Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00859

MASSACHUSETTS INVESTORS GROWTH STOCK FUND

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2014

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

SEMIANNUAL REPORT

May 31, 2014

MASSACHUSETTS INVESTORS GROWTH STOCK FUND

MIG-SEM

Table of Contents

MASSACHUSETTS INVESTORS

GROWTH STOCK FUND

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

After gaining momentum late last year, U.S. economic output contracted this winter, as severe weather curtailed activity. More recently, various indicators show that the

U.S. economy could be regaining traction.

Although Europe emerged from its recession almost a year ago, its pace of growth has been slow, and high unemployment persists, along with the risk of deflation. Asia remains vulnerable. China’s economic growth has slowed, and Japan’s early progress toward an economic turnaround continues to face obstacles, including the recent sales tax increase. Emerging markets have been more turbulent.

With so much uncertainty, global financial markets began 2014 with much greater volatility than last year’s broad-based rally.

For equity investors, paying attention to company fundamentals has become more important. Bond investors have been attuned to heightened risks from possible interest rate increases.

As always at MFS®, active risk management is integral to how we manage your investments. We use a collaborative process, sharing insights across asset classes, regions and economic sectors. Our global team of investment professionals uses a multidiscipline, long-term, diversified investment approach.

We understand that these are challenging economic times. We believe that we can serve you best by applying proven principles, such as asset allocation and diversification, over the long term. We are confident that this approach can serve you well as you work with your financial advisors to reach your goals in the years ahead.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management

July 16, 2014

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

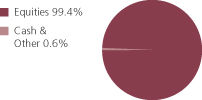

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets as of 5/31/14.

The portfolio is actively managed and current holdings may be different.

2

Table of Contents

Fund expenses borne by the shareholders during the period,

December 1, 2013 through May 31, 2014

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period December 1, 2013 through May 31, 2014.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Table of Contents

Expense Table – continued

| Share Class |

Annualized Ratio |

Beginning Account Value 12/01/13 |

Ending Account Value |

Expenses Paid During |

||||||||||||||

| A | Actual | 0.72% | $1,000.00 | $1,071.05 | $3.72 | |||||||||||||

| Hypothetical (h) | 0.72% | $1,000.00 | $1,021.34 | $3.63 | ||||||||||||||

| B | Actual | 1.48% | $1,000.00 | $1,066.94 | $7.63 | |||||||||||||

| Hypothetical (h) | 1.48% | $1,000.00 | $1,017.55 | $7.44 | ||||||||||||||

| C | Actual | 1.48% | $1,000.00 | $1,066.80 | $7.63 | |||||||||||||

| Hypothetical (h) | 1.48% | $1,000.00 | $1,017.55 | $7.44 | ||||||||||||||

| I | Actual | 0.48% | $1,000.00 | $1,071.96 | $2.48 | |||||||||||||

| Hypothetical (h) | 0.48% | $1,000.00 | $1,022.54 | $2.42 | ||||||||||||||

| R1 | Actual | 1.48% | $1,000.00 | $1,067.11 | $7.63 | |||||||||||||

| Hypothetical (h) | 1.48% | $1,000.00 | $1,017.55 | $7.44 | ||||||||||||||

| R2 | Actual | 0.98% | $1,000.00 | $1,069.31 | $5.06 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,020.04 | $4.94 | ||||||||||||||

| R3 | Actual | 0.72% | $1,000.00 | $1,070.72 | $3.72 | |||||||||||||

| Hypothetical (h) | 0.72% | $1,000.00 | $1,021.34 | $3.63 | ||||||||||||||

| R4 | Actual | 0.48% | $1,000.00 | $1,072.08 | $2.48 | |||||||||||||

| Hypothetical (h) | 0.48% | $1,000.00 | $1,022.54 | $2.42 | ||||||||||||||

| R5 | Actual | 0.40% | $1,000.00 | $1,072.50 | $2.07 | |||||||||||||

| Hypothetical (h) | 0.40% | $1,000.00 | $1,022.94 | $2.02 | ||||||||||||||

| 529A | Actual | 0.74% | $1,000.00 | $1,070.76 | $3.82 | |||||||||||||

| Hypothetical (h) | 0.74% | $1,000.00 | $1,021.24 | $3.73 | ||||||||||||||

| 529B | Actual | 1.52% | $1,000.00 | $1,066.66 | $7.83 | |||||||||||||

| Hypothetical (h) | 1.52% | $1,000.00 | $1,017.35 | $7.64 | ||||||||||||||

| 529C | Actual | 1.53% | $1,000.00 | $1,066.50 | $7.88 | |||||||||||||

| Hypothetical (h) | 1.53% | $1,000.00 | $1,017.30 | $7.70 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class A, Class R3, and Class 529A shares, this rebate reduced the expense ratio above by 0.01%, 0.01%, and 0.04%, respectively. See Note 3 in the Notes to Financial Statements for additional information.

4

Table of Contents

5/31/14 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Common Stocks - 99.4% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Aerospace - 4.0% | ||||||||

