Document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 10-Q

_____________________________________________

Quarterly Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2019

_____________________________________________

Marsh & McLennan Companies, Inc.

1166 Avenue of the Americas

New York, New York 10036

(212) 345-5000

_____________________________________________

Commission file number 1-5998

State of Incorporation: Delaware

I.R.S. Employer Identification No. 36-2668272

_____________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | |

Large Accelerated Filer x | | Accelerated Filer ¨ |

| |

Non-Accelerated Filer ¨(Do not check if a smaller reporting company) | | Smaller Reporting Company ¨ |

| | |

| | Emerging Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of April 24, 2019, there were outstanding 507,238,809 shares of common stock, par value $1.00 per share, of the registrant.

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains "forward-looking statements," as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management's current views concerning future events or results, use words like "anticipate," "assume," "believe," "continue," "estimate," "expect," "forecast," "intend," "plan," "project" and similar terms, and future or conditional tense verbs like "could," "may," "might," "should," "will" and "would."

Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements. Factors that could materially affect our future results include, among other things:

| |

• | our ability to successfully integrate or achieve the intended benefits of the acquisition of JLT; |

| |

• | the impact of any investigations, reviews, or other activity by regulatory or law enforcement authorities, including the ongoing investigations by the European Commission competition authority; |

| |

• | the impact from lawsuits, other contingent liabilities and loss contingencies arising from errors and omissions, breach of fiduciary duty or other claims against us; |

| |

• | our organization's ability to maintain adequate safeguards to protect the security of our information systems and confidential, personal or proprietary information, particularly given the large volume of our vendor network and the need to patch software vulnerabilities; |

| |

• | our ability to compete effectively and adapt to changes in the competitive environment, including to respond to disintermediation, digital disruption and other types of innovation; |

| |

• | the financial and operational impact of complying with laws and regulations where we operate, including cybersecurity and data privacy regulations such as the E.U.’s General Data Protection Regulation, anti-corruption laws and trade sanctions regimes; |

| |

• | the impact of macroeconomic, political, regulatory or market conditions on us, our clients and the industries in which we operate, including the impact and uncertainty around Brexit or the inability to collect on our receivables; |

| |

• | the regulatory, contractual and reputational risks that arise based on insurance placement activities and various broker revenue streams; |

| |

• | our ability to manage risks associated with our investment management and related services business, including potential conflicts of interest between investment consulting and fiduciary management services; |

| |

• | our ability to successfully recover if we experience a business continuity problem due to cyberattack, natural disaster or otherwise; |

| |

• | the impact of changes in tax laws, guidance and interpretations, including certain provisions of the U.S. Tax Cuts and Jobs Act, or disagreements with tax authorities; |

| |

• | our ability to repay our outstanding long-term debt in a timely manner and on favorable terms, including approximately $6.5 billion issued in connection with the acquisition of JLT; |

| |

• | the impact of fluctuations in foreign exchange and interest rates on our results; and |

| |

• | the impact of changes in accounting rules or in our accounting estimates or assumptions, including the impact the new lease accounting standard. |

The factors identified above are not exhaustive. We caution readers not to place undue reliance on any forward-looking statements, which are based only on information currently available to us and speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made.

Further information concerning Marsh & McLennan Companies and its businesses, including information about factors that could materially affect our results of operations and financial condition, is contained in the Company's filings with the Securities and Exchange Commission, including the "Risk Factors" section and in the "Management’s Discussion and Analysis of Financial Condition and Results of Operations" section of our most recently filed Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | |

| |

| | |

ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 2. | | |

| OF OPERATIONS | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| |

| |

| | |

ITEM 1. | | |

| | |

ITEM 1A. | | |

| | |

ITEM 2. | | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| | |

ITEM 5. | | |

| | |

ITEM 6. | | |

PART I. FINANCIAL INFORMATION

| |

Item 1. | Financial Statements. |

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31, |

(In millions, except per share amounts) | 2019 |

| | 2018 |

|

Revenue | $ | 4,071 |

| | $ | 4,000 |

|

Expense: | | | |

Compensation and benefits | 2,282 |

| | 2,224 |

|

Other operating expenses | 851 |

| | 868 |

|

Operating expenses | 3,133 |

| | 3,092 |

|

Operating income | 938 |

| | 908 |

|

Other net benefit credits | 64 |

| | 66 |

|

Interest income | 28 |

| | 3 |

|

Interest expense | (120 | ) | | (61 | ) |

Investment income | 5 |

| | — |

|

Change in fair value of acquisition related derivative contracts | 29 |

| | — |

|

Income before income taxes | 944 |

| | 916 |

|

Income tax expense | 217 |

| | 220 |

|

Net income before non-controlling interests | 727 |

| | 696 |

|

Less: Net income attributable to non-controlling interests | 11 |

| | 6 |

|

Net income attributable to the Company | $ | 716 |

| | $ | 690 |

|

Net income Per Share Attributable to the Company: | | | |

Basic | $ | 1.42 |

| | $ | 1.36 |

|

Diluted | $ | 1.40 |

| | $ | 1.34 |

|

Average number of shares outstanding: | | | |

Basic | 505 |

| | 508 |

|

Diluted | 511 |

| | 514 |

|

Shares outstanding at March 31, | 507 |

| | 508 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31, |

(In millions) | 2019 |

| | 2018 |

|

Net income before non-controlling interests | $ | 727 |

| | $ | 696 |

|

Other comprehensive income (loss), before tax: | | | |

Foreign currency translation adjustments | 96 |

| | 228 |

|

(Loss) related to pension/post-retirement plans | (43 | ) | | (84 | ) |

Other comprehensive income, before tax | 53 |

| | 144 |

|

Income tax (benefit) on other comprehensive income | (4 | ) | | (8 | ) |

Other comprehensive income, net of tax | 57 |

| | 152 |

|

Comprehensive income | 784 |

| | 848 |

|

Less: comprehensive income attributable to non-controlling interest | 11 |

| | 6 |

|

Comprehensive income attributable to the Company | $ | 773 |

| | $ | 842 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | |

(In millions, except share amounts) | (Unaudited)

March 31,

2019 | | December 31,

2018 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 1,117 |

| | $ | 1,066 |

|

Receivables | | | |

Commissions and fees | 4,315 |

| | 3,984 |

|

Advanced premiums and claims | 59 |

| | 79 |

|

Other | 372 |

| | 366 |

|

| 4,746 |

| | 4,429 |

|

Less-allowance for doubtful accounts and cancellations | (116 | ) | | (112 | ) |

Net receivables | 4,630 |

| | 4,317 |

|

Funds held in escrow for acquisition | 6,359 |

| | — |

|

Other current assets | 569 |

| | 551 |

|

Total current assets | 12,675 |

| | 5,934 |

|

Goodwill | 9,739 |

| | 9,599 |

|

Other intangible assets | 1,464 |

| | 1,437 |

|

Fixed assets

(net of accumulated depreciation and amortization of $1,889 at March 31, 2019 and $1,842 at December 31, 2018) | 716 |

| | 701 |

|

Pension related assets | 1,815 |

| | 1,688 |

|

Right of use assets | 1,625 |

| | — |

|

Deferred tax assets | 680 |

| | 680 |

|

Other assets | 1,423 |

| | 1,539 |

|

| $ | 30,137 |

| | $ | 21,578 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Continued)

|

| | | | | | | |

(In millions, except share amounts) | (Unaudited)

