Exhibit 10.30

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (“Agreement”), is made and entered into as of this 20th of December, 2019 (the “Effective Date”), by and between HAWAII WATER SERVICE COMPANY, INC., a Hawaii corporation or its designee entity (“Purchaser”), KAPALUA WATER COMPANY, LTD., a Hawaii corporation (“KWC”), KAPALUA WASTE TREATMENT COMPANY, LTD, a Hawaii corporation (“KWTC”) (KWC and KWTC, jointly and severally, “Seller”), and MAUI LAND & PINEAPPLE COMPANY, INC., a Hawaii corporation (“MLP”) (collectively “Parties”).

WHEREAS, KWC and KWTC are wholly-owned subsidiaries of MLP;

WHEREAS, KWC is a utility company regulated by the Public Utilities Commission of the State of Hawaii (“Commission”), currently providing potable and non-potable water services to residential and commercial customers located in Kapalua;

WHEREAS, KWTC is a utility company regulated by the Commission, currently providing wastewater collection and transmission services from residential and commercial customers located in Kapalua to the wastewater treatment plant located in Lahaina operated by the County of Maui (“Lahaina Wastewater Treatment Plant”);

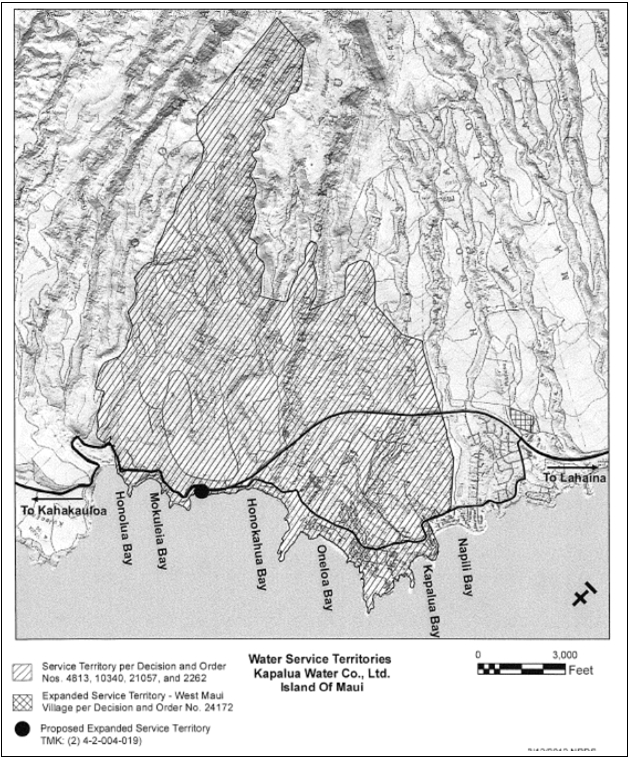

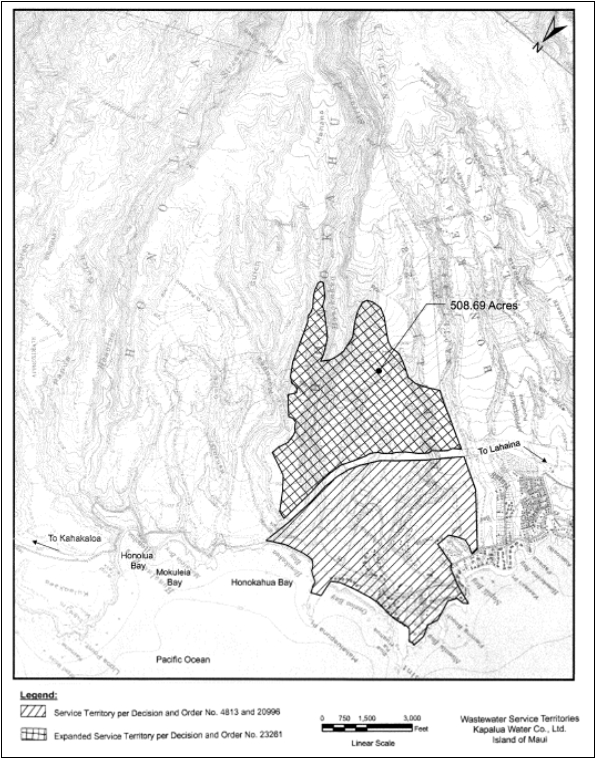

WHEREAS, KWC and KWTC, provide water services and wastewater services, respectively (collectively, the “Business”), within the areas identified in Exhibit A-1 (Service Area of KWC) and Exhibit A-2 (Service Area of KWTC) attached hereto and incorporated herein by reference (collectively, the “Service Areas”).

WHEREAS, KWC and KWTC are or at Closing will be the owners of:

(a) the facilities, equipment, fixtures and other property necessary and to operate the Business (collectively, the “Assets”) identified and more specifically described in Exhibit B-1 (Assets of KWC), Exhibit B-2 (Assets of KWTC), and Exhibit C (Capital Expenditure Projects for KWC and KWTC currently being made by Aqua Engineers, Inc. (“Operator”), the company that currently provides Seller with operation and maintenance services under certain existing agreements (the “Aqua O&M Agreements”) attached hereto and incorporated herein by reference);

(b) the perpetual easements in which the Assets are or shall be located, and the rights-of-way, rights of entry and licenses necessary and desirable to conduct the Business and to access, operate, maintain, remove and replace the Assets (collectively, the “Easements”);

(c) the parcels of real estate owned in fee simple by KWC that are identified as Lots 26 and 31 of the “Honolua Ridge -- Phase I” subdivision (TMKs (2) 4-2-8-26 & -27) and Lot 27 of the “Honolua Ridge -- Phase II” subdivision (TMKs (2) 4-2-9-27) (collectively, the “Real Property”) and

(d) the intangible and other right described herein necessary or desirable to operate the Business (collectively, the “Rights”).

WHEREAS, because KWC and KWTC are regulated utility companies in the State of Hawaii and subject to the rules and regulations thereof, the sale of the Assets, together with the Real Property, the Easements and the Rights (collectively, the “Acquired Assets”) are subject to the review and approval of the Commission; and

WHEREAS, Seller desires to sell to Purchaser all of the Acquired Assets, and Purchaser desires to purchase from Seller the same as an on-going business (the “Contemplated Transaction”), pursuant to the terms and conditions described herein at the closing (“Closing”).

NOW, THEREFORE, AND FOR VALUABLE CONSIDERATION, the sufficiency and receipt thereof which is hereby acknowledged by the Parties, and in consideration of the mutual covenants and promises set forth in this Agreement, the Parties hereby agree as follows:

1. PURCHASE AND SALE OF ACQUIRED ASSETS. Subject to the terms and conditions set forth in this Agreement, Seller and MLP agree to sell, assign, transfer and deliver to Purchaser, and Purchaser agrees to purchase and accept from Seller, at Closing, all of Seller’s and MLP’s right, title and interest in the Acquired Assets free and clear of all liens and encumbrances as set forth below.

1.1. Acquired Assets. The Acquired Assets include, without limitation:

(a) all fixed assets recorded on each of KWC and KWTC’s balance sheet, together with any other tangible or intangible assets useful or necessary for the continued operations of the Business (including but not limited to spare parts, inventory, etc.), free and clear of all liens and encumbrances except as provided below with respect to the Real Property, as set forth in Exhibits B-1 , B-2, and C attached hereto and incorporated herein by reference, including, but not limited to, the following:

