Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-6715

Analogic Corporation

(Exact name of registrant as specified in its charter)

| Massachusetts | 04-2454372 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 8 Centennial Drive, Peabody, Massachusetts | 01960 | |

| (Address of principal executive offices) | (Zip Code) | |

(978) 326-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.05 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant at January 31, 2016 was approximately $895,480,000. As of September 20, 2016, there were 12,401,682 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s definitive proxy statement, which will be issued in connection with the 2016 Annual Meeting of Stockholders, are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

1

Table of Contents

| Item 1. | Business |

Throughout this Annual Report on Form 10-K, unless the context states otherwise, the words “we,” “us,” “our” and “Analogic” refer to Analogic Corporation and all of its subsidiaries taken as a whole, and “our board of directors” refers to the board of directors of Analogic Corporation.

Description of Business

Analogic Corporation (NASDAQ:ALOG) designs, manufactures, and commercializes innovative real-time guidance, diagnostic imaging and threat detection technologies to advance the practice of medicine and save lives. We operate and report along three business segments: Medical Imaging, Ultrasound and Security and Detection. Our Medical Imaging segment provides critical enabling medical imaging systems and subsystems for computed tomography, or CT, magnetic resonance imaging, or MRI and high-resolution digital mammography. We sell our Medical Imaging products primarily through longstanding relationships with well-known multinational medical original equipment manufacturers, or OEMs, and new entrants in emerging markets. Our Ultrasound business provides real-time ultrasound procedure guidance systems for the urology, surgery and point of care markets. We sell our ultrasound products, under the BK Ultrasound brand, through our direct sales force in North America and Europe, as well as through a network of distributors to clinical practitioners throughout the world. Our Security and Detection segment designs and manufactures automated threat detection systems for aviation baggage inspection applications utilizing advanced medical CT technology and systems used for DNA analysis for law enforcement and government agencies. We sell our aviation threat detection and DNA systems through multinational partners. We were incorporated in the Commonwealth of Massachusetts in November 1967 and are headquartered in Peabody, Massachusetts.

Refer to Note 16 to the notes to Consolidated Financial Statements included in this Annual Report on Form 10-K as well as Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations for financial information regarding our segments. The following chart shows net revenue by segment in millions for fiscal years 2016, 2015 and 2014, respectively:

Medical Imaging

Our Medical Imaging segment, which accounted for approximately 57% of our net revenue in fiscal year 2016, consists primarily of systems and sub-systems for medical imaging that are sold globally to OEM producers of CT, MRI, and digital mammography systems. Our products are designed and manufactured to achieve high reliability resulting in the lowest overall cost of ownership for our customers.

2

Table of Contents

Computed Tomography

Analogic has been at the forefront of developments in computed tomography equipment technology from the introduction of the first single slice CT systems in the early 1970s to today’s multi-slice volumetric scanners. We are an industry leader in the development and sale of CT detector systems, data acquisition systems, or DAS, data management systems, or DMS, and fully integrated CT systems that drive the image processing in OEM CT imaging scanners sold around the world.

Our CT product portfolio consists primarily of the following:

| 1) | Detector Subsystems – These subsystems convert the x-ray energy in a CT machine to analog signals for further processing in the DAS. The detectors use state-of-the-art scintillator materials and photodiodes coupled with advanced semiconductor technology to process these highly precise signals. These signals are then fed to a computer through a DAS for image reconstruction. |

| 2) | DAS – These subsystems are used to process the signals created by the detectors and feed them as a digital stream to a reconstruction computer to create high resolution images. The DAS is designed with many multi-channel circuit boards that process the analog signals from the detectors and convert them into digital signals through an array of analog to digital, or A/D converters. |

| 3) | DMS – This is the most critical sub-system of the CT system and consists of both the detector array and the DAS in one package. This system provides our OEM customers a higher level of integration that allows for lower cost and faster time to market. |

| 4) | Full Integrated CT Systems – The components of the CT system (detectors, DAS, x-ray tube and power supplies) are mounted on a rotating ring assembly called a gantry. The ring enables the components of the CT systems to rotate around the patient at speeds up to 300 revolutions per minute for high resolution imaging. We provide full integrated gantries with image and iterative reconstruction algorithms to our OEM customers as another level of integration to facilitate a smoother and faster time to market and improve manufacturing efficiency. Our Low Dose Imaging Software, or LISA, is available in our integrated CT systems to provide high quality imaging capability at up to 40% lower x-ray dose as compared with conventional image reconstruction. Low dose imaging in medical diagnostics is used to prevent damage to healthy tissue. Our designs also include non-contact power, data transfer and other innovative capabilities that provide high reliability, lower total cost of ownership and dose reduction/modulation. We have sold over 130 full CT gantries to a major Chinese OEM manufacturer for the local China market. |

Full Integrated CT Gantry

3

Table of Contents

The detector, DAS and DMS products we sell are used in a wide range of CT systems, from dual slice count to the most advanced multi-slice (at least 256 slices) systems, enabling advanced diagnostics such as cardiac imaging. Our CT products are designed to allow our customers to remain at the forefront of this rapidly advancing field. By leveraging our experience in integrating CT components and technology, we have also developed higher-level integrated systems for the radiotherapy market primarily used for image guided radiation treatment of cancerous tumors.

Magnetic Resonance Imaging

For OEM producers of MRI equipment, we supply two key enabling sub-systems: gradient amplifiers and radio frequency, or RF amplifiers. We have developed a wide range of amplifier solutions for our customers ranging from low-magnetic-field systems (under 0.3 Tesla) to ultra-high-magnetic-field systems (> 7.0 Tesla). Our ability to provide very high power levels with fast response, low noise and industry-leading reliability enables our OEM customers to deliver innovative technologies such as new, wide-bore (i.e. larger opening) MRI scanners addressing growing requirements related to obesity and patient comfort.

Our MRI product portfolio consists primarily of the following:

| 1) | Gradient Amplifiers – These high power systems are used to drive a set of coils located inside the MRI system and around the patient. The coils energize the atomic structure of a patients’ anatomy in order to create tissue and structure images. Gradient amplifiers must be designed at specific power levels for different MRI field strengths ranging from under 0.3 Tesla to 7.0 Tesla and higher. |

| 2) | RF Amplifiers – These power systems are used to control another set of the coils within the MRI system that are used to read-back the signals from the anatomy generated by the gradient coils. These signals are then processed in a reconstruction computer to create images. The RF amplifiers must have a very high signal-to-noise ratio to produce the cleanest images. |

RF Amplifier

Digital Mammography

Our digital mammography products consist primarily of digital mammography selenium based detector plates, sold directly to OEM customers for breast cancer screening and diagnostic applications in mammography. These detector plates are used by OEMs in mammography systems to convert x-ray signals into high resolution 2-D and 3-D images of breast tissue to aid in the detection of breast cancer. Our detector plates for mammography applications are sold to medical OEMs for use in products worldwide. Our digital mammography product portfolio consists of the following:

| 1) | Large field of view (FOV) detector (AXS-2430 and AXS-ScreenPlus) – Our large field of view detector plate, based on selenium technology, is used primarily for European and U.S. markets. The plate and power supply is designed to be easily adapted to many types of mammography systems. This detector plate is also compatible with systems that can perform tomosynthesis, which creates 3-D images through a series of exposures to more accurately detect lesions in the breast. |

4

Table of Contents

| 2) | Small field of view (FOV) detector (AXS-1824) – Our small field of view detector plate uses the same selenium-based technology as the AXS-2430 detector and is manufactured primarily for the Asian markets. |

Other Products

Within our Medical Imaging segment, we also design and manufacture servo and stepper (motion control) devices, which we supply to OEM customers for use in computer-controlled automation systems primarily in the semiconductor and laboratory automation markets.

