☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the C o mmission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☒ |

No fee required. | |

☐ |

Fee paid previously with preliminary materials. | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT |

DEAR STOCKHOLDER:

You are cordially invited to attend the annual meeting of stockholders of Marsh McLennan at:

|

DATE

Thursday, May 18, 2023 |

|

TIME

ONLINE CHECK-IN BEGINS: 9:45 a.m. Eastern Time

MEETING BEGINS: 10:00 a.m. Eastern Time

|

|

LOCATION

Meeting live via the Internet—please visit: WWW.VIRTUALSHAREHOLDER MEETING.COM/MMC2023

|

|

This year’s annual meeting will be held virtually. Stockholders will be able to listen, vote, and submit questions remotely via the Internet. Information on how to participate in the virtual annual meeting is on page 86. There are five items of business for this year’s annual meeting:

ITEMS OF BUSINESS

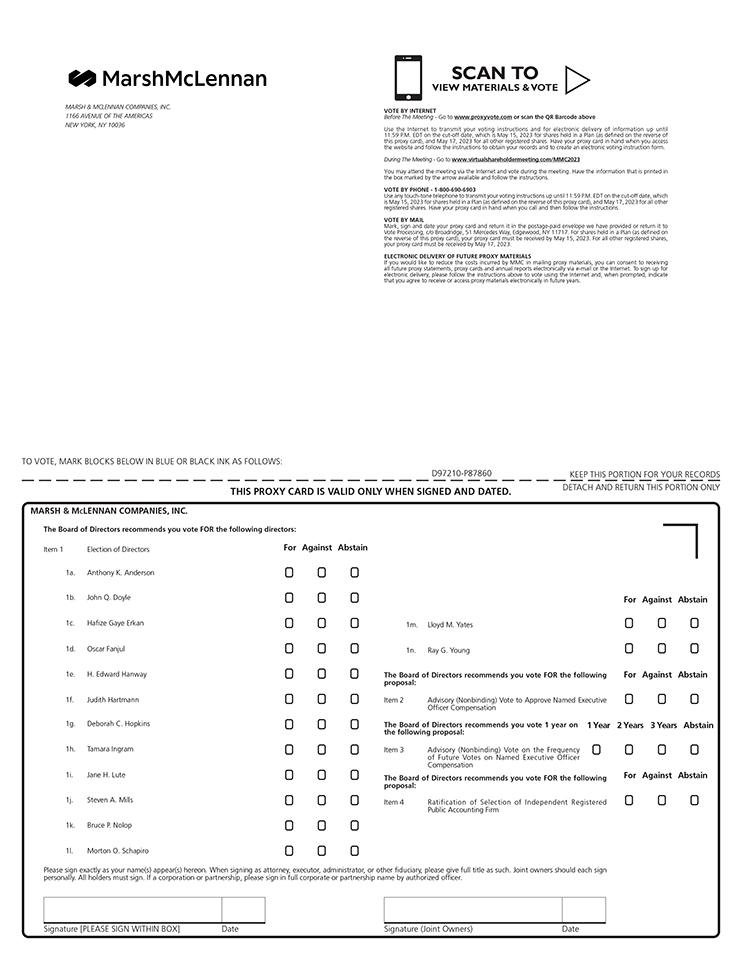

| 1. | To elect fourteen (14) persons named in the accompanying proxy statement to serve as directors for a one-year term; |

| 2. | To approve, by nonbinding vote, the compensation of our named executive officers; |

| 3. | To recommend, by nonbinding vote, whether future stockholder votes to approve the compensation of our named executive officers should occur every one, two or three years; |

| 4. | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm; and |

| 5. | To conduct any other business that may properly come before the meeting. |

YOUR VOTE IS VERY IMPORTANT

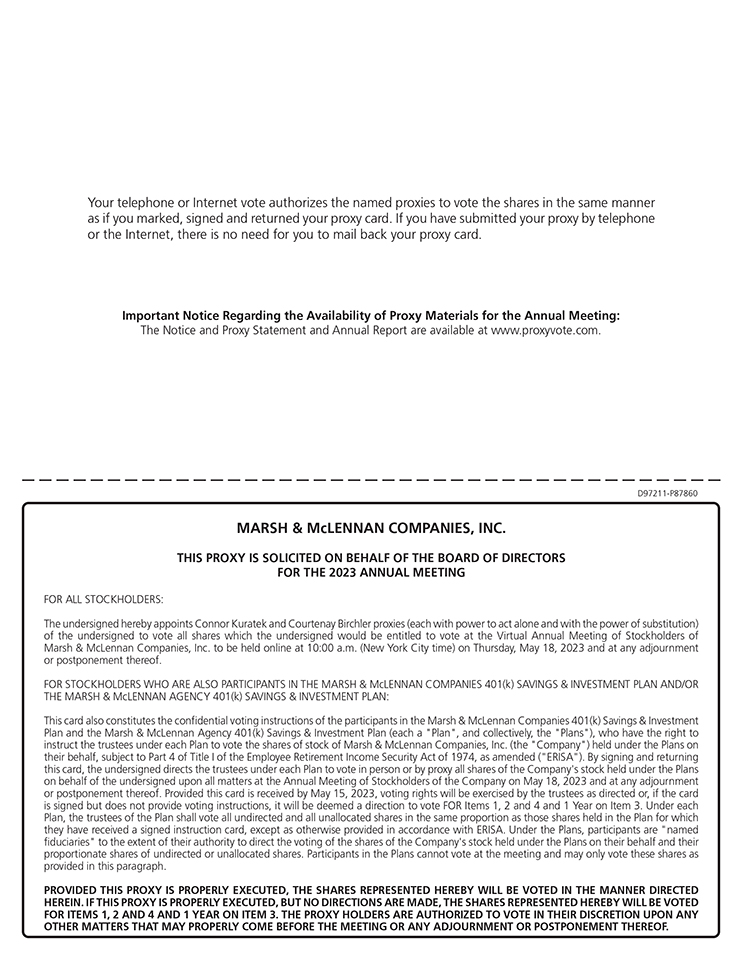

If you were a stockholder at the close of business on March 20, 2023, you are eligible to vote at this year’s annual meeting. Whether or not you plan to participate in the annual meeting, your vote is very important. We urge you to participate in the election of our directors and in deciding the other items on the agenda for the annual meeting.

You may vote on the Internet, by telephone or by mail.

| • | If you accessed this proxy statement through the Internet, instructions appear in the Notice of Internet Availability of Proxy Materials. |

| • | If you received this proxy statement by mail, you may also vote by mail and instructions appear on the enclosed proxy card. |

CONNOR KURATEK

Deputy General Counsel & Corporate Secretary

March 31, 2023

Important Notice Regarding the Availability of Proxy Materials for the Marsh McLennan Annual Meeting of Stockholders to Be Held on May 18, 2023: This proxy statement and the Company’s 2022 Annual Report, which includes financial statements as of and for the fiscal year ended December 31, 2022, are available at proxy.mmc.com

This notice and proxy statement is first being mailed or made available on the Internet to stockholders on or about March 31, 2023.

In these materials, we refer to Marsh & McLennan Companies, Inc. as “Marsh McLennan”, the “Company”, “we”, and “our”.

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 1NOT |

|

PROXY SUMMARY

|

This summary highlights information contained elsewhere in this proxy statement. You should read the entire proxy statement carefully before voting.

| VOTING MATTERS

|

Page number for more information

|

Board’s recommendation

|

|

|||||||||||||

|

Election of Directors (Item 1) |

|

19

|

|

|

FOR

|

|

||||||||||

|

To elect fourteen (14) persons named in the accompanying proxy

|

||||||||||||||||

|

Advisory (Nonbinding) Vote to Approve Named

|

|

28

|

|

|

FOR

|

|

||||||||||

|

To approve, by nonbinding vote, the compensation of our

|

||||||||||||||||

|

Advisory (Nonbinding) Vote on the Frequency of Future

|

29 | ONE YEAR | ||||||||||||||

|

To recommend by nonbinding vote, a stockholder vote on the compensation

|

||||||||||||||||

|

Ratification of Independent Auditor (Item 4)

|

|

72

|

|

|

FOR

|

|

||||||||||

|

To ratify the selection of Deloitte & Touche LLP as our independent

|

||||||||||||||||

HIGHLIGHTS OF OUR BUSINESS AND STRATEGY

|

Business |

We are the world’s leading professional services firm in the areas of risk, strategy and people. With annual revenue of over $20 billion, we help clients navigate an increasingly dynamic and complex environment through four market-leading businesses:

Marsh provides data-driven risk advisory services and insurance solutions to commercial and consumer clients.

