pu

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| Chairman’s Letter |

Dear McDonald’s

Shareholders, Colleagues,

Crew Members, Franchisees

and Customers,

My last few annual letters have each been prefaced with an acknowledgement of broader societal challenges. And as I write this year, I look back at how the war in Ukraine and the widespread economic fallout that followed tested the world yet again.

In these times of uncertainty, customers increasingly favor brands that are focused on making a positive impact on the world. This requires McDonald’s to continue to find new ways for the Arches to shine in our communities while they remain a familiar place of comfort – of hope, even – for millions.

In 2022, guided by our values-based leadership, we achieved yet another year of exceptional performance, demonstrating that our Accelerating the Arches growth strategy is working and has put McDonald’s in an advantaged position.

Acting on the most pressing issues in our communities

McDonald’s approach of integrating our purpose to feed and foster communities within our growth strategy is critical to driving customer trust, and we’ve seen that strategy working and making the Company stronger. McDonald’s has once again been named one of the most admired brands in the world.

But we know that trust is not a given―it must be refreshed and strengthened constantly through action and accountability. I’m proud of the significant progress we made in 2022 on some of the most pressing issues facing our business and the communities we serve.

One of our priorities is to make balanced meals more accessible to families around the world. In 2022, we made substantial strides against our ambitious Global Happy Meal Goals across 20 major markets―representing nearly 85% of global Happy Meal sales―and look forward to sharing the results in later in 2023.

We also continue to make progress against our climate ambition to reach net zero emissions globally by 2050. Within the last year, we brought two additional large-scale U.S. Virtual Power Purchase Agreements (VPPAs) online to contribute more renewable energy to the grid. As the 2019–2022 transacted U.S. renewable energy projects come online, they are expected to contribute to a 27% reduction in restaurant and office greenhouse gas emissions from our global 2015 baseline.

Finally, we continue to prioritize the health and welfare of animals throughout our supply chain. In 2022, we released our Broiler Welfare Progress Update, showcasing our progress across eight commitment areas for Broiler Welfare in 14 of our key markets, which we expect to be fully implemented by the end of 2024.

Enhancing Board strength and expertise through refreshment

Our Board must ensure it continues to represent the highest caliber of values-based leadership. That involves maintaining an appropriate balance of continuity and institutional knowledge with fresh perspectives among our Directors.

In 2022, our Board continued to execute its ongoing refreshment strategy. This resulted in significant Board and Committee refreshment and the election of four new independent Directors to the Board:

| ● | As President and Chief Executive Officer at Marriott International Inc., Tony Capuano brings significant expertise in customer experience and real estate, as well as leadership of an organization with a significant focus on franchising and driving digital customer engagement. |

| ● | Kareem Daniel is a seasoned leader with a strong track record of building brands that resonate with audiences globally. Most recently serving as Chairman, Disney Media and Entertainment Distribution at The Walt Disney Company, Kareem’s unique combination of business and consumer expertise benefits our Board. |

| ● | As Executive Vice President and Worldwide Chairman, Pharmaceuticals at Johnson & Johnson, Jennifer Taubert brings extensive experience in navigating the complexities of a global business in a highly dynamic environment, in addition to her recognized leadership in DEI. |

| ● | Amy Weaver, who serves as President and Chief Financial Officer of Salesforce, Inc., brings expertise in customer relationship management technology, as well as extensive financial, legal, and digital experience. |

The election of these Directors increases our existing strengths in a number of key areas – including digital, brand management, sustainability and real estate – while ensuring an appropriate mix of skills, experiences and perspectives are represented.

Alongside these four additions, Sheila Penrose retired from the Board in 2022. In March 2023, Robert “Bob” A. Eckert and John W. Rogers notified the Company of their retirements from the Board effective at the Company’s 2023 Annual Shareholders’ Meeting. All three of these Directors have made significant contributions to McDonald’s and helped guide expansion of the global business while bringing McDonald’s closer to the communities it serves. McDonald’s is stronger today thanks to their leadership and steadfast commitment to the Company.

| ● | Through her leadership of the Sustainability and Corporate Responsibility Committee of the Board, Sheila oversaw McDonald's critical progress against our ambitious climate, responsible sourcing and diversity, equity and inclusion goals, positioning us as a leader in the industry. |

| ● | Bob brought valuable expertise to the Board serving as Chairman of the Compensation Committee and the inaugural Chairman of the Public Policy & Strategy Committee where he helped oversee the Company’s long-term strategy and operations. |

| ● | John is a prominent leader in the Chicago and business community who has helped to significantly expand the Company’s efforts to promote equitable opportunity and diversity across the full range of the business including employees, franchisees and suppliers. |

Following the changes outlined above, more than half of the Directors have joined in the last four years and more than half of the Board are women or identify as racially or ethnically diverse.

We know that in this current environment, McDonald’s needs to stay as nimble as ever. The Board and management will continue to evaluate any necessary strategic adjustments as part of our ongoing refreshment strategy.

Further strengthening a values-based leadership team

To engender trust, it is critical that we maintain a world-class, values-based leadership team that can steward the McDonald’s Brand and leave it in a better position than before.

The Board provides guidance and oversight on talent management and succession planning, including regularly reviewing short and long-term succession plans and setting targets for initiatives related to promoting diversity within our workforce and across the System.

The continued momentum of our business in 2022, alongside the advancement of efforts to support the communities we serve, is a testament to the strength of our leadership team and the dedication of all three legs of our stool.

I’m proud that we have the right leaders in place, at the right time, to advance our growth strategy and further build on the rich legacy of McDonald’s.

Deploying our Brand as a beacon in our communities

Our CEO Chris Kempczinski is right when he says that “McDonald’s is one of the world’s greatest Brands.”

We see it every day in the ways in which our franchisees, crew, employees and suppliers meaningfully contribute to our communities, bring smiles to our customers’ faces and serve as beacons of hope amid so much volatility and uncertainty in our society.

No one embodied the spirit of community more so than the late McDonald’s Chairman Emeritus, Andrew “Andy” McKenna, who passed away in February 2023. Leading with purpose, Andy guided our organization through significant periods in history, having served as a member of the Board of Directors from 1991 until 2016, including 12 years as Chairman. Andy was an exemplar of our values. He led with the utmost integrity, and on a purely human level, he poured his heart into his family and community. McDonald’s is a better place due to his leadership and wisdom.

We will miss Andy dearly, but we will always carry the lessons he taught us all. Chief among them was his belief that, “the measure of success is not how much you've got, but how much you've given.” With those words in mind, together, McDonald’s will continue to live our values-based leadership legacy.

Fundamental to long-term sustainable value creation for all shareholders is that we continue to live our values-based legacy, lead on addressing the issues most important to our communities, and steward the Brand to remain relevant for all stakeholders. That includes continuing to advance economic opportunity and foster a diverse workforce and franchisee base that reflects the communities we serve.

As ever, I am incredibly proud of the McDonald’s System and hopeful for the future of our Brand and the role we can play in our communities.

To the entire McDonald’s System, our Shareholders and Customers, thank you for your many contributions that made the Arches shine brighter in 2022.

Sincerely,

Enrique Hernandez, Jr.

Chairman of the Board

4 McDonald’s Corporation |

|

| Notice of 2023 Annual |

| Meeting Date & Time May 25, 2023 |

|

| Virtual Shareholders’ Meeting We will have a virtual meeting at www.cesonlineservices.com/mcd23_vm. There will not be a physical location for the meeting, and you will not be able to attend the meeting in person. |

We will provide this Notice, the accompanying Proxy Statement, our 2022 Annual Report on Form 10-K and the form of proxy card, or the Notice of Internet Availability of Proxy Materials, beginning on or about April 14, 2023 to shareholders of record as of March 27, 2023.

To McDonald’s Corporation Shareholders:

At our 2023 Annual Shareholders’ Meeting, you will be asked to vote upon the following proposals:

AGENDA | OUR BOARD’S VOTING | ||||

Proposal 1 | Election of 13 Directors to serve until our 2024 Annual Shareholders’ Meeting and until their successors have been elected and qualified | “FOR” EACH OF OUR BOARD’S DIRECTOR NOMINEES | |||

Proposal 2 | Advisory vote to approve executive compensation | “FOR” | |||

Proposal 3 | Advisory vote on the frequency of future advisory votes on executive compensation | “1 YEAR” | |||

Proposal 4 | Advisory vote to ratify the appointment of Ernst & Young LLP as independent auditor for 2023 | “FOR” | |||

Proposals 5–11 | Advisory votes on seven shareholder proposals, each only if properly presented. | “AGAINST” EACH SHAREHOLDER PROPOSAL | |||

In addition, we will transact any other business properly presented at the meeting, including any adjournment or postponement thereof, by or at the direction of our Board.

