Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

For the Fiscal Year Ended December 31, 2011

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| For the Fiscal Year Ended December 31, 2011 | Commission File Number 1-5794 |

MASCO CORPORATION

(Exact name of Registrant as Specified in its Charter)

| Delaware | 38-1794485 | |

| (State of Incorporation) |

(I.R.S. Employer Identification No.) | |

| 21001 Van Born Road, Taylor, Michigan | 48180 | |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: 313-274-7400

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange On Which Registered | |

| Common Stock, $1.00 par value |

New York Stock Exchange, Inc. |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the Registrant’s Common Stock held by non-affiliates of the Registrant on June 30, 2011 (based on the closing sale price of $12.03 of the Registrant’s Common Stock, as reported by the New York Stock Exchange on such date) was approximately $4,179,174,000.

Number of shares outstanding of the Registrant’s Common Stock at January 31, 2012:

357,294,300 shares of Common Stock, par value $1.00 per share

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be filed for its 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Masco Corporation

2011 Annual Report on Form 10-K

| Item |

Page | |||||

| PART I | ||||||

| 1. |

2 | |||||

| 1A. |

8 | |||||

| 1B. |

13 | |||||

| 2. |

14 | |||||

| 3. |

14 | |||||

| 4. |

14 | |||||

| PART II | ||||||

| 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 15 | ||||

| 6. |

17 | |||||

| 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 | ||||

| 7A. |

41 | |||||

| 8. |

42 | |||||

| 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 90 | ||||

| 9A. |

90 | |||||

| 9B. |

90 | |||||

| PART III | ||||||

| 10. |

91 | |||||

| 11. |

91 | |||||

| 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 91 | ||||

| 13. |

Certain Relationships and Related Transactions, and Director Independence |

91 | ||||

| 14. |

91 | |||||

| PART IV | ||||||

| 15. |

91 | |||||

| 93 | ||||||

1

Table of Contents

PART I

| Item 1. Business. |

Masco Corporation manufactures, distributes and installs home improvement and building products, with emphasis on brand-name consumer products and services holding leadership positions in their markets. We are among the largest manufacturers in North America of a number of home improvement and building products, including faucets, cabinets, architectural coatings and windows, and we are one of the largest installers of insulation for the new home construction market. We provide broad product offerings in a variety of styles and price points and distribute products through multiple channels, including directly to homebuilders and wholesale and retail channels. Approximately 76 percent of our 2011 sales were generated by our North American operations.

In 2011, we experienced increased commodity costs while the economy continued to experience declining home values, lack of job creation and depressed consumer confidence, hindering a housing recovery, all of which impacted our performance. Notwithstanding this challenging environment, we continued to take actions designed to increase our market share in our major product categories, strengthen our brands, invest in product innovation and introduce new products. We have done this while continuing to rationalize our business operations and manage our cost structure. We believe our strategy has improved our business execution and has positioned us well for a recovery in our markets.

We have taken many actions to increase our market share and strengthen our brands and businesses. We are gaining share in the U.S. with our DELTA®, PEERLESS®, BRIZO®, HOT SPRING® and CALDERA® brands. We are also extending the Delta and Peerless brands to additional product categories, including tub and shower bathing systems and bath hardware, and are pursuing international opportunities for these brands. In 2011, we achieved year-over-year overall share gains in our Installation and Other Services segment and we also completed the implementation of a new Enterprise Resource Planning (“ERP”) system in this segment. Behr increased its brand share across all DIY architectural coatings categories, and is also pursuing international opportunities. Milgard Manufacturing continued to gain share in the western United States, and the U.K. Window Group is gaining share in its markets in the United Kingdom.

We are focused on enhancing customer experience through new product development and product innovation. In 2011, Delta Faucet Company launched its innovative TOUCH2O® technology for lavatory faucets. Behr introduced a new low-VOC formula in its core PREMIUM PLUS® paint line and also launched the KILZ® PRO-X™ coatings line program at The Home Depot. Masco Cabinetry introduced a countertop product for the kitchen and an integrated bathroom vanity countertop solution. Arrow Fastener has introduced several new products to enhance their core product line including the T50 ELITE™ tool line, which is gaining share with domestic and international retailers.

We believe our commitment to developing innovative products and building our brands is demonstrated by the recognition we received in 2011. KraftMaid cabinetry ranked “Highest in Customer Satisfaction with Cabinets” in the J.D. Power and Associates 2011 U.S. Kitchen Cabinet Satisfaction StudySM. Delta Faucet was named WaterSense® Partner of the Year by the Environmental Protection Agency in recognition of its ongoing commitment to promoting advancements in water efficiency. Hansgrohe again received the prestigious Product Design Award from the Federal Republic of Germany. Behr was recognized by The Home Depot as “2011 Partner of the Year Department 24 – Paint” in the U.S. and in Canada, and Behr products again achieved #1 rankings in a leading consumer study. The Kilz brand ranked highest among paint brands for the second year in a row based on a 2011 Harris poll. MILGARD® ESSENCE SERIES® windows received the 2011 Crystal Achievement Award for Most Innovative New Window for a Large Manufacturer from Window & Door, a trade magazine. The MILGARD® TUSCANY® SERIES windows and doors with the SMARTTOUCH® technology was named winner of the 2011 Smart Choice Award by the 50+ Housing Council, a group

2

Table of Contents

focused on the needs of the aging population in Southern California. Builder, a leading magazine for the residential construction industry, named Milgard Windows and Doors as the Brand Leader in Overall Vinyl Quality in its 2012 Brand Use Study, marking the seventh time Milgard products have been recognized. Lastly, the HOT SPRING ARIA® spa received the “Best Buy” distinction from Consumers Digest.

Since the economic downturn, we have taken significant actions designed to rationalize our business operations, manage our cost structure and improve our business processes. We have successfully managed our cash position, resulting in approximately $1.7 billion of cash at December 31, 2011. Over the last several years, we have closed 28 facilities and reduced headcount by over 30,000, enabling us to achieve a significant reduction in our fixed costs. We have improved our global supply chain by leveraging our size to realize purchasing cost savings, simplify the purchasing process, and coordinate logistical operations. At several of our businesses, we have implemented new ERP systems to improve the operations of our businesses, including customer service and inventory management and reduce costs. We are also implementing lean principles and production process studies to reduce production costs and improve efficiencies. Our Retail and Builder Cabinet businesses have been integrated, achieving profit and process improvements as a result of integration savings, lean and sourcing activities and spending reductions.

In 2011, we took additional actions designed to manage our costs, including additional plant closures and divestitures, further reducing our headcount. We also commenced the integration of our WELLHOME® business into our Masco Contractor Services (“MCS”) group to enhance MCS’s sales and marketing capability and further expand our retrofit insulation business. Finally, we completed the common architecture program for the MERILLAT® and QUALITY CABINETSTM brands at Masco Cabinetry and completed the exit of our ready-to-assemble product line in North America.

