Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-1023

S&P Global Inc.

(Exact name of registrant as specified in its charter)

|

| | |

New York | | 13-1026995 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

55 Water Street, New York, New York | | 10041 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 212-438-1000

|

| | |

Title of each class | | Name of exchange on which registered |

Common Stock — $1 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ¨ NO þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ¨ NO þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

þ Large accelerated filer | | o Accelerated filer | | o Non-accelerated filer | | o Smaller reporting company |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO þ

The aggregate market value of voting stock held by non-affiliates of the Registrant as of the last business day of the second fiscal quarter ended June 30, 2016, was $28.3 billion, based on the closing price of the common stock as reported on the New York Stock Exchange of $107.26 per common share. For purposes of this calculation, it is assumed that directors, executive officers and beneficial owners of more than 10% of the registrant outstanding stock are affiliates. The number of shares of common stock of the Registrant outstanding as of January 27, 2017 was 258.4 million shares.

Part III incorporates information by reference from the definitive proxy statement for the 2017 annual meeting of shareholders.

TABLE OF CONTENTS

|

| | |

| PART I | |

Item | | Page |

1 | | |

1a. | | |

1b. | | |

2 | | |

3 | | |

4 | | |

| | |

| | |

| PART II | |

| | |

5 | | |

6 | | |

7 | | |

7a. | | |

8. | | |

9. | | |

9a. | | |

9b. | | |

| | |

| PART III | |

| | |

10 | | |

11 | | |

12 | | |

13 | | |

14 | | |

| | |

| PART IV | |

| | |

15 | | |

| | |

| | |

| | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s current views concerning future events, trends, contingencies or results, appear at various places in this report and use words like “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would.” For example, management may use forward-looking statements when addressing topics such as: the outcome of contingencies; future actions by regulators; changes in the Company’s business strategies and methods of generating revenue; the development and performance of the Company’s services and products; the expected impact of acquisitions and dispositions; the Company’s effective tax rates; and the Company’s cost structure, dividend policy, cash flows or liquidity.

Forward-looking statements are subject to inherent risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements include, among other things:

| |

• | worldwide economic, political and regulatory conditions, including conditions that may result from legislative, regulatory and policy changes associated with the current U.S. administration or the United Kingdom’s likely exit from the European Union; |

| |

• | the rapidly evolving regulatory environment, in the United States and abroad, affecting Ratings, Market and Commodities Intelligence and Indices, including new and amended regulations and the Company’s compliance therewith; |

| |

• | the Company’s ability to maintain adequate physical, technical and administrative safeguards to protect the security of confidential information and data, and the potential for unauthorized access to our systems or a system or network disruption that results in improper disclosure of confidential information or data, regulatory penalties and remedial costs; |

| |

• | our ability to make acquisitions and dispositions and successfully integrate the businesses we acquire; |

| |

• | the outcome of litigation, government and regulatory proceedings, investigations and inquiries; |

| |

• | the health of debt and equity markets, including credit quality and spreads, the level of liquidity and future debt issuances; |

| |

• | the demand and market for credit ratings in and across the sectors and geographies where the Company operates; |

| |

• | concerns in the marketplace affecting the Company’s credibility or otherwise affecting market perceptions of the integrity or utility of independent credit ratings; |

| |

• | the effect of competitive products and pricing, including the level of success of new product developments and global expansion; |

| |

• | consolidation in the Company’s end-customer markets; |

| |

• | the impact of customer cost-cutting pressures, including in the financial services industry and commodities markets; |

| |

• | a decline in the demand for credit risk management tools by financial institutions; |

| |

• | the level of merger and acquisition activity in the United States and abroad; |

| |

• | the volatility of the energy marketplace and the health of the commodities markets; |

| |

• | our ability to attract, incentivize and retain key employees; |

| |

• | the Company’s ability to successfully recover should it experience a disaster or other business continuity problem from a hurricane, flood, earthquake, terrorist attack, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural or man-made event; |

| |

• | changes in applicable tax or accounting requirements, including potential tax reform under the current U.S. administration; |

| |

• | the level of the Company’s future cash flows and capital investments; |

| |

• | the impact on the Company’s revenue and net income caused by fluctuations in foreign currency exchange rates; and |

| |

• | the Company’s exposure to potential criminal sanctions or civil penalties if it fails to comply with foreign and U.S. laws and regulations that are applicable in the domestic and international jurisdictions in which it operates, including sanctions laws relating to countries such as Iran, Russia, Sudan and Syria, anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act of 2010, and local laws prohibiting corrupt payments to government officials, as well as import and export restrictions. |

The factors noted above are not exhaustive. The Company and its subsidiaries operate in a dynamic business environment in which new risks emerge frequently. Accordingly, the Company cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made, except as required by applicable law. Further information about the Company’s businesses, including information about factors that could materially affect its results of operations and financial condition, is contained in the Company’s filings with the SEC, including Item 1a, Risk Factors, in this Annual Report on Form 10-K.

PART I

Item 1. Business

Overview

S&P Global Inc. (together with its consolidated subsidiaries, the “Company,” the “Registrant,” “we,” “us” or “our”) is a leading provider of transparent and independent ratings, benchmarks, analytics and data to the capital and commodity markets worldwide. The capital markets include asset managers, investment banks, commercial banks, insurance companies, exchanges, and issuers; and the commodity markets include producers, traders and intermediaries within energy, metals, petrochemicals and agriculture. We serve our global customers through a broad range of products and services available through both third-party and proprietary distribution channels. We were incorporated in December of 1925 under the laws of the state of New York.

On April 27, 2016, we changed our name to S&P Global Inc. from McGraw Hill Financial, Inc.

We have repositioned S&P Global as a more focused company in the capital and commodity markets by exiting non-core assets and investing for growth in markets that have size and scale. In 2016, we continued to create a portfolio focused on scalable, industry leading, interrelated businesses in the capital and commodity markets. A discussion of significant changes that were made to our portfolio during the three years ended December 31, 2016 can be found within “MD&A – Overview” contained in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K.

Our Businesses

Our operations consist of three reportable segments: Ratings, Market and Commodities Intelligence and S&P Dow Jones Indices ("Indices"). For a discussion on the competitive conditions in our businesses, see “MD&A – Segment Review” contained in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K.

Effective beginning with the fourth quarter of 2016, we realigned certain of our reportable segments to be consistent with changes to our organizational structure and how our Chief Executive Officer evaluates the performance of these segments. Beginning in the fourth quarter of 2016, S&P Global Market Intelligence and S&P Global Platts are included in a new reportable segment named Market and Commodities Intelligence. Our historical segment reporting has been retroactively revised to reflect the current organizational structure.

Ratings

Ratings is an independent provider of credit ratings, research and analytics to investors, issuers and other market participants. Credit ratings are one of several tools investors can use when making decisions about purchasing bonds and other fixed income investments. They are opinions about credit risk and our ratings express our opinion about the ability and willingness of an issuer, such as a corporation or state or city government, to meet its financial obligations in full and on time. Our credit ratings can also relate to the credit quality of an individual debt issue, such as a corporate or municipal bond, and the relative likelihood that the debt issue may default.