Guy Carpenter develops advanced risk, reinsurance and capital strategies that help clients grow profitably and identify and capitalize on emerging opportunities.

Mercer delivers advice and technology-driven solutions that help organizations redefine the world of work, shape retirement and investment outcomes, and advance health and well-being for a changing workforce.

Oliver Wyman Group serves as a critical strategic, economic and brand advisor to private sector and governmental clients.

Our more than 85,000 colleagues advise clients in over 130 countries.

|

| 1 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

PROXY SUMMARY (Continued)

|

| Strategy | We are more than 85,000 colleagues united by a common purpose—

TO MAKE A DIFFERENCE IN THE MOMENTS THAT MATTER.

We work with our clients to tackle many of society’s most pressing challenges and deliver insights and solutions around the world. Three commitments unite us as we strive to live our purpose:

• Succeeding Together—We are in business to expand what’s possible for our clients and each other

• Accelerating Impact—We embrace changes and create enduring client value

• Advancing Good—We strive to serve the greater good

| |

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 2 |

|

PROXY SUMMARY (Continued)

|

KEY GOVERNANCE POLICIES AND PRACTICES

|

BOARD OF DIRECTORS

|

|

✓ Our newest directors, Judith Hartmann and Ray G. Young, joined the Board in March 2023

✓ Effective upon his appointment as our President and CEO, John Q. Doyle joined the Board as of January 2023

✓ In accordance with the mandatory retirement provisions in our Governance Guidelines, the Board has determined that R. David Yost, who has served on the Board since 2012, will not stand for re-election at the May 2023 annual meeting

✓ Our chairman of the Board is an independent director

✓ All of our directors are elected annually

✓ Our directors’ areas of expertise are presented in a matrix on pages 11 and 12

✓ Our Governance Guidelines articulate the Board’s responsibility, alongside management, for setting the “tone at the top” and overseeing management’s strategy to promote a culture of integrity throughout the Company

|

|

KEY DIRECTOR STATISTICS

|

|||||||||||

|

*Key director statistics are as of May 18, 2023

|

||||||||||||

|

We appointed our EIGHTH |

In the past 5 YEARS, we have

|

As of our 2023 annual meeting, we expect 36% OF OUR |

||||||||||

| 3 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

PROXY SUMMARY (Continued)

|

|

ENVIRONMENTAL,

|

Our 2022 ESG Report discloses against aspects of the Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) standards, describes the six UN Sustainable Development Goals (UNSDG) we have prioritized and highlights our ESG goals and achievements, including:

• We have been a certified CarbonNeutral® company since September 1, 2021. In 2022, we announced our commitment to chart a path to net-zero across our core operations by 2050, with an emissions reduction target of 50% by 2030 from a baseline of 2019, in line with the Science-Based Targets Initiative.

• We conduct an annual study to identify discrepancies in pay based on gender globally and race/ethnicity in the U.S. A statistical analysis examines the current base salaries and total compensation of colleagues in comparable roles to determine whether there are differences in pay that cannot be explained by objective factors such as level, performance, location, experience and skills. When unexplained discrepancies in pay are identified in our analysis, adjustments are made. The results of our most recent annual pay equity study, as modified for the adjustments described above, showed a difference of less than 1% between women and men globally and between non-white and white colleagues in the US on both pay and total compensation as of June 1, 2022.

• As of our 2023 annual meeting, we expect 36% of our Board to be women.

Our ESG Report, Pay Equity Statement, statement on Human Rights and related information are available on our website at marshmclennan.com/about/esg.html. These reports and our website are not deemed part of this report and are not incorporated by reference.

|

|||

|

STOCKHOLDER ENGAGEMENT

|

✓ In each of the past five years, we have engaged with institutional stockholders holding approximately 36% to 45% of our outstanding common stock

✓ In 2022, we held meaningful discussions with stockholders covering corporate governance matters, executive compensation and CEO succession, inclusion and diversity, and climate and other environmental topics such as our progress against our ESG goals

✓ We incorporated stockholder feedback in evaluating how we report our progress against our ESG goals and in considering Board committee rotation in light of factors including tenure and diversity

|

|||

|

STOCKHOLDER

|

✓ Our bylaws provide for proxy access

✓ Our bylaws allow holders of at least 20% of the voting power of the Company’s outstanding common stock to call a special meeting

✓ Directors must receive a majority of the votes cast to be elected in uncontested elections

|

|||

|

COMPENSATION

|

✓ We have stock ownership guidelines for directors and senior executives

✓ We prohibit hedging transactions by directors and colleagues, including senior executives

✓ Directors and senior executives are prohibited from pledging Company securities as collateral for a loan or otherwise

|

|||

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 4 |

|

PROXY SUMMARY (Continued)

|

KEY EXECUTIVE COMPENSATION POLICIES AND PRACTICES

|

STOCKHOLDER

|

• Our senior executives have a high percentage of variable (‘‘at risk’’) pay

• Long-term incentive compensation for our senior executives is delivered in stock options and performance stock unit awards, the value of which depends on stock price appreciation or achievement of specific Company financial objectives and the Company’s relative total stockholder return (“TSR”) versus S&P 500® constituents

• We generally mitigate the potential dilutive effect of equity-based awards through our share repurchase program

• The Compensation Committee has engaged an independent compensation consultant

|

|||

|

COMPENSATION

|

• We maintain clawback policies for senior executive annual bonus awards and for equity-based compensation

|

|||

|

SEVERANCE AND

|

• Severance protections for our senior executives, including our CEO, are at a 1x multiple of base salary and bonus, with a pro-rata bonus for the year of termination. Further, we are required as a matter of policy to obtain stockholder approval for severance agreements with certain senior executives if they provide for cash severance that exceeds 2.99x the executive’s base salary and three-year average annual bonus award

• We provide “double-trigger” vesting of equity-based awards and payment of severance benefits following a change in control of the Company

• We do not provide golden parachute excise tax gross-ups in connection with a change in control of the Company

|

|||

|

SAY ON PAY

|

• We hold a nonbinding advisory vote on named executive officer compensation each year

• Stockholder support of our executive compensation program has been consistently strong with an approval rate of 94% in 2022 and 95% in 2021, and 93% or higher since 2013

|

|||

| 5 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

PROXY SUMMARY (Continued)

|

HIGHLIGHTS OF OUR 2022 PERFORMANCE AND COMPENSATION

|

FINANCIAL

|

• In 2022, Marsh McLennan delivered strong results as we successfully continued to invest in our talent and capabilities, both organically and through acquisitions

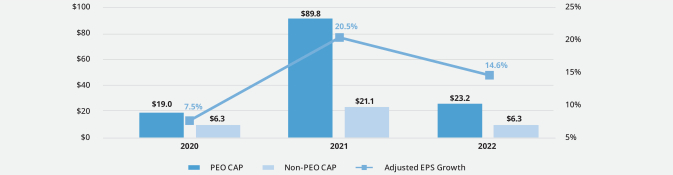

• Our GAAP EPS decreased 1%. We delivered 11% growth in adjusted EPS*

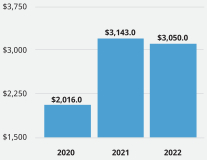

• We generated $20.7 billion of revenue, an increase of 5% on a GAAP basis compared with 2021. We achieved 9% growth in underlying revenue

• Our GAAP operating income decreased by 1%. We grew our adjusted operating income* by 11%, and expanded adjusted margins for our 15th consecutive year

* Please see Exhibit A for a reconciliation of our non-GAAP financial measures to GAAP financial measures and related disclosures.

|

|||

|

CAPITAL

|

• In 2022, we deployed close to $4 billion of capital across dividends, share repurchases and acquisitions

• We increased our quarterly dividend by 10.3% in the third quarter of 2022, paying total dividends of $1.1 billion in 2022 ($2.25 per share). We have increased our dividend every year since 2010

