board, as well as relevant experience in committee and board service, which the Board believes qualifies him to serve as a director.

Michael Toporek served as our Chief Executive Officer from November 2020 until May 1, 2023 when he stepped down from that position and was selected as Chairman of the Board as of that date. Mr. Toporek has served as a member of the Board since October 2016. Since 2003, Mr. Toporek has served as the Managing General Partner of Brookstone Partners, a lower middle market private equity firm based in New York and an affiliate of Brookstone XXIV. Prior to founding Brookstone Partners in 2003, Mr. Toporek was both an active principal investor and an investment banker. Mr. Toporek began his career in Chemical Bank’s Investment Banking Group, later joining Dillon, Read and Co., which became UBS Warburg Securities Ltd. during his tenure, and SG Cowen and Company. Mr. Toporek currently serves on the Board of Directors of Capstone Therapeutics Corp. Mr. Toporek has a B.A. in Economics and an M.B.A. from the University of Chicago in Finance/Accounting. Mr. Toporek brings strategic and financial expertise to the Board as a result of his experience with Brookstone Partners, which the Board believes qualifies him to serve as a director. As part of our sale of 3,750,000 shares of Common Stock to Brookstone XXIV in October 2016, Brookstone XXIV has two designated directors that sit on the Board; Mr. Toporek is one such director.

| 5 |

Matthew E. Lipman has served as a member of the Board since October 2016. Since 2004, Mr. Lipman has served as Managing Director of Brookstone Partners, a lower middle market private equity firm based in New York and an affiliate of Brookstone Partners Acquisition XXIV, LLC (“Brookstone XXIV”). Mr. Lipman’s responsibilities at Brookstone Partners include identifying and evaluating investment opportunities, performing transaction due diligence, managing the capital structure of portfolio companies, and working with management teams to implement operational and growth strategies. In addition, Mr. Lipman is responsible for executing add-on acquisitions and other portfolio company-related strategic projects. From July 2001 through June 2004, Mr. Lipman was an analyst in the mergers and acquisitions group at UBS Financial Services Inc., responsible for formulating and executing on complex merger, acquisition, and financing strategies for Fortune 500 companies in the industrial, consumer products, and healthcare sectors. Mr. Lipman currently serves on the Board of Directors of Denison Pharmaceuticals, LLC, Advanced Disaster Recovery Inc., Totalstone, LLC, Harmattan Energy Limited and Capstone Therapeutics Corp. Mr. Lipman has a B.S. in Business Administration from Babson College. Mr. Lipman brings 20 years of experience working with companies to establish growth strategies and execute acquisitions, is proficient in reading and understanding financial statements, generally accepted accounting principles, and internal controls as a direct result of his investment experience evaluating companies for potential investments and the management of financial reporting and capital structure for three portfolio companies, as well as relevant experience in serving on other boards of directors, which the Board believes qualifies him to serve as a director. As part of our sale of 3,750,000 shares of Common Stock to Brookstone XXIV in October 2016, Brookstone XXIV has two designated directors that sit on the Board; Mr. Lipman is one such director.

David C. Michaels has served as a member of the Board since August 2013, served as our Lead Independent Director from June 2016 until April 2023 and as our Chairman of the Board from January 2017 to January 2022. Mr. Michaels was selected as Interim Chief Financial Officer on April 24, 2023. Mr. Michaels served as the Chief Financial Officer of the American Institute for Economic Research, Inc., an internationally-recognized economics research and education organization, from October 2008 until his retirement in May 2018. Prior to that, Mr. Michaels served as Chief Financial Officer at Starfire Systems, Inc. from December 2006 to September 2008. Mr. Michaels worked at Albany International Corp. from March 1987 to December 2006 as Vice President, Treasury and Tax, and Chief Risk Officer. Mr. Michaels also worked at Veeco Instruments from May 1979 to March 1987 in various roles including Controller and Tax Manager. Mr. Michaels is the Chairman of the Board of Directors and Chair of the Audit Committee of Iverson Genetic Diagnostics, Inc. Mr. Michaels also serves as a member of the Board of Governors and Treasurer of the Country Club of Troy. Mr. Michaels has a Bachelor of Science degree with dual majors in Accounting and Finance and a minor in Economics from the University at Albany and completed graduate-level coursework at the C.W. Post campus of Long Island University. Mr. Michaels also completed the Leadership Institute Program at the Lally School of Management & Technology at Rensselaer Polytechnic Institute. Mr. Michaels contributes more than 30 years of international financial and operating experience in a wide variety of roles in both public and private organizations to the Board, which the Board believes qualifies him to serve as a director. Effective April 21, 2023, Mr. Michaels will serve as Chief Financial Officer of the Company.