With offices in over 25 countries around the world, Ratings is an important part of the world's financial infrastructure and has played a leading role for over 150 years in providing investors with information and independent benchmarks for their investment and financial decisions as well as access to the capital markets. The key constituents Ratings serves are investors, corporations, governments, municipalities, commercial and investment banks, insurance companies, asset managers, and other debt issuers.

As the capital markets continue to evolve, Ratings is well-positioned to capitalize on opportunities, driven by continuing regulatory changes, through its global network, well-established position in corporate markets and strong investor reputation.

Ratings differentiates its revenue between transaction and non-transaction. Transaction revenue primarily includes fees associated with:

| |

• | ratings related to new issuance of corporate and government debt instruments, and structured finance debt instruments; |

| |

• | corporate credit estimates, which are intended, based on an abbreviated analysis, to provide an indication of our opinion regarding creditworthiness of a company which does not currently have a Ratings credit rating. |

Non-transaction revenue primarily includes fees for surveillance of a credit rating, annual fees for customer relationship-based pricing programs, fees for entity credit ratings and global research and analytics.

Market and Commodities Intelligence

Market and Commodities Intelligence's portfolio of capabilities are designed to help the financial community track performance, generate better investment returns, identify new trading and investment ideas, perform risk analysis, develop mitigation strategies and provide high-value information to the commodity and energy markets that enable its customers to make better informed trading and business decisions. The key constituents Market and Commodities Intelligence serves are asset managers; investment banks; investors; brokers; financial advisors; insurance companies; investment sponsors; companies’ back-office functions, including compliance, operations, risk, clearance, and settlement; and producers, traders, and intermediaries within energy, metals and agriculture markets.

Market and Commodities Intelligence includes the following business lines:

| |

• | Financial Data & Analytics — a product suite that provides data, analytics and third-party research for global finance professionals, which includes the S&P Capital IQ Desktop, SNL, Leveraged Commentary & Data, Investment Advisory and integrated bulk data feeds that can be customized, which include CUSIP and Compustat; |

| |

• | Risk Services — commercial arm that sells Ratings' credit ratings and related data, analytics and research, which includes subscription-based offerings, RatingsDirect® and RatingsXpress®; and |

| |

• | S&P Global Platts — the leading independent provider of information and benchmark prices for the commodity and energy markets. S&P Global Platts provides essential price data, analytics, and industry insight that enable the commodities and energy markets to perform with greater transparency and efficiency. Additionally, S&P Global Platts generates revenue from licensing of our proprietary market price data and price assessments to commodity exchanges. |

As of September 7, 2016, we completed the sale of J.D. Power and the results are included in Market and Commodities Intelligence results through that date.

Indices

Indices is a global index provider that maintains a wide variety of indices to meet an array of investor needs. Indices’ mission is to provide transparent benchmarks to help with decision making, collaborate with the financial community to create innovative products and provide investors with tools to monitor world markets.

Indices primarily derives revenue from asset linked fees based on the S&P and Dow Jones indices and to a lesser extent generates subscription revenue and transaction revenue. Specifically, Indices generates revenue from the following sources:

| |

• | Investment vehicles — asset linked fees such as exchange traded funds (“ETFs”) and mutual funds, that are based on S&P Dow Jones Indices' benchmarks and generate revenue through fees based on assets and underlying funds; |

| |

• | Exchange traded derivatives — generate royalties based on trading volumes of derivatives contracts listed on various exchanges; |

| |

• | Index-related licensing fees — fixed or variable annual and per-issue fees for over-the-counter derivatives and retail-structured products; and |

| |

• | Data and customized index subscription fees — fees from supporting index fund management, portfolio analytics and research. |

Segment and Geographic Data

The relative contribution of our operating segments to operating revenue, operating profit, long-lived assets and geographic area for the three years ended December 31, 2016 are included in Note 12 – Segment and Geographic Information to the consolidated financial statements under Item 8, Consolidated Financial Statements and Supplementary Data, in this Annual Report on Form 10-K.

Our Personnel

As of December 31, 2016, we had approximately 20,000 employees located worldwide, of which approximately 5,100 were employed in the U.S.

Available Information

The Company's investor kit includes Annual Reports on Form 10-K, Proxy Statements, Quarterly Reports on Form 10-Q, current reports on Form 8-K, the current earnings release and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. For online access, go to http://investor.spglobal.com. Requests for printed copies, free of charge, can be e-mailed to investor.relations@spglobal.com or mailed to Investor Relations, S&P Global Inc., 55 Water Street, New York, NY 10041-0001. Interested parties can also call Investor Relations toll-free at 866-436-8502 (domestic callers) or 212-438-2192 (international callers). The information on our website is not, and shall not be deemed to be part hereof or incorporated into this or any of our filings with the Securities and Exchange Commission (“SEC”).

Access to more than 10 years of the Company's filings made with the SEC is available through the Company's Investor Relations website. Go to http://investor.spglobal.com and click on the SEC Filings link. In addition, these filings are available to the public on the Commission's website through their EDGAR filing system at www.sec.gov. Interested parties may also read and copy materials that the Company has filed with the SEC at the SEC's public reference room located at 100 F Street, NE, Washington, D.C. 20549 on official business days between the hours of 10AM and 3PM. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room.

Item 1a. Risk Factors

We are providing the following cautionary statements which identify all known material risks, uncertainties and other factors that could cause our actual results to differ materially from historical and expected results.

We operate in the capital, commodities and commercial markets. The capital markets include asset managers, investment banks, commercial banks, insurance companies, exchanges, and issuers; the commodities markets include producers, traders and intermediaries within energy, metals, petrochemicals and agriculture; and the commercial markets include professionals and corporate executives within automotive, financial services, insurance and marketing / research information services. Certain risk factors are applicable to certain of our individual segments while other risk factors are applicable company-wide.

