UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

T |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013 |

||

|

OR |

||

|

¨ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE TRANSITION PERIOD FROM _____TO _____ |

||

Mechanical Technology, Incorporated

(Exact name of registrant as specified in its charter)

__________________

|

New York |

000-06890 |

14-1462255 |

|

(State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

|

of incorporation or organization) |

|

Identification No.) |

325 Washington Avenue Extension, Albany, New York 12205

(Address of principal executive offices)

(518) 218-2550

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

None |

None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

($0.01 par value)

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No ¨

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large Accelerated Filer¨ |

Accelerated Filer¨ |

Non-Accelerated Filer¨ (Do not check if a smaller reporting company) |

Smaller reporting company T |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No T

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2013 (based on the last sale price of $0.51 per share for such stock reported on the over-the-counter market for that date) was $2,477,110.

As of February 27, 2014, the Registrant had 5,256,883 shares of common stock outstanding.

Documents incorporated by reference: Portions of the registrant’s Proxy Statement for its 2014 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

1

INDEX TO FORM 10-K

|

PART I |

||||

|

Item 1. |

|

|

Page |

|

|

|

|

|

||

|

Item 1A. |

|

|

7 |

|

|

|

|

|

||

|

Item 1B. |

|

|

12 |

|

|

|

|

|

||

|

Item 2. |

|

|

12 |

|

|

|

|

|

||

|

Item 3. |

|

|

12 |

|

|

|

|

|

||

|

Item 4. |

|

|

12 |

|

|

|

|

|||

|

PART II |

||||

|

|

|

|

||

|

Item 5. |

|

|

13 |

|

|

|

|

|

||

|

Item 6. |

|

|

13 |

|

|

|

|

|

||

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

13 |

|

|

|

|

||

|

Item 7A. |

|

|

19 |

|

|

|

|

|

||

|

Item 8. |

|

|

20 |

|

|

|

|

|

||

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

20 |

|

|

|

|

||

|

Item 9A. |

|

|

20 |

|

|

|

|

|

||

|

Item 9B. |

|

|

20 |

|

|

|

|

|||

|

PART III |

||||

|

|

|

|

||

|

Item 10. |

|

|

21 |

|

|

|

|

|

||

|

Item 11. |

|

|

21 |

|

|

|

|

|

||

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

21 |

|

|

|

|

||

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

21 |

|

|

|

|

||

|

Item 14. |

|

|

22 |

|

|

|

|

|||

|

PART IV |

||||

|

|

|

|

||

|

Item 15. |

|

|

23 |

|

2

Unless the context requires otherwise in this Annual Report on Form 10-K, the terms the “Company,” “we,” “us,” and “our” refer to Mechanical Technology, Incorporated, “MTI Instruments” refers to MTI Instruments, Inc., and “MTI Micro” refers to MTI MicroFuel Cells, Inc. Other trademarks, trade names, and service marks used in this Annual Report on Form 10-K are the property of their respective owners.

Mechanical Technology, Incorporated, a New York corporation, was incorporated in 1961. The Company’s core business is conducted through MTI Instruments, Inc., a wholly-owned subsidiary incorporated in New York on March 8, 2000 and the sole component of the Company’s Test and Measurement Instrumentation segment. The Company’s operations are headquartered in Albany, NY where it designs, manufactures, and markets its products globally. Through the year ended December 31, 2013, the Company also operated in a New Energy segment with business conducted through MTI MicroFuel Cells, Inc. On December 31, 2013, as a result of a stock warrant exercise, the Company transferred management of MTI Micro to Dr. Walter L. Robb (a member of the Company’s and MTI Micro’s board of directors) and his new management team. The Company is consequently no longer reporting MTI Micro as a variable interest entity (VIE) as of the close of business on December 31, 2013 (date of MTI Micro deconsolidation). The Company determined that the effect of the deconsolidation of the VIE would be to remove MTI Micro in the consolidated balance sheet as of December 31, 2013 but include MTI Micro’s activity in the consolidated statement of operations for the year ended December 31, 2013. The fair value of the Company’s current non-controlling interest in MTI Micro has been determined to be $0 as December 31, 2013 based on MTI Micro’s net position and expected cash flows. In the future, the Company will record its investment in MTI Micro using the equity method of accounting, if applicable. As of December 31, 2013, the Company owned an aggregate of approximately 47.5% of MTI Micro’s outstanding common stock.

MTI Instruments is a supplier of precision linear displacement solutions, vibration measurement and system balancing solutions, and wafer inspection tools; these tools and solutions are developed for markets that require the precise measurements and control of products processes for the development and implementation of automated manufacturing, assembly, and consistent operation of complex machinery.

As part of its strategy, MTI Instruments provides its customers with enabling sensors and sensing technologies that help advance manufacturing processes and new product development efforts. The demand for higher quality and lower cost products ranging from semiconductor chips to electronics and large items such as automobiles continues to drive Original Equipment Manufacturers (OEMs) and their suppliers to invest in technology and the capability to rapidly produce high quality products. Industry has moved towards flexible manufacturing doctrines around mass customization and production incorporating six sigma, and lean principles to reduce labor and waste, while increasing quality. Modern manufacturing advances at a very rapid pace with the help of automation controls and precision sensing technologies for operating equipment, processes in factories, and other applications with minimal or reduced human intervention. OEMs find that using automation helps them not only improve on quality, but also can save labor, energy and materials while significantly improving accuracy and precision. In some industries like semiconductors, fabrication facilities are fully automated and are aided by humans on a low frequency basis.

Using a combination of integrated smart robotics, manufacturing lines, and a myriad of sensors that measure ongoing equipment performance, monitoring and drive controls have resulted in significant advancements in productivity and quality in manufacturing. There is no question that the world is moving from classic manufacturing and assembly towards automation and measurement.

MTI Instruments has decades of experience in working with OEMs and their suppliers in the development of sensor technology to complement OEMs manufacturing processes, and now in their development of new automation controls and processes by providing sensors and sensing technologies. The Company has taken steps to move towards a market-based approach by examining and targeting specific segments including the industrial and consumer electronics, automotive and other precision automated manufacturing industries, turbo machinery and research for both product and process development segments that lead to the key markets served.

This same approach is driving the demand for engine vibration measurement and balancing. Ongoing efforts to improve engine performance and lower fuel consumption drive both military and commercial axial turbo-machinery operators to maintain their equipment at peak performance.

3

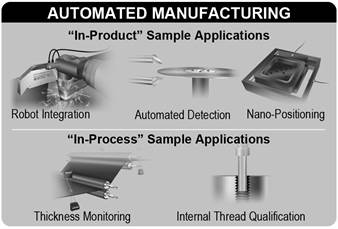

Precision

Automated Manufacturing

As demand increases for higher quality, lower cost, and more efficient products, there is a world-wide need for OEMs to drive continuous improvement efforts through use of the most innovative manufacturing and assembly techniques in products and processes. Due to the level of precision required, these products or processes are managed through automated systems (Piezo positioners, robots, etc.) and require precise measurement, data transmission, analysis and management.