We believe that our actions have managed our businesses successfully through the economic crisis and subsequent recession of recent years. We also believe that our actions have strengthened our businesses and that we are ready to meet the economic challenges that will come with growth out of the recession in all of our markets.

Our Business Segments

We report our financial results in five business segments aggregated by similarity in products and services. The following table sets forth the contribution of our segments to net sales and operating (loss) profit for the three years ended December 31, 2011, 2010 and 2009. Additional financial information concerning our operations by segment and by geographic regions, as well as general corporate expense, net, as of and for the three years ended December 31, 2011, is set forth in Note O to our consolidated financial statements included in Item 8 of this Report.

| (In Millions) | ||||||||||||

| Net Sales(1) | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Cabinets and Related Products |

$ | 1,231 | $ | 1,464 | $ | 1,674 | ||||||

| Plumbing Products |

2,913 | 2,692 | 2,564 | |||||||||

| Installation and Other Services |

1,077 | 1,041 | 1,121 | |||||||||

| Decorative Architectural Products |

1,670 | 1,693 | 1,714 | |||||||||

| Other Specialty Products |

576 | 596 | 584 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 7,467 | $ | 7,486 | $ | 7,657 | ||||||

|

|

|

|

|

|

|

|||||||

3

Table of Contents

| Operating (Loss) Profit (1)(2)(3)(4) | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Cabinets and Related Products |

$ | (206 | ) | $ | (250 | ) | $ | (64 | ) | |||

| Plumbing Products |

322 | 331 | 237 | |||||||||

| Installation and Other Services |

(79 | ) | (798 | ) | (116 | ) | ||||||

| Decorative Architectural Products |

196 | 345 | 375 | |||||||||

| Other Specialty Products |

(401 | ) | 19 | (199 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | (168 | ) | $ | (353 | ) | $ | 233 | ||||

|

|

|

|

|

|

|

|||||||

| (1) | Amounts exclude discontinued operations. |

| (2) | Operating (loss) profit is before general corporate expense, net, charge for defined-benefit plan curtailment, accelerated stock compensation expense, and loss on corporate fixed assets, net. |

| (3) | Operating (loss) profit is before charges of $9 million regarding the 2011 litigation settlements in the Cabinets and Related Products and the Other Specialty Products segments. Operating (loss) profit is before a charge of $7 million regarding the 2009 litigation settlement in the Cabinets and Related Products segment. |

| (4) | Operating (loss) profit includes impairment charges for goodwill and other intangible assets as follows: For 2011 – Cabinets and Related Products – $44 million; Plumbing Products – $1 million; Decorative Architectural Products – $75 million; and Other Specialty Products – $374 million. For 2010 – Plumbing Products – $1 million; and Installation and Other Services – $697 million. For 2009 – Plumbing Products – $39 million; and Other Specialty Products – $223 million. |

All of our operating segments, except the Plumbing Products segment, normally experience stronger sales during the second and third calendar quarters, corresponding with the peak season for new home construction and repair and remodel activity.

Cabinets and Related Products

In North America, we manufacture and sell value-priced, stock and semi-custom assembled cabinetry for kitchen, bath, storage, home office and home entertainment applications in a broad range of styles and price points to address consumer preferences. We have also expanded our product offerings in this segment to include the manufacture and sale of kitchen countertops, as well as an integrated bathroom vanity and countertop solution. In Europe, we manufacture and sell assembled and ready-to-assemble kitchen, bath, storage, home office and home entertainment cabinetry. These products are sold in the United States and in Europe under a number of trademarks including KRAFTMAID®, TVILUM® and WOODGATE® primarily to dealers and home centers, and under the MERILLAT®, MOORES™ and QUALITY CABINETS™ brands primarily to distributors and homebuilders for both the home improvement and new home construction markets. Cabinet sales are significantly affected by levels of activity in both new home construction and retail consumer spending, particularly spending for major kitchen and bathroom renovation projects. A significant portion of our sales for the home improvement market are made through home center retailers.

New home construction has declined over 70 percent during the last six years, and this segment has been particularly affected by this downturn. This segment has also been negatively affected by a downturn in the repair and remodel market, particularly by consumers deferring expenditures for big-ticket items. In response, we have closed several manufacturing plants in this segment, and in 2011 we idled two additional facilities and completed the exit of our North American ready-to-assemble cabinet product line. Additionally, we continue to be focused on improving cabinet production efficiencies at lower volumes. We completed the common architecture platform for our MERILLAT® and QUALITY CABINETS™ brands in 2011, which we believe will enhance our manufacturing flexibility. Lastly, we have completed the integration of our Builder Cabinet Group and Retail Cabinet Group to form Masco Cabinetry, and we are beginning to realize cost savings from the integration.

4

Table of Contents

The cabinet manufacturing industry in the United States and Europe is highly competitive, with several large competitors and numerous local and regional competitors. In 2011, we experienced greater promotional pricing activity in this segment, which impacts the segment’s results of operations. In addition to price, we believe that competition in this industry is based largely on product quality, responsiveness to customer needs, product features and selection. Our significant North American competitors include American Woodmark Corporation and Fortune Brands Home & Security, Inc.

Plumbing Products

The businesses in our Plumbing Products segment sell a wide variety of faucet and showering devices that are manufactured by or for us. The majority of our plumbing products are sold in North America and Europe under the brand names DELTA®, PEERLESS®, HANSGROHE®, AXOR®, BRIZO®, BRASSTECH®, BRISTANtm, GINGER®, NEWPORT BRASS®, ALSONS® and PLUMB SHOP®. Our products include single-handle and double-handle faucets, showerheads, handheld showers and valves, which are sold to major retail accounts and to wholesalers and distributors who, in turn, sell our products to plumbers, building contractors, remodelers, smaller retailers and others.

We believe that our plumbing products are among the leaders in sales in the North American and European markets, with American Standard, Kohler, Moen and Pfister as major brand competitors. We also have several European competitors, primarily in Germany, including Friedrich Grohe. We face significant competition from private label products (including house brands sold by certain of our customers). Many of the faucet and showering products with which our products compete are manufactured in Asia. The businesses in our Plumbing Products segment source products from Asia and manufacture products in the United States, Europe and Asia.

Other plumbing products manufactured and sold by us include products branded as AQUA GLASS®, MIROLIN®, AMERICAN SHOWER & BATH™ and Innovex® acrylic and gelcoat tub and shower systems, bath and shower enclosure units, shower trays and laundry tubs, which are sold primarily to wholesale plumbing distributors and home center retailers for the North American home improvement and new home construction markets. Our spas are manufactured and sold under HOT SPRING®, CALDERA® and other trademarks directly to independent dealers. Major competitors include Kohler, Lasco, Maax and Jacuzzi. We sell HÜPPE® shower enclosures through wholesale channels primarily in Western Europe. HERITAGE™ ceramic and acrylic bath fixtures and faucets are principally sold in the United Kingdom directly to selected retailers.