| Precision Castparts Corp. | 264,675 | $ | 66,957,483 | |||||

| United Technologies Corp. | 1,625,568 | 188,923,514 | ||||||

|

|

|

|||||||

| $ | 255,880,997 | |||||||

| Alcoholic Beverages - 1.7% | ||||||||

| Pernod Ricard S.A. | 900,311 | $ | 110,391,940 | |||||

| Apparel Manufacturers - 4.7% | ||||||||

| LVMH Moet Hennessy Louis Vuitton S.A. | 818,123 | $ | 162,766,995 | |||||

| NIKE, Inc., “B” | 860,942 | 66,215,049 | ||||||

| VF Corp. | 1,149,576 | 72,446,280 | ||||||

|

|

|

|||||||

| $ | 301,428,324 | |||||||

| Automotive - 1.0% | ||||||||

| Johnson Controls, Inc. | 1,265,268 | $ | 61,188,360 | |||||

| Broadcasting - 9.2% | ||||||||

| Discovery Communications, Inc., “A” (a) | 1,071,880 | $ | 82,491,885 | |||||

| Omnicom Group, Inc. | 533,250 | 37,940,738 | ||||||

| Time Warner, Inc. | 2,177,580 | 152,060,411 | ||||||

| Twenty-First Century Fox, Inc. | 2,960,300 | 104,824,223 | ||||||

| Viacom, Inc., “B” | 523,330 | 44,655,749 | ||||||

| Walt Disney Co. | 1,990,460 | 167,218,545 | ||||||

|

|

|

|||||||

| $ | 589,191,551 | |||||||

| Brokerage & Asset Managers - 3.9% | ||||||||

| Charles Schwab Corp. | 1,133,730 | $ | 28,581,333 | |||||

| CME Group, Inc. | 1,111,720 | 80,043,840 | ||||||

| Franklin Resources, Inc. | 2,557,978 | 141,225,965 | ||||||

|

|

|

|||||||

| $ | 249,851,138 | |||||||

| Business Services - 5.6% | ||||||||

| Accenture PLC, “A” | 3,182,874 | $ | 259,245,087 | |||||

| Cognizant Technology Solutions Corp., “A” (a) | 997,800 | 48,503,058 | ||||||

| Experian Group Ltd. | 1,614,350 | 28,060,945 | ||||||

| MSCI, Inc., “A” (a) | 503,014 | 21,710,084 | ||||||

|

|

|

|||||||

| $ | 357,519,174 | |||||||

| Chemicals - 1.5% | ||||||||

| Monsanto Co. | 815,175 | $ | 99,329,074 | |||||

5

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Computer Software - 3.0% | ||||||||

| Oracle Corp. | 4,526,191 | $ | 190,190,546 | |||||

| Computer Software - Systems - 4.1% | ||||||||

| Apple, Inc. | 79,754 | $ | 50,484,282 | |||||

| EMC Corp. | 5,713,086 | 151,739,564 | ||||||

| International Business Machines Corp. | 314,445 | 57,971,080 | ||||||

|

|

|

|||||||

| $ | 260,194,926 | |||||||

| Construction - 1.0% | ||||||||

| Sherwin-Williams Co. | 325,292 | $ | 66,557,996 | |||||

| Consumer Products - 6.3% | ||||||||

| Church & Dwight Co., Inc. | 581,884 | $ | 40,283,829 | |||||

| Colgate-Palmolive Co. | 3,113,915 | 212,991,786 | ||||||

| Procter & Gamble Co. | 1,853,571 | 149,750,001 | ||||||

|

|

|

|||||||

| $ | 403,025,616 | |||||||

| Electrical Equipment - 9.4% | ||||||||

| Amphenol Corp., “A” | 506,010 | $ | 48,475,758 | |||||

| Danaher Corp. | 2,688,336 | 210,846,192 | ||||||

| Mettler-Toledo International, Inc. (a) | 415,454 | 101,794,539 | ||||||

| Sensata Technologies Holding B.V. (a) | 3,119,367 | 133,789,651 | ||||||

| W.W. Grainger, Inc. | 423,210 | 109,344,768 | ||||||

|

|

|

|||||||

| $ | 604,250,908 | |||||||

| Electronics - 2.9% | ||||||||

| Microchip Technology, Inc. | 2,041,021 | $ | 97,152,600 | |||||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 4,442,561 | 91,339,054 | ||||||

|

|

|

|||||||

| $ | 188,491,654 | |||||||

| Energy - Independent - 0.8% | ||||||||

| Occidental Petroleum Corp. | 545,583 | $ | 54,389,169 | |||||

| Food & Beverages - 4.5% | ||||||||

| Groupe Danone | 1,668,897 | $ | 124,280,897 | |||||

| Mead Johnson Nutrition Co., “A” | 1,245,590 | 111,442,937 | ||||||

| PepsiCo, Inc. | 578,918 | 51,135,827 | ||||||

|

|

|

|||||||

| $ | 286,859,661 | |||||||

| Food & Drug Stores - 2.5% | ||||||||

| CVS Caremark Corp. | 2,037,476 | $ | 159,575,120 | |||||

| General Merchandise - 0.5% | ||||||||

| Target Corp. | 575,192 | $ | 32,647,898 | |||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Internet - 5.6% | ||||||||

| eBay, Inc. (a) | 876,195 | $ | 44,449,372 | |||||

| Google, Inc., “A” (a) | 546,068 | 312,159,772 | ||||||

|

|

|

|||||||

| $ | 356,609,144 | |||||||

| Medical & Health Technology & Services - 2.5% | ||||||||

| Express Scripts Holding Co. (a) | 1,906,223 | $ | 136,237,758 | |||||

| Patterson Cos., Inc. | 699,458 | 27,390,775 | ||||||

|

|

|

|||||||

| $ | 163,628,533 | |||||||

| Medical Equipment - 6.4% | ||||||||

| Abbott Laboratories | 2,131,130 | $ | 85,266,511 | |||||

| DENTSPLY International, Inc. | 2,013,763 | 95,230,852 | ||||||

| St. Jude Medical, Inc. | 552,040 | 35,827,396 | ||||||

| Thermo Fisher Scientific, Inc. | 1,209,203 | 141,367,923 | ||||||

| Waters Corp. (a) | 557,620 | 55,851,219 | ||||||

|

|

|

|||||||

| $ | 413,543,901 | |||||||

| Metals & Mining - 0.4% | ||||||||

| Rio Tinto PLC | 524,227 | $ | 26,862,143 | |||||

| Oil Services - 2.9% | ||||||||

| Schlumberger Ltd. | 1,777,390 | $ | 184,919,656 | |||||

| Other Banks & Diversified Financials - 4.8% | ||||||||

| MasterCard, Inc., “A” | 1,038,634 | $ | 79,403,569 | |||||

| Visa, Inc., “A” | 1,055,265 | 226,702,580 | ||||||

|

|

|

|||||||

| $ | 306,106,149 | |||||||

| Pharmaceuticals - 3.9% | ||||||||

| Allergan, Inc. | 196,161 | $ | 32,849,121 | |||||

| Johnson & Johnson | 833,985 | 84,616,118 | ||||||

| Zoetis, Inc. | 4,406,270 | 135,272,489 | ||||||

|

|

|

|||||||

| $ | 252,737,728 | |||||||

| Printing & Publishing - 0.7% | ||||||||

| Equifax, Inc. | 631,260 | $ | 44,686,895 | |||||

| Restaurants - 1.7% | ||||||||

| McDonald’s Corp. | 1,102,183 | $ | 111,794,422 | |||||

| Specialty Chemicals - 1.7% | ||||||||

| Praxair, Inc. | 845,236 | $ | 111,774,009 | |||||

| Specialty Stores - 0.7% | ||||||||

| Industria de Diseno Textil S.A. | 294,655 | $ | 42,776,679 | |||||

7

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Trucking - 1.5% | ||||||||

| Expeditors International of Washington, Inc. | 2,071,140 | $ | 94,257,581 | |||||

| Total Common Stocks (Identified Cost, $4,811,810,137) | $ | 6,380,660,892 | ||||||

| Money Market Funds - 0.5% | ||||||||

| MFS Institutional Money Market Portfolio, 0.07%, at Cost and Net Asset Value (v) |