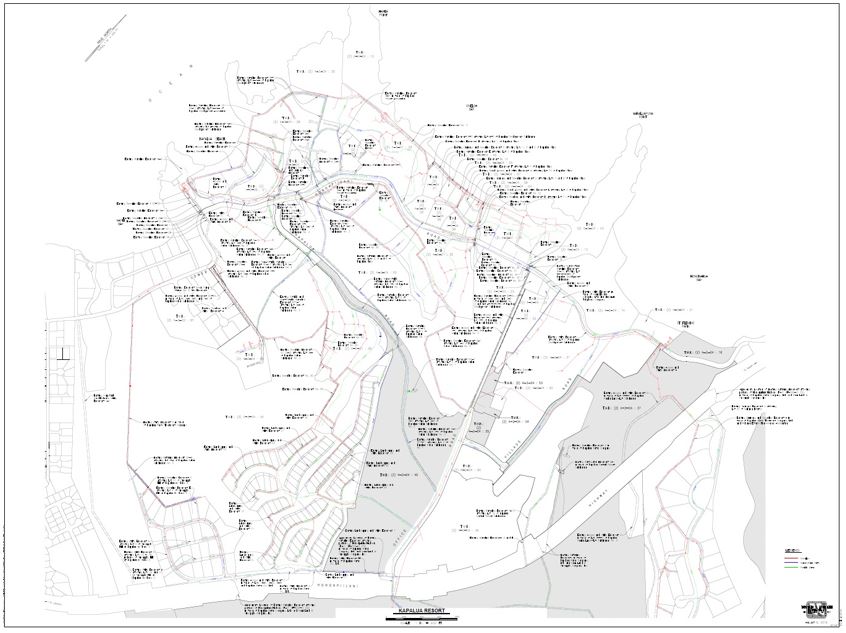

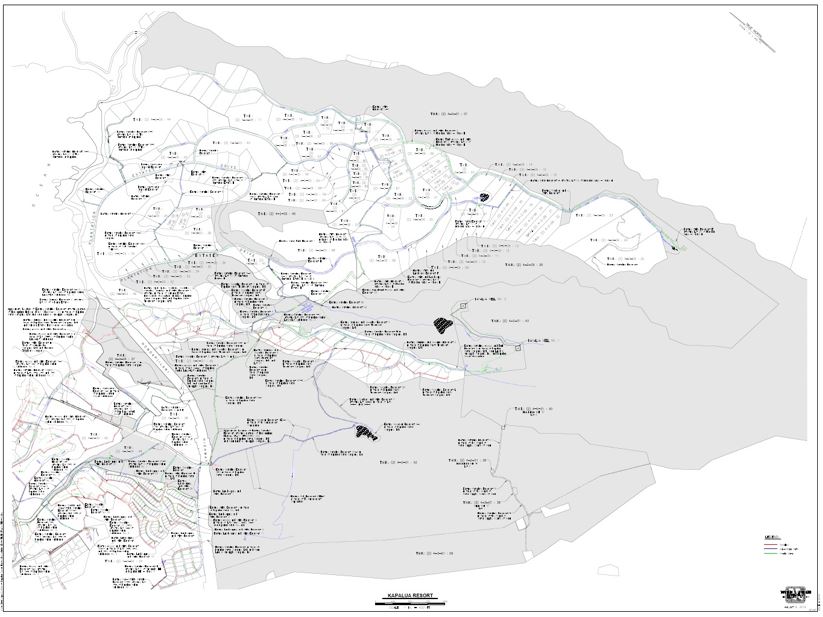

(1) all potable and non-potable water transmission facilities, pumping equipment, conduits, connections, tanks, mains, pipelines, meters and other equipment and appliances used and/or owned by KWC for the provision of potable and non-potable water to the Service Areas (collectively, “Water System”);

(2) all wastewater collection and transmission equipment and facilities, wells, pumping equipment, conduits, connections, tanks, lagoons, sewage pumping stations, mains, pipelines, meters, and other equipment and appliances used and/or owned by KWTC for the provision of wastewater collection and transmission from the Service Areas to the connection to the county sewer system located on or near Lower Honoapiilani Road by the parking lot for Merriman’s Kapalua, One Bay Club Place, Lahaina, HI 96761 (collectively, “Wastewater System”);

(b) the goodwill and other Rights relating to the Business;

(c) rights to use potable and non-potable water from current source(s) utilized by KWC in the provision of water services to the Service Areas, as further described in the forms attached hereto and incorporated herein by reference as said agreements may be modified pursuant to Sections 3.5 and 3.6 of this Agreement:

i. Exhibit D, Water Delivery Agreement (Non-Potable Water); and

ii. Exhibit E, Water Delivery Agreement (Well Water) (collectively, the “Water Delivery Agreements”);

(d) the Easements, whether transferred at Closing or after Closing, as explained more fully in Section 4.3 below, and other easements, licenses rights-of-way or rights of entry necessary or desirable to build, construct, reconstruct, rebuild, repair, maintain and operate the Water System and the Wastewater System (collectively, the “Systems”);

(e) the Certificates of Public Convenience Necessity (“CPCNs”) issued to KWC and KWTC (pursuant to Commission approval of transfer of same) to enable continuing operation of the Systems in the Service Areas;

(f) any contributions in aid of construction (“CIAC”), as reflected in KWC’s and KWTC’s accounting records;

(g) any manufacturer or service warranties related to equipment and other utility assets comprising the Systems;

(h) customer deposits, if any, held by KWC or KWTC related to the Business; any deposits by KWC or KWTC held by government agencies, contractors, lessors and other vendors; and any accounts receivable and rights to payment for services provided after the Closing Date;

(i) all assignable existing contracts relating to the Business (including, but not limited to existing contracts with Seller’s service providers), books, files, financial records, tax returns, and accounts, for the Business, excluding the Aqua O&M Agreements which Seller shall terminate prior to or at Closing;

(j) all prepaid rent, utilities, taxes and other prepaid expenses and/or security deposits given;

(k) all payments from insurance contracts and/or policies for casualty to the Assets occurring between the Effective Date and the Closing Date which Seller has not already applied to restore, repair or replace the damaged Assets;

(l) all other intangible assets owned by KWC or KWTC and used in the Business, including but not limited to vehicles, office and computer equipment, software, furniture, fixtures, and other equipment, any propriety rights or designs, and any intellectual trade secrets;

(m) the telephone number(s), email addresses and website urls used by the Business;

(n) all existing inventory of KWC and KWTC including, but not limited to component parts and spare parts;

(o) all rights to the trade names “Kapalua Water Company” and “Kapalua Waste Treatment Company”, as more specifically set forth below in Section 1.3;

(p) any customer and vendor lists of the Business;

(q) all licenses, authorizations, and other approvals necessary or required to provide authorized services, or to operate the Business and/or related to the Business;

(r) all claims against third parties, if any, arising from ownership of the Acquired Assets that exist at Closing; and

(s) all other property which includes, without limitation, all customer service contracts and all site plans, plans and specifications, “as-built” plans and drawings, and, to the extent transferable, permits and other governmental reviews, approvals and entitlements related to the Systems and much of the foregoing as have been heretofore prepared, applied for, obtained or otherwise are in the name or possession of, under the control of or available to KWC, KWTC or MLP, relating to the Business.

(t) the right, subject to Hawaii Public Utilities Commission approval, to provide wastewater and potable and non-potable water services to the “Kapalua Mauka” future expansion area (TMK 4-2-001-042 and TMK 4-3-001-006) that is more particularly described in the County of Maui’s zoning code as “West Maui Project District 2 -- Kapalua Mauka”.

(u) the Real Property, subject to only those liens and encumbrances deemed acceptable by Purchaser prior to the end of the Due Diligence Period.

1.2. Excluded Assets. Notwithstanding anything contained in Section 1.1 to the contrary, the Acquired Assets shall not include the following assets, properties or rights of Seller or MLP relating to the Business (“Excluded Assets”):

(a) all cash and accounts receivable of the Business existing immediately prior to the Closing (except for cash associated with CIAC set forth in Section 1.1(f) or customer deposits set forth in Section 1.1(h)); and

(b) Seller’s internal corporate governance records and items, including, without limitation, corporate minute and stock books, and corporate seal; and

(c) The existing potable water wells and Honolua Ditch owned by MLP that are the source of potable and non-potable water, respectively, used by KWC in the operation of its Business, and the transmission infrastructure and storage facilities (including the Kapalua Plantation Reservoir and the Village Reservoir (collectively, the “Reservoirs”)) located between those sources and the points of water delivery under the Water Delivery Agreements, all of which are owned and retained by MLP.

1.3. Only Certain Liabilities Being Assumed; Retained Liabilities. Except those liabilities and service commitments expressly as described in Schedule 1.3 hereof (“Assumed Liabilities”), Purchaser will not assume or be obligated to satisfy or perform any of the liabilities, or commitments, whether fixed or contingent, which relate to the Seller’s Business prior to the Closing Date, the Acquired Assets or the Excluded Assets including any other liabilities, obligations or commitments of Seller and MLP whether fixed or contingent, or known or unknown, including but not limited to Seller’s tax, environmental and water quality liabilities that exist prior to the Closing Date including without limitation taxes arising from the sale of the Acquired Assets (“Retained Liabilities”) which shall remain the sole responsibility of Seller and MLP and be paid, performed and discharged solely by Seller and MLP.

1.4 Use of Name. Effective as of Closing, Purchaser shall be entitled to utilize the trade names “Kapalua Water Company” and “Kapalua Waste Treatment Company”. Upon request by Purchaser, Seller shall change its corporate names and consent to Purchaser’s registration of such name with the Department of Commerce and Consumer Affairs, of the State of Hawaii, Business Registration Division.

2. PURCHASE PRICE. In consideration of the sale of the Acquired Assets, Purchaser will, in full payment thereof, pay to Seller a total price of THREE MILLION EIGHT HUNDRED THIRTY-FOUR THOUSAND FIVE HUNDRED THIRTY-NINE DOLLARS ($3,834,539.00) (“Purchase Price”), as may be adjusted by the Capital Expenditures Adjustment, as set forth in Section 2.1 below.