March 31,

2019 | | December 31,

2018 |

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

Short-term debt | $ | 1,562 |

| | $ | 314 |

|

Accounts payable and accrued liabilities | 2,244 |

| | 2,234 |

|

Accrued compensation and employee benefits | 892 |

| | 1,778 |

|

Acquisition related derivatives | 283 |

| | 441 |

|

Current lease liabilities | 291 |

| | — |

|

Accrued income taxes | 256 |

| | 157 |

|

Dividends payable | 211 |

| | — |

|

Total current liabilities | 5,739 |

| | 4,924 |

|

Fiduciary liabilities | 5,243 |

| | 5,001 |

|

Less – cash and investments held in a fiduciary capacity | (5,243 | ) | | (5,001 | ) |

| — |

| | — |

|

Long-term debt | 11,472 |

| | 5,510 |

|

Pension, post-retirement and post-employment benefits | 1,874 |

| | 1,911 |

|

Long-term lease liabilities | 1,590 |

| | — |

|

Liabilities for errors and omissions | 282 |

| | 287 |

|

Other liabilities | 1,194 |

| | 1,362 |

|

Commitments and contingencies | — |

| | — |

|

Equity: | | | |

Preferred stock, $1 par value, authorized 6,000,000 shares, none issued | — |

| | — |

|

Common stock, $1 par value, authorized 1,600,000,000 shares, issued 560,641,640 shares at March 31, 2019 and December 31, 2018 | 561 |

| | 561 |

|

Additional paid-in capital | 681 |

| | 817 |

|

Retained earnings | 14,642 |

| | 14,347 |

|

Accumulated other comprehensive loss | (4,590 | ) | | (4,647 | ) |

Non-controlling interests | 77 |

| | 73 |

|

| 11,371 |

| | 11,151 |

|

Less – treasury shares, at cost, 53,623,897 shares at March 31, 2019 and 56,804,468 shares at December 31, 2018 | (3,385 | ) | | (3,567 | ) |

Total equity | 7,986 |

| | 7,584 |

|

| $ | 30,137 |

| | $ | 21,578 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS(Unaudited) |

| | | | | | | |

For the Three Months Ended March 31, | | | |

(In millions) | 2019 |

| | 2018 |

|

Operating cash flows: | | | |

Net income before non-controlling interests | $ | 727 |

| | $ | 696 |

|

Adjustments to reconcile net income to cash used for operations: | | | |

Depreciation and amortization of fixed assets and capitalized software | 74 |

| | 80 |

|

Amortization of intangible assets | 51 |

| | 45 |

|

Amortization of right of use asset | 68 |

| | — |

|

Adjustments and payments related to contingent consideration liability | (18 | ) | | (5 | ) |

Provision for deferred income taxes | (9 | ) | | 11 |

|

(Gain) loss on investments | (5 | ) | | — |

|

(Gain) loss on disposition of assets | — |

| | (1 | ) |

Share-based compensation expense | 57 |

| | 50 |

|

Change in fair value of acquisition-related derivative contracts | (29 | ) | | — |

|

Changes in assets and liabilities: | | | |

Net receivables | (309 | ) | | (357 | ) |

Other current assets | (37 | ) | | 2 |

|

Other assets | (1 | ) | | (32 | ) |

Accounts payable and accrued liabilities | 79 |

| | 135 |

|

Accrued compensation and employee benefits | (886 | ) | | (905 | ) |

Accrued income taxes | 96 |

| | 61 |

|

Contributions to pension and other benefit plans in excess of current year expense/credit | (80 | ) | | (96 | ) |

Other liabilities | 42 |

| | 17 |

|

Operating lease liabilities | (73 | ) | | — |

|

Effect of exchange rate changes | (23 | ) | | (65 | ) |

Net cash used for operations | (276 | ) | | (364 | ) |

Financing cash flows: | | | |

Purchase of treasury shares | — |

| | (250 | ) |

Net increase in commercial paper | 748 |

| | 249 |

|

Proceeds from issuance of debt | 6,462 |

| | 592 |

|

Repayments of debt | (3 | ) | | (3 | ) |

Acquisition-related hedging payments | (129 | ) | | — |

|

Shares withheld for taxes on vested units – treasury shares | (86 | ) | | (61 | ) |

Issuance of common stock from treasury shares | 77 |

| | 32 |

|

Payments of deferred and contingent consideration for acquisitions | (29 | ) | | (70 | ) |

Distributions of non-controlling interests | (4 | ) | | (6 | ) |

Dividends paid | (210 | ) | | (189 | ) |

Net cash provided by financing activities | 6,826 |

| | 294 |

|

Investing cash flows: | | | |

Capital expenditures | (73 | ) | | (58 | ) |

Sales of long-term investments | 115 |

| | 9 |

|

Purchase of equity investment | (88 | ) | | — |

|

Proceeds from sales of fixed assets | 1 |

| | 1 |

|

Dispositions | — |

| | 3 |

|

Acquisitions | (140 | ) | | (24 | ) |

Other, net | (2 | ) | | (1 | ) |

Net cash used for investing activities | (187 | ) | | (70 | ) |

Effect of exchange rate changes on cash and cash equivalents | 47 |

| | 103 |

|

Increase (decrease) in cash and cash equivalents and funds held in escrow | 6,410 |

| | (37 | ) |

Cash and cash equivalents at beginning of period | 1,066 |

| | 1,205 |

|

| | | |

Cash balances, end of period | | | |

Cash and cash equivalents at end of period | 1,117 |

| | 1,168 |

|

Funds held in escrow for acquisition | 6,359 |

|

| — |

|

Total | $ | 7,476 |

|

| $ | 1,168 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

|

| | | | | | | |

For the Three Months Ended March 31, | | | |

(In millions, except per share amounts) | 2019 |

| | 2018 |

|

COMMON STOCK | | | |

Balance, beginning and end of period | $ | 561 |

| | $ | 561 |

|

ADDITIONAL PAID-IN CAPITAL | | | |

Balance, beginning of year | $ | 817 |

| | $ | 784 |

|

Change in accrued stock compensation costs | (101 | ) | | (75 | ) |

Issuance of shares under stock compensation plans and employee stock purchase plans | (35 | ) | | (27 | ) |

Balance, end of period | $ | 681 |

| | $ | 682 |

|

RETAINED EARNINGS | | | |

Balance, beginning of year | $ | 14,347 |

| | $ | 13,140 |

|

Cumulative effect of adoption of the revenue recognition standard (See Note 19) | — |

| | 364 |

|

Cumulative effect of adoption of other accounting standards (See Note 19) | — |

| | — |

|

Net income attributable to the Company | 716 |

| | 690 |

|

Dividend equivalents declared – (per share amounts: $0.83 in 2019 and $0.75 in 2018) | (2 | ) | | (1 | ) |

Dividends declared – (per share amounts: $0.83 in 2019 and $0.75 in 2018) | (419 | ) | | (381 | ) |

Balance, end of period | $ | 14,642 |

| | $ | 13,812 |

|

ACCUMULATED OTHER COMPREHENSIVE LOSS | | | |

Balance, beginning of year | $ | (4,647 | ) | | $ | (4,043 | ) |

Cumulative effect of adoption of the financial instruments standard (See Note 19) | — |

| | (14 | ) |

Other comprehensive income, net of tax | 57 |

| | 152 |

|

Balance, end of period | $ | (4,590 | ) | | $ | (3,905 | ) |

TREASURY SHARES | | | |

Balance, beginning of year | $ | (3,567 | ) | | $ | (3,083 | ) |

Issuance of shares under stock compensation plans and employee stock purchase plans | 182 |

| | 123 |

|

Purchase of treasury shares | — |

| | (250 | ) |

Balance, end of period | $ | (3,385 | ) | | $ | (3,210 | ) |

NON-CONTROLLING INTERESTS | | | |

Balance, beginning of year | $ | 73 |

| | $ | 83 |

|

Net income attributable to non-controlling interests | 11 |

| | 6 |

|

Distributions and other changes | (7 | ) | | (8 | ) |

Balance, end of period | $ | 77 |

| | $ | 81 |

|

TOTAL EQUITY | $ | 7,986 |

| | $ | 8,021 |

|

The accompanying notes are an integral part of these unaudited consolidated statements.