29,197,564 | $ | 29,197,564 | |||||

| Total Investments (Identified Cost, $4,841,007,701) | $ | 6,409,858,456 | ||||||

| Other Assets, Less Liabilities - 0.1% | 5,957,692 | |||||||

| Net Assets - 100.0% | $ | 6,415,816,148 | ||||||

| (a) | Non-income producing security. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

See Notes to Financial Statements

8

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 5/31/14 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

| Investments- |

||||

| Non-affiliated issuers, at value (identified cost, $4,811,810,137) |

$6,380,660,892 | |||

| Underlying affiliated funds, at cost and value |

29,197,564 | |||

| Total investments, at value (identified cost, $4,841,007,701) |

$6,409,858,456 | |||

| Receivables for |

||||

| Fund shares sold |

5,582,760 | |||

| Interest and dividends |

10,684,461 | |||

| Other assets |

133,281 | |||

| Total assets |

$6,426,258,958 | |||

| Liabilities | ||||

| Payable for fund shares reacquired |

$6,557,650 | |||

| Payable to affiliates |

||||

| Investment adviser |

177,464 | |||

| Shareholder servicing costs |

3,313,447 | |||

| Distribution and service fees |

43,640 | |||

| Program manager fees |

53 | |||

| Payable for independent Trustees’ compensation |

190,152 | |||

| Accrued expenses and other liabilities |

160,404 | |||

| Total liabilities |

$10,442,810 | |||

| Net assets |

$6,415,816,148 | |||

| Net assets consist of | ||||

| Paid-in capital |

$4,705,837,981 | |||

| Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies |

1,568,885,485 | |||

| Accumulated net realized gain (loss) on investments and foreign currency |

120,702,215 | |||

| Undistributed net investment income |

20,390,467 | |||

| Net assets |

$6,415,816,148 | |||

| Shares of beneficial interest outstanding |

272,441,145 |

9

Table of Contents

Statement of Assets and Liabilities (unaudited) – continued

| Net assets | Shares outstanding |

Net asset value per share (a) |

||||||||||

| Class A |

$3,631,621,459 | 153,342,759 | $23.68 | |||||||||

| Class B |

95,327,069 | 4,503,297 | 21.17 | |||||||||

| Class C |

260,191,593 | 12,357,295 | 21.06 | |||||||||

| Class I |

437,915,575 | 18,092,444 | 24.20 | |||||||||

| Class R1 |

36,692,744 | 1,756,511 | 20.89 | |||||||||

| Class R2 |

205,868,475 | 8,894,026 | 23.15 | |||||||||

| Class R3 |

496,540,864 | 21,143,334 | 23.48 | |||||||||

| Class R4 |

922,607,331 | 38,735,442 | 23.82 | |||||||||

| Class R5 |

315,901,846 | 13,035,859 | 24.23 | |||||||||

| Class 529A |

9,766,676 | 416,626 | 23.44 | |||||||||

| Class 529B |

521,476 | 25,103 | 20.77 | |||||||||

| Class 529C |

2,861,040 | 138,449 | 20.66 | |||||||||

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Classes A and 529A, for which the maximum offering prices per share were $25.12 [100 / 94.25 x $23.68] and $24.87 [100 / 94.25 x $23.44], respectively. On sales of $50,000 or more, the maximum offering prices of Class A and Class 529A shares are reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B, and Class 529C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, R5, and 529A. |

See Notes to Financial Statements

10

Table of Contents

Financial Statements

Six months ended 5/31/14 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income | ||||

| Income |

||||

| Dividends |

$46,873,950 | |||

| Interest |

486,037 | |||

| Dividends from underlying affiliated funds |

25,523 | |||

| Foreign taxes withheld |

(1,149,049 | ) | ||

| Total investment income |

$46,236,461 | |||

| Expenses |

||||

| Management fee |

$10,066,728 | |||

| Distribution and service fees |

7,361,543 | |||

| Program manager fees |

6,216 | |||

| Shareholder servicing costs |

3,648,098 | |||

| Administrative services fee |

235,821 | |||

| Independent Trustees’ compensation |

49,946 | |||

| Custodian fee |

112,609 | |||

| Shareholder communications |

120,710 | |||

| Audit and tax fees |

31,372 | |||

| Legal fees |

23,194 | |||

| Miscellaneous |

231,340 | |||

| Total expenses |

$21,887,577 | |||

| Fees paid indirectly |

(8 | ) | ||

| Reduction of expenses by investment adviser and distributor |

(246,439 | ) | ||

| Net expenses |

$21,641,130 | |||

| Net investment income |

$24,595,331 | |||

| Realized and unrealized gain (loss) on investments and foreign currency |

||||

| Realized gain (loss) (identified cost basis) |

||||

| Investments |

$177,175,566 | |||

| Foreign currency |

(108,467 | ) | ||

| Net realized gain (loss) on investments and foreign currency |

$177,067,099 | |||

| Change in unrealized appreciation (depreciation) |

||||

| Investments |

$220,063,148 | |||

| Translation of assets and liabilities in foreign currencies |

(55,204 | ) | ||

| Net unrealized gain (loss) on investments and foreign currency translation |

$220,007,944 | |||

| Net realized and unrealized gain (loss) on investments and foreign currency |

$397,075,043 | |||

| Change in net assets from operations |

$421,670,374 | |||

See Notes to Financial Statements

11

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Six months ended 5/31/14 |

Year ended 11/30/13 |

|||||||

| Change in net assets | (unaudited) | |||||||

| From operations | ||||||||

| Net investment income |

$24,595,331 | $32,115,840 | ||||||

| Net realized gain (loss) on investments and foreign currency |

177,067,099 | 284,396,912 | ||||||

| Net unrealized gain (loss) on investments and foreign currency translation |

220,007,944 | 813,082,906 | ||||||

| Change in net assets from operations |

$421,670,374 | $1,129,595,658 | ||||||

| Distributions declared to shareholders | ||||||||

| From net investment income |

$(30,000,113 | ) | $(32,000,095 | ) | ||||

| From net realized gain on investments |

(60,263,184 | ) | — | |||||

| Total distributions declared to shareholders |

$(90,263,297 | ) | $(32,000,095 | ) | ||||

| Change in net assets from fund share transactions |

$389,874,256 | $862,577,556 | ||||||

| Total change in net assets |

$721,281,333 | $1,960,173,119 | ||||||

| Net assets | ||||||||

| At beginning of period |

5,694,534,815 | 3,734,361,696 | ||||||

| At end of period (including undistributed net investment income of $20,390,467 and $25,795,249, respectively) |