Competition

We are subject to competition based upon product design, performance, pricing, quality and service. We believe that our innovative engineering and product reliability have been important factors in our historical growth.

In our Medical Imaging segment, systems and subsystems are customized for the needs of our customers. In many cases, due to the limited number of companies with technology comparable to ours, we consider selection by our OEM customers for the design and manufacture of these products and our other medical products to be due more to the “make-or-buy” decision of the individual OEM customers than a function of other competitors in the field.

Marketing and Distribution

Our Medical Imaging segment directly sells to OEM customers, both domestically and abroad, primarily through our headquarters in the U.S. We also sell products through our subsidiaries in Canada, China, and the U.S.

Seasonal Aspect of Business

There are no material seasonal elements to our Medical Imaging segment, although holidays and plant closings in the summer, particularly in Europe, tend to decrease the procurement activities of certain customers during the first quarter of our fiscal year.

Ultrasound

Our Ultrasound segment designs and manufactures medical ultrasound systems, principally for applications in procedure guidance.

Our BK Ultrasound brand products are primarily sold to clinical end-users in urology, surgery, point-of-care and general imaging applications and accounted for approximately 32% of our net revenue in fiscal year 2016. Our ultrasound systems use acoustic waves to generate real-time images of the body’s internal anatomy that are

5

Table of Contents

used for interventional and medical diagnostic procedures, including guiding surgical procedures and guiding prostate cancer treatment employing procedures such as brachytherapy.

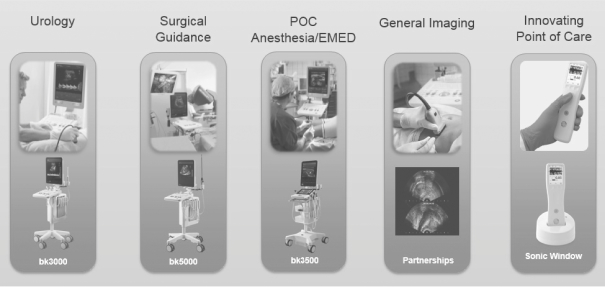

Our product portfolio under the BK Ultrasound brand name consists of four families: Flexfocus, BK, Sonix and Sonic Window ultrasound systems used primarily for guiding procedures in urology, surgery, regional anesthesia and point of care (POC).

In 2015 we introduced the high end bk3000 and the bk5000, which are based on our innovative TriCore technology, that expands the portfolio of existing Flexfocus systems with high-end entries. The TriCore technology allows for high definition imaging by processing three times more information compared with traditional systems. The bk3000 is primarily used for high-end urology and general imaging applications while the bk5000 is a premium system used for guiding surgical procedures.

In early 2016 we introduced the bk3500 as an advanced ultrasound solution for point of care (POC) applications such as for the emergency department and anesthesiology. The bk3500 combines high resolution imaging and workflow with a streamlined touchscreen interface, that was originally used in our Sonix product lines. The system has four probe connectors, an integrated bar code reader and a streamlined touchscreen that guides the user through the procedure.

In mid-2014, we signed an agreement with a new technology partner to expand into the radiology and OB/GYN market. As part of this agreement, we manufacture an advanced ultrasound platform using our partner’s brand and sell through their established sales channel. The growth into the general imaging market combined with our existing presence in the urology, surgery and POC markets increases our total market opportunity to over $4 billion.

Ultrasound Product Portfolio

6

Table of Contents

Our Sonic Window® is a handheld ultrasound device for visualizing vasculature for kidney dialysis cannulation and fistula assessment, as well as guiding peripheral intravenous access, or PIV. This ultra-compact device provides direct visualization of structures beneath the skin. Unlike existing portable devices on the market today, the Sonic Window handheld is self-contained and does not require a cart or stand to operate. We began commercialization and received first orders for the dialysis market in the second quarter of 2016 from a domestic dialysis center.

Sonic Window® – Handheld Ultrasound System

In the middle of fiscal 2016, we entered the veterinary telemedicine market through the acquisition of Oncura Partners. Oncura provides for veterinary medicine BK ultrasound systems with the remote capabilities for (1) assisting the practitioner to deliver diagnostic scans, (2) trouble shooting operator or system performance and (3) delivering diagnoses by board certified radiologists. We see this technology as having benefits for our presence in the human telemedicine market.

We also design and manufacture advanced ultrasound transducers sold to OEM customers within our Ultrasound segment. Using our advanced acoustic design and manufacturing capability, we provide a variety of transducers to OEMs for both diagnostic and procedure driven applications such as cardiology, radiology, OB/GYN, surgery and interventional radiology.

Competition

We are subject to competition based upon product design, performance, pricing, quality and service. We believe that our innovative engineering and product reliability have been important factors in our historical growth. While we try to maintain competitive pricing on those products that are directly comparable to products manufactured by others, in many instances, our products conform to more precise specifications and carry a higher price than similar products manufactured by others.

The Ultrasound segment participates in markets primarily focused in urology, surgery, anesthesia and other point-of-care markets. We compete in these markets based on image quality, ease of use, mobility, reliability and flexibility with a robust portfolio of specialized ultrasound transducers. Our competitors are companies and business units of large medical device companies, such as General Electric Corporation, or GE and Koninklijke Philips Electronics N.V., or Philips, that primarily focus on the conventional ultrasound markets, as well as smaller business units of large multi-national companies, such as Hitachi Medical Corporation and Fujifilm that sell under brands such as Aloka and SonoSite in our target markets. We also compete against newer global market entrants such as Mindray Medical International Limited, or Mindray.

Marketing and Distribution

Our Ultrasound segment globally distributes its products to end users both through a direct sales force and through a network of independent sales representatives and distributors located around the world. Our direct sales force, located in the U.S., Canada, Germany, Belgium, United Kingdom, Italy, and Scandinavia, accounted for approximately 58% of our Ultrasound revenue in fiscal year 2016, generated from product sales, service and application support. Our remaining Ultrasound revenue was generated through a network of generally non-exclusive, independent distributors in more than 60 other countries and sales of transducers to OEM customers both domestically and abroad.

7

Table of Contents

Our global marketing department is responsible for defining future products, uncovering unmet needs and validating value propositions based on customer insights. Management of key opinion leaders and global reference sites is supervised by a team of clinical scientists and product applications specialists. Our global marketing communications team is responsible for protecting and expanding the BK Ultrasound brand on all relevant customer touchpoints.