MARSH & McLENNAN COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Nature of Operations

Marsh & McLennan Companies, Inc. and its consolidated subsidiaries (the "Company"), a global professional services firm, is organized based on the different services that it offers. Under this structure, the Company’s two segments are Risk and Insurance Services and Consulting.

The Risk and Insurance Services segment provides risk management solutions, services, advice and insurance broking, reinsurance broking and insurance program management services for businesses, public entities, insurance companies, associations, professional services organizations, and private clients. The Company conducts business in this segment through Marsh and Guy Carpenter. The Company conducts business in its Consulting segment through Mercer and Oliver Wyman Group. Mercer provides consulting expertise, advice, services and solutions in the areas of health, wealth and career consulting services and products. Oliver Wyman Group provides specialized management and economic and brand consulting services.

On April 1, 2019, the Company completed its previously announced acquisition (the "Transaction") of all of the outstanding shares of Jardine Lloyd Thompson Group plc ("JLT"), a public company organized under the laws of England and Wales. Acquisitions and dispositions impacting the Risk and Insurance Services and Consulting segments are discussed in Note 8 to the consolidated financial statements.

2. Principles of Consolidation and Other Matters

The consolidated financial statements included herein have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission. While certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such rules and regulations for interim filings, the Company believes that the information and disclosures presented are adequate to make such information and disclosures not misleading. These consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 (the "2018 Form 10-K").

The financial information contained herein reflects all normal recurring adjustments which are, in the opinion of management, necessary for a fair presentation of the Company’s consolidated financial statements as of and for the three month periods ended March 31, 2019 and 2018.

Cash and Cash Equivalents

Cash and cash equivalents primarily consist of certificates of deposit and time deposits, with original maturities of three months or less, and money market funds. The estimated fair value of the Company's cash and cash equivalents approximates their carrying value. The Company is required to maintain operating funds primarily related to regulatory requirements outside of the United States or as collateral under captive insurance arrangements. At March 31, 2019, the Company maintained $196 million related to these regulatory requirements.

Funds Held in Escrow For Acquisition

The Company received proceeds from debt issuances related to the JLT Transaction in the first quarter of 2019, which were placed in escrow. At March 31, 2019, these funds were reported as funds held in escrow for acquisition in the consolidated balance sheet. The funds were released from escrow upon the completion of the Transaction in April 2019.

Investments

The caption "Investment income (loss)" in the consolidated statements of income comprises realized and unrealized gains and losses from investments recognized in earnings. It includes, when applicable, other than temporary declines in the value of securities, mark-to-market increases or decreases in equity investments with readily determinable fair values and equity method gains or losses on the Company's investments in private equity funds.

The Company holds investments in certain private equity funds that are accounted for under the equity method of accounting using a consistently applied three-month lag period adjusted for any known significant changes from the lag period to the reporting date of the Company. The underlying private equity funds follow investment company accounting, where investments within the fund are carried at fair value. Investment gains or losses for the Company's proportionate share of the change in fair value of the funds are recorded in earnings. Investments

accounted for using the equity method of accounting are included in "other assets" in the consolidated balance sheets.

The Company recorded net investment income of $5 million for the three months ended March 31, 2019 compared to a net investment loss of less than $1 million for the same period in the prior year. The three month period ending March 31, 2019 includes gains of $3 million related to mark-to-market changes in equity securities and gains of $2 million related to investments in private equity funds and other investments.

Leases

Effective January 1, 2019, the Company adopted the new accounting guidance related to leases. Under the new guidance, a lessee is required to recognize assets and liabilities for its leases with lease terms more than 12 months. The Company adopted this new standard using the modified retrospective method, which applies the new guidance beginning with the year of adoption, with the cumulative effect of initially applying the guidance recognized as an adjustment to retained earnings at January 1, 2019. There was no cumulative-effect adjustment required to be booked to retained earnings upon transition. Prior period results have not been restated to reflect the adoption of this new standard.

On January 1, 2019, the Company recognized a lease liability of $1.9 billion and a corresponding right-of-use asset ("ROU asset") of $1.7 billion, including the reclassification of approximately $0.2 billion of unamortized lease incentives and restructuring liabilities, upon the adoption of this standard, with minimal impact on the consolidated statement of income.

See Note 12 for further information related to Leases.

Income Taxes

The Company's effective tax rate in the first quarter of 2019 was 23% compared with 23.9% in the first quarter of 2018. The tax rates in both periods reflect the impact of discrete tax matters such as excess tax benefits related to share-based compensation, tax legislation, changes in uncertain tax positions, deferred tax adjustments and nontaxable adjustments to contingent acquisition consideration. The excess tax benefit related to share-based payments is the most significant discrete item, reducing the effective tax rate by 3.2% and 2.4% in the first quarters of 2019 and 2018, respectively.

The Company is routinely examined by tax authorities in the jurisdictions in which it has significant operations. The Company regularly considers the likelihood of assessments in each of the taxing jurisdictions resulting from examinations. When evaluating the potential imposition of penalties, the Company considers a number of relevant factors under penalty statutes, including appropriate disclosure of the tax return position, the existence of legal authority supporting the Company's position, and reliance on the opinion of professional tax advisors.

The Company reports a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in tax returns. The Company's gross unrecognized tax benefits decreased from $78 million at December 31, 2018 to $74 million at March 31, 2019 due to current accruals offset by settlements of audits and expirations of statutes of limitation. It is reasonably possible that the total amount of unrecognized tax benefits will decrease between zero and approximately $10 million within the next twelve months due to settlements of audits and expirations of statutes of limitation.

3. Revenue

The core principle of the revenue recognition guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that principle, the entity applies the following steps: identify the contract(s) with the customer, identify the performance obligations in the contract(s), determine the transaction price, allocate the transaction price to the performance obligations in the contract and recognize revenue when (or as) the entity satisfies a performance obligation.

Other revenue included in the consolidated statements of income that is not from contracts with customers is approximately 1% of total revenue, and therefore is not presented as a separate line item.

Risk and Insurance Services

Risk and Insurance Services revenue reflects compensation for brokerage and consulting services through commissions and fees. Commission rates and fees vary in amount and can depend upon a number of factors, including the type of insurance or reinsurance coverage provided, the particular insurer or reinsurer selected, and the capacity in which the broker acts and negotiates with clients. For the majority of the insurance and reinsurance brokerage arrangements, advice and services provided which culminate in the placement of an effective policy are

considered a single performance obligation. Arrangements with clients may include the placement of a single policy, multiple policies or a combination of policy placements and other services. Consideration related to such "bundled arrangements" is allocated to the individual performance obligations based on their relative fair value. Revenue for policy placement is generally recognized on the policy effective date, at which point control over the services provided by the Company has transferred to the client and the client has accepted the services. The contractual terms for certain fee based brokerage arrangements meet the criteria for revenue recognition over time. For such arrangements, revenue is recognized using output measures, which correspond to the progress toward completing the performance obligation. Fees for non-risk transfer services provided to clients are recognized over time in the period the services are provided, using a proportional performance model, primarily based on input measures. These measures of progress provide a faithful depiction of the progress towards completion of the performance obligation.