You should carefully review the accompanying Proxy Statement, which provides detailed information about the matters to be considered at the meeting. We encourage you to vote as promptly as possible, even if you plan to attend the virtual meeting.

Important Voting Information: Follow the instructions below to ensure your vote is received by 10:59 p.m. Central Time on May 24, 2023. Registered shareholders (who hold shares through our transfer agent, Computershare) and beneficial owners (who hold shares through a bank or brokerage account) may vote using one of the following options. | Your Vote is Carefully review the proxy materials and vote your shares as promptly as possible, even if you plan to attend the virtual meeting. | |||

|

|

| ||

Visit www.proxyvote.com | Dial (800) 690-6903 (toll-free, 24/7) | If you received a proxy card or voting instruction form by mail, mark, date, sign and return it in the postage-paid envelope furnished for that purpose | ||

| 2023 Proxy Statement 5 |

Notice of 2023 Annual Shareholders’ Meeting

If you have questions or require assistance with voting, contact our proxy solicitation firm at: Kingsdale Advisors 745 5th Avenue, Suite 500 Important Notice Regarding the Availability of Proxy Materials for the Shareholders’ Meeting to be Held on May 25, 2023. This notice, the accompanying Proxy Statement and our 2022 Annual Report on Form 10-K are available free of charge at www.proxyvote.com. | How to Attend Our Virtual 2023 Annual Shareholders’ Meeting: Shareholders must register in advance to ask questions or vote at the meeting by using the control number located on their Notice of Internet Availability of Proxy Materials, proxy card, voting instruction form or other communication. See “Meeting Logistics” on page 116. Only shareholders of record as of March 27, 2023 may attend the virtual meeting. By order of our Board of Directors,

Desiree Ralls-Morrison Executive Vice President, Chief Legal Officer and Corporate Secretary McDonald’s Corporation April 14, 2023 | ||||

6 McDonald’s Corporation |

|

| Table of Contents |

| 2023 Proxy Statement 7 |

| Proxy Summary |

This summary highlights important information about our Company, as well as other matters discussed elsewhere in this Proxy Statement. You should carefully review this entire Proxy Statement. We encourage you to vote as promptly as possible so that your views are reflected, even if you plan to attend our virtual 2023 Annual Shareholders’ Meeting.

About McDonald’s

2022 Performance

Despite continued volatility in nearly every corner of the globe, McDonald’s delivered exceptional performance and strong growth throughout 2022. These results are a testament to the competitive advantages of our System and demonstrate that our Accelerating the Arches growth strategy is working. Accelerating the Arches is anchored by our MCD growth pillars: maximizing our marketing; committing to the core menu; and doubling down on digital, drive-thru and delivery. Our 2022 performance highlights the continued potential in each growth pillar. Despite significant headwinds, we achieved full-year revenues of $23.2 billion and record Systemwide sales1 of $118.2 billion. Despite this continued strong performance, we continue to focus on ways to improve. That is why, in January 2023, we announced an evolution of Accelerating the Arches, which is described in more detail below. We believe this refreshed strategy will allow us to continue to deliver sustained, long-term profitable growth for our System and stakeholders. | ~11% |

Comparable Sales Growth | |

~35% | |

of Systemwide Sales1 in Our Top Six Markets Came from Digital Channels |

Company Values

We are guided by the five core values depicted below, which were defined as part of our Accelerating the Arches growth strategy with input from employees, franchisees, suppliers and customers on what makes them proud to be part of our McFamily. We believe our people, all around the world, set us apart and bring these values to life on a daily basis. Our philosophy of “doing the right thing,” which is enshrined in our core values, guides not only the way we conduct our business, but also how we fulfill our broader role in the communities we serve.

|

|

|

|

| ||||

Serve | Inclusion | Integrity | Community | Family | ||||

We put our |

| We open |

| We do the right |

| We are good |

| We get better |

1 | Systemwide sales include sales at all restaurants, whether operated by our Company or franchisees. This includes sales from digital channels, which are comprised of the mobile app, delivery and kiosk, at both Company-operated and franchised restaurants. While franchised sales are not recorded as revenues by our Company, management believes the information is important in understanding our financial performance because these sales are the basis on which we calculate and record franchised revenues and are indicative of the financial health of the franchisee base. Our Company’s revenues consist solely of sales by Company-operated restaurants and fees from franchised restaurants operated by conventional franchisees, developmental licensees and affiliates. Changes in Systemwide sales are primarily driven by comparable sales and net restaurant unit expansion. |

Accelerating the Arches

In January 2023, we announced an evolution of our successful Accelerating the Arches growth strategy, which continues to encompass all aspects of our business as the leading global omni-channel restaurant brand. It focuses on the imperative that we deliver across five critical areas: our purpose to feed and foster communities; our mission to create delicious feel-good moments for everyone; our core values described under “Company Values” above; our MCD growth pillars depicted below; and our foundation of running great restaurants, empowering our people and modernizing ways of working.

In recognition of our ability to accelerate the pace of restaurant openings to fully capture the increased demand that we have driven over the past few years, we have added “Restaurant Development” to our MCD growth pillars. In addition, our foundation now includes Accelerating the Organization, an internal effort aimed at modernizing the way we work so that we are faster, more innovative and more efficient. We believe Accelerating the Arches will continue to build on our historic strengths by leveraging our competitive advantages and investing in innovations to enhance the customer experience and deliver long-term growth.

More information on Accelerating the Arches and our purpose, mission and values can be found in our 2022 Annual Report on Form 10-K, as well as on the “Our Mission & Values” section of our website at https://corporate.mcdonalds.com/corpmcd/our-company/who-we-are/our-values.html.

Governance Highlights

Board & Governance Practices

Our Board’s commitment to strong corporate governance is highlighted by the following practices:

● Independent Board Chairman ● 12 of 13 Directors are independent (all except CEO)(1) ● All standing Committees are independent (except Executive Committee, chaired by our CEO) ● Regular executive sessions of independent Directors ● Annual election of all Directors ● Majority voting standard for uncontested Director elections ● Ongoing Board assessment and refreshment led by our Governance Committee, with more than half of our Directors having joined our Board within the last four years(1) | ● Demonstrated commitment to diversity, with more than half of our Board comprised of gender and racially/ethnically-diverse Directors(1) ● Regular succession planning and effective leadership transitions at the CEO and executive management levels ● No supermajority voting provisions ● No “poison pill” (shareholder rights plan) ● Board access to independent advisors ● Meaningful limitations on Directors’ service on other boards | ● Proxy access for Director candidates nominated by shareholders reflecting standard market practices ● Annual Board self-evaluation ● Ability for shareholders to call special meetings ● Robust Director stock ownership requirements ● No Director hedging/pledging of Company stock ● Public disclosure of corporate political contributions and certain trade association memberships ● Significant shareholder outreach and engagement program |

(1) Reflects the recent changes summarized under “Board Composition & Refreshment” on page 11.

Shareholder Engagement

We understand the importance of engaging with our shareholders and are committed to regularly discussing their perspectives on significant issues. Our Board and management team have developed a robust shareholder engagement program that helps us better understand shareholder priorities and perspectives, gives us an opportunity to elaborate on our initiatives and fosters constructive dialogue. Since last year’s Annual Shareholders’ Meeting, we have engaged with shareholders representing approximately 45% of our outstanding shares of common stock. Members of management and our independent Directors participate in these discussions.

Shareholder feedback received through direct discussions and prior shareholder votes, as well as engagement with proxy and other investor advisory firms that represent the interests of a wide array of shareholders, is reported to our Governance Committee and other relevant Committees periodically throughout the year. We also review our practices against guidelines published by shareholders and proxy advisory firms.