Edward R. Hirshfield has served as a member of the Board since October 2016. He served as a director of our former subsidiary, MTI Instruments, Inc. (“MTI Instruments”), from October 2016 until its sale in April 2022 and of our subsidiary, Soluna Computing, Inc., formerly known as EcoChain, Inc. (“SCI”), since its incorporation in January 2020. Since 2018, Mr. Hirshfield has served as Managing Director in the restructuring group at B. Riley FBR, Inc., a leading financial services provider, where he advises stressed and distressed companies and their constituencies. From 2015 until 2018, Mr. Hirshfield served as a partner at Steppingstone Group, LLC, a special situations private equity fund located in New York. Mr. Hirshfield’s responsibilities in this role included business development activities, conducting extensive credit analysis on target companies, as well as portfolio management. Mr. Hirshfield began his career as a loan officer at CIT Group Inc. and then became a restructuring advisor at a boutique investment bank, CDG Group. In 2003, Mr. Hirshfield moved over to the buy side and joined Longacre Fund Management, LLC, a $2.5 billion distressed debt fund. Mr. Hirshfield continued as a distressed investor at Del Mar Asset Management, LP, Ramius LLC, and most recently Apple Ridge Advisors LLC from 2010 through 2015. Mr. Hirshfield has a B.S. in Applied Mathematics from Union College and an M.B.A. from Fordham University Graduate School of Business. Mr. Hirshfield brings over 20 years of experience understanding and analyzing public and private companies. He has an expertise in providing operational and investment recommendations as well as providing extensive valuation and credit analysis, which the Board believes qualifies him to serve as a director.

| 6 |

William P. Phelan has served as our Chairman of the Board since January 2022 and as a member of the Board since December 2004. He also served as interim Chief Executive Officer and President of SCI from March 2020 to November 2020, and as interim Vice President of SCI from November 2020 to March 2021. Mr. Phelan is the co-founder and Chief Executive Officer of Bright Hub, Inc., a software company founded in 2005 that focuses on the development of online software for commerce. In May 1999, Mr. Phelan founded OneMade, Inc., an electronic commerce marketplace technology systems and tools provider. Mr. Phelan served as Chief Executive Officer of OneMade, Inc. from May 1999 to May 2004, including for a year after it was sold to, and remained a subsidiary of, America Online. Mr. Phelan serves on the Board of Trustees and is a Finance Committee member, an Executive Committee Member, an Investment Committee Chair and a Compensation Committee Chair for Capital District Physician’s Health Plan, Inc. Mr. Phelan also serves on the Board of Trustees and Chairman of the Audit Committee of the Paradigm Mutual Fund Family. He has also held numerous executive positions at Fleet Equity Partners, Cowen & Company, First Albany Corporation, and UHY Advisors, Inc., formerly Urbach Kahn & Werlin, PC. Mr. Phelan has a B.A. in Accounting and Finance from Siena College and an M.S. in Taxation from City College of New York, and is a Certified Public Accountant. Mr. Phelan contributes leadership, capital markets experience, and strategic insight as well as innovation in technology to the Board, which the Board believes qualifies him to serve as a director.

John Bottomley has served as a member of the Board since October 2021. Mr. Bottomley served on the Executive Committee of SCI since January 2021 prior to our acquisition of Soluna Callisto Holdings Inc., formerly known as Soluna Computing, Inc. (“Soluna Callisto”). Mr. Bottomley is the co-founder, Partner and has been Chief Development Officer of v-ridium Europe, since June 2020. Mr. Bottomley has also served as a Deputy Strategy Director at Blockchain Climate Institute, a London-based think tank, since July 2021. From August 2017 to March 2020, Mr. Bottomley served as the SVP, Global Development at Vestas Wind Systems, a market leader in the wind industry. Mr. Bottomley served various leadership roles at GE Capital EFS, from September 2014 to May 2017. He also held numerous executive positions at The AES Corporation, Verde Ventures Ltd and Enron Europe Ltd. Additionally, Mr. Bottomley served various international joint venture boards, including the boards of directors of Vestas-WEB development JV (Italy, Germany and France) from 2018 to 2020, Vestas-WKN joint venture (Poland) from 2018 to 2019, Vestas-GEO joint venture (Poland) from 2018 to 2020 Vestas EMP Holdings (Ireland, Iceland, Uganda and Ghana) from 2018 to 2020, Sowitech, a German based international renewable energy development from 2019 and 2020, GE-Advanced Power JV (U.S.) from 2015 to 2016, GE-Maintream JV (Vietnam) from 2015 to 2016, AES-Innovent (France) from 2009 to 2012, AES-WEL (UK) from 2008 to 2012, and Enron-OPET (Turkey) from 2000 to 2001. Mr. Bottomley has a B.S. in Computer Engineering from Clemson University and an MBA in Finance and International Business from NYU Stern School of Business, and is a Chartered Financial Analyst.

