UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

For the fiscal year ended December 31 , 2020

or

For the transition period from ___________ to ___________

Commission file number: 1-5794

(Exact name of Registrant as Specified in its Charter)

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |||||||||||||

| | ||||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

Registrant's telephone number, including area code: (313 ) 274-7400

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange On Which Registered | ||||||||||||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☑ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the Registrant's Common Stock held by non-affiliates of the Registrant on June 30, 2020 (based on the closing sale price of $50.21 of the Registrant's Common Stock, as reported by the New York Stock Exchange on such date) was approximately $13,053,334,100 .

Number of shares outstanding of the Registrant's Common Stock at January 31, 2021:

DOCUMENTS INCORPORATED BY REFERENCE

Masco Corporation

2020 Annual Report on Form 10-K

TABLE OF CONTENTS

| Item | Page | |||||||||||||

1

PART I

Item 1.Business.

Masco Corporation is a global leader in the design, manufacture and distribution of branded home improvement and building products. Our portfolio of industry-leading brands includes BEHR® paint; DELTA® and HANSGROHE® faucets, bath and shower fixtures; KICHLER® decorative and outdoor lighting; LIBERTY® branded decorative and functional hardware; and HOT SPRING® spas. We leverage our powerful brands across product categories, sales channels and geographies to create value for our customers and shareholders.

We believe that our solid results of operations and financial position for 2020 resulted from strong consumer demand for our lower ticket, repair and remodel-oriented products and increased spending on repair and remodel activity, along with our continued focus on our three strategic pillars:

•drive the full potential of our core businesses;

•leverage opportunities across our enterprise; and

•actively manage our portfolio.

In 2020, we completed the divestiture of our Masco Cabinetry business ("Cabinetry"), and completed the acquisitions of Kraus USA Inc. ("Kraus"), Work Tools International Inc. and Elder & Jenks, LLC (collectively "Work Tools"), and SmarTap A.Y Ltd. ("SmarTap"). We also entered into an agreement in November 2020 to purchase a majority stake in Easy Sanitary Solutions B.V. ("ESS"). This transaction closed on January 4, 2021. Additionally in 2020, we continued to return value to our shareholders by repurchasing approximately 18.8 million shares of our common stock and increasing our quarterly dividend by approximately 4 percent.

Our Business Segments

We report our financial results in two segments, our Plumbing Products segment and our Decorative Architectural Products segment, which are aggregated by product similarity. Our Decorative Architectural Products segment is impacted by seasonality and normally experiences stronger sales during the second and third calendar quarters, corresponding with the peak season for repair and remodel activity.

Plumbing Products

The businesses in our Plumbing Products segment sell a wide variety of products that are manufactured or sourced by us.

•Our plumbing products include faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks and toilets. We sell these products to home center and online retailers and to wholesalers and distributors that, in turn, sell them to plumbers, building contractors, remodelers, smaller retailers and consumers. The majority of our faucet, bathing and showering products are sold primarily in North America and Europe under the brand names DELTA®, BRIZO®, PEERLESS®, HANSGROHE®, AXOR®, KRAUS®, GINGER®, NEWPORT BRASS®, BRASSTECH® and WALTEC®. Our BRISTAN™ and HERITAGE™ products are sold primarily in the United Kingdom.

•We manufacture acrylic tubs, bath and shower enclosure units, and shower bases and trays. Our DELTA, PEERLESS and MIROLIN® products are sold primarily to home center retailers in North America. Our MIROLIN products are also sold to wholesalers and distributors in Canada. Our HÜPPE® shower enclosures and shower trays are sold through wholesale channels primarily in Europe.

•Our spas, exercise pools and fitness systems are manufactured and sold under our HOT SPRING®, CALDERA®, FREEFLOW SPAS®, FANTASY SPAS® and ENDLESS POOLS® brands, as well as under other trademarks. Our spa and exercise pools are sold worldwide to independent specialty retailers and distributors and to online mass merchant retailers. Certain exercise pools are also available on a consumer-direct basis in North America and Europe, while our fitness systems are sold through independent specialty retailers as well as on a consumer-direct basis in some areas.

2

•Included in our Plumbing Products segment are brass, copper and composite plumbing system components and other non-decorative plumbing products that are sold to plumbing, heating and hardware wholesalers, home center and online retailers, hardware stores, building supply outlets and other mass merchandisers. These products are marketed primarily in North America under our BRASSCRAFT®, PLUMB SHOP®, COBRA®, COBRA PRO™ and MASTER PLUMBER® brands and are also sold under private label.

•Within our Plumbing Products segment we develop connected water products that enhance the experience with water in homes and businesses. These systems include touchless activation, voice activation, controlled volume dispensing and provide for monitoring and controlling the temperature and flow of water and are compatible with a wide range of faucets, showerheads and other showering components.

•We also supply high-quality, custom thermoplastic solutions, extruded plastic profiles and specialized fabrications, as well as PEX tubing, to manufacturers, distributors and wholesalers for use in diverse applications that include faucets and plumbing supplies, appliances, oil and gas equipment, building products and automotive components.

We believe that our plumbing products are among the leaders in sales in North America and Europe. Competitors of the majority of our products in this segment include Elkay Manufacturing Company, Fortune Brands Home & Security, Inc.'s Moen, Rohl and Riobel brands, Kohler Co., Lixil Group Corporation’s American Standard and Grohe brands and Spectrum Brands Holdings, Inc.’s Pfister faucets. Competitors of our spas and exercise pools and systems include Artesian Spas, Jacuzzi and Master Spas brands. Foreign manufacturers competing with us are located primarily in Europe and China. We face significant competition from private label products and digitally native brands. Many of the faucet and showering products with which our products compete are manufactured by foreign manufacturers that contribute to price competition. The businesses in our Plumbing Products segment manufacture products primarily in North America and Europe as well as in Asia and source products from Asia and other regions. Competition for our plumbing products is based largely on brand reputation, product features and innovation, product quality, customer service, breadth of product offering and price.

Many of our plumbing products contain brass, the major components of which are copper and zinc. We have multiple sources, both domestic and foreign, for the raw materials used in this segment. We have encountered price volatility for brass, brass components and any components containing copper and zinc. To help reduce the impact of this volatility, from time to time we may enter into long-term agreements with certain significant suppliers or, occasionally, use derivative instruments. In addition, some of the products in this segment that we import have been and may in the future be subject to duties and tariffs.

Decorative Architectural Products

Our Decorative Architectural Products segment primarily includes architectural coatings, including paints, primers, specialty coatings, stains and waterproofing products, as well as paint applicators and accessories. These products are sold in North America, South America and China under the brand names BEHR®, KILZ®, WHIZZ®, Elder & Jenks® and other trademarks to “do‑it‑yourself” and professional customers through home center retailers and other retailers. Net sales of architectural coatings comprised approximately 33 percent, 31 percent and 30 percent of our consolidated net sales from our continuing operations in 2020, 2019, and 2018, respectively. Our BEHR products are sold through The Home Depot, our largest customer overall, as well as this segment’s largest customer. Our Behr business grants Behr brand exclusivity in the retail sales channel in North America to The Home Depot. The granting of exclusivity affects our ability to sell those products and brands to other customers and the loss of this segment’s sales to The Home Depot would have a material adverse effect on this segment’s business and on our consolidated business as a whole.