$6,415,816,148 | $5,694,534,815 | ||||||

See Notes to Financial Statements

12

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Six months 5/31/14 (unaudited) |

Years ended 11/30 | |||||||||||||||||||||||

| Class A | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| Net asset value, beginning of |

$22.46 | $17.74 | $15.80 | $14.39 | $13.01 | $9.60 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.09 | $0.14 | $0.14 | $0.09 | $0.07 | $0.06 | ||||||||||||||||||

| Net realized and unrealized |

1.47 | 4.73 | 1.89 | 1.39 | 1.37 | 3.41 | ||||||||||||||||||

| Total from investment |

$1.56 | $4.87 | $2.03 | $1.48 | $1.44 | $3.47 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.11 | ) | $(0.15 | ) | $(0.09 | ) | $(0.07 | ) | $(0.06 | ) | $(0.06 | ) | ||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.34 | ) | $(0.15 | ) | $(0.09 | ) | $(0.07 | ) | $(0.06 | ) | $(0.06 | ) | ||||||||||||

| Net asset value, end of |

$23.68 | $22.46 | $17.74 | $15.80 | $14.39 | $13.01 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

7.11 | (n) | 27.67 | 12.95 | 10.33 | 11.08 | 36.44 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.73 | (a) | 0.75 | 0.79 | 0.82 | 0.95 | 0.99 | |||||||||||||||||

| Expenses after expense |

0.72 | (a) | 0.74 | 0.79 | 0.82 | 0.95 | 0.99 | |||||||||||||||||

| Net investment income |

0.80 | (a)(l) | 0.72 | 0.82 | 0.59 | 0.55 | 0.53 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$3,631,621 | $3,186,058 | $2,506,173 | $2,327,953 | $2,354,751 | $2,345,636 | ||||||||||||||||||

See Notes to Financial Statements

13

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class B | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$20.08 | $15.86 | $14.15 | $12.92 | $11.71 | $8.64 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$0.00 | (w) | $(0.01 | ) | $0.01 | $(0.02 | ) | $(0.01 | ) | $(0.01 | ) | |||||||||||||

| Net realized and unrealized |

1.32 | 4.25 | 1.70 | 1.25 | 1.22 | 3.08 | ||||||||||||||||||

| Total from investment |

$1.32 | $4.24 | $1.71 | $1.23 | $1.21 | $3.07 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$— | $(0.02 | ) | $— | $— | $— | $— | |||||||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.23 | ) | $(0.02 | ) | $— | $— | $— | $— | ||||||||||||||||

| Net asset value, end of |

$21.17 | $20.08 | $15.86 | $14.15 | $12.92 | $11.71 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

6.69 | (n) | 26.77 | 12.08 | 9.52 | 10.33 | 35.53 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

1.48 | (a) | 1.50 | 1.54 | 1.56 | 1.60 | 1.65 | |||||||||||||||||

| Expenses after expense |

1.48 | (a) | 1.50 | 1.54 | 1.56 | 1.60 | 1.65 | |||||||||||||||||

| Net investment income (loss) |

0.02 | (a)(l) | (0.03 | ) | 0.05 | (0.16 | ) | (0.12 | ) | (0.13 | ) | |||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$95,327 | $101,840 | $103,780 | $126,402 | $168,679 | $233,635 | ||||||||||||||||||

See Notes to Financial Statements

14

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class C | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$19.97 | $15.80 | $14.09 | $12.86 | $11.66 | $8.60 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$0.00 | (w) | $(0.01 | ) | $0.01 | $(0.02 | ) | $(0.01 | ) | $(0.01 | ) | |||||||||||||

| Net realized and unrealized |

1.32 | 4.22 | 1.70 | 1.25 | 1.21 | 3.07 | ||||||||||||||||||

| Total from investment |

$1.32 | $4.21 | $1.71 | $1.23 | $1.20 | $3.06 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$— | $(0.04 | ) | $— | $— | $— | $— | |||||||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.23 | ) | $(0.04 | ) | $— | $— | $— | $— | ||||||||||||||||

| Net asset value, end of |

$21.06 | $19.97 | $15.80 | $14.09 | $12.86 | $11.66 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

6.73 | (n) | 26.67 | 12.14 | 9.56 | 10.29 | 35.58 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

1.48 | (a) | 1.50 | 1.54 | 1.56 | 1.60 | 1.64 | |||||||||||||||||

| Expenses after expense |

1.48 | (a) | 1.50 | 1.54 | 1.56 | 1.60 | 1.64 | |||||||||||||||||

| Net investment income (loss) |

0.03 | (a)(l) | (0.04 | ) | 0.07 | (0.15 | ) | (0.10 | ) | (0.12 | ) | |||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$260,192 | $250,751 | $203,787 | $199,268 | $203,860 | $213,483 | ||||||||||||||||||