MTI Instruments provides advanced, ultra precision linear displacement solutions that help customers achieve higher levels of efficiency through precision measurement systems that enable valuable data collection and allow process control. We customize linear displacement solutions for OEMs that can be incorporated into a tool or equipment manufactured by a company to monitor performance and/or achieve control (“in product application”) or into a process to control the manufacture of parts or measure critical parameters of parts as they enter or leave a process (“in process applications”).

MTI Instruments is a preferred supplier for applications that require complex and extremely precise measurement of small, intricate targets and assemblies. MTI Instruments uses its significant track record and experience using capacitance, laser and fiber optic technologies to make accurate linear displacement measurements to the sub-nanometer level of accuracy. These advanced sensing and physical measurement technologies are used to produce products that range from basic sensors to complete, fully integrated measurement systems. Applications include precision positioning, material surface measurements, off-center vibration measurements, and pattern recognition analysis.

Listed below are selected MTI Instruments’ Automated Manufacturing product offerings and technologies:

|

|

Product |

Description |

|

|

Accumeasure Series |

Ultra-high precision capacitive systems offering nanotechnology accuracy. |

|

NEW PRODUCT |

Accumeasure D Series |

Ultra-high precision digital capacitive systems offering sub-nanotechnology accuracy. |

|

|

Microtrak 3

|

Single spot laser sensor equipped with the latest complementary metal oxide semiconductor (CMOS) sensor technology with higher sensitivity than previous generation. |

|

NEW PRODUCT |

Microtrak LTS

|

Easy to use single spot laser thickness systems with the latest CMOS sensor technology, and digital linearization for superb linearity. |

|

|

Microtrak PRO-2D |

2D laser triangulation scanners that provide profile, displacement, and 3D images. |

|

|

MTI-2100 Fotonic Sensor Series |

Fiber-optic based vibration sensor systems with high frequency response. |

Axial Turbo Machinery

Turbo machines are categorized according to the type of flow. When

the fuel and air flow is parallel to the axis of rotation, they are referred to

as axial flow machines. MTI Instruments is a leader in the development and

commercialization of vibration measurement and system balancing for axial type

engines – typically medium and large turbo fan aircraft engines – for both

military and commercial applications.

Turbo machines are categorized according to the type of flow. When

the fuel and air flow is parallel to the axis of rotation, they are referred to

as axial flow machines. MTI Instruments is a leader in the development and

commercialization of vibration measurement and system balancing for axial type

engines – typically medium and large turbo fan aircraft engines – for both

military and commercial applications.

MTI Instruments designs and manufactures computer-based portable balancing systems (PBS) products which automatically collect and record engine vibration data, identifying vibration or balance trouble, and calculating a solution to the problem. These products are designed to quickly pinpoint engine vibration issues.

4

PBS products are used by major aircraft engine manufacturers, the U.S. and foreign militaries, and commercial airlines, as well as gas turbine manufacturers.

Listed below are selected MTI Instruments’ Turbo Machinery product offerings and technologies:

|

|

Product |

Description |

|

|

PBS-4100+ Portable Balancing System |

Detects engine vibration and a trim balance problem and provides a solution. |

|

|

PBS-4100R Test Cell Vibration Analysis & Trim Balance System |

Advanced trim balancing and diagnostics for engine test cells. |

|

|

TSC-4800A Tachometer Signal Conditioner |

Tachometer signal conditioner detects and conditions signals for monitoring, measuring, and indicating engine speeds. |

|

|

1510A Calibrator

|

National Institute of Standards and Technology (NIST) traceable signal generator that outputs voltage signals useful to test and calibrate electronic equipment. |

Industrial and Academic Research and Development (R&D)

Present-day research and process development is a core part of the modern business world; critical decisions are made from data and discoveries made through these efforts. As companies understand and profit from the benefits of organized R&D efforts, they also make further commitments and investments into new R&D cycles making internal R&D budgets reach higher and higher levels. R&D is also a tool for modern companies to proactively leapfrog competition and keep pace with trends, enhance manufacturing processes, and develop products to meet new customer demands.

MTI Instruments has a long track record of working with private sector companies as well as academic institutions on their R&D efforts. We have a dedicated line of tabletop linear displacement instruments, material testers, and wafer metrology tools that help provide valuable information to enhance products and processes. Our family of R&D related products are used widely in applications including wafer surface metrology, nano-material testing, and precision linear displacement and positioning. Our customers include testing and R&D departments in large industry and academia as well as process development laboratories focused in automotive, electronics, semiconductor, solar, and material development.

Listed below are MTI Instruments’ Industrial and Academic Research and Development product offerings and technologies:

|

|

Product |

Description |

|

|

Proforma 200SA/300SA |

Semi-automated, non-contact semiconductor full wafer surface scanning system for thickness, total thickness variation (TTV), bow, warp, site and global flatness. |

|

|

Proforma 300 |

Manual, non-contact measurement of semiconductor wafer thickness, TTV and bow. |

|

|

PV 1000 |

In process tool for measuring thickness and bow of solar wafers. |

|

|

MTII/Fullam Tensile Stages

|

Tensile testers specifically designed for use inside scanning electron and other microscopes. |

|

|

Accumeasure Series |

Ultra-high precision capacitive systems offering nanotechnology accuracy. |

|

NEW PRODUCT |

Accumeasure D Series

|

Ultra-high precision digital capacitive systems offering sub-nanotechnology accuracy. |

|

|

MTI-2100 Fotonic Sensor Series

|

Fiber-optic based vibration sensor systems with high frequency response.

|

Marketing and Sales

MTI Instruments markets its products and services using selected and specific channels of distribution. In the Americas, for precision automated manufacturing and the R&D sectors, MTI Instruments uses a combination of direct sales and representatives. Overseas, particularly in Europe and Asia, MTI Instruments uses distributors and agents specific to our targeted end markets. For axial turbo machinery, MTI Instruments primarily sells directly to end users.

5

To supplement these efforts, we use both commercial and industrial search engines, targeted newsletters, purchased customer lists and participation in trade shows to identify and expand its customer base.

Product Development and Manufacturing

MTI Instruments conducts research and develops technology to support both its existing and new products. Management believes that MTI Instruments’ success depends to a large extent upon identifying market requirements, innovation, and utilizing our technological expertise to develop and implement new products.

In 2013, efforts were dedicated to the development and commercialization of a brand new family of products – the Accumeasure D series. Using 30 plus years of linear displacement experience, engineers and scientists worked hand in hand to combine capacitance principles with modern enabling digital technology – the result, an ultra precise linear displacement capacitance system with a true digital output.