Our competitors in this segment include large national and international brands such as Benjamin Moore & Co., PPG Industries, Inc.'s Glidden, Olympic, Pittsburgh Paints and PPG brands, The Sherwin‑Williams Company's Minwax, Sherwin-Williams, Thompson’s Water Seal, Valspar and Purdy brands, RPM International, Inc.'s Rust-Oleum and Zinsser brands and the Wooster Brush Company, as well as many regional and other national brands. We believe that brand reputation is an important factor in consumer selection, and that competition in this industry is also based largely on product features and innovation, product quality, customer service, breadth of product offering and price.

3

Titanium dioxide and acrylic resins are principal raw materials in the manufacture of architectural coatings. The price for titanium dioxide can fluctuate as a result of global supply and demand dynamics and production capacity limitations, which can have a material impact on our costs and results of operations in this segment. The price of acrylic resins fluctuates based on the price of its components, which can also have a material impact on our costs and results of operations in this segment. In addition, the prices of crude oil, natural gas and certain petroleum by-products can impact our costs and results of operations in this segment. We have agreements with certain significant suppliers for this segment that are intended to help assure continued supply.

Our Decorative Architectural Products segment includes branded cabinet and door hardware, functional hardware, wall plates, hook and hook rail products, closet organization systems and picture hanging accessories, which are manufactured for us and sold to home center retailers, mass retailers, online retailers, other specialty retailers, original equipment manufacturers and wholesalers. These products are sold under the LIBERTY®, BRAINERD®, FRANKLIN BRASS® and other trademarks. Our key competitors in North America include Amerock Hardware, Richelieu Hardware Ltd., Top Knobs and private label brands. Decorative bath hardware, shower accessories, mirrors and shower doors are sold under the brand names DELTA® and FRANKLIN BRASS® and other trademarks to home center retailers, mass retailers, online retailers, other specialty retailers and wholesalers. Competitors for these products include Fortune Brands Home & Security, Inc.'s Moen brand, Gatco Fine Bathware, Kohler Co. and private label brands.

This segment also includes decorative indoor and outdoor lighting fixtures, ceiling fans, landscape lighting and LED lighting systems. These products are sold to home center retailers, online retailers, electrical distributors, landscape distributors and lighting showrooms under the brand names KICHLER® and ÉLAN® and under other trademarks. Competitors of these products include Acuity, FX Luminaire, Generation Brands, Hinkley Lighting, Inc., Hubbell Incorporated's Progress Lighting brand, Hunter Fan Company and private label brands.

Certain products in our Decorative Architectural Products segment contain propylene, methyl methacrylate (MMA), titanium dioxide and zinc. We have multiple sources, both domestic and foreign, for the raw materials used in this segment. We have encountered price volatility for propylene and MMA and, to a lesser extent in this segment, zinc. To help reduce the impact of this volatility, from time to time we may enter into long-term agreements with certain significant suppliers or, occasionally, use derivative instruments. We import certain materials and products for this segment that have been and may in the future be subject to duties and tariffs.

Additional Information

Intellectual Property

We hold numerous U.S. and foreign patents, patent applications, licenses, trademarks, trade names, trade secrets and proprietary manufacturing processes. We view our trademarks and other intellectual property rights as important, but do not believe that there is any reasonable likelihood of a loss of such rights that would have a material adverse effect on our present business as a whole.

Laws and Regulations Affecting Our Business

We are subject to federal, state, local and foreign government laws and regulations. For a more detailed description of the various laws and regulations that impact our business, see Item 1A. Risk Factors.

We monitor applicable laws and regulations and incur ongoing expense relating to compliance, however we do not expect that compliance with federal, state, local and foreign regulations, will result in material capital expenditures or have a material adverse effect on our results of operations and financial position.

Human Capital Management

We believe that the performance of our Company is impacted by our human capital management, and as a result we consistently work to attract, select, develop, engage and retain strong, diverse talent. We are focused on three key strategic talent priorities: leadership, diversity, equity and inclusion, and our future workforce. Our Chief Human Resources Officer is responsible for developing and executing our human capital strategy and provides regular updates to our Board of Directors’ Organization and Compensation Committee on our progress toward the achievement of our strategic initiatives. We believe that all of our human capital initiatives work together to assure we have an environment where our employees are engaged, feel a sense of belonging, and can reach their full potential.

4

Leadership

We support and grow our employees by providing continuous development practices and tools that build and strengthen leadership capabilities. Our leadership framework is designed to serve as the foundation for how we select, develop and measure the performance of our leaders. We have also placed a specific focus on building a coaching culture by enabling frequent and candid feedback discussions about performance and development between employees and their managers, across peers, and within teams.

Diversity, Equity and Inclusion ("DE&I")

We believe a workplace that encourages different voices, perspectives and backgrounds creates better teams, better solutions and more innovation. For the past several years, we have strived to create a culture of inclusion, reduce bias in our talent practices, and invest in and engage with our communities. We are focused on the following three key areas:

•Our workplace: who we are and how it feels to work at Masco

•Our communities: how we can help increase access, equity, and inclusion with our diverse community partners

•Our marketplace: how we represent our consumers and use our buying power to support advancing economic equity

We are refining strategic objectives and expectations within each of these focus areas. We are also developing multiple internal channels to increase communication and opportunity for engagement among our employees. In 2020, we established a global, enterprise DE&I Council and several local councils and employee resource groups at our business units and our corporate headquarters to help implement action plans tailored to their specific needs and challenges.

Future Workforce

We are consistently working to identify the critical capabilities our employees and the organization need to help us achieve our businesses objectives. We leverage our Masco Operating System to ensure our businesses are focused on the right capabilities and are providing the right tools, training and structure to building these new and important skills.

Employee Health and Safety

The safety of our employees is integral to our company. In support of our safety efforts, we identify, assess and investigate incidents and injury data, and each year set a goal to improve key safety performance indicators. We train, promote, consult and communicate with our workforce in this process. In 2020, the Coronavirus Disease 2019 ("COVID-19") pandemic highlighted the importance of employee welfare. Our cross-functional Infectious Illness Response Team reacted quickly to keep our employees safe through the implementation of policies and safety measures that adhered to best practices from the World Health Organization and the Centers for Disease Control.

Our Workforce

At December 31, 2020, we employed approximately 18,000 people.

Available Information

Our website is www.masco.com. Our periodic reports and all amendments to those reports required to be filed or furnished pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after those reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). This Report is being posted on our website concurrently with its filing with the SEC. Material contained on our website is not incorporated by reference into this Report. Our reports filed with the SEC also may be found on the SEC’s website at www.sec.gov.

5

Item 1A. Risk Factors.

There are a number of business risks and uncertainties that could affect our business. These risks and uncertainties could cause our actual results to differ from past performance or expected results. We consider the following risks and uncertainties to be most relevant to our specific business activities. Additional risks and uncertainties not presently known to us, or that we currently believe to be immaterial, also may adversely impact our business, results of operations and financial position.

Coronavirus Disease 2019 Risks

The ongoing COVID-19 pandemic is disrupting our business, and has and may continue to impact our results of operations and financial condition.

The spread of COVID-19 has created a global health crisis that has resulted in widespread disruption to economic activity, both in the U.S. and globally.