• We repurchased 12.2 million shares for $1.9 billion

• We completed 20 acquisitions

|

|||

|

POSITIONING

|

• We completed seamless leadership transitions at Marsh McLennan, Marsh and Guy Carpenter, drawing on internal talent

• Realized benefits of our recent investments in talent

• Continued to expand Marsh McLennan Agency (MMA), our middle market insurance business, completing 15 acquisitions, including two top-100 agencies. MMA has now surpassed 100 acquisitions since its inception in 2009

• Expanded our business capabilities and geographic reach at Mercer through an agreement with WestPac to acquire BT-Super Trust and Advance Asset Management in Australia and at Oliver Wyman with acquisitions of specialty consultant Avascent and Booz Allen’s Middle East North Africa practice

|

|||

|

STOCK

|

• Our 2022 total stockholder return (“TSR”) outperformed the S&P 500® index. While our TSR fell 3.5%, the S&P 500® index fell 18.1%

• Our five-year annualized TSR of 17.2% outperformed the S&P 500® index TSR by 7.8 percentage points

|

|||

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 6 |

|

PROXY SUMMARY (Continued)

|

|

EXECUTIVE

|

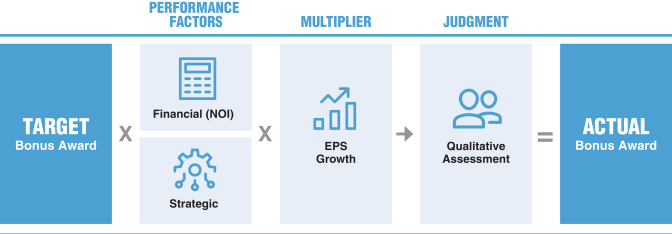

• In February 2023, the Compensation Committee assessed management’s performance against our 2022 objectives. The Compensation Committee determined bonuses that were above-target for all of our named executive officers commensurate with strong performance with respect to our financial and strategic objectives

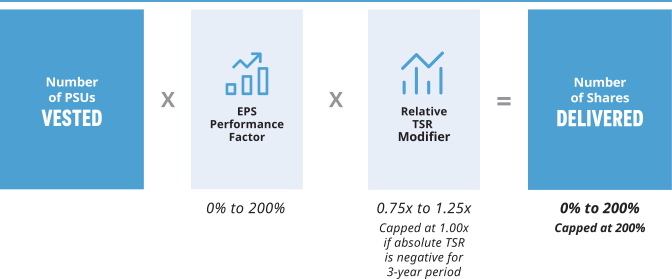

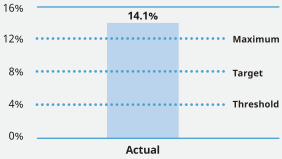

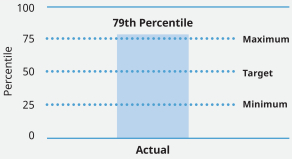

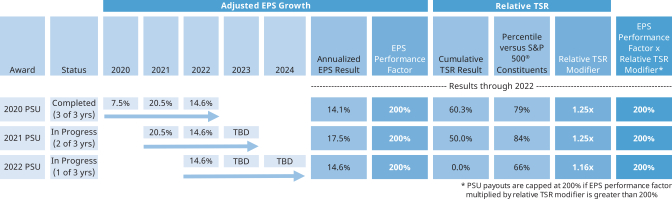

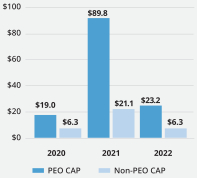

• We achieved three-year annualized adjusted EPS growth of 14.1%* for our 2020 performance stock unit (PSU) awards. This was above our 8% target for the award and resulted in the maximum payout at 200% of target. Despite the impact of the pandemic on our 2020 financial performance, the Compensation Committee did not reset or adjust the 8% target for three-year annualized adjusted EPS growth applicable to any of the then-outstanding PSU awards, including the 2020 awards. In addition, our three-year TSR was above the 75th percentile versus S&P 500® constituents*, which resulted in the maximum 1.25x relative TSR modifier; however, the modifier had no impact on the actual payout of awards since they were capped at the maximum 200% of target based on our adjusted EPS growth

* Please see “Definitions of Financial Performance Measures” on page 51 for information about calculation of adjusted EPS growth and TSR for our PSU awards.

|

|||

|

SENIOR

|

The Company made the following senior executive changes:

Effective January 1, 2023

• John Q. Doyle was appointed President and Chief Executive Officer succeeding Dan Glaser upon his retirement. Mr. Doyle previously served as Group President and Chief Operating Officer

• John J. Jones was appointed Chief Marketing and Communications Officer. Mr. Jones previously served as Chief Marketing Officer of Marsh

Effective March 11, 2022

• Katherine J. Brennan was appointed Senior Vice President and General Counsel. Ms. Brennan previously served as General Counsel of Marsh

Effective January 1, 2022

• Martin South was appointed President and Chief Executive Officer of Marsh, succeeding Mr. Doyle. Mr. South was previously President of Marsh US and Canada

• Dean Klisura was appointed President and Chief Executive Officer of Guy Carpenter, succeeding Peter Hearn. Mr. Klisura was previously President of Guy Carpenter

|

|||

| 7 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

PROXY SUMMARY (Continued)

|

|

OUR BUSINESS AND STRATEGY TIE TO OUR EXECUTIVE COMPENSATION PROGRAM

As a professional services firm, our business relies on the expertise and capabilities of our colleagues to lead the Company and our various businesses in ways that meet our clients’ needs and, in turn, promote the long-term interests of our stockholders. We have designed our executive compensation program to achieve our business objectives and attract, motivate and retain highly talented individuals.

We continued to evaluate performance in our executive compensation program against the following long-term financial and strategic objectives:

• Deliver on financial objectives

• Generate top line growth through innovation and organic investments

• Make Marsh McLennan a great place to work, including by delivering on our I&D and sustainability initiatives

• Focus on strategic priorities, including mergers and acquisitions, technology and innovation

• Execute a balanced capital management strategy

• Promote a culture of integrity and inclusion

The financial performance measures used in our executive compensation program, which include Company and business net operating income, EPS growth and relative TSR, are defined in “Definitions of Financial Performance Measures” on page 51.

|

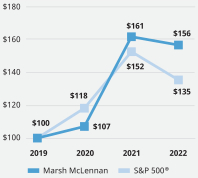

The strength of our financial performance and strategic accomplishments over the past five years is reflected in our TSR. The following graph compares the annual cumulative stockholder return for the five-year period ended December 31, 2022 of Marsh McLennan common stock with the S&P 500® Stock Index, assuming an investment of $100 on December 31, 2017.

|

COMPARISON OF CUMULATIVE TOTAL STOCKHOLDER RETURN ($100 invested 12/31/17 with dividends reinvested)

|

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 8 |

|

TABLE OF CONTENTS

|

| CORPORATE GOVERNANCE | 1 | |||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| Environmental, Social and Governance (ESG) Oversight and Activities |

4 | |||

| 4 | ||||

| CEO Succession Planning and Succession Planning for Senior Executives |

5 | |||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| Stockholder Recommendations and Nominations for Director Candidates |

8 | |||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| BOARD OF DIRECTORS AND COMMITTEES | 10 | |||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| ELECTION OF DIRECTORS | 19 | |||

| 19 | ||||

| 1TOC | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

CORPORATE GOVERNANCE

|

We describe key features of the Company’s corporate governance environment below and in the next section of this proxy statement, captioned “Board of Directors and Committees.” Our key corporate governance materials are available online at mmc.com/about/corporate-governance.html.

OVERVIEW

Our Board of Directors currently has fifteen (15) members, including H. Edward Hanway, our Independent Chair, and John Q. Doyle, our President and Chief Executive Officer. In accordance with the mandatory retirement provisions in our Governance Guidelines, the Board has determined that R. David Yost will not stand for re-election at the May 2023 annual meeting. Mr. Doyle is the only member of management who serves as a director. As described in more detail under “Board of Directors and Committees,” our Board maintains an Audit Committee, a Compensation Committee, a Directors and Governance Committee, a Finance Committee, an ESG Committee and an Executive Committee.

CORPORATE GOVERNANCE PRACTICES

The Company is committed to best practices in corporate governance. Highlights of our corporate governance practices are described below.