During the fourth quarter of 2012, MTI Instruments launched the Microtrak 3 family of single spot laser sensors equipped with the latest CMOS sensor technology for better performance than previous products. Today, this product is being used in some of the largest consumer electronics assembly operations in Asia.

We seek to achieve a competitive position by continuously advancing our technology, producing new state of the art precision measurement equipment, expanding our worldwide distribution, and providing intimate customer support.

MTI Instruments develops, assembles and tests its products at its facility located in Albany, New York. Management believes that most of the raw materials used in our products are readily available from a variety of vendors.

Intellectual Property and Proprietary Rights

We rely on trade secret and copyright laws to establish and protect the proprietary rights of our products. In addition, we enter into standard confidentiality agreements with our employees and consultants and seek to control access to and distribution of our proprietary information. Even with these precautions, it may be possible for a third party to copy or otherwise obtain and use our products or technology without authorization or to develop similar technology independently. In addition, effective copyright and trade secret protection may be unavailable or limited in certain foreign countries.

Significant Customers

MTI Instruments’ largest customer is the U.S. Air Force. We also have strong relationships with companies in the electronics, aircraft, aerospace, automotive, semiconductor and research industries. The U.S. Air Force accounted for 27.2% and 22.3%, respectively, of product revenues during 2013 and 2012. The largest commercial customer in 2013 was an Asian customer, who accounted for 6.8% of total product revenues in 2013. The largest commercial customer in 2012 was an Asian distributor, who accounted for 6.9% of total product revenues in 2012.

Competition

We compete with several companies, substantially all of which are larger than MTI Instruments.

In the precision automated manufacturing market, MTI Instruments faces competition from companies including Keyence, Micro Epsilon, Microsense, Schmitt Industries, Capacitec, and Lion Precision Instruments.

In axial turbo machinery, MTI Instruments competes with companies including ACES Systems and Meggitt Sensing Systems.

In R&D, competition includes companies in precision linear displacement, including Gatan, Deben, Sigma Tech Corporation, and E+H (Eichhorn+Hausmann) GmbH.

The primary competitive considerations in MTI Instruments’ markets are product quality, performance, price, timely delivery, and the ability to identify, pursue and obtain new customers. MTI Instruments believes that its employees, product development skills, sales and marketing systems and reputation are competitive advantages.

Research and Development

MTI Instruments conducts research and develops technology to support its existing products and develop new products. Management believes that the success of MTI Instruments depends to a large extent upon identifying market requirements, innovation, technological expertise and new product development.

MTI has incurred research and development costs of approximately $1.3 million and $1.4 million, which is primarily related to MTI Instruments, for the years ended December 31, 2013 and 2012, respectively. We expect to continue to invest in research and development in the future at MTI Instruments as part of our growth strategy.

6

Employees

As of December 31, 2013, we had 35 employees including 31 full-time employees.

Factors Affecting Future Results

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements contained, or incorporated by reference, in this Annual Report on Form 10-K that are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” “should,” “could,” “may,” “will” and similar words or phrases, we are identifying forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding:

- anticipated growth in revenues and cashflows;

- management’s belief that it will have adequate resources to fund the Company’s operations and capital expenditures over at least the next twelve months;

- anticipated levels of future earnings and continued positive cash flow;

- the expectation that further cost-cutting measures will be avoided;

- future capital expenditures and spending on research and development;

- needing to hire additional personnel and purchase equipment;

- expected funding of future cash expenditures;

- projected inventory reductions; and

- the impact of pending legal proceedings.

Forward-looking statements involve risks, uncertainties, estimates and assumptions that may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Important factors that could cause these differences include the following:

- statements with respect to management’s strategy and planned initiatives;

- sales revenue growth of our MTI Instruments business may not be achieved or maintained;

- the dependence of our MTI Instruments business on a small number of customers and potential loss of government contracts - particularly in light of expected defense department spending reductions resulting from the sequestration implemented in 2013 or cuts that may be imposed as a result of ongoing Congressional budget negotiations;

- our lack of long-term purchase commitments from our customers and the ability of our customers to cancel, reduce, or delay orders for our products;

- our inability to build and maintain relationships with our customers;

- our inability to develop and utilize new technologies that address the needs of our customers;

- the cyclical nature of the electronics and military industries;

- the uncertainty of the U.S. and global economy;

- the impact of future exchange rate fluctuations;

- failure of our strategic alliances to achieve their objectives or perform as contemplated and the risk of cancellation or early termination of such alliance by either party;

- the loss of services of one or more of our key employees or the inability to hire, train, and retain key personnel;

- risks related to protection and infringement of intellectual property;

- our occasional dependence on sole suppliers or a limited group of suppliers for MTI Instruments’ business;

- our ability to generate income to realize the tax benefit of our historical net operating losses;

- risks related to the limitation of the use, for tax purposes, of our net historical operating losses in the event of certain ownership changes; and

- other risks discussed below.

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in, or incorporated by reference into, this Annual Report on Form 10-K as a result of new information or future events or developments. Thus, assumptions should not be made that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

7

Risk Factors

You should consider carefully the following risks, along with other information contained in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones that may affect us. Additional risks and uncertainties also may adversely affect our business and operations including those discussed in the heading “Factors Affecting Future Results” above. Any of the following events, should they actually occur, could materially and adversely affect our business and financial results.

If we are unsuccessful at addressing our business challenges, our business and results of operations and financial condition may be adversely affected and our ability to invest in and grow our business could be limited.

In order to achieve profitability and improve liquidity, we must successfully achieve all or some combination of the following initiatives: increasing sales, developing new products, controlling operating expenses, managing our cash flows, achieving our targeted cost savings and efficiencies from prior cost reduction initiatives, improving operational efficiency and estimating and projecting accurately our liquidity and capital resources. In Management’s Discussion and Analysis of Financial Condition and Results of Operations — Management’s Plan, Liquidity and Capital Resources in this Annual Report on Form 10-K, we made estimates regarding our cash flow, results of operations and ability to access our existing line of credit at MTI Instruments for the year ending December 31, 2014. If our cash flow, results of operations or ability to borrow under our line of credit are less favorable than we have estimated, we may not be able to make all of our planned operating or capital expenditures or fully execute all of our other plans. Our financial success depends in part on management’s ability to execute our growth strategy. We expect that we will depend primarily on cash generated by our operations for funds to pay our expenses and any amounts due under our credit facility and any other indebtedness we may incur. Our ability to make these payments depends on our future performance, which will be affected by financial, business, economic and other factors, many of which we cannot control. Our business may not generate sufficient cash flows from operations in the future and our currently anticipated growth in revenues and cash flows may not be realized, either or both of which could result in our being unable to repay indebtedness or to fund other liquidity needs. If we do not have enough money, we may be required to sell assets or borrow money, in each case on terms that may not be acceptable to us. In addition, the terms of existing or future debt agreements, including our existing line of credit, may restrict us from adopting any of these alternatives. In addition, any significant levels of indebtedness in the future could place us at a competitive disadvantage compared to our competitors that may have access to additional resources or proportionately less debt and could make us more vulnerable to economic downturns and adverse developments in our business. Any future loss incurred by the Company could have a material adverse effect on our business and our ability to generate the cash needed to operate our business. Even though we achieved profitability during 2013, we may be unable to sustain or increase our profitability in the future. Failure to continue to implement these initiatives successfully, or the failure of such initiatives to result in improved profitability, could have a material adverse effect on our business plans, liquidity, results of operations and financial condition and may result in a further downsize to the business.