We operate facilities in the United States and around the world which are being adversely affected by this pandemic. The U.S. federal government and numerous state, local and foreign governments implemented certain measures to attempt to slow and limit the spread of COVID-19, including shelter-in-place and social distancing orders, which are subject to change and the respective governmental authorities may tighten such restrictions at any time. Due to such measures we have experienced, and may continue to experience, the closure of certain of our facilities, delays or disruptions in the supply of raw materials, component parts and services and decreased employee availability, which has resulted and may continue to result in delays in our ability to produce and distribute our products.

In addition, COVID-19 has adversely affected and may continue to adversely affect domestic and international economic activity, including reduced consumer confidence, instability in the credit and financial markets and reduced business and consumer spending, which may adversely affect our results of operations. Economic uncertainly as a result of COVID-19 may also make it difficult for us and our customers and suppliers to accurately forecast and plan future business activities and may weaken the financial position of some of our suppliers and customers.

Due to the uncertain nature and potential duration of the COVID-19 pandemic, we are unable to fully estimate the extent of the impact it may have on the markets in which we operate or our business at this time. The extent of such impact will depend on a number of factors, including the duration and severity of the COVID-19 pandemic, its effect on our customers, suppliers and employees, its effect on domestic and international economies and markets, including consumer discretionary spending, and the response of governmental authorities. We are continuing to take action to mitigate the impact of the COVID-19 pandemic on our business and operations, including through cost reduction measures and other initiatives, however the effectiveness of our mitigation efforts remains uncertain. A continued disruption of our operations and an on-going slowdown in domestic and international economic activity could materially and adversely affect our results of operations and financial condition.

To the extent COVID-19 continues to impact our business, financial position and results of operations, it may also have the effect of heightening certain of the other risks described in this Annual Report on Form 10-K, such as those relating to our international operations and global strategies, our dependence on third-party suppliers, and compliance with covenants under our credit facility.

Strategic Risks

Our business strategy is focused on residential repair and remodeling activity and, to a lesser extent, on new home construction activity, both of which are impacted by a number of economic factors and other factors.

Our business relies on residential repair and remodeling activity and, to a lesser extent, on new home construction activity. A number of factors impact consumers’ spending on home improvement projects as well as new home construction activity, including:

•consumer confidence levels;

•fluctuations in home prices;

•existing home sales;

•unemployment and underemployment levels;

•consumer income and debt levels;

6

•household formation;

•the availability of skilled tradespeople for repair and remodeling work;

•the availability of home equity loans and mortgages and the interest rates for and tax deductibility of such loans;

•trends in lifestyle and housing design; and

•natural disasters, terrorist acts, pandemics or other catastrophic events.

The fundamentals driving our business are impacted by economic cycles. Adverse changes or uncertainty involving the factors listed above or an economic contraction in the United States and worldwide could result in a decline in spending on residential repair and remodeling activity and a decline in demand for new home construction, which could adversely affect our results of operations and financial position.

We may not achieve all of the anticipated benefits of our strategic initiatives.

We continue to pursue our strategic initiatives of investing in our brands, developing innovative products, and focusing on operational excellence through the Masco Operating System, our methodology to drive growth and productivity. These initiatives are designed to grow revenue, improve profitability and increase shareholder value over the mid- to long-term. Our business performance and results could be adversely affected if we are unable to successfully execute these initiatives or if we are unable to execute these initiatives in a timely and efficient manner. We could also be adversely affected if we have not appropriately prioritized and balanced our initiatives or if we are unable to effectively manage change throughout our organization.

We may not be able to successfully execute our acquisition strategy or integrate businesses that we acquire.

Pursuing the acquisition of businesses complementary to our portfolio is a component of our strategy for future growth. If we are not able to identify suitable acquisition candidates or consummate potential acquisitions within a desired time frame or at acceptable terms and prices, our long-term competitive positioning may be affected. Even if we are successful in acquiring businesses, the businesses we acquire may not be able to achieve the revenue, profitability or growth we anticipate, or we may experience challenges and risks in integrating these businesses into our existing business. Such risks include:

•difficulties realizing expected synergies and economies of scale;

•diversion of management attention and our resources;

•unforeseen liabilities;

•issues or conflicts with our new or existing customers or suppliers; and

•difficulties in retaining critical employees of the acquired businesses.

Future foreign acquisitions may also increase our exposure to foreign currency risks and risks associated with interpretation and enforcement of foreign regulations. Our failure to address these risks could cause us to incur additional costs and fail to realize the anticipated benefits of our acquisitions and could adversely affect our results of operations and financial position.

Business and Operational Risks

Variability in the cost and availability of our raw materials, component parts and finished goods, including the imposition of tariffs could affect our results of operations and financial position.

We purchase substantial amounts of raw materials, component parts and finished goods from outside sources, including international sources, and we manufacture certain of our products outside of the United States. Increases in the cost of the materials we purchase have in the past and may in the future increase the prices for our products, including as a result of new tariffs. For example, the continuing trade dispute between the United States and China has resulted in tariffs which raised the cost of certain of our materials. There is a risk that additional tariffs on imports from China or new tariffs could be imposed, which could further increase the cost of the materials we purchase or import or the products we manufacture internationally. Further, our production could be affected if we or our suppliers are unable to procure our requirements for various commodities, including, among others, brass, resins, titanium dioxide and zinc, or if a shortage of these commodities results in significantly increased costs. Rising energy costs could also increase our production and transportation costs. In addition, water is a significant component of our architectural coatings products and may be subject to restrictions in certain regions. These factors could adversely affect our results of operations and financial position.

7

It can be difficult for us to pass on to customers our cost increases. Our existing arrangements with customers, competitive considerations and customer resistance to price increases may delay or make us unable to adjust selling prices. If we are not able to sufficiently increase the prices of our products or achieve cost savings to offset increased material and production costs, including the impact of increasing tariffs, our results of operations and financial position could be adversely affected. Increased selling prices for our products have and may in the future lead to sales declines and loss of market share, particularly if those prices are not competitive. When our material costs decline, we have experienced and may in the future receive pressure from our customers to reduce our prices. Such reductions could adversely affect our results of operations and financial position.

From time to time we enter into long-term agreements with certain significant suppliers to help ensure continued availability of the commodities we require to produce our products and to establish firm pricing, but at times these contractual commitments may result in our paying above market prices for commodities during the term of the contract. Occasionally, we may also use derivative instruments, including commodity futures and swaps. This strategy increases the possibility that we may make commitments for these commodities at prices that subsequently exceed their market prices, which has occurred and could occur in the future and may adversely affect our results of operations and financial position.

We are dependent on third-party suppliers.

We are dependent on third-party suppliers for many of our products and components, and our ability to offer a wide variety of products depends on our ability to obtain an adequate and timely supply of these products and components. Failure of our suppliers to timely provide us quality products on commercially reasonable terms, or to comply with applicable legal and regulatory requirements, or our policies regarding our supplier business practices, could have a material adverse effect on our results of operations and financial position or could damage our reputation. Sourcing these products and components from alternate suppliers, including suppliers from new geographic regions, is time-consuming and costly and could result in inefficiencies or delays in our business operations. Accordingly, the loss of critical suppliers, or a substantial decrease in the availability of products or components from our suppliers, could disrupt our business and adversely affect our results of operations and financial position.

Many of the suppliers we rely upon are located in foreign countries, primarily China. The differences in business practices, shipping and delivery requirements, changes in economic conditions and trade policies and laws and regulations, together with the limited number of suppliers, have increased the complexity of our supply chain logistics and the potential for interruptions in our production scheduling. If we are unable to effectively manage our supply chain or if we experience constraints to or disruption in transporting the products or components or we have to pay higher transportation costs for timely delivery of our products or components, our results of operations and financial position could be adversely affected.