John Belizaire has served as a member of the Board and as Chief Executive Officer of SCI since October 2021 and began service as the Chief Executive Officer of the Company on May 1, 2023. Additionally, Mr. Belizaire served as the Chief Executive Officer of Soluna Callisto from June 2018 until our acquisition of Soluna Callisto in October 2021. He also serves as an Operating Advisor of Pilot Growth Equity, a technology growth equity firm, since October 2020. In addition, Mr. Belizaire serves on the Board of Directors of Center for American Entrepreneurship, since May 2020, and the Board of Directors at BanQu Inc, since June 2018. Mr. Belizaire served as the Managing Partner of NextStage LLC, a venture capital firm, from 2002 to 2016. Since June 2006, Mr. Belizaire was the Co-Founder and Chief Executive Officer of FirstBest Systems, which was acquired by Guidewire Software in September 2016, where he served as a Senior Industry Advisor until May 2017. Since January 1997, Mr. Belizaire was the Co-Founder, President and Chief Executive Officer of TheoryCenter, Inc., which was acquired by BEA Systems, Inc. in November 1999, where he served as a Senior Director, Business Development and Strategic Planning until April 2002. Mr. Belizaire has a B.S. in Computer Science and a Master of Engineering in Computer Science from Cornell University. Mr. Belizaire also attended the Executive Development Program at The Wharton School from 2001 to 2002.

There are no family relationships among any of our directors or executive officers.

| 7 |

Board Diversity

| Board Diversity Matrix (As of May 1, 2023) | ||||||||||||||||

| Total Number of Directors | 9 | |||||||||||||||

| Did Not Disclose | ||||||||||||||||

| Female | Male | Non-Binary | Gender | |||||||||||||

| Directors | 9 | |||||||||||||||

| Number of Directors who identify in any of the Categories Below: | ||||||||||||||||

| African American or Black | 1 | |||||||||||||||

| Alaskan Native or Native American | ||||||||||||||||

| Asian | ||||||||||||||||

| Hispanic or Latinx | ||||||||||||||||

| Native Hawaiian or Pacific Islander | ||||||||||||||||

| White | 8 | |||||||||||||||

| Two or More Races or Ethnicities | ||||||||||||||||

| LGBTQ+ | ||||||||||||||||

| Did not Disclose Demographic Background | ||||||||||||||||

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

The Board held six official meetings during 2022. All directors attended at least 80% of all meetings of the Board and any Committee of which they were a member during 2022. The Board has no formal policy regarding attendance at our annual meeting of stockholders; directors are, however, encouraged, but not required, to attend any meetings of our stockholders. All directors, at the time of the meeting, virtually attended the 2022 annual meeting of stockholders. Also, beginning on September 2, 2022, the Board of Directors were holding weekly update calls through the remainder of fiscal year 2022, and continuing to the present day.

The Board has an Audit Committee, a Nominating and Corporate Governance Committee, a Compensation Committee, and an Executive Committee.

Audit Committee

The Audit Committee meets on a regular basis, at least quarterly and more frequently as necessary. The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to the stockholders and others, the system of internal controls which management has established and the audit and financial reporting process. The Audit Committee as of the date of this report consists of Messrs. Hirshfield, Phelan, Marusak (Chair) and Bottomley. The Board has determined that each member of the Audit Committee is independent, as defined under the applicable rules and listing standards of Nasdaq and SEC rules and regulations. In addition, the Board has determined that Mr. Phelan qualifies as an “audit committee financial expert” as defined in the rules and regulations of the SEC. Mr. Phelan’s designation by the Board as an “audit committee financial expert” is not intended to be a representation that he is an expert for any purpose as a result of such designation, nor is it intended to impose on him any duties, obligations, or liability greater than the duties, obligations, or liability imposed on him as a member of the Audit Committee and the Board in the absence of such designation.