The Purchase Price is calculated as follows:

|

CATEGORY |

DESCRIPTION |

AMOUNT |

|

Rate Base Assets |

Capital cost of Acquired Assets owned by KWC (Exhibit B-1) and KWTC (Exhibit B-2), being the original cost of such assets net of accumulated depreciation from the in-service date to the Effective Date, and related contribution in aid of construction, advances in aid of construction, deferred income taxes, and Commission adjustments for excess capacity. |

KWC: $1,197, 786.00 KWTC: $ 136,753.00 $1,334,539.00

These calculations are subject to Purchaser’s verification during the Due Diligence Period. |

|

Additional Consideration |

Additional consideration paid by Purchaser for intangible assets of KWC and KWTC |

$2,500,000.00 |

2.1. Modification of Purchase Price Pursuant to Seller’s Capital Expenditures. Purchaser and Seller agree that at Closing the Purchase Price shall be adjusted by the following amounts (collectively, the “Capital Expenditures Adjustment”):

(a) accumulated depreciation of the Acquired Assets included in Seller’s rate base from the Effective Date to the Closing Date (as defined in Section 6 below) shall be deducted from the Purchase Price;

(b) capital expenditures made and funded by KWC, KWTC and/or MLP for projects or assets that are placed in service and approved for inclusion in the rate base of KWC or KWTC from and after the Effective Date through the Closing Date and included in Acquired Assets (including projects listed in Exhibit C), reduced by the depreciation accumulated from the date placed in-service to the Closing Date, shall be added to the Purchase Price; and

(c) accumulated depreciation of the Assets other than those listed in the preceding paragraphs from the Effective Date to the Closing Date shall be deducted from the Purchase Price.

2.2 Escrow. The purchase and sale of the Assets shall be conducted through escrow at Title Guaranty Escrow Services, Inc., Main Branch attn: Jeremy Trueblood (“Escrow”) pursuant to instructions consistent with the provisions of this Agreement. All amounts payable to Seller (other than the amounts specified in Section 4.3(d)) shall be released by Escrow only upon Seller’s delivery to Escrow and Purchaser of an approved Report of Bulk Sale or Transfer (Form G-8A) from the State of Hawaii Department of Taxation dated no earlier than ten (10) days prior to the Closing Date indicating that all taxes due and payable by Seller, including all taxes due under the relevant provisions of Hawaii law and under Form G-8A, have been paid, and the satisfaction of all conditions to Closing.

3. PURCHASER’S REVIEW OF THE BUSINESS, THE ACQUIRED ASSETS, REAL PROPERTY AND EASEMENTS.

3.1 Due Diligence Period. Purchaser shall conduct Purchaser’s review of the Acquired Assets, Easements, and Seller’s business beginning upon the execution of this Agreement and for a period of 60 days, with up to three 30 day extensions if requested by Purchaser (the “Due Diligence Period”). In addition to the specific documents and records referenced in Sections 3.2 and 3.3, Seller and MLP shall give Purchaser and its counsel, accountants and other representatives, on reasonable prior notice, access during normal business hours to all properties, books, accounts, records, contracts and documents of or relating to the Business, the Acquired Assets and operations, excluding only privileged documents. Seller and MLP shall furnish to Purchaser and its representatives and consultants such additional data and information concerning the Business, operations and the Assets that may be reasonably requested as part of a customary due diligence review (“Due Diligence Review”). Notwithstanding any of the foregoing, in no event, shall the fact that Purchaser had the opportunity to conduct the Due Diligence Review be used by Seller or MLP as a defense or otherwise to Purchaser’s enforcement of a Seller or MLP representation, warranty or covenant

3.2 Seller’s Documents and Records.

(a) Documents in KWC’s, KWTC’s or MLP’s Possession. Within five (5) business days of the Effective Date, Seller and MLP shall provide to Purchaser, all non-privileged material documents in the possession of KWC, KWTC or MLP which pertain to the ownership or operation of the Business and the Acquired Assets, including the following (collectively, the “Available Due Diligence Materials”):

(1) site plans, plans and specifications, “as-built” plans and drawings regarding the Assets;

(2) existing water purchase agreements;

(3) the Sewer Agreement dated April 23, 1987, by and between the County of Maui, Seller and KWTC, as supplemented by the Lahaina Wastewater Reclamation Facility Expansion Agreement dated January 20, 1994, for the treatment of wastewater at its Lahaina Wastewater Treatment Plant (collectively, the “Wastewater Treatment Agreement”);

(4) copies of all existing and proposed leases, easements, rights-of-way, rights of entry, licenses, and other agreements affecting the Easements and Real Property;

(5) existing contracts pertaining to the Business, excluding the Aqua O&M Agreements;

(6) copies of all existing water and wastewater customer agreements (“Customer Agreements”) and all written notice of adequate capacity to provide potable or non-potable water or wastewater services to new customers in the Service Areas (“Will Serve Letters”);

(7) existing surveys and maps, including but not limited to the makai easement map prepared by Warren S. Unemori Engineering, Inc. (“WSUE”), attached as Exhibit F-1, and mauka easement map, also prepared by WSUE, attached as Exhibit F-2, both reflecting, in reasonable detail, the location of the Easements in proximity to the Assets (collectively, the “Easement Map”);

(8) listing of misaligned and missing Easements;

(9) existing financial statements of Seller including balance sheets income statements and retained earnings statements for the previous three fiscal years, and year-to-date financial statement by month;

(10) Commission Annual Reports for the three previous years;

(11) Consumer Confidence Reports, water quality laboratory analysis, and any notices of violation and inspection reports from Hawaii Department of Health for the three previous years; and

(12) Title reports, for the Real Property and the Easements (if any for the Easements) from Title Guaranty of Hawaii, Inc.

(b) Additional Documents. Within thirty (30) days of the Effective Date, Seller shall provide Purchaser with the following (“Additional Due Diligence Documents”):

(1) a complete list of all Easements that have been granted and recorded to date;

(2) an updated list that identifies those areas over which, to the best of Seller’s or MLP’s knowledge, recorded easements are necessary to build, construct, reconstruct, rebuild, repair, maintain and operate the Systems, but have not yet been obtained;

(3) Real Property related documents including but not limited to deeds, and existing title reports and title policies for all Real Properties and Easements, encumbrances, leases, land use permits, certificates of occupancy;

(4) Commission approved tariffs, rules of service, and orders and all files and filings relating to Commission matters.

3.3 Inspection; Inspection Indemnity. During the Due Diligence Period, Purchaser and Purchaser’s employees, agents, consultants, advisors, or other representatives (collectively “Purchaser’s Representatives”) shall have the right, upon reasonable notice to Seller and at times reasonably convenient to Seller and Purchaser, to perform reasonable non-destructive inspections and tests of the Acquired Assets. Prior to any such entry Purchaser shall provide Seller with a certificate of liability insurance in form acceptable to Seller naming Seller and MLP as additional insureds. Purchaser agrees that it will engage such consultants as it deems necessary to complete such inspections and testing. Without limiting the generality of the foregoing, at any time prior to the expiration of the Due Diligence Period, Purchaser may engage a reputable third-party environmental consulting company to perform a Phase I and Phase 2 environmental assessment and/or any non-destructive testing of the soil, groundwater, building components, tanks, containers and equipment on the Real Property or Easements, as Purchaser deems necessary or appropriate to confirm the condition of such properties. Any investigation or examination of the Acquired Assets is performed at the sole risk and expense of Purchaser, and Purchaser shall be solely responsible for the negligent acts or omissions of any of Purchaser’s Representatives while performing such testing and inspection. Purchaser shall defend, indemnify and hold Seller harmless from and against all claims for personal injury, wrongful death or property damage against Seller, or the Acquired Assets arising from or as a result of, any negligent act or omission of Purchaser or Purchaser’s Representatives, in connection with any inspection or examination of the Acquired Assets or the books and records of the Business by Purchaser or Purchaser’s Representatives, except to the extent arising from or as a result of the negligent or willful misconduct of Seller, MLP or their respective officers, directors, employees, consultants or any other representatives. This obligation to indemnify shall survive closing or termination of this Agreement.

3.4 Purchaser’s Right to Waive or Terminate. During the Due Diligence Period, Purchaser will review the Acquired Assets and various aspects of Purchaser's potential acquisition of the Acquired Assets. Purchaser may accept the condition of the Acquired Assets and waive the time remaining in the Due Diligence Period by issuing to Seller a written notification of acceptance of the Acquired Assets prior to the expiration of the Due Diligence Period. In addition, the Parties agree that Purchaser, in Purchaser’s sole and unreviewable discretion, may terminate this Agreement for any reason by written notice received by Seller on or before 4:00 p.m., Hawaii time, on the last day of the Due Diligence Period. If the last day of the Due Diligence Period falls on a Saturday, Sunday or holiday, the Due Diligence Period shall end on the next following business day. If Purchaser exercises such right of termination, the Parties agree that the Parties shall have no further obligations to each other under this Agreement except with respect to the obligations set forth in Section 3.3 (Inspection; Inspection Indemnity) above.

3.5 Non-Potable Water Delivery Agreement. A draft Agreement for Water Delivery (Non-Potable Water) is attached as Exhibit D. The Parties agree to act in good faith and diligently pursue completion of negotiations of a final form of non-potable water delivery agreement, in form and substance acceptable to the Parties for execution and delivery at Closing, at least five (5) business days prior to the end of the Due Diligence Period. If the Parties are unable to reach agreement on the Agreement for Water Delivery (Non-Potable Water), either Party may prior to the end of the Due Diligence Period terminate this Agreement.

3.6 Potable Water Delivery Agreement. A draft Agreement for Water Delivery (Well Water) is attached as Exhibit E. The Parties agree to act in good faith and diligently pursue completion of negotiations of a final form of potable water delivery agreement, in form and substance acceptable to the Parties for execution and delivery at Closing, at least five (5) business days prior to the end of the Due Diligence Period. If the Parties are unable to reach agreement on the Agreement for Water Delivery (Well Water), either Party may prior to the end of the Due Diligence Period terminate this Agreement.