There are risks associated with our international operations and global strategies.

In 2020, 19 percent of our sales from continuing operations were made outside of North America (principally in Europe) and transacted in currencies other than the U.S. dollar. In addition to our European operations, we manufacture products in Asia and source products and components from third parties globally. Risks associated with our international operations include:

•differences in culture, economic and labor conditions and practices;

•the policies of the U.S. and foreign governments;

•disruptions in trade relations and economic instability;

•differences in enforcement of contract and intellectual property rights;

•social and political unrest; and

•natural disasters, terrorist attacks, pandemics or other catastrophic events.

We are also affected by domestic and international laws and regulations applicable to companies doing business abroad or importing and exporting goods and materials. These include tax laws, laws regulating competition, anti-bribery/anti-corruption and other business practices, and trade regulations, including duties and tariffs. Compliance with these laws is costly, and future changes to these laws may require significant management attention and disrupt our operations. Additionally, while it is difficult to assess what changes may occur and the relative effect on our international tax structure, significant changes in how U.S. and foreign jurisdictions tax cross-border transactions could adversely affect our results of operations and financial position.

8

Our results of operations and financial position are also impacted by changes in currency exchange rates. Unfavorable currency exchange rates, particularly the Euro, the Chinese Yuan Renminbi, the Canadian dollar and the British pound sterling, have in the past adversely affected us, and could adversely affect us in the future. Fluctuations in currency exchange rates may present challenges in comparing operating performance from period to period.

Additionally, following the United Kingdom's exit from the European Union, we could experience volatility in the currency exchange rates or a change in the demand for our products and services, particularly in our U.K. and European markets, or there could be disruption of our operations and our customers’ and suppliers’ businesses.

The long-term performance of our businesses relies on our ability to attract, develop and retain talented and diverse personnel.

To be successful, we must invest significant resources to attract, develop and retain highly qualified, talented and diverse employees at all levels, who have the experience, knowledge and expertise to implement our strategic initiatives. We compete for employees with a broad range of employers in many different industries, including large multinational firms, and we may fail in recruiting, developing, motivating and retaining them, particularly when there are low unemployment levels. From time to time, we have been affected by a shortage of qualified personnel in certain geographic areas. Our growth, competitive position and results of operations and financial position could be adversely affected by our failure to attract, develop and retain key employees and diverse talent, to build strong leadership teams, or to develop effective succession planning to assure smooth transitions of those employees and the knowledge and expertise they possess, or by a shortage of qualified employees.

Restrictive covenants in our credit agreement could limit our financial flexibility.

We must comply with both financial and nonfinancial covenants in our credit agreement, and in order to borrow under it, we cannot be in default with any of those provisions. Our ability to borrow under the credit agreement could be affected if our earnings significantly decline to a level where we are not in compliance with the financial covenants or if we default on any nonfinancial covenants. In the past, we have been able to amend the covenants in our credit agreement, but there can be no assurance that in the future we would be able to further amend them. If we were unable to borrow under our credit agreement, our financial flexibility could be restricted.

Competitive Risks

We could lose market share if we do not maintain our strong brands, develop innovative products or respond to changing purchasing practices and consumer preferences or if our reputation is damaged.

Our competitive advantage is due, in part, to our ability to maintain our strong brands and to develop and introduce innovative new and improved products. Our initiatives to invest in brand building, brand awareness and product innovation may not be successful. The uncertainties associated with developing and introducing innovative and improved products, such as gauging changing consumer demands and preferences and successfully developing, manufacturing, marketing and selling these products, may impact the success of our product introductions. If the products we introduce do not gain widespread acceptance or if our competitors improve their products more rapidly or effectively than we do, we could lose market share or be required to reduce our prices, which could adversely impact our results of operations and financial position.

In recent years, consumer purchasing practices and preferences have shifted and our customers’ business models and strategies have changed. As our customers execute their strategies to reach end consumers through multiple channels, they rely on us to support their efforts with our infrastructure, including maintaining robust and user-friendly websites with sufficient content for consumer research and providing comprehensive supply chain solutions and differentiated product development. If we are unable to successfully provide this support to our customers or if our customers are unable to successfully execute their strategies, our brands may lose market share.

If we do not timely and effectively identify and respond to changing consumer preferences, including a continued shift in consumer purchasing practices toward e-commerce, our relationships with our customers and with consumers could be harmed, the demand for our brands and products could be reduced and our results of operations and financial position could be adversely affected.

9

Our public image and reputation are important to maintaining our strong brands and could be adversely affected by various factors, including product quality and service, claims and comments in social media or the press, or a negative perception regarding our company practices, including regarding disputes or legal action against us, even if unfounded. Damage to our public image or reputation could adversely affect our sales and results of operations and financial position.

We face significant competition and operate in an evolving competitive landscape.

Our products face significant competition. We believe that brand reputation is an important factor affecting product selection and that we compete on the basis of product features, innovation, quality, customer service, warranty and price. We sell many of our products through home center retailers, online retailers, distributors and independent dealers and rely on these customers to market and promote our products to consumers. Our success with our customers is dependent on our ability to provide quality products and timely delivery. In addition, home center retailers, which have historically concentrated their sales efforts on retail consumers and remodelers, are selling directly to professional contractors and installers, which may adversely affect our margins on our products that contractors and installers would otherwise buy through our dealers and wholesalers.

Certain of our customers are selling products sourced from low-cost foreign manufacturers under their own private label brands, which directly compete with our brands. As this trend continues, we may experience lower demand for our products or a shift in the mix of some products we sell toward more value-priced or opening price point products, which may affect our profitability.

In addition, we face competitive pricing pressure in the marketplace, including sales promotion programs, that could affect our market share or result in price reductions, which could adversely impact our results of operations and financial position.

Further, the growing e-commerce channel brings an increased number of competitors and greater pricing transparency for consumers, as well as conflicts between our existing distribution channels and a need for different distribution methods. These factors could affect our results of operations and financial position. In addition, our relationships with our customers, including our home center customers, may be affected if we increase the amount of business we transact in the e-commerce channel.

If we are unable to maintain our competitive position in our industries, our results of operations and financial position could be adversely affected.

Our sales are concentrated with two significant customers and this concentration may continue to increase. In 2020, our net sales from our continuing operations to The Home Depot were $2.8 billion (approximately 39 percent of our consolidated net sales), and our net sales from our continuing operations to Lowe’s were less than 10 percent of our consolidated net sales. These home center retailers can significantly affect the prices we receive for our products and the terms and conditions on which we do business with them. Additionally, these home center retailers may reduce the number of vendors from which they purchase and could make significant changes in their volume of purchases from us. Although other retailers, dealers, distributors and homebuilders represent other channels of distribution for our products and services, we might not be able to quickly replace, if at all, the loss of a substantial portion of our sales to The Home Depot or the loss of all of our sales to Lowe’s, and any such loss would have a material adverse effect on our business, results of operations and financial position.

In addition, our Behr business grants Behr brand exclusivity in the retail sales channel in North America to The Home Depot, and from time to time, certain of our other businesses grant product and/or brand exclusivity to our customers. The granting of exclusivity affects our ability to sell those products and brands to other customers and can increase the complexity of our product offerings and can increase our costs.