Exposure to litigation and government and regulatory proceedings, investigations and inquiries could have a material adverse effect on our business, financial condition or results of operations.

| |

• | In the normal course of business, both in the United States and abroad, we and our subsidiaries are defendants in numerous legal proceedings and are often the subject of government and regulatory proceedings, investigations and inquiries, as discussed under Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K and in Note 13 - Commitments and Contingencies to the consolidated financial statements under Item 8, Consolidated Financial Statements and Supplementary Data, in this Annual Report on Form 10-K, and we face the risk that additional proceedings, investigations and inquiries will arise in the future. |

| |

• | Many of these proceedings, investigations and inquiries relate to the ratings activity of S&P Global Ratings brought by issuers and alleged purchasers of rated securities. In addition, various government and self-regulatory agencies frequently make inquiries and conduct investigations into our compliance with applicable laws and regulations, including those related to ratings activities and antitrust matters. |

| |

• | Any of these proceedings, investigations or inquiries could ultimately result in adverse judgments, damages, fines, penalties or activity restrictions, which could have a material adverse effect on our business, financial condition or results of operations. |

| |

• | In view of the uncertainty inherent in litigation and government and regulatory enforcement matters, we cannot predict the eventual outcome of the matters we are currently facing or the timing of their resolution, or in most cases reasonably estimate what the eventual judgments, damages, fines, penalties or impact of activity restrictions may be. As a result, we cannot provide assurance that the outcome of the matters we are currently facing or that we may face in the future will not have a material adverse effect on our business, financial condition or results of operations. |

| |

• | As litigation or the process to resolve pending matters progresses, as the case may be, we continuously review the latest information available and assess our ability to predict the outcome of such matters and the effects, if any, on our consolidated financial condition, cash flows, business and competitive position, which may require that we record liabilities in the consolidated financial statements in future periods. |

| |

• | Legal proceedings impose additional expenses on the Company and require the attention of senior management to an extent that may significantly reduce their ability to devote time addressing other business issues. |

| |

• | Risks relating to legal proceedings may be heightened in foreign jurisdictions that lack the legal protections or liability standards comparable to those that exist in the United States. In addition, new laws and regulations have been and may continue to be enacted that establish lower liability standards, shift the burden of proof or relax pleading requirements, |

thereby increasing the risk of successful litigations against the Company in the United States and in foreign jurisdictions. These litigation risks are often difficult to assess or quantify and could have a material adverse effect on our business, financial condition or results of operations.

| |

• | We may not have adequate insurance or reserves to cover these risks, and the existence and magnitude of these risks often remains unknown for substantial periods of time and could have a material adverse effect on our business, financial condition or results of operations. |

Our acquisitions and other strategic transactions may not produce anticipated results.

| |

• | We have made and expect to continue to make acquisitions or enter into other strategic transactions to strengthen our business and grow our Company. Such transactions present significant challenges and risks. |

| |

• | The market for acquisition targets and other strategic transactions is highly competitive, especially in light of industry consolidation, which may affect our ability to complete such transactions. |

| |

• | If we are unsuccessful in completing such transactions or if such opportunities for expansion do not arise, our business, financial condition or results of operations could be materially adversely affected. |

| |

• | If such transactions are completed, the anticipated growth and other strategic objectives of such transactions may not be fully realized, and a variety of factors may adversely affect any anticipated benefits from such transactions. For instance, the process of integration may require more resources than anticipated, we may assume unintended liabilities, there may be unexpected regulatory and operating difficulties and expenditures, we may fail to retain key personnel of the acquired business and such transactions may divert management’s focus from other business operations. |

| |

• | The anticipated benefits from an acquisition or other strategic transaction may not be realized fully, or may take longer to realize than expected. As a result, the failure of acquisitions and other strategic transactions to perform as expected could have a material adverse effect on our business, financial condition or results of operations. |

Changes in the volume of securities issued and traded in domestic and/or global capital markets, asset levels and flows into investment products, changes in interest rates and volatility in the financial markets, and volatility in the commodities markets could have a material adverse effect on our business, financial condition or results of operations.

| |

• | Our business is impacted by general economic conditions and volatility in the United States and world financial markets. Therefore, since a significant component of our credit-rating based revenue is transaction-based, and is essentially dependent on the number and dollar volume of debt securities issued in the capital markets, unfavorable financial or economic conditions that either reduce investor demand for debt securities or reduce issuers’ willingness or ability to issue such securities could reduce the number and dollar volume of debt issuances for which Ratings provides credit ratings. |

| |

• | Our Indices business is impacted by market volatility, asset levels of investment products tracking indices, and trading volumes of certain exchange traded derivatives. A decrease in our revenues attributable to these products could have a material adverse effect on our business, financial condition or results of operations. Volatile capital markets, as well as changing investment styles, among other factors, may influence an investor’s decision to invest in and maintain an investment in an index-linked investment product. |

| |

• | Increases in interest rates or credit spreads, volatility in financial markets or the interest rate environment, significant political or economic events, defaults of significant issuers and other market and economic factors may negatively impact the general level of debt issuance, the debt issuance plans of certain categories of borrowers, the level of derivatives trading and/or the types of credit-sensitive products being offered, any of which could have a material adverse effect on our business, financial condition or results of operations. |

| |

• | Our Platts business is impacted by volatility in the commodities markets. Weak economic conditions, especially in our key markets, including the energy industry, could reduce demand for our products, impacting our revenues and margins. As a result of volatility in commodity prices and trading activity in physical commodities and commodities derivatives, we may encounter difficulty in achieving sustained market acceptance of past or future contract terms, which could have a material adverse effect on our financial position, results of operations and cash flows. |

| |

• | Any weakness in the macroeconomic environment could constrain customer budgets across the markets we serve, potentially leading to a reduction in their employee headcount and a decrease in demand for our subscription-based products. |

Increasing regulation of our Ratings business in the United States, Europe and elsewhere can increase our costs of doing business and therefore could have a material adverse effect on our business, financial condition or results of operations.

| |

• | The financial services industry is highly regulated, rapidly evolving and subject to the potential for increasing regulation in the United States, Europe and elsewhere. The businesses conducted by Ratings are in certain cases regulated under the Credit Rating Agency Reform Act of 2006 (the “Reform Act”), the Dodd-Frank Wall Street Reform and Consumer |

Protection Act (the “Dodd-Frank Act”), the U.S. Securities Exchange Act of 1934 (the “Exchange Act”), and/or the laws of the states or other jurisdictions in which they conduct business.

| |

• | In the past several years, the U.S. Congress, the International Organization of Securities Commissions ("IOSCO"), the SEC and the European Commission, including through the European Securities Market Authority ("ESMA"), as well as regulators in other countries in which Ratings operates, have been reviewing the role of rating agencies and their processes and the need for greater oversight or regulations concerning the issuance of credit ratings or the activities of credit rating agencies. Other laws, regulations and rules relating to credit rating agencies are being considered by local, national and multinational bodies and are likely to continue to be considered in the future, including provisions seeking to reduce regulatory and investor reliance on credit ratings, rotation of credit rating agencies and liability standards applicable to credit rating agencies. |

| |

• | These laws and regulations, and any future rulemaking, could result in reduced demand for credit ratings and increased costs, which we may be unable to pass through to customers. In addition, there may be uncertainty over the scope, interpretation and administration of such laws and regulations. We may be required to incur significant expenses in order to comply with such laws and regulations and to mitigate the risk of fines, penalties or other sanctions. Legal proceedings could become increasingly lengthy and there may be uncertainty over and exposure to liability. It is difficult to accurately assess the future impact of legislative and regulatory requirements on our business and our customers’ businesses, and they may affect Ratings’ communications with issuers as part of the rating assignment process, alter the manner in which Ratings’ ratings are developed, affect the manner in which Ratings or its customers or users of credit ratings operate, impact the demand for ratings and alter the economics of the credit ratings business. Each of these developments increases the costs and legal risk associated with the issuance of credit ratings and may have a material adverse effect on our operations, profitability and competitiveness, the demand for credit ratings and the manner in which such ratings are utilized. |

| |

• | Additional information regarding rating agencies is provided under Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report on Form 10-K. |