See Notes to Financial Statements

15

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class I | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$22.98 | $18.14 | $16.15 | $14.72 | $13.30 | $9.83 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.12 | $0.17 | $0.18 | $0.14 | $0.13 | $0.10 | ||||||||||||||||||

| Net realized and unrealized |

1.49 | 4.86 | 1.94 | 1.41 | 1.39 | 3.49 | ||||||||||||||||||

| Total from investment |

$1.61 | $5.03 | $2.12 | $1.55 | $1.52 | $3.59 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.16 | ) | $(0.19 | ) | $(0.13 | ) | $(0.12 | ) | $(0.10 | ) | $(0.12 | ) | ||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.39 | ) | $(0.19 | ) | $(0.13 | ) | $(0.12 | ) | $(0.10 | ) | $(0.12 | ) | ||||||||||||

| Net asset value, end of |

$24.20 | $22.98 | $18.14 | $16.15 | $14.72 | $13.30 | ||||||||||||||||||

| Total return (%) (r)(s)(x) |

7.20 | (n) | 28.02 | 13.29 | 10.60 | 11.46 | 36.92 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.48 | (a) | 0.50 | 0.54 | 0.56 | 0.60 | 0.63 | |||||||||||||||||

| Expenses after expense |

0.48 | (a) | 0.50 | 0.54 | 0.56 | 0.60 | 0.63 | |||||||||||||||||

| Net investment income |

1.04 | (a)(l) | 0.82 | 1.05 | 0.87 | 0.91 | 0.89 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$437,916 | $397,294 | $85,219 | $93,722 | $70,064 | $63,052 | ||||||||||||||||||

See Notes to Financial Statements

16

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class R1 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$19.91 | $15.75 | $14.04 | $12.83 | $11.62 | $8.57 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$0.00 | (w) | $(0.01 | ) | $0.01 | $(0.02 | ) | $(0.01 | ) | $(0.01 | ) | |||||||||||||

| Net realized and unrealized |

1.30 | 4.21 | 1.70 | 1.23 | 1.22 | 3.06 | ||||||||||||||||||

| Total from investment |

$1.30 | $4.20 | $1.71 | $1.21 | $1.21 | $3.05 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.09 | ) | $(0.04 | ) | $— | $— | $(0.00 | )(w) | $— | |||||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.32 | ) | $(0.04 | ) | $— | $— | $(0.00 | )(w) | $— | |||||||||||||||

| Net asset value, end of |

$20.89 | $19.91 | $15.75 | $14.04 | $12.83 | $11.62 | ||||||||||||||||||

| Total return (%) (r)(s)(x) |

6.71 | (n) | 26.71 | 12.18 | 9.43 | 10.42 | 35.59 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

1.48 | (a) | 1.51 | 1.54 | 1.56 | 1.60 | 1.64 | |||||||||||||||||

| Expenses after expense |

1.48 | (a) | 1.51 | 1.54 | 1.56 | 1.60 | 1.63 | |||||||||||||||||

| Net investment income (loss) |

0.03 | (a)(l) | (0.07 | ) | 0.07 | (0.15 | ) | (0.10 | ) | (0.12 | ) | |||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$36,693 | $35,206 | $6,968 | $6,594 | $6,555 | $6,696 | ||||||||||||||||||

See Notes to Financial Statements

17

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class R2 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$21.95 | $17.36 | $15.47 | $14.12 | $12.77 | $9.43 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.06 | $0.09 | $0.10 | $0.06 | $0.06 | $0.04 | ||||||||||||||||||

| Net realized and unrealized |

1.44 | 4.62 | 1.86 | 1.35 | 1.33 | 3.35 | ||||||||||||||||||

| Total from investment |

$1.50 | $4.71 | $1.96 | $1.41 | $1.39 | $3.39 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.07 | ) | $(0.12 | ) | $(0.07 | ) | $(0.06 | ) | $(0.04 | ) | $(0.05 | ) | ||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.30 | ) | $(0.12 | ) | $(0.07 | ) | $(0.06 | ) | $(0.04 | ) | $(0.05 | ) | ||||||||||||

| Net asset value, end of |

$23.15 | $21.95 | $17.36 | $15.47 | $14.12 | $12.77 | ||||||||||||||||||

| Total return (%) (r)(s)(x) |

6.98 | (n) | 27.33 | 12.74 | 10.04 | 10.90 | 36.21 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.98 | (a) | 1.00 | 1.04 | 1.06 | 1.10 | 1.14 | |||||||||||||||||

| Expenses after expense |

0.98 | (a) | 1.00 | 1.04 | 1.06 | 1.10 | 1.14 | |||||||||||||||||

| Net investment income |

0.53 | (a)(l) | 0.44 | 0.61 | 0.38 | 0.44 | 0.38 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$205,868 | $192,103 | $113,177 | $62,125 | $36,420 | $27,249 | ||||||||||||||||||

See Notes to Financial Statements

18

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class R3 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$22.29 | $17.61 | $15.69 | $14.32 | $12.94 | $9.59 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.09 | $0.14 | $0.15 | $0.09 | $0.09 | $0.06 | ||||||||||||||||||

| Net realized and unrealized |

1.45 | 4.70 | 1.87 | 1.38 | 1.36 | 3.39 | ||||||||||||||||||

| Total from investment |

$1.54 | $4.84 | $2.02 | $1.47 | $1.45 | $3.45 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.12 | ) | $(0.16 | ) | $(0.10 | ) | $(0.10 | ) | $(0.07 | ) | $(0.10 | ) | ||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.35 | ) | $(0.16 | ) | $(0.10 | ) | $(0.10 | ) | $(0.07 | ) | $(0.10 | ) | ||||||||||||

| Net asset value, end of |

$23.48 | $22.29 | $17.61 | $15.69 | $14.32 | $12.94 | ||||||||||||||||||

| Total return (%) (r)(s)(x) |

7.07 | (n) | 27.71 | 12.99 | 10.29 | 11.25 | 36.39 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.73 | (a) | 0.75 | 0.79 | 0.81 | 0.85 | 0.89 | |||||||||||||||||

| Expenses after expense |

0.72 | (a) | 0.74 | 0.79 | 0.81 | 0.85 | 0.89 | |||||||||||||||||

| Net investment income |

0.80 | (a)(l) | 0.69 | 0.87 | 0.61 | 0.70 | 0.61 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$496,541 | $412,052 | $226,452 | $77,578 | $50,795 | $30,110 | ||||||||||||||||||