Areas of focus for our 2022–2023 shareholder engagement program included:

● Business strategy and initiatives ● Company values and culture ● Board oversight, governance, composition, tenure and refreshment ● Executive compensation | ● Our environmental and sustainability initiatives, including those relating to climate change and animal health and welfare ● Our human capital management initiatives, including those relating to diversity, equity and inclusion (“DEI”) ● Our ongoing civil rights audit |

10 McDonald’s Corporation |

|

Board Composition & Refreshment

Our Board is committed to ongoing Board refreshment, as it believes there should be an appropriate balance of continuity and institutional knowledge, together with fresh perspectives, among our Directors. Following the recent Board and Committee refreshment summarized below, more than half of our Directors have joined our Board within the last four years. See “Board Composition & Refreshment” on page 33 for more information.

2023

| ● | Robert Eckert and John Rogers, Jr. are retiring and will not stand for re-election at our 2023 Annual Shareholders’ Meeting (see page 18) |

2022

| ● | Four new independent Directors were elected to our Board: |

| ● | Anthony Capuano, President and CEO of Marriott International, Inc. (see page 20) |

| ● | Kareem Daniel, former Chairman of Disney Media & Entertainment Distribution (see page 21) |

| ● | Jennifer Taubert, EVP and Worldwide Chairman, Pharmaceuticals at Johnson & Johnson (see page 29) |

| ● | Amy Weaver, President and CFO of Salesforce, Inc. (see page 31) |

| ● | Sheila Penrose retired from our Board |

| ● | Committee membership and leadership was refreshed, including: |

| ● | Catherine Engelbert was named our Audit & Finance Committee Chair |

| ● | John Mulligan was named our Public Policy & Strategy Committee Chair |

| ● | Paul Walsh was named our Sustainability & Corporate Responsibility Committee Chair |

2019–2020

| ● | Two independent Directors (Catherine Engelbert and Paul Walsh) and Christopher Kempczinski (our CEO) were elected to our Board |

| ● | One Director retired from our Board |

| ● | Board Committee membership was refreshed |

| ● | Richard Lenny was named our Compensation Committee Chair |

These changes demonstrate our Board’s commitment to ongoing refreshment and help ensure that an appropriate mix of skills, experiences and perspectives are represented on our Board and its Committees. Consistent with its succession planning strategy, our Board believes the overlap of new and longer-tenured Directors provides new Directors with the opportunity to learn from the knowledge and experience of longer-tenured Directors and allows for smooth role and responsibility transitions. The following table reflects our Board’s composition following the changes summarized above.

Four new independent Directors elected to our Board in 2022 7 of 13 Directors joined our Board within the last four years 12 of 13 Directors are independent (all except our CEO) | Balanced Experience

|

| 2023 Proxy Statement 11 |

Board Diversity

Our Board is keenly focused on ensuring that our Directors represent a wide range of backgrounds, viewpoints, perspectives and experiences in order to support the diverse demands of our global business. Following the recent changes summarized under “Board Composition & Refreshment” on page 11, more than half of our Board is comprised of Directors who are women or racially/ethnically diverse, and more than 30% of our Board is comprised of female Directors. See “Board Diversity” on page 34 for more information.

> 50% 7 of 13 Directors are women or racially/ethnically diverse |

Talent Management & Executive Succession Planning

Our talent management and succession planning, including initiatives relating to promoting diversity within our workforce and across our System, are important components of our business strategy. Attracting, developing and retaining talent is key to our ability to continue to drive long-term sustainable growth. To that end, our Board regularly reviews short- and long-term succession plans for our CEO and other senior leaders. In doing so, our independent Directors identify the skills, experiences and attributes they believe are required to be an effective leader in light of our global business strategies, opportunities and challenges. We also endeavor to ensure a diverse candidate pool and workforce. These talent management and succession planning processes are designed to prepare us for expected transitions, such as those arising from promotions, retirements and other role changes, as well as unexpected departures.

Several senior leadership transitions occurred in 2022 and early 2023. As highlighted below, these included both new additions to our Company and promotions from within our strong internal talent pipeline, which we believe demonstrates the effectiveness of our talent management and succession planning processes:

| ● | Jonathan Banner joined McDonald’s as our new EVP – Global Chief Impact Officer |

| ● | Ian Borden, who has served McDonald’s for nearly 30 years, most recently as President, International, became our new EVP and Chief Financial Officer |

| ● | Morgan Flatley, who has served McDonald’s for six years, most recently as SVP – Global Chief Marketing Officer, became our new EVP – Global Chief Marketing Officer and New Business Ventures |

| ● | Marion Gross, who has served McDonald’s for 30 years, most recently as SVP – Chief Supply Chain Officer, North America, became our new EVP – Global Chief Supply Chain Officer |

| ● | Jill McDonald, who previously served McDonald’s from 2006 to 2015, became our new EVP and President, International Operated Markets |

| ● | Kevin Ozan, who has served McDonald's for 25 years, most recently as EVP and Chief Financial Officer, became our new Senior EVP – Strategic Initiatives |

| ● | Brian Rice joined McDonald’s as our new EVP – Global Chief Information Officer |

12 McDonald’s Corporation |

|

Overview of Directors

The following table provides an overview of the 13 Directors who are standing for re-election at our 2023 Annual Shareholders’ Meeting. Robert Eckert and John Rogers, Jr. have notified us that they are retiring and will not stand for re-election at our 2023 Annual Shareholders’ Meeting, at which time the size of our Board will be reduced to 13. See “Proposal 1: Election of Directors” on page 18 for more information.

BOARD | STANDING COMMITTEE MEMBERSHIP | OTHER PUBLIC COMPANY | |||||||||||||||||||||||||||||

NAME | TENURE | PRIMARY OCCUPATION | INDEPENDENT | AFC |

| CC | GC | SCR | PPS | EC | BOARDS | ||||||||||||||||||||

| Anthony | < 1 year | President and CEO Marriott International, Inc. |

| ⚫ | ⚫ | 1 | ||||||||||||||||||||||||

| Kareem | < 1 year | Former Chairman Disney Media & Entertainment Distribution |

| ⚫ | ⚫ | 0 | ||||||||||||||||||||||||

| Lloyd | 7 years | Chief Executive Emeritus and Founding Executive CommonSpirit Health |

| ⚫ | ⚫ | 2 | ||||||||||||||||||||||||

| Catherine | 3 years | Commissioner Women’s National Basketball Association |

|

| ⚫ | ⚫ | 1 | |||||||||||||||||||||||

| Margaret | 8 years | Co-Founder and CEO Montai Health |

|

| ⚫ | 1 | ||||||||||||||||||||||||

| Enrique | 26 years | Executive Chairman Inter-Con Security Systems, Inc. |

Independent Chairman | ⚫ | ⚫ | ⚫ | 2 | |||||||||||||||||||||||

| Christopher | 3 years | President and CEO McDonald’s Corporation |

| 1 | ||||||||||||||||||||||||||

| Richard | 17 years | Non-Executive Chairman Conagra Brands, Inc. |

|

| ⚫ | ⚫ | 2 | |||||||||||||||||||||||

| John | 7 years | EVP and COO Target Corporation |

|

|

| ⚫ | 0 | |||||||||||||||||||||||

| Jennifer | < 1 year | EVP, Worldwide Chairman, Pharmaceuticals Johnson & Johnson |

| ⚫ | ⚫ | 0 | ||||||||||||||||||||||||

| Paul | 4 years | Executive Chairman McLaren Group Limited |

| ⚫ |

| ⚫ | 2 | |||||||||||||||||||||||

| Amy | < 1 year | President and CFO Salesforce, Inc. |

|

| ⚫ | 0 | ||||||||||||||||||||||||

| Miles | 14 years | Former Executive Chairman Abbott Laboratories |

|

| ⚫ | ⚫ | 0 | |||||||||||||||||||||||

AFC: | Audit & Finance Committee | SCR: | Sustainability & Corporate Responsibility Committee | ⚫ | Member |

CC: | Compensation Committee | PPS: | Public Policy & Strategy Committee |

| Committee Chair |

GC: | Governance Committee | EC: | Executive Committee |

| Financial Expert |

| 2023 Proxy Statement 13 |

ESG Highlights: Our Purpose & Impact

We drive impact by living our purpose, which is to feed and foster communities. Our impact strategy is centered around four areas: Our Planet; Food Quality & Sourcing; Jobs, Inclusion & Empowerment; and Community Connection. Recent highlights within each of these areas are depicted below.