Revenue related to reinsurance brokerage for excess of loss ("XOL") treaties is estimated based on contractually specified minimum or deposit premiums, and adjusted as additional evidence of the ultimate amount of brokerage is received. Revenue for quota share treaties is estimated based on indications of estimated premium income provided by the ceding insurer. The estimated brokerage revenue recognized for quota share treaties is constrained to an amount that is probable to not have a significant negative adjustment. The estimated revenue and the constraint are evaluated as additional evidence of the ultimate amount of underlying risks to be covered is received over the 12 to 18 months following the effective date of the placement.

In addition to commissions and fees from its clients, the Company also receives other compensation from insurance companies. This other insurer compensation includes, among other things, payments for consulting and analytics services provided to insurers, fees for administrative and other services provided to or on behalf of insurers (including services relating to the administration and management of quota shares, panels and other facilities in which insurers participate). The Company is also eligible for certain contingent commissions from insurers based on the attainment of specified metrics (i.e., volume and loss ratio measures) relating to Marsh's placements, particularly in Marsh & McLennan Agency ("MMA") and in parts of Marsh's international operations. Revenue for contingent commissions from insurers is estimated based on historical evidence of the achievement of the respective contingent metrics and recorded as the underlying policies that contribute to the achievement of the metric are placed. Due to the uncertainty of the amount of contingent consideration that will be received, the estimated revenue is constrained to an amount that is probable to not have a significant negative adjustment. Contingent consideration is generally received in the first quarter of the subsequent year.

A significant majority of the Company's Risk and Insurance Services revenue is for performance obligations recognized at a point in time. Marsh and Guy Carpenter also receive interest income on certain funds (such as premiums and claims proceeds) held in a fiduciary capacity for others.

Insurance brokerage commissions are generally invoiced on the policy effective date. Fee based arrangements generally include a percentage of the total fee due upon signing the arrangement, with additional fixed installments payable over the remainder of the year. Payment terms range from receipt of invoice up to 30 days from invoice date.

Reinsurance brokerage revenue is recognized on the effective date of the treaty. Payment terms depend on the type of reinsurance. For XOL treaties, brokerage revenue is typically collected in four installments during an annual treaty period based on a contractually specified minimum or deposit premium. For proportional or quota share treaties, brokerage is billed as underlying insured risks attach to the reinsurance treaty, generally over 12 to 18 months.

Consulting

The major component of revenue in the Consulting business is fees paid by clients for advice and services. Mercer, principally through its health line of business, also receives revenue in the form of commissions received from insurance companies for the placement of group (and occasionally individual) insurance contracts, primarily health, life and accident coverages. Revenue for Mercer’s investment management business and certain of Mercer’s defined benefit administration services consists principally of fees based on assets under delegated management or administration.

Consulting projects in Mercer’s wealth and career businesses, as well as consulting projects in Oliver Wyman typically consist of a single performance obligation, which is recognized over time as control is transferred continuously to customers. Typically, revenue is recognized over time using an input measure of time expended to date relative to total estimated time incurred at project completion. Incurred hours represent services rendered and thereby faithfully depicts the transfer of control to the customer.

On a limited number of engagements, performance fees may also be earned for achieving certain prescribed performance criteria. Revenue for achievement is estimated and constrained to an amount that is probable to not have a significant negative adjustment.

A significant majority of fee revenues in the Consulting segment is recognized over time.

For consulting projects, Mercer generally invoices monthly in arrears with payment due within 30 days of the invoice date. Fees for delegated management services are either deducted from the net asset value of the fund or invoiced to the client on a monthly or quarterly basis in arrears. Oliver Wyman typically bills its clients 30-60 days in arrears with payment due upon receipt of the invoice.

Health brokerage and consulting services are components of both Marsh, which includes MMA, and Mercer, with approximately 65% of such revenues reported in Mercer. Health contracts typically involve a series of distinct services that are treated as a single performance obligation. Revenue for these services is recognized over time based on the amount of remuneration the Company expects to be entitled in exchange for these services. Payments for health brokerage and consulting services are typically paid monthly in arrears from carriers based on insured lives under the contract.

The following schedule disaggregates components of the Company's revenue:

|

| | | | |

| | Three Months Ended

March 31, |

| | 2019 |

Marsh: | | |

EMEA | | $ | 633 |

|

Asia Pacific | | 165 |

|

Latin America | | 78 |

|

Total International | | 876 |

|

U.S./Canada | | 861 |

|

Total Marsh | | 1,737 |

|

Guy Carpenter | | 663 |

|

Subtotal | | 2,400 |

|

Fiduciary interest income | | 23 |

|

Total Risk and Insurance Services | | $ | 2,423 |

|

| | |

Mercer: | | |

Wealth | | $ | 543 |

|

Health | | 442 |

|

Career | | 170 |

|

Total Mercer | | 1,155 |

|

Oliver Wyman | | 518 |

|

Total Consulting | | $ | 1,673 |

|

The following schedule provides contract assets and contract liabilities information from contracts with customers.

|

| | | | | | | |

(In millions) | | March 31, 2019 | January 1, 2019 |

Contract Assets | | $ | 198 |

| $ | 112 |

|

Contract Liabilities | | $ | 611 |

| $ | 545 |

|

The Company records accounts receivable when the right to consideration is unconditional, subject only to the passage of time. Contract assets primarily relate to quota share reinsurance brokerage and contingent insurer revenue. The Company does not have the right to bill and collect revenue for quota share brokerage until the underlying policies written by the ceding insurer attach to the treaty. Estimated revenue related to achievement of volume or loss ratio metrics cannot be billed or collected until all related policy placements are completed and the contingency is resolved. The change in contract assets from January 1, 2019 to March 31, 2019 is primarily due to $128 million of additions during the period partly offset by $42 million transferred to accounts receivables, as the

rights to bill and collect became unconditional. Contract assets are included in other current assets in the Company's consolidated balance sheet. Contract liabilities primarily relate to the advance consideration received from customers. Contract liabilities are included in current liabilities in the Company's consolidated balance sheet. Revenue recognized in the first three months of 2019 that was included in the contract liability balance at the beginning of the year was $169 million. The amount of revenue recognized in the first three months of 2019 from performance obligations satisfied in previous periods, mainly due to variable consideration from contracts with insurers, quota share business and consulting contracts previously considered constrained was $17 million. The Company applies the practical expedient and therefore does not disclose the value of unsatisfied performance obligations for (1) contracts with original contract terms of one year or less and (2) contracts where the Company has the right to invoice for services performed. The revenue expected to be recognized in future periods during the non-cancellable term of existing contracts greater than one year that is related to performance obligations that are unsatisfied or partially satisfied at the end of the reporting period is approximately $30 million for Marsh, $429 million for Mercer and $3 million for Oliver Wyman. The Company expects revenue in 2020, 2021, 2022, 2023 and 2024 and beyond of $190 million, $130 million, $81 million, $44 million and $17 million, respectively, related to these performance obligations.

4. Fiduciary Assets and Liabilities

In its capacity as an insurance broker or agent, the Company collects premiums from insureds and, after deducting its commissions, remits the premiums to the respective insurance underwriters. The Company also collects claims or refunds from underwriters on behalf of insureds. Unremitted insurance premiums and claims proceeds are held by the Company in a fiduciary capacity. Risk and Insurance Services revenue includes interest on fiduciary funds of $23 million and $13 million for the three months ended March 31, 2019 and 2018, respectively. The Consulting segment recorded fiduciary interest income of $1 million in each of the three month periods ended March 31, 2019 and 2018, respectively. Since fiduciary assets are not available for corporate use, they are shown in the consolidated balance sheets as an offset to fiduciary liabilities.