The Audit Committee met four times during 2022. The responsibilities of the Audit Committee are set forth in the charter of the Audit Committee, which was adopted by the Board and is published on our website at https://www. solunacomputing.com/investors/governance/. The Committee, among other matters, is responsible for the annual appointment of, and for compensating, retaining, overseeing and, where appropriate, replacing, the independent registered public accounting firm as the Company’s auditors, reviews the arrangements for and the results of the auditors’ examination of our books and records, and assists the Board in its oversight of the reliability and integrity of the Company’s accounting policies, financial statements and financial reporting, and disclosure practices, including its system of internal controls, and the establishment and maintenance of processes to assure compliance with all relevant laws, regulations, and company policies. The Audit Committee also reviews the adequacy of charter of the Audit Committee and recommends changes to the Board that it considers necessary or appropriate.

| 8 |

Nominating and Corporate Governance Committee

The Board has adopted a Nominating and Corporate Governance Committee charter, which is published on our website at https://www.solunacomputing.com/investors/governance/. The Nominating and Corporate Governance Committee consists of Messrs.. Hirshfield (Chairman), Hazelip and Marusak. The Board has determined that each member of the Nominating and Corporate Governance Committee is independent, as defined under the applicable rules and listing standards of Nasdaq.

The Nominating and Corporate Governance Committee met once during 2022. The role of the Nominating and Corporate Governance Committee is to assist the Board by: 1) reviewing, identifying, evaluating, and recommending the nomination of Board members; 2) selecting and recommending director candidates to the Board; 3) developing and recommending governance policies of the Company to the Board; 4) addressing governance matters; 5) making recommendations to the Board regarding Board size, composition, and criteria; 6) making recommendations to the Board regarding existing Committees and report on the performance and effectiveness of the Committees to the Board; 7) periodically evaluating the performance of the Board; and 8) assisting the Board with other assigned tasks as needed.

In appraising potential director candidates, the Nominating and Corporate Governance Committee focuses on desired characteristics and qualifications of candidates, and although there are no stated minimum requirements or qualifications, preferred characteristics include business savvy and experience, concern for the best interests of our stockholders, proven success in the application of skills relating to our areas of business activities, adequate availability to participate actively in the Board’s affairs, high levels of integrity, and sensitivity to current business and corporate governance trends and legal requirements, and that candidates, when warranted, meet applicable director independence standards. The Nominating and Corporate Governance Committee has adopted a formal policy for the consideration of director candidates recommended by stockholders. Individuals recommended by stockholders are evaluated in the same manner as other potential candidates. A stockholder wishing to submit such a recommendation should forward it in writing to our Secretary at 325 Washington Avenue Extension, Albany, New York 12205. The mailing envelope should include a clear notation that the enclosure is a “Director Nominee Recommendation.” The recommending party should be identified as a stockholder and should provide a brief summary of the recommended candidate’s qualifications, taking into account the desired characteristics and qualifications considered for potential Board members mentioned above.

Compensation Committee

The Board has adopted a Compensation Committee charter, which is published on our website at https://www. solunacomputing.com/investors/governance/. The Compensation Committee as of the date of this report consists of Messrs. Phelan (Chairman), Hazelip, and Bottomley. The Board has determined that each member of the Compensation Committee is independent, as defined under the applicable rules and listing standards of Nasdaq and SEC rules and regulations.

The Compensation Committee met five times during 2022. The Compensation Committee is charged with ensuring that the Company’s compensation programs are aligned with Company goals and are adequately designed to attract, motivate, and retain executives and key employees. The role of the Compensation Committee is to assist the Board by:

1) regarding the overall compensation programs, philosophy, and practices of the Company, particularly as it relates to its executive officers, key employees, and directors; 2) reviewing and evaluating Company objectives and goals regarding our Chief Executive Officer’s compensation; 3) determining the compensation program for members of the Board; 4) developing and overseeing the Chief Executive Officer’s process for evaluating the performance objectives and compensation of executive officers; 5) administering the Company’s equity compensation plans; 6) determining succession planning and management development for the Chief Executive Officer and other executive officers; and 7) assisting the Board with other assigned tasks as needed.

| 9 |

In fulfilling its responsibilities, the Compensation Committee may delegate any or all of its responsibilities to a subcommittee of the Compensation Committee and, to the extent not expressly reserved to the Compensation Committee by the Board or by applicable law, rule, or regulation, to any other committee of directors appointed by it.

The Compensation Committee has the sole authority to retain and terminate any compensation consultant, outside counsel, or other advisers as it deems appropriate to perform its duties and responsibilities, including the authority to approve the fees payable to such counsel or advisers and any other terms of retention. The Compensation Committee did not engage any such consultants, counsel, or advisers during 2022.