Also included in the Plumbing Products segment are brass and copper plumbing system components and other plumbing specialties, which are sold to plumbing, heating and hardware wholesalers and to home center retailers, hardware stores, building supply outlets and other mass merchandisers. These products are marketed in North America for the wholesale trade under the BRASSCRAFT® and BRASSTECH® trademarks and for the “do-it-yourself” market under the MASTER PLUMBER® and PLUMB SHOP® trademarks, and are also sold under private label.

In addition to price, we believe that competition in our Plumbing Products markets is based largely on brand reputation, product quality, product innovation and features, and breadth of product offering.

A substantial portion of our plumbing products contain brass, the major components of which are copper and zinc. We have encountered price volatility for brass, brass components and any components containing copper and zinc; therefore, we have implemented a hedging strategy to minimize the impact of this volatility. Legislation enacted in California, Vermont and Maryland mandates new standards for acceptable lead content in plumbing products sold in those states. Federal legislation mandating a national standard for lead content in plumbing products will become effective in January 2014. Faucet and water supply valve manufacturers, including our plumbing product companies, will be required to obtain adequate supplies of lead-free brass or suitable alternative materials for continued production of faucets and certain of our plumbing products. Over the

5

Table of Contents

last several years, our Delta Faucet business introduced the DIAMOND™ SEAL TECHNOLOGY, which reduces the number of potential leak points in a faucet, simplifies installation and satisfies legislation regarding the acceptable lead content in plumbing products.

Installation and Other Services

Our Installation and Other Services segment sells installed building products and distributes building products primarily to the new home construction market, and, to a lesser extent, the retrofit and commercial construction markets, throughout the United States. In addition to insulation, we sell installed gutters, after-paint products, fireplaces and garage doors. The installation and distribution of insulation comprised approximately nine percent of our consolidated net sales in 2011, 2010 and 2009. Installed building products are supplied primarily to custom and production homebuilders by our network of branches located across the United States. Distributed products include insulation, insulation accessories, gutters, fireplaces and roofing. Distributed products are sold primarily to contractors and dealers (including lumber yards) from distribution centers in various parts of the United States.

In order to respond to the significant decrease in demand in the new home construction industry over the past several years, we have implemented various cost savings initiatives, including the consolidation and closure of approximately 110 branch locations. This rationalization has been accomplished while maintaining our strategic presence in most of the top 100 Metropolitan Statistical Areas in the United States. In addition, we have de-emphasized the installation of certain non-insulation building products that are not core to our service offering, including windows and paint. In 2011, we announced the decision to divest four non-core businesses in this segment that offered commercial drywall installation, millwork and framing services. We also completed the implementation of an ERP system, which we anticipate will enable us to achieve future efficiencies through the automation of manual processes and to provide superior customer service to our customers.

Also in response to the depressed new home construction market, we have expanded our ability to serve the residential retrofit and light commercial markets. Within the Installation and Other Services segment, we have several initiatives related to improved residential energy efficiency, including retrofit installation services (primarily insulation) delivered directly to homeowners, as well as through retailers and dealer outlets.

In addition to price, we believe that competition in this industry is based largely on customer service and the quality of installation service. We believe that we are the largest national provider of installed insulation in the new home construction industry in the United States. Our competitors include several regional contractors, as well as numerous local contractors and lumber yards. We believe that our capabilities and financial resources are substantial compared to regional and local contractors.

Decorative Architectural Products

We produce architectural coatings including paints, primers, specialty paint products, stains and waterproofing products. The products are sold in the United States, Canada, China, Mexico and South America under the brand names BEHR®, KILZ® and BEHR EXPRESSIONS® to “do-it-yourself” and professional customers through home centers, paint stores and other retailers. Net sales of architectural coatings comprised approximately 20 percent of our consolidated net sales in 2011, 2010 and 2009. Competitors in the architectural coatings market include large national and international brands such as Benjamin Moore, Glidden, Olympic, Sherwin-Williams, Valspar and Zinsser, as well as many regional and other national brands. In addition to price, we believe that competition in this industry is based largely on product quality, technology and product innovation, customer service and brand reputation. Recently our competitors have begun to offer combined paint and primer products similar to Behr’s PREMIUM PLUS ULTRA paint, which we introduced in 2009.

6

Table of Contents

Our BEHR products are sold through The Home Depot, the segment’s and our largest customer. The paint departments at The Home Depot stores include the Behr color center and computer kiosk with the COLOR SMART BY BEHR® computerized color-matching system that enables consumers to select and coordinate their paint-color selection. The loss of this segment’s sales to The Home Depot would have a material adverse effect on this segment’s business and on our consolidated business as a whole.

Titanium dioxide is a major ingredient in the manufacture of paint. The industry continues to experience cost increases for titanium dioxide as a result of surges in global demand and production capacity limitations, which has impacted our operating results in this segment. Petroleum products are also used in the manufacture of architectural coatings. Significant increases in the cost of crude oil and natural gas lead to higher raw material costs (e.g., for resins, solvents and packaging, as well as titanium dioxide), which can adversely affect the segment’s results of operations.

Our Decorative Architectural Products segment also includes LIBERTY® and BRAINERD® branded cabinet, door, window and other hardware, which is manufactured for us and sold to home centers, other retailers, original equipment manufacturers and wholesale markets. Key competitors in North America include Amerock, Top Knobs, Direct Import, Hickory Hardware and Stanley Black & Decker. Decorative bath hardware and shower accessories are sold under the brand names DELTA®, FRANKLIN BRASS® and DECOR BATHWARE® to distributors, home centers and other retailers. Competitors include Moen and Gatco.

Other Specialty Products

We manufacture and sell vinyl, fiberglass and aluminum windows and patio doors under the MILGARD® brand name to the home improvement and new home construction markets, principally in the western United States. MILGARD products are sold primarily through dealers and, to a lesser extent, directly to production and custom homebuilders and through lumber yards and home centers. In late 2010, Milgard Manufacturing introduced the ESSENCE SERIES™ wood windows and doors, which combines a wood interior with a fiberglass exterior. This segment’s competitors in North America include national brands, such as Jeld-Wen, Simonton, Pella and Andersen, and numerous regional brands. In 2011, we closed four plants in this segment.

In the United Kingdom, we manufacture and sell windows, related products and components under several brand names including GRIFFIN™, CAMBRIAN™, PREMIER™ and DURAFLEX™. Sales are primarily through dealers and wholesalers to the repair and remodeling markets, although our DURAFLEX products are also sold to other window fabricators. United Kingdom competitors include many small and mid-sized firms and a few large, vertically integrated competitors. In addition to price, we believe that competition in this industry is based largely on customer service and product quality.

We manufacture and sell a complete line of manual and electric staple gun tackers, staples and other fastening tools under the brand names ARROW® and POWERSHOT®. We sell these products through various distribution channels including home centers and other retailers and wholesalers. Our principal North American competitor in this product line is Stanley Black & Decker.