Technology and Intellectual Property Risks

We rely on information systems and technology, and a breakdown of these systems could adversely affect our results of operations and financial position.

We rely on many information systems and technology to process, transmit, store and manage information to support our business activities. We may be adversely affected if our information systems breakdown, fail, or are no longer supported. In addition to the consequences that may occur from interruptions in our systems, global cybersecurity vulnerabilities, threats and more sophisticated and targeted attacks pose a risk to our information technology systems.

10

We have implemented security policies, processes and layers of defense designed to help identify and protect against intentional and unintentional misappropriation or corruption of our systems and information and disruption of our operations. Despite these efforts, our systems have been and may in the future be damaged, disrupted, or shut down due to cybersecurity attacks by unauthorized access, malware, ransomware, undetected intrusion, hardware failures, or other events, and in these circumstances our disaster recovery plans may be ineffective or inadequate. These breaches or intrusions have led and could in the future lead to business interruption, production or operational downtime, product shipment delays, exposure or loss of proprietary, confidential, personal or financial information, data corruption, an inability to report our financial results in a timely manner, damage to the reputation of our brands, damage to our relationships with our customers and suppliers, exposure to litigation, and increased costs associated with the remediation and mitigation of such attacks. Such events could adversely affect our results of operations and financial position. In addition, we could be adversely affected if any of our significant customers or suppliers experiences any similar events that disrupt their business operations or damage their reputation.

We may not experience the anticipated benefits from our investments in new technology.

We continue to invest in new technology systems throughout our company, including implementations of and upgrades to Enterprise Resource Planning (“ERP”) systems at our business units. ERP implementations and upgrades are complex and require significant management oversight, and we have experienced, and may continue to experience, unanticipated expenses and interruptions to our operations during these implementations. Our results of operations and financial position, as well as the effectiveness of our internal controls over financial reporting, could be adversely affected if we do not appropriately select, implement and upgrade our technology systems in a timely manner or if we experience significant unanticipated expenses or disruptions in connection with the implementation and upgrade of ERP systems.

We may not be able to adequately protect or prevent the unauthorized use of our intellectual property.

Protecting our intellectual property is important to our growth and innovation efforts. We own a number of patents, trade names, brand names and other forms of intellectual property in our products and manufacturing processes throughout the world. There can be no assurance that our efforts to protect our intellectual property rights will prevent violations. Our intellectual property has been and may again be challenged or infringed upon by third parties, particularly in countries where property rights are not highly developed or protected. In addition, the global nature of our business increases the risk that we may be unable to obtain or maintain our intellectual property rights on reasonable terms. Furthermore, others may assert intellectual property infringement claims against us. Current and former employees, contractors, customers or suppliers have or may have had access to proprietary or confidential information regarding our business operations that could harm us if used by them, or disclosed to others, including our competitors. Protecting and defending our intellectual property could be costly, time consuming and require significant resources. If we are not able to protect our existing intellectual property rights, or prevent unauthorized use of our intellectual property, sales of our products may be affected and we may experience reputational damage to our brand names, increased litigation costs and adverse impact to our competitive position, which could adversely affect our results of operations and financial position.

Litigation and Regulatory Risks

Claims and litigation could be costly.

We are involved in various claims and litigation, including class actions, mass torts and regulatory proceedings, that arise in the ordinary course of our business and that could have a material adverse effect on us. The types of matters may include, among others: competition, product liability, employment, warranty, advertising, contract, personal injury, environmental, intellectual property, product compliance and insurance coverage. The outcome and effect of these matters are inherently unpredictable, and defending and resolving them can be costly and can divert management’s attention. We have and may continue to incur significant costs as a result of claims and litigation.

We are also subject to product safety regulations, product recalls and direct claims for product liability that can result in significant costs and, regardless of the ultimate outcome, create adverse publicity and damage the reputation of our brands and business. Also, we rely on other manufacturers to provide products or components for products that we sell. Due to the difficulty of controlling the quality of products and components we source from other manufacturers, we are exposed to risks relating to the quality of such products and to limitations on our recourse against such suppliers.

11

We maintain insurance against some, but not all, of the risks of loss resulting from claims and litigation. The levels of insurance we maintain may not be adequate to fully cover our losses or liabilities. If any significant accident, judgment, claim or other event is not fully insured or indemnified against, it could adversely affect our results of operations and financial position.

Refer to Note U to the consolidated financial statements included in Item 8 of this Report for additional information about litigation involving our businesses.

Compliance with laws, government regulation and industry standards is costly, and our failure to comply could adversely affect our results of operations and financial position.

We are subject to a wide variety of federal, state, local and foreign laws and regulations pertaining to:

•securities matters;

•taxation;

•anti-bribery/anti-corruption;

•employment matters;

•minimum wage requirements;

•environment, health and safety matters;

•the protection of employees and consumers;

•product compliance;

•competition practices;

•trade, including duties and tariffs;

•data privacy and the collection and storage of information; and

•climate change and protection of the environment.

In addition to complying with current requirements and known future requirements, even more stringent requirements could be imposed on us in the future.

As we sell new types of products or existing products in new geographic areas or channels or for new applications, we are subject to the requirements applicable to those sales. Additionally, some of our products must be certified by industry organizations. Compliance with new or changed laws, regulations and industry standards may require us to alter our product designs, our manufacturing processes, our packaging or our sourcing. These compliance activities are costly and require significant management attention and resources. If we do not effectively and timely comply with such regulations and industry standards, our results of operations and financial position could be adversely affected.

Item 1B. Unresolved Staff Comments.

None.

Item 2.Properties.

The table below lists principal North American properties as of December 31, 2020.

| Business Segment | Manufacturing | Warehouse and Distribution | ||||||||||||

| Plumbing Products | 21 | 8 | ||||||||||||

| Decorative Architectural Products | 8 | 18 | ||||||||||||

| Totals | 29 | 26 | ||||||||||||

Most of our North American facilities range from single warehouse buildings to complex manufacturing facilities. We own most of our North American manufacturing facilities, none of which is subject to significant encumbrances. A substantial number of our warehouse and distribution facilities are leased.

12

The table below lists principal properties outside of North America as of December 31, 2020.

| Business Segment | Manufacturing | Warehouse and Distribution | ||||||||||||

| Plumbing Products | 10 | 16 | ||||||||||||

| Decorative Architectural Products | — | — | ||||||||||||

| Totals | 10 | 16 | ||||||||||||

Most of our international facilities are in China, Germany and the United Kingdom. We own most of our international manufacturing facilities, none of which is subject to significant encumbrances. A substantial number of our international warehouse and distribution facilities are leased.

We lease our corporate headquarters in Livonia, Michigan, and we own a building in Taylor, Michigan that is used by our Masco Technical Services (research and development) department. We also lease an office facility in Luxembourg, which serves as a headquarters for most of our foreign operations.

Each of our operating divisions assesses the manufacturing, distribution and other facilities needed to meet its operating requirements. Our buildings, machinery and equipment have been generally well maintained and are in good operating condition. We believe our facilities have sufficient capacity and are adequate for our production and distribution requirements.

Item 3.Legal Proceedings.

Information regarding legal proceedings involving us is set forth in Note U to the consolidated financial statements included in Item 8 of this Report and is incorporated herein by reference.

Item 4.Mine Safety Disclosures.

Not applicable.

13

PART II

Item 5.Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The New York Stock Exchange is the principal market on which our common stock is traded, under the ticker symbol MAS. On January 31, 2021, there were approximately 2,900 holders of record of our common stock.