The Compensation Committee administers our executive compensation programs. This Committee is responsible for establishing the policies that govern base salaries, as well as short- and long-term incentives, for executives and senior management. The Committee considers recommendations made by our Chief Executive Officer and certain other executives when reaching its compensation decisions, including with respect to executive and director compensation. The Committee has approval authority regarding the compensation of the Company’s Chief Executive Officer, as well as the Company’s other executive officers after the review of the Chief Executive Officer’s recommendation and the results of such officer’s performance review.

Executive Committee

The Board formed an Executive Committee in January 2022 and adopted an Executive Committee charter, which is published on our website at https://www.solunacomputing.com/investors/governance/. The Executive Committee as of the date of this report consists of Messrs. Phelan (Chairman), Bottomley, Lipman, and Toporek. The Board has determined that each of Mr. Phelan and Mr. Bottomley are independent, as defined under the applicable rules and listing standards of Nasdaq.

The Executive Committee met every other week for a total 22 meetings in fiscal year 2022. The purpose of the Executive Committee is to represent and assist the Board in its review and approval of certain transactions and other matters requiring Board consideration, and to take action, where necessary, appropriate and authorized by the Board during intervals between regular and special meetings of the Board. The Executive Committee has authority to: 1) monitor the management’s performance against the approved budget of record; 2) authorize mining equipment purchase transactions; 3) authorize the price at which equity securities of the Company are sold; 4) authorize the payment of dividends to holders of preferred stock of the Company; and 5) identify and assess business risks and develop and propose recommendations to management and the Board to minimize such risks. Notwithstanding anything in the foregoing, the Executive Committee is not authorized to 1) take any action that requires an adoption by an independent majority of the Board; 2) complete any transaction that would have a material effect on the Company’s financial statements; or 3) complete any transaction that qualifies as a related party transaction.

The Board’s Role in Risk Oversight

The Board executes its oversight responsibility for risk management directly and through its Committees, as follows:

| ● | The Audit Committee has primary responsibility for overseeing the integrity of the Company’s financial reporting risk by reviewing: (i) the Company’s disclosure controls and procedures; (ii) any significant deficiencies in the design or operation of internal controls; (iii) any fraud material or otherwise; (iv) the use of judgments in management’s preparation of the financial statements; and (v) through consultation with Company’s independent registered public accounting firm on the above items. The Board is kept abreast of the Committee’s risk oversight and other activities via reports of the Committee Chairman to the full Board. | |

| ● | The Compensation Committee oversees the risks associated with our compensation policies and practices, with respect to both executive compensation and compensation generally. The Board is kept abreast of the Committee’s risk oversight and other activities via reports of the Committee Chairman to the full Board. | |

| ● | The Executive Committee is responsible for identifying and assessing business risks and proposing recommendations to management and the full Board. The Board is kept abreast of the Committee’s risk oversight and other activities via reports of the Committee Chairman to the full Board. | |

| ● | The Board considers specific risk topics, including risks associated with our strategic plan, our capital structure, and our development activities. In addition, the Board receives detailed regular reports from the heads of our principal business and corporate functions that include discussions of the risks and exposures involved in their respective areas of responsibility. These reports are provided in connection with every regular Board meeting and are discussed, as necessary, at Board meetings. Further, the Board is routinely informed of developments at the Company that could affect our risk profile or other aspects of our business. |

| 10 |

We do not believe that the Board’s role in risk oversight has any impact on its leadership structure, as discussed below.

Executive Sessions of Directors

Executive sessions, or meetings of outside (non-management) directors without management present, are held periodically throughout the year. At these executive sessions, the outside directors review, among other things, the criteria upon which the performance of the Chief Executive Officer and other executive officers is based, the performance of the Chief Executive Officer against such criteria, and the compensation of the Chief Executive Officer and other executive officers. Meetings are held from time to time with the Chief Executive Officer to discuss relevant subjects.

Board Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single, generally accepted approach to providing Board leadership and that given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. As of the date of this report, Michael Toporek will serve as Executive Chairman of the Board and William Phelan will serve as our Lead Independent Director. The Board recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the Company continues to grow. Michael Toporek had served as our Chief Executive Officer since October 2020, and effective May 1, 2023, John Belizaire began service as Chief Executive Officer and Michael Toporek serves as Executive Chairman. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to the Chief Executive Officer and presides over meetings of the full Board and the Lead Independent Director coordinates the activities of the other independent directors and performs such other duties and responsibilities as the Board may determine. We believe that this separation of responsibilities also provides a balanced approach to managing the Board and overseeing the Company.