Additional Information

| • | We hold United States and foreign patents, patent applications, licenses, trademarks, trade names, trade secrets and proprietary manufacturing processes. As a manufacturer and distributor of brand name products, we view our trademarks and other intellectual property rights as important, but do not believe that there is any reasonable likelihood of a loss of such rights that would have a material adverse effect on our present business as a whole. |

7

Table of Contents

| • | We are subject to laws and regulations relating to the protection of the environment. In addition to our responsibilities for environmental remediation, our businesses are subject to other requirements regarding protection of the environment and worker health and safety. Our businesses are subject to requirements relating to the emission of volatile organic compounds which may impact our sourcing of particleboard, require that we install special equipment in manufacturing facilities or that we reformulate paint products. As described above, our Plumbing Products segment is subject to restrictions on lead content in some of its products. Compliance with such laws and regulations could significantly affect product performance as well as our production costs. We monitor applicable laws and regulations relating to the protection of the environment, climate disruption and worker health and safety, and incur ongoing expense relating to compliance. We do not expect compliance with the federal, state and local regulations relating to the discharge of materials into the environment, or otherwise relating to the protection of the environment and worker health and safety, will result in material capital expenditures or have a material adverse effect on our earnings or competitive position. |

| • | We do not consider backlog orders to be material. |

| • | At December 31, 2011, we employed approximately 31,000 people. Satisfactory relations have generally prevailed between us and our employees. |

Available Information

Our website is www.masco.com. Our periodic reports and all amendments to those reports required to be filed or furnished pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after those reports are electronically filed with or furnished to the Securities and Exchange Commission. This Report is being posted on our website concurrently with its filing with the Securities and Exchange Commission. Material contained on our website is not incorporated by reference into this Report.

| Item 1A. | Risk Factors. |

There are a number of business risks and uncertainties that could affect our business. These risks and uncertainties could cause our actual results to differ from past performance or expected results. We consider the following risks and uncertainties to be most relevant to our specific business activities. Additional risks and uncertainties not presently known to us, or that we currently believe to be immaterial, also may adversely impact our business, financial condition and results of operations.

A significant portion of our business relies on home improvement and new home construction activity levels, both of which are experiencing a prolonged and substantial downturn.

A significant portion of our business relies on home improvement (including repair and remodel) and new home construction activity levels, principally in North America and Europe. The current economic decline has adversely affected our home improvement businesses. Continued low levels of consumer confidence, high levels of unemployment, and the downward pressure on home prices have limited consumers’ discretionary spending and have made consumers reluctant to make additional investments in existing homes, including large kitchen and bath remodeling projects. The increasing number of households with negative equity in their homes, and more conservative residential lending practices for home equity loans that are often used to finance repairs and remodeling, are limiting the ability of consumers to finance home improvements. Additionally, sales of existing homes, which significantly impact our home improvement business, have decreased significantly in the past few years.

New home construction, which is cyclical in nature, is experiencing a prolonged and substantial downturn marked by continued softness in the demand for new homes, an oversupply of existing

8

Table of Contents

homes on the market and more stringent standards for homebuyers seeking financing. The oversupply of existing homes held for sale is exacerbated by slower household formation growth rates, the significant number of short sales and home mortgage foreclosures, as well as uncertainties in the home foreclosure process, all of which continue to contribute to the downward pressure on home prices. Further, the expiration or scaling back of homebuyer tax credits and other government programs has also negatively impacted home sales. It is uncertain when, and to what extent, these trends and factors might reverse or improve.

Although we believe that the long-term outlook for home improvement and new home construction is favorable, we cannot predict the type, timing or strength of a recovery in these areas. The large number of borrowers who remain at risk of potentially losing their homes through foreclosures or short sales, coupled with the voluntary and involuntary halts of foreclosure proceedings by lenders due to legal challenges, could prolong the downturn in home improvement and new home construction activity. Prolonged depressed activity levels in consumer spending for home improvements and new home construction will continue to adversely affect our results of operations and our financial position and may disproportionately affect our business segments that are most heavily dependent on new home construction and large consumer investments in home remodeling projects.

The prolonged economic downturn could result in our taking additional significant non-cash charges, which may reduce our financial resources and flexibility and could negatively affect our earnings and reduce shareholders’ equity.

We have recorded significant goodwill and other intangible assets related to prior business combinations on our balance sheet. The valuation of these assets is largely dependent upon the expectations for future performance of our businesses. In recent years, we have recorded significant non-cash impairment charges for financial investments and goodwill and other intangible assets. We have also recorded a valuation allowance related to our deferred tax assets. A further decline in the expectation of our future performance, or a further deterioration in expectations regarding the timing and the extent of the recovery of the new home construction and home improvement segments, may cause us to recognize additional non-cash, pre-tax impairment charges for goodwill and other indefinite-lived intangible assets or other long-lived assets, which are not determinable at this time. If the value of goodwill or other intangible assets is impaired, our earnings and shareholders’ equity would be adversely affected.

Further, our credit agreement contains financial covenants we must comply with, including covenants regarding limits on our debt to total capitalization ratio. If we are required to record additional non-cash impairment charges, which would reduce our shareholders’ equity, our borrowing capacity under our credit agreement may be limited. We recently amended our credit agreement to allow for the add-back to shareholders’ equity for impairment charges we have taken. There can be no assurance that we would be able to further amend the credit agreement in the future or that alternative financing would be available on acceptable terms and at acceptable rates, or that we would be permitted to obtain alternative financing under the terms of our existing financing arrangements.

If we do not maintain strong brands, develop new products or respond to changing consumer preferences and purchasing practices, our results could be adversely affected.

Our competitive advantage is due, in part, to our ability to maintain our strong brands and to develop and introduce innovative new and improved products. We have increased our focus on investment in brand building and brand awareness, as well as new product development and product innovation. The uncertainties associated with developing and introducing new and improved products, such as gauging changing consumer preferences and successfully developing, manufacturing, marketing and selling new or improved products may impact the success of our new product introductions. If our new products do not gain widespread market acceptance, we could lose market share, which could negatively impact our operating results.

9

Table of Contents

Further, the volatile and challenging economic environment of recent years has caused shifts in consumer preferences and purchasing practices and changes in the business models and strategies of our customers. For example, the size of new homes has decreased, and demand has increased for multi-family housing units such as apartments and condominiums, which are often smaller than single-family housing units. The effect of these trends has resulted in smaller kitchens and smaller and fewer bathrooms, each with fewer cabinets and faucets, as well as the use of less insulation. Such shifts, which may or may not be long-term, have altered the quantity, type and prices of products demanded by the end-consumer and our customers. Additionally, consumers are increasingly using the internet and mobile technology to research home improvement products and enhance their purchasing experience for these products. If we do not timely and effectively identify and respond to these changing consumer preferences and purchasing practices, our relationships with our customers could be harmed, the demand for our products could be reduced and our market share could be negatively affected.

Our response to the prolonged economic downturn has been to continue our focus on implementation of cost-savings initiatives, which have been costly and may not be effective.

During the current downturn in home improvement and new home construction, we have focused on cost-saving initiatives, including rationalizing our businesses, particularly the consolidation of our cabinet businesses, as well as plant closures, headcount reductions, and system implementations.