Seasonal Aspect of Business

Customer purchases in our Ultrasound segment have historically been higher in the second and fourth quarters of our fiscal year due in part to the timing of customer budgeting cycles.

Security and Detection

Utilizing our advanced CT technology, the Security and Detection segment, which accounted for approximately 11% of our net revenue in fiscal year 2016, designs and manufactures airport baggage screening systems and subsystems. The airport screening systems generate 3-D images of objects contained within baggage and utilize highly sophisticated algorithms to provide threat analysis of materials contained within the bags. We also design and manufacture DNA analysis systems.

Our certified checked baggage screening systems and subsystems are sold through our OEM customers L-3 Communications Security and Detection Systems, or L-3 and Smiths Detection, or Smiths, to the Transportation Security Agency in the U.S. airports and to international airport authorities and foreign governments for installation at airports around the world.

We sell the following checked baggage systems through L-3.

|

1) eXaminer® XLB (High Speed) – The XLB was the first certified explosives detection system, or EDS specifically optimized for high speed screening of checked baggage. Capable of scanning up to 1,200 bags per hour, the XLB keeps bags continuously moving through a meter-wide tunnel. Combining high-resolution helical CT with dual-energy imaging, the XLB offers superior detection capabilities and advanced 3-D imaging. | |

|

2) eXaminer 3DX (Medium Speed) – Our CT technology is utilized in the 3DX, a medium speed EDS that scans up to 550 bags per hour in-line and up to 330 bags in standalone configuration. The enhanced speed 3DX-ES scans up to 750 bags per hour in the in-line configuration. Both systems are designed to provide high levels of reliability and low false-alarm rates. With over 1,200 systems installed since 2003, the 3DX is one of most widely used checked baggage systems in the U.S. | |

|

3) eXaminer SX (Reduced Size) – The SX is a lower-cost, reduced size EDS designed for small and medium-sized airports. Able to scan up to 360 bags per hour in-line and up to 300 bags per hour in standalone configuration, the SX offers customers a reduced footprint system with high resolution 3-D imaging and low false-alarm rates. | |

eXaminer ® is a registered trademark of L-3.

8

Table of Contents

The Smiths Detection HI-SCAN 10080 XCT, which incorporates Analogic CT technology, is capable of screening up to 1,800 bags per hour in its approved configuration with a belt speed of 0.5 meters per second. The system offers a large one meter wide tunnel that meets the requirements of high speed in-line baggage handling systems and allows rapid, efficient scanning of larger items. The system is well positioned for international sales as the market converts to CT level detection for checked baggage.

Smiths Detection HI-SCAN 10080 XCT

Our COBRA checkpoint CT system is the first system to achieve European Civil Aviation Conference Type-D and D+ Standard-2 approval. The COBRA successfully met Standard-2 in Type-D operations, where liquids, aerosols and gels (LAGs) remain inside passenger carry-on bags, and Type D+ operations, where LAGs and complex electronics, such as laptops, remain inside passenger carry-on bags. The COBRA checkpoint CT system has also been approved by the United Kingdom’s Department for Transport as an Advanced Cabin Baggage X-ray system.

COBRA Check-Point CT System

9

Table of Contents

Other Products

Within our Security and Detection segment, we also design and manufacture Rapid DNA Analysis systems. These systems, which we supply to our OEM customer, are designed to rapidly analyze multiple human DNA samples to provide “DNA fingerprints.” The analysis process yields results in less than ninety minutes, a significant improvement over conventional technologies. Unlike conventional techniques, which require highly trained personnel working in a laboratory setting, our systems are designed for non-technical users with minimal training in a variety of environments. These systems have potential application in fields that benefit from the rapid identification of individuals, including law enforcement, defense, and immigration.

Rapid DNA Analysis System

Competition

We are subject to competition based upon product design, performance, pricing, quality and service. We believe that our innovative engineering and product reliability have been important factors in our historical growth.

In our Security and Detection segment, competition in baggage scanning is limited due to the high barriers of entry resulting from the cost of developing the capability to design and manufacture CT technology. Due to the degree of customization required and the limited number of companies with technology comparable to ours, we consider selection by our OEM customers to be due more to the “make-or-buy” decision of our customers than a function of other competitors in the field.

Principal entrants in the aviation baggage scanning market include L-3, Smiths Detection, Morpho Detection (formerly GE’s security business) and Rapiscan (a division of OSI systems).

Marketing and Distribution

Our Security and Detection segment sells its checked baggage systems and subsystems and its DNA analysis system to our OEM customers. We offer our checkpoint solutions to customers in the U.S. and internationally. Our Security and Detection segment conducts its sales and marketing activities primarily through our headquarters in the U.S.

Seasonal Aspect of Business

There are no material seasonal elements to our Security and Detection segment, although holidays and plant closings in the summer, particularly in Europe, tend to decrease the procurement activities of certain customers during the first quarter of our fiscal year.

10

Table of Contents

Material Customers

We had three customers during fiscal year 2016 and four customers during fiscal years 2015 and 2014, as set forth in the table below, which accounted for 10% or more of our net revenue.

| For the Year ended July 31, | ||||||||||||

| 2016 | 2015 | 2014 | ||||||||||

| Koninklijke Philips Electronics N.V., or Philips |

13 | % | 14 | % | 16 | % | ||||||

| Siemens AG |

12 | % | 11 | % | 11 | % | ||||||

| Toshiba Corporation, or Toshiba |

11 | % | 11 | % | 12 | % | ||||||

| L-3 Communications Corporation, or L-3 |

* | 13 | % | 11 | % | |||||||

Note (*): Total net revenue was less than 10% in this fiscal year.

Philips’, Toshiba’s, and Siemens’ revenues were primarily in the Medical Imaging segment and L-3’s revenue was in the Security and Detection segment.

Our ten largest customers as a group accounted for 61%, 64% and 66% of our net revenue for fiscal years 2016, 2015 and 2014, respectively.

The following table summarizes the net accounts receivable due from our customers with net accounts receivable balances greater than or equal to 10% of our total net accounts receivable balance:

| As of | As of | |||||||

| July 31, | July 31, | |||||||

| 2016 | 2015 | |||||||

| L-3 |

17 | % | 17 | % | ||||

| Philips |

15 | % | 16 | % | ||||

Our OEM business involves large customers whose placement of large orders can vary based on timing. Our backlog, which consists of cancellable and non-cancellable orders primarily shippable within twelve months, was $148.7 million and $128.5 million as of July 31, 2016 and 2015, respectively. The increase in backlog was primarily due to timing of customer orders in our Security and Detection segment and our Medical Imaging segment, partially offset by decreased orders in OEM probes within our Ultrasound segment.

Government Contracts

We do a significant amount of business with agencies of the U.S. Federal Government through our Security and Detection segment, either directly or as a subcontractor. Our contracts with government agencies, and the government contracts of other parties under which we serve as a subcontractor, are subject to termination at the election of the government agency. While none of our government contracts or subcontracts provide for renegotiation of profits at the election of the government, it is possible that the government agency could request, and that we could under certain circumstances agree to, the renegotiation of the payments provided for under such contracts. However, we have not in the past renegotiated significant payment terms under our government contracts or subcontracts.