See Notes to Financial Statements

19

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class R4 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$22.62 | $17.86 | $15.90 | $14.50 | $13.10 | $9.68 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.12 | $0.19 | $0.20 | $0.14 | $0.13 | $0.09 | ||||||||||||||||||

| Net realized and unrealized |

1.47 | 4.77 | 1.89 | 1.38 | 1.37 | 3.45 | ||||||||||||||||||

| Total from investment |

$1.59 | $4.96 | $2.09 | $1.52 | $1.50 | $3.54 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.16 | ) | $(0.20 | ) | $(0.13 | ) | $(0.12 | ) | $(0.10 | ) | $(0.12 | ) | ||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.39 | ) | $(0.20 | ) | $(0.13 | ) | $(0.12 | ) | $(0.10 | ) | $(0.12 | ) | ||||||||||||

| Net asset value, end of |

$23.82 | $22.62 | $17.86 | $15.90 | $14.50 | $13.10 | ||||||||||||||||||

| Total return (%) (r)(s)(x) |

7.21 | (n) | 28.03 | 13.31 | 10.55 | 11.49 | 36.98 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.48 | (a) | 0.50 | 0.54 | 0.56 | 0.60 | 0.64 | |||||||||||||||||

| Expenses after expense |

0.48 | (a) | 0.50 | 0.54 | 0.56 | 0.60 | 0.64 | |||||||||||||||||

| Net investment income |

1.04 | (a)(l) | 0.92 | 1.19 | 0.87 | 0.96 | 0.88 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$922,607 | $814,203 | $394,699 | $103,881 | $61,376 | $33,525 | ||||||||||||||||||

See Notes to Financial Statements

20

Table of Contents

Financial Highlights – continued

| Six months ended 5/31/14 (unaudited) |

Years ended 11/30 | |||||||||||

| Class R5 | 2013 | 2012 (i) | ||||||||||

| Net asset value, beginning of period |

$23.01 | $18.15 | $16.55 | |||||||||

| Income (loss) from investment operations | ||||||||||||

| Net investment income (d) |

$0.13 | $0.21 | $0.30 | |||||||||

| Net realized and unrealized gain (loss) on investments |

1.50 | 4.85 | 1.30 | (g) | ||||||||

| Total from investment operations |

$1.63 | $5.06 | $1.60 | |||||||||

| Less distributions declared to shareholders | ||||||||||||

| From net investment income |

$(0.18 | ) | $(0.20 | ) | $— | |||||||

| From net realized gain on investments |

(0.23 | ) | — | — | ||||||||

| Total distributions declared to shareholders |

$(0.41 | ) | $(0.20 | ) | $— | |||||||

| Net asset value, end of period (x) |

$24.23 | $23.01 | $18.15 | |||||||||

| Total return (%) (r)(s)(x) |

7.25 | (n) | 28.16 | 9.67 | (n) | |||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||

| Expenses before expense reductions (f) |

0.40 | (a) | 0.41 | 0.43 | (a) | |||||||

| Expenses after expense reductions (f) |

0.40 | (a) | 0.41 | 0.43 | (a) | |||||||

| Net investment income |

1.12 | (a)(l) | 0.99 | 3.42 | (a)(l) | |||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | ||||||||

| Net assets at end of period (000 omitted) |

$315,902 | $293,107 | $85,242 | |||||||||

See Notes to Financial Statements

21

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class 529A | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$22.24 | $17.56 | $15.64 | $14.25 | $12.89 | $9.46 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (d) |

$0.09 | $0.14 | $0.13 | $0.08 | $0.06 | $0.05 | ||||||||||||||||||

| Net realized and unrealized |

1.45 | 4.69 | 1.87 | 1.37 | 1.35 | 3.38 | ||||||||||||||||||

| Total from investment |

$1.54 | $4.83 | $2.00 | $1.45 | $1.41 | $3.43 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$(0.11 | ) | $(0.15 | ) | $(0.08 | ) | $(0.06 | ) | $(0.05 | ) | $— | |||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.34 | ) | $(0.15 | ) | $(0.08 | ) | $(0.06 | ) | $(0.05 | ) | $— | |||||||||||||

| Net asset value, end of |

$23.44 | $22.24 | $17.56 | $15.64 | $14.25 | $12.89 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

7.08 | (n) | 27.68 | 12.91 | 10.23 | 10.97 | 36.26 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

0.83 | (a) | 0.85 | 0.89 | 0.92 | 1.05 | 1.09 | |||||||||||||||||

| Expenses after expense |

0.74 | (a) | 0.76 | 0.84 | 0.89 | 1.05 | 1.08 | |||||||||||||||||

| Net investment income |

0.78 | (a)(l) | 0.69 | 0.78 | 0.52 | 0.46 | 0.44 | |||||||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$9,767 | $8,692 | $6,345 | $5,115 | $4,117 | $3,657 | ||||||||||||||||||

See Notes to Financial Statements

22

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class 529B | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$19.71 | $15.59 | $13.91 | $12.71 | $11.53 | $8.51 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$(0.00 | )(w) | $(0.01 | ) | $0.00 | (w) | $(0.03 | ) | $(0.02 | ) | $(0.02 | ) | ||||||||||||

| Net realized and unrealized |

1.29 | 4.16 | 1.68 | 1.23 | 1.20 | 3.04 | ||||||||||||||||||

| Total from investment |

$1.29 | $4.15 | $1.68 | $1.20 | $1.18 | $3.02 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$— | $(0.03 | ) | $— | $— | $— | $— | |||||||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.23 | ) | $(0.03 | ) | $— | $— | $— | $— | ||||||||||||||||

| Net asset value, end of |

$20.77 | $19.71 | $15.59 | $13.91 | $12.71 | $11.53 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

6.67 | (n) | 26.66 | 12.08 | 9.44 | 10.23 | 35.49 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

1.58 | (a) | 1.60 | 1.64 | 1.66 | 1.70 | 1.74 | |||||||||||||||||

| Expenses after expense |

1.52 | (a) | 1.55 | 1.59 | 1.64 | 1.70 | 1.74 | |||||||||||||||||

| Net investment income (loss) |

(0.02 | )(a)(l) | (0.08 | ) | 0.01 | (0.24 | ) | (0.19 | ) | (0.22 | ) | |||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$521 | $519 | $528 | $574 | $712 | $658 | ||||||||||||||||||

See Notes to Financial Statements

23

Table of Contents

Financial Highlights – continued

| Six months 5/31/14 |

Years ended 11/30 | |||||||||||||||||||||||

| Class 529C | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Net asset value, beginning of |