The consolidation of our cabinet businesses has involved the integration of multiple manufacturing processes and information technology platforms, which has been complex, time-consuming and expensive. If we cannot successfully implement this consolidation or our other cost-savings initiatives, or if it becomes more expensive to make future cost-savings changes, we may not fully achieve the anticipated benefits from these initiatives. Further, if we do not effectively balance our focus on cost savings with the need to maintain a strong sales presence for our brands, we could lose market share. In the future, we will need to continually evaluate our productivity to assess opportunities to reduce costs, and we may incur additional costs and charges relating to further cost-savings initiatives. However, gaining additional efficiencies may become increasingly difficult over time. If the eventual recovery of our markets is fast-paced and robust, we may not be able to replace our reduced manufacturing and installation capacity in a timely fashion and our ability to respond to increased demand could be limited, which could result in lost market share and, ultimately, could negatively impact our operating results.

We rely on key customers and may encounter conflicts within and between our distribution channels.

The size and importance of individual customers to our businesses has increased as customers in our major distribution channels have consolidated or exited the business. Larger customers can make significant changes in their volume of purchases and can otherwise significantly affect the prices we receive for our products and services, our costs of doing business with them and the terms and conditions on which we do business. Sales of our home improvement and building products to home centers are substantial. In 2011, sales to our largest customer, The Home Depot, were $2.0 billion (approximately 27 percent of our consolidated net sales). Lowe’s is our second largest customer. In 2011, our sales to Lowe’s were less than ten percent of our consolidated net sales. Although homebuilders, dealers and other retailers represent other channels of distribution for our products and services, the loss of a substantial portion of our sales to The Home Depot or the loss of our sales to Lowe’s would have a material adverse effect on our business.

As some of our customers expand their markets and their targeted customers, conflicts between our existing distribution channels have and will continue to occur. In addition, we may undermine the business relationships we have with customers who purchase our products through traditional wholesale channels as we increase the amount of business we transact directly with our customers. In

10

Table of Contents

addition, our large retail customers are increasingly requesting product exclusivity, which may affect our ability to offer products to other customers and may diminish our ability to leverage economies of scale.

Our principal markets are highly competitive.

The major geographic markets for our products and services are highly competitive. Competition is further intensified during economic downturns. Home centers are increasing their purchases of products directly from low-cost overseas suppliers for sale as private label and house brand merchandise. Additionally, home centers, which have historically concentrated their sales efforts on retail consumers and remodelers, are increasingly turning their marketing efforts directly toward professional contractors and installers. We believe that competition in our industries is based on price, product and service quality, brand reputation, customer service and product features and innovation.

In addition to the challenges we have faced as a result of the economic downturn, our ability to maintain our competitive positions in our markets and to grow our businesses depends to a large extent upon successfully maintaining our relationships with major customers, implementing growth strategies in our existing markets and entering new geographic markets, including successful penetration of international markets, capitalizing on and strengthening our brand names, managing our cost structure, accommodating shorter life-cycles for our products and product development and innovation.

Increased commodity costs and limited availability of commodities could affect our operating results.

We buy various commodities to manufacture our products, including, among others, wood, brass (made of copper and zinc), titanium dioxide and resins. Fluctuations in the availability and prices of these commodities could increase our costs to manufacture our products. Further, increases in energy costs not only increase our production costs, but also the cost to transport our products, each of which could negatively affect our financial condition and operating results.

It has been, and likely will continue to be, difficult for us to pass on to customers cost increases to cover our increased commodity and production costs. Our existing arrangements with customers, competitive considerations and customer resistance to price increases may delay or make us unable to adjust selling prices. If we are not able to increase the prices of our products or achieve cost savings to offset increased commodity and production costs, our financial condition and operating results could be negatively impacted. If we are able to increase our selling prices, sustained price increases for our products may lead to sales declines and loss of market share, particularly if our competitors do not increase their prices. When commodity prices decline, we may receive pressure from our customers to reduce prices for our products and services.

To reduce the price volatility associated with certain anticipated commodity purchases, we use derivative instruments, including commodity futures and swaps. We may incur net substantial costs as part of our strategy to hedge against price volatility of certain commodities we purchase and we may make commitments to purchase these commodities at prices that subsequently exceed their market prices, which could adversely affect our financial condition and operating results.

We are dependent on third-party suppliers and manufacturers, and the loss of a key supplier or manufacturer could negatively affect our operating results.

Our ability to offer a wide variety of products depends on our ability to obtain an adequate supply of products and components from manufacturers and other suppliers. We rely heavily or, in certain cases, exclusively, on outside suppliers for some of our products and key components. Failure by our suppliers to provide us quality products on commercially reasonable terms, and to comply with legal requirements for business practices, could have a material adverse effect on our financial condition or

11

Table of Contents

operating results. Although these products and components are generally obtainable in sufficient quantities from other sources, resourcing them to another supplier could take time and could involve significant costs. Accordingly, the loss of a key supplier, or a substantial decrease in the availability of products or components from our suppliers, could disrupt our business and adversely impact our operating results.

Further, we manufacture products in Asia and source products and components from third parties in Asia. The distances involved in these arrangements, together with differences in business practices, shipping and delivery requirements, the limited number of suppliers, and laws and regulations, have increased the difficulty of managing our supply chain, the complexity of our supply chain logistics and the potential for interruptions in our production scheduling. If we are unable to effectively manage our supply chain, our operating results could be negatively affected.

International political, monetary, economic and social developments affect our business.

Over 20 percent of our sales are made outside of North America (principally in Europe) and are transacted in currencies other than U.S. dollars (principally the euro and the British pound sterling). Increased international sales make up an important part of our future strategic plans. In addition, we manufacture products in Asia and source products and components from third parties in Asia. Our international business faces risks associated with changes in political, monetary, economic and social environments, labor conditions and practices, the laws, regulations and policies of foreign governments, cultural differences and differences in enforcement of contract and intellectual property rights. U.S. laws affecting activities of U.S. companies doing business abroad, including tax laws and laws regulating various business practices, also impact our international business. Our international operating results may be influenced, when compared to our North American results, in part by relative economic conditions in the European markets, including uncertainty regarding the European sovereign debt crisis, and competitive pricing pressures on certain products. The financial reporting of our consolidated operating results is affected by fluctuations in currency exchange rates, which may present challenges in comparing operating performance from period to period and in forecasting future performance.

We have financial commitments and investments in financial assets, including assets that are not readily marketable and involve financial risk.

We continue to reduce our investment in private equity funds. Since there is no active trading market for investments in private equity funds, they are for the most part illiquid. These investments, by their nature, can also have a relatively higher degree of business risk, including financial leverage, than other financial investments. Future changes in market conditions, the future performance of the underlying investments or new information provided by private equity fund managers could affect the recorded values of such investments or the amounts realized upon liquidation. In addition, we have commitments that require us to contribute additional capital to these private equity funds upon receipt of a capital call from the private equity fund.

Claims and litigation could be costly.