3.7 Negotiation of Assignment of Existing Wastewater Treatment Agreement with County of Maui. The Parties have agreed to execute the Assignment and Assumption of Wastewater Treatment Agreement attached hereto as Exhibit H and incorporated herein by reference, to be effective as of the Closing Date if the Contemplated Transactions close. Seller shall use commercially reasonable efforts to assist Purchaser in obtaining the acknowledgement of the County of Maui, that no consent is required from the County of Maui, and of the Assignment and Assumption of Wastewater Treatment Agreement.

3.8 Negotiation of Operation and Maintenance Service Agreement for Wells and Reservoirs. The Parties agree to use commercially reasonable efforts to negotiate in good faith the definitive terms and form of an Operations and Maintenance Service Agreement for Purchaser to operate and maintain the Kapalua Potable Well 1 & 2 and related infrastructure (the “O&M Agreement for Wells and Reservoirs”), in form and substance acceptable to the Parties for execution and delivery at Closing, at least five (5) business days prior to the end of the Due Diligence Period. If the Parties are unable to reach agreement on the O&M Agreement for Wells and Reservoirs, either Party may prior to the end of the Due Diligence Period terminate this Agreement.

3.9 Negotiation of Operation and Maintenance Service Agreement for Ditch System. The Parties agree to use commercially reasonable efforts to negotiate in good faith the definitive terms and form of an Operations and Maintenance Service Agreement for Purchaser to operate and maintain the West Maui Honokohau Ditch system, the Reservoirs and related infrastructure (the “O&M Agreement for Ditch System”), in form and substance acceptable to the Parties for execution and delivery at Closing, at least five (5) business days prior to the end of the Due Diligence Period. If the Parties are unable to reach agreement on the O&M Agreement for Ditch System, either Party may prior to the end of the Due Diligence Period terminate this Agreement.

4. PARTIES’ PRE-CLOSING COVENANTS AND ACTIVITIES.

4.1 Continued Operation and Management of the Business.

(a) Seller shall, and MLP shall cause Seller , without making any commitments or agreements on behalf of Purchaser, to keep its business organization intact, to preserve its present relationships with suppliers, customers and others having business relationships with it and to operate the Business in the ordinary course of business consistent with its prior practices and to maintain the Acquired Assets in good condition and repair. Without limiting the generality of the foregoing, Seller shall not and MLP shall cause Seller not to do, or agree to do, any of the following acts without the prior written consent of Purchaser:

(1) enter into any contract or agreement with, make any commitment on behalf of or for the benefit of, or make any distribution of money or property to, in each case MLP or any person or entity related to or affiliated with MLP;

(2) Enter into any contract or transaction not in the ordinary course of business, except, however, Purchaser shall not unreasonably withhold written consent in the event that a contract or transaction is necessary to correct an interruption in service to any customer(s);

(3) Enter into any contract or transaction in the ordinary course of business involving an amount exceeding ten thousand dollars ($10,000) individually or twenty thousand dollars ($20,000) in the aggregate, except, however, Purchaser shall not unreasonably withhold written consent in the event that a contract or transaction is necessary to correct an interruption in service to any customer(s);

(4) Sell or dispose of any capital assets with a net book value in excess of one thousand dollars ($1,000) individually or two thousand dollars ($2,000) in the aggregate; or

(5) Make a distribution of money or property to MLP or any person or entity affiliated with MLP (whether as a dividend or otherwise) or incur any indebtedness to MLP or any person or entity affiliated with MLP.

(b) Seller shall continue to carry its existing insurance, subject to variations in amounts required by the ordinary operations of its business.

(c) No later than January 31, 2020, Seller shall provide Purchaser true and correct copies of all Will Serve letters and customer agreements executed by Seller up to and including the date such copies are provided to Purchaser (the “Will Serve Disclosure Date”) and, further, Seller shall obtain the prior written approval of Purchaser for any new Will Serve Letters and customer agreements that Seller wishes to enter into during the period from the Will Serve Disclosure Date to the Closing Date.

(d) Provided that Purchaser shall elect to proceed with the Contemplated Transaction, the Parties agree that they will use commercially reasonable efforts to jointly secure Commission authorization for the Contemplated Transaction (which shall include any Commission authorization necessary) for: (1) the expansion of such services to Kapalua Mauka (as defined in Section 4.4 below); (2) the relocation of the site office and storage area (as provided in Section 4.5 below); (3) the Agreement for Water Delivery (Non-Potable Water) described in Section 3.5 above; (4) the Agreement for Water Delivery (Well Water) described in Section 3.6 above; and (5) the assignment of the Wastewater Treatment Agreement to Purchaser. Additionally, the Parties agree to use their best efforts to amend the tariff for KWC to limit the liability of Purchaser for inadequate flow surface water resulting from events beyond Purchaser’s reasonable control. To this end, the Parties agree to file an Application for Commission authorization with 15 business days of Seller’s receipt of Purchaser’s decision to proceed with the Contemplated Transaction and to diligently prosecute such Commission authorization. The legal and other costs of seeking Commission authorization shall be shared equally between Seller and Purchaser.

(e) As of the Closing, there will be no action, suit, proceeding, claim arbitration, or investigation, audit, or inquiry, at law or in equity, before or by any court or federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, pending or, to the knowledge of Seller or MLP, threatened, against the Business which materially affects the Business or relates to the Acquired Assets, other than the pending Hawaii Commission on Water Resources proceedings regarding the Honolua Ditch and West Maui streams from which it draws.

(f) Except as may otherwise be provided herein, the Business shall be in compliance with any and all county, state or federal health, environmental, or similar laws, rules and regulations applicable to the operation of the Systems.

4.2 [RESERVED].

4.3. Pre-closing and Post-closing Easements. Provided Purchaser shall elect to proceed with the Contemplated Transaction, Seller and MLP jointly and severally agree as follows:

(a) Existing Easements. During the Due Diligence Period, Purchaser may conduct such investigations as it desires with respect to all easements held by Seller for the System that will be assigned to Purchaser at Closing (“Existing Easements”), including securing such commitments from Title Guaranty of Hawaii, LLC, to insure Purchaser’s interest in the Existing Easements at Closing.

(b) Agreed Easement Actions. Seller and Purchaser acknowledge that Seller holds certain recorded perpetual easements covering various areas of the Systems located on lands not owned by Seller, but does not currently have easements necessary for all aspects of the Systems located on lands held by Seller, MLP or third-parties, as the case may be or to allow Purchaser physical access to the Systems (“Missing Easements”), or that there may be existing easements that are not correctly aligned with the KWC or KWTC lines or facilities that they are intended to cover (“Misaligned Easements”). No later than five (5) days before the end of the Due Diligence Period, Seller and Purchaser shall mutually agree on (a) a list of the Missing Easements that Seller and MLP will pursue pursuant to this Section, and (b) a list of the Misaligned Easements and the specific amendments necessary to address them that Seller and MLP will pursue pursuant to this Section (collectively, the “Agreed Easement Actions”). If the Parties are unable to reach agreement on the Agreed Easement Actions, either Party may prior to the end of the Due Diligence Period terminate this Agreement.

(c) Seller’s and MLP’s Obligation to Diligently Pursue. Provided Purchaser shall elect to proceed with the Contemplated Transaction at the end of the Due Diligence Period, Seller and MLP will exercise commercially reasonable efforts to complete the Agreed Easement Actions prior to Closing and after Closing for a period of two (2) years. Agreed Easement Actions with respect to Missing Easements shall be deemed complete when Seller or MLP have secured recorded grants of easement in form reasonably acceptable to Purchaser and for which Title Guaranty of Hawaii is willing to insure (“Insurable Easements”). Agreed Easement Actions with respect to Misaligned Easements shall be deemed complete when Seller or MLP have completed the specific agreed actions on the list of Agreed Easement Actions. All Easements granted by MLP over its own lands after the end of the Due Diligence Period shall be made on Purchaser’s standard Grant of Easement form, attached hereto as Exhibit 4.3(a).

(d) Seller’s List of Easements Obtained Prior to Closing. At least thirty (30) days prior to Closing, Seller shall provide an updated true, complete and correct list of all Agreed Easement Actions that have been completed (“Pre-closing Easements”), and a list of all Agreed Easement Actions that have not been completed (“Post-closing Easements”).

(e) Seller’s Obligation at Closing. At Closing, Seller and MLP shall assign to Purchaser all of its right, title and interest in the Existing Easements and the Pre-closing Easements. Post-closing, Purchaser agrees to cooperate with Seller to secure the Post-closing Easements, and to execute such related and necessary documentation as is usual and customary. For the avoidance of doubt, Post-closing Easements includes amendments to existing easements and new grants to address misaligned easements as well as new grants for Systems in locations nor covered by any grant.