Net uncollected premiums and claims and the related payables amounted to $9.2 billion at March 31, 2019 and $7.3 billion at December 31, 2018. The Company is not a principal to the contracts under which the right to receive premiums or the right to receive reimbursement of insured losses arises. Accordingly, net uncollected premiums and claims and the related payables are not assets and liabilities of the Company and are not included in the accompanying consolidated balance sheets.

In certain instances, the Company advances premiums, refunds or claims to insurance underwriters or insureds prior to collection. These advances are made from corporate funds and are reflected in the accompanying consolidated balance sheets as receivables.

5. Per Share Data

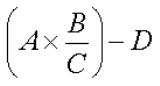

Basic net income per share attributable to the Company is calculated by dividing the after-tax income attributable to the Company by the weighted average number of outstanding shares of the Company’s common stock.

Diluted net income per share attributable to the Company is calculated by dividing the after-tax income attributable to the Company by the weighted average number of outstanding shares of the Company’s common stock, which have been adjusted for the dilutive effect of potentially issuable common shares.

|

| | | | | | | |

Basic and Diluted EPS Calculation | Three Months Ended

March 31, |

(In millions, except per share amounts) | 2019 |

| | 2018 |

|

Net income before non-controlling interests | $ | 727 |

| | $ | 696 |

|

Less: Net income attributable to non-controlling interests | 11 |

| | 6 |

|

Net income attributable to the Company | $ | 716 |

| | $ | 690 |

|

Basic weighted average common shares outstanding | 505 |

| | 508 |

|

Dilutive effect of potentially issuable common shares | 6 |

| | 6 |

|

Diluted weighted average common shares outstanding | 511 |

| | 514 |

|

Average stock price used to calculate common stock equivalents | $ | 88.54 |

| | $ | 82.83 |

|

6. Supplemental Disclosures to the Consolidated Statements of Cash Flows

The following schedule provides additional information concerning acquisitions, interest and income taxes paid for the three-month periods ended March 31, 2019 and 2018.

|

| | | | | | | |

(In millions) | 2019 |

| | 2018 |

|

Assets acquired, excluding cash | $ | 180 |

| | $ | 35 |

|

Liabilities assumed | (5 | ) | | (4 | ) |

Contingent/deferred purchase consideration | (35 | ) | | (7 | ) |

Net cash outflow for current year acquisitions | $ | 140 |

| | $ | 24 |

|

|

| | | | | | | |

(In millions) | 2019 |

| | 2018 |

|

Interest paid | $ | 98 |

| | $ | 80 |

|

Income taxes paid, net of refunds | $ | 131 |

| | $ | 128 |

|

The classification of contingent consideration in the statement of cash flows is determined by whether the payment was part of the initial liability established on the acquisition date (financing) or an adjustment to the acquisition date liability (operating).

The following amounts are included in the consolidated statements of cash flows as a financing activity. The Company paid deferred and contingent consideration of $29 million for the three months ended March 31, 2019. This consisted of deferred purchase consideration related to prior years' acquisitions of $23 million and contingent consideration of $6 million. For the three months ended March 31, 2018, the Company paid deferred and contingent consideration of $70 million, consisting of deferred purchase consideration related to prior years' acquisitions of $40 million and contingent consideration of $30 million.

The following amounts are included in the operating section of the consolidated statements of cash flows. For the three months ended March 31, 2019, the Company recorded an expense for adjustments to contingent consideration liabilities of $11 million and made contingent consideration payments of $29 million. For the three months ended March 31, 2018, the Company recorded an expense for adjustments to contingent consideration liabilities of $5 million and made contingent consideration payments of $10 million.

The Company had non-cash issuances of common stock under its share-based payment plan of $158 million and $125 million for the three months ended March 31, 2019 and 2018, respectively. The Company recorded stock-based compensation expense for equity awards related to restricted stock units, performance stock units and stock options of $57 million and $50 million for the three-month periods ended March 31, 2019 and 2018, respectively.

The funds held in the acquisition related escrow account comprises proceeds from issuance of debt of $6.462 billion plus interest earned during the period of $25 million, less $129 million of payments on acquisition related derivative contracts.

Effective January 1, 2019, the Company adopted the new accounting guidance related to leases, which requires a lessee to recognize assets and liabilities for its leases. Upon adoption of this accounting standard, the Company recorded a non cash ROU asset of $1.7 billion and lease liability of $1.9 billion during the first quarter of 2019.

7. Other Comprehensive Income (Loss)

The changes, net of tax, in the balances of each component of Accumulated Other Comprehensive Income ("AOCI") for the three-month periods ended March 31, 2019 and 2018, including amounts reclassified out of AOCI, are as follows: |

| | | | | | | | | | | | | | | |

(In millions) | Unrealized Investment Gains (Losses) | | Pension/Post-Retirement Plans Gains (Losses) | | Foreign Currency Translation Gains (Losses) | | Total Gains (Losses) |

Balance as of December 31, 2018 | $ | — |

| | $ | (2,953 | ) | | $ | (1,694 | ) | | $ | (4,647 | ) |

Other comprehensive (loss) income before reclassifications | — |

| | (59 | ) | | 94 |

| | 35 |

|

Amounts reclassified from accumulated other comprehensive income | — |

| | 22 |

| | — |

| | 22 |

|

Net current period other comprehensive (loss) income | — |

| | (37 | ) | | 94 |

| | 57 |

|

Balance as of March 31, 2019 | $ | — |

| | $ | (2,990 | ) | | $ | (1,600 | ) | | $ | (4,590 | ) |

|

| | | | | | | | | | | | | | | |

(In millions) | Unrealized Investment Gains (Losses) | | Pension/Post-Retirement Plans Gains (Losses) | | Foreign Currency Translation Gains (Losses) | | Total Gains (Losses) |

Balance as of December 31, 2017 | $ | 14 |

| | $ | (2,892 | ) | | $ | (1,165 | ) | | $ | (4,043 | ) |

Cumulative effect of amended accounting standard | (14 | ) | | — |

| | — |

| | (14 | ) |

Other comprehensive (loss) income before reclassifications | — |

| | (100 | ) | | 223 |

| | 123 |

|

Amounts reclassified from accumulated other comprehensive income | — |

| | 29 |

| | — |

| | 29 |

|

Net current period other comprehensive (loss) income | — |

| | (71 | ) | | 223 |

| | 152 |

|

Balance as of March 31, 2018 | $ | — |

| | $ | (2,963 | ) | | $ | (942 | ) | | $ | (3,905 | ) |

The components of other comprehensive income (loss) for the three-month period ended March 31, 2019 and 2018 are as follows: |

| | | | | | | | | | | | | | | | | | | |

Three Months Ended March 31, | 2019 | | 2018 |

(In millions) | Pre-Tax | Tax (Credit) | Net of Tax | | Pre-Tax | Tax (Credit) | Net of Tax |

Foreign currency translation adjustments | $ | 96 |

| $ | 2 |

| $ | 94 |

| | $ | 228 |

| $ | 5 |

| $ | 223 |

|

Pension/post-retirement plans: | | | | | | | |

Amortization of (gains) losses included in net periodic pension cost: |

|

| | | | | | |

Prior service credits (a) | (1 | ) | — |

| (1 | ) | | (1 | ) | — |

| (1 | ) |

Net actuarial losses (a) | 26 |

| 6 |

| 20 |

| | 37 |

| 7 |

| 30 |

|

Effect of settlement (a) | 4 |

| 1 |

| 3 |

| | — |

| — |

| — |

|

Subtotal | 29 |

| 7 |

| 22 |

| | 36 |

| 7 |

| 29 |

|

Foreign currency translation adjustments | (72 | ) | (13 | ) | (59 | ) | | (120 | ) | (20 | ) | (100 | ) |