We are, from time to time, involved in various claims, litigation matters and regulatory proceedings that arise in the ordinary course of our business and which could have a material adverse effect on us. These matters may include contract disputes, automobile liability and other personal injury claims, warranty disputes, environmental claims or proceedings, other tort claims, employment and tax matters and other proceedings and litigation, including class actions.

We are subject to product safety regulations, recalls and direct claims for product liability that can result in significant liability and, regardless of the ultimate outcome, can be costly to defend or manage. Also, we increasingly rely on other manufacturers to provide us with products or components for

12

Table of Contents

products that we sell. Due to the difficulty of controlling the quality of products or components sourced from other manufacturers, we are exposed to risks relating to the quality of such products and to limitations on our recourse against such suppliers.

We have also experienced class action lawsuits in recent years predicated upon claims for antitrust violations, product liability and wage and hour issues. We have generally denied liability and have vigorously defended these cases. Due to their scope and complexity, however, these lawsuits are particularly costly to resolve and significant exposures have been alleged.

Increasingly, our homebuilder customers are subject to construction defect and home warranty claims in the ordinary course of their business. Our contractual arrangements with these customers may include our agreement to defend and indemnify them against various liabilities caused by our negligence. These claims, often asserted several years after completion of construction, can result in complex lawsuits or claims against the homebuilders and many of their subcontractors, including us, and may require us to incur defense and indemnity costs even when our products or services are not the principal basis for the claims.

Although we intend to defend all claims and litigation matters vigorously, given the inherently unpredictable nature of claims and litigation, we cannot predict with certainty the outcome or effect of any claim or litigation matter.

We maintain insurance against some, but not all, of these risks of loss resulting from claims and litigation. We may elect not to obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. The levels of insurance we maintain may not be adequate to fully cover any and all losses or liabilities. If any significant accident, judgment, claim or other event is not fully insured or indemnified against, it could have a material adverse impact on our business, financial condition and results of operations.

See Note S to the consolidated financial statements included in Item 8 of this Report for additional information about litigation involving our businesses.

Government and industry responses to environmental and health and safety concerns could impact our capital expenditures and operating results.

We are subject to U.S. and foreign government regulations pertaining to health and safety (including protection of employees and consumers), climate disruption and environmental issues. In addition to complying with current requirements and requirements that will become effective at a future date, even more stringent requirements could be imposed on our industries in the future. Additionally, some of our products must be certified by industry organizations. Compliance with these regulations and industry standards may require us to alter our manufacturing and installation processes and our sourcing, which could adversely impact our competitive position. Further, if we do not effectively and timely comply with such regulations and industry standards, our operating results could be negatively affected.

The long-term performance of our businesses relies on our ability to attract, develop and retain talented personnel.

To be successful, we must attract, develop and retain highly qualified and talented personnel and, as we consider entering new international markets, skilled personnel familiar with these markets. We compete for employees with a broad range of employers in many different industries, including large multinational firms, and we invest significant resources in recruiting, developing, motivating and retaining them. The failure to attract, develop, motivate and retain key employees could negatively affect our competitive position and our operating results.

| Item 1B. Unresolved | Staff Comments. |

None.

13

Table of Contents

| Item 2. Properties. |

The table below lists our principal North American properties for segments other than Installation and Other Services.

| Business Segment |

Manufacturing | Warehouse and Distribution |

||||||

| Cabinets and Related Products |

12 | 13 | ||||||

| Plumbing Products |

23 | 6 | ||||||

| Decorative Architectural Products |

8 | 8 | ||||||

| Other Specialty Products |

10 | 6 | ||||||

|

|

|

|

|

|||||

| Totals |

53 | 33 | ||||||

|

|

|

|

|

|||||

Most of our North American facilities range from single warehouse buildings to complex manufacturing facilities. We own most of our North American manufacturing facilities, none of which are subject to significant encumbrances. A substantial number of our warehouse and distribution facilities are leased.

Our Installation and Other Services segment operates approximately 188 installation branch locations and approximately 70 distribution centers in the United States, most of which are leased.

The table below lists our principal properties outside of North America.

| Business Segment |

Manufacturing | Warehouse and Distribution |

||||||

| Cabinets and Related Products |

5 | 11 | ||||||

| Plumbing Products |

13 | 27 | ||||||

| Decorative Architectural Products |

— | — | ||||||

| Other Specialty Products |

7 | 1 | ||||||

|

|

|

|

|

|||||

| Totals |

25 | 39 | ||||||

|

|

|

|

|

|||||

Most of our international facilities are located in China, Denmark, Germany and the United Kingdom. We generally own our international manufacturing facilities, none of which are subject to significant encumbrances. A substantial number of our international warehouse and distribution facilities are leased.

Our corporate headquarters are located in Taylor, Michigan and are owned by us. We own an additional building near our corporate headquarters that is used by our corporate research and development department.

Each of our operating divisions assesses the manufacturing, distribution and other facilities needed to meet its operating requirements. Our buildings, machinery and equipment have been generally well maintained and are in good operating condition. We believe our facilities have sufficient capacity and are adequate for our production and distribution requirements.

Information regarding legal proceedings involving us is set forth in Note S to our consolidated financial statements included in Item 8 of this Report and is incorporated herein by reference.

Item 4. [Removed and Reserved.]

14

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

The New York Stock Exchange is the principal market on which our common stock is traded. The following table indicates the high and low sales prices of our common stock as reported by the New York Stock Exchange and the cash dividends declared per common share for the periods indicated:

| Market Price | Dividends Declared |

|||||||||||

| Quarter |

High | Low | ||||||||||

| 2011 |

||||||||||||

| Fourth |

$ | 10.71 | $ | 6.60 | $ | .075 | ||||||

| Third |

12.50 | 6.78 | .075 | |||||||||

| Second |

14.43 | 11.73 | .075 | |||||||||

| First |

15.03 | 12.41 | .075 | |||||||||

|

|

|

|||||||||||

| Total |

$ | .30 | ||||||||||

|

|

|

|||||||||||

| 2010 |

||||||||||||

| Fourth |

$ | 13.54 | $ | 10.46 | $ | .075 | ||||||

| Third |

12.05 | 9.94 | .075 | |||||||||

| Second |

18.78 | 10.74 | .075 | |||||||||

| First |

15.75 | 12.76 | .075 | |||||||||

|

|

|

|||||||||||

| Total |

$ | .30 | ||||||||||

|

|

|

|||||||||||

On January 31, 2012, there were approximately 5,350 holders of record of our common stock.

We expect that our practice of paying quarterly dividends on our common stock will continue, although the payment of future dividends is at the discretion of our Board of Directors and will depend upon our earnings, capital requirements, financial condition and other factors.

Equity Compensation Plan Information

We grant equity under our 2005 Long Term Stock Incentive Plan (the “Plan”). The following table sets forth information as of December 31, 2011 concerning the Plan, which was approved by our stockholders. We do not have any equity compensation plans that are not approved by stockholders.