We currently derive all of our product revenue from our MTI Instruments business.

All of our revenue is currently derived from our MTI Instruments business. We do not have a broad portfolio of other products we could rely on to support operations if we were to experience a substantial slowdown in our MTI Instruments business, which is subject to a number of risks, including:

- dependence on a small number of customers;

- a continued slow down or cancellation of sales to the military as a result of a potential redeployment, or sequestration, of governmental funding;

- our ability to maintain, improve, or expand its direct and indirect channels of distribution;

- the potential failure to expand or maintain the business as a result of competition, a lack of brand awareness, or market saturation; and

- an inability to launch new products as a result of intense competition, uncertainty of new technology development, or limited or unavailable resources to fund development.

In addition, revenues from the sale of MTI Instruments’ products can vary significantly from one period to the next. We may sell a significant amount of our products to one or a few customers for various short term projects in one period, and then have markedly decreased sales in following periods as these projects end or customers have the products they require for the foreseeable future. This scenario played out in 2012, when MTI Instruments experienced a significant decline compared to the prior year. The fact that we sell a significant amount of our products to a relatively few number of customers also results in a customer concentration risk. The loss of any significant portion of such customers or a material adverse change in the financial condition of any one of these customers could have a material adverse effect on our revenues, our business and our ability to generate the cash needed to operate our business.

Variability of customer requirements resulting in cancellations, reductions, or delays may adversely affect our operating results.

We are

required to provide rapid product turnaround and respond to short lead times. A

variety of conditions, both specific to individual customers and generally

affecting the demand for OEMs’ products, may cause customers to cancel, reduce,

or delay orders. Cancellations, reductions, or delays by a significant customer

or by a group of customers could adversely affect our operating results. Conversely,

if our customers unexpectedly and significantly increase product orders, we may

be required to rapidly increase production, which could strain our resources

and reduce our margins.

8

If we do not keep pace with technological innovations, our products may not be competitive and our revenue and operating results may suffer.

The electronic, semiconductor, solar, automotive and general industrial segments are subject to constant technological change. Our future success will depend on our ability to respond appropriately to changing technologies and changes in product function and quality. If we rely on products and technologies that are not attractive to end users, we may not be successful in capturing or retaining market share. Technological advances, the introduction of new products, and new design techniques could adversely affect our business prospects unless we are able to adapt to the changing conditions. Technological advances could render our products obsolete, and we may not be able to respond effectively to the technological requirements of evolving markets. As a result, we will be required to expend substantial funds for and commit significant resources to:

-

continue research and development activities on all product lines;

-

hire additional engineering and other technical personnel; and

-

purchase advanced design tools and test equipment.

Our business could be harmed if we are unable to develop and utilize new technologies that address the needs of our customers, or our competitors do so more effectively than we do.

We may not be able to enhance our product solutions and develop new product solutions in a timely manner.

Our future operating results will depend to a significant extent on our ability to provide new products that compare favorably with alternative solutions on the basis of time to introduction, cost, performance, and end-user preferences. Our success in attracting and retaining customers and developing business will depend on various factors, including the following:

-

innovative development of new products for customers;

-

utilization of advances in technology;

-

maintenance of quality standards;

-

efficient and cost-effective solutions; and

-

timely completion of the design and introduction of new products.

Our inability to develop new product solutions on a timely basis could harm our operating results and impede our growth.

Our efforts to develop new technologies may not result in commercial success and/or may result in delays in development, which could cause a decline in our revenue and could harm our business.

Our research and development efforts with respect to our technologies may not result in customer or market acceptance. Some or all of those technologies may not successfully make the transition from the research and development lab to cost-effective production as a result of technology problems, competitive cost issues, yield problems, and other factors. Even when we successfully complete a research and development effort with respect to a particular technology, our customers may decide not to introduce or may discontinue products utilizing the technology for a variety of reasons, including the following:

-

difficulties with other suppliers of components for the products;

-

superior technologies developed by our competitors and unfavorable comparisons of our solutions with these technologies;

-

price considerations; and

-

lack of anticipated or actual market demand for the products.

The nature of our business will require us to make continuing investments for new technologies. Significant expenses relating to one or more new technologies that ultimately prove to be unsuccessful for any reason could have a material adverse effect on us. In addition, any investments or acquisitions made to enhance our technologies may prove to be unsuccessful. If our efforts are unsuccessful, our business could be harmed.

The electronics and military industries are cyclical and may result in fluctuations in our operating results.

The electronics and military industries have experienced significant economic downturns at various times. These downturns are characterized by diminished product demand, accelerated erosion of average selling prices, and production overcapacity. We may seek to reduce our exposure to industry downturns by providing design and production services for leading companies in rapidly expanding industry segments. We may, however, experience substantial period-to-period fluctuations in future operating results because of general industry conditions or events occurring in the general economy.

9

Our operating results may experience significant fluctuations.

In addition to the variability resulting from the short-term nature of our customers’ commitments, other factors contribute to significant periodic and seasonal quarterly fluctuations in our results of operations. These factors include:

-

the cyclicality of the markets we serve;

-

the timing and size of orders;

-

the volume of orders relative to our capacity;

-

product introductions and market acceptance of new products or new generations of products;

-

evolution in the life cycles of our customers’ products;

-

timing of expenses in anticipation of future orders;

-

changes in product mix;

-

availability of manufacturing and assembly services;

-

changes in cost and availability of labor and components;

-

timely delivery of product solutions to customers;

-

pricing and availability of competitive products;

-

introduction of new technologies into the markets we serve;

-

pressures on reducing selling prices;

-

our success in serving new markets; and

-

changes in economic conditions.

International sales risks could adversely affect our operating results. Furthermore, our operating results could be adversely affected by fluctuations in the value of the U.S. dollar against foreign currencies.

Having a worldwide distribution network for our products exposes us to various economic, political, and other risks that could adversely affect our operations and operating results, including the following:

-

unexpected changes in regulatory requirements;

-

timing to meet regulatory requirements;

-

tariffs, duties and other trade barrier restrictions;

-

greater difficulty in collecting accounts receivable;

-

the burdens and costs of compliance with a variety of foreign laws;

-

potentially reduced protection for intellectual property rights; and

-

political or economic instability in certain parts of the world.

The risks associated with international sales could negatively affect our operating results.