We expect that our practice of paying quarterly dividends on our common stock will continue, although the payment of future dividends is at the discretion of our Board of Directors and will depend upon our earnings, capital requirements, financial condition and other factors. Subject to declaration by our Board of Directors, we intend to increase the annual dividend to $0.94 per share, beginning in the second quarter of 2021.

In September 2019, our Board of Directors authorized the repurchase, for retirement, of up to $2.0 billion of shares of our common stock in open-market transactions or otherwise. During 2020, we repurchased and retired 18.8 million shares of our common stock (including 0.4 million shares to offset the dilutive impact of restricted stock units granted during the year), for approximately $727 million. At December 31, 2020, we had $774 million remaining under the 2019 authorization. Our Board of Directors authorized the repurchase, for retirement, of up to $2.0 billion shares of our common stock in open-market transactions or otherwise, effective February 10, 2021, replacing the 2019 authorization.

The following table provides information regarding the repurchase of our common stock for the three-month period ended December 31, 2020.

| Period | Total Number of Shares Purchased | Average Price Paid Per Common Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Value of Shares That May Yet Be Purchased Under the Plans or Programs | |||||||||||||||||||

| 10/1/20 - 10/31/20 | 93,847 | $ | 53.28 | 93,847 | $ | 894,936,955 | |||||||||||||||||

| 11/1/20 - 11/30/20 | 921,892 | $ | 54.99 | 921,892 | $ | 844,243,773 | |||||||||||||||||

| 12/1/20 - 12/31/20 | 1,315,241 | $ | 53.23 | 1,315,241 | $ | 774,230,631 | |||||||||||||||||

| Total for the quarter | 2,330,980 | 2,330,980 | $ | 774,230,631 | |||||||||||||||||||

14

Performance Graph

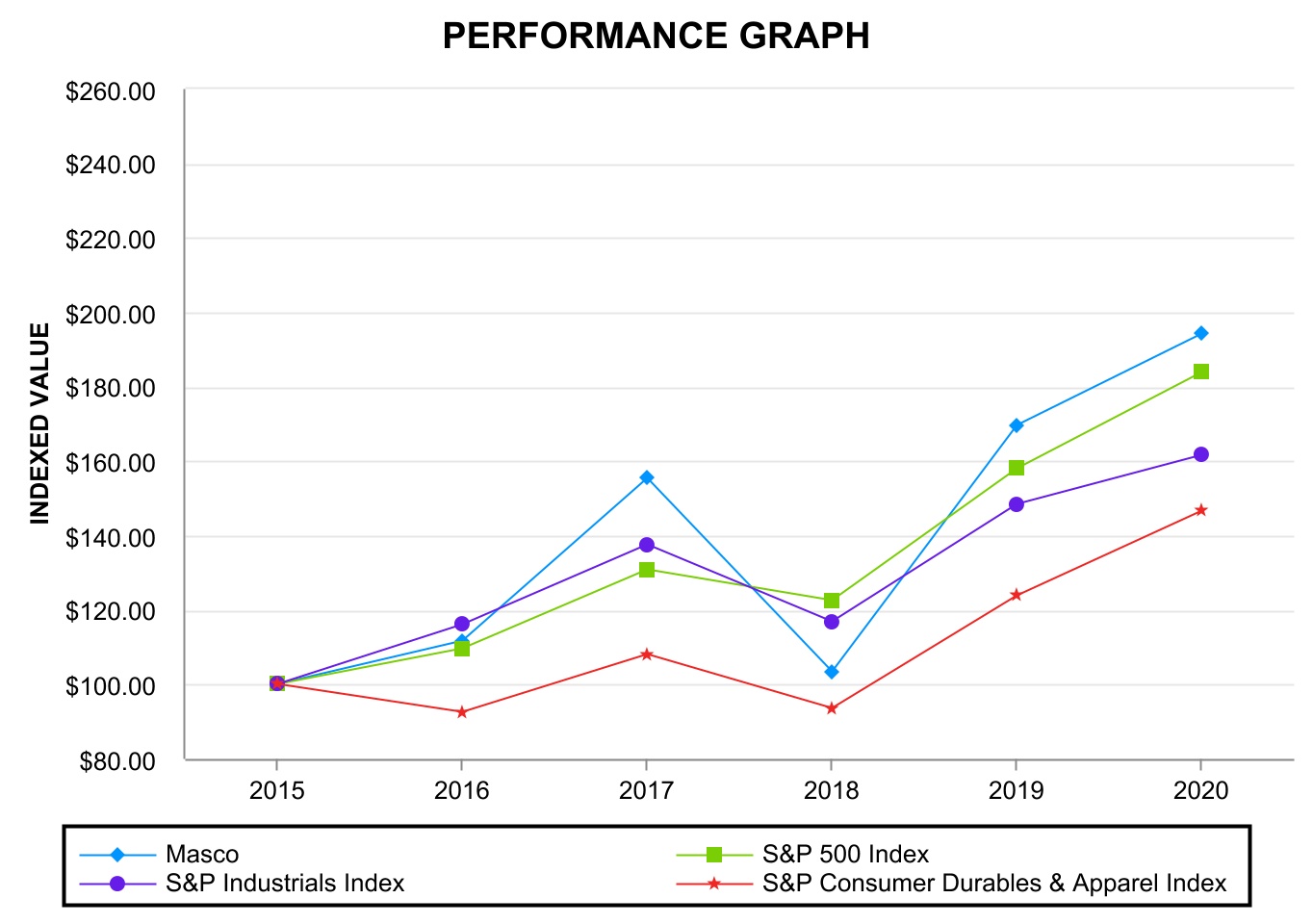

The table below compares the cumulative total shareholder return on our common stock with the cumulative total return of (i) the Standard & Poor's 500 Composite Stock Index ("S&P 500 Index"), (ii) The Standard & Poor's Industrials Index ("S&P Industrials Index") and (iii) the Standard & Poor's Consumer Durables & Apparel Index ("S&P Consumer Durables & Apparel Index"), from December 31, 2015 through December 31, 2020, when the closing price of our common stock was $54.93. The graph assumes investments of $100 on December 31, 2015 in our common stock and in each of the three indices and the reinvestment of dividends.

The table below sets forth the value, as of December 31 for each of the years indicated, of a $100 investment made on December 31, 2015 in each of our common stock, the S&P 500 Index, the S&P Industrials Index and the S&P Consumer Durables & Apparel Index and includes the reinvestment of dividends.

| 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||

| Masco | $ | 111.73 | $ | 155.27 | $ | 103.32 | $ | 169.58 | $ | 194.10 | |||||||||||||||||||

| S&P 500 Index | $ | 109.54 | $ | 130.81 | $ | 122.65 | $ | 158.07 | $ | 183.77 | |||||||||||||||||||

| S&P Industrials Index | $ | 116.08 | $ | 137.60 | $ | 116.96 | $ | 148.34 | $ | 161.70 | |||||||||||||||||||

| S&P Consumer Durables & Apparel Index | $ | 92.67 | $ | 108.05 | $ | 93.67 | $ | 123.90 | $ | 146.71 | |||||||||||||||||||

15

Item 6.Selected Financial Data.

| Dollars in Millions (Except Per Common Share Data) | |||||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||

Net sales (1) | $ | 7,188 | $ | 6,707 | $ | 6,654 | $ | 6,014 | $ | 5,754 | |||||||||||||||||||