Sources of Raw Materials and Components

In general, our products are composed of internally-designed electronic and mechanical elements, including proprietary integrated circuits, printed circuit boards, detectors, power supplies, and displays manufactured by us and others in accordance with our specifications. We order raw materials and components to complete our customers’ orders, and some of these raw materials and components are ordered from sole-source suppliers. We believe that most items procured from third-party suppliers are available from more than one source. However, if

11

Table of Contents

a given component ceases to be available, it might become necessary for us to modify a product design to adapt to a substitute component, or to purchase new tooling to enable a new supplier to manufacture the component, either of which could result in additional expense and/or delay in product sales. Also, from time to time the availability of certain electronic components has been disrupted. Accordingly, we carry a safety stock of raw materials and components in an effort to ensure our ability to make timely delivery to our customers.

Intellectual Property

We rely on a combination of patent, trade secret, copyright and trademark laws, as well as contractual agreements, to safeguard our products, technologies, and processes. We hold patents of varying duration in the U.S. and in various foreign jurisdictions, which cover technologies that we have developed. We regularly file U.S. patent applications and, where appropriate, foreign patent applications. As of July 31, 2016, we hold approximately 348 patent families, including pending and issued patents, in various jurisdictions. In seeking to limit access to sensitive information, we routinely enter into confidentiality and assignment of invention agreements with each of our employees, and confidentiality agreements with our key customers and vendors.

We believe that, while the legal protections afforded by the intellectual property laws are an important factor in our ability to compete, our future prospects also depend on the continuing level of excellence and creativity of our engineers in developing products that satisfy customer needs, and the marketing skills and managerial competence of our personnel in selling those products. Moreover, we believe that market positioning and rapid market entry are important to the success of our products. Our management believes that the loss of any individual patent would not have a material effect on our competitive position.

Research and Development

Research and development, or R&D is a significant element of our business. We maintain a constant and comprehensive R&D program directed toward the creation of new products, the improvement and refinement of our present products, and the expansion of their applications. Certain R&D projects are funded by our customers, typically OEM customers, and such funding is generally treated as engineering revenue, with the associated costs classified as engineering cost of sales. The costs of internally-funded R&D efforts are included within operating expenses.

We evaluate developing technologies in areas where we have technological or marketing expertise for possible investment or acquisition. We intend to continue to invest in R&D and focus our internal and external investments in fields that we believe will offer the greatest potential for near and long-term growth. We are committed to investing in products that have a demonstrable clinical impact and value to the healthcare system and through which we can benefit from our core competencies and global infrastructure.

The cost of customer-funded R&D, which is classified as engineering cost of sales, amounted to:

| For the Year ended July 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| Customer-funded R&D |

$ | 5.2 | $ | 7.8 | $ | 6.9 | ||||||

The cost of internally-funded R&D included in operating expenses amounted to:

| For the Year ended July 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| Internally-funded R&D |

$ | 67.1 | $ | 68.5 | $ | 73.8 | ||||||

12

Table of Contents

Environment

Our manufacturing facilities are subject to numerous environmental laws and regulations, particularly with respect to industrial waste and emissions. Compliance with these laws and regulations have not had a material impact on our capital expenditures, earnings, or competitive position.

Employees

As of July 31, 2016, we employed 1,577 employees. A limited number of employees at our Denmark facility are covered by a works council. We consider our relations with our employees to be generally good.

Financial Information about Foreign and Domestic Operations and Export Revenue

Revenues are attributed to countries based on the location of our customers. For OEM sales, our customer’s location may differ from the location of where the ultimate completed systems are sold by the OEM into the market.

| For the Year ended July 31, | ||||||||||||||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||||||||||||||

| Net Revenue |

||||||||||||||||||||||||

| Domestic |

$ | 192.3 | 38 | % | $ | 215.3 | 40 | % | $ | 183.8 | 36 | % | ||||||||||||

| Foreign |

316.5 | 62 | % | 325.0 | 60 | % | 333.7 | 64 | % | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total net revenue |

$ | 508.8 | $ | 540.3 | $ | 517.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

Refer to Note 16 to the notes to Consolidated Financial Statements included in this Annual Report on Form 10-K for financial information regarding our domestic and foreign revenue and long lived assets.

Available Information

Our website address is www.analogic.com. The information on our website is not incorporated by reference into this document and should not be considered to be a part of this document. Our website address is included in this document as an inactive textual reference only.

We make available free of charge through our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Annual Form SD and amendments to the reports as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission, or the SEC.

| Item 1A. | Risk Factors |

This Annual Report on Form 10-K contains statements, which, to the extent that they are not a recitation of historical facts, constitute “forward-looking statements” pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases these forward-looking statements can be identified by the use of words such as “may,” “could,” “should,” “would,” “expect,” “project,” “predict,” “potential” or the negative of these words or comparable words. Investors are cautioned that all forward-looking statements, including without limitation, statements about product development, market and industry trends, strategic initiatives, regulatory approvals, sales, profits, expenses, price trends, R&D expenses and trends, and capital expenditures, involve risk and uncertainties, and actual events and results may differ materially from those indicated in any forward-looking statement as a result of a number of important factors, including those discussed below and elsewhere in this Form 10-K.

13

Table of Contents

In addition, any forward-looking statements represent management’s views only as of the date of this Annual Report on Form 10-K was filed with the SEC and should not be relied upon as representing management’s views as of any subsequent date. While management may elect to update forward-looking statements at some point in the future, it specifically disclaims any obligation to do so, even if its views change, except as required by law.

You should carefully consider the risks described below before making an investment decision with respect to our common stock. Additional risks not presently known to us, or that we currently deem immaterial, may also impair our business. Any of these could have a material and negative effect on our business, financial condition, or results of operations.

Because a significant portion of our revenue currently comes from a small number of customers, any decrease in revenue from these customers could harm our operating results.

We depend on a small number of customers for a large portion of our business, and changes in our customers’ orders could have a significant impact on our operating results. If a major customer significantly reduces the amount of business it does with us, there would be an adverse impact on our operating results.

We had three customers during fiscal year 2016 and four customers during fiscal years 2015 and 2014, which accounted for 10% or more of our net revenue.

Our ten largest customers as a group accounted for 61%, 64%, and 66% of our net revenue for fiscal years 2016, 2015, and 2014, respectively.

Although we seek to broaden our customer base, we will continue to depend on sales to a relatively small number of major customers. Because it often takes significant time to replace lost business, it is likely that our operating results would be adversely affected if one or more of our major customers were to cancel, delay, or reduce significant orders in the future. Our customer agreements typically permit the customer to discontinue future purchases after timely notice.

In addition, we generate significant accounts receivable in connection with the products we sell and the services we provide to our major customers. Although our major customers are large corporations, if one or more of our customers were to become insolvent or otherwise be unable to pay for our products and services, our operating results and financial condition could be adversely affected.