More information can be found under “ESG: Our Purpose & Impact” on page 43, as well as on the “Our Purpose & Impact” section of our website at https://corporate.mcdonalds.com/corpmcd/our-purpose-and-impact.html. In addition, we recently released our 2021–2022 Purpose & Impact Global Progress Summary, which highlights our priorities and progress across all four focus areas, and our inaugural Global Diversity, Equity & Inclusion Report, which showcases our strategy, goals and progress across our ongoing DEI efforts. Both reports are available on the “Our Purpose & Impact” section of our website.

Our Planet | ● Achieved a 2.9% reduction in the absolute greenhouse gas emissions of our restaurants and offices and a 7.8% reduction in supply chain greenhouse gas emissions intensity (as of the end of 2021, compared to 2015) ● Continued to substantially achieve a deforestation-free supply chain across our primary commodities (beef, soy for chicken feed, palm oil, coffee and fiber used in guest packaging), with 97.7% of volumes supporting a deforestation-free supply chain in 2021 | |||

Food Quality & Sourcing | ● Each of France, Germany, Australia and the U.K. achieved a 100% cage-free egg supply chain, and the U.S. achieved a more than 74% cage-free egg supply chain, as of the end of 2021, with a goal of a 100% cage-free egg supply chain in the U.S. by the end of 2025 ● On track to achieve our 2024 Broiler Welfare Commitments, which, once fully implemented, will positively impact more than 70% of our global chicken supply | |||

Jobs, Inclusion & Empowerment | ● Closed the small pay gaps identified in our 2022 pay gap analysis, which showed that women globally in Company-owned and operated markets are paid $0.9991 on the dollar in base pay on average of what men are paid for similar work, and that on an aggregate basis there was no base pay gap disfavoring underrepresented groups in the U.S. ● In addition to existing quantitative human capital metrics that are incorporated into our executives’ annual incentive compensation, introduced an owner/operator diversity modifier into annual incentive compensation awards for key officers and managing directors | |||

Community Connection | ● Invested in 40 Chicagoland neighborhood organizations through our newly launched Chicago Community Impact Grants Program, developed in partnership with The Chicago Community Trust ● Partnered with the Obama Foundation to support the Obama Presidential Center in our shared hometown, as well as its global programming and local Chicago initiatives, by making a two-year, $5 million commitment ● Together with our developmental licensee partner in Turkey, donated $1 million in 2023 to support relief efforts, and provided free meals to victims, following devastating earthquakes in the region ● Donated $5 million to our Employee Assistance Fund and support relief efforts led by the International Red Cross in response to the war in Ukraine and resulting humanitarian crisis in Europe | |||

14 McDonald’s Corporation |

|

Executive Compensation Highlights

Our executive compensation program supports the following long-standing guiding principles, each of which drives the design, implementation and risk profile of our compensation program:

| ● | Pay for performance; |

| ● | Drive business results with a focus on creating long-term shareholder value; and |

| ● | Pay competitively. |

Performance-Based Compensation Philosophy

Our executives’ compensation opportunity is predominantly performance-based, consisting of both annual and long-term incentive awards subject to objective performance thresholds, as reflected in the following graphics:

| 91% of CEO’s target total direct |

| 82% of other named executive officers’ target total direct compensation opportunity* as a group is performance-based |

* | These graphics represent our CEO’s and other named executive officers’ target total direct compensation for 2022, using their salaries, target Short-Term Incentive Plan payouts and Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”) values for equity awards granted in 2022. |

Our Compensation Practices

What We Do | What We Do Not Do | |||

Strong pay-for-performance alignment Robust performance targets, and payouts under our incentive plans can vary significantly based on Company performance Performance metrics support our growth strategy and align interests of management with interests of shareholders Short-Term Incentive Plan (“STIP”) includes quantitative human capital metrics Majority of total direct compensation paid over the long term Significant stock ownership and retention requirements Clawback provisions in equity agreements and STIP Independent compensation consultant Double-trigger change in control equity provisions Annual compensation peer group review Annual “Say-on-Pay” vote | Ò Change in control agreements Ò Tax gross-up on perquisites Ò Repricing of stock options Ò Backdating of stock options Ò Encourage unreasonable risk taking Ò Employment agreements Ò Hedging or pledging of Company stock | |||

| 2023 Proxy Statement 15 |

Compensation Program Summary for 2022

The following graphic depicts our key compensation elements and percentage of direct CEO pay opportunity for 2022:

KEY COMPENSATION ELEMENTS AND % OF CEO PAY OPPORTUNITY | PRIMARY METRICS | KEY TERMS | |||||||||

BASE SALARY |

| ● N/A | ● Based on competitive considerations, scope of responsibilities, individual performance, tenure in position, internal pay equity and the effect on our general and administrative expenses | ||||||||

SHORT-TERM INCENTIVE PLAN |

| ● Operating income growth (42.5%) ● Systemwide sales growth (42.5%) ● Human capital metrics (15%) | ● Operating income growth requires us to balance increases in revenue with financial discipline to produce strong margins and cash flow ● Systemwide sales is an important metric in a franchise business, as income generation is closely correlated to sales growth and is a measure of the financial health of our franchisees ● Includes quantitative human capital metrics focused on increasing representation of women and underrepresented minorities and championing our values ● Payouts are limited to 200% of the target award | ||||||||

LONG-TERM INCENTIVES | |||||||||||

PERFORMANCE-BASED | Performance-Based Restricted Stock Units |

| ● Earnings per share (“EPS”) growth (75%) ● Return on invested capital (“ROIC”) (25%) ● Relative total shareholder return (“TSR”) (+/- 25 points) | ● Provide the right to receive a share of our common stock at the end of a three-year service period, subject to our achievement of EPS and ROIC ● Also subject to a modifier based on relative TSR over the performance period compared to the S&P 500 Index ● Payouts are limited to 200% of the target award ● See page 64 for more information on performance-based restricted stock unit metrics | |||||||

Stock Options |

| ● Share price | ● Provide value only if our share price increases (with an exercise price equal to the stock price on the grant date), which closely aligns executive pay with shareholder interests ● Vest ratably 25% per year with a 10-year term | ||||||||

Commitment to Our Pay-for-Performance Philosophy

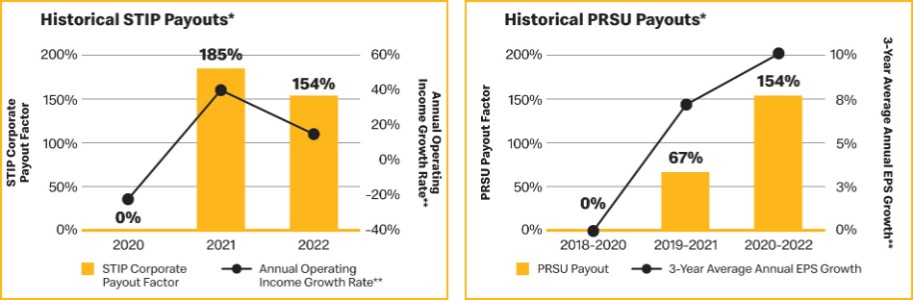

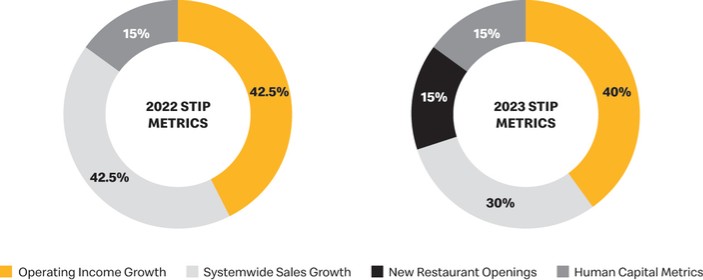

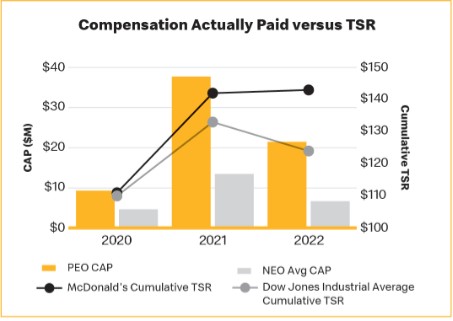

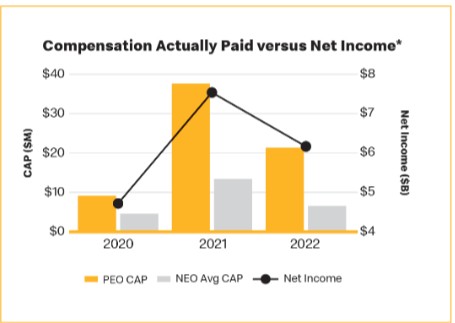

As a result of our strong top- and bottom-line financial results across the world, we achieved an above-target payout factor with a Corporate STIP of 153.7% (inclusive of both financial and human capital metrics). Due to strong performance during the 2020–2022 performance period, the performance-based restricted stock units that vested in early 2023 paid out above target at 153.7% despite the impact of the COVID-19 pandemic on our 2020 performance. These payouts demonstrate our Compensation Committee’s commitment to align payouts with Company performance over different time periods in order to drive long-term value creation for our shareholders.