(f) Optional Post-closing Easement Deposit. In consideration of the commitments in this Section 4.3, at Closing Purchaser may elect to instruct Escrow to retain from the Purchase Price, a sum equal to the estimated sum necessary to pursue, process, grant and record any Post-closing Easements (“Post-closing Easement Deposit”). For purposes of establishing the Post-closing Easement Deposit, Seller and Purchaser agree that $100,000 will be retained by Escrow for each Post-closing Easement. When Seller or MLP complete each Post-Closing Easement (as such completion is defined in Section 4.3(c)), Escrow shall promptly disburse to Seller or MLP from the Easement Deposit the amount of $100,000, less reasonable expenses of escrow, conveyance and recordation paid by Escrow with respect to the Post-Closing Easement in question. Seller and MLP agree that Seller and MLP shall exercise commercially reasonably efforts to obtain and record all Post-closing Easements or Assignments to Purchaser of the Post-closing Easements within twenty four (24) months of the Closing Date. Seller, MLP and Purchaser agree that if, despite such efforts on the part of Seller and MLP, Seller and MLP are still unable to obtain all of the Post-closing Easements twenty four (24) months following Closing, Purchaser shall have the right, following notice to Seller, to have Escrow disburse to Purchaser all or any portion of the Post-closing Easement Deposit remaining for the Post-closing Easements which Seller or MLP have not then yet completed and Purchaser elects to pursue on its own. Following Escrow’s release of the Post-closing Easement Deposit to Purchaser, Purchaser shall thereafter be responsible for obtaining the applicable Post-closing Easements represented by the Post-closing Easement Deposit retained by Purchaser. Seller and MLP shall thereafter be released from any further obligation to pursue the applicable Post-closing Easement(s) and Seller and MLP shall have no further obligation or liability with respect to the Post-closing Easements except that Seller and MLP shall not be released with respect to their lands or lands of Seller, MLP or any of their respective owners, affiliates or related parties, and as to unrelated third-parties, Seller and MLP shall cooperate and assist Purchaser, including without limitation by exercise of any rights held by Seller or MLP to obtain or grant easements, unless commercially unreasonable.

(g) Good Faith Efforts to Provide all Easements. Notwithstanding the foregoing provisions of Sections 4.3, so as to minimize the need to pursue Post-closing Easements, Seller and MLP, jointly and severally, shall use good faith efforts to assign and provide to Purchaser at Closing all easements necessary to operate the Systems.

4.4. Agreement to Expand Service Areas to Include Future Kapalua Developments and the Construction of All Related Water and Wastewater Infrastructures in Future Kapalua Developments. As part of the Application that KWC and KWTC will jointly file with the Commission for approval of the sale of the Acquired Assets to Purchaser, transfer of the CPCNs to Purchaser, and any other transfer that is part of the Contemplated Transaction, the Parties further agree to expand the Service Areas to include the provision of water and wastewater services to Seller’s future developments in Kapalua, including Kapalua Mauka (Maui Tax Map Key Parcels 4-2-001:042 and 4-3-001:006). After Closing, MLP shall have the option to have Purchaser construct or have constructed all water and wastewater utility infrastructure serving the Service Areas, including infrastructure reasonably designated by Seller to serve future Kapalua developments, including but not limited to Kapalua Mauka (Maui Tax Map Key Parcels 4-2-001:042 and 4-3-001:006) Central Resort (Maui Tax Map Key Parcel 4-2-004:049) and Lot 1D (Maui Tax Map Key Parcel 4-2-004:037) (“New System Infrastructure”). Any such construction that MLP requests Purchaser to undertake shall be subject to applicable Commission approved financing requirements, rules, and tariffs, which may require that MLP or other landowners and developers bear all or some of such expense of construction through contributions in aid of construction or otherwise in accordance with Commission approved rules and tariffs. Seller and MLP shall provide Purchaser with necessary land and easements to provide utility service to the Service Areas at no additional cost to Purchaser. MLP reserves the right to construct or cause others to construct New System Infrastructure, in which case (i) the design shall be pursuant to plans and specifications approved by Purchaser and all construction in conformance with such Purchaser approved plans and specifications and (ii) upon completion, Purchaser shall have the right to inspect and approve, in its sole discretion, all New System Infrastructure prior to any dedication thereof to Purchaser.

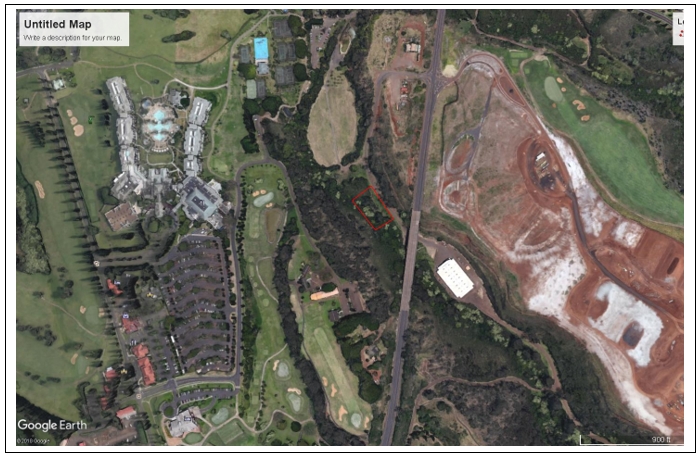

4.5 Identification and Agreement for Purchaser’s Acquisition of New Office and Storage Area. Exhibit J (Purchaser’s Proposed Location for New Office and Storage Area) attached hereto and incorporated herein reflects the location acceptable to Purchaser for a new office and storage area within the Service Areas. The Parties shall diligently pursue to completion, negotiations for the lease or conveyance of the fee simple interest in a subdivided lot of the property identified in Exhibit J and proper zoning for construction and use as Purchaser’s office and storage area, in form and substance acceptable to the Parties for execution and delivery at Closing, at least five (5) business days prior to the end of the Due Diligence Period.. Seller agrees that Purchaser shall be permitted to occupy the current operator’s onsite office and storage area until such time as Purchaser has completed the acquisition and construction of the new office and storage area.

4.6 Notifications. Between the date of this Agreement and the Closing, Seller shall promptly notify Purchaser in writing if Seller or MLP become aware of (i) any fact or condition that causes or constitutes a breach of any of Seller’s or MLP’s representations and warranties made as of the date of this Agreement or (ii) the occurrence after the date of this Agreement of any fact or condition that would or be reasonably likely to (except as expressly contemplated by this Agreement) cause or constitute a breach of any such representation or warranty had that representation or warranty been made as of the time of the occurrence of, or Seller’s or MLP’s discovery of, such fact or condition. Such delivery shall not affect any rights of either party under Section 10 under this Agreement.

4.7 Filing of HI DOTAX Form D-37. Seller agrees Purchaser may file Hawaii State Tax Department Form D-37 at any time prior to Closing but after the receipt of a non-appealable Commission order approving the Contemplated Transactions.

5. CAPITAL EXPENDITURES.

5.1 Expenditures by the Business. All capital expenditures funded by Seller on behalf of the Business between the Effective Date and the Closing Date shall be subject to Purchaser’s pre-approval and shall result an increase in the Purchase Price as set forth in Section 2 above.

6. CLOSING. Closing shall occur at Title Guaranty of Hawaii, located at the Main Office, Honolulu, Hawaii or at some other mutually agreeable location, on the date agreeable to both Seller and Purchaser, within thirty (30) business days after the receipt of all final non-appealable orders issued by the Commission approving the Contemplated Transaction, which date must allow for reasonable coordination of billing cycles, (the “Closing Date”). Time is of the essence with respect to closing this Agreement.

6.1. Closing Costs. Subject to the prorations described in Section 6.3, all closing costs related to the purchase of the Acquired Assets will be divided evenly between Purchaser and Seller and include, but are not limited to, escrow fees, recording fees, conveyance taxes and any other related fees related to Closing. Taxes related to Seller’s compliance with the Bulk Sales laws as described in Section 6.2(a)(6) shall be the responsibility of Seller.

6.2. Deliveries at Closing. Unless the parties agree to handle specific matters outside of Escrow, the following shall be done through Escrow to effect the Closing:

(a) Seller's Deliveries. Not later than two (2) business days prior to Closing, Seller shall deposit or cause to be deposited with Escrow, the following funds, items and documents, in each case duly executed by Seller, MLP or the appropriate person, and if applicable, acknowledged and in recordable form:

(1) [intentionally deleted];

(2) Limited Warranty deeds for Real Property in forms mutually agreed to during the Due Diligence Period;

(3) An original and two (2) copies of a Bill of Sale in forms mutually agreed to during the Due Diligence Period;

(4) Any required assignment/assumption agreements, including but not limited to those related to Customer Agreements and Will Serve Letters (in forms mutually agreed to during the Due Diligence Period), the Pre-closing Easements, and the Assignment and Assumption of the Wastewater Treatment Agreement attached as Exhibit H) and all third-party consents as may be necessary for the assignment of the same;

(5) Possession of the Acquired Assets not already in Purchaser’s possession;

(6) a Tax Clearance Certificate for Seller issued by the Department of Taxation of the State of Hawaii not more than fifteen (15) days prior to the Closing Date and a Report of Bulk Sale or Transfer (Form G-8A) from the State of Hawaii Department of Taxation dated not more than ten (10) days prior to the Closing Date and containing the certification of the Director of Taxation that all taxes, penalties and interest by Seller on the date of the certificate have been paid; provided that if the certificate of the Director of Taxation has not been received by the scheduled Closing Date the Parties agree to extend the Closing Date until the earliest practical date after the Director’s certificate is received; provided in no event shall the Closing Date be extended beyond thirty (30) days beyond the 24 month period described in Section 10.1(e);