Competition from existing or new companies in the Medical Imaging and Security and Detection industries could cause us to experience downward pressure on prices, fewer customer orders, reduced margins, loss of new business opportunities, and the loss of market share.

We operate in highly competitive industries. We are subject to competition based on product design, performance, pricing, quality, and service offerings, and we believe our innovative engineering and product reliability have been important factors in our historical growth. While we try to maintain competitive pricing on those products which are comparable to products manufactured by others, in many instances our products conform to more precise specifications and may carry a higher price than analogous products manufactured by others. In addition, the trend of consolidation in the medical device industry and among our customers could result in greater competition and pricing pressures.

Our competitors include divisions of larger, more diversified organizations as well as specialized companies. Some of them have greater resources and larger staffs than we have. A number of our existing and potential OEM customers have the ability to design and manufacture internally the products that we manufacture for them. We face competition from the R&D groups and manufacturing operations of our existing and potential customers, who continually compare the benefits of internal research, product development, and manufacturing with the costs and benefits of outsourcing.

14

Table of Contents

We depend on our suppliers, some of which are the sole-source for certain components, and our production could be substantially curtailed if these suppliers were not able to meet our demands and alternative sources were not available.

We order raw materials and components to complete our customers’ orders, and some of these raw materials and components are ordered from sole-source suppliers. Although we work with our customers and suppliers to minimize the impact of shortages in raw materials and components, we sometimes experience short-term adverse effects due to price fluctuations and delayed shipments. In the past, there have been industry-wide shortages of electronics components. If a significant shortage of raw materials or components were to occur, we might have to delay shipments or pay premium pricing, which could adversely affect our operating results. In some cases, supply shortages of particular components could substantially curtail our production of products using these components. We are not always able to pass on price increases to our customers. Accordingly, some raw material and component price increases could adversely affect our operating results. We also depend on a small number of suppliers to provide many of the other raw materials and components that we use in our business. Some of these suppliers are affiliated with customers or competitors, and others are small companies. If we were unable to continue to purchase these raw materials and components from our suppliers, our operating results could be adversely affected. Because many of our costs are fixed, our margins depend on the volume of output at our facilities, and a reduction in volume could adversely affect our margins.

We rely on successful performance by and relationships with suppliers. This reliance could have a material adverse effect on our results of operations and financial condition.

We have formed arrangements with suppliers for various services and components. We have formed these arrangements because it is commercially more efficient to outsource these services and purchase these components than it would be for us to perform these services or manufacture these components, which in some cases require, among other things, a high degree of technical skill and advanced equipment that is not practical or cost-effective for us to develop or acquire. As a result, if one of our suppliers were to experience quality problems, capacity constraints, decreased yields, or delivery delays, or were to raise prices significantly, we could face product liability claims, product shortages, decreased revenues or lost customers, which could adversely affect our operating results.

If we were to be left with excess inventory, our operating results could be adversely affected.

Because of long lead times and specialized product designs, in certain cases we purchase components and manufacture products in anticipation of customer orders based on customer forecasts. For a variety of reasons, such as decreased end-user demand for our products, inadequate or inaccurate forecasts, or other issues that might impact production planning, our customers might not purchase all the products that we have manufactured or for which we have purchased components. In any such event, we would attempt to recoup material and manufacturing costs by means such as returning components to our vendors, disposing of excess inventory through other channels, or requiring our OEM customers to purchase or otherwise compensate us for such excess inventory. Some of our significant customer agreements do not give us the ability to require our OEM customers to do this. To the extent that we were unsuccessful in recouping our material and manufacturing costs, our gross margin and operating results could be adversely affected. Moreover, carrying excess inventory would reduce the working capital we have available to continue to operate and grow our business.

Uncertainties and adverse trends affecting our industry or any of our major customers could adversely affect our operating results.

Our business operates primarily within three business segments: Medical Imaging, Ultrasound, and Security and Detection. The Medical and Security and Detection equipment markets in which our segments operate are subject to changes in technology, pricing, and profit margins and have been historically subject to cyclical downturns characterized by diminished product demand, rapid declines in average selling prices, and production

15

Table of Contents

over-capacity. In addition, changes in government policy and regulations relating to the purchase or use of medical and security-related capital equipment could also affect our sales. Our customers’ markets are also subject to economic cycles and are likely to experience periodic contractions. The economic conditions affecting our industry in general or any of our major customers in particular, might adversely affect our operating results.

In Security and Detection, our OEM customers’ purchasing dynamics are generally affected by the level of government funding, the expansion and/or upgrade of airport terminals, the timing of government tenders and fluctuations in airline passenger volume.

Our customers’ or our delay in obtaining or inability to obtain any necessary U.S. or foreign regulatory clearances or approvals for products could have a material adverse effect on our business.

Our products in the Medical Imaging and Ultrasound segments are finished medical devices or are components used by our customers in the production of finished medical devices that are subject to a high level of regulatory oversight. A delay in obtaining or inability to obtain any necessary U.S. or foreign regulatory clearances or approvals for products could have a material adverse effect on our business. The process of obtaining clearances and approvals can be costly and time-consuming. There is a further risk that any approvals or clearances, once obtained, might be withdrawn or modified. Medical devices cannot be marketed in the U.S. without clearance from the U.S. Food and Drug Administration, or FDA. Medical devices sold in the U.S. must also be manufactured in compliance with FDA rules and regulations, which regulate the design, manufacturing, packaging, storage, and installation of medical devices. Moreover, medical devices are required to comply with FDA regulations relating to investigational research and labeling. States may also regulate the manufacturing, sale, and use of medical devices. Medical devices are also subject to approval and regulation by foreign regulatory and safety agencies. Our products must also meet the requirements of these governments and agencies for approval and distribution. As with the U.S., foreign governments or agencies can withdraw or modify their approvals.

Our business strategy includes the pursuit of acquisitions or business combinations, which, if consummated, could be difficult to integrate, disrupt our business, dilute stockholder value, or divert management attention.

As part of our business strategy, we may seek attractive acquisitions and other business combinations. Acquisitions are typically accompanied by a number of risks, including the difficulty of integrating the operations and personnel of the acquired companies, the potential disruption of our ongoing business and distraction of management, expenses related to the acquisition, and potential unknown or underestimated liabilities associated with acquired businesses. If we do not successfully complete acquisitions, we could incur substantial expenses and devote significant management time and resources without generating any benefit to us. In addition, substantial portions of our available cash might be utilized as consideration for these acquisitions.

Our annual and quarterly operating results are subject to fluctuations, which could affect the market price of our common stock.