Pension/post-retirement plans (loss) gains | (43 | ) | (6 | ) | (37 | ) | | (84 | ) | (13 | ) | (71 | ) |

Other comprehensive income (loss) | $ | 53 |

| $ | (4 | ) | $ | 57 |

| | $ | 144 |

| $ | (8 | ) | $ | 152 |

|

(a) Components of net periodic pension cost are included in other net benefit credits in the consolidated statements of income. Tax on prior service costs and net actuarial losses is included in income tax expense. |

8. Acquisitions and Dispositions

The Company’s acquisitions have been accounted for as business combinations. Net assets and results of operations are included in the Company’s consolidated financial statements commencing at the respective purchase closing dates. In connection with acquisitions, the Company records the estimated values of the net tangible assets and the identifiable intangible assets purchased, which typically consist of customer lists, developed technology, trademarks and non-compete agreements. The valuation of purchased intangible assets involves significant estimates and assumptions. Refinement and completion of final valuation of net assets acquired could affect the carrying value of tangible assets, goodwill and identifiable intangible assets.

The Risk and Insurance Services segment completed two acquisitions during the first three months of 2019.

| |

• | February – MMA acquired Bouchard Insurance, Inc., a Florida-based full service agency and Employee Benefits Group, Inc., a Maryland-based independent insurance agency. |

Total purchase consideration for acquisitions made during the three months ended March 31, 2019 was $177 million, which consisted of cash paid of $142 million and deferred purchase and estimated contingent consideration of $35 million. Contingent consideration arrangements are based primarily on earnings before interest, tax, depreciation and amortization ("EBITDA") or revenue targets over a period of two to four years. The fair value of the contingent consideration was based on projected revenue or EBITDA of the acquired entities. Estimated fair values of assets acquired and liabilities assumed are subject to adjustment when purchase accounting is finalized. The Company also paid $23 million of deferred purchase consideration and $35 million of contingent consideration related to acquisitions made in prior years.

The following table presents the preliminary allocation of the acquisition cost to the assets acquired and liabilities assumed during 2019 based on their fair values: |

| | | |

For the Three Months Ended March 31, 2019 | |

(In millions) | |

Cash | $ | 142 |

|

Estimated fair value of deferred/contingent consideration | 35 |

|

Total consideration | $ | 177 |

|

Allocation of purchase price: | |

Cash and cash equivalents | $ | 2 |

|

Accounts receivable, net | 5 |

|

Property, plant, and equipment | 1 |

|

Other intangible assets | 71 |

|

Goodwill | 97 |

|

Other assets | 6 |

|

Total assets acquired | 182 |

|

Current liabilities | 5 |

|

Other liabilities | — |

|

Total liabilities assumed | 5 |

|

Net assets acquired | $ | 177 |

|

Other intangible assets acquired are based on initial estimates and subject to change based on final valuations during the measurement period post acquisition date. The following chart provides information about other intangible assets acquired during 2019:

|

| | | | | | |

| | Amount | | Weighted Average Amortization Period |

Client relationships | | $ | 67 |

| | 11 years |

Other | | 4 |

| | 5 years |

| | $ | 71 |

| | |

In January 2019, Marsh increased its equity ownership in Marsh India from 26% to 49%. Marsh India continues to be accounted for under the equity method.

Prior-Year Acquisitions

The Risk and Insurance Services segment completed twelve acquisitions during 2018.

| |

• | February – MMA acquired Highsmith Insurance Agency, a North Carolina-based independent insurance brokerage firm. |

| |

• | March – Marsh acquired Hoken Soken, Inc., a Japan-based insurance agency. |

| |

• | May – Marsh acquired Mountlodge Limited, a Scotland-based independent insurance broker and Lorant Martínez Salas y Compañía Agente de Seguros y de Fianzas, S.A. de C.V., a Mexico-based multi-line insurance broker. |

| |

• | June – MMA acquired Bleakley Insurance Services, a California-based provider of employee benefits solutions; Klein Agency, Inc., a Minnesota-based surety and property/casualty agency; and Insurance Associates, Inc., a Maryland-based independent insurance agency. |

| |

• | August – Marsh acquired John L. Wortham & Son, L.P., a Houston-based independent insurance broker. |

| |

• | October – MMA acquired Eustis Insurance, Inc., a Louisiana-based insurance agency. |

| |

• | November – MMA acquired James P. Murphy & Associates, Inc., a Connecticut-based insurance agency. |

| |

• | December – MMA acquired Otis-Magie Insurance Agency, Inc., a Minnesota-based insurance agency, and Marsh acquired Hector Insurance PCC Ltd, a U.K.-based captive management company. |

The Consulting segment completed eight acquisitions during 2018.

| |

• | January – Oliver Wyman acquired Draw Ltd., a U.K.-based digital transformation agency. |

| |

• | March – Oliver Wyman acquired 8Works Limited, a U.K.-based design thinking consultancy. |

| |

• | May – Mercer acquired EverBe SAS, a France-based Workday implementer and advisory firm; and Evolve Intelligence Pty Ltd., an Australia-based talent strategy firm. |

| |

• | June – Mercer acquired India Life Capital Private Ltd., an India-based investment advisor. |

| |

• | November – Mercer acquired Induslynk Training Services Private Ltd., an India-based talent assessment company, Pavilion Financial Corp., a Canada-based investment services firm and Summit Strategies Inc., a Missouri-based investment consulting firm. |

Total purchase consideration for acquisitions made during the first three months of 2018 was $36 million, which consisted of cash paid of $29 million and deferred purchase and estimated contingent consideration of $7 million. Contingent consideration arrangements are primarily based on EBITDA or revenue targets over a period of two to four years. The fair value of the contingent consideration was based on projected revenue or earnings of the acquired entities. Estimated fair values of assets acquired and liabilities assumed are subject to adjustment when purchase accounting is finalized. In the first three months of 2018, the Company also paid $40 million of deferred purchase consideration and $40 million of contingent consideration related to acquisitions made in prior years.

Pro-Forma Information

The following unaudited pro-forma financial data gives effect to the acquisitions made by the Company during 2019 and 2018. In accordance with accounting guidance related to pro-forma disclosures, the information presented for current year acquisitions is as if they occurred on January 1, 2018 and reflects acquisitions made in 2018 as if they occurred on January 1, 2017. The unaudited pro-forma information adjusts for the effects of amortization of acquired intangibles. The unaudited pro-forma financial data is presented for illustrative purposes only and is not necessarily indicative of the operating results that would have been achieved if such acquisitions had occurred on the dates indicated, nor is it necessarily indicative of future consolidated results.

|

| | | | | | | |

| Three Months Ended

March 31, |

(In millions, except per share figures) | 2019 |

| | 2018 |

|

Revenue | $ | 4,080 |

| | $ | 4,098 |

|

Net income attributable to the Company | $ | 717 |

| | $ | 694 |

|

Basic net income per share attributable to the Company | $ | 1.42 |

| | $ | 1.37 |

|

Diluted net income per share attributable to the Company | $ | 1.40 |

| | $ | 1.35 |

|

The consolidated statements of income include the results of operations of acquired companies since their respective acquisition dates. The consolidated statements of income for the three month period ended March 31, 2019 includes approximately $4 million of revenue and an operating gain of less than $1 million for acquisitions made in 2019. The consolidated statements of income for the three month period ended March 31, 2018 included $3 million of revenue and an operating loss of $1 million related to acquisitions made in 2018.