16 McDonald’s Corporation |

|

Voting Matters & Recommendations

We are asking shareholders to vote on the following matters at our 2023 Annual Shareholders’ Meeting:

ITEM TO BE VOTED ON | OUR BOARD’S VOTING | PAGE | |||

MANAGEMENT PROPOSALS |

|

| |||

Proposal 1 | Election of 13 Directors to serve until our 2024 Annual Shareholders’ Meeting and until their successors have been elected and qualified | “FOR” EACH OF OUR BOARD’S DIRECTOR NOMINEES | 18 | ||

Proposal 2 | Advisory vote to approve executive compensation |

| “FOR” |

| 52 |

Proposal 3 | Advisory vote on the frequency of future advisory votes on executive compensation | “1 YEAR” | 82 | ||

Proposal 4 | Advisory vote to ratify the appointment of Ernst & Young LLP as independent auditor for 2023 |

| “FOR” |

| 83 |

SHAREHOLDER PROPOSALS |

|

|

|

| |

Proposals 5–11 | Advisory vote on seven shareholder proposals, each only if properly presented |

| “AGAINST” EACH SHAREHOLDER PROPOSAL |

| 86 |

Your vote is extremely important. Our Board unanimously recommends that you vote “FOR” the re-election of each of our Board’s Director nominees and in accordance with our Board’s voting recommendation associated with all of the other proposals properly presented at the meeting.

Forward-Looking Statements & Website Links

This Proxy Statement contains forward-looking statements about future events and circumstances. Generally, any statement not based upon historical fact is a forward-looking statement. Forward-looking statements can also be identified by the use of forward-looking or conditional words such as “could,” “should,” “can,” “continue,” “aim,” “estimate,” “forecast,” “intend,” “look,” “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “remain,” “confident” and “commit” or similar expressions. In particular, statements regarding our plans, strategies, prospects and expectations regarding our business and industry, as well as environmental, social and governance (“ESG”) and similar commitments, are forward-looking statements. They reflect expectations, are not guarantees of performance and speak only as of the date of this Proxy Statement. Factors that could cause actual results to differ materially from those in the forward-looking statements include those that are described in our 2022 Annual Report on Form 10-K and elsewhere in our filings with the Securities and Exchange Commission (the “SEC”). If any of these considerations or risks materialize or intensify, our expectations (or underlying assumptions) may change and our performance may be adversely affected. Except as required by law, we do not undertake to update such forward-looking statements. You should not rely unduly on forward-looking statements.

Website links included in this Proxy Statement are for convenience only. Information contained on or accessible through such website links is not incorporated in, and does not constitute a part of, this Proxy Statement.

| 2023 Proxy Statement 17 |

| PROPOSAL 1 Election of Directors |

Our Board unanimously recommends the re-election of each of the 13 Director nominees named below, to serve on our Board for a one-year term beginning in May 2023 and continuing until our 2024 Annual Shareholders’ Meeting and until their successors have been elected and qualified. Robert Eckert and John Rogers, Jr., members of our Board since 2003, have notified us that they are retiring and will not stand for re-election at our 2023 Annual Shareholders’ Meeting, at which time the size of our Board will be reduced to 13. We thank Mr. Eckert and Mr. Rogers for their years of service to McDonald’s. | |||||||||

●Anthony Capuano | ●Enrique Hernandez, Jr. | ●Paul Walsh | |||||||

●Kareem Daniel | ●Christopher Kempczinski | ●Amy Weaver | |||||||

●Lloyd Dean | ●Richard Lenny | ●Miles White | |||||||

●Catherine Engelbert | ●John Mulligan | ||||||||

●Margaret Georgiadis | ●Jennifer Taubert | ||||||||

Our Board unanimously recommends that you vote “FOR” each of its Director nominees. | |||||||||

Director Qualifications

Our Board is comprised of a diverse, highly-engaged group of individuals that provides strong, effective oversight of our Company. Both individually and collectively, our Directors have the relevant qualifications, skills and experiences that contribute to our Board’s oversight of our global operations and long-term priorities, including our Accelerating the Arches growth strategy.

Importantly, each Director has senior executive experience, including having served as a CEO or high-level executive of large and complex global organizations. Specifically, several Directors have leadership experience in the consumer products or food sectors, which is particularly relevant to our business as a leading global food service retailer. Our Board values expertise in our industry, global experience, information technology/cybersecurity, human capital management, DEI and sustainability matters, which are important to Accelerating the Arches and are areas of increasing focus for stakeholders. This experience, along with the other skills and attributes discussed on the following pages and described more fully under “New Director Candidate Selection Process” on page 35, is a key consideration in evaluating the composition of our Board.

All of our Board’s Director nominees possess the following key attributes and skills:

● A high level of integrity and ethics ● Strength of character and judgment ● Ability to devote significant time to Board duties ● Desire and ability to continually build expertise in emerging areas of strategic focus for our Company ● Demonstrated focus on promoting equity and inclusion ● Business and professional achievements | ● Ability to represent the interests of all shareholders ● Knowledge of corporate governance matters ● Understanding of the advisory and proactive oversight responsibility of our Board ● Comprehension of the role of a public company director and the fiduciary duties owed to shareholders ● Intellectual and analytical skills |

18 McDonald’s Corporation |

|

Election of Directors

In addition, our Board’s Director nominees contribute to our Board the individual experiences, qualifications and skills depicted in the following matrix. The matrix is intended as a high-level summary and not an exhaustive list. It is intended to depict notable areas of focus for each nominee, and not having a mark does not mean that a particular nominee does not possess that experience, qualification or skill. Nominees have acquired these experiences, qualifications and skills through education, direct experience and oversight responsibilities. For information on our Board diversity, see “Board Diversity” on page 34.

| CAPUANO | DANIEL | DEAN | ENGELBERT | GEORGIADIS | HERNANDEZ | KEMPCZINSKI | LENNY | MULLIGAN | TAUBERT | WALSH | WEAVER | WHITE | |

| BRAND MANAGEMENT: Contributes to an understanding of how our business, standards and performance are essential to protecting and increasing the value of our brand | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

| CUSTOMER-CENTRIC: Provides an understanding of our business, operations and customer-centric Accelerating the Arches growth strategy, focusing on our purpose, values and MCD growth pillars | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

| DIGITAL: Provides an understanding of how the 4-D’s (digital, delivery, drive-thru and restaurant development) leverage competitive strengths | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ||

| FINANCE / CAPITAL MARKETS: Supports the oversight of our financial statements and strategy and financial reporting to investors and other stakeholders | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

| GLOBAL EXPERIENCE: Contributes to an understanding of how our business is structured to enable the right level of support for our international markets and the sharing of solutions across international markets | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |

| HUMAN CAPITAL MANAGEMENT: Provides an understanding of how we manage and develop our workforce, and how we focus on promoting equity and inclusion throughout the organization | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

| INFORMATION TECHNOLOGY / CYBERSECURITY: Contributes to an understanding of information technology capabilities, cloud computing, scalable data analytics and risks associated with cybersecurity matters | ⚫ | ⚫ | ⚫ | ⚫ | |||||||||

| MARKETING: Provides awareness of culturally relevant approaches that effectively communicate the story of our brand, food and purpose | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | |||

| OTHER PUBLIC COMPANY BOARD: Demonstrates a practical understanding of organizations, processes, governance and oversight of strategy, risk management and growth | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ||||

| REAL ESTATE: Provides an understanding of how owning or leasing real estate, combined with co-investment by franchisees, enables us to achieve high restaurant performance levels | ⚫ | ⚫ | ⚫ | ||||||||||

| SUSTAINABILITY / CORPORATE RESPONSIBILITY: Contributes to an understanding of sustainability issues and corporate responsibility, and their relationship to our business and strategy | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ |

Other Information

Director nominees who receive a majority of the votes cast will be elected to our Board. If any Director nominee does not receive a majority of the votes cast, he or she has previously tendered an irrevocable resignation that, subject to our Governance Committee’s recommendation and our Board’s acceptance, will be effective following our Annual Shareholders’ Meeting. All of our Board’s Director nominees have given their consent to being named as nominees for election and have indicated their intention to serve as Director if elected. Our Board does not anticipate that any of its Director nominees will be unable to serve. If for some reason any such nominee were unable to serve, or for good cause would not serve if elected, the persons named as proxies may vote for a substitute nominee recommended by our Board and, unless you indicate otherwise when voting, your shares will be voted in favor of our Board’s remaining nominees. In the alternative, our Board may reduce its size, as permitted by our By-Laws. If a substitute nominee is designated prior to

| 2023 Proxy Statement 19 |

Election of Directors

our Annual Shareholders’ Meeting, we will file amended proxy materials that, as applicable, identify such nominee, disclose that such nominee has consented to being named in the amended proxy materials and to serving as Director if elected, and set forth certain biographical and other information about such nominee as required by SEC rules.

Biographical Information

Biographical information about our Board’s Director nominees as of the date of this Proxy Statement, including their ages, professional experiences, Board tenure, Committee memberships, qualifications and other public company directorships, is set forth on the following pages.

ANTHONY CAPUANO PRESIDENT AND CHIEF EXECUTIVE OFFICER, MARRIOTT INTERNATIONAL, INC. | ||||||||||

| Professional Experience ● Marriott International, Inc., a global hospitality company President and Chief Executive Officer (2023 – Present) Chief Executive Officer (2021 – 2023) Group President, Global Development, Design and Operations Services (2020 – 2021) Executive Vice President and Global Chief Development Officer (2009 – 2020) Senior Vice President, Development, North America, Caribbean and Latin America (2008 – 2009) Senior Vice President, Development, North America (2005 – 2008) Marketing Plan and Feasibility and Development Teams (1995 – 2005) Director Qualifications Mr. Capuano brings to our Board over 25 years of leadership experience gained from his senior executive roles, including president and chief executive officer, at Marriott. His service at a global hospitality company known for its focus on creating a positive guest experience contributes an important perspective to our Board’s discussions regarding enhancing our own customers’ experiences. Our Board also benefits from Mr. Capuano’s significant global development experience, and his service on the social impact committee of Marriott’s board of directors provides our Board with valuable insights regarding our own corporate responsibility and sustainability efforts. Mr. Capuano’s public company board experience also gives him a broad understanding of governance issues facing public companies. Other Public Company Directorships Mr. Capuano also serves on the board of Marriott International, Inc. | |||||||||

Age: 57 Board Tenure: < 1 year Board Committees ● Compensation ● Public Policy & Strategy | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

|

| |

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | Real Estate | Sustainability / | |

20 McDonald’s Corporation |

|

Election of Directors

KAREEM DANIEL FORMER CHAIRMAN, DISNEY MEDIA & ENTERTAINMENT DISTRIBUTION | ||||||||||

| Professional Experience ● The Walt Disney Company, a global entertainment and media company Chairman, Disney Media & Entertainment Distribution (2020 – 2022) President, Consumer Products, and Chief of Staff, Office of the Chief Executive Officer (2020) President, Walt Disney Imagineering Operations, Product Creation, Publishing and Games (2019 – 2020) Executive Vice President, Global Business Operations, Walt Disney Imagineering (2017 – 2019) Senior Vice President, Strategy and Business Development, Disney Consumer Products and Interactive Media (2011 – 2017) Vice President, Distribution Strategy, Walt Disney Studios (2009 – 2011) Director, Corporate Strategy and Business Development (2007 – 2009) Director Qualifications Mr. Daniel brings to our Board valuable leadership experience gained from his senior executive roles at Walt Disney, one of the world’s most well-known and admired brands. His extensive corporate development experience includes leading transformation across several Disney divisions. The knowledge Mr. Daniel has gained through leading the creation of a direct-to-consumer e-commerce business, as well as overseeing the development of new distribution and commercialization models, offers a valuable perspective to our Board’s discussions regarding strategy and business development. Other Public Company Directorships None. | |||||||||

Age: 48 Board Tenure: < 1 year Board Committees ● Compensation ● Sustainability & Corporate Responsibility | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Information | Marketing | Sustainability / | ||

| 2023 Proxy Statement 21 |

Election of Directors

LLOYD DEAN CHIEF EXECUTIVE EMERITUS AND FOUNDING EXECUTIVE, COMMONSPIRIT HEALTH | ||||||||||

| Professional Experience ● CommonSpirit Health, a non-profit, Catholic health system Chief Executive Emeritus and Founding Executive (2022 – Present) Chief Executive Officer (2019 – 2022) ● Dignity Health, one of the nation’s largest healthcare systems President and Chief Executive Officer (2000 – 2019) ● Advocate Health Care, a healthcare organization Chief Operating Officer (1997 – 2000) Director Qualifications Mr. Dean brings to our Board over 25 years of leadership, management and strategy experience, which contributes an important perspective to our Board’s discussions of opportunities and challenges in a constantly changing business environment. In his career in executive management at leading healthcare organizations, Mr. Dean has led significant strategic, operational and financial transformations. Mr. Dean’s healthcare experience and knowledge of health and safety risks are particularly important in light of the COVID-19 pandemic and enhance his ability to oversee human capital management matters. Our Board also benefits from Mr. Dean’s finance, systems operations, service quality, human resources, customer-centric operations, community affairs and regulatory experience. Other Public Company Directorships Mr. Dean also serves on the boards of Golden Arrow Merger Corp. and Progyny, Inc. He previously served on the board of Wells Fargo & Company. | |||||||||

Age: 72 Board Tenure: 7 years Board Committees ● Compensation ● Governance | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

| |||||

Brand | Customer- | Finance / Capital | Human Capital | Other Public | Sustainability / | |||||

22 McDonald’s Corporation |

|

Election of Directors

CATHERINE ENGELBERT COMMISSIONER, WOMEN’S NATIONAL BASKETBALL ASSOCIATION | ||||||||||

| Professional Experience ● Women’s National Basketball Association (WNBA), a professional basketball league Commissioner (2019 – Present) ● Deloitte LLP, an industry-leading audit, consulting, tax and advisory services firm Chief Executive Officer (2015 – 2019) ● Deloitte & Touche LLP, audit subsidiary of Deloitte LLP Chairman and Chief Executive Officer (2014 – 2015) Partner (1998 – 2019) Director Qualifications Ms. Engelbert brings to our Board a wealth of experience in global business operations, finance, leadership, brand, customer strategy, financial reporting and internal controls, and risk management matters gained from her service as Commissioner of a professional sports league and as former chief executive officer of Deloitte LLP. Having led more than 100,000 professionals at Deloitte, she also provides our Board valuable insights on talent management and other human capital management matters. Ms. Engelbert has strong leadership and governance experience from her previous roles on the private company board of Deloitte LLP and as chairman and chief executive officer of Deloitte & Touche LLP, and valuable regulatory experience from her roles on the strategic investment, risk, regulatory & government relations, and finance & audit committees of the board of Deloitte LLP. As a certified public accountant, Ms. Engelbert further brings to our Board a deep understanding of accounting principles and financial reporting rules and regulations, and her qualification as an “audit committee financial expert” is an important attribute as our Audit & Finance Committee Chair. Other Public Company Directorships Ms. Engelbert also serves on the board of Royalty Pharma plc. | |||||||||