Our annual and quarterly results could vary significantly depending on various factors, many of which are beyond our control, and may not meet the expectations of securities analysts or investors. If this occurs, the price of our common stock could decline. These factors include:

| • | variations in the timing and volume of customer orders; |

| • | introduction and market acceptance of our customers’ or our own new products; |

| • | changes in demand for our customers’ or our own existing products; |

| • | the timing of our expenditures in anticipation of future orders; |

16

Table of Contents

| • | effectiveness in managing our manufacturing processes; |

| • | changes in competitive and economic conditions generally in our or our customers’ markets; |

| • | changes in the cost or availability of components or skilled labor; |

| • | changes in our effective tax rate; |

| • | fluctuations in manufacturing yields; |

| • | foreign currency and commodity price exposures; |

| • | investor and analyst perceptions of events affecting us, our competitors, and/or our industry; |

| • | changes in laws or regulatory requirements affecting the health care or aviation security industries or our products; and |

| • | changes in contingent consideration valuation. |

A delay in anticipated sales beyond the end of a particular quarter could have a significant effect on our operating results for that quarter. In addition, most of our operating expenses do not vary directly with net revenue and are difficult to adjust in the short term. As a result, if revenue for a particular quarter was below our expectations, we could not proportionately reduce operating expenses for that quarter. Hence, the revenue shortfall could have a disproportionate adverse effect on our operating results for that quarter.

Loss of key personnel could hurt our business because of their industry experience and their technological expertise.

We operate in a highly competitive industry and depend on the services of our key senior executives and our technological experts. The loss of the services of one or several of our key personnel or an inability to attract, train, and retain qualified and skilled personnel, specifically engineering and operations personnel, could result in the loss of customers or otherwise inhibit our ability to operate and grow our business successfully.

If we fail to effectively manage our growth or, alternatively, our spending during economic downturns, our business could be disrupted, which could harm our operating results.

Our ability to offer our products and implement our business plan in evolving markets successfully requires an effective planning and management process. We must effectively manage our spending and operations to ensure our competitive position during economic downturns, and must preserve our future opportunities when the economy improves. A failure to manage our spending and operations effectively could disrupt our business and harm our operating results. A growth in sales, combined with the challenges of managing geographically dispersed operations, can place a significant strain on our management systems and resources, and growth in future operations could continue to place such a strain. The failure to manage our growth effectively could disrupt our business and harm our operating results.

If we are unable to maintain our expertise in research and development, manufacturing processes, and marketing new products, we might not be able to compete successfully.

We believe that our future success depends upon our ability to provide research and development, provide manufacturing services that meet the changing needs of our customers, and market new products. Technological changes may adversely impact orders and sales of our existing products, or make them less desirable or even obsolete. This requires that we successfully anticipate and respond to technological changes in design and manufacturing processes in a cost-effective and timely manner. As a result, we continually evaluate the advantages and feasibility of new product designs and manufacturing processes. We may not be able to develop and introduce new and improved products in a timely or efficient manner. New and improved products, if developed, may not achieve price and profitability targets or market acceptance. Commercialization of new products may prove challenging, and we may be required to invest more time and money than expected to introduce these products into the market successfully.

17

Table of Contents

Major terrorist attacks and threats have increased financial expectations that may not materialize.

Major terrorist attacks and threats have created increased interest in our security and detection systems. However, the level of demand for our products is not predictable and may vary over time. We do not know what solutions will continue to be adopted by the U.S. Department of Homeland Security as a result of terrorism and whether our products will continue to be a part of the solutions. Additionally, should our products be considered as a part of future security solutions, it is unclear what the level of purchases may be and how quickly funding to purchase our products may be made available. These factors could adversely impact us and create unpredictability in our revenues and operating results.

We are exposed to risks associated with international operations and markets.

We source and manufacture certain components and systems outside the U.S., we market and sell products in international markets, and we have established offices and subsidiaries in Europe, Canada, and Asia. Our foreign revenue accounted for 62%, 60%, and 64% of our total net revenue for fiscal years 2016, 2015, and 2014, respectively. There are inherent risks in transacting business internationally, including:

| • | changes in applicable laws and regulatory requirements; |

| • | export and import restrictions; |

| • | export controls relating to technology; |

| • | trade agreements, tariffs, and other trade barriers; |

| • | intellectual property laws that offer less protection for our proprietary rights; |

| • | difficulties in staffing and managing foreign operations; |

| • | problems in collecting accounts receivable and longer payment cycles; |

| • | political instability and changes in the international political environment; |

| • | fluctuations in currency exchange rates; |

| • | difficulties in managing employee relations, including differences in employment practices and works councils; |

| • | difficulties in maintaining uniform standards, controls, procedures and policies across our global operations, including inventory management and financial consolidation; |

| • | expatriation controls; and |

| • | potential adverse tax consequences. |

There is significant uncertainty about the stability of global currency, credit and financial markets. These economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. Various macroeconomic factors such as sudden adverse changes to foreign exchange rates, unemployment rates, availability of credit, strength or weakness of real estate markets and other such factors may cause our customers to cancel, decrease or delay their existing or future orders for our products. We are unable to predict the impact of this instability and if economic conditions worsen, our business and results of operations could be materially and adversely affected.

We must comply with the U.S. Foreign Corrupt Practices Act and antitrust, competition and similar laws in other jurisdictions and our failure to do so could lead to substantial liability. We could also face investigations by one or more government agencies that could be costly to respond to and divert the attention of key personnel from our business operations. An adverse outcome from any such investigation could subject us to fines or other penalties, which could adversely affect our business, financial condition and results of operations.

Any one or more of these factors may have a material adverse effect on our future international activities and, consequently, on our business and results of operations.

18

Table of Contents

There are risks associated with our operations in China.

We conduct certain manufacturing operations at, and are transitioning additional manufacturing operations to, our facility in Shanghai, China in order to reduce costs and streamline our manufacturing operations. There are administrative, legal, and governmental risks to operating in China that could result in increased operating expenses or could hamper us in the development of our operations in China. The risks from operating in China that could increase our operating expenses and adversely affect our operating results, financial condition and ability to deliver our products and grow our business include, without limitation:

| • | difficulties in staffing and managing foreign operations, particularly in attracting and retaining personnel qualified to design, sell, test and support our products; |

| • | difficulties in managing employee relations; |

| • | material changes in the value of the Chinese Yuan, or CNY; |

| • | difficulties in coordinating our operations in China with those in the U.S., Canada, and Europe; |

| • | difficulties in enforcing contracts in China; |

| • | difficulties in protecting intellectual property; |

| • | diversion of management attention; |

| • | imposition of burdensome governmental regulations; |

| • | difficulties in maintaining uniform standards, controls, procedures and policies across our global operations, including inventory management and financial consolidation; |

| • | regional political and economic instability, which could have an adverse impact on foreign exchange rates in Asia and impair our ability to conduct our business in China; and |

| • | inadequacy of the local infrastructure to support our operations. |

Our operations are vulnerable to interruption or loss due to natural disasters, epidemics, terrorist acts and other events beyond our control, which would adversely affect our business.

Although we perform manufacturing in multiple locations, we generally do not have redundant manufacturing capabilities in place for any particular product or component. As a result, we depend on our current facilities for the continued operation of our business. A natural disaster, pandemic, terrorist act, act of war, or other natural or manmade disaster affecting any of our facilities could significantly disrupt our operations, or delay or prevent product manufacturing and shipment for the time required to repair, rebuild, or replace our manufacturing facilities. This delay could be lengthy and we could incur significant expenses to repair or replace the facilities. Any similar natural or manmade disaster that affects a key supplier or customer could lead to a similar disruption in our business.