In considering its leadership structure, the Board has taken a number of factors into account. The Board, which consists of directors who are highly qualified and experienced, eight of whom are independent directors, exercises a strong, independent oversight function. This oversight function is enhanced by the fact that the Board’s three of the four standing committees – the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee – are comprised solely of independent directors and the Executive Committee, is comprised of a majority of independent directors.

Board Membership

To fulfill its responsibility to recruit and recommend to the full Board nominees for election as directors, the Nominating and Corporate Governance Committee reviews the size and composition of the Board to determine the qualifications and areas of expertise needed to further enhance the composition of the Board and works with management in attracting candidates with those qualifications. The goal of the Nominating and Corporate Governance Committee, and the Board as a whole, is to achieve a Board that, as a whole, provides effective oversight of the management and business of the Company, through the appropriate diversity of experience, expertise, skills, specialized knowledge, and other qualifications and attributes of the individual directors. Important criteria for Board membership include the following:

| ● | Members of the Board should be individuals of high integrity and independence, substantial accomplishments, and have prior or current associations with institutions noted for their excellence. | |

| ● | Members of the Board should have demonstrated leadership ability, with broad experience, diverse perspectives, and the ability to exercise sound business judgment. | |

| ● | The background and experience of members of the Board should be in areas important to the operations of the Company such as business, education, finance, government, law, science, blockchain, energy, and cryptocurrency. | |

| ● | The composition of the Board should reflect the benefits of diversity as to gender, ethnic background, and experience. |

| 11 |

The satisfaction of these criteria is implemented and assessed through ongoing consideration of directors and nominees by the Nominating and Corporate Governance Committee and the Board. Based upon these activities and its review of the current composition of the Board, the Committee and the Board believe that most of these criteria have been satisfied, and is actively pursuing the addition of at least one additional director that would help the Board in meeting the diversity goals noted above.

In addition, in accordance with the Nominating and Corporate Governance Committee Charter, the Committee considers the number of boards of directors of other public companies on which a candidate serves. Moreover, directors are expected to act ethically at all times and adhere to the Company’s Code of Conduct and Ethics.

The Nominating and Corporate Governance Committee and the Board believe that each of the nominees for election at the Annual Meeting brings a strong and unique set of attributes, experiences, and skills and provides the Board as a whole with an optimal balance of experience, leadership, competencies, qualifications, and skills in areas of importance to the Company. Under “Proposal 1—Election of Directors” above, we provide an overview of the nominees’ principal occupation, business experience, and other directorships, together with the key attributes, experience, and skills viewed as particularly meaningful in providing value to the Board, the Company, and our stockholders.

REPORT OF THE AUDIT COMMITTEE

In accordance with the Committee’s charter, as published on the Company’s website at https://www. solunacomputing.com/investors/governance, management has the primary responsibility for the Company’s financial statements and the financial reporting process, including maintaining an adequate system of internal control over financial reporting. The Company’s independent registered public accounting firm reports directly to the Audit Committee and is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board. The Audit Committee, among other matters, is responsible for appointing the Company’s independent registered public accounting firm, evaluating such independent registered public accounting firm’s qualifications, independence, and performance, determining the compensation for such independent registered public accounting firm, and pre-approval of all audit and non-audit services provided to the Company. Additionally, the Audit Committee is responsible for oversight of the Company’s accounting and financial reporting processes and audits of the Company’s financial statements, including the work of the independent registered public accounting firm. The Audit Committee reports to the Board with regard to:

| ● | the scope of the annual audit; | |

| ● | fees to be paid to the independent registered public accounting firm: | |

| ● | the performance of the independent registered public accounting firm; | |

| ● | compliance with accounting and financial policies and financial statement presentation; and | |

| ● | the procedures and policies relative to the adequacy of internal accounting controls. |

The Audit Committee reviewed and discussed with Company management and UHY LLP (“UHY”), the Company’s independent registered accounting firm during 2022, the Company’s 2022 annual consolidated financial statements, including management’s assessment of the effectiveness of the Company’s internal control over financial reporting. The Company’s management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The Audit Committee has discussed with UHY the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC, which includes, among other items, matters related to the conduct of the audit of the annual consolidated financial statements. The Audit Committee has also discussed the critical accounting policies used in the preparation of the Company’s annual consolidated financial statements, alternative treatments of financial information within generally accepted accounting principles that UHY discussed with management, the ramifications of using such alternative treatments, and other written communications between UHY and management.

| 12 |

The Audit Committee has received from UHY the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with UHY their independence. The Audit Committee has also concluded that UHY’s performance of non-audit services is compatible with UHY’s independence.