Age: 58 Board Tenure: 3 years Board Committees ● Audit & Finance (Chair since 2022) ● Sustainability & Corporate Responsibility ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | Sustainability / | ||

| 2023 Proxy Statement 23 |

Election of Directors

MARGARET GEORGIADIS CO-FOUNDER AND CHIEF EXECUTIVE OFFICER, MONTAI HEALTH | ||||||||||

| Professional Experience ● Montai Health, a digital medical technology company Co-Founder and Chief Executive Officer (2022 – Present) ● Flagship Pioneering, a bioplatform innovation company CEO-Partner (2022 – Present) ● Synetro Group, a private investment and strategic advisory firm Managing Partner (2021 – Present) ● General Catalyst, a venture capital firm Endurance Partner-in-Residence, XIR (2021 – 2022) ● Ancestry, a global family history and consumer genomics company President and Chief Executive Officer (2018 – 2020) ● Mattel, Inc., a leading global toy company and entertainment franchise Chief Executive Officer (2017 – 2018) ● Google Inc., a global technology company President, Americas (2011 – 2017) Vice President, Global Sales Operations (2009 – 2011) Director Qualifications Ms. Georgiadis brings to our Board valuable strategy and development, finance and leadership experience gained from her senior executive roles, including at Ancestry, Mattel and Google, and her positions at a private investment and strategic advisory firm. Her experience as a senior executive at large global businesses affords her a broad knowledge of global consumer businesses, as well as of technology and cybersecurity, digital consumer insights, e-commerce and marketing. Her knowledge in these and other areas provides critical insights to our business, particularly as our Board considers the impact of technology, digital and cybersecurity risks. Ms. Georgiadis also has over 15 years of analytical and strategic experience at McKinsey & Company, a global management and consulting firm. In addition, Ms. Georgiadis’ qualification as an “audit committee financial expert” is an important attribute as a member of our Audit & Finance Committee. Other Public Company Directorships Ms. Georgiadis also serves on the board of AppLovin Corporation. She previously served on the board of Mattel, Inc. | |||||||||

Age: 59 Board Tenure: 8 years Board Committees ● Audit & Finance ● Sustainability & Corporate Responsibility | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

|

| |

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Information | Marketing | Other Public | Sustainability / | |

24 McDonald’s Corporation |

|

Election of Directors

ENRIQUE HERNANDEZ, JR. EXECUTIVE CHAIRMAN, INTER-CON SECURITY SYSTEMS, INC. | ||||||||||

| Professional Experience ● Inter-Con Security Systems, Inc., a provider of security services to corporations, governments, diplomatic missions and non-profit organizations Executive Chairman (2021 – Present) Chairman and Chief Executive Officer (1986 – 2021) ● Nordstrom, Inc., a leading fashion retailer Non-Executive Chairman and Presiding Director (2006 – 2016) Director Qualifications Mr. Hernandez is executive chairman and former chairman and chief executive officer of Inter-Con Security Systems, Inc., a privately owned global security company, providing him with knowledge of physical and electronic security. He also has been a director of several large public companies in various industries. In particular, Mr. Hernandez served for five years as lead director, and ten years as non-executive chairman and presiding director, at Nordstrom, Inc., a large publicly traded fashion retailer known for its customer service and brand management, providing him with significant experience in corporate governance, leadership development, succession planning and finance. Through his extensive experience managing complex, people-oriented organizations, Mr. Hernandez is well-suited to oversee the important human capital management element of our business. Mr. Hernandez’s experience also facilitates our Board’s oversight and counsel regarding strategy and business development, as well as legal and regulatory matters. Other Public Company Directorships Mr. Hernandez also serves on the boards of Chevron Corporation and The Macerich Company. He previously served on the boards of Nordstrom, Inc. and Wells Fargo & Company. | |||||||||

Age: 67 Board Tenure: 26 years Board Committees ● Governance ● Public Policy & Strategy ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Information | Other Public | Sustainability / | ||

| 2023 Proxy Statement 25 |

Election of Directors

CHRISTOPHER KEMPCZINSKI PRESIDENT AND CHIEF EXECUTIVE OFFICER, MCDONALD’S CORPORATION | |||||||||||

| Professional Experience ● McDonald’s Corporation President and Chief Executive Officer (2019 – Present) President, McDonald’s USA (2017 – 2019) Executive Vice President – Strategy, Business Development and Innovation (2015 – 2016) ● The Kraft-Heinz Company, a packaged food company Executive Vice President of Growth Initiatives and President of Kraft International (2014 – 2015) President of Kraft Canada (2012 – 2014) Senior Vice President – U.S. Grocery (2008 – 2012) Director Qualifications Mr. Kempczinski is President and CEO of our Company, having previously served as President of McDonald’s USA, where he was responsible for approximately 14,000 McDonald’s restaurants. He first joined our Company in 2015, overseeing global strategy, business development and innovation. In these roles, he has been instrumental in identifying new ideas and best practices to accelerate growth to increase the overall value of the McDonald’s System. His experience leading our U.S. business and overseeing global strategy contributes an important Company perspective to our Board, and he was the architect of our Accelerating the Arches growth strategy. This experience and deep knowledge of the food industry strengthen our Board’s knowledge and understanding as it oversees our operations and strategy. Other Public Company Directorships Mr. Kempczinski also serves on the board of The Procter & Gamble Company. | ||||||||||

Age: 54 Board Tenure: 3 years Board Committees ● Executive (Chair since 2019) | |||||||||||

Skills & Qualifications | |||||||||||

|

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | Real Estate | Sustainability / | ||

26 McDonald’s Corporation |

|

Election of Directors

RICHARD LENNY NON-EXECUTIVE CHAIRMAN, CONAGRA BRANDS, INC. | ||||||||||

| Professional Experience ● Conagra Brands, Inc., a leading branded food company Non-Executive Chairman (2018 – Present) ● Information Resources, Inc., a market research firm Non-Executive Chairman (2013 – 2018) ● FFL Partners, LLC, a private equity firm Senior Advisor (2014 – 2016) Operating Partner (2011 – 2014) ● The Hershey Company, an industry-leading snacks company Chairman, President and Chief Executive Officer (2001 – 2007) Director Qualifications Mr. Lenny brings to our Board extensive knowledge of strategy and business development, finance, marketing and consumer insights, supply chain management and distribution, sustainability and social responsibility matters gained from his experience as chief executive officer of a global retail food company with a major consumer brand. He previously served in executive-level positions at Kraft Foods, Nabisco Biscuit and Snacks and the Pillsbury Company, providing him extensive experience with major consumer brands in the food industry. His current and former leadership positions on several notable large public company boards, including at one of North America’s leading food companies, give him strong leadership insights and a broad understanding of governance issues facing public companies. Other Public Company Directorships Mr. Lenny also serves as non-executive chairman of the board of Conagra Brands, Inc. and as the lead independent director of Illinois Tool Works Inc. He previously served on the board of Discover Financial Services. | |||||||||

Age: 71 Board Tenure: 17 years Board Committees ● Compensation (Chair since 2019) ● Sustainability & Corporate Responsibility ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | Sustainability / | ||

| 2023 Proxy Statement 27 |

Election of Directors

JOHN MULLIGAN EXECUTIVE VICE PRESIDENT AND CHIEF OPERATING OFFICER, TARGET CORPORATION | ||||||||||

| Professional Experience ● Target Corporation, a general merchandise retailer Executive Vice President and Chief Operating Officer (2015 – Present) Executive Vice President and Chief Financial Officer (2012 – 2015) Senior Vice President, Treasury, Accounting and Operations (2010 – 2012) Director Qualifications Mr. Mulligan brings to our Board extensive experience in finance, global supply chain, operations, e- commerce, real estate and human resources gained from his service in senior executive roles at Target. His service at a leading general merchandise retailer known for its focus on creating an exceptional guest experience brings customer-centric experience to our Board. In addition, his experience in digital and technology issues, including cybersecurity risks, is an important asset as our Board considers these topics and their potential impact on our Company. In addition, Mr. Mulligan’s qualification as an “audit committee financial expert” is an important attribute as a member of our Audit & Finance Committee. Other Public Company Directorships None. | |||||||||

Age: 57 Board Tenure: 7 years Board Committees ● Audit & Finance ● Public Policy & Strategy (Chair since 2022) ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Information | Marketing | Real Estate | ||