Our business could be harmed if we are unable to protect our intellectual property or if we become subject to intellectual property infringement claims.

We rely on a combination of trade secrets, patents, trademarks, copyrights and confidentiality procedures to protect our technology. Despite our efforts, the steps we have taken to protect our technology may be inadequate. Existing trade secret, patent, trademark and copyright laws offer only limited protection. Our patents could be invalidated or circumvented. In addition, others may develop substantially equivalent or superseding proprietary technology, or competitors may offer similar competing products, thereby substantially reducing the value of our proprietary rights. The laws of some foreign countries in which our products are or may be manufactured or sold may not protect our products or intellectual property rights to the same extent as do the laws of the U.S. The steps we have taken to protect our intellectual property may not be adequate to prevent misappropriation of our technology. Our inability to protect our intellectual property could have a negative impact on our operations and financial results.

19

Table of Contents

We may also become subject to claims that we infringe the intellectual property rights of others in the future. We cannot ensure that, if made, these claims will not be successful. Any claim of infringement could cause us to incur substantial costs defending against the claim even if the claim is invalid, and could distract management from other business. Any judgment against us could require substantial payment in damages and could also include an injunction or other court order that could prevent us from offering certain products.

We rely significantly on information technology and any failure, inadequacy, interruption or security lapse of that technology could harm our ability to operate our business effectively.

We rely extensively on information technology systems to interact with our employees and our customers and to run our business effectively. These interactions include ordering and managing materials from suppliers, converting materials to finished products, shipping product to customers, processing transactions, summarizing and reporting results of operations, complying with regulatory, legal and tax requirements, and other processes necessary to manage our business. Our systems could become damaged or cease to function properly due to any number of causes, including issues caused by ongoing projects to improve our information technology systems and the delivery of services, failures of third-party service providers, catastrophic events, power outages, and security breaches. Any failure or malfunctioning of our information technology systems, errors or misuse by system users, or inadequacy of the systems in addressing the needs of our operations, could disrupt our ability to timely and accurately manufacture and ship products, which could have a material adverse effect on our business, financial condition and results of operations. Any such failure, errors, misuse or inadequacy could also disrupt our ability to timely and accurately process, report and evaluate key operations metrics and key components of our results of operations, financial position and cash flows. Any such disruptions would likely divert our management and key employees’ attention away from other business matters. Any disruptions or difficulties that may occur in connection with our information technology systems could also adversely affect our ability to complete important business processes such as the evaluation of our internal control over financial reporting and attestation activities.

We face attempts by others to gain unauthorized access to our information technology systems and have been subject to information security breaches caused by illegal hacking, none of which, in the aggregate, have materially impacted our operations and financial condition to date. We may be subject to additional information security breaches caused by illegal hacking, computer viruses, or acts of vandalism or terrorism. We have implemented procedures to mitigate these risks. We monitor our data, information technology and personnel usage of our systems to reduce these risks and continue to do so on an ongoing basis for any current or potential threats; however, our security measures or those of our third-party service providers may not detect or prevent such breaches and, in some instances we, our customers, and the users of our products might be unaware of an incident or its magnitude and effect. These threats are constantly evolving, thereby increasing the difficulty of successfully defending against them or implementing adequate preventative measures. Any such compromise to our information security could result in an interruption in our operations, the unauthorized publication of our confidential business or proprietary information, the unauthorized release of customer, vendor, or employee data, the violation of privacy or other laws, and the exposure to litigation, any of which could harm our business and operating results.

If our security and detection systems fail to detect weapons, explosives or other devices that are used to commit a terrorist act, we could be exposed to product liability and related claims for which we may not have adequate insurance coverage.

Our business exposes us to potential product liability risks that are inherent in the development, manufacturing, sale and service of security and detection systems. Our customers use our security and inspection systems to help them detect items that could be used in performing terrorist acts or other crimes. The training, reliability and competence of the customers’ operators are crucial to the detection of suspicious items. In addition, our security and detection systems are not designed to work under all circumstances or may otherwise fail to detect a threat. We test the reliability of our security and detection systems during both their development

20

Table of Contents

and manufacturing phases. We also perform such tests if we are requested to perform installation, warranty or post-warranty servicing. However, our security and detection systems are advanced mechanical and electronic devices and therefore can malfunction.

As a result of the September 11, 2001, and 1993 World Trade Center terrorist attacks, and the potential for future attacks, product liability insurance coverage for such threats is extremely difficult and costly to obtain. It is possible, subject to the applicability of the Support Anti-terrorism by Fostering Effective Technologies Act of 2002, or SAFETY Act, that if we were found liable following a major act of terrorism, our insurance might not fully cover the claims for damages.

The SAFETY Act is a Federal law in the U.S. enacted to provide certain legal liability protections for providers of certain anti-terrorism technologies. If applicable to claims against Analogic, the SAFETY Act could mitigate some of this risk.

Our Security and Detection segment depends in part on purchases of products and services by the U.S. Federal Government and its agencies, which purchases may be only partially funded, and are subject to potential termination and reductions and delays in government spending.

As an indirect subcontractor or team member with prime contractors and in other cases directly to the U.S. Federal Government and its agencies, our security and detection systems are included in many different domestic programs. Over the lifetime of a program, the award of many different individual contracts and subcontracts could impact our products’ requirements. The funding of U.S. Federal Government programs are subject to Congressional appropriations. Although multiple-year contracts may be planned in connection with major procurements, Congress generally appropriates funds only on a single fiscal year basis. Consequently, programs are often only partially funded initially, and additional funds are committed only as Congress makes further appropriations and prime contracts receive such funding. The reduction or delay in funding or termination of a government program in which we are involved could result in a loss of or delay in receiving anticipated future revenues attributable to that program and contracts or orders received. The U.S. Federal Government could reduce or terminate a prime contract under which we are a subcontractor or team member irrespective of the quality of our products or services. The termination of a program or reduction in, or failure to commit additional funds to, a program in which we are involved could negatively impact our revenue and have a material adverse effect on our financial condition and results of operations.

Changes in laws affecting the health care industry could adversely affect our business, operations and financial condition.