(7) The Agreement for Purchaser’s Acquisition of New Office and Storage Location described in Section 4.5 above;

(8) The mutually acceptable non-potable water delivery agreement as described in Section 3.5 above;

(9) The mutually acceptable potable water delivery agreement as described in Section 3.6 above;

(10) The Assignment and Assumption of the Waste Water Treatment Agreement described in Section 3.7 and attached hereto as Exhibit H;

(11) The mutually acceptable O&M Agreement for Wells and Reservoirs described in Section 3.8 above;

(12) The mutually acceptable O&M Agreement for Ditch System described in Section 3.9 above;

(11) Estimated funds to pay for its share of the costs of Closing;

(12) A certificate of non-foreign status in form and content required by law certifying that Seller is not a “foreign person” as such term is used under Section 1445 of the Internal Revenue Code;

(13) A certificate of resident status in form and content required by law certifying Seller is a “resident person” as such term is used in H.R.S. Section 235-68;

(14) A search conducted by the Title Company confirming that no financing statements or liens have been recorded against the Acquired Assets except for such financing statements and liens that will be released at Closing;

(15) a Good Standing Certificate for Seller issued by the Director of the Department of Commerce and Consumer Affairs for the State of Hawaii, dated not more than five (5) calendar days prior to the Closing Date; and

(16) Such other documents as Purchaser may reasonably request for the purpose of: (i) evidencing the accuracy of any of Seller’s and MLP’s representations and warranties; (ii) evidencing the performance by Seller or MLP or the compliance by Seller or MLP with any covenant or obligation required to be performed or complied with by Seller or MLP; (iii) evidencing the satisfaction of any condition referred to in Article 9; (iv) otherwise facilitating the consummation or performance of any of the Contemplated Transactions, including without limitation a Certificate of an offer of Seller in the form mutually agreed to during the Due Diligence Period, or (v) such other documents and instruments as shall be reasonably necessary to effect the transactions contemplated hereby, or as may be reasonably requested by Purchaser or its counsel.

(b) Purchaser's Deliveries. Not later than two (2) business days prior to Closing, Purchaser will deposit with Escrow, the following funds and documents, in each case duly executed by Purchaser or the appropriate person, and if applicable, acknowledged and in recordable form:

(1) The total Purchase Price pursuant to Section 2 above;

(2) Any required assignment/assumption agreements, including but not limited to those related to the Pre-closing Easements, and Assignment and Assumption of the Wastewater Treatment Agreement;

(3) Agreement for Purchaser’s Acquisition of New Office and Storage Location described in Section 4.5 above;

(4) The non-potable water delivery agreement described in Section 3.5 above;

(5) The potable water delivery agreement described in Section 3.6 above;

(6) The Assignment and Assumption of the Waste Water Treatment Agreement described in Section 3.7 and attached hereto as Exhibit H;

(7) The mutually acceptable O&M Agreement for Wells and Reservoirs described in Section 3.8 above;

(8) The mutually acceptable O&M Agreement for Ditch System described in Section 3.9 above;

(7) Estimated funds to pay for its share of the costs of Closing;

(8) a Good Standing Certificate for Purchaser issued by the Director of the Department of Commerce and Consumer Affairs for the State of Hawaii, dated not more than five (5) calendar days prior to the Closing Date; and

(9) such other documents as Seller may reasonably request for the purpose of: (i) evidencing the accuracy of any of Purchaser’s representations and warranties; (ii) evidencing the performance by Purchaser of, or the compliance by Purchaser of or with, any covenant or obligation required to be performed or complied with by Purchaser; (iii) evidencing the satisfaction of any condition referred to in Article 9; or (iv) otherwise facilitating the consummation or performance of any of the Contemplated Transactions, including without limitation a Certificate of an officer of Purchaser in a form mutually agreed to during the Due Diligence Period, or (v) such other documents and instruments as shall be reasonably necessary to effect the transactions contemplated hereby, or as may be reasonably requested by Seller or its counsel

6.3 Closing Prorations.

(a) Insurance. Purchaser shall pay to Seller the unexpired premium of any insurance policies assigned by Seller to Purchaser; provided, however, Purchaser shall have the option to decline to have the insurance assigned, in which event no adjustment shall be made for insurance.

(b) Revenues. The Parties acknowledge that billing for residential customers’ sewer charges are billed in advance. However, for commercial customers, a monthly minimum service charge is billed in advance and the sewer treatment charge, which is based on the customer’s billed water usage, will be billed in a subsequent billing period. The Parties agree to cooperate with each other to allow the proper sewer charges to be assessed to customers in accordance with the Closing, the intent being that Purchaser and Seller shall each be entitled to sewer revenues including the sewer treatment charge properly allocated for pre-closing and post–closing periods of ownership.

(c) Prepaid Real Property Taxes. Purchaser shall pay to Seller the prorated amount of any real property taxes paid by Seller in connection with any Real Property.

(d) Other Expenses. Except as may otherwise set forth in this Agreement, Closing expenses will be prorated and apportioned as is customary at the Closing.

(e) Time of Prorations. Prorations shall be made as of 12:01 a.m. on the date of the Closing, with Purchaser to be entitled to all revenues (except as set forth above) and to be charged for all expenses for such day. All prorations shall be final. If the amount of any prorated item is not known at Closing, the parties agree that such items shall be prorated at Closing upon the basis of the best information available, and shall be adjusted when the actual amount (s) of such items are known, with appropriate charges and credits to be made. If subsequent to the Closing, any adjustment pursuant to this Section 6.3 shall be necessitated, then either party hereto who is entitled to additional monies shall give written notice to the other party of such additional amounts as may be owing, and such amount shall be paid within five (5) days from receipt of the invoice. The provisions of this Section 6.3(e) shall survive the closing of the Contemplated Transaction.

7. REPRESENTATIONS AND WARRANTIES OF SELLER. Seller and MLP jointly and severally represent and warrant to Purchaser as follows:

7.1. Organization, Standing and Qualifications.

KWC and KWTC are corporations, duly organized, validly existing and in good standing under the laws of the State of Hawaii; and have all requisite corporate power and authority and is entitled to carry on the Business as now being conducted and to own, lease or operate its properties as and in the places where the Business is now conducted. Seller is engaged in the business of a water and wastewater utility serving areas in Kapalua, Maui, Hawaii, and with respect to which, it holds valid permits issued by the State of Hawaii and Maui County. There are no dissolution, disassociation, winding-up, liquidation or bankruptcy proceedings pending or threatened against Seller or MLP. There are no events which could result in a dissolution of Seller or MLP. Seller is not doing business in any state other than Hawaii. Seller does not own, directly or indirectly, any interest or investment (whether equity or debt) in or control any corporation, partnership, business, trust, joint venture or other entity. Complete and accurate copies of the governing documents of Seller, as currently in effect, are attached as Exhibit 7.1. There are no contracts relating to the issuance, sale or transfer of any equity securities or other securities of Seller. MLP is the sole shareholder of KWC and KWTC.

7.2. Authorization of Agreement. Upon receipt of the approval of Seller’s Board of Directors and of MLP, no approvals or consents of any person other than the Commission are necessary for or in connection with the performance of Seller’s and MLP’s obligations hereunder. No other corporate proceeding on the part of KWC, KWTC or MLP is necessary to authorize this Agreement and the Contemplated Transaction. This Agreement has been duly and validly executed by an authorized officer of KWC, KWTC and MLP and along with any and all documents and agreements to be executed and delivered by KWC, KWTC and MLP, as the case may be, are valid and binding on KWC, KWTC and MLP in accordance with their respective terms.

7.3. Assets of Business.

(a) All of the assets required to operate the Business are included with the Acquired Assets and Seller has sole, exclusive, good and marketable title to all of the Acquired Assets, which shall be conveyed free and clear of all liens, mortgages, pledges, encumbrances, and any other restrictions or defects in title excepting only those liabilities and obligations, if any, which are expressly to be assumed by Purchaser hereunder.

(b) Except for such covenants, representations and warranties that are expressly set forth in this Agreement or in the documents to be delivered at the Closing the Easements and Acquired Assets are being sold “as is, where is.”

7.4 Licenses. To Seller’s actual knowledge and to MLP’s actual knowledge, Seller possesses and holds in its name all licenses, permits, consents, franchises, approvals, authorization, qualifications, and orders of all Governmental Bodies required to enable Seller to conduct its business as presently conducted and to own, lease and operate its assets as presently owned, leased and operated. To Seller’s or MLP’s knowledge, all of the Licenses held by Seller are in full force and effect and there is no default of any provision thereof which would affect the ability of Seller to engage in its business. No action is pending or, to Seller’s or MLP’s knowledge, threatened, seeking the suspension, modification, cancellation, revocation or limitation of any License and, to Seller’s or MLP’s knowledge, there is no basis for such actions.

7.5 Financial Statements. The Seller financial statements delivered to Purchaser pursuant to this Agreement are true and correct in all material respects, fairly present the financial position of Seller as of the respective dates of the balance sheets included in the Seller financial statements, and the results of its operations for the respective periods indicated.