Subsequent Event - Acquisition of JLT

On April 1, 2019, the Company completed its previously announced Transaction of all of the outstanding shares of JLT. Under the terms of the Transaction, JLT shareholders received £19.15 in cash for each JLT share, which valued JLT’s existing issued and to be issued share capital at approximately £4.3 billion (or approximately $5.6 billion based on an exchange rate of U.S. $1.31:£1) and assumed existing JLT indebtedness of approximately $1 billion. The Company implemented the Transaction by way of a scheme of arrangement under Part 26 of the United Kingdom Companies Act 2006, as amended. The pro-forma information above excludes the results of JLT because it was not practicable due to the timing of when the acquisition occurred, and to include such information would require significant estimates related to the impact of adjustments from JLT's historical accounting under International Accounting Standards to U.S. GAAP and to the allocation of purchase consideration.

Financing and hedging activities related to the Transaction are discussed in more detail in Notes 11 and 14 of the consolidated financial statements.

9. Goodwill and Other Intangibles

The Company is required to assess goodwill and any indefinite-lived intangible assets for impairment annually, or more frequently if circumstances indicate impairment may have occurred. The Company performs the annual impairment assessment for each of its reporting units during the third quarter of each year. In accordance with applicable accounting guidance, the Company assesses qualitative factors to determine whether it is necessary to perform the two-step goodwill impairment test. As part of its assessment, the Company considers numerous factors, including that the fair value of each reporting unit exceeds its carrying value by a substantial margin based on its most recent estimates, whether significant acquisitions or dispositions occurred which might alter the fair value of its reporting units, macroeconomic conditions and their potential impact on reporting unit fair values, actual performance compared with budget and prior projections used in its estimation of reporting unit fair values, industry and market conditions, and the year-over-year change in the Company’s share price. The Company completed its qualitative assessment in the third quarter of 2018 and concluded that a two-step goodwill impairment test was not required in 2018 and that goodwill was not impaired.

Other intangible assets that are not deemed to have an indefinite life are amortized over their estimated lives and reviewed for impairment upon the occurrence of certain triggering events in accordance with applicable accounting literature.

Changes in the carrying amount of goodwill are as follows:

|

| | | | | | | |

March 31, | | | |

(In millions) | 2019 |

| | 2018 |

|

Balance as of January 1, | $ | 9,599 |

| | $ | 9,089 |

|

Goodwill acquired | 97 |

| | 15 |

|

Other adjustments(a) | 43 |

| | 90 |

|

Balance at March 31, | $ | 9,739 |

| | $ | 9,194 |

|

(a) Primarily reflects the impact of foreign exchange.

The goodwill acquired of $97 million in 2019, all of which is deductible for tax purposes, related to the Risk and Insurance Services segment.

Goodwill allocable to the Company’s reportable segments at March 31, 2019 is as follows: Risk and Insurance Services, $6.9 billion and Consulting, $2.8 billion.

The gross cost and accumulated amortization at March 31, 2019 and December 31, 2018 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2019 | | December 31, 2018 |

(In millions) | Gross Cost |

| | Accumulated Amortization |

| | Net Carrying Amount |

| | Gross Cost |

| | Accumulated Amortization |

| | Net Carrying Amount |

|

Client Relationships | $ | 2,046 |

| | $ | 685 |

| | $ | 1,361 |

| | $ | 1,970 |

| | $ | 639 |

| | $ | 1,331 |

|

Other (a) | 267 |

| | 164 |

| | 103 |

| | 259 |

| | 153 |

| | 106 |

|

Amortized intangibles | $ | 2,313 |

| | $ | 849 |

| | $ | 1,464 |

| | $ | 2,229 |

| | $ | 792 |

| | $ | 1,437 |

|

(a) Primarily non-compete agreements, trade names and developed technology.

Aggregate amortization expense for the three months ended March 31, 2019 and 2018 was $51 million and $45 million, respectively. The estimated future aggregate amortization expense is as follows:

|

| | | |

For the Years Ending December 31, | |

(In millions) | Estimated Expense |

|

2019 (excludes amortization through March 31, 2019) | $ | 151 |

|

2020 | 187 |

|

2021 | 174 |

|

2022 | 159 |

|

2023 | 156 |

|

Subsequent years | 637 |

|

| $ | 1,464 |

|

10. Fair Value Measurements

Fair Value Hierarchy

The Company has categorized its assets and liabilities that are valued at fair value on a recurring basis into a three-level fair value hierarchy as defined by the FASB. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets and liabilities (Level 1) and lowest priority to unobservable inputs (Level 3). In some cases, the inputs used to measure fair value might fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy, for disclosure purposes, is determined based on the lowest level input that is significant to the fair value measurement. Assets and liabilities recorded in the consolidated balance sheets at fair value are categorized based on the inputs in the valuation techniques as follows:

| |

Level 1. | Assets and liabilities whose values are based on unadjusted quoted prices for identical assets or liabilities in an active market (examples include active exchange-traded equity securities and exchange-traded money market mutual funds). |

Assets and liabilities measured using Level 1 inputs include exchange-traded equity securities, exchange-traded mutual funds and money market funds.

| |

Level 2. | Assets and liabilities whose values are based on the following: |

| |

a) | Quoted prices for similar assets or liabilities in active markets; |

| |

b) | Quoted prices for identical or similar assets or liabilities in non-active markets (examples include corporate and municipal bonds, which trade infrequently); |

| |

c) | Pricing models whose inputs are observable for substantially the full term of the asset or liability (examples include most over-the-counter derivatives, including interest rate and currency swaps); and |

| |

d) | Pricing models whose inputs are derived principally from or corroborated by observable market data through correlation or other means for substantially the full asset or liability (for example, certain mortgage loans). |

Assets and liabilities using Level 2 inputs include treasury locks and an equity security.

| |

Level 3. | Assets and liabilities whose values are based on prices, or valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement. These inputs reflect management’s own assumptions about the assumptions a market participant would use in pricing the asset or liability. |

Liabilities measured using Level 3 inputs include liabilities for contingent purchase consideration and the deal contingent foreign exchange contract (the "FX Contract").

Valuation Techniques

Equity Securities, Money Market Funds and Mutual Funds – Level 1

Investments for which market quotations are readily available are valued at the sale price on their principal exchange or, for certain markets, official closing bid price. Money market funds are valued using a valuation technique that results in price per share at $1.00.

Treasury Locks - Level 2

In connection with the JLT Transaction, to hedge the risk of increases in future interest rates prior to its issuance of fixed rate debt, in the fourth quarter of 2018 the Company entered into treasury locks related to $2 billion of expected issuances of senior notes in January 2019. The fair value at December 31, 2018 was based on the published treasury rate plus forward premium as of December 31, 2018, compared to the all in rate at the inception of the contract. These treasury locks were settled during the first quarter of 2019.

Contingent Purchase Consideration Liability – Level 3

Purchase consideration for some acquisitions made by the Company includes contingent consideration arrangements. These arrangements typically provide for the payment of additional consideration if earnings or revenue targets are met over periods from two to four years. The fair value of the contingent purchase consideration liability is estimated as the present value of future cash flows to be paid, based on projections of revenue and earnings and related targets of the acquired entities.