Board Structure

| • | Board Independence. All of the Company’s directors are independent, with the exception of our CEO, who is the only member of management serving on the Board. |

| • | Independent Chair. The Company maintains separate roles of chief executive officer and Board chair as a matter of policy. An independent director acts as Board chair. |

| • | Offer to Resign upon Change in Circumstances. Pursuant to our Governance Guidelines, any director undergoing a significant change in professional circumstances must offer to resign from the Board. |

Election of Directors

| • | Annual Election of Directors. The Company’s charter provides for the annual election of directors. |

| • | Majority Voting in Director Elections. The Company’s bylaws provide that, in uncontested elections, director candidates must be elected by a majority of the votes cast. Each director candidate has previously tendered an irrevocable resignation that will be effective upon his or her failure to receive the requisite votes and the Board’s acceptance of such resignation. |

Proxy Access

| • | Proxy Access. The Company’s bylaws permit a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years to nominate and include in the Company’s proxy materials directors constituting up to the greater of two or 20% of board seats, if the stockholder(s) and the nominee(s) meet the requirements in our bylaws. |

Right of Stockholders to Call Special Meetings

| • | Stockholder Right to Call Special Meetings. The Company’s bylaws allow holders of record of at least 20% of the voting power of the Company’s outstanding common stock to call a special meeting. |

Stockholder Rights Plan

| • | No Poison Pill. The Company does not have a stockholder rights plan in place. |

Compensation Practices

| • | Compensation Structure for Independent Directors. The Company’s director compensation structure is transparent to investors and does not provide for meeting fees or retainers for non-chair committee membership. |

| • | Cap on Executive Severance Payments. The Company is required as a matter of policy to obtain stockholder approval for severance agreements with certain senior executives if they provide for cash severance that exceeds 2.99x the executive’s base salary and three-year average annual bonus award. Severance protections for |

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 1 |

|

CORPORATE GOVERNANCE (Continued)

|

| our senior executives, including our CEO, are at a 1x multiple of base salary and bonus, as described in “Severance Arrangements” on page 53. |

| • | “Double-Trigger” Condition for Vesting of Equity-Based Awards following a Change in Control. Our equity-based awards contain a “double-trigger” vesting provision, which requires both a change in control of the Company and a specified termination of employment in order for vesting to be accelerated. |

| • | “Clawback” Policies. The Company may as a matter of policy recoup (or “claw back”) certain executive bonuses in the event of misconduct leading to a financial restatement. Also, our 2020 Incentive and Stock Award Plan allows the Company to “claw back” outstanding or already settled equity-based awards. In light of the NYSE’s proposed Clawback listing standards (and the SEC final Clawback rule), the Company is reviewing its policies and will recommend that the Compensation Committee amend the policy or adopt a new policy to comply with NYSE’s final listing standards. |

Equity Ownership and Holding Requirements

| • | Senior Executive Equity Ownership and Holding Requirements. The Company requires senior executives to hold shares or stock units of our common stock (excluding performance stock units) with a value equal to a multiple of base salary. The multiple for our Chief Executive Officer is six, and the multiple for our other senior executives is three. Senior executives are required to hold shares of the Company’s common stock acquired in connection with equity-based awards until they reach their ownership multiple and may not sell any shares of the Company’s common stock unless they maintain their ownership multiple. Stock options (whether vested or unvested) are not counted in the ownership calculation. |

| • | Director Equity Ownership and Holding Requirements. Directors are required to acquire over time, and thereafter hold (directly or indirectly), shares or stock units of our common stock with a value equal to at least 5x the Board’s basic annual retainer (currently, $650,000). Directors may not sell shares of the Company’s common stock until this ownership threshold is attained. |

GUIDELINES FOR CORPORATE GOVERNANCE

The Company and the Board of Directors formally express many of our governance policies through our Guidelines for Corporate Governance (our “Governance Guidelines”). The Governance Guidelines are posted on our website at marshmclennan.com/about/corporate-governance.html.

The Governance Guidelines summarize certain policies and practices designed to assist the Board in fulfilling its fiduciary obligations to the Company’s stockholders, including the following (parenthetical references are to the relevant section of the Governance Guidelines):

| • | The Board’s responsibility, alongside management, for setting the “tone at the top” and overseeing management’s strategy to promote a culture of integrity throughout the Company. (Section A) |

| • | Specific Board functions (Section B), such as: |

Corporate Focus

| • | reviewing, monitoring and, where appropriate, approving the Company’s strategic and operating plans, fundamental financial objectives and major corporate actions; |

| • | assessing major risks facing the Company and reviewing enterprise risk management (“ERM”) programs and processes; |

| • | overseeing the integrity of the Company’s financial statements and financial reporting processes; |

| • | reviewing processes to maintain the Company’s compliance with legal and ethical standards; and |

| • | reviewing and monitoring the effectiveness of the Company’s corporate governance practices. |

Management Focus

| • | selecting the CEO and planning for succession; |

| • | regularly evaluating the performance of, and determining the compensation paid to, the CEO; and |

| 2 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

CORPORATE GOVERNANCE (Continued)

|

| • | providing oversight and guidance regarding the selection, evaluation, development, succession and compensation of other senior executives. |

| • | Succession planning and management development. (Section C) |

| • | Director qualification standards and director independence. (Sections D.2 and D.3) |

| • | Limits on serving on more than four public company boards. (Section D.5) |

| • | Majority voting in director elections. (Section E.3) |

| • | Resignation and retirement requirements for independent directors. (Section E.5) |

| • | Separation of chairman and CEO roles. (Section F.2) |

| • | Executive sessions of independent directors at every in-person meeting of the Board. (Section H.3) |

| • | Annual Board review of the Company’s long-term strategic plan and the strategic plans of the Company’s businesses. (H.4) |

| • | Board access to management and professional advisors. (Section I) |

| • | Director stock ownership requirements. (Section K.2) |

| • | Prohibition on directors’ hedging and pledging Company securities. (Section K.3) |

| • | Annual Board and committee evaluations. (Section L) |

| • | Policy on interested stockholder transactions. (Section O) |

STOCKHOLDER ENGAGEMENT

We have a longstanding commitment to stockholder engagement. In each of the past five years, we have engaged with institutional stockholders holding approximately 36% to 45% of our outstanding common stock. In 2022, we held meaningful discussions with stockholders covering corporate governance matters, executive compensation and CEO succession, inclusion and diversity, and climate and other environmental topics such as our progress against our ESG goals. Feedback received during the stockholder engagement process is shared with senior executives, the Board and its committees and is considered in making decisions on the issues discussed. For example, we incorporated stockholder feedback in evaluating how we report our progress against our ESG goals and in considering Board committee rotation in light of factors including tenure and diversity. We are committed to ongoing engagement with our stockholders and intend to continue these outreach efforts.

RISK OVERSIGHT

It is the responsibility of the Company’s senior management to assess and manage our exposure to risk and to bring to the Board’s attention the most material risks facing the Company. Our annual enterprise risk management review process consists of a bottom-up review of risks facing Marsh McLennan, with business risk committees ultimately escalating risks to the Marsh McLennan Risk Committee and a top-down review of all risks facing the company through Board and Executive Committee risk assessments. The Board oversees risk management directly and through its committees, including with respect to significant existing and emerging risks.

Annually, the Board reviews management’s assessment of the Company’s key enterprise risks. Senior management then briefs the Board on its strategy with respect to each risk and provides a mid-year status update and a report at year-end. The Board receives updates from management on specific risks throughout the year, including on ESG, human capital management and cybersecurity.

The Audit Committee regularly reviews the Company’s policies and practices with respect to risk assessment and risk management, including cybersecurity risk. For example, in 2022, as part of Marsh McLennan’s commitment to ongoing cyber education, the Audit Committee was briefed on our new privacy and security awareness training for all colleagues that outlined expectations and best practices. The Directors and Governance Committee considers risks related to CEO succession planning, the Compensation Committee considers risks relating to the design of executive compensation programs and arrangements and the ESG Committee considers risks related to ESG and climate initiatives, including as the regulatory landscape for climate-related matters evolves. See the discussion under “Committees” on page 14 for additional information about the Board’s committees.