7.6 Liabilities. Except as set forth in the Seller’s financial statements there are to neither Seller’s actual knowledge or MLP’s actual knowledge, any liabilities, fixed or contingent, known or unknown, to which Seller, its business or assets are subject, other than those incurred in the ordinary course of business consistent with past practices. Seller is not a party to, nor are its Assets bound by, any agreement not entered into in the ordinary course of business, or any indenture, mortgage, deed of trust, lease or any agreement that is unusual in nature, duration or amount (including, without limitation, any agreement requiring the performance by Seller of any obligation for a period of time extending beyond one year from the Closing Date, calling for consideration of more than $5,000, or requiring purchase at prices in excess of prevailing market prices). Seller is not a party to, nor is Seller or any of its assets bound by, any agreement that is materially adverse to the business, assets, prospects or financial condition of Seller. Except as disclosed to Purchaser, there are no royalty obligations, warranty and guarantee obligations, product liability obligations, or easement maintenance obligations with respect to the Acquired Assets.

7.7 Leases, Liens and Encumbrances; Real Property. Seller is not a party to any agreement for the lease of real property, and Seller owns all tangible personal property and other assets necessary to conduct the Business as now conducted not subject to any lien or encumbrance. Schedule 7.7 contains a correct legal description, street address (if any) and tax parcel identification number of all Real Property including tracts, parcels and subdivided lots and easements which Seller is using in the Business. Seller has good title to such Real Property. The Real Property may have the following encumbrances: (i) liens for taxes for the current tax year which are not yet due and payable; and (ii) those Encumbrances deemed acceptable to Purchaser during the Due Diligence Period. True and complete copies of (A) all deeds, existing title insurance policies and surveys of or pertaining to the Real Property, and (B) all instruments, agreements and other documents evidencing, creating or constituting any encumbrances on the Real Property have been delivered to Purchaser.

7.8. Customer Agreements and Will Serve Letters. The customer agreements and will serve letters identified in Exhibit N attached hereto and incorporated herein by reference represent all existing customer agreements and will serve letters issued by Seller. True, correct and complete copies of these customer agreements and will serve letters have been provided to Purchaser.

7.9 Payment of Taxes. Seller has filed all federal, state and local tax returns required to be filed, and has paid all taxes owed by Seller including all taxes shown by those returns to be due and payable with respect to the Business. Seller have made (or will make as of the Closing) timely payment of all applicable taxes. There are no Encumbrances on any of the Acquired Assets that arose in connection with any failure (or alleged failure) to pay any Tax. Seller has withheld and paid all taxes required to have been withheld and paid in connection with any amounts paid or owing to any employee, independent contractor, creditor, member, stockholder, or other third party. Forms W-2 and 1099 required with respect thereto have been properly completed and timely filed. There are no audits or examinations of any tax returns pending or threatened that relate to Seller's operation of the Utility Systems or the Acquired Assets. Seller is not a party to any action or proceeding by any governmental body for the assessment or collection of taxes relating to the operation of the Utility Systems or Acquired Assets, nor has such event been asserted or threatened.

7.10. No Adverse Conditions. Except as disclosed by Seller to Purchaser in writing, to neither Seller’s actual knowledge or MLP’s actual knowledge, there is no legal action, suit, claim, investigation, or other proceeding, whether civil, criminal, or administrative, is pending or threatened against or affecting KWC, KWTC, MLP or the Acquired Assets.

7.11. Adequate Advice. Seller and MLP have had the opportunity to receive independent tax and legal advice, at Seller's cost, with respect to the advisability of executing this Agreement.

7.12. No Broker's Fees. Seller will not have any liability or obligation to pay any fees or commission to any broker, finder, or agent with respect to the Contemplated Transaction for which Purchaser could become liable or obligated.

7.13. Compliance with Laws. To the best of actual Seller’s or MLP’s knowledge, Seller is in compliance with, and not in violation of, all applicable laws, rules, regulations, and ordinances affecting the Business and the Acquired Assets.

7.14 No Hazardous Waste. Neither Seller or MLP have received written notice from any government agency alleging that Acquired Assets (a) contain, or have been contaminated by or used for the storage, disposal or release of “Hazardous Materials” or (b) contain any underground storage tanks. To Seller’s or MLP’s actual knowledge there are no Hazardous Materials on any of the Acquired Assets or used in connection with the Business or Acquired Assets, other than Hazardous Materials that are used in the ordinary course of business, and which are not required under current law to be remediated or disposed of in their current state. For purposes of this Agreement, the term “Hazardous Materials” includes, without limitation, asbestos, any substance containing more than 0.1 percent asbestos, the group of compounds known as polychlorinated biphenyls, flammable explosives, radioactive materials, petroleum and petroleum by-products, pollutants, effluents, contaminants, hazardous materials, hazardous wastes, hazardous or toxic substances, and any materials included in the definitions of hazardous or toxic waste, materials or substances (regardless of concentration) in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (42 U.S.C. Sections 9601, et seq.), the Hazardous Materials Transportation act, as amended (49 U.S.C. Sections 1801, et seq.), the Resource Conservation and Recovery act of 1976, as amended (42 U.S.C. Sections 6901, et seq.), and in the regulations adopted and publications promulgated pursuant thereto, or any other federal, state or local environmental laws, ordinances, rules, or regulations.

7.15 Compliance with Water Quality Requirements. Neither Seller or MLP have received written notice from a governmental agency alleging current or pending violations of applicable federal, state and local water quality regulations and requirements.

7.16 Environmental Matters. Neither Seller or MLP have received written notice from a governmental agency alleging that Seller is not in compliance with all Environmental Laws. To Seller’s knowledge and to MLP’s knowledge there are no pending or threatened claims arising pursuant to any Environmental Law which relate to any of the Acquired Assets or the Business. For purposes of this Agreement, “Environmental Law” means any federal, state, local, municipal, foreign, international, multinational or other constitution, law, ordinance, principle of common law, code, regulation, statute or treaty that requires or relates to: (a) advising appropriate authorities, employees or the public of intended or actual releases of pollutants or hazardous substances or materials, violations of discharge limits or other prohibitions and the commencement of activities, such as resource extraction or construction, that could have significant impact on the Environment; (b) preventing or reducing to acceptable levels the release of pollutants or hazardous substances or materials into the environment; (c) reducing the quantities, preventing the release or minimizing the hazardous characteristics of wastes that are generated; (d) assuring that products are designed, formulated, packaged and used so that they do not present unreasonable risks to human health or the environment when used or disposed of; protecting resources, species or ecological amenities; (e) reducing to acceptable levels the risks inherent in the transportation of hazardous substances, pollutants, oil or other potentially harmful substances; and (f) cleaning up pollutants that have been released, preventing the threat of release or paying the costs of such clean up or prevention; or making responsible parties pay private parties, or groups of them, for damages done to their health or the environment or permitting self-appointed representatives of the public interest to recover for injuries done to public assets.

7.17 Conduct of Business in Ordinary Course. From the Effective Date until the Closing Date, there has not been nor will there be any:

(a) Transaction by KWC, KWTC or MLP (on behalf of the Business), except in the ordinary course of business as conducted on that date consistent with past practices;

(b) Capital expenditure by KWC, KWTC or MLP except as otherwise provided in this Agreement;

(c) Obligation incurred by KWTC, KWC or MLP (on behalf of the Business), except trade or business obligations incurred in the ordinary course of business consistent with past practices and the payment of Purchaser’s invoices described in Section 4.2 above;

(d) Cancellation or compromise by KWC, KWTC or MLP (on behalf of the Business), of any debt or claim, except in the ordinary course of business consistent with past practices;

(e) Material Adverse Change in the financial condition, liabilities, assets, business, or results of operations of Seller. For purposes of this Agreement, Material Adverse Change means with respect to KWC or KWTC any event, change, development, or occurrence that, individually or together with any other event, change, development, or occurrence, is materially adverse to their respective Business, condition (financial or otherwise), assets, results of operations, or prospects.

(f) Destruction, damage to or loss of any assets of Seller (if used by Seller in providing utility service), whether or not covered by insurance, that materially and adversely affects the financial condition, business or operations of the Business;

(g) Sale or transfer of any asset of Seller (if used by Seller in providing utility services), except in the ordinary course of business consistent with past practices;

(h) Execution, creation, amendment or termination of any material contract, agreement or license to which KWC, KWTC or MLP on behalf of the Business is a party, except in the ordinary course of business consistent with past practices;

(i) Waiver or release of any right or claim of KWC, KWTC or MLP (on behalf of the Business), material to the Business or the Systems, except in the ordinary course of business;

(j) Mortgage, pledge or other encumbrance of any asset of KWTC, KWC or MLP (if used by KWC or KWTC in providing utility services);

(k) Cancellation or the giving of notice of cancellation of any insurance policy insuring KWC or KWTC, its Business or assets;

(l) Other event or condition within Seller’s or MLP’s control of any character that has or might reasonably have a material and adverse effect on the financial condition, assets, business or results of operations of KWC or KWTC; or

(m) Agreement by KWC, KWTC or MLP (on behalf of the Business), to do any of the things described in the preceding clauses (a) through (l) except as agreed to in writing by Purchaser.