Our Indices and Market and Commodities Intelligence businesses are subject to the potential for increased or changing regulation in the United States, Europe and elsewhere, which can increase our costs of doing business globally and therefore could have a material adverse effect on our business, financial condition or results of operations.

| |

• | In addition to the extensive and evolving U.S. laws and regulations, foreign jurisdictions, principally in Europe, have taken measures to increase regulation of the financial services and commodities industries. |

| |

• | In October of 2012, IOSCO issued its Principles for Oil Price Reporting Agencies ("PRA Principles"), which IOSCO states are intended to enhance the reliability of oil price assessments that are referenced in derivative contracts subject to regulation by IOSCO members. Platts has taken steps to align its operations with the PRA Principles and, as recommended by IOSCO in its final report on the PRA Principles, has aligned to the PRA Principles for other commodities for which it publishes benchmarks. |

| |

• | In July of 2013, IOSCO issued its Principles for Financial Benchmarks ("Financial Benchmark Principles"), which are intended to promote the reliability of benchmark determinations, and address governance, benchmark quality and accountability mechanisms, including with regard to the indices published by Indices. Indices has taken steps to align its governance regime and operations with the Financial Benchmark Principles and engaged an independent auditor to perform a reasonable assurance review of such alignment. |

| |

• | The financial benchmarks industry is subject to the new pending benchmark regulation in the European Union (the “E.U. Benchmark Regulation”) as well as potential increased regulation in other jurisdictions, including Australia. The E.U. Benchmark Regulation was published on June 30, 2016 and included provisions applicable to Indices and Platts, which will become effective January 1, 2018. The E.U. Benchmark Regulation requires Indices and Platts in due course to obtain registration or authorization in connection with their respective benchmark activities in Europe. This legislation will likely cause additional operating obligations but they are not expected to be material at this time, although the exact impact remains unclear. |

| |

• | The European Union has recently finalized a package of legislative measures known as MiFID II ("MiFID II"), which revise and update the existing E.U. Markets in Financial Instruments Directive framework. MiFID II applies in full in all E.U. Member States as of January 3, 2017. MiFID II includes provisions that, among other things: (i) impose new conditions and requirements on the licensing of benchmarks and provide for non-discriminatory access to exchanges and clearing houses; (ii) modify the categorization and treatment of certain classes of derivatives; (iii) expand the categories of trading venue that are subject to regulation; and (iv) provide for the mandatory trading of certain derivatives on exchanges (complementing the mandatory derivative clearing requirements in the E.U. Market Infrastructure Regulation of 2011). Although the MiFID II package is “framework” legislation (meaning that much of the detail of the rules will be set out in subordinate measures to be agreed upon in the period before 2017), it is possible that the introduction of these laws and rules could affect Indices’ and Platts’ abilities both to administer and license their indices and price assessments, respectively. MiFID II and the Market Abuse Regulation (“MAR”) may impose additional regulatory |

burdens on Market and Commodities Intelligence's activities in the European Union, although the exact severity and cost are not yet known.

| |

• | Market and Commodities Intelligence operates regulated investment advisory businesses in the United States, the European Union and Malaysia. These and other Market and Commodities Intelligence businesses may increasingly become subject to new or more stringent regulations that will increase the cost of doing business, which could have a material adverse effect on our business, financial condition or results of operations. |

Future legislation, regulatory reform or policy changes under the current U.S. administration could have a material effect on our business and results of operations.

| |

• | There exists the potential for comprehensive tax reform in the United States that may significantly change the tax rules applicable to U.S. domiciled corporations. Changes such as lower corporate tax rates, repatriation allowances, removal of the interest expense deduction, removal of the municipal bond tax exemption or the introduction of a border adjustment tax could impact the Company as a U.S. taxpayer, as well as the demand for our products and services. At this time, we cannot assess what the overall effect of such potential legislation could be on our results of operations or cash flows. |

| |

• | Other legislation, regulatory reform or policy changes under the current U.S. administration, such as financial services regulatory reform, U.S. oil deregulation, government-sponsored enterprise (GSE) reform and increased infrastructure spending, could impact our business. At this time, we cannot predict the scope or nature of these changes or assess what the overall effect of such potential changes could be on our results of operations or cash flows. |

Regulatory changes and economic conditions leading up to and following the United Kingdom’s likely exit from the European Union could have a material adverse effect on our business and results of operations.

| |

• | Following a referendum on June 23, 2016 in which voters in the United Kingdom ("U.K.") approved an exit from the European Union ("EU"), it is expected that the U.K. government will initiate a process to leave the EU (often referred to as Brexit) and begin negotiating the terms of the U.K.’s future relationship with the EU. |

| |

• | Any impact from Brexit on the Company will depend, in part, on the outcome of tariff, trade and other negotiations. In addition, Brexit could lead to legal uncertainty and potentially divergent national laws and regulations between the U.K and the EU as the U.K. determines which EU laws to replace or replicate and the EU determines how to treat regulated activities (e.g., the activities of credit rating agencies) originating in the U.K. Our businesses are subject to increasing regulation of the financial services and commodities industries in Europe. Potential changes in EU regulation and/or additional regulation in the U.K. could cause additional operating obligations and increased costs for our businesses. |

| |

• | Any of these effects of Brexit, and others we cannot anticipate, could adversely affect our business, business opportunities, results of operations, financial condition and cash flows. |

We may become subject to liability based on the use of our products by our clients.

| |

• | Some of our products support the investment processes of our clients, which, in the aggregate, manage trillions of dollars of assets. Use of our products as part of the investment process creates the risk that clients, or the parties whose assets are managed by our clients, may pursue claims against us for very significant dollar amounts, which could have a material adverse effect on our business, financial condition or results of operations. |

| |

• | Any such claim, even if the outcome were to be ultimately favorable to us, would involve a significant commitment of our management, personnel, financial and other resources and could have a negative impact on our reputation. In addition, such claims and lawsuits could have a material adverse effect on our business, financial condition or results of operations. |

Increased competition could result in a loss of market share or revenue.

| |

• | The markets for credit ratings, financial research, investment and advisory services, market data, index-based products, and commodities price assessments and related news and information about these markets are intensely competitive. Ratings, Market and Commodities Intelligence and Indices compete domestically and internationally on the basis of a number of factors, including the quality of its ratings, data, research and advisory services, client service, reputation, price, geographic scope, range of products and technological innovation. |

| |

• | While our businesses face competition from traditional content and analytics providers, we also face competition from non-traditional providers such as exchanges, asset managers, investment banks and technology-led companies that are adding content and analytics capabilities to their core businesses. |

| |

• | In addition, in some of the countries in which Ratings competes, governments may provide financial or other support to locally-based rating agencies and may from time to time establish official credit rating agencies, credit ratings criteria or procedures for evaluating local issuers. |

| |

• | Sustained downward pressure on oil and other commodities prices and trading activity in those markets could have a material adverse effect on the rate of growth of Platts’ revenue, including subscription and licensing fees. |