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 3 |

|

CORPORATE GOVERNANCE (Continued)

|

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) OVERSIGHT AND ACTIVITIES

The Board has formally focused on key aspects of the Company’s ESG initiatives since 2008, when it created a Board committee with oversight of these issues. In addition, the Company has a management committee with colleagues across our four global businesses and corporate departments to coordinate and communicate on the Company’s ESG initiatives. Our 2022 ESG Report, Pay Equity Statement, statement on Human Rights and related information are available on our website at marshmclennan.com/about/esg.html. The reports and our website are not deemed part of this proxy statement and are not incorporated by reference.

The Board oversees the Company’s ESG initiatives and strategies primarily through its committees.

ESG Committee. The ESG Committee oversees and supports the Company’s commitment to social, environmental and other public policy initiatives. It is comprised of members who have been selected based upon their tenure, skills and expertise. The ESG Committee receives reports at least annually on environmental matters from the Chair of the Company’s Management ESG Committee and on inclusion and diversity and social impact matters from the Company’s Chief People Officer. The ESG Committee coordinates with the Directors and Governance Committee and the Compensation Committee on matters of mutual interest relating to corporate governance and inclusion and diversity.

Compensation Committee. The Compensation Committee has responsibility to review certain key human resource strategic activities, including those relating to inclusion and diversity, training and recruitment. The Compensation Committee coordinates with the ESG Committee on inclusion and diversity initiatives and receives annual reports on inclusion and diversity from the Company’s Chief People Officer.

Directors and Governance Committee. The Directors and Governance Committee takes a leadership role in shaping the Company’s corporate governance principles and practices. It receives regular updates on governance practices and developments from the Company’s General Counsel.

Audit Committee. The Audit Committee has responsibility for the Company’s policies, systems and controls designed to promote ethical behavior and compliance with applicable legal and regulatory requirements. It receives regular updates from the Company’s Chief Compliance Officer, Head of Internal Audit and Global Controller.

Following each committee meeting, the respective committee chair reports on the meeting to the full Board. See the discussion under “Committees” on page 14 for additional information about the Board’s committees.

Management ESG Committee. An internal committee with members drawn from across the Company’s senior management helps coordinate the Company’s ESG initiatives. The committee is comprised of colleagues from our four global businesses and corporate departments. Members of the committee include the Company’s Deputy General Counsel & Corporate Secretary, the Global Controller, Head of Investor Relations and Chief Public Affairs Officer, as well as other colleagues who support the Company’s ESG initiatives.

CODES OF CONDUCT

Our reputation is fundamental to our business. The Company’s directors, senior executives and colleagues are expected to act ethically at all times. The Company’s codes of conduct and ethics are posted on the Company’s website at marshmclennan.com and copies are available to any stockholder upon request.

The Greater Good

Our Code of Conduct, The Greater Good, is the cornerstone of our culture of integrity. Available in 13 languages, it underpins our values, ethical commitments and standards of business integrity and professionalism. It provides guidance on many topics including anti-corruption, data handling, conflicts of interest, trade sanctions, anti-money laundering and environmental and social responsibility and is aligned around three key pillars: (1) Win With Integrity, (2) You Are Never Alone, and (3) Speak Up.

| 4 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

CORPORATE GOVERNANCE (Continued)

|

The Greater Good applies to all of our directors, officers and other colleagues and requires the Company’s agents, subcontractors and suppliers to comply with relevant aspects of our compliance policies. Each year, the Company’s directors and senior executives certify their commitment to The Greater Good.

The Greater Good supports colleagues in making decisions in situations where it may not be clear—or easy. Our colleagues are provided with comprehensive training and communication of The Greater Good, including through our digital hub at integrity.mmc.com. Colleagues can ask questions of our compliance chatbot, consult FAQs and review our video series, Choose Your Path, all in one convenient and easy to remember website. We have also deployed a one-click desktop shortcut on every company computer and mobile device to allow colleagues to seamlessly engage with our Code of Conduct.

Code of Ethics for the CEO and Senior Financial Officers

The Company has also adopted an additional Code of Ethics for the Chief Executive Officer and Senior Financial Officers, which applies to our chief executive officer, chief financial officer and controller. We will disclose any amendments to, or waivers of, the Code of Ethics for the Chief Executive Officer and Senior Financial Officers on our website at marshmclennan.com within four business days.

CEO SUCCESSION PLANNING AND SUCCESSION PLANNING FOR SENIOR EXECUTIVES

The Board believes that planning for CEO succession is one of its most important responsibilities. The recent appointment as of January 1, 2023 of John Q. Doyle as President and Chief Executive Officer, succeeding Dan Glaser upon his retirement, reflects the execution of a thoughtful, well-coordinated CEO succession plan overseen by the Board with support from the Directors & Governance and Compensation Committees.

CEO succession planning is regularly discussed at Board meetings and in executive sessions. In addition, every year our CEO and Chief People Officer review with the Board potential internal candidates, including their qualifications, experience and development. At least annually, independent directors meet with the CEO to discuss potential successor candidates and their qualifications, experience and preparedness. The Board, taking into account the recommendations of the Directors and Governance Committee, approves and maintains a succession plan for the CEO. A confidential procedure is also maintained for the transfer of the CEO’s responsibilities in the event of an emergency or his sudden incapacitation or departure. In addition, our Governance Guidelines provide that, to the extent that a search firm is retained to identify external candidates for CEO, the Board will instruct the search firm to reflect gender, race and ethnic diversity in the initial pool of candidates.

The Board also believes that planning for succession below the CEO level is a key responsibility. The CEO periodically reviews with the independent directors the performance of senior executives and their qualifications, experience and development. The Compensation Committee has responsibility for reviewing the Company’s executive talent review process for senior executives. Every year, our Chief People Officer and CEO review with the Compensation Committee succession plans for direct reports to the CEO and other key executive positions.

Directors engage with senior executives and others at Board, committee and preparatory meetings as well as at an annual joint meeting of the Board and the Marsh McLennan Executive Committee. Directors also engage with senior executives and others in less formal settings to allow directors to personally assess potential candidates for CEO and senior executive roles.

DIRECTOR RECRUITMENT, NOMINATION AND SUCCESSION PLANNING

The Board, taking into account the recommendation of the Directors and Governance Committee, is responsible for nominating a slate of director candidates for election at the Company’s annual meeting of stockholders.

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 5 |

|

CORPORATE GOVERNANCE (Continued)

|

Director Recruitment

The Board has delegated to the Directors and Governance Committee the authority to identify, consider and recommend to the Board potential new director candidates. An overview of the Board’s director recruitment process is provided below.

| OVERVIEW OF DIRECTOR RECRUITMENT PROCESS

|

||||

| Evaluate Board Composition | • The Directors and Governance Committee reviews Board composition at least annually

• The Committee reviews with the Board periodically the skills and characteristics to be sought in director candidates

|

|||

|

Identify Diverse Pool of Candidates |

• The Directors and Governance Committee and the Board seek to reflect gender, racial and ethnic diversity in the pool of director candidates

• Candidates may be recommended by search firms engaged by the Committee, other directors and stockholders

• Our Governance Guidelines provide that, to the extent that a search firm is retained to identify external director candidates, the Board will instruct the search firm to reflect gender, race, ethnic and cultural diversity in the initial pool of candidates

|

|||

|

Assess Potential Candidates |

• Potential candidates are evaluated against the “Director Qualifications” on page 10 and the skills and experiences shown in the “Director Skills and Experience” matrix on pages 11 and 12, as well as for independence and potential conflicts • Members of the Directors and Governance Committee and other directors meet with potential candidates

|

|||

|

Recommend Candidates for Approval |

• The Directors and Governance Committee recommends candidates to the Board for approval

• Stockholders vote on director nominees at the annual meeting of stockholders

|

|||

Director Nomination Planning

As part of the process for nominating director candidates, the Board evaluates each individual director in the context of the Board as a whole, with the objective of recommending a group that can best support the success of our business and represent stockholder interests. In deciding whether to nominate an incumbent director for re-election, the Board considers many factors, including the criteria described under “Director Qualifications” on page 10 such as gender, racial and ethnic diversity, as well as his or her length of service and performance on the Board.