The Audit Committee also discussed with UHY the overall scope and plans for its audit and has met with UHY, with and without management present, to discuss the results of its audit and the overall quality of the Company’s financial reporting. The Audit Committee also discussed with UHY whether there were any audit problems or difficulties, and management’s response.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, for filing with the SEC. This report is provided by the following directors, who constitute the Committee.

Audit Committee:

Mr. David C. Michaels (Former Chairman)*

Mr. Edward R. Hirshfield

Mr. William P. Phelan

Mr. Thomas Marusak (Current Chairman)

Mr. John Bottomley

*At the time of the issuance of the Annual Report on Form 10-K issued on March 31, 2023, Mr. Michaels was Chairman of the Audit Committee. On April 24, 2022 he resigned from the Audit Committee to assume the role of Interim Chief Financial Officer

| 13 |

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected UHY as the Company’s independent registered public accounting firm for fiscal year 2023, and the Board is asking stockholders to ratify that selection. UHY had previously served as the Company’s independent registered public accounting firm from 2012 through 2017 and also served as the Company’s independent registered public accounting firm in 2021 and 2022.

Although current law, rules, and regulations, as well as the charter of the Audit Committee, require the Audit Committee to engage, retain, and supervise the Company’s independent registered public accounting firm, the Board considers the selection of the independent registered public accounting firm to be an important matter of stockholder concern and is submitting the selection of UHY for ratification by stockholders as a matter of good corporate practice.

The affirmative vote of holders of a majority of the shares of Common Stock cast in person or by proxy at the meeting is required to approve the ratification of the selection of UHY as the Company’s independent registered public accounting firm for the current fiscal year.

If the stockholders fail to ratify this appointment, the Audit Committee will reconsider whether to retain UHY and may retain that firm or another firm without resubmitting the matter to the Company’s stockholders. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of different independent public accountants at any time during the year if it determines that such change would be in the best interests of the Company and our stockholders.

A representative from UHY is expected to be present at the Annual Meeting and will have the opportunity to make a statement and answer appropriate questions from stockholders.

Accounting Fees

The following sets forth the aggregate fees billed to us for professional services rendered by UHY for the year ended December 31, 2022(1):

| Year Ended | ||||

| December 31, | ||||

| 2022 | ||||

| Audit Fees | $ | 600,000 | ||

| Audit-Related Fees | –– | |||

| Tax Fees | 21,115 | |||

| All Other Fees | –– | |||

| Total | $ | 621,115 | ||

The following sets forth the aggregate fees billed to us for professional services rendered by UHY for the year ended December 31, 2021(1):

| Year Ended | ||||

| December 31, | ||||

| 2021 | ||||

| Audit Fees | $ | 475,500 | ||

| Audit-Related Fees | –– | |||

| Tax Fees | –– | |||

| All Other Fees | –– | |||

| Total | $ | 475,500 | ||

| (1) | The aggregate amounts included in Audit Fees and Tax Fees are classified by the related fiscal periods for the audit of our annual financial statements and review of financial statements and statutory and regulatory filings or engagements. The aggregate fees included in each of the other categories are fees billed or to be billed during those fiscal periods. |

| 14 |

Audit Fees

Audit fees for the fiscal years ended December 31, 2022 and 2021, were for professional services rendered for the annual financial statements audit and related audit procedures, the audit of internal control over financial reporting, work performed in connection with any registration statements, including comfort letters, and any applicable Current Reports on Form 8-K and the review of any of our Quarterly Reports on Form 10-Q.

Tax Fees

Tax fees during the fiscal year ended December 31, 2022 were for services related to tax compliance, including the preparation of tax returns and claims for refunds, and tax planning and tax advice, including advice related to proposed transactions.

The Audit Committee has considered whether the provision of the non-audit services above is compatible with maintaining the auditors’ independence, and has concluded that it is.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted the following policies and procedures under which frequently-utilized audit and non-audit services are pre-approved by the Audit Committee and the authority to authorize the independent registered public accountants to perform such services is delegated to a single committee member or executive officer.