Operating profit (1) | 1,295 | 1,088 | 1,077 | 1,029 | 986 | ||||||||||||||||||||||||

Income from continuing operations attributable to Masco Corporation (1) | 810 | 639 | 636 | 426 | 426 | ||||||||||||||||||||||||

Income per common share from continuing operations (1): | |||||||||||||||||||||||||||||

| Basic | $ | 3.05 | $ | 2.21 | $ | 2.06 | $ | 1.34 | $ | 1.29 | |||||||||||||||||||

| Diluted | 3.04 | 2.20 | 2.05 | 1.33 | 1.28 | ||||||||||||||||||||||||

| Dividends declared | 0.550 | 0.510 | 0.450 | 0.410 | 0.390 | ||||||||||||||||||||||||

| Dividends paid | 0.545 | 0.495 | 0.435 | 0.405 | 0.385 | ||||||||||||||||||||||||

| At December 31: | |||||||||||||||||||||||||||||

| Total assets | $ | 5,777 | $ | 5,027 | $ | 5,393 | $ | 5,534 | $ | 5,164 | |||||||||||||||||||

| Long-term debt | 2,792 | 2,771 | 2,971 | 2,969 | 2,995 | ||||||||||||||||||||||||

| Shareholders' equity (deficit) | 421 | (56) | 69 | 183 | (96) | ||||||||||||||||||||||||

______________________________

(1)Amounts exclude discontinued operations for all periods presented. Refer to Note C to the consolidated financial statements for further details.

16

Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations.

The financial and business analysis below provides information which we believe is relevant to an assessment and understanding of our consolidated financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with the consolidated financial statements and related notes.

The following discussion and certain other sections of this Report contain statements that reflect our views about our future performance and constitute "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "outlook," "believe," "anticipate," "appear," "may," "will," "should," "intend," "plan," "estimate," "expect," "assume," "seek," "forecast," and similar references to future periods. Our views about future performance involve risks and uncertainties that are difficult to predict and, accordingly, our actual results may differ materially from the results discussed in our forward-looking statements. We caution you against relying on any of these forward-looking statements.

In addition to the various factors included in the "Executive Level Overview," "Critical Accounting Policies and Estimates" and "Outlook for the Company" sections, our future performance may be affected by the levels of residential repair and remodel activity, and to a lesser extent, new home construction, our ability to maintain our strong brands and reputation and to develop innovative products, our ability to maintain our competitive position in our industries, our reliance on key customers, the length and severity of the ongoing COVID-19 pandemic, including its impact on domestic and international economic activity, consumer confidence, our production capabilities, our employees and our supply chain, the cost and availability of materials and the imposition of tariffs, our dependence on third-party suppliers, risks associated with our international operations and global strategies, our ability to achieve the anticipated benefits of our strategic initiatives, our ability to successfully execute our acquisition strategy and integrate businesses that we have and may acquire, our ability to attract, develop and retain talented and diverse personnel, risks associated with our reliance on information systems and technology, and our ability to achieve the anticipated benefits from our investments in new technology. These and other factors are discussed in detail in Item 1A. "Risk Factors" of this Report. Any forward-looking statement made by us speaks only as of the date on which it was made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

Executive Level Overview

We design, manufacture and distribute branded home improvement and building products. These products are sold primarily for repair and remodeling activity and, to a lesser extent, new home construction. We sell our products through home center retailers, online retailers, wholesalers and distributors, mass merchandisers, hardware stores, direct to the consumer and homebuilders.

2020 Results

Net sales were positively impacted by increased sales volume across our two segments. Such increases were partially offset by unfavorable net selling prices in our Decorative Architectural Products segment.

Our Plumbing Products segment operating profit was positively impacted by cost saving initiatives, including actions taken to mitigate the COVID-19 pandemic impact, and higher sales volume. These positive impacts were partially offset by increased commodity costs, including tariffs, and an increase in other expenses (such as salaries and legal costs). Our Decorative Architectural Products segment operating profit benefited primarily from higher sales volume mostly due to paints and other coating products, as well as cost savings initiatives, including actions taken to mitigate the COVID-19 pandemic impact. Additionally, operating profit was positively impacted by the non-recurrence of a 2019 non-cash impairment charge related to an other indefinite-lived intangible asset for a trademark associated with lighting products. These positive impacts were partially offset by unfavorable net selling prices, higher fixed expenses in our lighting business, and an increase in other expenses (such as salaries, legal costs, and advertising).

17

COVID-19 Impact and Response

During 2020, certain aspects of our businesses were adversely affected by the COVID-19 pandemic. Many, but not all, of our businesses remained operating in 2020 because the products we provide are critical to infrastructure sectors and the day-to-day operations of homes and businesses in our communities as defined by applicable local orders. However, some of our facilities experienced reduced capacity due to social distancing requirements and/or full closures ranging from a few days to 6-8 weeks, and if certain governmental orders are reimposed or if we are required to close a facility for employee safety reasons, we could experience new or extended closures which might adversely impact our ability to produce and distribute our products. Operational activity that was previously slowed at certain of our facilities, as a result of the pandemic and governmental orders, largely resumed operations at normal capacities by the third quarter of 2020 enabling them to progress on the fulfillment of production backlogs that developed in the first half of the year as well as to meet current consumer demand. Finally, we may experience supply chain disruptions, particularly disruptions related to our ability to source plumbing, lighting and builders’ hardware products.

Given our portfolio of lower ticket, repair and remodel-oriented product and the increased demand for repair and remodel spending, we experienced strong consumer demand in 2020. These levels of demand may or may not continue and we may experience an adverse impact in our 2021 results due to economic contraction as a result of continued high unemployment levels and remaining or potential renewed shelter-in-place and social distancing orders. The COVID-19 pandemic and the mitigating measures taken by many countries have adversely impacted and could in the future materially adversely impact the Company’s business, results of operations and financial condition.

During 2020, we implemented mitigating efforts to manage operating spend and preserve cash and liquidity including the temporary suspension of our share repurchase activity beginning in the second quarter of 2020, which we resumed in the fourth quarter of 2020. Currently, we have not identified, and will continue to monitor for, any substantive risk attributable to customer credit and have not experienced a significant impact from permanent store closures or retail bankruptcies.

We continue to be committed to the safety and well-being of our employees during this time, and, led by our cross-functional Infectious Illness Response Team, we have employed best practices and followed guidance from the World Health Organization and the Centers for Disease Control and Prevention. We have implemented and are continuing to implement alternative work arrangements to support the health and safety of our employees, including working remotely and avoiding large gatherings. In addition, we have modified work areas and workstations to provide protective measures for employees, are staggering shifts, requiring the use of face coverings, practicing social distancing and increasing the cleaning of our facilities, and in the event that we learn of an employee testing positive for COVID-19, we are completing contact tracing and requiring impacted employees to self-quarantine.

18

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of these financial statements requires us to make certain estimates and assumptions that affect or could have affected the reported amounts of assets and liabilities, disclosure of any contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We regularly review our estimates and assumptions, which are based upon historical experience, as well as current economic conditions and various other factors (including the anticipated impact of the COVID-19 pandemic) that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of certain assets and liabilities and related disclosures, and future revenues and expenses, that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions.

Note A to the consolidated financial statements includes our accounting policies, estimates and methods used in the preparation of our consolidated financial statements.