28 McDonald’s Corporation |

|

Election of Directors

JENNIFER TAUBERT EXECUTIVE VICE PRESIDENT AND WORLDWIDE CHAIRMAN, PHARMACEUTICALS, JOHNSON & JOHNSON | ||||||||||

| Professional Experience ● Johnson & Johnson, a researcher, developer and manufacturer of medical devices, pharmaceuticals and consumer packaged goods Executive Vice President and Worldwide Chairman, Pharmaceuticals (2018 – Present) Company Group Chairman, The Americas, Pharmaceuticals (2015 – 2018) Company Group Chairman, North America, Pharmaceuticals (2012 – 2015) Director Qualifications Ms. Taubert brings to our Board extensive management, marketing, finance, business development and global operations experience gained from her senior executive roles at one of the world’s largest global healthcare companies. Her experience leading a global pharmaceuticals division, and as a member of Johnson & Johnson’s executive committee, provide her with a broad understanding of the range of complex issues facing a large, global consumer business. Our Board also benefits from Ms. Taubert’s extensive regulatory and public policy knowledge, as well as her human capital management experience, including her recognized leadership in the area of DEI. Other Public Company Directorships None. | |||||||||

Age: 59 Board Tenure: < 1 year Board Committees ● Compensation ● Public Policy & Strategy | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

| ||||

Brand | Customer- | Finance / Capital | Global | Human Capital | Marketing | Sustainability / | ||||

| 2023 Proxy Statement 29 |

Election of Directors

PAUL WALSH EXECUTIVE CHAIRMAN, MCLAREN GROUP LIMITED | ||||||||||

| Professional Experience ● McLaren Group Limited, a privately owned luxury automotive and technology group Executive Chairman (2020 – Present) ● Chime Communications Limited, a marketing services company Non-Executive Chairman (2016 – Present) ● L.E.K. Consulting, a global strategy consulting firm Advisor (2014 – Present) ● TPG Capital LLP, a private investment firm Advisor (2014 – Present) ● Bespoke Capital Partners LLC, an investment company Operating Partner (2016 – 2021) ● Compass Group PLC, a leading food service and support services company Chairman (2014 – 2020) ● Avanti Communications Group plc, a leading satellite operator providing internet and data services Chairman (2013 – 2019) ● Diageo plc, a multinational beverage company Chief Executive Officer (2000 – 2013) Chief Operating Officer (2000) Director Qualifications Mr. Walsh brings to our Board substantial corporate leadership experience and knowledge of consumer-centric companies gained from his experience as former chief executive officer of a large multinational corporation. His experience at Diageo brings broader food and beverage industry perspective. He also has held executive-level finance positions, including as chief financial officer of Grand Metropolitan Foods and Intercontinental Hotels. Throughout his career, Mr. Walsh has built success and growth at his companies through the deployment of effective brand marketing strategies, which brings valuable perspective to our Board. His background as a U.K. national based in London provides international diversity on our Board. Other Public Company Directorships Mr. Walsh also serves as independent lead director of the board of Vintage Wine Estates, Inc. (f/k/a Bespoke Capital Acquisition Corp.) and as a director of FedEx Corporation. He previously served on the boards of Compass Group PLC, HSBC Holdings plc, RM2 International, S.A. and TPG Pace Holdings Corp. | |||||||||

Age: 67 Board Tenure: 4 years Board Committees ● Governance ● Sustainability & Corporate Responsibility (Chair since 2022) ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

|

| ||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | Sustainability / | ||

30 McDonald’s Corporation |

|

Election of Directors

AMY WEAVER PRESIDENT AND CHIEF FINANCIAL OFFICER, SALESFORCE, INC. | ||||||||||

| Professional Experience ● Salesforce Inc., a cloud-based software company President and Chief Financial Officer (2021 – Present) President and Chief Legal Officer (2020 – 2021) President, Legal Corporate Affairs and General Counsel (2017 – 2020) Executive Vice President and General Counsel (2015 – 2017) Senior Vice President and General Counsel (2013 – 2015) ● Univar, Inc., a global chemical and ingredients distributor Senior Vice President and General Counsel (2010 – 2013) ● Expedia, Inc., an online travel shopping company Senior Vice President and Deputy General Counsel (2005 – 2010) Director Qualifications Ms. Weaver brings to our Board valuable and varied leadership experience gained from her senior executive roles at one of the world’s largest enterprise software companies. She leads Salesforce’s global finance organization, and previously led its legal and corporate affairs organizations. This contributes a unique and valuable perspective to our Board’s discussions of strategy, finance, regulatory and public policy matters. In addition, Ms. Weaver’s qualification as an “audit committee financial expert” is an important attribute as a member of our Audit & Finance Committee. Other Public Company Directorships None. | |||||||||

Age: 56 Board Tenure: < 1 year Board Committees ● Audit & Finance ● Governance | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

| ||||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Sustainability / | ||||

| 2023 Proxy Statement 31 |

Election of Directors

MILES WHITE FORMER EXECUTIVE CHAIRMAN, ABBOTT LABORATORIES | ||||||||||

| Professional Experience ● Abbott Laboratories, a global healthcare company Executive Chairman (2020 – 2021) Chairman and Chief Executive Officer (1999 – 2020) Director Qualifications Mr. White brings to our Board extensive knowledge of strategy and business development, global operations, finance, leadership development and succession planning, corporate governance, and regulatory and public policy matters gained from his experience as former chairman and chief executive officer of a global healthcare company. Mr. White’s healthcare experience and knowledge of healthcare technology advances has also enhanced his ability to oversee human capital management, particularly in light of the COVID-19 pandemic. In addition, Abbott’s focus on developing consumer products and technologies brings customer-centric, marketing, digital and healthcare knowledge to our Board. We also benefit from Mr. White’s strong experience in addressing the needs of a global public company, as well as insights into our Board’s responsibility to oversee management and operations matters. As our Governance Committee Chair, Mr. White leads our Board’s succession planning and Director candidate selection process, and he is periodically involved in shareholder engagement. Other Public Company Directorships Mr. White previously served as executive chairman of the board of Abbott Laboratories and as a director of Caterpillar, Inc. | |||||||||

Age: 68 Board Tenure: 14 years Board Committees ● Governance (Chair since 2014) ● Public Policy & Strategy ● Executive | ||||||||||

Skills & Qualifications | ||||||||||

|

|

|

|

|

|

|

| |||

Brand | Customer- | Digital | Finance / Capital | Global | Human Capital | Marketing | Other Public | |||

32 McDonald’s Corporation |

|

| Board & Governance Matters |

Board Leadership

Our Board assesses its leadership structure annually and currently has separate Chairman and CEO roles. Our independent Chairman oversees corporate governance matters, and our CEO leads our business. In addition, independent Directors chair each of our Board Committees (other than the Executive Committee, which is chaired by our CEO). Our Board believes this structure, under current circumstances, promotes effective oversight and strengthens our Board’s independent leadership, each of which drives enhanced shareholder value.

Enrique Hernandez, Jr. was elected as our independent Chairman in May 2016 and has been re-elected each year since then in view of his accomplishments in the role and his extensive knowledge of our operations and governance. Mr. Hernandez has significant experience with Company strategy, business practices and management of human capital, and has facilitated smooth leadership transitions and strong independent Board oversight during his tenure.

Our Chairman oversees our Board and facilitates the flow of information between it and management. This fosters open dialogue and constructive feedback among our independent Directors and management. Further, our Chairman leads a critical evaluation of our management, business practices, culture and oversight of Company strategy. Our Board will continue to assess its leadership structure annually to confirm it continues to meet the evolving needs of our Company and best serves the interests of our shareholders.

Board Composition & Refreshment

Our Board is comprised of a diverse, highly-engaged group of individuals with a wide range of relevant qualifications, skills and experiences, each of whom contributes to overall Board and Committee effectiveness. Each of our Directors is a dynamic leader whose experiences and perspectives are continually evolving as they navigate today’s fast-paced, ever-changing business environment, both as a Director of our Company and in their other professional roles.

Our Governance Committee is primarily responsible for maintaining a balanced and diverse Board through robust succession planning and refreshment processes, which include recommending Directors for re-election and identifying new Director candidates who will bring complementary skills and varied perspectives to our Board. Our Governance Committee evaluates and determines the most impactful and desirable mix of diverse characteristics, skills and experiences for our Board as a whole, as well as the qualifications and attributes of individual Director candidates. When identifying, evaluating and recommending new Director candidates, our Governance Committee considers the qualifications discussed on page 18.