Introduction of new products, services or technologies could impact our profitability.

| |

• | We operate in highly competitive markets that continue to change to adapt to customer needs. In order to maintain a competitive position, we must continue to invest in new offerings and new ways to deliver our products and services. These investments may not be profitable or may be less profitable than what we have experienced historically. |

| |

• | We could experience threats to our existing businesses from the rise of new competitors due to the rapidly changing environment in which we operate. |

| |

• | We rely on our information technology environment and certain critical databases, systems and applications to support key product and service offerings. We believe we have appropriate policies, processes and internal controls to ensure the stability of our information technology, provide security from unauthorized access to our systems and maintain business continuity, but our business could be subject to significant disruption and our business, financial condition or results of operations could be materially and adversely affected by unanticipated system failures, data corruption or unauthorized access to our systems. |

A significant increase in operating costs and expenses could have a material adverse effect on our profitability.

| |

• | Our major expenditures include employee compensation and capital investments. |

| |

• | We offer competitive salary and benefit packages in order to attract and retain the quality employees required to grow and expand our businesses. Compensation costs are influenced by general economic factors, including those affecting the cost of health insurance and postretirement benefits, and any trends specific to the employee skill sets we require. |

| |

• | We make significant investments in information technology data centers and other technology initiatives and we cannot provide assurances that such investments will result in increased revenues. |

| |

• | Although we believe we are prudent in our investment strategies and execution of our implementation plans, there is no assurance as to the ultimate recoverability of these investments. |

Increased availability of free or relatively inexpensive information sources may reduce demand for our products and have a could have a material adverse effect on our business, financial condition or results of operations.

| |

• | In recent years, more public sources of free or relatively inexpensive information have become available, particularly through the Internet, and advances in public cloud computing and open source software may continue. |

| |

• | Public sources of free or relatively inexpensive information may reduce demand for our products and services. Demand could also be reduced as a result of cost-cutting initiatives at certain companies and organizations. Although we believe our products are enhanced by our analysis, tools and applications, our financial results may be adversely affected if our customers choose to use these public sources as a substitute for our products or services. |

Consolidation of customers as well as staffing levels across our customer base could impact our available markets and revenue growth.

| |

• | Our businesses have a customer base which is largely comprised of members from the corporate, financial services and commodities industries. The consolidation of customers resulting from mergers and acquisitions across these industries can result in reductions in the number of firms and workforce which can impact the size of our customer base. |

| |

• | Our customers that strive to reduce their operating costs may seek to reduce their spending on our products and services. If a large number of smaller customers or a critical number of larger customers reduce their spending with us, our business, financial condition or results of operations could be materially and adversely affected. |

| |

• | Alternatively, customers may use other strategies to reduce their overall spending on financial and commodity market products and services by consolidating their spending with fewer vendors, including by selecting other vendors with lower-cost offerings, or by self-sourcing their need for financial and commodity market products and services. If customers elect to consolidate their spending on financial and commodity market products and services with other vendors and not us, if we lose business to lower priced competitors, or if customers elect to self-source their product and service needs, our business, financial condition or results of operations could be materially and adversely affected. |

| |

• | A material portion of our revenues in our Indices business is concentrated in some of our largest customers, who have significant assets under management in index funds and exchange-traded funds. A loss of a substantial portion of revenue from our largest customers could have a material and adverse effect on our business, financial condition or results of operations. |

If we lose key outside suppliers of data and products or if the data or products of these suppliers have errors or are delayed, we may not be able to provide our clients with the information and products they desire.

| |

• | Our ability to produce our products and develop new products is dependent upon the products of other suppliers, including certain data, software and service suppliers. Some of our products are dependent upon (and of little value without) updates from our data suppliers and most of our information and data products are dependent upon (and of little value without) continuing access to historical and current data. |

| |

• | We utilize certain data provided by third-party data sources in a variety of ways, including large volumes of data from certain stock exchanges around the world. |

| |

• | If the data from our suppliers has errors, is delayed, has design defects, is unavailable on acceptable terms or is not available at all, it could have a material adverse effect on our business, financial condition or results of operations. |

| |

• | Some of our agreements with data suppliers allow them to cancel on short notice. Termination of one or more of our significant data agreements or exclusion from, or restricted use of, or litigation in connection with, a data provider’s information could decrease the available information for us to use (and offer our clients) and could have a material adverse effect on our business, financial condition or results of operations. |

Changes in the legislative, regulatory, and commercial environments in which we operate may materially and adversely impact our ability to collect, compile, use, and publish data and may impact our financial results.

| |

• | Certain types of information we collect, compile, use, and publish, including offerings in our Market and Commodities Intelligence business, are subject to regulation by governmental authorities in jurisdictions in which we operate. In addition, there is increasing concern among certain privacy advocates and government regulators regarding marketing and privacy matters, particularly as they relate to individual privacy interests. |

| |

• | These concerns may result in new or amended laws and regulations. Future laws and regulations with respect to the collection, compilation, use, and publication of information and consumer privacy could result in limitations on our operations, increased compliance or litigation expense, adverse publicity, or loss of revenue, which could have a material adverse effect on our business, financial condition, and results of operations. It is also possible that we could be prohibited from collecting or disseminating certain types of data, which could affect our ability to meet our customers’ needs. |

Our ability to protect our intellectual property rights could impact our competitive position.

| |

• | Our products contain intellectual property delivered through a variety of digital and other media. Our ability to achieve anticipated results depends in part on our ability to defend our intellectual property against infringement. Our business, financial condition or results of operations could be materially and adversely affected by inadequate or changing legal and technological protections for intellectual property and proprietary rights in some jurisdictions and markets. |

| |

• | Our products also contain intellectual property of third party sources. Any violation by us of the intellectual property rights of such third parties could result in litigation and reputational damage which materially and adversely affects our business, financial condition or results of operations. |

We are exposed to multiple risks associated with the global nature of our operations.

| |

• | The geographic breadth of our activities subjects us to significant legal, economic, operational, market, compliance and reputational risks. These include, among others, risks relating to: |

| |

▪ | economic and political conditions around the world, |

| |

▪ | fluctuation in interest rates and currency exchange rates, |

| |

▪ | limitations that foreign governments may impose on the conversion of currency or the payment of dividends or other remittances to us from our non-U.S. subsidiaries, |

| |

▪ | differing accounting principles and standards, |

| |

▪ | unexpected increases in taxes or changes in U.S. or foreign tax laws, |

| |

▪ | the costs of repatriating cash held by entities outside the United States, including withholding or other taxes that foreign governments may impose on the payment of dividends or other remittances to us from our non-U.S. subsidiaries, |

| |

▪ | potential costs and difficulties in complying with a wide variety of foreign laws and regulations (including tax systems) administered by foreign government agencies, some of which may conflict with U.S. or other sources of law, |

| |

▪ | changes in applicable laws and regulatory requirements, |

| |

▪ | the possibility of nationalization, expropriation, price controls and other restrictive governmental actions, |

| |

▪ | competition with local rating agencies that have greater familiarity, longer operating histories and/or support from local governments or other institutions, |

| |

▪ | civil unrest, terrorism, unstable governments and legal systems, and other factors. |