We transact our business in U.S. dollars and bill and collect our sales in U.S. dollars. In 2013, approximately 34.6% of our revenue was from customers outside of the United States. A weakening of the dollar could cause our overseas vendors to require renegotiation of either the prices or currency we pay for their goods and services. Similarly, a strengthening of the dollar could cause our products to be more expensive for our international customers, which could impact price and margins and/or cause the demand for our products, and thus our revenue, to decline.

In the future, customers may negotiate pricing and make payments in non-U.S. currencies. If our overseas vendors or customers require us to transact business in non-U.S. currencies, fluctuations in foreign currency exchange rates could affect our cost of goods, operating expenses, and operating margins and could result in exchange losses. In addition, currency devaluation can result in a loss to us if we hold deposits of that currency. Hedging foreign currencies can be difficult, especially if the currency is not freely traded. We cannot predict the impact that future exchange rate fluctuations may have on our operating results.

Continuing uncertainty of the U.S. and global economy may have serious implications for the growth and stability of our business.

Revenue growth and continued profitability of our business will depend significantly on the overall demand for test and measurement instrumentations in key markets including research and development, automotive, semiconductor and electronics. Softening demand in these markets caused by ongoing economic uncertainty, technological developments, competitive changes or other factors may result in decreased revenue or earnings levels. The U.S. and global economy has been historically cyclical and market conditions continue to be challenging, which has resulted in individuals and companies delaying or reducing expenditures. Further delays or reductions in spending could have a material adverse effect on demand for our products, and consequently on our business, financial condition, results of operations, prospects, stock price, and ability to continue to operate.

10

We depend on key personnel who would be difficult to replace, and our business will likely be harmed if we lose their services or cannot hire additional qualified personnel.

Our success depends substantially on the efforts and abilities of our senior management and key personnel. The competition for qualified management and key personnel, especially engineers, is intense. Although we maintain non-competition and non-disclosure covenants with most of our key personnel, we do not have employment agreements with most of them. The loss of services of one or more of our key employees or the inability to hire, train, and retain key personnel, especially engineers, technical support personnel, and capable sales and customer-support employees outside the United States, could delay the development and sale of our products, disrupt our business, and interfere with our ability to execute our business plan.

We may become subject to claims of infringement or misappropriation of the intellectual property rights of others, which could prohibit us from selling our products, require us to obtain licenses from third parties or to develop non-infringing alternatives, and subject us to substantial monetary damages and injunctive relief.

We may receive notices from third parties that the manufacture, use, or sale of any products we develop infringes upon one or more claims of their patents. Moreover, because patent applications can take many years to issue, there may be currently pending applications, unknown to us, that may later result in issued patents that materially and adversely affect our business. Third parties could also assert infringement or misappropriation claims against us with respect to our future product offerings, if any. We cannot be certain that we have not infringed the intellectual property rights of any third parties. Any infringement or misappropriation claim could result in significant costs, substantial damages, and our inability to manufacture, market, or sell any of our product offerings that are found to infringe. Even if we were to prevail in any such action, the litigation could result in substantial cost and diversion of resources that could materially and adversely affect our business. If a court determined, or if we independently discovered, that our product offerings violated third-party proprietary rights, there can be no assurance that we would be able to re-engineer our product offerings to avoid those rights or obtain a license under those rights on commercially reasonable terms, if at all. As a result, we could be prohibited from selling products that are found to infringe upon the rights of others. Even if obtaining a license were feasible, it may be costly and time-consuming. A court could also enter orders that temporarily, preliminarily, or permanently enjoin us from making, using, selling, offering to sell, or importing our products that are found to infringe on third parties’ intellectual property rights, or could enter orders mandating that we undertake certain remedial actions. Further, a court could order us to pay compensatory damages for any such infringement, plus prejudgment interest, and could in addition treble the compensatory damages and award attorneys’ fees. Any such payments could materially and adversely affect our business and financial condition.

Our confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary information, which could limit our ability to compete.

We rely on trade secrets to protect our proprietary technology and processes. Trade secrets are difficult to protect. We enter into confidentiality and intellectual property assignment agreements with our employees, consultants, and other advisors. These agreements generally require that the other party keep confidential and not disclose to third parties confidential information developed by the party under such agreements or made known to the party by us during the course of the party’s relationship with us. However, these agreements may not be honored and enforcing a claim that a party illegally obtained and is using our trade secrets is difficult, expensive and time-consuming, and the outcome is unpredictable. Our failure to obtain and maintain trade secret protection could adversely affect our competitive position.

We experienced an ownership change in MTI Micro that resulted in a limitation of tax attributes relating to the use of their net operating losses, and we may experience further ownership changes in MTI which would result in a further limitation of the use of our net operating losses.

We estimate that as of December 31, 2013, the Company and MTI Instruments have net operating loss (NOL) carryforwards of approximately $51.9 million and MTI Micro has NOL carryforwards of approximately $16.8 million. As a result of the conversion of the bridge notes in December 2009, MTI no longer maintained an 80% or greater ownership in MTI Micro. Thus, MTI Micro was no longer included in Mechanical Technology, Incorporated and Subsidiaries' consolidated federal and combined New York State tax returns, effective December 9, 2009. Pursuant to the Internal Revenue Service's consolidated tax return regulations (IRS Regulation Section 1.1502-36), upon MTI Micro leaving the Mechanical Technology, Incorporated and Subsidiaries’ consolidated group, MTI elected to reduce a portion of its stock tax basis in MTI Micro by "reattributing" a portion of MTI Micro's NOL carryforwards to MTI, for an amount equivalent to its built-in loss amount in MTI's investment in MTI Micro's stock. As the result of MTI making this election with its December 31, 2009 tax return, MTI reattributed approximately $45.2 million of MTI Micro's NOLs (reducing its tax basis in MTI Micro's stock by the same amount), leaving MTI Micro with approximately $13 million of separate company NOL carryforwards at the time of conversion of the Bridge Notes.

A corporation generally undergoes an “ownership change” when the ownership of its stock, by value, changes by more than 50 percentage points over any three-year testing period. In the event of an ownership change, Section 382 of the Internal Revenue Code of 1986 imposes an annual limitation on the amount of post-ownership change taxable income a corporation may offset with pre-ownership change NOL carryforwards and certain recognized built-in losses.

11

Our ability to utilize the MTI NOL carryforwards, including any future NOL carryforwards that may arise, may be limited by Section 382 if we undergo any further “ownership changes” as a result of subsequent changes in the ownership of our outstanding common stock pursuant to the exercise of MTI options outstanding, additional financings obtained, or otherwise.

Item 1B: Unresolved Staff Comments

Not applicable.

We lease approximately 17,400 square feet of office, manufacturing and research and development space at 325 Washington Avenue Extension, Albany, NY 12205. The current lease agreement expires on November 30, 2014 and negotiations are underway for leasing facilities beyond this time period. We believe our facilities are generally well maintained and adequate for our current needs and for expansion, if required.