$19.61 | $15.53 | $13.85 | $12.66 | $11.48 | $8.48 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

| Net investment income (loss) (d) |

$(0.00 | )(w) | $(0.02 | ) | $0.00 | (w) | $(0.03 | ) | $(0.02 | ) | $(0.02 | ) | ||||||||||||

| Net realized and unrealized |

1.28 | 4.14 | 1.68 | 1.22 | 1.20 | 3.02 | ||||||||||||||||||

| Total from investment |

$1.28 | $4.12 | $1.68 | $1.19 | $1.18 | $3.00 | ||||||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

| From net investment income |

$— | $(0.04 | ) | $— | $— | $— | $— | |||||||||||||||||

| From net realized gain on |

(0.23 | ) | — | — | — | — | — | |||||||||||||||||

| Total distributions declared to |

$(0.23 | ) | $(0.04 | ) | $— | $— | $— | $— | ||||||||||||||||

| Net asset value, end of |

$20.66 | $19.61 | $15.53 | $13.85 | $12.66 | $11.48 | ||||||||||||||||||

| Total return (%) (r)(s)(t)(x) |

6.65 | (n) | 26.61 | 12.13 | 9.40 | 10.28 | 35.38 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: |

||||||||||||||||||||||||

| Expenses before expense |

1.58 | (a) | 1.60 | 1.64 | 1.66 | 1.70 | 1.73 | |||||||||||||||||

| Expenses after expense |

1.53 | (a) | 1.55 | 1.59 | 1.64 | 1.70 | 1.73 | |||||||||||||||||

| Net investment income (loss) |

(0.01 | )(a)(l) | (0.10 | ) | 0.03 | (0.22 | ) | (0.18 | ) | (0.21 | ) | |||||||||||||

| Portfolio turnover |

14 | (n) | 25 | 33 | 28 | 46 | 58 | |||||||||||||||||

| Net assets at end of period |

$2,861 | $2,709 | $1,992 | $1,689 | $1,574 | $1,322 | ||||||||||||||||||

See Notes to Financial Statements

24

Table of Contents

Financial Highlights – continued

| (a) | Annualized. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount varies from the net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amount of realized and unrealized gains and losses at such time. |

| (i) | For the period from the class inception, June 1, 2012, through the stated period end. |

| (l) | Recognition of net investment income by the fund may be affected by the timing of the declaration of dividends by companies in which the fund invests and the actual annual net investment income ratio may differ. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. Excluding the effect of the proceeds from a non-recurring litigation settlement against Tyco International Ltd., the Class A, Class B, Class C, Class I, Class R1, Class R2, Class R3, Class R4, Class 529A, Class 529B, and Class 529C total returns for the year ended November 30, 2010 would have been lower by 0.73%, 0.72%, 0.72%, 0.73%, 0.72%, 0.72%, 0.73%, 0.73%, 0.72%, 0.72%, and 0.72%, respectively. Excluding the effect of the proceeds received from a non-recurring administrative proceeding concerning market timing, the Class A, Class B, Class C, Class I, Class R1, Class R2, Class R3, Class R4, Class 529A, Class 529B, and Class 529C total returns for the year ended November 30, 2010 would have been lower by 1.14%, 1.13%, 1.13%, 1.14%, 1.13%, 1.14%, 1.14%, 1.14%, 1.14%, 1.13%, and 1.13%, respectively. Excluding the effect of the proceeds received from a non-recurring administrative proceeding concerning market timing, the Class A, Class B, Class C, Class I, Class R1, Class R2, Class R3, Class R4, Class 529A, Class 529B, and Class 529C total returns for the year ended November 30, 2011 would have been lower by 0.70%, 0.70%, 0.70%, 0.71%, 0.70%, 0.70%, 0.70%, 0.70%, 0.70%, 0.70%, and 0.70%, respectively. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

25

Table of Contents

(unaudited)

(1) Business and Organization

Massachusetts Investors Growth Stock Fund (the fund) is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In this reporting period, the fund adopted the disclosure provisions of FASB Accounting Standards Update 2011-11 (“ASU 2011-11”), Balance Sheet (Topic 210) – Disclosures about Offsetting Assets and Liabilities along with the related scope clarification provisions of FASB Accounting Standards Update 2013-01 (“ASU 2013-01”) entitled Balance Sheet (Topic 210) – Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities. ASU 2011-11 is intended to enhance disclosures on the offsetting of financial assets and liabilities by requiring entities to disclose both gross and net information about financial instruments and transactions that are either offset in the statement of financial position or subject to an enforceable Master Netting Agreement or similar arrangement. ASU 2013-01 limits the scope of ASU 2011-11’s disclosure requirements on offsetting to financial assets and financial liabilities related to derivatives, repurchase and reverse repurchase agreements, and securities lending and securities borrowing transactions.

The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party

26

Table of Contents

Notes to Financial Statements (unaudited) – continued

pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

27

Table of Contents

Notes to Financial Statements (unaudited) – continued

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of May 31, 2014 in valuing the fund’s assets or liabilities:

| Investments at Value | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Equity Securities | $6,380,660,892 | $— | $— | $6,380,660,892 | ||||||||||||

| Mutual Funds | 29,197,564 | — | — | 29,197,564 | ||||||||||||

| Total Investments | $6,409,858,456 | $— | $— | $6,409,858,456 | ||||||||||||

For further information regarding security characteristics, see the Portfolio of Investments.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Security Loans – Under its Securities Lending Agency Agreement with the fund, JPMorgan Chase and Co. (“Chase”), as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. Chase provides the fund with indemnification against Borrower default. In the event of Borrower default, Chase will for the benefit of the fund either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, Chase assumes the fund’s rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, Chase is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral

28

Table of Contents

Notes to Financial Statements (unaudited) – continued

reinvestment for which the fund bears the risk of loss. On loans collateralized by cash, the cash collateral is invested in a money market fund or short-term securities. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is included in “Interest” income in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income. At May 31, 2014, there were no securities on loan or collateral outstanding.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended May 31, 2014, is shown as a reduction of total expenses in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests.