Adverse developments in any of these areas could have a material adverse effect on our business, financial condition or results of operations.

| |

• | Additionally, we are subject to complex U.S., European and other local laws and regulations that are applicable to our operations abroad, including trade sanctions laws, anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act 2010, anti-bribery laws, anti-money laundering laws, and other financial crimes laws. Although we have implemented internal controls, policies and procedures and employee training and compliance programs to deter prohibited practices, such measures may not be effective in preventing employees, contractors or agents from violating or circumventing such internal policies and violating applicable laws and regulations. Any determination that we have violated trade sanctions, anti-bribery or anti-corruption laws could have a material adverse effect on our business, financial condition or results of operations. |

| |

• | Compliance with international and U.S. laws and regulations that apply to our international operations increases the cost of doing business in foreign jurisdictions. Violations of such laws and regulations may result in fines and penalties, criminal sanctions, administrative remedies, restrictions on business conduct and could have a material adverse effect on our reputation, our ability to attract and retain employees, our business, financial condition or results of operations. |

Our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm or legal liability.

| |

• | Should we experience a local or regional disaster or other business continuity problem, such as an earthquake, hurricane, flood, terrorist attack, pandemic, security breach, cyber attack, power loss, telecommunications failure or other natural or man-made disaster, our ability to continue to operate will depend, in part, on the availability of our personnel, our office facilities and the proper functioning of our computer, telecommunication and other related systems and operations. In such an event, we could experience operational challenges with regard to particular areas of our operations, such as key executive officers or personnel, that could have a material adverse effect on our business. |

| |

• | We regularly assess and take steps to improve our existing business continuity plans and key management succession. However, a disaster on a significant scale or affecting certain of our key operating areas within or across regions, or our inability to successfully recover should we experience a disaster or other business continuity problem, could materially interrupt our business operations and result in material financial loss, loss of human capital, regulatory actions, reputational harm, damaged client relationships or legal liability. |

Outsourcing certain aspects of our business could result in disruption and increased costs.

| |

• | We have outsourced certain support functions to third-party service providers to leverage leading specialized capabilities and achieve cost efficiencies. Outsourcing these functions involves the risk that the third-party service providers may not perform to our standards or legal requirements, may not produce reliable results, may not perform in a timely manner, may not maintain the confidentiality of our proprietary information, or may fail to perform at all. Failure of these third parties to meet their contractual, regulatory, confidentiality, or other obligations to us could result in material financial loss, higher costs, regulatory actions and reputational harm. |

| |

• | Outsourcing these functions also involves the risk that the third-party service providers may not maintain adequate physical, technical and administrative safeguards to protect the security of our confidential information and data. Failure of these third parties to maintain these safeguards could result in unauthorized access to our systems or a system or network disruption that could lead to improper disclosure of confidential information or data, regulatory penalties and remedial costs. |

We rely heavily on network systems and the Internet and any failures or disruptions may adversely affect our ability to serve our customers.

| |

• | Many of our products and services are delivered electronically, and our customers rely on our ability to process transactions rapidly and deliver substantial quantities of data on computer-based networks. Our customers also depend on the continued capacity, reliability and security of our electronic delivery systems, our websites and the Internet. |

| |

• | Our ability to deliver our products and services electronically may be impaired due to infrastructure or network failures, malicious or defective software, human error, natural disasters, service outages at third-party Internet providers or increased government regulation. |

| |

• | Delays in our ability to deliver our products and services electronically may harm our reputation and result in the loss of customers. In addition, a number of our customers entrust us with storing and securing their data and information on our servers. |

| |

• | Although we have disaster recovery plans that include backup facilities for our primary data centers, our systems are not always fully redundant, and our disaster planning may not always be sufficient or effective. As such, these disruptions may affect our ability to store, handle and secure such data and information. |

Our operations and infrastructure may malfunction or fail, which could have a material adverse effect on our business, financial condition or results of operations.

| |

• | Our ability to conduct business may be materially and adversely impacted by a disruption in the infrastructure that supports our businesses and the communities in which we are located, including New York City, the location of our headquarters, and major cities worldwide in which we have offices. |

| |

• | This may include a disruption involving physical or technological infrastructure used by us or third parties with or through whom we conduct business, whether due to human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, intentional acts of vandalism, acts of terrorism, political unrest, war or otherwise. Our efforts to secure and plan for potential disruptions of our major operating systems may not be successful. |

| |

• | We also do not have fully redundant systems for most of our smaller office locations and low-risk systems, and our disaster recovery plan does not include restoration of non-essential services. If a disruption occurs in one of our locations or systems and our personnel in those locations or those who rely on such systems are unable to utilize other systems or communicate with or travel to other locations, such persons’ ability to service and interact with our clients and customers may suffer. |

| |

• | We cannot predict with certainty all of the adverse effects that could result from our failure, or the failure of a third party, to efficiently address and resolve these delays and interruptions. A disruption to our operations or infrastructure could have a material adverse effect on our business, financial condition or results of operations. |

We are exposed to risks related to cybersecurity and protection of confidential information.

| |

• | Our operations rely on the secure processing, storage and transmission of confidential, sensitive and other types of data and information in our computer systems and networks and those of our third-party vendors. |

| |

• | All of our businesses have access to material non-public information concerning the Company’s customers, including sovereigns, corporate issuers and other third parties around the world, the unauthorized disclosure of which could affect the trading markets for such customers’ securities and could damage such customers’ competitive positions. The cyber risks the Company faces range from cyber-attacks common to most industries, to more sophisticated and targeted attacks intended to obtain unauthorized access to certain information or systems due in part to our prominence in the global marketplace, such as our ratings on debt issued by sovereigns and corporate issuers, or the composition of our indices. Unauthorized disclosure of this information could cause our customers to lose faith in our ability to protect their confidential information and therefore cause customers to cease doing business with us. |

| |

• | Breaches of our or our vendors’ systems and networks, whether from circumvention of security systems, denial-of-service attacks or other cyber-attacks, hacking, computer viruses or malware, employee error, malfeasance, physical breaches or other actions, may cause material interruptions or malfunctions in our or such vendors’ websites, applications or data processing, or may compromise the confidentiality and integrity of material information regarding us, our business or our customers. |

| |

• | Misappropriation, improper modification, destruction, corruption or unavailability of our data and information due to cyber incidents, attacks or other security breaches could damage our brand and reputation, result in litigation and regulatory actions, and lead to loss of customer confidence in our security measures and reliability, which would harm our ability to retain customers and gain new ones. |