Director Succession Planning

The Board is committed to effective succession planning. The Directors and Governance Committee has responsibility to review the composition and structure of the Board as a whole, taking into account such factors as the Board’s current mix and diversity of skills, backgrounds and experiences, and to make recommendations to the Board as appropriate. In its review of Board composition, the Directors and Governance Committee considers succession planning in light of factors such as skills needed and upcoming retirements and other potential departures.

Changes in Directors Since the Last Annual Meeting of Stockholders

Mr. Doyle joined the Board in January 2023 in connection with his appointment as Marsh McLennan’s President and Chief Executive Officer. He is the only member of management on the Board.

| 6 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

CORPORATE GOVERNANCE (Continued)

|

Ms. Hartmann and Mr. Young joined the Board in March 2023. They were identified and recommended to the Directors and Governance Committee by a search firm retained by the Committee. In addition to identifying and providing information on a number of potential director candidates during the process, the search firm reviewed and provided information about Ms. Hartmann and Mr. Young for review by the Committee and the Board.

Additionally, in accordance with the mandatory retirement provisions in our Governance Guidelines, the Board has determined that R. David Yost will not stand for re-election at the May 2023 annual meeting.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

New directors participate in an orientation program throughout their first year on the Board to familiarize them with the Company’s business, strategy, finances, policies, corporate governance practices and culture. The orientation program includes one-on-one meetings with the Company’s senior executives and comprehensive background materials including our code of conduct, The Greater Good. Orientation sessions with key advisors are provided for incoming Audit and Compensation Committee members. Orientation sessions are also tailored upon request to meet directors’ needs and interests.

Directors are also encouraged to participate in continuing education programs. Continuing education programs may be part of regular Board or committee meetings or third-party presentations. Additionally, directors are provided access to third-party resources that provide updates on issues and programs relevant to public companies and their directors.

DIRECTOR INDEPENDENCE

The Board has determined that all directors other than Mr. Doyle are independent under the New York Stock Exchange (“NYSE”) listed company rules and the standards set forth in the Governance Guidelines. Therefore, the Board has satisfied the objective, set forth in the Governance Guidelines, that a substantial majority of the Company’s directors be independent of management.

For a director to be considered independent, the Board must affirmatively determine that the director has no direct or indirect material relationship with the Company. The Board has established standards to assist it in making determinations of director independence. These standards conform to, or are more exacting than, the independence requirements provided in the NYSE listed company rules. The Company’s director independence standards are set forth as Annex A to our Governance Guidelines.

All members of the Audit, Compensation and Directors and Governance Committees must be independent directors under the NYSE listed company rules and the standards set forth in the Company’s Governance Guidelines. Members of the Audit Committee must also satisfy a separate Securities and Exchange Commission (“SEC”) and NYSE independence requirement, which provides that they may not be affiliates and may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, other than compensation received in their capacity as members of the Board or any committee of the Board. The Board evaluated each member of the Audit Committee and determined that they meet the separate SEC and NYSE independence requirement. The Board also evaluated each member of the Compensation Committee under the additional NYSE compensation committee member independence standards and determined that these members qualify as “non-employee directors” (as defined under Rule 16b-3 under the Securities Exchange Act of 1934).

Under our Governance Guidelines, if a director whom the Board has deemed independent has a change in circumstances or relationships that might cause the Board to reconsider that determination, he or she must immediately notify the Independent Chair and the chair of the Directors and Governance Committee.

REVIEW OF RELATED PERSON TRANSACTIONS

The Company maintains a written Policy Regarding Related Person Transactions, which sets forth standards and procedures for the review and approval or ratification of transactions between the Company and related persons. The policy is administered by the Directors and Governance Committee with assistance from the Company’s Corporate Secretary.

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 7 |

|

CORPORATE GOVERNANCE (Continued)

|

In determining whether to approve or ratify a related person transaction, the Directors and Governance Committee will review the facts and circumstances including: the commercial reasonableness of the transaction; the benefits of the transaction to the Company; the availability of other sources for the products or services involved in the transaction; the materiality and nature of the related person’s direct or indirect interest in the transaction; the potential public perception of the transaction and the potential impact of the transaction on the independence of any of the Company’s directors. The Directors and Governance Committee will approve or ratify a related person transaction only if the Committee determines that the related person transaction is in, or is not inconsistent with, the best interests of the Company and its stockholders.

If the Directors and Governance Committee determines not to approve or ratify a related person transaction, the transaction will not be entered into or continued. No member of the Directors and Governance Committee will participate in any review or determination if the Committee member or any of his or her immediate family members is the related person.

See the discussion under “Transactions with Management and Others” on page 84.

STOCKHOLDER RECOMMENDATIONS AND NOMINATIONS FOR DIRECTOR CANDIDATES

Stockholders may recommend or nominate director candidates in writing to the Company’s Corporate Secretary. All stockholder recommendations for director candidates are considered, and they are evaluated in the same manner as other director candidates. Stockholder nominations for director elections must meet the requirements described in Article III of our bylaws. The notice of nomination also must meet bylaw requirements, including as the procedures and information required. Recommendations and notices of nomination should be delivered to the Company’s Corporate Secretary at our principal executive offices: Marsh McLennan, Attn: Directors and Governance Committee, c/o Corporate Secretary, 1166 Avenue of the Americas, New York, New York 10036-2774. See the discussion under “Submission of Stockholder Proposals and Other Items of Business for 2024 Annual Meeting” on page 88.

DIRECTOR ELECTION VOTING STANDARD

The Company’s bylaws provide that, in an uncontested election of directors, such as this one, where the number of nominees does not exceed the number of directors to be elected, a director nominee must receive more votes cast “for” than “against” his or her election in order to be elected to the Board.

In connection with the Company’s majority voting standard for director elections, the Board has adopted the following procedures, which are set forth more fully in Section E.3 of our Governance Guidelines:

| • | The Board shall nominate for election only director candidates who agree to tender to the Board an irrevocable resignation that will be effective upon (i) a director’s failure to receive the required number of votes for re-election at the next meeting of stockholders at which he or she faces re-election and (ii) the Board’s acceptance of such resignation. |

| • | Following a meeting of stockholders at which an incumbent director who was a nominee for re-election does not receive the required number of votes for election, the Directors and Governance Committee shall make a recommendation to the Board as to whether to accept or reject such director’s resignation. Within 90 days following the certification of the election results, the Board shall decide whether to accept or reject the director’s resignation and shall publicly disclose that decision and its rationale. |

| • | If the Board accepts a director’s resignation, the Directors and Governance Committee will recommend to the Board whether to fill the resultant vacant Board seat or reduce the size of the Board. |

COMMUNICATING WITH DIRECTORS

Holders of the Company’s common stock and other interested parties may send communications to the Board of Directors, the Independent Chair, any of the directors or the independent directors as a group by mail (addressed to Corporate Secretary, at the address shown below), online at ethicscomplianceline.com or by telephone (local dialing instructions can be found at ethicscomplianceline.com). Items unrelated to the directors’ duties and responsibilities as Board members may be excluded by the Corporate Secretary, including solicitations and advertisements, product-related communications, surveys and job referral materials such as resumes.

| 8 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

CORPORATE GOVERNANCE (Continued)

|

COMMUNICATING CONCERNS REGARDING ACCOUNTING MATTERS

The Audit Committee of the Board of Directors has established procedures to enable anyone who has a concern about the Company’s accounting, internal accounting controls or auditing practices to communicate that concern directly to the Audit Committee. These communications, which may be made on a confidential or anonymous basis, may be submitted in writing, by telephone or online as follows:

By mail to:

Marsh McLennan

Audit Committee of the Board of Directors

c/o Corporate Secretary

1166 Avenue of the Americas, Legal Department

New York, New York 10036-2774

By telephone or online:

Go to this website for dialing instructions or to raise a concern online:

ethicscomplianceline.com

Further details of the Company’s procedures for handling complaints and concerns of colleagues and other interested parties regarding accounting matters are posted on our website at marshmclennan.com/about/corporate-governance.html.

Company policy prohibits retaliation against anyone who raises a concern in good faith.

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 9 |

|

BOARD OF DIRECTORS AND COMMITTEES

|

BOARD COMPOSITION, LEADERSHIP AND SIZE

At the 2023 annual meeting, stockholders will vote on the election of fourteen (14) directors. H. Edward Hanway currently serves as the Board’s Independent Chair. In accordance with the mandatory retirement provisions in our Governance Guidelines, the Board has determined that R. David Yost will not stand for re-election at the May 2023 annual meeting.