29

Table of Contents

Notes to Financial Statements (unaudited) – continued

Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| 11/30/13 | ||||

| Ordinary income (including any short-term capital gains) |

$32,000,095 | |||

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 5/31/14 | ||||

| Cost of investments | $4,845,066,678 | |||

| Gross appreciation | 1,570,337,643 | |||

| Gross depreciation | (5,545,865 | ) | ||

| Net unrealized appreciation (depreciation) | $1,564,791,778 | |||

| As of 11/30/13 | ||||

| Undistributed ordinary income | 25,952,726 | |||

| Undistributed long-term capital gain | 7,957,277 | |||

| Other temporary differences | (67,543 | ) | ||

| Net unrealized appreciation (depreciation) | 1,344,728,630 | |||

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution, service, and program manager fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B and Class 529B shares will convert to Class A and Class 529A shares, respectively, approximately eight years after

30

Table of Contents

Notes to Financial Statements (unaudited) – continued

purchase. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| From net investment income |

From net realized gain on investments |

|||||||||||||||

| Six months ended 5/31/14 |

Year ended 11/30/13 |

Six months ended 5/31/14 |

Year ended 11/30/13 |

|||||||||||||

| Class A | $15,815,442 | $21,115,104 | $33,355,178 | $— | ||||||||||||

| Class B | — | 137,183 | 1,192,091 | — | ||||||||||||

| Class C | — | 457,417 | 2,940,607 | — | ||||||||||||

| Class I | 2,855,684 | 911,858 | 4,086,459 | — | ||||||||||||

| Class R1 | 166,013 | 16,230 | 413,213 | — | ||||||||||||

| Class R2 | 626,032 | 808,038 | 2,074,465 | — | ||||||||||||

| Class R3 | 2,275,421 | 2,107,313 | 4,411,822 | — | ||||||||||||

| Class R4 | 5,929,271 | 5,261,282 | 8,629,338 | — | ||||||||||||

| Class R5 | 2,289,176 | 1,126,737 | 3,029,871 | — | ||||||||||||

| Class 529A | 43,074 | 52,515 | 92,294 | — | ||||||||||||

| Class 529B | — | 977 | 6,205 | — | ||||||||||||

| Class 529C | — | 5,441 | 31,641 | — | ||||||||||||

| Total | $30,000,113 | $32,000,095 | $60,263,184 | $— | ||||||||||||

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.33% of the fund’s average daily net assets.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $516,977 and $3,932 for the six months ended May 31, 2014, as its portion of the initial sales charge on sales of Class A and Class 529A shares of the fund, respectively.

The Board of Trustees has adopted a distribution plan for certain share classes pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

31

Table of Contents

Notes to Financial Statements (unaudited) – continued

Distribution Plan Fee Table:

| Distribution Fee Rate (d) |

Service Fee Rate (d) |

Total Distribution Plan (d) |

Annual Effective Rate (e) |

Distribution and Service Fee |

||||||||||||||||

| Class A | — | 0.25% | 0.25% | 0.24% | $4,308,910 | |||||||||||||||

| Class B | 0.75% | 0.25% | 1.00% | 1.00% | 492,636 | |||||||||||||||

| Class C | 0.75% | 0.25% | 1.00% | 1.00% | 1,265,980 | |||||||||||||||

| Class R1 | 0.75% | 0.25% | 1.00% | 1.00% | 179,796 | |||||||||||||||

| Class R2 | 0.25% | 0.25% | 0.50% | 0.50% | 504,966 | |||||||||||||||

| Class R3 | — | 0.25% | 0.25% | 0.24% | 581,485 | |||||||||||||||

| Class 529A | — | 0.25% | 0.25% | 0.21% | 11,462 | |||||||||||||||

| Class 529B | 0.75% | 0.25% | 1.00% | 1.00% | 2,569 | |||||||||||||||

| Class 529C | 0.75% | 0.25% | 1.00% | 1.00% | 13,739 | |||||||||||||||

| Total Distribution and Service Fees | $7,361,543 | |||||||||||||||||||

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’s average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the six months ended May 31, 2014 based on each class’s average daily net assets. MFD has voluntarily agreed to rebate a portion of each class’s 0.25% service fee attributable to accounts for which MFD retains the 0.25% service fee except for accounts attributable to MFS or its affiliates’ seed money. For the six months ended May 31, 2014, this rebate amounted to $204,414, $1,473, $1,505, $28,586, $1,870, $12, and $8 for Class A, Class B, Class C, Class R3, Class 529A, Class 529B, and Class 529C, respectively, and is included in the reduction of total expenses in the Statement of Operations. |

Certain Class A shares are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 18 months of purchase for shares purchased on or after August 1, 2012, and within 24 months of purchase for shares purchased prior to August 1, 2012. Class C and Class 529C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B and Class 529B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the six months ended May 31, 2014, were as follows:

| Amount | ||||

| Class A | $4,251 | |||

| Class B | 37,136 | |||

| Class C | 4,548 | |||

| Class 529B | — | |||

| Class 529C | — | |||

The fund has entered into and may from time to time enter into contracts with program managers and other parties which administer the tuition programs through which an investment in the fund’s 529 share classes is made. The fund has entered into an agreement with MFD pursuant to which MFD receives an annual fee of up to 0.10% of the average daily net assets attributable to each 529 share class. MFD has agreed to waive a portion of this fee in an amount equal to 0.05% of the average daily net assets for each 529 share class. This waiver agreement will expire on

32

Table of Contents

Notes to Financial Statements (unaudited) – continued

March 31, 2015, unless MFD elects to extend the waiver. For the six months ended May 31, 2014, this waiver amounted to $3,108 and is included in the reduction of total expenses in the Statement of Operations. The program manager fee incurred for the six months ended May 31, 2014 was equivalent to an annual effective rate of 0.05% of the average daily net assets attributable to each 529 share class. The services provided by MFD, or a third party with which MFD contracts, include recordkeeping and tax reporting and account services, as well as services designed to maintain the program’s compliance with the Internal Revenue Code and other regulatory requirements. Program manager fees and waivers for the six months ended May 31, 2014, were as follows:

| Fee | Waiver | |||||||

| Class 529A | $4,585 | $2,293 | ||||||

| Class 529B | 257 | 128 | ||||||

| Class 529C | 1,374 | 687 | ||||||

| Total Program Manager Fees and Waivers | $6,216 | $3,108 | ||||||

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the six months ended May 31, 2014, the fee was $771,968, which equated to 0.0253% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to affiliated and unaffiliated service providers. Class R5 shares do not incur sub-accounting fees. For the six months ended May 31, 2014, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $2,876,130.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended May 31, 2014 was equivalent to an annual effective rate of 0.0077% of the fund’s average daily net assets.