In January 2013, an action commenced and is pending in the State of New York Supreme Court in Albany County upon a complaint of the plaintiff, Berkshire Bank, against Kingfisher, LLC; Edward L. Hoe, Jr.; Mechanical Technology, Incorporated; MTI MicroFuel Cells Inc.; Xcelaero Corporation; Regional Emergency Medical Services Council of the Hudson-Mohawk Valleys, Inc.; Inverters Unlimited Inc.; and John Doe No. 1 through John Doe No. 15 (the named defendants) for the foreclosure of the mortgaged premises located at 431 New Karner Road, Town of Colonie, County of Albany, New York. The Company was named as a party defendant to this action by virtue of its former possession of a portion of the mortgaged premises, and the fact that they have, or claim to have, a leasehold or other possessory interest in a portion of the mortgaged premises. On October 1, 2013, the State of New York Supreme Court in Albany County granted a judgment of foreclosure and closed out this action. The Company is under no obligations in relation to this judgment.

At any point in time, we may be involved in various lawsuits or other legal proceedings. Such lawsuits could arise from the sale of products or services or from other matters relating to our regular business activities, compliance with various governmental regulations and requirements, or other transactions or circumstances. We do not believe there are any such proceedings presently pending that could have a material effect on our business, financial condition or results of operations.

Item 4: Mine Safety Disclosure

Not applicable.

12

(a)

Market Information

Our common stock is quoted on the OTC Markets Group quotation system under the symbol “MKTY.” The following table sets forth the high and low bid information for our common stock as reported on the OTC Market Group quotation system for the periods indicated:

|

|

High |

Low |

|||

|

Fiscal Year Ended December 31, 2013 |

|

|

|

|

|

|

First Quarter |

$ |

.39 |

$ |

.11 |

|

|

Second Quarter |

|

.70 |

|

.22 |

|

|

Third Quarter |

|

1.65 |

|

.49 |

|

|

Fourth Quarter |

|

1.08 |

|

.75 |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31, 2012 |

|

|

|

|

|

|

First Quarter |

$ |

.74 |

$ |

.11 |

|

|

Second Quarter |

|

.58 |

|

.11 |

|

|

Third Quarter |

|

.39 |

|

.11 |

|

|

Fourth Quarter |

|

.37 |

|

.17 |

|

Holders

We have one class of common stock, par value $.01, and are authorized to issue 75,000,000 shares of common stock. Each share of the Company’s common stock is entitled to one vote on all matters submitted to stockholders. As of December 31, 2013 and 2012 there were 5,256,883 shares of common stock issued and outstanding. As of February 19, 2014, there were approximately 237 shareholders of record of the Company’s common stock.

Dividends

We have never declared or paid dividends on our common stock and do not anticipate or contemplate paying cash dividends on our common stock in the foreseeable future. We currently intend to use all available funds to develop our business. We can give no assurances that we will ever have excess funds available to pay dividends. Any future determination as to the payment of dividends will depend upon critical requirements and limitations imposed by our credit agreements, if any, and such other factors as our board of directors may consider.

Item 6: Selected Financial Data

Not applicable.

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and the related notes included elsewhere in this Annual Report. This discussion contains forward-looking statements, which involve risk and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including those discussed in Item 1A: “Risk Factors” and elsewhere in this Annual Report.

13

Overview

MTI’s core business is conducted through MTI Instruments, Inc., a wholly-owned subsidiary and the sole component of the Company’s Test and Measurement Instrumentation segment. The Company also operated in a New Energy segment with business conducted through MTI MicroFuel Cells, Inc. until December 31, 2013 (date of MTI Micro deconsolidation).

Test and Measurement Instrumentation Segment – MTI Instruments is a supplier of precision linear displacement solutions, vibration measurement and system balancing solutions, precision tensile measurement systems and wafer inspection tools, serving markets that require 1) the precise measurements and control of products and processes in automated manufacturing, assembly, and consistent operation of complex machinery, 2) metrology tools for semiconductor and solar wafer characterization, tensile stage systems for materials testing and precision linear displacement gauges all for use in academic and industrial research and development settings, and 3) engine balancing and vibration analysis systems for both military and commercial aircraft.

We are continuously working on ways to increase our sales reach, including expanded worldwide sales coverage and enhanced internet marketing.

New Energy Segment – MTI Micro had been developing an off-the-grid power solution for various portable electronic devices. Its patented proprietary direct methanol fuel cell technology platform converts methanol fuel to usable electricity capable of providing continuous power, as long as necessary fuel flows are maintained.

Recent Developments

The Company appointed Kevin G. Lynch as the Chief Executive Officer of the Company, effective May 1, 2013. Mr. Lynch had served as the Acting Chief Executive Officer, in an advisory role, since September 12, 2012. In connection with his permanent appointment, Mr. Lynch receives an annual base salary of $260,000 and is eligible for an annual bonus of up to $200,000 based upon achieving milestones as established by the Board of Directors. Mr. Lynch also received options to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.46 per share based on the closing market price of our common stock on the date of grant.

On August 28, 2013, the Board of Directors of the Company appointed David C. Michaels to the Board of Directors. Mr. Michaels was also elected to the Governance, Compensation & Nominating Committee and the Audit Committee of the Board. Upon joining the Board, Mr. Michaels received options to purchase 12,500 shares of the Company’s common stock at an exercise price of $0.90 per share based on the closing market price of our common stock on the date of grant.

Results of Operations

Results of Operations for the Year Ended December 31, 2013 Compared to the Year Ended December 31, 2012.

Test and Measurement Instrumentation Segment

Product Revenue: Product revenue relates to revenue recognized from the Test and Measurement Instrumentation product lines.

Product revenue in our Test and Measurement Instrumentation segment for the year ended December 31, 2013 increased by $2.5 million, or 41.6%, to $8.4 million in 2013 from $5.9 million in 2012. This increase in product revenue was attributable to a 57.2% increase in shipments of military and commercial aviation balancing systems and accessory kits most notably under existing Air Force contracts. Also contributing to the overall increase was a 37.3% rise in general instrumentation revenue, which was driven by higher capacitance product, tensile stage and laser system sales. For the year ended December 31, 2013, the largest commercial customer for the segment was an Asian customer, which accounted for 6.8% of annual product revenue. In 2012, the largest commercial customer for the segment was an Asian distributor, which accounted for 6.9% of annual product revenue. The U.S. Air Force was the largest government customer for the year ended December 31, 2013 and accounted for 27.2% of annual product revenue. The U.S. Air Force was also the largest government customer for the year ended December 31, 2012 and accounted for 22.3% of annual product revenue.