In recent years, the healthcare industry has undergone significant changes driven by various efforts to reduce costs, including increased levels of managed care, cuts in Medicare, consolidation of healthcare distribution companies and collective purchasing arrangements by office-based healthcare practitioners. In addition, numerous governments have undertaken efforts to control healthcare costs through legislation and regulation. In the U.S. in March 2010, President Obama signed into law health care reform legislation in the form of the Patient Protection and Affordable Care Act, or PPACA. The PPACA could meaningfully change the way healthcare is developed, marketed and delivered, and may materially impact numerous aspects of our business, results of operations, and financial conditions. The implementation of health care reform and medical cost containment measures in the U.S. and in foreign countries in which we operate could:

| • | limit the use of our products and adversely affect the use of new therapies for which our products may be targeted; |

| • | reduce reimbursement available to our customers for using our products; and |

| • | decrease the price we might establish for our products and products that we may develop, which would result in lower product revenues to us. |

21

Table of Contents

In addition, because we operate in a highly regulated industry, other governmental actions may adversely affect our business, operations and financial condition, including:

| • | changes in FDA and foreign regulations that may require additional safety monitoring, labeling changes, restrictions on product distribution or use, or other measures after the introduction of our products to market, which could increase our costs of doing business, or otherwise adversely affect the market for our products; |

| • | new laws, regulations and judicial decisions affecting pricing or marketing practices; and |

| • | changes in the tax laws relating to our operations. |

Impact of transactions involving our Danish subsidiary BK Medical ApS (“BK Medical”) and certain of its distributors with respect to which we have raised questions as to compliance with law.

As initially disclosed in our Annual Report on Form 10-K for the fiscal year ended July 31, 2011, we identified certain transactions involving our Danish subsidiary BK Medical ApS, or BK Medical, and certain of its foreign distributors, with respect to which we raised questions concerning compliance with law, including Danish law and the U.S. Foreign Corrupt Practices Act, and our business policies. These have included transactions in which the distributors paid BK Medical amounts in excess of amounts owed and BK Medical transferred the excess amounts, at the direction of the distributors, to third parties identified by the distributors. We have terminated the employment of certain BK Medical employees and also terminated our relationships with the BK Medical distributors that were involved in the transactions. We have concluded that the identified transactions have been properly accounted for in our reported financial statements in all material respects. However, we were unable to ascertain with certainty the ultimate beneficiaries or the purpose of these transfers.

We voluntarily disclosed this matter to the Danish Government, the U.S. Department of Justice, or DOJ, and the SEC, and cooperated with inquiries by the Danish Government, the DOJ and the SEC to reach a resolution of this matter in the fiscal year ended July 31, 2016. On June 22, 2016, we issued a press release announcing that we had reached agreements with the SEC, the DOJ and the Danish Government to resolve the matters we had voluntarily disclosed. As a result of these resolutions, we paid a total of $14.9 million in disgorgement, interest and penalties. We do not expect any further inquiries related to this matter.

We incurred inquiry-related costs of approximately $0.4 million, $1.4 million, and $1.4 million in our fiscal years ended July 31, 2016, 2015, and 2014, respectively, in connection with this matter.

Compliance or the failure to comply with current and future environmental regulations could cause us significant expense.

We are subject to various environmental regulations. From time to time new regulations are enacted, and it is difficult to anticipate how such regulations will be implemented and enforced. We continue to evaluate the necessary steps for compliance with environmental regulations as they are enacted. These regulations include, for example, the Registration, Evaluation, Authorization and Restriction of Chemical substances, or REACH, the Restriction on the Use of Certain Hazardous Substances in Electrical and Electronic Equipment Directive, or RoHS and the Waste Electrical and Electronic Equipment Directive, or WEEE enacted in the European Union which regulate the use of certain hazardous substances in, and require the collection, reuse and recycling of waste from, certain products we manufacture. This and similar legislation that has been or is in the process of being enacted in Japan, China, Korea and various states of the U.S. may require us to redesign our products to ensure compliance with the applicable standards, for example by requiring the use of different types of materials. These redesigns or alternative materials may detrimentally impact the performance of our products, add greater testing lead-times for product introductions or have other similar effects. We believe we comply with all such legislation

22

Table of Contents

where our products are sold and we will continue to monitor these laws and the regulations being adopted under them to determine our responsibilities. In addition, we are monitoring legislation relating to the reduction of carbon emissions from industrial operations to determine whether we may be required to incur any material, additional material costs, or expenses associated with our operations. Our failure to comply with any of the foregoing regulatory requirements could result in our being directly or indirectly liable for costs, fines or penalties and third-party claims, and could jeopardize our ability to conduct business in the U.S. and foreign countries.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

As of July 31, 2016, we owned or leased the primary facilities described below:

| Location |

Approximate Sq. Ft. | Principal Use(s) |

Principal Segment(s) | |||||||||

| Peabody, MA (1) |

Owned | 514,000 | Executive and administrative offices, manufacturing, R&D, customer service, and sales | All segments | ||||||||

| Shanghai, China (2) |

Owned | 145,000 | Administrative offices, manufacturing, customer service, and sales | Medical Imaging and Ultrasound | ||||||||

| Herlev, Denmark (3) |

Owned | 135,000 | Administrative offices, R&D, customer service, and sales | Ultrasound | ||||||||

| State College, PA |

Owned | 66,000 | Administrative offices, manufacturing, R&D, customer service, and sales | Ultrasound | ||||||||

| Montreal, Canada |

Leased | 54,000 | Administrative offices, manufacturing, R&D, customer service, and sales | Medical Imaging | ||||||||

| Canton, MA |

Leased | 33,000 | R&D, customer service, and sales | Medical Imaging | ||||||||

| Vancouver, Canada (4) |

Leased | 31,000 | Administrative offices, manufacturing, R&D, customer service, and sales | Ultrasound | ||||||||

| (1) | We own approximately 60 acres of land at this location, which can accommodate future expansion as required. |

| (2) | Our Shanghai, China facility, built on leased land, opened in April 2012. |

| (3) | We are not currently utilizing all the space of this facility. We have leased a portion of this facility and are currently in process of exploring various uses for the unused space. |

| (4) | This property was assumed as part of the acquisition of Ultrasonix Medical Corporation, which we refer to as Ultrasonix, acquired in March 2013. |

We lease a number of other smaller facilities in the U.S. and locations such as, the United Kingdom, Germany, Italy, Sweden and Belgium.

We believe that our existing facilities are generally adequate to meet our current needs, and that suitable additional or substitute space will be available on commercially reasonable terms when needed. Refer to Note 12 to the Consolidated Financial Statements included in this report for further information concerning certain leases.

| Item 3. | Legal Proceedings |

For a discussion of legal matters as of July 31, 2016, please read Note 11 to the notes to our Consolidated Financial Statements included in this Annual Report on Form 10-K, which is incorporated into this item by reference.

23

Table of Contents

| Item 4. | Mine Safety Disclosure |

None.

Executive Officers of the Registrant

Our current executive officers are:

| Name |

Age | Position |

Date Since Office Has Been Held |

|||||||

| James W. Green |

58 | President and Chief Executive Officer | 2007 | |||||||

| Mark Frost |

53 | Senior Vice President, Chief Financial Officer and Treasurer | 2015 | |||||||

| Shalabh Chandra |

51 | Senior Vice President and General Manager, Ultrasound Business | 2015 | |||||||

| John J. Fry |

54 | Senior Vice President, General Counsel, and Secretary | 2007 | |||||||

| Mervat Faltas |

64 | Senior Vice President and General Manager Medical Imaging Business | 2010 | |||||||

| James P. Ryan |

46 | Senior Vice President and General Manager, Security Systems, Medical Imaging Technologies and Global Operations | 2015 | |||||||