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in the First Column) |

|||||||||

| Equity compensation plans approved by stockholders |

36,305,607 | $ | 20.93 | 8,318,400 | ||||||||

The remaining information required by this Item will be contained in our definitive Proxy Statement for our 2012 Annual Meeting of Stockholders, to be filed on or before April 29, 2012, and such information is incorporated herein by reference.

15

Table of Contents

Performance Graph

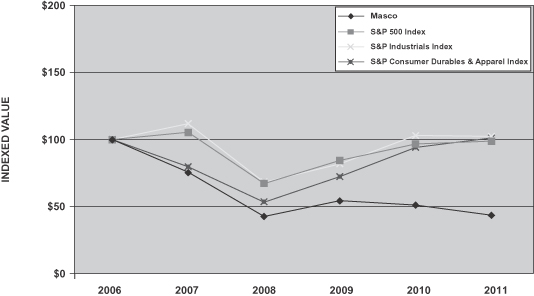

The table below compares the cumulative total shareholder return on our common stock with the cumulative total return of (i) the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), (ii) The Standard & Poor’s Industrials Index (“S&P Industrials Index”) and (iii) the Standard & Poor’s Consumer Durables & Apparel Index (“S&P Consumer Durables & Apparel Index”), from December 31, 2006 through December 31, 2011, when the closing price of our common stock was $10.48. The graph assumes investments of $100 on December 31, 2006 in our common stock and in each of the three indices and the reinvestment of dividends.

PERFORMANCE GRAPH

The table below sets forth the value, as of December 31 for each of the years indicated, of a $100 investment made on December 31, 2006 in each of our common stock, the S&P 500 Index, the S&P Industrials Index and the S&P Consumer Durables & Apparel Index and includes the reinvestment of dividends.

| 2007 |

2008 |

2009 |

2010 |

2011 |

||||||||||||||||

| Masco |

$ | 75.39 | $ | 42.06 | $ | 53.92 | $ | 50.60 | $ | 43.09 | ||||||||||

| S&P 500 Index |

$ | 105.48 | $ | 66.93 | $ | 84.28 | $ | 96.78 | $ | 98.81 | ||||||||||

| S&P Industrials Index |

$ | 111.99 | $ | 67.86 | $ | 81.56 | $ | 103.08 | $ | 102.47 | ||||||||||

| S&P Consumer Durables & Apparel Index |

$ | 79.60 | $ | 52.88 | $ | 72.07 | $ | 94.08 | $ | 101.33 | ||||||||||

In July 2007, our Board of Directors authorized the purchase of up to 50 million shares of our common stock in open-market transactions or otherwise. At December 31, 2011, we had remaining authorization to repurchase up to 25 million shares. During 2011, we repurchased and retired two million shares of our common stock, for cash aggregating $30 million to offset the dilutive impact of the 2011 grant of two million shares of long-term stock awards. We have not purchased any shares since April 2011.

16

Table of Contents

| Item 6. | Selected Financial Data. |

| Dollars in Millions (Except Per Common Share Data) | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Net Sales (1) |

$ | 7,467 | $ | 7,486 | $ | 7,657 | $ | 9,338 | $ | 11,251 | ||||||||||

| Operating (loss) profit (1)(2)(3)(4)(5)(6) |

$ | (295 | ) | $ | (463 | ) | $ | 70 | $ | 149 | $ | 1,052 | ||||||||

| (Loss) income from continuing operations attributable to Masco Corporation (1)(2)(3)(4)(5)(6)(7) |

$ | (465 | ) | $ | (1,022 | ) | $ | (130 | ) | $ | (329 | ) | $ | 496 | ||||||

| Per share of common stock: |

||||||||||||||||||||

| (Loss) income from continuing operations: |

||||||||||||||||||||

| Basic |

$ | (1.34 | ) | $ | (2.94 | ) | $ | (.38 | ) | $ | (.95 | ) | $ | 1.31 | ||||||

| Diluted |

$ | (1.34 | ) | $ | (2.94 | ) | $ | (.38 | ) | $ | (.95 | ) | $ | 1.31 | ||||||

| Dividends declared |

$ | .30 | $ | .30 | $ | .30 | $ | .93 | $ | .92 | ||||||||||

| Dividends paid |

$ | .30 | $ | .30 | $ | .46 | $ | .925 | $ | .91 | ||||||||||

| At December 31: |

||||||||||||||||||||

| Total assets |

$ | 7,297 | $ | 8,140 | $ | 9,175 | $ | 9,483 | $ | 10,907 | ||||||||||

| Long-term debt |

3,222 | 4,032 | 3,604 | 3,915 | 3,966 | |||||||||||||||

| Shareholders’ equity |

742 | 1,582 | 2,817 | 2,981 | 4,142 | |||||||||||||||

| (1) | Amounts exclude discontinued operations. |

| (2) | The year 2011 includes non-cash impairment charges for goodwill and other intangible assets aggregating $335 million after tax ($494 million pre-tax). |

| (3) | The year 2010 includes non-cash impairment charges for goodwill and other intangible assets aggregating $586 million after tax ($698 million pre-tax). The year 2010 also includes a valuation allowance on U.S. deferred tax assets of $372 million. |

| (4) | The year 2009 includes non-cash impairment charges for goodwill aggregating $180 million after tax ($262 million pre-tax). |

| (5) | The year 2008 includes non-cash impairment charges for goodwill and other intangible assets aggregating $412 million after tax ($415 million pre-tax). |

| (6) | The year 2007 includes non-cash impairment charges for goodwill and other intangible assets aggregating $100 million after tax ($119 million pre-tax). |

| (7) | (Loss) income from continuing operations excludes income from noncontrolling interest of $42 million, $41 million, $38 million, $39 million and $37 million in 2011, 2010, 2009, 2008 and 2007, respectively. |

17

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The financial and business analysis below provides information which we believe is relevant to an assessment and understanding of our consolidated financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with the consolidated financial statements and related notes.

The following discussion and certain other sections of this Report contain statements reflecting our views about our future performance and constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “believe,” “estimate,” “expect,” “assume,” “seek,” “appear,” “may,” “should,” “will,” “forecast” and similar references to future periods. These views involve risks and uncertainties that are difficult to predict and, accordingly, our actual results may differ materially from the results discussed in such forward-looking statements. We caution you against relying on any of these forward-looking statements. In addition to the various factors included in the “Executive Level Overview,” “Critical Accounting Policies and Estimates” and “Outlook for the Company” sections, our future performance may be affected by our reliance on new home construction and home improvement, our reliance on key customers, the cost and availability of raw materials, shifts in consumer preferences and purchasing practices, and our ability to achieve cost savings through business rationalizations and other initiatives. These and other factors are discussed in detail in Item 1A “Risk “Factors” of this Report. Any forward-looking statement made by us in this Report speaks only as of the date on which it was made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

Executive Level Overview

We manufacture, distribute and install home improvement and building products. These products are sold to the home improvement and new home construction markets through mass merchandisers, hardware stores, home centers, homebuilders, distributors and other outlets for consumers and contractors and direct to the consumer.