The only member of management who serves on the Board is John Q. Doyle, the Company’s President and Chief Executive Officer. The position of chairman of the Board has been held by an independent director since 2005. The Board believes that this currently is the best leadership structure for the Company. The Independent Chair provides leadership to the Board and has responsibilities including those outlined in our Guidelines for Corporate Governance. The Board generally believes that the Chair should be an independent director, unless the Board concludes that the interests of the Company and its stockholders would be better served by combining the roles of Chair and CEO.

|

KEY DIRECTOR STATISTICS

*Key director statistics are as of May 18, 2023

|

DIRECTOR QUALIFICATIONS

As provided in our Governance Guidelines, all directors must demonstrate the highest standards of ethics and integrity, must be independent thinkers with strong analytical ability and must be committed to representing all of the Company’s stockholders rather than any particular interest group. In addition to these characteristics, our Governance Guidelines provide that each director candidate be evaluated by the Board against the following criteria: (1) the candidate’s personal and professional reputation and background; (2) the candidate’s knowledge and experience with the Company’s businesses and industries; (3) the candidate’s experience with businesses or other organizations comparable to the Company in terms of size or complexity; (4) the interplay of the candidate’s skills and experience with those of the incumbent directors; (5) the extent to which the candidate would provide substantive expertise that is currently sought by the Board or any committees of the Board; (6) the candidate’s ability to commit the time necessary to fulfill a director’s responsibilities; (7) relevant legal and regulatory requirements and evolving best practices in corporate governance; (8) the gender, racial and ethnic diversity of each potential candidate and (9) any other criteria the Board deems appropriate.

| 10 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

DIRECTOR SKILLS AND EXPERIENCE

As a global professional services firm offering clients advice and solutions in risk, strategy and people, the eight areas of expertise described in the chart below support our business and strategy. While each director possesses other relevant skills and experience, the chart below identifies the five principal skills that the Directors and Governance Committee considered for each director when evaluating that director’s experience and qualifications to serve as a director. Additional information about each director’s background, business experience and other matters, as well as a description of how each individual’s experience qualifies him or her to serve as a director of the Company is provided under the heading “Item 1—Election of Directors” beginning on page 19.

|

|

SKILLS AND EXPERIENCE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

|

|

Leadership: Business and strategic management experience from service in a significant leadership position, such as a chief executive officer, chief financial officer or other senior leadership role. |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● | |||||||||||||||

|

|

Financial: Background and experience in finance, accounting, banking, capital markets, financial reporting or economics, including from experience overseeing the preparation of audited financial statements. |

● |

● |

● |

● |

● |

● |

● |

|

|

● |

● |

● |

● |

● | |||||||||||||||

|

|

Industry: Experience in the Company’s businesses and industries, including insurance, insurance and reinsurance brokerage, consulting, investment management and healthcare. |

● |

● |

● |

|

● |

|

|

|

|

● |

|

|

|

| |||||||||||||||

|

|

International: International background or experience with multinational or global firms, including in growth markets. |

|

● |

|

● |

● |

● |

|

● |

● |

● |

|

● |

|

● | |||||||||||||||

|

|

Technology and Cybersecurity: Experience in technology, innovation, data analytics or cybersecurity risks and solutions, particularly as a senior executive. |

|

|

● |

|

|

|

● |

● |

● |

● |

|

|

|

| |||||||||||||||

|

|

Corporate Governance & ESG: Experience with corporate governance for large companies or institutions or ESG matters, including climate risks, sustainability initiatives and inclusion and diversity efforts. |

● |

|

|

● |

|

● |

● |

● |

|

|

● |

● |

● |

● | |||||||||||||||

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 11 |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

|

|

SKILLS AND EXPERIENCE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

|

|

Government Relations & Regulatory: Experience with government relations, political affairs, regulatory matters or regulated industries, particularly insurance, insurance and reinsurance brokerage and investment management. |

|

|

|

● |

● |

|

|

● |

● |

|

● |

|

● |

| |||||||||||||||

|

|

Risk Management: Experience in risk management, risk mitigation, stress testing, or strategic planning. |

● |

● |

● |

|

|

● |

● |

|

● |

|

● |

● |

● |

● | |||||||||||||||

|

|

Diversity: Gender, racial or ethnic diversity. |

● |

|

● |

● |

|

● |

● |

● |

● |

|

|

|

● |

● | |||||||||||||||

BOARD DIVERSITY

We are committed to maintaining a diverse and inclusive Board. We appointed our eighth consecutive director who meets our diversity criteria in 2023. In the past five years, we have appointed five independent directors, all of whom meet our diversity criteria.

Of the 14 directors standing for election, four are men who are racially or ethnically diverse and five are women. As of our 2023 annual meeting, we expect 36% of the Board to be women.

Our Governance Guidelines specify that the gender, racial and ethnic diversity of each potential director candidate be considered by the Board. In its recruitment process, the Directors and Governance Committee and the Board seek to reflect gender, race and ethnic diversity in the pool of director candidates. Further, our Governance Guidelines provide that, to the extent that a search firm is retained to identify external candidates for Board membership, the Board will instruct the search firm to reflect gender, race and ethnic diversity in the initial pool of candidates. The Directors and Governance Committee and the Board also consider gender, race and ethnic diversity in the director nomination process.

BOARD REFRESHMENT

The Board is committed to effective succession planning and refreshment. Seven independent directors have joined since 2016, enhancing the Board’s breadth and depth of experience and diversity. The average tenure of our directors is eight years. In deciding whether to nominate an incumbent director for re-election, the Board considers many factors, including tenure and an assessment of independence. The Board believes that term limits may arbitrarily deprive the Board of the contributions of directors who have valuable insight, developed over time, into the Company and its industries. The Board believes that a mix of director tenures provides fresh viewpoints, institutional knowledge and historical perspective.

RETIREMENT

Our Governance Guidelines require our independent directors not to stand for re-nomination at the annual meeting of stockholders following their 75th birthday. Any director who is an employee of the Company will resign from the Board when his or her employment ends.

| 12 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

ATTENDANCE

The Board held seven meetings during 2022. The average attendance by directors at meetings of the Board and its committees held during 2022 was approximately 97%. All directors attended at least 75% of the meetings of the Board and committees on which they served. The Board’s policy is to have all directors attend the annual meetings of stockholders. All directors attended the 2022 annual meeting of stockholders.

EXECUTIVE SESSIONS

Our independent directors meet in executive session without management at regularly scheduled multi-day Board meetings. In 2022 they held six executive sessions, which were presided over by the Independent Chair. In addition, the members of the Audit, Compensation and Directors and Governance Committees meet in executive session without management at regularly scheduled committee meetings.

BOARD AND COMMITTEE EVALUATIONS

Our Governance Guidelines provide that the Directors and Governance Committee oversees an annual evaluation of the Board’s performance and effectiveness. In addition, the charters for the Audit, Compensation, Directors and Governance, Finance and ESG Committees provide that each committee evaluates its own performance annually.

Board Evaluations

The annual evaluation of the Board focuses on its contribution to the Company over the preceding year, including areas in which the Board or management believes the Board could enhance its future contributions. More generally, directors are encouraged to make suggestions at any time for improving the Board’s practices.

An overview of the Board self-evaluation process is provided below.

|

OVERVIEW OF BOARD SELF-EVALUATION PROCESS

|

||||

| Determine Form and Content of Self-Evaluation |

• The Directors and Governance Committee determines the form and content of the evaluation each year, taking into account director and stockholder feedback and best practices.

• The Directors and Governance Committee has considered engaging a third party for the evaluation.

• The Committee determined to conduct individual director interviews as part of the self-evaluation process for 2022.

|

|||

|

Individual Director Interviews |

• Individual interviews with each independent director were conducted by the Independent Chair and the Chair of the Directors & Governance Committee. Topics included director skills, board practices and committee rotation.

|

|||

|

Discuss in Executive Session |

• The self-evaluation takes place in executive session using a compilation of unattributed responses, which is provided to directors in advance of the meeting.

|

|||

|

Respond to Feedback |

• Based on director feedback, changes are considered and, as appropriate, implemented.

|

|||

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 13 |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

For the evaluation of 2022, the Directors and Governance Committee considered the form of the evaluation and determined to use a questionnaire soliciting qualitative commentary and quantitative ratings from each director and to conduct individual director interviews as part of the self-evaluation process.