| |

• | Although S&P Global and its affiliates devote significant resources to maintain and regularly update their systems and processes that are designed to protect the security of our computer systems, software, networks and other technology assets and the confidentiality, integrity and availability of information belonging to the enterprise and our customers, clients and employees, there is no assurance that all of our security measures will provide absolute security. |

| |

• | Measures that we take to avoid or mitigate material incidents can be expensive, and may be insufficient, circumvented, or become obsolete. Any material incidents could cause us to experience reputational harm, loss of customers, regulatory actions, sanctions or other statutory penalties, litigation or financial losses that are either not insured against or not fully covered through any insurance maintained by us, and increased expenses related to addressing or mitigating the risks associated with any such material incidents. |

| |

• | Cyber threats are rapidly evolving and are becoming increasingly sophisticated. Despite our efforts to ensure the integrity of our systems, as cyber threats evolve and become more difficult to detect and successfully defend against, one or more cyber threats might defeat the measures that we or our vendors take to anticipate, detect, avoid or mitigate such threats. Certain techniques used to obtain unauthorized access, introduce malicious software, disable or degrade service, or sabotage systems may be designed to remain dormant until a triggering event and we may be unable to anticipate these |

techniques or implement adequate preventative measures since techniques change frequently or are not recognized until launched, and because cyberattacks can originate from a wide variety of sources.

| |

• | If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed and could result in damage to our reputation and a loss of confidence in the security of our products and services. |

| |

• | The theft, loss, or misuse of personal data collected, used, stored, or transferred by us to run our business could result in significantly increased security costs or costs related to defending legal claims. Global privacy legislation, enforcement, and policy activity in this area are rapidly expanding and creating a complex regulatory compliance environment. Costs to comply with and implement these privacy-related and data protection measures could be significant. In addition, if despite our best efforts an inadvertent failure to comply with federal, state, or international privacy-related or data protection laws and regulations should occur, this could result in proceedings against us by governmental entities or others. |

| |

• | Any of the foregoing could have a material adverse effect on our business, financial condition or results of operations. |

Inability to attract and retain key qualified personnel could have a material adverse effect on our business and results of operations.

| |

• | The development, maintenance and support of our products and services are dependent upon the knowledge, experience and ability of our highly skilled, educated and trained employees. Accordingly, our business is dependent on successfully attracting and retaining talented employees. If the Company is less successful in its recruiting efforts, or if it is unable to retain key employees, its ability to develop and deliver successful products and services or achieve strategic goals may be adversely affected. |

Hiver2016!

Our brand and reputation are key assets and competitive advantages of our Company and our business may be affected by how we are perceived in the marketplace.

| |

• | Our ability to attract and retain customers is affected by external perceptions of our brand and reputation. Negative perceptions or publicity could damage our reputation with customers, prospects and the public generally, which could negatively impact, among other things, our ability to attract and retain customers, employees and suppliers, as well as suitable candidates for acquisition or other combinations. |

Item 1b. Unresolved Staff Comments

None.

Item 2. Properties

Our corporate headquarters are located in leased premises located at 55 Water Street, New York, NY 10041. We lease office facilities at 102 locations; 32 are in the U.S. In addition, we own real property at 7 locations, of which 2 are in the U.S. Our properties consist primarily of office space used by each of our segments. We believe that all of our facilities are well maintained and are suitable and adequate for our current needs.

Item 3. Legal Proceedings

For information on our legal proceedings, see Note 13 – Commitments and Contingencies under Item 8, Consolidated Financial Statements and Supplementary Data, in this Annual Report on Form 10-K.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of the Registrant

The following individuals are the executive officers of the Company:

|

| | | | |

Name | | Age | | Position |

Douglas L. Peterson | | 58 | | President and Chief Executive Officer |

Ewout Steenbergen | | 47 | | Executive Vice President, Chief Financial Officer |

Ratings |

John L. Berisford | | 53 | | President, S&P Global Ratings |

Market and Commodities Intelligence |

Michael Chinn | | 44 | | President, Market and Commodities Intelligence |

Martin Fraenkel | | 56 | | President, S&P Global Platts |

Martina L. Cheung | | 41 | | Head of Global Risk Services |

Indices | | | | |

Alex J. Matturri, Jr. | | 58 | | Chief Executive Officer, S&P Dow Jones Indices |

S&P Global Functions |

Courtney Geduldig | | 41 | | Executive Vice President, Public Affairs |

France M. Gingras | | 52 | | Executive Vice President, Human Resources |

Steve Kemps | | 52 | | Executive Vice President, General Counsel |

Nancy Luquette | | 51 | | Senior Vice President, Chief Risk & Audit Executive |

Krishna Nathan | | 54 | | Chief Information Officer |

Paul Sheard | | 62 | | Executive Vice President and Chief Economist |

Mr. Berisford, prior to becoming President of S&P Global Ratings on November 3, 2015, was Executive Vice President, Human Resources since 2011. Prior to that, he held senior management positions at PepsiCo, including Senior Vice President, Human Resources for Pepsi Beverages Company.

Ms. Cheung, prior to becoming Head of Global Risk Services on November 3, 2015, held management positions at S&P Global Ratings and was most recently S&P Global’s Chief Strategy Officer. Prior to joining S&P Global, she worked in the consulting industry, first in Accenture’s Financial Services Strategy group and later as a Partner at Mitchell Madison Consulting.

Mr. Chinn, prior to becoming President of Market and Commodities Intelligence in September 2016 and President of S&P Global Market Intelligence in September 2015, was Chief Executive Officer of SNL since 2010 and President of SNL since 2000.

Mr. Fraenkel, prior to becoming President of S&P Global Platts in September 2016, was Global Head of Content, responsible for leading Platts’ 450-member global editorial and analytics team, as well as being a member of the Platts Executive Committee regarding the division’s strategy and offerings in data, pricing, news and analysis. Mr. Fraenkel joined S&P Global Platts in June 2015 from CME Group, where he was Managing Director and Global Head of Energy.

Ms. Geduldig, prior to becoming Executive Vice President, Public Affairs on May 1, 2015, was Managing Director, Global Government and Public Policy since 2013, and Vice President of Global Regulatory Affairs at S&P Global Ratings. Prior to that, she was Managing Director and Head of Federal Government Relations at the Financial Services Forum.

Ms. Gingras, prior to becoming Executive Vice President, Human Resources on November 3, 2015, was Senior Vice President, Total Rewards since 2012. Prior to that, she was Head of Compensation and Benefits at Time, Inc.

Mr. Kemps, prior to becoming Executive Vice President, General Counsel at S&P Global in August 2016, served as Executive Vice President and General Counsel at Quanta Services, where he oversaw all legal affairs and advised the business on regulatory, ethical and compliance matters. Prior to joining Quanta, he served as General Counsel of Hess Retail Corporation and Dean Foods Company.