2011 Results. The following is a summary of the significant factors affecting us in 2011: Our Cabinets and Related Products segment continues to be negatively affected by softness in the new home construction market and increased competitive market conditions in the repair and remodel market. Further, the Cabinets and Related Products segment continued to incur costs and charges related to the integration of our North American cabinet manufacturers that began in 2010 and other plant closures and consolidations, including the exit of certain product lines. This segment also incurred goodwill impairment charges related to our ready-to-assemble cabinet manufacturer in Europe. Our Plumbing Products segment continues to realize increased sales volume and selling prices, offset by increased commodity costs and a less favorable product mix. The Installation and Other Services segment was positively affected by increased distribution sales, increased selling prices and increased retrofit and commercial sales, which partially offset decreases in sales volume related to the new home construction market. We also decided to divest certain operations in the Installation and Other Services segment that are not core to our long-term growth strategy; such operations have been classified as discontinued operations. The Decorative Architectural Products segment was negatively affected by lower sales volume of paints and stains due to increasingly competitive market conditions and increased commodity costs; this segment also incurred goodwill impairment charges related to the builders’ hardware business unit and rationalization costs related to the exit of a builders’ hardware product line. Our Other Specialty Products segment was negatively impacted by lower sales volume due to continuing weakness in our markets and increased business rationalization costs related to the closure of several facilities.

18

Table of Contents

In 2011, we experienced increased commodity costs, and the economy continued to experience a further decline in home values, lack of job creation and depressed consumer confidence, hindering a housing recovery, all of which negatively impacted our performance. During 2011 we continued to take actions to further reduce our cost structure, including closing several branch locations in the Installation and Other Services segment, closing several manufacturing facilities related to our North American window manufacturer, closing one manufacturing facility related to our European ready-to-assemble cabinet manufacturer, one facility related to our North American cabinet manufacturer and continued to integrate our North American cabinet manufacturers. We incurred costs and charges related to these and other actions of $121 million. We believe that these actions, together with actions taken over the last several years, have positioned us well for the current environment and for the recovery in our markets.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of these financial statements requires us to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We regularly review our estimates and assumptions, which are based upon historical experience, as well as current economic conditions and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of certain assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions.

We believe that the following critical accounting policies are affected by significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition and Receivables

We recognize revenue as title to products and risk of loss is transferred to customers or when services are rendered. We record revenue for unbilled services performed based upon estimates of material and labor incurred in the Installation and Other Services segment; such amounts are recorded in Receivables. We record estimated reductions to revenue for customer programs and incentive offerings, including special pricing and co-operative advertising arrangements, promotions and other volume-based incentives. We maintain allowances for doubtful accounts receivable for estimated losses resulting from the inability of customers to make required payments. In addition, we monitor our customer receivable balances and the credit worthiness of our customers on an on-going basis. During downturns in our markets, declines in the financial condition and creditworthiness of customers impact the credit risk of the receivables involved and we have incurred bad debt expense related to customer defaults. Our bad debt expense was $12 million, $18 million and $34 million for the years ended December 31, 2011, 2010 and 2009, respectively.

Inventories

We record inventories at the lower of cost or net realizable value, with expense estimates made for obsolescence or unsaleable inventory equal to the difference between the recorded cost of inventories and their estimated market value based upon assumptions about future demand and market conditions. On an on-going basis, we monitor these estimates and record adjustments for differences between estimates and actual experience. Historically, actual results have not significantly deviated from those determined using these estimates.

19

Table of Contents

Financial Investments

We follow accounting guidance that defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements for our financial investments and liabilities. This guidance defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Further, it defines a fair value hierarchy, as follows: Level 1 inputs as quoted prices in active markets for identical assets or liabilities; Level 2 inputs as observable inputs other than Level 1 prices, such as quoted market prices for similar assets or liabilities or other inputs that are observable or can be corroborated by market data; and Level 3 inputs as unobservable inputs that are supported by little or no market activity and that are financial instruments whose value is determined using pricing models or instruments for which the determination of fair value requires significant management judgment or estimation.

If applicable, we record investments in available-for-sale securities at fair value, and unrealized gains or losses (that are deemed to be temporary) are recognized, net of tax effect, through shareholders’ equity, as a component of other comprehensive income in our consolidated balance sheet. During 2011 and 2010, we sold all of our shares of our investment in TriMas common stock for cash of $43 million and $10 million, respectively.

In the past, we have invested excess cash in auction rate securities. Auction rate securities are investment securities that have interest rates which are reset every 7, 28 or 35 days. At December 31, 2011, our investment in auction rate securities was $22 million; we have not increased our investment in auction rate securities since 2007. The fair value of auction rate securities is estimated, on a recurring basis, using a discounted cash flow model (Level 3 input). If we changed the discount rate used in the fair value estimate by 75 basis points, the value of the auction rate securities would change by approximately $1 million.

We have maintained investments in a number of private equity funds, which aggregated $86 million at December 31, 2011. We carry our investments in private equity funds and other private investments at cost. It is not practicable for us to estimate a fair value for private equity funds and other private investments because there are no quoted market prices, and sufficient information is not readily available for us to utilize a valuation model to determine the fair value for each fund. These investments are evaluated, on a non-recurring basis, for potential other-than-temporary impairment when impairment indicators are present, or when an event or change in circumstances has occurred, that may have a significant adverse effect on the fair value of the investment. Due to the significant unobservable inputs, the fair value measurements used to evaluate impairment are a Level 3 input.

Impairment indicators we consider include the following: whether there has been a significant deterioration in earnings performance, asset quality or business prospects; a significant adverse change in the regulatory, economic or technological environment; a significant adverse change in the general market condition or geographic area in which the investment operates; industry and sector performance; current equity and credit market conditions; and any bona fide offers to purchase the investment for less than the carrying value. We also consider specific adverse conditions related to the financial health of and business outlook for the fund, including industry and sector performance. The significant assumptions utilized in analyzing a fund for potential other-than-temporary impairment include current economic conditions, market analysis for specific funds and performance indicators in residential and commercial construction, bio-technology, health care and information technology sectors in which the applicable funds’ investments operate.

At December 31, 2011, we have investments in 17 venture capital funds, with an aggregate carrying value of $17 million. The venture capital funds invest in start-up or smaller, early-stage established businesses, principally in the information technology, bio-technology and health care sectors. At December 31, 2011, we also have investments in 22 buyout funds, with an aggregate carrying value of $69 million. The buyout funds invest in later-stage, established businesses and no buyout fund has a concentration in a particular sector.

20

Table of Contents

Since there is no active trading market for these investments, they are for the most part illiquid. These investments, by their nature, can also have a relatively higher degree of business risk, including financial leverage, than other financial investments. The timing of distributions from the funds, which depends on particular events related to the underlying investments, as well as the funds’ schedules for making distributions and their needs for cash, can be difficult to predict. As a result, the amount of income we record from these investments can vary substantially from quarter to quarter. Future changes in market conditions, the future performance of the underlying investments or new information provided by private equity fund managers could affect the recorded values of these investments and the amounts realized upon liquidation.