The questionnaire begins with open-ended discussion questions and also solicits the directors’ views on topics such as:

|

• the Board’s key priorities

• the Board’s knowledge base

• fulfillment of the Board’s and committees’ responsibilities

|

• the Board’s interaction with management

• the Board’s structure, composition

• Board meetings and related processes | |

Recent changes to the questionnaire include adding discussion questions about the Company’s investment in ESG and how we balance the interests of our clients, colleagues and communities. Changes made in response to director feedback from the Board evaluation have included enhancements to director continuing education programming and rotating certain committee assignments.

Committee Evaluations

The Audit, Compensation, Directors and Governance, Finance and ESG Committees evaluate their own performance annually pursuant to their respective charters. Material is provided in advance to assist the committee with assessing its performance of its responsibilities under its charter and our Governance Guidelines. These materials include questions for discussion, summaries of the committee’s activities and responsibilities and feedback from the Board self-evaluation regarding the committee. Committee self-evaluations are conducted in executive session.

COMMITTEES

Our Board maintains an Audit Committee, a Compensation Committee, a Directors and Governance Committee, a Finance Committee, an ESG Committee and an Executive Committee to assist the Board in discharging its responsibilities. Following each committee meeting, the respective committee chair reports the highlights of the meeting to the full Board.

Membership on each of the Audit, Compensation and Directors and Governance Committees is limited to independent directors as required by the Company, the listing standards of the NYSE and the SEC’s independence rules. The ESG and Finance Committees must consist of a majority of independent directors as required by the Company. Each of these committees is governed by a charter, which is available on our website at marshmclennan.com/about/corporate-governance.html.

| 14 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

The table below shows current committee assignments and the number of times each committee met in 2022:

| Director | Audit | Compensation | Directors and Governance |

Finance | ESG | Executive | ||||||

| Anthony K. Anderson |

X |

|

|

|

X |

| ||||||

| John Q. Doyle |

|

|

|

X |

|

X | ||||||

| Hafize Gaye Erkan |

X |

|

X |

|

|

| ||||||

| Oscar Fanjul |

|

X |

|

X |

|

| ||||||

| H. Edward Hanway |

|

X | X | X |

|

X(chair) | ||||||

| Judith Hartmann |

X |

|

|

|

|

| ||||||

| Deborah C. Hopkins |

|

|

X | X(chair) |

|

X | ||||||

| Tamara Ingram |

X |

|

|

|

X |

| ||||||

| Jane H. Lute |

X |

|

|

|

X |

| ||||||

| Steven A. Mills |

|

X(chair) | X |

|

|

X | ||||||

| Bruce P. Nolop |

X(chair) |

|

|

X |

|

X | ||||||

| Morton O. Schapiro |

|

X | X(chair) |

|

|

X | ||||||

| Lloyd M. Yates |

|

|

|

X | X(chair) |

| ||||||

| R. David Yost (1) |

|

X | X | X |

|

| ||||||

| Ray G. Young |

X |

|

|

|

|

| ||||||

| 2022 Meetings |

10 | 6 | 5 | 5 | 5 | 0 | ||||||

| (1) | In accordance with the mandatory retirement provisions in our Governance Guidelines, the Board has determined that Mr. Yost will not stand for re-election at the May 2023 annual meeting. |

Audit Committee

The Audit Committee is charged, among other things, with assisting the Board in fulfilling its oversight responsibilities with respect to:

| • | the integrity of the Company’s financial statements; |

| • | the qualifications, independence and performance of our independent registered public accounting firm; |

| • | the performance of the Company’s internal audit function; |

| • | the Company’s policies and implementation of systems and controls designed to promote ethical behavior; |

| • | compliance by the Company with legal and regulatory requirements; and |

| • | the Company’s enterprise risk management programs and processes, including cyber risk. |

The Audit Committee selects, oversees and approves, pursuant to a pre-approval policy, all services to be performed by our independent registered public accounting firm. The Company’s independent registered public accounting firm reports to the Audit Committee.

All members of the Audit Committee are “financially literate,” as required by the NYSE and determined by the Board. The Board has determined that Anthony K. Anderson, Judith Hartmann, Bruce P. Nolop and Ray G. Young have the requisite qualifications to satisfy the SEC definition of “audit committee financial expert.” Additionally, Jane H. Lute serves on the Audit Committee and is a cybersecurity expert.

Compensation Committee

The primary responsibilities of the Compensation Committee are to:

| • | evaluate the performance and determine the compensation of our chief executive officer; |

| • | review and approve the compensation of our other senior executives; |

| Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement | 15 |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

| • | review certain key human resource strategic activities, including those relating to talent management, succession planning, inclusion and diversity, training and recruitment; and |

| • | oversee and discharge its responsibilities for the Company’s incentive compensation plans for our senior executives and equity-based award plans. |

Meeting Schedule. The Compensation Committee met six times in 2022, including a special meeting in February to complete its annual review of, and make decisions on, executive compensation. Decisions relating to significant matters are usually presented to the Compensation Committee and discussed at more than one meeting to allow for full consideration of the implications and possible alternatives before a final decision is made. The Compensation Committee receives support from its independent compensation consultant and the Company’s management, including the Company’s human resources staff, as described below. At each of its meetings, the Compensation Committee meets in executive session and without management present. The independent compensation consultant attends portions of the executive sessions.

The Compensation Committee may delegate all or a portion of its duties and responsibilities to the chair of the Compensation Committee or a subcommittee of the Compensation Committee. If necessary, the chair is authorized to take action on behalf of the Compensation Committee between its regularly scheduled meetings, within prescribed guidelines. If any such action is taken, the chair reports such action to the Compensation Committee at its next regularly scheduled meeting.

The Compensation Committee reports its discussions on a regular basis and, where appropriate, reviews its actions, including executive compensation determinations, with the full Board.

Independent Compensation Consultant. The Compensation Committee has engaged Pay Governance LLC as its independent compensation consultant to support the Compensation Committee in performing its duties and to provide analysis and make recommendations to the Compensation Committee regarding our executive compensation program. The independent compensation consultant reports directly to the Compensation Committee and provides advice and analysis solely to the Compensation Committee. The independent compensation consultant supports the Compensation Committee by:

| • | participating in meetings and executive sessions of the Compensation Committee to advise the Compensation Committee on specific matters that arise; |

| • | offering objective advice regarding the compensation and policy recommendations presented to the Compensation Committee by the Company’s management, including senior members of the Company’s human resources colleagues; and |

| • | providing data regarding the compensation practices of comparable companies. |

The Compensation Committee requested and received advice from the independent compensation consultant with respect to all significant matters addressed by the Compensation Committee during 2022. Except for the services provided to the Board, neither the individual compensation consultant nor Pay Governance LLC nor any of its affiliates provided any services to the Company or its affiliates in 2022.

The Compensation Committee assessed the work of Pay Governance LLC during 2022 pursuant to SEC rules and the listing standards of the NYSE and concluded that Pay Governance’s work did not raise any conflict of interest.

Company Management. The Company’s management, including the Company’s human resources colleagues, supports the Compensation Committee by:

| • | developing meeting agendas in consultation with the chair of the Compensation Committee and preparing background materials for Compensation Committee meetings; |

| • | making recommendations to the Compensation Committee on the Company’s compensation philosophy, governance initiatives and short-term and long-term incentive (“LTI”) compensation design, and by providing input regarding the individual performance component of annual bonus awards; and |

| • | responding to actions and initiatives proposed by the Compensation Committee. |

| 16 | Marsh & McLennan Companies, Inc. Notice of Annual Meeting and 2023 Proxy Statement |

|

BOARD OF DIRECTORS AND COMMITTEES (Continued)

|

In addition, our President and Chief Executive Officer provides recommendations with respect to the compensation of our other senior executives.

Our President and Chief Executive Officer, senior members of the Company’s human resources staff and internal legal counsel attended Compensation Committee meetings when invited but were not present for executive sessions or for any discussion of their own compensation.