|

|

14

Information regarding government contracts included in product revenue is as follows:

|

(Dollars in thousands) |

|

|

|

Revenues for the Year Ended |

Contract Revenues to Date |

Total Contract Orders Received To Date |

||||||||

|

|

|

|

|

December 31, |

December 31, |

December 31, |

||||||||

|

Contract(1) |

Expiration |

|

2013 |

|

2012 |

2013 |

2013 |

|||||||

|

Aviation Balancing Systems |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

$6.5 million U.S. Air Force Maintenance |

09/27/2014 |

(2) |

|

$ |

863 |

|

$ |

504 |

$ |

4,271 |

$ |

4,273 |

||

|

$4.1 million U.S. Air Force Systems |

08/29/2015 |

(2) |

|

$ |

399 |

|

$ |

171 |

$ |

1,254 |

$ |

1,254 |

||

|

$917 thousand U.S. Air Force Kit |

09/30/2014 |

(3) |

|

$ |

585 |

|

$ |

184 |

$ |

769 |

$ |

769 |

||

____________________

|

(1) |

|

Contract values represent maximum potential values at time of contract placement and may not be representative of actual results. |

|

(2) |

|

Date represents expiration of contract, which includes the exercise of all four option extensions. |

|

(3) |

|

Date represents expiration of contract, which includes the exercise of two option extensions. |

Cost of Product Revenue: Cost of product revenue includes the direct material and labor cost as well as an allocation of overhead costs that relate to the manufacturing of products we sell. In addition, cost of product revenue also includes the labor and material costs incurred for product maintenance, replacement parts and service under our contractual obligations.

Cost of product revenue in our Test and Measurement Instrumentation segment for the year ended December 31, 2013 increased by $288 thousand, or 9.7%, to $3.3 million in 2013 from $3.0 million in 2012 primarily as a result of the increased sales as discussed above under Product Revenue, partially offset by reduced production overhead, lower product material costs and improved inventory management. Such offsetting factors also resulted in gross profit, as a percentage of product revenue, increasing to 61.0% compared to 49.7% during 2012.

Unfunded Research and Product Development Expenses: Unfunded research and product development expenses (meaning research and development that we conduct that is not reimbursed by customers) includes the costs of materials to build development and prototype units, cash and non-cash compensation and benefits for the engineering and related staff, expenses for contract engineers, fees paid to outside suppliers for subcontracted components and services, fees paid to consultants for services provided, materials and supplies consumed, facility related costs such as computer and network services, and other general overhead costs associated with our research and development activities.

Unfunded research and product development expenses in our Test and Measurement Instrumentation segment for the year ended December 31, 2013 decreased by $45 thousand, or 3.3%, to $1.3 million in 2013 from $1.4 million in 2012. This decrease was due to reduced external development spending and lower personnel costs.

Selling, General and Administrative Expenses: Selling, general and administrative expenses includes cash and non-cash compensation, benefits and related costs in support of our general corporate functions, including general management, finance and accounting, human resources, selling and marketing, information technology and legal services.

Selling, general and administrative expenses in our Test and Measurement Instrumentation segment for the year ended December 31, 2013 increased by $143 thousand, or 7.5%, to $2.1 million in 2013 from $1.9 million in 2012. This increase is the result of additional staffing in the sales department, higher commissions to external sales representatives and increased international travel.

New Energy Segment

Unfunded Research and Product Development Expenses: Unfunded research and product development expenses includes materials to build development and prototype units, cash and non-cash compensation and benefits for the engineering and related staff, expenses for contract engineers, fees paid to outside suppliers for subcontracted components and services, fees paid to consultants for services provided, materials and supplies consumed, facility related costs such as computer and network services, and other general overhead costs associated with our research and development activities.

There was no unfunded research and product development expenses in our New Energy segment for the year ended December 31, 2013, compared to unfunded research and product development income of $1 thousand in 2012. This decrease is attributable to the suspension of MTI Micro’s operations that began in late 2011. As of December 31, 2013, the Company no longer reported the New Energy segment as a VIE. Refer to the Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

15

Selling, General and Administrative Expenses: Selling, general and administrative expenses includes cash and non-cash compensation, benefits and related costs in support of our general corporate functions, including general management, finance and accounting, human resources, selling and marketing, information technology and legal services.

Selling, general and administrative expenses in our New Energy segment decreased by $71 thousand to $89 thousand for the year ended December 31, 2013, compared to $160 thousand in 2012. This decrease is attributable to the suspension of operations that began in late 2011. As of December 31, 2013, the Company no longer reported the New Energy segment as a VIE. Refer to the Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

MTI Parent – Corporate Entity

Selling, General and Administrative Expenses: Selling, general and administrative expenses includes cash and non-cash compensation, benefits and related costs in support of our general corporate functions, including general management, finance and accounting, human resources, selling and marketing, information technology and legal services.

Selling, general and administrative expenses from the Corporate Entity for the year ended December 31, 2013 decreased by $468 thousand, or 26.8%, to $1.3 million in 2013 from $1.7 million in 2012. This decrease is the result of a decrease in audit fees for 2013 as well as decreases in salary and benefits related to management changes in 2012.

Results of Consolidated Operations

Operating Income (Loss): Operating income for the year ended December 31, 2013 was $361 thousand compared to operating loss of $2.2 million in 2012. This increase in operating income was a result of the factors noted above.

Gain on Variable Interest Entity Deconsolidation: Gain on variable interest entity deconsolidation was $3.6 million and $0 for the years ended December 31, 2013 and 2012, respectively. As of December 31, 2013, the Company no longer reported MTI Micro as a VIE and the removal of the associated non-controlling interest from MTI’s consolidated equity triggered this one-time gain. Refer to the Consolidated Financial Statements Note 2 regarding the deconsolidation of the VIE.

Other (Expense) Income: Other expense for the year ended December 31, 2013 was $366 thousand compared to other income of $162 thousand in 2012. The increase in expense of $528 thousand primarily relates to the $380 thousand allowance recorded on a related party note receivable with MTI Micro in 2013 and a reduction of the gain on sale of assets of $200 thousand as 2012 included the sales of certain surplus equipment by MTI Micro, of which there was no comparable sales in 2013.

Income Tax (Expense) Benefit: Income tax expense for the years ended December 31, 2013 and 2012 was $35 thousand and $6 thousand, respectively. Our income tax rate for the years ended December 31, 2013 and 2012 was 1% and 0%, respectively. The year ended December 31, 2013 expense consists of minimal state tax expense of under $1 thousand and $35 thousand in deferred tax expense related to utilization of our deferred tax assets and an increase in the valuation allowance. The year ended December 31, 2012 expense consists of only state tax expense.

Net Loss Attributed to Non-Controlling Interests (of MTI Micro): The net loss attributed to non-controlling interests for the year ended December 31, 2013 increased by $72 thousand to $75 thousand in 2013 from $3 thousand in 2012. This is the result of an increase in the net loss of MTI Micro from $5 thousand in 2012 to $143 thousand in 2013, partially offset by an increase in the percentage of ownership of the non-controlling interest of MTI Micro in 2013.