7.18 Tax Returns. Within the times and in the manner prescribed by law, KWC, KWTC or MLP (on behalf of the Business), has filed or caused to be filed all federal, state and local tax returns required by law, on a consolidated or individual basis, as appropriate, and has paid all taxes, assessments and penalties due and payable. These tax returns reflect KWC’s, KWTC’s and Seller’s liability for taxes applicable to KWC and KWTC operations for the periods covered thereby.

7.19 Agreement Will Not Cause Breach or Violation. Neither the entering into this Agreement nor the consummation of the Contemplated Transaction will directly or indirectly (with or without notice or lapse of time) result in or constitute any of the following: (a) a default or any event that would be a default, breach or violation of (i) the Articles of Incorporation or By-Laws of Seller or MLP or (ii) any material lease, franchise, license, promissory note, conditional sales contract, commitment, indenture, mortgage, deed of trust, or other agreement, instrument, or arrangement to which Seller or MLP is a party or by which Seller, MLP, the Business or its assets are bound, (b) an event that would permit any party to terminate any material agreement or policy of insurance of Seller, (c) the creation of imposition of any lien, charge or encumbrance on any of the Acquired Assets, or (d) the violation of any permit, license, law, regulation, ordinance, judgment, order or decree applicable to or affecting Seller, MLP, or the Business, its assets or financial condition which would have an adverse effect on the Systems or give any governmental body the right to revoke, withdraw, suspend, cancel, terminate or modify, any governmental authorization that is held by Seller or that otherwise relates to the Acquired Assets or to the Business. Other than the approval of the Commission and, potentially, the County with respect to the Assignment and Assumption of Wastewater Agreement, neither Seller nor MLP is required to give any notice to or obtain any consent from any person, entity or governmental body in connection with the execution and delivery of this Agreement or the consummation or performance of any of the Contemplated Transactions.

7.20 Duration of Representation and Warranties. The representation and warranties made hereinabove will be correct and accurate in all material respects as of the Closing and shall survive the Closing for a period of three (3) years.

7.21 Disclosure. To Seller’s actual knowledge and to MLP’s actual knowledge, no representation or warranty or other statement made by Seller or MLP in this Agreement, any Schedule to this Agreement or supplement hereto or any document delivered in connection with this Agreement or otherwise in connection with the Contemplated Transactions contains any untrue statement or omits to state a material fact necessary to make any of them, in light of the circumstances in which it was made, not misleading.

7.23 Insurance. During the Due Diligence Period Seller shall provide Purchaser with a list of all policies or binders of fire, liability, product liability, worker’s compensation, vehicular and other insurance held by or on behalf of the Seller. Such policies and binders are valid and binding in accordance with their terms, are in full force and effect, and insure against risks and liabilities to an extent and in a manner customary in the industries in which the Seller operates. Seller is not in default with respect to any provision contained in any such policy or binder and has not failed to give any notice or present any claim under any such policy or binder in due and timely fashion. Except as disclosed by Seller in writing, there are no outstanding unpaid claims under any such policy or binder, and the Seller has not received any notice of cancellation or non-renewal of any such policy or binder. Except as disclosed by Seller in writing, the Seller has not received any notice from any of its insurance carriers that any insurance premiums will or may be materially increased in the future or that any listed insurance coverage will or may not be available in the future on substantially the same terms as now in effect, and to Seller’s actual knowledge and to MLP’s actual knowledge, there is no basis for the issuance of any such notice or for any such action.

7.24 Solvency. Seller is not now insolvent and will not be rendered insolvent by any of the Contemplated Transactions by this Agreement. As used herein, “insolvent” means that the sum of the debts and other probable liabilities of Seller exceeds the present fair saleable value of the Seller’s assets.

8. REPRESENTATIONS AND WARRANTIES OF PURCHASER.

Purchaser represents and warrants to Seller as follows:

8.1. Organization, Standing and Qualifications. Purchaser is a corporation, duly organized, validly existing and in good standing under the laws of the State of Hawaii; it has all requisite corporate power and authority and is entitled to carry on its business as now being conducted and to own, lease or operate its properties as and in the places where such business is now conducted.

8.2. No Adverse Conditions. No legal action, suit, claim, investigation, or other proceeding, whether civil, criminal, or administrative, is pending or threatened against Purchaser that would adversely affect its ability to consummate the Contemplated Transaction.

8.3. Adequate Advice. Purchaser has had the opportunity to receive independent tax and legal advice, at Purchaser's cost, with respect to the advisability of executing this Agreement.

8.4. No Broker's Fees. Purchaser has no liability or obligation to pay any fees or commission to any broker, finder, or agent with respect to the Contemplated Transaction for which Seller could become liable or obligated. If Purchaser has retained a broker, any fees or commissions owing to said broker are solely the obligation of Purchaser.

8.5. Agreement Will Not Cause Breach or Violation. Neither the entry into this Agreement nor the consummation of the Contemplated Transaction will result in or constitute any of the following: (a) a default or any event that, with notice or lapse of time, or both, would be a default, breach or violation of the Articles of Incorporation or By-Laws of Purchaser or of any material lease, franchise, license, promissory note, conditional sales contract, commitment, indenture, mortgage, deed of trust, or other agreement, instrument, or arrangement to which Purchaser or is a party or by which Purchaser or its assets are bound, or (b) the violation of any permit, license, law, regulation, ordinance, judgment, order or decree applicable to or affecting Purchaser or its business, assets or financial condition which would have a material adverse effect on its business.

8.6 Duration of Representation and Warranties. The representation and warranties made hereinabove will be correct and accurate in all material respects as of the Closing Date and shall survive the Closing Date for a period of three (3) years.

9. CONDITIONS PRECEDENT TO OBLIGATIONS TO CLOSE.

9.1. Conditions to Purchaser's Obligation. All obligations of Purchaser hereunder are subject at the option of Purchaser, to the fulfillment of each of the following conditions at or prior to the Closing, and Seller and MLP shall exert their best efforts to cause such condition to be so fulfilled:

(a) All representations and warranties of Seller and MLP contained herein shall be true and correct in all material respects at and as of the date of the Closing (said representations and warranties to survive Closing), except for changes in ordinary course of business after the date hereof;

(b) All covenants, agreements and obligations required by the terms of this Agreement to be performed by Seller or MLP at or before the Closing shall have been duly and properly performed in all material respects and all deliverables to be provided by Seller and MLP at Closing as described in Section 6.2(a) shall have been duly executed and delivered;

(c) No action, suit or proceeding shall be pending or threatened before any court, governmental agency or authority to enjoin, restrain or prohibit this Agreement or the consummation of the Contemplated Transaction or threaten the Acquired Assets in a material manner;

(d) No Material Adverse Change shall have occurred with respect to the operation, condition, finances or prospects of the Business or the Acquired Assets since the Effective Date;

(e) That approval for the transfer of the Acquired Assets and the Contemplated Transaction, including (i) the existing water wheeling agreement with the golf course, and (ii) the ability of Purchaser to serve the Kapalua future expansion area, have been duly and properly obtained from the Commission in form and content acceptable to Purchaser in its sole and absolute discretion;

(f) That DOH authorization for Purchaser to operate the Systems shall be in full force and effect on the Closing;

(g) That the transfers of the Acquired Assets, except for Post-closing Easements, concurrently close;

(h) That all material agreements, consents, and approvals of any persons necessary to the consummation of the Contemplated Transaction, or otherwise pertaining to the matters covered by it, shall have been obtained by Seller or Purchaser as the case may be, and delivered to the Parties; including without limitation, approval of the Commission and the consent of the County of Maui to the Assignment and Assumption of Wastewater Agreement (or in lieu thereof evidence to Purchaser’s sole satisfaction that the County of Maui’s consent is not required) ;

(i) that Purchaser has been satisfied with the conclusions and results of its due diligence;

(j) that Purchaser has received approval of its Board of Directors no later than the end of the Due Diligence Period;

(k) Purchaser shall be satisfied with all inspections and investigations concerning title to and surveys of the Real Property, Easements, Water Rights and other Acquired Assets. Failure of Purchaser to be satisfied under this section is not a breach of this Agreement by Seller.

(l) that Purchaser shall have received an irrevocable commitment from a title company of its choice for an ALTA Extended Owner’s policy of title insurance for the Real Property and Easements to be issued to and acceptable to Purchaser, including such endorsements and in such amounts as Purchaser may reasonably require, effective as of the Closing Date.

9.2. Conditions to Seller's Obligation. All obligations of Seller hereunder are subject at the option of Seller, to the fulfillment of each of the following conditions at or prior to the Closing, and Purchaser shall exert its best efforts to cause such condition to be so fulfilled:

(a) All representations and warranties of Purchaser contained herein shall be true and correct in all material respects at and as of the date of the Closing (said representations and warranties to survive Closing);

(b) All covenants, agreements and obligations required by the terms of this Agreement to be performed by Purchaser at or before the Closing shall have been duly and properly performed in all material respects and all deliverables to be provided by Purchaser at Closing as described in Section 6.2(b) shall have been duly executed and delivered;