| a) | Annual audit, quarterly review, and annual tax return services will be pre-approved upon review and acceptance of the tax and audit engagement letters submitted by the independent registered public accountants to the Audit Committee. | |

| b) | Additional audit and non-audit services related to the resolution of accounting issues or the adoption of new accounting standards, audits by tax authorities, or reviews of public filings by the SEC must be pre-approved by the Audit Committee and the authority to authorize the independent registered public accounting firm to perform such services is delegated to the Chairman of the Audit Committee for fees up to $5,000, and for fees above $5,000 entire Committee approval is required. | |

| c) | Additional audit and non-audit services related to tax savings strategies, tax issues arising during the preparation of tax returns, tax estimates, and tax code interpretations must be pre-approved by the Audit Committee and the authority to authorize the independent registered public accounting firm to perform such services is delegated to the Chairman of the Audit Committee for fees up to $5,000, and for fees above $5,000 entire Committee approval is required. | |

| d) | Additional audit and non-audit services related to the tax and accounting treatments of proposed business transactions must be pre-approved by the Audit Committee and the authority to authorize the independent registered public accountants to perform such services is delegated to the Chairman of the Audit Committee for fees up to $5,000, and for fees above $5,000 entire Committee approval is required. | |

| e) | Quarterly and annually, a detailed analysis of audit and non-audit services will be provided to and reviewed with the Audit Committee. |

All of the 2022 services described under the caption “Audit Fees” and “Tax Fees” were approved by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM IN PROPOSAL 2.

| 15 |

PROPOSAL 3:

THE REVERSE STOCK SPLIT PROPOSAL

Our board of directors has approved an amendment to our Certificate of Incorporation, as amended, to combine the outstanding shares of our common stock into a lesser number of outstanding shares (a “Reverse Stock Split”).

If approved by our stockholders, this proposal would permit (but not require) the board of directors to effect a Reverse Stock Split of the outstanding shares of our common stock within one (1) year of the date the proposal is approved by stockholders, at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-twenty-five (1-for-25) split, with the specific ratio to be fixed within this range by the board of directors in its sole discretion without further stockholder approval. We believe that enabling the board of directors to fix the specific ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders.

In fixing the ratio, the board of directors may consider, among other things, factors such as: the initial and continued listing requirements of the Nasdaq Capital Market; the number of shares of our common stock outstanding; potential financing opportunities; and prevailing general market and economic conditions.

The Reverse Stock Split, if approved by our stockholders, would become effective upon the filing of the amendment to our Certificate of Incorporation with the Secretary of State of the State of Nevada, or at the later time set forth in the amendment. The exact timing of the amendment will be determined by the board of directors based on its evaluation as to when such action will be the most advantageous to our Company and our stockholders. In addition, the board of directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to abandon the amendment and the Reverse Stock Split if, at any time prior to the effectiveness of the filing of the amendment with the Secretary of State of the State of Nevada, the board of directors, in its sole discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed.

The proposed form of amendment to our certificate of incorporation to effect the Reverse Stock Split is attached as Appendix A to this Proxy Statement. Any amendment to our certificate of incorporation to effect the Reverse Stock Split will include the Reverse Stock Split ratio fixed by the board of directors, within the range approved by our stockholders.

Reasons for the Reverse Stock Split

The Company’s primary reasons for approving and recommending the Reverse Stock Split are to make our common stock more attractive to certain institutional investors, which would provide for a stronger investor base and to increase the per share price and bid price of our common stock to regain compliance with the continued listing requirements of Nasdaq.

On December 21, 2022, we received a written notice from Nasdaq (the “Nasdaq Letter”) notifying the Company that it was not in compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed companies to maintain a minimum bid price of $1.00 per share (the “Bid Price Requirement”). Under Nasdaq Listing Rule 5810(c)(3)(A), the Company had been granted a period of 180 calendar days to regain compliance with the Bid Price Requirement.

Reducing the number of outstanding shares of common stock should, absent other factors, generally increase the per share market price of the common stock. Although the intent of the Reverse Stock Split is to increase the price of the common stock, there can be no assurance, however, that even if the Reverse Stock Split is effected, that the Company’s bid price of the Company’s common stock will be sufficient, over time, for the Company to regain or maintain compliance with the Nasdaq minimum bid price requirement.

| 16 |

In addition, the Company believes the Reverse Stock Split will make its common stock more attractive to a broader range of investors, as it believes that the current market price of the common stock may prevent certain institutional investors, professional investors and other members of the investing public from purchasing stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Furthermore, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were higher. The Company believes that the Reverse Stock Split will make our common stock a more attractive and cost-effective investment for many investors, which in turn would enhance the liquidity of the holders of our common stock.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum Bid Price Requirement of Nasdaq or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

If the Reverse Stock Split proposal is approved, the outstanding share of Series X Preferred Stock will be automatically redeemed upon the effectiveness of the amendment to the Articles of Incorporation implementing the Reverse Stock Split.