We believe that the following critical accounting policies are affected by significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition and Receivables

We recognize revenue as control of our products is transferred to our customers, which is generally at the time of shipment or upon delivery based on the contractual terms with our customers. We provide customer programs and incentive offerings, including special pricing and co-operative advertising arrangements, promotions and other volume-based incentives. These customer programs and incentives are considered variable consideration. We include in revenue variable consideration only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the variable consideration is resolved. This determination is made based upon known customer program and incentive offerings at the time of sale, and expected sales volume forecasts as it relates to our volume-based incentives. This determination is updated each reporting period.

We monitor our exposure for credit losses on customer receivable balances and the credit worthiness of customers on an on-going basis and maintain allowances for doubtful accounts receivable for estimated losses resulting from the inability of our customers to make required payments. Allowances are estimated based upon specific customer balances, where a risk of loss has been identified, and also include a provision for losses based upon historical collection and write-off activity as well as reasonable and supportable forecast information that considers macro-economic factors and industry-specific trends associated with our businesses, among others. A separate allowance is recorded for customer incentive rebates and is generally based upon sales activity.

Goodwill and Other Intangible Assets

We record the excess of purchase cost over the fair value of net tangible assets of acquired companies as goodwill or other identifiable intangible assets. In the fourth quarter of each year, or as events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount, we complete the impairment testing of goodwill utilizing a discounted cash flow method. We selected the discounted cash flow methodology because we believe that it is comparable to what would be used by market participants. We have defined our reporting units and completed the impairment testing of goodwill at the operating segment level.

19

Determining market values using a discounted cash flow method requires us to make significant estimates and assumptions, including long-term projections of cash flows, market conditions and appropriate discount rates. Our judgments are based upon historical experience, current market trends, consultations with external valuation specialists and other information. While we believe that the estimates and assumptions underlying the valuation methodology are reasonable, different estimates and assumptions could result in different outcomes. In estimating future cash flows, we rely on internally generated five-year forecasts for sales and operating profits, and, currently, a two percent to three percent long-term assumed annual growth rate of cash flows for periods after the five-year forecast. We generally develop these forecasts based upon, among other things, recent sales data for existing products, planned timing of new product launches, estimated repair and remodel activity and, to a lesser extent, estimated housing starts. Our assumptions included U.S. Gross Domestic Product growing at approximately 4.2 percent in 2021 and develop into a relatively stable 2.8 percent each year thereafter, and a eurozone Gross Domestic Product growing at approximately 5.2 percent in 2021 and developing into a relatively stable 2.2 percent per annum over the five-year forecast.

We utilize our weighted average cost of capital of approximately 8.0 percent as the basis to determine the discount rate to apply to the estimated future cash flows. Our weighted average cost of capital in 2020 was consistent with 2019. In 2020, based upon our assessment of the risks impacting each of our businesses, we applied a risk premium to increase the discount rate to a range of 10.0 percent to 12.0 percent for our reporting units.

If the carrying amount of a reporting unit exceeds its fair value, an impairment loss is recognized to the extent that a reporting unit's recorded carrying value exceeds its fair value, not to exceed the carrying amount of goodwill in that reporting unit.

In the fourth quarter of 2020, we estimated that future discounted cash flows projected for all of our reporting units were greater than the carrying values. Accordingly, we did not recognize any impairment charges for goodwill. A 10 percent decrease in the estimated fair value of our reporting units would have resulted in a $6 million impairment to one of our reporting units.

We review our other indefinite-lived intangible assets for impairment annually, in the fourth quarter, or as events occur or circumstances change that indicate the assets may be impaired without regard to the business unit. Potential impairment is identified by comparing the fair value of an other indefinite-lived intangible asset to its carrying value. We utilize a relief-from-royalty model to estimate the fair value of other indefinite-lived intangible assets. We consider the implications of both external (e.g., market growth, competition and local economic conditions) and internal (e.g., product sales and expected product growth) factors and their potential impact on cash flows related to the intangible asset in both the near- and long-term. We also consider the profitability of the business, among other factors, to determine the royalty rate for use in the impairment assessment.

We utilize our weighted average cost of capital of approximately 8.0 percent as the basis to determine the discount rate to apply to the estimated future cash flows. In 2020, based upon our assessment of the risks impacting each of our businesses and the nature of the trade name, we applied a risk premium to increase the discount rate to a range of 11.0 percent to 12.5 percent for our other indefinite-lived intangible assets.

In the fourth quarter of 2020, we estimated that future discounted cash flows projected for our other indefinite-lived intangible assets were greater than the carrying values. Accordingly, we did not recognize any impairment charges for other indefinite-lived intangible assets. A 10 percent decrease in the estimated fair value of our other indefinite-lived intangible assets would have resulted in a $3 million impairment for one of our trade names.

Employee Retirement Plans

As of January 1, 2010, substantially all our domestic and foreign qualified and domestic non-qualified defined-benefit pension plans were frozen to future benefit accruals.

Accounting for defined-benefit pension plans involves estimating the cost of benefits to be provided in the future, based upon vested years of service, and attributing those costs over the time period each employee works. We develop our pension costs and obligations from actuarial valuations. Inherent in these valuations are key assumptions regarding expected return on plan assets, mortality rates and discount rates for obligations and expenses. We consider current market conditions, including changes in interest rates, in selecting these assumptions. While we believe that the estimates and assumptions underlying the valuation methodology are reasonable, different estimates and assumptions could result in different reported pension costs and obligations within our consolidated financial statements.

20

In December 2019, our Board of Directors approved the termination of our qualified domestic defined-benefit pension plans. As a result of this decision, the projected benefit obligations for these plans were increased to reflect the incremental costs to terminate the plans. Upon termination in 2021, we expect to recognize from accumulated other comprehensive loss approximately $450 million of pre-tax actuarial losses and approximately $95 million of income tax benefit, which includes approximately $11 million of tax expense from the elimination of a disproportionate tax effect.

In December 2020, our discount rate for obligations decreased to a weighted average of 1.7 percent from 2.5 percent. The discount rate for obligations is based primarily upon the expected duration of each defined-benefit pension plan's liabilities matched to the December 31, 2020 Willis Towers Watson Rate Link Curve. For our qualified domestic defined-benefit pension plans, the projected benefit obligations include the estimated incremental cost related to the termination. For these plans, the discount rate was then set equal to the discount rate that results in the same projected benefit obligation resulting from the normal projected benefit obligation calculation plus the estimated incremental cost to terminate. The discount rates we use for our defined-benefit pension plans ranged from 0.7 percent to 2.1 percent, with the most significant portion of the liabilities having a discount rate for obligations of 1.6 percent or higher. Due to the anticipated termination of our qualified domestic defined-benefit pension plans and the related plan assets comprised mostly of fixed income and cash, the assumed asset return for these assets was 2.0 percent.

The net underfunded amount for our qualified defined-benefit pension plans, which is the difference between the projected benefit obligation and plan assets, increased to $255 million at December 31, 2020 from $254 million at December 31, 2019. Our projected benefit obligation for our unfunded, non-qualified, defined-benefit pension plans increased to $162 million at December 31, 2020 from $161 million at December 31, 2019. These unfunded plans are not subject to the funding requirements of the Pension Protection Act of 2006. In accordance with the Pension Protection Act, the Adjusted Funding Target Attainment Percentage for the various defined-benefit pension plans ranges from 113 percent to 117 percent.