Net Income (Loss): Net income for the year ended December 31, 2013 was $3.7 million compared to a net loss of $2.1 million for the same period in 2012. The increase in net income of $5.7 million for the year ended December 31, 2013 as compared to the same period in 2012 is primarily attributed to the $3.6 million gain on variable interest entity deconsolidation in 2013 and an increase in MTI Instruments net income in 2013 of $2.3 million. These are a result of the factors discussed above.

16

Management’s Plan, Liquidity and Capital Resources

Several key indicators of our liquidity are summarized in the following table:

|

(Dollars in thousands) |

Years Ended December 31, |

|||||||

|

|

2013 |

|

2012 |

|||||

|

Cash |

$ |

1,211 |

|

|

$ |

289 |

|

|

|

Working capital |

|

1,771 |

|

|

|

1,350 |

|

|

|

Net income (loss) attributed to MTI |

|

3,654 |

|

|

|

(2,086) |

|

|

|

Net cash provided by (used in) operating activities |

|

1,017 |

|

|

|

(1,506) |

|

|

|

Purchase of property, plant and equipment |

|

(108) |

|

|

|

(17) |

|

|

The Company has historically incurred significant losses, until 2012 the majority stemming from the direct methanol fuel cell product development and commercialization programs of MTI Micro, and had a consolidated accumulated deficit of $118.5 million as of December 31, 2013. During the year ended December 31, 2013, the Company generated net income attributed to MTI of $3.7 million and had cash provided by operating activities totaling $1.0 million, and had working capital of $1.8 million at December 31, 2013, a $421 thousand increase from December 31, 2012. The increase in working capital was the result of the cost saving initiatives that we implemented in the second half 2012. Management believes that the reorganized Company currently has adequate resources to avoid any other cost cutting measures that could adversely affect the business. As of December 31, 2013, we had no debt, no outstanding commitments for capital expenditures and approximately $1.2 million of cash available to fund our operations.

If production levels rise at MTI Instruments, additional capital equipment may be required in the foreseeable future. We expect to spend approximately $250 thousand on capital equipment and $1.5 million in research and development on MTI Instruments’ products during 2014. We expect to finance any future expenditures and continue funding our operations from our current cash position and our projected 2014 cash flow pursuant to management’s current plan. We may also seek to supplement our resources through sales of stock or assets. Besides the line of credit at MTI Instruments, the Company has no other commitments for funding future needs of the organization at this time and such additional financing during 2014, if required, may not be available to us on acceptable terms or at all.

While it cannot be assured, management believes that, due in part to our current working capital level, the aforementioned cost reductions implemented in the second half of 2012, recent replacements in sales staff and projected inventory reductions, the Company should continue the positive cash flows it experienced during 2013 to fund the Company’s active operations for the foreseeable future. However, if near-term revenue estimates are delayed or missed, the Company may need to implement additional steps to ensure liquidity including, but not limited to, the deferral of planned capital spending, postponing anticipated new hires and/or delaying existing or pending product development initiatives. Such steps, if required, could potentially have a material and adverse effect on our business, results of operations and financial condition.

Line of Credit

On September 20, 2011, MTI Instruments entered into a working capital line of credit with First Niagara Bank, N.A. MTI Instruments may borrow from time to time up to $400 thousand to support its working capital needs. The note is payable upon demand, and the interest rate on the note is equal to the prime rate with a floor of 4.0% per annum. The note is secured by a lien on all of the assets of MTI Instruments and is guaranteed by the Company. The line of credit was renewed on September 23, 2013. The line of credit is subject to a review date of June 30, 2014. Under the line of credit, MTI Instruments is required to maintain a line balance of $0 for thirty consecutive days during each calendar year. As of December 31, 2013 and December 31, 2012 there were no amounts outstanding under the line of credit.

Backlog, Inventory and Accounts Receivable

At December 31, 2013, the Company’s order backlog was $198 thousand, compared to $1.6 million at December 31, 2012. The decrease in backlog was due to lower bookings under existing US Air Force contracts, higher shipping levels during 2013 and $591 thousand of deferred revenue, which was in the backlog at December 31, 2012.

|

|

17

Our inventory turnover ratios and average accounts receivable days outstanding for the years ended December 31, 2013 and 2012 and their changes are as follows:

|

|

Years Ended December 31, |

|

|

|

|

2013 |

2012 |

Change |

|

Inventory turnover |

3.8 |

2.1 |

1.7 |

|

Average accounts receivable days outstanding |

42 |

41 |

1 |

The increase in inventory turns is due to a 29% decrease in average inventory balances on a 41.6% rise in sales during the comparable periods.

The average accounts receivable days’ outstanding increased one day in 2013 compared with 2012 due to an increase in direct sales to Asia, rather than through distributors.

Off-Balance Sheet Arrangements

We have no off balance sheet arrangements.

Critical Accounting Policies and Significant Judgments and Estimates

The prior discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. Note 2 of the Consolidated Financial Statements included in this Annual Report on Form 10-K includes a summary of our most significant accounting policies. The preparation of these consolidated financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosure of assets and liabilities. On an ongoing basis, we evaluate our estimates and judgments, including those related to revenue recognition, inventories, income taxes, share-based compensation and derivatives. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. Periodically, our management reviews our critical accounting estimates with the Audit Committee of our Board of Directors.

The significant accounting policies that we believe are most critical to aid in fully understanding and evaluating our consolidated financial statements include the following:

Revenue Recognition. We recognize product revenue when there is persuasive evidence of an arrangement, delivery of the product to the customer or distributor has occurred, at which time title generally is passed to the customer or distributor, and we have determined that collection of a fixed fee is probable, all of which occur upon shipment of the product. If the product requires that we provide installation, all revenue related to the product is deferred and recognized upon the completion of the installation.

Inventory. Inventory is valued at the lower of cost or the current estimated market value of the inventory. We periodically review inventory quantities on hand and record a provision for excess or obsolete inventory based primarily on our estimated forecast of product demand, as well as based on historical usage. Demand and usage for products and materials can fluctuate significantly. A significant decrease in demand for our products could result in a short-term increase in the cost of inventory purchases and an increase of excess inventory quantities on hand. Therefore, although we make every effort to assure the accuracy of our forecasts of future product demand, any significant unanticipated changes in demand could have a significant impact on the value of our inventory and our reported operating results.

Share-Based Payments. We grant options to purchase our common stock and award restricted stock to our employees and directors under our equity incentive plans. The benefits provided under these plans are share-based payments subject to the appropriate accounting provisions regarding Share-Based Payments. Effective January 1, 2006, we use the fair value method of accounting with the modified prospective application, which provides for certain changes to the method for valuing share-based compensation. The valuation provisions apply to new awards and to awards that are outstanding on the effective date and subsequently modified. Under the modified prospective application, prior periods are not revised for comparative purposes.