Ms. Luquette, prior to becoming Senior Vice President, Chief Risk & Audit Executive for S&P Global in June 2016, led the S&P Global Internal Audit function and the Ratings Risk Review function for S&P Global Ratings as the Chief Audit Executive for the Company. She became S&P Global’s Chief Risk & Audit Executive and assumed leadership of the Risk Management function in June 2016. Before joining the Company, Ms. Luquette was Vice President and General Auditor for Avaya, and prior to that was a Partner in PwC’s Internal Audit and Global Risk Management Services practices.

Mr. Matturri, prior to becoming Chief Executive Officer at S&P Dow Jones Indices on July 2, 2012, served as an Executive Managing Director of S&P Indices. Prior to joining S&P Indices, Mr. Matturri served as Senior Vice President and Director of Global Equity Index Management at Northern Trust Global Investments (NTGI). He previously held management positions with Deutsche Asset Management’s Index and Quantitative Investment business and The Bank of New York.

Mr. Nathan, prior to becoming Chief Information Officer at S&P Global in May 2016, was Vice President of Systems at IBM, responsible for the development and execution of the research strategy and activity in a variety of areas such as next generation data centers, cognitive systems design, security and a range of future Systems technologies. At IBM, he held a wide variety of leadership positions, both corporate and business-aligned, spanning the U.S. and Europe.

Mr. Peterson, prior to becoming President and Chief Executive Officer on November 1, 2013, was President of Standard & Poor's Ratings Services since 2011. Prior to that, he was Chief Operating Officer of Citibank, NA.

Mr. Sheard, prior to becoming Executive Vice President and Chief Economist on November 3, 2015, was Chief Global Economics and Head of Global Economics and Research of Standard & Poor’s Ratings Services. Prior to that, he held economist positions at Nomura Securities and at Lehman Brothers.

Mr. Steenbergen, prior to becoming Executive Vice President and Chief Financial Officer at S&P Global in November 2016, was Executive Vice President and Chief Financial Officer of Voya Financial, Inc. Prior to his role as Voya's Chief Financial Officer, Mr. Steenbergen was Chief Financial Officer and Chief Risk Officer for ING Asia-Pacific and held a number of management roles for ING Group, including serving as regional general manager in Hong Kong and as a Chief Executive Officer of RVS, an ING Group company based in the Netherlands.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Price Range of Common Stock

On January 27, 2017, the closing price of our common stock was $120.69 per share as reported on the New York Stock Exchange (“NYSE”) under the ticker symbol “SPGI”. S&P Global Inc. began trading under its new ticker symbol "SPGI" on April 28, 2016. Previously, the Company's common stock traded on the NYSE under the ticker symbol "MHFI". The approximate number of record holders of our common stock as of January 27, 2017 was 3,220. The high and low sales prices of S&P Global Inc.'s common stock on the NYSE for the past two fiscal years are as follows:

|

| | | |

| 2016 | | 2015 |

First Quarter | $99.85 - $78.55

| | $109.13 - $85.06

|

Second Quarter | 112.75 - 95.83

| | 108.14 - 100.44

|

Third Quarter | 128.40 - 104.75

| | 107.50 - 84.64

|

Fourth Quarter | 127.68 - 107.21 | | 101.27 - 86.10

|

Year | 128.40 - 78.55 | | 109.13 - 84.64

|

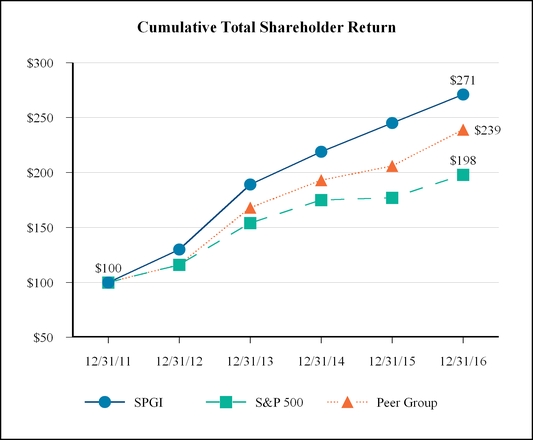

The performance graph below compares our cumulative total shareholder return during the previous five years with a performance indicator of the overall market (i.e., S&P 500), and our peer group. The peer group consists of the following companies: Thomson Reuters Corporation, Moody’s Corporation, CME Group Inc., MSCI Inc., FactSet Research Systems Inc. and IHS Markit Ltd. Returns assume $100 invested on December 31, 2011 and total return includes reinvestment of dividends through December 31, 2016.

Dividends

We expect to continue our policy of paying regular cash dividends, although there is no assurance as to future dividend payments because they depend on future earnings, capital requirements and our financial condition. Regular quarterly dividends per share of our common stock for 2016 and 2015 were as follows:

|

| | | | | | | |

| 2016 | | 2015 |

$0.36 per quarter in 2016 | $ | 1.44 |

| | |

$0.33 per quarter in 2015 | | | $ | 1.32 |

|

On January 25, 2017, the Board of Directors approved an increase in the quarterly common stock dividend from $0.36 per share to $0.41 per share.

Transfer Agent and Registrar for Common Stock

Computershare is the transfer agent for S&P Global. Computershare maintains the records for the Company's registered shareholders and can assist with a variety of shareholder related services.

Shareholder correspondence should be mailed to:

Computershare

P.O. Box 30170

College Station, TX 77842-3170

Overnight correspondence should be mailed to:

Computershare

211 Quality Circle, Suite 210

College Station, TX 77845

Visit the Investor Center™ website to view and manage shareholder account online: www.computershare.com/investor

For shareholder assistance:

|

| |

In the U.S. and Canada: | 888-201-5538 |

Outside the U.S. and Canada: | 201-680-6578 |

TDD for the hearing impaired: | 800-231-5469 |

TDD outside the U.S. and Canada: | 201-680-6610 |

E-mail address: | web.queries@computershare.com |

Shareholder online inquiries | https://www-us.computershare.com/investor/Contact |

Repurchase of Equity Securities

On December 4, 2013, the Board of Directors approved a share repurchase program authorizing the purchase of up to 50 million shares, which was approximately 18% of the Company's outstanding shares at that time. During the fourth quarter of 2016, we received an additional 0.9 million shares from the conclusion of our accelerated share repurchase ("ASR") agreement that we entered into on September 7, 2016. Further discussion relating to our ASR agreement can be found in Note 9 - Equity. As of December 31, 2016, 25.8 million shares remained under our current repurchase program.

Repurchased shares may be used for general corporate purposes, including the issuance of shares for stock compensation plans and to offset the dilutive effect of the exercise of employee stock options. Our current repurchase program has no expiration date and purchases under this program may be made from time to time on the open market and in private transactions, depending on market conditions.

The following table provides information on our purchases of our outstanding common stock during the fourth quarter of 2016 pursuant to our current share repurchase program (column c). In addition to these purchases, the number of shares in column (a) include shares of common stock that are tendered to us to satisfy our employees’ tax withholding obligations in connection with the vesting of awards of restricted shares (we repurchase such shares based on their fair market value on the vesting date).

There were no other share repurchases during the quarter outside the repurchases noted below.

|

| | | | | | | | | | | | |