Foreign Exchange Forward Contract Liabilities - Level 3

In connection with the JLT Transaction, the Company entered into the FX Contract, to hedge the risk of appreciation of the GBP-denominated purchase price. On April 1, 2019, the Company purchased £5.2 billion at a contracted exchange rate, which is discussed in Note 11. The fair value of the FX Contract at March 31, 2019 was based on the all in forward rate, adjusted to exclude the value of the liquidity premium compared to the foreign exchange spot rate at March 31, 2019. Since all conditions to close had been satisfied at March 31, 2019, no value was assigned to the deal contingency feature.

The fair value at December 31, 2018 was determined using the probability distribution approach, comparing the all in forward rate to the foreign exchange rate for possible dates the JLT Transaction could close, discounted to the valuation date and adjusted for the fair value of the deal contingency feature. Determining the fair value of the FX Contract required significant management judgments or estimates about the potential closing dates of the transaction and remaining value of the deal contingency feature. The FX Contract was settled on April 1, 2019.

The following fair value hierarchy table presents information about the Company’s assets and liabilities measured at fair value on a recurring basis as of March 31, 2019 and December 31, 2018.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Identical Assets (Level 1) | | Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) | | Total |

(In millions) | 03/31/19 |

| | 12/31/18 |

| | 03/31/19 |

| | 12/31/18 |

| | 03/31/19 |

| | 12/31/18 |

| | 03/31/19 |

| | 12/31/18 |

|

Assets: | | | | | | | | | | | | | | | |

Financial instruments owned: | | | | | | | | | | | | | | | |

Exchange traded equity securities(a) | $ | 21 |

| | $ | 133 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 21 |

| | $ | 133 |

|

Mutual funds(a) | 145 |

| | 151 |

| | — |

| | — |

| | — |

| | — |

| | 145 |

| | 151 |

|

Money market funds(b) | 67 |

| | 118 |

| | — |

| | — |

| | — |

| | — |

| | 67 |

| | 118 |

|

Other equity investment(a) | — |

| | — |

| | 8 |

| | 8 |

| | — |

| | — |

| | 8 |

| | 8 |

|

Total assets measured at fair value | $ | 233 |

| | $ | 402 |

| | $ | 8 |

| | $ | 8 |

| | $ | — |

| | $ | — |

| | $ | 241 |

| | $ | 410 |

|

Fiduciary Assets: | | | | | | | | | | | | | | | |

U.S. Treasury Bills | $ | — |

| | $ | 20 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 20 |

|

Money market funds | 60 |

| | 80 |

| | — |

| | — |

| | — |

| | — |

| | 60 |

| | 80 |

|

Total fiduciary assets measured at fair value | $ | 60 |

| | $ | 100 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 60 |

| | $ | 100 |

|

Liabilities: | | | | | | | | | | | | | | | |

Contingent purchase consideration liability(c) | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 171 |

| | $ | 183 |

| | $ | 171 |

| | $ | 183 |

|

Acquisition related derivative contracts | — |

| | — |

| | — |

| | 116 |

| | 283 |

| | 325 |

| | 283 |

| | 441 |

|

Total liabilities measured at fair value | $ | — |

| | $ | — |

| | $ | — |

| | $ | 116 |

| | $ | 454 |

| | $ | 508 |

| | $ | 454 |

| | $ | 624 |

|

(a) Included in other assets in the consolidated balance sheets.

(b) Included in cash and cash equivalents in the consolidated balance sheets.

(c) Included in accounts payable and accrued liabilities and other liabilities in the consolidated balance sheets.

During the three-month period ended March 31, 2019, there were no assets or liabilities that were transferred between any of the levels.

The table below sets forth a summary of the changes in fair value of the Company’s Level 3 liabilities for the three month periods ended March 31, 2019 and 2018:

|

| | | | | | | |

| Three Months Ended

March 31, |

(In millions) | 2019 |

| | 2018 |

|

Balance at beginning of period, | $ | 508 |

| | $ | 189 |

|

Additions | 11 |

| | 6 |

|

Payments | (35 | ) | | (40 | ) |

Revaluation Impact | 11 |

| | 5 |

|

Change in fair value of the FX contract | (42 | ) | | — |

|

Other (a) | 1 |

| | 1 |

|

Balance at March 31, | $ | 454 |

| | $ | 161 |

|

(a) Primarily reflects the impact of foreign exchange.

As set forth in the table above, based on the Company's ongoing assessment of the fair value of contingent consideration, the Company recorded a net increase in the estimated fair value of such liabilities for prior-period acquisitions of $11 million in the three-month period ended March 31, 2019. A 5% increase in the projections used to estimate the contingent consideration would increase the liability by approximately $44 million. A 5% decrease would decrease the liability by approximately $36 million.

Long-Term Investments

The Company holds investments in certain private equity investments, public companies and private companies that are accounted for using the equity method of accounting. The carrying value of these investments was $388 million and $287 million at March 31, 2019 and December 31, 2018, respectively.

Investments Accounted For Using the Equity Method of Accounting

Investments in Public and Private Companies

Alexander Forbes: The Company owns approximately 33% of the common stock of Alexander Forbes ("AF"), a South African company listed on the Johannesburg Stock Exchange, which it purchased in 2014 for 7.50 South African Rand per share. In the third quarter of 2018, the Company concluded the decline in value of the investment was other than temporary and recorded an impairment charge of $83 million. As of March 31, 2019, the carrying value of the Company's investment in AF was approximately $149 million. As of March 31, 2019, the market value of the approximately 443 million shares of AF owned by the Company, based on the March 31, 2019 closing share price of 5.03 South African Rand per share, was $157 million.

The Company has other investments in private insurance and consulting companies with a carrying value of $155 million and $61 million at March 31, 2019 and December 31, 2018, respectively.

The Company’s investment in Alexander Forbes and its other equity investments in insurance and consulting companies are accounted for using the equity method of accounting, the results of which are included in revenue in the consolidated statements of income and the carrying value of which is included in other assets in the consolidated balance sheets. The Company records its share of income or loss on its equity method investments on a one quarter lag basis.

Private Equity Investments

The Company's investments in private equity funds were $84 million and $82 million at March 31, 2019 and December 31, 2018, respectively. The carrying values of these private equity investments approximate fair value. The underlying private equity funds follow investment company accounting, where investments within the fund are carried at fair value. The Company records in earnings its proportionate share of the change in fair value of the funds on the investment income line in the consolidated statements of income. These investments are included in other assets in the consolidated balance sheets. The Company recorded net investment income of $2 million from these investments for the three months ended March 31, 2019 compared to a net investment gain of $7 million for the same period in 2018.

Other Investments

At March 31, 2019 and December 31, 2018, the Company held certain equity investments with readily determinable market values of $35 million and $146 million, respectively. The Company recorded an investment gain on these investments of $3 million and an investment loss of $8 million in the three month periods ended March 31, 2019 and 2018, respectively. The Company also held investments without readily determinable market values of $74 million and $75 million at March 31, 2019 and December 31, 2018, respectively. In March 2019, the Company disposed of its investment in BenefitFocus for total proceeds of approximately $132 million. The Company received $115 million in the first quarter of 2019 and $17 million in April 2019 as final settlement on the sale.

11. Derivatives

On September 20, 2018, the Company entered into the FX Contract to purchase £5.2 billion at a contracted exchange rate, to hedge the risk of appreciation of the GBP-denominated purchase price of JLT. The settlement of the FX Contract was contingent upon the closing of the JLT Transaction. The all in contract exchange rate included the cost of a liquidity premium (due to the size of the JLT Transaction) and a deal contingent feature, which together increased the exchange rate in the FX Contract to purchase the £5.2 billion by .0343.